Investor Relations Presentation February, 2015 Exhibit 99.3

Safe Harbor Statement Page Any statements set forth herein that are not historical facts are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding update to Diodes Incorporated’s first quarter 2015 business outlook as of February 11, 2015, which includes the following: expect revenue to be range between $206 million and $220 million, or down 1.6 percent to 7.9 percent sequentially due to normal seasonality combined with the currency impact from a stronger U.S. dollar; expect gross profit margin to be 30.5 percent, plus or minus 2 percent; operating expenses are expected to be approximately 23.2 percent of revenue, plus or minus 1 percent; expect income tax rate to be 28 percent, plus or minus 3 percent, and shares used to calculate diluted EPS for the first quarter to be approximately 49 million; and other statements identified by words such as “estimates,” “expects,” “projects,” “plans,” “will” and similar expressions. Potential risks and uncertainties include, but are not limited to, such factors as: the risk that such expectations may not be met: the risk that the expected benefits of acquisitions may not be realized; Diodes’ business and growth strategy; the introduction and market reception to new product announcements; fluctuations in product demand and supply; prospects for the global economy; continued introduction of new products; Diodes’ ability to maintain customer and vendor relationships; technological advancements; impact of competitive products and pricing; growth in targeted markets; successful integration of acquired companies and/or assets; Diodes’ ability to successfully make additional acquisitions; risks of domestic and foreign operations, including excessive operation costs, labor shortages, higher tax rates and joint venture prospects; unfavorable currency exchange rates; availability of tax credits; Diodes’ ability to maintain its current growth strategy or continue to maintain its current performance and loadings in manufacturing facilities; our future guidance may be incorrect; the global economic weakness may be more severe or last longer than Diodes currently anticipate; and other information, including the “Risk Factors,” detailed from time to time in filings with the United States Securities and Exchange Commission. This presentation also contains non-GAAP measures. See the Company’s press release on February 11, 2015 titled, “Diodes Incorporated Reports Fourth Quarter and Fiscal 2014 Financial Results” for detailed information related to the Company’s non-GAAP measures and a reconciliation of GAAP net income to non-GAAP net income.

Management Representative Page Dr. Keh-Shew Lu President and CEO President and CEO Since 2005 Texas Instruments 28 years Experience: Senior Vice President of TI Worldwide Analog and Logic President of Texas Instruments – Asia Education: Master's Degree and Doctorate in Electrical Engineering Texas Tech University Bachelor's Degree in Engineering National Cheng Kung University - Taiwan

Company Representative Page Laura Mehrl Director of Investor Relations Since May 2010 Experience: Director of Investor Relations, Diodes Incorporated, Plano, Texas Senior Business Development Manager, STMicroelectronics, Carrollton, Texas Sales Director for Analog Devices Inc., Shanghai, China Product Marketing Manager at Texas Instruments (TI), Dallas, Texas Senior Engineer at Lattice Semiconductor Inc., Hillsboro, Oregon Wafer fab design engineer and product engineer at TI, Lubbock, Texas Education: MBA with concentration in International Marketing, Texas Tech University BS in Electrical and Computer Engineering, University of Iowa

Page A leading global manufacturer and supplier of high-quality application specific, standard products within the broad discrete, logic and analog markets, serving the consumer, computing, communications, Industrial and automotive segments. About Diodes Incorporated

Business Objective To consistently achieve above-market profitable growth, utilizing our innovative and cost-effective packaging and silicon technology, suited for high volume, high growth markets by leveraging process expertise and design excellence to deliver high quality semiconductor products. Page

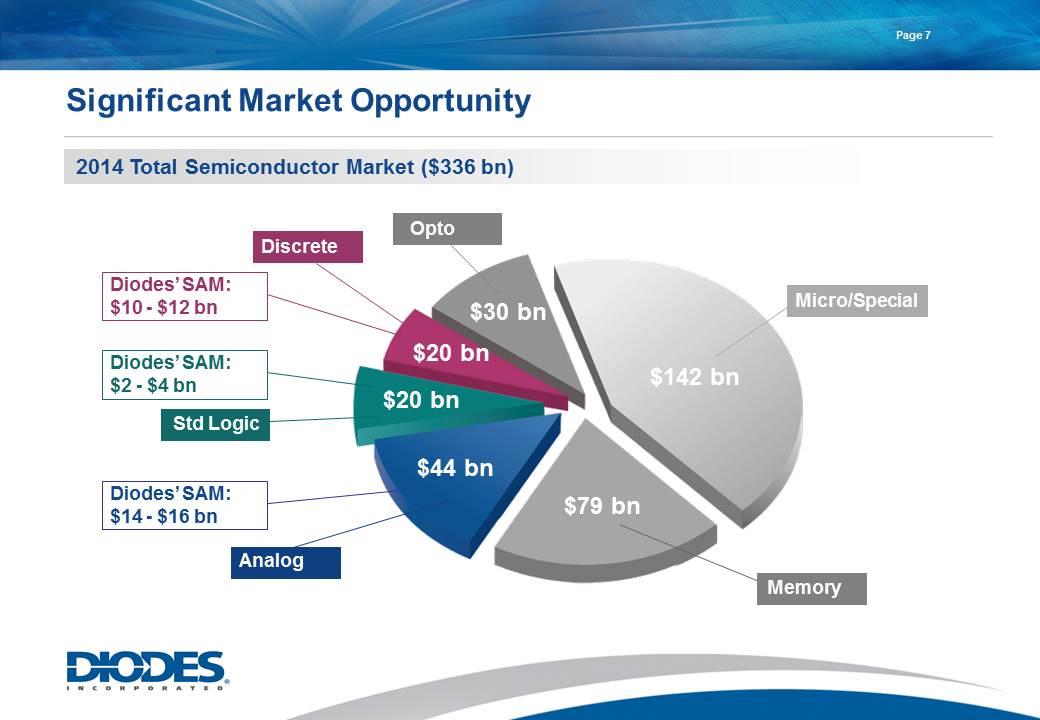

2014 Total Semiconductor Market ($336 bn) Significant Market Opportunity Page $142 bn $30 bn $79 bn $44 bn $20 bn Diodes’ SAM: $10 - $12 bn Diodes’ SAM: $14 - $16 bn Opto $20 bn Std Logic Analog Discrete Micro/Special Memory Diodes’ SAM: $2 - $4 bn

Diodes Growth Strategy Page Many Paths for Growth: Product Portfolio Product arena Product line expansion Performance enhancement Application Space Targeted end equipment Broad customer base Increased product coverage Packaging Breadth Broad packaging portfolio Increased power density Small form factor

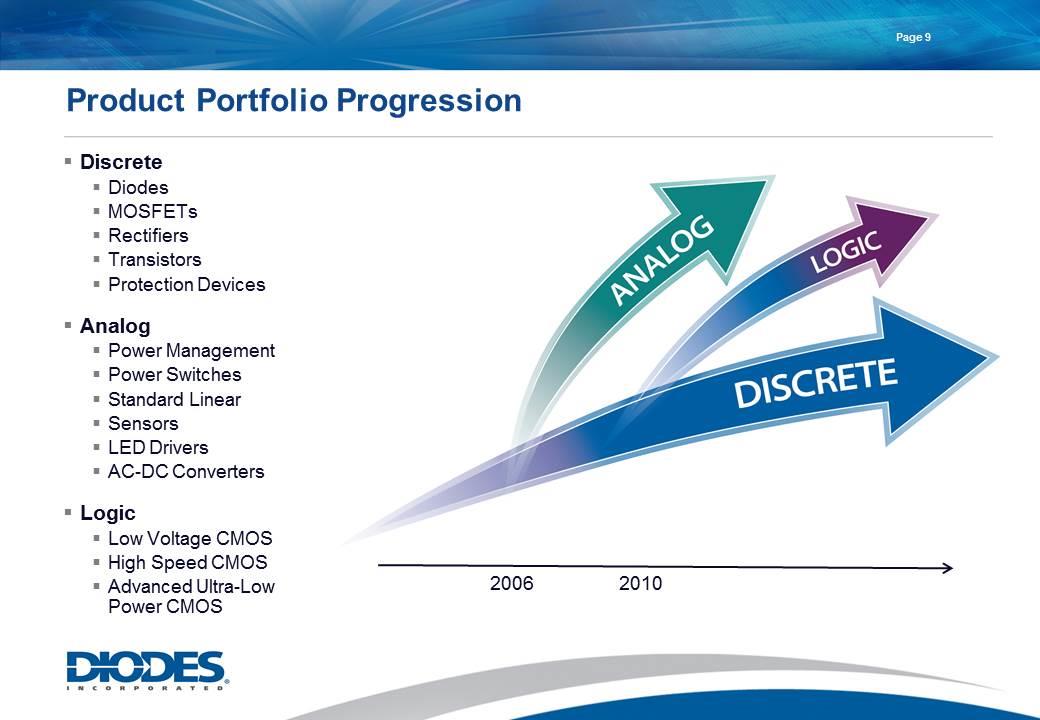

2006 2010 Product Portfolio Progression Page Discrete Diodes MOSFETs Rectifiers Transistors Protection Devices Analog Power Management Power Switches Standard Linear Sensors LED Drivers AC-DC Converters Logic Low Voltage CMOS High Speed CMOS Advanced Ultra-Low Power CMOS

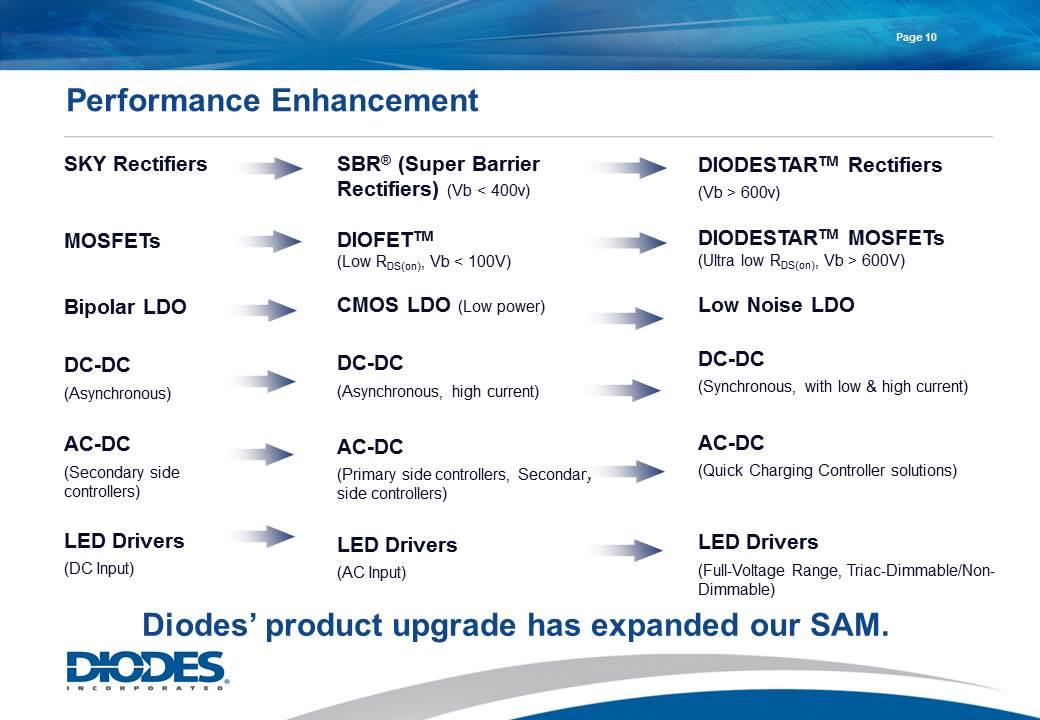

SKY Rectifiers MOSFETs Bipolar LDO DC-DC (Asynchronous) AC-DC (Secondary side controllers) LED Drivers (DC Input) Performance Enhancement Page Diodes’ product upgrade has expanded our SAM. SBR® (Super Barrier Rectifiers) (Vb < 400v) DIOFETTM (Low RDS(on), Vb < 100V) CMOS LDO (Low power) DC-DC (Asynchronous, high current) AC-DC (Primary side controllers, Secondary side controllers) LED Drivers (AC Input) DIODESTARTM Rectifiers (Vb > 600v) DIODESTARTM MOSFETs (Ultra low RDS(on), Vb > 600V) Low Noise LDO DC-DC (Synchronous, with low & high current) AC-DC (Quick Charging Controller solutions) LED Drivers (Full-Voltage Range, Triac-Dimmable/Non-Dimmable)

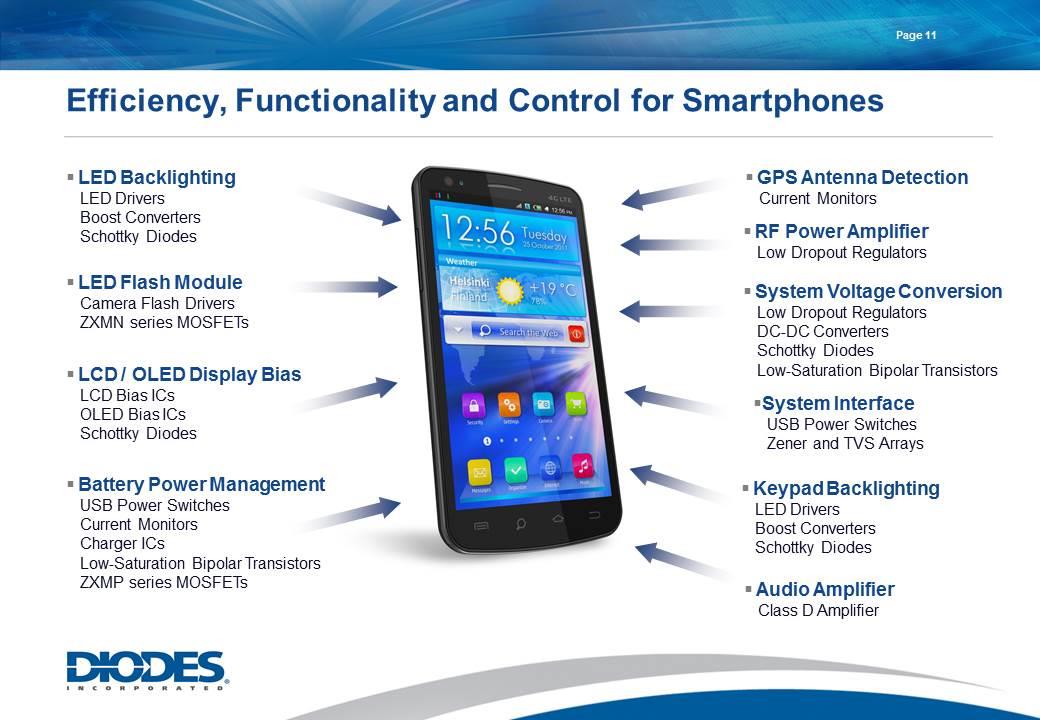

Efficiency, Functionality and Control for Smartphones Page LED Backlighting LED Drivers Boost Converters Schottky Diodes LCD / OLED Display Bias LCD Bias ICs OLED Bias ICs Schottky Diodes LED Flash Module Camera Flash Drivers ZXMN series MOSFETs Keypad Backlighting LED Drivers Boost Converters Schottky Diodes System Voltage Conversion Low Dropout Regulators DC-DC Converters Schottky Diodes Low-Saturation Bipolar Transistors GPS Antenna Detection Current Monitors Battery Power Management USB Power Switches Current Monitors Charger ICs Low-Saturation Bipolar Transistors ZXMP series MOSFETs RF Power Amplifier Low Dropout Regulators Audio Amplifier Class D Amplifier System Interface USB Power Switches Zener and TVS Arrays

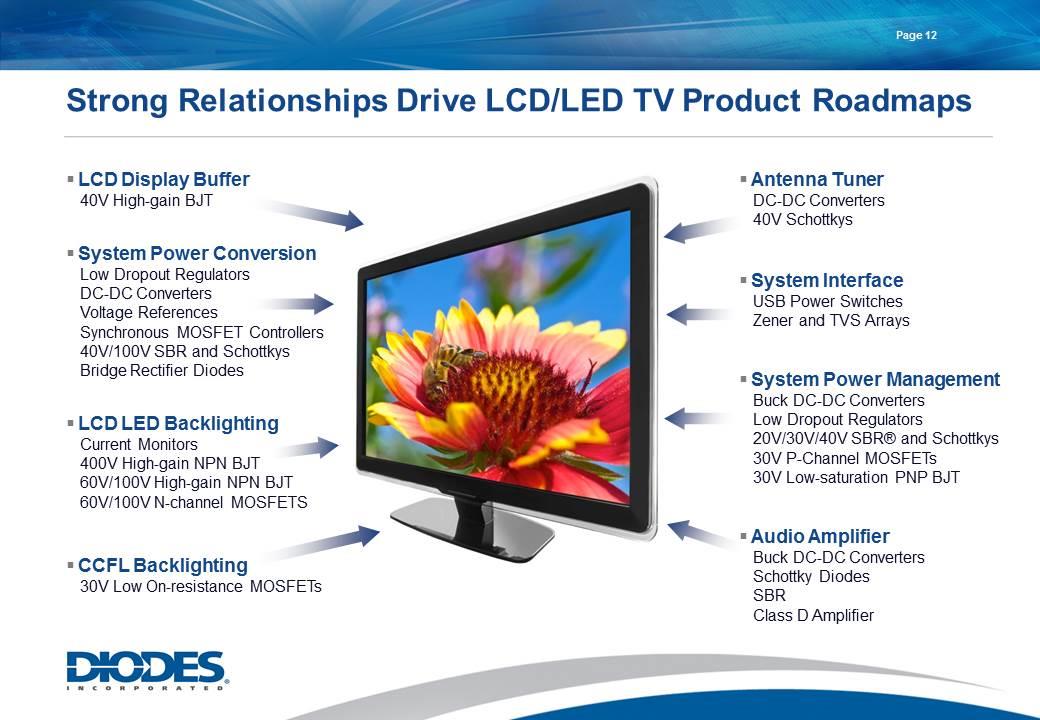

Page Strong Relationships Drive LCD/LED TV Product Roadmaps LCD Display Buffer 40V High-gain BJT System Power Conversion Low Dropout Regulators DC-DC Converters Voltage References Synchronous MOSFET Controllers 40V/100V SBR and Schottkys Bridge Rectifier Diodes LCD LED Backlighting Current Monitors 400V High-gain NPN BJT 60V/100V High-gain NPN BJT 60V/100V N-channel MOSFETS CCFL Backlighting 30V Low On-resistance MOSFETs System Interface USB Power Switches Zener and TVS Arrays System Power Management Buck DC-DC Converters Low Dropout Regulators 20V/30V/40V SBR® and Schottkys 30V P-Channel MOSFETs 30V Low-saturation PNP BJT Antenna Tuner DC-DC Converters 40V Schottkys Audio Amplifier Buck DC-DC Converters Schottky Diodes SBR Class D Amplifier

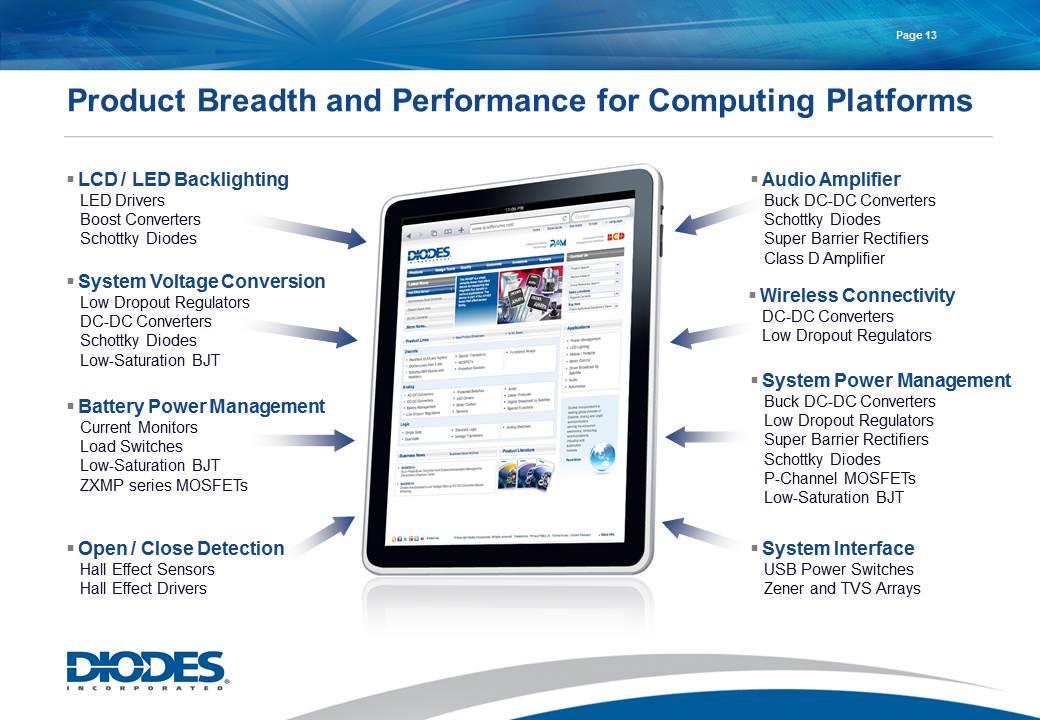

Page Product Breadth and Performance for Computing Platforms LCD / LED Backlighting LED Drivers Boost Converters Schottky Diodes Battery Power Management Current Monitors Load Switches Low-Saturation BJT ZXMP series MOSFETs System Voltage Conversion Low Dropout Regulators DC-DC Converters Schottky Diodes Low-Saturation BJT Open / Close Detection Hall Effect Sensors Hall Effect Drivers System Power Management Buck DC-DC Converters Low Dropout Regulators Super Barrier Rectifiers Schottky Diodes P-Channel MOSFETs Low-Saturation BJT System Interface USB Power Switches Zener and TVS Arrays Audio Amplifier Buck DC-DC Converters Schottky Diodes Super Barrier Rectifiers Class D Amplifier Wireless Connectivity DC-DC Converters Low Dropout Regulators

Page Automotive Networking ESD Protection TVS Protection Seat Control Module Hall Sensor SBR IntelliFET® Voltage Reference Body Control Module Bipolar Transistors Shunt Regulator Voltage Reference IntelliFET MOSFETs Hall Sensor Braking Control Unit Voltage Reference IntelliFETs MOSFETs Hall Sensor Powertrain MOSFET Hall Sensor Super Barrier Rectifier® (SBR) Daytime Running Lights LED Drivers Schottky Diodes MOSFETs Bipolar Transistors Interior Light LED Drivers Schottky Diodes MOSFETs Bipolar Transistors SBR and IntelliFET are registered trademarks of Diodes Incorporated Automotive Quality for Demanding Automotive Applications

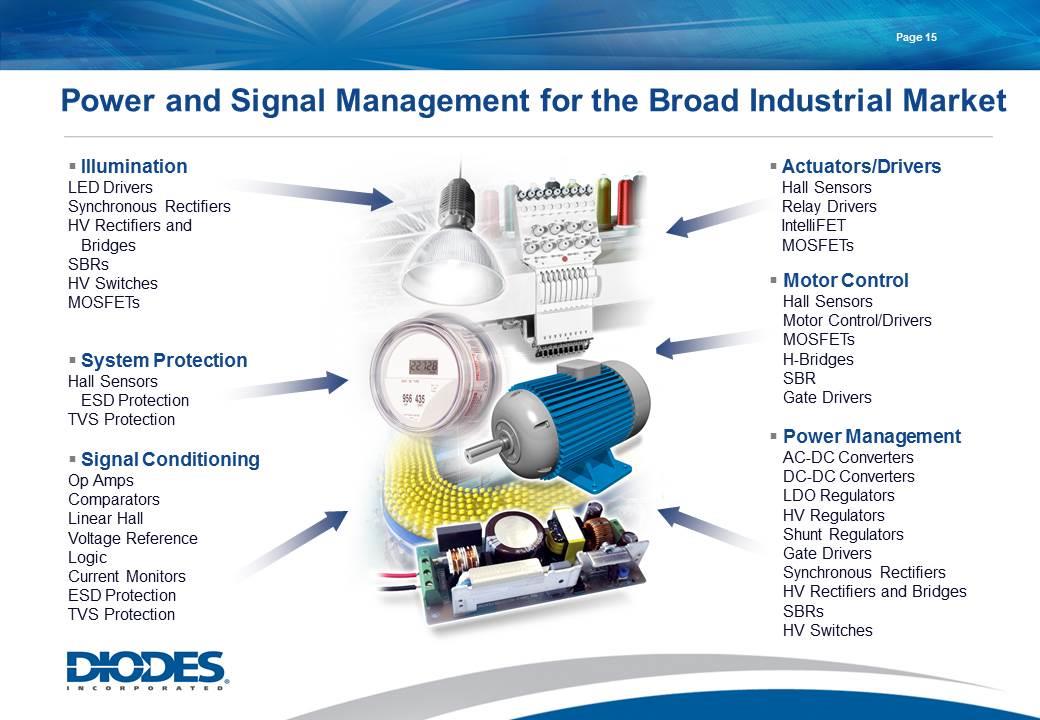

Page Power and Signal Management for the Broad Industrial Market Power Management AC-DC Converters DC-DC Converters LDO Regulators HV Regulators Shunt Regulators Gate Drivers Synchronous Rectifiers HV Rectifiers and Bridges SBRs HV Switches Signal Conditioning Op Amps Comparators Linear Hall Voltage Reference Logic Current Monitors ESD Protection TVS Protection Illumination LED Drivers Synchronous Rectifiers HV Rectifiers and Bridges SBRs HV Switches MOSFETs System Protection Hall Sensors ESD Protection TVS Protection Motor Control Hall Sensors Motor Control/Drivers MOSFETs H-Bridges SBR Gate Drivers Actuators/Drivers Hall Sensors Relay Drivers IntelliFET MOSFETs

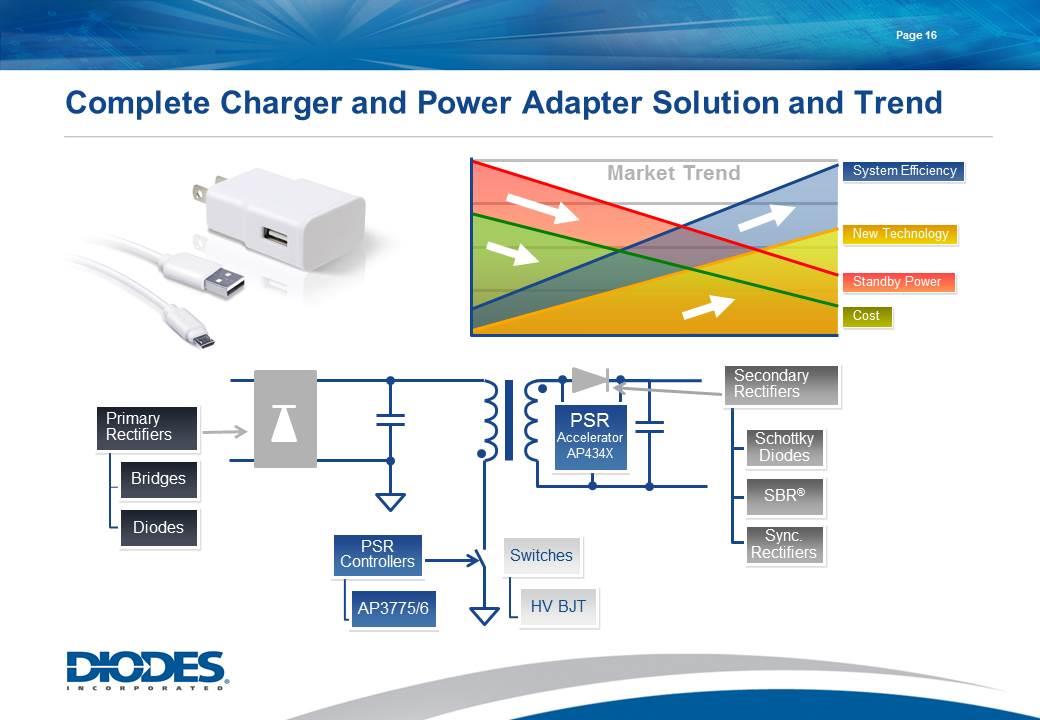

Page Market Trend Complete Charger and Power Adapter Solution and Trend Primary Rectifiers Bridges Diodes Switches HV BJT PSR Controllers AP3775/6 Secondary Rectifiers Schottky Diodes SBR® Sync. Rectifiers Standby Power Cost System Efficiency New Technology PSR Accelerator AP434X

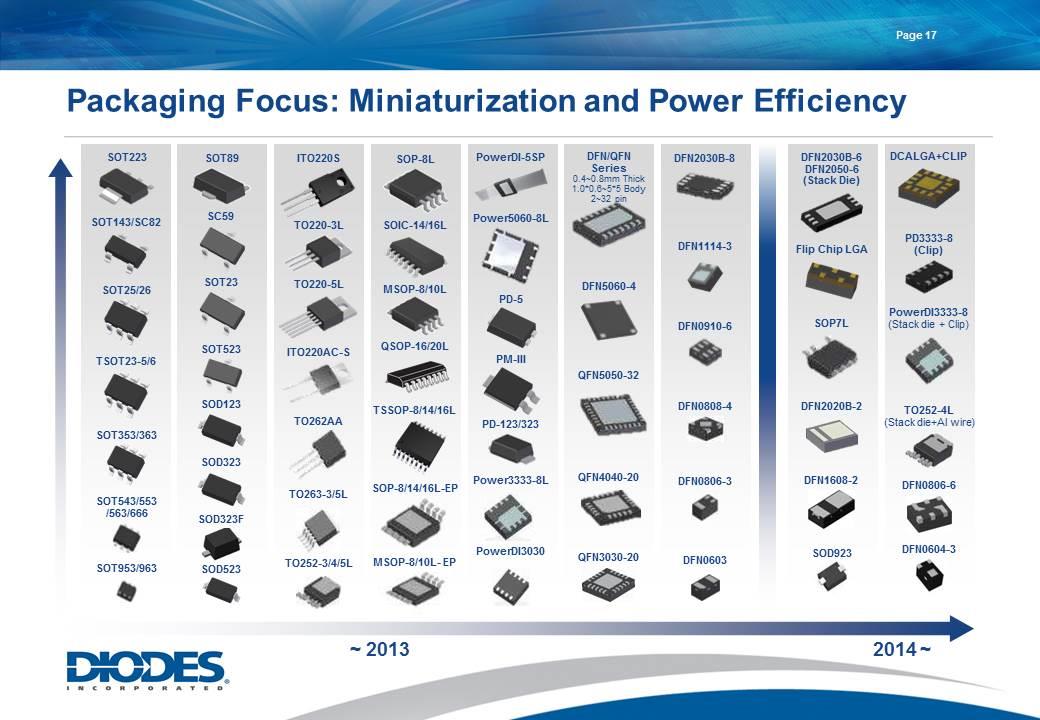

TSSOP-8/14/16L SOT89 SC59 SOD323 SOT353/363 SOT143/SC82 SOT543/553 /563/666 PM-III SOT223 ~ 2013 SOT953/963 QSOP-16/20L TSOT23-5/6 DFN0603 PowerDI-5SP Power5060-8L ITO220AC-S DFN1114-3 DFN5060-4 Power3333-8L DFN0808-4 DFN0806-3 PD-123/323 PowerDI3030 MSOP-8/10L TO263-3/5L TO220-3L DFN/QFN Series 0.4~0.8mm Thick 1.0*0.6~5*5 Body 2~32 pin DFN0910-6 DFN2030B-8 SOP-8/14/16L-EP MSOP-8/10L- EP TO252-3/4/5L SOD523 SOD323F SOIC-14/16L TO220-5L ITO220S TO262AA QFN5050-32 SOP-8L QFN4040-20 PD-5 SOT23 SOT523 SOT25/26 PowerDI3333-8 (Stack die + Clip) DFN2030B-6 DFN2050-6 (Stack Die) DFN0604-3 SOD923 PD3333-8 (Clip) SOP7L DFN2020B-2 2014 ~ TO252-4L (Stack die+Al wire) DCALGA+CLIP Flip Chip LGA SOD123 QFN3030-20 DFN1608-2 DFN0806-6 Packaging Focus: Miniaturization and Power Efficiency Page

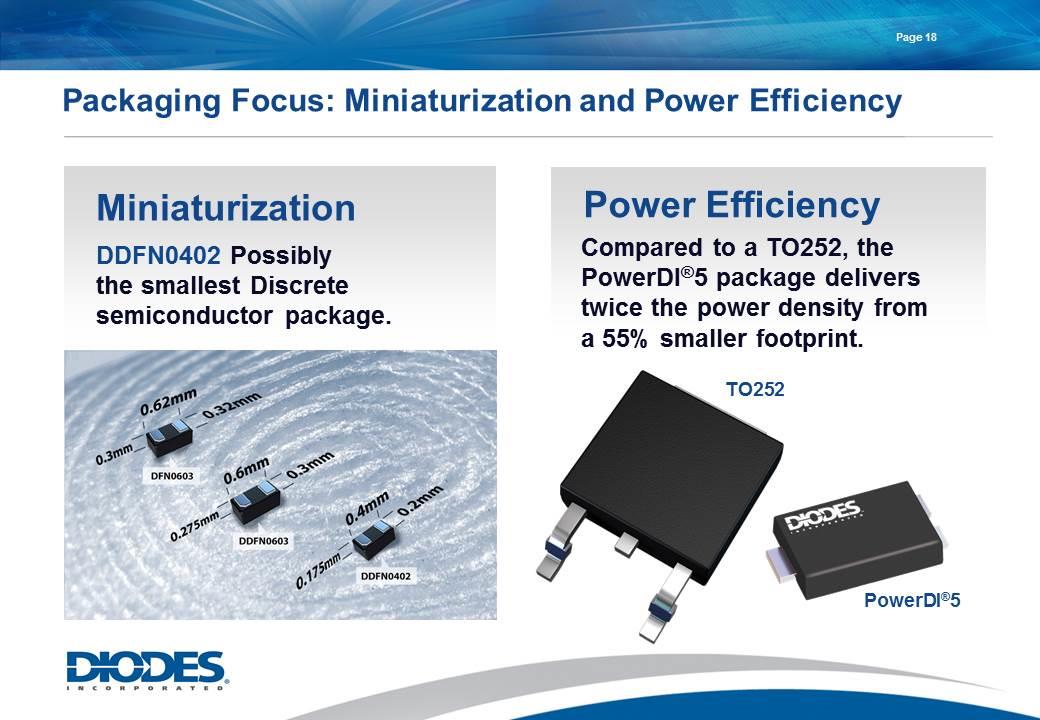

Page Packaging Focus: Miniaturization and Power Efficiency Power Efficiency Miniaturization DDFN0402 Possibly the smallest Discrete semiconductor package. Compared to a TO252, the PowerDI®5 package delivers twice the power density from a 55% smaller footprint. PowerDI®5 TO252

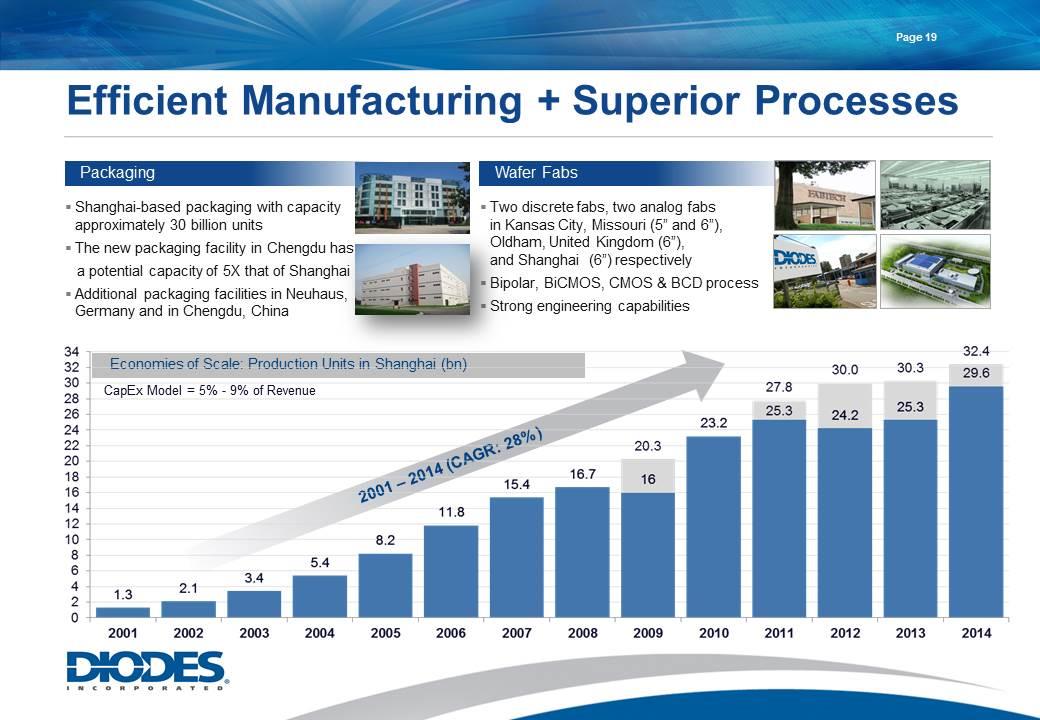

Page Shanghai-based packaging with capacity approximately 30 billion units The new packaging facility in Chengdu has a potential capacity of 5X that of Shanghai Additional packaging facilities in Neuhaus, Germany and in Chengdu, China Two discrete fabs, two analog fabs in Kansas City, Missouri (5” and 6”), Oldham, United Kingdom (6”), and Shanghai (6”) respectively Bipolar, BiCMOS, CMOS & BCD process Strong engineering capabilities CapEx Model = 5% - 9% of Revenue Packaging Wafer Fabs Economies of Scale: Production Units in Shanghai (bn) 2001 – 2014 (CAGR: 28%) Efficient Manufacturing + Superior Processes

Collaborative Customer Relationships Page Quanta Hon Hai

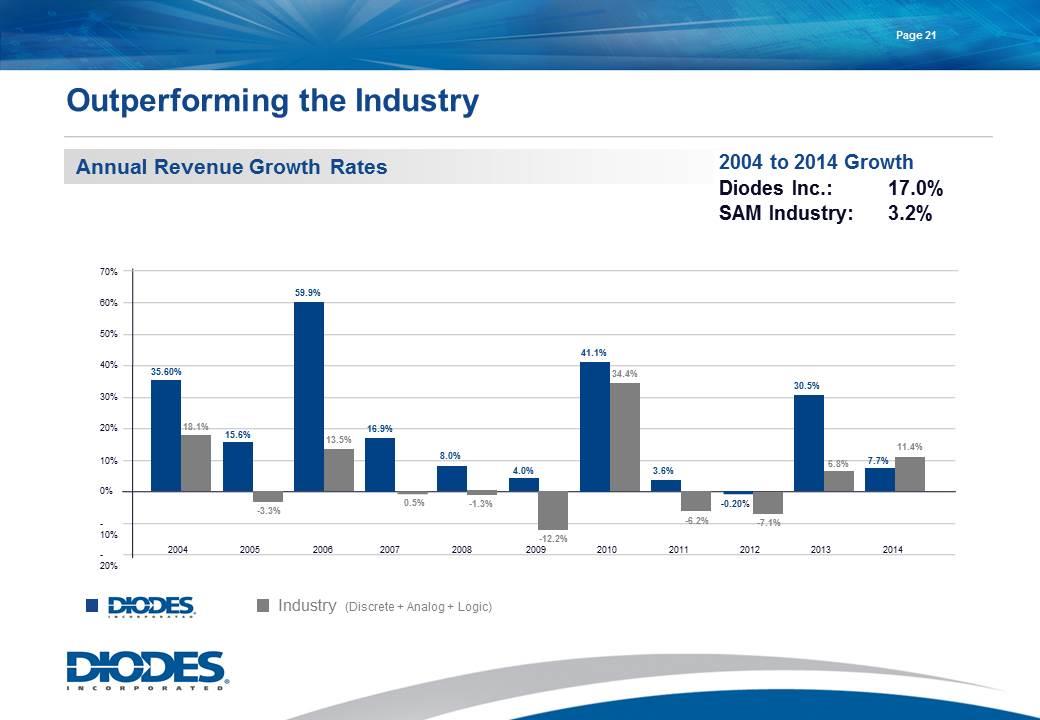

Annual Revenue Growth Rates Outperforming the Industry Page Industry (Discrete + Analog + Logic) 2004 to 2014 Growth Diodes Inc.: 17.0% SAM Industry: 3.2% 70% 60% 50% 40% 30% 20% 10% 0% -10% -20% 35.60% 18.1% 15.6% -3.3% 59.9% 13.5% 16.9% 0.5% 8.0% -1.3% 4.0% -12.2% 41.1% 34.4% 3.6% -6.2% -0.20% -7.1% 30.5% 6.8% 7.7% 11.4% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

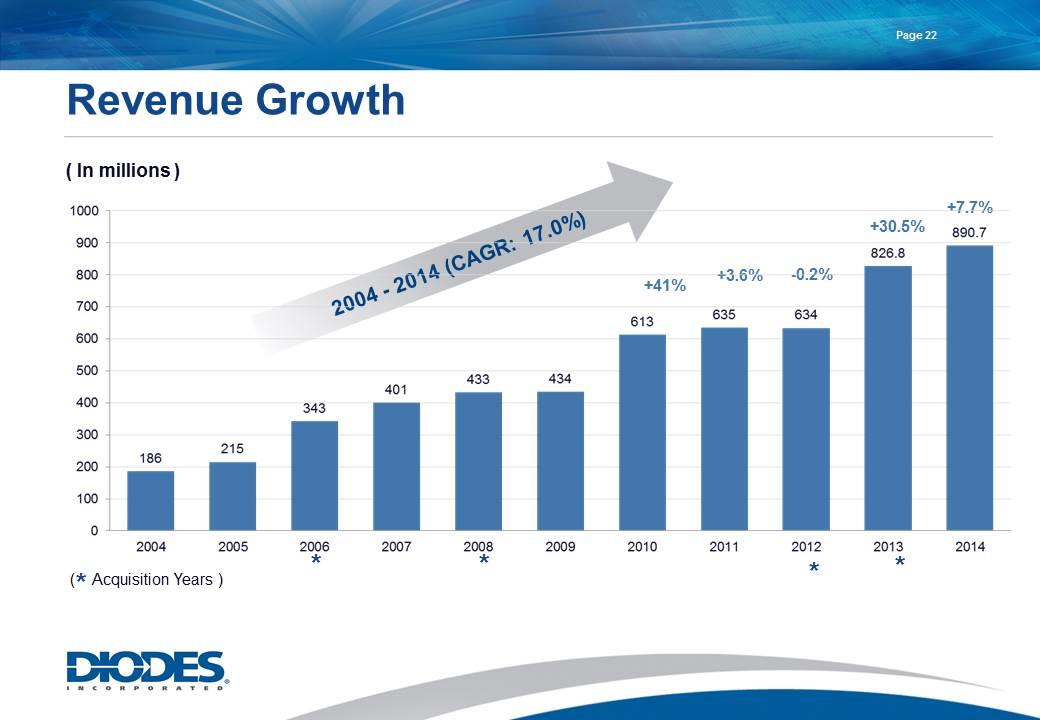

Revenue Growth ( In millions ) +41% +3.6% -0.2% +7.7% ( Acquisition Years ) * * * * * +30.5% Page

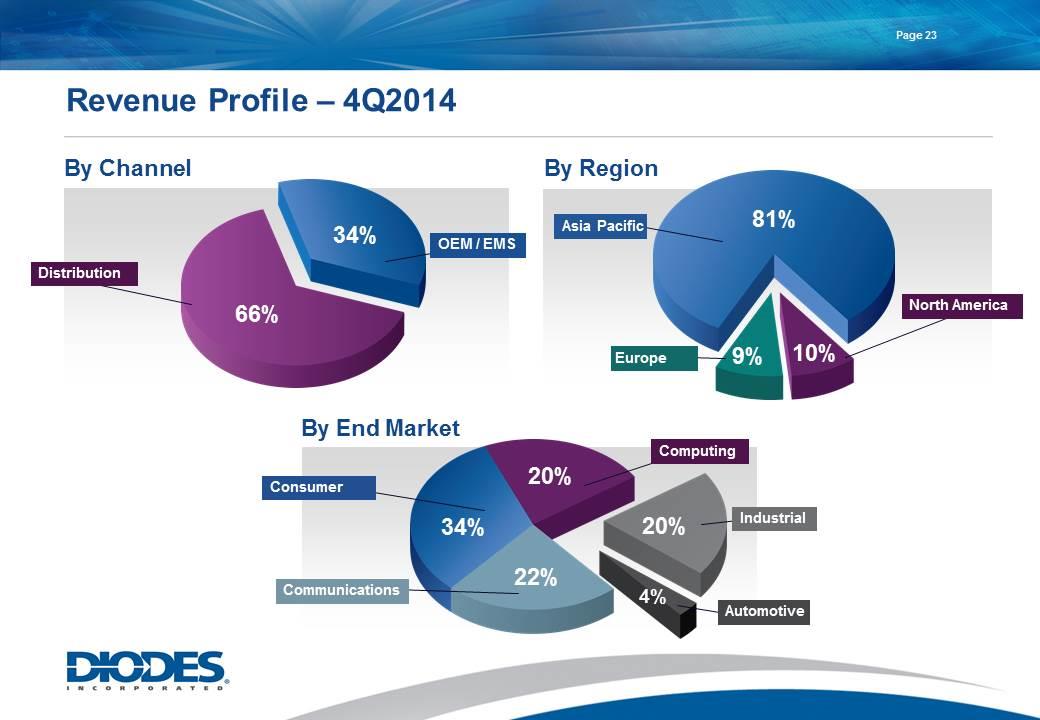

Revenue Profile – 4Q2014 By Channel By Region By End Market Page 10% 81% 9% Asia Pacific Europe North America 66% 34% Distribution OEM / EMS 20% 20% 22% 34% 4% Industrial Consumer Communications Automotive Computing

Page Year 2014 Highlights Revenue grew to a record $890.7 million, an increase of 7.7 percent over the $826.8 million in 2013; Gross profit was a record 277.3 million compared to $237.8 million in 2013; GAAP gross margin was 31.1 percent compared to 28.8 percent in 2013; GAAP net income was $63.7 million, or $1.31 per diluted share, compared to $26.5 million, or $0.56 per diluted share in 2013; Non-GAAP adjusted net income was a $70.1 million, or $1.44 per diluted share, compared to $50.1 million, or $1.05 per diluted share in 2013; Excluding $9.2 million, net of tax, share-based compensation expense, both GAAP income and non-GAAP adjusted net income would have increased by $0.19 per diluted share; Achieved $134.1 million cash flow from operations and $76.4 millions free cash flow, including $58.9 million of capital expenditures. Net cash flow was $46.4 million, which includes the pay down of $42.7million of long-term debt to $140.8 million

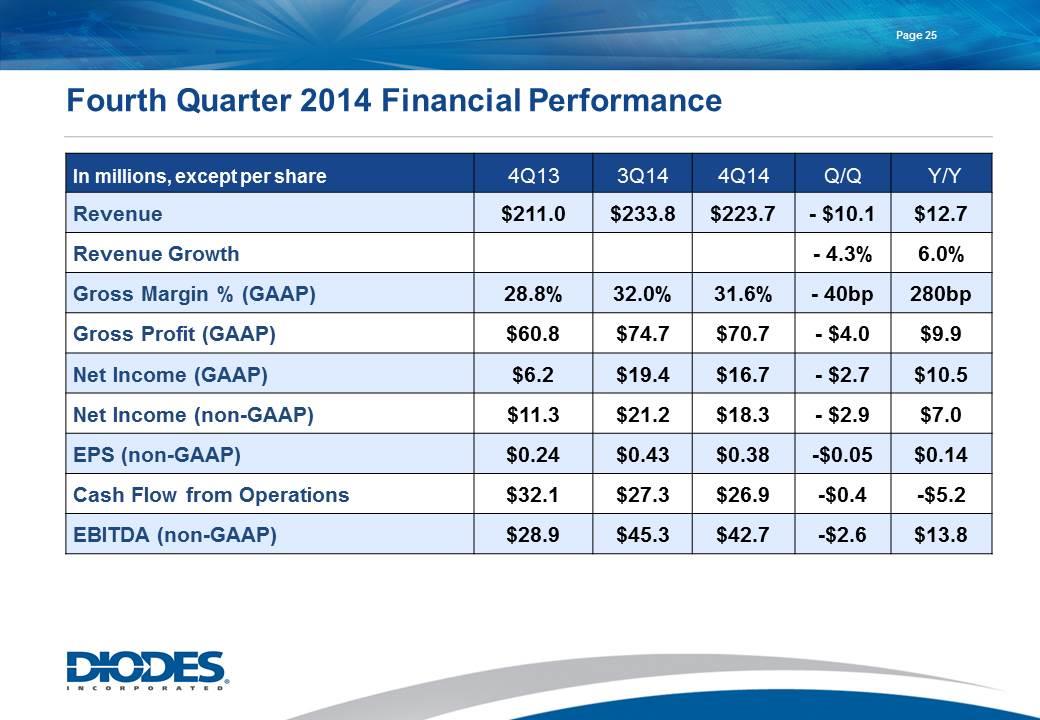

Fourth Quarter 2014 Financial Performance Page In millions, except per share 4Q13 3Q14 4Q14 Q/Q Y/Y Revenue $211.0 $233.8 $223.7 - $10.1 $12.7 Revenue Growth - 4.3% 6.0% Gross Margin % (GAAP) 28.8% 32.0% 31.6% - 40bp 280bp Gross Profit (GAAP) $60.8 $74.7 $70.7 - $4.0 $9.9 Net Income (GAAP) $6.2 $19.4 $16.7 - $2.7 $10.5 Net Income (non-GAAP) $11.3 $21.2 $18.3 - $2.9 $7.0 EPS (non-GAAP) $0.24 $0.43 $0.38 -$0.05 $0.14 Cash Flow from Operations $32.1 $27.3 $26.9 -$0.4 -$5.2 EBITDA (non-GAAP) $28.9 $45.3 $42.7 -$2.6 $13.8

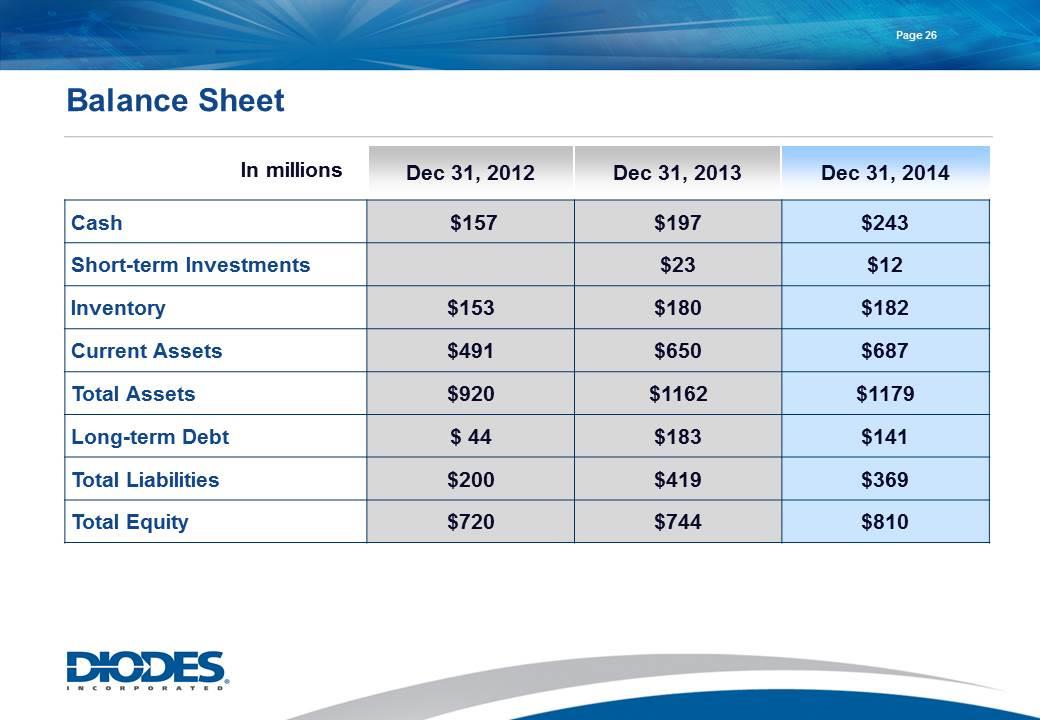

Balance Sheet Page Dec 31, 2013 Cash $157 $197 $243 Short-term Investments $23 $12 Inventory $153 $180 $182 Current Assets $491 $650 $687 Total Assets $920 $1162 $1179 Long-term Debt $ 44 $183 $141 Total Liabilities $200 $419 $369 Total Equity $720 $744 $810 Dec 31, 2014 In millions Dec 31, 2012

Page Expect revenue to range between $206 million and $220 million, or down 1.6 percent to 7.9 percent sequentially due to normal seasonality combined with the currency impact from a stronger U.S. dollar; Expect gross profit margin to be 30.5 percent, plus or minus 2 percent; Operating expenses are expected to be approximately 23.2 percent of revenue, plus or minus 1 percent; Expect income tax rate to be 28 percent, plus or minus 3 percent, and shares used to calculate diluted EPS for the first quarter to be approximately 49 million. 1Q 2015 Business Outlook

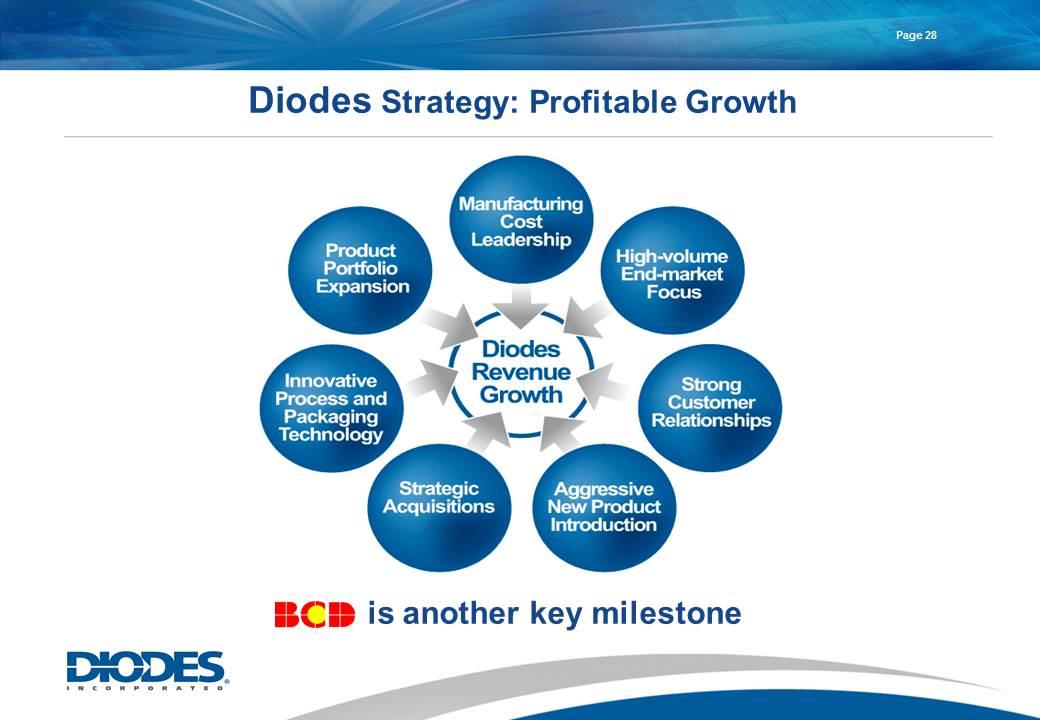

Diodes Strategy: Profitable Growth Page is another key milestone

Thank you Company Contact: Diodes Incorporated Laura Mehrl Director of Investor Relations P: 972-987-3959 E: laura_mehrl@diodes.com Investor Relations Contact: Shelton Group Leanne K. Sievers EVP, Investor Relations P: 949-224-3874 E: lsievers@diodes.com www.diodes.com Diodes was named one of the 10 Best Stocks of the Past 20 Years March 2012