Non-GAAP Financial Measures and Other Information

To supplement our condensed consolidated financial statements presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted diluted earnings per share, free cash flow (use) and unlevered free cash flow (use), net debt, EBITDA, adjusted EBITDA and constant currency results. The company calculates constant currency by translating the prior year results at current year exchange rates. The company uses these non-GAAP financial measures, in addition to GAAP financial measures, to evaluate our operating and financial performance and to compare such performance to that of prior periods and to the performance of our competitors. Also, the company uses these non-GAAP financial measures in making operational and financial decisions and in establishing operational goals. The company also believes providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors evaluate our operating and financial performance and trends in our business, consistent with how management evaluates such performance and trends. The company also believes these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the company and the non-GAAP financial measures of other companies may not be calculated in the same manner. We provide EBITDA and Adjusted EBITDA because we believe that investors and securities analysts will find EBITDA and adjusted EBITDA to be useful measures for evaluating our operating performance and comparing our operating performance with that of similar companies that have different capital structures and for evaluating our ability to meet our future debt service, capital expenditure and working capital requirements. We are also providing EBITDA and adjusted EBITDA in light of our credit agreement and the secured and unsecured senior notes. We consider free cash flow (use) to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the purchase of property and equipment and capitalized software development, changes in cash of assets held for sale and the use of cash for M&A and the legal settlement for impaired cloud implementation costs, and excluding the use/proceeds of cash for the settlement of foreign exchange derivative instruments, can be used for debt servicing, strategic opportunities, including investing in the business, making strategic acquisitions, strengthening the balance sheet and paying dividends. Unlevered free cash flow (use) provides incremental visibility into the company’s liquidity by excluding cash used for interest payments from free cash flow (use). For more information, please refer to the section, “Notes for Non-GAAP Measures.”

Differences throughout may occur due to rounding.

Segment Reporting Structure

As previously mentioned, the company reorganized its reportable segments due to the simplification of its organizational structure. The new reportable segments are Global Banking and Global Retail, which aligns with how the company makes key operating decisions, allocate resources and assess performance going forward. The new Banking segment’s sales and cost of sales are the summation of the historical Americas Banking and Eurasia Banking segments. The segment change has no impact on Retail’s sales or cost of sales. Certain corporate costs and Non-GAAP adjustments are not assigned to our reportable segments, as these charges are managed separately from the segment information the company uses to make operating decisions and assess performance.

Also in connection with the operating structure simplification, the company will no longer be separately reporting software sales and software cost of sales in its earnings materials. Rather, and consistent with its historical reporting on Form 10-Q and Form 10-K, the company will report product and service sales and cost of sales. Software licenses are included in product, while software maintenance and support and professional services are reported within service.

Prior-periods have been recast to conform to the new reporting structure. Reconciliations between the new and historical format are included in the back of this shareholder letter. These changes did not impact the consolidated financial statements.

Forward-Looking Statements

This letter contains statements that are not historical information and are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding potential impact of the ongoing coronavirus (COVID-19) pandemic, anticipated operating results, future liquidity and financial position.

Statements can generally be identified as forward looking because they include words such as “believes,” “anticipates,” “expects,” “could,” “should” or words of similar meaning. Statements that describe the company’s future plans, objectives or goals are also forward-looking statements. Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that may affect the company’s results include, among others:

17 | Shareholder Letter / Q2 2022

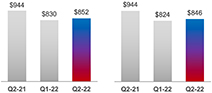

$252 $185 $161 $262 $186 $210 26.7% 22.3% 18.9% 27.7% 22.5% 24.8% Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22

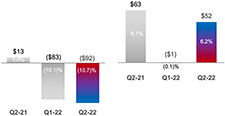

$252 $185 $161 $262 $186 $210 26.7% 22.3% 18.9% 27.7% 22.5% 24.8% Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22 $13 ($83) ($92) $63 ($1) $52 1.4% (10.1)% (10.7)% Q2-21 (0.1)% 6.7% 6.2% Q1-22 Q2-22 Q2-21 Q1-22 Q2-22

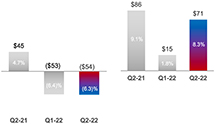

$13 ($83) ($92) $63 ($1) $52 1.4% (10.1)% (10.7)% Q2-21 (0.1)% 6.7% 6.2% Q1-22 Q2-22 Q2-21 Q1-22 Q2-22 $45 4.7% ($53) (6.4)% ($54) (6.3)% $86 9.1% $15 1.8% $71 8.3% Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22

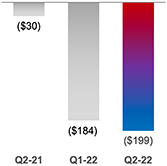

$45 4.7% ($53) (6.4)% ($54) (6.3)% $86 9.1% $15 1.8% $71 8.3% Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22 ($30) Q2-21 ($184) Q1-22 ($199) Q2-22

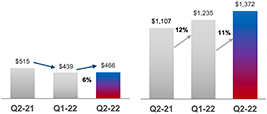

($30) Q2-21 ($184) Q1-22 ($199) Q2-22 $515 $439 $466 6% $1,107 $1,235 11% $1,372 Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22

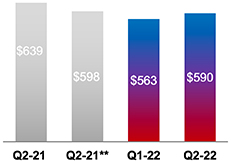

$515 $439 $466 6% $1,107 $1,235 11% $1,372 Q2-21 Q1-22 Q2-22 Q2-21 Q1-22 Q2-22 $639 $598 $563 $590 Q2-21 Q2-21** Q1-22 Q2-22

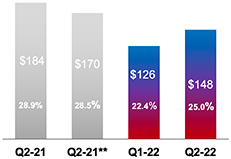

$639 $598 $563 $590 Q2-21 Q2-21** Q1-22 Q2-22 $184 28.9% $170 28.5% $126 22.4% $148 25.0% Q2-21 Q2-21** Q1-22 Q2-22

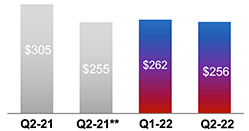

$184 28.9% $170 28.5% $126 22.4% $148 25.0% Q2-21 Q2-21** Q1-22 Q2-22 $305 $255 $262 $256 Q2-21 Q2-21** Q1-22 Q2-22

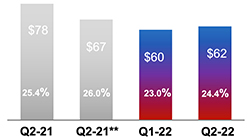

$305 $255 $262 $256 Q2-21 Q2-21** Q1-22 Q2-22 $78 25.4% $67 26.0% $60 23.0% $62 24.4% Q2-21 Q2-21** Q1-22 Q2-22

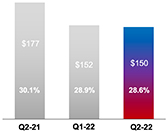

$78 25.4% $67 26.0% $60 23.0% $62 24.4% Q2-21 Q2-21** Q1-22 Q2-22 $177 30.1% $152 28.9% $150 28.6% Q2-21 Q1-22 Q2-22

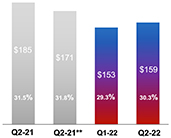

$177 30.1% $152 28.9% $150 28.6% Q2-21 Q1-22 Q2-22 $185 31.5% $171 31.8% $153 29.3% $159 30.3% Q2-21 Q2-21** Q1-22 Q2-22

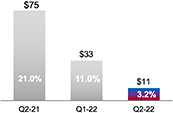

$185 31.5% $171 31.8% $153 29.3% $159 30.3% Q2-21 Q2-21** Q1-22 Q2-22 $75 21.0% $33 11.0% $11 3.2% Q2-21 Q1-22 Q2-22

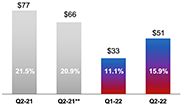

$75 21.0% $33 11.0% $11 3.2% Q2-21 Q1-22 Q2-22 $77 21.5% $66 20.9% $33 11.1% $51 15.9% Q2-21 Q2-21** Q1-22 Q2-22

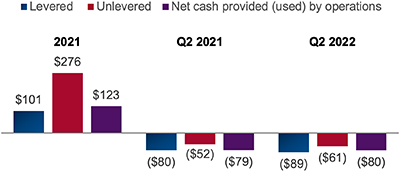

$77 21.5% $66 20.9% $33 11.1% $51 15.9% Q2-21 Q2-21** Q1-22 Q2-22 $101 2021 $276 $123 Q2 2021 Q2 2022 ($80) ($52) ($79) ($89) ($61) ($80)

$101 2021 $276 $123 Q2 2021 Q2 2022 ($80) ($52) ($79) ($89) ($61) ($80)

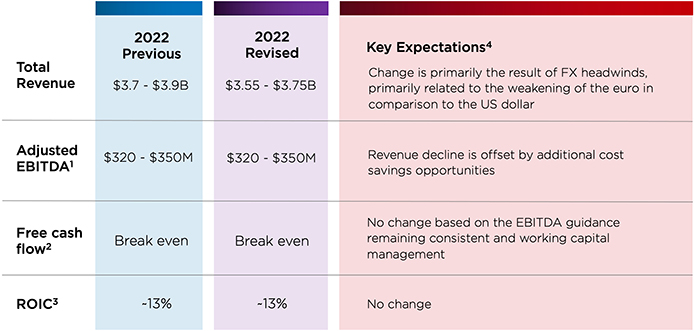

Total Revenue Adjusted EBITDA1 Free cash flow2 ROIC3 2022 Previous $3.7 - $3.9B 2022 Revised $3.55 - $3.75B Key Expectations4 Change is primarily the result of FX headwinds, Primarily related to the weakening of the euro in comparison to the US dollar $320 - $350M $320 - $350M Revenue decline is offset by additional cost savings opportunites Break even Break even No change based on the EBITDA guidance remaining consisted and working capital management -13% -13% No change

Total Revenue Adjusted EBITDA1 Free cash flow2 ROIC3 2022 Previous $3.7 - $3.9B 2022 Revised $3.55 - $3.75B Key Expectations4 Change is primarily the result of FX headwinds, Primarily related to the weakening of the euro in comparison to the US dollar $320 - $350M $320 - $350M Revenue decline is offset by additional cost savings opportunites Break even Break even No change based on the EBITDA guidance remaining consisted and working capital management -13% -13% No change