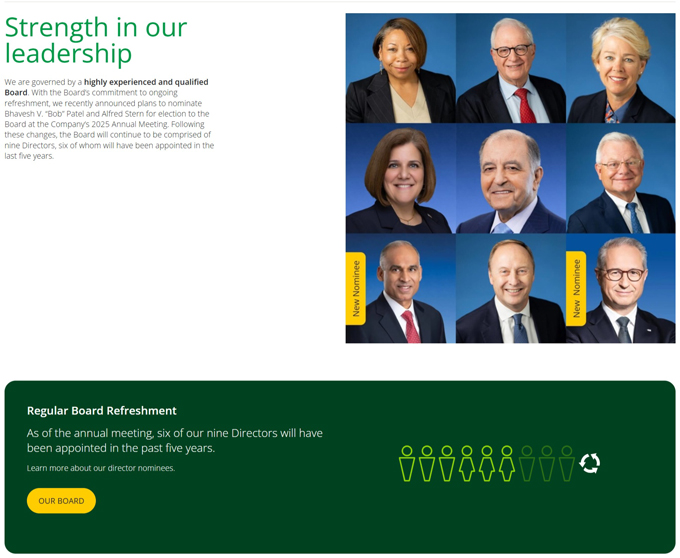

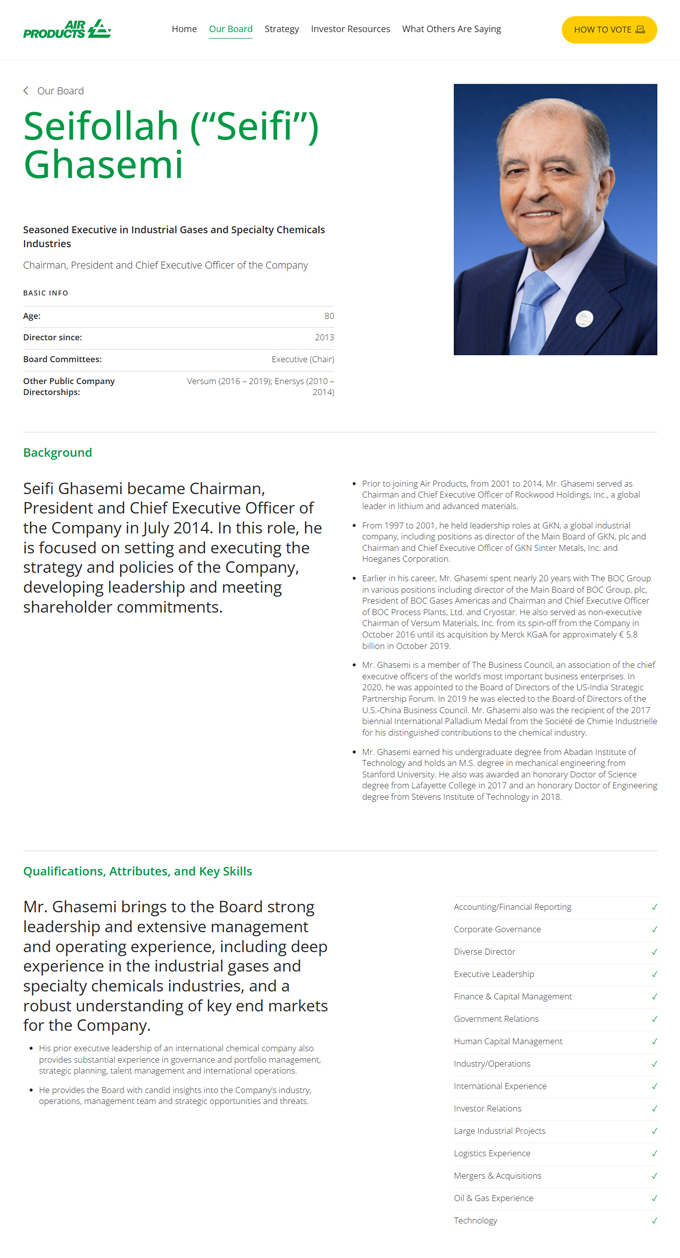

The Board also recognizes that succession planning is one of our most important roles, and an ongoing process based on the needs of the Company. Led by the Management Development and Compensation Committee, the Board annually reviews executive development and succession planning to ensure the Company has a strong bench of talented leaders to drive the business forward.

On August 1, 2024, Air Products announced that it was conducting a search for a President to serve as a qualified CEO successor to Mr. Ghasemi. This Board-driven process is being led by our Lead Independent Director, whom Mantle Ridge described in its communications to the Company as “the kind of truly independent, high-integrity and shareholder-oriented director nominee[ ] that we think can best serve shareholders”.8

To ensure the new President is set up for success, he or she will also immediately sit on the Company’s Board. The Board is in advanced stages of recruiting a candidate of superior caliber and experience: someone well known to investors and a current or former public company CEO with significant international experience and relationships. Already, several highly qualified candidates have been identified and are involved in the process. The Board expects to announce the Company’s new President and related timelines for CEO succession no later than March 31, 2025.

WHOLESALE CHANGE OF THE BOARD TO SERVE THE SHORT-TERM INTERESTS OF ONE SHAREHOLDER IS UNNECESSARY, DESTABILIZING AND WOULD BE HARMFUL TO SHAREHOLDERS. MANTLE RIDGE’S DEMANDS TO UNILATERALLY DICTATE THE COMPOSITION OF THE BOARD AND SENIOR MANAGEMENT PROVIDED NO BASIS FOR ADDITIONAL ENGAGEMENT

Mantle Ridge’s campaign is nothing less than an attempt to unilaterally seize full control of Air Products without paying a control premium, and with a level of representation that is entirely incongruent with its ownership stake. We believe they are pursuing their own limited, short-term gain, at the expense of other shareholders.

The Board is open to engaging with shareholders and regularly speaks with them to hear their views and perspectives. In the case of Mantle Ridge, in its first meeting with the Board, which came less than a week after we first learned of their investment, Mantle Ridge focused the discussion on taking control of the Board, and on replacing a majority of the management team, including effectively firing Mr. Ghasemi in the very near-term. Whereas the Air Products Board is focused on a well-planned and properly executed succession to ensure a smooth transition, Mantle Ridge’s approach would create serious risk and instability.

This is a playbook that Mantle Ridge has run in each of its three activist campaigns since its founding, and in each case forced major changes, including replacing the CEOs, but failed to create long-term value relative to the S&P 500.

| | • | | For example, at Dollar Tree, Inc., Mantle Ridge demanded that the Company reconstitute the Board and insert its handpicked executive as the new CEO. In less than two years, that CEO resigned, and the total shareholder return fell by approximately 55%, while the S&P 500 increased over 42% during the same period. |

| | • | | Similarly, in its engagement at CSX Corporation, Mantle Ridge placed a CEO candidate at CSX who was known to be unwell, and ultimately unable to fulfill the duties of the position – serving only nine months in the role. Nonetheless, CSX shareholders funded the CEO’s obligation to reimburse Mantle Ridge for compensation and benefits totaling $84 million,9 which he chose to forego at Canadian Pacific. Ultimately, the company has underperformed the S&P 500 by over 48% during Mantle Ridge Founder and CEO Paul Hilal’s time on the CSX board thus far. |

Mantle Ridge’s campaign to seize control of Air Products should concern every Air Products shareholder. In suggesting a fundamental change of a growth strategy that is in motion and being executed as planned, while also implementing a wholesale turnover of the management team, they are demonstrating a reckless desire for short-term gain at the

expense of other shareholders. Mantle Ridge’s pattern of behavior, which is highlighted in greater detail below, left no basis for reasonable or constructive engagement. Here are the facts:

| 8 | Permission to use quote was neither sought nor obtained. |

| 9 | Source: Publicly available CSX filings. |