Exhibit 99.2 October 17, 2019 – 9:00am CT Earnings Conference Call Third Quarter 2019

Forward-Looking Statements and Non-GAAP Measures We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties and risks. We caution everyone to be guided in their analysis of Dover Corporation by referring to the documents we file from time to time with the SEC, including our Form 10-K for 2018, for a list of factors that could cause our results to differ from those anticipated in any such forward-looking statements. We would also direct your attention to our website, dovercorporation.com, where considerably more information can be found. In addition to financial measures based on U.S. GAAP, Dover provides supplemental non-GAAP financial information. Management uses non-GAAP measures in addition to GAAP measures to understand and compare operating results across periods, make resource allocation decisions, and for forecasting and other purposes. Management believes these non-GAAP measures reflect results in a manner that enables, in many instances, more meaningful analysis of trends and facilitates comparison of results across periods and to those of peer companies. These non-GAAP financial measures have no standardized meaning presented in U.S. GAAP and may not be comparable to other similarly titled measures used by other companies due to potential differences between the companies in calculations. The use of these non-GAAP measures has limitations and they should not be considered as substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP. Reconciliations and definitions are included either in this presentation or in Dover’s earnings release and investor supplement for the third quarter, which are available on Dover’s website. 2

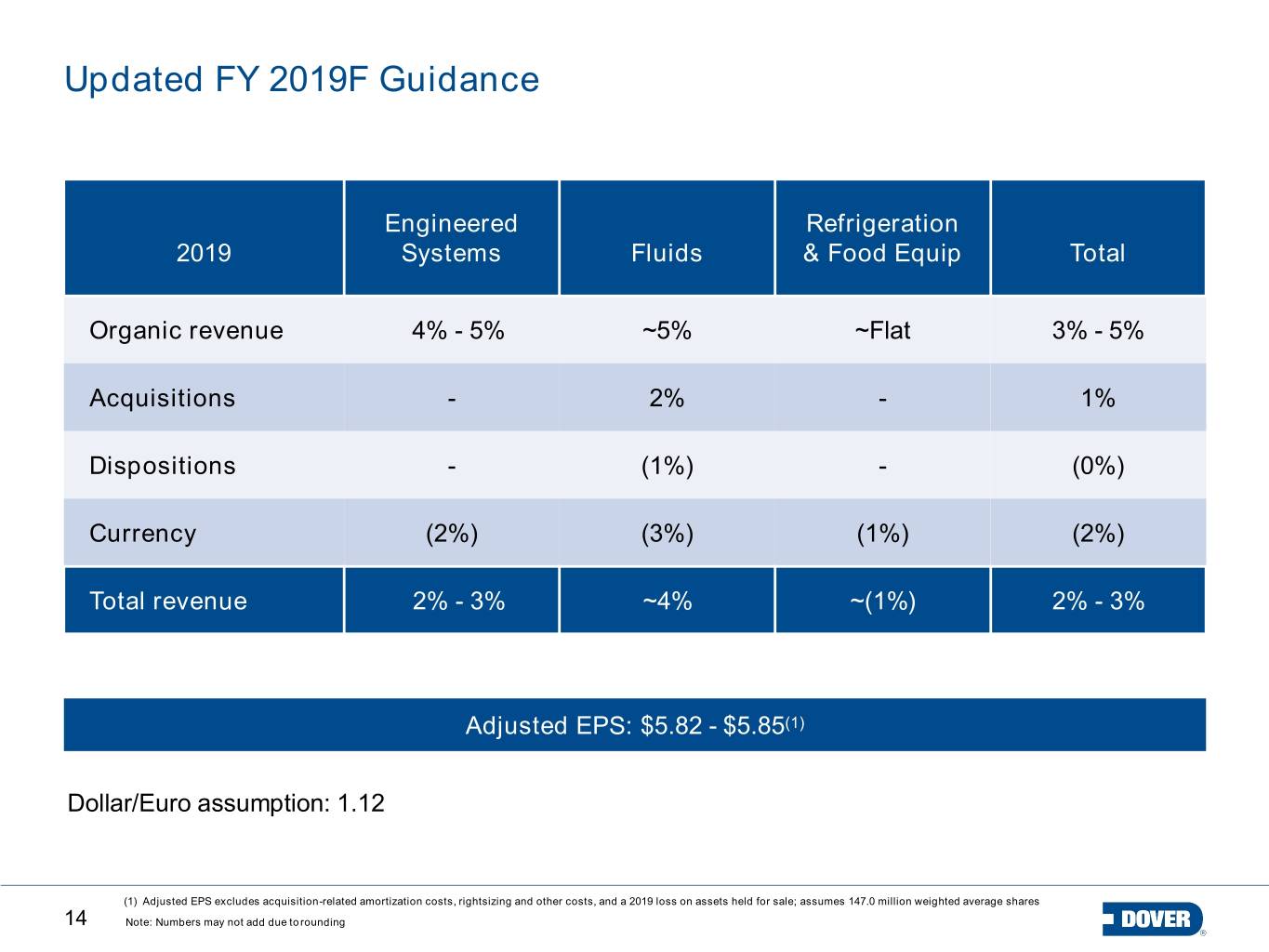

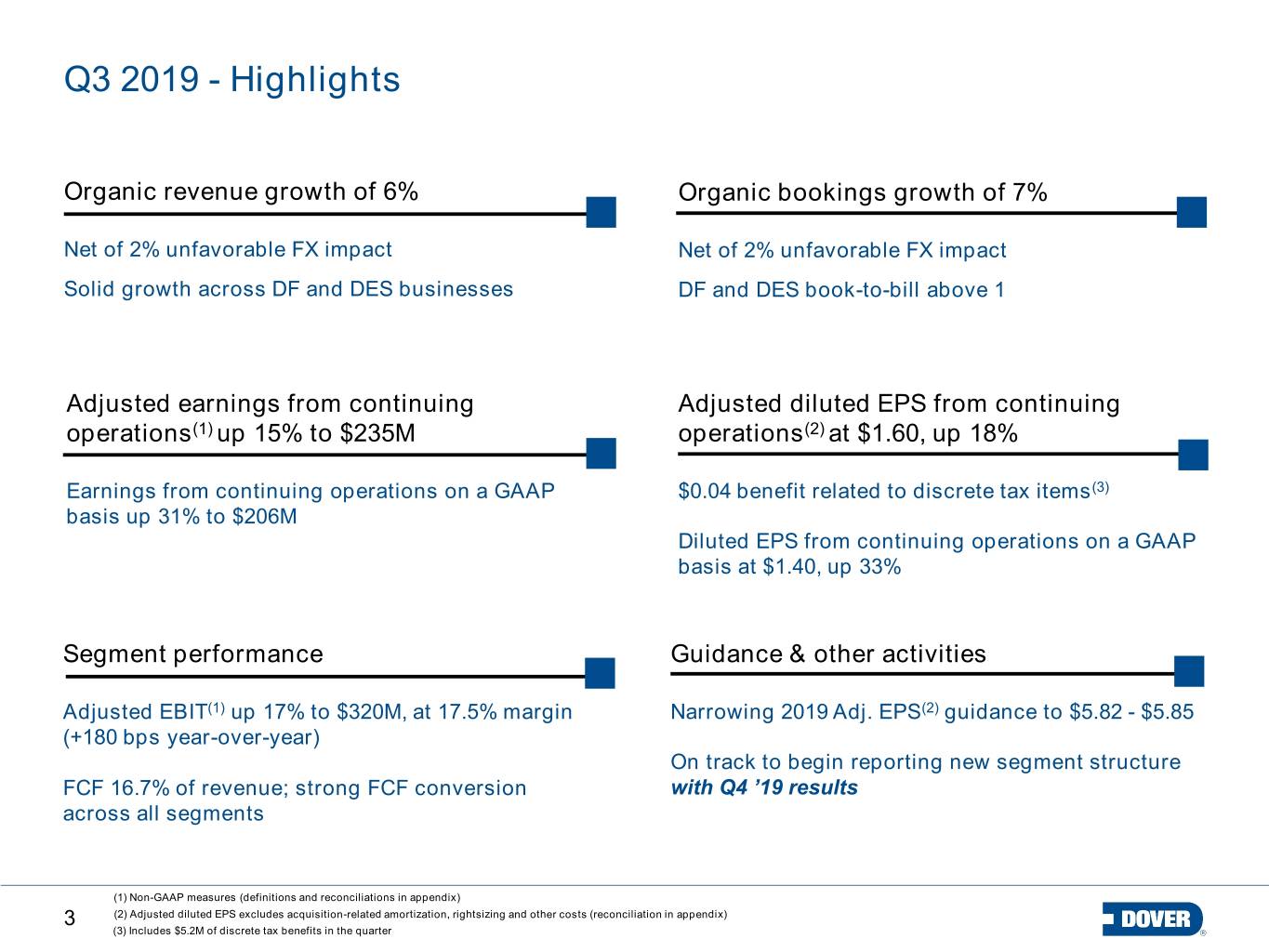

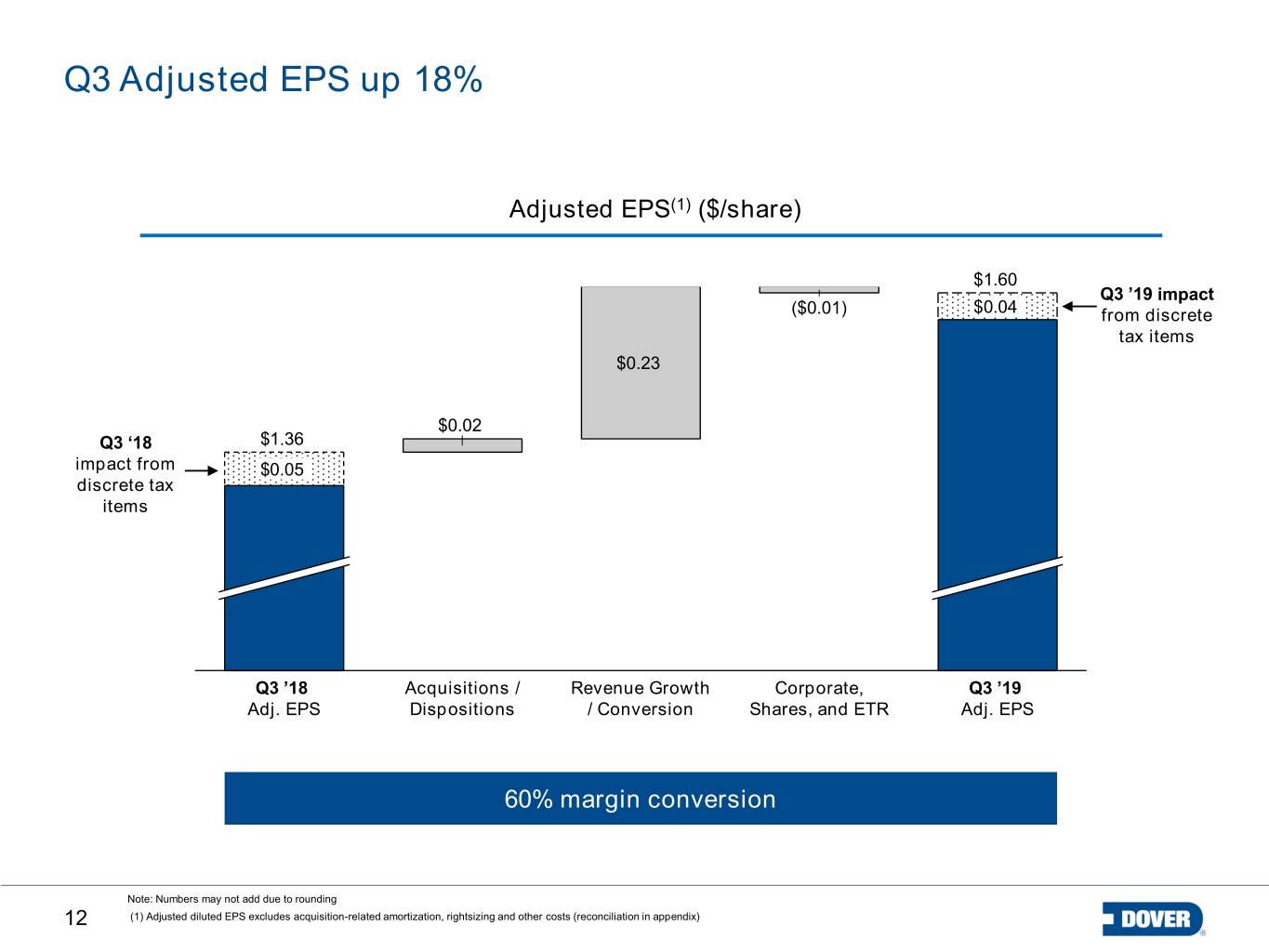

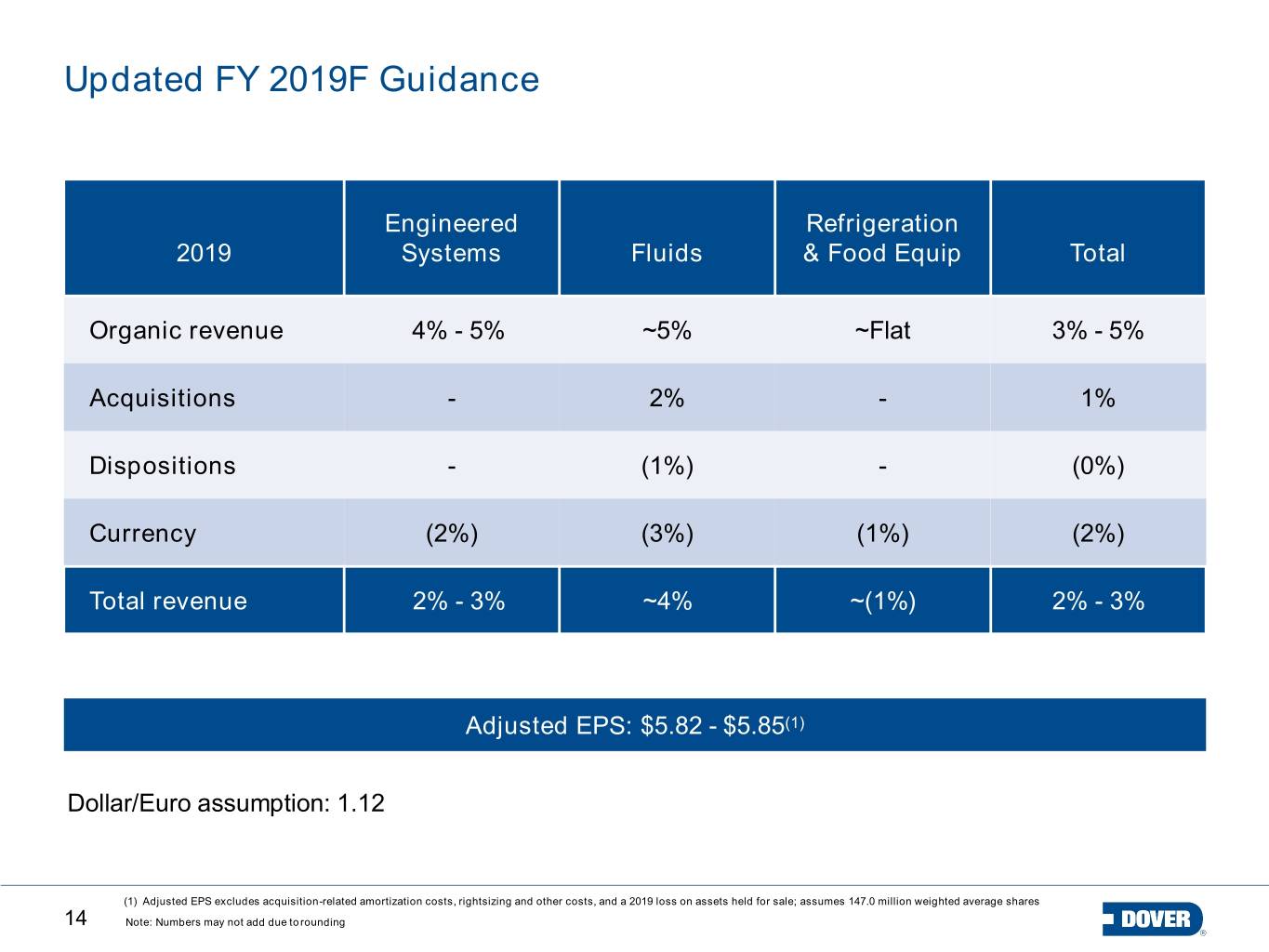

Q3 2019 - Highlights Organic revenue growth of 6% Organic bookings growth of 7% Net of 2% unfavorable FX impact Net of 2% unfavorable FX impact Solid growth across DF and DES businesses DF and DES book-to-bill above 1 Adjusted earnings from continuing Adjusted diluted EPS from continuing operations(1) up 15% to $235M operations(2) at $1.60, up 18% Earnings from continuing operations on a GAAP $0.04 benefit related to discrete tax items(3) basis up 31% to $206M Diluted EPS from continuing operations on a GAAP basis at $1.40, up 33% Segment performance Guidance & other activities Adjusted EBIT(1) up 17% to $320M, at 17.5% margin Narrowing 2019 Adj. EPS(2) guidance to $5.82 - $5.85 (+180 bps year-over-year) On track to begin reporting new segment structure FCF 16.7% of revenue; strong FCF conversion with Q4 ’19 results across all segments (1) Non-GAAP measures (definitions and reconciliations in appendix) 3 (2) Adjusted diluted EPS excludes acquisition-related amortization, rightsizing and other costs (reconciliation in appendix) (3) Includes $5.2M of discrete tax benefits in the quarter

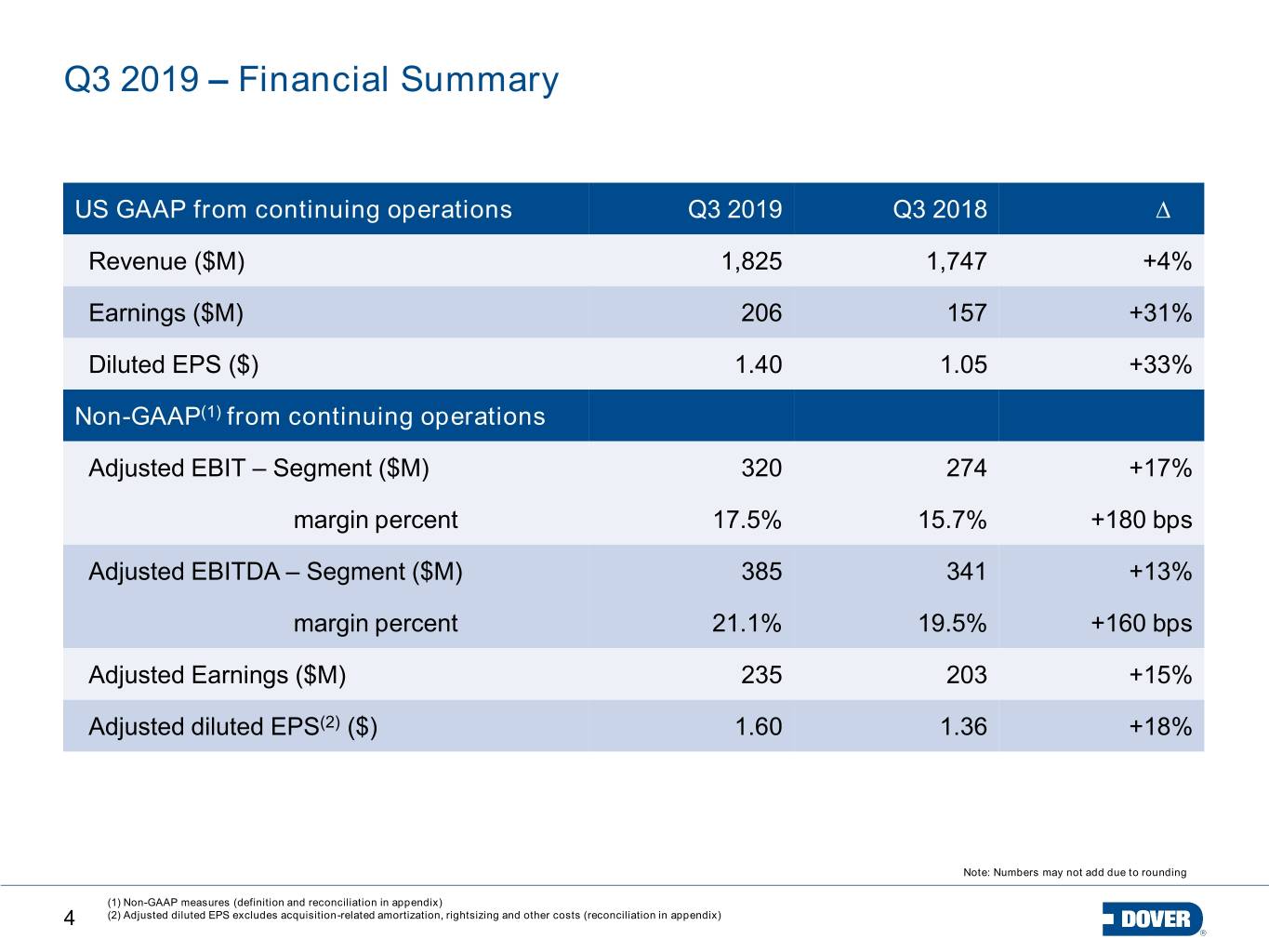

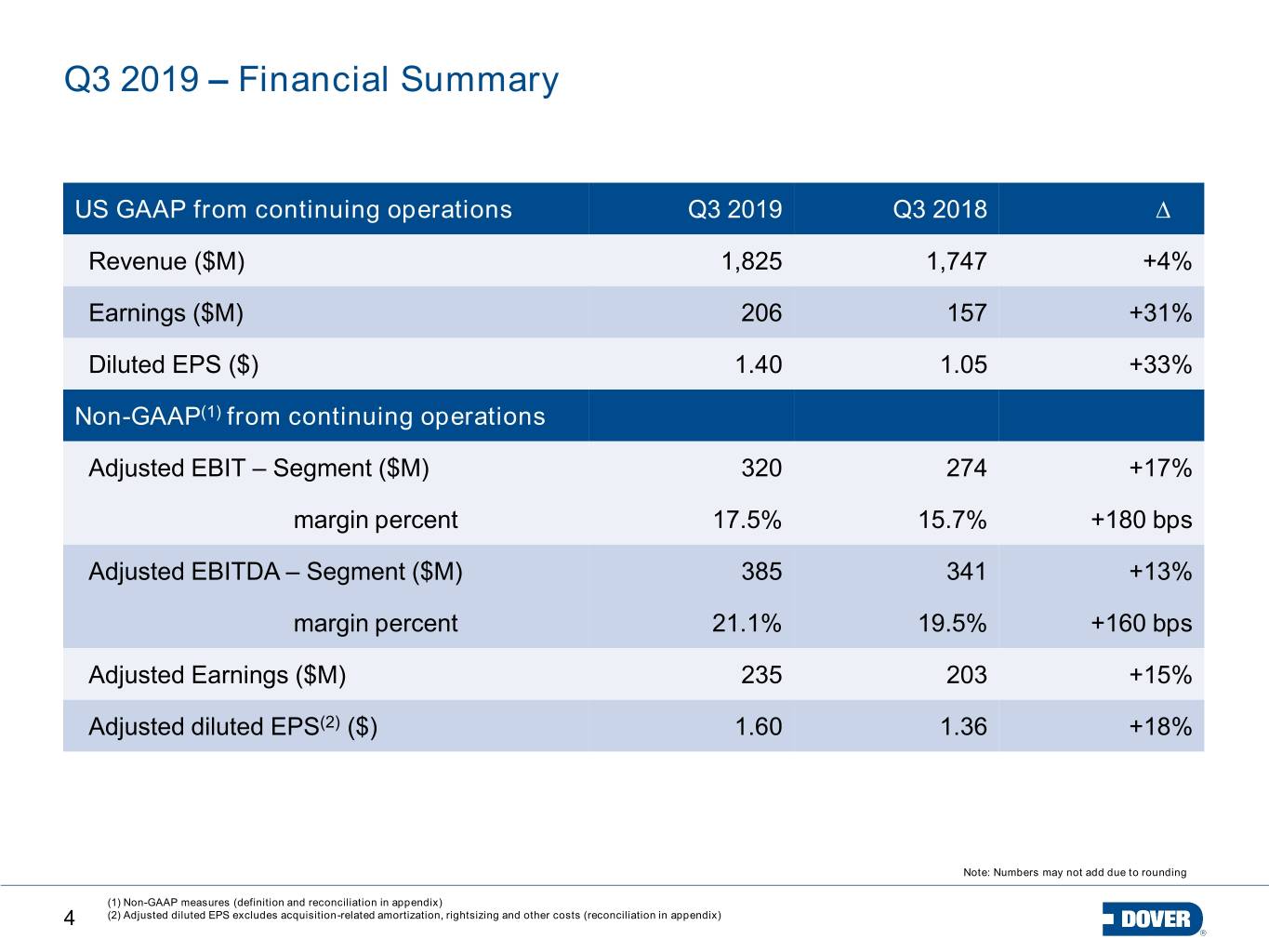

Q3 2019 – Financial Summary US GAAP from continuing operations Q3 2019 Q3 2018 ∆ Revenue ($M) 1,825 1,747 +4% Earnings ($M) 206 157 +31% Diluted EPS ($) 1.40 1.05 +33% Non-GAAP(1) from continuing operations Adjusted EBIT – Segment ($M) 320 274 +17% margin percent 17.5% 15.7% +180 bps Adjusted EBITDA – Segment ($M) 385 341 +13% margin percent 21.1% 19.5% +160 bps Adjusted Earnings ($M) 235 203 +15% Adjusted diluted EPS(2) ($) 1.60 1.36 +18% Note: Numbers may not add due to rounding (1) Non-GAAP measures (definition and reconciliation in appendix) 4 (2) Adjusted diluted EPS excludes acquisition-related amortization, rightsizing and other costs (reconciliation in appendix)

Q3 2019 - Revenue & Bookings Revenue Split Revenue Change in Organic Revenue: +$98M, or 5.6% 4% 13% By Region 54% 21% 8% ($M) US 1,747 42 68 -12 -29 9 1,825 OTHER AMER. Q3 2018 DES DF DRFE FX ACQ./ Q3 2019 ORG. ORG. ORG. DISP. (1) EUROPE ASIA OTHER Bookings Change in Organic Bookings: +$114M, or 6.7% 20% -3% By 39% Segment DES 41% DF 1,717 61 61 -8 -27 9 1,814 ($M) DRFE Q3 2018 DES DF DRFE FX ACQ./ Q3 2019 ORG. ORG. ORG. DISP. (2) Note: Numbers may not add due to rounding (1) Acquisitions: $18M, dispositions: $9M 5 (2) Acquisitions: $16M, dispositions: $7M

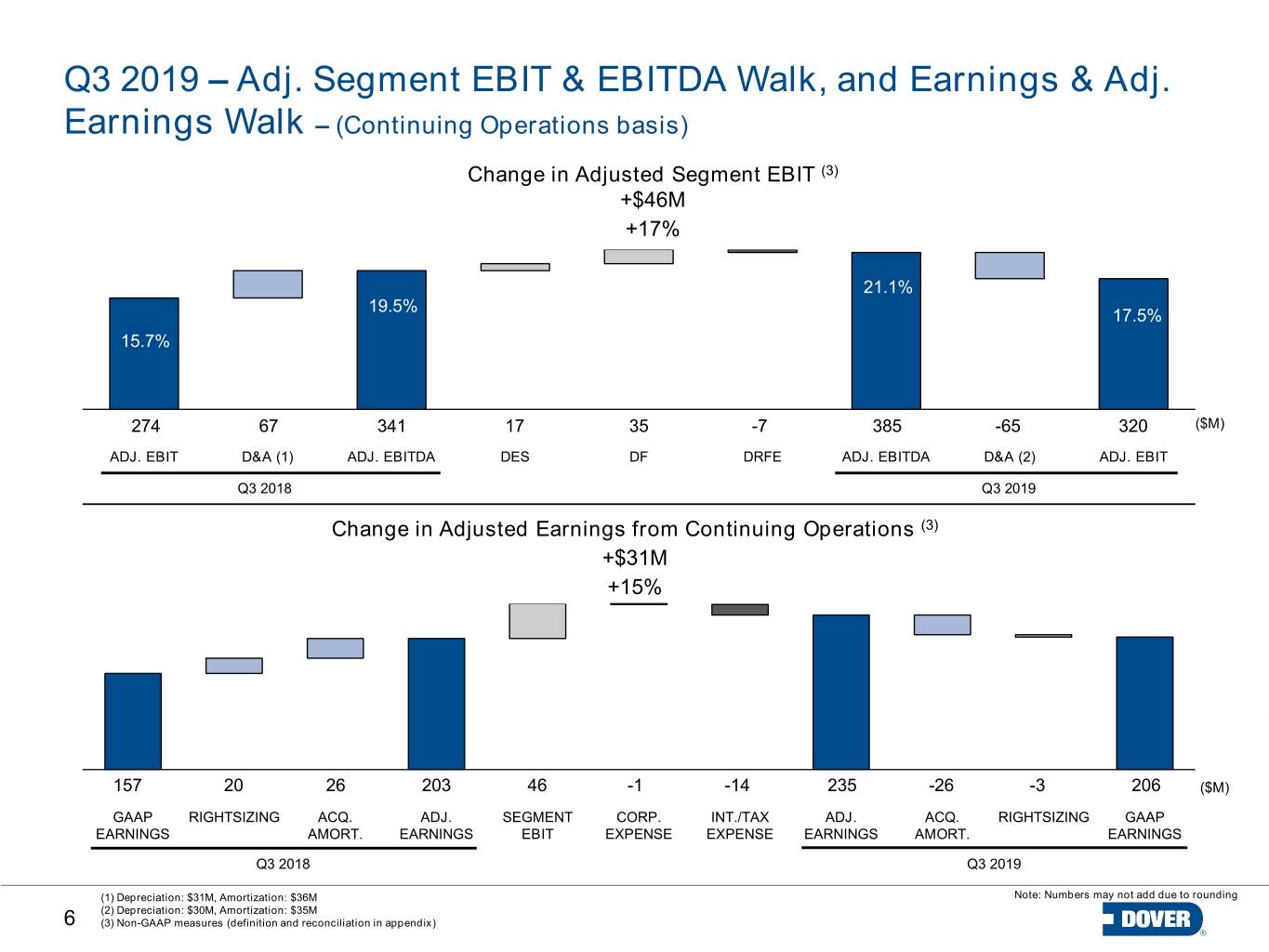

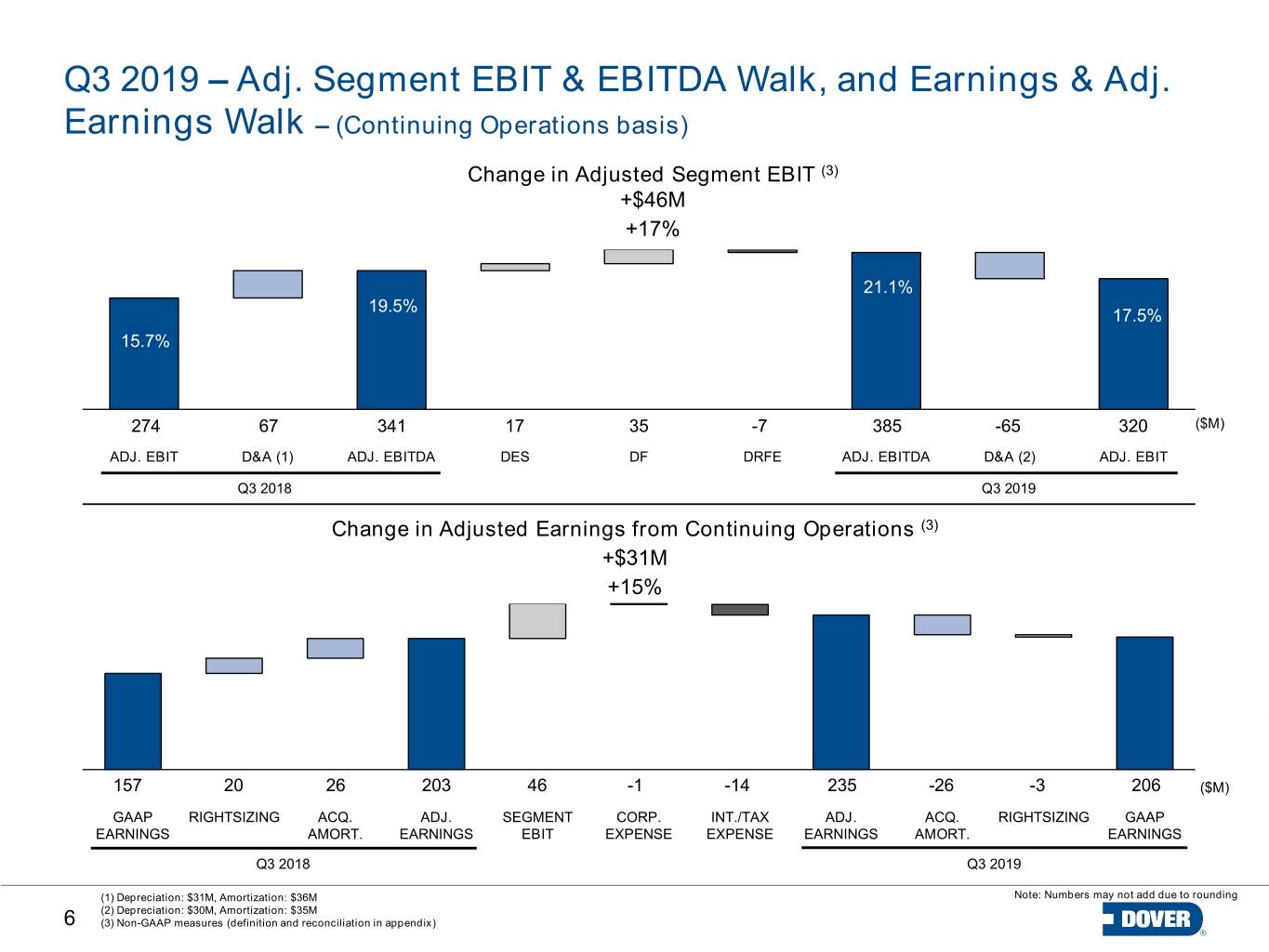

Q3 2019 – Adj. Segment EBIT & EBITDA Walk, and Earnings & Adj. Earnings Walk – (Continuing Operations basis) Change in Adjusted Segment EBIT (3) +$46M +17% 21.1% 19.5% 17.5% 15.7% 274 67 341 17 35 -7 385 -65 320 ($M) ADJ. EBIT D&A (1) ADJ. EBITDA DES DF DRFE ADJ. EBITDA D&A (2) ADJ. EBIT Q3 2018 Q3 2019 Change in Adjusted Earnings from Continuing Operations (3) +$31M +15% 157 20 26 203 46 -1 -14 235 -26 -3 206 ($M) GAAP RIGHTSIZING ACQ. ADJ. SEGMENT CORP. INT./TAX ADJ. ACQ. RIGHTSIZING GAAP EARNINGS AMORT. EARNINGS EBIT EXPENSE EXPENSE EARNINGS AMORT. EARNINGS Q3 2018 Q3 2019 (1) Depreciation: $31M, Amortization: $36M Note: Numbers may not add due to rounding (2) Depreciation: $30M, Amortization: $35M 6 (3) Non-GAAP measures (definition and reconciliation in appendix)

9M 2019 – Free Cash Flow $M 9M 2019 9M 2018 ∆ Net earnings $510 $429 $81 Loss from disc. ops. 0 4 (4) Loss on assets held for sale 47 0 47 D&A 202 206 (4) Chg. in working capital (146) (162) 16 Chg. in other(1) (29) (58) 29 Cash flow from operations $584 419 $165 Capex (137) (135) (3) Free cash flow $447 $28412.3% $163 FCF as a % of revenue 8.3% 5.5% • Q3 2019 FCF 16.7% of revenue (compared to 11.8% in Q3 2018) Note: Numbers may not add due to rounding (1) Includes stock-based compensation and changes in other current and non-current assets and liabilities 7

Segment Information 8

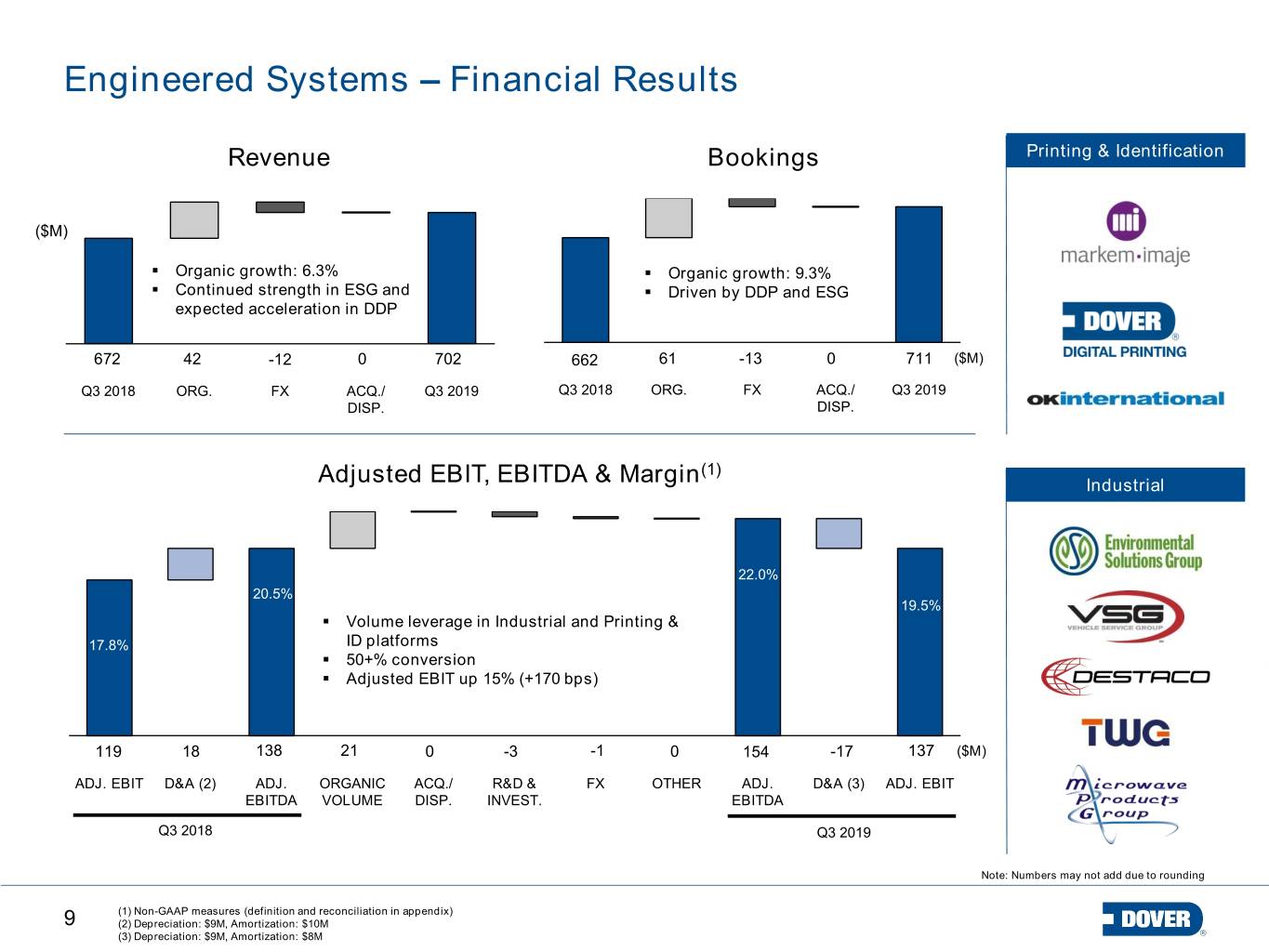

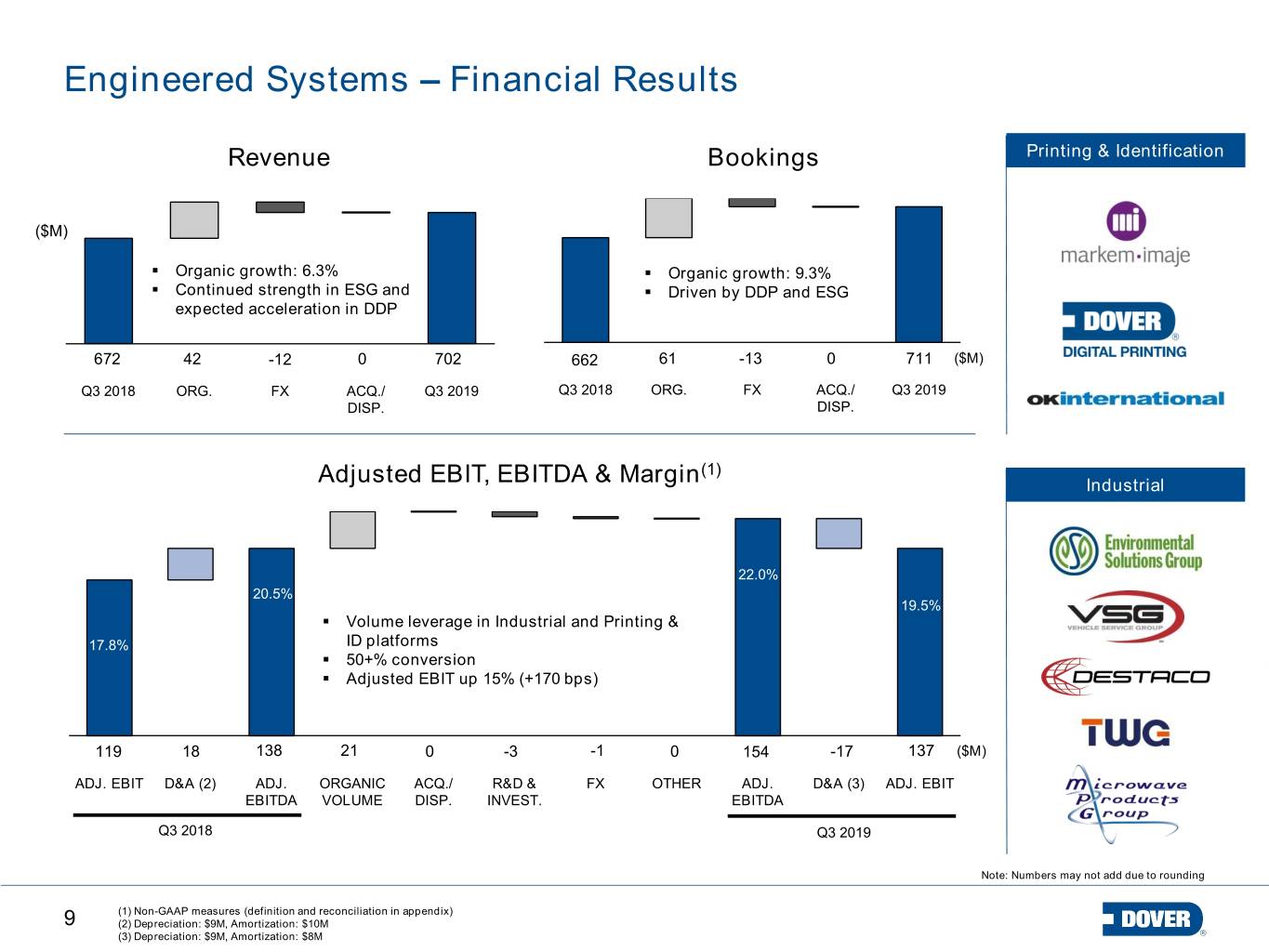

Engineered Systems – Financial Results Revenue Bookings Printing & Identification ($M) . Organic growth: 6.3% . Organic growth: 9.3% . Continued strength in ESG and . Driven by DDP and ESG expected acceleration in DDP 672 42 -12 0 702 662 61 -13 0 711 ($M) Q3 2018 ORG. FX ACQ./ Q3 2019 Q3 2018 ORG. FX ACQ./ Q3 2019 DISP. DISP. (1) Adjusted EBIT, EBITDA & Margin Industrial 22.0% 20.5% 19.5% . Volume leverage in Industrial and Printing & 17.8% ID platforms . 50+% conversion . Adjusted EBIT up 15% (+170 bps) 119 18 138 21 0 -3 -1 0 154 -17 137 ($M) ADJ. EBIT D&A (2) ADJ. ORGANIC ACQ./ R&D & FX OTHER ADJ. D&A (3) ADJ. EBIT EBITDA VOLUME DISP. INVEST. EBITDA Q3 2018 Q3 2019 Note: Numbers may not add due to rounding (1) Non-GAAP measures (definition and reconciliation in appendix) 9 (2) Depreciation: $9M, Amortization: $10M (3) Depreciation: $9M, Amortization: $8M

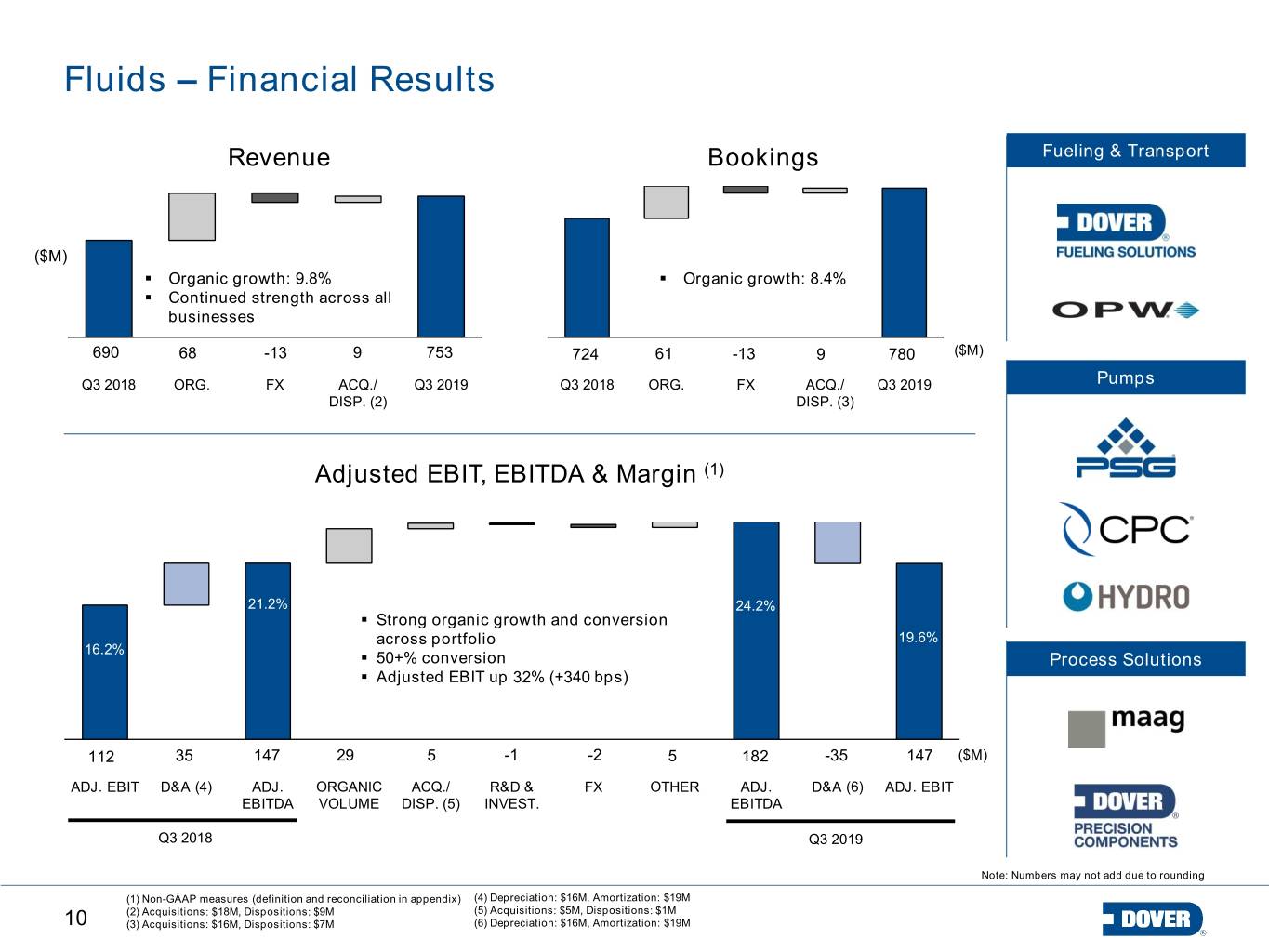

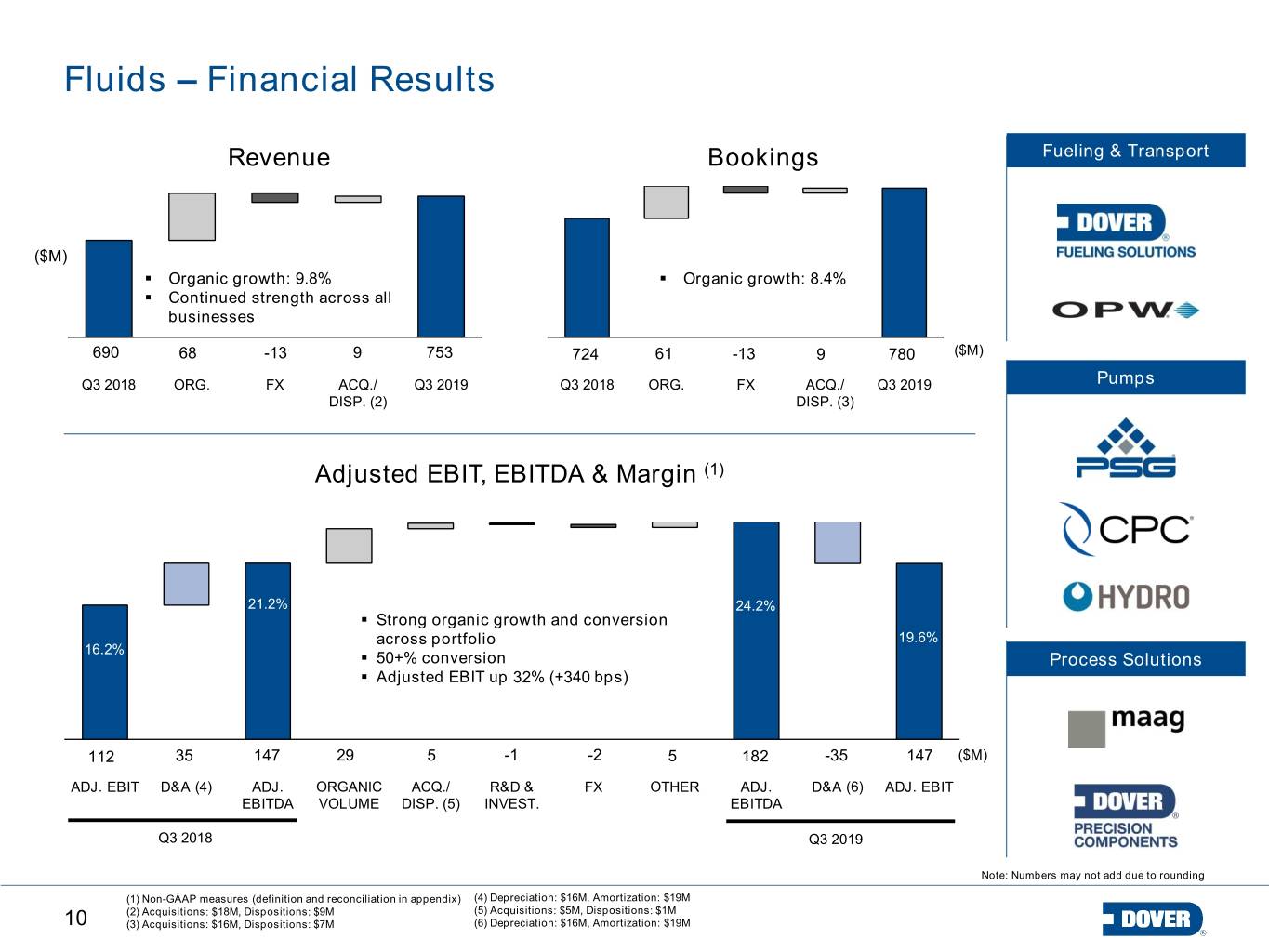

Fluids – Financial Results Revenue Bookings Fueling & Transport ($M) . Organic growth: 9.8% . Organic growth: 8.4% . Continued strength across all businesses 690 68 -13 9 753 724 61 -13 9 780 ($M) Q3 2018 ORG. FX ACQ./ Q3 2019 Q3 2018 ORG. FX ACQ./ Q3 2019 Pumps DISP. (2) DISP. (3) Adjusted EBIT, EBITDA & Margin (1) 21.2% 24.2% . Strong organic growth and conversion across portfolio 19.6% 16.2% . 50+% conversion Process Solutions . Adjusted EBIT up 32% (+340 bps) 112 35 147 29 5 -1 -2 5 182 -35 147 ($M) ADJ. EBIT D&A (4) ADJ. ORGANIC ACQ./ R&D & FX OTHER ADJ. D&A (6) ADJ. EBIT EBITDA VOLUME DISP. (5) INVEST. EBITDA Q3 2018 Q3 2019 Note: Numbers may not add due to rounding (1) Non-GAAP measures (definition and reconciliation in appendix) (4) Depreciation: $16M, Amortization: $19M (2) Acquisitions: $18M, Dispositions: $9M (5) Acquisitions: $5M, Dispositions: $1M 10 (3) Acquisitions: $16M, Dispositions: $7M (6) Depreciation: $16M, Amortization: $19M

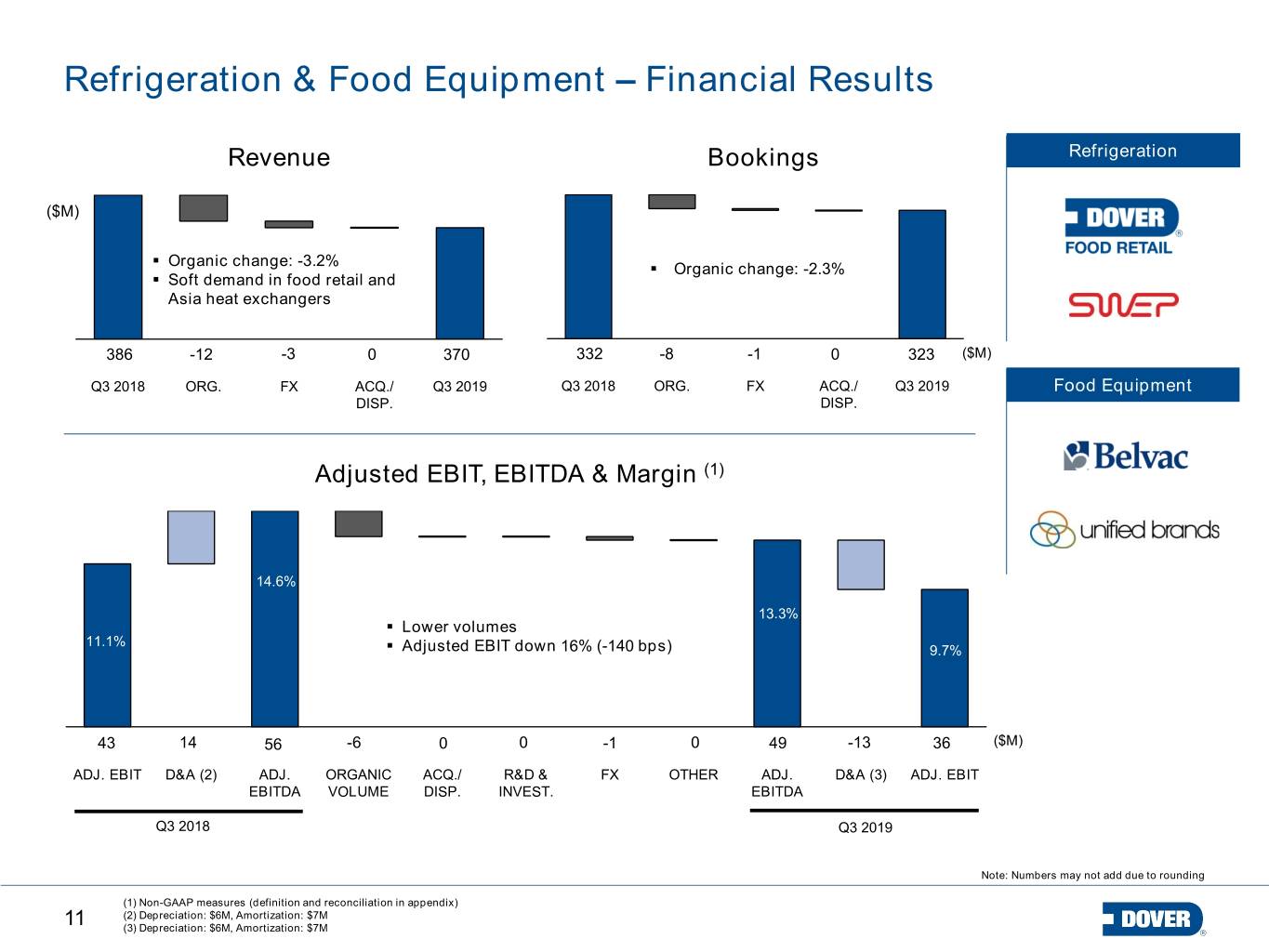

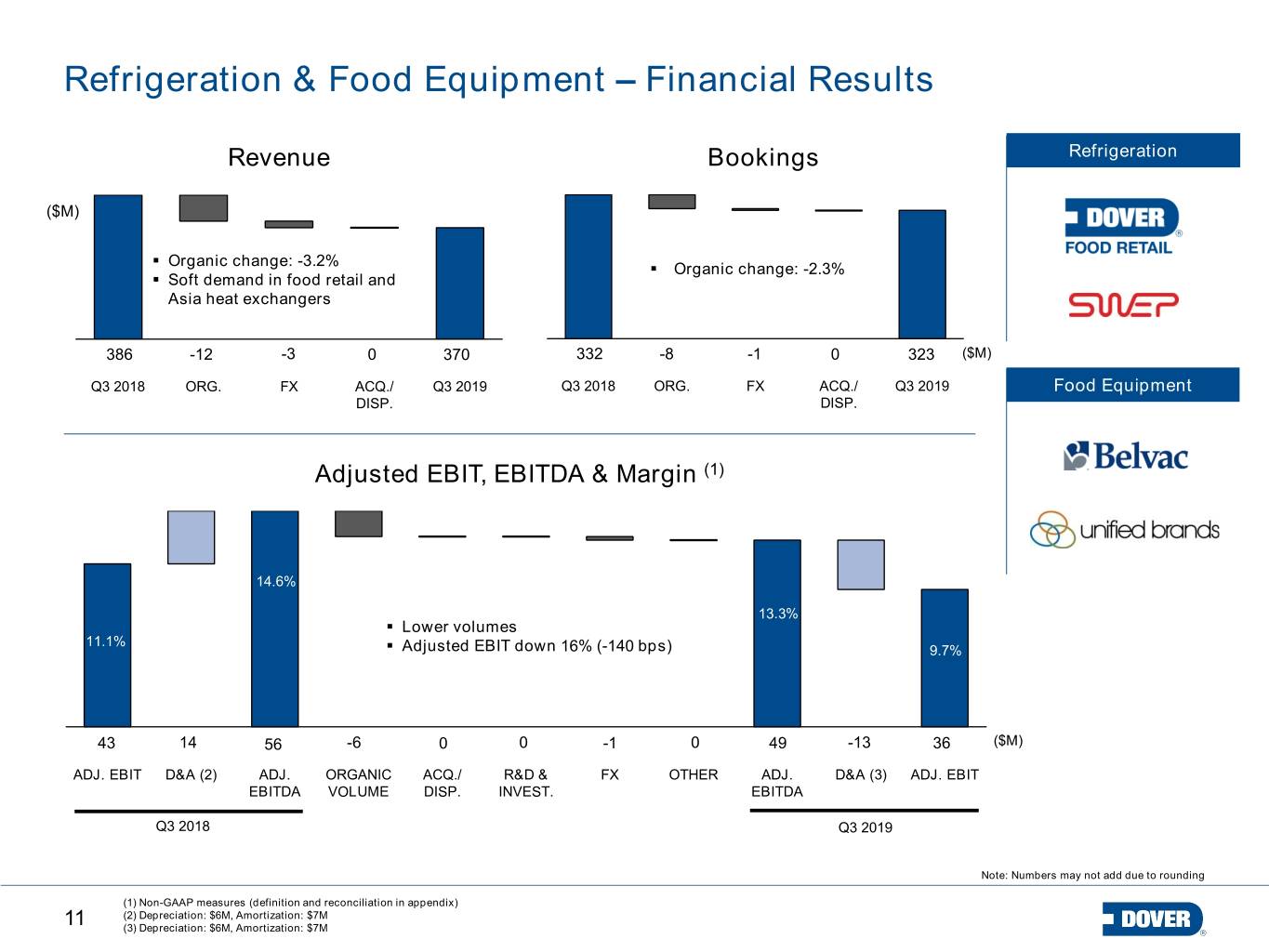

Refrigeration & Food Equipment – Financial Results Revenue Bookings Refrigeration ($M) . Organic change: -3.2% . Organic change: -2.3% . Soft demand in food retail and Asia heat exchangers 386 -12 -3 0 370 332 -8 -1 0 323 ($M) Q3 2018 ORG. FX ACQ./ Q3 2019 Q3 2018 ORG. FX ACQ./ Q3 2019 Food Equipment DISP. DISP. Adjusted EBIT, EBITDA & Margin (1) 14.6% 13.3% . Lower volumes 11.1% . Adjusted EBIT down 16% (-140 bps) 9.7% 43 14 56 -6 0 0 -1 0 49 -13 36 ($M) ADJ. EBIT D&A (2) ADJ. ORGANIC ACQ./ R&D & FX OTHER ADJ. D&A (3) ADJ. EBIT EBITDA VOLUME DISP. INVEST. EBITDA Q3 2018 Q3 2019 Note: Numbers may not add due to rounding (1) Non-GAAP measures (definition and reconciliation in appendix) (2) Depreciation: $6M, Amortization: $7M 11 (3) Depreciation: $6M, Amortization: $7M

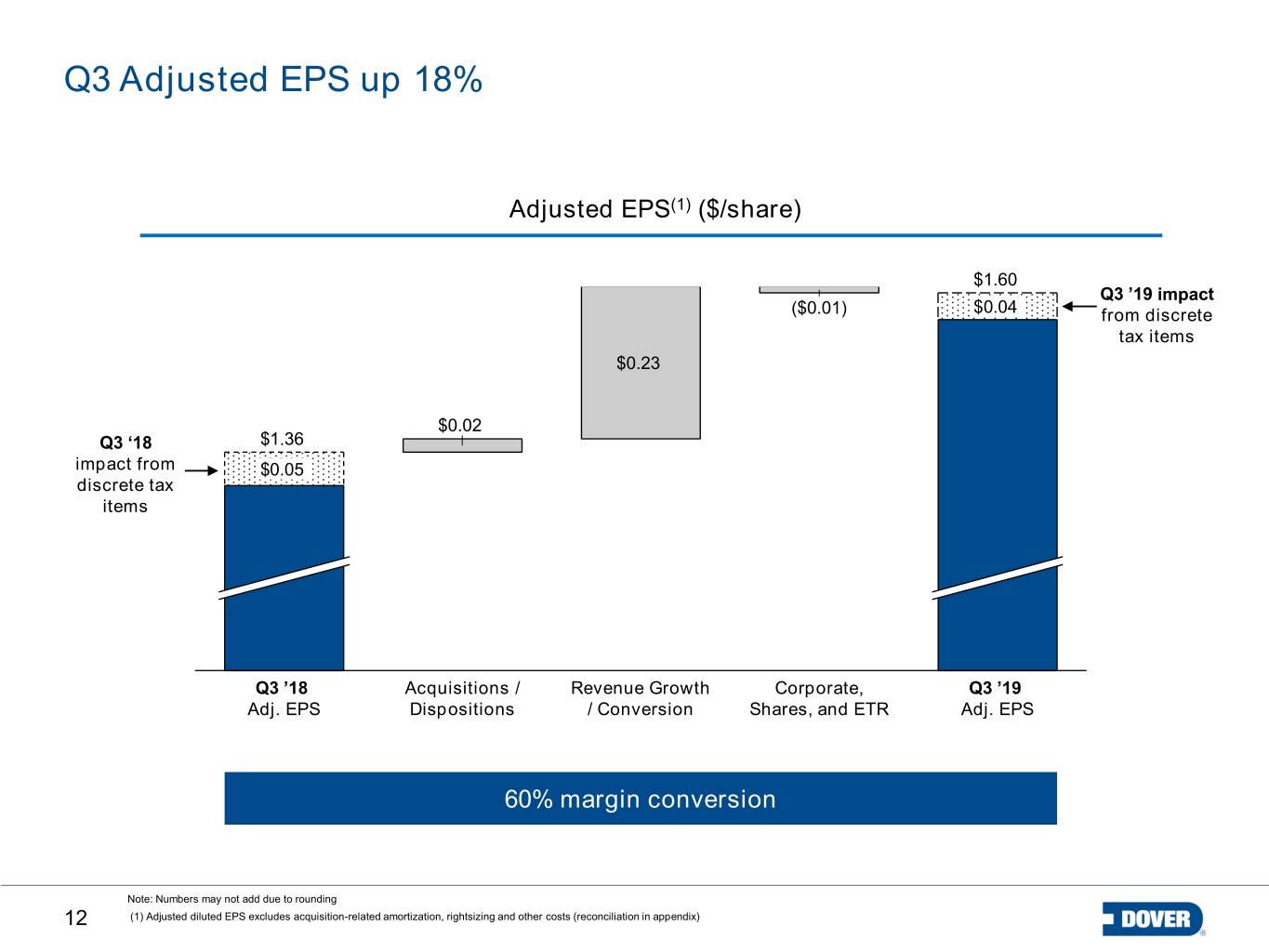

Q3 Adjusted EPS up 18% Adjusted EPS(1) ($/share) $1.60 Q3 ’19 impact ($0.01) $0.04 from discrete tax items $0.23 $0.02 Q3 ‘18 $1.36 impact from $0.05 discrete tax items Q3 ’18 Acquisitions / Revenue Growth Corporate, Q3 ’19 Adj. EPS Dispositions / Conversion Shares, and ETR Adj. EPS 60% margin conversion Note: Numbers may not add due to rounding 12 (1) Adjusted diluted EPS excludes acquisition-related amortization, rightsizing and other costs (reconciliation in appendix)

2019 FY Guidance 13

Updated FY 2019F Guidance Engineered Refrigeration 2019 Systems Fluids & Food Equip Total Organic revenue 4% - 5% ~5% ~Flat 3% - 5% Acquisitions - 2% - 1% Dispositions - (1%) - (0%) Currency (2%) (3%) (1%) (2%) Total revenue 2% - 3% ~4% ~(1%) 2% - 3% Adjusted EPS: $5.82 - $5.85(1) Dollar/Euro assumption: 1.12 (1) Adjusted EPS excludes acquisition-related amortization costs, rightsizing and other costs, and a 2019 loss on assets held for sale; assumes 147.0 million weighted average shares 14 Note: Numbers may not add due torounding

Appendix 15

Reconciliation of Q3 2019 Earnings from Continuing Operations to Adj. EBIT and Adj. EBITDA and calculation of Adj. EBIT margin and Adj. EBITDA margin by Segment (U.S. GAAP) Q3 2019 ($ in millions) DES DF DRFE Total Revenue 702 753 370 1,825 Earnings from continuing operations - - - 206 Add back: Corporate expense - - - 29 Interest expense, net - - - 30 Income tax expense - - - 52 EBIT 136 146 35 317 EBIT % 19.4% 19.3% 9.5% 17.4% Adjustments: Rightsizing and other costs 1 2 1 3 Adjusted EBIT - Segment 137 147 36 320 Adjusted EBIT % 19.5% 19.6% 9.7% 17.5% Adjusted depreciation and amortization expense(1) 17 35 13 65 Adjusted EBITDA - Segment 154 182 49 385 Adjusted EBITDA % 22.0% 24.2% 13.3% 21.1% Note: Numbers may not add due to rounding (1) Adjusted depreciation and amortization expense excludes depreciation and amortization included within rightsizing and other costs 16

Reconciliation of Q3 2018 Earnings from Continuing Operations to Adj. EBIT and Adj. EBITDA and calculation of Adj. EBIT margin and Adj. EBITDA margin by Segment (U.S. GAAP) Q3 2018 ($ in millions) DES DF DRFE Total Revenue 672 690 386 1,748 Earnings from continuing operations - - - 157 Add back: Corporate expense - - - 30 Interest expense, net - - - 29 Income tax expense - - - 36 EBIT 109 101 42 252 EBIT % 16.2% 14.7% 11.0% 14.4% Adjustments: Rightsizing and other costs 11 10 0 22 Adjusted EBIT - Segment 119 112 43 274 Adjusted EBIT % 17.8% 16.2% 11.1% 15.7% Depreciation and amortization expense 18 35 14 67 Adjusted EBITDA - Segment 138 147 56 341 Adjusted EBITDA % 20.5% 21.2% 14.6% 19.5% Note: Numbers may not add due to rounding 17

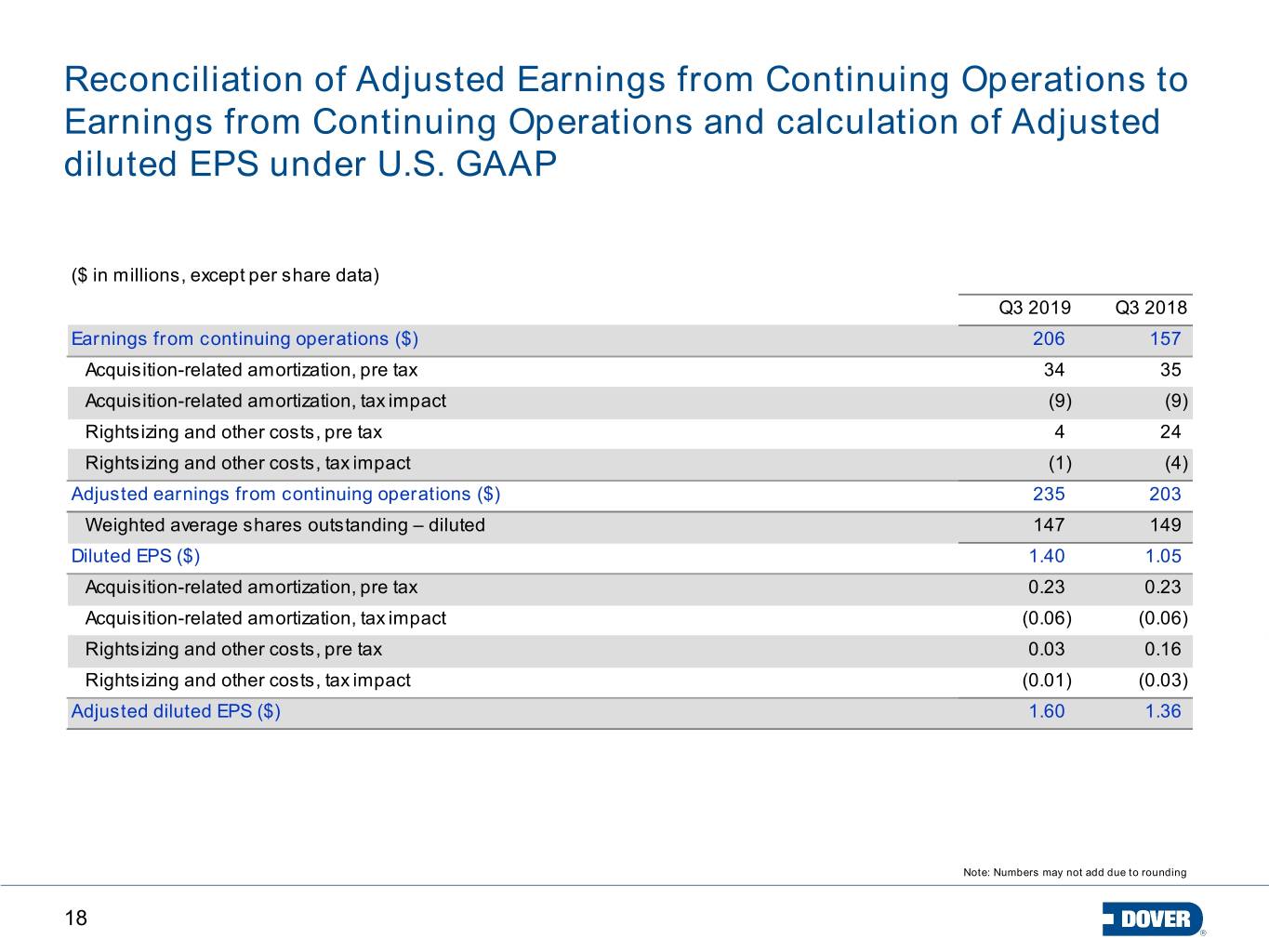

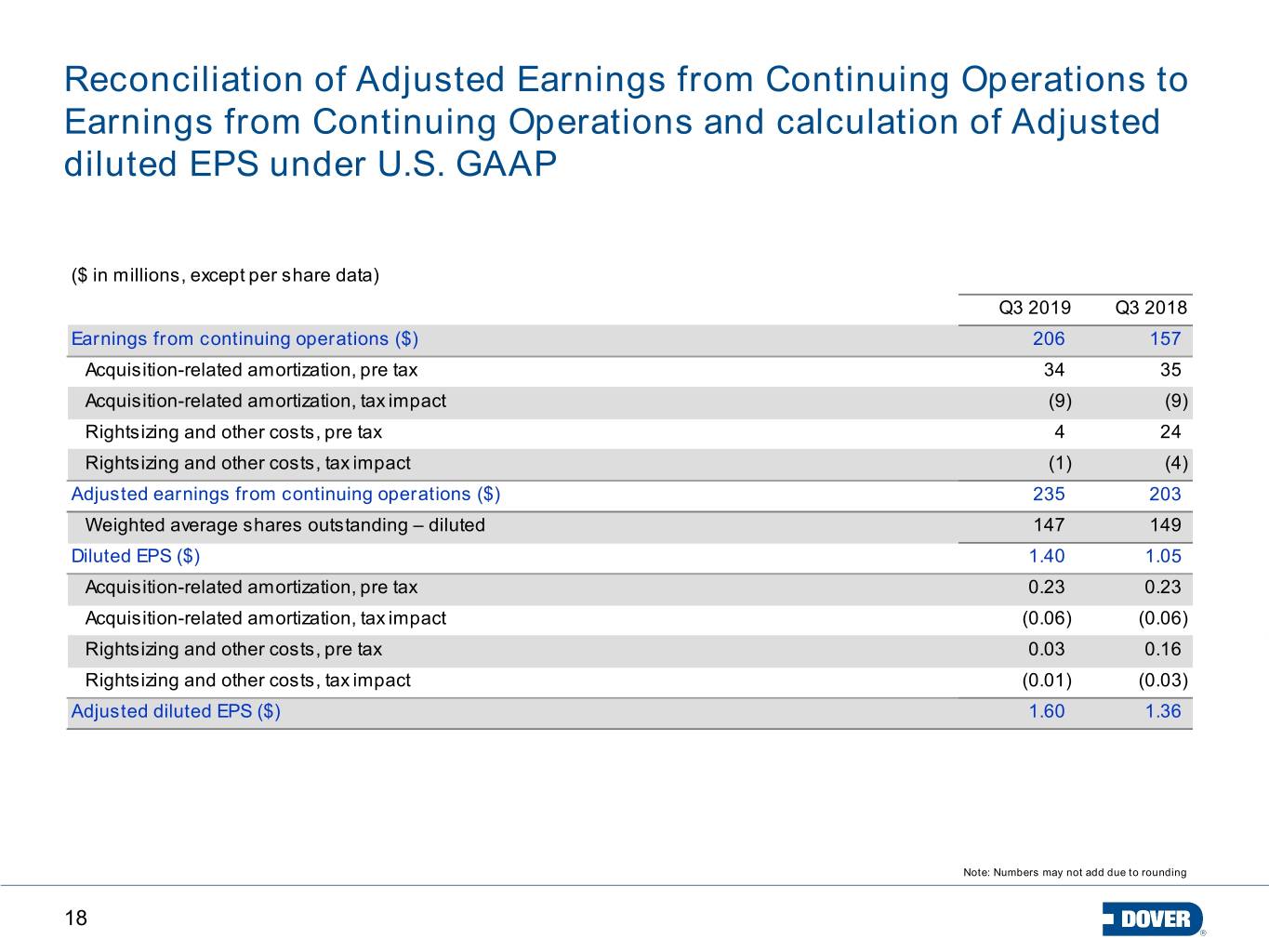

Reconciliation of Adjusted Earnings from Continuing Operations to Earnings from Continuing Operations and calculation of Adjusted diluted EPS under U.S. GAAP ($ in millions, except per share data) Q3 2019 Q3 2018 Earnings from continuing operations ($) 206 157 Acquisition-related amortization, pre tax 34 35 Acquisition-related amortization, tax impact (9) (9) Rightsizing and other costs, pre tax 4 24 Rightsizing and other costs, tax impact (1) (4) Adjusted earnings from continuing operations ($) 235 203 Weighted average shares outstanding – diluted 147 149 Diluted EPS ($) 1.40 1.05 Acquisition-related amortization, pre tax 0.23 0.23 Acquisition-related amortization, tax impact (0.06) (0.06) Rightsizing and other costs, pre tax 0.03 0.16 Rightsizing and other costs, tax impact (0.01) (0.03) Adjusted diluted EPS ($) 1.60 1.36 Note: Numbers may not add due to rounding 18

Reconciliation of Free Cash Flow; and EPS from Continuing Operations to Adjusted EPS from Continuing Operations Reconciliation Free Cash Flow Reconciliation Sep 30, Sep 30, ($ millions) 2019 2018 Net Cash Provided by Operating Activities 584 419 Capital Expenditures (137) (135) Free Cash Flow 447 284 Adjusted EPS from Continuing Operations Reconciliation Range 2019 Guidance for Earnings per Share from Continuing Operations (GAAP) $4.69 $4.72 Acquisition-related amortization, net 0.71 Rightsizing and other costs, net 0.10 Loss on assets held for sale 0.32 2019 Guidance for Adjusted Earnings per Share from Continuing Operations $5.82 $5.85 Note: Numbers may not add due to rounding 19

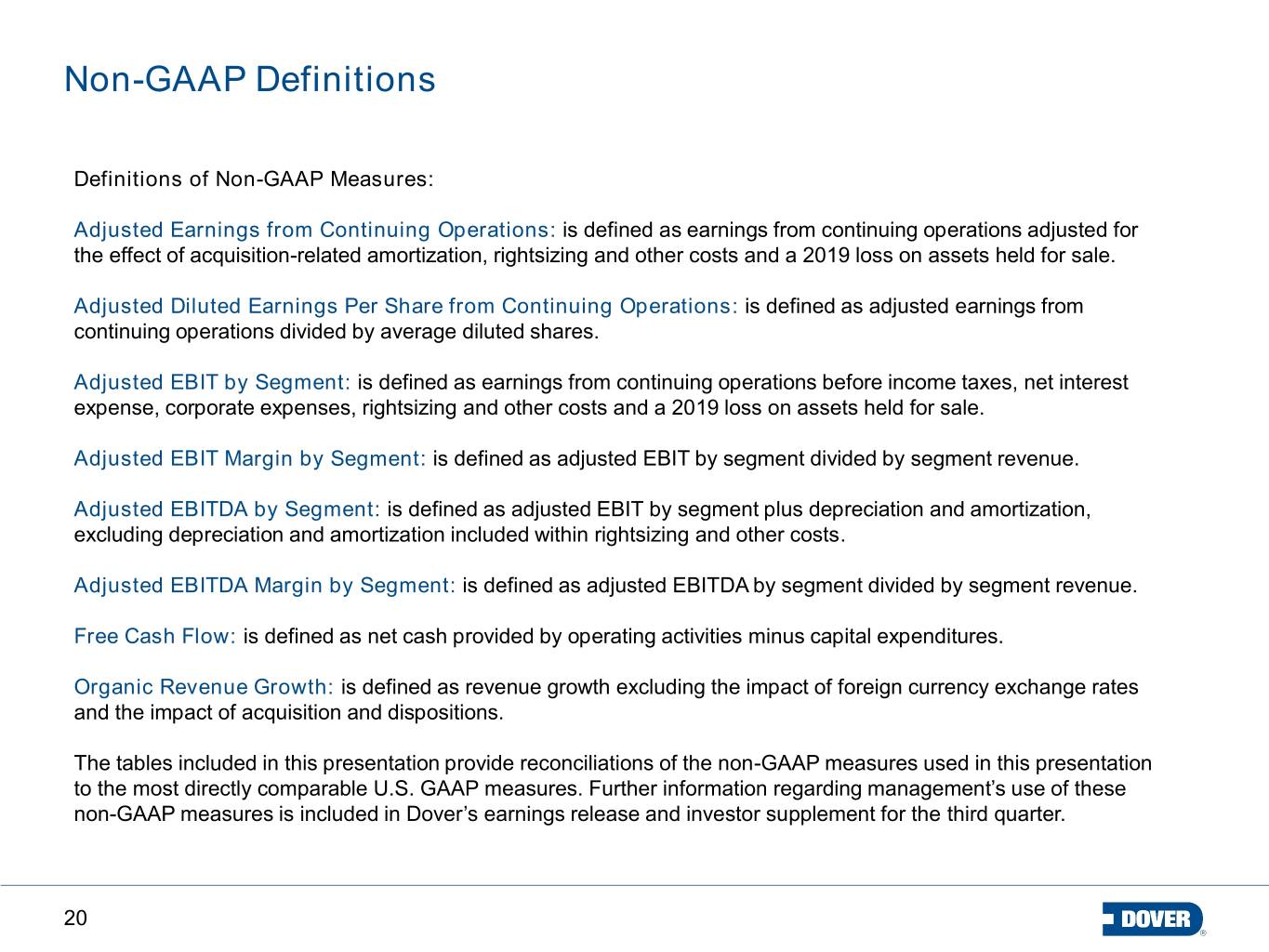

Non-GAAP Definitions Definitions of Non-GAAP Measures: Adjusted Earnings from Continuing Operations: is defined as earnings from continuing operations adjusted for the effect of acquisition-related amortization, rightsizing and other costs and a 2019 loss on assets held for sale. Adjusted Diluted Earnings Per Share from Continuing Operations: is defined as adjusted earnings from continuing operations divided by average diluted shares. Adjusted EBIT by Segment: is defined as earnings from continuing operations before income taxes, net interest expense, corporate expenses, rightsizing and other costs and a 2019 loss on assets held for sale. Adjusted EBIT Margin by Segment: is defined as adjusted EBIT by segment divided by segment revenue. Adjusted EBITDA by Segment: is defined as adjusted EBIT by segment plus depreciation and amortization, excluding depreciation and amortization included within rightsizing and other costs. Adjusted EBITDA Margin by Segment: is defined as adjusted EBITDA by segment divided by segment revenue. Free Cash Flow: is defined as net cash provided by operating activities minus capital expenditures. Organic Revenue Growth: is defined as revenue growth excluding the impact of foreign currency exchange rates and the impact of acquisition and dispositions. The tables included in this presentation provide reconciliations of the non-GAAP measures used in this presentation to the most directly comparable U.S. GAAP measures. Further information regarding management’s use of these non-GAAP measures is included in Dover’s earnings release and investor supplement for the third quarter. 20