February 2014 Investor Presentation Contact: Jon Faulkner CFO The Dixie Group Phone: 706-876-5814 jon.faulkner@dixiegroup.com Exhibit 99.1

• Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2 Forward Looking Statements The Dixie Group, Inc.

• Began operations in 1920 • Transitioned from textiles to floorcovering in 1990’s – now 100% floorcovering • Refined focus on upper-end markets in 2004 • For over 90 years we have focused on specialized products • Traditionally we have outperformed the industry and expect to do so in the future 3 Dixie History

Dixie Today • Commitment to brands in the upper- end market with strong growth potential • Diversified between Commercial and Residential markets • Diversified customer base (TTM Basis) – Top 10 carpet customers • 18% of sales – Top 20 carpet customers • 22% of sales 4

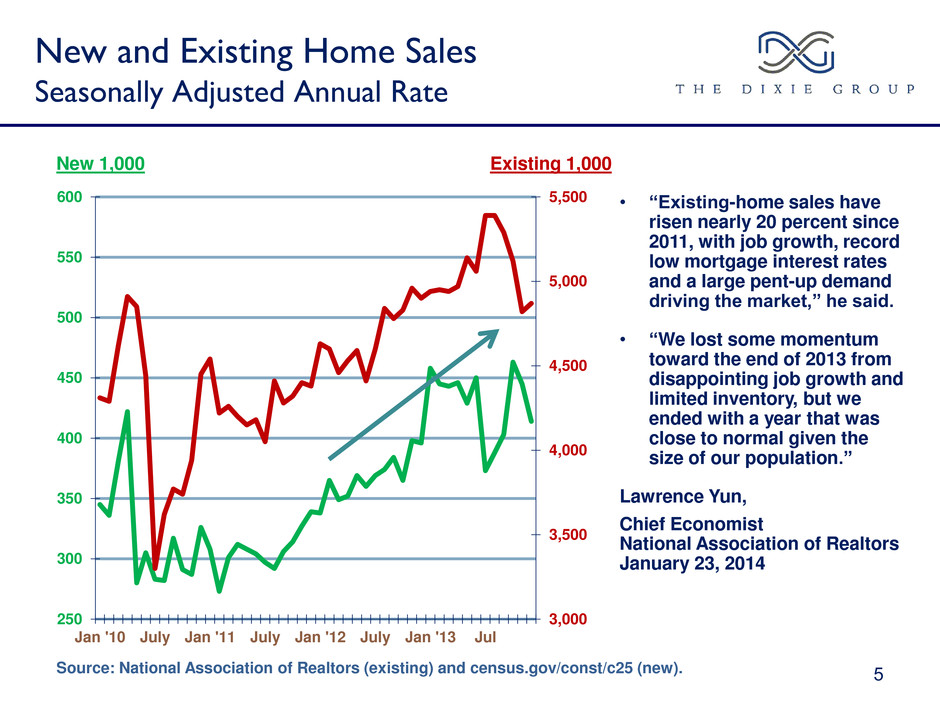

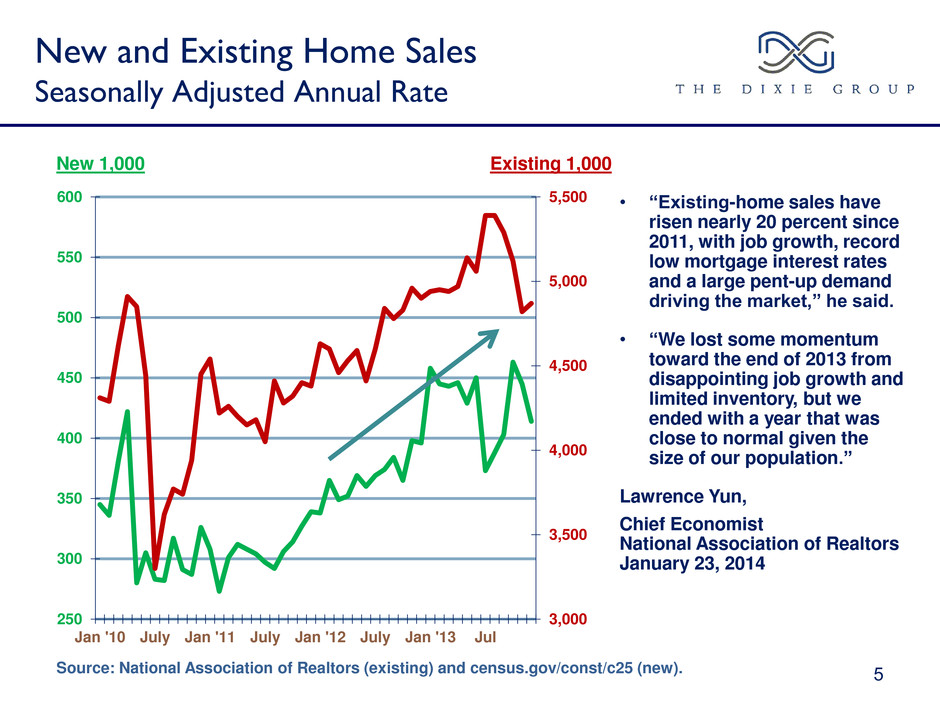

New and Existing Home Sales Seasonally Adjusted Annual Rate New 1,000 Existing 1,000 Source: National Association of Realtors (existing) and census.gov/const/c25 (new). 5 3,000 3,500 4,000 4,500 5,000 5,500 250 300 350 400 450 500 550 600 Jan '10 July Jan '11 July Jan '12 July Jan '13 Jul • “Existing-home sales have risen nearly 20 percent since 2011, with job growth, record low mortgage interest rates and a large pent-up demand driving the market,” he said. • “We lost some momentum toward the end of 2013 from disappointing job growth and limited inventory, but we ended with a year that was close to normal given the size of our population.” Lawrence Yun, Chief Economist National Association of Realtors January 23, 2014

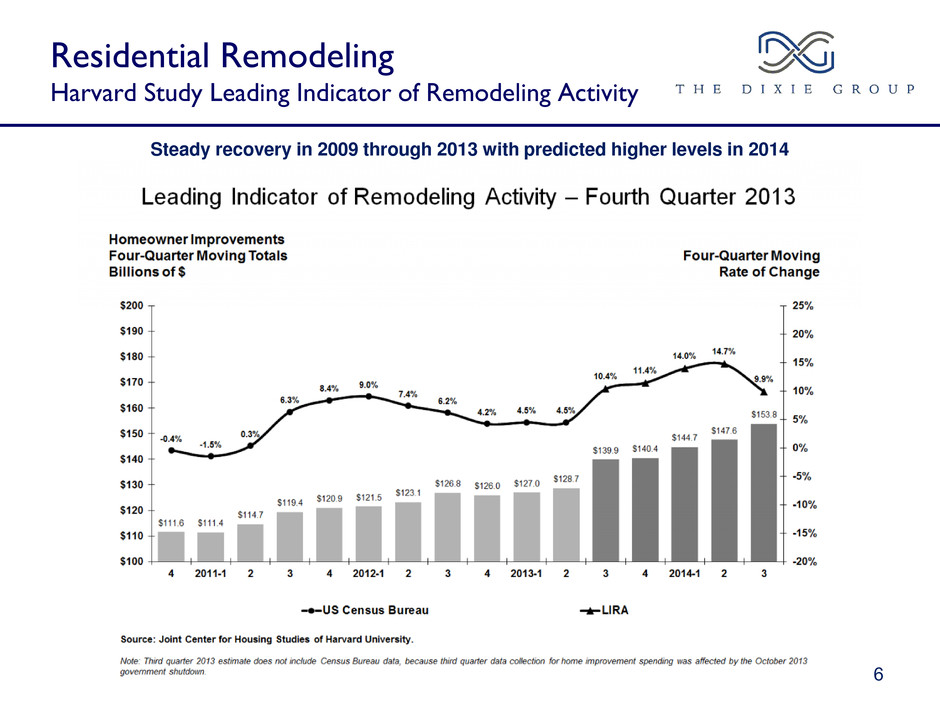

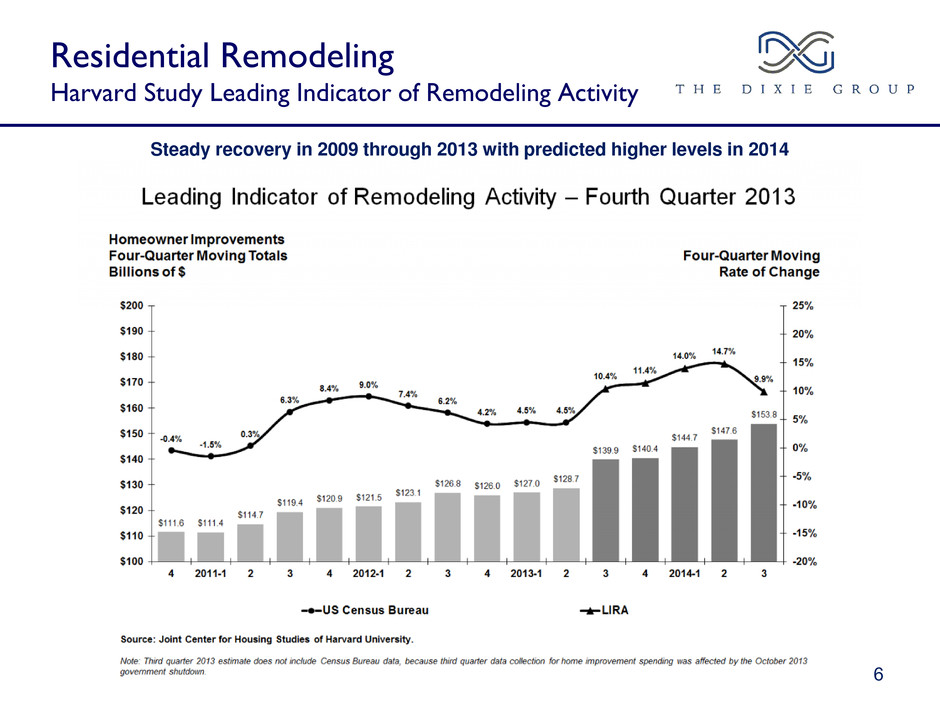

6 Steady recovery in 2009 through 2013 with predicted higher levels in 2014 Residential Remodeling Harvard Study Leading Indicator of Remodeling Activity

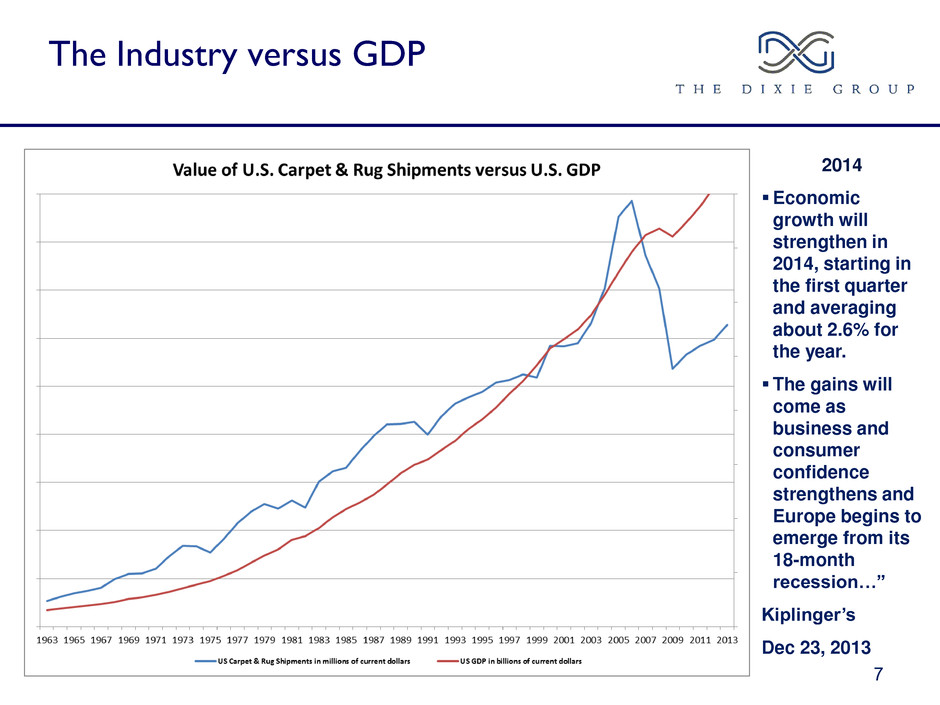

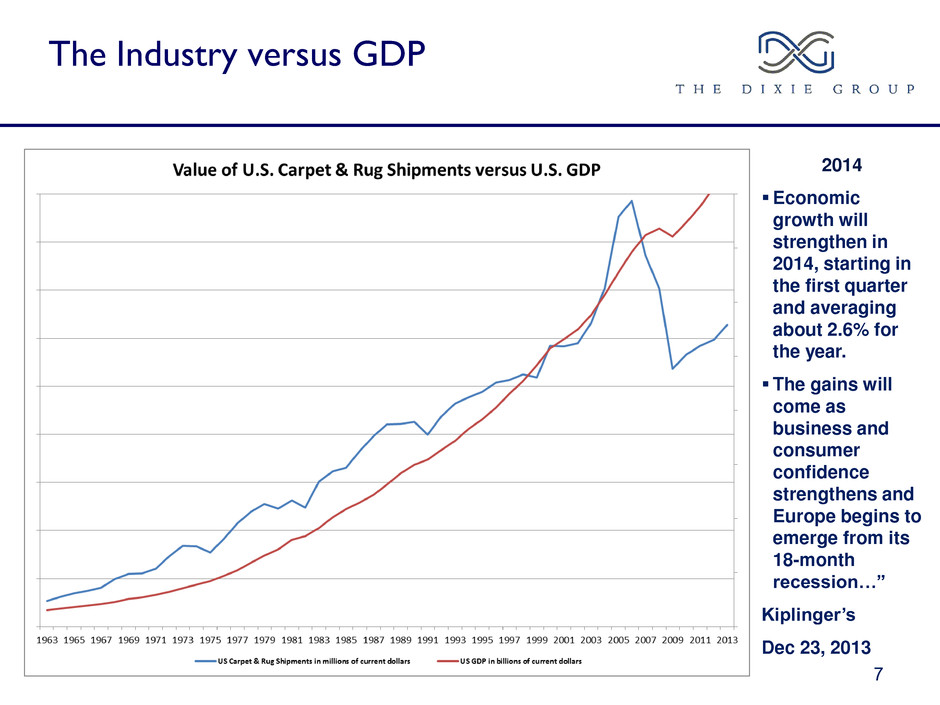

7 2014 Economic growth will strengthen in 2014, starting in the first quarter and averaging about 2.6% for the year. The gains will come as business and consumer confidence strengthens and Europe begins to emerge from its 18-month recession…” Kiplinger’s Dec 23, 2013 The Industry versus GDP

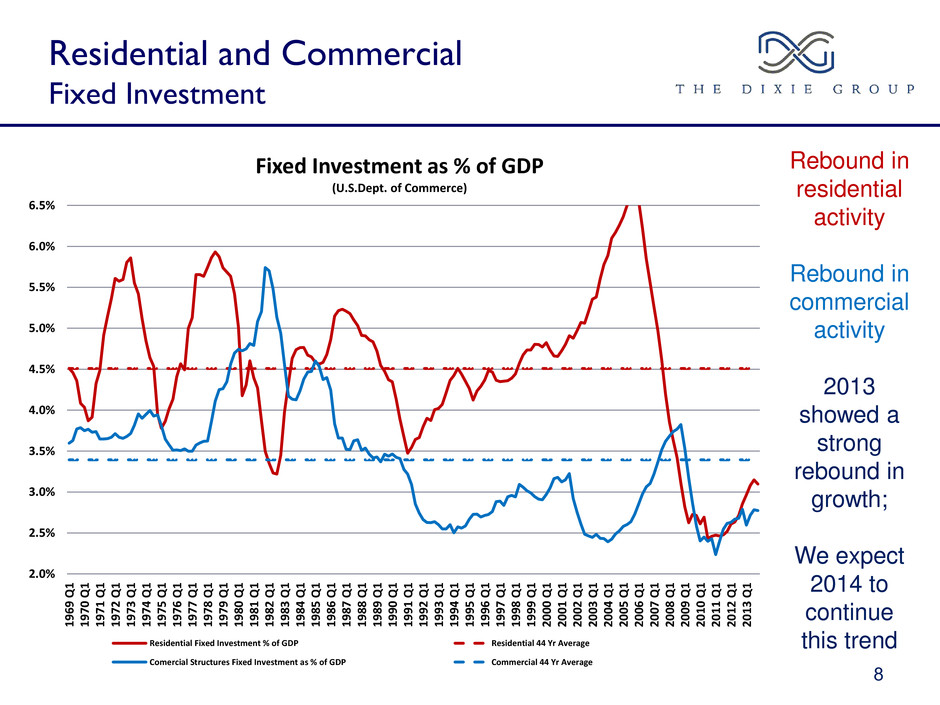

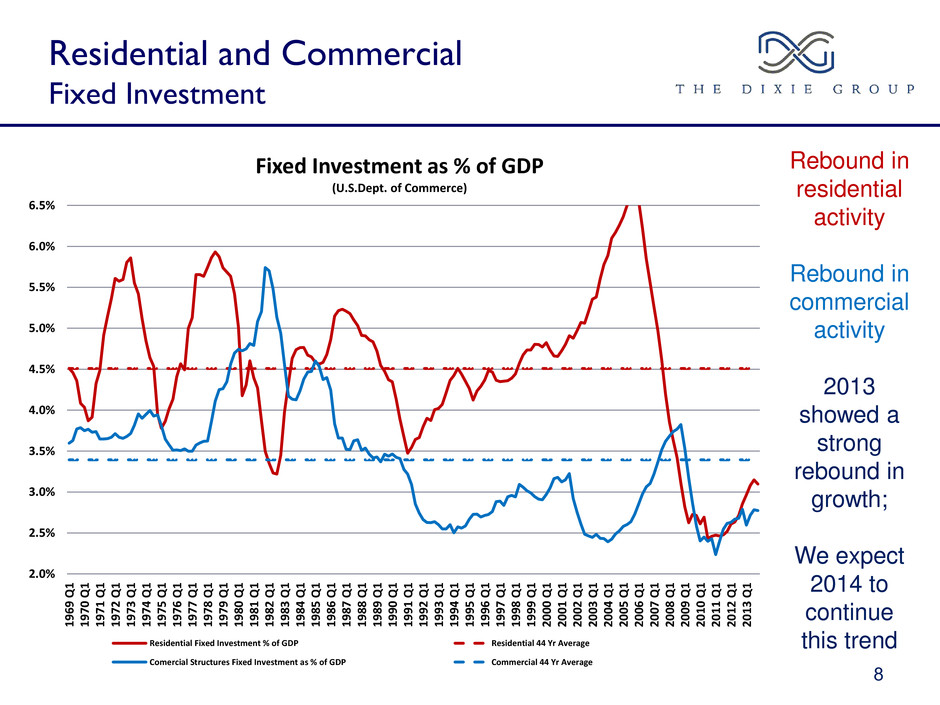

Residential and Commercial Fixed Investment 8 Rebound in residential activity Rebound in commercial activity 2013 showed a strong rebound in growth; We expect 2014 to continue this trend 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 1 9 69 Q 1 1 9 70 Q 1 1 9 71 Q 1 1 9 7 2 Q 1 1 9 73 Q 1 1 9 74 Q 1 1 9 75 Q 1 1 9 76 Q 1 1 9 77 Q 1 1 9 78 Q 1 1 9 79 Q 1 1 9 8 0 Q 1 1 9 81 Q 1 1 9 82 Q 1 1 9 83 Q 1 1 9 84 Q 1 1 9 85 Q 1 1 9 86 Q 1 1 9 87 Q 1 1 9 88 Q 1 1 9 89 Q 1 1 9 90 Q 1 1 9 91 Q 1 1 9 92 Q 1 1 9 93 Q 1 1 9 94 Q 1 1 9 95 Q 1 1 9 96 Q 1 1 9 97 Q 1 1 9 98 Q 1 1 9 99 Q 1 2 0 00 Q 1 2 0 0 1 Q 1 2 0 02 Q 1 2 0 03 Q 1 2 0 04 Q 1 2 0 05 Q 1 2 0 06 Q 1 2 0 07 Q 1 2 0 08 Q 1 2 0 0 9 Q 1 2 0 10 Q 1 2 0 11 Q 1 2 0 12 Q 1 2 0 13 Q 1 Fixed Investment as % of GDP (U.S.Dept. of Commerce) Residential Fixed Investment % of GDP Residential 44 Yr Average Comercial Structures Fixed Investment as % of GDP Commercial 44 Yr Average

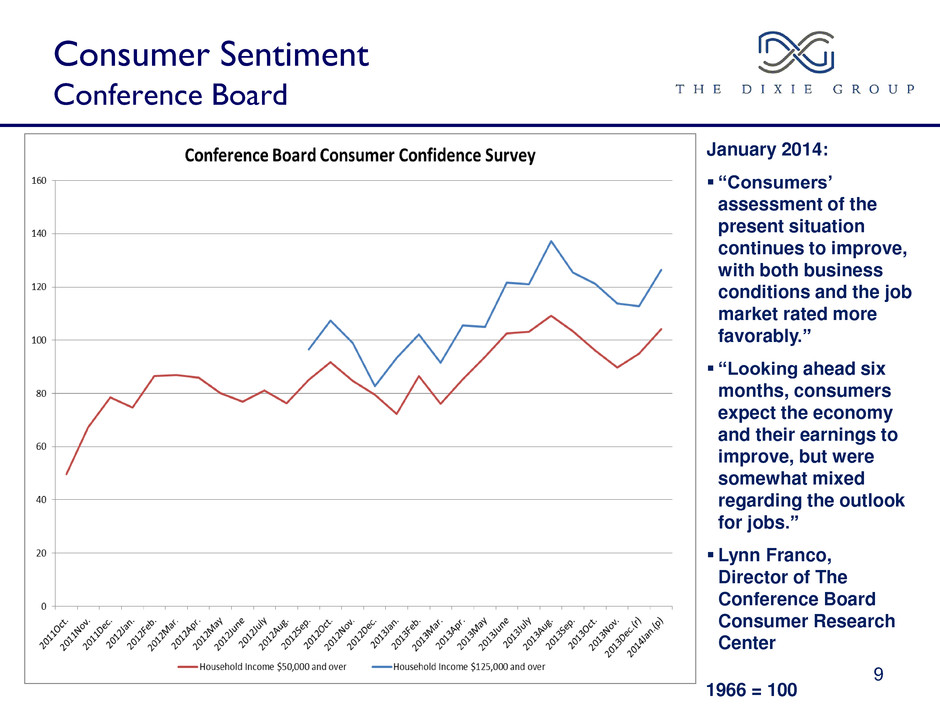

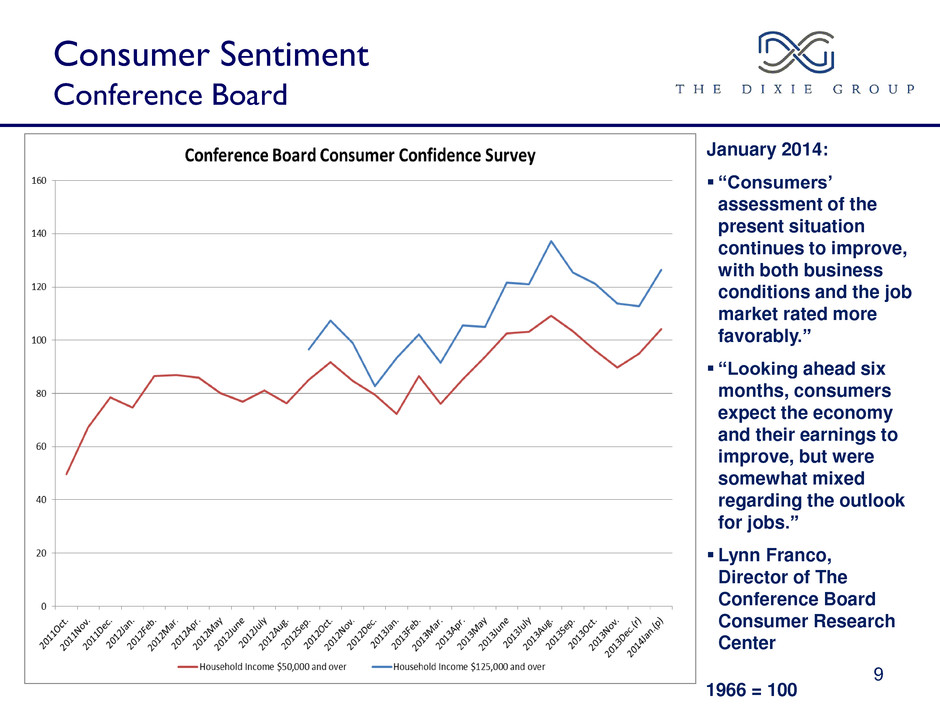

9 Consumer Sentiment Conference Board January 2014: “Consumers’ assessment of the present situation continues to improve, with both business conditions and the job market rated more favorably.” “Looking ahead six months, consumers expect the economy and their earnings to improve, but were somewhat mixed regarding the outlook for jobs.” Lynn Franco, Director of The Conference Board Consumer Research Center 1966 = 100

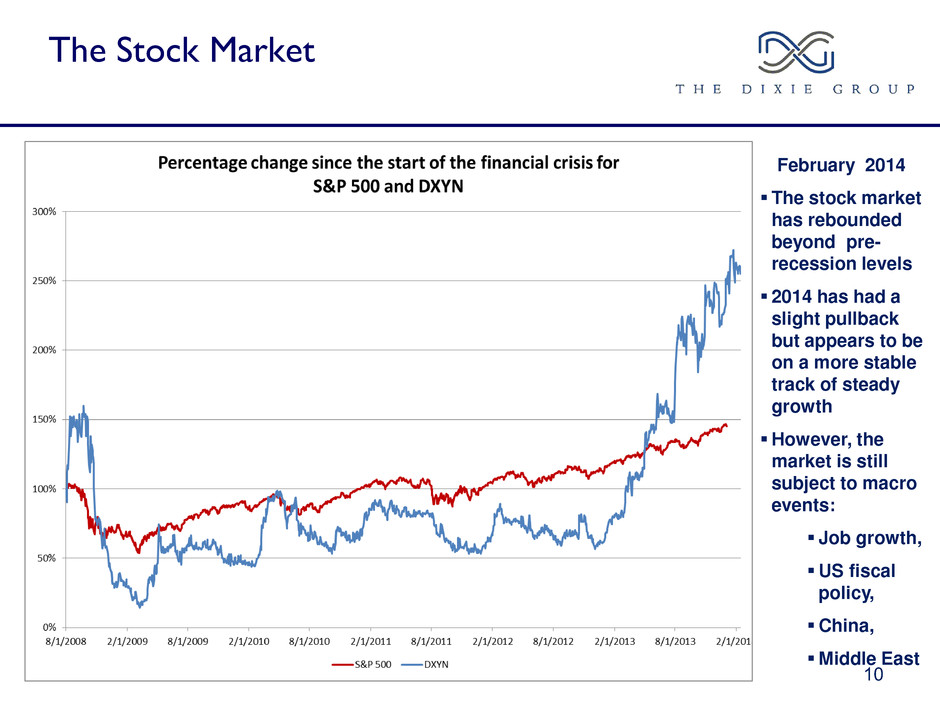

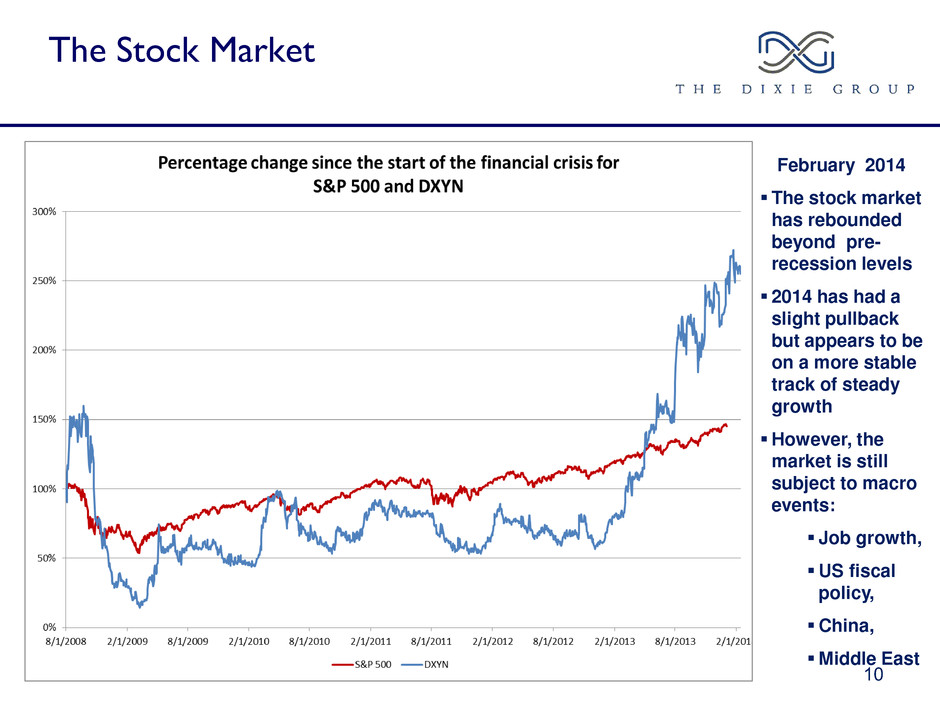

The Stock Market 10 February 2014 The stock market has rebounded beyond pre- recession levels 2014 has had a slight pullback but appears to be on a more stable track of steady growth However, the market is still subject to macro events: Job growth, US fiscal policy, China, Middle East

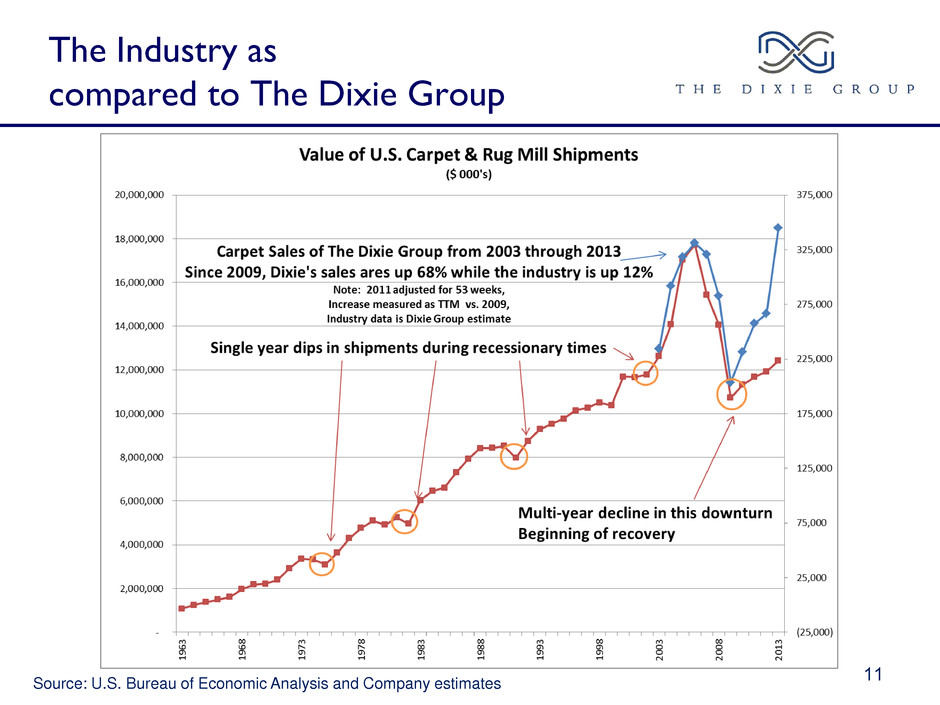

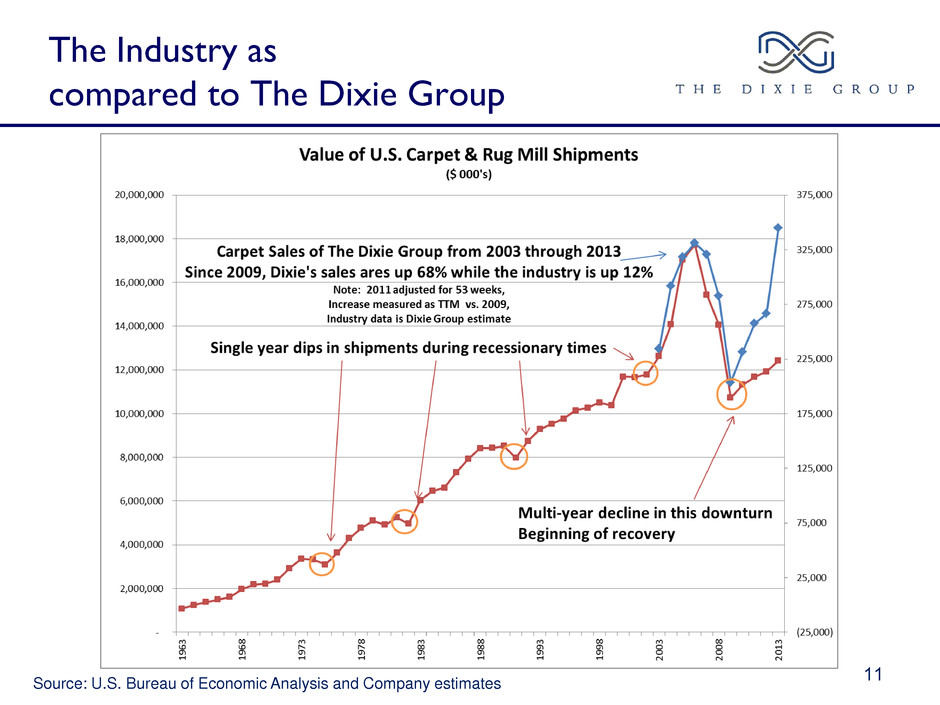

The Industry as compared to The Dixie Group 11 Source: U.S. Bureau of Economic Analysis and Company estimates

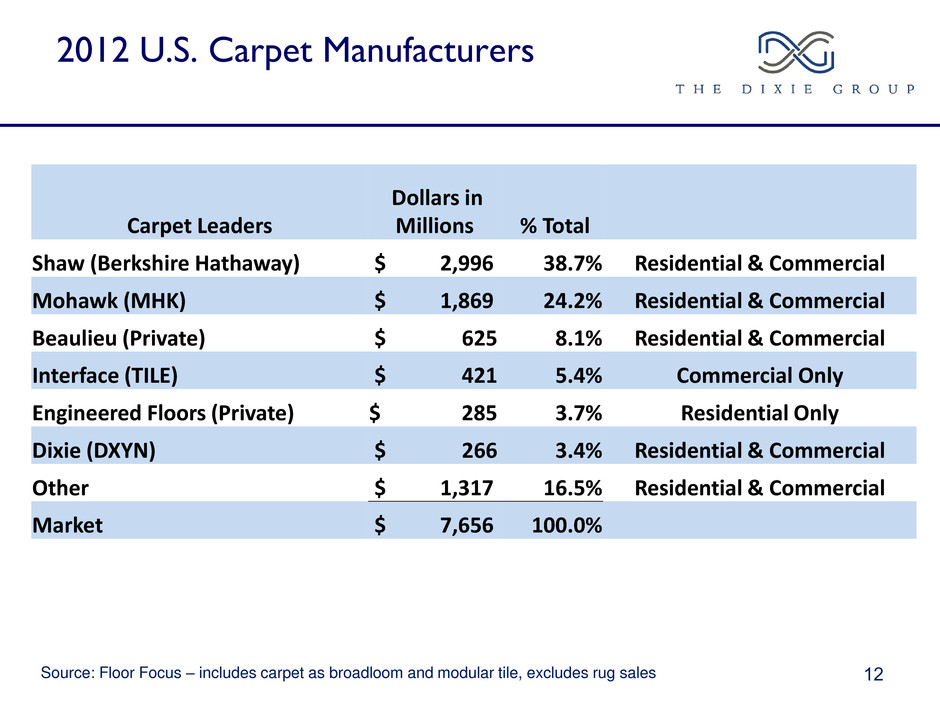

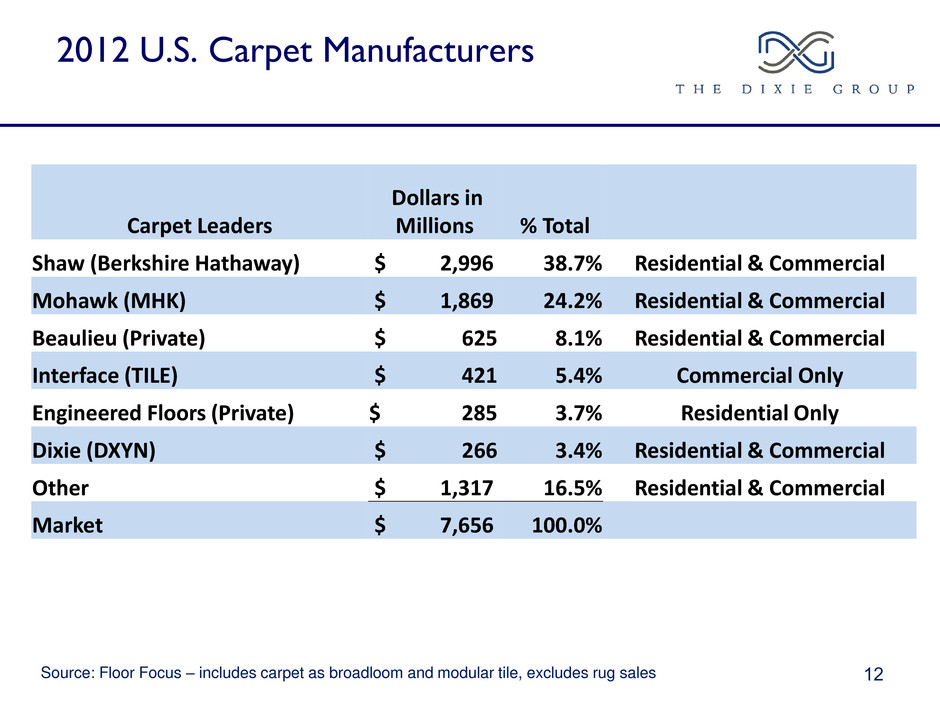

2012 U.S. Carpet Manufacturers 12 Source: Floor Focus – includes carpet as broadloom and modular tile, excludes rug sales Carpet Leaders Dollars in Millions % Total Shaw (Berkshire Hathaway) $ 2,996 38.7% Residential & Commercial Mohawk (MHK) $ 1,869 24.2% Residential & Commercial Beaulieu (Private) $ 625 8.1% Residential & Commercial Interface (TILE) $ 421 5.4% Commercial Only Engineered Floors (Private) $ 285 3.7% Residential Only Dixie (DXYN) $ 266 3.4% Residential & Commercial Other $ 1,317 16.5% Residential & Commercial Market $ 7,656 100.0%

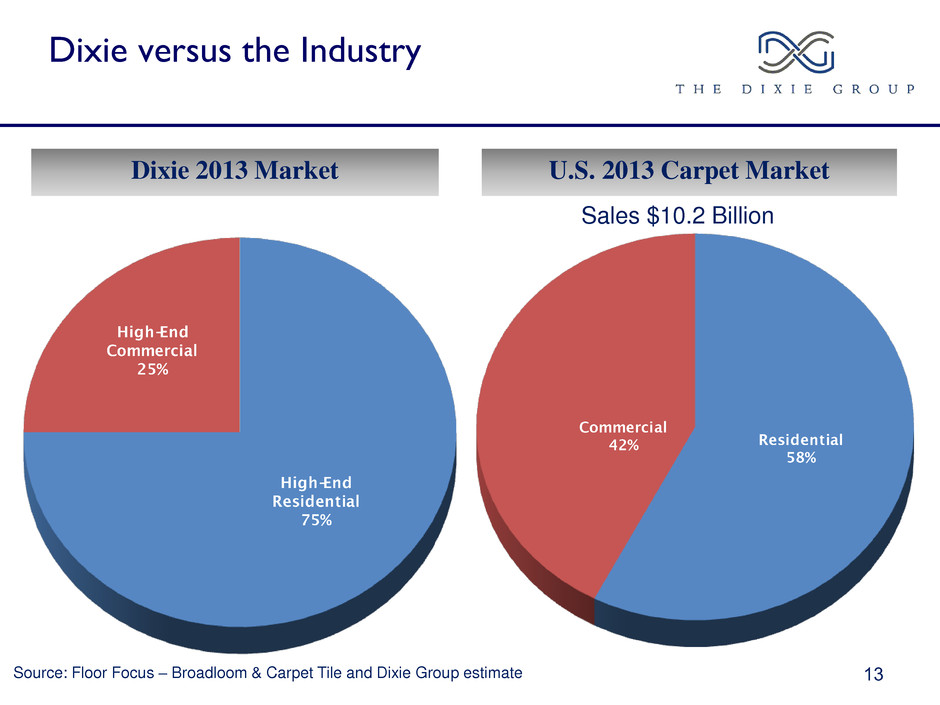

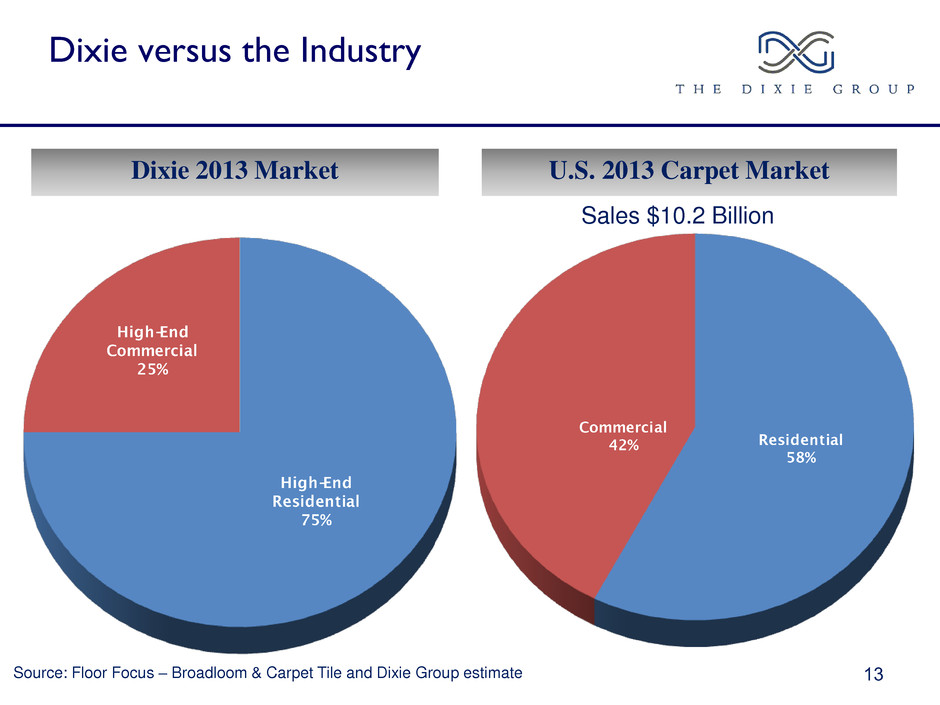

U.S. 2013 Carpet Market 13 Sales $10.2 Billion Source: Floor Focus – Broadloom & Carpet Tile and Dixie Group estimate Dixie versus the Industry Dixie 2013 Market

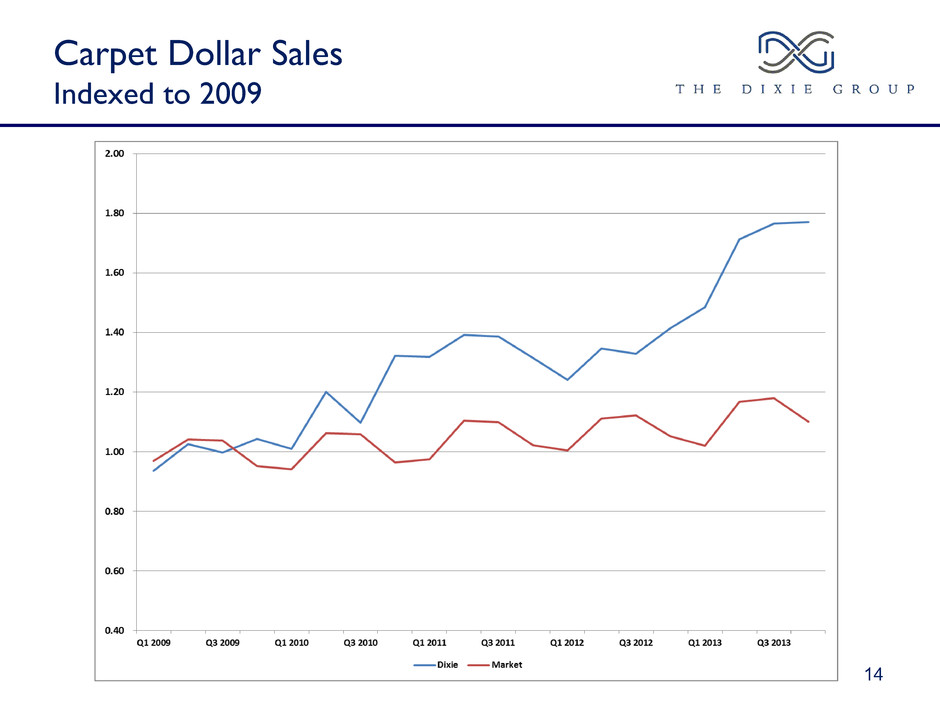

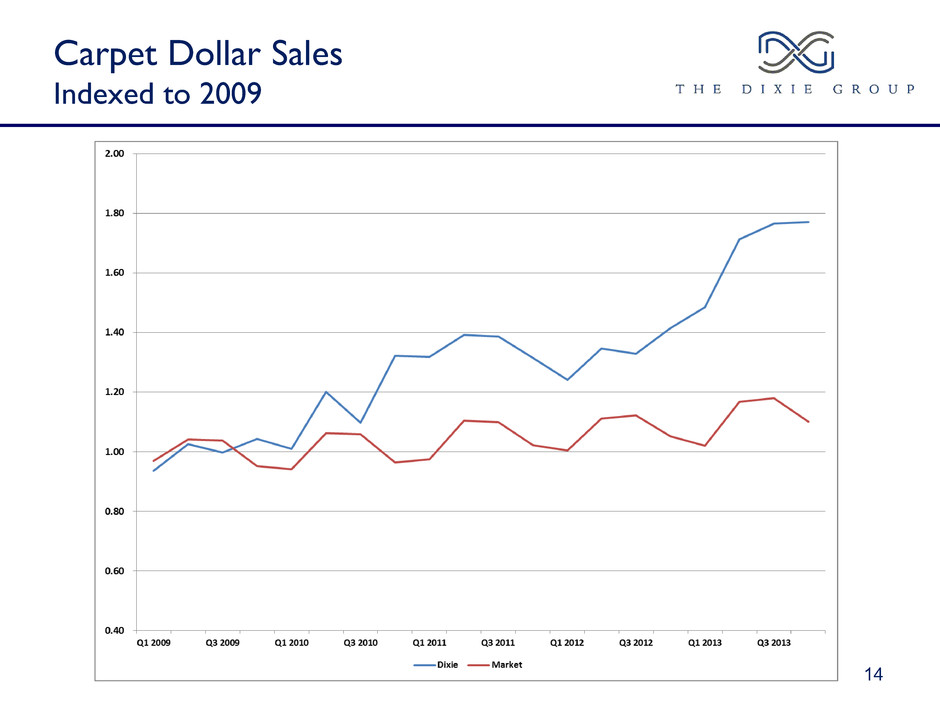

Carpet Dollar Sales Indexed to 2009 14

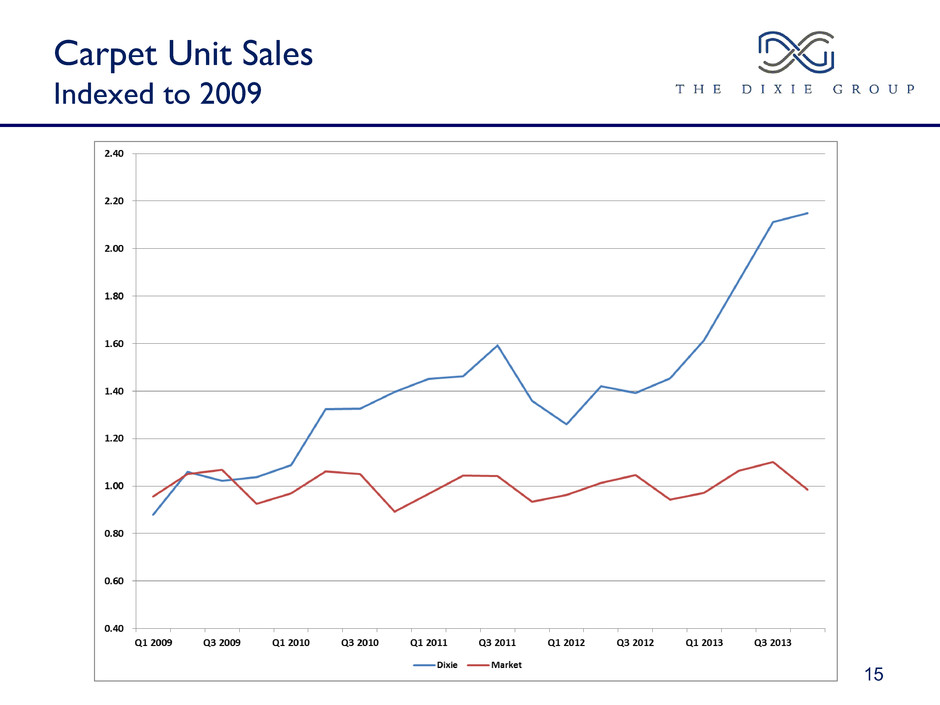

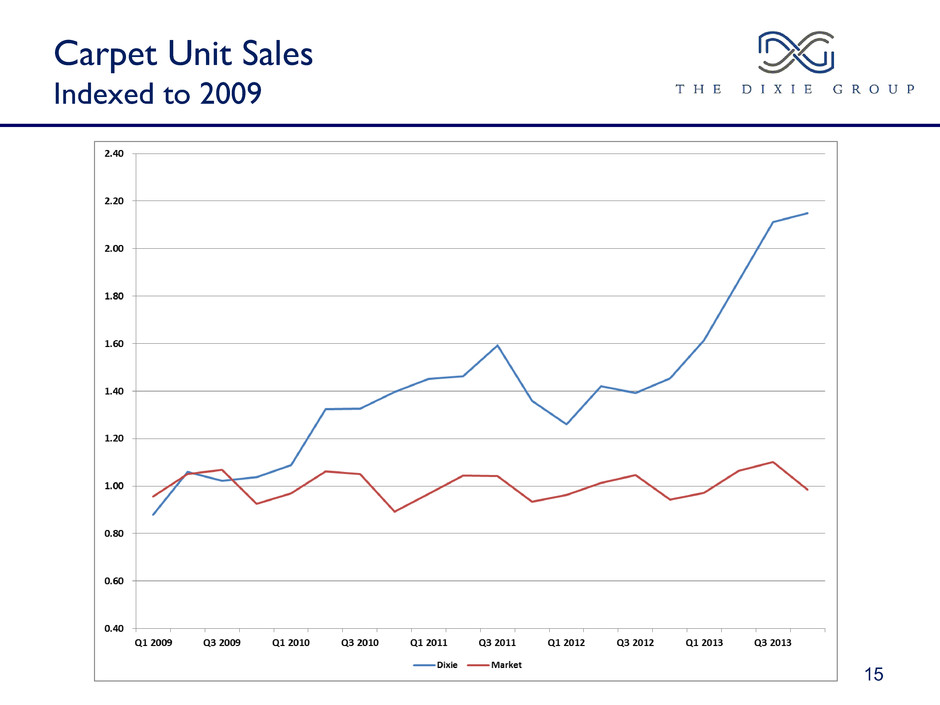

Carpet Unit Sales Indexed to 2009 15

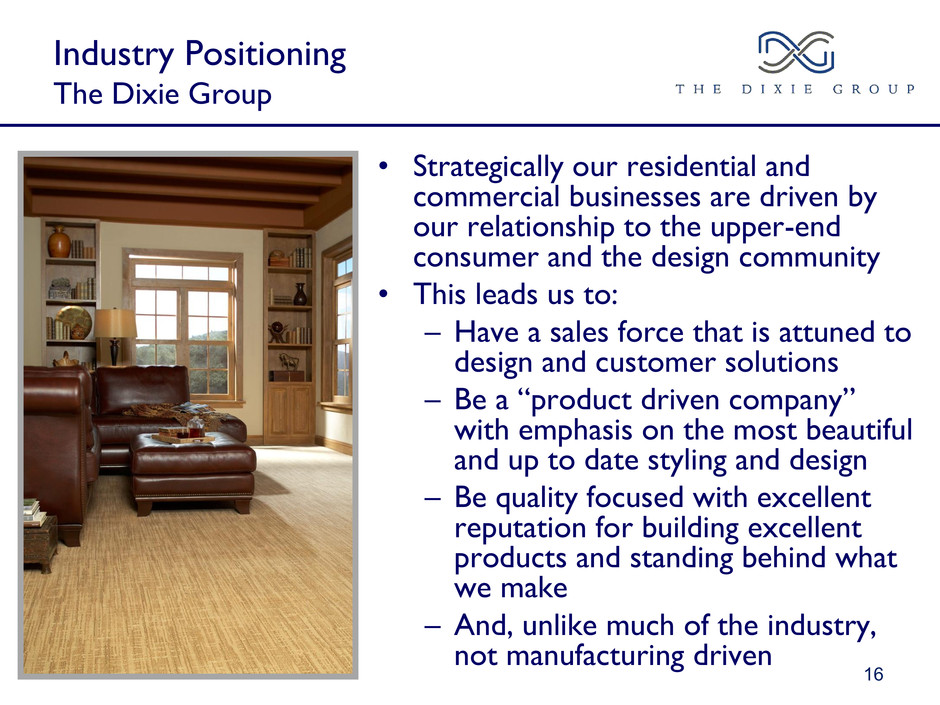

Industry Positioning The Dixie Group 16 • Strategically our residential and commercial businesses are driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with emphasis on the most beautiful and up to date styling and design – Be quality focused with excellent reputation for building excellent products and standing behind what we make – And, unlike much of the industry, not manufacturing driven

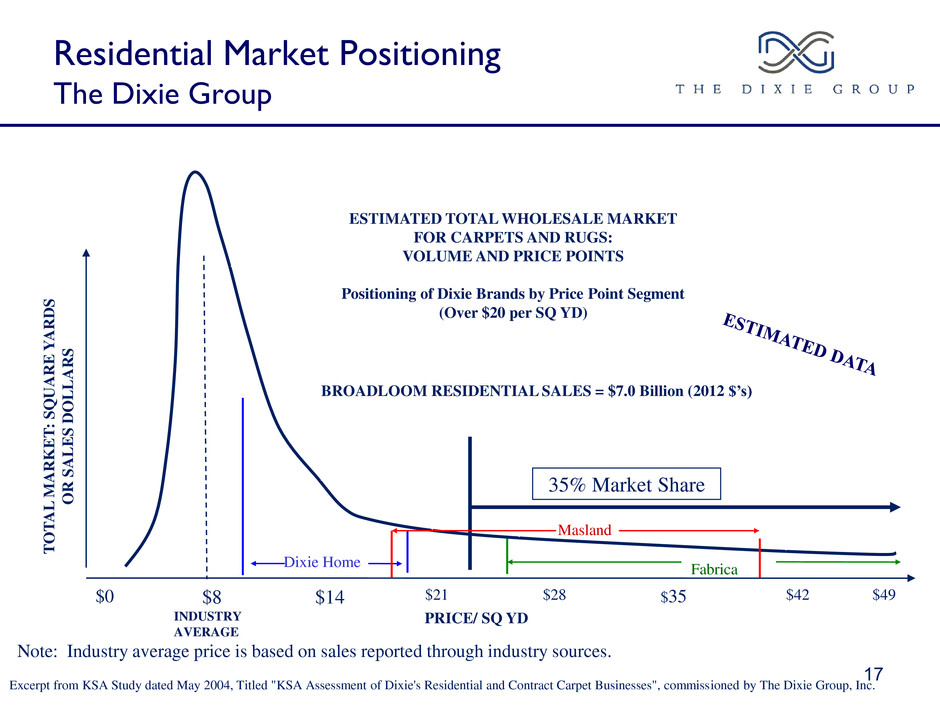

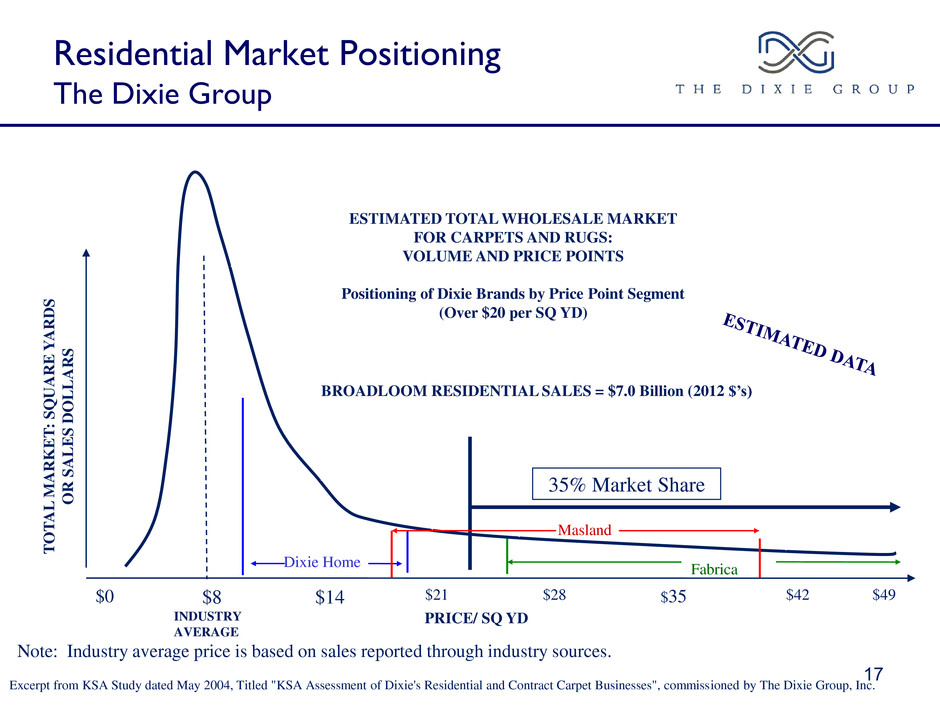

Residential Market Positioning The Dixie Group 17 BROADLOOM RESIDENTIAL SALES = $7.0 Billion (2012 $’s) 35% Market Share T O T A L M A R K E T : S QUA R E Y A R DS OR S AL E S DO L L A R S ESTIMATED TOTAL WHOLESALE MARKET FOR CARPETS AND RUGS: VOLUME AND PRICE POINTS Positioning of Dixie Brands by Price Point Segment (Over $20 per SQ YD) Dixie Home Fabrica INDUSTRY AVERAGE PRICE/ SQ YD $0 $14 $21 $28 $35 $42 $49 Note: Industry average price is based on sales reported through industry sources. Excerpt from KSA Study dated May 2004, Titled "KSA Assessment of Dixie's Residential and Contract Carpet Businesses", commissioned by The Dixie Group, Inc. $8 Masland

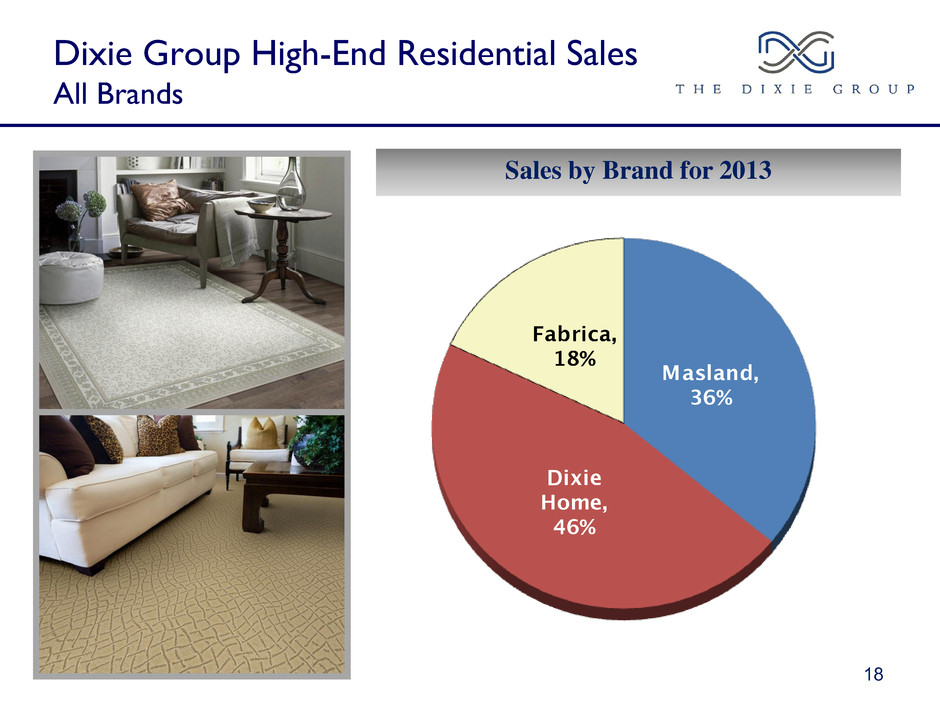

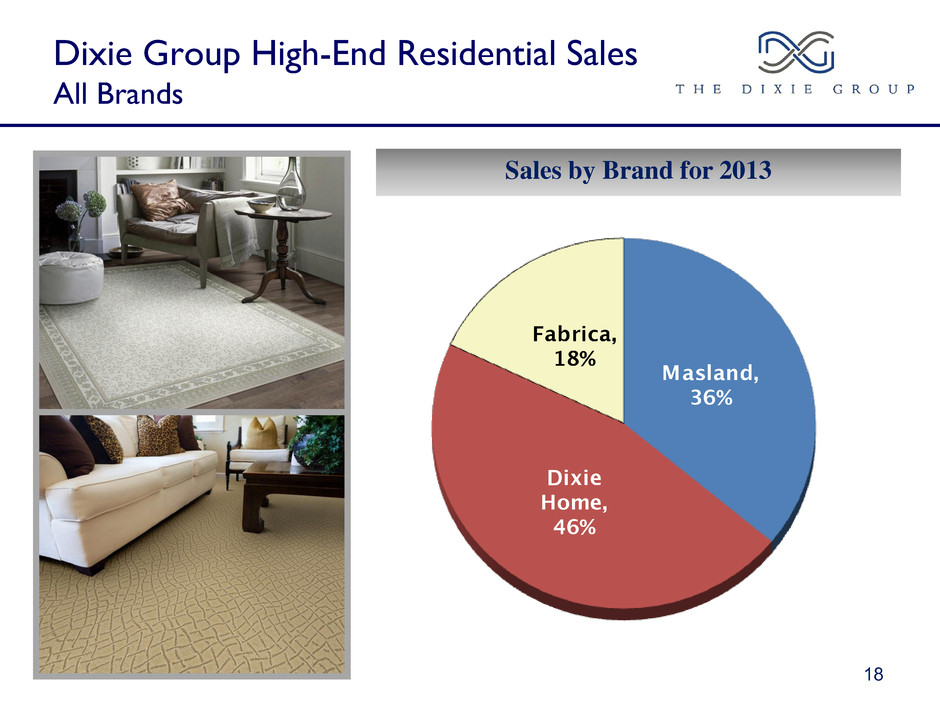

Dixie Group High-End Residential Sales All Brands 18 Sales by Brand for 2013

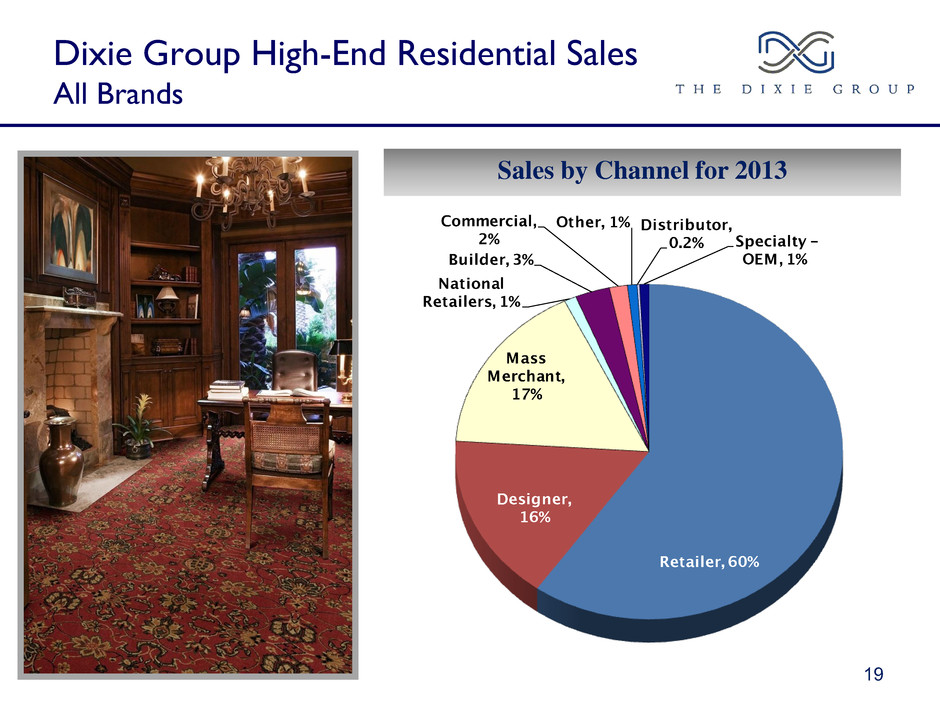

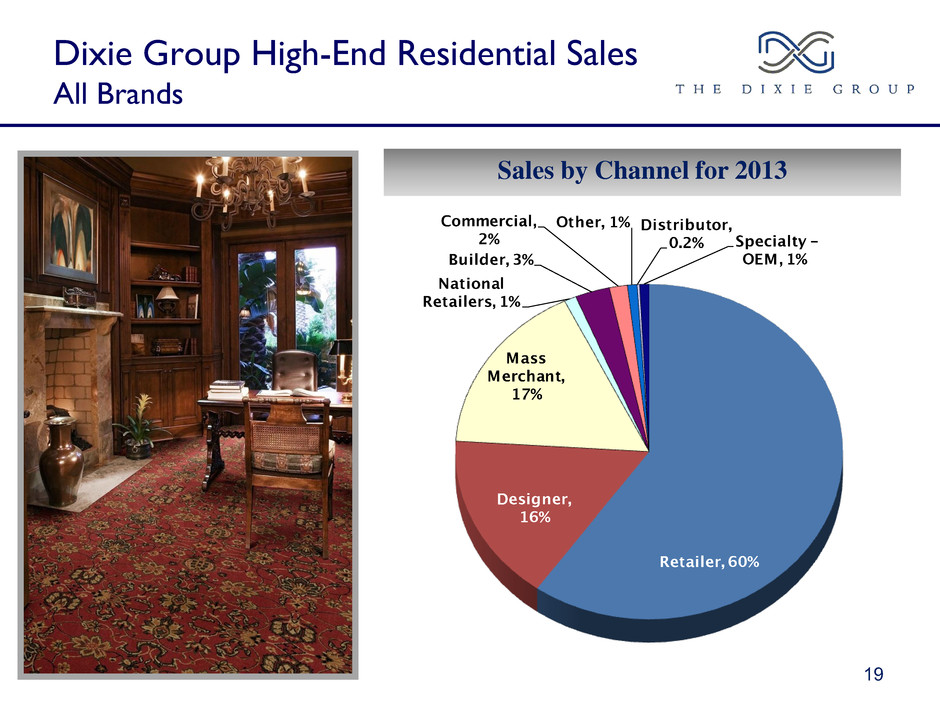

Dixie Group High-End Residential Sales All Brands 19 Sales by Channel for 2013

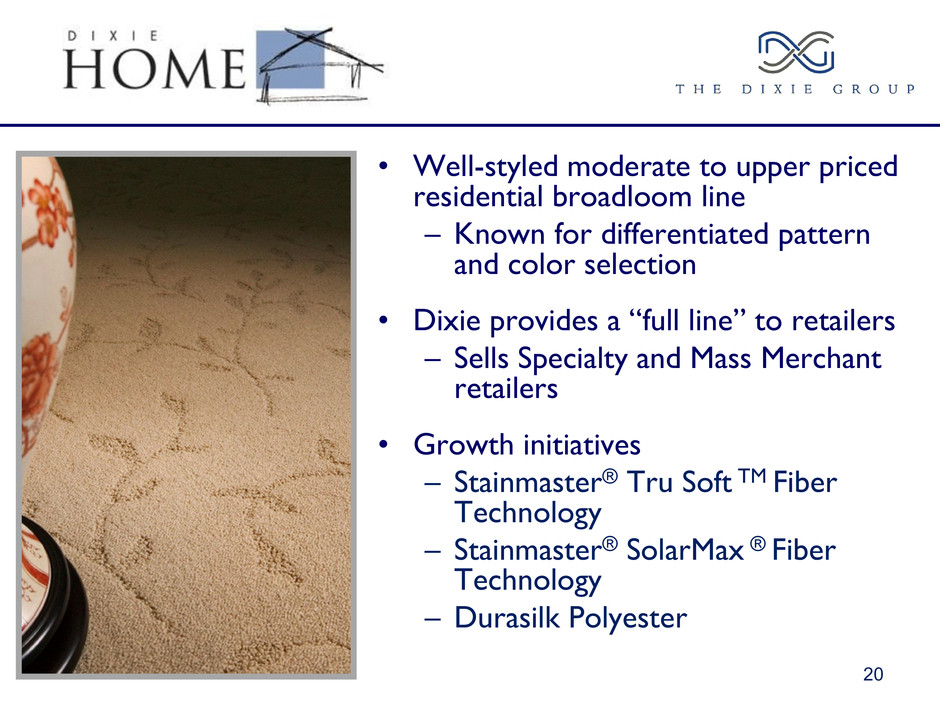

• Well-styled moderate to upper priced residential broadloom line – Known for differentiated pattern and color selection • Dixie provides a “full line” to retailers – Sells Specialty and Mass Merchant retailers • Growth initiatives – Stainmaster® Tru Soft TM Fiber Technology – Stainmaster® SolarMax ® Fiber Technology – Durasilk Polyester 20

• Leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven – Approximately 28% of sales directly involve a designer • Hand crafted and imported rugs • Growth initiative – Stainmaster® TruSoft™ Fiber Technology – Wool products in both tufted and woven constructions 21

• Premium high-end brand – “Quality without Compromise” • Designer focused – Approximately 40% of sales directly involve a designer • Hand crafted and imported rugs • Growth initiatives – Stainmaster® TruSoft™ Fiber Technology – Fabrica Permaset dyeing process “unlimited color selection in wool” 22

Commercial Market Positioning The Dixie Group 23 • We focus on the “high end specified soft floorcovering contract market” • We have positioned our brands to serve this market through: – Our Masland Contract division • Broad product line for diverse commercial markets through a direct sales model – Our Avant division • Corporate focus using a multi- line sales agent based model – Our Masland Residential sales force • Sells “main street commercial” through retailers

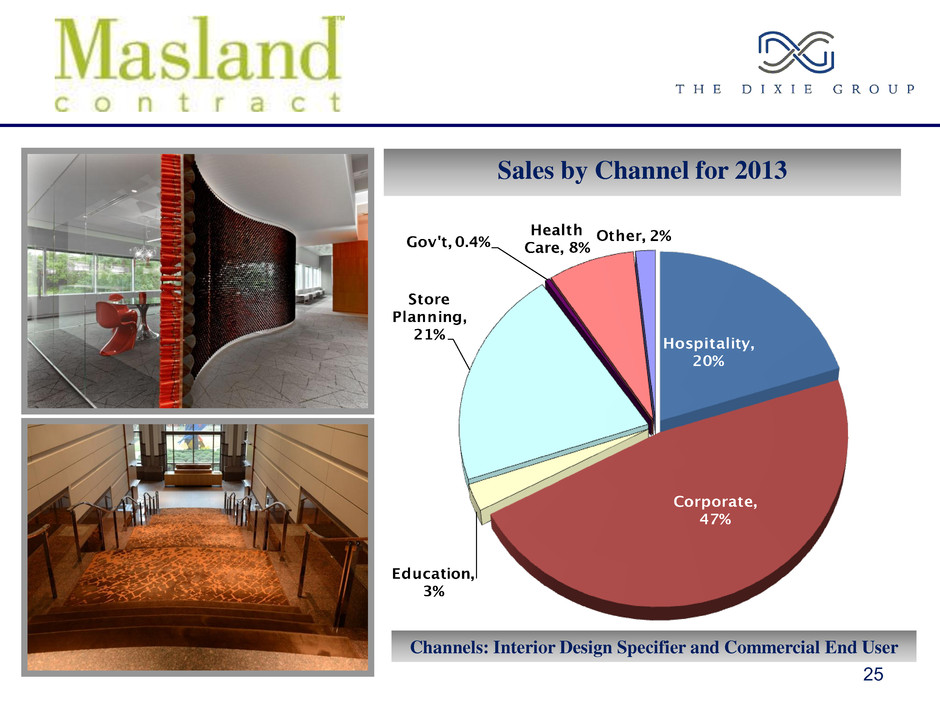

• Premium brand in the specified commercial marketplace – Corporate, End User, Store Planning, Hospitality, Health Care, Government and Education markets • Designer focused • Strong national account base – Nordstrom’s, Target, Delta Air Lines, Best Buy, Club Corp • Growth initiative – SPEAK modular carpet tile and FIT office remodel collections – End User Channel 24

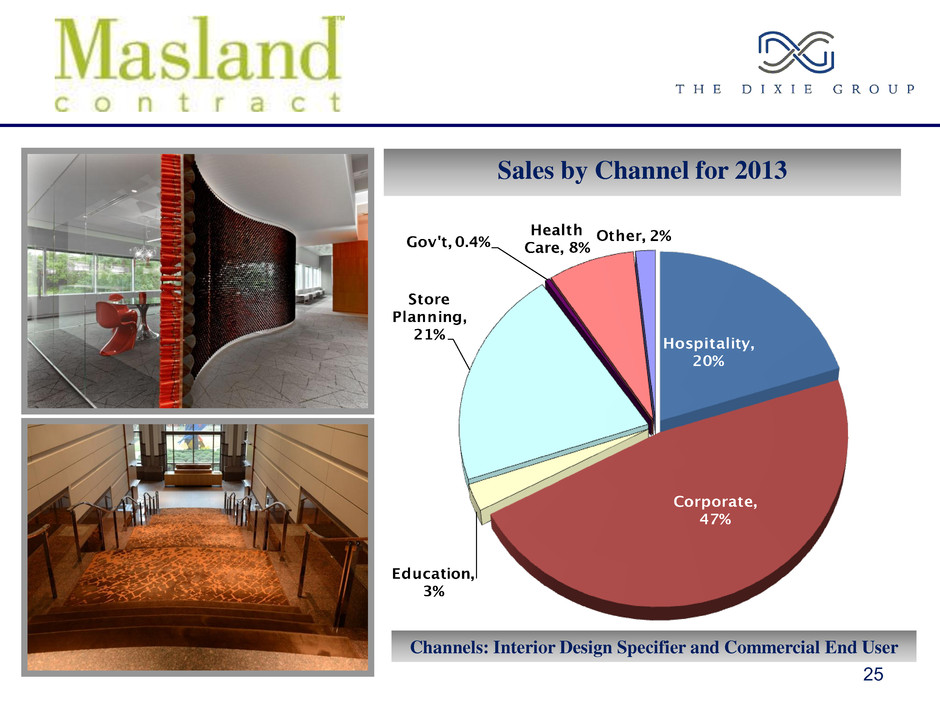

25 Sales by Channel for 2013 Channels: Interior Design Specifier and Commercial End User

• Avant is our newest brand • Dedicated to servicing the designer through the multi-line interior finishes sales agent • Focus is on the corporate market through high fashion broadloom and modular carpet tile offerings 26

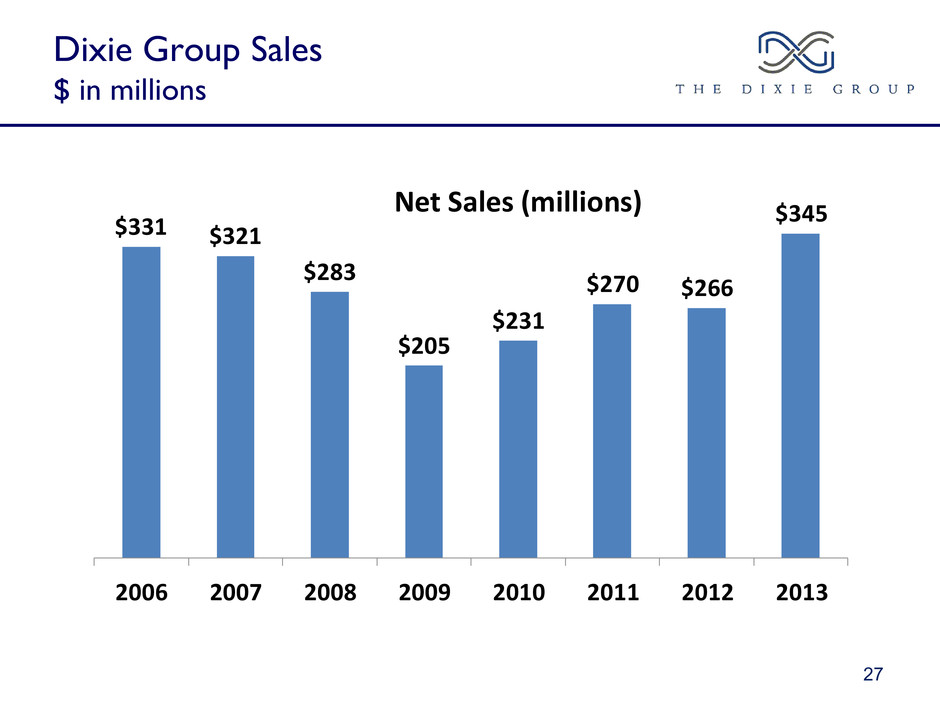

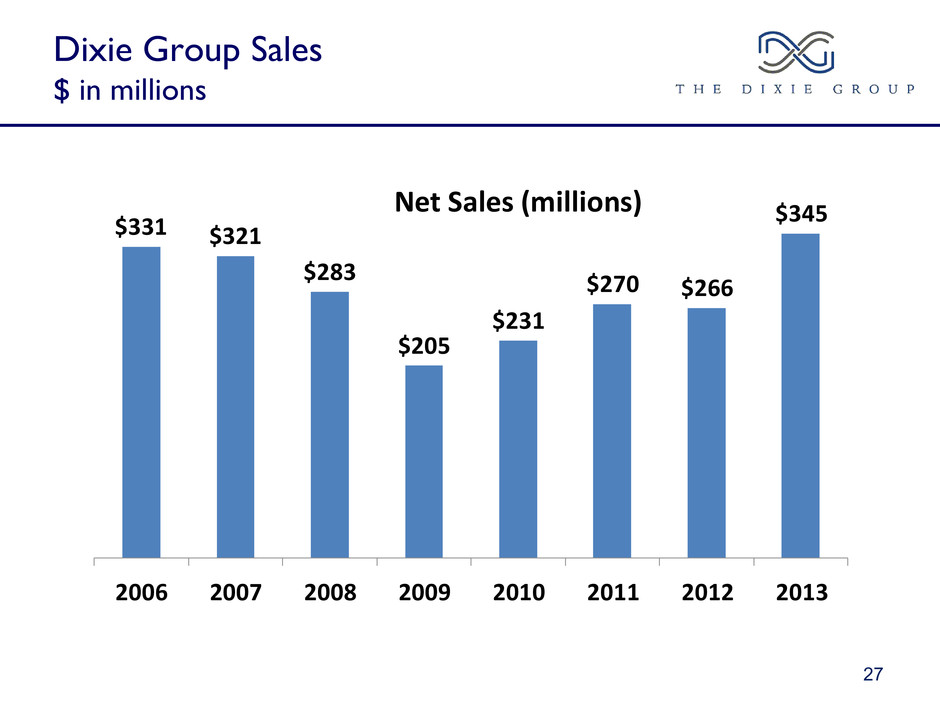

$331 $321 $283 $205 $231 $270 $266 $345 2006 2007 2008 2009 2010 2011 2012 2013 Net Sales (millions) 27 Dixie Group Sales $ in millions

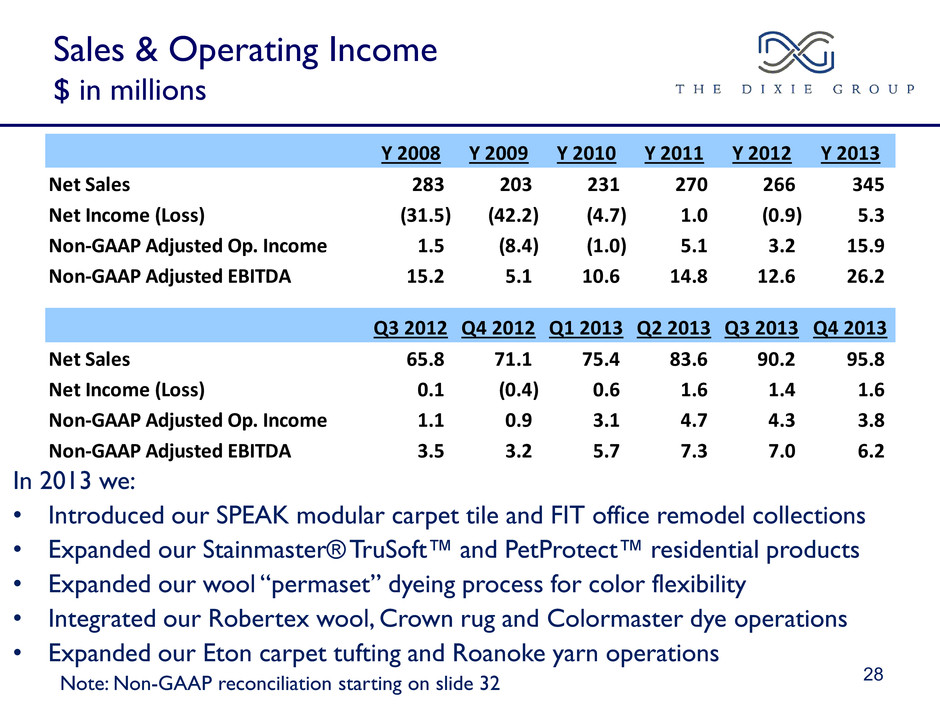

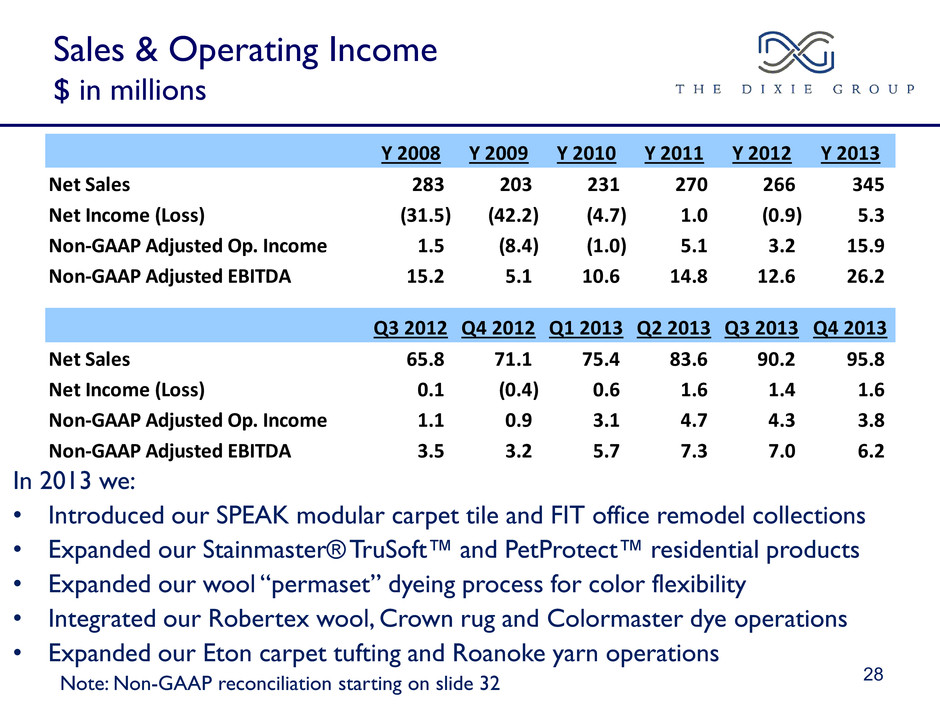

Sales & Operating Income $ in millions 28 In 2013 we: • Introduced our SPEAK modular carpet tile and FIT office remodel collections • Expanded our Stainmaster® TruSoft™ and PetProtect™ residential products • Expanded our wool “permaset” dyeing process for color flexibility • Integrated our Robertex wool, Crown rug and Colormaster dye operations • Expanded our Eton carpet tufting and Roanoke yarn operations Note: Non-GAAP reconciliation starting on slide 32 Y 2008 Y 2009 Y 2010 Y 2011 Y 2012 Y 2013 Net Sales 283 203 231 270 266 345 Net Income (Loss) (31.5) (42.2) (4.7) 1.0 (0.9) 5.3 Non-GAAP Adjusted Op. Income 1.5 (8.4) (1.0) 5.1 3.2 15.9 Non-GAAP Adjusted EBITDA 15.2 5.1 10.6 14.8 12.6 26.2 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Sales 65.8 71.1 75.4 83.6 90.2 95.8 Net Income (Loss) 0.1 (0.4) 0.6 1.6 1.4 1.6 Non-GAAP Adjusted Op. Income 1.1 0.9 3.1 4.7 4.3 3.8 Non-GAAP Adjusted EBITDA 3.5 3.2 5.7 7.3 7.0 6.2

- The residential floorcovering market continued to show positive trends at retail. The market is growing due to an improving housing sector. - Residentially we have momentum in our Stainmaster® TruSoft™, Stainmaster® PetProtect™ and wool product offerings, an expanded sales force and excellent retail market positioning for upper end goods. - Commercially we have grown significantly with the our SPEAK high performance modular carpet tile and FIT office remodel collections. - We announced both a joint venture and distribution agreement with Desso to expand our reach in the commercial marketplace - Our sales for the 4th quarter were up 35% vs. the same quarter last year - Commercial product sales increased 46% versus prior year - Residential product sales increased 31% versus prior year - All brands had double digit growth 29 Current Business Conditions Fourth quarter 2013 activity

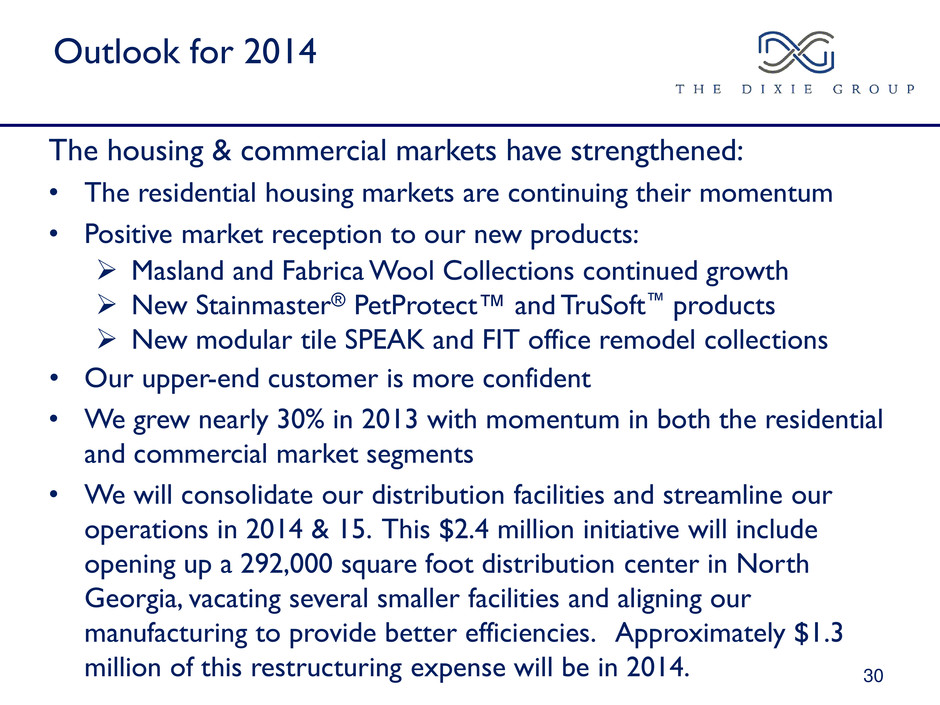

Outlook for 2014 The housing & commercial markets have strengthened: • The residential housing markets are continuing their momentum • Positive market reception to our new products: Masland and Fabrica Wool Collections continued growth New Stainmaster® PetProtect™ and TruSoft™ products New modular tile SPEAK and FIT office remodel collections • Our upper-end customer is more confident • We grew nearly 30% in 2013 with momentum in both the residential and commercial market segments • We will consolidate our distribution facilities and streamline our operations in 2014 & 15. This $2.4 million initiative will include opening up a 292,000 square foot distribution center in North Georgia, vacating several smaller facilities and aligning our manufacturing to provide better efficiencies. Approximately $1.3 million of this restructuring expense will be in 2014. 30

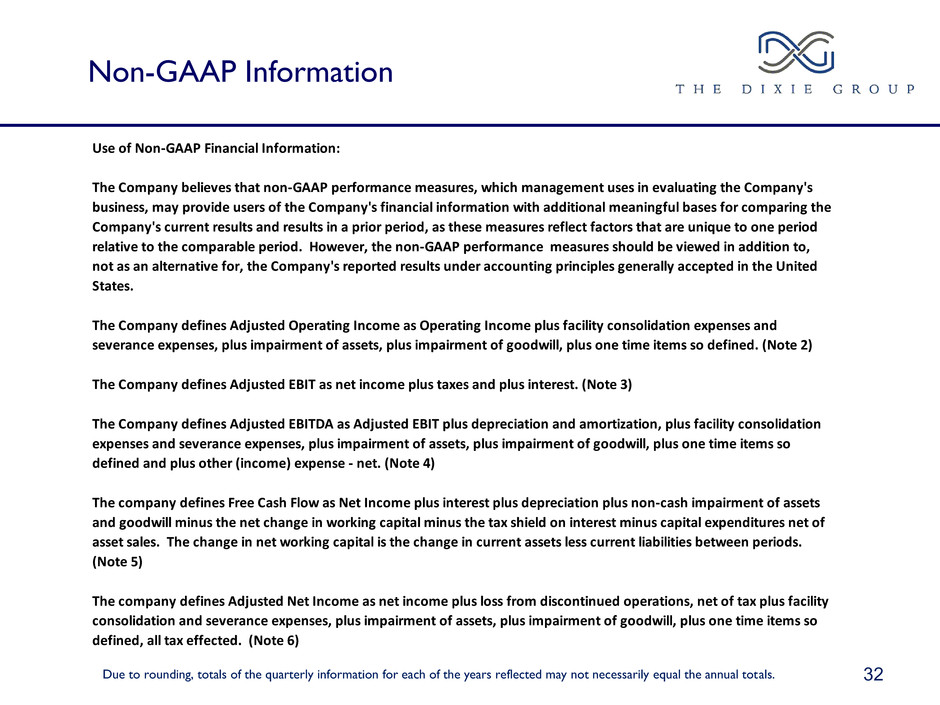

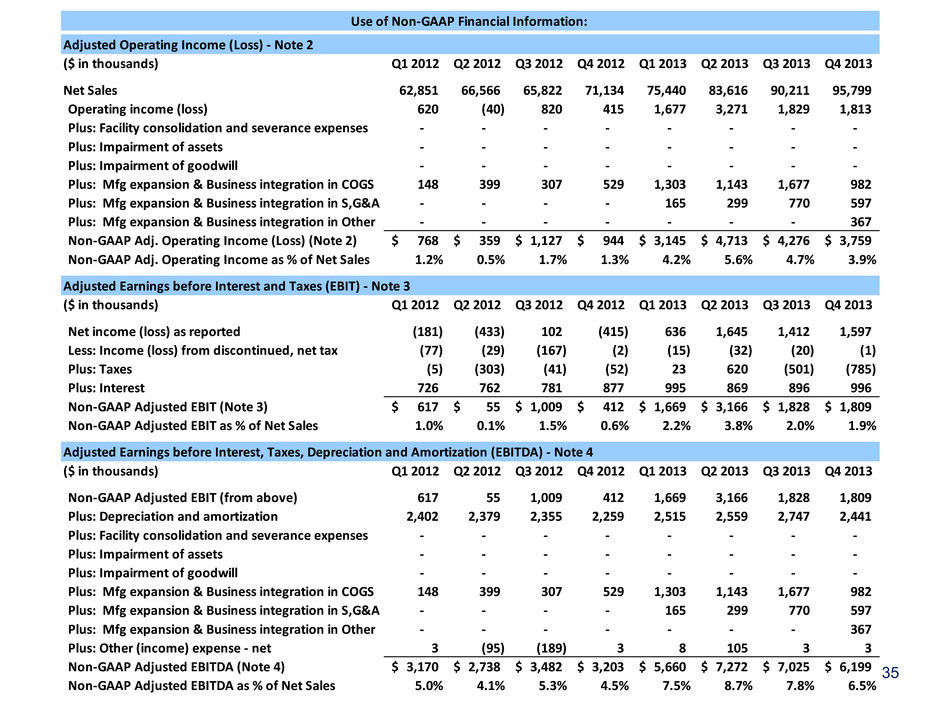

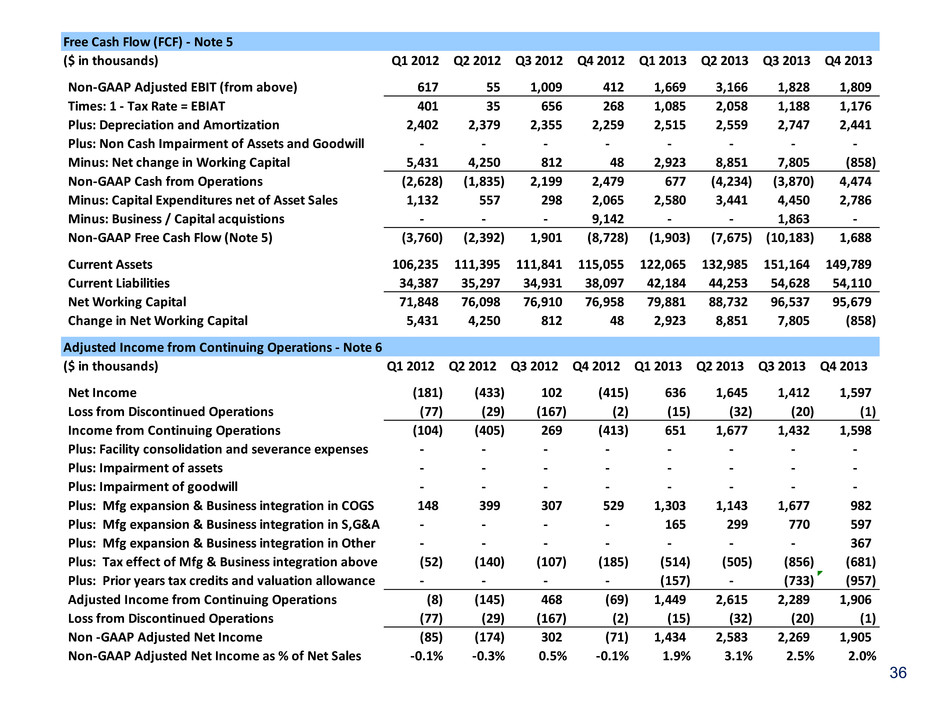

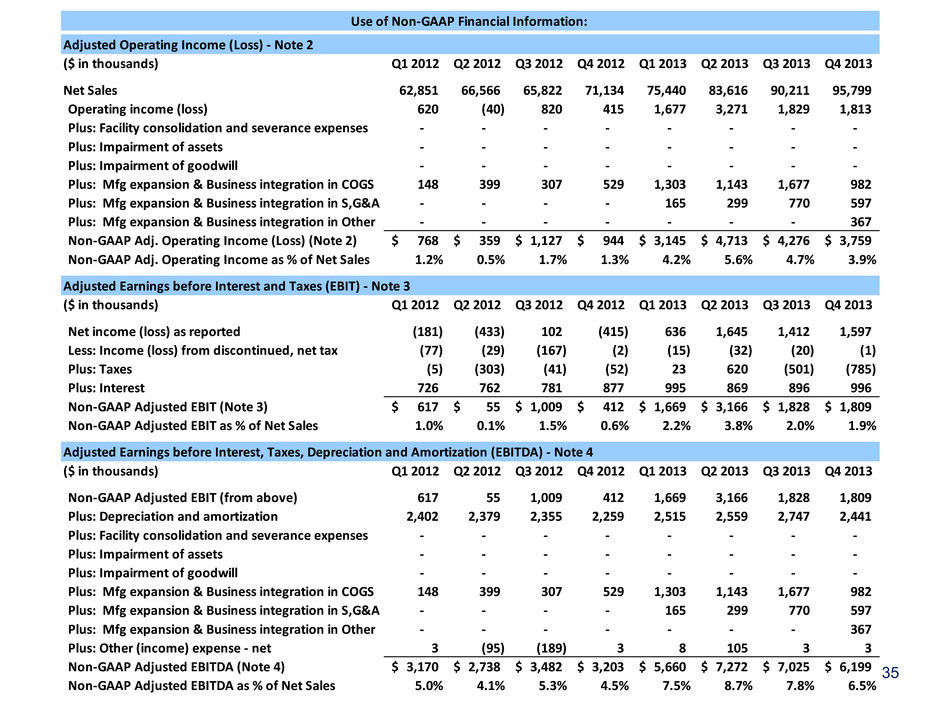

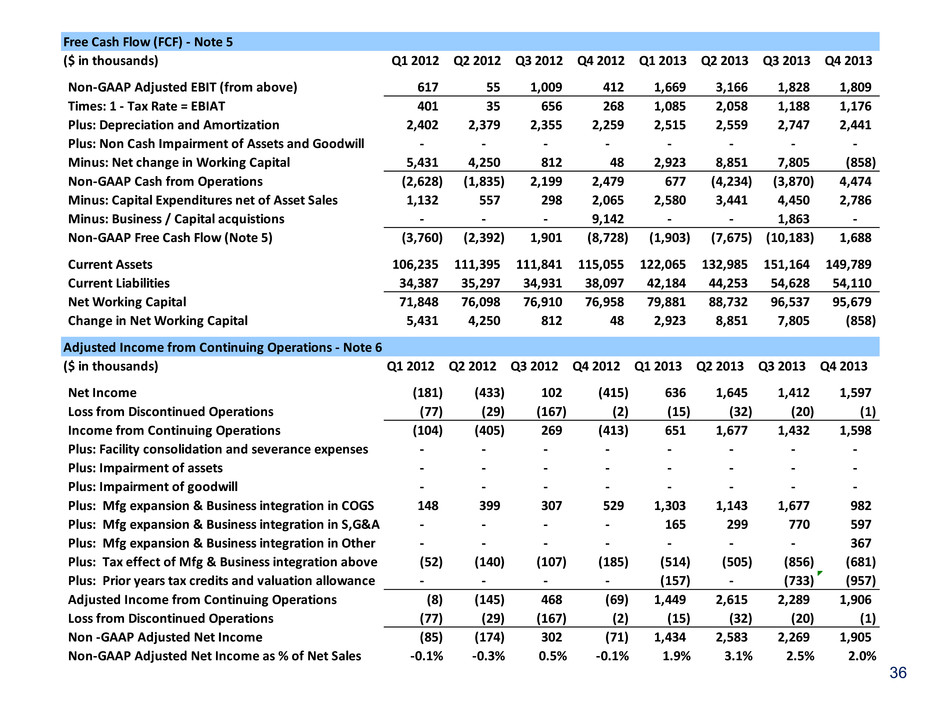

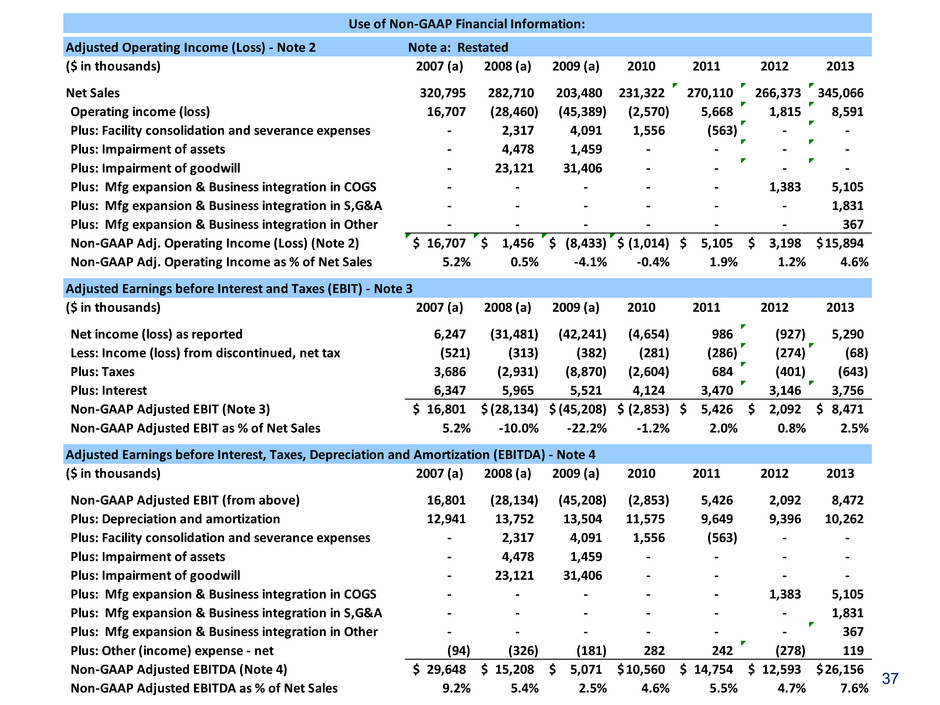

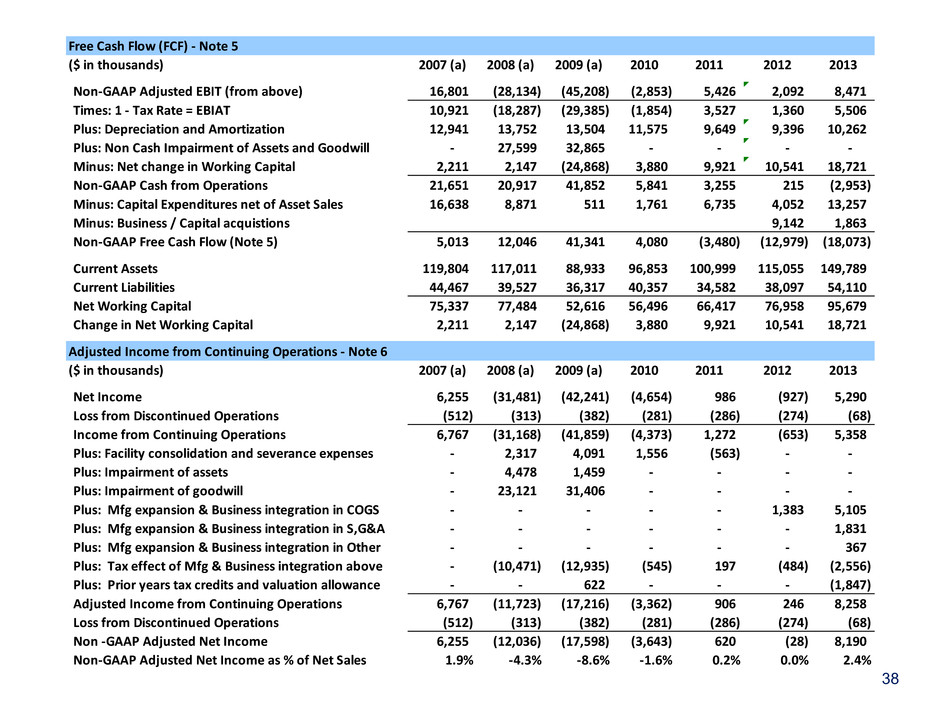

Non-GAAP Information 32 Use of Non-GAAP Financial Information: The Company believes that non-GAAP performance measures, which management uses in evaluating the Company's business, may provide users of the Company's financial information with additional meaningful bases for comparing the Company's current results and results in a prior period, as these measures reflect factors that are unique to one period relative to the comparable period. However, the non-GAAP performance measures should be viewed in addition to, not as an alternative for, the Company's reported results under accounting principles generally accepted in the United States. The Company defines Adjusted Operating Income as Operating Income plus facility consolidation expenses and severance expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined. (Note 2) The Company defines Adjusted EBIT as net income plus taxes and plus interest. (Note 3) The Company defines Adjusted EBITDA as Adjusted EBIT plus depreciation and amortization, plus facility consolidation expenses and severance expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined and plus other (income) expense - net. (Note 4) The company defines Free Cash Flow as Net Income plus interest plus depreciation plus non-cash impairment of assets and goodwill minus the net change in working capital minus the tax shield on interest minus capital expenditures net of asset sales. The change in net working capital is the change in current assets less current liabilities between periods. (Note 5) The company defines Adjusted Net Income as net income plus loss from discontinued operations, net of tax plus facility consolidation and severance expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined, all tax effected. (Note 6) Due to rounding, totals of the quarterly information for each of the years reflected may not necessarily equal the annual totals.

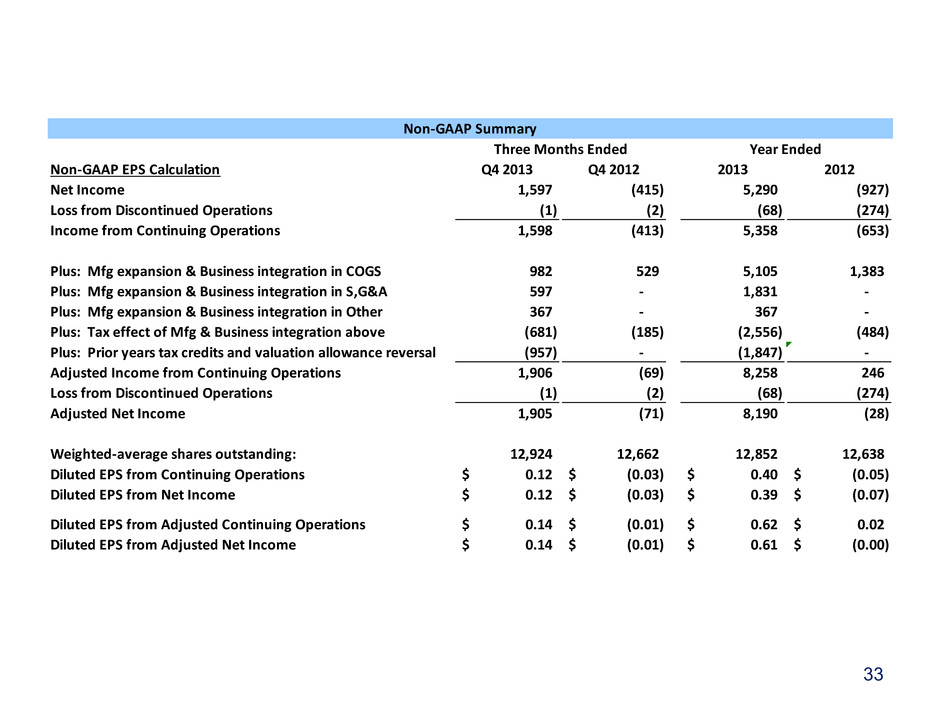

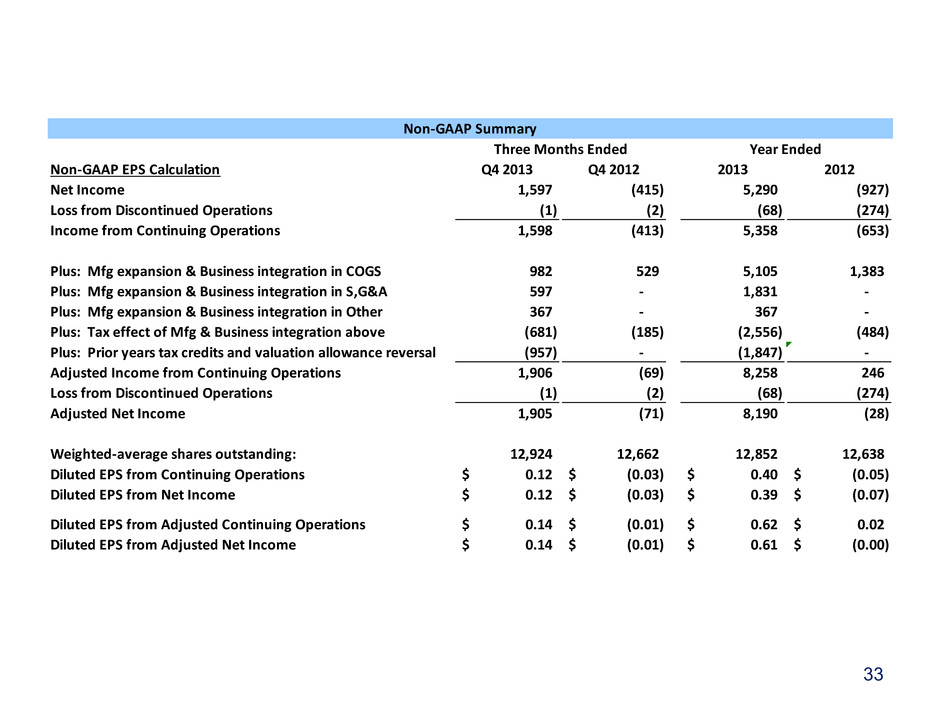

33 Non-GAAP EPS Calculation Q4 2013 Q4 2012 2013 2012 Net Income 1,597 (415) 5,290 (927) Loss from Discontinued Operations (1) (2) (68) (274) Income from Continuing Operations 1,598 (413) 5,358 (653) Plus: Mfg expansion & Business integration in COGS 982 529 5,105 1,383 Plus: Mfg expansion & Business integration in S,G&A 597 - 1,831 - Plus: Mfg expansion & Business integration in Other 367 - 367 - Plus: Tax effect of Mfg & Business integration above (681) (185) (2,556) (484) Plus: Prior years tax credits and valuation allowance reversal (957) - (1,847) - Adjusted Income from Continuing Operations 1,906 (69) 8,258 246 Loss from Discontinued Operations (1) (2) (68) (274) Adjusted Net Income 1,905 (71) 8,190 (28) Weighted-average shares outstanding: 12,924 12,662 12,852 12,638 Diluted EPS from Continuing Operations 0.12$ (0.03)$ 0.40$ (0.05)$ Diluted EPS from Net Income 0.12$ (0.03)$ 0.39$ (0.07)$ Diluted EPS from Adjusted Continuing Operations 0.14$ (0.01)$ 0.62$ 0.02$ Diluted EPS from Adjusted Net Income 0.14$ (0.01)$ 0.61$ (0.00)$ Three Months Ended Year Ended Non-GAAP Summary

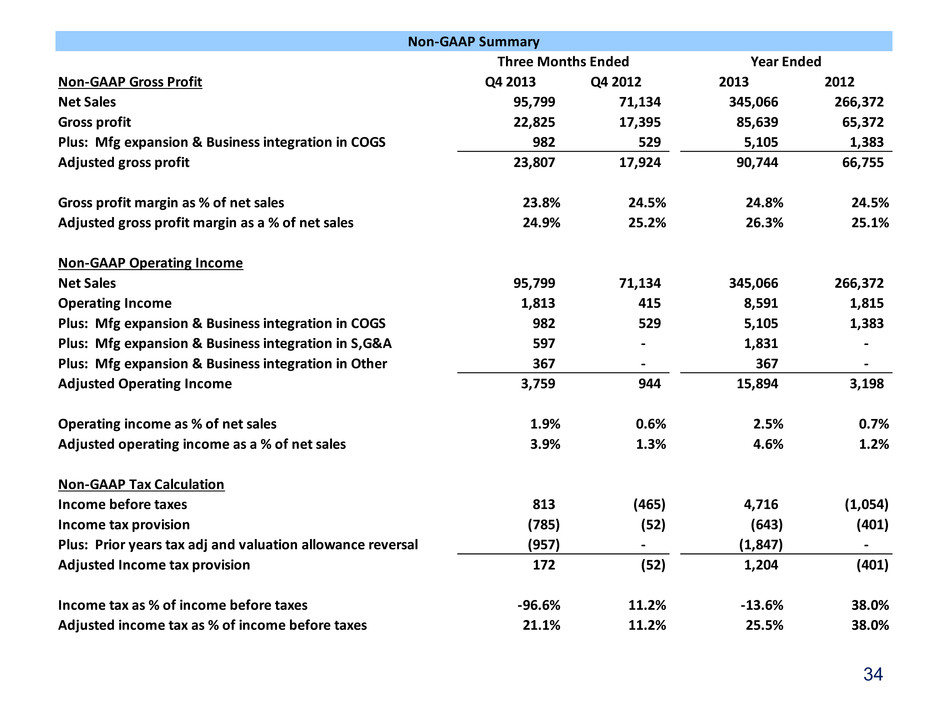

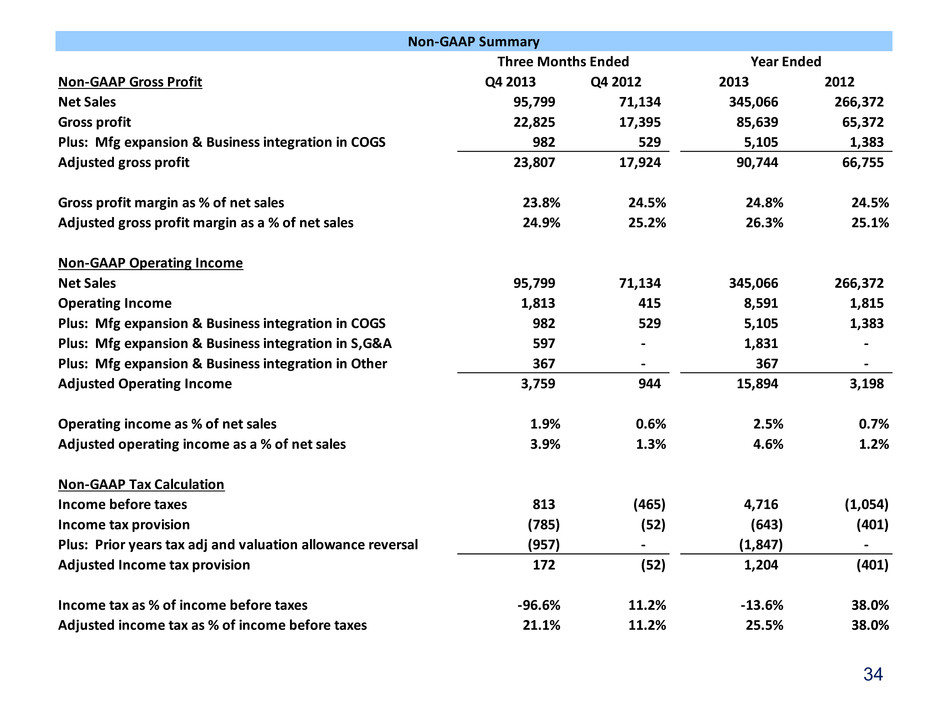

34 Non-GAAP Gross Profit Q4 2013 Q4 2012 2013 2012 Net Sales 95,799 71,134 345,066 266,372 Gross profit 22,825 17,395 85,639 65,372 Plus: Mfg expansion & Business integration in COGS 982 529 5,105 1,383 Adjusted gross profit 23,807 17,924 90,744 66,755 Gross profit margin as % of net sales 23.8% 24.5% 24.8% 24.5% Adjusted gross profit margin as a % of net sales 24.9% 25.2% 26.3% 25.1% Non-GAAP Operating Income Net Sales 95,799 71,134 345,066 266,372 Operating Income 1,813 415 8,591 1,815 Plus: Mfg expansion & Business integration in COGS 982 529 5,105 1,383 Plus: Mfg expansion & Business integration in S,G&A 597 - 1,831 - Plus: Mfg expansion & Business integration in Other 367 - 367 - Adjusted Operating Income 3,759 944 15,894 3,198 Operating income as % of net sales 1.9% 0.6% 2.5% 0.7% Adjusted operating income as a % of net sales 3.9% 1.3% 4.6% 1.2% Non-GAAP Tax Calculation Income before taxes 813 (465) 4,716 (1,054) Income tax provision (785) (52) (643) (401) Plus: Prior years tax adj and valuation allowance reversal (957) - (1,847) - Adjusted Income tax provision 172 (52) 1,204 (401) Income tax as % of income before taxes -96.6% 11.2% -13.6% 38.0% Adjusted income tax as % of income before taxes 21.1% 11.2% 25.5% 38.0% Three Months Ended Year Ended Non-GAAP Summary

35 Adjusted Operating Income (Loss) - Note 2 ($ in thousands) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Sales 62,851 66,566 65,822 71,134 75,440 83,616 90,211 95,799 Operating income (loss) 620 (40) 820 415 1,677 3,271 1,829 1,813 Plus: Facility consolidation and severance expenses - - - - - - - - Plus: Impairment of assets - - - - - - - - Plus: Impairment of goodwill - - - - - - - - Plus: Mfg expansion & Business integration in COGS 148 399 307 529 1,303 1,143 1,677 982 Plus: Mfg expansion & Business integration in S,G&A - - - - 165 299 770 597 Plus: Mfg expansion & Business integration in Other - - - - - - - 367 Non-GAAP Adj. Operating Income (Loss) (Note 2) 768$ 359$ 1,127$ 944$ 3,145$ 4,713$ 4,276$ 3,759$ Non-GAAP Adj. Operating Income as % of Net Sales 1.2% 0.5% 1.7% 1.3% 4.2% 5.6% 4.7% 3.9% Adjusted Earnings before Interest and Taxes (EBIT) - Note 3 ($ in thousands) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net income (loss) as reported (181) (433) 102 (415) 636 1,645 1,412 1,597 Less: Income (loss) from discontinued, net tax (77) (29) (167) (2) (15) (32) (20) (1) Plus: Taxes (5) (303) (41) (52) 23 620 (501) (785) Plus: Interest 726 762 781 877 995 869 896 996 Non-GAAP Adjusted EBIT (Note 3) 617$ 55$ 1,009$ 412$ 1,669$ 3,166$ 1,828$ 1,809$ Non-GAAP Adjusted EBIT as % of Net Sales 1.0% 0.1% 1.5% 0.6% 2.2% 3.8% 2.0% 1.9% Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) - Note 4 ($ in thousands) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Non-GAAP Adjusted EBIT (from above) 617 55 1,009 412 1,669 3,166 1,828 1,809 Plus: Depreciation and amortization 2,402 2,379 2,355 2,259 2,515 2,559 2,747 2,441 Plus: Facility consolidation and severance expenses - - - - - - - - Plus: Impairment of assets - - - - - - - - Plus: Impairment of goodwill - - - - - - - - Plus: Mfg expansion & Business integration in COGS 148 399 307 529 1,303 1,143 1,677 982 Plus: Mfg expansion & Business integration in S,G&A - - - - 165 299 770 597 Plus: Mfg expansion & Business integration in Other - - - - - - - 367 Plus: Other (income) expense - net 3 (95) (189) 3 8 105 3 3 Non-GAAP Adjusted EBITDA (Note 4) 3,170$ 2,738$ 3,482$ 3,203$ 5,660$ 7,272$ 7,025$ 6,199$ Non-GAAP Adjusted EBITDA as % of Net Sales 5.0% 4.1% 5.3% 4.5% 7.5% 8.7% 7.8% 6.5% Use of Non-GAAP Financial Information:

36 Free Cash Flow (FCF) - Note 5 ($ in thousands) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Non-GAAP Adjusted EBIT (from above) 617 55 1,009 412 1,669 3,166 1,828 1,809 Times: 1 - Tax Rate = EBIAT 401 35 656 268 1,085 2,058 1,188 1,176 Plus: Depreciation and Amortization 2,402 2,379 2,355 2,259 2,515 2,559 2,747 2,441 Plus: Non Cash Impairment of Assets and Goodwill - - - - - - - - Minus: Net change in Working Capital 5,431 4,250 812 48 2,923 8,851 7,805 (858) Non-GAAP Cash from Operations (2,628) (1,835) 2,199 2,479 677 (4,234) (3,870) 4,474 Minus: Capital Expenditures net of Asset Sales 1,132 557 298 2,065 2,580 3,441 4,450 2,786 Minus: Business / Capital acquistions - - - 9,142 - - 1,863 - Non-GAAP Free Cash Flow (Note 5) (3,760) (2,392) 1,901 (8,728) (1,903) (7,675) (10,183) 1,688 Current Assets 106,235 111,395 111,841 115,055 122,065 132,985 151,164 149,789 Current Liabilities 34,387 35,297 34,931 38,097 42,184 44,253 54,628 54,110 Net Working Capital 71,848 76,098 76,910 76,958 79,881 88,732 96,537 95,679 Change in Net Working Capital 5,431 4,250 812 48 2,923 8,851 7,805 (858) Adjusted Income from Continuing Operations - Note 6 ($ in thousands) Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Income (181) (433) 102 (415) 636 1,645 1,412 1,597 Loss from Discontinued Operations (77) (29) (167) (2) (15) (32) (20) (1) Income from Continuing Operations (104) (405) 269 (413) 651 1,677 1,432 1,598 Plus: Facility consolidation and severance expenses - - - - - - - - Plus: Impairment of assets - - - - - - - - Plus: Impairment of goodwill - - - - - - - - Plus: Mfg expansion & Business integration in COGS 148 399 307 529 1,303 1,143 1,677 982 Plus: Mfg expansion & Business integration in S,G&A - - - - 165 299 770 597 Plus: Mfg expansion & Business integration in Other - - - - - - - 367 Plus: Tax effect of Mfg & Business integration above (52) (140) (107) (185) (514) (505) (856) (681) Plus: Prior years tax credits and valuation allowance - - - - (157) - (733) (957) Adjusted Income from Continuing Operations (8) (145) 468 (69) 1,449 2,615 2,289 1,906 Loss from Discontinued Operations (77) (29) (167) (2) (15) (32) (20) (1) Non -GAAP Adjusted Net Income (85) (174) 302 (71) 1,434 2,583 2,269 1,905 Non-GAAP Adjusted Net Income as % of Net Sales -0.1% -0.3% 0.5% -0.1% 1.9% 3.1% 2.5% 2.0%

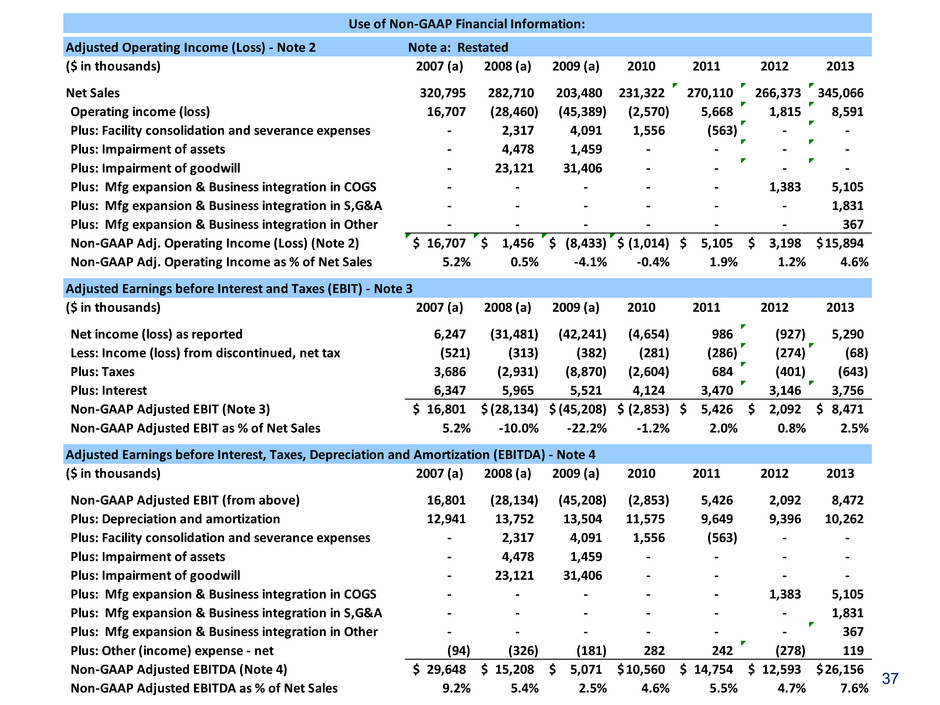

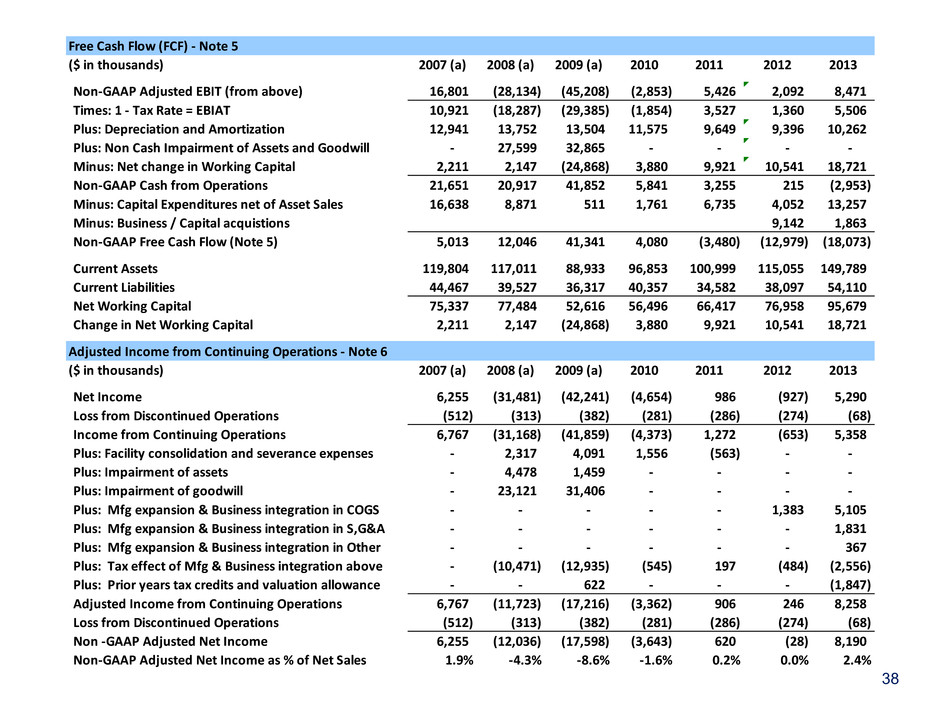

37 Adjusted Operating Income (Loss) - Note 2 Note a: Restated ($ in thousands) 2007 (a) 2008 (a) 2009 (a) 2010 2011 2012 2013 Net Sales 320,795 282,710 203,480 231,322 270,110 266,373 345,066 Operating income (loss) 16,707 (28,460) (45,389) (2,570) 5,668 1,815 8,591 Plus: Facility consolidation and severance expenses - 2,317 4,091 1,556 (563) - - Plus: Impairment of assets - 4,478 1,459 - - - - Plus: Impairment of goodwill - 23,121 31,406 - - - - Plus: Mfg expansion & Business integration in COGS - - - - - 1,383 5,105 Plus: Mfg expansion & Business integration in S,G&A - - - - - - 1,831 Plus: Mfg expansion & Business integration in Other - - - - - - 367 Non-GAAP Adj. Operating Income (Loss) (Note 2) 16,707$ 1,456$ (8,433)$ (1,014)$ 5,105$ 3,198$ 15,894$ Non-GAAP Adj. Operating Income as % of Net Sales 5.2% 0.5% -4.1% -0.4% 1.9% 1.2% 4.6% Adjusted Earnings before Interest and Taxes (EBIT) - Note 3 ($ in thousands) 2007 (a) 2008 (a) 2009 (a) 2010 2011 2012 2013 Net income (loss) as reported 6,247 (31,481) (42,241) (4,654) 986 (927) 5,290 Less: Income (loss) from discontinued, net tax (521) (313) (382) (281) (286) (274) (68) Plus: Taxes 3,686 (2,931) (8,870) (2,604) 684 (401) (643) Plus: Interest 6,347 5,965 5,521 4,124 3,470 3,146 3,756 Non-GAAP Adjusted EBIT (Note 3) 16,801$ (28,134)$ (45,208)$ (2,853)$ 5,426$ 2,092$ 8,471$ Non-GAAP Adjusted EBIT as % of Net Sales 5.2% -10.0% -22.2% -1.2% 2.0% 0.8% 2.5% Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) - Note 4 ($ in thousands) 2007 (a) 2008 (a) 2009 (a) 2010 2011 2012 2013 Non-GAAP Adjusted EBIT (from above) 16,801 (28,134) (45,208) (2,853) 5,426 2,092 8,472 Plus: Depreciation and amortization 12,941 13,752 13,504 11,575 9,649 9,396 10,262 Plus: Facility consolidation and severance expenses - 2,317 4,091 1,556 (563) - - Plus: Impairment of assets - 4,478 1,459 - - - - Plus: Impairment of goodwill - 23,121 31,406 - - - - Plus: Mfg expansion & Business integration in COGS - - - - - 1,383 5,105 Plus: Mfg expansion & Business integration in S,G&A - - - - - - 1,831 Plus: Mfg expansion & Business integration in Other - - - - - - 367 Plus: Other (income) expense - net (94) (326) (181) 282 242 (278) 119 Non-GAAP Adjusted EBITDA (Note 4) 29,648$ 15,208$ 5,071$ 10,560$ 14,754$ 12,593$ 26,156$ Non-GAAP Adjusted EBITDA as % of Net Sales 9.2% 5.4% 2.5% 4.6% 5.5% 4.7% 7.6% Use of Non-GAAP Financial Information:

38 Free Cash Flow (FCF) - Note 5 ($ in thousands) 2007 (a) 2008 (a) 2009 (a) 2010 2011 2012 2013 Non-GAAP Adjusted EBIT (from above) 16,801 (28,134) (45,208) (2,853) 5,426 2,092 8,471 Times: 1 - Tax Rate = EBIAT 10,921 (18,287) (29,385) (1,854) 3,527 1,360 5,506 Plus: Depreciation and Amortization 12,941 13,752 13,504 11,575 9,649 9,396 10,262 Plus: Non Cash Impairment of Assets and Goodwill - 27,599 32,865 - - - - Minus: Net change in Working Capital 2,211 2,147 (24,868) 3,880 9,921 10,541 18,721 Non-GAAP Cash from Operations 21,651 20,917 41,852 5,841 3,255 215 (2,953) Minus: Capital Expenditures net of Asset Sales 16,638 8,871 511 1,761 6,735 4,052 13,257 Minus: Business / Capital acquistions 9,142 1,863 Non-GAAP Free Cash Flow (Note 5) 5,013 12,046 41,341 4,080 (3,480) (12,979) (18,073) Current Assets 119,804 117,011 88,933 96,853 100,999 115,055 149,789 Current Liabilities 44,467 39,527 36,317 40,357 34,582 38,097 54,110 Net Working Capital 75,337 77,484 52,616 56,496 66,417 76,958 95,679 Change in Net Working Capital 2,211 2,147 (24,868) 3,880 9,921 10,541 18,721 Adjusted Income from Continuing Operations - Note 6 ($ in thousands) 2007 (a) 2008 (a) 2009 (a) 2010 2011 2012 2013 Net Income 6,255 (31,481) (42,241) (4,654) 986 (927) 5,290 Loss from Discontinued Operations (512) (313) (382) (281) (286) (274) (68) Income from Continuing Operations 6,767 (31,168) (41,859) (4,373) 1,272 (653) 5,358 Plus: Facility consolidation and severance expenses - 2,317 4,091 1,556 (563) - - Plus: Impairment of assets - 4,478 1,459 - - - - Plus: Impairment of goodwill - 23,121 31,406 - - - - Plus: Mfg expansion & Business integration in COGS - - - - - 1,383 5,105 Plus: Mfg expansion & Business integration in S,G&A - - - - - - 1,831 Plus: Mfg expansion & Business integration in Other - - - - - - 367 Plus: Tax effect of Mfg & Business integration above - (10,471) (12,935) (545) 197 (484) (2,556) Plus: Prior years tax credits and valuation allowance - - 622 - - - (1,847) Adjusted Income from Continuing Operations 6,767 (11,723) (17,216) (3,362) 906 246 8,258 Loss from Discontinued Operations (512) (313) (382) (281) (286) (274) (68) Non -GAAP Adjusted Net Income 6,255 (12,036) (17,598) (3,643) 620 (28) 8,190 Non-GAAP Adjusted Net Income as % of Net Sales 1.9% -4.3% -8.6% -1.6% 0.2% 0.0% 2.4%