QuickLinks -- Click here to rapidly navigate through this documentCALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities Offered

| | Maximum Aggregate

Offering Price

| | Amount of

Registration Fee

|

|---|

|

| Buffered Accelerated Return Equity Securities (BARES) Linked to the Value of a Global Basket of Equity Indices due March 31, 2011 | | $46,514,000 | | $4,977 |

|

Filed Pursuant to Rule 424(B)2

Registration No. 333-131970

PRICING SUPPLEMENT TO PROSPECTUS SUPPLEMENT DATED SEPTEMBER 6, 2006 TO

PROSPECTUS DATED FEBRUARY 21, 2006

$46,514,000

Credit Suisse (USA), Inc.

Buffered Accelerated Return Equity Securities (BARES)SM

due March 31, 2011

Linked to the Value of a Global Basket of Equity Indices

| Issuer: | | Credit Suisse (USA), Inc. |

Maturity Date: |

|

March 31, 2011, subject to postponement if a market disruption event occurs on a valuation date. |

Coupon: |

|

We will not pay interest on the securities being offered by this pricing supplement. |

Valuation Date: |

|

The valuation date is March 24, 2011, subject to a postponement if a market disruption event occurs on the valuation date. |

Underlying Indices: |

|

The return will be based on the performance of a basket of indices during the term of the securities. The basket will be comprised of six reference indices, with each index having the following weightings: S&P 500 Index—70%; Russell 2000 Index—10%; EURO STOXX 50 Index—8%; Nikkei 225 Index—5%; FTSE 100 Index—5% and S&P/ASX 200 Index—2%. |

Redemption Amount: |

|

You will receive a redemption amount in cash at maturity that will equal the principal amount of the securities you hold multiplied by the sum of 1 plus the basket return, calculated as set forth below. If the final basket level is greater than the initial basket level, the basket return will be equal to the percentage increase in the basket level multiplied by an additional percentage of 116%. If the final basket level is less than or equal to the initial basket level, but is greater than or equal to 80% of the initial basket level, then the basket return will be zero and you will receive only an amount equal to the principal amount of your securities at maturity. If the final basket level is less than 80% of the initial basket level, then the basket return will be negative and you will receive less than the principal amount, but not less than 20% of the principal amount, of your securities at maturity, as explained herein. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this pricing supplement or the prospectus supplement or prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

| | Price to the Public

| | Underwriting Discounts and

Commissions

| | Proceeds to the Company

|

|---|

| Per security | | $ | 10,000 | | $0 | | $ | 10,000 |

| Total | | $ | 46,514,000 | | $0 | | $ | 46,514,000 |

Delivery of the securities in book-entry form only will be made through The Depository Trust Company on or about March 28, 2007. The securities will be issued in minimum denominations of $10,000 and integral multiples of $1,000 in excess of that amount.

Credit Suisse

The date of this pricing supplement is March 23, 2007.

TABLE OF CONTENTS

| | Page

|

|---|

Pricing Supplement |

|

|

| SUMMARY | | PS-3 |

| RISK FACTORS | | PS-10 |

| CREDIT SUISSE (USA), INC. | | PS-14 |

| USE OF PROCEEDS AND HEDGING | | PS-14 |

| DESCRIPTION OF THE SECURITIES | | PS-15 |

| THE REFERENCE INDICES | | PS-21 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | PS-38 |

| CERTAIN ERISA CONSIDERATIONS | | PS-41 |

| UNDERWRITING | | PS-42 |

| INCORPORATION BY REFERENCE | | PS-43 |

Prospectus Supplement |

|

|

| | DESCRIPTION OF NOTES | | S-3 |

| | PLAN OF DISTRIBUTION | | S-6 |

|

|

|

Prospectus |

|

|

| ABOUT THIS PROSPECTUS | | 3 |

| CREDIT SUISSE (USA), INC | | 3 |

| WHERE YOU CAN FIND MORE INFORMATION | | 3 |

| FORWARD-LOOKING STATEMENTS | | 4 |

| USE OF PROCEEDS | | 5 |

| DESCRIPTION OF DEBT SECURITIES | | 6 |

| SPECIAL PROVISION RELATING TO FOREIGN CURRENCY DENOMINATED DEBT SECURITIES | | 31 |

| FOREIGN CURRENCY RISKS | | 34 |

| DESCRIPTION OF WARRANTS | | 36 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | 38 |

| EUROPEAN UNION DIRECTIVE ON TAXATION OF CERTAIN INTEREST PAYMENTS | | 45 |

| ERISA | | 46 |

| PLAN OF DISTRIBUTION | | 47 |

| LEGAL MATTERS | | 48 |

| EXPERTS | | 48 |

You should rely only on the information contained in this document or to which we refer you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

We are offering the securities for sale in those jurisdictions in the United States where it is lawful to make such offers. The distribution of this pricing supplement and the accompanying prospectus supplement and prospectus and the offering of the securities in some jurisdictions may be restricted by law. If you possess this pricing supplement and the accompanying prospectus supplement and prospectus, you should find out about and observe these restrictions. This pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom such offer or sale is not permitted. We refer you to the "Underwriting" section of this pricing supplement.

In this pricing supplement and accompanying prospectus supplement and prospectus, unless otherwise specified or the context otherwise requires, references to "we," "us" and "our" are to Credit Suisse (USA), Inc. and its consolidated subsidiaries, and references to "dollars" and "$" are to United States dollars.

PS-2

SUMMARY

The following is a summary of the terms of the securities and factors that you should consider before deciding to invest in the securities. You should read this pricing supplement and the accompanying prospectus supplement and prospectus carefully to understand fully the terms of the securities and other considerations that are important in making a decision about investing in the securities. You should, in particular, review the "Risk Factors" section of this pricing supplement, which sets forth a number of risks related to the securities. All of the information set forth below is qualified in its entirety by the detailed explanations set forth elsewhere in this pricing supplement and the accompanying prospectus supplement and prospectus.

What are the Buffered Accelerated Return Equity Securities?

The Buffered Accelerated Return Equity Securities (BARES)SM, or the securities, are medium-term notes issued by us, the return on which is linked to the performance of a basket of indices comprised of the S&P 500 Index, the Russell 2000 Index, the EURO STOXX 50 Index, the Nikkei 225 Index, the FTSE 100 Index, and the S&P/ASX 200 Index, referred to as the reference indices. You will receive a redemption amount in cash at maturity that will equal the principal amount of the securities you hold multiplied by the sum of 1 plus the basket return, calculated as set forth below. If the final basket level is greater than the initial basket level, the basket return will be equal to the percentage increase in the basket level multiplied by an additional percentage of 116%. If the final basket level is less than or equal to the initial basket level, but is greater than or equal to 80% of the initial basket level, then the basket return will be zero and you will receive only an amount equal to the principal amount of your securities at maturity. If the final basket level is less than 80% of the initial basket level, then the basket return will be negative and you will receive less than the principal amount, but not less than 20% of the principal amount, of your securities at maturity, as explained herein.

For a description of how the redemption amount at maturity will be calculated, please refer to "How is the redemption amount calculated?" and "Description of the Securities—Redemption amount."

Are there risks involved in investing in the securities?

An investment in the securities involves risks. Please see the "Risk Factors" section beginning on page PS-10.

The securities are not principal-protected.An investment in the securities is not principal-protected and you may receive less at maturity than you originally invested if the final basket level is less than the initial basket level (each as calculated in accordance with the terms of the securities) and you could lose up to 80% of the value of your investment in the securities.

Will I receive interest on the securities?

You will not receive any interest payments on the securities for the entire term of the securities.

Will I receive any dividend payments on, or have shareholder rights in, the stocks comprising the reference indices?

As a holder of the securities, you will not receive any dividend payments or other distributions on the stocks underlying the reference indices or have voting or any other rights of a holder of the stocks underlying the reference indices.

Will there be an active trading market in the securities?

The securities will not be listed on any securities exchange. Accordingly, there is no assurance that a liquid trading market will develop for the securities. Credit Suisse Securities (USA) LLC currently

PS-3

intends to make a market in the securities, although it is not required to do so and may stop making a market at any time.

If you have to sell your securities prior to maturity, you may have to sell them at a substantial loss.

What are the U.S. federal income tax considerations for making an investment in the securities?

Please refer to "Certain United States Federal Income Tax Considerations" beginning on page PS-38 for a discussion of certain U.S. federal income tax consequences of an investment in the securities.

How is the redemption amount calculated?

We will redeem the securities at maturity for a redemption amount in cash that will equal the principal amount of the securities multiplied by the sum of 1 plus the basket return. The basket return will be based on the difference between the final basket level and the initial basket level, expressed as a percentage. How the basket return will be calculated depends on whether the final basket level is greater than, less than or equal to the initial basket level and, if less than the initial basket level, how much less:

- •

- If the final basket level is greater than the initial basket level, then the basket return will equal:

| |

| |

|

|---|

| 116% * | | final basket level - initial basket level

initial basket level | | |

Thus, if the final basket level is greater than the initial basket level, the basket return will be a positive number, and you will receive more than the principal amount of your securities at maturity.

- •

- If the final basket level is less than or equal to the initial basket level, but is greater than or equal to 80% of the initial basket level, then the basket return will equal zero and the redemption amount will equal the principal amount of the securities.

- •

- If the final basket level is less than 80% of the initial basket level, then the basket return will equal:

| |

| |

|

|---|

| | | final basket level - (80% * initial basket level)

initial basket level | | |

Thus, if the final basket level is less than 80% of the initial basket level, the basket return will be negative, and you will receive less than the principal amount of your securities at maturity, and you could lose up to 80% of the value of your investment in the securities.

For purposes of calculating the basket return, the basket level on the valuation date will be equal to the sum of:

- (i)

- the product of (x) .70, the weighting of the S&P 500 Index in the basket, and (y) the closing level of the S&P 500 Index on the valuation date divided by 1437.50, the closing level of the S&P 500 Index on March 26, 2007, the index business day immediately following the date the securities are priced for initial sale to the public, which we refer to as the trade date;

- (ii)

- the product of (x) .10, the weighting of the Russell 2000 Index in the basket, and (y) the closing level of the Russell 2000 Index on the valuation date divided by 808.94, the closing level of the Russell 2000 Index on March 26, 2007, the index business day immediately following the trade date;

PS-4

- (iii)

- the product of (x) .08, the weighting of the EURO STOXX 50 Index in the basket, and (y) the closing level of the EURO STOXX 50 Index on the valuation date divided by 4142.11, the closing level of the EURO STOXX 50 Index on March 26, 2007, the index business day immediately following the trade date;

- (iv)

- the product of (x) .05, the weighting of the Nikkei 225 Index in the basket, and (y) the closing level of the Nikkei 225 Index on the valuation date divided by 17521.96, the closing level of the Nikkei 225 Index on March 26, 2007, the index business day immediately following the trade date;

- (v)

- the product of (x) .05, the weighting of the FTSE 100 Index in the basket, and (y) the closing level of the FTSE 100 Index on the valuation date divided by 6291.90, the closing level of the FTSE 100 Index on March 26, 2007, the index business day immediately following the trade date; and

- (vi)

- the product of (x) .02, the weighting of the S&P/ASX 200 Index in the basket, and (y) the closing level of the S&P/ASX 200 Index on the valuation date divided by 5990.70, the closing level of the S&P/ASX 200 Index on March 26, 2007, the index business day immediately following the trade date.

The following terms used in this pricing supplement have the following definitions:

The "basket level" on the valuation date will be determined as set forth above.

The "initial basket level" equals 1.0.

The "initial level" of the S&P 500 Index, the Russell 2000 Index, the EURO STOXX 50 Index, the Nikkei 225 Index, the FTSE 100 Index, the S&P/ASX 200 Index is 1437.50, 808.94, 4142.11, 17521.96, 6291.90 and 5990.70, respectively.

The "final basket level" will equal the closing level of the basket on the valuation date.

The "final level" for each reference index will equal the closing level of such reference index on the valuation date.

The "valuation date" is March 24, 2011, subject to a postponement if a market disruption event occurs on the valuation date.

How has each of the reference indices and the hypothetical basket performed historically?

The historical values of each of the reference indices and the hypothetical basket are provided in the section "The Reference Indices—Historical performance of the reference indices" on page PS-20. Past performance is not necessarily indicative of how the reference indices or the hypothetical basket will perform in the future.

PS-5

What are some hypothetical redemption amounts at maturity of the securities?

The table below sets forth a sampling of hypothetical redemption amounts at maturity of a $10,000 investment in the securities when the additional percentage used in calculation of the basket return if the final basket level is greater than the initial basket level is 116%. The actual final basket level will be determined on the valuation date, as further described herein.

Principal Amount

of Securities

| | Percentage Difference between

Initial Basket Level and Final

Basket Level

| | Redemption Amount

at Maturity

|

|---|

| $10,000 | | -100 | % | $ 2,000 |

| $10,000 | | -90 | % | $ 3,000 |

| $10,000 | | -80 | % | $ 4,000 |

| $10,000 | | -70 | % | $ 5,000 |

| $10,000 | | -60 | % | $ 6,000 |

| $10,000 | | -50 | % | $ 7,000 |

| $10,000 | | -40 | % | $ 8,000 |

| $10,000 | | -30 | % | $ 9,000 |

| $10,000 | | -20 | % | $10,000 |

| $10,000 | | -10 | % | $10,000 |

| $10,000 | | 0 | % | $10,000 |

| $10,000 | | 10 | % | $11,160 |

| $10,000 | | 20 | % | $12,320 |

| $10,000 | | 30 | % | $13,480 |

| $10,000 | | 40 | % | $14,640 |

| $10,000 | | 50 | % | $15,800 |

PS-6

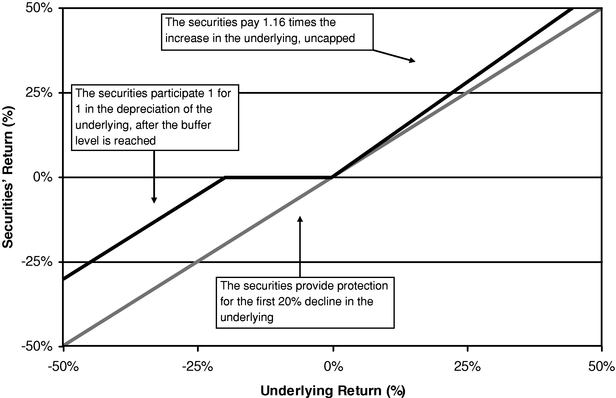

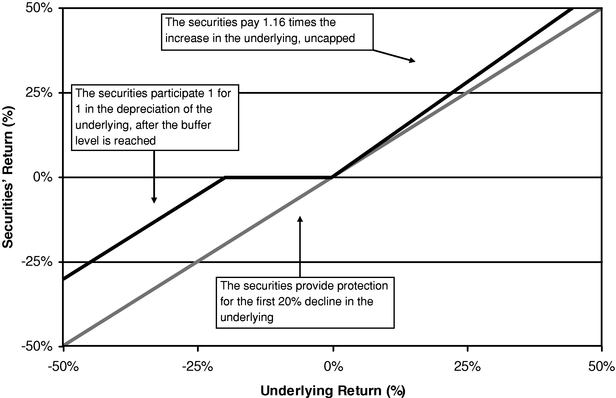

The graph of hypothetical returns at maturity set forth below is intended to demonstrate the effect of the leveraged upside. The gray line shows hypothetical percentage return at maturity for an investment in an instrument directly linked to the value of the basket when the additional percentage used in calculation of the basket return if the final basket level is greater than the initial basket level is 116%. The actual final basket level will be determined on the valuation date, as further described herein. The thick black line shows hypothetical percentage return at maturity for a similar investment in the securities.

These examples are for illustrative purposes only. The actual basket return will depend on the final basket level of the basket determined by the calculation agent as provided in this pricing supplement and that the additional percentage used.

Examples of the hypothetical redemption amounts of the securities

The following are illustrative examples of how the redemption amount would be calculated with hypothetical final basket levels that are greater than, and equal to or less than, the initial basket levels. Each of the examples assumes that the initial investment in the securities is $10,000 and the initial level for each reference index is 1000 and assumes that the additional percentage used in calculation of the basket return if the final basket level is greater than the initial basket level is 116%. The actual final basket level will be determined on the valuation date, as further described herein.

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. S&P 500 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 2. Russell 2000 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 3. EURO STOXX 50 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 4. Nikkei 225 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 5. FTSE 100 Index | | 1000 | | 1100 | | 1100 | | 1100 |

| 6. S&P/ASX 200 Index | | 1000 | | 1100 | | 1100 | | 1100 |

PS-7

| Basket Level on each Valuation Date | | = (.70*(final level(1)/initial level(1)))

+ (.10*(final level(2)/initial level(2)))

+ (.08*(final level(3)/initial level(3)))

+ (.05*(final level(4)/initial level(4)))

+ (.05*(final level(5)/initial level(5)))

+ (.02*(final level(6)/initial level(6))) |

|

|

= ((.70*(1100/1000)) + (.10*(1100/1000)) + (.08*(1100/1000)) + (.05*(1100/1000))

+ (.05*(1100/1000)) + (.02*(1100/1000))) |

Basket Level on each Valuation Date = (.77 + .11 + .088 + .055 + .055 + .022) = 1.1

Final Basket Level = (1.1 + 1.1 + 1.1)/3 = 1.1

Determination of basket return when final basket level is greater than initial basket level

Basket Return = 1.16 * (1.1 - 1.0)/1.0) = .116

Redemption Amount = Principal * (1.0 + basket return)

Redemption Amount = $10,000 * (1.0 + .116)

Redemption Amount = $11,160

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. S&P 500 Index | | 1000 | | 950 | | 950 | | 950 |

| 2. Russell 2000 Index | | 1000 | | 950 | | 950 | | 950 |

| 3. EURO STOXX 50 Index | | 1000 | | 950 | | 950 | | 950 |

| 4. Nikkei 225 Index | | 1000 | | 950 | | 950 | | 950 |

| 5. FTSE 100 Index | | 1000 | | 950 | | 950 | | 950 |

| 6. S&P/ASX 200 Index | | 1000 | | 950 | | 950 | | 950 |

| Basket Level on each Valuation Date | | = (.70*(final level(1)/initial level(1)))

+ (.10*(final level(2)/initial level(2)))

+ (.08*(final level(3)/initial level(3)))

+ (.05*(final level(4)/initial level(4)))

+ (.05*(final level(5)/initial level(5)))

+ (.02*(final level(6)/initial level(6)))

= ((.70*(1100/1000)) + (.10*(1100/1000)) + (.08*(950/1000)) + (.05*(950/1000))

+ (.05*(950/1000)) + (.02*(950/1000))) |

Basket Level on each Valuation Date |

|

= (.6650 + .0950 + .0760 + .0475 + .0475 + .0190)= .95 |

Final Basket Level = (.95 + .95 + .95)/3 = .95

Determination of basket return when final basket level is less than initial basket level but greater than 80% of initial basket level

Since the final basket level (.95) is less than the initial basket level (1.0) but is greater than 80% of the initial basket level (.08), the basket return equals 0.0.

Redemption Amount = Principal * (1.0 + basket return)

Redemption Amount = $10,000 * (1.0 - 0.0)

Redemption Amount = $10,000

PS-8

EXAMPLE 3: Both increases and decreases in final levels of each reference index on each valuation date:

| |

| | Final Level on Valuation Date

|

|---|

Reference Index

| | Initial Level

|

|---|

| | 1

| | 2

| | 3

|

|---|

| 1. S&P 500 Index | | 1000 | | 900 | | 600 | | 800 |

| 2. Russell 2000 Index | | 1000 | | 700 | | 900 | | 1000 |

| 3. EURO STOXX 50 Index | | 1000 | | 1100 | | 600 | | 1100 |

| 4. Nikkei 225 Index | | 1000 | | 900 | | 800 | | 700 |

| 5. FTSE 100 Index | | 1000 | | 500 | | 700 | | 600 |

| 6. S&P/ASX 200 Index | | 1000 | | 600 | | 1200 | | 500 |

| Basket Level on each Valuation Date | | = (.70*(final level(1)/initial level(1)))

(.10*(final level(2)/initial level(2)))

(.08*(final level(3)/initial level(3)))

+ (.05*(final level(4)/initial level(4)))

+ (.05*(final level(5)/initial level(5)))

+ (.02*(final level(6)/initial level(6))) |

Basket Level1 = (.70*(900/1000))+ (.10* (700/1000)) + (.08*(1100/1000)) + (.05*(900/1000)) + (.05*(500/1000)) + (.02*(600/1000))) = .870

Basket Level2 = (.70*(600/1000)) + (.10* (900/1000)) + (.08*(600/1000)) + (.05*(800/1000)) + (.05*(700/1000)) + (.02*(1200/1000))) = ..657

Basket Level3 = (.70*(800/1000)) + (.10* (1000/1000)) + (.08*(1100/1000)) + (.05*(700/1000)) + (.05*(600/1000)) + (.02*(500/1000))) = .823

Final Basket Level = (.870 + .657 + .823)/3= .783

Determination of basket return when final basket level is less than 80% of initial basket level

Basket Return = ((.783 - (.80*1.0))/1.0) = -.017

Redemption Amount = Principal * (1.0 + basket return)

Redemption Amount = $10,000 * (1.0 - .017)

Redemption Amount = $9,830

PS-9

RISK FACTORS

A purchase of the securities involves risks. This section describes significant risks relating to the securities. We urge you to read the following information about these risks, together with the other information in this pricing supplement and the accompanying prospectus supplement and prospectus before investing in the securities.

The securities are only 20% principal-protected

An investment in the securities is only 20% principal-protected and you may receive less at maturity than you originally invested. If the final basket level is less than 80% of the initial basket level (each as calculated in accordance with the terms of the securities) you will bear a portion of the loss in the basket down to 20% of the principal amount of your securities.

The securities do not pay interest

We will not pay interest on the securities. You may receive less at maturity than you could have earned on ordinary interest-bearing debt securities with similar maturities, including other of our debt securities, since the redemption amount at maturity is based on the appreciation or depreciation of the basket. Because the redemption amount due at maturity may be less than the amount originally invested in the securities, the return on the securities (the effective yield to maturity) may be negative. Even if it is positive, the return payable on each security may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time.

An investment in the securities is not the same as an investment in the stocks underlying the reference indices or a security directly linked to the reference indices

The payment of dividends on the stocks which comprise, or underlie, the reference indices generally has no effect on the calculation of the index level for the reference indices. Therefore, the return on your investment based on the percentage change in the reference indices is not the same as the total return based on the purchase of those underlying stocks and will not be the same as a security directly linked to the reference indices held for a similar period as a result of the leverage factor if the basket return is positive and the downside protection if the basket return declines more than 80%. As an investor in the securities, you will not have voting rights, rights to receive dividends or other distributions or any other rights with respect to the stocks that underlie the reference indices.

The formula for determining the redemption amount does not take into account changes in the level of the basket prior to the valuation dates

Changes in the level of the basket during the term of the securities before the dates on which the final basket level is calculated is calculated will not be reflected in the calculation of the redemption amount payable at maturity. The calculation agent will calculate the redemption amount by comparing only the initial and final level of the basket. No other basket levels will be taken into account. As a result, you may receive less than your principal amount at maturity even if the basket has risen at certain times during the term of the securities before falling to a level less than 80% of the initial basket level on the valuation dates.

There may be little or no secondary market for the securities

The securities will not be listed on any securities exchange. We cannot assure you that a secondary market for the securities will develop. Credit Suisse Securities (USA) LLC currently intends to make a market in the securities, although it is not required to do so and may stop making a market at any time. If you have to sell your securities prior to maturity, you may have to sell them at a substantial loss.

PS-10

You have no recourse to the index sponsors or to the issuers of the stocks comprising the reference indices

You will have no rights against the sponsors of the reference indices (the "index sponsors"), or against any issuer of a stock comprising the reference indices. The securities are not sponsored, endorsed, sold or promoted by any index sponsor or any such issuer. No index sponsor or any such issuer has passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the securities. No index sponsor or any such issuer makes any representation or warranty, express or implied, to you or any member of the public regarding the advisability of investing in securities generally or the securities in particular, or the ability of the reference indices to track general stock performance. The index sponsors' only relationship to us is in the licensing of trademarks or service marks and certain trade names and the use of the indices, which are determined, composed and calculated by the index sponsors without regard to us or the securities. The index sponsors have no obligation to take our needs or your needs into consideration in determining, composing or calculating the reference indices. No index sponsor or any issuer of a stock comprising the reference indices is responsible for, and none of them has participated in the determination of, the timing, prices or quantities of the securities to be issued or in the determination or calculation of the equation by which the redemption amount of the securities is to be determined. No index sponsor or any such issuer has any liability in connection with the administration, marketing or trading of the securities.

The U.S. federal income tax considerations of the securities are uncertain

No ruling is being requested from the Internal Revenue Service, or the IRS, with respect to the securities and we cannot assure you that the IRS or any court will agree with the conclusions expressed under "Certain United States Federal Income Tax Considerations" in this pricing supplement.

The market price of the securities may be influenced by many unpredictable factors

Many factors, most of which are beyond our control, will influence the value of the securities and the price at which Credit Suisse Securities (USA) LLC may be willing to purchase or sell the securities in the secondary market, including:

- •

- The current level of the reference indices.

- •

- Interest and yield rates in the market.

- •

- The volatility of the reference indices.

- •

- Economic, financial, political and regulatory or judicial events that affect the securities underlying the reference indices or stock markets generally and that may affect the level of the reference indices.

- •

- The time remaining to the maturity of the securities.

- •

- The dividend rate on the stocks underlying the reference indices.

- •

- Credit Suisse's creditworthiness.

Some or all of these factors may influence the price that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

PS-11

The inclusion of commissions and projected profit from hedging in the original issue price of the securities is likely to adversely affect secondary market prices

Assuming no change in market conditions or any other relevant factors, the price, if any, at which Credit Suisse Securities (USA) LLC is willing to purchase the securities in secondary market transactions will likely be lower than the original issue price, since the original issue price included, and secondary market prices are likely to exclude, commissions paid with respect to the securities, as well as the projected profit included in the cost of hedging our obligations under the securities. In addition, any such prices may differ from values determined by pricing models used by Credit Suisse Securities (USA) LLC, as a result of dealer discounts, mark-ups or other transaction costs.

Historical performance of the reference indices is not indicative of future performance

The future performance of the reference indices cannot be predicted based on their historical performance. We cannot guarantee that the levels of the reference indices, and therefore the level of the basket, will increase or that you will receive at maturity an amount greater than the principal amount of your securities.

Adjustments to the reference indices could adversely affect the securities

The index sponsors are responsible for calculating and maintaining the reference indices. The index sponsors can add, delete or substitute the stocks underlying the reference indices or make other methodological changes that could change the value of the reference indices at any time. The index sponsors may discontinue or suspend calculation or dissemination of the reference indices.

If one or more of these events occurs, the calculation of the redemption amount at maturity will be adjusted to reflect such event or events. Please refer to "Description of the Securities—Adjustments to the calculation of the reference indices." Consequently, any of these actions could adversely affect the redemption amount at maturity and/or the market value of the securities.

Changes in the value of one or more of the reference indices may offset each other

Price movements in the reference indices may not correlate with each other. At a time when the level of one or more of the reference indices increases, the level of one or more of the other reference indices may not increase as much or may even decline.

Therefore, in calculating the basket level as of any valuation date, increases in the level of one or more of the reference indices may be moderated, or wholly offset, by declines in the level of one or more of the other reference indices. You can review the historical levels of each of the reference indices under "The Reference Indices," in this pricing supplement. However, you cannot predict the future performance of any of the reference indices or of the basket as a whole, or whether increases in the levels of any of the reference indices will be offset by decreases in the levels of other reference indices, based on their historical performance.

Investing in a security linked to indices based on foreign stocks bears potential risks

An investment in the securities may involve considerations that may not be associated with a security linked to indices based on the stocks of U.S. issuers. These considerations relate to foreign market factors generally and may include, for example, different accounting requirements and regulations, different securities trading rules and conventions and different and, in some cases, more adverse, economic environments.

PS-12

There may be potential conflicts of interest

We, Credit Suisse Securities (USA) LLC and/or any other affiliate may from time to time buy or sell stocks underlying the reference indices or derivative instruments related to the reference indices for our or their own accounts in connection with our or their normal business practices. Although we do not expect them to, these transactions could affect the price of such stocks or the levels of the reference indices, and thus affect the market price of the securities.

In addition, because Credit Suisse International, which is initially acting as the calculation agent for the securities, is an affiliate of ours, potential conflicts of interest may exist between the calculation agent and you, including with respect to certain determinations and judgments that the calculation agent must make in determining amounts due to you.

Finally, we and our affiliates may, now or in the future, engage in business with the issuers of the stocks underlying the reference indices, including providing advisory services. These services could include investment banking and mergers and acquisitions advisory services. These activities could present a conflict of interest between us or our affiliates and you. We or our affiliates may have also published and may in the future publish research reports regarding some or all of the issuers of the stocks comprising the reference indices. This research is modified periodically without notice and may express opinions or provide recommendations that may affect the market price of the stocks comprising the reference indices and/or the levels of the reference indices and, consequently, the market price and the redemption amount payable at maturity of the securities.

The original issue price of the securities includes commissions paid to Credit Suisse Securities (USA) LLC and certain costs of hedging our obligations under the securities. The subsidiaries through which we hedge our obligations under the securities expect to make a profit. Since hedging our obligations entails risk and may be influenced by market forces beyond our or our subsidiaries' control, such hedging may result in a profit that is more or less than initially projected.

A market disruption event may postpone the calculation of the final basket level or the maturity date

If the calculation agent determines that a market disruption event, as defined below, exists in respect of a reference index on a valuation date, then the valuation date for that reference index will be postponed to the first succeeding index business day, as defined below, on which the calculation agent determines that no market disruption event exists in respect of such reference index, unless in respect of the final valuation date the calculation agent determines that a market disruption event in respect of such reference index exists on each of the five index business days immediately following the scheduled final valuation date. In that case, the fifth index business day following the scheduled final valuation date will be deemed to be the final valuation date of such reference index, notwithstanding the existence of a market disruption event in respect of such reference index, and the calculation agent will determine the index level for such final valuation date on that fifth succeeding index business day. The valuation date for each reference index not affected by a market disruption event will be the scheduled valuation date.

In the event that a market disruption event exists in respect of a reference index on the final valuation date, the maturity date of the securities will be postponed to the fifth business day following the day as of which the final level for each of the reference indices has been calculated. Consequently, the existence of a market disruption event could result in a postponement of the maturity date, but no interest or other payment will be payable because of such postponement. Please refer to "Description of the Securities—Maturity date" and "—Market disruption events."

PS-13

CREDIT SUISSE (USA), INC.

We are a leading integrated investment bank serving institutional, corporate, government and high-net-worth clients. We provide our clients with a broad range of products and services that include securities underwriting, sales and trading, financial advisory services, alternative investments, full-service brokerage services, derivatives and risk management products, asset management and investment research. We are an indirect wholly owned subsidiary, and part of the banking businesses, of Credit Suisse Group, or CSG. CSG is a global financial services company providing a comprehensive range of banking, investment banking, asset management and insurance products and services. Our principal subsidiary is Credit Suisse Securities (USA) LLC (formerly known as Credit Suisse First Boston LLC), CSG's principal U.S. registered broker-dealer subsidiary. Effective January 16, 2006, we changed our name from Credit Suisse First Boston (USA), Inc. to Credit Suisse (USA), Inc.

For further information about our company, we refer you to the accompanying prospectus supplement and prospectus and the documents referred to under "Incorporation by Reference" on page PS-43 of this product supplement and "Where You Can Find More Information" on page 3 of the accompanying prospectus.

USE OF PROCEEDS AND HEDGING

The net proceeds from this offering will be approximately $46,514,000. We intend to use the net proceeds for our general corporate purposes, which may include the rationalization of our debt capital structure. We may also use some or all of the net proceeds from this offering to hedge our obligations under the securities.

One or more of our affiliates before and following the issuance of any securities may acquire or dispose of the stocks underlying the reference indices or listed or over-the-counter options contracts in, or other derivatives or synthetic instruments related to, the reference indices to hedge our obligations under the securities. In the course of pursuing such a hedging strategy, the price at which such positions may be acquired or disposed of may be a factor in determining the levels of the reference indices. Although we and our affiliates have no reason to believe that our or their hedging activities will have a material impact on the levels of the reference indices, there can be no assurance that the levels will not be affected.

From time to time after issuance and prior to the maturity of any securities, depending on market conditions (including the levels of the reference indices), in connection with hedging certain of the risks associated with the securities, we expect that one or more of our affiliates will increase or decrease their initial hedging positions using dynamic hedging techniques and may take long or short positions in listed or over-the-counter options contracts in, or other derivative or synthetic instruments related to, the reference indices. In addition, we or one or more of our affiliates may take positions in other types of appropriate financial instruments that may become available in the future. To the extent that we or such affiliates have a hedge position in the reference indices, we or one or more of our affiliates may liquidate a portion of those holdings at or about the time of the maturity of any securities. Depending, among other things, on future market conditions, the aggregate amount and the composition of such positions are likely to vary over time. Our or our affiliates' hedging activities will not be limited to any particular securities exchange or market.

The original issue price of the securities will include the commissions paid to Credit Suisse Securities (USA) LLC with respect to the securities and the cost of hedging our obligations under the securities. The cost of hedging includes the projected profit that our subsidiaries expect to realize in consideration for assuming the risks inherent in managing the hedging transactions. Since hedging our obligations entails risk and may be influenced by market forces beyond our or our subsidiaries' control, such hedging may result in a profit that is more or less than initially projected, or could result in a loss.

PS-14

DESCRIPTION OF THE SECURITIES

This description of the terms of the securities adds information to the descriptions of the general terms and provisions of our debt securities in the accompanying prospectus supplement and prospectus. If this description differs in any way from the description in the accompanying prospectus supplement and prospectus, you should rely on this description. It is important for you to consider the information contained in the accompanying prospectus supplement and prospectus in making your investment decision.

General

We will issue the securities under an indenture, dated as of June 1, 2001, between us and The Bank of New York, as successor trustee to JPMorgan Chase Bank, as trustee. The indenture is more fully described under "Description of Debt Securities" on page 6 of the accompanying prospectus. The securities will be an issue of medium-term notes of the type described under "Description of Notes" on page S-3 of the accompanying prospectus supplement.

The securities will be issued in one or more fully registered global securities in denominations of $10,000 and integral multiples of $1,000 greater than $10,000. The securities will not be entitled to the benefit of any mandatory sinking fund.

The securities will be our unsecured obligations and will rank prior to all of our subordinated indebtedness and on an equal basis with all of our other senior unsecured indebtedness.

You will receive a redemption amount in cash at maturity that will equal the principal amount of the securities you hold multiplied by the sum of 1 plus the basket return, calculated as set forth below. If the final basket level is greater than the initial basket level, the basket return will be equal to the percentage increase in the basket level multiplied by an additional percentage expected to be within the range of 112% to 116%, and which will be determined on the trade date. If the final basket level is less than than or equal to the initial basket level, but is greater than or equal to 80% of the initial basket level, then the basket return will be zero and you will receive only an amount equal to the principal amount of your securities at maturity. If the final basket level is less than 80% of the initial basket level, than the basket return will be negative and you will receive less than the principal amount, but not less than 20% of the principal amount, of your securities at maturity.

The securities will not be listed on any securities exchange.

Interest

We will not pay you interest during the term of the securities.

Redemption; Defeasance

The securities are not subject to redemption prior to maturity at our option or at the option of any holder and are not subject to the defeasance provisions described in the accompanying prospectus under "Description of Debt Securities—Defeasance."

Maturity date

The maturity date of the securities is March 31, 2011; however, if a market disruption event exists in respect of any of the reference indices on the final valuation date, as determined by the calculation agent, the maturity date will be postponed until the fifth business day following the day as of which the final basket level has been calculated. Please refer to "—Market disruption events" below. No interest or other payment will be payable because of any postponement of the maturity date.

PS-15

Redemption at maturity

Unless previously purchased by us and cancelled, each security will be redeemed on the maturity date at the cash redemption amount described below.

Redemption amount

We will redeem the securities at maturity for a redemption amount in cash that will equal the principal amount of the securities multiplied by the sum of 1 plus the basket return. The basket return will be based on the difference between the final basket level and the initial basket level, expressed as a percentage. How the basket return will be calculated depends on whether the final basket level is greater than or less than or equal to the initial basket level and, if less than the initial basket level, how much less:

- •

- If the final basket level is greater than the initial basket level, then the basket return will equal:

| |

| |

|

|---|

| 116% * | | final basket level - initial basket level

initial basket level | | |

Thus, if the final basket level is greater than the initial basket level, the basket return will be a positive number, and you will receive more than the principal amount of your securities at maturity.

- •

- If the final basket level is less than or equal to the initial basket level but is greater than or equal to 80% of the initial basket level, then the basket return will equal zero and the redemption amount will equal the principal amount of the securities.

- •

- If the final basket level is less than 80% of the initial basket level, then the basket return will equal:

| |

| |

|

|---|

| | | final basket level - (80%* initial basket level)

initial basket level | | |

Thus, if the final basket level is less than 80% of the initial basket level, the basket return will be negative, and you will receive less than the principal amount of your securities at maturity and you could lose up to 80% of of the value of your investment.

For purposes of calculating the basket return, the basket level on the valuation date will be equal to the sum of:

- (i)

- the product of (x) .70, the weighting of the S&P 500 Index in the basket, and (y) the closing level of the S&P 500 Index on the valuation date divided by 1437.50, the closing level of the S&P 500 Index on March 26, 2007, the index business day immediately following the trade date;

- (ii)

- the product of (x) .10, the weighting of the Russell 2000 Index in the basket, and (y) the closing level of the Russell 2000 Index on the valuation date divided by 808.94, the closing level of the Russell 2000 Index on March 26, 2007, the index business day immediately following the trade date;

- (iii)

- the product of (x) .08, the weighting of the EURO STOXX 50 Index in the basket, and (y) the closing level of the EURO STOXX 50 Index on the valuation date divided by 4142.11, the closing level of the EURO STOXX 50 Index on March 26, 2007, the index business day immediately following the trade date;

PS-16

- (iv)

- the product of (x) .05, the weighting of the Nikkei 225 Index in the basket, and (y) the closing level of the Nikkei 225 Index on the valuation date divided by 17521.96, the closing level of the Nikkei 225 Index on March 26, 2007, the index business day immediately following the trade date;

- (v)

- the product of (x) .05, the weighting of the FTSE 100 Index in the basket, and (y) the closing level of the FTSE 100 Index on the valuation date divided by 6291.90, the closing level of the FTSE 100 Index on March 26, 2007, the index business day immediately following the trade date; and

- (vi)

- the product of (x) .02, the weighting of the S&P/ASX 200 Index in the basket, and (y) the closing level of the S&P/ASX 200 Index on the valuation date divided by 5990.70, the closing level of the S&P/ASX 200 Index on March 26, 2007, the index business day immediately following the trade date.

The following terms used in this pricing supplement have the following definitions:

The "closing level" for any reference index will be, on any relevant index business day, the level of that reference index determined by the calculation agent at the "valuation time" for that reference index, which is the time at which the index sponsor for that reference index calculates the closing level of that reference index on such index business day, as such level is calculated and published by such index sponsor, subject to the provisions described under "—Adjustments to the calculation of the reference indices" below.

A "business day" is any day, other than a Saturday, Sunday or a day on which banking institutions in New York, New York are generally authorized or obligated by law or executive order to close.

An "index business day" with respect to any reference index is any day that is (or, but for the occurrence of a market disruption event, would have been) a day on which trading is generally conducted on the applicable exchanges and related exchanges (each as defined below), other than a day on which one or more of the applicable exchanges or related exchanges is scheduled to close prior to its regular weekday closing time. "Exchange" with respect to any reference index means the principal exchange on which any stock underlying that reference index is traded. "Related exchange" means any exchange on which futures or options contracts relating to that reference index are traded.

A "market disruption event" is, in respect of any reference index, the occurrence or existence on any index business day for that reference index during the one-half hour period that ends at the relevant valuation time, of any suspension of or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) on:

- (a)

- an exchange in securities that comprise 20% or more of the level of the relevant reference index based on a comparison of (1) the portion of the level of the reference index attributable to each security in which trading is, in the determination of the calculation agent, materially suspended or materially limited relative to (2) the overall level of the reference index, in the case of (1) or (2) immediately before that suspension or limitation;

- (b)

- a related exchange in options contracts on the relevant reference index; or

- (c)

- a related exchange in futures contracts on the relevant reference index;

in the case of (a), (b) or (c) if, in the determination of the calculation agent, such suspension or limitation is material.

Market disruption events

If the calculation agent determines that a market disruption event exists in respect of a reference index on the valuation date, then that valuation date for such reference index will be postponed to the

PS-17

first succeeding index business day for that reference index on which the calculation agent determines that no market disruption event exists in respect of such reference index, unless the calculation agent determines that a market disruption event exists in respect of such reference index on each of the five index business days immediately following the scheduled valuation date. In that case, (a) the fifth succeeding index business day following the scheduled valuation date will be deemed to be the valuation date for such reference index, notwithstanding the market disruption event in respect of such reference index, and (b) the calculation agent will determine the index level for that reference index on that deemed valuation date in accordance with the formula for and method of calculating that reference index last in effect prior to the commencement of the market disruption event in respect of such reference index using exchange traded prices on the relevant exchanges (as determined by the calculation agent in its sole and absolute discretion) or, if trading in any security or securities comprising such reference index has been materially suspended or materially limited, its good faith estimate of the prices that would have prevailed on the exchanges (as determined by the calculation agent in its sole and absolute discretion) but for the suspension or limitation, as of the valuation time on that deemed valuation date, of each such security comprising such reference index (subject to the provisions described under "—Adjustments to the calculation of the reference indices" below). The valuation date for each reference index not affected by a market disruption event shall be the scheduled valuation date.

In the event that a market disruption event exists in respect of a reference index on the valuation date, the maturity date of the securities will be postponed to the fifth business day following the day as of which the closing level on the valuation date for each reference index has been calculated. No interest or other payment will be payable because of any such postponement of the maturity date.

Adjustments to the calculation of the reference indices

If any of the reference indices is (a) not calculated and announced by its sponsor but is calculated and announced by a successor acceptable to the calculation agent or (b) replaced by a successor index using, in the determination of the calculation agent, the same or a substantially similar formula for and method of calculation as used in such reference index, then such reference index will be deemed to be the index so calculated and announced by that successor sponsor or that successor index, as the case may be.

Upon any selection by the calculation agent of a successor index, the calculation agent will cause notice to be furnished to us and the trustee, which will provide notice of the selection of the successor index to the registered holders of the securities in the manner set forth below.

If (x) on or prior to a valuation date any index sponsor makes, in the determination of the calculation agent, a material change in the formula for or the method of calculating a reference index or in any other way materially modifies a reference index (other than a modification prescribed in that formula or method to maintain such reference index in the event of changes in constituent stocks and capitalization and other routine events) or (y) on any valuation date an index sponsor (or a successor sponsor) fails to calculate and announce a reference index, then the calculation agent will calculate the redemption amount using, in lieu of a published level for such reference index, the level for such reference index as at the valuation time on the valuation date as determined by the calculation agent in accordance with the formula for and method of calculating such reference index last in effect prior to that change or failure, but using only those securities that comprised such reference index immediately prior to that change or failure. Notice of adjustment of such reference index will be provided by the trustee in the manner set forth below.

All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will be conclusive for all purposes and binding on us and the beneficial owners of the securities, absent manifest error.

PS-18

Events of default and acceleration

In case an event of default (as defined in the accompanying prospectus) with respect to any securities shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the securities (in accordance with the acceleration provisions set forth in the accompanying prospectus) will be determined by the calculation agent and will equal, for each security, the arithmetic average, as determined by the calculation agent, of the fair market value of the securities as determined by at least three but not more than five broker-dealers (which may include Credit Suisse Securities (USA) LLC or any of our other subsidiaries or affiliates) as will make such fair market value determinations available to the calculation agent.

Purchases

We may at any time purchase any securities, which may, in our sole discretion, be held, sold or cancelled.

Cancellation

If we purchase any securities and surrender the securities to the trustee for cancellation, the trustee will cancel them.

Book-Entry, Delivery and Form

We will issue the securities in the form of one or more fully registered global securities, or the global notes, in denominations of $10,000 or integral multiples of $1,000 greater than $10,000. We will deposit the global notes with, or on behalf of, The Depository Trust Company, New York, New York, or DTC, as the depositary, and will register the global notes in the name of Cede & Co., DTC's nominee. Your beneficial interests in the global notes will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. Except as set forth below, the global notes may be transferred, in whole and not in part, only to another nominee of DTC or to a successor of DTC or its nominee.

As long as the securities are represented by the global notes, we will pay the redemption amount on the securities to or as directed by DTC as the registered holder of the global notes. Payments to DTC will be in immediately available funds by wire transfer. DTC will credit the relevant accounts of their participants on the applicable date.

DTC has advised us that it is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. DTC holds securities deposited with it by its participants and facilitates the settlement of transactions among its participants in such securities through electronic computerized book-entry changes in accounts of the participants, thereby eliminating the need for physical movement of securities certificates. DTC's participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations, some of whom (and/or their representatives) own DTC. Access to DTC's book-entry system is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a participant, either directly or indirectly.

According to DTC, the foregoing information with respect to DTC has been provided to the financial community for informational purposes only and is not intended to serve as a representation, warranty or contract modification of any kind.

PS-19

Calculation Agent

The calculation agent is Credit Suisse International, an affiliate of ours. The calculations and determinations of the calculation agent will be final and binding upon all parties (except in the case of manifest error). The calculation agent will have no responsibility for good faith errors or omissions in its calculations and determinations, whether caused by negligence or otherwise. The calculation agent will not act as your agent. Because the calculation agent is an affiliate of ours, potential conflicts of interest may exist between you and the calculation agent. Please refer to "Risk Factors—There may be potential conflicts of interest."

Further Issues

We may from time to time, without notice to or the consent of the registered holders of the securities, create and issue further securities ranking on an equal basis with the securities being offered hereby in all respects. Such further securities will be consolidated and form a single series with the securities being offered hereby and will have the same terms as to status, redemption or otherwise as the securities being offered hereby.

Notices

Notices to holders of the securities will be made by first class mail, postage prepaid, to the registered holders.

PS-20

THE REFERENCE INDICES

The S&P 500 Index

Unless otherwise stated, all information regarding the S&P 500 Index provided in this pricing supplement is derived from the sponsor of the reference index, Standard & Poor's, a division of The McGraw-Hill Companies, Inc. ("S&P"), or other publicly available sources. Such information reflects the policies of S&P as stated in such sources, and such policies are subject to change by S&P. S&P is under no obligation to continue to publish, and may discontinue or suspend the publication of, the S&P 500 Index at any time. We do not assume any responsibility for the accuracy or completeness of any information relating to the S&P 500 Index.

As of September 30, 2006, the aggregate market value of the 500 companies included in the S&P 500 Index represented approximately 75% of the market value of United States equities. S&P chooses companies for inclusion in the S&P 500 Index with the aim of achieving a distribution by broad industry groupings that approximates the distribution of these groupings in the common stock population of the NYSE, which S&P uses as an assumed model for the composition of the total market. Relevant criteria employed by S&P include the financial viability of the particular company, a public float of at least 50% and the extent to which that company represents the industry sector to which it is assigned.

As of December 27, 2006, the 500 companies included in the S&P 500 Index were divided into 10 Global Industry Classification Standard sectors. The Global Industry Classification Standard sectors included (with the number of companies currently included in such sectors indicated in parentheses): Consumer Discretionary (89), Financials (88), Information Technology (75), Health Care (55), Industrials (52), Consumer Staples (38), Energy (33), Utilities (32), Materials (29) and Telecommunication Services (9). S&P may from time to time, in its sole discretion, add companies to, or delete companies from, the S&P 500 Index to achieve the objectives stated above.

The S&P 500 Index does not reflect the payment of dividends on the stocks underlying it and therefore the return on your securities will not be the same as the return you would receive if you were to purchase such underlying stocks and hold them until the maturity date.

On March 21, 2005, S&P began to calculate the S&P 500 Index based on a half float adjusted formula, and on September 16, 2005 the S&P 500 Index was fully float adjusted. S&P's criteria for selecting stocks for the S&P 500 Index will not be changed by the shift to float adjustment. However, the adjustment affects each company's weight in the S&P 500 Index (i.e., its market value).

Under float adjustment, the share counts used in calculating the S&P 500 Index will reflect only those shares that are available to investors and not all of a company's outstanding shares. S&P defines three groups of shareholders whose holdings are subject to float adjustment:

- •

- holdings by other publicly traded corporations, venture capital firms, private equity firms, strategic partners, or leveraged buyout groups;

- •

- holdings by government entities, including all levels of government in the United States or foreign countries; and

- •

- holdings by current or former officers and directors of the company, founders of the company, or family trusts of officers, directors, or founders, as well as holdings of trusts, foundations, pension funds, employee stock ownership plans, or other investment vehicles associated with and controlled by the company.

However, treasury stock, stock options, restricted shares, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. In cases where holdings in a

PS-21

group exceed 10% of the outstanding shares of a company, the holdings of that group will be excluded from the float-adjusted count of shares to be used in the S&P 500 Index calculation. Mutual funds, investment advisory firms, pension funds, or foundations not associated with the company and investment funds in insurance companies, shares of a United States company traded in Canada as "exchangeable shares", shares that trust beneficiaries may buy or sell without difficulty or significant additional expense beyond typical brokerage fees, and, if a company has multiple classes of stock outstanding, shares in an unlisted or non-traded class if such shares are convertible by shareholders without undue delay and cost, are also part of the float.

For each stock, an investable weight factor ("IWF") is calculated by dividing the available float shares, defined as the total shares outstanding less shares held in one or more of the three groups listed above where the group holdings exceed 10% of the outstanding shares, by the total shares outstanding. The float adjusted index will then be calculated by dividing the sum of the IWF multiplied by both the price and the total shares outstanding for each stock by the index divisor. For companies with multiple classes of stock, S&P will calculate the weighted average IWF for each stock using the proportion of the total company market capitalization of each share class as weights.

The S&P 500 Index is calculated using a base-weighted aggregate methodology: the level of the S&P 500 Index reflects the total market value of all 500 S&P 500 component stocks relative to the S&P 500 Index's base period of 1941-43 (the "base period").

An indexed number is used to represent the results of this calculation in order to make the value easier to work with and track over time.

The actual total market value of the S&P 500 component stocks during the base period has been set equal to an indexed value of 10. This is often indicated by the notation 1941-43=10. In practice, the daily calculation of the S&P 500 Index is computed by dividing the total market value of the S&P 500 component stocks by a number called the index divisor. By itself, the index divisor is an arbitrary number. However, in the context of the calculation of the S&P 500 Index, it is the only link to the original base period level of the S&P 500 Index. The index divisor keeps the S&P 500 Index comparable over time and is the manipulation point for all adjustments to the S&P 500 Index ("index maintenance").

Index maintenance includes monitoring and completing the adjustments for company additions and deletions, share changes, stock splits, stock dividends, and stock price adjustments due to company restructurings or spinoffs.

To prevent the level of the S&P 500 Index from changing due to corporate actions, all corporate actions which affect the total market value of the S&P 500 Index require an index divisor adjustment. By adjusting the index divisor for the change in total market value, the level of the S&P 500 Index remains constant. This helps maintain the level of the S&P 500 Index as an accurate barometer of stock market performance and ensures that the movement of the S&P 500 Index does not reflect the corporate actions of individual companies in the S&P 500 Index. All index divisor adjustments are made after the close of trading. Some corporate actions, such as stock splits and stock dividends, require simple changes in the common shares outstanding and the stock prices of the companies in the S&P 500 Index and do not require index divisor adjustments.

PS-22

The table below summarizes the types of index maintenance adjustments and indicates whether or not an index divisor adjustment is required.

Type of Corporate Action

| | Adjustment Factor

| | Divisor

Adjustment

Required

|

|---|

Stock split (e.g., 2-for-1) |

|

Shares outstanding multiplied by 2;

Stock price divided by 2 |

|

No |

Share issuance (i.e., change is greater than or equal to 5%) |

|

Shares outstanding plus newly issued shares |

|

Yes |

Share repurchase (i.e., change is greater than or equal to 5%) |

|

Shares outstanding minus repurchased shares |

|

Yes |

Special cash dividends |

|

Share price minus special dividend |

|

Yes |

Company change |

|

Add new company market value minus old company market value |

|

Yes |

Rights offering |

|

Price of parent company minus |

|

|

|

|

(Price of rights)

(Right ratio) |

|

Yes |

Spinoffs |

|

Price of parent company minus |

|

|

|

|

(Price of spinoff co.)

(Share exchange ratio) |

|

Yes |

Stock splits and stock dividends do not affect the index divisor of the S&P 500 Index, because following a split or dividend both the stock price and number of shares outstanding are adjusted by S&P so that there is no change in the market value of the S&P 500 component stock. All stock split and dividend adjustments are made after the close of trading on the day before the ex-dividend date.

Each of the corporate events exemplified in the table requiring an adjustment to the index divisor has the effect of altering the market value of the S&P 500 component stock and consequently of altering the aggregate market value of the S&P 500 component stocks (the "Post-Event Aggregate Market Value"). In order that the level of the S&P 500 Index (the "Pre-Event Index Value") not be affected by the altered market value (whether increase or decrease) of the affected S&P 500 component stock, a new index divisor ("New Divisor") is derived as follows:

| Pre-Event Index Value | | = | | Post-Event Aggregate Market Value

New Divisor |

| New Divisor | | = | | Post-Event Aggregate Market Value

Pre-Event Index Value |

A large part of the index maintenance process involves tracking the changes in the number of shares outstanding of each of the S&P 500 Index companies. Four times a year, on a Friday close to the end of each calendar quarter, the share totals of companies in the S&P 500 Index are updated as required by any changes in the number of shares outstanding. After the totals are updated, the index

PS-23

divisor is adjusted to compensate for the net change in the total market value of the S&P 500 Index. In addition, any changes over 5% in the current common shares outstanding for the index companies are carefully reviewed on a weekly basis, and when appropriate, an immediate adjustment is made to the index divisor.

We or one of our affiliates and S&P are parties to a non-exclusive license agreement providing for the license to us, in exchange for a fee, of the right to use indices owned and published by S&P in connection with certain securities, including these securities. "Standard & Poor's®", "S&P®", "S&P 500®", Standard & Poor's 500", and "500" are trademarks of Standard & Poor's Corporation and have been licensed for use by Credit Suisse.

The license agreement between S&P and us provides that language substantially the same as the following language must be stated in this pricing supplement:

The securities are not sponsored, endorsed, sold or promoted by Standard & Poor's Corporation ("S&P"). S&P makes no representation or warranty, express or implied, to the owners of the securities or any member of the public regarding the advisability of investing in securities generally or in the securities particularly or the ability of the S&P 500 Index to track general stock market performance. S&P's only relationship to the Licensee is the licensing of certain trademarks and trade names of S&P and of the S&P 500 Index which is determined, composed and calculated by S&P without regard to the Licensee or the securities. S&P has no obligation to take the needs of the Licensee or the owners of the securities into consideration in determining, composing or calculating the S&P 500 Index. S&P is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the securities to be issued, sold, purchased, written or entered into by Licensee or in the determination or calculation of the equation by which the securities are to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the securities.

S&P DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE S&P 500 INDEX OR ANY DATA INCLUDED THEREIN. S&P MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE LICENSEE, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500 INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER OR FOR ANY OTHER USE. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE S&P 500 INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FORGOING, IN NO EVENT SHALL S&P HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

The Russell 2000 Index

Unless otherwise stated, all information herein regarding the Russell 2000 Index (the "Index") is derived from the sponsor of the reference index, Russell Investment Group ("Russell"), a subsidiary of Northwestern Mutual Life Insurance Company, or other publicly available sources. Such information reflects the policies of Russell as stated in such sources and such policies are subject to change by Russell. Russell is under no obligation to continue to publish the Index and may discontinue publication of the Index at any time. We do not assume any responsibility for the accuracy or completeness of such information relating to the Index.

PS-24

The Index is calculated, published and disseminated by Russell, and measures the composite price performance of the 1,000th to 3,000th largest U.S. companies as determined by market capitalization. The 2,000 companies represent approximately 8% of the total market capitalization of the largest 3,000 companies of the Russell 3000 Index. As of January 31, 2007, the average market capitalization of the Index was approximately $1.25 billion; the median market capitalization was approximately $664 million. The largest company in the index had an approximate market capitalization of $3.485 billion and a smallest of $74 million. All 2,000 stocks are traded on the New York Stock Exchange, the American Stock Exchange, Nasdaq or in the over-the-counter market. As of January 31, 2007, the five largest Global Industry Classification Standard sectors (major industry groups) covered in the Index were as follows: Financials, Information Technology, Consumer Discretionary, Industrials and Health Care.

Only common stocks belonging to corporations domiciled in the United States and its territories are eligible for inclusion in the Index. Beginning on May 31, 2007, companies incorporated in the following countries/regions are also reviewed for eligibility if their headquarters is in the United States or their primary exchange for local shares is in the United States: Bahamas, Belize, Bermuda, British Virgin Islands, Cayman Islands, Channel Islands, Cook Islands, Gibraltar, Isle of Man, Liberia, Marshall Islands, and Netherlands Antilles. Stocks must trade at or above $1.00 on May 31 to be eligible for inclusion. However, if a stock trades below $1.00 after May 31, such stock is not removed from the Index unless such stock trades below $1.00 on the following May 31. American Depositary Receipts, preferred stock, convertible preferred stock, participating preferred stock, paired shares, warrants and rights are excluded. Trust receipts, Royalty Trusts, limited liability companies, OTC Bulletin Board companies, pink sheets, closed-end mutual funds, and limited partnerships that are traded on U.S. exchanges are also ineligible for inclusion. Generally, only one class of securities of a company is allowed in the Index, although exceptions to this general rule may be made where Russell has determined that the common stock class shares act independently of each other.