Exhibit 99.1

Constar Update

Deutsche Bank

4th Annual Basic Industries Conference

New York

March 31, 2003

Forward Looking Statements

• | | This presentation and related discussion contain forward-looking statements, financial projections and forecasts of future growth in markets we serve. Please refer to the “Forward-Looking Statements” section of our 10-K |

|

• | | Please refer to our S-1, particularly the “Risk Factors” section, for factors that may cause actual results to differ from those presented or discussed today, including without limitation continuing conversion to plastic packaging, increasing demand for packaging requiring our expertise, our ability to protect our intellectual property, changes in resin prices, political disruption, and our ability to control costs |

Management Representatives

• Mike Hoffman Chief Executive Officer • Jim Cook Chief Financial Officer • Jim Bolton Sr. VP Administration & Strategic Planning |

Constar IPO & Financing |

|

• | | IPO executed November 2002 |

|

• | | Separated from former parent, CCK |

|

• | | Concurrent with the IPO: |

| | | Issued $175 million of Senior Sub Notes

and $150 million of Term Loan B

plus $100 million revolver, of which

$57.3 million was undrawn at closing |

Investment Highlights |

|

• | | Proven track record as a pioneer and leader in PET |

|

• | | PET Industry showing attractive growth in all sectors |

|

• | | Long-term relationships with leading consumer products companies |

|

• | | Strong portfolio of the technology necessary to capitalize on PET growth opportunities |

|

• | | Low-cost production model |

|

• | | Strong cash flow potential and disciplined capital investment policy |

Near-term Objectives |

|

• | | Deliver improved returns |

|

• | | Delight our customers with the new Constar & obtain new agreements that support profitable growth |

|

• | | Execute capacity expansion well, balance capacity with demand |

|

• | | Exploit our Oxbar technology |

|

• | | Integrate new team members and align compensation more closely with performance |

|

• | | Complete separation & build excellent standalone capabilities |

Business Overview |

|

• | | Pioneer and leader in PET bottle industry |

|

• | | $704 million Sales | | • | | 2,057 Employees |

Convention PET | | 79% of Sales | | Custom PET | | 15% of Sales |

|

| | | Soft Drinks | | Hot-Filled Beverages | | |

| | | Water | | Food | | |

| | | Preforms | | Beer / FABs | | |

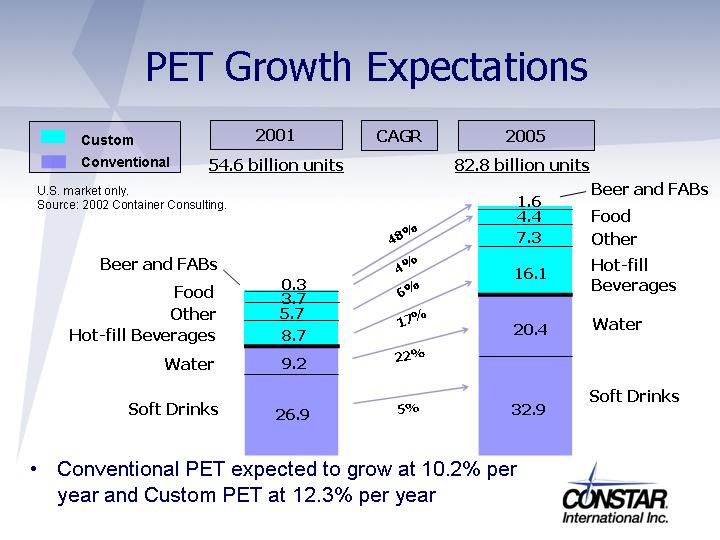

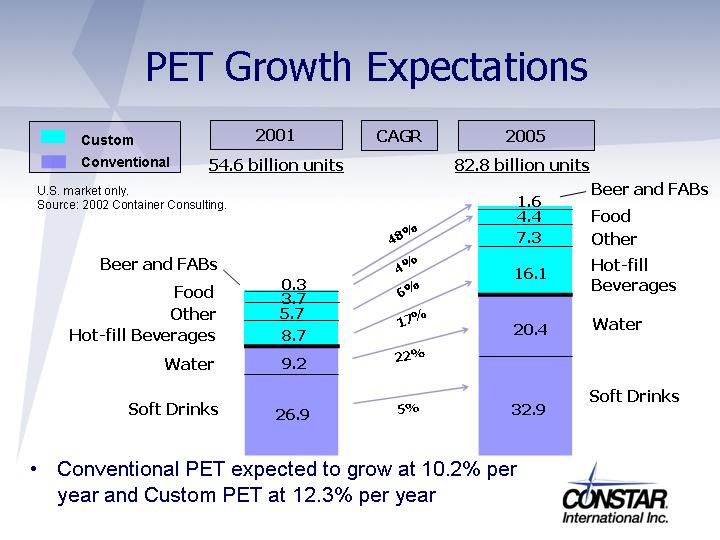

PET Growth Expectations

Custom | | 2001 | | CAGR | | 2005 | | |

Conventional | | 54.6 billion units | | | | 82.8 billion units |

|

U.S. market only. | | | | | | | | |

Source: 2002 Container Consulting. | | | | | | | | |

|

Beer and FABs | | 0.3 | | 48% | | 1.6 | | Beer and FABs |

Food | | 3.7 | | 4% | | 4.4 | | Food |

Other | | 5.7 | | 6% | | 7.3 | | Other |

Hot-fill Beverages | | 8.7 | | 17% | | 16.1 | | Hot-fill Beverages |

Water | | 9.2 | | 22% | | 20.4 | | Water |

Soft Drinks | | 26.9 | | 5% | | 32.9 | | Soft Drinks |

| | • | | Conventional PET expected to grow at 10.2% per year and Custom PET at 12.3% per year |

Leading Supplier to Consumer

Packaged Goods Companies

• | | Greater than 10 year relationship with 9 of top 10 customers |

• | | 37% of Constar’s sales are to PepsiCo, contract through 2007 |

Great Customer Reception to Independent Constar |

|

• | | Customers tell us they are pleased and comfortable with the independent Constar |

|

• | | Availability of capital to support new customer contracts has attracted attention |

|

• | | Several new long term contracts signed since IPO |

|

• | | Assessment under way to understand and improve our customer’s perception of Constar and Oxbar |

Constar’s Technology Portfolio |

|

• | | Superior performance light-weight containers for soft drinks and water |

|

• | | Full range of heat set containers for hot-fill applications |

|

• | | Superior O2 and CO2 barrier technology |

|

• | | Mono- and multi-layer pasteurizable bottle technology |

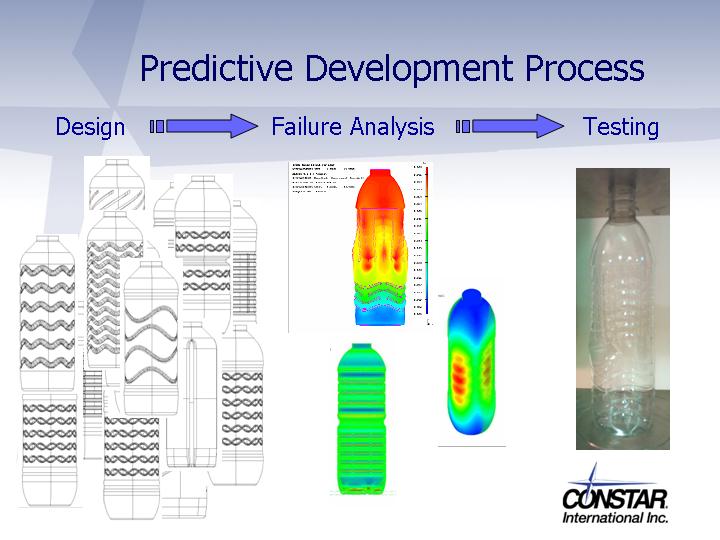

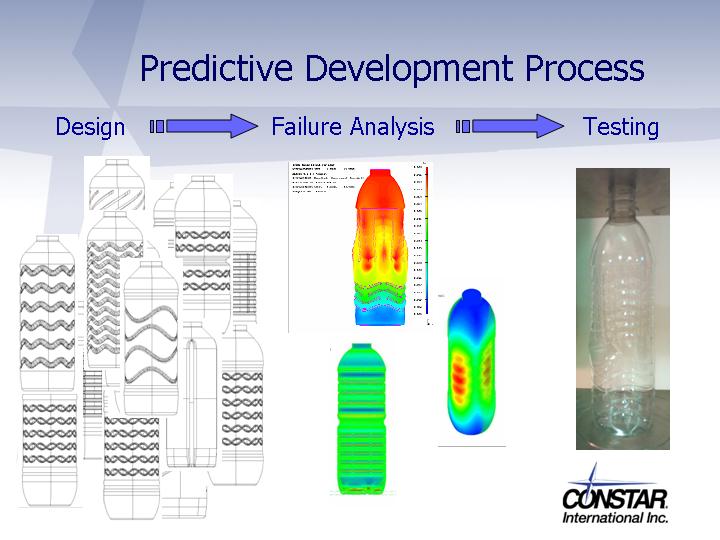

Predictive Development Process

Design è Failure Analysis è Testing

Process Result: Strong, Lightweight 500ml Water Bottle |

• | | Superior top-load compared to other bottles in the market |

|

• | | 26% reduction in gram weight from existing commercial design |

|

• | | Patents applied for functional design elements |

Constar’s Multi-Layer Oxbar® System:

The Best Performing Barrier Technology

Technology Update |

|

• | | Favorable decision on Chevron lawsuit |

|

• | | Favorable FDA compliance opinion received from Keller & Heckman for monolayer Oxbar |

|

• | | Successful commercial line trials completed on LN2 injection for hotfill |

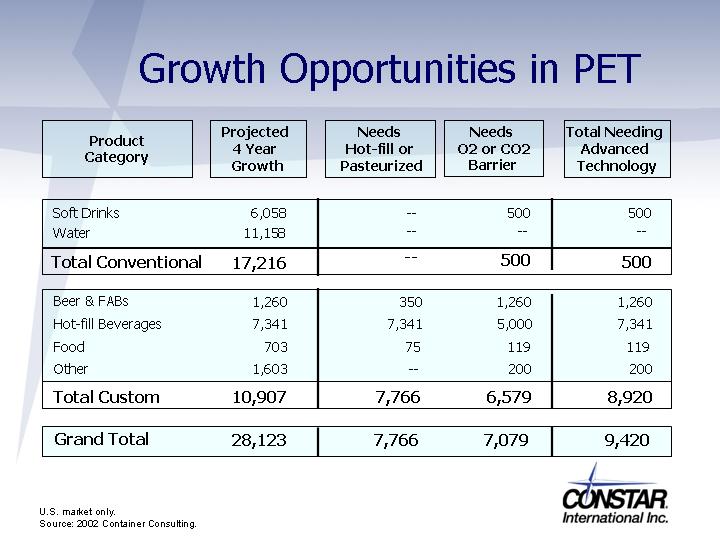

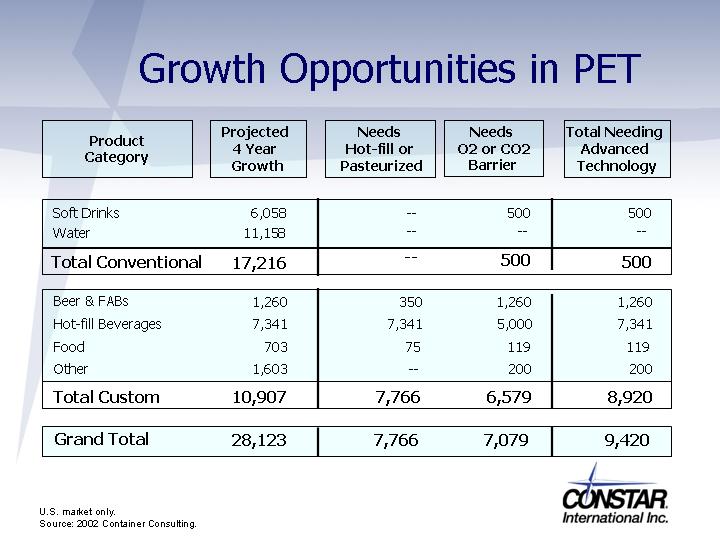

Growth Opportunities in PET

Product Category | | Projected 4 Year Growth | | Needs Hot-fill or Pasteurized | | Needs O2 or CO2 Barrier | | Total Needing Advanced Technology |

|

Soft Drinks | | 6,058 | | — | | 500 | | 500 |

Water | | 11,158 | | — | | — | | — |

|

Total Conventional | | 17,216 | | — | | 500 | | 500 |

|

|

Beer & FABs | | 1,260 | | 350 | | 1,260 | | 1,260 |

Hot-fill Beverages | | 7,341 | | 7,341 | | 5,000 | | 7,341 |

Food | | 703 | | 75 | | 119 | | 119 |

Other | | 1,603 | | — | | 200 | | 200 |

|

Total Custom | | 10,907 | | 7,766 | | 6,579 | | 8,920 |

|

Grand Total | | 28,123 | | 7,766 | | 7,079 | | 9,420 |

|

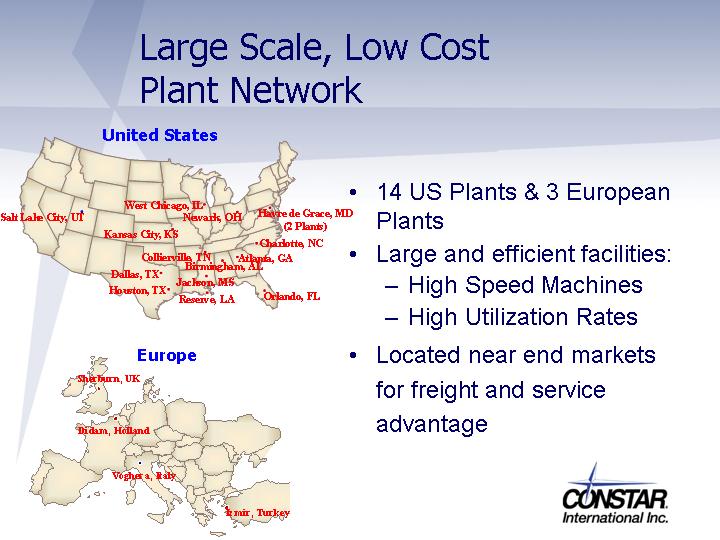

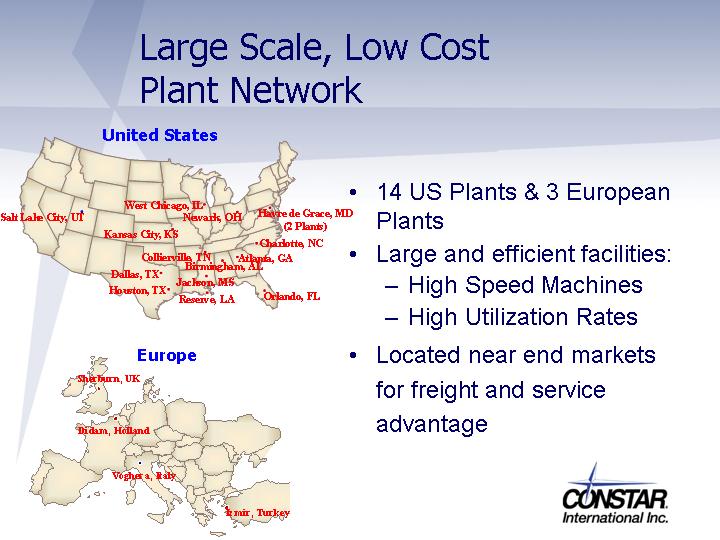

Large Scale, Low Cost

Plant Network

• | | 14 US Plants & 3 European Plants |

|

• | | Large and efficient facilities: |

|

| | | – High Speed Machines – High Utilization Rates |

|

• | | Located near end markets for freight and service advantage |

Cost Reduction Activities

• | | Purchasing: Project started to consolidate more purchases, reduce prices and inventory |

|

• | | Logistics: Projects target better warehouse utilization and improved planning process |

|

• | | New system implementation targets machine maintenance costs, freight cost, and inventory reductions |

|

• | | Continuous evolution to lower cost platforms |

|

• | | Aggressive cost reduction in Turkey to offset volume and price declines |

|

• | | Linespeed improvements and labor savings |

Strategy for Value Creation

• | | Fully utilize existing manufacturing assets |

|

• | | Grow with our customers using lowest cost equipment |

|

• | | Capital investments tied to long-term contracts with 20% plus MIRR |

|

• | | Leverage existing infrastructure to minimize new overhead costs |

|

• | | Compensation tied to performance |

|

• | | Continue to innovate and improve |

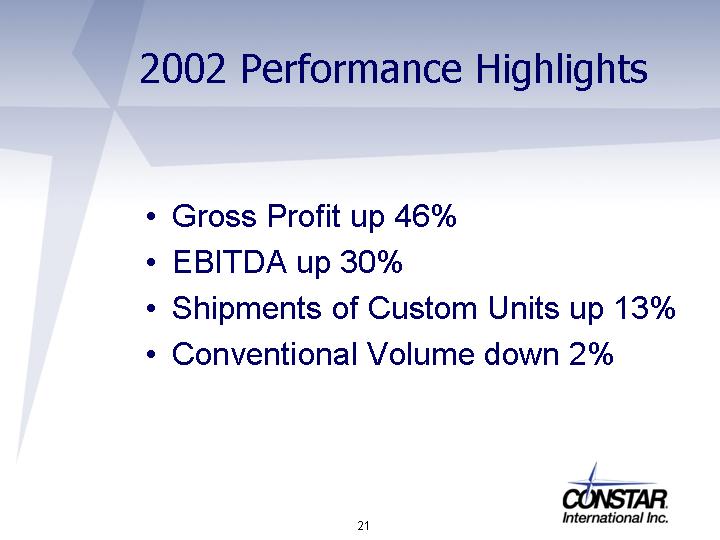

2002 Performance Highlights

• | | Gross Profit up 46% |

|

• | | EBITDA up 30% |

|

• | | Shipments of Custom Units up 13% |

|

• | | Conventional Volume down 2% |

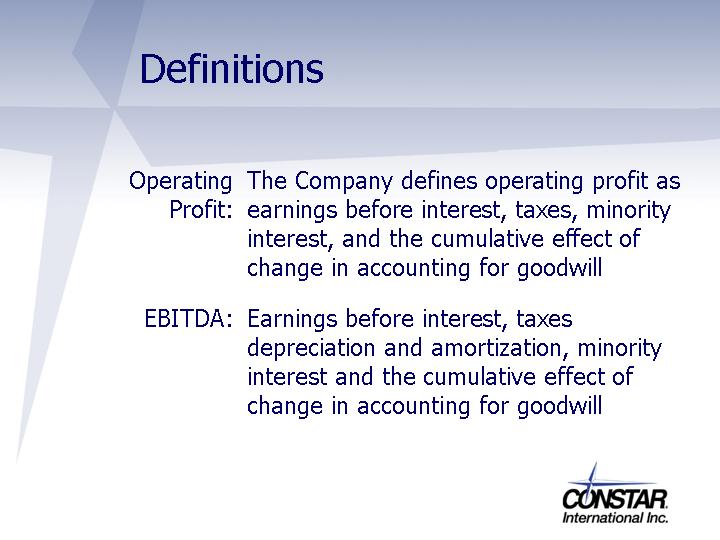

Definitions

Operating Profit: | | The Company defines operating profit as earnings before interest, taxes, minority interest, and the cumulative effect of change in accounting for goodwill |

|

EBITDA: | | Earnings before interest, taxes depreciation and amortization, minority interest and the cumulative effect of change in accounting for goodwill |

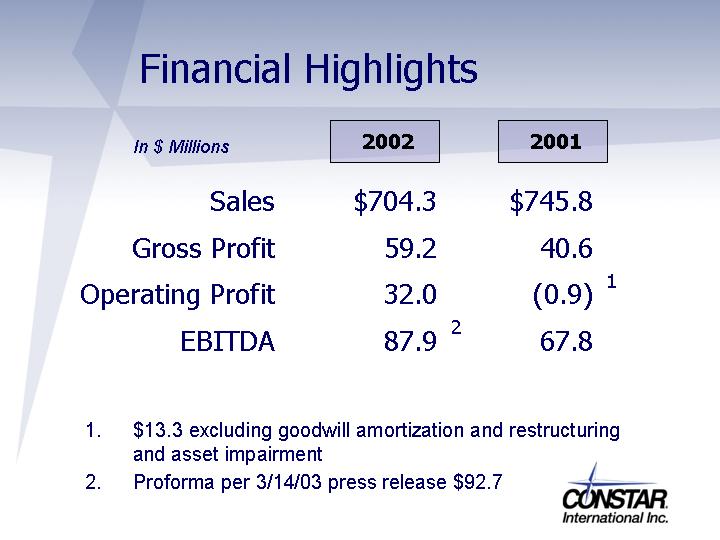

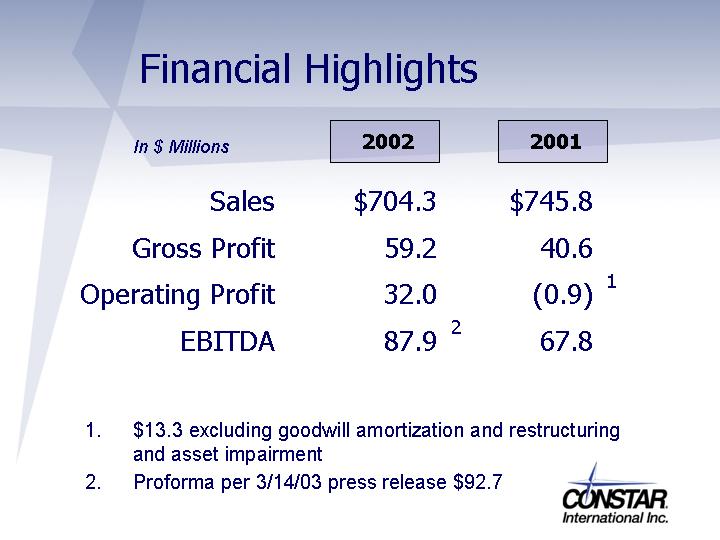

Financial Highlights

In $ Millions | | 2002 | | | 2001 | |

|

Sales | | $ | 704.3 | | | $ | 745.8 | |

|

Gross Profit | | | 59.2 | | | | 40.6 | |

|

Operating Profit | | | 32.0 | | | | 0.9 | 1 |

|

EBITDA | | | 87.9 | 2 | | | 67.8 | |

| | 1. | | $13.3 excluding goodwill amortization and restructuring and asset impairment |

| | 2. | | Proforma per 3/14/03 press release $92.7 |

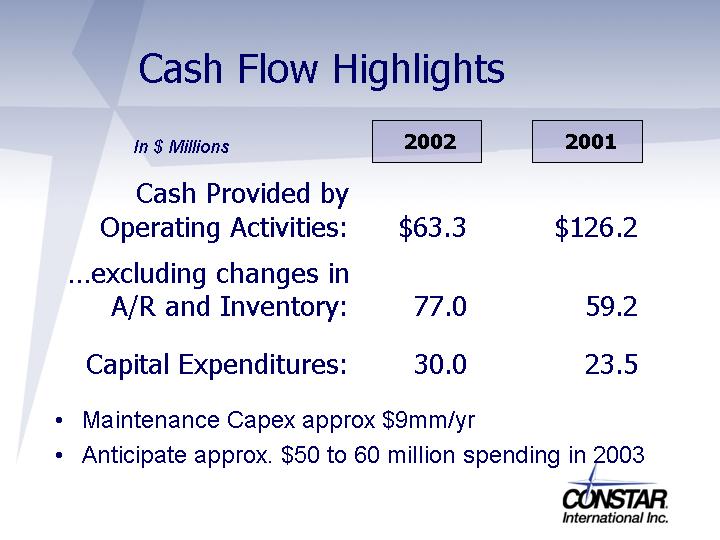

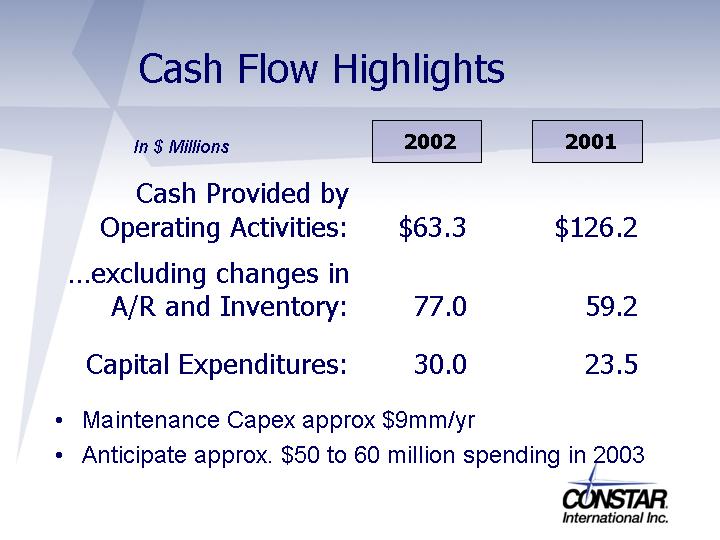

Cash Flow Highlights

In $ Millions | | 2002 | | 2001 |

|

Cash Provided by | | | | | | |

|

Operating Activities: | | $ | 63.3 | | $ | 126.2 |

|

...excluding changes in A/R and Inventory: | | | 77.0 | | | 59.2 |

|

Capital Expenditures: | | | 30.0 | | | 23.5 |

| | • | | Maintenance Capex approx $9mm/yr |

| | • | | Anticipate approx. $50 to 60 million spending in 2003 |

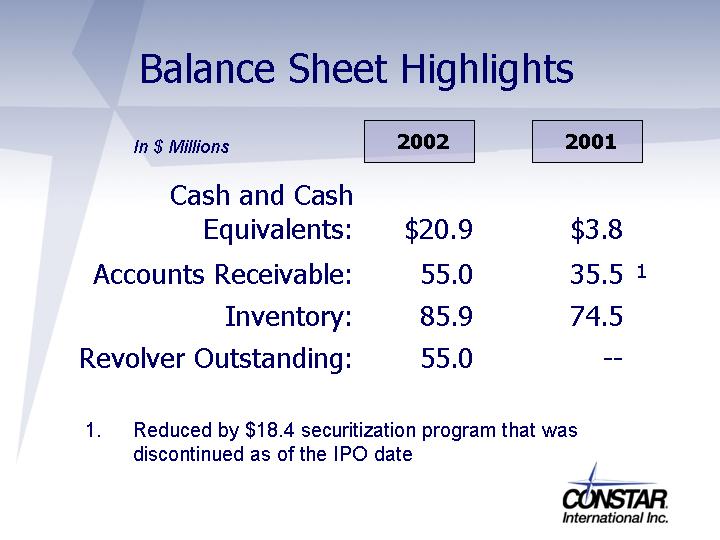

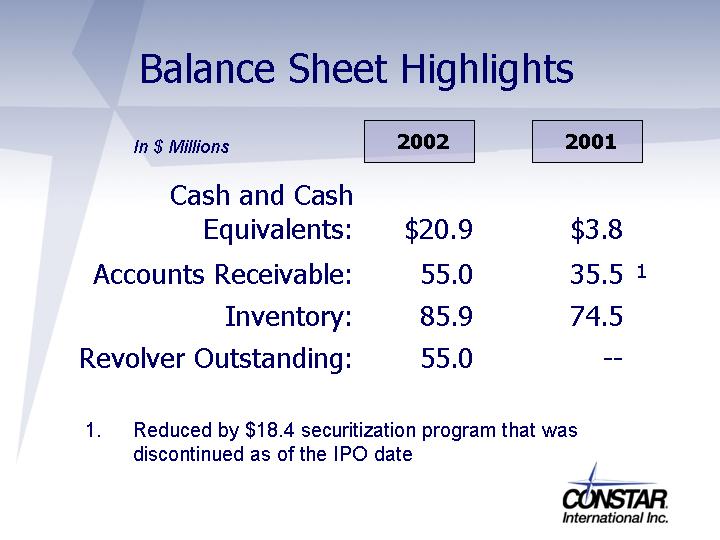

Balance Sheet Highlights

In $ Millions | | 2002 | | 2001 | |

|

Cash and Cash Equivalents: | | $ | 20.9 | | $ | 3.8 | |

|

Accounts Receivable: | | | 55.0 | | | 35.5 | 1 |

|

Inventory: | | | 85.9 | | | 74.5 | |

|

Revolver Outstanding: | | | 55.0 | | | — | |

| | 1. | | Reduced by $18.4 securitization program that was discontinued as of the IPO date |

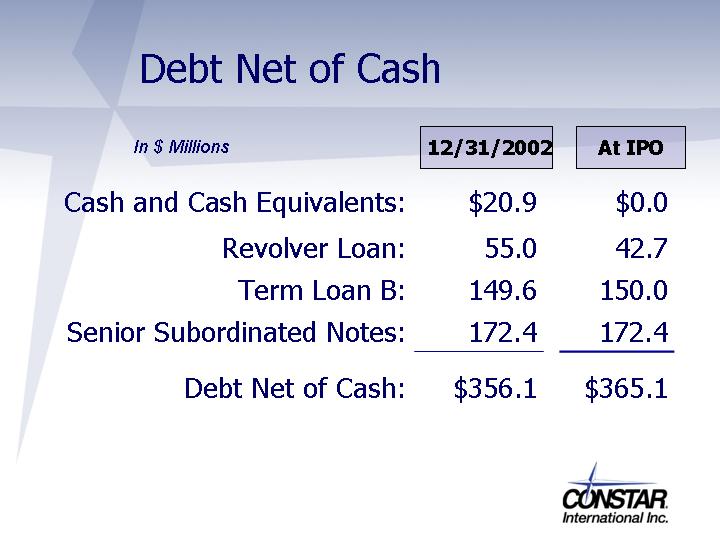

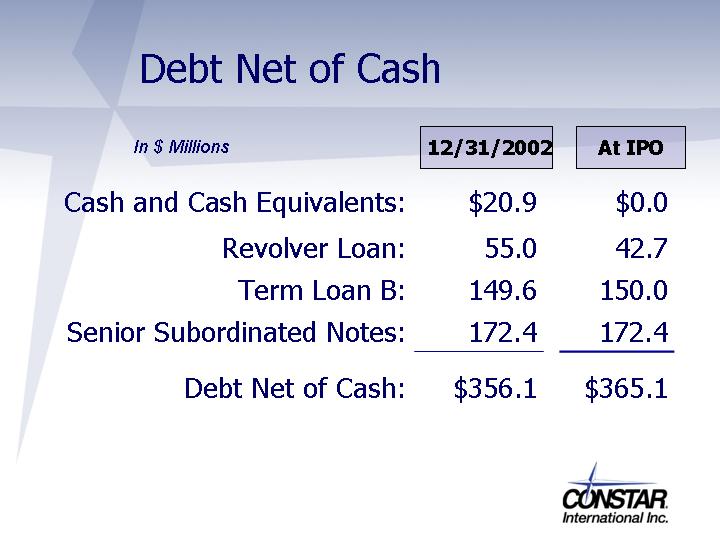

Debt Net of Cash

In $ Millions | | 12/31/2002 | | At IPO |

|

Cash and Cash Equivalents: | | $ | 20.9 | | $ | 0.0 |

|

Revolver Loan: | | | 55.0 | | | 42.7 |

|

Term Loan B: | | | 149.6 | | | 150.0 |

|

Senior Subordinated Notes: | | | 172.4 | | | 172.4 |

| | |

|

| |

|

|

|

Debt Net of Cash: | | $ | 356.1 | | $ | 365.1 |

Stand-alone Update

• | | Uneventful separation: no customer collection, payable, or payroll issues |

|

• | | Search for new headquarters office location is on track |

|

• | | IT plan validated and vendor selection process for implementation near completion. |

|

• | | Insurance costs were higher than expected |

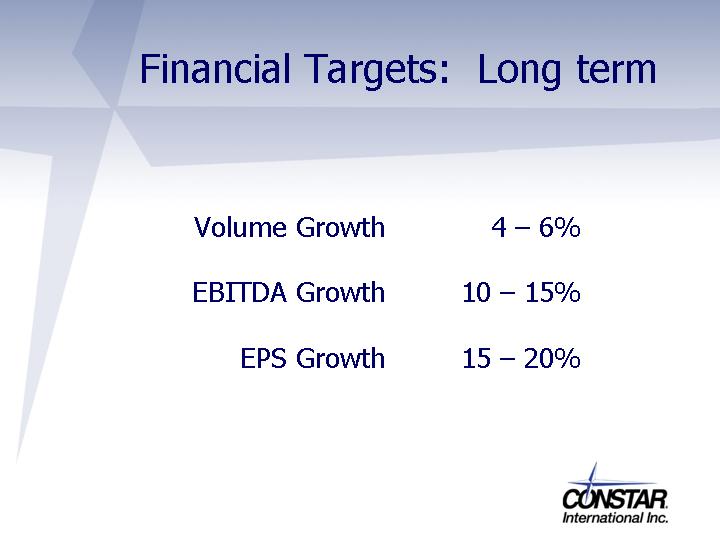

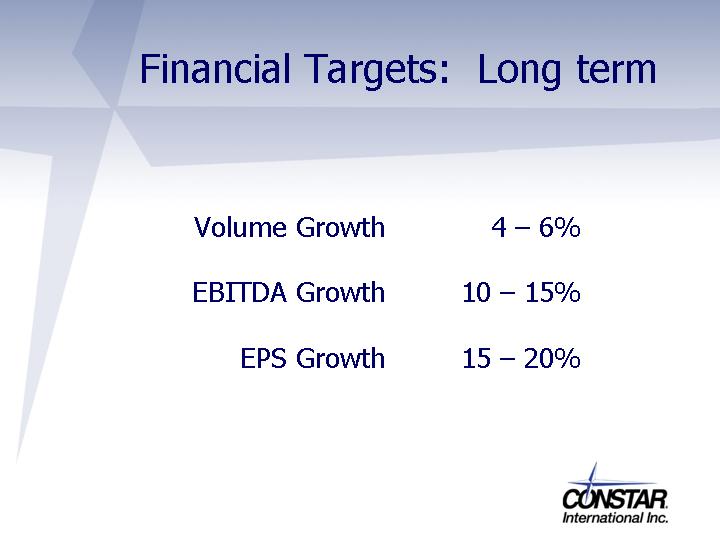

Financial Targets: Long term

Volume Growth | | 4 – 6% |

|

EBITDA Growth | | 10 – 15% |

|

EPS Growth | | 15 – 20% |

Investment Highlights

• | | Proven track record as a pioneer and leader in PET |

|

• | | Long-term relationships with leading branded consumer products companies |

|

• | | Strong portfolio of the technology necessary to achieve growth in conventional and custom products |

|

• | | Attractive growth in all PET industry sectors |

|

• | | Low-cost production model for both conventional and custom product lines |

|

• | | Strong cash generation and disciplined capital investment policy |

Constar Update

Deutsche Bank

4th Annual Basic Industries Conference

New York

March 31, 2003