QuickLinks -- Click here to rapidly navigate through this documentAs Filed Pursuant to Rule 424(b)2

Registration No. 333-131970

The information in this pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these securities and we are not solicitiing an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED FEBRUARY 6, 2007

PRICING SUPPLEMENT TO PRODUCT SUPPLEMENT DATED DECEMBER 5, 2006 TO

PROSPECTUS SUPPLEMENT DATED SEPTEMBER 6, 2006 TO PROSPECTUS DATED FEBRUARY 21, 2006

$

Credit Suisse (USA), Inc.

ProNotes®

due November 30, 2011

Linked to the Value of a Global Basket of Indices

2007—ProNotes—1

| Issuer: | | Credit Suisse (USA), Inc. |

Maturity Date: |

|

November 30, 2011, subject to postponement if a market disruption event occurs on a valuation date. |

Coupon: |

|

We will not pay interest on the securities being offered by this pricing supplement. |

Valuation Dates: |

|

The valuation dates are the 23rd day of each month from and including August 23, 2011 through and including November 23, 2011, which will be the final valuation date, subject to a postponement if a market disruption event occurs on a valuation date. |

Underlying Indices: |

|

The return will be based on the performance of a basket of indices during the term of the securities. The basket will be comprised of four reference indices, with each index having the following weightings: MSCI Singapore Free Index—25%; MSCI Taiwan Index—25%; Korea Stock Price 200 ("KOSPI 200") Index—25% and FTSE/Xinhua China 25 Index—25%. |

Redemption Amount: |

|

You will receive a redemption amount in cash at maturity that will equal the principal amount of the securities that you hold multiplied by the sum of 1 plus the basket return, calculated as set forth below. If the final basket level is greater than the initial basket level, the basket return will equal the percentage increase of the basket. If the final basket level is less than or equal to the initial basket level, the basket return will equal zero, and you will receive only an amount equal to the principal amount of your securities at maturity. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this pricing supplement or the product supplement, prospectus supplement or prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

| | Price to the Public

| | Underwriting Discounts and Commissions

| | Proceeds to the Company

|

|---|

| Per security | | $ | | | $ | | | $ | |

| Total | | $ | | | $ | | | $ | |

Delivery of the securities in book-entry form only will be made through The Depository Trust Company on or about February , 2007. The securities will be issued in minimum denominations of $10,000 and integral multiples of $1,000 in excess of that amount.

Credit Suisse

The date of this pricing supplement is February , 2007.

CALCULATION OF BASKET RETURN

The basket return is based on the difference between the final basket level and the initial basket level. How the basket return will be calculated depends on whether the final basket level is greater than or less than or equal to the initial basket level:

- •

- If the final basket level is greater than the initial basket level, then the basket return will equal:

| |

| |

|

|---|

| | | final basket level - initial basket level

initial basket level | | |

Thus, if the final basket level is greater than the initial basket level, the basket return will be a positive number, and you will receive more than the principal amount of your securities at redemption.

- •

- If the final basket level is less than or equal to the initial basket level, then the basket return will equal zero, and the redemption amount will equal the principal amount of the securities.

For purposes of calculating the basket return, the basket level on any valuation date will be equal to the sum of:

- (i)

- the product of (x) 0.25, the weighting of the MSCI Singapore Free Index in the basket, and (y) the closing level of the MSCI Singapore Free Index on that valuation date divided by , the closing level of the MSCI Singapore Free Index on , 2007, the index business day immediately following the date the securities are priced for initial sale to the public, which we refer to as the trade date;

- (ii)

- the product of (x) 0.25, the weighting of the MSCI Taiwan Index in the basket, and (y) the closing level of the MSCI Taiwan Index on that valuation date divided by , the closing level of the MSCI Taiwan Index on , 2007, the index business day immediately following the trade date;

- (iii)

- the product of (x) 0.25, the weighting of the KOSPI 200 Index in the basket, and (y) the closing level of the KOSPI 200 Index on that valuation date divided by , the closing level of the KOSPI 200 Index on , 2007, the index business day immediately following the trade date; and

- (iv)

- the product of (x) 0.25, the weighting of the FTSE/Xinhua China 25 Index in the basket, and (y) the closing level of the FTSE/Xinhua China 25 Index on that valuation date divided by , the closing level of the FTSE/Xinhua China 25 Index on , 2007, the index business day immediately following the trade date.

The "initial basket level" equals 1.0.

The "final basket level" will equal the arithmetic average of the basket levels on the valuation dates.

U-2

Examples of the hypothetical redemption amounts of the securities

The following are illustrative examples of how the redemption amount would be calculated with hypothetical final basket levels that are greater than, equal to or less than the initial basket level. Each of the examples assumes that the initial investment in the securities is $10,000 and that the initial level for each reference index is 1000. The actual final basket level will be determined on the valuation dates, as further described herein.

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. MSCI Singapore Free Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 2. MSCI Taiwan Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 3. KOSPI 200 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 4. FTSE/Xinhua China 25 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| |

|

|---|

| Basket Level | | = (.25*(final level(1)/initial level(1))) |

| | | + (.25*(final level(2)/initial level(2))) |

| | | + (.25*(final level(3)/initial level(3))) |

| | | + (.25*(final level(4)/initial level(4))) |

|

|

= ((.25*(1100/1000)) + (.25*(1100/1000)) +

(.25*(1100/1000)) + (.25*(1100/1000))) |

Basket Level on each valuation date |

|

= (.275 + .275 + .275 + .275) = 1.1 |

Final Basket Level = (1.1 + 1.1 + 1.1)/3 = 1.1 |

Basket Return = (1.1 - 1.0)/1.0) = .1 |

Determination of redemption amount when final basket level is greater than initial basket level

Redemption Amount = Principal * (1.0 + basket return)

Redemption Amount = $10,000 * (1.0 +.1)

Redemption Amount = $11,000

Payment at Maturity = $11,000

EXAMPLE 2: Decrease of 5% in closing levels of each reference index on each valuation date:

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. MSCI Singapore Free Index | | 1000 | | 950 | | 950 | | 950 |

| 2. MSCI Taiwan Index | | 1000 | | 950 | | 950 | | 950 |

| 3. KOSPI 200 Index | | 1000 | | 950 | | 950 | | 950 |

| 4. FTSE/Xinhua China 25 Index | | 1000 | | 950 | | 950 | | 950 |

U-3

| |

|

|---|

| Basket Level on each valuation date | | = (.25*(final level(1)/initial level(1))) |

| | | + (.25*(final level(2)/initial level(2))) |

| | | + (.25*(final level(3)/initial level(3))) |

| | | + (.25*(final level(4)/initial level(4))) |

|

|

= ((.25*(950/1000)) + (.25*(950/1000)) + (.25*(950/1000)) + (.25*(950/1000))) |

Basket Level |

|

= (.2375 + .2375 + .2375 + .2375) = .95 |

Final Basket Level = (.95 + .95 + .95)/3 = .95 |

Since the final basket level (.95) is less than the initial basket level (1.0), the basket return equals 0.0. |

Determination of redemption amount when final basket level is less than initial basket level

Redemption Amount = Principal * (1.0 + 0)

Redemption Amount = $10,000 * (1.0 + 0)

Redemption Amount = $10,000

Payment at Maturity = $10,000

EXAMPLE 3: Both increases and decreases in closing levels of each reference index on each valuation date:

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. MSCI Singapore Free Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 2. MSCI Taiwan Index | | 1000 | | 900 | | 800 | | 1100 |

| 3. KOSPI 200 Index | | 1000 | | 1100 | | 1200 | | 1300 |

| 4. FTSE/Xinhua China 25 Index | | 1000 | | 1000 | | 900 | | 800 |

| |

|

|---|

| Basket Level | | = (.25*(final level(1)/initial level(1))) |

| | | + (.25*(final level(2)/initial level(2))) |

| | | + (.25*(final level(3)/initial level(3))) |

| | | + (.25*(final level(4)/initial level(4))) |

Basket Level1 |

|

= ((.25*(1100/1000)) + ((.25*(900/1000)) + ((.25*(1100/1000)) + ((.25*(1000/1000)) = 1.025 |

Basket Level2 |

|

= ((.25*(1100/1000)) + ((.25*(800/1000)) + ((.25*(1200/1000)) + ((.25*(900/1000)) = 1.0 |

Basket Level3 |

|

= ((.25*(1100/1000)) + ((.25*(1100/1000)) + ((.25*(1300/1000)) + ((.25*(800/1000)) = 1.075 |

Final Basket Level = (1.025 + 1.0 + 1.075)/3=1.03 |

Basket Return = (1.03 - 1.0)/1.0) = .03 |

U-4

Determination of redemption amount when final basket level is greater than initial basket level

Redemption Amount = Principal * (1.0 + basket return)

Redemption Amount = $10,000 * (1.0 +.03)

Redemption Amount = $13,000

Payment at Maturity = $13,000

The table below sets forth a sampling of hypothetical redemption amounts at maturity of a $10,000 investment in the securities.

Principal Amount

of Securities

| | Percentage Difference between

Initial Basket Level and Final

Basket Level (Basket Return)

| | Redemption Amount

at Maturity

|

|---|

| $10,000 | | -100 | % | $ | 10,000 |

| $10,000 | | -90 | % | $ | 10,000 |

| $10,000 | | -80 | % | $ | 10,000 |

| $10,000 | | -70 | % | $ | 10,000 |

| $10,000 | | -60 | % | $ | 10,000 |

| $10,000 | | -50 | % | $ | 10,000 |

| $10,000 | | -40 | % | $ | 10,000 |

| $10,000 | | -30 | % | $ | 10,000 |

| $10,000 | | -20 | % | $ | 10,000 |

| $10,000 | | -10 | % | $ | 10,000 |

| $10,000 | | 0 | % | $ | 10,000 |

| $10,000 | | 10 | % | $ | 11,000 |

| $10,000 | | 20 | % | $ | 12,000 |

| $10,000 | | 30 | % | $ | 13,000 |

| $10,000 | | 40 | % | $ | 14,000 |

| $10,000 | | 50 | % | $ | 15,000 |

| $10,000 | | 60 | % | $ | 16,000 |

| $10,000 | | 70 | % | $ | 17,000 |

| $10,000 | | 80 | % | $ | 18,000 |

| $10,000 | | 90 | % | $ | 19,000 |

| $10,000 | | 100 | % | $ | 20,000 |

U-5

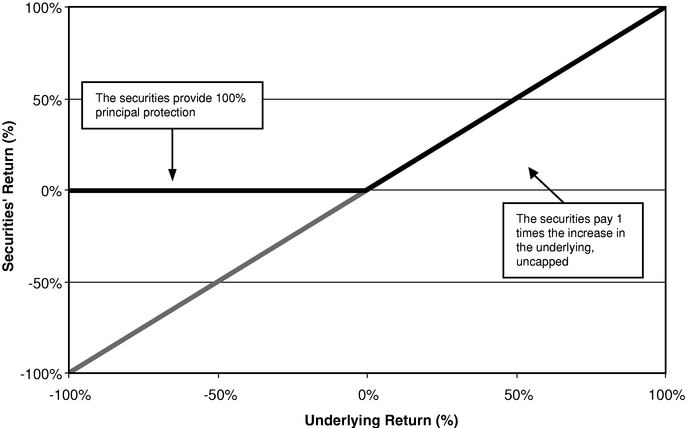

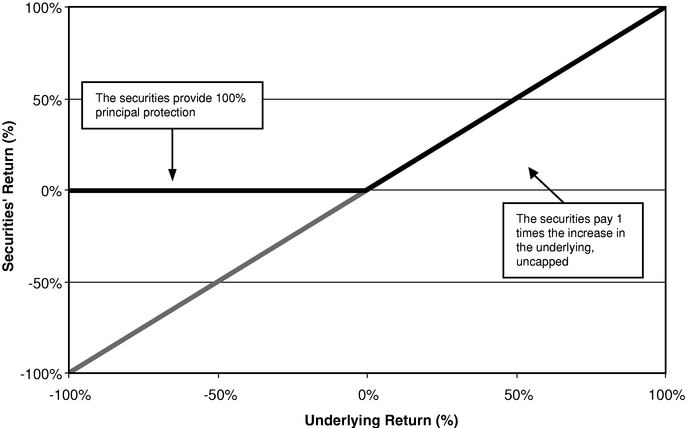

The graph of hypothetical returns at maturity set forth below is intended to demonstrate the effect of the principal protection. The thin black line shows hypothetical percentage return at maturity for an investment in an instrument directly linked to the value of the basket. The thick black line shows hypothetical percentage return at maturity for a similar investment in the securities.

These examples are for illustrative purposes only. The actual basket return will depend on the final basket level determined by the calculation agent as provided in this pricing supplement.

U-6

SUPPLEMENTAL USE OF PROCEEDS

The net proceeds from this offering will be approximately $ . We intend to use the net proceeds for our general corporate purposes, which may include the rationalization of our debt capital structure. We may also use some or all of the net proceeds from this offering to hedge our obligations under the securities. Please refer to "Use of Proceeds and Hedging" on page PS-10 of the accompanying product supplement.

U-7

THE REFERENCE INDICES

The MSCI Singapore Free Index

Unless otherwise stated, all information regarding the MSCI Singapore Free Index provided in this pricing supplement is derived from Morgan Stanley Capital International Inc. ("MSCI") or other publicly available sources. Such information reflects the policies of MSCI as stated in such sources, and such policies are subject to change by MSCI. We do not assume any responsibility for the accuracy or completeness of such information. MSCI is under no obligation to continue to publish the MSCI Singapore Free Index and may discontinue publication of the MSCI Singapore Free Index at any time.

The MSCI Singapore Free Index is a capitalization-weighted index that monitors the performance of stocks from the country of Singapore. The index has a base date of January 1, 1988.

Neither we nor any of our affiliates accepts any responsibility for the calculation, maintenance or publication of, or for any error, omission or disruption in, the MSCI Singapore Free Index or any successor index. MSCI does not guarantee the accuracy or completeness of the MSCI Singapore Free Index or any data included in the MSCI Singapore Free Index. MSCI assumes no liability for any errors, omissions or disruption in the calculation and dissemination of the MSCI Singapore Free Index. MSCI disclaims all responsibility for any errors or omissions in the calculation and dissemination of the MSCI Singapore Free Index or the manner in which the MSCI Singapore Free Index is applied in determining the amount payable on the securities.

The MSCI Singapore Free Index is reported by Bloomberg Financial Markets under the ticker symbol "SGY."

MSCI Singapore Free Index Selection Criteria

As of February 6, 2007, the top ten member stocks on the MSCI Singapore Free Index were the following:

Name

| | % Weight in the Index

| |

|---|

| DBS Group Holdings | | 12.76 | % |

| Singapore Telecom | | 12.69 | % |

| United Overseas Bank | | 11.39 | % |

| OCBC Bank | | 10.44 | % |

| Keppel Corp. | | 5.20 | % |

| Singapore Airlines | | 4.77 | % |

| Capitaland | | 4.31 | % |

| City Developments | | 3.50 | % |

| Singapore Press Holdings | | 3.48 | % |

| Singapore Exchange | | 2.65 | % |

| Total | | 71.19 | % |

MSCI targets an 85% free float adjusted market representation level within each industry group in Singapore. The security selection process within each industry group is based on analysis of the following:

- •

- Each company's business activities and the diversification that its securities would bring to the index.

- •

- The size of the securities based on free float adjusted market capitalization. All other things being equal, MSCI targets for inclusion the most sizable securities in an industry group; securities that do not meet the minimum size guidelines are not considered for inclusion. Although the following limits are subject to revision, currently a security will be eligible for inclusion in the MSCI Singapore Free Index if it achieves a free float adjusted market capitalization of U.S.$250 million and will be eligible for removal if its capitalization falls below

U-8

U.S.$125 million at the time of the annual review. If, however, the free float adjusted market capitalization level falls significantly below the free float adjusted market capitalization level for deletions prior to such annual review, such as, for example, during a quarterly review, then the security may be deleted prior to such annual review.

- •

- The liquidity of the securities. MSCI generally targets for inclusion the most liquid securities in an industry group and securities with inadequate liquidity are not considered for inclusion. MSCI does not define absolute minimum or maximum liquidity levels for stock inclusion or exclusion from the MSCI Singapore Free Index, but MSCI considers each stock's relative standing within Singapore and between cycles. A useful measure to compare liquidity within the same market is the Annualized Traded Value Ratio ("ATVR"), which screens out extreme daily trading volumes and factors in the difference in market capitalization size. The ATVR Ratio of each security is calculated via a three-step process:

- •

- First, monthly median traded values are computed using the daily median traded value, multiplied by the number of days in the month that the security traded. The daily traded value of a security is equal to the number of shares traded during the day, multiplied by the closing price of that security. The daily median traded value is the median of the daily traded values in a given month.

- •

- Second, the monthly median traded value ratio is obtained by dividing the monthly median traded value of a security by its free float adjusted security market capitalization at the end of the month.

- •

- Third, the ATVR is calculated by multiplying the average of the monthly median trade value ratios of the previous 12 months—or the number of months for which this data is available—by 12.

Only securities of companies with an estimated overall or security free float greater than 15% are generally considered for inclusion in the MSCI Singapore Free Index.

For securities not subject to foreign ownership limitations, the free float of a security is estimated as its total number of shares outstanding less shareholdings classified as strategic and/or non-free float. For securities subject to foreign ownership limitations, the estimated free float available to foreign investors is equal to the lesser of (a) the total number of shares outstanding less shareholdings classified as strategic or non-free float and (b) foreign ownership limitation adjusted for non-free float stakes held by foreign investors.

MSCI free float adjusts the market capitalization of each security using an adjustment factor referred to as the Foreign Inclusion Factor ("FIF"). Securities not subject to foreign ownership limitations have a FIF equal to (a) the estimated free float, rounded up to the closest 5%, if the securities have a free float greater than 15% or (b) the estimated free float, rounded to the closest one percent, if the securities have a free float less than 15%. For securities subject to foreign ownership limitations, the FIF is equal to the lesser of (a) the estimated free float available to foreign investors (i) rounded up to the closest five percent, if the free float is greater than 15% or (ii) rounded to the closest one percent, if the free float is less than 15% and (b) foreign ownership limitation rounded to the closest one percent.

The free float adjusted market capitalization of a security is calculated as the product of the FIF and the security's full market capitalization.

MSCI Singapore Free Index Calculation

The MSCI Singapore Free Index is computed generally by multiplying the previous day's index level by the free float adjusted market capitalization level of each share in the MSCI Singapore Free Index on the prior day divided by the free float adjusted market capitalization level of each share in

U-9

the MSCI Singapore Free Index on the current day. The numerator is adjusted market capitalization, but the denominator is unadjusted—i.e., the price adjustment factor is applied to the numerator, but not to the denominator.

MSCI Singapore Free Index Maintenance

There are three broad categories of MSCI Singapore Free Index maintenance:

- •

- An annual full country index review that reassesses the various parameters of the equity universe in Singapore;

- •

- Quarterly index reviews, designed to promptly reflect other significant market events; and

- •

- Ongoing event-related changes, such as mergers and acquisitions, which are generally implemented in the index as they occur.

During the annual review, additions or deletions of securities are made (i) following the re-appraisal of the free float adjusted industry group representation within a country relative to an 85% target, (ii) following an update of the minimum size guidelines for additions and deletions and (iii) based on a company's and/or security's free float of less than 15% that has decreased in size in terms of free float adjusted market capitalization due to reduction in free float or due to performance and that no longer meet certain criteria.

During a quarterly review, securities may be added to or deleted from the MSCI Singapore Free Index for a variety of reasons, including:

- •

- Due to one or more industry groups having become significantly over- or under-represented as a result of mergers, acquisitions, restructuring and other major market events affecting that industry group.

- •

- Resulting from changes in industry classification, significant increases or decreases in free float and relaxation/removal or decreases of foreign ownership limits not implemented immediately.

- •

- Additions of large companies that did not meet the minimum size criterion for early inclusion at the time of their initial public offerings or secondary offerings.

- •

- Replacement of companies that are no longer representative of their industry.

- •

- Deletion of securities whose issuing company and/or security free float has fallen to less than 15% and that do not meet certain criteria.

- •

- Deletion of securities that have become very illiquid.

- •

- Replacement of securities resulting from the review of price source for constituents with both domestic and foreign board quotations.

License Agreement with MSCI

We and MSCI have entered into a non-exclusive license agreement providing for the license to us, in exchange for a fee, of the right to use the MSCI Taiwan Index and the MSCI Singapore Free Index in connection with the securities.

The license agreement between MSCI and us provides that language substantially the same as the following language must be stated in this pricing supplement:

"THE SECURITIES ARE NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY MORGAN STANLEY CAPITAL INTERNATIONAL INC. ("MSCI"), ANY AFFILIATE OF MSCI OR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES ARE SERVICE MARK(S) OF MSCI OR ITS AFFILIATES AND

U-10

HAVE BEEN LICENSED FOR USE FOR CERTAIN PURPOSES BY CREDIT SUISSE (USA), INC. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, TO THE OWNERS OF THE SECURITIES OR ANY MEMBER OF THE PUBLIC REGARDING THE ADVISABILITY OF INVESTING IN FINANCIAL SECURITIES GENERALLY OR IN THE SECURITIES PARTICULARLY OR THE ABILITY OF ANY MSCI INDEX TO TRACK CORRESPONDING STOCK MARKET PERFORMANCE. MSCI OR ITS AFFILIATES ARE THE LICENSORS OF CERTAIN TRADEMARKS, SERVICE MARKS AND TRADE NAMES AND OF THE MSCI INDEXES WHICH ARE DETERMINED, COMPOSED AND CALCULATED BY MSCI WITHOUT REGARD TO THE SECURITIES OR THE ISSUER OR OWNER OF THE SECURITIES. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX HAS ANY OBLIGATION TO TAKE THE NEEDS OF THE ISSUERS OR OWNERS OF THE SECURITIES INTO CONSIDERATION IN DETERMINING, COMPOSING OR CALCULATING THE MSCI INDEXES. NEITHER MSCI, ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX IS RESPONSIBLE FOR OR HAS PARTICIPATED IN THE DETERMINATION OF THE TIMING OF, PRICES AT, OR QUANTITIES OF THE SECURITIES TO BE ISSUED OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY WHICH THE SECURITIES ARE REDEEMABLE FOR CASH. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, THE MAKING OR COMPILING ANY MSCI INDEX HAS ANY OBLIGATION OR LIABILITY TO THE OWNERS OF THE SECURITIES IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR OFFERING OF THE SECURITIES.

ALTHOUGH MSCI SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE MSCI INDEXES FROM SOURCES WHICH MSCI CONSIDERS RELIABLE, NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO MAKING OR COMPILING ANY MSCI INDEX WARRANTS OR GUARANTEES THE ORIGINALITY, ACCURACY AND/OR THE COMPLETENESS OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, LICENSEE'S CUSTOMERS OR COUNTERPARTIES, ISSUERS OF THE SECURITIES, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY, FROM THE USE OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER OR FOR ANY OTHER USE. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX SHALL HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS OF OR IN CONNECTION WITH ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. FURTHER, NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX MAKES ANY EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, AND MSCI, ANY OF ITS AFFILIATES AND ANY OTHER PARTY INVOLVED IN, OR RELATED TO MAKING OR COMPILING ANY MSCI INDEX HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO ANY MSCI INDEX AND ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL MSCI, ANY OF ITS AFFILIATES OR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER

U-11

DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES."

The MSCI Taiwan Index and MSCI Singapore Free Index are the exclusive property of MSCI. Morgan Stanley Capital International is a service mark of MSCI and has now been licensed for use by Credit Suisse.

The MSCI Taiwan Index

Unless otherwise stated, all information regarding the MSCI Taiwan Index provided in this pricing supplement is derived from publicly available information. That information reflects the policies of, and is subject to change by, MSCI. MSCI has no obligation to continue to publish, and may discontinue publication of, the MSCI Taiwan Index. We make no representation or warranty as to the accuracy or completeness of any information relating to the MSCI Taiwan Index.

The MSCI Taiwan Index is a free float adjusted market capitalization index of securities listed on the Taiwan Stock Exchange. The index has a base date of December 31, 1987.

Selection Criteria

As of February 6, 2007, the top ten member stocks on the MSCI Taiwan Index were the following:

Name

| | % Weight in the Index

| |

|---|

| Taiwan Semiconductor Manufacturing | | 14.40 | % |

| Hon Hai Precision Ind. Co. | | 9.57 | % |

| Cathay Fiancial Holdings | | 4.03 | % |

| United Microelectronics | | 3.61 | % |

| Chunghwa Telecom Co. | | 3.17 | % |

| China Steel Corp. | | 2.97 | % |

| AU Optronics Corp. | | 2.86 | % |

| Nan Ya Plastic | | 2.81 | % |

| Mediatek, Inc. | | 2.81 | % |

| Formosa Plastic Corp. | | 2.30 | % |

| Total | | 48.53 | % |

MSCI targets an 85% free float adjusted market representation level within each industry group in Taiwan. The security selection process within each industry group is based on analysis of the following:

- •

- Each company's business activities and the diversification that its securities would bring to the MSCI Taiwan Index.

- •

- The size of the securities based on free float adjusted market capitalization. All other things being equal, MSCI targets for inclusion the most sizable securities in an industry group. In addition, securities that do not meet the minimum size guidelines are not considered for inclusion. Though the following limits are subject to revision, presently, a security will be eligible for inclusion in the MSCI Taiwan Index if it achieves a free float adjusted market capitalization of U.S.$400 million and will be eligible for deletion if such capitalization falls below U.S.$200 million as of the yearly review. If, however, the free float adjusted market capitalization level falls significantly below the free float adjusted market capitalization level for deletions prior to a yearly review, for example during a quarterly review, then the security may be deleted prior to such yearly review.

- •

- The liquidity of the securities. All other things being equal, MSCI targets for inclusion the most liquid securities in an industry group. In addition, securities that have inadequate liquidity are not considered for inclusion. MSCI does not define absolute minimum or maximum liquidity levels for stock inclusion or exclusion from the MSCI Taiwan Index but considers each stock's

U-12

relative standing within Taiwan and between cycles. A useful measure to compare liquidity within the same market is the Annualized Traded Value Ratio ("ATVR"), which screens out extreme daily trading volumes and takes into account the difference in market capitalization size. The ATVR Ratio of each security is calculated via the following 3-step process:

- •

- First, monthly median traded values are computed using the daily median traded value, multiplied by the number of days in the month that the security traded. The daily traded value of a security is equal to the number of shares traded during the day, multiplied by the closing price of that security. The daily median traded value is the median of the daily traded values in a given month.

- •

- Second, the monthly median traded value ratio is obtained by dividing the monthly median traded value of a security by its free float adjusted security market capitalization at the end of the month.

- •

- Third, the ATVR is obtained by multiplying the average of the monthly median trade value ratios of the previous 12 months—or the number of months for which this data is available—by 12.

Only securities of companies with an estimated overall or security free float greater than 15% are generally considered for inclusion in the MSCI Taiwan Index. For securities not subject to foreign ownership limitations, the free float of a security is estimated as its total number of shares outstanding less shareholdings classified as strategic and/or non-free float. For securities subject to foreign ownership limitations, the estimated free float available to foreign investors is equal to the lesser of (a) the total number of shares outstanding less shareholdings classified as strategic or non-free float and (b) foreign ownership limitation adjusted for non-free float stakes held by foreign investors.

MSCI free float adjusts the market capitalization of each security using an adjustment factor referred to as the Foreign Inclusion Factor ("FIF"). Securities not subject to foreign ownership limitations have a FIF equal to (a) the estimated free float, rounded up to the closest 5%, if the securities have a free float greater than 15% or (b) the estimated free float, rounded to the closest 1%, if the securities have a free float less than 15%. For securities subject to foreign ownership limitations, the FIF is equal to the lesser of (a) the estimated free float available to foreign investors (i) rounded up to the closest 5%, if the free float is greater than 15% or (ii) rounded to the closest 1%, if the free float is less than 15% and (b) foreign ownership limitation rounded to the closest 1%.

The free float adjusted market capitalization of a security is calculated as the product of the FIF and the security's full market capitalization.

Calculation

The MSCI Taiwan Index is computed generally by multiplying the previous day's index level by the free float adjusted market capitalization level of each share in the MSCI Taiwan Index on the prior day divided by the free float adjusted market capitalization level of each share in the MSCI Taiwan Index on the current day. The numerator is adjusted market capitalization, but the denominator is unadjusted, meaning that the price adjustment factor is applied to the numerator, but not to the denominator.

Index Maintenance

There are three broad categories of MSCI Taiwan Index maintenance:

- •

- An annual full country index review that reassesses the various dimensions of the equity universe in Taiwan;

- •

- Quarterly index reviews, aimed at promptly reflecting other significant market events; and

U-13

- •

- Ongoing event-related changes, such as mergers and acquisitions, which are generally implemented in the index rapidly as they occur.

During the annual review, additions or deletions of securities are made (i) following the re-appraisal of the free float adjusted industry group representation within a country relative to an 85% target, (ii) following an update of the minimum size guidelines for additions and deletions and (iii) based on a company's and/or security's free float of less than 15% that has decreased in size in terms of free float adjusted market capitalization due to reduction in free float or due to performance and that no longer meet certain criteria.

During a quarterly index review, securities may be added to or deleted from the MSCI Taiwan Index for a variety of reasons, including the following:

- •

- Additions or deletions of securities, due to one or more industry groups having become significantly over- or under-represented as a result of mergers, acquisitions, restructuring and other major market events affecting that industry group.

- •

- Additions or deletions resulting from changes in industry classification, significant increases or decreases in free float and relaxation/removal or decreases of foreign ownership limits not implemented immediately.

- •

- Additions of large companies that did not meet the minimum size criterion for early inclusion at the time of their initial public offering or secondary offering.

- •

- Replacement of companies which are no longer suitable industry representatives.

- •

- Deletion of securities whose issuing company and/or security free float has fallen to less than 15% and which do not meet certain criteria.

- •

- Deletion of securities that have become very small or illiquid.

- •

- Replacement of securities (additions or deletions) resulting from the review of price source for constituents with both domestic and foreign board quotations.

License agreement with MSCI

We or one of our affiliates have entered into a non-exclusive license agreement with MSCI providing for the license to us and certain of our affiliated or subsidiary companies, in exchange for a fee, of the right to use the MSCI Taiwan Index in connection with certain securities, including these securities.

The license agreement between MSCI and us provides that the following language must be stated in this pricing supplement:

The securities are not sponsored, endorsed, sold or promoted by MSCI or any affiliate of MSCI. Neither MSCI nor any other party makes any representation or warranty, express or implied, to the owners of the securities or any member of the public regarding the advisability of investing in securities generally or in the securities particularly or the ability of the MSCI Taiwan Index and MSCI Singapore Free Index to track general stock market performance. MSCI is the licensor of certain trademarks, service marks and trade names of MSCI and of the MSCI Taiwan Index and MSCI Singapore Free Index which are determined, composed and calculated by MSCI without regard to the issuer of the securities or the securities. MSCI has no obligation to take the needs of the issuer of the securities or the owners of the Securities into consideration in determining, composing or calculating the MSCI Taiwan Index and MSCI Singapore Free Index. MSCI is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the securities to be issued or in the determination or calculation of the equation by which the securities are redeemable for cash. Neither MSCI nor any other party has an obligation or liability to owners of the securities in connection with the administration, marketing or trading of the securities.

U-14

ALTHOUGH MSCI SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEXES FROM SOURCES WHICH MSCI CONSIDERS RELIABLE, NEITHER MSCI NOR ANY OTHER PARTY GUARANTEES THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEXES OR ANY DATA INCLUDED THEREIN. NEITHER MSCI NOR ANY OTHER PARTY MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, LICENSEE'S CUSTOMERS AND COUNTERPARTIES, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEXES OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER OR FOR ANY OTHER USE. NEITHER MORGAN STANLEY NOR ANY OTHER PARTY MAKES ANY EXPRESS OR IMPLIED WARRANTIES AND MSCI HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEXES OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL MSCI OR ANY OTHER PARTY HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

The KOSPI 200 Index

Unless otherwise stated, all information regarding the KOSPI 200 Index provided in this pricing supplement is derived from the Korea Stock Exchange ("KSE") or other publicly available sources. Such information reflects the policies of KSE as stated in such sources, and such policies are subject to change by KSE. We do not assume any responsibility for the accuracy or completeness of such information. KSE is under no obligation to continue to publish the KOSPI 200 Index and may discontinue publication of the KOSPI 200 Index at any time.

The KOSPI 200 Index is a market capitalization based index and was developed as an underlying index for derivatives products (index futures and index options) traded on the KSE market. The calculation of the value of the KOSPI 200 Index (discussed below in further detail) is based on the relative value of the aggregated current Market Value (as defined below) of the common stocks of 200 companies (the "Constituent Stocks") as of a particular time as compared to the aggregated average Market Value of the common stocks of 200 companies at the Base Date of January 3, 1990. The current "Market Value" of any Constituent Stock is the product of the market price per share and the number of the then outstanding shares of such Constituent Stock. KSE chooses companies for inclusion in the KOSPI 200 Index with an aim of accurately representing overall market movement. KSE may from time to time, in its sole discretion, add companies to, or delete companies from, the KOSPI 200 Index to achieve the objectives stated above. The KOSPI 200 Index selects stocks of companies that belong to one of eight industry groups, whose market capitalization is at least 1% of the total market capitalization. The capitalization requirement ensures the high percentage of market capitalization of Constituent Stocks against the total. Stocks initially listed or relisted after May 1 of the year preceding the year of the periodic realignment review date, stocks designated as administrative issue as of the periodic realignment review date, stocks of securities investment companies, issues of liquidation sale and stocks deemed unsuitable are ineligible to become a Constituent Stock of the KOSPI 200 Index.

Basic selection criteria are the average market capitalization obtained by dividing the aggregated value (attained by multiplying the closing price of the listed common shares by the number of listed common shares for one year from April of the year preceding the year to which the periodic realignment review date belongs), by 12, and the sum of daily trading value for the same period. In the case of a stock which has been reclassified under a different industry group, such stock is grouped with the newly classified industry group.

U-15

First, the Constituent Stocks from non-manufacturing industries are chosen on the basis of rank order of average monthly market capitalization, while ensuring that the accumulated market capitalization of a stock is at least 70% of the total market capitalization of the same industry group. The number of stocks selected is considered as is the number of Constituent Stocks chosen from the same industry group. However, a stock is excluded if its ranking of annual trading value is below 85% of the same industry group, and a stock that satisfies the trading value requirement is chosen from among the stocks whose market capitalization is ranked next.

Second, the Constituent Stocks from the manufacturing industry are selected by rank order of market capitalization, while ensuring that annual trading value of stocks are ranked above 85% of the industry group. The number of the stocks selected from the manufacturing industry is the number obtained by subtracting the number of Constituent Stocks chosen from the non-manufacturing industry group from 200.

Notwithstanding the above criteria, a stock whose market capitalization is within the top 50 of its industry group may be included in the constituents. The KOSPI Maintenance Committee (the "KOSPI Committee") makes the decision while taking into account such factors as the percentage of market capitalization of the industry group to the total and the liquidity of such stock.

To ensure that KOSPI 200 Index accurately represents the overall market movement, its constituent stocks are realigned as the need arises. There are two types of realignments: periodic realignment and special realignment. Periodic realignment takes place regularly once a year, on the trading day following the day which is the last trading day of June contracts of both the index futures and index options. Special realignment takes place at the time when a stock has to be excluded from the constituents as a result of, for instance, delisting, designation as administrative issue or a merger.

The method of periodic realignment is similar to the method used for selection of Constituent Stocks. However, to maintain constancy of the KOSPI 200 Index, a replacement stock must both satisfy the criteria for selection of Constituent Stocks, and its ranking of market capitalization should be within 90% of total market capitalization of the constituents of the same industry group. However, even if an existing Constituent Stock does not satisfy the criteria for selection of Constituent Stocks, such stock remains a constituent as long as its ranking of market capitalization is within 110% of the market capitalization of the constituents. In the case of a stock with a market capitalization ranking that has reached 90% of the total market capitalization of the constituents of the same industry group, such stock is excluded unless there is an existing Constituent Stock whose ranking falls below 110% of the constituents.

Special realignment is carried out by choosing a stock from a replacement list prepared beforehand in a priority order by industry group. In the event that the replacement list includes no stock for a specific industry, a stock is chosen from the manufacturing industry group.

In cases where there is an initial listing of a stock that is deemed to have high liquidity and is worthy in terms of its impact on KOSPI 200 Index, a constituent stock is merged into non-constituent stock or a company is established as result of merger between the constituent, is possible to include such initially listed stock or stocks of the new companies in the constituents before the periodic realignment date.

Calculation of the KOSPI 200 Index

The level of the KOSPI 200 Index reflects the total current Market Value of all 200 Constituent Stocks relative to the KOSPI 200 Index's base date of January 3, 1990 (the "Base Date"). An indexed number is used to represent the results of this calculation.

The actual aggregate Market Value of the Constituent Stocks at the Base Date ("The Base Market Value") has been set. In practice, the calculation of the KOSPI 200 Index is computed by dividing the

U-16

total current aggregated Market Value of the Constituent Stocks by the Base Market Value and then multiplying by 100 (the "Base Index.").

In order to maintain the consistency of the Index, the Market Value and Base Market Value can be readjusted. Readjustment includes changing the Base Market Value when there is an event, such as a distribution of rights or dividends, that affects the stock price, in order to equalize the stock price index on the day before the event and the stock price index on the day of the event. The following formula is used:

| Current Market Value on the day before thechange | | = | | Current Market Value on the day before thechange | | ± | | Amount of Change inValue |

| | | |

|

| Old Market Value | | New Base Market Value |

Current Market Value increases or decreases when there is a rights offering a new listing, a delisting or merger. Therefore, to maintain consistency, the Base Market Value is adjusted when there is a change in current Market Value, using the following formula:

| New Base Market Value | | = | | Old Market Value | | × | | Current Market Value on the day before thechange | | ± | | Amount of change in the current MarketValue |

| | | | | | | | |

|

| | | | | | | | | Current Market Value on the day

before the change |

The KOSPI Committee is charged with reviewing matters relating to calculation and management of the KOSPI 200 Index. The KOSPI Committee is composed of 10 members who are chosen as representatives of institutional investors and securities related institutions, legal and accounting professions, and professors and researchers. The KOSPI Committee is responsible for matters relating to the calculation method of the KOSPI 200 Index; matters relating to selection and realignment of KOSPI 200 Constituent Stocks; matters relating to establishment, amendment and abolishment of the criteria for selection of KOSPI 200 Constituent Stocks; and any other matters that are requested by the chief executive officer of the KSE.

Regular meetings of the KOSPI Committee are held in May of each year for the purpose of realigning the Constituent Stocks, but a special meeting can be called if need arises.

Although KSE currently employs the above methodology to calculate the KOSPI 200 Index, we cannot assure you that KSE will not modify or change this methodology in a manner that may affect the redemption amount at maturity to beneficial owners of the securities.

As of February 6, 2007, the top ten member stocks on the KOSPI 200 Index were the following:

Name

| | % Weight in the Index

| |

|---|

| Samsung Electronics Co. Ltd. | | 14.27 | % |

| POSCO | | 4.30 | % |

| Korea Electric Power Corp. | | 4.07 | % |

| Kookmin Bank | | 3.77 | % |

| Shinhan Financial Group Co Ltd | | 2.81 | % |

| Woori Finance Holdings Co Ltd | | 2.65 | % |

| Hyundai Motor Co. | | 2.58 | % |

| SK Telecom Co. Ltd. | | 2.43 | % |

| Hynix Semiconductor Inc. | | 2.15 | % |

| KT Corp. | | 1.79 | % |

| Total | | 40.82 | % |

U-17

License Agreement with KSE

We and KSE are parties to a non-exclusive license agreement providing for the license to us, in exchange for a fee, of the right to use indices owned and published by KSE in connection with certain securities, including these securities.

The license agreement between KSE and us provides that language substantially the same as the following language must be stated in this pricing supplement:

"The securities are not sponsored, endorsed, sold or promoted by Korea Stock Exchange ("KSE"). KSE makes no representation or warranty, express or implied, to the owners of the securities or any member of the public regarding the advisability of investing in securities generally or in the securities particularly or the ability of the KOSPI Indexes to track general stock market performance. KSE's only relationship to the Licensee is the licensing of certain trademarks and trade names of KSE and of the KOSPI Indexes which is determined, composed and calculated by KSE without regard to the Licensee or the securities. KSE has no obligation to take the needs of the Licensee or the owners of the securities into consideration in determining, composing or calculating the KOSPI Indexes. KSE is not responsible for and has not participated in the determination of the prices and amount of the securities or the timing of the issuance or sale of the securities or in the determination or calculation of the equation by which the securities is to be converted into cash. KSE has no obligation or liability in connection with the administration, marketing or trading of the securities.

KSE DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE KOSPI INDEXES OR ANY DATA INCLUDED THEREIN AND KSE SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. KSE MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE KOSPI INDEXES OR ANY DATA INCLUDED THEREIN. KSE MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE KOSPI INDEXES OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL KSE HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES."

"KOSPI" and "KOSPI200" are trademarks/service marks of the Korea Stock Exchange and have been licensed for use by Credit Suisse.

The FTSE/Xinhua China 25 Index

Unless otherwise stated, all information regarding the FTSE/Xinhua China 25 Index provided in this pricing supplement is derived from FTSE, Xinhua Financial Network ("XFN"), FTSE/Xinhua Index Limited or other publicly available sources. Such information reflects the policies of FTSE/Xinhua Index Limited as stated in such sources, and such policies are subject to change by FTSE/Xinhua Index Limited. We do not assume any responsibility for the accuracy or completeness of such information. FTSE/Xinhua Index Limited is under no obligation to continue to publish the FTSE/ Xinhua China 25 Index and may discontinue publication of the FTSE/Xinhua China 25 Index at any time.

The FTSE/Xinhua China 25 Index is a stock index calculated, published and disseminated by FTSE/Xinhua Index Limited that measures the composite price performance of selected Chinese stocks. The FTSE/Xinhua China 25 Index currently is based on 25 underlying stocks (the "Underlying

U-18

Stocks") trading on the Hong Kong Stock Exchange (the "HKSE") and is designed to represent the performance of investments in the mainland Chinese market available to international investors. The FTSE/Xinhua China 25 Index consists of the largest 25 companies by full market value, weighted based on the free float adjusted total market value of their shares, so that securities with higher total market values generally have a higher representation in the FTSE/Xinhua China 25 Index. FTSE/Xinhua China 25 Index constituents are screened for liquidity and weightings are capped to avoid over-concentration in any one stock. The inception date of the FTSE/Xinhua China 25 Index was March 2001. As of October 25, 2006, the FTSE/Xinhua China 25 Index's top three holdings were China Mobile Communications Corporation, Petrochina Company Limited and Bank of China.

Calculation of the FTSE/Xinhua China 25 Index

The FTSE/Xinhua China 25 Index is rule-based and is monitored by a governing committee. The FTSE Xinhua Index Committee (the "Index Committee") is responsible for conducting the quarterly review of constituents of the FTSE/Xinhua China 25 Index and for making changes to the FTSE/Xinhua China 25 Index in accordance with the index procedures. Until further notice, only Red Chip shares and H shares are eligible for the FTSE/Xinhua China 25 Index. Red Chip shares are securities of Hong Kong incorporated companies that trade on the HKSE. They are quoted in Hong Kong dollars. Red Chips are companies that are substantially owned directly or indirectly by the Chinese Government and have the majority of their business interests in mainland China. H shares are securities of companies incorporated in the People's Republic of China and nominated by the Chinese Government for listing and trading on the HKSE. They are quoted and traded in Hong Kong dollars. Like other securities trading on the HKSE, there are no restrictions on who can trade H shares. The FTSE/Xinhua China 25 Index also provides for A shares and B shares, neither of which is currently eligible for inclusion in the index. Although only eligible share classes are included in the index weighting, in determining the full market capitalization of a company for index ranking purposes, all share classes, including A shares and B shares, are included. A shares are securities of Chinese incorporated companies that trade on either the Shanghai or Shenzhen stock exchanges. They are quoted in RenMinBi. They can only be traded by residents of the People's Republic of China or under the Qualified Foreign Institutional Investor rules. B shares are securities of Chinese incorporated companies that trade on either the Shanghai or Shenzhen stock exchanges. They are quoted in U.S. dollars on the Shanghai stock exchange and Hong Kong dollars on the Shenzhen stock exchange. They can be traded by non-residents of the People's Republic of China and also residents of the People's Republic of China with appropriate foreign currency dealing accounts.

The weight of each Underlying Stock in the FTSE/Xinhua China 25 Index is calculated by (i) multiplying the per share price of each Underlying Stock by the exchange rate required to convert the security's home currency into the FTSE/Xinhua China 25 Index base currency (the "Base Currency"), (ii) multiplying each resulting product by the number of shares in issue according to FTSE/Xinhua Index Limited, (iii) multiplying each resulting product by the product of each security's float factor (the "Free Float Factor") multiplied by its capping factor (the "Capping Factor"), (iv) calculating the sum of all these products and (v) dividing such sum by a divisor (the "Divisor"). The Base Currency for the FTSE/Xinhua China 25 Index is the Hong Kong dollar. The Free Float Factor is a number between 1 and 0, where 1 represents a 100% free float, and is published by FTSE/Xinhua Index Limited. The Capping Factor is a number between 1 and 0, where 1 represents no cap, that allows the weight of each security to be capped at no more than 10%, and is published by FTSE/Xinhua Index Limited. The Divisor represents the total issued share capital of the FTSE/Xinhua China 25 Index at the base date and can be adjusted to allow changes in the issued share capital of individual securities without distorting the FTSE/Xinhua China 25 Index.

When calculating the weight of an Underlying Stock, individual constituents' shares held by governments, corporations, strategic partners or other control groups are excluded from the company's

U-19

shares outstanding. Shares owned by other companies are also excluded regardless of whether such companies are index constituents. Where a foreign investment limit exists at the sector or company level, the constituent's weight will reflect either the foreign investment limit or the percentage float, whichever is the more restrictive. Stocks are screened to ensure there is sufficient liquidity to be traded. Factors in determining liquidity include the availability of current and reliable price information and the level of trading volume relative to shares outstanding. Value traded and float turnover are also analyzed on a monthly basis to ensure ample liquidity. Fundamental analysis is not part of the selection criteria for inclusion or exclusion of stocks from the FTSE/Xinhua China 25 Index. The financial and operating condition of a company are not analyzed.

Adjustment to the composition of the FTSE/Xinhua China 25 Index

An Underlying Stock may be added or deleted by FTSE/Xinhua Index Limited or the percentage of that Underlying Stock or the Capping Factor or Free Float Factor may be adjusted. Any stock becoming ineligible for any of the following reasons, among others, will be deleted from the FTSE/Xinhua China 25 Index: (i) delisting of such stock, (ii) such stock ceases to have a firm quotation or accurate and reliable price, (iii) the constituent company is subject to a takeover, (iv) the constituent company ceases, in the opinion of the Index Committee, or its nominated deputies, to be a viable constituent due to changes in liquidity or total market capitalization, (v) the constituent company, at the time of the periodic review, has fallen to 36th position or below in the ranking of eligible companies by full market value as computed by FTSE/Xinhua Index Limited before the application of any investability weightings, or (vi) the company has the lowest ranking full market value on the FTSE/Xinhua China 25 Index as computed by FTSE/Xinhua Index Limited and another security has qualified for inclusion on the index. After deletion of a stock, FTSE/Xinhua Index Limited will select a new Underlying Stock from the reserve list of the five highest-ranking non-constituents of the index that are constituents of the FTSE All World Index and meet the FTSE/Xinhua China 25 Index requirements.

The Index Committee is responsible for undertaking the review of the FTSE/Xinhua China 25 Index and for approving changes of constituents in accordance with the index rules and procedures. The FTSE Global Classification Committee is responsible for the industry classification of constituents of the FTSE/Xinhua China 25 Index within the FTSE Global Classification System. The FTSE Global Classification Committee may approve changes to the FTSE Global Classification System and Management Rules. FTSE/Xinhua Index Limited appoints the Chairman and Deputy Chairman of the Index Committee. The Chairman chairs meetings of the Index Committee and represents the Index Committee outside meetings. Adjustments to reflect a major change in the amount or structure of a constituent company's issued capital will be made before the start of the index calculation on the day on which the change takes effect. Adjustments to reflect less significant changes will be implemented before the start of the index calculation on the day following the announcement of the change. All adjustments are made before the start of the index calculations on the day concerned, unless market conditions prevent this.

The FTSE/Xinhua China 25 Index is reviewed quarterly for changes in free float. These reviews will coincide with the quarterly reviews undertaken of the FTSE/Xinhua China 25 Index as a whole. Implementation of any changes will be after the close of the index calculation on the third Friday in January, April, July and October. The quarterly review of the FTSE/Xinhua China 25 Index constituents takes place in January, April, July and October. Any constituent changes will be implemented on the next trading day following the third Friday of the same month of the review meeting. Details of the outcome of the review and the dates on which any changes are to be implemented will be published as soon as possible after the Index Committee meeting has concluded.

The FTSE/Xinhua China 25 Index is calculated in real time and published every minute during the index period (09:15 - 16:00 Local Hong Kong Time). It is available in real time directly from FTSE and from the following vendors: Reuters, Bloomberg, Telekurs, FTID and LSE/Proquote. The end of day

U-20

index value is distributed at 16:15 (Local Hong Kong Time). Daily values are also made available to the Financial Times Asia edition and other major newspapers and are available at the FTSE Index Services web site: www.ftse.com. The FTSE/Xinhua China 25 Index uses local stock exchange trade prices and Reuters real-time spot currency rates.

Neither we nor any of our affiliates accepts any responsibility for the calculation, maintenance or publication of, or for any error, omission or disruption in, the FTSE/Xinhua China 25 Index or any successor index. FTSE/Xinhua Index Limited does not guarantee the accuracy or completeness of the FTSE/Xinhua China 25 Index or any data included in the FTSE/Xinhua China 25 Index. FTSE/Xinhua Index Limited assumes no liability for any errors, omissions or disruption in the calculation and dissemination of the FTSE/Xinhua China 25 Index. FTSE/Xinhua Index Limited disclaims all responsibility for any errors or omissions in the calculation and dissemination of the FTSE/Xinhua China 25 Index or the manner in which the FTSE/Xinhua China 25 Index is applied in determining the amount payable on the securities.

License Agreement with FTSE/Xinhua Index Limited

We and FTSE/Xinhua Index Limited have entered into a non-exclusive license agreement providing for the license to us, in exchange for a fee, of the right to use certain indices calculated by FTSE/Xinhua Index Limited in connection with certain securities, including these securities.

The license agreement between FTSE/Xinhua and us provides that the following information must be set forth in this pricing supplement:

"The securities are not in any way sponsored, endorsed, sold or promoted by FTSE/Xinhua Index Limited ("FXI"), FTSE International Limited ("FTSE") or Xinhua Financial Network Limited ("Xinhua") or by the London Stock Exchange PLC (the "Exchange") or by The Financial Times Limited ("FT") and neither FXI, FTSE, Xinhua nor the Exchange nor FT makes any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE/Xinhua China 25 Index ("the Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by or on behalf of FXI. However, neither FXI or FTSE or Xinhua or the Exchange or FT shall be liable (whether in negligence or otherwise) to any person for any error in the Index and neither FXI, FTS, Xinhua or Exchange or FT shall be under any obligation to advise any person of any error therein."

FTSE™ is a trademark of London Stock Exchange Limited and The Financial Times Limited and is used by FTSE International Limited under license.

U-21

Historical performance of the reference indices

The following table sets forth the published high and low closing levels of each reference index during each calendar quarter from January 1, 2002 through February 2, 2007. The closing level of the MSCI Singapore Free Index, MSCI Taiwan Index, KOSPI 200 Index and the FTSE/Xinhua China 25 Index on February 2, 2007 was 393.52, 316.03, 183.20 and 15700.53, respectively. We obtained the index levels and other information below from Bloomberg Financial Markets, without independent verification. You should not take the historical levels of the reference indices as an indication of future performance of the reference indices or the securities. We cannot give you any assurance that the levels of any of the reference indices will increase over the term of the securities.

| | Low

| | High

| |

| | Low

| | High

|

|---|

| MSCI Singapore Free Index | | | | | | | | | | |

| 2002 | | | | | | 2005 | | | | |

| First Quarter | | 202.17 | | 229.23 | | First Quarter | | 246.80 | | 259.20 |

| Second Quarter | | 189.73 | | 226.36 | | Second Quarter | | 248.44 | | 264.63 |

| Third Quarter | | 165.57 | | 205.72 | | Third Quarter | | 263.42 | | 282.90 |

| Fourth Quarter | | 163.05 | | 183.61 | | Fourth Quarter | | 259.52 | | 278.94 |

2003 |

|

|

|

|

|

2006 |

|

|

|

|

| First Quarter | | 147.78 | | 173.25 | | First Quarter | | 280.16 | | 300.76 |

| Second Quarter | | 150.37 | | 189.38 | | Second Quarter | | 271.72 | | 317.49 |

| Third Quarter | | 179.64 | | 202.56 | | Third Quarter | | 275.73 | | 307.74 |

| Fourth Quarter | | 200.35 | | 222.12 | | Fourth Quarter | | 310.75 | | 364.68 |

2004 |

|

|

|

|

|

2007 |

|

|

|

|

| First Quarter | | 219.29 | | 232.26 | | First Quarter (through | | | | |

| Second Quarter | | 207.08 | | 230.32 | | February 2, 2007) | | 358.89 | | 393.52 |

| Third Quarter | | 223.63 | | 242.27 | | | | | | |

| Fourth Quarter | | 233.90 | | 246.86 | | | | | | |

| | Low

| | High

| |

| | Low

| | High

|

|---|

| MSCI Taiwan Index | | | | | | | | | | |

| 2002 | | | | | | 2005 | | | | |

| First Quarter | | 246.39 | | 282.99 | | First Quarter | | 240.29 | | 261.15 |

| Second Quarter | | 223.34 | | 289.96 | | Second Quarter | | 235.89 | | 266.97 |

| Third Quarter | | 178.84 | | 240.93 | | Third Quarter | | 247.38 | | 271.34 |

| Fourth Quarter | | 162.81 | | 210.31 | | Fourth Quarter | | 235.23 | | 277.65 |

2003 |

|

|

|

|

|

2006 |

|

|

|

|

| First Quarter | | 181.33 | | 216.15 | | First Quarter | | 267.98 | | 285.78 |

| Second Quarter | | 177.59 | | 219.73 | | Second Quarter | | 262.49 | | 316.10 |

| Third Quarter | | 217.56 | | 258.49 | | Third Quarter | | 258.49 | | 289.53 |

| Fourth Quarter | | 248.82 | | 273.90 | | Fourth Quarter | | 284.67 | | 318.25 |

2004 |

|

|

|

|

|

2007 |

|

|

|

|

| First Quarter | | 261.11 | | 300.55 | | First Quarter (through | | | | |

| Second Quarter | | 233.12 | | 292.39 | | February 2, 2007) | | 309.70 | | 323.31 |

| Third Quarter | | 224.29 | | 249.84 | | | | | | |

| Fourth Quarter | | 234.90 | | 257.67 | | | | | | |

U-22

| | Low

| | High

| |

| | Low

| | High

|

|---|

| KOSPI 200 Index | | | | | | | | | | |

| 2002 | | | | | | 2005 | | | | |

| First Quarter | | 88.63 | | 112.68 | | First Quarter | | 112.71 | | 131.97 |

| Second Quarter | | 88.61 | | 117.66 | | Second Quarter | | 117.58 | | 130.39 |

| Third Quarter | | 81.37 | | 101.05 | | Third Quarter | | 130.54 | | 159.06 |

| Fourth Quarter | | 73.35 | | 93.52 | | Fourth Quarter | | 146.55 | | 177.43 |

2003 |

|

|

|

|

|

2006 |

|

|

|

|

| First Quarter | | 65.64 | | 84.92 | | First Quarter | | 168.04 | | 182.39 |

| Second Quarter | | 68.40 | | 88.11 | | Second Quarter | | 155.43 | | 190.20 |

| Third Quarter | | 86.15 | | 98.87 | | Third Quarter | | 159.69 | | 178.32 |

| Fourth Quarter | | 90.63 | | 106.48 | | Fourth Quarter | | 171.78 | | 186.54 |

2004 |

|

|

|

|

|

2007 |

|

|

|

|

| First Quarter | | 106.65 | | 119.28 | | First Quarter (through | | | | |

| Second Quarter | | 94.05 | | 122.44 | | February 2, 2007) | | 174.99 | | 185.70 |

| Third Quarter | | 93.19 | | 110.42 | | | | | | |

| Fourth Quarter | | 104.13 | | 115.25 | | | | | | |

| | Low

| | High

| |

| | Low

| | High

|

|---|

| FTSE/Xinhua China 25 Index | | | | | | | | |

| 2002 | | | | | | 2005 | | | | |

| First Quarter | | 4391.50 | | 5001.89 | | First Quarter | | 7827.26 | | 8767.79 |

| Second Quarter | | 4816.63 | | 5169.69 | | Second Quarter | | 7889.44 | | 8529.93 |

| Third Quarter | | 4328.78 | | 5083.68 | | Third Quarter | | 8363.14 | | 9736.78 |

| Fourth Quarter | | 4081.49 | | 4528.84 | | Fourth Quarter | | 8272.52 | | 9430.76 |

2003 |

|

|

|

|

|

2006 |

|

|

|

|

| First Quarter | | 4309.18 | | 4707.99 | | First Quarter | | 9346.46 | | 11123.08 |

| Second Quarter | | 4234.37 | | 5260.29 | | Second Quarter | | 9981.00 | | 12304.50 |

| Third Quarter | | 5170.81 | | 6279.46 | | Third Quarter | | 11010.07 | | 12076.24 |

| Fourth Quarter | | 6193.19 | | 8324.97 | | Fourth Quarter | | 11948.32 | | 16689.44 |

2004 |

|

|

|

|

|

2007 |

|

|

|

|

| First Quarter | | 7879.50 | | 8845.71 | | First Quarter (through | | | | |

| Second Quarter | | 6222.20 | | 8614.24 | | February 2, 2007) | | 15265.28 | | 17289.21 |

| Third Quarter | | 6950.06 | | 8040.70 | | | | | | |

| Fourth Quarter | | 7594.53 | | 8512.93 | | | | | | |

U-23

Historical Basket Values

The following table sets forth the historical performance of the basket from January 1, 2002 through February 2, 2007, assuming that the basket was weighted in the same manner as described in this pricing supplement. We obtained the closing levels of the reference indices from Bloomberg Financial Markets. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg Financial Markets.

The historical levels of the basket should not be taken as an indication of future performance, and no assurance can be given as to the final basket level. We cannot give you assurance that the performance of the basket will allow you to receive more than the principal amount of your initial investment.

| | Low

| | High

| | Close

| |

| | Low

| | High

| | Close

|

|---|

| 2002 | | | | | | | | 2005 | | | | | | |

| First Quarter | | 0.5227 | | 0.5950 | | 0.5937 | | First Quarter | | 0.6321 | | 0.6837 | | 0.6589 |

| Second Quarter | | 0.4977 | | 0.6066 | | 0.5088 | | Second Quarter | | 0.6352 | | 0.6915 | | 0.6861 |

| Third Quarter | | 0.4275 | | 0.5382 | | 0.4275 | | Third Quarter | | 0.6848 | | 0.7407 | | 0.7407 |

| Fourth Quarter | | 0.4026 | | 0.4743 | | 0.4321 | | Fourth Quarter | | 0.6827 | | 0.7862 | | 0.7838 |

2003 |

|

|

|

|

|

|

|

2006 |

|

|

|

|

|

|

| First Quarter | | 0.3993 | | 0.4677 | | 0.4083 | | First Quarter | | 0.7832 | | 0.8290 | | 0.8290 |

| Second Quarter | | 0.4044 | | 0.4980 | | 0.4794 | | Second Quarter | | 0.7530 | | 0.9052 | | 0.8145 |

| Third Quarter | | 0.4861 | | 0.5644 | | 0.5443 | | Third Quarter | | 0.7752 | | 0.8566 | | 0.8562 |

| Fourth Quarter | | 0.5547 | | 0.6184 | | 0.6184 | | Fourth Quarter | | 0.8539 | | 1.0008 | | 1.0008 |

2004 |

|

|

|

|

|

|

|

2007 |

|

|

|

|

|

|

| First Quarter | | 0.6305 | | 0.6839 | | 0.6513 | | First Quarter through | | | | | | |

| Second Quarter | | 0.5434 | | 0.6758 | | 0.5957 | | February 2, 2007 | | 0.9576 | | 1.0144 | | 1.0000 |

| Third Quarter | | 0.5682 | | 0.6290 | | 0.6176 | | | | | | | | |

| Fourth Quarter | | 0.5999 | | 0.6500 | | 0.6500 | | | | | | | | |

U-24

SUPPLEMENTAL INFORMATION REGARDING U.S. FEDERAL INCOME TAX CONSIDERATIONS

Under the Contingent Debt Regulations, as defined in the attached product supplement, you will be required to include original issue discount in income each year, regardless of your usual method of tax accounting, based on the comparable yield of the securities. We have determined the comparable yield of the securities based on the rate, as of the initial issue date, at which we would issue a fixed rate debt instrument with no contingent payments but with terms and conditions similar to the securities. Accordingly, we have determined that the comparable yield is an annual rate of 5.235%, compounded semi-annually.

We are required to furnish to you the comparable yield and, solely for tax purposes, a projected payment schedule that estimates the amount and timing of contingent interest payments (generally the redemption amount in excess of par paid upon the Maturity Date). For purposes of this determination—and only for purposes of this determination, which is required for federal income tax purposes—we have assumed that the securities will not be called and will be held until the Maturity Date. Accordingly, the projected payment schedule attached as Exhibit A indicates that you will receive no interest until the Maturity Date, at which time the projected payment amount includes $ of interest. For U.S. federal income tax purposes, you must use the comparable yield and the schedule of projected payments in determining your original issue discount accruals (and the adjustments thereto described below) in respect of the securities, unless you timely disclose and justify the use of a different comparable yield and projected payment schedule to the Internal Revenue Service.

The comparable yield and the projected payment schedule are provided solely for the U.S. federal income tax treatment of the securities and do not constitute a projection or representation regarding the actual amount of the payments on a security.

IRS CIRCULAR 230 REQUIRES THAT WE INFORM YOU THAT ANY TAX STATEMENT HEREIN REGARDING ANY US FEDERAL TAX IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BY USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING ANY PENALTIES. ANY SUCH STATEMENT HEREIN WAS WRITTEN TO SUPPORT THE MARKETING OR PROMOTION OF THE TRANSACTION(S) OR MATTER(S) TO WHICH THE STATEMENT RELATES. A PROSPECTIVE INVESTOR (INCLUDING A TAX-EXEMPT INVESTOR) IN THE SECURITIES SHOULD CONSULT ITS OWN TAX ADVISOR IN DETERMINING THE TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES, INCLUDING THE APPLICATION OF STATE, LOCAL OR OTHER TAX LAWS AND THE POSSIBLE EFFECTS OF CHANGES IN FEDERAL OR OTHER TAX LAWS.

UNDERWRITING

Under the terms and subject to the conditions contained in a distribution agreement dated June 25, 2004, as supplemented by a terms agreement dated , 2007, which we refer to collectively as the distribution agreement, we have agreed to sell $ principal amount of securities to Credit Suisse Securities (USA) LLC.

The distribution agreement provides that Credit Suisse Securities (USA) LLC is obligated to purchase all of the securities if any are purchased.

Credit Suisse Securities (USA) LLC proposes to offer the securities at the offering price set forth on the cover page of this pricing supplement. If all of the securities are not sold at the initial offering price, Credit Suisse may change the public offering price and other selling terms.

We estimate that our out-of-pocket expenses for this offering will be approximately $2,000.

Please refer to "Underwriting" on page PS-22 of the accompanying product supplement.

We expect that delivery of the securities will be made against payment therefor on or about , 2006, which will be the fifth business day following the date the securities are priced for initial sale to the public.

U-25

PRODUCT SUPPLEMENT TO PROSPECTUS SUPPLEMENT DATED SEPTEMBER 6, 2006 TO PROSPECTUS DATED FEBRUARY 21, 2006

Credit Suisse (USA), Inc.

ProNotes®

Linked to the Value of a Basket of Indices

This product supplement should be read in conjunction with the pricing supplement relating to a particular issue of securities. To the extent the terms of any such pricing supplement are inconsistent with the terms of this product supplement, the pricing supplement will prevail.

The maturity date of each security will be specified in the relevant pricing supplement, subject to postponement if a market disruption event occurs on the final valuation date.

We will not pay interest on the securities.

You will receive a redemption amount in cash at maturity that will equal the principal amount of the securities that you hold multiplied by the sum of 1 plus the basket return, calculated as set forth below. If the final basket level is greater than the initial basket level, the basket return will equal the percentage increase of the basket. If the final basket level is equal to or less than the initial basket level, the basket return will equal zero, and you will receive only an amount equal to the principal amount of your securities at maturity.