QuickLinks -- Click here to rapidly navigate through this documentPROSPECTUS SUPPLEMENT TO PROSPECTUS DATED APRIL 29, 2002

$10,000,000

Credit Suisse First Boston (USA), Inc.

Five-Year Contingent Protection Securities

due November 26, 2008

Linked to the S&P 500® Index

| Issuer: | | Credit Suisse First Boston (USA), Inc. |

| Maturity Date: | | November 26, 2008 |

| Coupon: | | We will not pay interest on the Securities (as defined herein) being offered by this prospectus supplement. |

| Underlying Index: | | The index return will be based on the performance of the S&P 500® Index during the term of the Securities. |

| Redemption Amount: | | You will receive a redemption amount in cash at maturity that will equal the amount you invested in the Securities, or your Investment Amount, multiplied by the sum of 1 plus the index return. If at all times during the term of the Securities the level of the S&P 500® Index remains above the Loss of Protection Trigger, which is equal to 60.0% of the closing level of the S&P 500® Index on November 20, 2003, or the Initial Index Level, the index return will equal the greater of zero and any percentage increase in the level of the S&P 500® Index. In this case, you will participate in any appreciation in the S&P 500® Index over the term of the Securities and will receive at least your Investment Amount at maturity. If at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, the index return will equal the actual percentage increase or decrease in the level of the S&P 500® Index.In this case, you will participate in any appreciation or depreciation in the level of the S&P 500® Index, you will no longer be assured of receiving at least your Investment Amount at maturity, and you could receive zero. This would be the case if at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, even if it later exceeds that trigger or is above the Loss of Protection Trigger at maturity. The Initial Index Level is 1033.65. The Loss of Protection Trigger expressed numerically is 620.19. |

| Listing: | | The Securities have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "IPJ.B". |

Investing in the Securities involves risks. See "Risk Factors" beginning on page S-7.

| | Price to the Public

| | Underwriting

Discounts and

Commissions(1)

| | Proceeds to the Company(1)

| |

|---|

| Per Security | | | 100 | % | | 1.955 | % | | 100 | % |

| Total | | $ | 10,000,000 | | $ | 195,540 | | $ | 10,000,000 | |

- (1)

- The underwriting discounts and commissions will be paid on our behalf by Credit Suisse First Boston International, an affiliate of ours. See "Underwriting" on page S-32.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these Securities or determined if this prospectus supplement or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the Securities in book-entry form only will be made through The Depository Trust Company on or about November 26, 2003. You may elect to hold interests in the Securities through Clearstream, Luxembourg and Euroclear.

Credit Suisse First Boston

The date of this prospectus supplement is November 20, 2003.

TABLE OF CONTENTS

| Prospectus Supplement | | |

| | Page

|

|---|

SUMMARY |

|

S-3 |

| RISK FACTORS | | S-7 |

CREDIT SUISSE FIRST

BOSTON (USA), INC. | | S-11 |

RATIO OF EARNINGS TO FIXED

CHARGES | | S-12 |

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION | | S-13 |

| USE OF PROCEEDS AND HEDGING | | S-15 |

| CAPITALIZATION | | S-16 |

| DESCRIPTION OF THE SECURITIES | | S-17 |

| THE S&P 500® INDEX | | S-25 |

| CERTAIN UNITED STATES FEDERAL | | |

| | INCOME TAX CONSIDERATIONS | | S-30 |

| UNDERWRITING | | S-32 |

| NOTICE TO CANADIAN RESIDENTS | | S-33 |

| CERTAIN ERISA CONSIDERATIONS | | S-34 |

| INCORPORATION BY REFERENCE | | S-35 |

|

|

|

| Prospectus | | |

| | Page

|

|---|

ABOUT THIS PROSPECTUS |

|

2 |

| WHERE YOU CAN FIND MORE INFORMATION | | 2 |

| FORWARD-LOOKING STATEMENTS | | 3 |

| USE OF PROCEEDS | | 3 |

| RATIO OF EARNINGS TO FIXED CHARGES | | 3 |

| CREDIT SUISSE FIRST BOSTON (USA), INC. | | 4 |

| DESCRIPTION OF DEBT SECURITIES | | 5 |

| DESCRIPTION OF WARRANTS | | 12 |

| ERISA | | 14 |

| PLAN OF DISTRIBUTION | | 15 |

| LEGAL MATTERS | | 16 |

| EXPERTS | | 16 |

You should rely only on the information contained in this document or to which we referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these Securities. The information in this document may only be accurate on the date of this document.

We are offering the Securities globally for sale in those jurisdictions in the United States, Europe, Asia and elsewhere where it is lawful to make such offers. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the Securities in some jurisdictions may be restricted by law. If you possess this prospectus supplement and the accompanying prospectus, you should find out about and observe these restrictions. This prospectus supplement and the accompanying prospectus are not an offer to sell these Securities and we are not soliciting an offer to buy these Securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom such offer or sale is not permitted. We refer you to "Underwriting" on page S-32 of this prospectus supplement.

In this prospectus supplement and accompanying prospectus, unless otherwise specified or the context otherwise requires, references to "we", "us" and "our" are to Credit Suisse First Boston (USA), Inc. and its consolidated subsidiaries, and references to "dollars" and "$" are to United States dollars.

"Standard & Poor's", "S&P", "S&P 500®", "Standard & Poor's 500" and "500" are trademarks of Standard & Poor's Corporation, or S&P, and have been licensed for use by Credit Suisse First Boston (USA), Inc. and its affiliates, as Licensee.

S-2

SUMMARY

The following is a summary of the terms of the Securities and factors that you should consider before deciding to invest in the Securities. You should read this prospectus supplement and the accompanying prospectus carefully to understand fully the terms of the Securities and other considerations that are important in making a decision about investing in the Securities. You should, in particular, review the "Risk Factors" section, which sets forth a number of risks related to the Securities. All of the information set forth below is qualified in its entirety by the detailed explanations set forth elsewhere in this prospectus supplement and the accompanying prospectus.

What are the Five-Year Contingent Protection Securities?

The Five-Year Contingent Protection Securities, or the "Securities", are medium-term securities issued by us, the return on which is linked to the performance of the S&P 500® Index. You will receive a redemption amount in cash at maturity that will equal the amount you invested in the Securities multiplied by the sum of 1 plus the index return. If at all times during the term of the Securities the level of the S&P 500® Index remains above the Loss of Protection Trigger, which is 60.0% of the Initial Index Level, the index return will equal the greater of zero and any percentage increase in the level of the S&P 500® Index. In this case, you will participate in any appreciation in the S&P 500® Index over the term of the Securities and will receive at least your Investment Amount at maturity. If at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, the index return will equal the actual percentage increase or decrease in the level of the S&P 500® Index. In this case, you will participate in any appreciation or depreciation in the level of the S&P 500® Index, you will no longer be assured of receiving at least your Investment Amount at maturity, and you could receive zero. This would be the case if at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, even if it later exceeds that trigger or is above the Loss of Protection Trigger at maturity. The Initial Index Level is 1033.65. The Loss of Protection Trigger expressed numerically is 620.19. For a description of how the redemption amount at maturity will be calculated, please refer to "How is the Redemption Amount Calculated?" on page S-4 and "Description of the Securities—Redemption Amount" on page S-18.

The Securities are linked to the S&P 500® Index, which is designed to measure the performance of the broad U.S. domestic economy through the changes in aggregate market value of 500 stocks representing all major U.S. industries.

Are there risks involved in investing in the Securities?

An investment in the Securities involves risks. The significant risks are described in more detail in "Risk Factors" on page S-7. Some of these risks are summarized below.

If on any day during the term of the Securities the S&P 500® Index falls to or below the Loss of Protection Trigger, you will no longer be assured of receiving at least your Investment Amount at maturity and you will bear the full effect of any depreciation in the S&P 500® Index.

An investment in the Securities is assured of receiving at least the amount you invested in the Securities at maturity only for so long as the level of the S&P 500® Index remains above the Loss of Protection Trigger. If, on any day during the term of the Securities, the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, a decline of 40.0% or more from the Initial Index Level, you will no longer be assured of receiving at least your Investment Amount at maturity, even if the level of the S&P 500® Index subsequently increases above the Loss of Protection Trigger prior to maturity, and you will be fully exposed to any decline in the level of the S&P 500® Index. Consequently, if at maturity the final level of the S&P 500® Index, or the Final Index Level, is less than the Initial Index Level, you will receive less at maturity than you originally invested, and you could receive nothing.

S-3

The yield on the Securities may be lower than the return on an ordinary debt security with similar maturity.

We will not pay interest on the Securities. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including our debt securities, since the redemption amount at maturity is based on the appreciation or depreciation of the S&P 500® Index and whether it remains above the Loss of Protection Trigger for the term of the Securities. Because the redemption amount due at maturity may be less than the amount originally invested in the Securities, the return on the Securities (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each Security may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

Will I receive interest on the Securities?

You will not receive any interest payments on the Securities for the term of the Securities.

Will I receive any dividend payments on, or have shareholder rights in, the stocks comprising the S&P 500® Index?

As a holder of the Securities, you will not receive any dividend payments or other distributions on the stocks comprising the S&P 500® Index or have voting or any other rights that holders of the stocks comprising the S&P 500® Index may have.

Will there be an active trading market in the Securities?

The Securities have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "IPJ.B". You should recognize that this listing may not ensure that a liquid trading market is available for the Securities. Credit Suisse First Boston LLC currently intends to make a market in the Securities, although it is not required to do so and may stop making a market at any time.

If you have to sell your Securities prior to maturity, you may have to sell them at a substantial loss.

What are the U.S. federal income tax consequences of investing in the Securities?

We and, by your acceptance of a Security, you agree to treat your Securities for U.S. federal income tax purposes as a pre-paid, cash-settled forward contract with respect to the stocks that comprise the S&P 500® Index. Please refer to the discussion under "Certain United States Federal Income Tax Considerations" on page S-30.

How is the redemption amount calculated?

The redemption amount at maturity will equal an amount in dollars per Security determined in accordance with the following formula:

Redemption Amount = Investment Amount × (1 + Index Return)

The index return is expressed as a percentage and is calculated as follows:

- •

- If at all times during the term of the Securities the level of the S&P 500® Index remains above the Loss of Protection Trigger, the index return will be the greater of:

| (a) | | | | Zero; and |

| | | | | | | | | |

| (b) | | | | [ | | Final Index Level—Initial Index Level

Initial Index Level | | ] |

S-4

Thus, in the event that the level of the S&P 500® Index remains above the Loss of Protection Trigger for the term of the Securities, the redemption amount will equal at least your Investment Amount.

- •

- If on any day during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, the index return will be:

| | | | | [ | | Final Index Level—Initial Index Level

Initial Index Level | | ] |

Therefore, if on any day during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, whether or not it subsequently increases above that trigger, the index return will be the actual percentage change in the level of the S&P 500® Index, which may be negative.

For purposes of calculating the index return, the Initial Index Level is 1033.65, which is the closing level of the S&P 500® Index on November 20, 2003. The Final Index Level will equal the closing level of the S&P 500® Index on November 20, 2008. Please refer to "Description of the Securities—Redemption Amount" on page S-18 and "—Market Disruption Events" on page S-19.

What are some hypothetical redemption amounts at maturity of the Securities?

Because the return on the Securities depends upon whether the S&P 500® Index remains above the Loss of Protection Trigger during the term of the Securities and on the increase or decrease in the S&P 500® Index from the Initial Index Level to the Final Index Level, it is not possible to present a complete range of possible redemption amounts at maturity for the Securities. The tables below set forth a sampling of hypothetical redemption amounts for the Securities at maturity.

If the S&P 500® Index remains above the Loss of Protection Trigger

during the term of the Securities

Principal Amount of Securities

| | Percentage Difference Between Initial

Index Level and Final Index Level

| | Redemption Amount at Maturity

|

|---|

| $ | 1,000 | | <-40 | % | $ | 1,000 |

| $ | 1,000 | | -30 | % | $ | 1,000 |

| $ | 1,000 | | -20 | % | $ | 1,000 |

| $ | 1,000 | | -10 | % | $ | 1,000 |

| $ | 1,000 | | 0 | | $ | 1,000 |

| $ | 1,000 | | +3 | % | $ | 1,030 |

| $ | 1,000 | | +5 | % | $ | 1,050 |

| $ | 1,000 | | +10 | % | $ | 1,100 |

S-5

If the S&P 500 Index falls to or below the Loss of Protection Trigger

at any time during the term of the Securities

Principal Amount of Securities

| | Percentage Difference Between

Initial Index Level

and Final Index

Level

| | Redemption Amount at Maturity

|

|---|

| $ | 1,000 | | -100 | % | $ | 0 |

| $ | 1,000 | | -90 | % | $ | 100 |

| $ | 1,000 | | -80 | % | $ | 200 |

| $ | 1,000 | | -70 | % | $ | 300 |

| $ | 1,000 | | -60 | % | $ | 400 |

| $ | 1,000 | | -50 | % | $ | 500 |

| $ | 1,000 | | -40 | % | $ | 600 |

| $ | 1,000 | | -30 | % | $ | 700 |

| $ | 1,000 | | -20 | % | $ | 800 |

| $ | 1,000 | | -10 | % | $ | 900 |

| $ | 1,000 | | 0 | | $ | 1,000 |

| $ | 1,000 | | +3 | % | $ | 1,030 |

| $ | 1,000 | | +5 | % | $ | 1,050 |

| $ | 1,000 | | +10 | % | $ | 1,100 |

These examples are for illustration purposes only. The actual index return will depend on the performance of the S&P 500® Index during the term of the Securities, the Initial Index Level and the Final Index Level determined by the calculation agent as provided in this prospectus supplement.

Who publishes the S&P 500® Index and what does it measure?

The S&P 500® Index is published by S&P. The S&P 500® Index is a capitalization-weighted index, meaning that each underlying stock's weight in the index is based on its total market capitalization. The level of the S&P 500® Index does not reflect the value of dividend payments or other distributions on the stocks comprising the S&P 500® Index. The S&P 500® Index is designed to measure performance of the broad U.S. domestic economy through changes in the aggregate market value of 500 stocks representing all major U.S. industries.

As of November 20, 2003, the major industry groups covered in the S&P 500® Index (listed according to their respective capitalization in the S&P 500® Index) were as follows: Financials (20.7%), Information Technology (17.8%), Health Care (13.7%), Consumer Staples (11.5%) and Consumer Discretionary (11.3%). A list of the companies comprising the S&P 500® Index can be found on the internet at http://www2.standardandpoors.com/spf/xls/index/500_20030506_C.xls.

The securities included in the S&P 500® Index are evaluated on an annual basis. However, the composition of the S&P 500® Index is examined quarterly and such examination may result in changes in the stocks comprising the S&P 500® Index. Changes in the stocks comprising the S&P 500® Index may also occur from time to time when, for example, S&P determines that a company or companies included in the S&P 500® Index are involved in mergers, acquisitions or restructurings such that they no longer meet the criteria for inclusion.

The level of the S&P 500® Index can be found in a variety of publicly available sources.

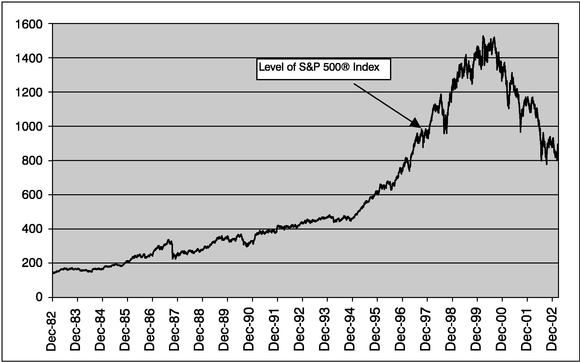

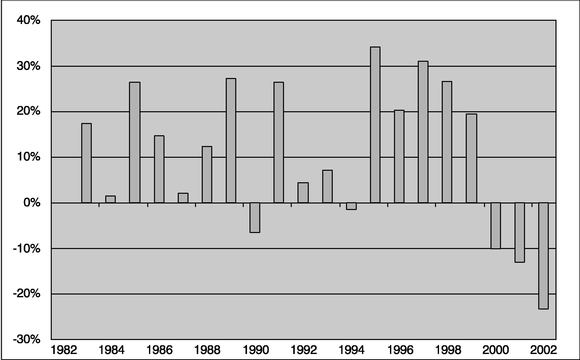

How has the S&P 500® Index performed historically?

A table and graph containing the annual appreciation or depreciation of the S&P 500® Index for each year from the year ending December 31, 1982 have been provided in the section "The S&P 500® Index—Performance of the S&P 500® Index" in this prospectus supplement. Past performance is not necessarily indicative of how the S&P 500® Index will perform in the future.

S-6

RISK FACTORS

A purchase of the Securities involves risks. This section describes significant risks relating to the Securities. We urge you to read the following information about these risks, together with the other information in this prospectus supplement and the accompanying prospectus, before investing in the Securities.

If on any day during the term of the Securities the S&P 500® Index falls to or below the Loss of Protection Trigger you will no longer be assured of receiving at least your Investment Amount at maturity and you will bear the full effect of any depreciation in the S&P 500® Index

You are assured of receiving at least the amount you invested in the Securities at maturity only if the level of the S&P 500® Index remains above the Loss of Protection Trigger for the term of the Securities. If on any day during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, you will no longer be assured of receiving at least your Investment Amount at maturity, even if the level of the S&P 500® Index subsequently increases above the Loss of Protection Trigger prior to maturity, and you will be fully exposed to any decline in the level of the S&P 500® Index. Consequently, if at maturity the Final Index Level is less than the Initial Index Level, you will receive less at maturity than you originally invested, and you could receive nothing.

The yield on the Securities may be lower than the return on an ordinary debt security with similar maturity

We will not pay interest on the Securities. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including our debt securities, since the redemption amount at maturity is based on the appreciation or depreciation of the S&P 500® Index and whether it remains above the Loss of Protection Trigger for the term of the Securities. Because the redemption amount due at maturity may be less than the amount originally invested in the Securities, the return on the Securities (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each Security may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

An investment in the Securities is not the same as an investment in the stocks underlying the S&P 500® Index

The payment of dividends on the stocks which comprise, or underlie, the S&P 500® Index has no effect on the calculation of the index level for the S&P 500® Index. Therefore, the return on your investment based on the percentage change in the S&P 500® Index is not the same as the total return based on the purchase of those underlying stocks held for a similar period.

There may be little or no secondary market for the Securities

There is currently no secondary market for the Securities. Although the Securities have been approved for listing on the American Stock Exchange, subject to official notice of issuance, we cannot assure you that a secondary market for the Securities will develop. Credit Suisse First Boston LLC currently intends to make a market in the Securities, although it is not required to do so and may stop making a market at any time. If you have to sell your Securities prior to maturity, you may have to sell them at a substantial loss.

You have no recourse to S&P or to the issuers of the stocks comprising the S&P 500® Index

You will have no rights against S&P as the sponsor of the S&P 500® Index or against any issuer of a stock comprising the S&P 500® Index. The Securities are not sponsored, endorsed, sold or promoted

S-7

by S&P or by any such issuer. Neither S&P nor any such issuer has passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Securities. Neither S&P nor any such issuer makes any representation or warranty, express or implied, to you or any member of the public regarding the advisability of investing in securities generally or the Securities particularly, or the ability of the S&P 500® Index to track general stock performance. S&P's only relationship to us is in the licensing of the S&P 500®, S&P 500® Index and S&P trademarks or service marks, and certain trade names of S&P and the use of the S&P 500® Index, which is determined, composed and calculated by S&P without regard to us or the Securities. S&P has no obligation to take our needs or your needs into consideration in determining, composing or calculating the S&P 500® Index. Neither S&P nor any issuer of a stock comprising the S&P 500® Index is responsible for, and none of them has participated in the determination of, the timing, prices or quantities of the Securities to be issued or in the determination or calculation of the equation by which the Securities are to be converted into cash. Neither S&P nor any such issuer has any liability in connection with the administration, marketing or trading of the Securities.

The United States federal income tax consequences of the Securities are uncertain

No ruling is being requested from the Internal Revenue Service, or the IRS, with respect to the Securities and the federal income tax treatment of the Securities is not free from doubt. Accordingly, we cannot assure you that the IRS or any court will agree with the conclusions expressed under "Certain United States Federal Income Tax Considerations" in this prospectus supplement.

The market price of the Securities may be influenced by many unpredictable factors

Many factors, most of which are beyond our control, will influence the value of the Securities, including:

The level of the S&P 500® Index. We expect that the market value of the Securities will likely depend substantially on the relationship between the Initial Index Level, which is 1033.65, and the future level of the S&P 500® Index. If you choose to sell your Securities when the level of the S&P 500® Index exceeds the Initial Index Level, you may receive substantially less than the amount that would be payable at maturity based on that level of the S&P 500® Index because of expectations that the S&P 500® Index will continue to fluctuate between that time and the time when the final level of the S&P 500® Index is determined. If you choose to sell your Securities when the level of the S&P 500® Index is below the Initial Index Level, particularly if it has ever fallen to or below the Loss of Protection Trigger, you may receive less than your original investment;

Interest and yield rates in the market. We expect that the market value of the Securities will be affected by changes in U.S. interest rates. In general, if U.S. interest rates increase, the value of the Securities may decrease, and if U.S. interest rates decrease, the value of the Securities may increase. Interest rates may also affect the economy and, in turn, the level of the S&P 500® Index, which would affect the value of the Securities;

The volatility of the S&P 500® Index. Volatility is the term used to describe the frequency and magnitude of changes, and if the level of the S&P 500® Index is volatile, the trading value of the Securities may be reduced;

Economic, financial, political and regulatory or judicial events that affect the securities underlying the S&P 500® Index or stock markets generally and which may affect the appreciation of the S&P 500® Index. General economic conditions and earnings results of the companies whose common stocks comprise the S&P 500® Index and real or anticipated changes in those conditions or results, as well as legislative, regulatory and other changes affecting those companies, may affect the value of the S&P 500® Index and the market value of the Securities;

S-8

The time remaining to the maturity of the Securities. The less time there is remaining until maturity, the greater the effect the then-current level of the S&P 500® Index will have on the value of the Securities;

The dividend rate on the stocks underlying the S&P 500® Index. If the dividend yields on the stocks underlying the S&P 500® Index increase, the value of the Securities may be adversely affected because the S&P 500® Index does not incorporate the value of dividend payments. Conversely, if dividend yields on the stocks decrease, the value of the Securities may be favorably affected; and

Credit Suisse First Boston (USA), Inc.'s creditworthiness. Actual or anticipated changes in our credit ratings, financial condition or results of operations may affect the value of the Securities.

Some or all of these factors may influence the price that holders will receive if they sell their Securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

Historical performance of the S&P 500® Index is not indicative of future performance

The future performance of the S&P 500® Index cannot be predicted based on its historical performance. We cannot guarantee that the level of the S&P 500® Index will increase or that you will not receive at maturity an amount substantially less than the amount you invested in the Securities.

Adjustments to the S&P 500® Index could adversely affect the Securities

S&P is responsible for calculating and maintaining the S&P 500® Index. S&P can add, delete or substitute the stocks underlying the S&P 500® Index or make other methodological changes that could change the value of the S&P 500® Index at any time. S&P may discontinue or suspend calculation or dissemination of the S&P 500® Index. If one or more of these events occurs, the calculation of the redemption amount at maturity will be adjusted to reflect such event or events, and any of these events could adversely affect the redemption amount at maturity and/or the market value of the Securities. Please refer to "Description of the Securities—Adjustments to the Calculation of the S&P 500® Index".

There may be potential conflicts of interest

We, Credit Suisse First Boston LLC and/or any other affiliate may from time to time buy or sell stocks underlying the S&P 500® Index or derivative instruments related to the S&P 500® Index for our or their own accounts in connection with our or their normal business practices. Although we do not expect them to, these transactions could affect the price of such stocks or the value of the S&P 500® Index, and thus affect the market price of the Securities. See "Use of Proceeds and Hedging".

In addition, because Credit Suisse First Boston International, which is initially acting as the calculation agent for the Securities, is an affiliate of ours, potential conflicts of interest may exist between the calculation agent and you, including with respect to certain determinations and judgments that the calculation agent must make in determining amounts due to you.

Finally, we and our affiliates may, now or in the future, engage in business with the issuers of the stocks underlying the S&P 500® Index, including providing advisory services. These services could include investment banking and mergers and acquisitions advisory services. These activities could present a conflict of interest between us or our affiliates and you. We or our affiliates have also published and expect to continue to publish research reports regarding some or all of the issuers of the stocks comprising the S&P 500® Index. This research is modified periodically without notice and may express opinions or provide recommendations that may affect the market price of the stocks comprising the S&P 500® Index and/or the level of the S&P 500® Index and, consequently, the market price of the Securities.

S-9

A market disruption event may postpone the calculation of the final level of the S&P 500® Index or the maturity date

If the calculation agent determines that on the valuation date for the Final Index Level a market disruption event exists, then such valuation date will be postponed to the first succeeding index business day on which the calculation agent determines that no market disruption event exists, unless the calculation agent determines that a market disruption event exists on each of the five index business days immediately following the valuation date. In that case, the fifth index business day after the original valuation date will be deemed to be the valuation date for the Final Index Level, notwithstanding the existence of a market disruption event, and the calculation agent will determine the closing level of the S&P 500® Index on that fifth succeeding index business day.

In the event that a market disruption event exists on the valuation date for the Final Index Level, the maturity date of the Securities will be the later of November 26, 2008 and the third index business day following the day on which the Final Index Level is calculated. Consequently, the existence of a market disruption event could result in a postponement of the maturity date, but no interest or other payment will be payable because of such postponement.

Please refer to "Description of the Securities—Maturity Date" on page S-17 and "—Market Disruption Events" on page S-19.

S-10

CREDIT SUISSE FIRST BOSTON (USA), INC.

We are a leading integrated investment bank serving institutional, corporate, government and high-net-worth individual clients. We are the product of a business combination. On November 3, 2000, Credit Suisse Group, or CSG, acquired Donaldson, Lufkin & Jenrette, Inc., or DLJ. CSG is a global financial services company providing a broad range of products and services that include securities underwriting, sales and trading, investment banking, financial advisory services, private equity investments, full service brokerage services, derivatives and risk management products and research. Credit Suisse First Boston Corporation (now called Credit Suisse First Boston LLC), CSG's principal U.S. registered broker-dealer subsidiary, became a subsidiary of DLJ, and DLJ changed its name to Credit Suisse First Boston (USA), Inc. We are now part of the Credit Suisse First Boston business unit, or CSFB, of CSG.

For further information about our company, we refer you to the accompanying prospectus and the documents referred to under "Incorporation by Reference" on page S-35 of this prospectus supplement and "Where You Can Find More Information" on page 2 of the accompanying prospectus.

S-11

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratios of earnings to fixed charges for the periods indicated.

| |

| | Year Ended December 31,

|

|---|

| | Nine Months Ended

September 30, 2003

|

|---|

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| Ratio of earnings to fixed charges(1) | | 1.14 | | 0.91 | (2) | 0.96 | (3) | 0.73 | (4) | 1.18 | | 1.13 |

- (1)

- For the purpose of calculating the ratio of earnings to fixed charges, (a) earnings consist of income before the provision for income taxes and fixed charges and (b) fixed charges consist of interest expenses and one-third of rental expense, which is deemed representative of an interest factor.

- (2)

- The dollar amount of the deficiency in the ratio of earnings to fixed charges was $471 million for the year ended December 31, 2002.

- (3)

- The dollar amount of the deficiency in the ratio of earnings to fixed charges was $360 million for the year ended December 31, 2001.

- (4)

- The dollar amount of the deficiency in the ratio of earnings to fixed charges was $1.8 billion for the year ended December 31, 2000.

S-12

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

We are providing or incorporating by reference in this prospectus supplement selected historical financial information of Credit Suisse First Boston (USA), Inc. We derived this information from the consolidated financial statements of Credit Suisse First Boston (USA), Inc. for each of the periods presented. The information is only a summary and should be read together with the detailed information and financial statements included in the documents referred to under "Incorporation by Reference" on page S-35 of this prospectus supplement and "Where You Can Find More Information" on page 2 of the accompanying prospectus.

Our interim consolidated statement of operations data and statement of financial condition data as of and for the nine months ended September 30, 2003 and 2002 are unaudited and include, in our opinion, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results for the unaudited periods. You should not rely on interim results as being indicative of results we may expect for the full year.

| | As of and for the nine

months ended September 30,

| | As of and for the year ended December 31,

|

|---|

| | 2003

| | 2002

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

|---|

| | (unaudited)

| | (in millions)

|

|---|

| Selected Consolidated Statement of Operations Data(1)(2)(3): | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | |

| Total net revenues | | $ | 3,744 | | $ | 4,245 | | $ | 5,739 | | $ | 6,531 | | $ | 4,768 | | $ | 4,561 | | $ | 3,273 |

| Total expenses | | | 3,271 | | | 3,839 | | | 5,430 | | | 6,886 | | | 6,636 | | | 3,821 | | | 2,794 |

| Income (loss) from continuing operations before provision (benefit) for income taxes, discontinued operations, extraordinary items and cumulative effect of a change in accounting principle(2) | | | 473 | | | 406 | | | 309 | | | (355 | ) | | (1,868 | ) | | 740 | | | 479 |

| Net income (loss) | | | 1,220 | (4) | | 329 | | | 261 | | | (144 | ) | | (1,076 | ) | | 601 | | | 371 |

| | |

| |

| |

| |

| |

| |

| |

|

Selected Consolidated Statement of Financial Condition Data(1)(2)(3): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets | | $ | 240,989 | | $ | 234,525 | | $ | 236,385 | | $ | 217,386 | | $ | 212,219 | | $ | 109,012 | | $ | 72,226 |

| Long-term borrowings | | | 24,016 | | | 23,521 | | | 23,094 | | | 15,663 | | | 11,258 | | | 5,160 | | | 3,482 |

| Redeemable trust securities | | | — | | | — | | | — | | | — | | | 200 | | | 200 | | | 200 |

| Total stockholders' equity | | | 9,271 | | | 8,030 | | | 7,717 | | | 6,888 | | | 6,506 | | | 3,907 | | | 2,928 |

- (1)

- We are part of CSFB, but our results do not reflect the overall performance of CSFB or CSG. The consolidated statement of operations data and consolidated statement of financial condition data as of and for the years ended December 31, 1999 and 1998 represent the data of DLJ. The consolidated statement of operations data for the year ended December 31, 2000 represent the results of operations of only DLJ for the period from January 1, 2000 to November 2, 2000 and both DLJ and Credit Suisse First Boston LLC for the period from November 3, 2000 to December 31, 2000. The consolidated statement of operations data for the nine months ended September 30, 2003 and 2002 and for the years ended December 31, 2002 and 2001 represent the results of operations of both DLJ and Credit Suisse First Boston LLC. The consolidated statement of financial condition data as of September 30, 2003 and 2002 and as of December 31, 2002, 2001 and 2000 represent the data of both DLJ and Credit Suisse First Boston LLC. Due to the inclusion of Credit Suisse First Boston LLC data from November 3, 2000 through September 30, 2003, our financial statements may not be fully comparable with prior periods.

Prior year numbers have been changed to conform to current year presentation.

S-13

- (2)

- On May 1, 2003, we sold Pershing to The Bank of New York Company, Inc. and reported a pre-tax gain of approximately $1.3 billion and an after-tax gain of $852 million in the second quarter of 2003. We have presented the assets and liabilities of Pershing as of December 31, 2002 as "Assets held for sale" and "Liabilities held for sale" in our consolidated statements of financial condition. The operating results of Pershing, including the gain on the sale, have been presented as "Discontinued operations" for all periods presented in the consolidated statements of income. As a result, the selected consolidated financial information may not be fully comparable between periods.

- (3)

- Commencing in the first quarter of 2003, the transfer of Credit Suisse First Boston Management LLC, or Management LLC, is accounted for at historical cost in a manner similar to pooling-of-interest accounting because Management LLC and we were under the common control of Credit Suisse First Boston, Inc., an indirect wholly owned subsidiary of CSG, at the time of the transfer. The consolidated statement of income data for the nine months ended September 30, 2003 and 2002 include the results of operations of Management LLC. Such results of operations are not reflected in any other period. The consolidated statement of financial condition data as of September 30, 2003 include the financial position of Management LLC. The financial position of Management LLC is not reflected in any other period.

- (4)

- Net income (loss) includes the after-tax gain of $852 million from the sale of Pershing on May 1, 2003, which gain is included in discontinued operations.

S-14

USE OF PROCEEDS AND HEDGING

The net proceeds from this offering will be $9,998,000, after deducting certain offering expenses. The underwriting discounts and commissions will be paid on our behalf by Credit Suisse First Boston International, an affiliate of ours, and will not be deducted from the gross proceeds of this offering. See "Underwriting" on page S-32. We intend to use the net proceeds for our general corporate purposes, which may include the rationalization of our debt capital structure and hedging our obligations under the Securities.

One or more of our affiliates before and following the issuance of the Securities may acquire or dispose of listed or over-the-counter options contracts in, or other derivatives or synthetic instruments related to, the S&P 500® Index to hedge our obligations under the Securities. In the course of pursuing such a hedging strategy, the price at which such positions may be acquired or disposed of may be a factor affecting the level of the S&P 500® Index. Although we and our affiliates have no reason to believe that our hedging activities will have a material impact on the level of the S&P 500® Index, we cannot assure you that the price will not be affected.

From time to time after issuance and prior to the maturity of the Securities, depending on market conditions (including the level of the S&P 500® Index), in connection with hedging certain of the risks associated with the Securities, we expect that one or more of our affiliates will increase or decrease their initial hedging positions using dynamic hedging techniques and may take long or short positions in listed or over-the-counter options contracts in, or other derivative or synthetic instruments related to, the S&P 500® Index. In addition, we or one or more of our affiliates may take positions in other types of appropriate financial instruments that may become available in the future. To the extent that we or one or more of our affiliates have a long hedge position in options contracts in, or other derivative or synthetic instruments related to, the S&P 500® Index, we or one or more of our affiliates may liquidate a portion of those holdings at or about the time of the maturity of the Securities. Depending, among other things, on future market conditions, the aggregate amount and the composition of such positions are likely to vary over time. Our or our affiliates' hedging activities will not be limited to any particular securities exchange or market.

S-15

CAPITALIZATION

The table below shows our consolidated capitalization as of September 30, 2003. The "As Adjusted" column reflects the issuance of the Securities in this offering. Except as disclosed in this prospectus supplement, there has been no material change in our capitalization since September 30, 2003. You should read this table along with our consolidated financial statements, which are included in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | As of September 30, 2003

| |

|---|

| | Actual(1)

| | As Adjusted

| |

|---|

| | (in millions)

| |

|---|

| Debt: | | | | | | | |

| Commercial paper and short-term borrowings | | $ | 15,207 | | $ | 15,207 | |

| | |

| |

| |

| Long-term borrowings(1)(2) | | | 24,016 | | | 24,026 | |

| | |

| |

| |

| | Total long-term debt | | | 24,016 | | | 24,026 | |

| | |

| |

| |

| Stockholders' Equity: | | | | | | | |

| | Common Stock $.10 par value (50,000 shares authorized; 1,100 shares issued and outstanding)(3) | | | — | | | — | |

| | Paid-in capital | | | 7,604 | | | 7,604 | |

| | Retained earnings | | | 1,824 | | | 1,824 | |

| | Accumulated other comprehensive income (loss) | | | (157 | ) | | (157 | ) |

| | |

| |

| |

| | | Total stockholders' equity | | | 9,271 | | | 9,271 | |

| | |

| |

| |

| | | | Total capitalization(2) | | $ | 48,494 | | $ | 48,504 | |

| | |

| |

| |

- (1)

- Includes current portion of long-term borrowings of $2.1 billion.

- (2)

- Does not include $15,500,000 aggregate principal amount of our Five-Year Contingent Protection Securities due September 30, 2008 issued on October 6, 2003 or $1,000,000,000 aggregate principal amount of our 37/8% Notes due January 15, 2009 to be issued on or about November 24, 2003.

- (3)

- All of such shares are owned by Credit Suisse First Boston, Inc., an indirect wholly owned subsidiary of CSG.

S-16

DESCRIPTION OF THE SECURITIES

This description of the terms of the Securities adds information to the description of the general terms and provisions of debt securities in the accompanying prospectus. If this description differs in any way from the description in the accompanying prospectus, you should rely on this description.

General

We will issue the Securities under an indenture, dated as of June 1, 2001, between us and JPMorgan Chase Bank, as trustee. The indenture is more fully described in the accompanying prospectus under "Description of Debt Securities" on page 5 of the accompanying prospectus.

The Securities are being issued in an aggregate principal amount of $10,000,000, and will mature on November 26, 2008. The Securities will be issued in the form of one or more fully registered global securities in denominations of $1,000 or integral multiples of $1,000.

The Securities will be our unsecured obligations and will rank prior to all of our subordinated indebtedness and on an equal basis with all of our other senior unsecured indebtedness.

You will receive a redemption amount in cash at maturity that will equal the amount you invested in the Securities multiplied by the sum of 1 plus the index return. If at all times during the term of the Securities the level of the S&P 500® Index remains above the Loss of Protection Trigger, which is equal to 60.0% of the Initial Index Level, the index return will equal the greater of zero and any percentage increase in the level of the S&P 500® Index. In this case, you will participate in any appreciation in the S&P 500® Index over the term of the Securities and will receive at least your Investment Amount at maturity. If at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, the index return will equal the actual percentage increase or decrease in the level of the S&P 500® Index. In this case, you will participate in any appreciation or depreciation in the level of the S&P 500® Index, you will no longer be assured of receiving at least your Investment Amount at maturity, and you could receive zero. This would be the case if at any time during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, even if it later exceeds that trigger or is above the Loss of Protection Trigger at maturity. The Initial Index Level is 1033.65, which is the closing level of the S&P 500® Index on November 20, 2003. The Loss of Protection Trigger expressed numerically is 620.19.

We may, without your consent, increase the outstanding principal amount of the Securities in the future, on the same terms and conditions and with the same CUSIP number as the Securities being offered hereby, as more fully described in "—Further Issues" below.

The Securities have been approved for listing on the American Stock Exchange, subject to official notice of issuance, under the symbol "IPJ.B".

Interest

We will not pay you interest or other amounts during the term of the Securities.

Redemption at the Option of the Holder; Defeasance

The Securities are not subject to redemption at the option of any holder prior to maturity and are not subject to the defeasance provisions described in the accompanying prospectus under "Description of Debt Securities—Defeasance".

Maturity Date

The maturity date of the Securities is November 26, 2008; however, if a market disruption event exists on the valuation date for the Final Index Level, as determined by the calculation agent, the

S-17

maturity date will be the later of November 26, 2008 and the third index business day following the day on which the Final Index Level is calculated. Please refer to "—Market Disruption Events" below. No interest or other payment will be payable because of any postponement of the maturity date.

Redemption at Maturity

Unless previously redeemed, or purchased by us and cancelled, each Security will be redeemed on the maturity date at the cash redemption amount described below.

Redemption Amount

We will redeem the Securities at maturity for a redemption amount in cash that will equal your Investment Amount multiplied by the sum of 1 plus the index return.

The index return is based on the difference between the Final Index Level and the Initial Index Level, expressed as a percentage. How the index return will be calculated depends on whether the S&P 500® Index remains above the Loss of Protection Trigger for the term of the Securities:

- •

- If at all times during the term of the Securities the level of the S&P 500® Index remains above the Loss of Protection Trigger, the index return will be the greater of:

| (a) | | | | Zero; and |

| | | | | | | | | |

| (b) | | | | [ | | Final Index Level—Initial Index Level

Initial Index Level | | ] |

Thus, in the event that the level of the S&P 500® Index remains above the Loss of Protection Trigger for the term of the Securities, the redemption amount will equal at least your Investment Amount.

- •

- If on any day during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, the index return will be:

| | | | | [ | | Final Index Level—Initial Index Level

Initial Index Level | | ] |

Therefore, if on any day during the term of the Securities the level of the S&P 500® Index falls to or below the Loss of Protection Trigger, whether or not it subsequently increases above that trigger, the index return will be the actual percentage change in the level of the S&P 500® Index, which may be negative.

The Initial Index Level is 1033.65. The Final Index Level will equal the closing level of the S&P 500® Index on November 20, 2008 or, if such day is not an index business day, the first following day that is an index business day, subject to the provisions described in "—Market Disruption Events" below.

The closing level of the S&P 500® Index will, on any index business day, be the level of the S&P 500® Index determined by the calculation agent at the valuation time, which is the time at which S&P calculates the closing level of the S&P 500® Index on such index business day, as calculated and published by S&P, subject to the provisions described under "—Adjustments to the Calculation of the S&P 500® Index" below.

An index business day is any day that is (or, but for the occurrence of a market disruption event, would have been) a trading day on The Nasdaq Stock Market, the New York Stock Exchange, the American Stock Exchange, the Chicago Mercantile Exchange and the Chicago Board Options

S-18

Exchange, other than a day on which one or more of these exchanges is scheduled to close prior to its regular weekday closing time.

A market disruption event is, in respect of the S&P 500® Index, the occurrence or existence on any index business day during the one-half hour period that ends at the relevant valuation time, of any suspension of or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) on (a) The Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange in securities that comprise 21% or more of the level of the S&P 500® Index based on a comparison of (1) the portion of the level of the S&P 500® Index attributable to each security in which trading is, in the determination of the calculation agent, materially suspended or materially limited relative to (2) the overall level of the S&P 500® Index, in the case of (1) or (2) immediately before that suspension or limitation; (b) the Chicago Mercantile Exchange and/or the Chicago Board Options Exchange in options contracts on the S&P 500® Index; or (c) the Chicago Mercantile Exchange and/or the Chicago Board Options Exchange in futures contracts on the S&P 500® Index; in the case of (a), (b) or (c) if, in our determination, such suspension or limitation is material.

Market Disruption Events

If the calculation agent determines that on the valuation date for the Final Index Level a market disruption event exists, then such valuation date will be postponed to the first succeeding index business day on which the calculation agent determines that no market disruption event exists, unless the calculation agent determines that a market disruption event exists on each of the five index business days immediately following the valuation date. In that case, (a) the fifth succeeding index business day after the original valuation date will be deemed to be the valuation date, notwithstanding the market disruption event, and (b) the calculation agent will determine the Final Index Level on the deemed valuation date in accordance with the formula for and method of calculating the S&P 500® Index last in effect prior to the commencement of the market disruption event using exchange traded prices on The Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange (as determined by the calculation agent in its sole and absolute discretion) or, if trading in any security or securities comprising the S&P 500® Index has been materially suspended or materially limited, its good faith estimate of the prices that would have prevailed on The Nasdaq Stock Market, the New York Stock Exchange and/or the American Stock Exchange (as determined by the calculation agent in its sole and absolute discretion) but for the suspension or limitation, as of the valuation time on the deemed valuation date, of each such security comprising the S&P 500® Index (subject to the provisions described under "—Adjustments to the Calculation of the S&P 500® Index" below).

In the event that a market disruption event exists on the valuation date for the Final Index Level, the maturity date of the Securities will be the later of November 26, 2008 and the third index business day following the day on which the Final Index Level is calculated. No interest or other payment will be payable because of any such postponement of the maturity date.

Adjustments to the Calculation of the S&P 500® Index

If the S&P 500® Index is (a) not calculated and announced by S&P but is calculated and announced by a successor acceptable to the calculation agent or (b) replaced by a successor index using, in the determination of the calculation agent, the same or a substantially similar formula for and method of calculation as used in the calculation of the S&P 500® Index, then the S&P 500® Index will be deemed to be the index so calculated and announced by that successor sponsor or that successor index, as the case may be.

S-19

Upon any selection by the calculation agent of a successor index, the calculation agent will cause notice to be furnished to us and the trustee, which will provide notice (as described in "—Notices" below) of the selection of the successor index to the registered holders of the Securities.

If (x) on or prior to the valuation date for the Final Index Level, S&P makes, in the determination of the calculation agent, a material change in the formula for or the method of calculating the S&P 500® Index or in any other way materially modifies the S&P 500® Index (other than a modification prescribed in that formula or method to maintain the S&P 500® Index in the event of changes in constituent stocks and capitalization and other routine events) or (y) on such valuation date S&P (or a successor sponsor) fails to calculate and announce the S&P 500® Index, then the calculation agent will calculate the redemption amount using, in lieu of a published level for the S&P 500® Index, the closing level for the S&P 500® Index as at the valuation time on the valuation date as determined by the calculation agent in accordance with the formula for and method of calculating the S&P 500® Index last in effect prior to that change or failure, but using only those securities that comprised the S&P 500® Index immediately prior to that change or failure. Notice of adjustment of the S&P 500® Index will be provided as described in "—Notices" below.

All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will be conclusive for all purposes and binding on us and the beneficial owners of the Securities, absent manifest error.

Purchases

We may at any time purchase any Securities, which may, in our sole discretion, be held, sold or cancelled.

Cancellation

Upon (i) the purchase and surrender for cancellation of any Securities by us or (ii) the redemption of any Securities, such Securities will be cancelled by the trustee.

Events of Default and Acceleration

In case an event of default (as defined in the accompanying prospectus) with respect to any Securities shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the Securities (in accordance with the acceleration provisions set forth in the accompanying prospectus) will be determined by the calculation agent and will equal, for each Security, the redemption amount calculated as if the valuation date for the Final Index Level was the date of acceleration.

Book-Entry, Delivery and Form

We will issue the Securities in the form of one or more fully registered global securities, or the global securities, in denominations of $1,000 or integral multiples of $1,000. We will deposit the Securities with, or on behalf of, The Depository Trust Company, New York, New York, or DTC, as the depositary, and will register the Securities in the name of Cede & Co., DTC's nominee. Your beneficial interests in the global securities will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. You may elect to hold interests in the global securities through either DTC (in the United States) or Clearstream Banking, société anonyme, which we refer to as Clearstream, Luxembourg, or Euroclear Bank, S.A./N.V., or its successor, as operator of the Euroclear System, which we refer to as Euroclear, (outside of the United States) if you are participants of such systems, or indirectly through organizations which are participants in such systems. Interests held through Clearstream, Luxembourg and Euroclear will be recorded on DTC's books as being held by the U.S. depositary for each of Clearstream, Luxembourg

S-20

and Euroclear, which U.S. depositaries will in turn hold interests on behalf of their participants' customers' securities accounts. Except as set forth below, the global securities may be transferred, in whole and not in part, only to another nominee of DTC or to a successor of DTC or its nominee.

As long as the Securities are represented by global securities, we will pay the redemption amount of the Securities to or as directed by DTC as the registered holder of the global securities. Payments to DTC will be in immediately available funds by wire transfer. DTC, Clearstream, Luxembourg or Euroclear, as applicable, will credit the relevant accounts of their participants on the applicable date. We have been advised by DTC, Clearstream, Luxembourg and Euroclear, respectively, as follows:

- •

- As to DTC: DTC has advised us that it is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. DTC holds securities deposited with it by its participants and facilitates the settlement of transactions among its participants in such securities through electronic computerized book-entry changes in accounts of the participants, thereby eliminating the need for physical movement of securities certificates. DTC's participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations, some of whom (and/or their representatives) own DTC. Access to DTC's book-entry system is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a participant, either directly or indirectly.

According to DTC, the foregoing information with respect to DTC has been provided to the financial community for informational purposes only and is not intended to serve as a representation, warranty or contract modification of any kind.

- •

- As to Clearstream, Luxembourg: Clearstream, Luxembourg has advised us that it was incorporated as a limited liability company under Luxembourg law. Clearstream, Luxembourg is owned by Cedel International, société anonyme, and Deutsche Börse AG. The shareholders of these two entities are banks, securities dealers and financial institutions.

Clearstream, Luxembourg holds securities for its customers and facilitates the clearance and settlement of securities transactions between Clearstream, Luxembourg customers through electronic book-entry changes in accounts of Clearstream, Luxembourg customers, thus eliminating the need for physical movement of certificates. Transactions may be settled by Clearstream, Luxembourg in many currencies, including United States dollars. Clearstream, Luxembourg provides to its customers, among other things, services for safekeeping, administration, clearance and settlement of internationally traded securities, securities lending and borrowing. Clearstream, Luxembourg also deals with domestic securities markets in over 30 countries through established depositary and custodial relationships. Clearstream, Luxembourg interfaces with domestic markets in a number of countries. Clearstream, Luxembourg has established an electronic bridge with Euroclear Bank S.A./N.V., the operator of Euroclear, or the Euroclear operator, to facilitate settlement of trades between Clearstream, Luxembourg and Euroclear.

As a registered bank in Luxembourg, Clearstream, Luxembourg is subject to regulation by the Luxembourg Commission for the Supervision of the Financial Sector. Clearstream, Luxembourg customers are recognized financial institutions around the world, including underwriters, securities brokers and dealers, banks, trust companies and clearing corporations. In the United States, Clearstream, Luxembourg customers are limited to securities brokers and dealers and banks, and may include the underwriter for the Securities. Other institutions that maintain a custodial relationship with a Clearstream, Luxembourg customer may obtain indirect access to Clearstream, Luxembourg. Clearstream, Luxembourg is an indirect participant in DTC.

S-21

The redemption amount of the Securities held beneficially through Clearstream, Luxembourg will be credited to cash accounts of Clearstream, Luxembourg customers in accordance with its rules and procedures, to the extent received by Clearstream, Luxembourg from DTC.

- •

- As to Euroclear: Euroclear has advised us that it was created in 1968 to hold securities for participants of Euroclear and to clear and settle transactions between Euroclear participants through simultaneous electronic book-entry delivery against payment, thus eliminating the need for physical movement of certificates and risk from lack of simultaneous transfers of securities and cash. Transactions may now be settled in many currencies, including United States dollars and Japanese yen. Euroclear provides various other services, including securities lending and borrowing and interfaces with domestic markets in several countries generally similar to the arrangements for cross-market transfers with DTC described below.

Euroclear is operated by the Euroclear operator, under contract with Euroclear plc, a U.K. corporation. The Euroclear operator conducts all operations, and all Euroclear securities clearance accounts and Euroclear cash accounts are accounts with the Euroclear operator, not Euroclear plc. Euroclear plc establishes policy for Euroclear on behalf of Euroclear participants. Euroclear participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries and may include the underwriter for the Securities. Indirect access to Euroclear is also available to other firms that clear through or maintain a custodial relationship with a Euroclear participant, either directly or indirectly. Euroclear is an indirect participant in DTC. The Euroclear operator is a Belgian bank. The Belgian Banking Commission and the National Bank of Belgium regulate and examine the Euroclear operator.

The Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of the Euroclear System, or the Euroclear Terms and Conditions, and applicable Belgian law govern securities clearance accounts and cash accounts with the Euroclear operator. Specifically, these terms and conditions govern:

- •

- transfers of securities and cash within Euroclear;

- •

- withdrawal of securities and cash from Euroclear; and

- •

- receipt of payments with respect to securities in Euroclear.

All securities in Euroclear are held on a fungible basis without attribution of specific certificates to specific securities clearance accounts. The Euroclear operator acts under the terms and conditions only on behalf of Euroclear participants and has no record of or relationship with persons holding securities through Euroclear participants.

The redemption amount of the Securities held beneficially through Euroclear will be credited to the cash accounts of Euroclear participants in accordance with the Euroclear Terms and Conditions, to the extent received by the Euroclear operator from DTC.

Global Clearance and Settlement Procedures

You will be required to make your initial payment for the Securities in immediately available funds. Secondary market trading between DTC participants will occur in the ordinary way in accordance with DTC rules and will be settled in immediately available funds using DTC's Same-Day Funds Settlement System. Secondary market trading between Clearstream, Luxembourg customers and/or Euroclear participants will occur in the ordinary way in accordance with the applicable rules and operating procedures of Clearstream, Luxembourg and Euroclear and will be settled using the procedures applicable to conventional eurobonds in immediately available funds.

Cross-market transfers between persons holding directly or indirectly through DTC, on the one hand, and directly or indirectly through Clearstream, Luxembourg customers or Euroclear participants,

S-22

on the other, will be effected in DTC in accordance with DTC rules on behalf of the relevant European international clearing system by DTC; however, such cross-market transactions will require delivery of instructions to the relevant European international clearing system by the counterparty in such system in accordance with its rules and procedures and within its established deadlines (based on European time). The relevant European international clearing system will, if the transaction meets its settlement requirements, deliver instructions to DTC to take action to effect final settlement on its behalf by delivering or receiving securities in DTC, and make or receive payment in accordance with normal procedures for same-day funds settlement applicable to DTC. Clearstream, Luxembourg customers and Euroclear participants may not deliver instructions directly to their respective U.S. depositaries.

Because of time-zone differences, credits of securities received in Clearstream, Luxembourg or Euroclear as a result of a transaction with a DTC participant will be made during subsequent securities settlement processing and dated the business day following the DTC settlement date. Such credits or any transactions in such securities settled during such processing will be reported to the relevant Clearstream, Luxembourg customers or Euroclear participants on such business day. Cash received in Clearstream, Luxembourg or Euroclear as a result of sales of securities by or through a Clearstream, Luxembourg customer or a Euroclear participant to a DTC participant will be received with value on the DTC settlement date but will be available in the relevant Clearstream, Luxembourg or Euroclear cash account only as of the business day following settlement in DTC.

Although DTC, Clearstream, Luxembourg and Euroclear have agreed to the foregoing procedures in order to facilitate transfers of securities among participants of DTC, Clearstream, Luxembourg and Euroclear, they are under no obligation to perform or continue to perform such procedures and such procedures may be discontinued at any time.

Definitive Securities

If any of the events described under the last paragraph of "Description of Debt Securities—Book-Entry System" on page 6 of the accompanying prospectus occurs, we will issue a certificated form of definitive securities in an amount equal to a holder's beneficial interest in the Securities. Definitive securities will be issued in denominations of $1,000 or integral multiples of $1,000, and will be registered in the name of the person DTC specifies in a written instruction to the registrar of the Securities.

In the event definitive securities are issued:

- •

- holders of definitive securities will be able to receive the redemption amount on their Securities at the office of our paying agent maintained in the Borough of Manhattan;

- •

- holders of definitive securities will be able to transfer their Securities, in whole or in part, by surrendering the Securities, with a duly completed form of transfer, for registration of transfer at the office of our transfer agent, JPMorgan Chase Bank. We will not charge any fee for the registration of transfer or exchange, except that we may require the payment of a sum sufficient to cover any applicable tax or other governmental charge payable in connection with the transfer; and

- •

- any moneys we pay to our paying agent for the payment of the redemption amount on the Securities which remain unclaimed at the second anniversary of the date such payment was due will be returned to us, and thereafter holders of definitive securities may look only to us, as general unsecured creditors, for payment.

S-23

Calculation Agent

The calculation agent is Credit Suisse First Boston International, an affiliate of ours. The calculations and determinations of the calculation agent will be final and binding upon all parties (except in the case of manifest error). The calculation agent will have no responsibility for good faith errors or omissions in its calculations and determinations, whether caused by negligence or otherwise. The calculation agent will not act as your agent. You will not be entitled to make any claim against us and/or the calculation agent in the case where S&P or the distributor of the S&P 500® Index will have made any error, omission or other incorrect statement in connection with the calculation and public announcement of the S&P 500® Index. Because the calculation agent is an affiliate of ours, potential conflicts of interest may exist between you and the calculation agent. Please refer to "Risk Factors—There may be potential conflicts of interest".

Further Issues

We may from time to time, without notice to or the consent of the registered holders of the Securities, create and issue further securities ranking on an equal basis with the Securities being offered hereby in all respects. Such further securities will be consolidated and form a single series with the Securities being offered hereby and will have the same terms as to status, redemption or otherwise as the Securities being offered hereby.

Notices

Notices to holders of the Securities will be made by first class mail, postage prepaid, to the registered holders.

Governing Law

The indenture and the Securities will be governed by and construed in accordance with the laws of the State of New York.

S-24

THE S&P 500® INDEX

Unless otherwise stated, all information regarding the S&P 500® Index provided in this prospectus supplement is derived from S&P or other publicly available sources. Such information reflects the policies of S&P as stated in such sources, and such policies are subject to change by S&P. We do not assume any responsibility for the accuracy or completeness of such information. S&P is under no obligation to continue to publish the S&P 500® Index and may discontinue publication of the S&P 500® Index at any time.

The S&P 500® Index is intended to provide an indication of the pattern of common stock price movement. The value of the S&P 500® Index is calculated using a base-weighted aggregate methodology. This means that the level of the S&P 500® Index reflects the total market value of all 500 component stocks relative to a particular base period. The total market value of a company is determined by multiplying the price of its stock by the number of shares outstanding. The amount of dividends or other distributions paid on a company's stock is not taken into account in calculating the S&P 500® Index. Please refer to "—Calculation of the S&P 500® Index" below.

As of November 20, 2003, the major industry groups covered in the S&P 500® Index (listed according to their respective capitalization in the S&P 500® Index) were as follows: Financials (20.7%), Information Technology (17.8%), Health Care (13.7%), Consumer Staples (11.5%) and Consumer Discretionary (11.3%). S&P selects companies for inclusion in the S&P 500® Index with the goal of achieving a distribution by broad industry category that approximates the distribution of these categories over an assumed model of the total equity market. Relevant selection criteria include the viability of the company, the extent to which the company represents its assigned industry category, the extent to which the market price of the company's stock is responsive to changes in the affairs of the relevant industry and the market value and trading activity of the stock of the company.

The securities included in the S&P 500® Index are evaluated on an annual basis. However, the composition of the S&P 500® Index is examined quarterly and such examination may result in changes in the stocks comprising the S&P 500® Index. Changes in the stocks comprising the S&P 500® Index may also occur from time to time when, for example, S&P determines that a company or companies included in the S&P 500® Index are involved in mergers, acquisitions or restructurings such that they no longer meet the criteria for inclusion.

Calculation of the S&P 500® Index

S&P currently computes the S&P 500® Index as of a set time as follows:

- •

- the product of the market price per share and the number of then outstanding shares of each component stock is determined at that time (which we refer to as the market value of that stock);

- •

- the market values of all component stocks are then aggregated;

- •

- the mean average of the market values as of each week in the base period of the years 1941 through 1943 of the common stock of each company in a group of 500 substantially similar companies is determined;

- •

- the mean average market values of all these common stocks over the base period are aggregated (the aggregate amount being referred to as the base value);

- •

- the current aggregate market value of all component stocks is divided by the base value; and

- •

- the resulting quotient, expressed in decimals, is multiplied by ten.

S-25

While S&P currently employs the above methodology to calculate the S&P 500® Index, we cannot assure you that S&P will not modify or change this methodology in a manner that may affect the redemption amount at maturity to beneficial owners of the Securities.

S&P adjusts the foregoing formula to offset the effects of changes in the market value of a component stock that are determined by S&P to be arbitrary or not due to true market fluctuations. These changes may result from causes such as:

- •

- the issuance of stock dividends;

- •

- the granting to shareholders of rights to purchase additional shares of stock;

- •

- the purchase of shares by employees pursuant to employee benefit plans;

- •

- consolidations and acquisitions;

- •

- the granting to shareholders of rights to purchase other securities of the issuer;

- •

- the substitution by S&P of particular component stocks in the S&P 500® Index; or

- •