QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(2)

Registration No. 333-86720

PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED APRIL 29, 2002

$30,000,000

Credit Suisse First Boston (USA), Inc.

Accelerated Return Equity Securities (ARES)SM

due November 30, 2004

Linked to the S&P 500® Index

| Issuer: | | Credit Suisse First Boston (USA), Inc. |

| Maturity Date: | | November 30, 2004 |

| Coupon: | | We will not pay interest on the notes being offered by this prospectus supplement. |

| Underlying Index: | | The index return will be based on the performance of the S&P 500® Index during the term of the notes. |

| Redemption Amount: | | You will receive a redemption amount in cash at maturity that will equal the principal amount of the notes multiplied by the sum of 1 plus the index return. If the S&P 500® Index increases, the index return will equal three times the percentage increase in the S&P 500® Index, subject to a cap of 18.5%. Therefore, the maximum redemption amount at maturity for each $1,000 principal amount of notes will be $1,185. |

| | | If the S&P 500® Index decreases, the index return will equal the percentage decrease in the S&P 500® Index. Therefore, the notes will be fully exposed to any decline in the S&P 500® Index.If the S&P 500® Index decreases, the index return will be a negative number, and the redemption amount will be less than the principal amount of the notes and could be zero. |

| | | If there is no change in the S&P 500® Index, the index return will equal zero, and the redemption amount will equal the principal amount of the notes. |

| Listing: | | The notes have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "ARY.A". |

Investing in the notes involves risks. See "Risk Factors" beginning on page S-7.

| | Price to the Public

| | Underwriting

Discounts and

Commissions(1)

| | Proceeds to the Company(1)

|

|---|

| Per note | | 100% | | 1.17025 | % | 100% |

| Total | | $30,000,000 | | $351,075 | | $30,000,000 |

- (1)

- The underwriting discounts and commissions are being paid on our behalf by Credit Suisse First Boston International, an affiliate of ours. See "Underwriting" on page S-31.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the notes in book-entry form only will be made through The Depository Trust Company on or about June 18, 2003. You may elect to hold interests in the notes through Clearstream, Luxembourg and Euroclear.

"Accelerated Return Equity Securities (ARES)SM" is a registered service mark of Credit Suisse First Boston.

Credit Suisse First Boston

The date of this prospectus supplement is June 13, 2003.

TABLE OF CONTENTS

| Prospectus Supplement | | |

| | Page

|

|---|

SUMMARY |

|

S-3 |

| RISK FACTORS | | S-7 |

CREDIT SUISSE FIRST

BOSTON (USA), INC. | | S-11 |

RATIO OF EARNINGS TO FIXED

CHARGES | | S-13 |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION | | S-14 |

| USE OF PROCEEDS | | S-16 |

| CAPITALIZATION | | S-16 |

| DESCRIPTION OF THE NOTES | | S-17 |

| THE S&P 500® INDEX | | S-25 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | S-29 |

| UNDERWRITING | | S-31 |

| NOTICE TO CANADIAN RESIDENTS | | S-32 |

| CERTAIN ERISA CONSIDERATIONS | | S-33 |

| INCORPORATION BY REFERENCE | | S-34 |

|

|

|

| Prospectus | | |

| | Page

|

|---|

ABOUT THIS PROSPECTUS |

|

2 |

| WHERE YOU CAN FIND MORE INFORMATION | | 2 |

| FORWARD-LOOKING STATEMENTS | | 3 |

| USE OF PROCEEDS | | 3 |

RATIOS OF EARNINGS TO FIXED

CHARGES | | 3 |

CREDIT SUISSE FIRST

BOSTON (USA), INC. | | 4 |

| DESCRIPTION OF DEBT SECURITIES | | 5 |

| DESCRIPTION OF WARRANTS | | 12 |

| ERISA | | 14 |

| PLAN OF DISTRIBUTION | | 15 |

| LEGAL MATTERS | | 16 |

| EXPERTS | | 16 |

You should rely only on the information contained in this document or to which we referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

We are offering the notes globally for sale in those jurisdictions in the United States, Europe, Asia and elsewhere where it is lawful to make such offers. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the notes in some jurisdictions may be restricted by law. If you possess this prospectus supplement and the accompanying prospectus, you should find out about and observe these restrictions. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom such offer or sale is not permitted. We refer you to "Underwriting" on page S-31 of this prospectus supplement.

In this prospectus supplement and accompanying prospectus, unless otherwise specified or the context otherwise requires, references to "we", "us" and "our" are to Credit Suisse First Boston (USA), Inc. and its consolidated subsidiaries, and references to "dollars" and "$" are to United States dollars.

"Standard & Poor's®", "S&P®", "S&P 500®", "Standard & Poor's 500" and "500" are trademarks of Standard & Poor's Corporation, or S&P, and have been licensed for use by Credit Suisse First Boston (USA), Inc. and its affiliates, as Licensee.

S-2

SUMMARY

The following is a summary of the terms of the notes and factors that you should consider before deciding to invest in the notes. You should read this prospectus supplement and the accompanying prospectus carefully to understand fully the terms of the notes and other considerations that are important in making a decision about investing in the notes. You should, in particular, review the "Risk Factors" section, which sets forth a number of risks related to the notes. All of the information set forth below is qualified in its entirety by the detailed explanations set forth elsewhere in this prospectus supplement and the accompanying prospectus.

What are the Accelerated Return Equity Securities?

The Accelerated Return Equity Securities (ARES)SM, or the notes, are medium-term securities issued by us, the return on which is linked to the performance of the S&P 500® Index. You will receive a redemption amount in cash at maturity that will equal the principal amount of the notes multiplied by the sum of 1 plus the index return. If the S&P 500® Index increases, the index return will equal three times the percentage increase in the S&P 500® Index, subject to a cap of 18.5%. Therefore, the maximum redemption amount at maturity for each $1,000 principal amount of notes will be $1,185. We will not pay you interest during the term of the notes. The notes are not principal-protected and are fully exposed to any decline in the level of the S&P 500® Index; a negative index return will reduce your redemption amount at maturity and you could lose your entire investment. For a description of how the redemption amount at maturity will be calculated, please refer to "How is the Redemption Amount Calculated?" on page S-4 and "Description of the Notes—Redemption Amount" on page S-17.

The notes provide the potential to enhance equity returns by tripling a positive return on the S&P 500® Index, up to a cap of 18.5%.

The notes are linked to the S&P 500® Index, which is designed to measure the performance of the broad U.S. domestic economy through the changes in aggregate market value of 500 stocks representing all major U.S. industries.

Are there risks involved in investing in the notes?

An investment in the notes involves risks. The significant risks are described in more detail in "Risk Factors" on page S-7. Some of these risks are summarized below.

Not principal-protected. An investment in the notes is not principal-protected and you may receive less at maturity than you originally invested. You may lose some or all of your investment if the S&P 500® Index level declines. If the final level of the S&P 500® Index is less than the initial level of the S&P 500® Index (each as calculated in accordance with the terms of the notes), you will bear the full effect of the depreciation in the S&P 500® Index and you could lose your entire investment.

The notes may pay less than the full S&P 500® Index appreciation. If the S&P 500® Index increases, your return will be based on three times the percentage increase in the S&P 500® Index, subject to a cap of 18.5%. Thus, while you will benefit from enhanced appreciation if the S&P 500® Index increases, the return on your investment in the notes will not perform as well as a direct investment in the S&P 500® Index if the S&P 500® Index appreciates above the cap.

Will I receive interest on the notes?

You will not receive any interest payments on the notes for the entire term of the notes.

S-3

Will I receive any dividend payments on, or have shareholder rights in, the stocks comprising the S&P 500® Index?

As a holder of the notes, you will not receive any dividend payments or other distributions on the stocks comprising the S&P 500® Index or have voting or any other rights that holders of the stocks comprising the S&P 500® Index may have.

Will there be an active trading market in the notes?

The notes have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "ARY.A". You should recognize that this listing may not ensure that a liquid trading market is available for the notes. Credit Suisse First Boston LLC, or CSFB LLC, currently intends to make a market in the notes, although it is not required to do so and may stop making a market at any time.

If you have to sell your notes prior to maturity, you may have to sell them at a substantial loss.

What are the U.S. federal income tax consequences of investing in the notes?

We and, by your acceptance of a note, you agree to treat your notes for U.S. federal income tax purposes as a cash-settled capped, variable prepaid forward contract on the value of the S&P 500® Index. Please refer to the discussion under "Certain United States Federal Income Tax Considerations" on page S-29.

How is the redemption amount calculated?

The redemption amount at maturity will equal an amount in dollars per note determined in accordance with the following formula:

Redemption Amount = Principal Amount × (1 + Index Return)

The index return is expressed as a percentage and is calculated as follows:

- •

- If the final level is greater than the initial level:

| 3 | | × | | [ | | Final Level—Initial Level

Initial Level | | ] |

subject to a cap of 18.5%. The maximum redemption amount, therefore, for each $1,000 principal amount of notes will be $1,185.

- •

- If the final level is less than the initial level:

| | | | | [ | | Final Level—Initial Level

Initial Level | | ] |

Therefore, if the S&P 500® Index decreases, the index return will be a negative number, and the redemption amount will be less than the principal amount of the notes and may be zero.

- •

- If the final level is equal to the initial level, then the index return will equal zero and the redemption amount will equal the principal amount of the notes.

For purposes of calculating the index return, the initial level will equal the closing level of the S&P 500® Index on the date the notes are priced for initial sale to the public. The final level will equal the arithmetic average of the closing levels of the S&P 500® Index on each of the five index business days from and including November 18, 2004 to and including November 24, 2004, or, if any of those particular days is not an index business day, the first following day that is an index business day. Please

S-4

refer to "Description of the Notes—Redemption Amount" on page S-17 and "—Market Disruption Events" on page S-19.

What are some hypothetical redemption amounts at maturity of the notes?

Because the return on the notes is based on the increase or decrease in the S&P 500® Index from the initial level to the final level, it is not possible to present a complete range of possible redemption amounts at maturity for the notes. The table below sets forth a sampling of hypothetical redemption amounts at maturity.

Principal Amount of Notes

| | Percentage Difference Between

Initial Level and Final Level of the

S&P 500® Index

| | Redemption Amount

at Maturity

|

|---|

| $ | 1,000 | | -100 | % | $ | 0 |

| $ | 1,000 | | -90 | % | $ | 100 |

| $ | 1,000 | | -80 | % | $ | 200 |

| $ | 1,000 | | -70 | % | $ | 300 |

| $ | 1,000 | | -60 | % | $ | 400 |

| $ | 1,000 | | -50 | % | $ | 500 |

| $ | 1,000 | | -40 | % | $ | 600 |

| $ | 1,000 | | -30 | % | $ | 700 |

| $ | 1,000 | | -20 | % | $ | 800 |

| $ | 1,000 | | -10 | % | $ | 900 |

| $ | 1,000 | | 0 | | $ | 1,000 |

| $ | 1,000 | | +3 | % | $ | 1,090 |

| $ | 1,000 | | +5 | % | $ | 1,150 |

| $ | 1,000 | | >+6.167 | % | $ | 1,185 |

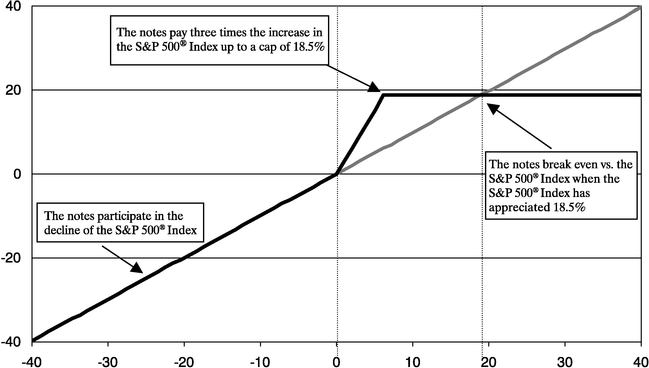

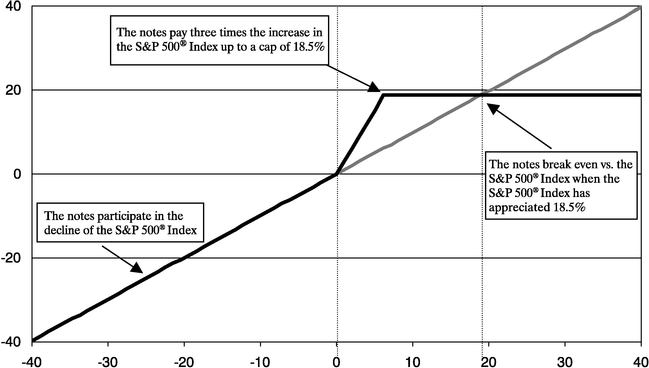

The graph of hypothetical redemption amounts at maturity set forth below is intended to demonstrate the effect of the appreciation cap and the enhanced appreciation on the redemption amount at maturity. The thin black line shows hypothetical payments at maturity for an investment of $1,000 in an instrument directly linked to the S&P 500® Index. The thick black line shows hypothetical redemption amounts at maturity for a similar investment in the notes.

S-5

These examples are for illustration purposes only. The actual index return will depend on the initial level and the final level of the S&P 500® Index determined by the calculation agent as provided in this prospectus supplement.

Who publishes the S&P 500® Index and what does it measure?

The S&P 500® Index is published by S&P. The S&P 500® Index is a capitalization-weighted index, meaning that each underlying stock's weight in the index is based on its total market capitalization. The level of the S&P 500® Index does not reflect the value of dividend payments or other distributions on the stocks comprising the S&P 500® Index. The S&P 500® Index is designed to measure performance of the broad U.S. domestic economy through changes in the aggregate market value of 500 stocks representing all major U.S. industries.

As of June 11, 2003, the major industry groups covered in the S&P 500® Index (listed according to their respective capitalization in the S&P 500® Index) were as follows: Financials (20.7%), Information Technology (16.1%), Health Care (14.6%), Consumer Staples (11.6%) and Consumer Discretionary (11.0%). A list of the companies comprising the S&P 500 Index can be found on the internet at http://www2.standardandpoors.com/spf/xls/index/500_20030506_C.xls.

The securities included in the S&P 500® Index are evaluated on an annual basis. However, the composition of the S&P 500® Index is examined quarterly and such examination may result in changes in the stocks comprising the S&P 500® Index. Changes in the stocks comprising the S&P 500® Index may also occur from time to time when, for example, S&P determines that a company or companies included in the S&P 500® Index are involved in mergers, acquisitions or restructurings such that they no longer meet the criteria for inclusion.

The level of the S&P 500® Index can be found in a variety of publicly available sources.

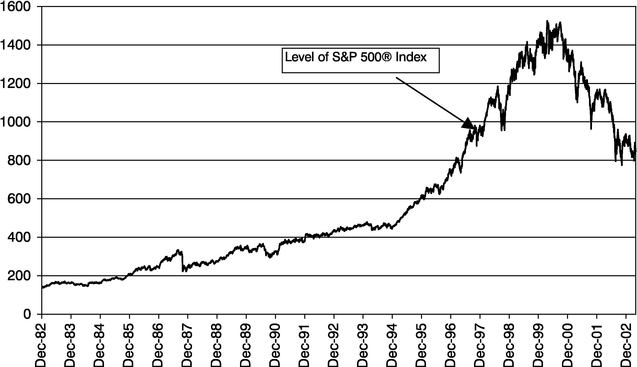

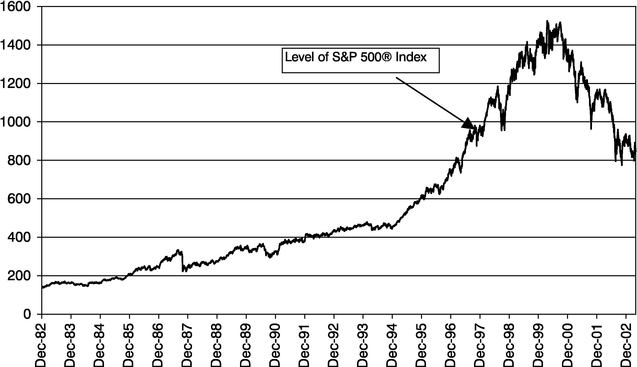

How has the S&P 500® Index performed historically?

A table and graph containing the annual appreciation or depreciation of the S&P 500® Index for each year from the year ending December 31, 1982 have been provided in the section "The S&P 500® Index—Performance of the S&P 500® Index" in this prospectus supplement. Past performance is not necessarily indicative of how the S&P 500® Index will perform in the future.

S-6

RISK FACTORS

A purchase of the notes involves risks. This section describes significant risks relating to the notes. We urge you to read the following information about these risks, together with the other information in this prospectus supplement and the accompanying prospectus, before investing in the notes.

The notes are not principal-protected

An investment in the notes is not principal-protected and you may receive less at maturity than you originally invested in the notes, or you may receive nothing. If the index return is negative, you will bear the full effect of the depreciation in the S&P 500® Index. This will be the case even if the index level is greater than the initial level at any time during the term of the notes but the final level at maturity is less than the initial level.

The notes may pay less than the full S&P 500® Index appreciation at maturity

If the S&P 500® Index increases, your return will be based on three times the percentage increase in the S&P 500® Index, subject to a cap of 18.5%. Thus, while you will benefit from enhanced appreciation if the S&P 500® Index increases, you will not benefit from any appreciation in the S&P 500® Index above that cap.

The yield on the notes may be lower than the return on an ordinary debt security with similar maturity

We will not pay interest on the notes. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including other of our debt securities, since the redemption amount at maturity is based on the appreciation or depreciation of the S&P 500® Index. Because the redemption amount due at maturity may be less than the amount originally invested in the notes, the return on the notes (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each note may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

An investment in the notes is not the same as an investment in the stocks underlying the S&P 500® Index or a security directly linked to the S&P 500® Index

The payment of dividends on the stocks which comprise, or underlie, the S&P 500® Index has no effect on the calculation of the index level for the S&P 500® Index. Therefore, the return on your investment based on the percentage change in the S&P 500® Index is not the same as the total return based on the purchase of those underlying stocks held for a similar period.

In addition, because of the cap on appreciation, the amount you receive at maturity on the notes could be less than if you owned for a similar period a security directly linked to the performance of the S&P 500® Index without such a cap.

There may be little or no secondary market for the notes

There is currently no secondary market for the notes. Although the notes have been approved for listing on the American Stock Exchange, subject to official notice of issuance, we cannot assure you that a secondary market for the notes will develop. CSFB LLC currently intends to make a market in the notes, although it is not required to do so and may stop making a market at any time. If you have to sell your notes prior to maturity, you may have to sell them at a substantial loss.

S-7

You have no recourse to S&P or to the issuers of the stocks comprising the S&P 500® Index

You will have no rights against S&P as the sponsor of the S&P 500® Index or against any issuer of a stock comprising the S&P 500® Index. The notes are not sponsored, endorsed, sold or promoted by S&P or by any such issuer. Neither S&P nor any such issuer has passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the notes. Neither S&P nor any such issuer makes any representation or warranty, express or implied, to you or any member of the public regarding the advisability of investing in securities generally or the notes particularly, or the ability of the S&P 500® Index to track general stock performance. S&P's only relationship to us is in the licensing of the S&P 500®, S&P 500® Index and S&P trademarks or service marks, and certain trade names of S&P and the use of the S&P 500® Index, which is determined, composed and calculated by S&P without regard to us or the notes. S&P has no obligation to take our needs or your needs into consideration in determining, composing or calculating the S&P 500® Index. Neither S&P nor any issuer of a stock comprising the S&P 500® Index is responsible for, and none of them has participated in the determination of, the timing, prices or quantities of the notes to be issued or in the determination or calculation of the equation by which the notes are to be converted into cash. Neither S&P nor any such issuer has any liability in connection with the administration, marketing or trading of the notes.

The United States federal income tax consequences of the notes are uncertain

No ruling is being requested from the Internal Revenue Service, or the IRS, with respect to the notes and we cannot assure you that the IRS or any court will agree with the conclusions expressed under "Certain United States Federal Income Tax Considerations" in this prospectus supplement.

The market price of the notes may be influenced by many unpredictable factors

Many factors, most of which are beyond our control, will influence the value of the notes, including:

The level of the S&P 500® Index. We expect that the market value of the notes will likely depend substantially on the relationship between the level of the S&P 500® Index on the date the notes are priced for initial sale to the public and the future level of the S&P 500® Index. If you choose to sell your notes when the level of the S&P 500® Index exceeds its initial level, you may receive substantially less than the amount that would be payable at maturity based on that level of the S&P 500® Index because of expectations that the S&P 500® Index will continue to fluctuate between that time and the time when the final level of the S&P 500® Index is determined. If you choose to sell your notes when the level of the S&P 500® Index is below the level of the index on the date the notes are priced for initial sale to the public, you may receive less than your original investment;

Interest and yield rates in the market. We expect that the market value of the notes will be affected by changes in U.S. interest rates. In general, if U.S. interest rates increase, the value of the notes may decrease, and if U.S. interest rates decrease, the value of the notes may increase. Interest rates may also affect the economy and, in turn, the level of the S&P 500® Index, which would affect the value of the notes;

The volatility of the S&P 500® Index. Volatility is the term used to describe the frequency and magnitude of changes, and if the level of the S&P 500® Index is volatile, the trading value of the notes may be reduced;

Economic, financial, political and regulatory or judicial events that affect the securities underlying the S&P 500® Index or stock markets generally and which may affect the appreciation of the S&P 500® Index. General economic conditions and earnings results of the companies whose common stocks comprise the S&P 500® Index and real or anticipated changes in those conditions or results, as well as legislative,

S-8

regulatory and other changes affecting those companies, may affect the value of the S&P 500® Index and the market value of the notes;

The time remaining to the maturity of the notes. The less time there is remaining until maturity, the greater the effect the then-current level of the S&P 500® Index will have on the value of the notes;

The dividend rate on the stocks underlying the S&P 500® Index. If the dividend yields on the stocks underlying the S&P 500® Index increase, the value of the notes may be adversely affected because the S&P 500® Index does not incorporate the value of dividend payments. Conversely, if dividend yields on the stocks decrease, the value of the notes may be favorably affected; and

Credit Suisse First Boston (USA), Inc.'s creditworthiness. Actual or anticipated changes in our credit ratings, financial condition or results may affect the value of the notes.

Some or all of these factors may influence the price that noteholders will receive if they sell their notes prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

Historical performance of the S&P 500® Index is not indicative of future performance

The future performance of the S&P 500® Index cannot be predicted based on its historical performance. We cannot guarantee that the level of the S&P 500® Index will increase or that you will not receive at maturity an amount substantially less than the principal amount of the notes.

Adjustments to the S&P 500® Index could adversely affect the notes

S&P is responsible for calculating and maintaining the S&P 500® Index. S&P can add, delete or substitute the stocks underlying the S&P 500® Index or make other methodological changes that could change the value of the S&P 500® Index at any time. S&P may discontinue or suspend calculation or dissemination of the S&P 500® Index. If one or more of these events occurs, the calculation of the redemption amount at maturity will be adjusted to reflect such event or events. Please refer to "Description of the Notes—Adjustments to the Calculation of the S&P 500® Index". Consequently, any of these actions could adversely affect the redemption amount at maturity and/or the market value of the notes.

There may be potential conflicts of interest

We, CSFB LLC and/or any other affiliate may from time to time buy or sell stocks underlying the S&P 500® Index or derivative instruments related to the S&P 500® Index for our or their own accounts in connection with our or their normal business practices. Although we do not expect them to, these transactions could affect the price of such stocks or the value of the S&P 500® Index, and thus affect the market price of the notes.

In addition, because Credit Suisse First Boston International, which is initially acting as the calculation agent for the notes, is an affiliate of ours, potential conflicts of interest may exist between the calculation agent and you, including with respect to certain determinations and judgments that the calculation agent must make in determining amounts due to you.

S-9

Finally, we and our affiliates may, now or in the future, engage in business with the issuers of the stocks underlying the S&P 500® Index, including providing advisory services. These services could include investment banking and mergers and acquisitions advisory services. These activities could present a conflict of interest between us or our affiliates and you. We or our affiliates have also published and expect to continue to publish research reports regarding some or all of the issuers of the stocks comprising the S&P 500® Index. This research is modified periodically without notice and may express opinions or provide recommendations that may affect the market price of the stocks comprising the S&P 500® Index and/or the level of the S&P 500® Index and, consequently, the market price of the notes.

A market disruption event may postpone the calculation of the final level of the S&P 500® Index or the maturity date

If the calculation agent determines that on any particular valuation date a market disruption event exists, then such valuation date will be postponed to the first succeeding index business day on which the calculation agent determines that no market disruption event exists, unless the calculation agent determines that a market disruption event exists on each of the five index business days immediately following the particular valuation date. In that case, the fifth index business day after the original valuation date will be deemed to be the valuation date for that day, notwithstanding the existence of a market disruption event, and the calculation agent will determine the index level for such valuation date on that fifth succeeding index business day. The final level will be calculated as the arithmetic average of the index level on each of the five valuation dates (whether or not postponed).

In the event that a market disruption event exists on any valuation date, the maturity date of the notes will be the later of November 30, 2004 and the third index business day following the day on which the index level for the fifth and final valuation date is calculated. Consequently, the existence of a market disruption event could result in a postponement of the maturity date, but no interest or other payment will be payable because of such postponement.

Please refer to "Description of the Notes—Maturity Date" on page S-17 and "—Market Disruption Events" on page S-19.

S-10

CREDIT SUISSE FIRST BOSTON (USA), INC.

We are a leading integrated investment bank serving institutional, corporate, government and high-net-worth individual clients. We are the product of a business combination. On November 3, 2000, Credit Suisse Group, or CSG, acquired Donaldson, Lufkin & Jenrette, Inc., or DLJ. CSG is a global financial services company providing a broad range of products and services that include securities underwriting, sales and trading, investment banking, financial advisory services, private equity investments, full service brokerage services, derivatives and risk management products and research. Credit Suisse First Boston Corporation (now called Credit Suisse First Boston LLC, which we refer to as CSFB LLC), Credit Suisse Group's principal U.S. registered broker-dealer subsidiary, became a subsidiary of DLJ, and DLJ changed its name to Credit Suisse First Boston (USA), Inc. We are now part of the Credit Suisse First Boston business unit, or CSFB, of CSG.

For further information about our company, we refer you to the accompanying prospectus and the documents referred to under "Incorporation by Reference" on page S-34 of this prospectus supplement and "Where You Can Find More Information" on page 2 of the accompanying prospectus.

Recent Developments

On January 17, 2003, our principal U.S. broker-dealer, Credit Suisse First Boston Corporation, was converted to the Delaware limited liability company CSFB LLC.

On March 20, 2003, our immediate parent company, Credit Suisse First Boston, Inc., or CSFBI, transferred Credit Suisse First Boston Management Corporation to us as a capital contribution, and on March 21, 2003, the company was converted to the Delaware limited liability company Credit Suisse First Boston Management LLC, or Management LLC. Management LLC engages in derivatives transactions and holds a portfolio of private equity, distressed assets and real estate investments. The derivatives transactions entered into by Management LLC have historically been designed to hedge certain trading and other positions held by CSFB LLC. Prior to the transfer of Management LLC to us, our results of operations reflected only these trading and other positions held by CSFB LLC without the offsetting effect of the related hedges maintained by Management LLC. We believe the transfer of Management LLC to us should reduce our earnings volatility because our ongoing results of operations will reflect both the gains and losses from trading and the offsetting effect of the related hedges. The transfer also represents a further integration of CSFB's U.S. operations into our consolidated group.

Commencing in the first quarter of 2003, the transfer of Management LLC is accounted for at historical cost in a manner similar to pooling-of-interest accounting because Management LLC and we were under the common control of CSFBI at the time of the transfer. Beginning with the financial statements for the first quarter of 2003, we will restate our financial information to reflect the results of operations and financial position of Management LLC as if we had acquired it on November 3, 2000, the date that we were acquired by CSFBI.

On April 28, 2003, we and other Wall Street firms finalized a global settlement with a coalition of state and federal regulators and self-regulatory organizations to settle the pending investigations into research analyst independence and certain initial public offering, or IPO, allocation practices. Consistent with the agreement in principle announced in December 2002, we agreed, without admitting or denying the allegations, findings or conclusions, to pay a total of $200 million, consisting of (a) $150 million to settle the enforcement actions and (b) $50 million to fund third-party research to clients over five years. We have also agreed to implement significant, industry-wide procedural and structural reforms to our business practices relating to both research analyst independence and the allocation of shares in IPOs.

S-11

On May 1, 2003, we completed the sale of our Pershing unit, which was part of our Financial Services segment, to The Bank of New York Company, Inc., or BONY, for $2 billion in cash, the repayment of a $480 million subordinated loan and an additional contingent payment of up to $50 million based on future performance. In connection with the closing, we entered into an amendment to the sale agreement that required us to deliver to BONY the Pershing unit with a total equity value of $645 million, an increase of $45 million. We expect to report in the second quarter of 2003 a gain from the completion of the sale of the Pershing unit of approximately $1.3 billion pre-tax and approximately $850 million after-tax. The sale of Pershing was structured as a sale of our U.S. broker-dealer, Donaldson, Lufkin, & Jenrette Securities Corporation (which was converted to the Delaware limited liability company Pershing LLC on January 17, 2003) and certain other subsidiaries through which the Pershing business had been conducted. In anticipation of the sale, the businesses of Pershing LLC that were not part of the Pershing business, principally the Private Client Services business, were transferred to CSFB LLC or other subsidiaries in the first quarter of 2003.

S-12

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratios of earnings to fixed charges for the periods indicated.

| |

| | Year Ended December 31,

|

|---|

| | Three Months

Ended

March 31, 2003

|

|---|

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| Ratio of earnings to fixed charges(1)(2)(3) | | 1.08 | | 0.91 | | 0.96 | | 0.73 | | 1.18 | | 1.13 |

- (1)

- For the purpose of calculating the ratio of earnings to fixed charges, (a) earnings consist of income before the provision for income taxes and fixed charges and (b) fixed charges consist of interest expenses and one-third of rental expense which is deemed representative of an interest factor.

- (2)

- Commencing in the first quarter of 2003, the transfer of Management LLC is accounted for at historical cost in a manner similar to pooling-of-interest accounting because Management LLC and we were under the common control of CSFBI at the time of the transfer. The financial statements for the first quarter of 2003 include the results of operations and financial position of Management LLC. The ratio of earnings to fixed charges for the three months ended March 31, 2003 and for the years ended December 31, 2002, 2001 and 2000 reflect the results of operations and financial position of Management LLC as if we had acquired it on November 3, 2000.

- (3)

- For the years ended December 31, 2002, 2001 and 2000, the dollar deficiency of the ratio of earnings to fixed charges was $471 million, $360 million and $1.8 billion, respectively.

S-13

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

We are providing or incorporating by reference in this prospectus supplement selected historical financial information of Credit Suisse First Boston (USA), Inc. We derived this information from the consolidated financial statements of Credit Suisse First Boston (USA), Inc. for each of the periods presented. The information is only a summary and should be read together with the detailed information and financial statements included in the documents referred to under "Incorporation by Reference" on page S-34 of this prospectus supplement and "Where You Can Find More Information" on page 2 of the accompanying prospectus.

Our interim consolidated statement of operations data and statement of financial condition data as of and for the three months ended March 31, 2003 and 2002 are unaudited and include, in our opinion, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results for the unaudited periods. You should not rely on interim results as being indicative of results we may expect for the full year.

| | As of and for the

three months ended

March 31,

| | As of and for the year ended December 31,

|

|---|

| | 2003

| | 2002

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| | (unaudited)

| | (in millions)

|

|---|

| Selected Consolidated Statement of Operations Data(1)(2)(3): | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | |

| Total net revenues | | $ | 1,189 | | $ | 1,979 | | $ | 5,739 | | $ | 6,531 | | $ | 4,768 | | $ | 4,561 | | $ | 3,273 |

| Total expenses | | | 1,099 | | | 1,454 | | | 5,430 | | | 6,886 | | | 6,636 | | | 3,821 | | | 2,794 |

| Income (loss) from continuing operations before provision (benefit) for income taxes, discontinued operations, extraordinary items and cumulative effect of a change in accounting principle(2) | | | 90 | | | 525 | | | 309 | | | (355 | ) | | (1,868 | ) | | 740 | | | 479 |

| Net income (loss) | | | 83 | | | 366 | | | 261 | | | (144 | ) | | (1,076 | ) | | 601 | | | 371 |

| | |

| |

| |

| |

| |

| |

| |

|

| Selected Consolidated Statement of Financial Condition Data(1)(2)(3): | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 248,911 | | | 232,686 | | $ | 236,868 | | $ | 217,386 | | $ | 212,219 | | $ | 109,012 | | $ | 72,226 |

| Long-term borrowings | | | 24,458 | | | 19,557 | | | 23,094 | | | 15,663 | | | 11,258 | | | 5,160 | | | 3,482 |

| Redeemable trust securities | | | — | | | — | | | — | | | — | | | 200 | | | 200 | | | 200 |

| Total stockholders' equity | | | 7,979 | | | 7,441 | | | 7,731 | | | 6,888 | | | 6,506 | | | 3,907 | | | 2,928 |

- (1)

- We are part of CSFB, but our results do not reflect the overall performance of CSFB or CSG. The consolidated statement of operations data and consolidated statement of financial condition data as of and for the years ended December 31, 1999 and 1998 represent the data of DLJ. The consolidated statement of operations data for the year ended December 31, 2000 represent the results of operations of only DLJ for the period from January 1, 2000 to November 2, 2000 and both DLJ and CSFB LLC for the period from November 3, 2000 to December 31, 2000. The consolidated statement of operations data for the three months ended March 31, 2003 and 2002 and for the years ended December 31, 2002 and December 31, 2001 represent the results of operations of both DLJ and CSFB LLC. The consolidated statement of financial condition data as of March 31, 2003 and 2002 and as of December 31, 2002, 2001 and 2000 represent the data of both DLJ and CSFB LLC. Due to the inclusion of CSFB LLC data from November 3, 2000 through December 31, 2002, our financial statements may not be fully comparable between periods.

- Prior

- year numbers have been changed to conform to current year presentation.

S-14

- (2)

- On January 7, 2003, we entered into a definitive agreement to sell Pershing to BONY. The transaction closed on May 1, 2003. We have presented the assets and liabilities of Pershing as of March 31, 2003 and December 31, 2002 as "Assets held for sale" and "Liabilities held for sale" in our consolidated statements of financial condition. The operating results of Pershing for all periods presented have been presented as "Discontinued operations" in the consolidated statements of operations. As a result, the selected consolidated financial information may not be fully comparable between periods.

- (3)

- Commencing in the first quarter of 2003, the transfer of Management LLC is accounted for at historical cost in a manner similar to pooling-of-interest accounting because Management LLC and we were under the common control of CSFBI at the time of the transfer. The consolidated statement of operations data for the three months ended March 31, 2003 and 2002 include the results of operations of Management LLC. Such results of operations are not reflected in any other period. The consolidated statement of financial condition data as of March 31, 2003 and December 31, 2002 include the financial position of Management LLC. The financial position of Management LLC is not reflected in any other period.

S-15

USE OF PROCEEDS

The net proceeds from this offering will be $29,995,000, after deducting certain offering expenses. The underwriting discounts and commissions are being paid on our behalf by Credit Suisse First Boston International, an affiliate of ours, and will not be deducted from the gross proceeds of this offering. We intend to use the net proceeds for our general corporate purposes, which may include the rationalization of our debt capital structure.

CAPITALIZATION

The table below shows our consolidated capitalization as of March 31, 2003. The "As Adjusted" column reflects the issuance of the notes in this offering. Except as disclosed in this prospectus supplement, there has been no material change in our capitalization since March 31, 2003. You should read this table along with our consolidated financial statements, which are included in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | As of March 31, 2003

| |

|---|

| | Actual(1)

| | As Adjusted

| |

|---|

| | (in millions)

| |

|---|

| Debt: | | | | | | | |

| Commercial paper and short-term borrowings (2) | | $ | 11,753 | | $ | 11,753 | |

| | |

| |

| |

| Long-term borrowings | | | 24,458 | | | 24,488 | |

| | |

| |

| |

| | | Total long-term debt | | | 24,458 | | | 24,488 | |

| | |

| |

| |

| Stockholders' Equity: | | | | | | | |

| | Common Stock, $.10 par value (50,000 shares authorized: | | | | | | | |

| | | 1,100 shares issued and outstanding) (3) | | | — | | | — | |

| | Paid-in capital | | | 7,448 | | | 7,448 | |

| | Retained earnings | | | 687 | | | 687 | |

| | Accumulated other comprehensive income (loss) | | | (156 | ) | | (156 | ) |

| | |

| |

| |

| | | Total stockholders' equity | | | 7,979 | | | 7,979 | |

| | |

| |

| |

| | | | Total capitalization | | $ | 44,190 | | $ | 44,220 | |

| | |

| |

| |

- (1)

- Reflects the transfer to us of Management LLC.

- (2)

- Includes current portion of long-term borrowings of $3.6 billion.

- (3)

- All of such shares are owned by CSFBI, an indirect wholly owned subsidiary of CSG.

S-16

DESCRIPTION OF THE NOTES

This description of the terms of the notes adds information to the description of the general terms and provisions of debt securities in the accompanying prospectus. If this description differs in any way from the description in the accompanying prospectus, you should rely on this description.

General

We will issue the notes under an indenture, dated as of June 1, 2001, between us and JPMorgan Chase Bank, as trustee. The indenture is more fully described in the accompanying prospectus under "Description of Debt Securities" on page 5 of the accompanying prospectus.

The notes are being issued in an aggregate principal amount of $30,000,000, and will mature on November 30, 2004. The notes will be issued in the form of one or more fully registered global securities in denominations of $1,000 or integral multiples of $1,000.

The notes will be our unsecured obligations and will rank prior to all of our subordinated indebtedness and on an equal basis with all of our other senior unsecured indebtedness.

You will receive a redemption amount in cash at maturity that will equal the principal amount of the notes multiplied by the sum of 1 plus the index return. If the S&P 500® Index increases, the index return will equal three times the percentage increase in the S&P 500® Index, subject to a cap of 18.5%. Therefore, the maximum redemption amount at maturity for each $1,000 principal amount of notes will be $1,185. We will not pay you interest during the term of the notes. The notes are not principal-protected and are fully exposed to any decline in the level of the S&P 500® Index; a negative index return will reduce your redemption amount at maturity and you could lose your entire investment.

We may, without your consent, increase the principal amount of the notes in the future, on the same terms and conditions and with the same CUSIP number as the notes being offered hereby, as more fully described in "—Further Issues" below.

The notes have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "ARY.A".

Interest

We will not pay you interest during the term of the notes.

Redemption at the Option of the Noteholder; Defeasance

The notes are not subject to redemption at the option of any holder prior to maturity and are not subject to the defeasance provisions described in the accompanying prospectus under "Description of Debt Securities—Defeasance".

Maturity Date

The maturity date of the notes is November 30, 2004; however, if a market disruption event exists on any valuation date, as determined by the calculation agent, the maturity date will be the later of November 30, 2004 and the third index business day following the day on which the index level for the fifth and final valuation date is calculated. Please refer to "—Market Disruption Events" below. No interest or other payment will be payable because of any postponement of the maturity date.

Redemption at Maturity

Unless previously redeemed, or purchased by us and cancelled, each note will be redeemed on the maturity date at the cash redemption amount described below.

Redemption Amount

We will redeem the notes at maturity for a redemption amount in cash that will equal the principal amount of the notes multiplied by the sum of 1 plus the index return.

S-17

The index return is based on the difference between the final level of the S&P 500® Index and the initial level of the S&P 500® Index, expressed as a percentage. How the index return will be calculated depends on whether the final level is greater than, less than or equal to the initial level:

- •

- If the final level is greater than the initial level, then the index return will equal:

| 3 | | × | | [ | | Final Level—Initial Level

Initial Level | | ] |

| | | | | [ | | Final Level—Initial Level

Initial Level | | ] |

Therefore, if the S&P 500® Index decreases, the index return will be a negative number, and the redemption amount will be less than the principal amount of the notes and may be zero.

- •

- If the final level is equal to the initial level then the index return will equal zero and the redemption amount will equal the principal amount of the notes.

The initial level is 998.51. The final level will equal the arithmetic average of the index level on each of the five index business days, or valuation dates, from and including November 18, 2004 to and including November 24, 2004, or, if any of those particular days is not an index business day, the first following day that is an index business day, subject to the provisions described in "—Market Disruption Events" below.

The index level will, on any relevant index business day, be the level of the S&P 500® Index determined by the calculation agent at the valuation time, which is the time at which S&P calculates the closing level of the S&P 500® Index on such index business day, as calculated and published by S&P, subject to the provisions described under "—Adjustments to the Calculation of the S&P 500® Index" below.

An index business day is any day that is (or, but for the occurrence of a market disruption event, would have been) a trading day on The Nasdaq Stock Market, the New York Stock Exchange, the American Stock Exchange, the Chicago Mercantile Exchange and the Chicago Board Options Exchange, other than a day on which one or more of these exchanges is scheduled to close prior to its regular weekday closing time.

A market disruption event is, in respect of the S&P 500® Index, the occurrence or existence on any index business day during the one-half hour period that ends at the relevant valuation time, of any suspension of or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) on (a) the Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange in securities that comprise 20% or more of the level of the S&P 500® Index based on a comparison of (1) the portion of the level of the S&P 500® Index attributable to each security in which trading is, in the determination of the calculation agent, materially suspended or materially limited relative to (2) the overall level of the S&P 500® Index, in the case of (1) or (2) immediately before that suspension or limitation; (b) the Chicago Mercantile Exchange and/or the Chicago Board Options Exchange in options contracts on the S&P 500® Index; or (c) the Chicago Mercantile Exchange and/or the Chicago Board Options Exchange in futures contracts on the S&P 500® Index; in the case of (a), (b) or (c) if, in our determination, such suspension or limitation is material.

S-18

Market Disruption Events

If the calculation agent determines that on any particular valuation date a market disruption event exists, then such valuation date will be postponed to the first succeeding index business day on which the calculation agent determines that no market disruption event exists, unless the calculation agent determines that a market disruption event exists on each of the five index business days immediately following that particular valuation date. In that case, (a) the fifth succeeding index business day after the original valuation date will be deemed to be that particular valuation date, notwithstanding the market disruption event, and (b) the calculation agent will determine the index level for that particular valuation date on that deemed valuation date in accordance with the formula for and method of calculating the S&P 500® Index last in effect prior to the commencement of the market disruption event using exchange traded prices on the Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange (as determined by the calculation agent in its sole and absolute discretion) or, if trading in any security or securities comprising the S&P 500® Index has been materially suspended or materially limited, its good faith estimate of the prices that would have prevailed on the Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange (as determined by the calculation agent in its sole and absolute discretion) but for the suspension or limitation, as of the valuation time on that deemed valuation date, of each such security comprising the S&P 500® Index (subject to the provisions described under "—Adjustments to the Calculation of the S&P 500® Index" below). The final level will always be calculated as the arithmetic average of the index level on each of the five valuation dates (whether or not postponed).

In the event that a market disruption event exists on any valuation date, the maturity date of the notes will be the later of November 30, 2004 and the third index business day following the day on which the index level for the fifth and final valuation date is calculated. No interest or other payment will be payable because of any such postponement of the maturity date.

Set forth below are some examples relating to market disruption events. These examples are for illustration purposes only and are not exhaustive.

- •

- If a market disruption event exists on the first valuation date, but not the second through the fifth valuation dates:

- •

- the index level for the first valuation date will be the index level at the close of the second valuation date (i.e., the first succeeding index business day on which no market disruption event exists),

- •

- the index level for each of the second through the fifth valuation dates will be the index level as of the close of such valuation dates, and

- •

- the final level will be the arithmetic average of the index levels for such five valuation dates and the maturity date will be November 30, 2004.

- •

- If a market disruption event does not exist on the first through the fourth valuation dates but exists on the fifth valuation date and continues for five succeeding index business days:

- •

- the index level for each of the first through the fourth valuation dates will be the index level as of the close of such valuation dates,

- •

- the index level for the fifth valuation date will be calculated on the fifth index business day following such valuation date, notwithstanding the existence of the market disruption event, and

- •

- the final level will be the arithmetic average of the index levels for such five valuation dates, and the maturity date will be postponed until the third index business day following the day on which the index level for the fifth and final valuation date is calculated.

S-19

- •

- If a market disruption event exists on each of the original five valuation dates and continues for five index business days thereafter:

- •

- the index level for each valuation date will be calculated on the fifth index business day following such valuation date, notwithstanding the existence of the market of the disruption event, and

- •

- the final level will be the arithmetic average of the index levels for such five valuation dates, and the maturity date will be postponed until the third index business day following the day on which the index level for the fifth and final valuation date is calculated.

Adjustments to the Calculation of the S&P 500® Index

If the S&P 500® Index is (a) not calculated and announced by S&P but is calculated and announced by a successor acceptable to the calculation agent or (b) replaced by a successor index using, in the determination of the calculation agent, the same or a substantially similar formula for and method of calculation as used in the calculation of the S&P 500® Index, then the S&P 500® Index will be deemed to be the index so calculated and announced by that successor sponsor or that successor index, as the case may be.

Upon any selection by the calculation agent of a successor index, the calculation agent will cause notice to be furnished to us and the trustee, which will provide notice (as described in "—Notices" below) of the selection of the successor index to the registered holders of the notes.

If (x) on or prior to any valuation date S&P makes, in the determination of the calculation agent, a material change in the formula for or the method of calculating the S&P 500® Index or in any other way materially modifies the S&P 500® Index (other than a modification prescribed in that formula or method to maintain the S&P 500® Index in the event of changes in constituent stocks and capitalization and other routine events) or (y) on any valuation date S&P (or a successor sponsor) fails to calculate and announce the S&P 500® Index, then the calculation agent will calculate the redemption amount using, in lieu of a published level for the S&P 500® Index, the level for the S&P 500® Index as at the valuation time on such valuation date as determined by the calculation agent in accordance with the formula for and method of calculating the S&P 500® Index last in effect prior to that change or failure, but using only those securities that comprised the S&P 500® Index immediately prior to that change or failure. Notice of adjustment of the S&P 500® Index will be provided as described in "—Notices" below.

All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will be conclusive for all purposes and binding on us and the beneficial owners of the notes, absent manifest error.

Purchases

We may at any time purchase any notes, which may, in our sole discretion, be held, sold or cancelled.

Cancellation

Upon (i) the purchase and surrender for cancellation of any notes by us or (ii) the redemption of any notes, such notes will be cancelled by the trustee.

Events of Default and Acceleration

In case an event of default (as defined in the accompanying prospectus) with respect to any notes shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the notes (in accordance with the acceleration provisions set forth in the accompanying prospectus) will be determined by the calculation agent and will equal, for each note, the arithmetic average, as determined by the calculation agent, of the fair market value of the notes as determined by at least three but not more than five broker-dealers (which may include CSFB LLC or any of our other

S-20

subsidiaries or affiliates) as will make such fair market value determinations available to the calculation agent.

Book-Entry, Delivery and Form

We will issue the notes in the form of one or more fully registered global securities, or the global notes, in denominations of $1,000 or integral multiples of $1,000. We will deposit the notes with, or on behalf of, The Depository Trust Company, New York, New York, or DTC, as the depositary, and will register the notes in the name of Cede & Co., DTC's nominee. Your beneficial interests in the global notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. You may elect to hold interests in the global notes through either DTC (in the United States) or Clearstream Banking, société anonyme, which we refer to as Clearstream, Luxembourg, or Euroclear Bank, S.A./N.V., or its successor, as operator of the Euroclear System, which we refer to as Euroclear, (outside of the United States) if you are participants of such systems, or indirectly through organizations which are participants in such systems. Interests held through Clearstream, Luxembourg and Euroclear will be recorded on DTC's books as being held by the U.S. depositary for each of Clearstream, Luxembourg and Euroclear, which U.S. depositaries will in turn hold interests on behalf of their participants' customers' securities accounts. Except as set forth below, the global notes may be transferred, in whole and not in part, only to another nominee of DTC or to a successor of DTC or its nominee.

As long as the notes are represented by global notes, we will pay the redemption amount of the notes to or as directed by DTC as the registered holder of the global notes. Payments to DTC will be in immediately available funds by wire transfer. DTC, Clearstream, Luxembourg or Euroclear, as applicable, will credit the relevant accounts of their participants on the applicable date. We have been advised by DTC, Clearstream, Luxembourg and Euroclear, respectively, as follows:

- •

- As to DTC: DTC has advised us that it is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. DTC holds securities deposited with it by its participants and facilitates the settlement of transactions among its participants in such securities through electronic computerized book-entry changes in accounts of the participants, thereby eliminating the need for physical movement of securities certificates. DTC's participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations, some of whom (and/or their representatives) own DTC. Access to DTC's book-entry system is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a participant, either directly or indirectly.

According to DTC, the foregoing information with respect to DTC has been provided to the financial community for informational purposes only and is not intended to serve as a representation, warranty or contract modification of any kind.

- •

- As to Clearstream, Luxembourg: Clearstream, Luxembourg has advised us that it was incorporated as a limited liability company under Luxembourg law. Clearstream, Luxembourg is owned by Cedel International, société anonyme, and Deutsche Börse AG. The shareholders of these two entities are banks, securities dealers and financial institutions.

Clearstream, Luxembourg holds securities for its customers and facilitates the clearance and settlement of securities transactions between Clearstream, Luxembourg customers through electronic book-entry changes in accounts of Clearstream, Luxembourg customers, thus eliminating the need for physical movement of certificates. Transactions may be settled by Clearstream, Luxembourg in many currencies, including United States dollars. Clearstream,

S-21

Luxembourg provides to its customers, among other things, services for safekeeping, administration, clearance and settlement of internationally traded securities, securities lending and borrowing. Clearstream, Luxembourg also deals with domestic securities markets in over 30 countries through established depositary and custodial relationships. Clearstream, Luxembourg interfaces with domestic markets in a number of countries. Clearstream, Luxembourg has established an electronic bridge with Euroclear Bank S.A./N.V., the operator of Euroclear, or the Euroclear operator, to facilitate settlement of trades between Clearstream, Luxembourg and Euroclear.

As a registered bank in Luxembourg, Clearstream, Luxembourg is subject to regulation by the Luxembourg Commission for the Supervision of the Financial Sector. Clearstream, Luxembourg customers are recognized financial institutions around the world, including underwriters, securities brokers and dealers, banks, trust companies and clearing corporations. In the United States, Clearstream, Luxembourg customers are limited to securities brokers and dealers and banks, and may include the underwriter for the notes. Other institutions that maintain a custodial relationship with a Clearstream, Luxembourg customer may obtain indirect access to Clearstream, Luxembourg. Clearstream, Luxembourg is an indirect participant in DTC.

The redemption amount of the notes held beneficially through Clearstream, Luxembourg will be credited to cash accounts of Clearstream, Luxembourg customers in accordance with its rules and procedures, to the extent received by Clearstream, Luxembourg from DTC.

- •

- As to Euroclear: Euroclear has advised us that it was created in 1968 to hold securities for participants of Euroclear and to clear and settle transactions between Euroclear participants through simultaneous electronic book-entry delivery against payment, thus eliminating the need for physical movement of certificates and risk from lack of simultaneous transfers of securities and cash. Transactions may now be settled in many currencies, including United States dollars and Japanese yen. Euroclear provides various other services, including securities lending and borrowing and interfaces with domestic markets in several countries generally similar to the arrangements for cross-market transfers with DTC described below.

Euroclear is operated by the Euroclear operator, under contract with Euroclear plc, a U.K. corporation. The Euroclear operator conducts all operations, and all Euroclear securities clearance accounts and Euroclear cash accounts are accounts with the Euroclear operator, not Euroclear plc. Euroclear plc establishes policy for Euroclear on behalf of Euroclear participants. Euroclear participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries and may include the underwriter for the notes. Indirect access to Euroclear is also available to other firms that clear through or maintain a custodial relationship with a Euroclear participant, either directly or indirectly. Euroclear is an indirect participant in DTC. The Euroclear operator is a Belgian bank. The Belgian Banking Commission and the National Bank of Belgium regulate and examine the Euroclear operator.

The Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of the Euroclear System, or the Euroclear Terms and Conditions, and applicable Belgian law govern securities clearance accounts and cash accounts with the Euroclear operator. Specifically, these terms and conditions govern:

- •

- transfers of securities and cash within Euroclear;

- •

- withdrawal of securities and cash from Euroclear; and

- •

- receipt of payments with respect to securities in Euroclear.

S-22

The redemption amount of the notes held beneficially through Euroclear will be credited to the cash accounts of Euroclear participants in accordance with the Euroclear Terms and Conditions, to the extent received by the Euroclear operator from DTC.

Global Clearance and Settlement Procedures

You will be required to make your initial payment for the notes in immediately available funds. Secondary market trading between DTC participants will occur in the ordinary way in accordance with DTC rules and will be settled in immediately available funds using DTC's Same-Day Funds Settlement System. Secondary market trading between Clearstream, Luxembourg customers and/or Euroclear participants will occur in the ordinary way in accordance with the applicable rules and operating procedures of Clearstream, Luxembourg and Euroclear and will be settled using the procedures applicable to conventional eurobonds in immediately available funds.

Cross-market transfers between persons holding directly or indirectly through DTC, on the one hand, and directly or indirectly through Clearstream, Luxembourg customers or Euroclear participants, on the other, will be effected in DTC in accordance with DTC rules on behalf of the relevant European international clearing system by DTC; however, such cross-market transactions will require delivery of instructions to the relevant European international clearing system by the counterparty in such system in accordance with its rules and procedures and within its established deadlines (based on European time). The relevant European international clearing system will, if the transaction meets its settlement requirements, deliver instructions to DTC to take action to effect final settlement on its behalf by delivering or receiving notes in DTC, and making or receiving payment in accordance with normal procedures for same-day funds settlement applicable to DTC. Clearstream, Luxembourg customers and Euroclear participants may not deliver instructions directly to their respective U.S. depositaries.

Because of time-zone differences, credits of notes received in Clearstream, Luxembourg or Euroclear as a result of a transaction with a DTC participant will be made during subsequent securities settlement processing and dated the business day following the DTC settlement date. Such credits or any transactions in such notes settled during such processing will be reported to the relevant Clearstream, Luxembourg customers or Euroclear participants on such business day. Cash received in Clearstream, Luxembourg or Euroclear as a result of sales of notes by or through a Clearstream, Luxembourg customer or a Euroclear participant to a DTC participant will be received with value on the DTC settlement date but will be available in the relevant Clearstream, Luxembourg or Euroclear cash account only as of the business day following settlement in DTC.

Although DTC, Clearstream, Luxembourg and Euroclear have agreed to the foregoing procedures in order to facilitate transfers of notes among participants of DTC, Clearstream, Luxembourg and Euroclear, they are under no obligation to perform or continue to perform such procedures and such procedures may be discontinued at any time.

Definitive Notes

If any of the events described under the last paragraph of "Description of Debt Securities—Book-Entry System" on page 6 of the accompanying prospectus occurs, we will issue a certificated form of definitive notes in an amount equal to a holder's beneficial interest in the notes. Definitive notes will be issued in denominations of $1,000 or integral multiples of $1,000, and will be registered in the name of the person DTC specifies in a written instruction to the registrar of the notes.

S-23

In the event definitive notes are issued:

- •

- holders of definitive notes will be able to receive the redemption amount on their notes at the office of our paying agent maintained in the Borough of Manhattan;

- •

- holders of definitive notes will be able to transfer their notes, in whole or in part, by surrendering the notes, with a duly completed form of transfer, for registration of transfer at the office of our transfer agent, JPMorgan Chase Bank. We will not charge any fee for the registration or transfer or exchange, except that we may require the payment of a sum sufficient to cover any applicable tax or other governmental charge payable in connection with the transfer; and

- •

- any moneys we pay to our paying agent for the payment of the redemption amount on the notes which remains unclaimed at the second anniversary of the date such payment was due will be returned to us, and thereafter holders of definitive notes may look only to us, as general unsecured creditors, for payment.

Calculation Agent

The calculation agent is Credit Suisse First Boston International, an affiliate of ours. The calculations and determinations of the calculation agent will be final and binding upon all parties (except in the case of manifest error). The calculation agent will have no responsibility for good faith errors or omissions in its calculations and determinations, whether caused by negligence or otherwise. The calculation agent will not act as your agent. You will not be entitled to make any claim against us and/or the calculation agent in the case where S&P or the distributor of the S&P 500® Index will have made any error, omission or other incorrect statement in connection with the calculation and public announcement of the S&P 500® Index. Because the calculation agent is an affiliate of ours, potential conflicts of interest may exist between you and the calculation agent. Please refer to "Risk Factors—There may be potential conflicts of interest".

Further Issues

We may from time to time, without notice to or the consent of the registered holders of the notes, create and issue further notes ranking on an equal basis with the notes being offered hereby in all respects. Such further notes will be consolidated and form a single series with the notes being offered hereby and will have the same terms as to status, redemption or otherwise as the notes being offered hereby.

Notices

Notices to holders of the notes will be made by first class mail, postage prepaid, to the registered holders.

Governing Law

The indenture and the notes will be governed by and construed in accordance with the laws of the State of New York.

S-24

THE S&P 500® INDEX

Unless otherwise stated, all information regarding the S&P 500® Index provided in this prospectus supplement is derived from S&P or other publicly available sources. Such information reflects the policies of S&P as stated in such sources, and such policies are subject to change by S&P. We do not assume any responsibility for the accuracy or completeness of such information. S&P is under no obligation to continue to publish the S&P 500® Index and may discontinue publication of the S&P 500® Index at any time.

The S&P 500® Index is intended to provide an indication of the pattern of common stock price movement. The value of the S&P 500® Index is calculated using a base-weighted aggregate methodology. This means that the level of the S&P 500® Index reflects the total market value of all 500 component stocks relative to a particular base period. The total market value of a company is determined by multiplying the price of its stock by the number of shares outstanding. The amount of dividends or other distributions paid on a company's stock is not taken into account in calculating the S&P 500® Index. Please refer to "—Calculation of the S&P 500® Index" below.

As of June 11, 2003, the major industry groups covered in the S&P 500® Index (listed according to their respective capitalization in the S&P 500® Index) were as follows: Financials (20.7%), Information Technology (16.1%), Health Care (14.6%), Consumer Staples (11.6%) and Consumer Discretionary (11.0%). S&P selects companies for inclusion in the S&P 500® Index with the goal of achieving a distribution by broad industry category that approximates the distribution of these categories over an assumed model of the total equity market. Relevant selection criteria include the viability of the company, the extent to which the company represents its assigned industry category, the extent to which the market price of the company's stock is responsive to changes in the affairs of the relevant industry and the market value and trading activity of the stock of the company.

The securities included in the S&P 500® Index are evaluated on an annual basis. However, the composition of the S&P 500® Index is examined quarterly and such examination may result in changes in the stocks comprising the S&P 500® Index. Changes in the stocks comprising the S&P 500® Index may also occur from time to time when, for example, S&P determines that a company or companies included in the S&P 500® Index are involved in mergers, acquisitions or restructurings such that they no longer meet the criteria for inclusion.

Calculation of the S&P 500® Index

S&P currently computes the S&P 500® Index as of a set time as follows:

- •

- the product of the market price per share and the number of then outstanding shares of each component stock is determined at that time (which we refer to as the market value of that stock);

- •

- the market values of all component stocks are then aggregated;

- •

- the mean average of the market values as of each week in the base period of the years 1941 through 1943 of the common stock of each company in a group of 500 substantially similar companies is determined;

- •

- the mean average market values of all these common stocks over the base period are aggregated (the aggregate amount being referred to as the base value);

- •

- the current aggregate market value of all component stocks is divided by the base value; and

- •

- the resulting quotient, expressed in decimals, is multiplied by ten.

S-25

While S&P currently employs the above methodology to calculate the S&P 500® Index, we cannot assure you that S&P will not modify or change this methodology in a manner that may affect the redemption amount at maturity to beneficial owners of the notes.

S&P adjusts the foregoing formula to offset the effects of changes in the market value of a component stock that are determined by S&P to be arbitrary or not due to true market fluctuations. These changes may result from causes such as:

- •

- the issuance of stock dividends;

- •

- the granting to shareholders of rights to purchase additional shares of stock;

- •

- the purchase of shares by employees pursuant to employee benefit plans;

- •

- consolidations and acquisitions;

- •

- the granting to shareholders of rights to purchase other securities of the issuer;

- •

- the substitution by S&P of particular component stocks in the S&P 500® Index; or

- •

- other reasons.

In these cases, S&P first recalculates the aggregate market value of all component stocks, after taking account of the new market price per share of the particular component stock or the new number of outstanding shares of that stock or both, as the case may be, and then determines the new base value in accordance with the following formula:

| Old Base Value | x | | New Market Value | | = | | New Base Value |

| | | |

| | | | |

| | | | Old Market Value | | | | |