Diodes, Inc. Pericom Semiconductor Acquisition Script Thursday, September 3 @ 12:00pm CST / 10:00am PST | EXHIBIT 99.2 |

Call Participants: Diodes: Dr. Keh-Shew Lu, Rick White, Mark King, Julie Holland and Laura Mehrl. Pericom Semiconductor: Alex Hui

Operator:

Good morning and welcome to Diodes Incorporated’s conference call regarding its proposed acquisition of Pericom Semiconductor Corporation. At this time, all participants are in a listen only mode. At the conclusion of today’s conference call, instructions will be given for the question and answer session. If anyone needs assistance at any time during the conference call, please press the star followed by the zero on your touchtone phone.

As a reminder, this conference call is being recorded today, Thursday, September 3, 2015. I would now like to turn the call to Shelton Group, the investor relations agency for Diodes Incorporated. Leanne, please go ahead.

Introduction: Leanne Sievers, EVP of Shelton Group

Good morning and thank you for joining our conference call today to discuss the proposed acquisition of Pericom Semiconductor. I’m Leanne Sievers, Executive Vice President of Shelton Group, Diodes’ investor relations firm.

With us today are Diodes’ President and CEO, Dr. Keh-Shew Lu; Chief Financial Officer, Rick White; Senior Vice President of Sales and Marketing, Mark King; Vice President of Worldwide Analog Products, Julie Holland and Director of Investor Relations, Laura Mehrl. Also joining us and available for questions is Pericom Semiconductor’s CEO, Alex Hui.

Page 2 of 13

If you have not yet received a copy of the press release, you can access a copy on Diodes’ website atwww.diodes.com under the Investor Relations section. There is also a slide presentation that we will be using in conjunction with this call that may be accessed through the webcast link on Diodes’ website and is also posted as a PDF in the Investor Relations section.

The slide presentation and management’s statements during this conference call will include discussions of certain measures and financial information in GAAP and non-GAAP terms.

Slide 2: Safe Harbor Statement(Leanne)

Before I turn the call over to Dr. Lu, I would like to remind our listeners that management’s prepared remarks contain forward-looking statements, which are subject to risks and uncertainties, and management may make additional forward-looking statements in response to your questions. These forward-looking statements include, but are not limited to, statements related to the benefits of the proposed transaction between Diodes Incorporated and Pericom Semiconductor. These forward-looking statements are based on information available to Diodes and Pericom as oftoday, September 3, 2015and current expectations, forecasts and assumptions involve a number of risks and uncertainties. Actual results may differ materially from these forward-looking statements, and therefore we refer you to a more detailed discussion of the risks and uncertainties in the Company’s filings with the Securities and Exchange Commission.

Page 3 of 13

The Company claims the protection of the safe harbor for forward-looking statements that is contained in the Private Securities Litigation Reform Act of 1995, and assumes no obligation to update these projections in the future as market conditions may or may not change.

For those of you unable to listen to the entire call at this time, a recording will be available via webcast for 60 days at the Investor Relations section of Diodes’ website at www.diodes.com.

And now, it’s my pleasure to turn the call over Diodes’ President and CEO, Dr. Keh-Shew Lu.

Dr. Keh-Shew Lu, President and CEO of Diodes

Thank you, Leanne. Welcome everyone, and thank you for joining us today.

We are very excited about today’s announcement regarding the proposed acquisition of Pericom Semiconductor by Diodes. In addition to offering substantial synergies and a compelling strategic rationale for both companies’ customers, employees, and shareholders, I believe this acquisition is a key milestone on Diodes’ path toward achieving our financial goals of $1 billion revenue and 35% gross profit margin. As we will discuss today, this transaction meets all of our acquisition criteria and will also be immediately accretive to GAAP earnings per share.

Page 4 of 13

As Leanne mentioned, there is a slide presentation available on our website. I have asked Julie Holland, our Vice President of Worldwide Analog Products to review this presentation with you as part of today’s call before we open the call for your questions.

Julie Holland, Vice President, Worldwide Analog Products

Thank you, Dr. Lu. It is my pleasure to be here today.

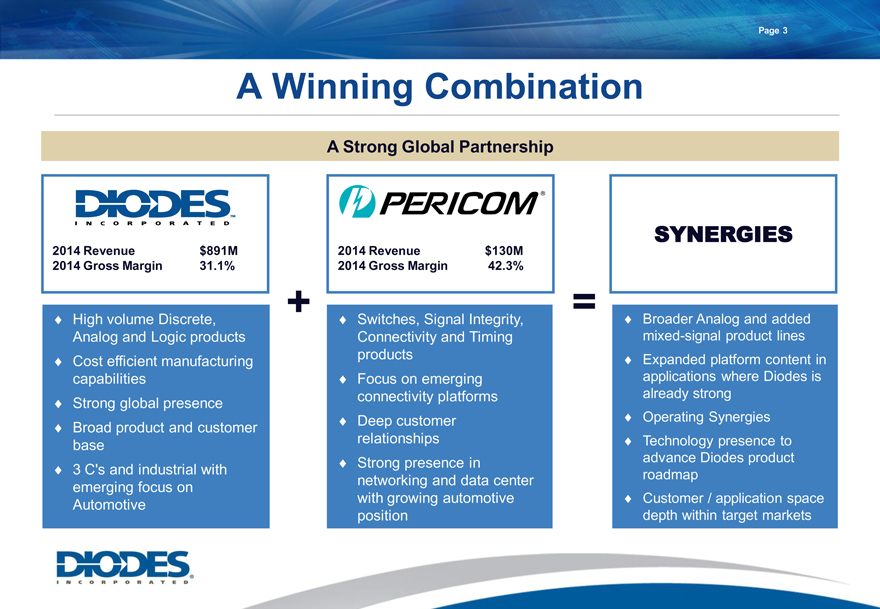

Slide 3: A Winning Combination

Diodes’ acquisition of Pericom Semiconductor creates a stronger global company with a greatly enhanced analog and mixed signal product offering. When looking at the strengths and expertise of each company, Diodes has:

| 1) | High volume discrete, analog and logic products; |

| 2) | Cost-efficient packaging capabilities; |

| 3) | Strong global presence; |

| 4) | A broad product and customer base; and |

| 5) | An existing focus on the consumer, computing and communications markets with an emphasis on expanding products in the industrial and automotive markets. |

Page 5 of 13

Pericom Semiconductor has:

| 1) | A broad portfolio of switches, signal integrity, connectivity and timing products; |

| 2) | A focus on emerging connectivity platforms; |

| 3) | Deep customer relationships with market-leading customers; and |

| 4) | A strong position in networking and data center applications with a growing presence in embedded automotive products. |

When combined, there are many synergies including:

| 1) | A broader product footprint including an expanded analog product line and the addition of a mixed signal connectivity portfolio; |

| 2) | Deeper platform content in multiple targeted applications; |

| 3) | Operating synergies; |

| 4) | Access to technology know-how that can advance the combined company’s product roadmap; and |

| 5) | Broader participation in applications and customers within our targeted market segments. |

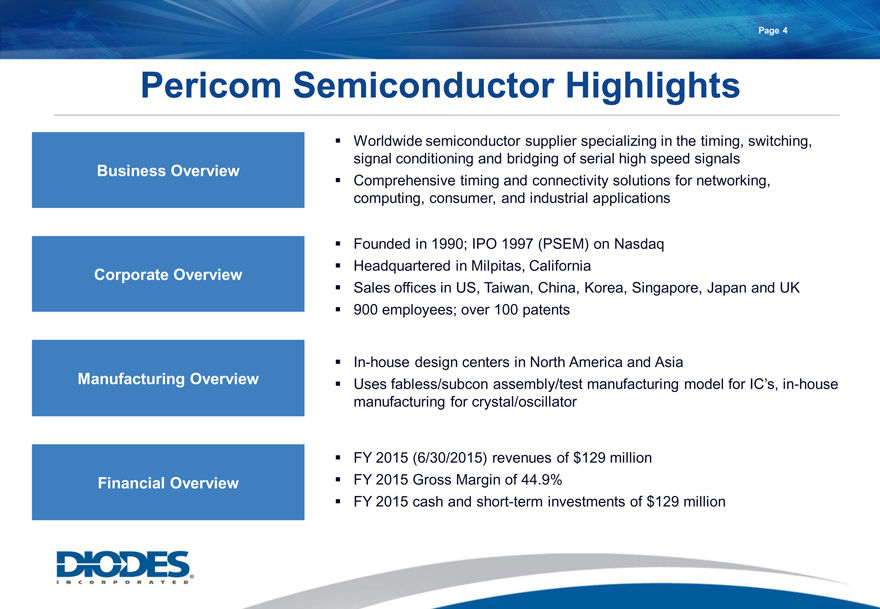

Slide 4: Pericom Highlights

Let me provide an overview of Pericom’s business from both a corporate and financial perspective. As a worldwide supplier of semiconductors specializing in timing, switching, signal conditioning, and bridging of high speed serial signals, Pericom has a comprehensive portfolio of products for timing and connectivity solutions in networking, data center, wireless access, and industrial applications.

Page 6 of 13

The company was founded in 1990, IPO’ed in October of 1997 on Nasdaq, and is headquartered in Milpitas, California. The company has over 900 employees with sales offices in Taiwan, China, Korea, Singapore, Japan and the US. Pericom has in-house design centers across several locations in the US and Asia, plus manufacturing sites for its crystal and crystal oscillator products in Jinan, China and Jhongli, Taiwan. Pericom uses a fabless model for their ICs, with their IC packaging outsourced to partners in Taiwan, China and Malaysia.

In terms of financials, Pericom reported revenue for their fiscal year 2015, ending in the June quarter, of $129 million with $14 million in EBITDA and gross margin of approximately 45%. During fiscal 2015, they generated $16.5 million in net free cash flow. Their cash and short-term investments were $129 million as of June 27, 2015.

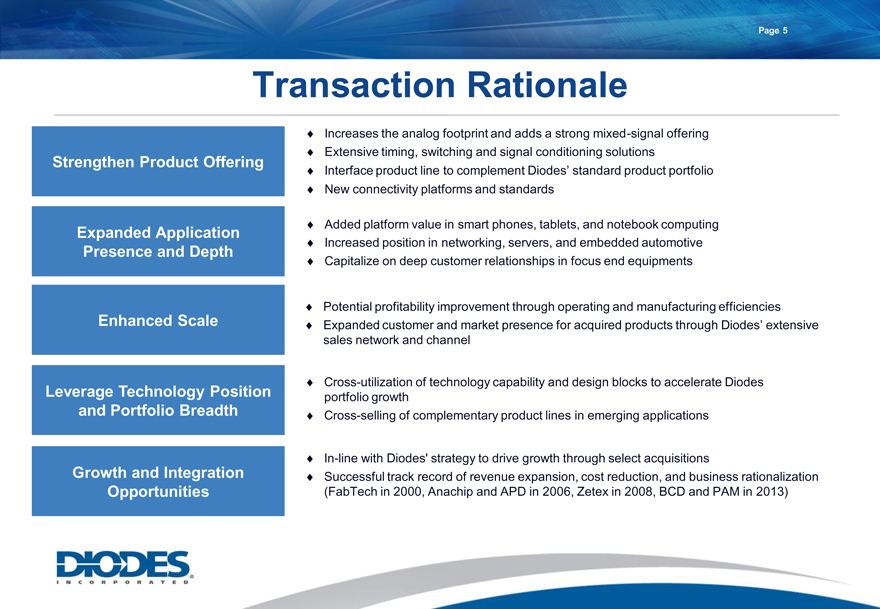

Slide 5: Transaction Rationale

Pericom’s business strengths and attributes strongly support our rationale for the transaction and will greatly benefit Diodes’ business and expand our product portfolio. The rationale for the transaction includes:

| 1) | The strengthening of our overall product offering with an extensive mixed-signal connectivity portfolio of switching, bridging, and signal conditioning products. It expands our analog standard products line with the addition of a complete line of timing products. |

Page 7 of 13

| 2) | It offers an expansion of our platform content and additional platform value in targeted applications such as smart phones and tablets, while increasing our presence in additional growing applications such as networking, cloud computing, and embedded automotive within our target end markets. |

| 3) | It allows us to capitalize on Pericom’s deep customer relationships at key accounts, while Diodes’ scale can be instrumental in expanding the presence and emphasis on the Pericom product line across Diodes’ more extensive sales network and worldwide channel. |

| 4) | The transaction will provide Diodes access to Pericom’s technology and design portfolio to accelerate Diodes’ product development. Additionally, the transaction creates cross-selling opportunities of our complementary analog and mixed-signal product lines in several emerging applications. |

| 5) | There are opportunities for profitability improvement through operating and administrative efficiencies due to the combined company’s enhanced scale. |

| 6) | And finally, it aligns with Diodes’ strategy to drive growth through select acquisitions. We have a successful track record of integrating acquisitions, including FabTech in 2000, Anachip and ADP Semiconductor in 2006, Zetex in 2008, and BCD and PAM in 2013. |

The terms of the acquisition include a purchase price of $17.00 per share for a total cost of approximately $400 million dollars. The acquisition is expected to close in the fourth quarter of this year. The boards of both companies have approved the transaction, which is still subject to approval by Pericom’s shareholders, as well as other customary closing conditions and regulatory approvals.

Page 8 of 13

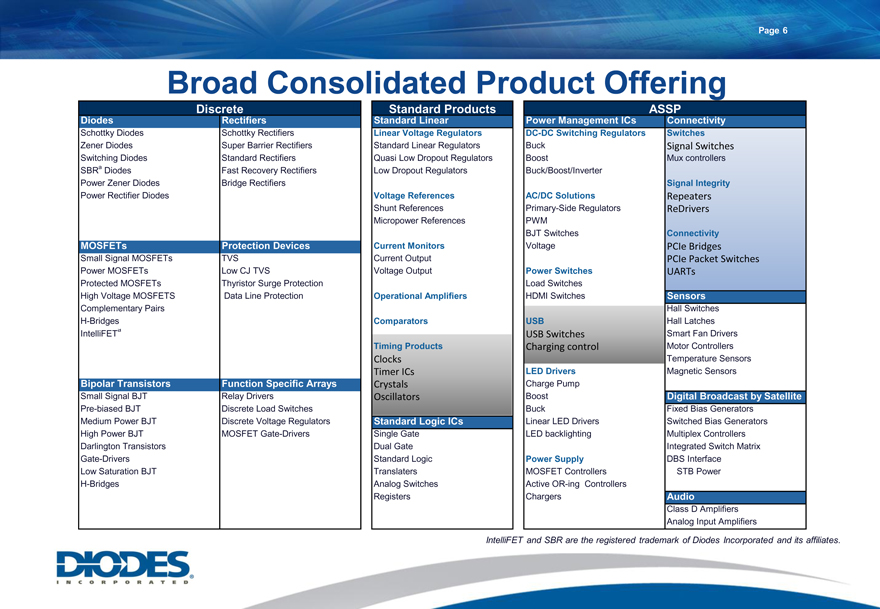

Slide 6: Broad Consolidated Product Offerings

From a product perspective, the combined company offers a significant increase in the depth and breadth of Diodes’ product offerings. The white areas of the chart represent Diodes’ existing products, the light blue highlighted section is the extensive line of Pericom’s connectivity products, which is expansionary to the Diodes’ portfolio, and the light grey shaded areas represent the synergistic product portfolio. Together, the combined portfolios are complementary and enhance the product offerings available to support a larger, more diverse customer and application base. As a result, we expect to realize opportunities from the increased scale afforded by Diodes’ extensive channel presence and global sales network, as well as cross-selling opportunities, which will increase the combined company’s sales across the expanded application and end equipment base.

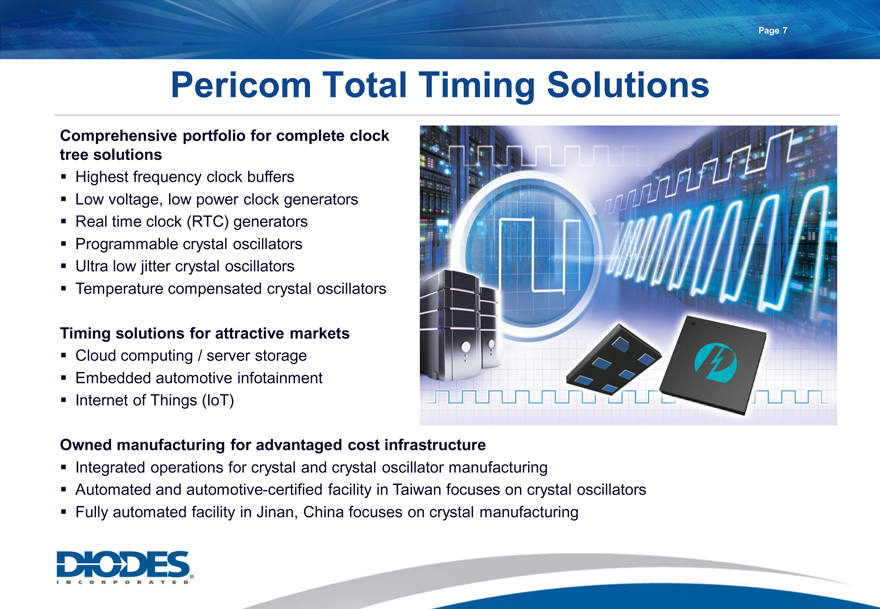

Slide 7: Pericom Total Timing Solutions

This transaction will enhance the Diodes’ analog footprint with the addition of Pericom’s line of complete clock tree solutions. This comprehensive portfolio includes clock buffers, a variety of clock generators and synthesizers, crystals, and crystal oscillators. Pericom’s timing solutions support a wide variety of applications, including attractive emerging markets such as cloud computing and automotive infotainment, as well as existing target applications within the networking, storage, digital media and industrial spaces.

Page 9 of 13

Pericom’s crystal and crystal oscillator product lines are supported with fully automated, in-house manufacturing facilities in Taiwan and China. The Jhongli and Jinan assembly sites provide a specialized, vertically-integrated source of supply for these product lines, and are consistent with Diodes’ strategy for owned manufacturing.

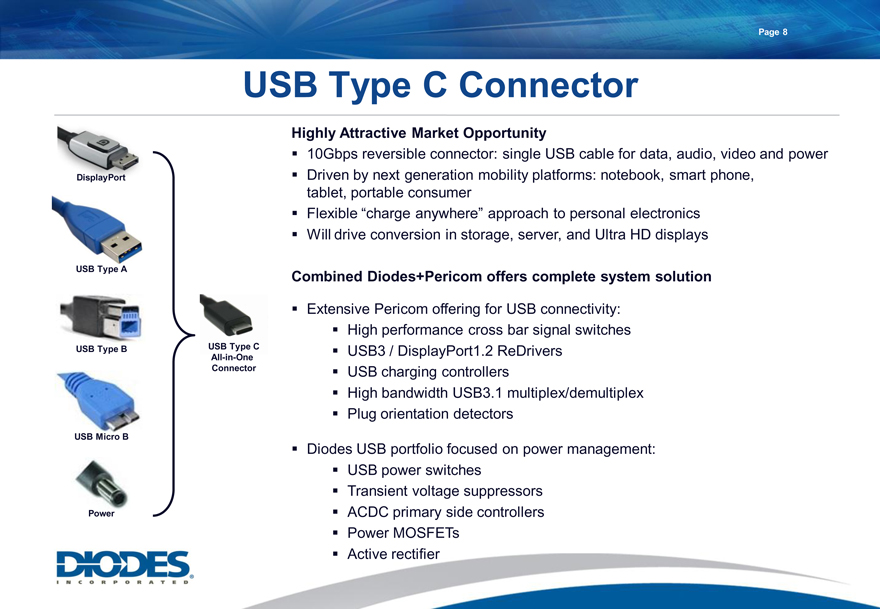

Slide 8: USB Type C Connector

The combination of Diodes’ and Pericom’s product portfolios will also enable us to capitalize on a highly attractive market opportunity supporting the emerging USB type C connector interface. This next generation standard will support high speed data communications, audio, video, and power all over a single cable with a reversible connector. Adoption of this standard is being driven within portable consumer electronics such as smart phone, tablets, and notebook computing, and is expected to be fanned out broadly to a wide range of applications in the storage, server, and display markets.

In addition to Diodes’ existing power management products such as USB power switches, transient voltage suppressors, power controllers and power MOSFETS, Pericom’s extensive line of USB connectivity products will allow us to offer a enhanced platform solution to address this exciting new standard and high-growth opportunity.

Page 10 of 13

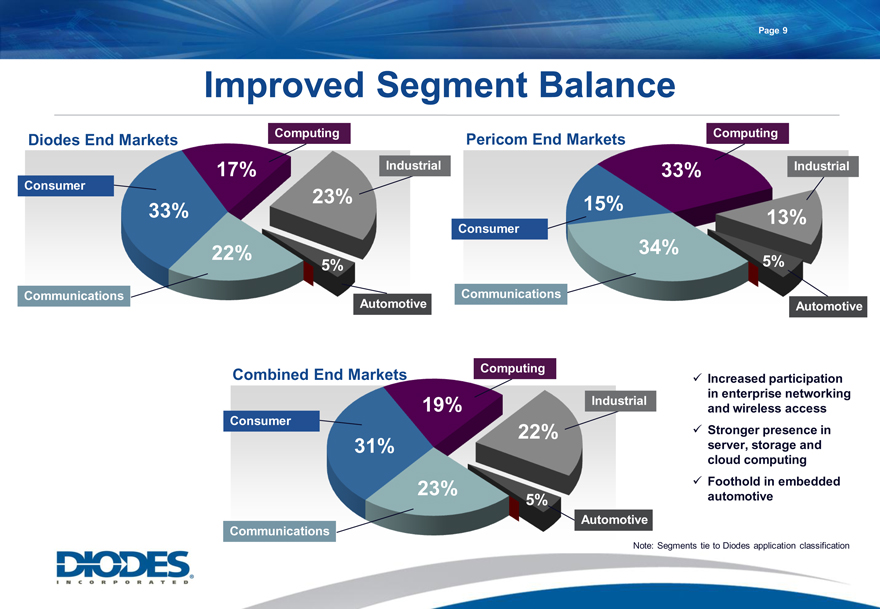

Slide 9: Improved Segment Balance

With Pericom’s presence in networking, server, and storage applications, the combined company will have a more balanced business base across our target end markets . We will see our participation in the communications space increase to 23% of the combined company, with a stronger position in enterprise networking and wireless access. In the computing market, we will see an increase to 19% of our revenue with a shift to large and growing data center applications such as servers, storage, and cloud computing. Pericom’s emerging position in embedded automotive applications will complement Diodes’ strategic push to grow our automotive business.

Slide 10: Global Manufacturing Infrastructure

In terms of manufacturing, our global infrastructure will consist of Diodes’ wafer fabs in Shanghai, China, Kansas City and Oldham, UK; and our packaging facilities in Shanghai, China, Neuhaus, Germany as well as our joint venture packaging facility in Chengdu, China. Pericom will add crystal and crystal oscillator manufacturing sites in Jinan, China and Jhongli, Taiwan.

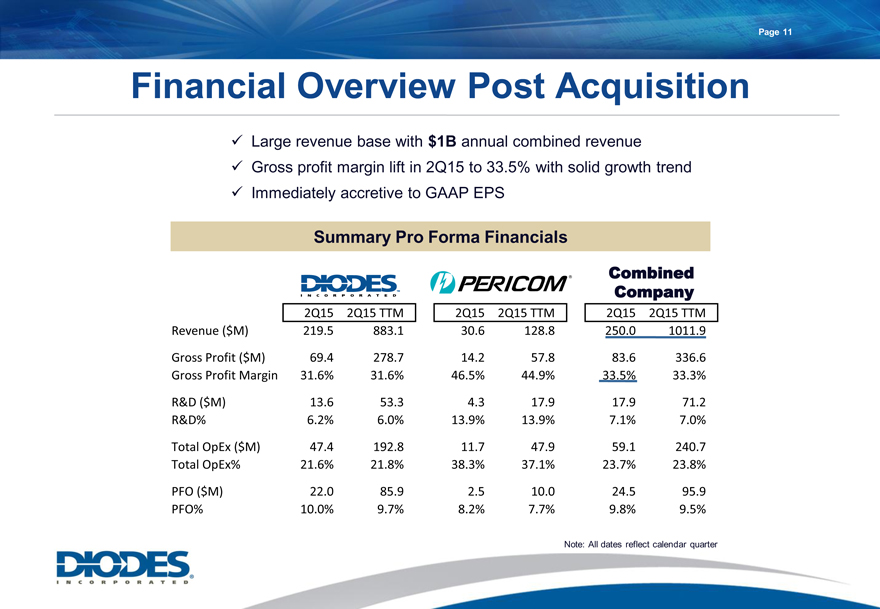

Slide 11: Financial Overview Post Acquisition

This transaction provides Diodes with a larger revenue base as well as the ability to achieve operational synergies to expand our markets and accelerate margin growth. We expect this transaction to be immediately accretive. When looking at pro-forma results based on a calendar year for the combined company, revenue for 2Q15 would have been approximately

Page 11 of 13

$250 million and $1 billion for the trailing twelve months. Gross profit for 2Q15 would expand to approximately $84 million, with an increased gross margin of approximately 33.5%. We believe there is opportunity for further revenue expansion and margin growth through cross-selling and capitalizing on Diodes’ scale advantage within the channel and global sales infrastructure.

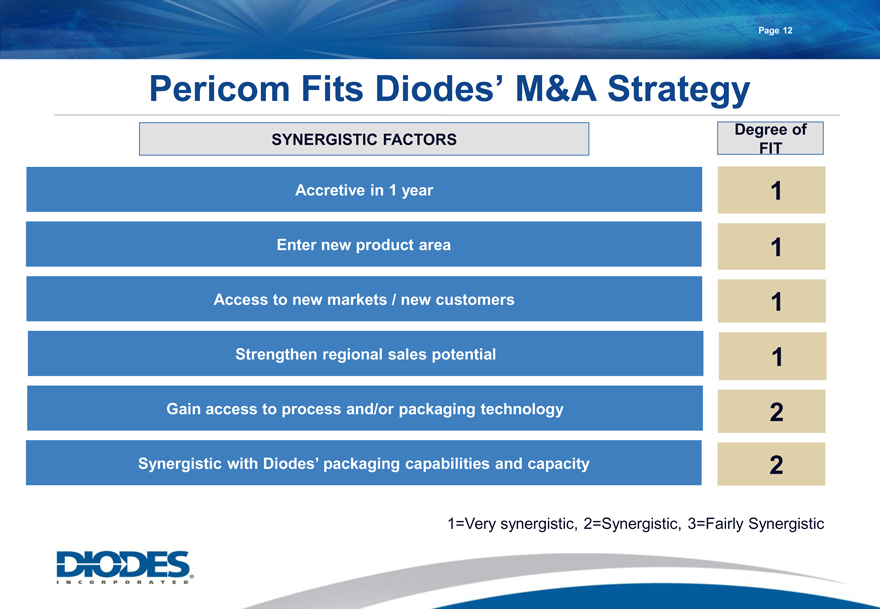

Slide 12: Pericom Fits Diodes’ M&A Strategy

We believe that Pericom Semiconductor is a strong strategic fit and meets the acquisition criteria that we have been consistently communicating to our shareholders and investors:

| 1) | First, the proposed transaction is immediately accretive to earnings, exceeding our typical one year goal for most acquisitions. |

| 2) | It allows us to expand our existing analog portfolio while also expanding into the high speed connectivity product arena as well. |

| 3) | It will provide us with access to additional key customers, and allow us to open several attractive new markets and application spaces. |

| 4) | We will have opportunities for cross-selling as well as revenue expansion by leveraging Diodes’ scale within the channel. |

| 5) | And finally, it gives us additional dedicated manufacturing capability for the crystal and crystal oscillator product lines. |

Page 12 of 13

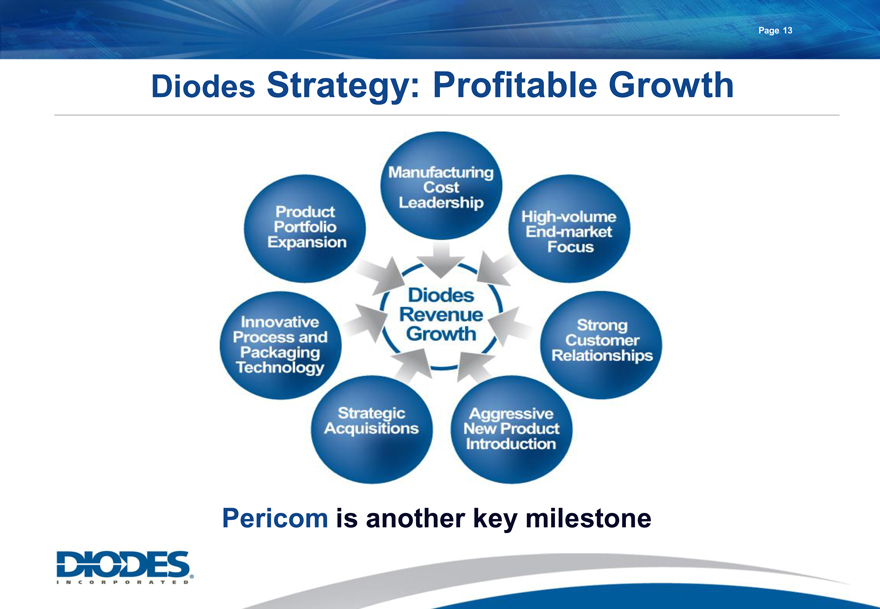

Slide 13: Diodes Strategy: Profitable Growth

To conclude, Diodes’ focus continues to be on generating profitable growth through a combination of manufacturing cost leadership, high volume end market focus, strong customer relationships, aggressive new product introductions, product portfolio expansion, innovative process and packaging technology as well as select strategic acquisitions. Pericom is another key milestone in this growth strategy, and we look forward to the combined company’s success.

With that, we will now open the call for questions.

Q&A Session

Upon Completion of the Q&A…

Thank you to everyone for joining us today. We look forward to providing additional updates regarding the integration of Pericom and the expanded opportunities for Diodes.

Operator, we may now disconnect.

Additional Information and Where to Find It

Pericom intends to file a proxy statement in connection with the merger. Investors and security holders are urged to read the proxy statement when it becomes available because it will contain important information about the transaction. Investors and security holders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at the SEC’s web site atwww.sec.gov. Diodes, Pericom and their

Page 13 of 13

directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Pericom in connection with the merger. Information regarding the special interest of these directors and executive officers in the transaction will be included in the proxy statement described above. Additional information regarding the directors and executive officers of Period is also included in Pericom’s proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on October 16, 2014. Additional information regarding the directors and executive officers of Diodes is also included in Diodes’ proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 16, 2015. These documents are available free of charge at the SEC’s website atwww.sec.gov and as described above.

|

Diodes to Acquire Pericom Semiconductor

September 3, 2015

|

Safe Harbor Statement

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any statements set forth above that are not historical facts are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such statements include statements as to: the expected benefits of the acquisition, including the acquisition being immediately accretive; the efficiencies, cost savings, revenues, and enhanced product offerings, market position, and design and manufacturing capabilities of Diodes after the acquisition; and other statements identified by words such as “estimates,” “expects,” “projects,” “plans,” “will” and similar expressions.

Potential risks and uncertainties include, but are not limited to, such factors as: the possibility that the transaction may not be consummated, including as a result of any of the conditions precedent; the risk of superior acquisition proposal from other parties; the risk of Diodes being unable to obtain sufficient financing from lenders to complete the acquisition; the risk of global market downturn conditions and volatilities impacting the completion of the acquisition or the funding; the risk that Pericom’s business will not be integrated successfully into Diodes’; the risk that the expected benefits of the acquisition may not be realized, including the realization of the accretive effect of the acquisition; the risk that Pericom’s standards, procedures and controls will not be brought into conformance within Diodes’ operation; difficulties coordinating Diodes’ and Pericom’s new product and process development, hiring additional management and other critical personnel, and increasing the scope, geographic diversity and complexity of Diodes’ operations; difficulties in consolidating facilities and transferring processes and know-how; difficulties in reducing the cost of Pericom’s business; the diversion of our management’s attention from the management of our business; Diodes may not be able to maintain its current growth strategy or continue to maintain its current performance, costs and loadings in its manufacturing facilities; risks of domestic and foreign operations, including excessive operation costs, labor shortages, higher tax rates and Diodes’ joint venture prospects; unfavorable currency exchange rates; and the impact of competition and other risk factors relating to our industry and business as detailed from time to time in Diodes’ filings with the United States Securities and Exchange Commission.

Additional Information and Where to Find It

Pericom intends to file a proxy statement in connection with the merger. Investors and security holders are urged to read the proxy statement when it becomes available because it will contain important information about the transaction. Investors and security holders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov. Diodes, Pericom and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Pericom in connection with the merger. Information regarding the special interest of these directors and executive officers in the transaction will be included in the proxy statement described above. Additional information regarding the directors and executive officers of Period is also included in Pericom’s proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on October 16, 2014. Additional information regarding the directors and executive officers of Diodes is also included in Diodes’ proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 16, 2015. These documents are available free of charge at the SEC’s website at www.sec.gov and as described above.

Page 2

|

Page 3

A Winning Combination

A Strong Global Partnership

SYNERGIES

2014 Revenue $891M 2014 Revenue $130M

2014 Gross Margin 31.1% 2014 Gross Margin 42.3%

High volume Discrete,

Analog and Logic products

Cost efficient manufacturing

capabilities

Strong global presence

Broad product and customer

base

3 |

| C’s and industrial with |

emerging focus on

Automotive

Switches, Signal Integrity,

Connectivity and Timing

products

Focus on emerging

connectivity platforms

Deep customer

relationships

Strong presence in

networking and data center

with growing automotive

position

Broader Analog and added

mixed-signal product lines

Expanded platform content in

applications where Diodes is

already strong

Operating Synergies

Technology presence to

advance Diodes product

roadmap

Customer / application space

depth within target markets

|

Page 4

Pericom Semiconductor Highlights

Worldwide semiconductor supplier specializing in the timing, switching,

signal conditioning and bridging of serial high speed signals

Business Overview Comprehensive timing and connectivity solutions for networking,

computing, consumer, and industrial applications

Founded in 1990; IPO 1997 (PSEM) on Nasdaq

Corporate Overview Headquartered in Milpitas, California

Sales offices in US, Taiwan, China, Korea, Singapore, Japan and UK

900 employees; over 100 patents

In-house design centers in North America and Asia

Manufacturing Overview Uses fabless/subcon assembly/test manufacturing model for IC’s, in-house

manufacturing for crystal/oscillator

FY 2015 (6/30/2015) revenues of $129 million

Financial Overview FY 2015 Gross Margin of 44.9%

FY 2015 cash and short-term investments of $129 million

|

Page 5

Transaction Rationale

Increases the analog footprint and adds a strong mixed-signal offering

Extensive timing, switching and signal conditioning solutions

Strengthen Product Offering

Interface product line to complement Diodes’ standard product portfolio

New connectivity platforms and standards

Expanded Application

Added platform value in smart phones, tablets, and notebook computing

Increased position in networking, servers, and embedded automotive

Presence and Depth

Capitalize on deep customer relationships in focus end equipments

Potential profitability improvement through operating and manufacturing efficiencies

Enhanced Scale

Expanded customer and market presence for acquired products through Diodes’ extensive

sales network and channel

Cross-utilization of technology capability and design blocks to accelerate Diodes

Leverage Technology Position

portfolio growth

and Portfolio Breadth

Cross-selling of complementary product lines in emerging applications

In-line with Diodes’ strategy to drive growth through select acquisitions

Growth and Integration

Successful track record of revenue expansion, cost reduction, and business rationalization

Opportunities

(FabTech in 2000, Anachip and APD in 2006, Zetex in 2008, BCD and PAM in 2013)

|

Page 6

Broad Consolidated Product Offering

Discrete

Standard Products

ASSP

Diodes

Rectifiers

Standard Linear

Power Management ICs

Connectivity

Schottky Diodes

Schottky Rectifiers

Linear Voltage Regulators

DC-DC Switching Regulators

Switches

Zener Diodes

Super Barrier Rectifiers

Standard Linear Regulators

Buck

Signal Switches

Switching Diodes

Standard Rectifiers

Quasi Low Dropout Regulators

Boost

Mux controllers

SBRâ Diodes

Fast Recovery Rectifiers

Low Dropout Regulators

Buck/Boost/Inverter

Power Zener Diodes

Bridge Rectifiers

Signal Integrity

Power Rectifier Diodes

Voltage References

AC/DC Solutions

Repeaters

Shunt References

Primary-Side Regulators

ReDrivers

Micropower References

PWM

BJT Switches

Connectivity

MOSFETs

Protection Devices

Current Monitors

Voltage

PCIe Bridges

Small Signal MOSFETs

TVS

Current Output

PCIe Packet Switches

Power MOSFETs

Low CJ TVS

Voltage Output

Power Switches

UARTs

Protected MOSFETs

Thyristor Surge Protection

Load Switches

High Voltage MOSFETS

Data Line Protection

Operational Amplifiers

HDMI Switches

Sensors

Complementary Pairs

Hall Switches

H-Bridges

Comparators

USB

Hall Latches

IntelliFETâ

USB Switches

Smart Fan Drivers

Timing Products

Charging control

Motor Controllers

Clocks

Temperature Sensors

Timer ICs

LED Drivers

Magnetic Sensors

Bipolar Transistors

Function Specific Arrays

Crystals

Charge Pump

Small Signal BJT

Relay Drivers

Oscillators

Boost

Digital Broadcast by Satellite

Pre-biased BJT

Discrete Load Switches

Buck

Fixed Bias Generators

Medium Power BJT

Discrete Voltage Regulators

Standard Logic ICs

Linear LED Drivers

Switched Bias Generators

High Power BJT

MOSFET Gate-Drivers

Single Gate

LED backlighting

Multiplex Controllers

Darlington Transistors

Dual Gate

Integrated Switch Matrix

Gate-Drivers

Standard Logic

Power Supply

DBS Interface

Low Saturation BJT

Translaters

MOSFET Controllers

STB Power

H-Bridges

Analog Switches

Active OR-ing Controllers

Registers

Chargers

Audio

Class D Amplifiers

Analog Input Amplifiers

IntelliFET and SBR are the registered trademark of Diodes Incorporated and its affiliates.

|

Page 7

Pericom Total Timing Solutions

Comprehensive portfolio for complete clock tree solutions

Highest frequency clock buffers

Low voltage, low power clock generators Real time clock (RTC) generators Programmable crystal oscillators Ultra low jitter crystal oscillators Temperature compensated crystal oscillators

Timing solutions for attractive markets

Cloud computing / server storage Embedded automotive infotainment Internet of Things (IoT)

Owned manufacturing for advantaged cost infrastructure

Integrated operations for crystal and crystal oscillator manufacturing

Automated and automotive-certified facility in Taiwan focuses on crystal oscillators Fully automated facility in Jinan, China focuses on crystal manufacturing

|

Page 8

USB Type C Connector

Highly Attractive Market Opportunity

10Gbps reversible connector: single USB cable for data, audio, video and power Driven by next generation mobility platforms: notebook, smart phone, tablet, portable consumer

Flexible “charge anywhere” approach to personal electronics

Will drive conversion in storage, server, and Ultra HD displays

Combined Diodes+Pericom offers complete system solution

Extensive Pericom offering for USB connectivity:

High performance cross bar signal switches

USB3 / DisplayPort1.2 ReDrivers

USB charging controllers High bandwidth USB3.1 multiplex/demultiplex

Plug orientation detectors

Diodes USB portfolio focused on power management:

USB power switches Transient voltage suppressors

ACDC primary side controllers Power MOSFETs Active rectifier

DisplayPort

USB Type A

USB Type B USB Type C

All-in-One

Connector

USB Micro B

Power

|

Page 9

Improved Segment Balance

Diodes End Markets Computing

17% Industrial

Consumer

23%

33%

22%

5%

Communications Automotive

Pericom End Markets Computing

33% Industrial

15%

13%

Consumer

34%

5%

Communications

Automotive

Com Computing

19% Industrial

Consumer

22%

31%

23% 5%

Automotive

Communications

Increased participation in enterprise networking and wireless access Stronger presence in server, storage and cloud computing Foothold in embedded automotive

Note: Segments tie to Diodes application classification

|

Page 10

Neuhaus, Germany

Packaging Chengdu, China

Packaging

2 |

|

Oldham, UK 3 Jinan, China

Wafer Fab Crystal Fab, Packaging

1 |

| 1 |

4 |

| Shanghai, China |

5 |

| 6 Wafer Fab |

Kansas City, MO 2 Shanghai, China

Wafer Fab Packaging

Jhongli, Taiwan

Oscillator Module Packaging

1 |

|

1 |

|

|

Page 11

Financial Overview Post Acquisition

Large revenue base with $1B annual combined revenue

Gross profit margin lift in 2Q15 to 33.5% with solid growth trend Immediately accretive to GAAP EPS

Summary Pro Forma Financials

Combined

Company

2Q15 2Q15 TTM 2Q15 2Q15 TTM 2Q15 2Q15 TTM

Revenue ($M) 219.5 883.1 30.6 128.8 250.0 1011.9

Gross Profit ($M) 69.4 278.7 14.2 57.8 83.6 336.6

Gross Profit Margin 31.6% 31.6% 46.5% 44.9% 33.5% 33.3%

R&D ($M) 13.6 53.3 4.3 17.9 17.9 71.2

R&D% 6.2% 6.0% 13.9% 13.9% 7.1% 7.0%

Total OpEx ($M) 47.4 192.8 11.7 47.9 59.1 240.7

Total OpEx% 21.6% 21.8% 38.3% 37.1% 23.7% 23.8%

PFO ($M) 22.0 85.9 2.5 10.0 24.5 95.9

PFO% 10.0% 9.7% 8.2% 7.7% 9.8% 9.5%

Note: All dates reflect calendar quarter

|

Page 11

Pericom Fits Diodes’ M&A Strategy

Degree of

SYNERGISTIC FACTORS FIT

Accretive in 1 year 1

Enter new product area 1

Access to new markets / new customers 1

Strengthen regional sales potential 1

Gain access to process and/or packaging technology 2

Synergistic with Diodes’ packaging capabilities and capacity 2

1=Very synergistic, 2=Synergistic, 3=Fairly Synergistic

|

Page 13

Diodes Strategy: Profitable Growth

Pericom is another key milestone

|

Thank you

Company Contact:

Diodes Incorporated Laura Mehrl Director of Investor Relations P: 972-987-3959

E: laura_mehrl@diodes.com

Investor Relations Contact:

Shelton Group

Leanne K. Sievers EVP, Investor Relations P: 949-224-3874

E: lsievers@diodes.com

www.diodes.com