Discussion of Operating Forecast

On Oct. 20, 2022, and as shown above, we provided our operating forecast and strategic operating model for FY2023 and FY2024 as well as our forecasted number of revenue units by year.

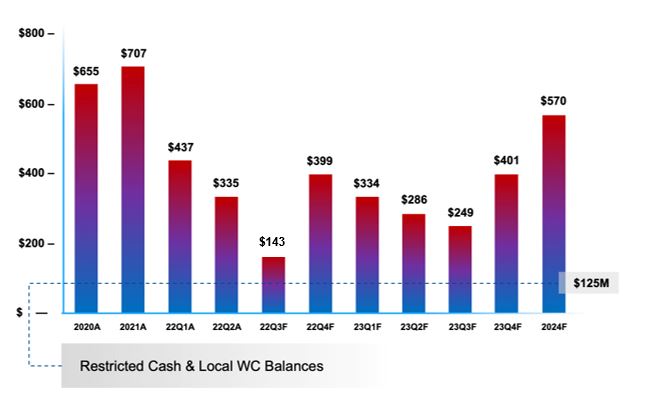

Overall supply chain material availability and logistics are improving; however, our models assumed a quicker normalization of supplier relationships than we are currently experiencing. However, it is also worth noting that this is more of a short-term challenge as we seek to normalize our working capital management, including with respect to our supplier relationships. In Q4, the conversion of backlog to revenue recognition will continue to be challenging and we could see as much as 15% risk of unit-to-revenue conversion and its corresponding attached services and software. Note a 15% variance in units would equate to approximately $100 million in revenue and approximately $30 million in adjusted EBITDA, depending on geography, customer and product mix. We expect that units that are not revenue recognized in Q4 will shift to 2023.

We remain encouraged by the consistent demand for our solutions. We ended the quarter with ~$1.4 billion in backlog and expect to cross into 2023 with approximately $1.3 billion of backlog, which equates to securing approximately 80% of our Product revenue. Coupled with our ~$1.4 billion in Services contract revenue, approximately 65% to 70% of our total FY2023 revenue is secured.

With respect to our cost savings plan that we initiated in May to streamline our operations to focus the organization on our customers, drive efficiencies and automate processes – we have now identified and are executing against approximately $200 million through our cost-savings restructuring plan and believe there are even more additional cost savings to be harvested as we continuously evaluate reducing redundancies and increasing operational efficiencies with our streamlined, simpler model for our business.

Despite the global challenges we have faced and continue to face in 2022, we believe the trends in our business and markets, the consistent demand for our solutions, and the completion of our refinancing favorably serve Diebold Nixdorf and will put our business back on track with our strategic operating models for FY2023 and FY2024. Our continued focus on operational rigor and simplifying our business strategically positions us to capitalize on our strong customer relationships and market opportunities as we deliver value to our shareholders.

Non-GAAP Financial Measures and Other Information

To provide investors with additional information regarding our financial results, the company discloses certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, levered free cash flow/(use) and unlevered free cash flow/(use), net debt, EBITDA, adjusted EBITDA, segment gross profit, segment gross margin and constant currency results. The company calculates constant currency by translating the prior year results at current exchange rates. The company uses these non-GAAP financial measures, in addition to GAAP financial measures, to evaluate our operating and financial performance and to compare such performance to that of prior periods and to the performance of our competitors. Also, the company uses these non-GAAP financial measures in making operational and financial decisions and in establishing operational goals. The company also believes providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors evaluate our operating and financial performance and trends in our business, consistent with how management evaluates such performance and trends. The company also believes these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the company and the non-GAAP financial measures of other companies may not be calculated in the same manner. We provide EBITDA and Adjusted EBITDA because we believe that investors and securities analysts will find EBITDA and adjusted EBITDA to be useful measures for evaluating our operating performance and comparing our operating performance with that of similar companies that have different capital structures and for evaluating our ability to meet our future debt service, capital expenditures and working capital requirements. We consider free cash flow (use) to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the purchase of property and equipment and capitalized software development, changes in cash of assets held for sale and the use of cash for M&A activities, and excluding the use/proceeds of cash for the settlement of foreign exchange derivative instruments, can be used for debt servicing, strategic opportunities, including investing in the business, making strategic acquisitions, strengthening the balance sheet and paying dividends. Unlevered free cash flow (use) provides incremental visibility into the company's liquidity by excluding cash used for interest payments from free cash flow (use). For more information, please refer to the Financial Tables in the back of this document.

Forward-Looking Statements

This letter may contain statements that are not historical information and are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. These forward-looking statements include, but are not limited to, projections, statements regarding the Company's expected future performance (including expected results of operations and financial guidance), future financial condition, potential impact of the ongoing coronavirus (COVID-19) pandemic, anticipated operating results, strategy plans, future liquidity and financial position.

Statements can generally be identified as forward looking because they include words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “will,” “estimates,” “potential,” “target,” “predict,” “project,” “seek,” and variations thereof or “could,” “should” or words of similar meaning. Statements that describe the Company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements reflect the current views of the Company with respect to future events and are subject to assumptions, risks and uncertainties that could cause actual results to differ materially. Although the Company believes that these forward-looking statements are based upon reasonable assumptions regarding, among other things, the economy, its knowledge of its business, and key performance indicators that impact the Company, these forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed in or implied by the forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

The factors that may affect the Company's results include, among others:

| ● | our ability to successfully complete the transactions contemplated by the TSA, including the ability to negotiate and execute definitive documentation, the receipt of required consents to any or all of such transactions, satisfaction of any conditions in any such documentation and the availability of alternative transactions; |

| ● | the overall impact of the global supply chain complexities on the Company and its business, including delays in sourcing key components as well as longer transport times, especially for container ships and U.S. trucking, given the Company’s reliance on suppliers, subcontractors and availability of raw materials and other components; |

| ● | our ability to successfully convert our backlog into sales, including our ability to overcome supply chain and liquidity challenges; |

| ● | the ultimate impact of the ongoing COVID-19 pandemic and other public health emergencies, including further adverse effects to the Company’s supply chain, maintenance of increased order backlog, and the effects of any COVID-19 related cancellations; |

| ● | the Company's ability to successfully meet its cost-reduction goals and continue to achieve benefits from its cost-reduction initiatives and other strategic initiatives, such as the current $150m+ cost savings plan; |

| ● | the success of the Company’s new products, including its DN Series line and EASY family of retail checkout solutions, and EV charging service business; |

| ● | the impact of a cybersecurity breach or operational failure on the Company's business; |

| ● | the Company's ability to generate sufficient cash to service its debt or to comply with the covenants contained in the agreements governing its debt and to successfully refinance its debt; |

| ● | the Company’s ability to attract, retain and motivate key employees; |

| ● | the Company’s reliance on suppliers, subcontractors and availability of raw materials and other components; |

| ● | changes in the Company's intention to further repatriate cash and cash equivalents and short-term investments residing in international tax jurisdictions, which could negatively impact foreign and domestic taxes; |

| ● | the Company's success in divesting, reorganizing or exiting non-core and/or non-accretive businesses and its ability to successfully manage acquisitions, divestitures, and alliances; |

| ● | the ultimate outcome of the appraisal proceedings initiated in connection with the implementation of the Domination and Profit Loss Transfer Agreement with the former Diebold Nixdorf AG (which was dismissed in the Company’s favor at the lower court level in May 2022) and the merger/squeeze-out; |

| ● | the impact of market and economic conditions, including the bankruptcies, restructuring or consolidations of financial institutions, which could reduce the Company’s customer base and/or adversely affect its customers' ability to make capital expenditures, as well as adversely impact the availability and cost of credit; |

| ● | the impact of competitive pressures, including pricing pressures and technological developments; |

| ● | changes in political, economic or other factors such as currency exchange rates, inflation rates (including the impact of possible currency devaluations in countries experiencing high inflation rates), recessionary or expansive trends, hostilities or conflicts (including the conflict between Russia and Ukraine), disruption in energy supply, taxes and regulations and laws affecting the worldwide business in each of the Company's operations; |

16 | Shareholder Letter / Q3 2022

| ● | the Company's ability to maintain effective internal controls; |

| ● | unanticipated litigation, claims or assessments, as well as the outcome/impact of any current/pending litigation, claims or assessments; |

| ● | the effect of changes in law and regulations or the manner of enforcement in the U.S. and internationally and the Company’s ability to comply with government regulations. |

| ● | and other factors included in the Company’s filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2021, its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, and in other documents the company files with the SEC. |

Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements.

17 | Shareholder Letter / Q3 2022

18 | Shareholder Letter / Q3 2022

19 | Shareholder Letter / Q3 2022

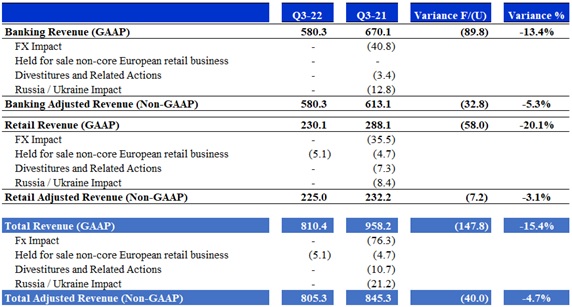

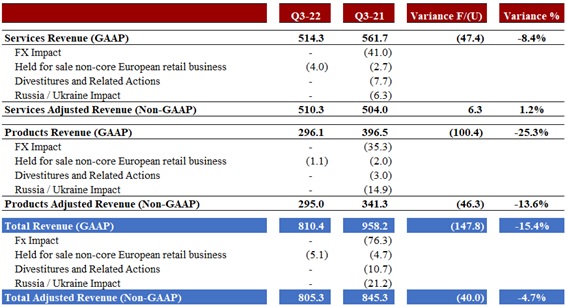

Q3-22 v Q3-21 QTD Revenue GAAP to Non-GAAP Revenue Reconciliation ($ in Millions)

Segment View

20 | Shareholder Letter / Q3 2022

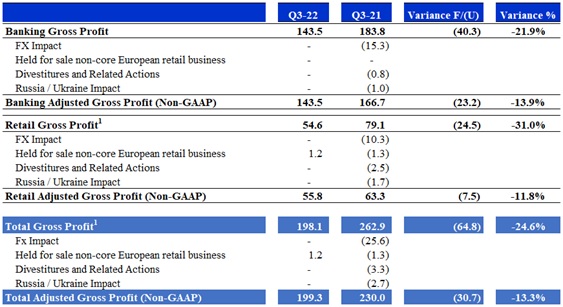

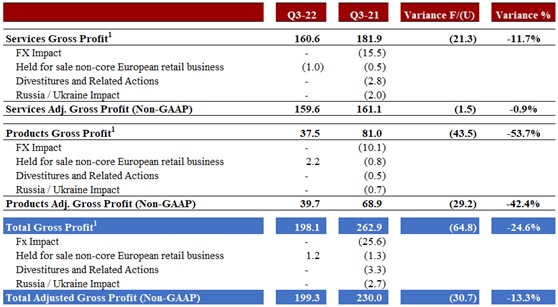

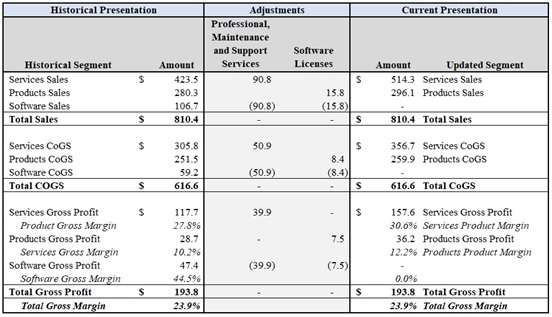

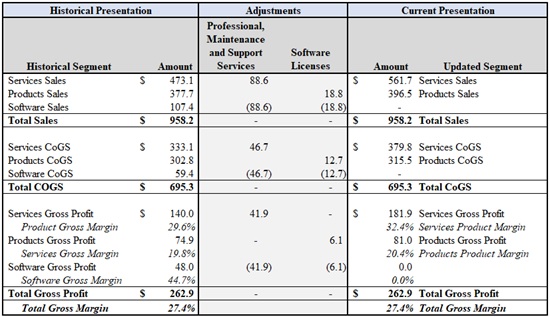

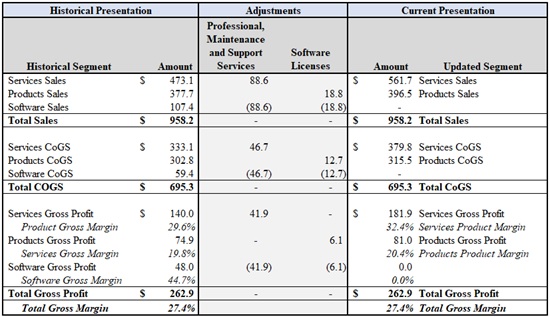

Q3-22 v Q3-21 QTD Gross Profit GAAP to Non-GAAP Reconciliation ($ in Millions)

Segment View

Business Line View

1 Amounts include the impact of held for sale non-core European retail business for comparability purposes. Otherwise, there is no difference between GAAP and Non-GAAP segment results; as the GAAP to Non-GAAP adjustments shown in Note 1 of the Earnings Release are not assigned to the segments, as these adjustments relate to items that are considered non-routine in nature and thus do not impact the way in which the business is managed or performance is assessed.

21 | Shareholder Letter / Q3 2022

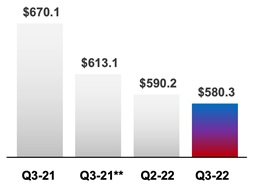

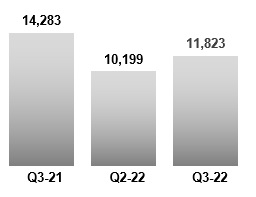

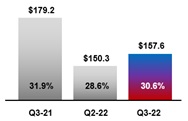

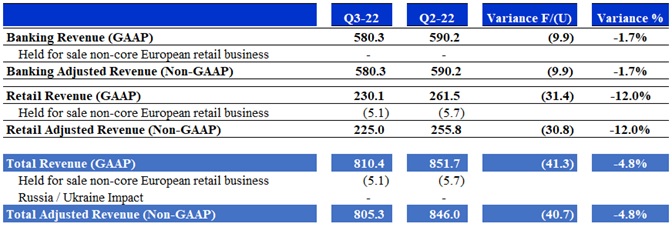

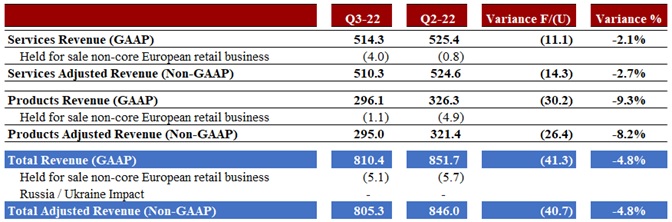

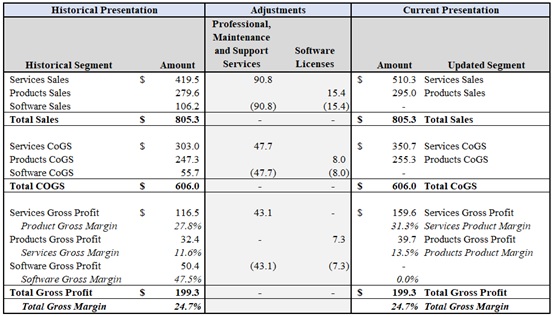

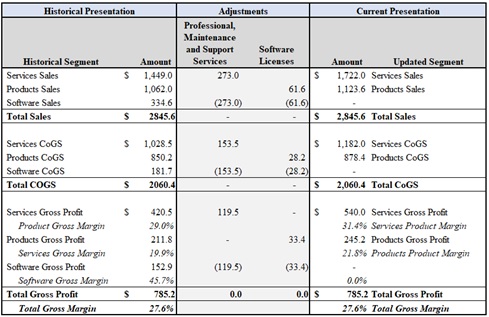

Q3-22 v Q2-22 QTD Revenue GAAP to Non-GAAP Revenue Reconciliation ($ in Millions)

Segment View

Business Line View

22 | Shareholder Letter / Q3 2022

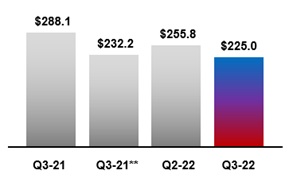

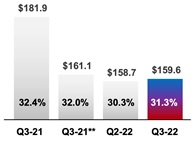

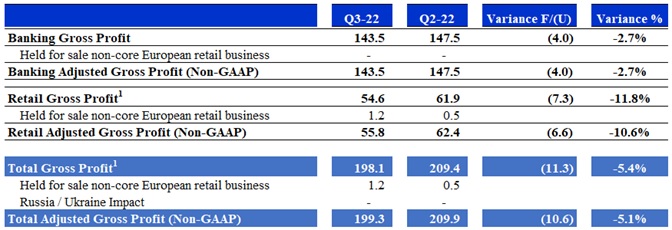

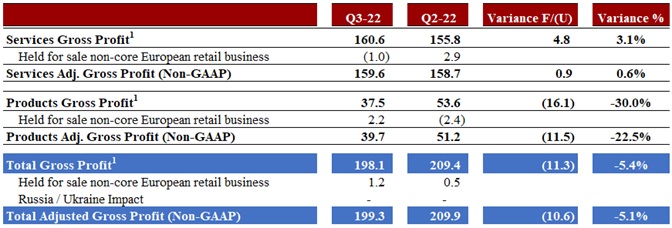

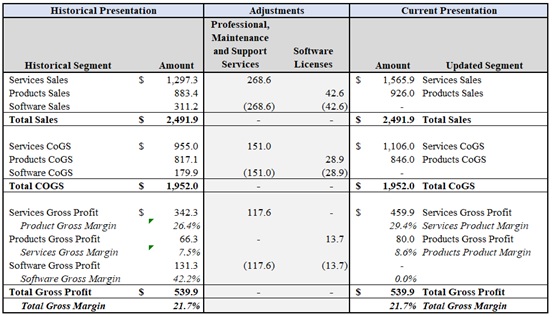

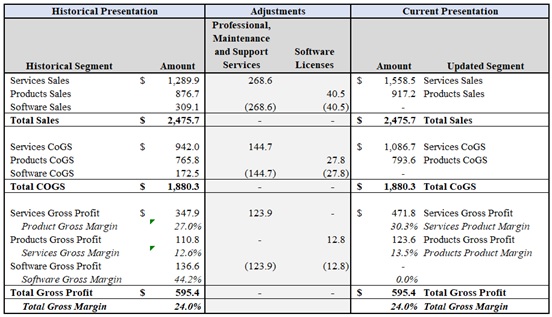

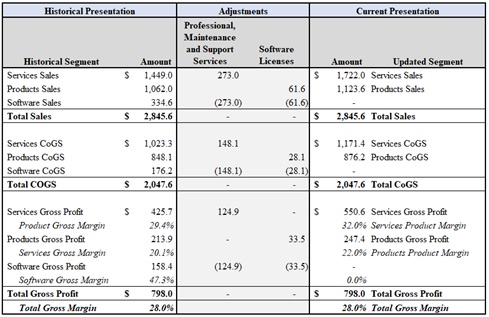

Q3-22 v Q2-22 QTD Revenue GAAP to Non-GAAP Gross Profit Reconciliation ($ in Millions)

Segment View

1 Amounts include the impact of held for sale non-core European retail business for comparability purposes. Otherwise, there is no difference between GAAP and Non-GAAP segment results; as the GAAP to Non-GAAP adjustments shown in Note 1 of the Earnings Release are not assigned to the segments, as these adjustments relate to items that are considered non-routine in nature and thus do not impact the way in which the business is managed or performance is assessed.

23 | Shareholder Letter / Q3 2022

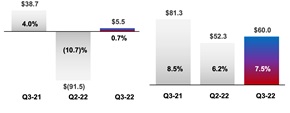

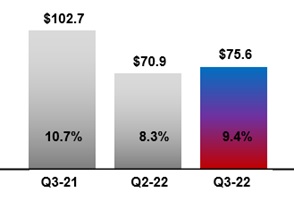

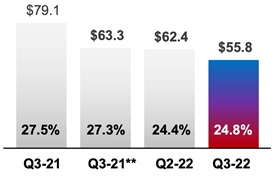

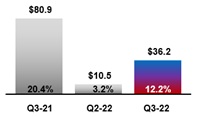

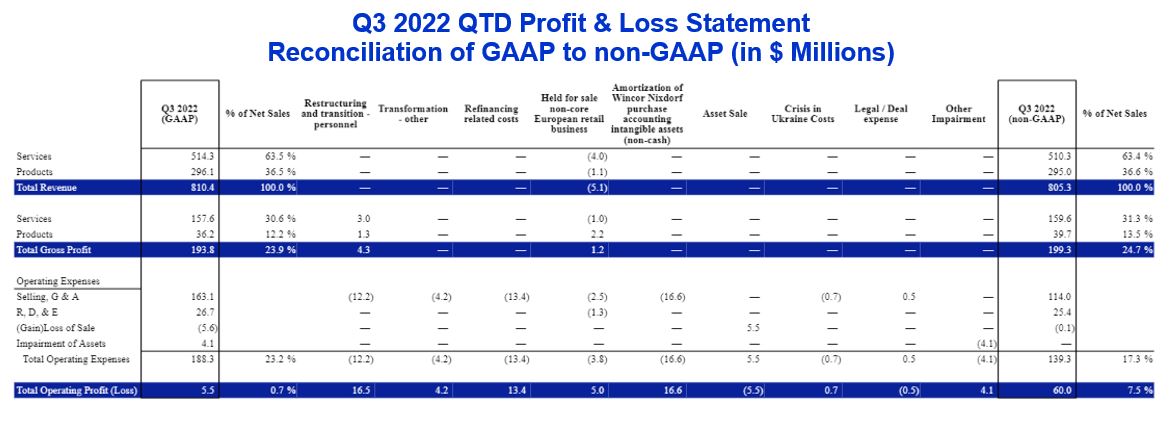

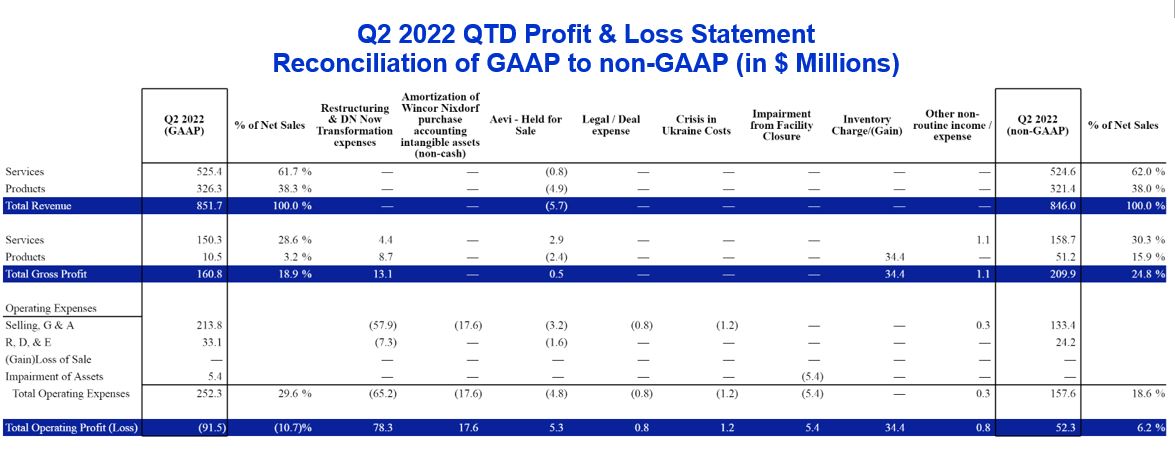

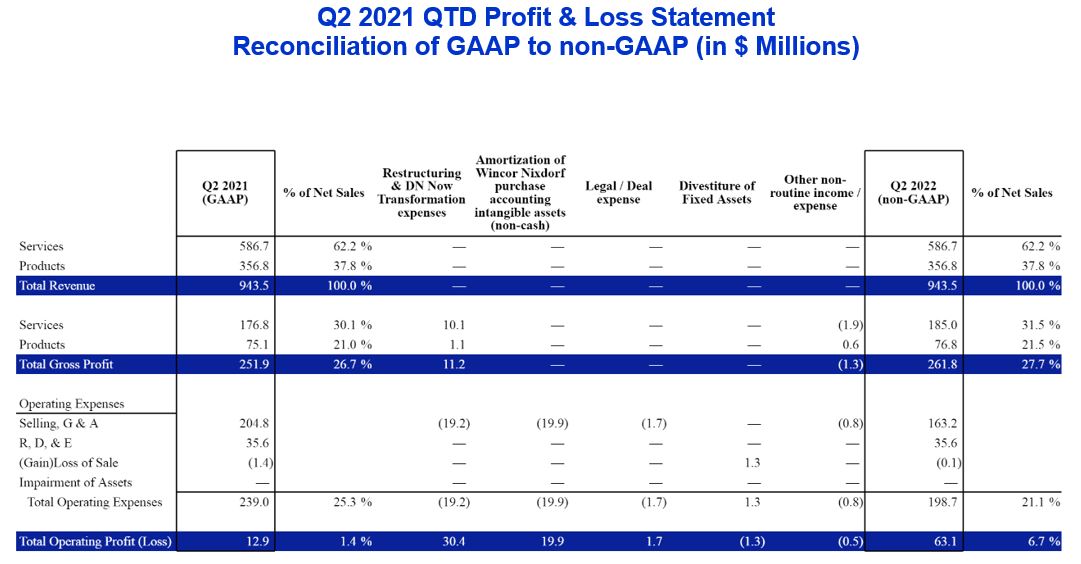

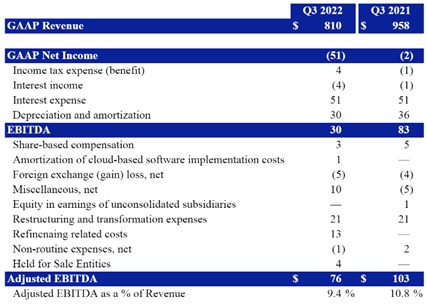

Q3 2022 QTD Adjusted EBITDA

(in $ Millions)

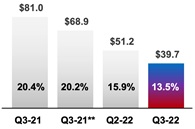

Trailing 12-month Adjusted EBITDA

(in $ Millions)

The company defines EBITDA as net loss excluding income tax benefit/expense, net interest expense, and depreciation and amortization expense. Consistent with the company's current credit agreement, Adjusted EBITDA is EBITDA excluding the effects of the following items: share-based compensation, amortization of cloud-based software implementation costs, foreign exchange gain/loss net, miscellaneous net, equity in earnings of unconsolidated subsidiaries, restructuring and transformation expenses, refinancing related costs, non-routine expenses and the adjusted EBITDA loss of our held for sale non-core European retail business, as outlined in Note 1 of the Non-GAAP measures. To remain comparable to the U.S. GAAP depreciation and amortization measures, the company excluded the amortization of Wincor Nixdorf purchase accounting intangible assets from non-routine expenses, net in the Adjusted EBITDA reconciliation of $16.6 and $19.5 for the three months ended September 30, 2022 and 2021 and $52.8 and $59.3 for the nine months ended September 30, 2022 and 2021. Additionally, $0.8 of restructuring-related share-based compensation activity was excluded from restructuring and transformation expenses for the nine months ended September 30, 2022 and $1.9 of accelerated depreciation expense for the nine months ended September 30, 2021 was excluded from restructuring and transformation expenses. Deferred financing fee amortization is included in interest expense; as a result, the company excluded from the depreciation and amortization caption $3.7 and $4.3 for the three months ended September 30, 2022 and 2021 and $12.0 and $13.0 for the nine months ended September 30, 2022 and 2021. $1.0 and $2.7 of depreciation and amortization expense was excluded from Held for sale non-core European retail business for the three and nine months ended September 30, 2022, respectively.

These are Non-GAAP financial measures used by management to enhance the understanding of our operating results. EBITDA and Adjusted EBITDA are key measures we use to evaluate our operational performance. We provide EBITDA and Adjusted EBITDA because we believe that investors and securities analysts will find EBITDA and Adjusted EBITDA to be useful measures for evaluating our operating performance and comparing our operating performance with that of similar companies that have different capital structures and for evaluating our ability to meet our future debt service, capital expenditures, and working capital requirements. However, EBITDA and Adjusted EBITDA should not be considered as alternatives to net income as a measure of operating results or as alternatives to cash flows from operating activities as a measure of liquidity in accordance with GAAP.

24 | Shareholder Letter / Q3 2022

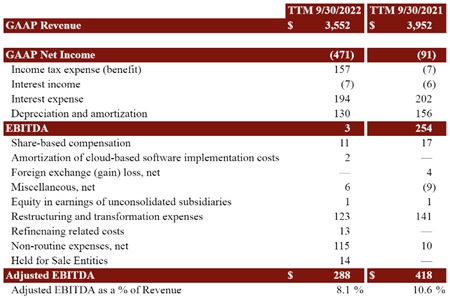

Q3 2022 QTD Free Cash Flow (in $ Millions)

Trailing 12-month Free Cash Flow (in $ Millions)

Free cash flow is a non-GAAP financial measure defined as net cash provided by operating activities from continuing operations less capital expenditures, less cash used for capitalized software development, and excluding the impact of changes in cash of assets held for sale and the use of cash for M&A and the legal settlement for impaired cloud implementation costs, and excluding the use of cash for the settlement of foreign exchange derivative instruments. Unlevered free cash flow (use) provides incremental visibility into the company's liquidity by excluding cash used for interest payments from free cash flow (use). With respect to the company’s non-GAAP unlevered free cash flow outlook for 2022, it is not providing a reconciliation to the most directly comparable GAAP financial measure because it is unable to predict with reasonable certainty those items that may affect such measure calculated and presented in accordance with GAAP without unreasonable effort. This measure primarily excludes the future impact of changes in cash of assets held for sale, cash used for M&A activities and the settlement of foreign exchange derivative instruments. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, net cash provided (used) by operating activities calculated and presented in accordance with GAAP.

25 | Shareholder Letter / Q3 2022

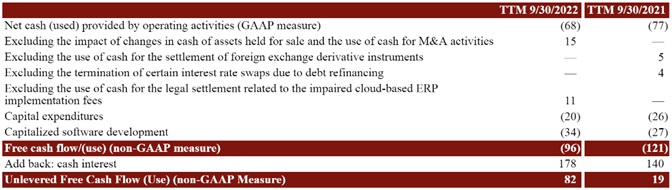

Q3 2022 Net Debt (in $ Millions)

Trailing 12-month Return on Invested Capital (ROIC)

(in $ Millions)

2 Return on invested capital (ROIC) is a non-GAAP financial measure defined as adjusted net operating profit after tax (NOPAT) utilizing a 30% estimated effective tax rate divided by average invested capital for the period. Invested capital consists of net debt, leases, pension and other post-retirement liabilities and equity.

3 Includes cash included in assets held for sale

26 | Shareholder Letter / Q3 2022

Software Business Line Distribution*

Q3 2022 QTD

(in $ Millions)

GAAP

27 | Shareholder Letter / Q3 2022

Non-GAAP

28 | Shareholder Letter / Q3 2022

Non-GAAP

29 | Shareholder Letter / Q3 2022

30 | Shareholder Letter / Q3 2022