November 2021 Investor Presentation Contact: Allen Danzey CFO The Dixie Group Phone: 706-876-5865 allen.danzey@dixiegroup.com Exhibit 99.1

Forward Looking Statements The Dixie Group, Inc. • Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2

Dixie History • 1920 Began as Dixie Mercerizing in Chattanooga, TN • 1990’s Transitioned from textiles to floorcovering • 2003 Refined focus on upper- end floorcovering market • 2003 Launched Dixie Home - upper end residential line • 2005 Launched modular tile carpet line – new product category • 2012 Purchased Colormaster dye house and Crown Rugs • 2013 Purchased Robertex - wool carpet manufacturing • 2014 Purchased Atlas Carpet Mills – high-end commercial business • 2014 Purchased Burtco - computerized yarn placement for hospitality • 2016 Launched Calibré luxury vinyl flooring in Masland Contract • 2017 Launched Stainmaster® LVF in Masland and Dixie Home • 2018 Launched engineered wood in our Fabrica brand • 2018 Unified Atlas and Masland Contract into single business unit • 2019 Launched TRUCOR™ and TRUCOR Prime™ LVF in Dixie Home and Masland • 2021 Sale of AtlasMasland Commercial Business 3

Dixie Today • Commitment to brands in the upper- end market with strong growth potential. • Diversified customer base (TTM Basis) – Top 10 customers • 13% of sales – Top 100 customers • 28% of sales 4

5 Dixie Group Business Drivers • Residentially • The flooring market is driven by residential remodeling activity, existing home sales and new construction of single family and multifamily housing. • Our residential business plays primarily in the mid to high end residential replacement segment, dependent upon consumer confidence, the health of the stock market and the wealth effect.

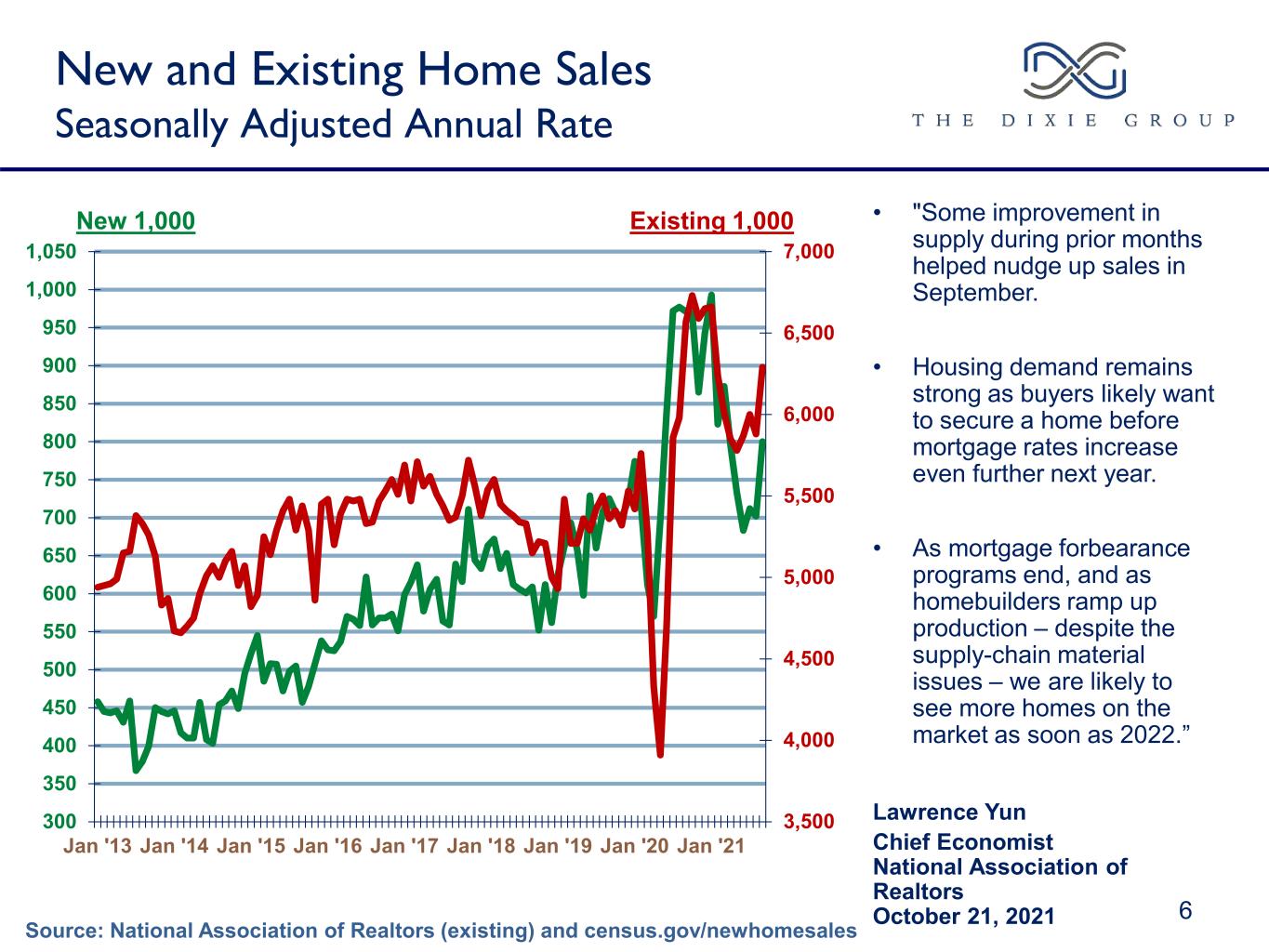

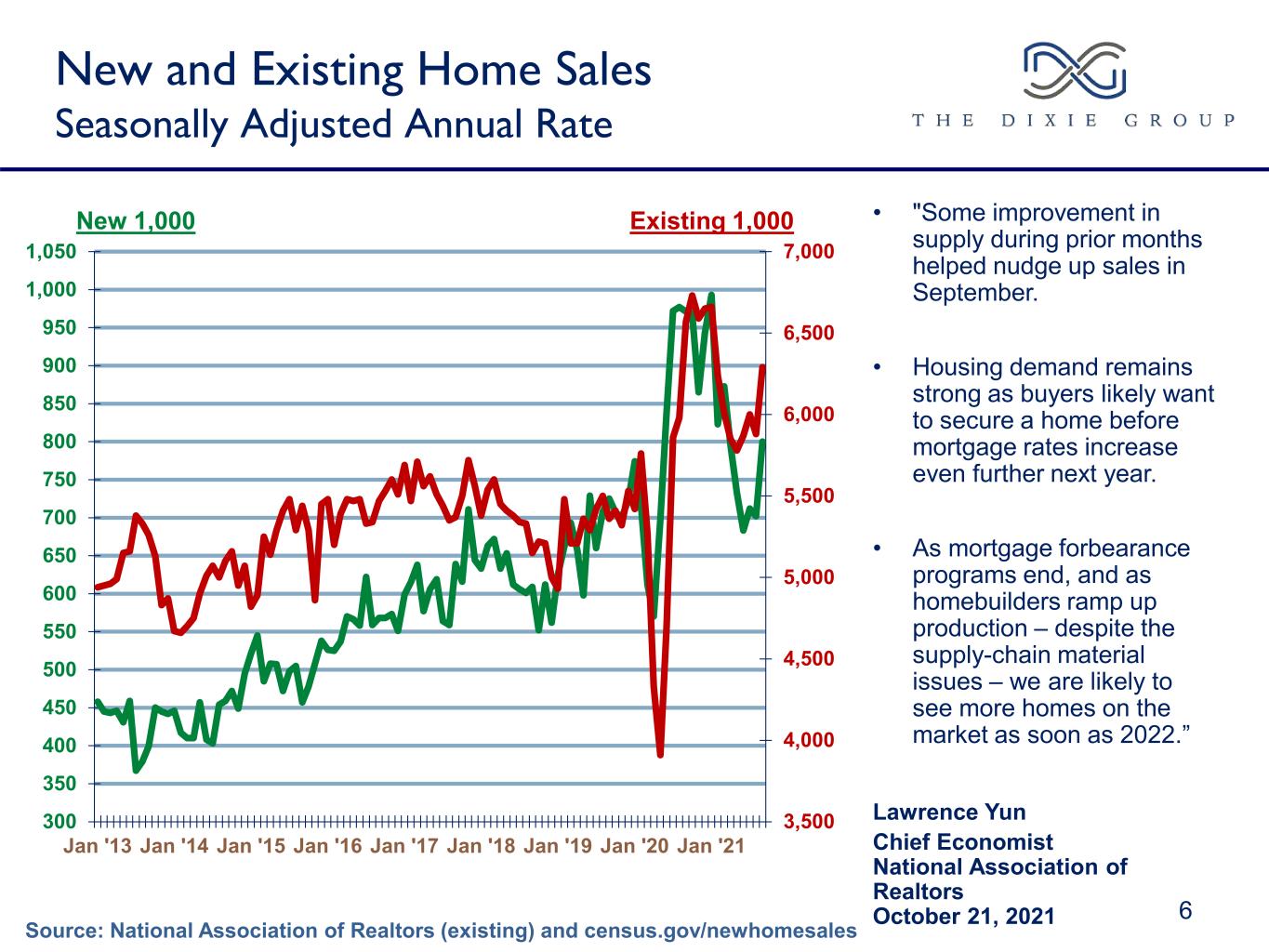

New and Existing Home Sales Seasonally Adjusted Annual Rate 6 New 1,000 Existing 1,000 Source: National Association of Realtors (existing) and census.gov/newhomesales 3,500 4,000 4,500 5,000 5,500 6,000 6,500 7,000 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1,000 1,050 Jan '13 Jan '14 Jan '15 Jan '16 Jan '17 Jan '18 Jan '19 Jan '20 Jan '21 • "Some improvement in supply during prior months helped nudge up sales in September. • Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year. • As mortgage forbearance programs end, and as homebuilders ramp up production – despite the supply-chain material issues – we are likely to see more homes on the market as soon as 2022.” Lawrence Yun Chief Economist National Association of Realtors October 21, 2021

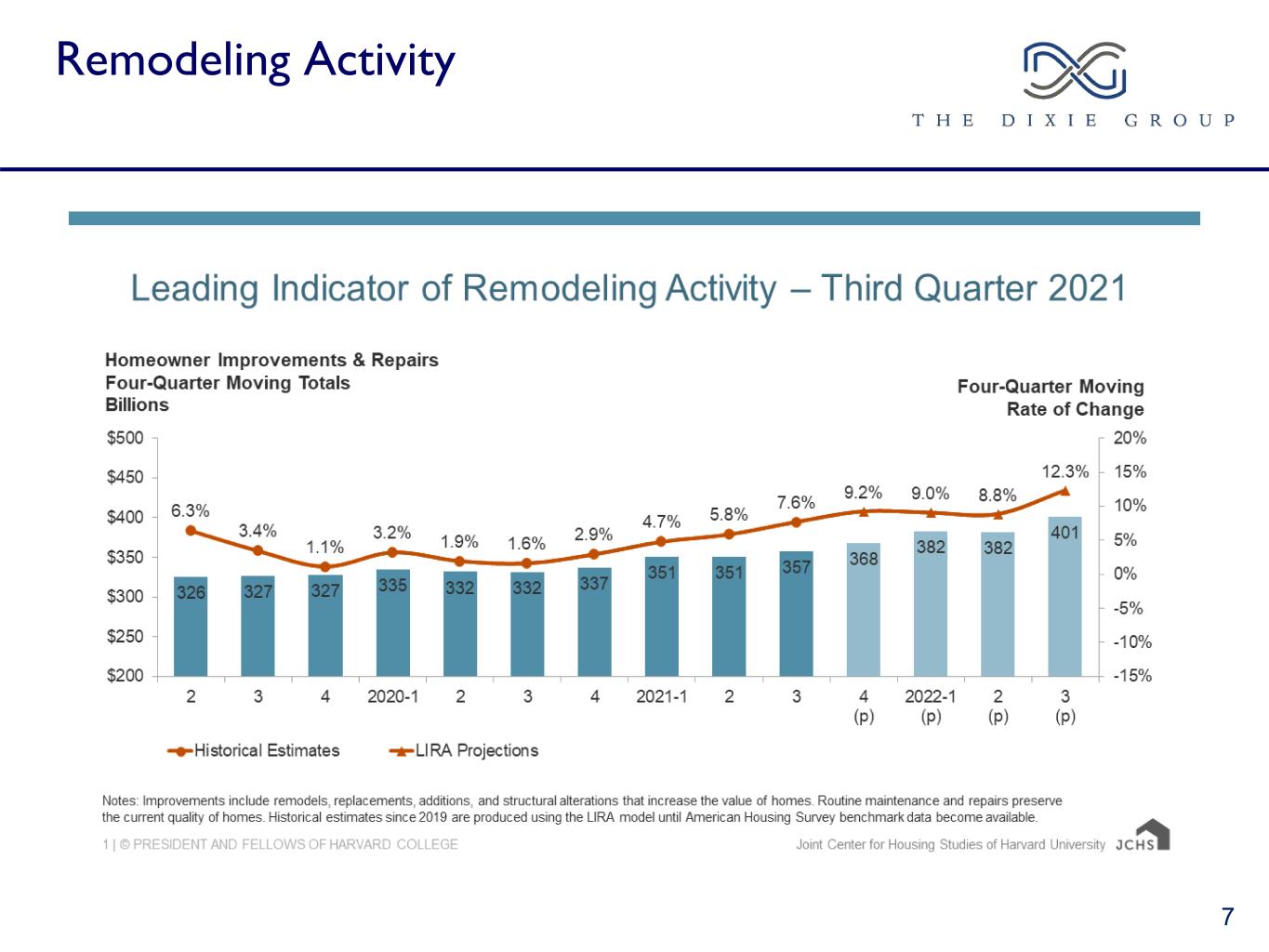

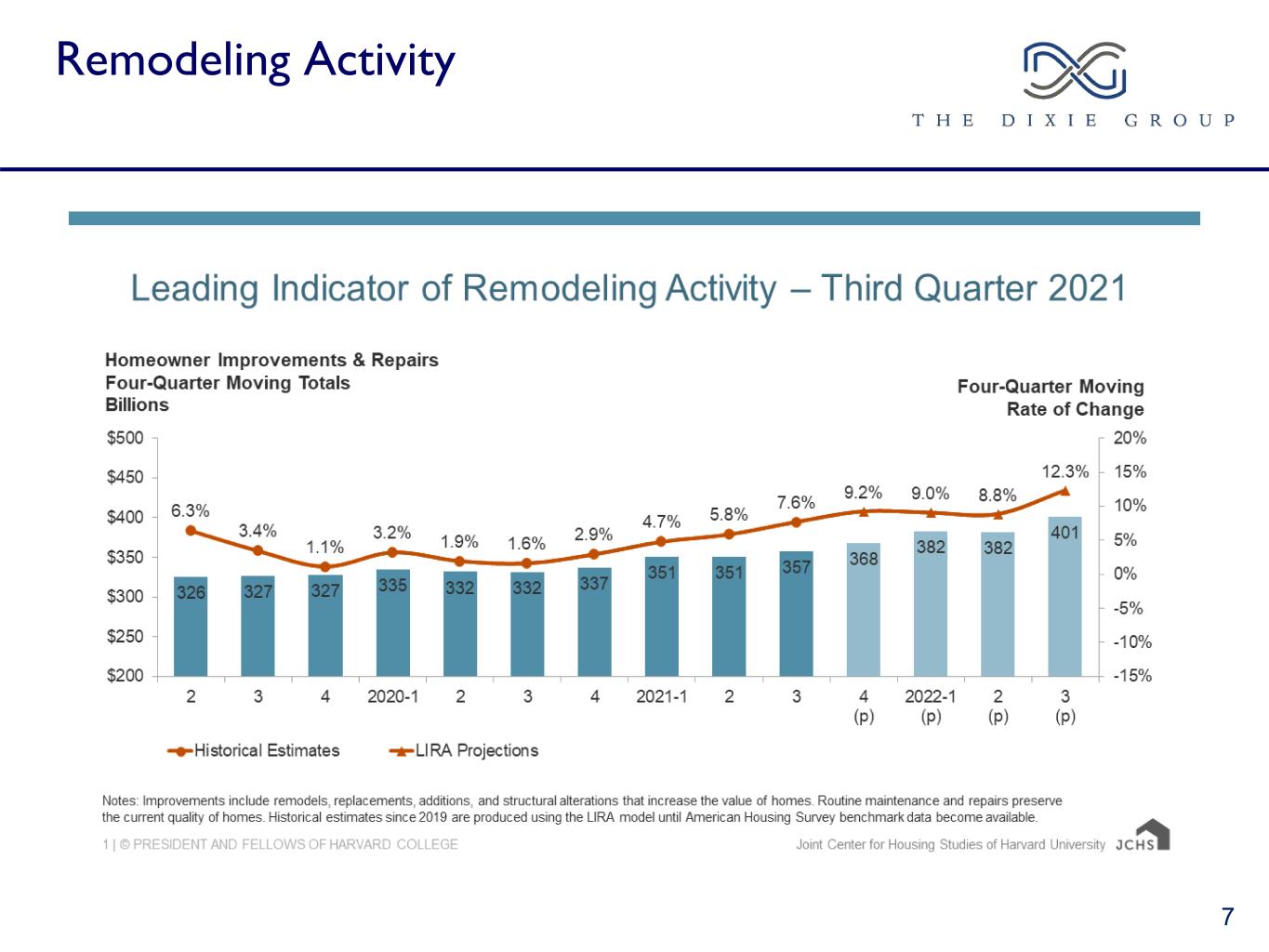

7 Remodeling Activity

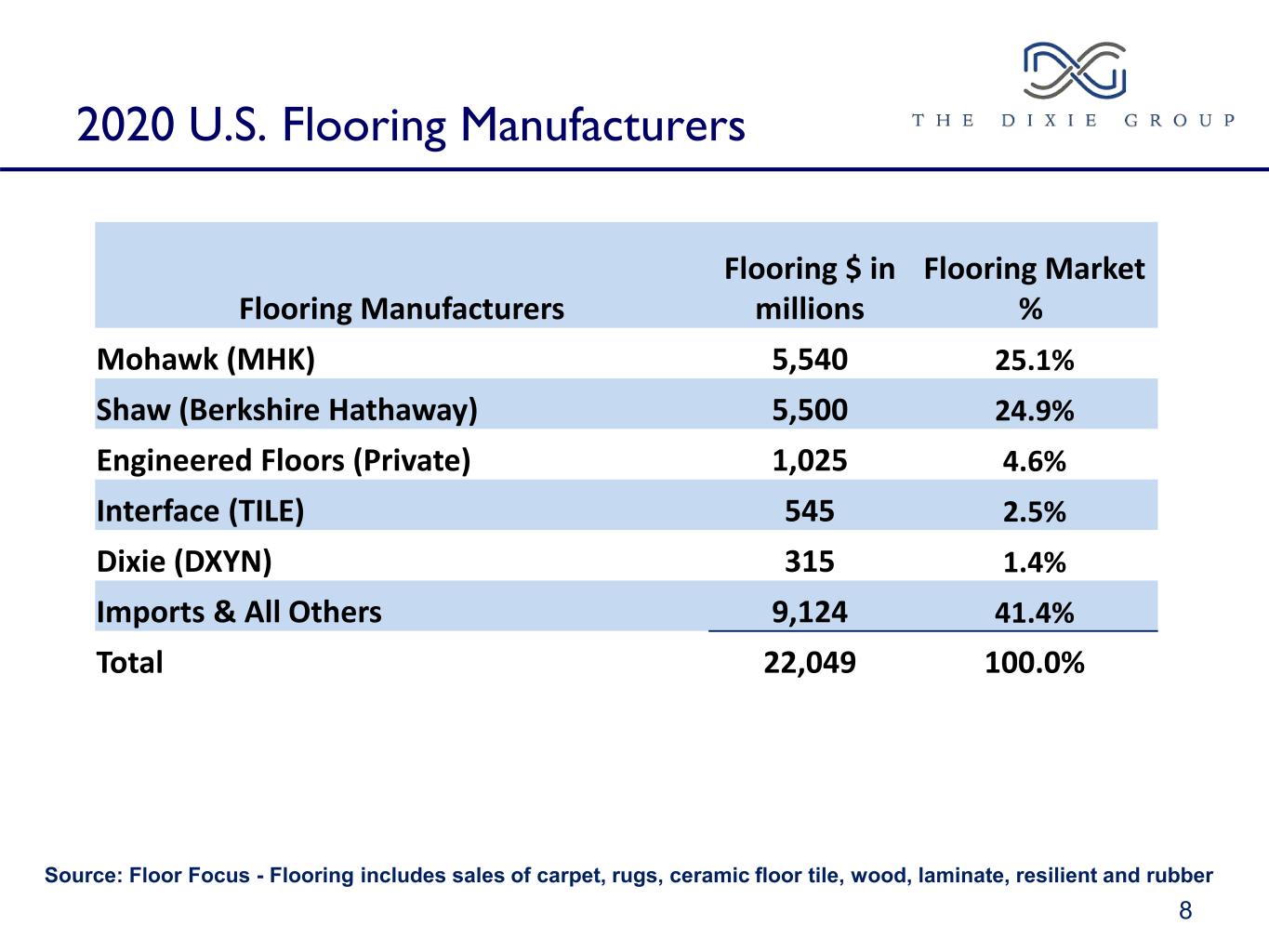

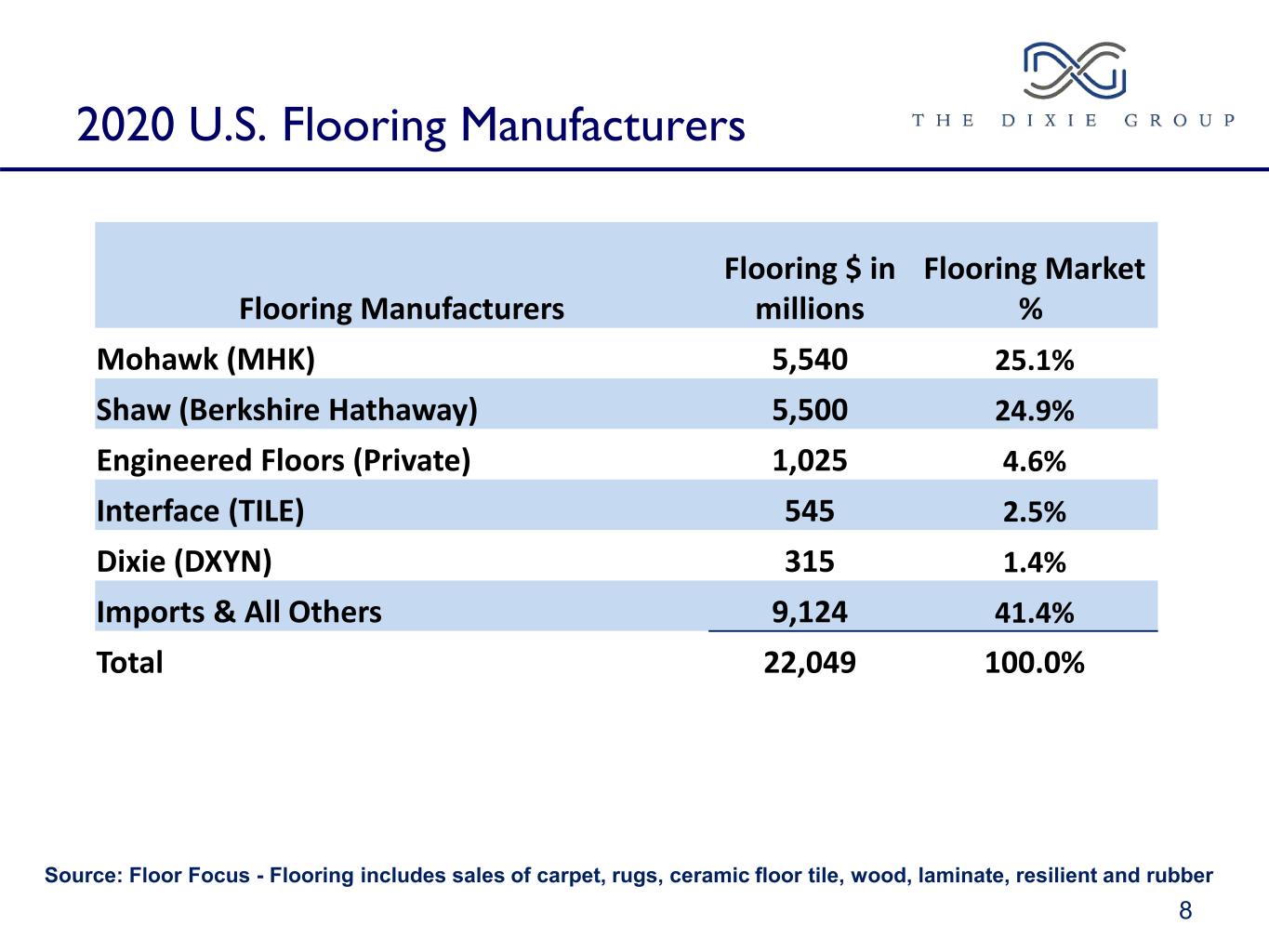

2020 U.S. Flooring Manufacturers 8 Source: Floor Focus - Flooring includes sales of carpet, rugs, ceramic floor tile, wood, laminate, resilient and rubber Flooring Manufacturers Flooring $ in millions Flooring Market % Mohawk (MHK) 5,540 25.1% Shaw (Berkshire Hathaway) 5,500 24.9% Engineered Floors (Private) 1,025 4.6% Interface (TILE) 545 2.5% Dixie (DXYN) 315 1.4% Imports & All Others 9,124 41.4% Total 22,049 100.0%

Industry Positioning The Dixie Group • Strategically our business is driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with emphasis on the most beautiful and up-to-date styling and design – Be quality focused with excellent reputation for building excellent products and standing behind what we make – And, unlike much of the industry, not manufacturing driven 9

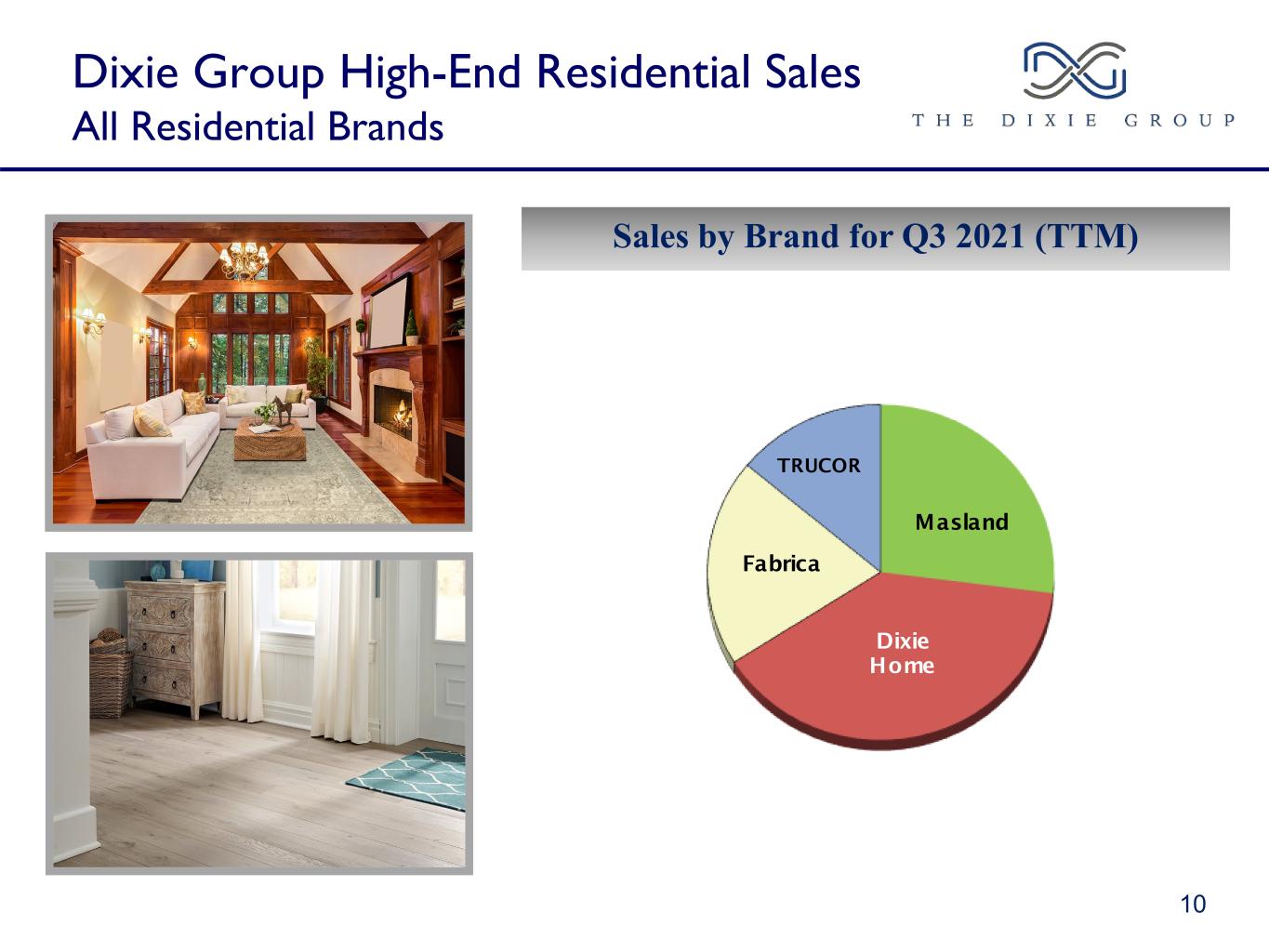

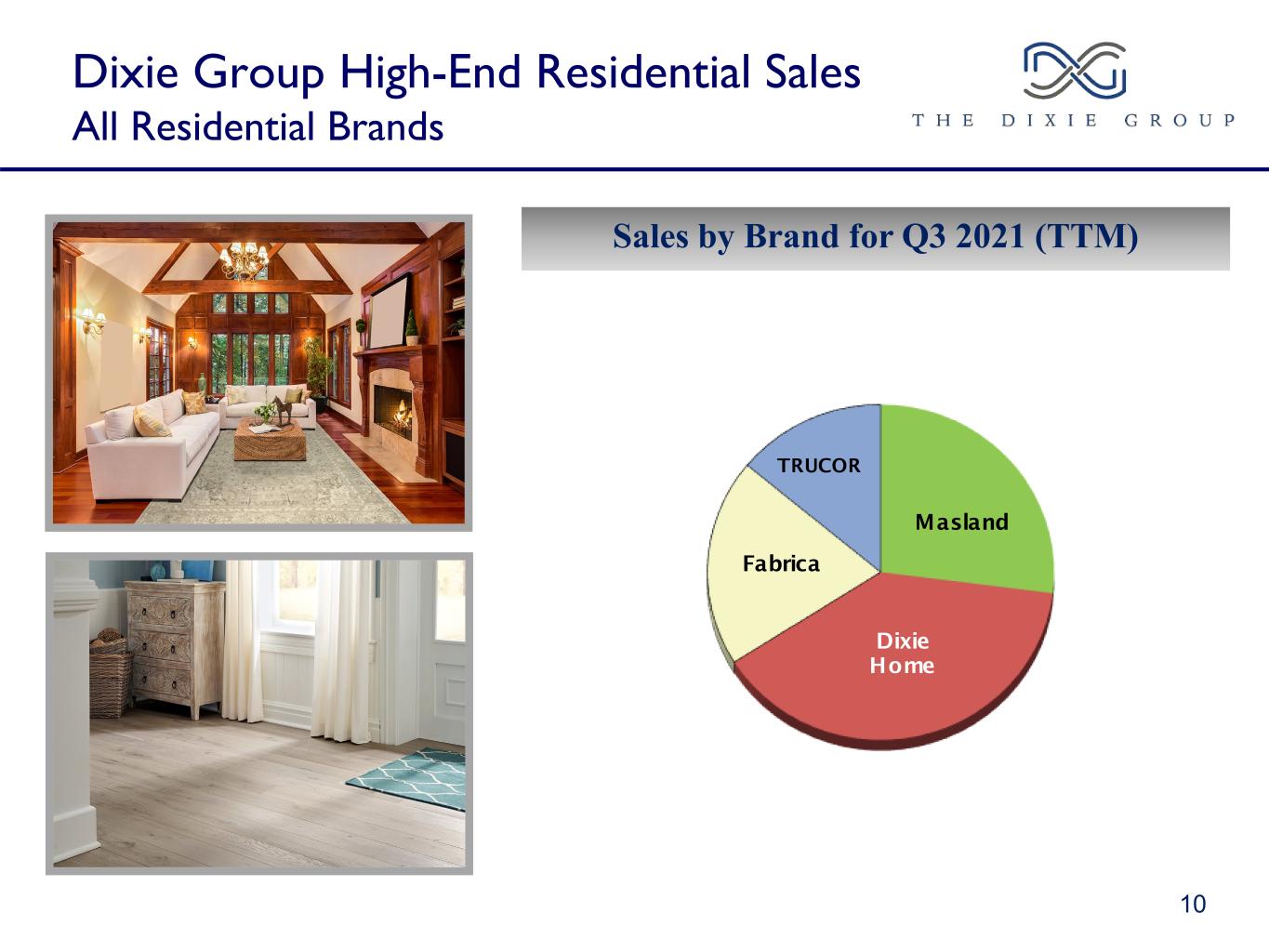

Dixie Group High-End Residential Sales All Residential Brands Masland Dixie Home Fabrica TRUCOR Sales by Brand for Q3 2021 (TTM) 10

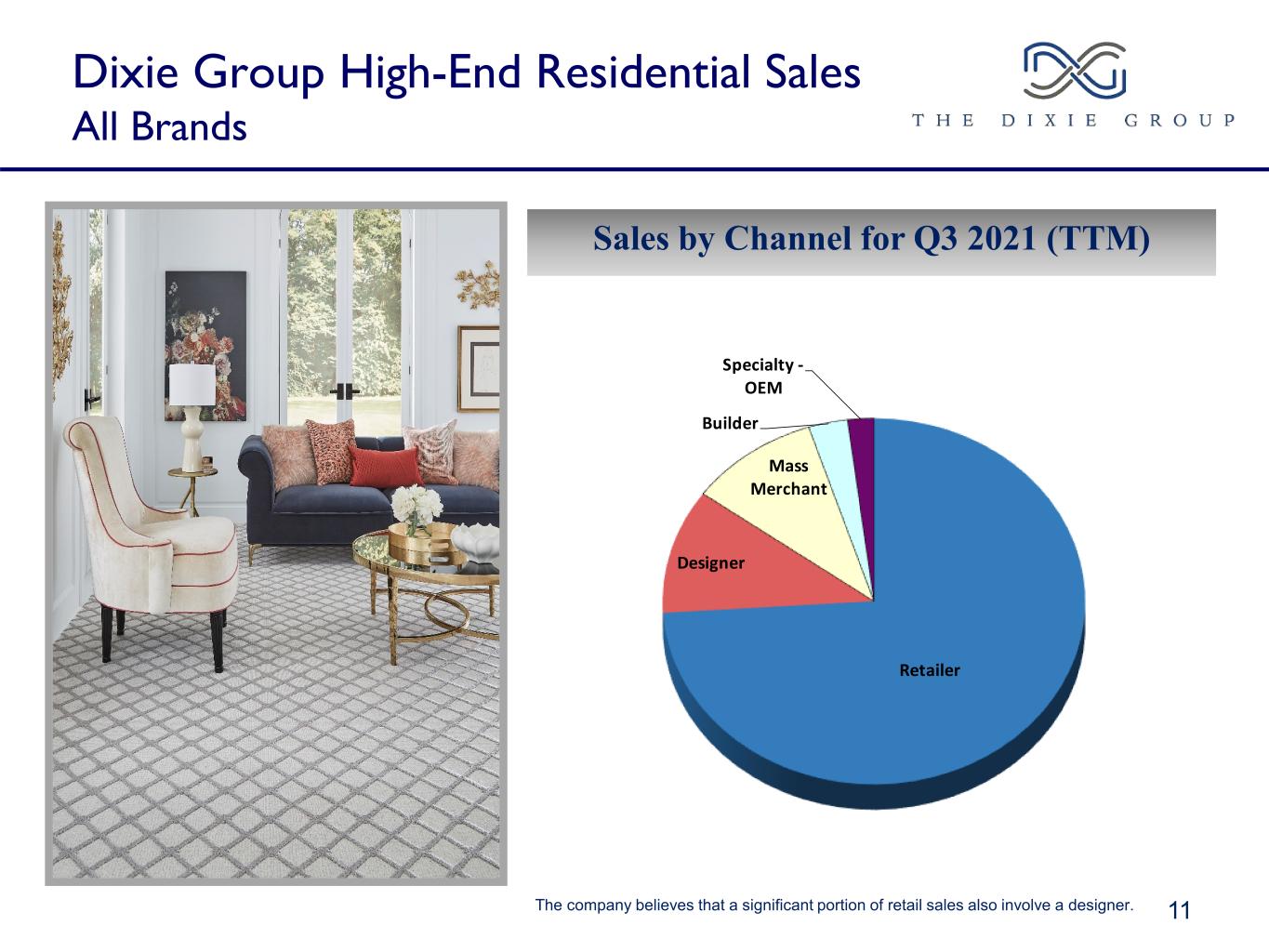

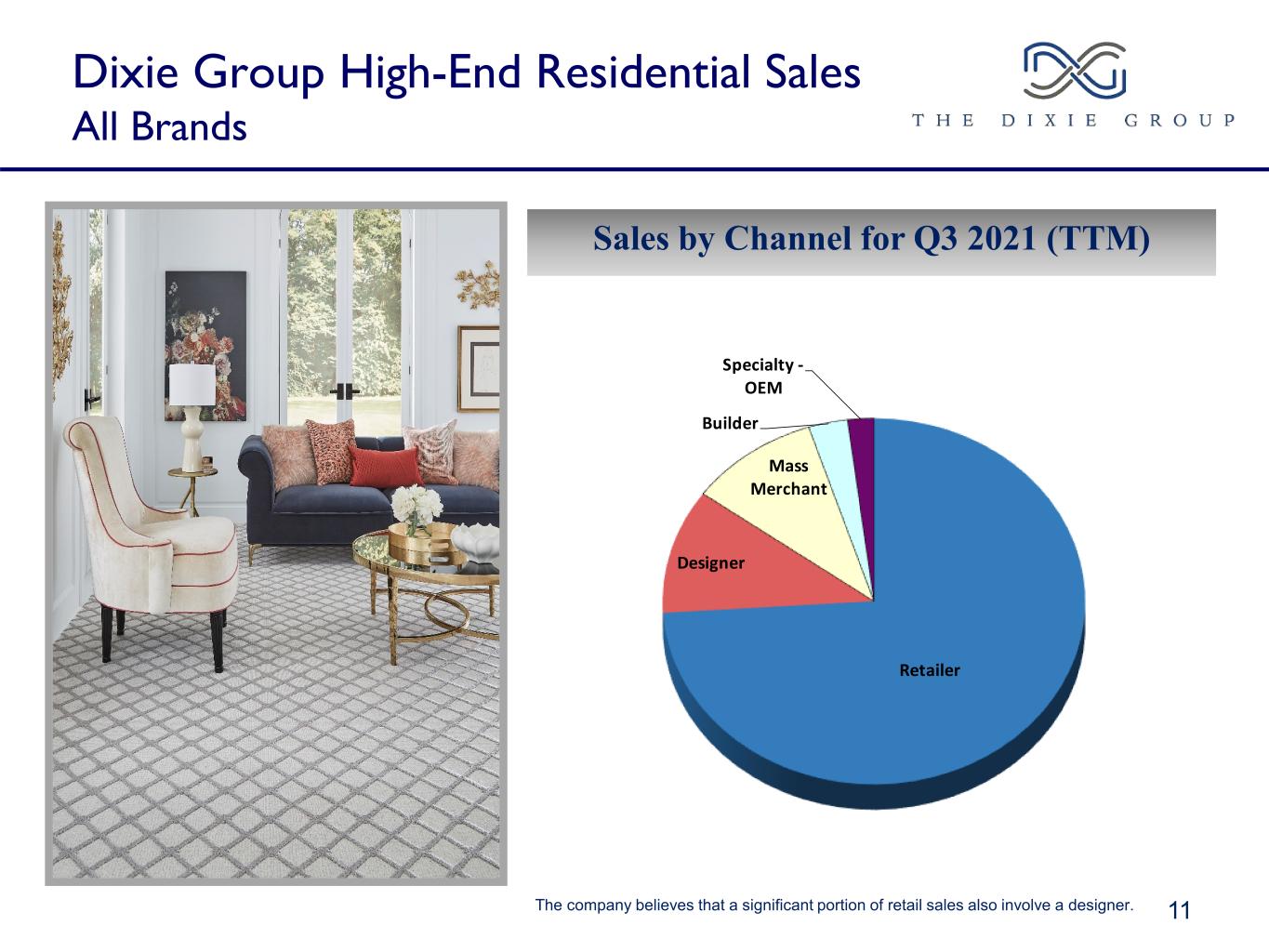

Dixie Group High-End Residential Sales All Brands Retailer Designer Mass Merchant Builder Specialty - OEM 11 Sales by Channel for Q3 2021 (TTM) The company believes that a significant portion of retail sales also involve a designer.

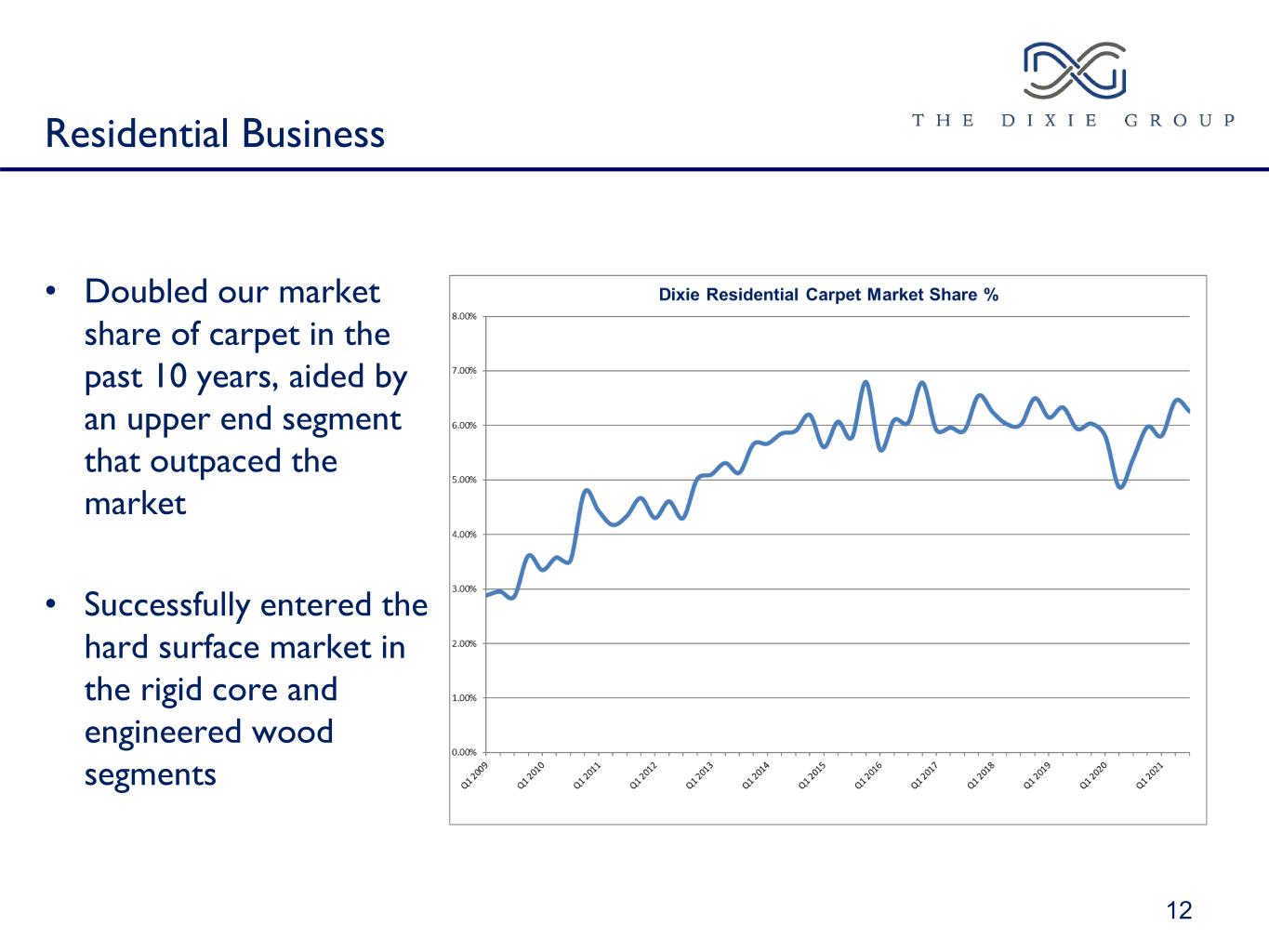

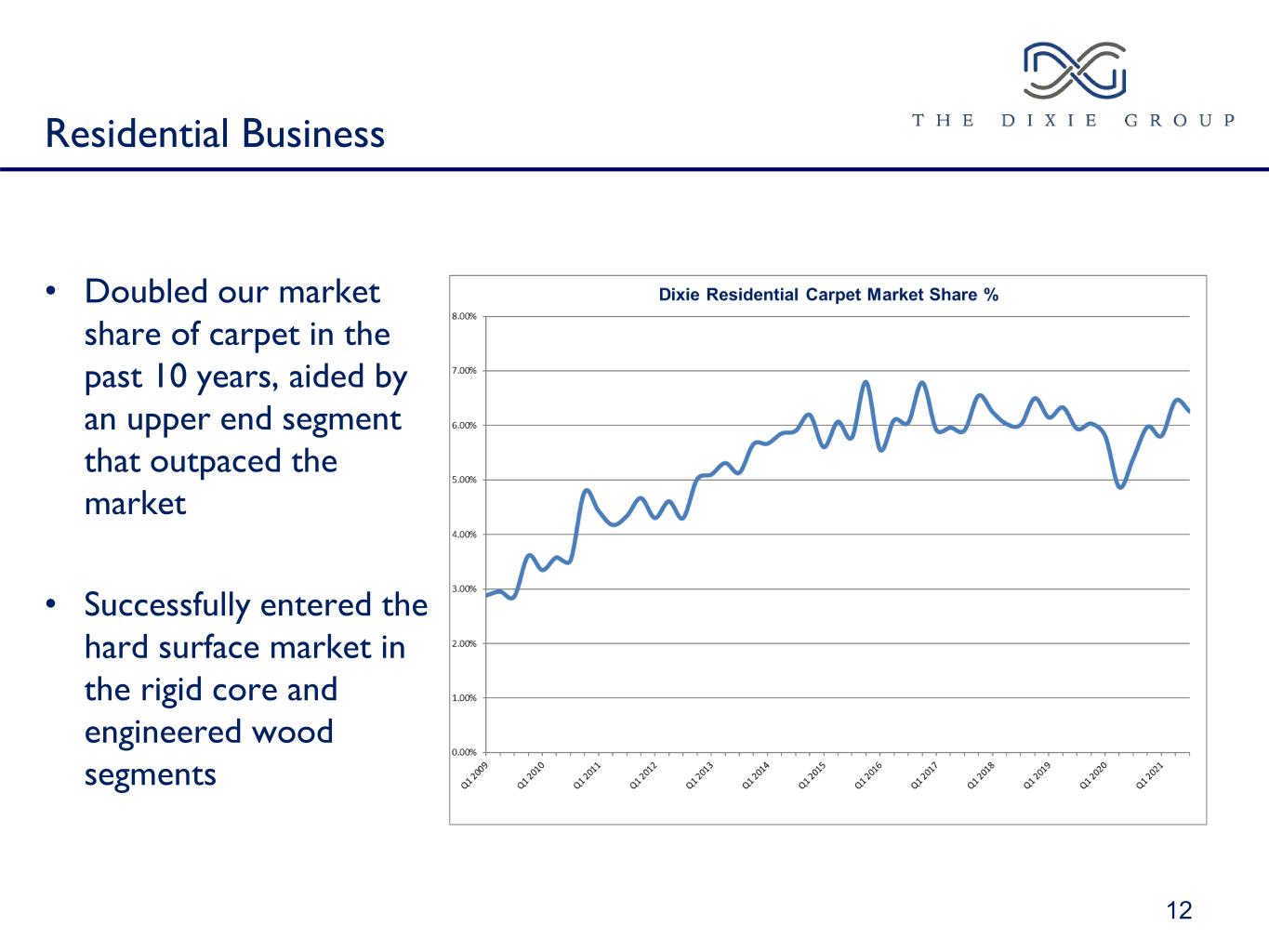

Residential Business • Doubled our market share of carpet in the past 10 years, aided by an upper end segment that outpaced the market • Successfully entered the hard surface market in the rigid core and engineered wood segments 12

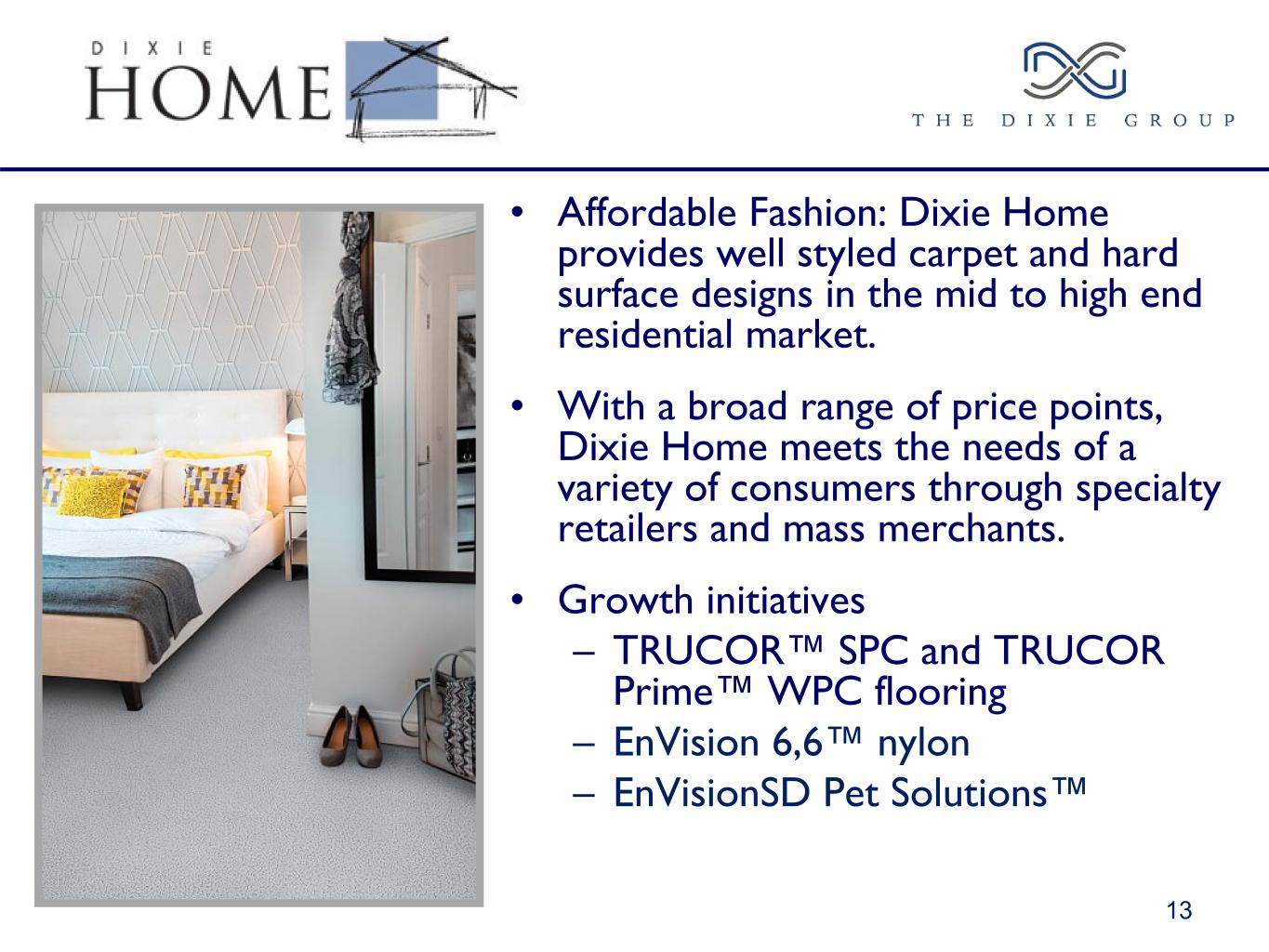

• Affordable Fashion: Dixie Home provides well styled carpet and hard surface designs in the mid to high end residential market. • With a broad range of price points, Dixie Home meets the needs of a variety of consumers through specialty retailers and mass merchants. • Growth initiatives – TRUCOR™ SPC and TRUCOR Prime™ WPC flooring – EnVision 6,6™ nylon – EnVisionSD Pet Solutions™ 13

• Leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven – Approximately 23% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiatives – TRUCOR Prime™ WPC Luxury Vinyl Flooring & – TRUCOR™ Energy SPC flooring – Wool products in both tufted and woven constructions – EnVision 6,6™ nylon – 1866 – expansion of decorative fabrics 14

• Premium high-end brand – “Quality without Compromise” • Designer focused – Approximately 28% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiatives – Fabrica Fine Wood Flooring, a sophisticated collection of refined wood flooring – EnVision 6,6™ nylon – Luxury wool products in tufted and woven constructions – DÉCOR – expansion of decorative fabrics 15

Current Business Conditions Outlook: • During the third quarter of 2021, our sales of residential carpet increased 23% compared to a year ago, versus the industry which was up high single digits. Year to date, our residential carpet sales are up 46% versus the industry, which is up in the mid 20% range. • Our residential growth initiatives: • In response to the sale of STAINMASTER® brand to Lowe’s, we are implementing a strategy through Premium Flooring Centers to transition our customers to our EnVision66™ and EnVisionSD Pet Solutions™ brands. • We continue to introduce new hard surface products to our rapidly growing TRUCOR™ collection of products. • We will be expanding our products in the decorative category through our Masland 1866 and Fabrica Décor offerings. • The momentum of our sales by residential products has continued into the 4th quarter. For the first 5 weeks of the quarter, our sales are up 20% from year ago levels. 16