Exhibit 99.1

JUNE 2005

Forward Looking Statements

Statements in this presentation, which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other risk factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission.

General information set forth in this presentation concerning market conditions, sales data and trends in the U.S carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information.

2

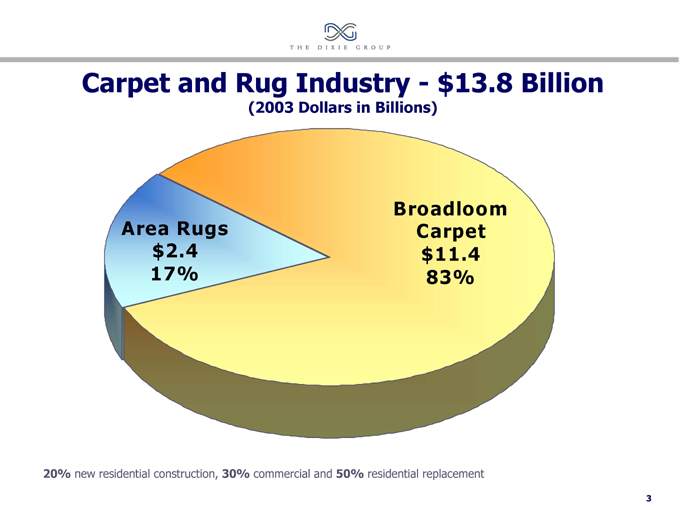

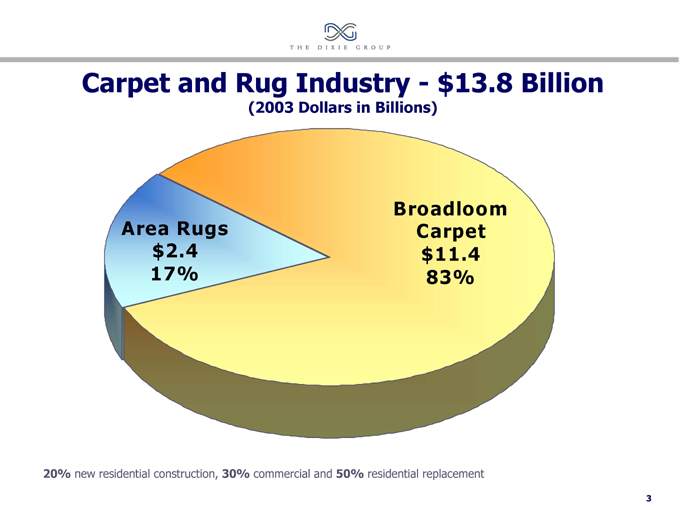

Carpet and Rug Industry—$13.8 Billion

(2003 Dollars in Billions)

Area Rugs $2.4 17%

Broadloom Carpet $11.4 83%

20% new residential construction, 30% commercial and 50% residential replacement

3

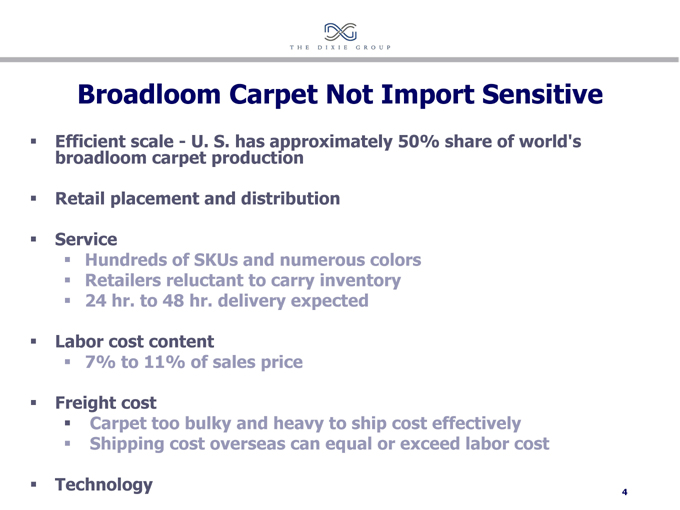

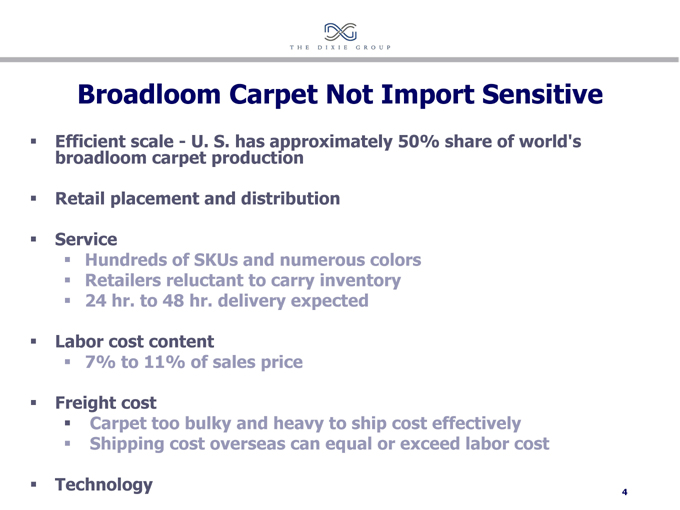

Broadloom Carpet Not Import Sensitive

Efficient scale—U. S. has approximately 50% share of world’s broadloom carpet production

Retail placement and distribution

Service

Hundreds of SKUs and numerous colors

Retailers reluctant to carry inventory

24 hr. to 48 hr. delivery expected

Labor cost content

7% to 11% of sales price

Freight cost

Carpet too bulky and heavy to ship cost effectively

Shipping cost overseas can equal or exceed labor cost

Technology

4

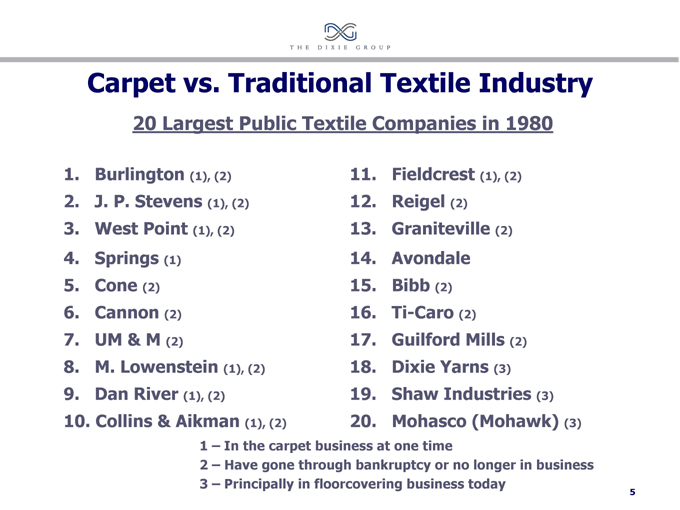

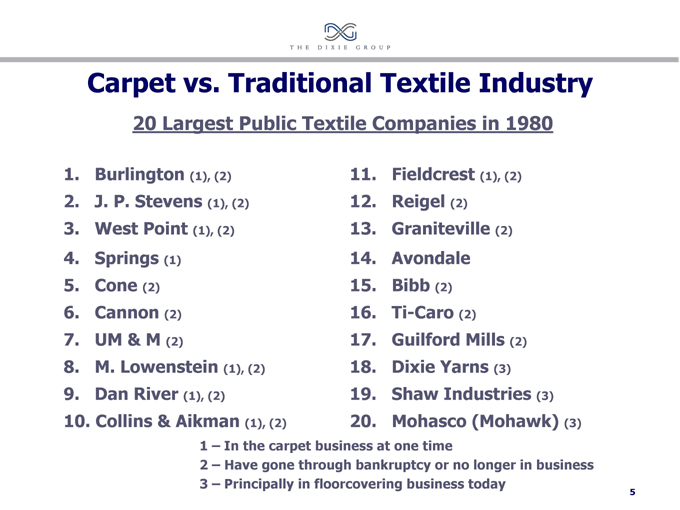

Carpet vs. Traditional Textile Industry

20 Largest Public Textile Companies in 1980

1. Burlington (1), (2) 11. Fieldcrest (1), (2)

2. J. P. Stevens (1), (2) 12. Reigel (2)

3. West Point (1), (2) 13. Graniteville (2)

4. Springs (1) 14. Avondale

5. Cone (2) 15. Bibb (2)

6. Cannon (2) 16. Ti-Caro (2)

7. UM & M (2) 17. Guilford Mills (2)

8. M. Lowenstein (1), (2) 18. Dixie Yarns (3)

9. Dan River (1), (2) 19. Shaw Industries (3)

10. Collins & Aikman (1), (2) 20. Mohasco (Mohawk) (3)

1 – In the carpet business at one time

2 – Have gone through bankruptcy or no longer in business 3 – Principally in floorcovering business today

5

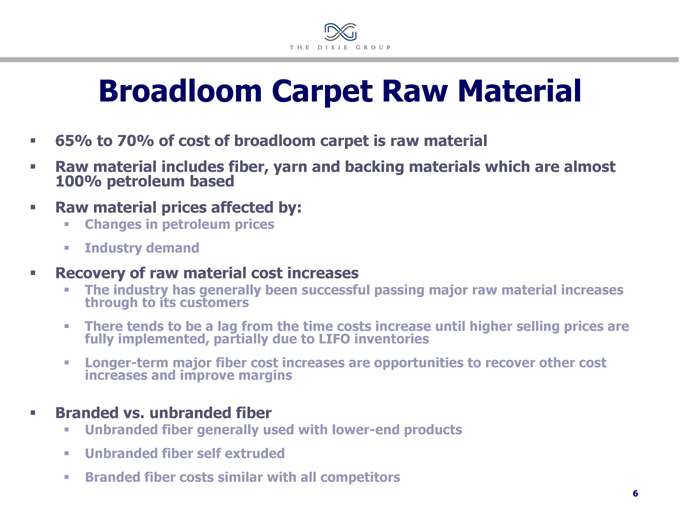

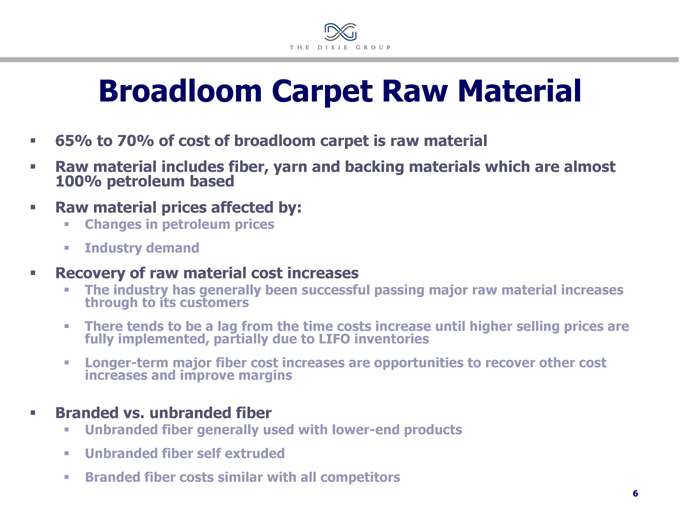

Broadloom Carpet Raw Material

65% to 70% of cost of broadloom carpet is raw material

Raw material includes fiber, yarn and backing materials which are almost100% petroleum based

Raw material prices affected by:

Changes in petroleum prices

Industry demand

Recovery of raw material cost increases

The industry has generally been successful passing major raw material increases through to its customers

There tends to be a lag from the time costs increase until higher selling prices are fully implemented, partially due to LIFO inventories

Longer-term major fiber cost increases are opportunities to recover other cost increases and improve margins

Branded vs. unbranded fiber

Unbranded fiber generally used with lower-end products

Unbranded fiber self extruded

Branded fiber costs similar with all competitors

6

Dixie Strategic Positioning

Grew floorcovering business from 1993 and exited textiles in 1999 – now 100% floorcovering

Eight acquisitions from 1993 through 2000

Demise of factory-built housing 65%

Commitment to brands and upper-end market led to the sale of our North Georgia operations

7

Shaw Transaction

Sold North Georgia carpet and yarn operations to Shaw for $212 million in November 2003

One-time P & L charge $16.2 million

Debt reduced $150 million

8

Dixie Today

Smaller, more profitable, growing company with strong balance sheet and strong brands in the upper-end market

Vastly improved risk profile

Financially Customer base

Top 20 carpet customers – 16% of total carpet sales

Top 40 carpet customers – 20% of total carpet sales

Carpet sales up 2nd Qtr. and YTD 5-21-05 vs. prior year:

Residential Carpet Sales – 2nd Qtr. 19%—YTD 19%

Contract Carpet Sales – 2nd Qtr. 20%—YTD 17%

Total Carpet Sales – 2nd Qtr. 19%—YTD 18%

Total sales expected to improve 15% for the year 2005

9

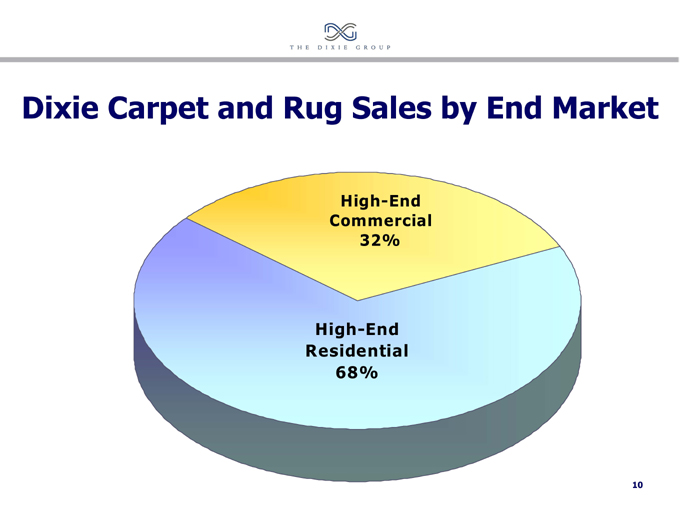

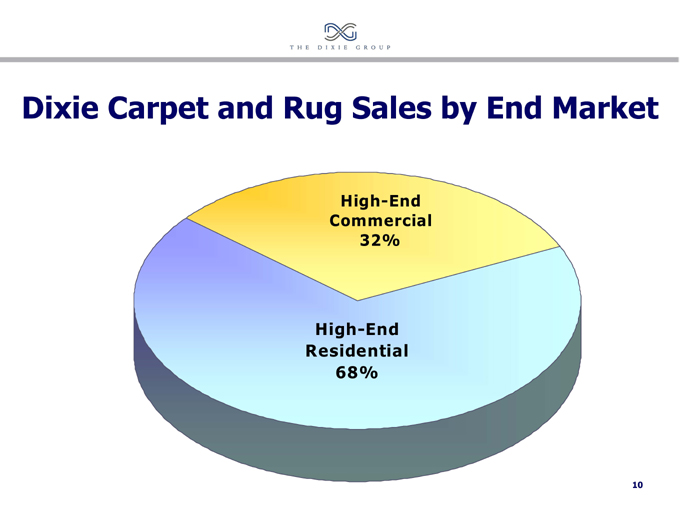

Dixie Carpet and Rug Sales by End Market

High-End Commercial 32%

High-End Residential 68%

10

Growth Initiatives

Masland Residential—Doubling rate of new product introductions

Dixie Home—Launch Dixie Home business

Fabrica

2003 hire new director of product development

2004 Increase rate of new product introductions

Masland Contract

2002 Launch Energy line

2005 Invest in modular / carpet tile manufacturing equipment.

2002 through 2005—Invest in new tufting technology to support product innovation

11

Dixie’s Broadloom and Area Rug Carpet sales have Out Performed the U.S. carpet market in recent years

In 2002, Dixie grew at 1% while the market grew at 2.6%

2002 growth initiatives In 2003 and 2004, Dixie grew 11% and 26%; respectively, while the carpet market grew at an estimated 1% in 2003 and 9% for 2004

In the 1st QT 2005 Dixie grew at 18% while the market grew at 9%

BROADLOOM AND AREA RUG CARPET SALES

CHANGE INDEX (2001=Base year)

Indexed versus 2001

Began Growth Initatives

170 160 150 140 130 120 110 100

2001 2002 2003 2004 1st QT 2005

Dixie

Industry

2003 Sales Industry—$13.8 Billion Dixie—$234 Million (1.7%)

12

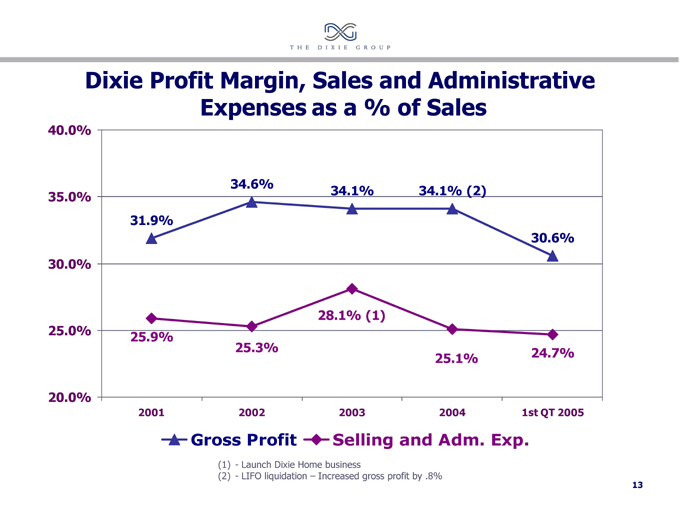

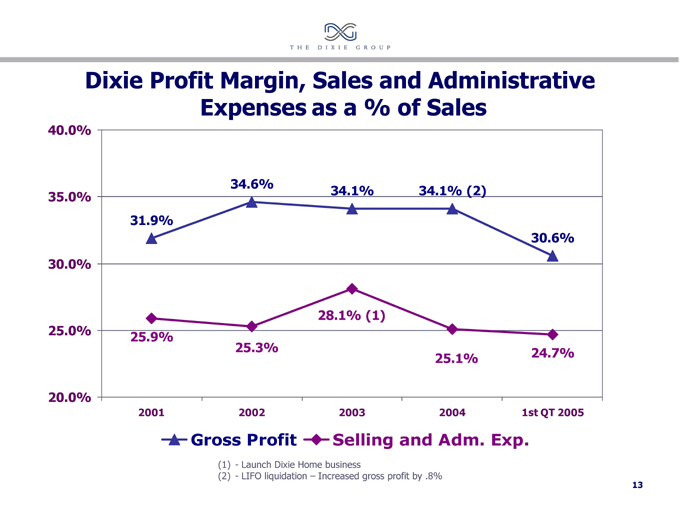

Dixie Profit Margin, Sales and Administrative Expenses as a % of Sales

40.0% 35.0% 30.0% 25.0% 20.0%

34.6%

34.1% 34.1% (2)

31.9%

30.6%

28.1% (1) 25.9%

25.3% 24.7% 25.1%

2001 2002 2003 2004 1st QT 2005

Gross Profit Selling and Adm. Exp.

(1)—Launch Dixie Home business

(2)—LIFO liquidation – Increased gross profit by .8%

13

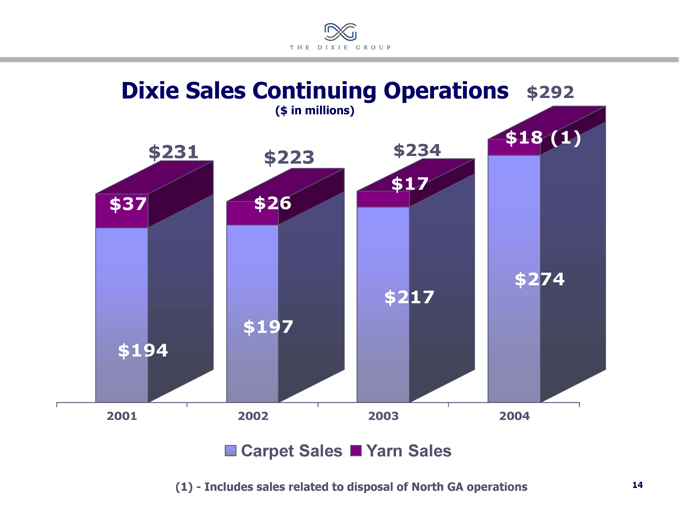

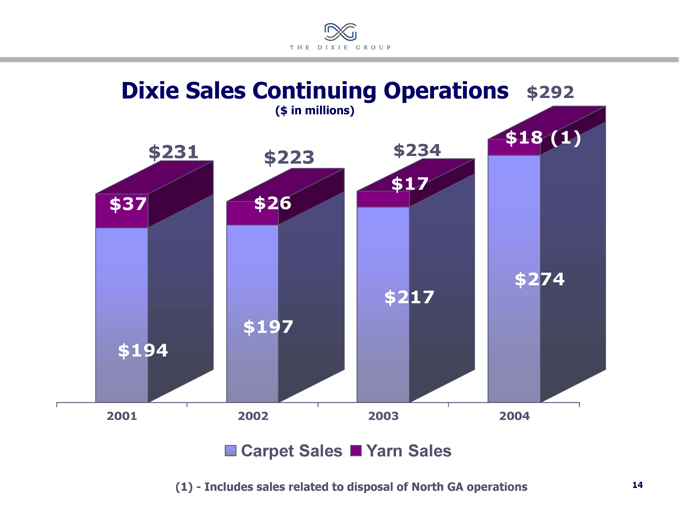

Dixie Sales Continuing Operations

($ in millions)

$231

$37

$194

$223

$26

$197

$234 $17

$217

$292

$18 (1)

$274

2001 2002 2003 2004

Carpet Sales Yarn Sales

(1)—Includes sales related to disposal of North GA operations

14

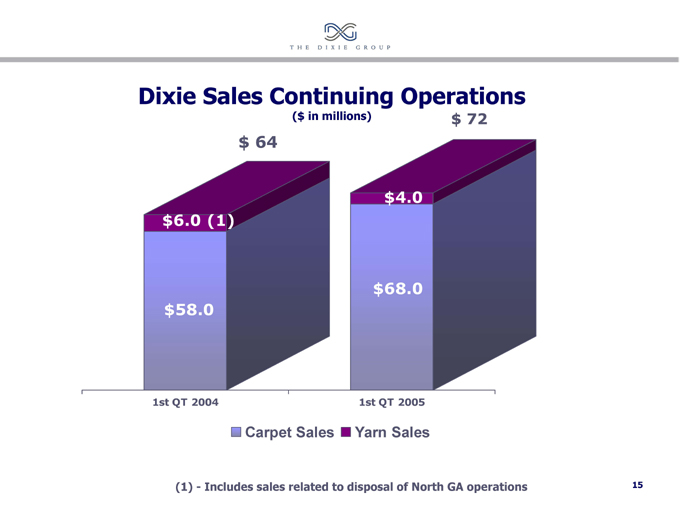

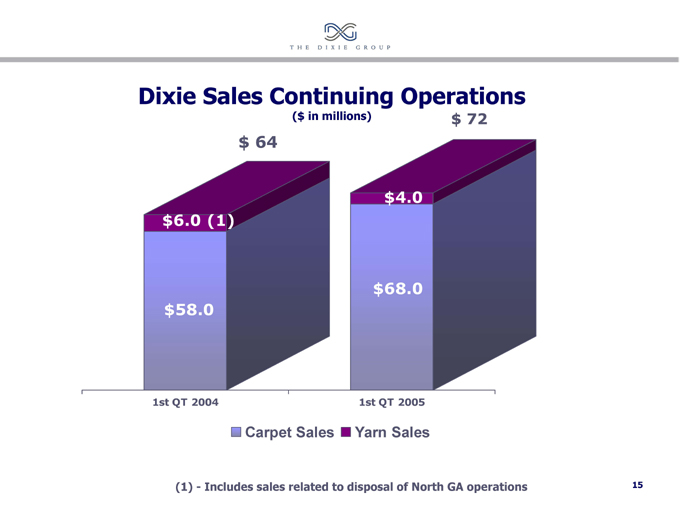

Dixie Sales Continuing Operations

($ in millions)

$ 64 $6.0 (1) $58.0

$ 72 $4.0

$68.0

1st QT 2004 1st QT 2005

Carpet Sales Yarn Sales

(1)—Includes sales related to disposal of North GA operations

15

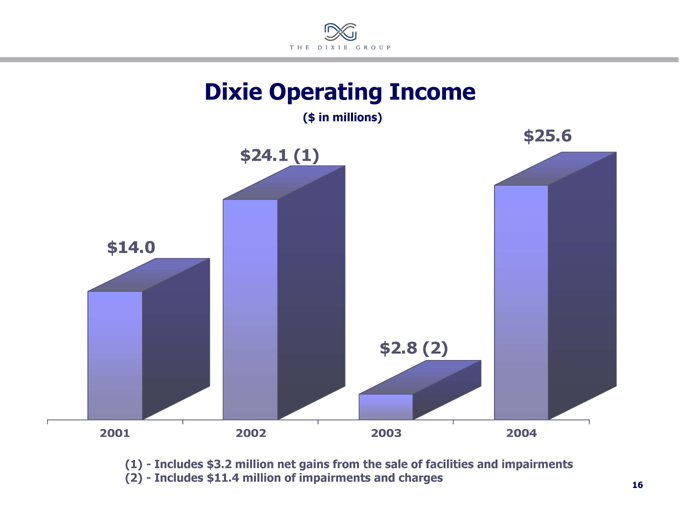

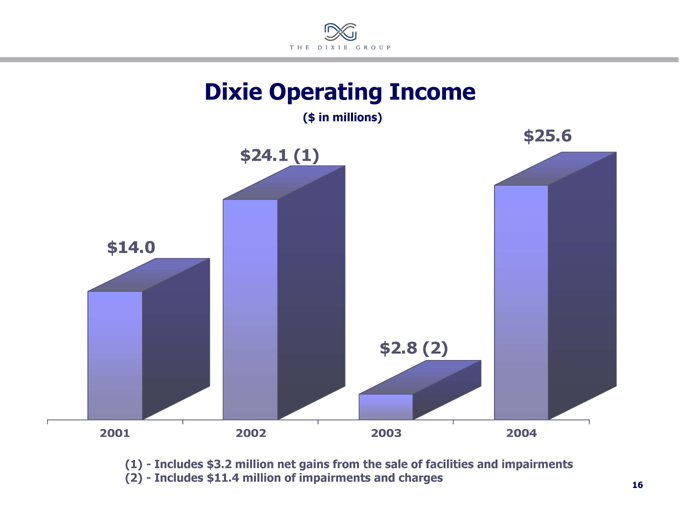

Dixie Operating Income

($ in millions)

$25.6 $24.1 (1)

$14.0

$2.8 (2)

2001 2002 2003 2004

(1)—Includes $3.2 million net gains from the sale of facilities and impairments (2)—Includes $11.4 million of impairments and charges

16

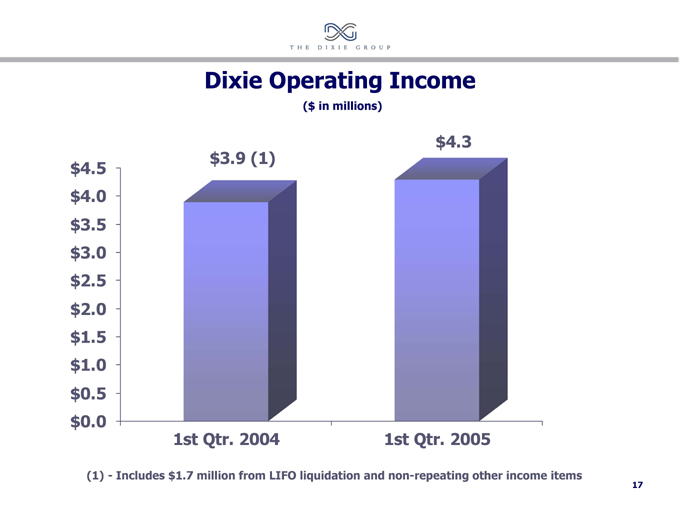

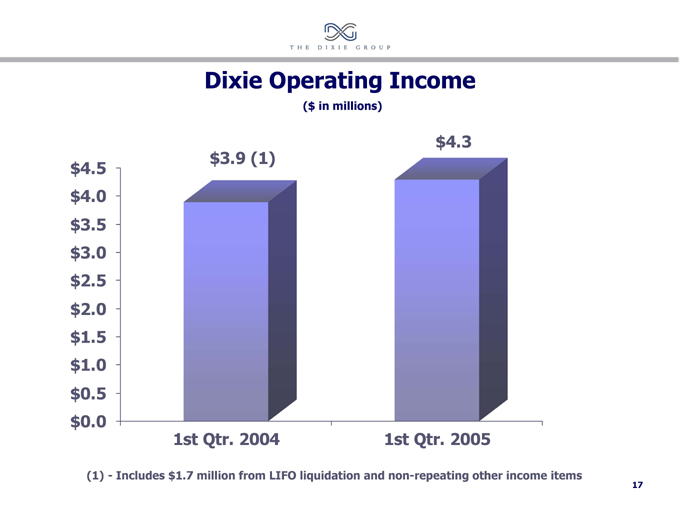

Dixie Operating Income

($ in millions)

$4.5 $4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

$4.3 $3.9 (1)

1st Qtr. 2004 1st Qtr. 2005

(1)—Includes $1.7 million from LIFO liquidation and non-repeating other income items

17

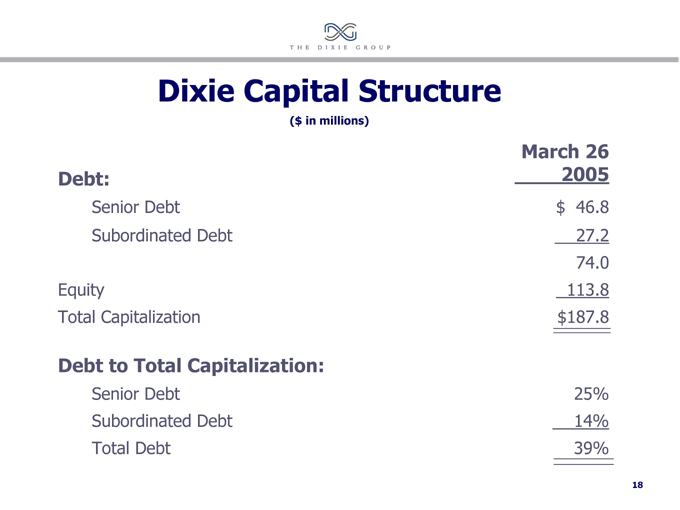

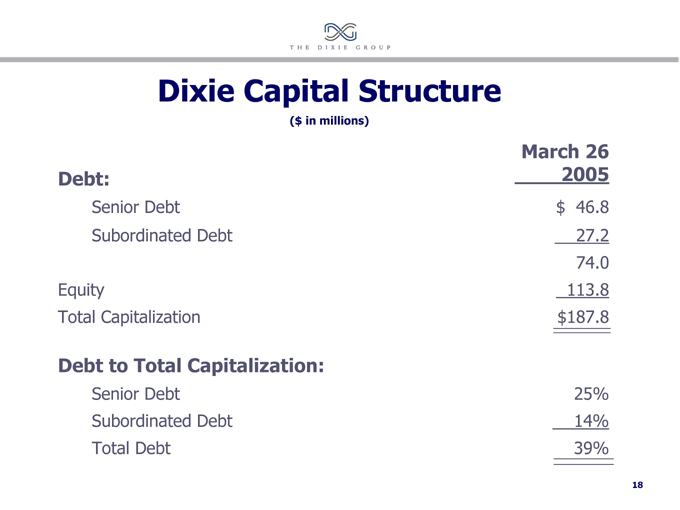

Dixie Capital Structure

($ in millions)

March 26 2005

Debt:

Senior Debt $ 46.8

Subordinated Debt 27.2

74.0

Equity 113.8

Total Capitalization $ 187.8

Debt to Total Capitalization:

Senior Debt 25%

Subordinated Debt 14%

Total Debt 39%

18

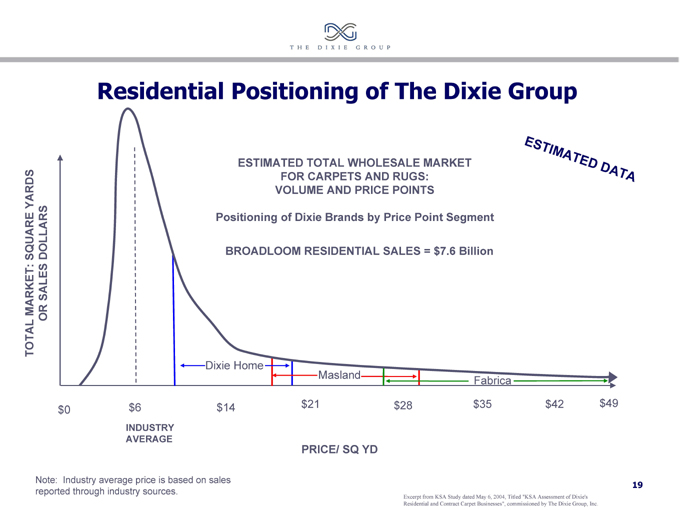

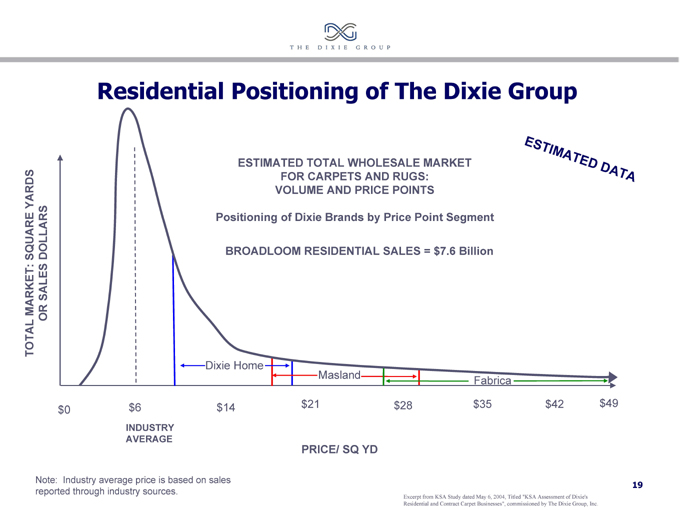

Residential Positioning of The Dixie Group

ESTIMATED TOTAL WHOLESALE MARKET

FOR CARPETS AND RUGS: VOLUME AND PRICE POINTS

Positioning of Dixie Brands by Price Point Segment

BROADLOOM RESIDENTIAL SALES = $7.6 Billion

ESTIMATED DATA

TOTAL MARKET: SQUARE YARDS OR SALES DOLLARS

Dixie Home

Masland

Fabrica

$6 $14 $21 $28 $35 $42 $49 $0

INDUSTRY AVERAGE

PRICE/ SQ YD

Note: Industry average price is based on sales reported through industry sources.

Excerpt from KSA Study dated May 6, 2004, Titled “KSA Assessment of Dixie’s Residential and Contract Carpet Businesses”, commissioned by The Dixie Group, Inc.

19

Dixie High-End Residential Sales

Fabrica 32%

Dixie Home 22%

Masland 46%

2004

Fabrica 30%

Dixie Home 26%

Masland 44%

2005

YTD 5-21-05

20

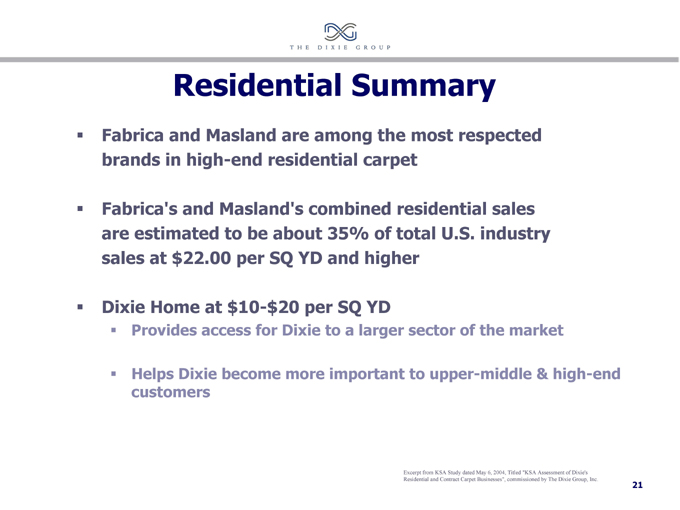

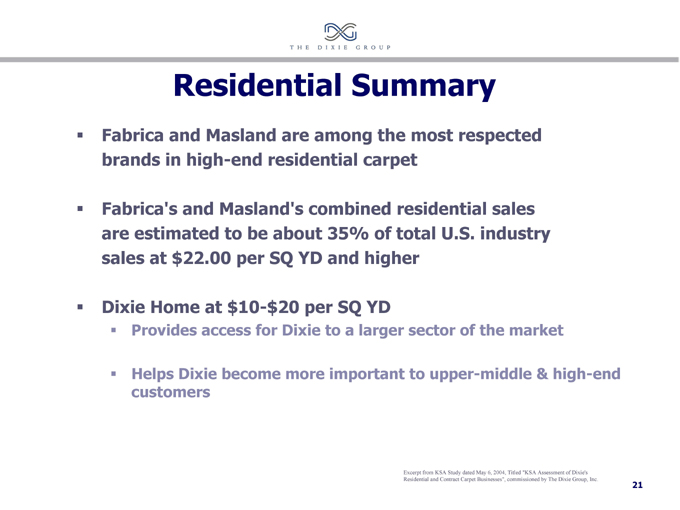

Residential Summary

Fabrica and Masland are among the most respected brands in high-end residential carpet

Fabrica’s and Masland’s combined residential sales are estimated to be about 35% of total U.S. industry sales at $22.00 per SQ YD and higher

Dixie Home at $10-$20 per SQ YD

Provides access for Dixie to a larger sector of the market

Helps Dixie become more important to upper-middle & high-end customers

Excerpt from KSA Study dated May 6, 2004, Titled “KSA Assessment of Dixie’s Residential and Contract Carpet Businesses”, commissioned by The Dixie Group, Inc.

21

Residential Broadloom—Dixie Home

Fulfill market need for third player

Well-styled moderate to upper priced line

Leverage needed by fiber suppliers for market access

Branded high-styled goods – not “me too”

Support fiber suppliers’ branded products

Limited distribution strategy attractive to retailers

Drive more volume on existing capacity at Masland/Dixie

22

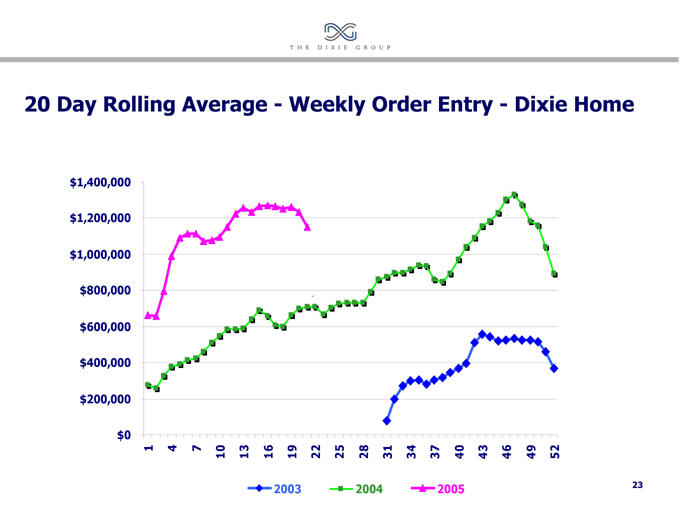

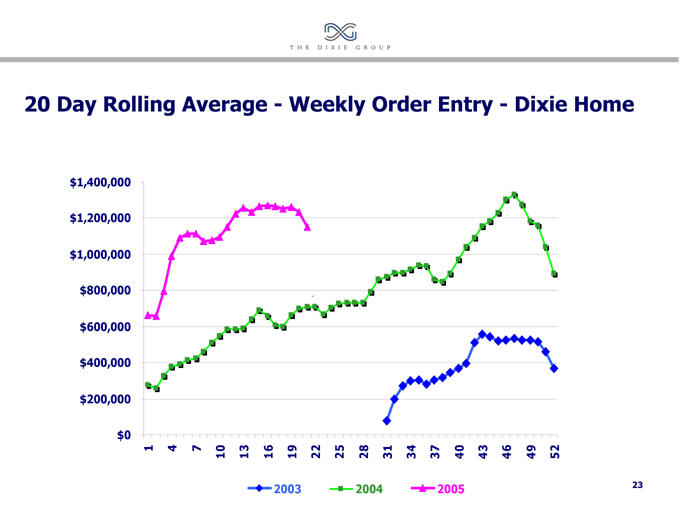

20 Day Rolling Average—Weekly Order Entry—Dixie Home

$1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52

2003 2004 2005

23

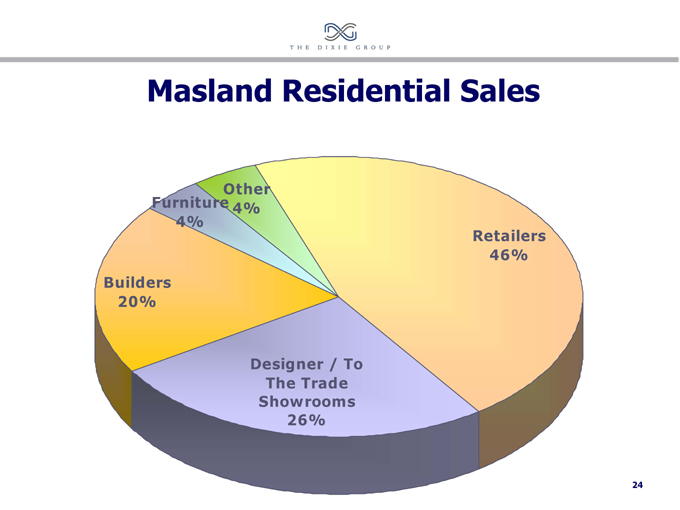

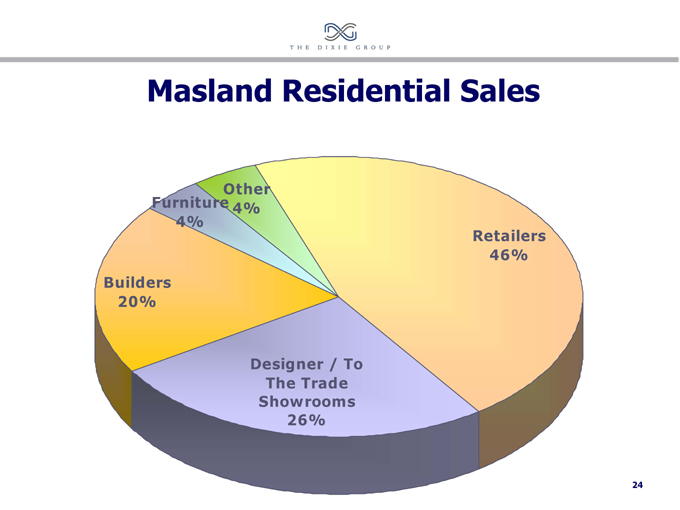

Masland Residential Sales

Other 4%

Furniture 4%

Builders 20%

Designer / To The Trade Showrooms 26%

Retailers 46%

24

Masland Residential

Leading high-end brand with reputation for development of products with innovative styling, design and color

Growth initiative—doubling product introductions to increase market penetration

Drive more volume on existing capacity at Masland/Dixie

25

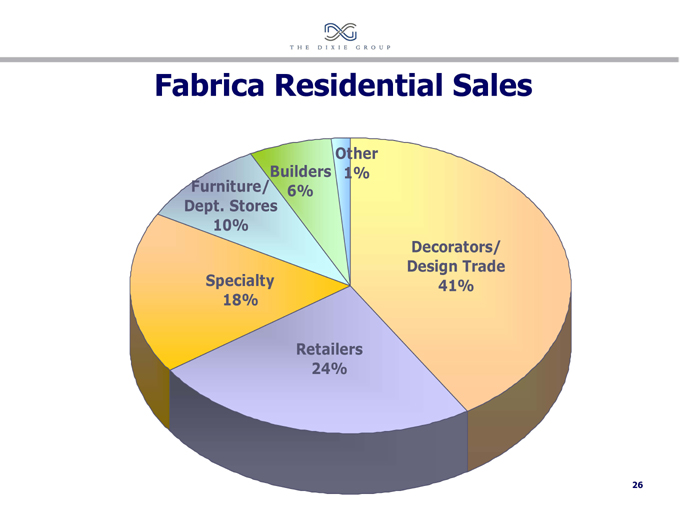

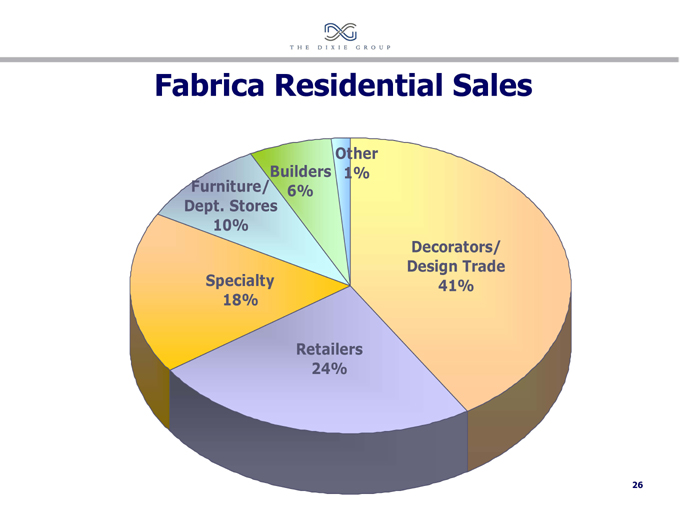

Fabrica Residential Sales

Other 1%

Furniture/ Dept. Stores 10%

Builders 6%

Specialty 18%

Retailers 24%

Decorators/ Design Trade 41%

26

Fabrica Residential

Premium high-end brand

Leader in styling/patterns/color

Consistent sales and profit growth

12 years consecutive sales growth

Over 50% profit growth since July 2000 acquisition

27

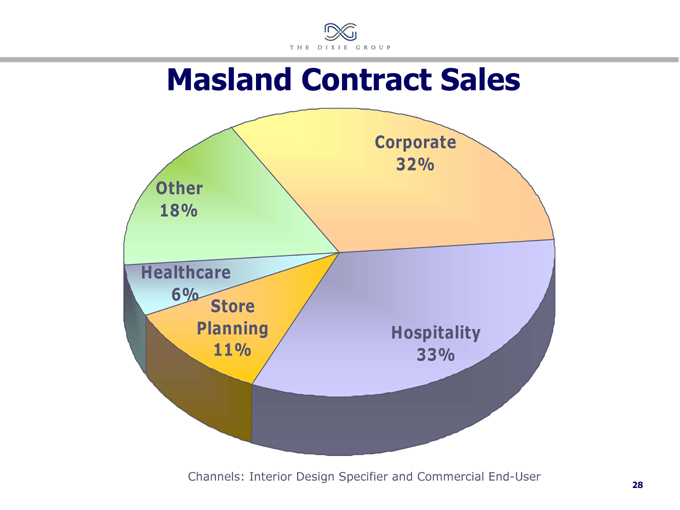

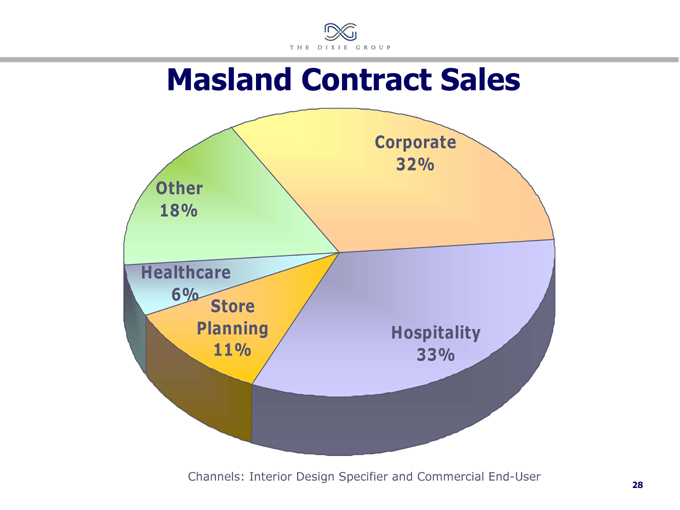

Masland Contract Sales

Other 18%

Healthcare 6%

Store Planning 11%

Corporate 32%

Hospitality 33%

Channels: Interior Design Specifier and Commercial End-User

28

Masland Contract

Good and growing position with premium brand Designer focused Strong national account base Strong growth from new “Energy Collection”

KSA study – identified potential opportunities

Invest in carpet tile

29

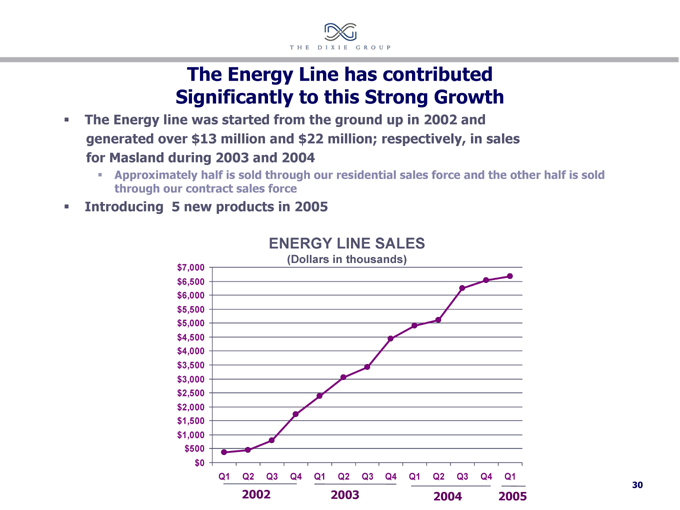

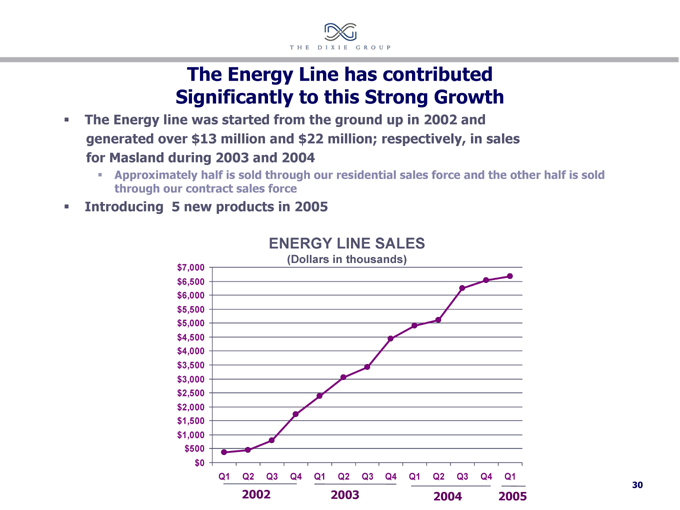

The Energy Line has contributed Significantly to this Strong Growth

The Energy line was started from the ground up in 2002 and generated over $13 million and $22 million; respectively, in sales for Masland during 2003 and 2004

Approximately half is sold through our residential sales force and the other half is sold through our contract sales force

Introducing 5 new products in 2005

ENERGY LINE SALES

(Dollars in thousands)

$7,000 $6,500 $6,000 $5,500 $5,000 $4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2002 2003 2004 2005

30

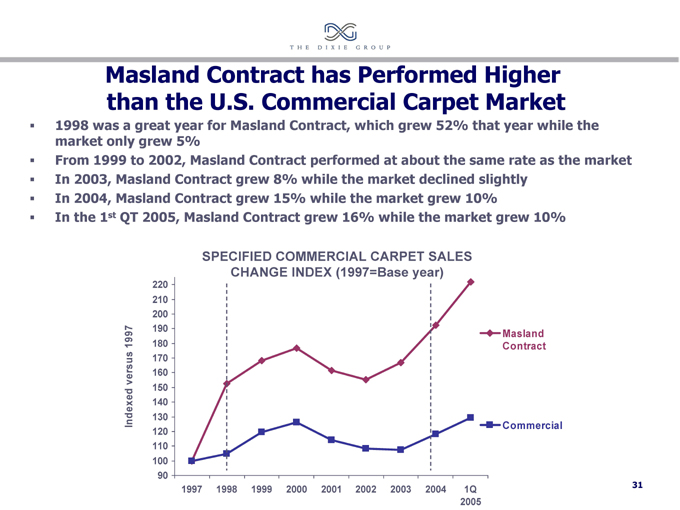

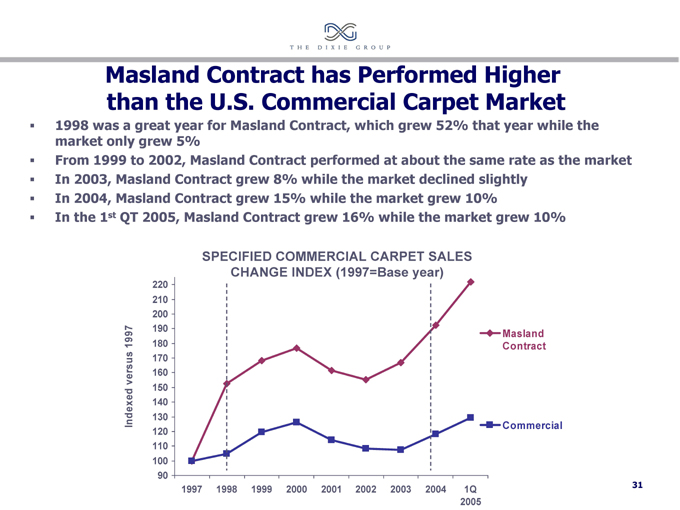

Masland Contract has Performed Higher than the U.S. Commercial Carpet Market

1998 was a great year for Masland Contract, which grew 52% that year while the market only grew 5%

From 1999 to 2002, Masland Contract performed at about the same rate as the market

In 2003, Masland Contract grew 8% while the market declined slightly

In 2004, Masland Contract grew 15% while the market grew 10%

In the 1st QT 2005, Masland Contract grew 16% while the market grew 10%

SPECIFIED COMMERCIAL CARPET SALES

CHANGE INDEX (1997=Base year)

Indexed versus 1997

220 210 200 190 180 170 160 150 140 130 120 110 100 90

1997 1998 1999 2000 2001 2002 2003 2004 1Q 2005

Masland Contract

Commercial

31

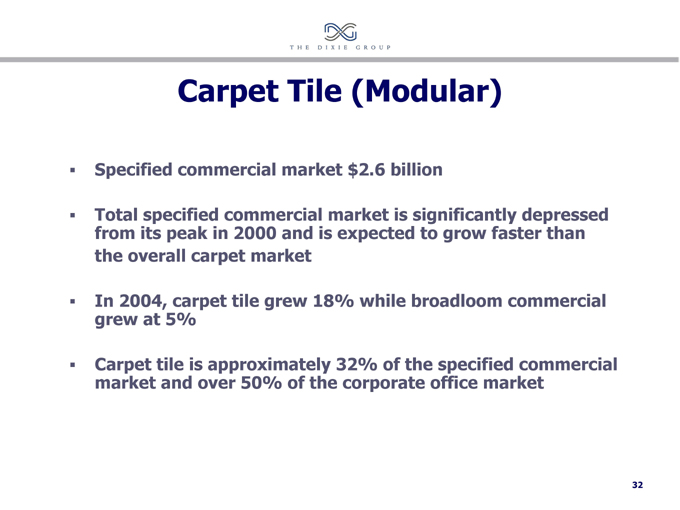

Carpet Tile (Modular)

Specified commercial market $2.6 billion

Total specified commercial market is significantly depressed from its peak in 2000 and is expected to grow faster than the overall carpet market

In 2004, carpet tile grew 18% while broadloom commercial grew at 5%

Carpet tile is approximately 32% of the specified commercial market and over 50% of the corporate office market

32

Focused on Internal Growth

Masland Residential – Impact beginning 3rd QT 2003 and continuing

Dixie Home – Impact beginning 3rd QT 2003 and continuing

Fabrica – Impact 3rd QT 2005

Masland Contract

Energy Collection – Introduced 2002 – continuing to add new products

Carpet Tile (Modular) – Introduced late 2005 Impact 2006 and beyond.

33