UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Roberta R.W. Kameda, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2023

Date of reporting period: JUNE 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) The following are the June 30, 2023 semi-annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of seven series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Emerging Markets Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Bond Fund.

The reports of each series were transmitted to their respective shareholders on August 23, 2023.

Stock Fund | Class I (dodgx) | Class X (doxgx)

ESTABLISHED 1965

06/23 SF SAR Printed on recycled paper

To Our Shareholders (unaudited)

The Dodge & Cox Stock Fund—Class I had a total return of 7.17% for the six-month period ended June 30, 2023, compared to a return of 16.89% for the S&P 500 Index and 5.12% for the Russell 1000 Value Index.1

Market Commentary

U.S. equity markets rose during the first half of 2023, amid resilient economic growth, slowing inflation, and a pause in interest-rate hikes by the Federal Reserve. The S&P 500 Index appreciated 16.9% and has gained more than 20% from its October 2022 low. The Information Technology and Communication Services sectors—among the worst-performing sectors in 2022—drove the S&P 500’s performance in the first half of 2023, principally fueled by excitement about artificial intelligence. Conversely, Energy, the best-performing sector of 2022, was the second worst-performing sector during the past six months due to a decline in commodity prices. Market leadership has been concentrated, with seven stocks in the S&P 500 accounting for 74% of the Index’s performance during the first half of 2023.2

After narrowing in 2022, the valuation disparity between U.S. value and growth stocks3 increased during the first half of 2023, as value stocks underperformed growth stocks by 23.9 percentage points.4 The Russell 1000 Value trades at 15.6 times forward earnings5 compared to 27.6 times for the Russell 1000 Growth Index.6

Investment Strategy

In the first half of 2023, the Fund had a positive absolute return. While it underperformed the S&P 500 by 9.7 percentage points, the Fund outperformed the Russell 1000 Value by 2.1 percentage points.7 The Fund’s underweight position and the performance of holdings in the Information Technology sector were the biggest detractors versus the S&P 500. The largest three Information Technology companies in the S&P 500—Apple, Microsoft, and NVIDIA—comprised 17.3% of the Index on June 30 and accounted for over 40% of the Index’s return. Of these three companies, the Fund held only an underweight position in Microsoft8 (2.6% of the Fund’s net assets compared to 6.8% of the S&P 500).

As a result of our value-oriented investment approach and focus on individual security selection, we increased the Fund’s exposure to companies that provide attractive dividends and trade at reasonable valuations in more stable sectors, including Health Care and Utilities. We also reduced the Fund’s exposure to companies that saw their valuations increase, including Meta Platforms, General Electric, and FedEx.

The Fund remains overweight the Financials (discussed below), Health Care, and Communication Services sectors and underweight Consumer Staples, Real Estate, and Utilities. We recently initiated two new positions—Dominion Energy and Norfolk Southern—which are also highlighted below.

Our Perspectives on the Financials Sector

The Financials sector has been a large detractor from the Fund’s relative results versus the S&P 500 this year, due to the Fund’s overweight position and the performance of its holdings. In March,

two U.S. regional banks not held in the Fund—Silicon Valley Bank and Signature Bank—collapsed and pressured Financials, particularly banks with weaker funding, sizable unrealized securities losses, and a greater concentration of customer deposits above the FDIC’s $250,000 insurance threshold. In May, regulators seized First Republic Bank (also not held in the Fund) and sold the majority of its assets to JPMorgan Chase.

We do not believe the weakness across U.S. Financials signals broader systemic risk for the sector. Key economic indicators are positive: corporate profits are healthy and consumer leverage is low. The Fund’s Financials exposure is primarily concentrated in two types of institutions. The first type is global, systemically important banks that already comply with tougher regulatory standards than regional banks and will likely gain deposit market share (e.g., Bank of America, Wells Fargo). The second type is financial institutions focused on capital markets with relatively little credit risk exposure (e.g., Bank of New York Mellon, Charles Schwab, Goldman Sachs).

Current valuations for the Fund’s Financials holdings are unusually inexpensive on both an absolute and relative basis, suggesting a pessimistic market outlook. Recent and potential headwinds include changes in depositor behavior, tougher regulatory capital standards, and potential reductions in credit quality due to tightening financial conditions, particularly within commercial real estate. Nevertheless, we remain more optimistic about the longer-term earnings capacity, margin resilience, and capital return potential for the Fund’s holdings. Importantly, rising interest rates have helped increase net interest income for the Fund’s banks. We believe a significant portion of this higher revenue is sustainable, absent a substantial decline in interest rates.

We continue to actively monitor the Financials sector and make portfolio decisions that incorporate our longer-term view of relative risk/reward opportunities. We have maintained the Fund’s overweight position in the Financials sector and recently added to bank holdings, including Truist Financial and Wells Fargo.

Dominion Energy

In the first quarter of this year, we started a position in Dominion Energy, a North American power and energy company headquartered in Richmond, Virginia. Dominion Energy has a strong electric utility franchise, but has faced considerable volatility in the past year, as concerns about the outcome of a regulatory review and a potential corporate restructuring have negatively impacted the stock price.

As part of our investment process, we seek to build a portfolio of individual companies whose current market valuation does not adequately reflect the company’s long-term profit opportunities, and Dominion Energy fits that description. The company has made significant efforts to prepare for the long-term energy transition away from fossil fuels. For many years, Dominion Energy traded at a premium valuation compared to other utilities, but now trades at a discount to both its industry peers and its own history. We believe this discounted valuation—along with the company’s 5% dividend yield—helps to mitigate the downside risk and doesn’t reflect the potential for multiple expansion if the current challenges are addressed successfully.

PAGE 1 ◾ Dodge & Cox Stock Fund

Norfolk Southern

During the second quarter, we initiated a position in Norfolk Southern, a railroad company with operations in the Eastern portion of the United States. The company competes in a stable duopoly (with CSX) whose participants prioritize return on invested capital (ROIC)9 and shareholder returns. Due to the highly publicized derailment of one of its trains in Ohio, Norfolk Southern’s shares underperformed significantly. Unfortunately, there are hundreds of train derailments in the United States each year; however, Norfolk Southern has dramatically improved its own safety record over the past two decades. The company is highly focused on operating a safer railroad and has committed to being the gold standard of safety in the railroad industry.

Norfolk Southern’s operating margins today materially lag its competition. The company can consistently pass along cost increases and has opportunities to improve margins, free cash flow10, and ROIC over time. We believe Norfolk Southern will see an improvement in its long-term volume growth as railroads continue to take market share from trucks, and the impact of declining revenues from the shrinking coal business diminishes. The company should also benefit as concerns about the financial impact of the derailment recede. We believe recent developments provided us an opportunity to buy an excellent franchise at a discounted valuation.

In Closing

We believe the Fund’s diversified portfolio is well positioned and could benefit if the wide valuation disparity between value and growth stocks narrows. The Fund’s portfolio trades at 12.5 times forward earnings, well below the S&P 500 and Russell 1000 Value’s valuations of 20.1 and 15.6 times, respectively. Since 1930, Dodge & Cox has navigated many challenging periods. In our experience, patience and persistence through turbulent markets have often been rewarded in the long run. We remain optimistic about the long-term outlook for the Fund.

Thank you for your continued confidence in Dodge & Cox. As always, we welcome your comments and questions.

For the Board of Trustees, | |

| |

Dana M. Emery,

Chair and President | |

July 31, 2023

| All returns are stated in U.S. dollars, unless otherwise noted. The Funds’ total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividend and/or interest income but, unlike Fund returns, do not reflect fees or expenses. The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. The Russell 1000 Value Index is a broad-based, unmanaged equity market index composed of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. |

| The top-seven contributors to the S&P 500’s absolute returns in the first half of 2023 were Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta Platforms, and Tesla. |

| Generally, stocks that have lower valuations are considered “value” stocks, while those with higher valuations are considered “growth” stocks. |

| For the first half of 2023, the Russell 1000 Value Index had a total return of 5.12% compared to 29.02% for the Russell 1000 Growth Index. The Russell 1000 Growth Index is a broad-based, unmanaged equity market index composed of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. |

| Price-to-earnings (forward) ratios are calculated using 12-month forward earnings estimates from third-party sources as of the reporting period. Estimates reflect a consensus of sell-side analyst estimates, which may lag as market conditions change. |

| Unless otherwise specified, all weightings and characteristics are as of June 30, 2023. |

| Return for the Stock Fund’s Class I shares. |

| The use of specific examples does not imply that they are more or less attractive investments than the portfolio’s other holdings. |

| Return on Invested Capital (ROIC) reflects the rate of return generated by a company using the funds contributed by its capital providers. This metric helps assess whether a company is creating value with its investments. |

| Free cash flow is the cash a company generates after paying all expenses and loans. |

Dodge & Cox Stock Fund ◾ PAGE 2

Year-to-Date Performance Review for the Fund's Class I Shares (unaudited)

The Fund underperformed the S&P 500 by 9.72 percentage points year to date.

Key contributors to relative results included the Fund's:

◾ Industrials holdings, notably General Electric and FedEx;

◾ Stock selection in Consumer Staples—including Molson Coors—and underweight position in the sector;

◾ Underweight position in Utilities; and

◾ Positions in Fiserv and Alphabet.

Key detractors from relative results included the Fund's:

◾ Information Technology holdings, largely the underweight position in Microsoft and not owning Apple and NVIDIA;

◾ Financials overweight and holdings, particularly Charles Schwab, MetLife, and Fidelity National Information Services;

◾ Health Care holdings—including Cigna, Gilead Sciences and Incyte—and overweight position;

◾ Underweight position in Consumer Discretionary, especially in Amazon, and not owning Tesla; and

◾ Energy overweight and elected holdings, especially Occidental Petroleum.

The Fund outperformed the Russell 1000 Value by 2.05 percentage points year to date.

Key contributors to relative results included the Fund's:

◾ Stock selection in Industrials, particularly General Electric and FedEx;

◾ Information Technology overweight position and certain holdings, notably Microsoft and Microchip Technology;

◾ Underweight position in Utilities;

◾ Consumer Discretionary holdings, particularly Amazon;

◾ Stock selection in Consumer Staples, mainly Molson Coors; and

◾ Positions in Alphabet, Fiserv, Capital One Financial, and Sanofi.

Key detractors from relative results included the Fund's:

◾ Financials holdings—particularly Charles Schwab, MetLife, and Fidelity National Information Services—and overweight position; and

◾ Positions in Occidental Petroleum, Cigna, Incyte, Gilead Sciences, DISH Network, BioMarin Pharmaceuticals, and

underweight exposure to Meta Platforms.

Key Characteristics of Dodge & Cox

Independent Organization

Dodge & Cox is one of the largest privately owned investment managers in the world. We remain committed to independence, with a goal of providing the highest-quality investment management service to our existing clients.

Over 90 Years of Investment Experience

Dodge & Cox was founded in 1930. We have a stable and well- qualified team of investment professionals, most of whom have spent their entire careers at Dodge & Cox.

Experienced Investment Team

The U.S. Equity Investment Committee, which is the decision-making body for the Stock Fund, is a seven-member committee with an average tenure of 21 years at Dodge & Cox.

One Business with a Single Decision-Making Office

Dodge & Cox manages equity (domestic, international, and global), fixed income (domestic and global), and balanced investments, all from one office in San Francisco.

Consistent Investment Approach

Our team decision-making process involves thorough, bottom-up fundamental analysis of each investment.

Long-Term Focus and Low Expenses

We invest with a three- to five-year investment horizon, which has historically resulted in low turnover relative to our peers. We manage Funds that maintain low expense ratios.

Risks: The Fund is subject to market risk, meaning holdings in the Fund may decline in value for extended periods due to the financial prospects of individual companies, or due to general market and economic conditions. Please read the prospectus and summary prospectus for specific details regarding the Fund's risk profile.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please see the Portfolio of Investments section in this report for a complete list of fund holdings.

PAGE 3 ◾ Dodge & Cox Stock Fund

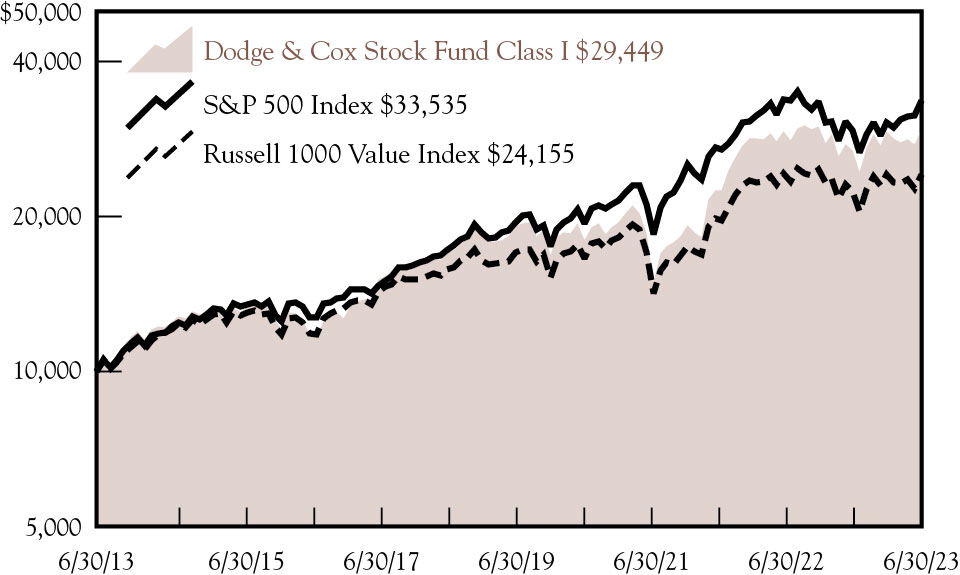

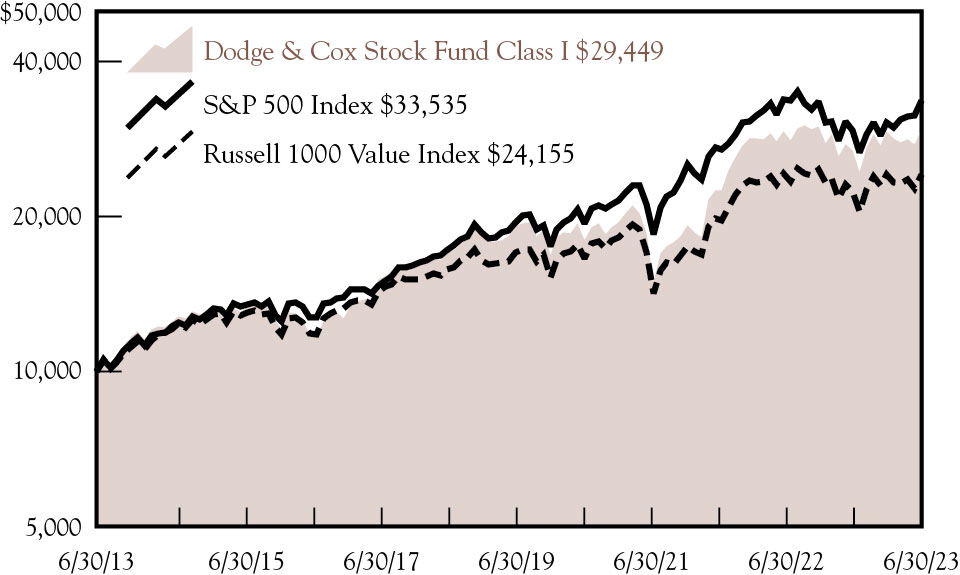

Growth of $10,000 Over 10 Years (unaudited)

For an Investment Made on June 30, 2013

Average Annual Total Return

For Periods Ended June 30, 2023

Expense Ratios

Per the Prospectus Dated May 1, 2023

| The Class X shares inception date is May 2, 2022. The returns shown prior to that date are for the Class I shares. |

| Dodge & Cox has contractually agreed to reimburse the Fund for all ordinary expenses to the extent necessary to maintain Total Annual Fund Operating Expenses of Class X at 0.41% until April 30, 2026. This agreement cannot be terminated prior to April 30, 2026 other than by resolution of the Fund’s Board of Trustees. For purposes of the foregoing, ordinary expenses shall not include nonrecurring shareholder account fees, fees and expenses associated with Fund shareholder meetings, fees on portfolio transactions such as exchange fees, dividends and interest on short positions, fees and expenses of pooled investment vehicles that are held by the Fund, interest expenses and other fees and expenses related to any borrowings, taxes, brokerage fees and commissions and other costs and expenses relating to the acquisition and disposition of Fund investments, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other non-routine expenses or extraordinary expenses not incurred in the ordinary course of the Fund’s business, such as litigation expenses. The term of the agreement will automatically renew for subsequent three-year terms unless terminated with at least 30 days’ written notice by either party prior to the end of the then-current term. The agreement does not permit Dodge & Cox to recoup any fees waived or payments made to the Fund for a prior year. |

Returns represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s website at dodgeandcox.com or call 800-621-3979 for current performance figures.

The Fund's total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividends but, unlike Fund returns, do not reflect fees or expenses. The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. The Russell 1000 Value Index is a broad-based, unmanaged equity market index composed of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

S&P 500® is a trademark of S&P Global Inc. Russell 1000® is a trademark of the London Stock Exchange Group plc.

For more information about these indices, visit:

www.dodgeandcox.com/stockfund

Dodge & Cox Stock Fund ◾ PAGE 4

Portfolio Information (unaudited) June 30, 2023

| Net Cash & Other includes cash, short-term investments, derivatives, receivables, and payables. |

Fund Expense Example (unaudited)

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

Actual Expenses

The first line of each share class in the table below provides information about actual account values and expenses based on the actual returns of the share class. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison with Other Mutual Funds

Information on the second line of each share class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the share class and an assumed 5% annual rate of return before expenses (not the actual return of the share class). The amount under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

Six Months Ended

June 30, 2023 | Beginning Account Value

1/1/2023 | Ending Account Value

6/30/2023 | Expenses Paid

During Period* | |

| | | | |

| | | | |

Based on hypothetical 5% yearly return | | | | |

| | | | |

| | | | |

Based on hypothetical 5% yearly return | | | | |

| Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. Though other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

PAGE 5 ◾ Dodge & Cox Stock Fund

Portfolio of Investments (unaudited) June 30, 2023

|

| | |

Communication Services: 12.2% |

Media & Entertainment: 11.1% |

Alphabet, Inc., Class A(a) | | |

Alphabet, Inc., Class C(a) | | |

Charter Communications, Inc., | | |

| | |

DISH Network Corp., Class A(a) | | |

| | |

| | |

Meta Platforms, Inc., Class A(a) | | |

| | |

| | |

Telecommunication Services: 1.1% |

| | |

| | |

Consumer Discretionary: 4.1% |

Automobiles & Components: 1.0% |

Honda Motor Co., Ltd. ADR (Japan) | | |

Consumer Discretionary Distribution & Retail: 1.9% |

| | |

| | |

| | |

|

Booking Holdings, Inc.(a) | | |

| | |

|

Food, Beverage & Tobacco: 2.0% |

Anheuser-Busch InBev SA/NV ADR (Belgium) | | |

Molson Coors Beverage Co., | | |

| | |

Household & Personal Products: 0.7% |

Haleon PLC ADR (United Kingdom) | | |

| | |

|

Baker Hughes Co., Class A | | |

| | |

Occidental Petroleum Corp.(b) | | |

Occidental Petroleum Corp., | | |

The Williams Companies, Inc. | | |

| | |

|

|

| | |

| | |

| | |

| | |

Financial Services: 15.4% |

Bank of New York Mellon Corp. | | |

Capital One Financial Corp.(b) | | |

| | |

Fidelity National Information Services, Inc. | | |

| | |

Goldman Sachs Group, Inc. | | |

|

| | |

| | |

UBS Group AG, NY Shs (Switzerland) | | |

| | |

|

Aegon NV, NY Shs (Netherlands) | | |

Brighthouse Financial, Inc.(a)(b) | | |

| | |

| | |

| | |

| | |

|

Health Care Equipment & Services: 6.5% |

| | |

GE HealthCare Technologies, Inc. | | |

| | |

| | |

| | |

Zimmer Biomet Holdings, Inc. | | |

| | |

Pharmaceuticals, Biotechnology & Life Sciences: 14.2% |

Alnylam Pharmaceuticals, Inc.(a) | | |

BioMarin Pharmaceutical, Inc.(a) | | |

| | |

Elanco Animal Health, Inc.(a)(b) | | |

| | |

GSK PLC ADR (United Kingdom) | | |

| | |

Novartis AG ADR (Switzerland) | | |

Regeneron Pharmaceuticals, Inc.(a) | | |

Roche Holding AG ADR (Switzerland) | | |

| | |

| | |

| | |

|

|

| | |

| | |

Johnson Controls International PLC | | |

| | |

Raytheon Technologies Corp. | | |

| | |

|

| | |

| | |

| | |

| | |

Information Technology: 14.3% |

Semiconductors & Semiconductor Equipment: 1.4% |

Microchip Technology, Inc. | | |

Software & Services: 6.2% |

Cognizant Technology Solutions Corp., Class A | | |

| | |

| | |

| | |

Technology, Hardware & Equipment: 6.7% |

| | |

| | |

See accompanying Notes to Financial StatementsDodge & Cox Stock Fund ◾ PAGE 6

Portfolio of Investments (unaudited) June 30, 2023

Common Stocks (continued) |

| | |

Dell Technologies, Inc., Class C | | |

Hewlett Packard Enterprise Co. | | |

| | |

Juniper Networks, Inc.(b) | | |

| | |

| | |

| | |

|

| | |

LyondellBasell Industries NV, Class A | | |

| | |

|

Equity Real Estate Investment Trusts (Reits): 0.2% |

Gaming and Leisure Properties, Inc. REIT | | |

|

| | |

Total Common Stocks

(Cost $62,740,198,847) | | |

Short-Term Investments: 1.4% |

| | |

Repurchase Agreements: 1.0% |

Fixed Income Clearing Corporation(c) 5.04%, dated 6/30/23, due 7/3/23, maturity value $630,264,600 | | |

Fixed Income Clearing Corporation(c) 2.45%, dated 6/30/23, due 7/3/23, maturity value $261,523,383 | | |

| | |

|

| | |

|

State Street Institutional U.S. Government Money Market Fund - Premier Class | | |

Total Short-Term Investments

(Cost $1,260,030,568) | |

Total Investments In Securities

(Cost $64,000,229,415) | | |

Other Assets Less Liabilities | | |

| | |

| |

| See below regarding holdings of 5% voting securities |

| Repurchase agreement is collateralized by U.S. Treasury Notes 1.125%-4.50%, 8/15/39-5/15/40. U.S. Treasury Inflation Indexed Notes 0.125%-2.125%, 10/15/25- 2/15/40. Total collateral value is $909,299,535. |

| The Fund usually classifies a company or issuer based on its country of risk, but may designate a different country in certain circumstances. |

| |

| |

ADR: American Depositary Receipt |

NY Shs: New York Registry Shares |

Futures Contracts

| | | | Value /

Unrealized

Appreciation/

(Depreciation) |

E-Mini S&P 500 Index— Long Position | | | | |

Holdings of 5% Voting Securities

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the six months ended June 30, 2023. Further detail on these holdings and related activity during the period appear below.

| Value at

Beginning of Period | | | | Net Change in

Unrealized

Appreciation/

Depreciation | | Dividend

Income

(net of foreign

taxes, if any) |

| | | | | | | |

Consumer Discretionary 0.3% | | | | | | | |

Qurate Retail, Inc., Series A | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Molson Coors Beverage Co., Class B | | | | | | | |

PAGE 7 ◾ Dodge & Cox Stock FundSee accompanying Notes to Financial Statements

Portfolio of Investments (unaudited) June 30, 2023

Holdings of 5% Voting Securities (continued)

| Value at Beginning of Period | | | | Net Change in Unrealized Appreciation/ Depreciation | | Dividend Income (net of foreign taxes, if any) |

| | | | | | | |

Occidental Petroleum Corp. | | | | | | | |

Occidental Petroleum Corp., | | | | | | | |

| | | | | | | |

| | | | | | | |

Brighthouse Financial, Inc.(b) | | | | | | | |

Capital One Financial Corp. | | | | | | | |

| | | | | | | |

| | | | | | | |

Elanco Animal Health, Inc.(b) | | | | | | | |

| | | | | | | |

| | | | | | | |

Information Technology 1.5% | | | | | | | |

| | | | | | | |

| | | | | | | |

Micro Focus International PLC ADR | | | | | | | |

| | | | | | | |

| | | | | | | |

| Company was not an affiliate at period end |

| |

See accompanying Notes to Financial StatementsDodge & Cox Stock Fund ◾ PAGE 8

Statement of Assets and Liabilities (unaudited)

| |

|

Investments in securities, at value | |

Unaffiliated issuers (cost $55,100,650,110) | |

Affiliated issuers (cost $8,899,579,305) | |

| |

Deposits with broker for futures contracts | |

Receivable for variation margin for futures contracts | |

Receivable for investments sold | |

Receivable for Fund shares sold | |

Dividends and interest receivable | |

Expense reimbursement receivable | |

Prepaid expenses and other assets | |

| |

|

Payable for investments purchased | |

Payable for Fund shares redeemed | |

| |

| |

| |

| |

|

| |

| |

| |

|

| |

Shares outstanding (par value $0.01 each, unlimited shares authorized) | |

Net asset value per share | |

|

| |

Shares outstanding (par value $0.01 each, unlimited shares authorized) | |

Net asset value per share | |

Statement of Operations (unaudited)

| Six Months Ended

June 30, 2023 |

| |

Dividends (net of foreign taxes of $38,629,077) | |

| |

| |

| |

| |

| |

| |

Administrative services fees | |

| |

| |

Custody and fund accounting fees | |

| |

| |

| |

| |

| |

| |

Expenses reimbursed by investment manager | |

| |

| |

Realized and Unrealized Gain (Loss): | |

| |

Investments in securities of unaffiliated issuers (Note 6) | |

Investments in securities of affiliated issuers (Note 6) | |

| |

Foreign currency transactions | |

Net change in unrealized appreciation/depreciation | |

Investments in securities of unaffiliated issuers | |

Investments in securities of affiliated issuers | |

| |

Foreign currency translation | |

Net realized and unrealized gain | |

Net Change in Net Assets From Operations | |

PAGE 9 ◾ Dodge & Cox Stock FundSee accompanying Notes to Financial Statements

Statement of Changes in Net Assets (unaudited)

| | |

| | |

| | |

| | |

| | |

Net change in unrealized appreciation/depreciation | | |

| | |

Distributions to Shareholders: | | |

| | |

| | |

| | |

| | |

| | |

Proceeds from sales of shares | | |

Reinvestment of distributions | | |

| | |

| | |

Proceeds from sales of shares | | |

Reinvestment of distributions | | |

| | |

Net change from Fund share transactions | | |

Total change in net assets | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Net change in shares outstanding | | |

| | |

| | |

| | |

| | |

Net change in shares outstanding | | |

See accompanying Notes to Financial StatementsDodge & Cox Stock Fund ◾ PAGE 10

Notes to Financial Statements (unaudited)

Note 1: Organization and Significant Accounting Policies

Dodge & Cox Stock Fund (the "Fund") is one of the series constituting the Dodge & Cox Funds (the "Trust" or the "Funds"). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund's Prospectus.

On May 1, 2022, the then-outstanding shares of the Fund were redesignated as Class I Shares, and Class X shares of the Fund were established. The share classes have different eligibility requirements and expense structures due to differing shareholder servicing arrangements. The share classes have the same rights as to redemption, dividends and liquidation proceeds, and voting privileges, except that each class has the exclusive right to vote on matters affecting only its class.

The Fund is an investment company and follows the accounting and reporting guidance issued in Topic 946 by the Financial Accounting Standards Board. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Actual results may differ from those estimates. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are normally valued as of the scheduled close of trading on the New York Stock Exchange (NYSE), generally 4 p.m. Eastern Time, each day that the NYSE is open for business.

Portfolio holdings for which market quotes are readily available are valued at market value. Listed securities, for example, are generally valued using the official quoted close price or the last sale on the exchange that is determined to be the primary market for the security. Exchange-traded derivatives are generally valued at the settlement price determined by the relevant exchange. Short-term securities less than 60 days to maturity may be valued at amortized cost if amortized cost approximates current value. Mutual funds are valued at their respective net asset values. Security values are not discounted based on the size of the Fund’s position and may differ from the value a Fund receives upon sale of the securities. All securities held by the Fund are denominated in U.S. dollars.

If market quotations are not readily available or if normal valuation procedures produce valuations that are deemed unreliable or inappropriate under the circumstances existing at the time, the investment will be valued at fair value as determined in good faith by Dodge & Cox. The Board of Trustees has appointed Dodge & Cox, the Fund’s investment manager, as its "valuation designee", as permitted by Rule 2a-5 under the Investment Company Act of 1940, to make fair value determinations in accordance with the Dodge & Cox Funds Valuation Policies (“Valuation Policies”), subject to Board oversight. Dodge & Cox has established a Pricing Committee that is comprised of representatives from Treasury, Legal, Compliance, and Operations. The Pricing Committee is responsible for implementing the Valuation Policies, including determining the fair value of securities and other investments when necessary. The Pricing Committee considers rel

evant indications of value that are reasonably available to it in determining the fair value assigned to a particular security, such as the value of similar financial instruments, trading volumes, contractual restrictions on disposition, related corporate actions, and changes in economic conditions. In doing so, the Pricing Committee employs various methods for calibrating fair valuation approaches, including a regular review of key inputs and assumptions, back-testing, and review of any related market activity.

Valuing securities through a fair value determination involves greater reliance on judgment than valuation of securities based on readily available market quotations. In some instances, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a security’s value. When fair value pricing is employed, the prices of securities used by the Fund to calculate its net asset value may differ from quoted or published prices for the same securities.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, or when the Fund first learns of the dividend/corporate action if the ex-dividend date has passed. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends characterized as return of capital for U.S. tax purposes are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Some expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust using methodologies determined by the nature of the expense.

Distributions to shareholders are recorded on the ex-dividend date.

Share class accounting Investment income, realized and unrealized gains and losses and expenses, other than class-specific expenses, are allocated to each share class of the Fund based upon the proportion of net assets of each class.

Foreign taxes The Fund may be subject to foreign taxes which may be imposed by certain countries in which the Fund invests. The Fund endeavors to record foreign taxes based on applicable foreign tax law. Withholding taxes are incurred on certain foreign dividends and are accrued at the time the associated dividend is recorded. The Fund files withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. The Fund records a reclaim receivable based on, among other things, a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention. In consideration of recent decisions rendered by European courts, the Fund has filed for additional reclaims ("EU reclaims") related to prior years. A corresponding receivable is established when both the amount is known and significant contingencies or uncertainties regarding collectability are removed. These amounts, if any, are reported in dividends and interest receivable in the Statement of Assets and Liabilities. Expenses incurred related to filing EU reclaims

PAGE 11 ◾ Dodge & Cox Stock Fund

Notes to Financial Statements (unaudited)

are recorded on the accrual basis in professional services in the Statement of Operations. Expenses that are contingent upon successful EU reclaims are recorded in professional services in the Statement of Operations once the amount is known.

Repurchase agreements Repurchase agreements are transactions under which a Fund purchases a security from a counterparty and agrees to resell the security to that counterparty on a specified future date at the same price, plus a specified interest rate. The Fund’s repurchase agreements are secured by U.S. government or agency securities. It is the Fund’s policy that its regular custodian or third party custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

Note 2: Valuation Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

◾ Level 1: Unadjusted quoted prices in active markets for identical securities

◾ Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, forward exchange rates, etc.)

◾ Level 3: Significant unobservable inputs (including Fund management’s assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s holdings at June 30, 2023:

| | LEVEL 2

(Other Significant

Observable Inputs) |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

| | LEVEL 2 (Other Significant Observable Inputs) |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

|

|

| | |

Note 3: Derivative Instruments

The Fund may use derivatives either to minimize the impact of certain risks to one or more of its investments (as a ‘‘hedging technique’’) or to implement its investment strategy. A derivative is a financial instrument whose value is derived from a security, currency, interest rate, index, or other financial instrument.

Futures contracts Futures contracts involve an obligation to purchase or sell (depending on whether the Fund has entered a long or short futures contract, respectively) an asset at a future date, at a price set at the time of the contract. Futures contracts are exchange-traded. Upon entering into a futures contract, the Fund is required to deposit an amount of cash or liquid assets (referred to as "initial margin") in a segregated account with the clearing broker. Subsequent payments (referred to as "variation margin") to and from the clearing broker are made on a daily basis based on changes in the market value of the contract. Changes in the market value of open futures contracts are recorded as unrealized appreciation or depreciation in the Statement of Operations. Realized gains and losses on futures contracts are recorded in the Statement of Operations at the closing or expiration of the contracts. Cash deposited with a broker as initial margin is recorded in the Statement of Assets and Liabilities. A receivable and/or payable to brokers for daily variation margin is also recorded in the Statement of Assets and Liabilities.

Investments in futures contracts may include certain risks, which may be different from, and potentially greater than, those of the underlying securities. To the extent the Fund uses futures, it is exposed to additional volatility and potential losses resulting from leverage.

The Fund used long S&P 500 Index futures contracts to provide equity exposure, approximately equal to some or all of the Fund's non-equity assets.

Additional derivative information The following identifies the location on the Statement of Assets and Liabilities and values of the Fund's derivative instruments categorized by primary underlying risk exposure.

Dodge & Cox Stock Fund ◾ PAGE 12

Notes to Financial Statements (unaudited)

| Includes cumulative appreciation (depreciation). Only the current day’s variation margin is reported in the Statement of Assets and Liabilities. |

The following summarizes the effect of derivative instruments on the Statement of Operations, categorized by primary underlying risk exposure.

| |

| |

| |

Net change in unrealized appreciation/depreciation |

| |

The following summarizes the range of volume in the Fund's derivative instruments during the six months ended June 30, 2023.

Note 4: Related Party Transactions

Investment advisory fee The Fund pays an investment advisory fee monthly at an annual rate of 0.40% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Administrative services fee The Fund pays Dodge & Cox a fee for administrative and shareholder services. The fee is accrued daily and paid monthly equal to an annual rate of the average daily net assets of 0.10% for Class I shares and 0.05% for Class X shares. Under this agreement, Dodge & Cox also pays for the Fund's transfer agent fees.

Expense reimbursement Dodge & Cox has contractually agreed to reimburse the Fund for all ordinary expenses to the extent necessary to maintain the ratio of total operating expenses of the Class X shares to average net assets of the Class X shares at 0.41% through April 30, 2026. The term of the agreement will automatically renew for subsequent three-year terms unless terminated with at least 30 days’ written notice by either party prior to the end of the then-current term. For the six months ended June 30, 2023, Dodge & Cox reimbursed expenses of $6,344,344.

Fund officers and trustees All officers and two of the trustees of the Trust are current or former senior executive officers of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

Note 5: Income Tax Information and Distributions to Shareholders

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of

its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, and such amounts may differ from net investment income and realized gains for financial reporting purposes. The Fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes. Financial reporting records are adjusted for permanent book to tax differences at year end to reflect tax character. Book to tax differences are primarily due to differing treatments of redemptions in-kind, wash sales, certain corporate action transactions, derivatives, and distributions.

Distributions during the periods noted below were characterized as follows for federal income tax purposes:

| Six Months Ended

June 30, 2023 | Year Ended

December 31, 2022 |

| | |

| | |

| | |

| | |

| | |

| | |

The components of distributable earnings on a tax basis are reported as of the Fund's most recent year end. At December 31, 2022, the tax basis components of distributable earnings were as follows:

Undistributed ordinary income | |

Undistributed long-term capital gain | |

Net unrealized appreciation | |

Total distributable earnings | |

At June 30, 2023, unrealized appreciation and depreciation for investments based on cost for federal income tax purposes were as follows:

| |

| |

| |

Net unrealized appreciation | |

Fund management has reviewed the tax positions for open periods (three years and four years, respectively, from filing the Fund’s Federal and State tax returns) as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

Note 6: Redemptions In-Kind

During the six months ended June 30, 2023, the Fund distributed securities and cash as payment for redemptions of Class I shares. For financial reporting purposes, the Fund realized a net gain of $236,555,605 attributable to the redemptions in-kind: $196,139,704 from unaffiliated issuers and $40,415,901 from affiliated issuers. For tax purposes, no capital gain on the redemptions in-kind was recognized.

PAGE 13 ◾ Dodge & Cox Stock Fund

Notes to Financial Statements (unaudited)

Note 7: Loan Facilities

Pursuant to an exemptive order issued by the Securities and Exchange Commission (SEC), the Fund may participate in an interfund lending facility (Facility). The Facility allows the Fund to borrow money from or loan money to the Funds. Loans under the Facility are made for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest on borrowings is the average of the current repurchase agreement rate and the bank loan rate. There was no activity in the Facility during the period.

All Funds in the Trust participate in a $500 million committed credit facility (Line of Credit) with State Street Bank and Trust Company, to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The maximum amount available to the Fund is $250 million. Each Fund pays an annual commitment fee on its pro-rata portion of the Line of Credit. For the six months ended June 30, 2023, the Fund’s

commitment fee amounted to $268,757 and is reflected as a Miscellaneous Expense in the Statement of Operations. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the period.

Note 8: Purchases and Sales of Investments

For the six months ended June 30, 2023, purchases and sales of securities, other than short-term securities, aggregated $3,798,680,470 and $5,005,139,227, respectively.

Note 9: Subsequent Events

Fund management has determined that no material events or transactions occurred subsequent to June 30, 2023, and through the date of the Fund’s financial statements issuance, which require disclosure in the Fund’s financial statements.

Dodge & Cox Stock Fund ◾ PAGE 14

Financial Highlights (unaudited)

Selected data and ratios

(for a share outstanding throughout each period) | | |

| | | | | | |

| | | | | | |

Net asset value, beginning of period | | | | | | |

Income from investment operations: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from investment operations | | | | | | |

Distributions to shareholders from: | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Ratios/supplemental data: | | | | | | |

Net assets, end of period (millions) | | | | | | |

Ratio of expenses to average net assets | | | | | | |

Ratio of net investment income to average net assets | | | | | | |

| | | | | | |

| | | | | | |

Net asset value, beginning of period | | | | | | |

Income from investment operations: | | | | | | |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total from investment operations | | | | | | |

Distributions to shareholders from: | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Ratios/supplemental data: | | | | | | |

Net assets, end of period (millions) | | | | | | |

Ratio of expenses to average net assets | | | | | | |

Ratio of expenses to average net assets, before reimbursement by investment manager | | | | | | |

Ratio of net investment income to average net assets | | | | | | |

| | | | | | |

| Net investment income per share includes significant amounts received for EU reclaims related to prior years, which amounted to approximately $0.20 per share. Excluding such amounts, the ratio of net investment income to average net assets would have been 1.87%. |

| |

| For 2022, the period covers 5/2/2022 (commencement of operations) to 12/31/2022 |

See accompanying Notes to Financial Statements

PAGE 15 ◾ Dodge & Cox Stock Fund

Board Approval of Funds’ Investment Advisory Agreement and Investment Advisory Fees

(unaudited)

On June 1, 2023, the Board of Trustees (the “Board”) of the Dodge & Cox Funds (the “Trust”), including the members of the Board who are not “interested persons” of Dodge & Cox (as such term is defined in the Investment Company Act of 1940) (the “Independent Trustees”), voted to continue the Investment Advisory Agreement between Dodge & Cox and the Trust (the “Advisory Agreement”) in effect for an additional year beginning July 1, 2023 for each series of the Trust (each a “Fund”). Prior to the Board’s vote, the Trust’s Contract Review Committee, consisting solely of Independent Trustees, met with independent counsel to the Independent Trustees on May 8 and June 1, 2023, to discuss whether the Investment Advisory Agreement should be continued. At its June 1 meeting, the Board, including the Independent Trustees, concluded that the Investment Advisory Agreement is fair and reasonable. In considering the Investment Advisory Agreement, the Board, including the Independent Trustees, did not identify any single factor or particular information as all-important or controlling. In reaching the decision to continue the Investment Advisory Agreement in effect, the Board considered several factors, and reached the conclusions, described below:

Nature, Extent and Quality of Services Provided by Dodge & Cox

◾ The Board considered the nature, extent, and quality of the services provided by Dodge & Cox to each Fund under the Advisory Agreement. This consideration included, among other things, Dodge & Cox’s investment process and philosophy; the education and experience of the principal personnel of Dodge & Cox who provide such services; the other resources (including technology) that Dodge & Cox uses in managing the Funds’ portfolios; Dodge & Cox’s record of compliance with the Funds’ investment policies and restrictions and relevant regulatory and tax compliance requirements; and such matters as Dodge & Cox’s business continuity planning and insurance coverage.

◾ The Board concluded that the nature, extent, and quality of the services Dodge & Cox provides are consistent with the terms of the Advisory Agreement and support the recommendation to continue the Advisory Agreement in effect for the coming year.

◾ The Board also took note of the nature, extent, and quality of the broad range of services that Dodge & Cox provides to the Funds and their shareholders under a separate Administrative and Shareholder Services Agreement. Although that Agreement does not require Board approval on an annual basis, the services provided thereunder are an important part of the Funds’ overall relationship with Dodge & Cox, and the Board’s understanding and assessment of those services was a factor in its decision to recommend continuation of the Investment Advisory Agreement.

Investment Performance

◾ The Board reviewed information regarding the total return of each Fund over the most recent 1-, 3-, 5-, 10-, and 20-year periods (or since Fund inception, if shorter). The Board compared these returns to those of the Fund’s broad benchmark index and, for the Stock, International Stock, Global Stock, and Balanced Funds, to those of a relevant value-oriented index. The Board also considered the volatility of the Funds’ investment returns over various time horizons, including both volatility data provided by Broadridge Financial Solutions (“Broadridge”) and longer-term volatility measures presented by Dodge & Cox.

◾ In addition, the Board reviewed a report prepared by Broadridge comparing each Fund’s performance with the performance of other mutual funds in such Fund’s broad Morningstar category (as modified by Broadridge to include only those funds that have similar share class and expense characteristics to such Fund’s, the “Morningstar custom category”), as well as with the performance of a smaller peer group of comparable funds identified by Broadridge (such Fund’s “peer group”). The Board received information regarding the methodology and process underlying the construction of the Morningstar custom categories and peer groups, and any changes in the methodology from prior years. The Board also reviewed a report prepared by Dodge & Cox comparing each Fund’s performance to the composite performance of other accounts (if any) managed by Dodge & Cox using the same investment approach as the Fund. This information regarding the performance of other mutual funds and of other accounts managed by Dodge & Cox provided helpful context for the Board’s evaluation of the Funds’ performance.

◾ The Board concluded that the investment performance and volatility experienced by each Fund were consistent with Dodge & Cox’s long-term, research-driven, bottom-up, active investment style and support the recommendation to continue the Advisory Agreement in effect for an additional year.

Fees and Expense Ratios

◾ The Board reviewed a comparison prepared by Broadridge of the net expense ratio of each Fund (including the separate expense ratios of the two share classes of those Funds that have a dual class structure), and the various elements of those expense ratios, to those of mutual funds in (1) the Fund’s Morningstar custom category and (2) the Fund’s peer group.

◾ For each Fund for which such a comparison is relevant, the Board reviewed information regarding the fee rates Dodge & Cox charges for managing other accounts using the same investment approach as the Fund. The Board took note of the broader scope of services that Dodge & Cox provides to the Funds than to separate accounts and sub-advised funds, as well as differences in regulatory, litigation, and other risks associated with sponsoring a mutual fund as compared to managing separate accounts or sub-advising another

Dodge & Cox Stock Fund ◾ PAGE 16

sponsor’s mutual fund, and certain characteristics of the market for institutional separate account management services.

◾ The Board concluded, after discussion and based on all the relevant information it received, that the advisory fee rate that each Fund pays to Dodge & Cox under the Advisory Agreement is reasonable in relation to the scope and quality of the services that Dodge & Cox provides to such Fund thereunder.

◾ In assessing the Funds’ expense ratios and the fees the Funds pay to Dodge & Cox, the Board took note of and discussed with Dodge & Cox changes over the past several years in the competitive landscape for asset management services. The Board anticipates further changes in the competitive landscape and will continue to monitor and assess the Funds’ competitive position.

Costs of Services Provided and Profits Realized by Dodge & Cox from its Relationship to the Funds

◾ Dodge & Cox informed the Board that it operates as a unified business, with most employees providing services to support the firm and its clients across multiple strategies and/or products. Consequently the firm does not utilize cost accounting to allocate expenses across lines of business or across the Funds for management purposes. Also, the firm is owned exclusively by its senior managers and other active employees, and generally distributes substantially all of its net revenues each year to its employees, either as compensation or as distributions with respect to the shares they own in the firm. Accordingly, it is difficult, and in the Board’s view not especially meaningful, to attempt to calculate a specific profit margin associated with Dodge & Cox’s relationship to any particular Fund.

◾ The Board believes that Dodge & Cox’s commitment to employee ownership of the firm enhances its ability to attract and retain key investment and other management professionals and reinforces a long-term perspective on the management of the firm and the Funds, which the Board believe aligns well with the interests of the Funds and their shareholders.

◾ The Board noted that the employee-shareholders of Dodge & Cox give up a substantial stock value (which would be taxed at long-term capital gains rates) as a consequence of the firm’s independence from outside ownership; the estimated market value of the company is substantially in excess of its book value.

◾ The Board also considered that Dodge & Cox’s fee revenues from the Funds fluctuate from year to year based on changes in the aggregate net assets of the Funds, and that the firm has continued to invest in improved systems, additional compliance resources, and enhanced research capabilities despite these fluctuations.

◾ The Board concluded that Dodge & Cox’s profits are a keystone of its independence, stability, and long-term investment performance.

Economies and Benefits of Scale

◾ The Board considered whether there have been economies or benefits of scale as the Funds have grown over the longer term, and whether fee levels reflect economies of scale for the benefit of Fund investors. In the Board’s view any consideration of economies of scale must take account of the relatively low overall fee and expense structure of the Funds. The Funds generally rank favorably when compared to their Broadridge custom categories and peer groups, on a net expense ratio basis.

◾ Dodge & Cox has built economies of scale into its fee structure by charging relatively low fees at the beginning of operations. A comparison of the Funds’ advisory fee rates to those of many otherwise comparable funds that employ fee “breakpoints” shows that the Funds’ advisory fee rates are in general relatively lower from the first dollar. As a result of their straightforward share class and fee structure and relatively low total expenses, the Funds provide small investors with access to professional, active portfolio management and related services at a reasonable cost. In addition to building economies of scale into its fee rates from the first dollar of each Fund’s assets, Dodge & Cox has capped the expenses borne by certain Funds in their early years of operations when those Funds are not yet operating at scale. The Global Bond Fund has benefited from such an expense cap since its inception in 2014, as has the Emerging Markets Stock Fund since its inception in 2021. Dodge & Cox has agreed to continue expense caps for those Funds, and for the X share class of each of the other Funds, through April 30, 2026.

◾ Over the years, Dodge & Cox has voluntarily forgone opportunities for growth in its assets under management and revenues in order to protect the Funds’ ability to achieve investment returns for shareholders. Dodge & Cox closed the International Stock Fund for a number of years beginning in 2015 and previously closed other Funds and limited the growth of its separate account business during periods of high growth--to Dodge & Cox’s economic detriment--and continues to closely monitor the size of the Funds.

◾ The Board also noted that Dodge & Cox has continued to make additional expenditures on staff and information technology to enable it to enhance its investment processes and to implement effectively the Funds’ strategies. The Board also considered that there may be certain diseconomies of scale associated with managing very large asset pools such as several of the Funds, insofar as certain of the costs or risks associated with managing the Funds potentially increase at a rate that exceeds the rate of asset growth.

PAGE 17 ◾ Dodge & Cox Stock Fund

Fall-Out Benefits

◾ The Board concluded that “fall-out” benefits derived by Dodge & Cox from its relationship with the Funds are not a significant issue.

Fund Holdings

The Fund provides a complete list of its holdings on a quarterly basis by filing the lists with the SEC on Form N-CSR (as of the end of the second and fourth quarters) and on Part F of Form N-PORT (as of the end of the first and third quarters). Shareholders may view the Fund’s Forms N-CSR and Part F of N-PORT on the SEC’s website at sec.gov. A list of the Fund’s quarter-end holdings is also available at dodgeandcox.com on or about the 15th day following each quarter end and remains available on the website until the list is updated for the subsequent quarter.

Proxy Voting

For a free copy of the Fund’s proxy voting policies and procedures, please call 800-621-3979, visit the Fund’s website at dodgeandcox.com, or visit the SEC’s website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available at dodgeandcox.com or shareholders may view the Fund's Form N-PX at sec.gov.

Household Mailings

The Fund routinely mails shareholder reports and summary prospectuses to shareholders and, on occasion, proxy statements. In order to reduce the volume of mail, when possible, only one copy of these documents will be sent to shareholders who are part of the same family and share the same residential address.

If you have a direct account with the Funds and you do not want the mailing of shareholder reports and summary prospectuses combined with other members in your household, contact the Funds at 800-621-3979. Your request will be implemented within 30 days.

Dodge & Cox Stock Fund ◾ PAGE 18

dodgeandcox.com

For Fund literature, transactions, and account

information, please visit the Funds’ website.

or write or call:

Dodge & Cox Funds

P.O. Box 219502

Kansas City, Missouri 64121-9502

(800) 621-3979

Investment Manager

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

Principal Underwriter

Foreside Fund Services, LLC

3 Canal Plaza, Suite 100

Portland, Maine 04101

(866) 251-6920

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of June 30, 2023, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

Global Stock Fund | Class I (dodwx) | Class X (doxwx)

ESTABLISHED 2008

06/23 GSF SAR Printed on recycled paper

To Our Shareholders (unaudited)

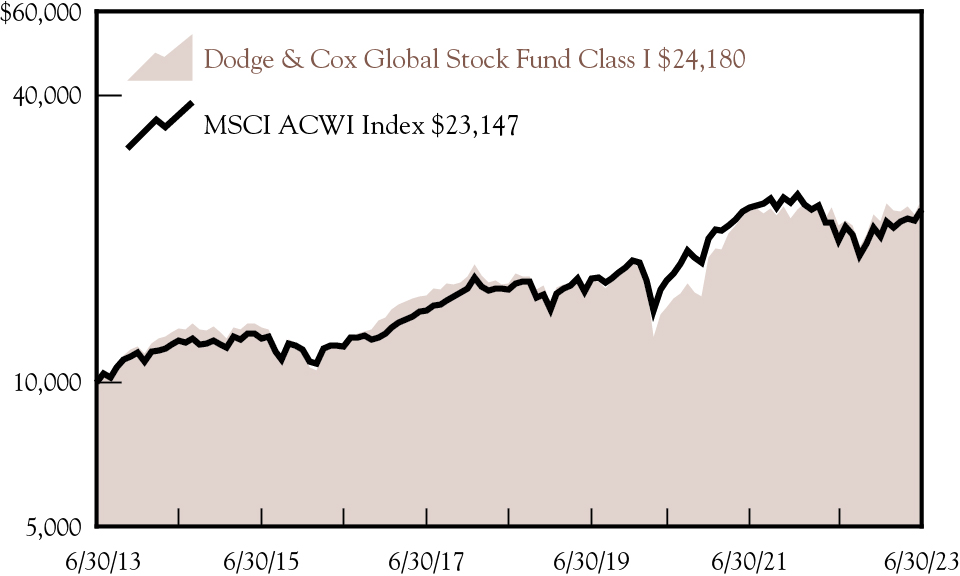

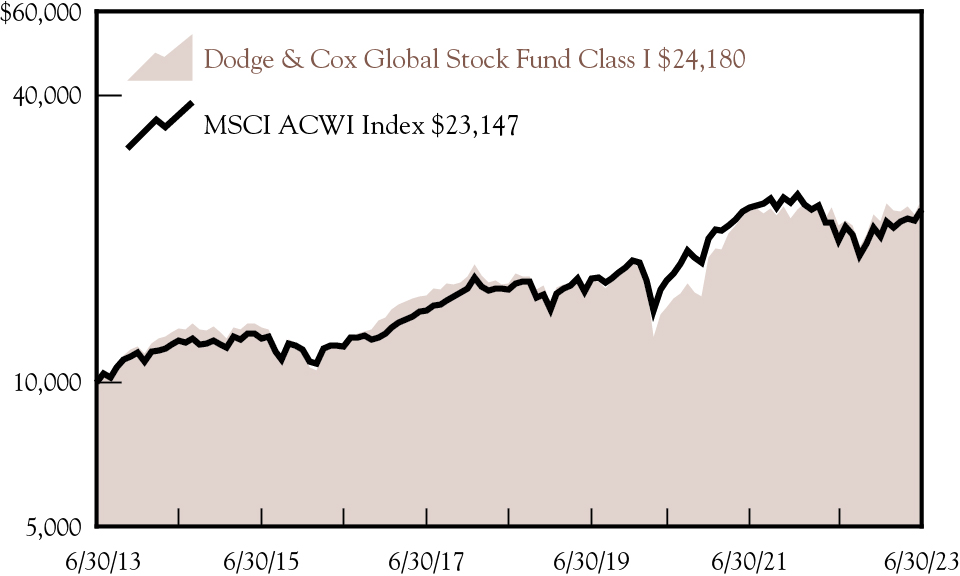

The Dodge & Cox Global Stock Fund—Class I had a total return of 10.94% for the six-month period ended June 30, 2023, compared to a return of 13.93% for the MSCI All Country World Index (ACWI).1

Market Commentary

Global equities continued to appreciate in the second quarter, after performing strongly in the first quarter of 2023. During the first half of 2023, the MSCI ACWI posted a total return of 13.9%, a resilient performance amid macroeconomic uncertainty, geopolitical concerns, and heightened volatility.

Global growth stocks2 outperformed value stocks by 20.0 percentage points during the first half of the year.3 The growth-oriented Information Technology and Communication Services sectors outperformed, while the value-oriented Energy, Real Estate, and Materials sectors underperformed. Notably, seven large technology-related companies (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla), which together represented only 13.9% of the MSCI ACWI, accounted for about half of the Index’s total return.4

With the recent rise in leading growth stocks, the valuation gap between value and growth stocks has widened: the MSCI ACWI Value Index5 now trades at 12.0 times forward earnings6 compared to 24.5 times for the MSCI ACWI Growth Index.7 In addition, international equities continue to trade at a substantial discount to U.S. equities: 13.0 times forward earnings for the MSCI EAFE Index, compared to 20.1 times for the S&P 500 Index.8

Investment Strategy

In the first half of 2023, the Fund had a positive absolute return. While it underperformed the MSCI ACWI by 3.0 percentage points, the Fund outperformed the MSCI ACWI Value by 6.7 percentage points.9 The Fund’s underweight position and the performance of holdings in the Information Technology sector were the biggest detractors versus the MSCI ACWI. The three largest Information Technology companies in the MSCI ACWI—Apple, Microsoft, and NVIDIA—comprised 10.3% of the Index on June 30 and accounted for almost a third of the Index’s return. Of these three companies, the Fund held only an underweight position in Microsoft10 (2.0% of the Fund’s net assets compared to 3.8% of the MSCI ACWI).

True to our value-oriented investment approach and focus on individual security selection, during the first six months of 2023, we trimmed areas of the Fund that saw their valuations increase, such as Information Technology and Communication Services (notable examples included Meta, Baidu, and NetEase). We also trimmed outperformers such as General Electric and FedEx. We leaned into areas of the market with more attractive valuations, including Financials (where we started a position in Truist Financial) and Transportation (where we initiated a position in Norfolk Southern).

Relative to the MSCI ACWI, the Fund continues to be overweight Financials (discussed below) and underweight Information Technology. By region, the Fund continues to be overweight international and underweight the United States. These relative weights are the culmination of our bottom-up research process, which focuses on individual security selection within the context of broader market conditions.

At Dodge & Cox, market volatility plays to our investment strengths. Our long-term investment horizon and valuation discipline help us take advantage of price dislocations in the market and, importantly, maintain conviction in the face of macroeconomic uncertainty. Our bottom-up approach enables us to capitalize on a variety of opportunities, ranging from deep value turnarounds to mispriced secular growth opportunities. The long tenure of our team of investment professionals helps us develop unique insights based on deep institutional knowledge of individual companies and industry dynamics.

The global economy currently faces challenges, including elevated inflation and rate hikes across major economies, as well as uncertainty around China’s economic recovery (discussed below). These challenges also present opportunities. The Fund’s diversified portfolio trades at only 10.5 times forward earnings, a significant discount to the MSCI ACWI at 16.3 times.

Our Perspectives on the Financials Sector

The Financials sector (28.9% of the Fund) has been a detractor from the Fund’s results relative to the MSCI ACWI this year, due to the Fund’s overweight position. In March, two U.S. regional banks not held in the Fund—Silicon Valley Bank and Signature Bank—collapsed, which was followed by share price weakness across Financials, and in particular banks with weaker funding, sizable unrealized securities losses, and a greater concentration of uninsured customer deposits. In May, regulators seized First Republic Bank (also not held in the Fund) and sold the majority of its assets to JPMorgan Chase.

We do not believe the weakness in U.S. Financials signals broader systemic risk for the sector. The Fund’s Financials exposure is broadly diversified across U.S., European, and emerging market banks, capital markets, and other financial services. The Fund’s U.S. Financials holdings represent only 10.6% of the Fund. The Fund’s largest U.S. Financials holdings include financial institutions focused on capital markets or financial services with relatively little credit risk exposure (e.g., Bank of New York Mellon, Charles Schwab, Fiserv) and Wells Fargo, a global, systemically important bank that already complies with tougher regulatory standards than regional banks and will likely gain deposit market share.

Following widespread bank share price declines, the Fund opportunistically started a position in Truist, a large U.S. regional bank. With Truist, we stress-tested earnings for possible adverse changes to deposits, credit quality, and regulations. We also explored how margins might evolve based on different scenarios for deposit flows and balance sheet composition. We analyzed Truist’s commercial real estate exposure and potential losses in stressed scenarios. We continue to monitor changes in bank funding dynamics by analyzing the Fed’s weekly aggregate data, industry data, and pricing information in the public domain. We believe the combination of Truist’s low valuation (7.3 times forward earnings, which is 40% below its long-term average), high starting dividend yield, and integration of BB&T and SunTrust offered us an opportunity to start a new position in an out-of-favor sector.

PAGE 1 ◾ Dodge & Cox Global Stock Fund

Finding Value in China Internet

After a strong finish to 2022, the MSCI China Index11 declined 5.5%, and the CSI Overseas China Internet Index12 was down 11.9% in the first half of 2023, as China’s post-COVID economic recovery was slower than expected and geopolitical tensions heightened. We continued to closely monitor holdings with exposure to this region. While we initially trimmed a number of China-related holdings—such as Prosus and Baidu—in the first quarter, we added to Alibaba and JD.com as valuations declined in the second quarter.

Alibaba, one of the largest China Internet13 holdings in the Fund, is a multinational technology company that started in e-commerce retailing. In late March, the company announced plans for a reorganization, which would separate its six business segments into independently run companies. Each of these business units would have a standalone board, its own incentive programs, and self-financing opportunities. We were encouraged by this announcement and anticipate increased productivity, enhanced operational agility, faster decision making, and an acceleration of growth. Alibaba has proven it can adapt in a very competitive environment. We will continue to monitor the reorganization. Trading at 9.9 times forward earnings, Alibaba comprises a 1.5% position in the Fund.

New Holding in Norfolk Southern

During the second quarter, we also initiated a position in Norfolk Southern, a railroad company with operations in the Eastern portion of the United States. The company competes in a stable duopoly (with CSX) whose participants prioritize return on invested capital (ROIC)14 and shareholder returns. Due to the highly publicized derailment of one of its trains in Ohio, Norfolk Southern’s shares underperformed significantly. Unfortunately, there are hundreds of train derailments in the United States each year; however, Norfolk Southern has dramatically improved its own safety record over the past two decades. The company is highly focused on operating a safer railroad and has committed to being the gold standard of safety in the railroad industry.

Norfolk Southern’s operating margins today materially lag its competition. The company can consistently pass along cost increases and has opportunities to improve margins, free cash flow15, and ROIC over time. We believe Norfolk Southern will see an improvement in its long-term volume growth as railroads take market share from trucks and the impact of declining revenues from the shrinking coal business diminishes. The company should also benefit as concerns about the financial impact of the derailment recede. We believe recent developments provided us an opportunity to buy an excellent franchise at a discounted valuation.

In Closing

Since 1930, Dodge & Cox has navigated many challenging periods. In our experience, patience and persistence in turbulent markets have often been rewarded in the long run. We remain optimistic about the long-term outlook for the Fund. Valuation changes can occur swiftly and without warning, so we encourage our shareholders to maintain a long-term perspective.

Thank you for your continued confidence in Dodge & Cox. As always, we welcome your comments and questions.

For the Board of Trustees, | |

| |

Dana M. Emery,

Chair and President | |

July 31, 2023

| All returns are stated in U.S. dollars, unless otherwise noted. The Funds’ total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividend and/or interest income but, unlike Fund returns, do not reflect fees or expenses. The MSCI ACWI (All Country World Index) is a broad-based, unmanaged equity market index aggregated from developed market and emerging market country indicies. |

| Generally, stocks that have lower valuations are considered “value” stocks, while those with higher valuations are considered “growth” stocks. |

| For the six months ended June 30, 2023, the MSCI ACWI Value Index had a total return of 4.25% and the MSCI ACWI Growth Index had a total return of 24.25%. |

| Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla had a combined average weight of 13.9% in the MSCI ACWI Index during the first half of 2023. |