March 2017 Investor Presentation Contact: Jon Faulkner CFO The Dixie Group Phone: 706-876-5814 jon.faulkner@dixiegroup.com Exhibit 99.1

Forward Looking Statements The Dixie Group, Inc. • Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2

Dixie History • 1920 Began as Dixie Mercerizing in Chattanooga, TN • 1990’s Transitioned from textiles to floorcovering • 2003 Refined focus on upper- end floorcovering market • 2003 Launched Dixie Home - upper end residential line • 2005 Launched modular tile carpet line – new product category • 2007 Launched wool products in Masland & Fabrica – high-end designers • 2010 Residential “soft products” growth strategy • 2012 New Masland Contract management – performance tile strategy • 2012 Purchased Colormaster dye house – lower cost • 2012 Purchased Crown rugs – wool rugs • 2013 Purchased Robertex - wool carpet manufacturing • 2014 Expanded and realigned manufacturing to increase capacity • 2014 Purchased Atlas Carpet Mills – high-end commercial business • 2014 Purchased Burtco - computerized yarn placement for hospitality 3

Dixie Today • Commitment to brands in the upper- end market with strong growth potential. • Diversified between Commercial and Residential markets. • Diversified customer base (TTM Basis) – Top 10 carpet customers • 14.6% of sales – Top 100 carpet customers • 28.4% of sales 4

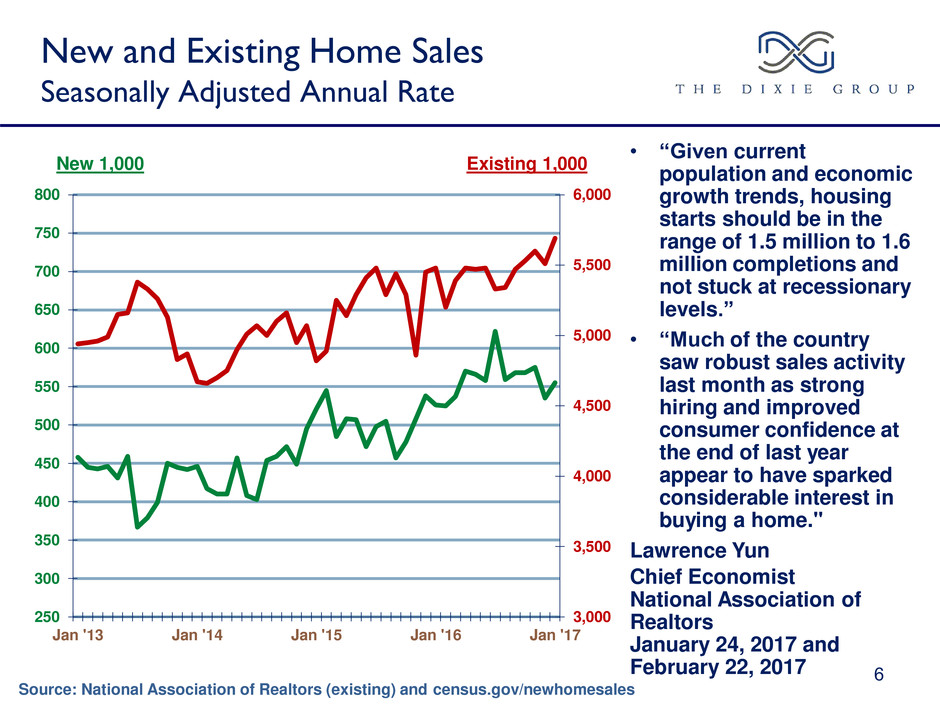

5 Dixie Group Drivers What affects our business? The market dynamics: • Residentially • The market is driven by home sales and remodeling. • New construction is a smaller effect. • Dixie is driven by the wealth effect. • The stock market and consumer confidence. • Commercially • The market is driven by remodeling of offices, schools, retail and hospitality as demonstrated by the investment in non-residential fixed structures. • Dixie is driven by upper-end remodeling in offices, retail remodeling, higher education, and upper-end hospitality that primarily involves a designer.

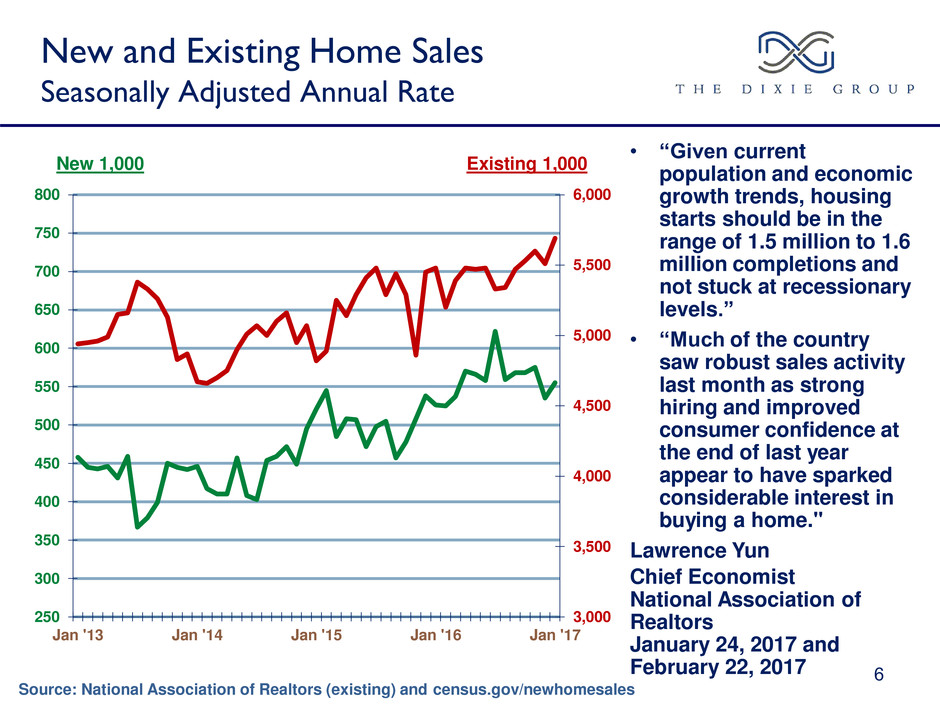

New and Existing Home Sales Seasonally Adjusted Annual Rate 6 New 1,000 Existing 1,000 Source: National Association of Realtors (existing) and census.gov/newhomesales 3,000 3,500 4,000 4,500 5,000 5,500 6,000 250 300 350 400 450 500 550 600 650 700 750 800 Jan '13 Jan '14 Jan '15 Jan '16 Jan '17 • “Given current population and economic growth trends, housing starts should be in the range of 1.5 million to 1.6 million completions and not stuck at recessionary levels.” • “Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have sparked considerable interest in buying a home." Lawrence Yun Chief Economist National Association of Realtors January 24, 2017 and February 22, 2017

Residential and Commercial Fixed Investment 7 Rebound in residential activity Commercial activity is flat We expect 2017 to continue the rebound of residential fixed investment as a percent of GDP

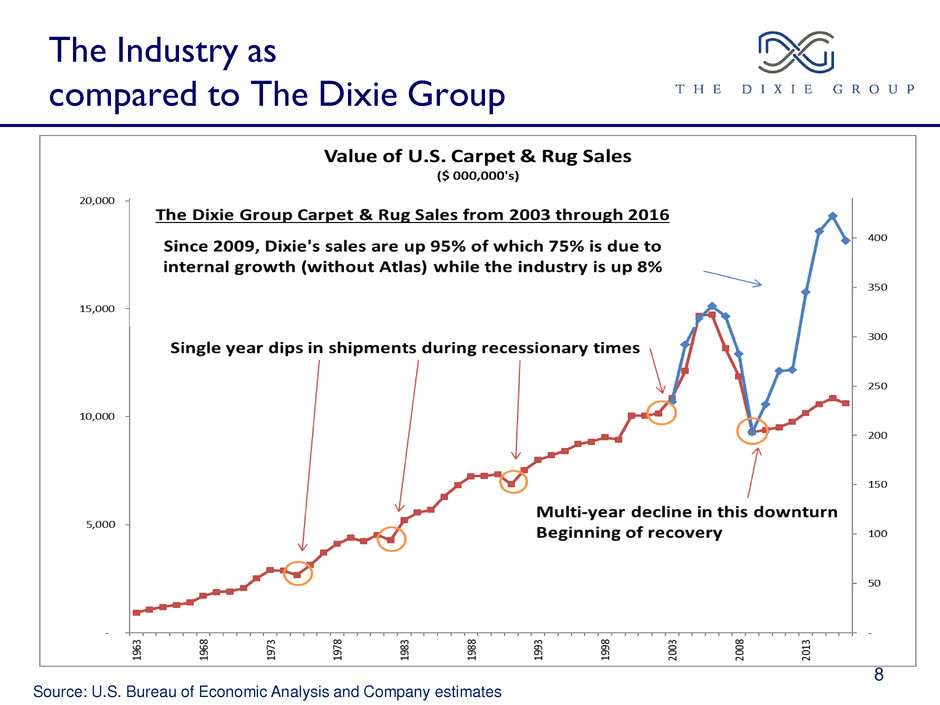

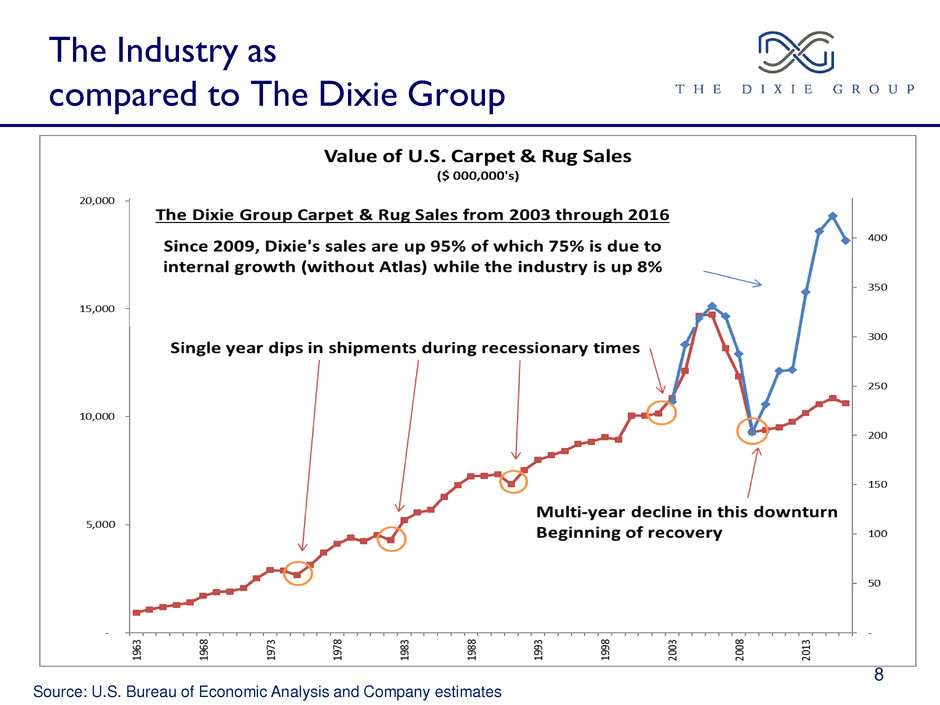

The Industry as compared to The Dixie Group 8 Source: U.S. Bureau of Economic Analysis and Company estimates

2015 U.S. Flooring Manufacturers 9 Source: Floor Focus Carpet includes sales of carpet as broadloom, modular tile and rugs Flooring includes sales of carpet, rugs, ceramic floor tile, wood, laminate, resilient and rubber Carpet & Rug Leaders Carpet $ in millions Carpet % Flooring $ in millions Flooring % Shaw (Berkshire Hathaway) $ 3,200 29.5% 3,929 19.1% Mohawk (MHK) $ 2,653 24.5% 4,585 22.3% Engineered Floors (Private) $ 540 5.0% 540 2.6% Interface (TILE) $ 520 4.8% 520 2.5% Beaulieu (Private) $ 504 4.6% 524 2.6% Dixie (DXYN) $ 419 3.9% 419 2.0% Imports & All Others $ 3,016 27.7% 10,009 48.9% U.S. Carpet & Rug Market $ 10,852 100% 20,526 100.0%

Dixie versus the Industry 2016 U.S. Carpet & Rug Market of $10.5 billion 10Source: Floor Covering Weekly and Dixie Group estimate 2016 Dixie sales

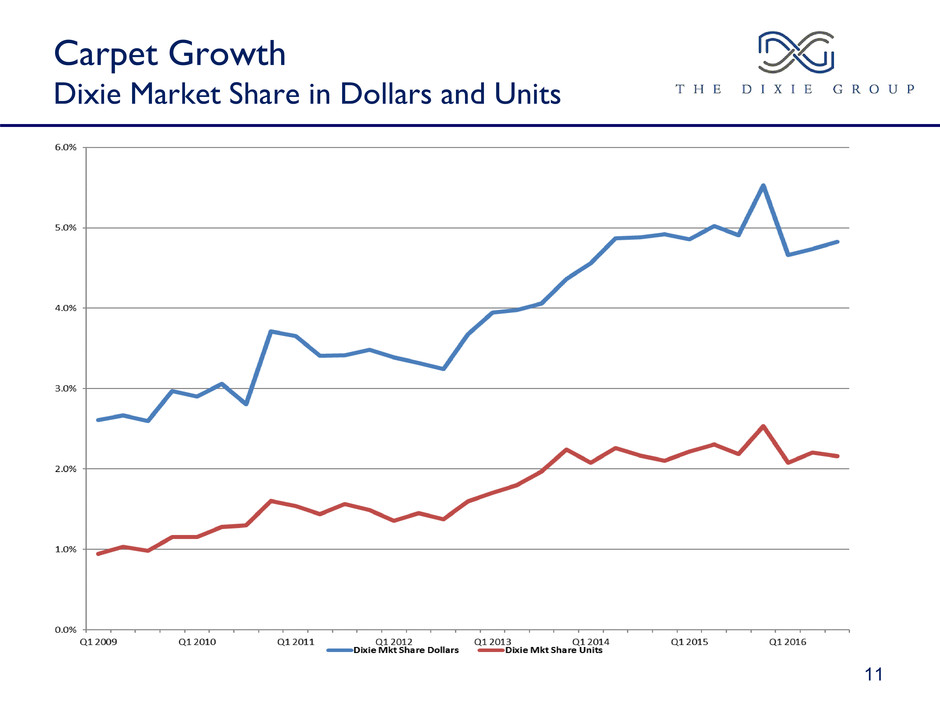

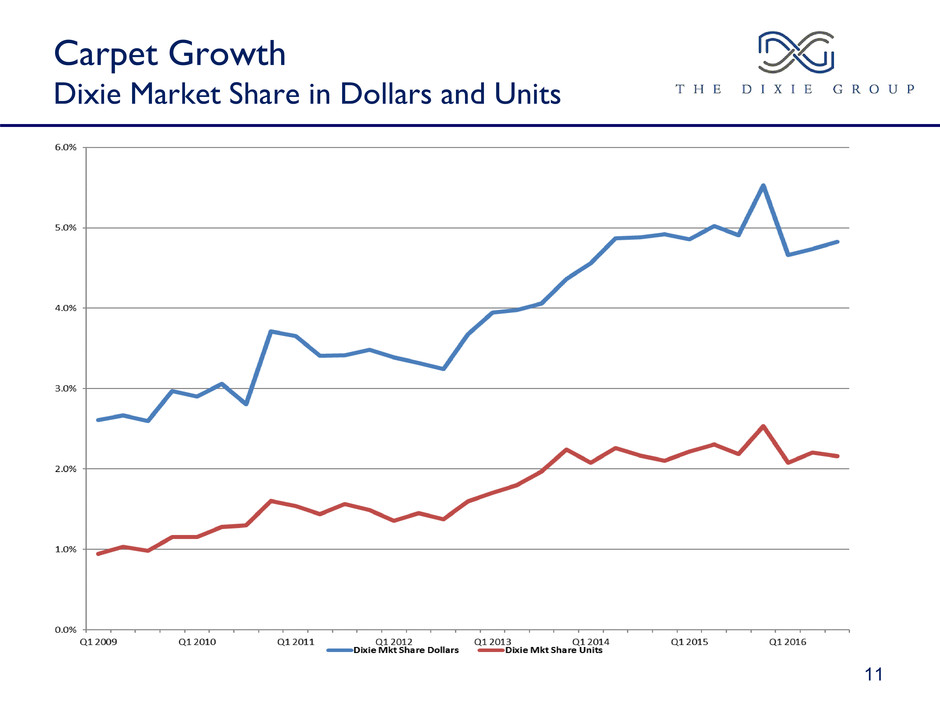

Carpet Growth Dixie Market Share in Dollars and Units 11

Industry Positioning The Dixie Group • Strategically our residential and commercial businesses are driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with emphasis on the most beautiful and up-to-date styling and design – Be quality focused with excellent reputation for building excellent products and standing behind what we make – And, unlike much of the industry, not manufacturing driven 12

Residential Market Positioning The Dixie Group 13 BROADLOOM RESIDENTIAL SALES T O T A L M A R K E T : S QUA R E Y A R DS OR S A L E S DO L L A R S ESTIMATED TOTAL WHOLESALE MARKET FOR CARPETS AND RUGS: VOLUME AND PRICE POINTS Positioning of Dixie Brands by Price Point Segment Dixie Home Fabrica INDUSTRY AVERAGE PRICE/ SQ YD $0 $14 $21 $28 $35 $42 $49 Note: Industry average price is based on sales reported through industry sources. Excerpt from KSA Study dated May 2004, Titled "KSA Assessment of Dixie's Residential and Contract Carpet Businesses", commissioned by The Dixie Group, Inc. $8 Masland FOCUSED NATIONAL SUPPLIER IN THE UPPER END OF THE SOFT FLOOR COVERING MARKET

Dixie Group High-End Residential Sales All Residential Brands 14 Sales by Brand for 2016

Dixie Group High-End Residential Sales All Brands Retailer Designer Mass Merchant Builder Commercial Specialty - OEM 15 Sales by Channel for 2016 The company believes that a significant portion of retail sales also involve a designer

• Well-styled moderate to upper priced residential broadloom line – Known for differentiated pattern and color selection • Dixie Home provides a “full line” to retailers – Sells specialty and mass merchant retailers • Growth initiatives – Stainmaster® Tru Soft TM Fiber Technology – Stainmaster® PetProtect ® Fiber Technology 16

• Leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven – Approximately 26% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiative – Stainmaster® TruSoft™ Fiber Technology – Stainmaster® PetProtect ® Fiber Technology – Wool products in both tufted and woven constructions 17

• Premium high-end brand – “Quality without Compromise” • Designer focused – Approximately 32% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiatives – Stainmaster® TruSoft™ Fiber Technology – Fabrica Permaset dyeing process “unlimited color selection in wool” 18

Commercial Market Positioning The Dixie Group • We focus on the “high-end specified soft floorcovering contract market” • Our Atlas brand – Designer driven focused on the fashion oriented market space • Our Masland Contract brand – Broad product line for diverse commercial markets • Our Masland Hospitality brand – Custom products for the hospitality industry • Our Masland Residential sales force – Sells “main street commercial” through retailers 19

• Atlas is our premium commercial brand • Dedicated to serving the architect and designer needing finer goods • Focus is on the corporate market through high fashion broadloom and modular carpet tile offerings • With state-of-the-art tufting machines Atlas can quickly manufacture both custom and running line products 20

• Upper-end brand in the specified commercial marketplace – Corporate, End User, Store Planning, Hospitality, Health Care, Government and Education markets • Designer focused • Strong national account base • Growth initiatives – Masland Contract Modular Carpet Tile – Masland Hospitality using “computerized yarn placement” technology – Calibre Luxury Vinyl Tile 21

22 Sales by Channel for 2016 Channels: Interior Design Specifier and Commercial End User

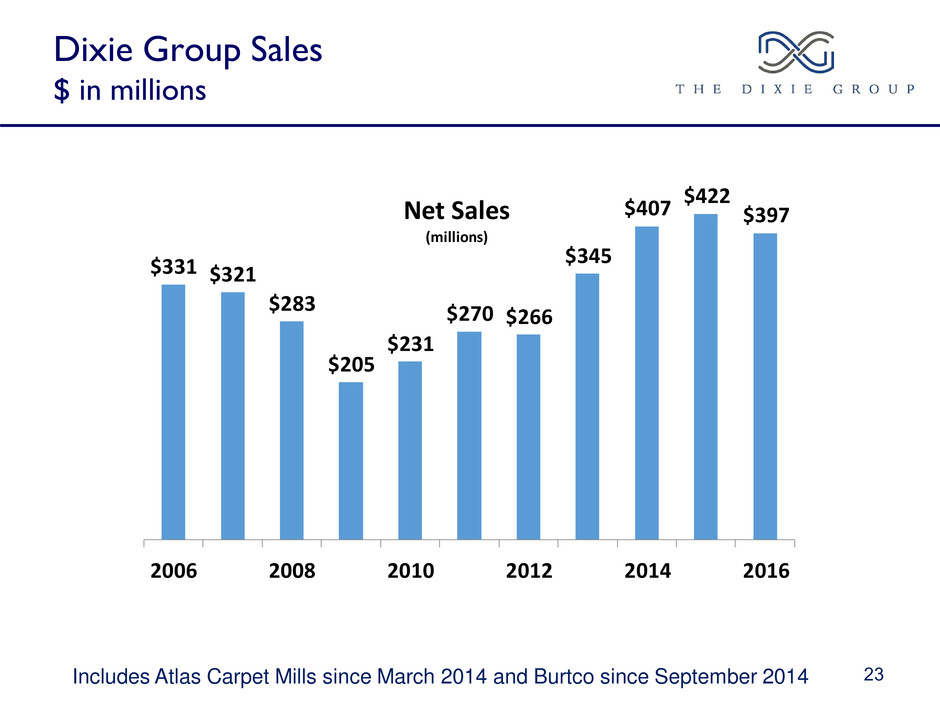

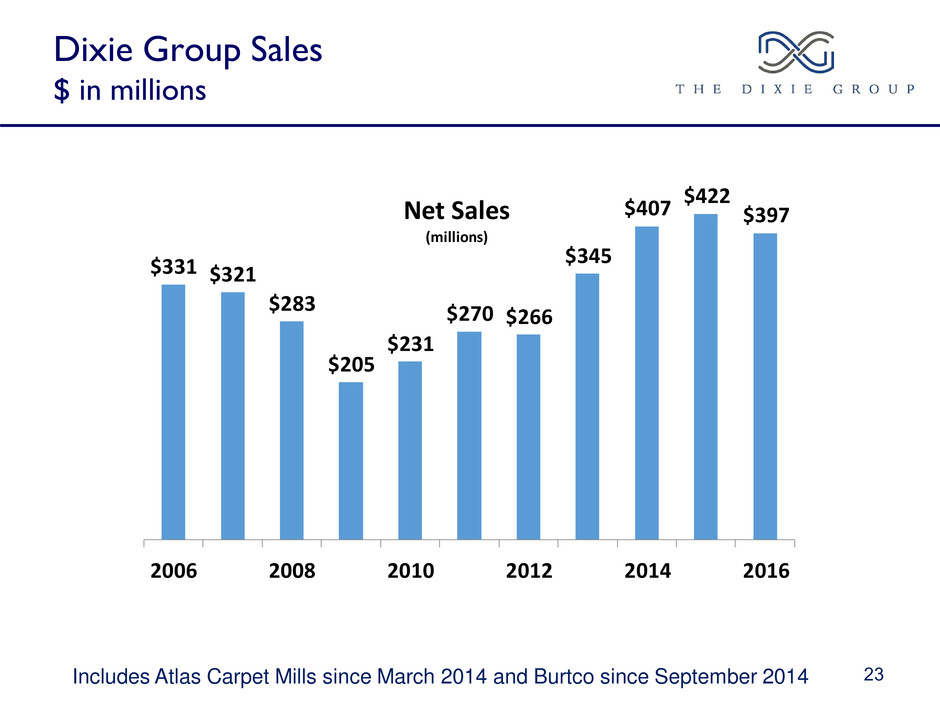

Dixie Group Sales $ in millions $331 $321 $283 $205 $231 $270 $266 $345 $407 $422 $397 2006 2008 2010 2012 2014 2016 Net Sales (millions) 23Includes Atlas Carpet Mills since March 2014 and Burtco since September 2014

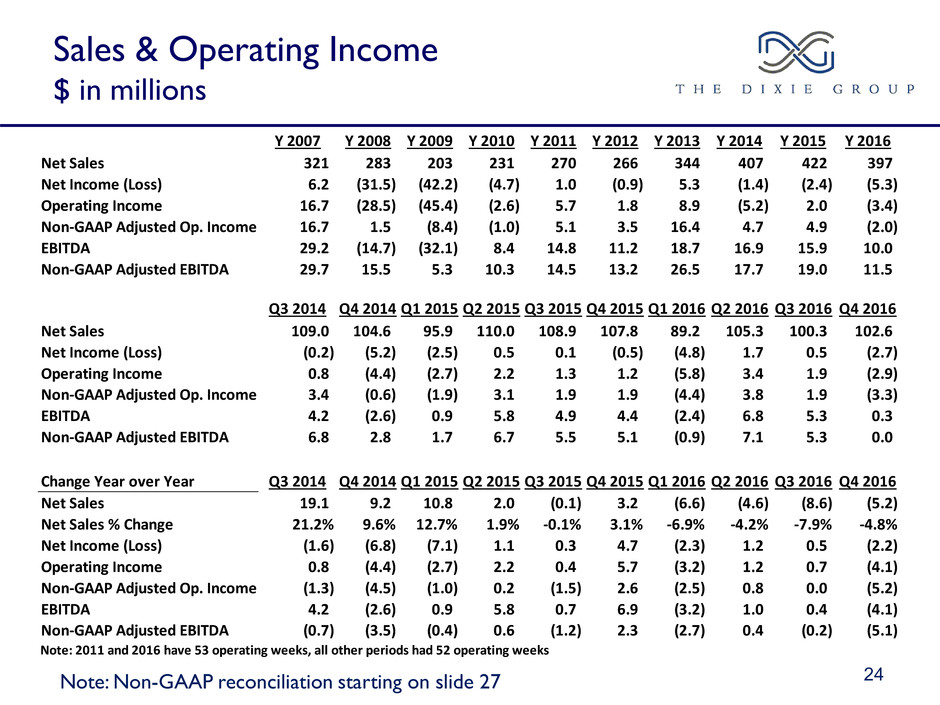

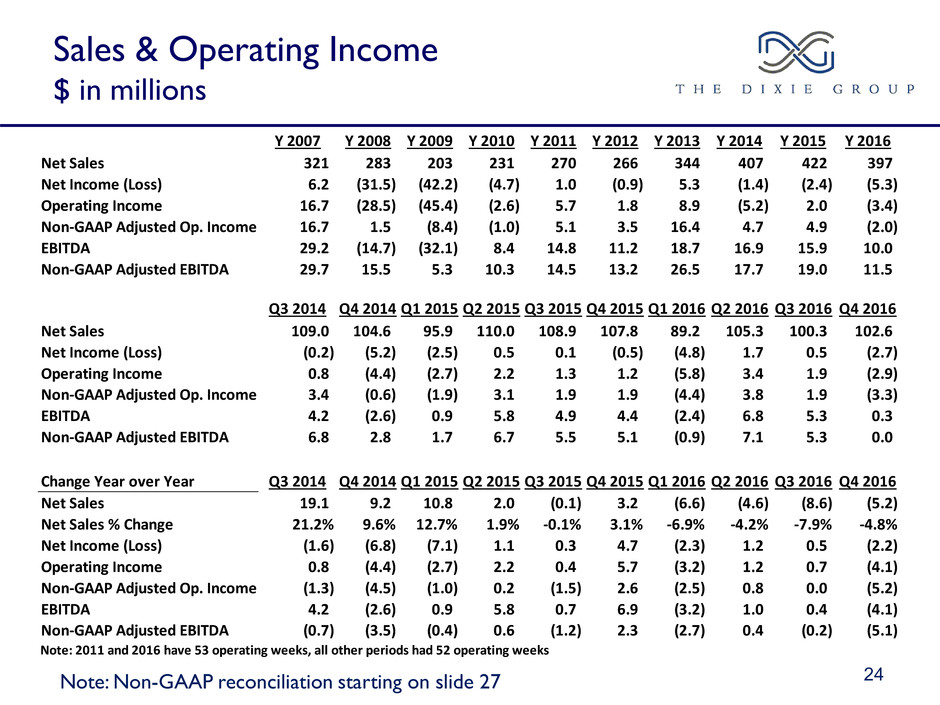

Sales & Operating Income $ in millions 24Note: Non-GAAP reconciliation starting on slide 27 Y 2007 Y 2008 Y 2009 Y 2010 Y 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Net Sales 321 283 203 231 270 266 344 407 422 397 Net Income (Loss) 6.2 (31.5) (42.2) (4.7) 1.0 (0.9) 5.3 (1.4) (2.4) (5.3) Operating Income 16.7 (28.5) (45.4) (2.6) 5.7 1.8 8.9 (5.2) 2.0 (3.4) Non-GAAP Adjusted Op. Income 16.7 1.5 (8.4) (1.0) 5.1 3.5 16.4 4.7 4.9 (2.0) EBITDA 29.2 (14.7) (32.1) 8.4 14.8 11.2 18.7 16.9 15.9 10.0 Non-GAAP Adjusted EBITDA 29.7 15.5 5.3 10.3 14.5 13.2 26.5 17.7 19.0 11.5 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Net Sales 109.0 104.6 95.9 110.0 108.9 107.8 89.2 105.3 100.3 102.6 Net Income (Loss) (0.2) (5.2) (2.5) 0.5 0.1 (0.5) (4.8) 1.7 0.5 (2.7) Operating Income 0.8 (4.4) (2.7) 2.2 1.3 1.2 (5.8) 3.4 1.9 (2.9) Non-GAAP Adjusted Op. Income 3.4 (0.6) (1.9) 3.1 1.9 1.9 (4.4) 3.8 1.9 (3.3) EBITDA 4.2 (2.6) 0.9 5.8 4.9 4.4 (2.4) 6.8 5.3 0.3 Non-GAAP Adjusted EBITDA 6.8 2.8 1.7 6.7 5.5 5.1 (0.9) 7.1 5.3 0.0 Change Year over Year Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Net Sales 19.1 9.2 10.8 2.0 (0.1) 3.2 (6.6) (4.6) (8.6) (5.2) Net Sales % Change 21.2% 9.6% 12.7% 1.9% -0.1% 3.1% -6.9% -4.2% -7.9% -4.8% Net Income (Loss) (1.6) (6.8) (7.1) 1.1 0.3 4.7 (2.3) 1.2 0.5 (2.2) Operating Income 0.8 (4.4) (2.7) 2.2 0.4 5.7 (3.2) 1.2 0.7 (4.1) Non-GAAP Adjusted Op. Income (1.3) (4.5) (1.0) 0.2 (1.5) 2.6 (2.5) 0.8 0.0 (5.2) EBITDA 4.2 (2.6) 0.9 5.8 0.7 6.9 (3.2) 1.0 0.4 (4.1) Non-GAAP Adjusted EBITDA (0.7) (3.5) (0.4) 0.6 (1.2) 2.3 (2.7) 0.4 (0.2) (5.1) Note: 2011 and 2016 have 53 operating weeks, all other periods had 52 operating weeks

Current Business Conditions 2017 Initiatives • We have improved our quality, delivery and production throughput as our new associates are now trained and productive. • We have completed our facility consolidation plan, separating our east coast residential and commercial businesses, and the consolidation of our west coast coater operations, streamlining our operations. • We reduced our inventory by $17.9 million in 2016, thus aligning sales and production levels for 2017. • We refinanced our long term debt, pushing out the maturity to 2021. • Masland Contract launched the new Calibré luxury vinyl tile line. • We have launched Stainmaster PetProtect® luxury vinyl tile through our Masland and Dixie Home residential brands with its “Claw Scratch Shield” and “Pet Traction Action” coating . • Our floorcovering sales over the first 9 weeks of the first quarter are up 8% as compared with the same period last year. Our total sales are up 5.9% on a year over year basis since our yarn sales have declined. 25

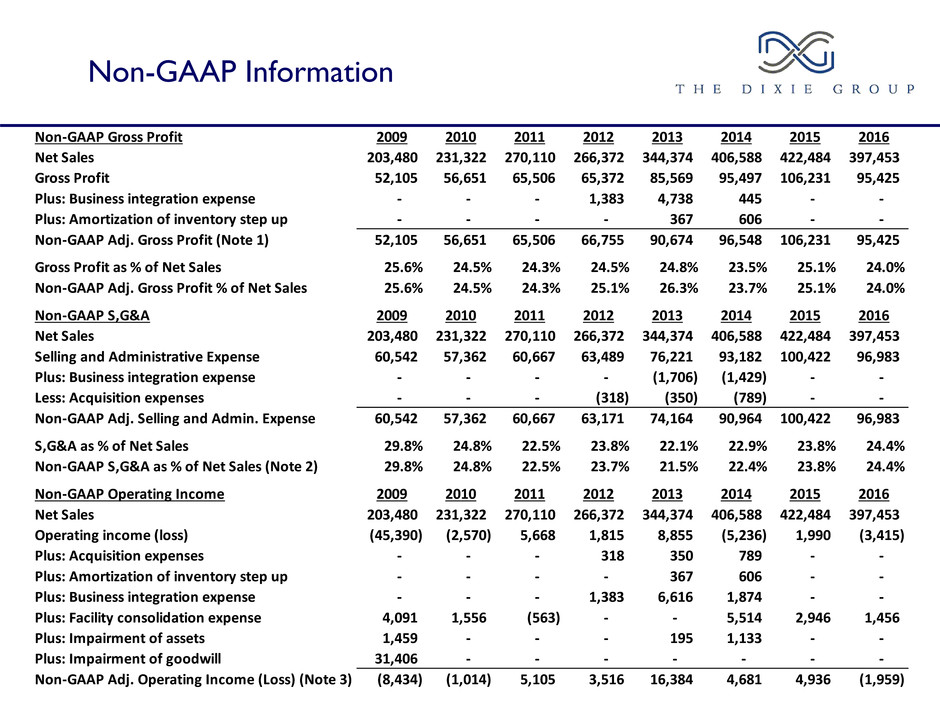

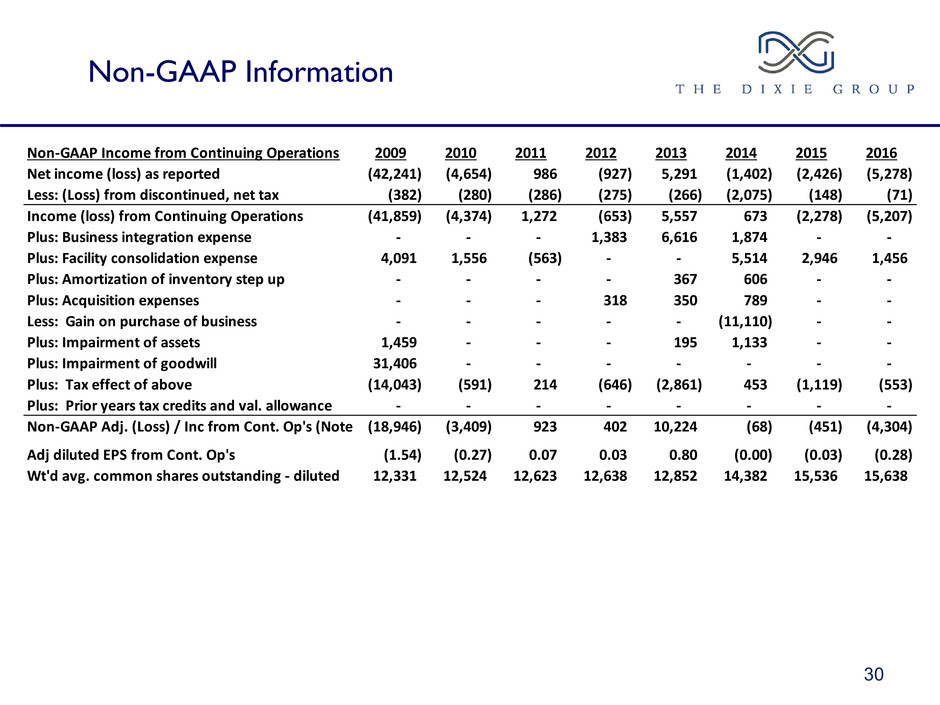

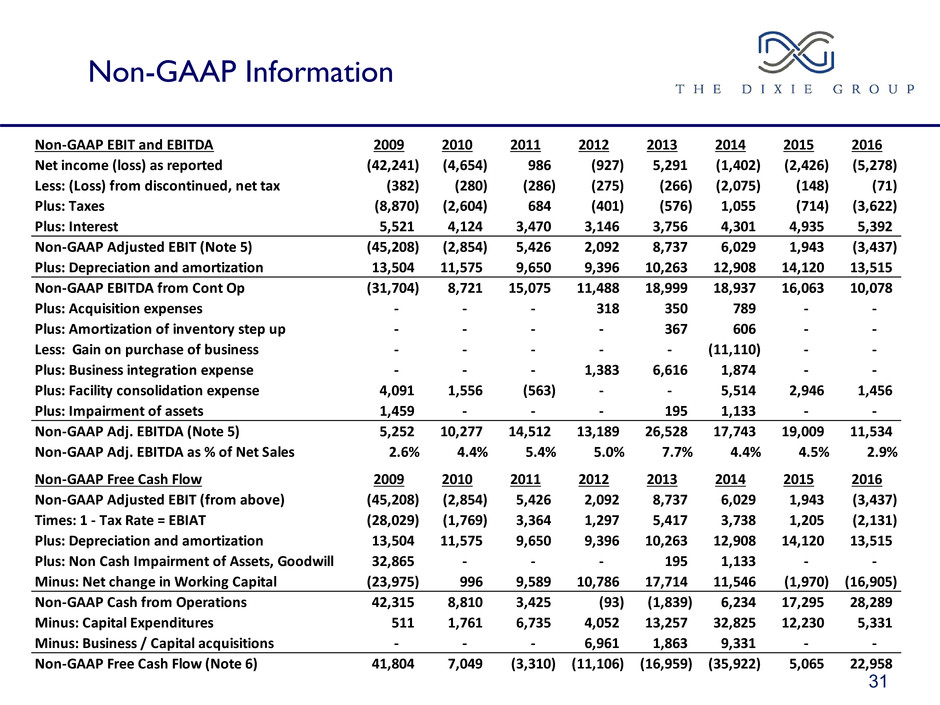

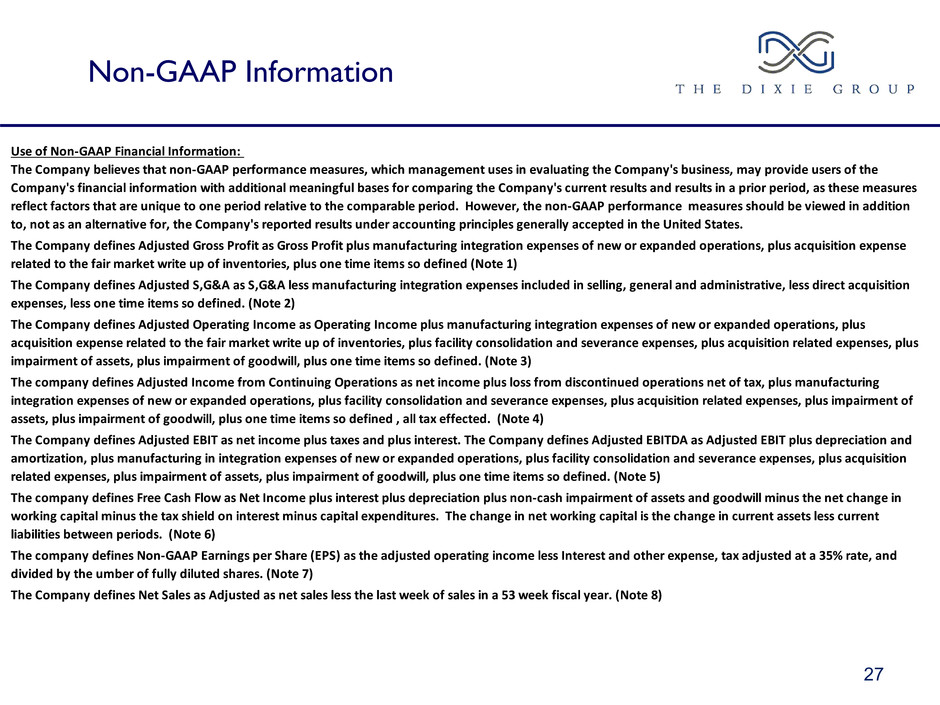

Non-GAAP Information 27 Use of Non-GAAP Financial Information: The Company believes that non-GAAP performance measures, which management uses in evaluating the Company's business, may provide users of the Company's financial information with additional meaningful bases for comparing the Company's current results and results in a prior period, as these measures reflect factors that are unique to one period relative to the comparable period. However, the non-GAAP performance measures should be viewed in addition to, not as an alternative for, the Company's reported results under accounting principles generally accepted in the United States. The Company defines Adjusted Gross Profit as Gross Profit plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair market write up of inventories, plus one time items so defined (Note 1) The Company defines Adjusted S,G&A as S,G&A less manufacturing integration expenses included in selling, general and administrative, less direct acquisition expenses, less one time items so defined. (Note 2) The Company defines Adjusted Operating Income as Operating Income plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair market write up of inventories, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined. (Note 3) The company defines Adjusted Income from Continuing Operations as net income plus loss from discontinued operations net of tax, plus manufacturing integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined , all tax effected. (Note 4) The Company defines Adjusted EBIT as net income plus taxes and plus interest. The Company defines Adjusted EBITDA as Adjusted EBIT plus depreciation and amortization, plus manufacturing in integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined. (Note 5) The c mpany defines Free Cash Flow as Net Income plus interest plus depreciation plus non-cash impairment of assets and goodwill minus the net change in working capital minus the tax shield on interest minus capital expenditures. The change in net working capital is the change in current assets less current liabilities between periods. (Note 6) The company defines Non-GAAP Earnings per Share (EPS) as the adjusted operating income less Interest and other expense, tax adjusted at a 35% rate, and divided by the umber of fully diluted shares. (Note 7) The Company defines Net Sales as Adjusted as net sales less the last week of sales in a 53 week fiscal year. (Note 8)

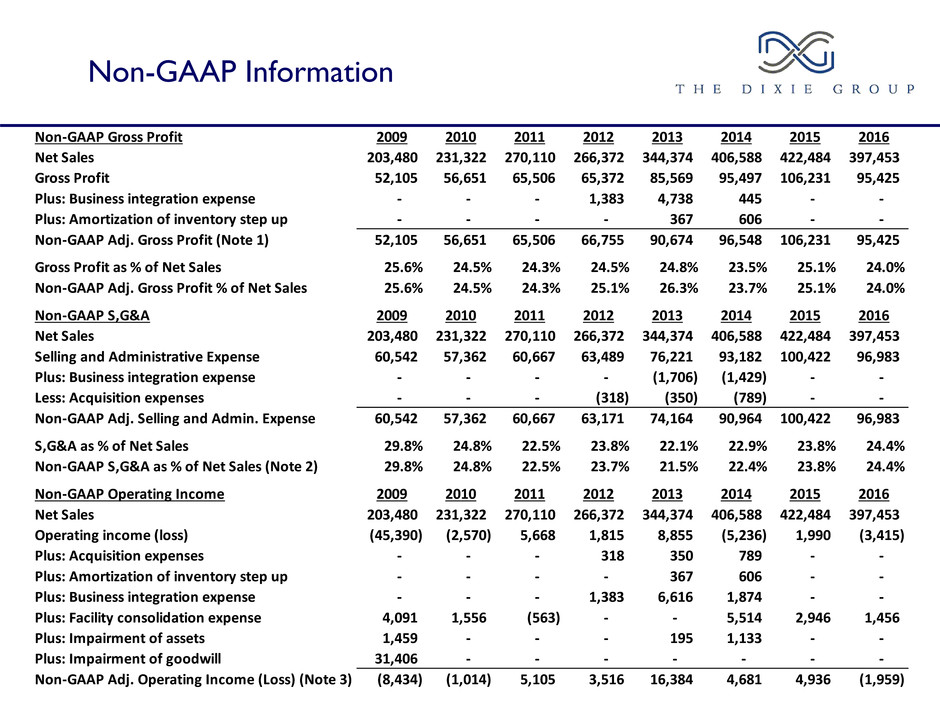

Non-GAAP Information Non-GAAP Gross Profit 2009 2010 2011 2012 2013 2014 2015 2016 Net Sales 203,480 231,322 270,110 266,372 344,374 406,588 422,484 397,453 Gross Profit 52,105 56,651 65,506 65,372 85,569 95,497 106,231 95,425 Plus: Business integration expense - - - 1,383 4,738 445 - - Plus: Amortization of inventory step up - - - - 367 606 - - Non-GAAP Adj. Gross Profit (Note 1) 52,105 56,651 65,506 66,755 90,674 96,548 106,231 95,425 Gross Profit as % of Net Sales 25.6% 24.5% 24.3% 24.5% 24.8% 23.5% 25.1% 24.0% Non-GAAP Adj. Gross Profit % of Net Sales 25.6% 24.5% 24.3% 25.1% 26.3% 23.7% 25.1% 24.0% Non-GAAP S,G&A 2009 2010 2011 2012 2013 2014 2015 2016 Net Sales 203,480 231,322 270,110 266,372 344,374 406,588 422,484 397,453 Selling and Administrative Expense 60,542 57,362 60,667 63,489 76,221 93,182 100,422 96,983 Plus: Business integration expense - - - - (1,706) (1,429) - - Less: Acquisition expenses - - - (318) (350) (789) - - Non-GAAP Adj. Selling and Admin. Expense 60,542 57,362 60,667 63,171 74,164 90,964 100,422 96,983 S,G&A as % of Net Sales 29.8% 24.8% 22.5% 23.8% 22.1% 22.9% 23.8% 24.4% Non-GAAP S,G&A as % of Net Sales (Note 2) 29.8% 24.8% 22.5% 23.7% 21.5% 22.4% 23.8% 24.4% Non-GAAP Operating Income 2009 2010 2011 2012 2013 2014 2015 2016 Net Sales 203,480 231,322 270,110 266,372 344,374 406,588 422,484 397,453 Operating income (loss) (45,390) (2,570) 5,668 1,815 8,855 (5,236) 1,990 (3,415) Plus: Acquisition expenses - - - 318 350 789 - - Plus: Amortization of inventory step up - - - - 367 606 - - Plus: Business integration expense - - - 1,383 6,616 1,874 - - Plus: Facility consolidation expense 4,091 1,556 (563) - - 5,514 2,946 1,456 Plus: Impairment of assets 1,459 - - - 195 1,133 - - Plus: Impairment of goodwill 31,406 - - - - - - - Non-GAAP Adj. Operating Income (Loss) (Note 3) (8,434) (1,014) 5,105 3,516 16,384 4,681 4,936 (1,959)

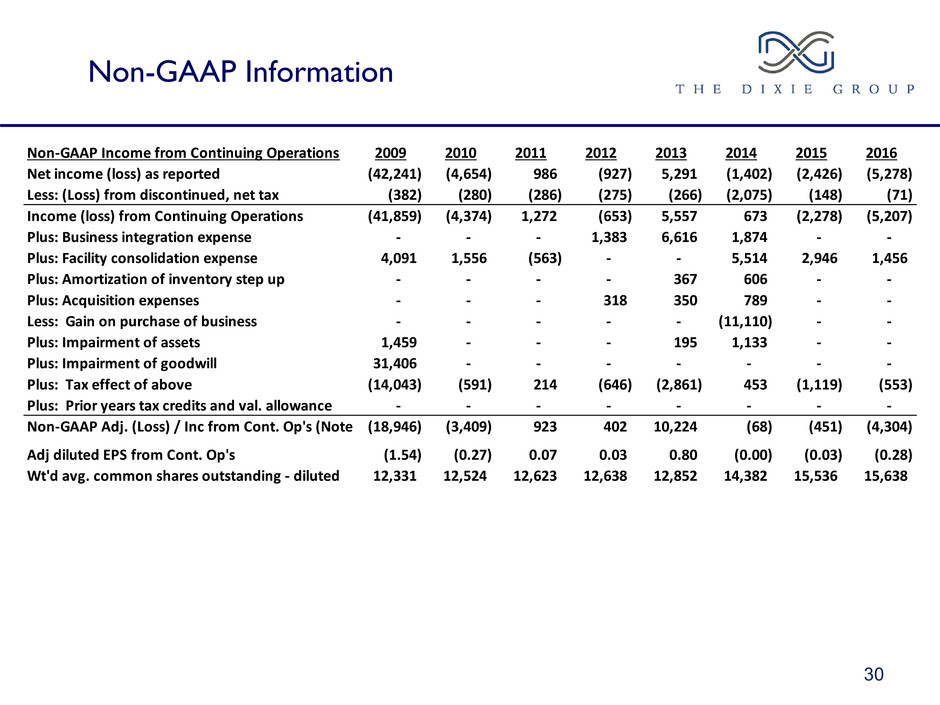

30 Non-GAAP Information Non-GAAP Income from Continuing Operations 2009 2010 2011 2012 2013 2014 2015 2016 Net income (loss) as reported (42,241) (4,654) 986 (927) 5,291 (1,402) (2,426) (5,278) Less: (Loss) from discontinued, net tax (382) (280) (286) (275) (266) (2,075) (148) (71) Income (loss) from Continuing Operations (41,859) (4,374) 1,272 (653) 5,557 673 (2,278) (5,207) Plus: Business integration expense - - - 1,383 6,616 1,874 - - Plus: Facility consolidation expense 4,091 1,556 (563) - - 5,514 2,946 1,456 Plus: Amortization of inventory step up - - - - 367 606 - - Plus: Acquisition expenses - - - 318 350 789 - - Less: Gain on purchase of business - - - - - (11,110) - - Plus: Impairment of assets 1,459 - - - 195 1,133 - - Plus: Impairment of goodwill 31,406 - - - - - - - Plus: Tax effect of above (14,043) (591) 214 (646) (2,861) 453 (1,119) (553) Plus: Prior years tax credits and val. allowance - - - - - - - - Non-GAAP Adj. (Loss) / Inc from Cont. Op's (Note 4)(18,946) (3,409) 923 402 10,224 (68) (451) (4,304) Adj diluted EPS from Cont. Op's (1.54) (0.27) 0.07 0.03 0.80 (0.00) (0.03) (0.28) Wt'd avg. common shares outstanding - diluted 12,331 12,524 12,623 12,638 12,852 14,382 15,536 15,638

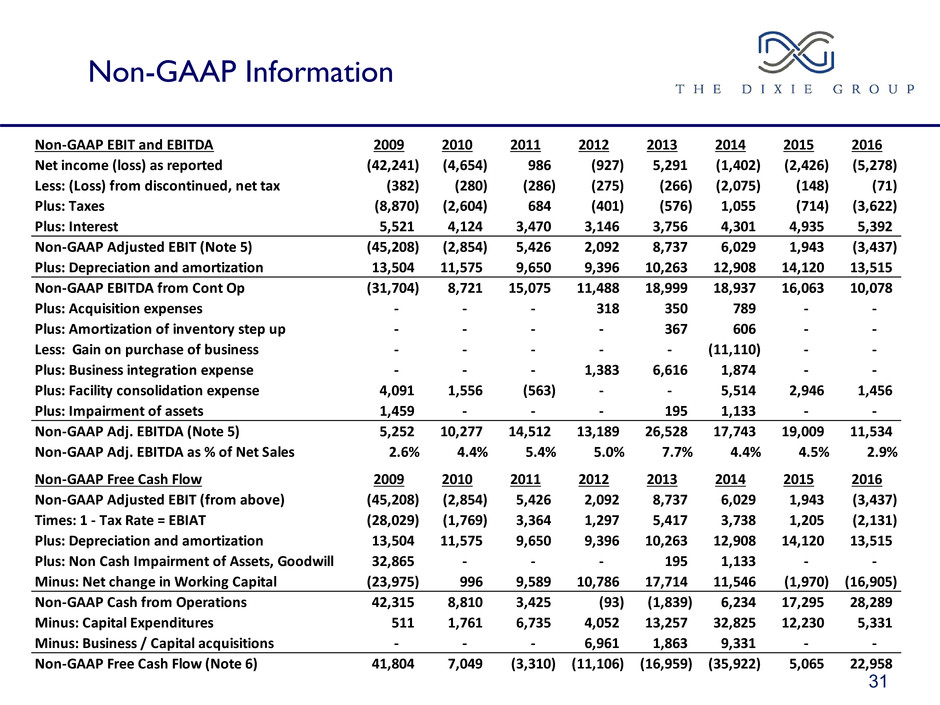

31 Non-GAAP Information Non-GAAP EBIT and EBITDA 2009 2010 2011 2012 2013 2014 2015 2016 Net income (loss) as reported (42,241) (4,654) 986 (927) 5,291 (1,402) (2,426) (5,278) Less: (Loss) from discontinued, net tax (382) (280) (286) (275) (266) (2,075) (148) (71) Plus: Taxes (8,870) (2,604) 684 (401) (576) 1,055 (714) (3,622) Plus: Interest 5,521 4,124 3,470 3,146 3,756 4,301 4,935 5,392 Non-GAAP Adjusted EBIT (Note 5) (45,208) (2,854) 5,426 2,092 8,737 6,029 1,943 (3,437) Plus: Depreciation and amortization 13,504 11,575 9,650 9,396 10,263 12,908 14,120 13,515 Non-GAAP EBITDA from Cont Op (31,704) 8,721 15,075 11,488 18,999 18,937 16,063 10,078 Plus: Acquisition expenses - - - 318 350 789 - - Plus: Amortization of inventory step up - - - - 367 606 - - Less: Gain on purchase of business - - - - - (11,110) - - Plus: Business integration expense - - - 1,383 6,616 1,874 - - Plus: Facility consolidation expense 4,091 1,556 (563) - - 5,514 2,946 1,456 Plus: Impairment of assets 1,459 - - - 195 1,133 - - Non-GAAP Adj. EBITDA (Note 5) 5,252 10,277 14,512 13,189 26,528 17,743 19,009 11,534 Non-GAAP Adj. EBITDA as % of Net Sales 2.6% 4.4% 5.4% 5.0% 7.7% 4.4% 4.5% 2.9% Non-GAAP Free Cash Flow 2009 2010 2011 2012 2013 2014 2015 2016 Non-GAAP Adjusted EBIT (from above) (45,208) (2,854) 5,426 2,092 8,737 6,029 1,943 (3,437) Times: 1 - Tax Rate = EBIAT (28,029) (1,769) 3,364 1,297 5,417 3,738 1,205 (2,131) Plus: Depreciation and amortization 13,504 11,575 9,650 9,396 10,263 12,908 14,120 13,515 Plus: Non Cash Impairment of Assets, Goodwill 32,865 - - - 195 1,133 - - Minus: Net change in Working Capital (23,975) 996 9,589 10,786 17,714 11,546 (1,970) (16,905) Non-GAAP Cash from Operations 42,315 8,810 3,425 (93) (1,839) 6,234 17,295 28,289 Minus: Capital Expenditures 511 1,761 6,735 4,052 13,257 32,825 12,230 5,331 Minus: Business / Capital acquisitions - - - 6,961 1,863 9,331 - - Non-GAAP Free Cash Flow (Note 6) 41,804 7,049 (3,310) (11,106) (16,959) (35,922) 5,065 22,958

31 Additional Information Facility Consolidation Plan Summary Q1 2016 Q2 2016 Q3 2016 Q4 2016 2016 Colormaster dryer write off - - - - - West Coast Facility consolidation - - - - - East Coast Facility consolidation 1,342 398 (1) (359) 1,380 East Coast Asset write off - - - - - Corporate Office consolidation 71 5 - - 76 Total facility consolidation and asset write off 1,413 403 (1) (359) 1,456 Net Sales as Adjusted Net Sales December 31, Extra December 31, December 26, As Adjusted 2016 Week 2016 2015 Difference % Change Net Sales as Adjusted 397,453$ (5,380)$ 392,073$ 422,483$ (30,410)$ -7.2% The Company defines Net Sales as Adjusted as net sales less the last week of sales in a 53 week fiscal year. (Note 8)