2024 Second Quarter July 16, 2024

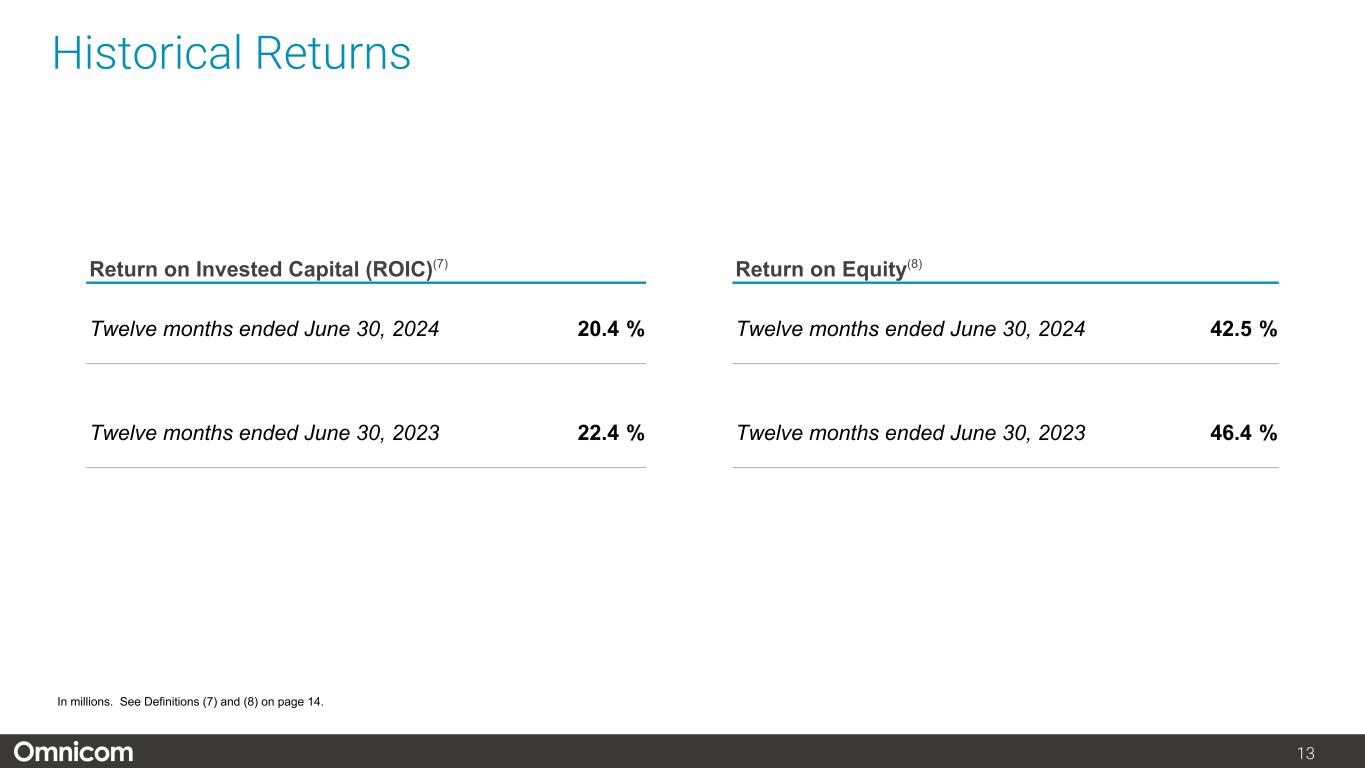

2 Highlights Revenue • 5.2% organic revenue growth in Q2 2024, 4.6% YTD, solidly within annual expectation of 4.0%-5.0% • Advertising & Media strong at +7.8% • +2.6% benefit from net acquisitions & dispositions Income • Q2 2024 reported operating income $510.3 million, 13.2% margin. Non-GAAP adjusted EBITA $589.6 million, increase of 5.5% from prior year and a 15.3% margin(i) • Q2 2024 reported diluted EPS of $1.65. Non-GAAP adjusted diluted EPS of $1.95, +4.8% from prior year(i) Business update • Strategic initiatives underway in 2024 include agency and market consolidation, unified production, scaled content solutions, expanding GenAI deployments, and growing e- commerce offerings • Strong net new business wins and pipeline expected to contribute to future growth Capital allocation • $249.8 million in share repurchases YTD • $278.9 million in dividends paid YTD • 42.5% Return on Equity and 20.4% Return on Invested Capital for the 12 months ended June 30, 2024 (i) See Non-GAAP reconciliations on pages 18 - 21.

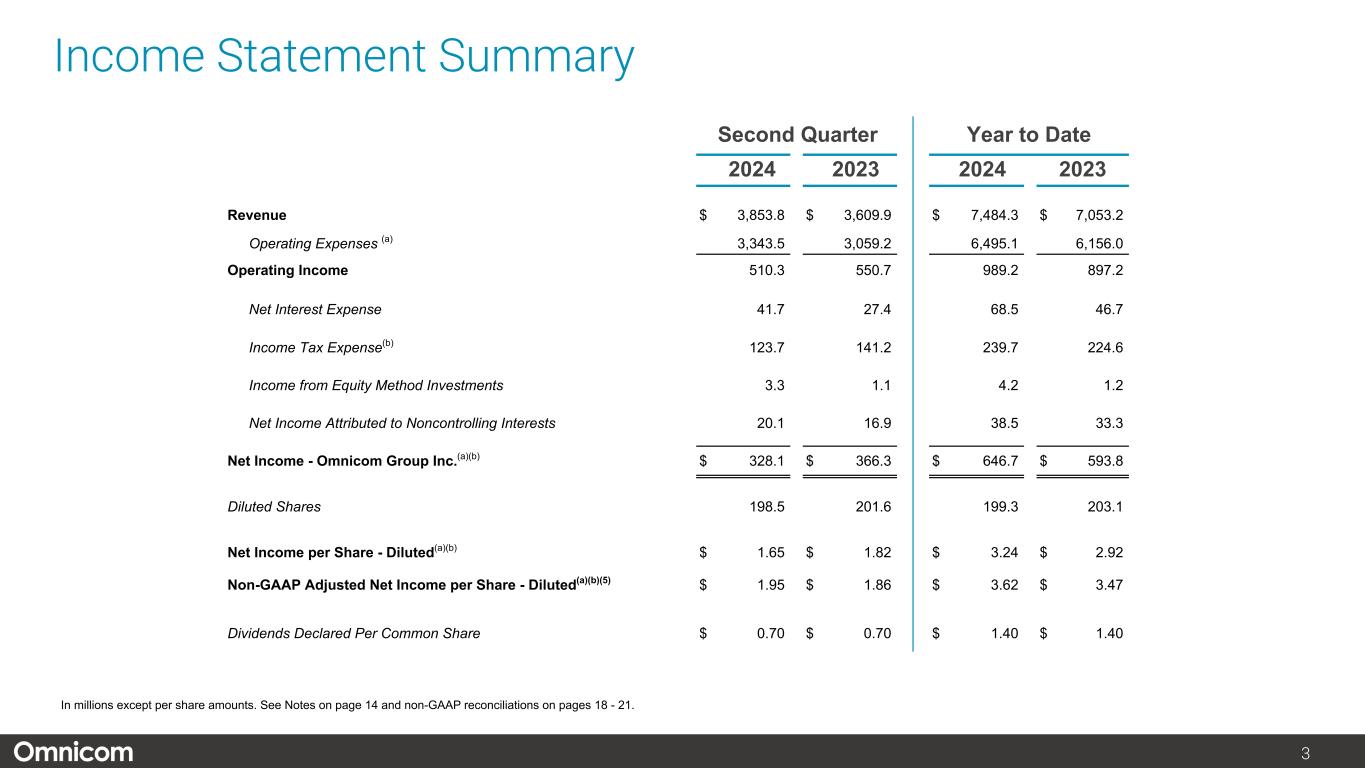

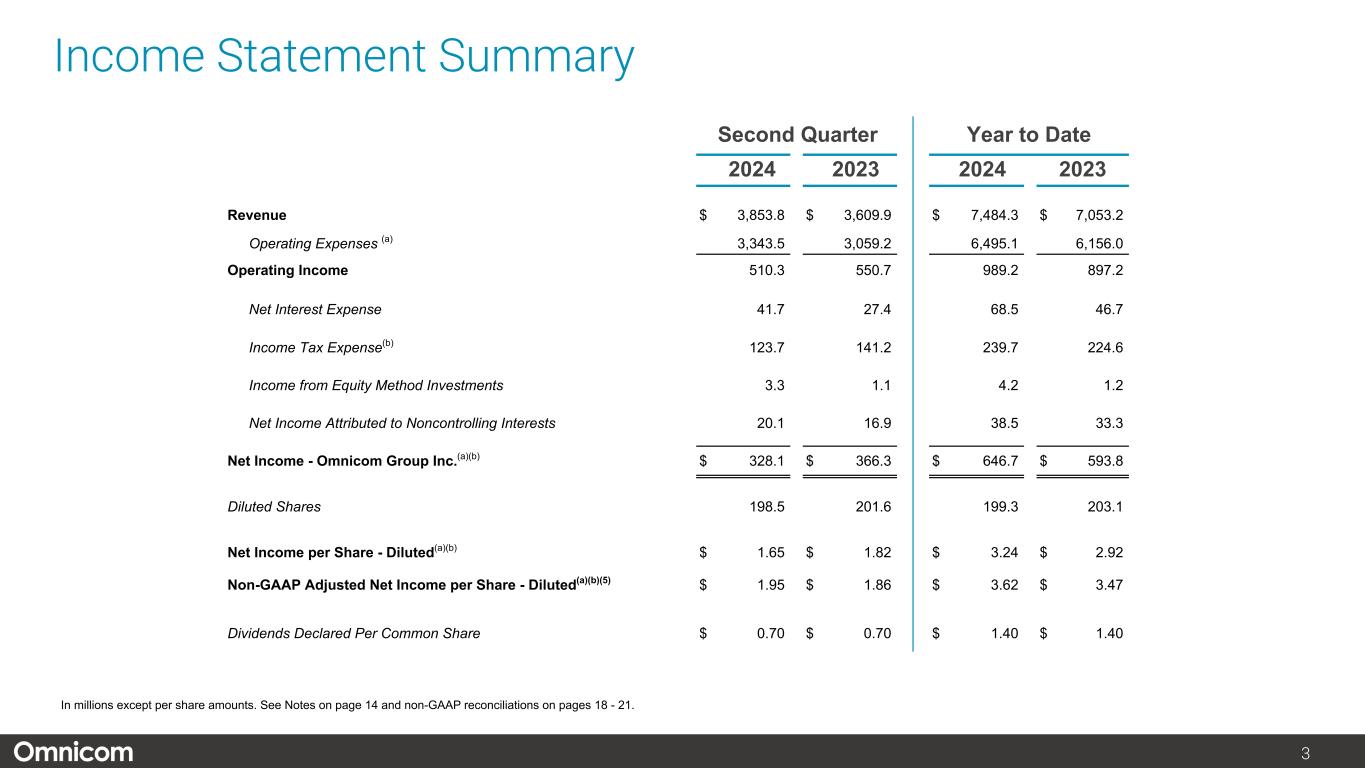

3 Second Quarter Year to Date 2024 2023 2024 2023 Revenue $ 3,853.8 $ 3,609.9 $ 7,484.3 $ 7,053.2 Operating Expenses (a) 3,343.5 3,059.2 6,495.1 6,156.0 Operating Income 510.3 550.7 989.2 897.2 Net Interest Expense 41.7 27.4 68.5 46.7 Income Tax Expense(b) 123.7 141.2 239.7 224.6 Income from Equity Method Investments 3.3 1.1 4.2 1.2 Net Income Attributed to Noncontrolling Interests 20.1 16.9 38.5 33.3 Net Income - Omnicom Group Inc.(a)(b) $ 328.1 $ 366.3 $ 646.7 $ 593.8 Diluted Shares 198.5 201.6 199.3 203.1 Net Income per Share - Diluted(a)(b) $ 1.65 $ 1.82 $ 3.24 $ 2.92 Non-GAAP Adjusted Net Income per Share - Diluted(a)(b)(5) $ 1.95 $ 1.86 $ 3.62 $ 3.47 Dividends Declared Per Common Share $ 0.70 $ 0.70 $ 1.40 $ 1.40 Income Statement Summary In millions except per share amounts. See Notes on page 14 and non-GAAP reconciliations on pages 18 - 21.

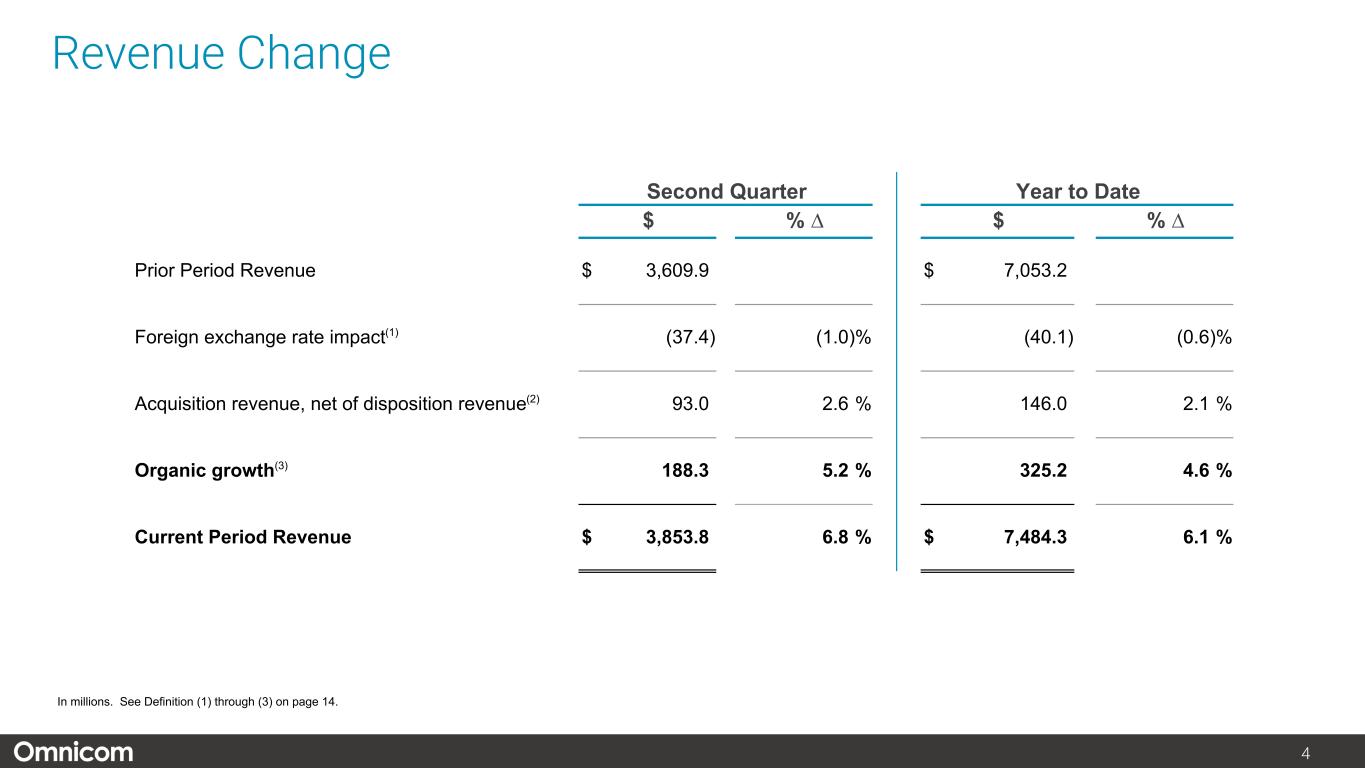

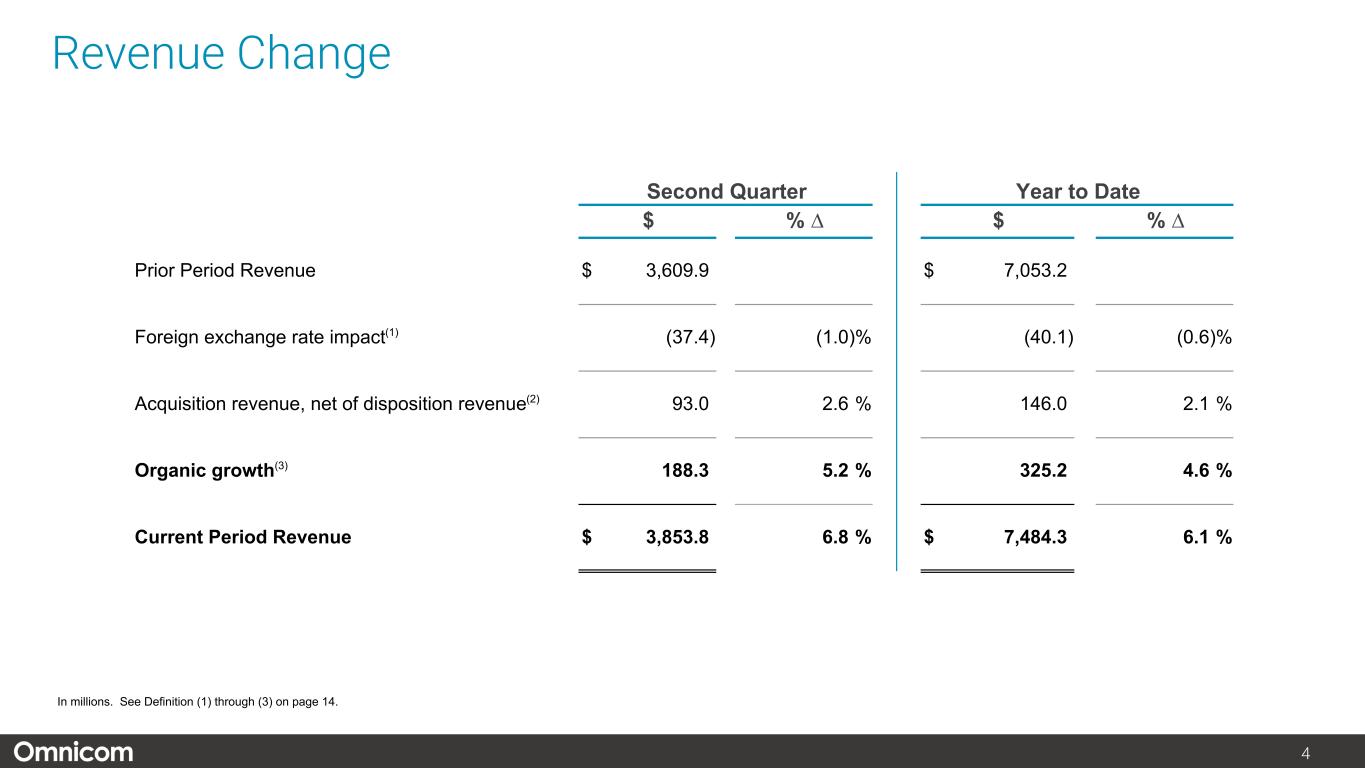

4 Revenue Change Second Quarter Year to Date $ % ∆ $ % ∆ Prior Period Revenue $ 3,609.9 $ 7,053.2 Foreign exchange rate impact(1) (37.4) (1.0) % (40.1) (0.6) % Acquisition revenue, net of disposition revenue(2) 93.0 2.6 % 146.0 2.1 % Organic growth(3) 188.3 5.2 % 325.2 4.6 % Current Period Revenue $ 3,853.8 6.8 % $ 7,484.3 6.1 % In millions. See Definition (1) through (3) on page 14.

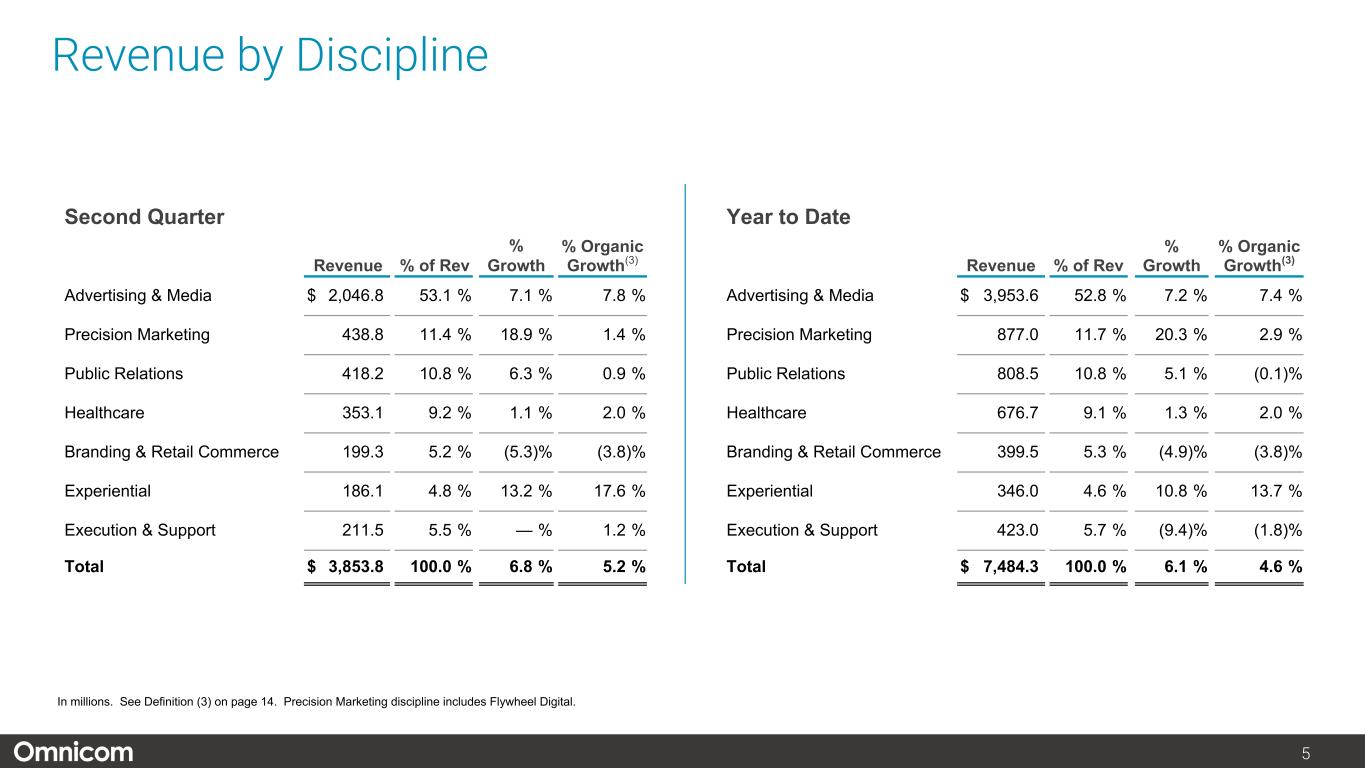

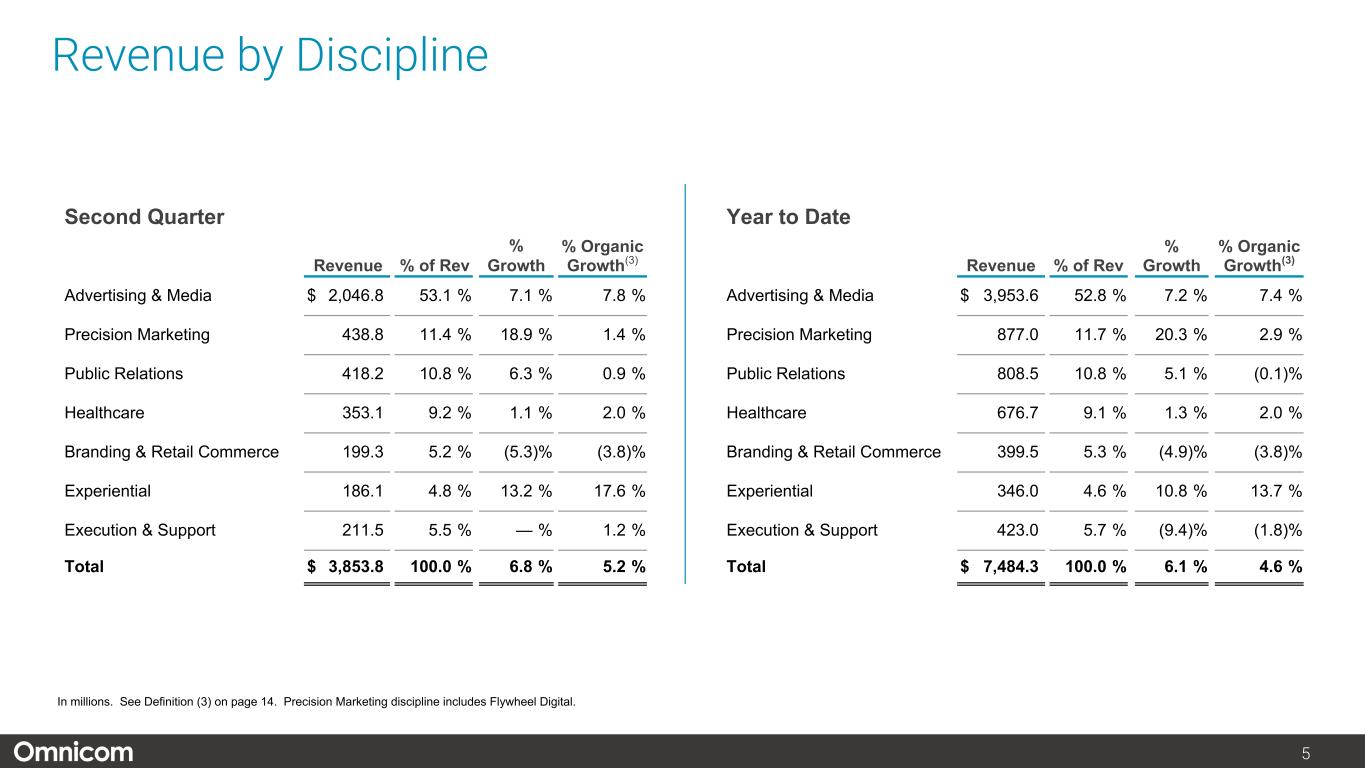

5 Revenue by Discipline Second Quarter Year to Date Revenue % of Rev % Growth % Organic Growth(3) Revenue % of Rev % Growth % Organic Growth(3) Advertising & Media $ 2,046.8 53.1 % 7.1 % 7.8 % Advertising & Media $ 3,953.6 52.8 % 7.2 % 7.4 % Precision Marketing 438.8 11.4 % 18.9 % 1.4 % Precision Marketing 877.0 11.7 % 20.3 % 2.9 % Public Relations 418.2 10.8 % 6.3 % 0.9 % Public Relations 808.5 10.8 % 5.1 % (0.1) % Healthcare 353.1 9.2 % 1.1 % 2.0 % Healthcare 676.7 9.1 % 1.3 % 2.0 % Branding & Retail Commerce 199.3 5.2 % (5.3) % (3.8) % Branding & Retail Commerce 399.5 5.3 % (4.9) % (3.8) % Experiential 186.1 4.8 % 13.2 % 17.6 % Experiential 346.0 4.6 % 10.8 % 13.7 % Execution & Support 211.5 5.5 % — % 1.2 % Execution & Support 423.0 5.7 % (9.4) % (1.8) % Total $ 3,853.8 100.0 % 6.8 % 5.2 % Total $ 7,484.3 100.0 % 6.1 % 4.6 % In millions. See Definition (3) on page 14. Precision Marketing discipline includes Flywheel Digital.

6 Second Quarter Revenue % of Rev % Growth % Organic Growth(3) United States $ 2,033.4 52.8 % 9.9 % 6.3 % Other North America 115.0 3.0 % (10.3) % (8.3) % United Kingdom 423.6 11.0 % 10.0 % 6.9 % Euro Markets & Other Europe 678.3 17.6 % 2.7 % 4.5 % Asia Pacific 431.5 11.2 % (1.6) % (0.1) % Latin America 106.4 2.7 % 25.8 % 24.5 % Middle East & Africa 65.6 1.7 % 4.8 % 8.0 % Total $ 3,853.8 100.0 % 6.8 % 5.2 % Revenue by Region Year to Date Revenue % of Rev % Growth % Organic Growth(3) United States $ 3,959.3 52.9 % 8.1 % 5.3 % Other North America 230.0 3.1 % (5.3) % (3.8) % United Kingdom 826.8 11.1 % 9.3 % 5.1 % Euro Markets & Other Europe 1,280.9 17.1 % 3.2 % 4.0 % Asia Pacific 839.2 11.2 % (0.6) % 1.4 % Latin America 202.9 2.7 % 27.9 % 23.5 % Middle East & Africa 145.2 1.9 % (1.6) % 1.0 % Total $ 7,484.3 100.0 % 6.1 % 4.6 % In millions. See Definition (3) on page 14.

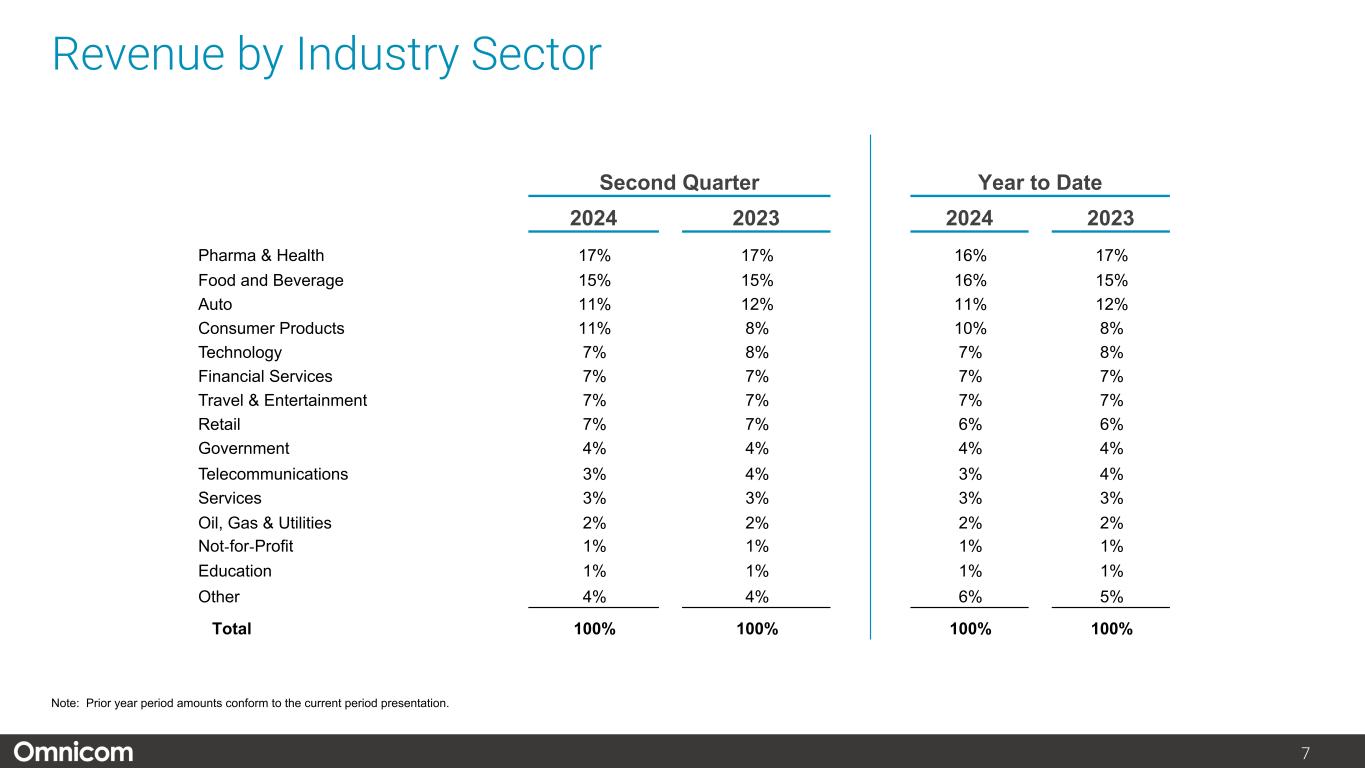

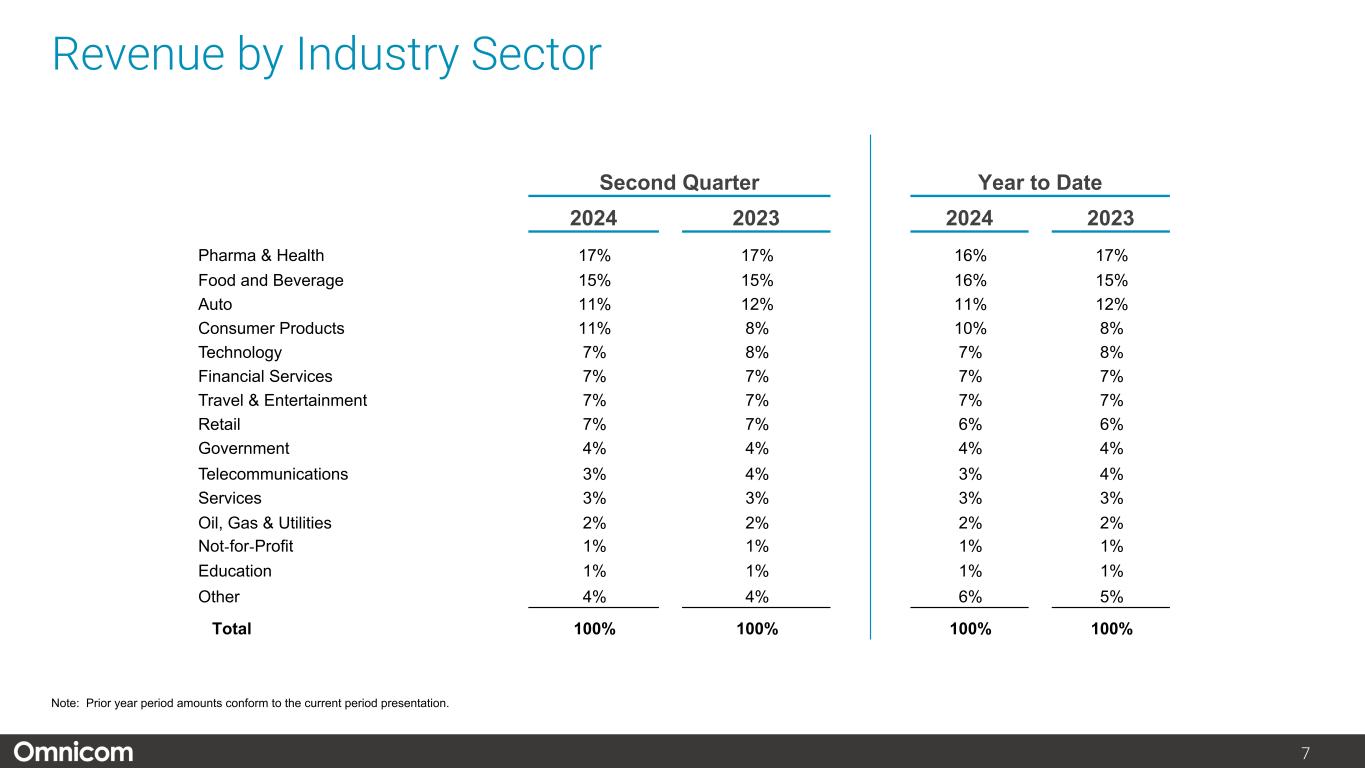

7 Second Quarter Year to Date 2024 2023 2024 2023 Pharma & Health 17% 17% 16% 17% Food and Beverage 15% 15% 16% 15% Auto 11% 12% 11% 12% Consumer Products 11% 8% 10% 8% Technology 7% 8% 7% 8% Financial Services 7% 7% 7% 7% Travel & Entertainment 7% 7% 7% 7% Retail 7% 7% 6% 6% Government 4% 4% 4% 4% Telecommunications 3% 4% 3% 4% Services 3% 3% 3% 3% Oil, Gas & Utilities 2% 2% 2% 2% Not-for-Profit 1% 1% 1% 1% Education 1% 1% 1% 1% Other 4% 4% 6% 5% Total 100% 100% 100% 100% Revenue by Industry Sector Note: Prior year period amounts conform to the current period presentation.

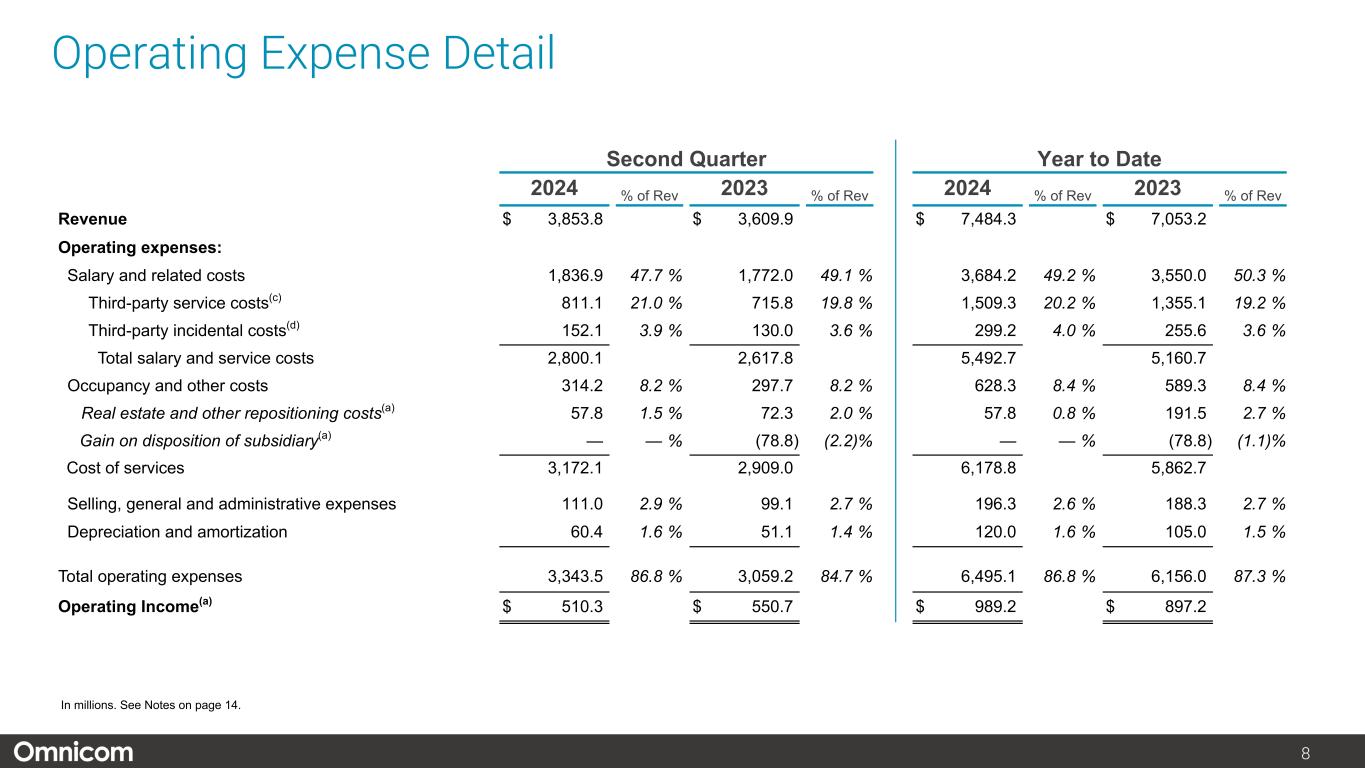

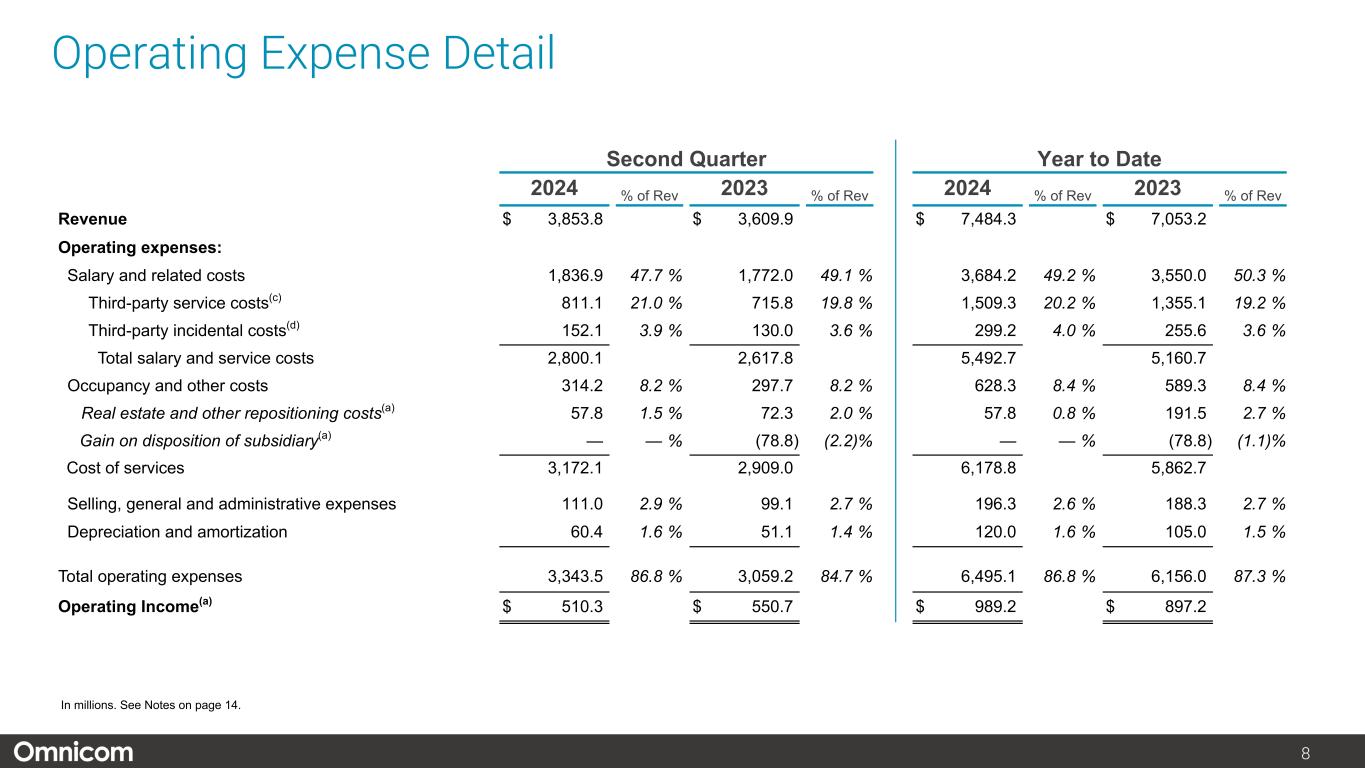

8 Operating Expense Detail Second Quarter Year to Date 2024 % of Rev 2023 % of Rev 2024 % of Rev 2023 % of Rev Revenue $ 3,853.8 $ 3,609.9 $ 7,484.3 $ 7,053.2 Operating expenses: Salary and related costs 1,836.9 47.7 % 1,772.0 49.1 % 3,684.2 49.2 % 3,550.0 50.3 % Third-party service costs(c) 811.1 21.0 % 715.8 19.8 % 1,509.3 20.2 % 1,355.1 19.2 % Third-party incidental costs(d) 152.1 3.9 % 130.0 3.6 % 299.2 4.0 % 255.6 3.6 % Total salary and service costs 2,800.1 2,617.8 5,492.7 5,160.7 Occupancy and other costs 314.2 8.2 % 297.7 8.2 % 628.3 8.4 % 589.3 8.4 % Real estate and other repositioning costs(a) 57.8 1.5 % 72.3 2.0 % 57.8 0.8 % 191.5 2.7 % Gain on disposition of subsidiary(a) — — % (78.8) (2.2) % — — % (78.8) (1.1) % Cost of services 3,172.1 2,909.0 6,178.8 5,862.7 Selling, general and administrative expenses 111.0 2.9 % 99.1 2.7 % 196.3 2.6 % 188.3 2.7 % Depreciation and amortization 60.4 1.6 % 51.1 1.4 % 120.0 1.6 % 105.0 1.5 % Total operating expenses 3,343.5 86.8 % 3,059.2 84.7 % 6,495.1 86.8 % 6,156.0 87.3 % Operating Income(a) $ 510.3 $ 550.7 $ 989.2 $ 897.2 In millions. See Notes on page 14.

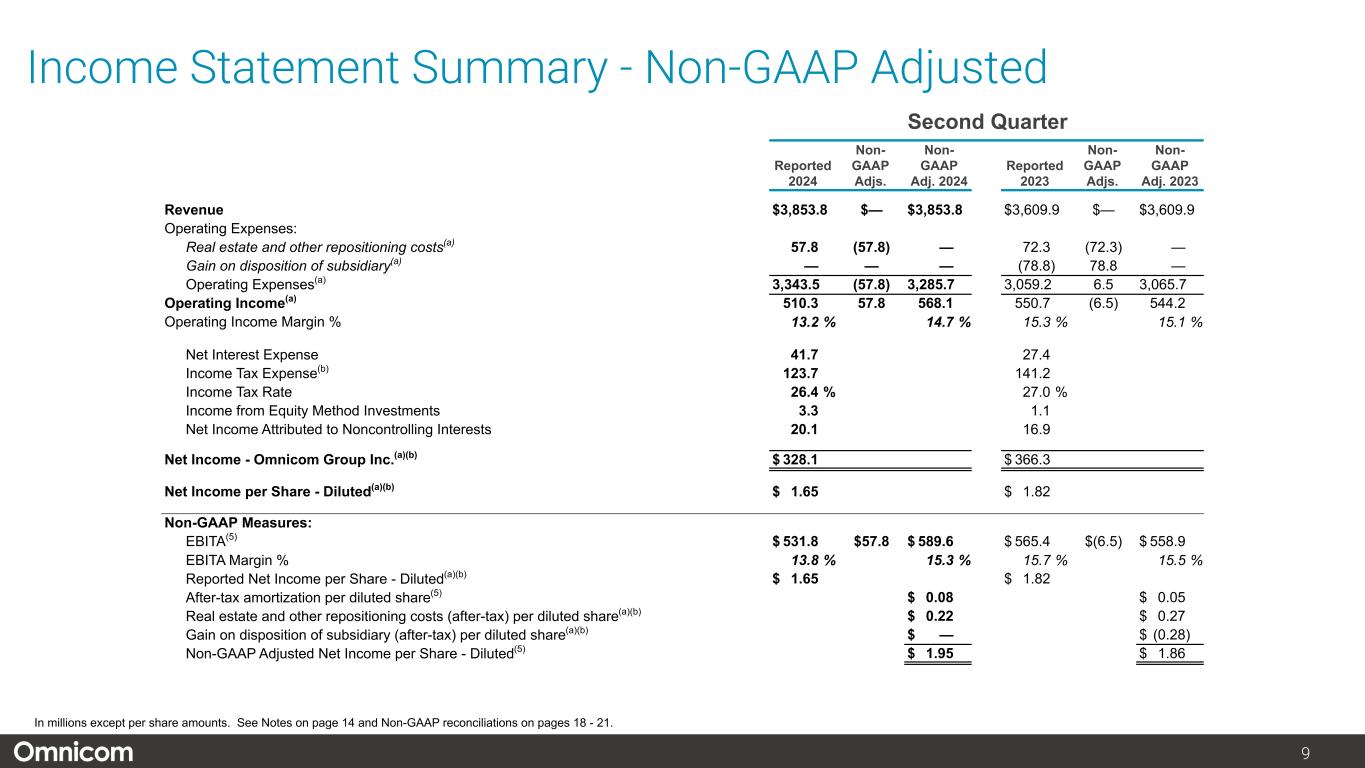

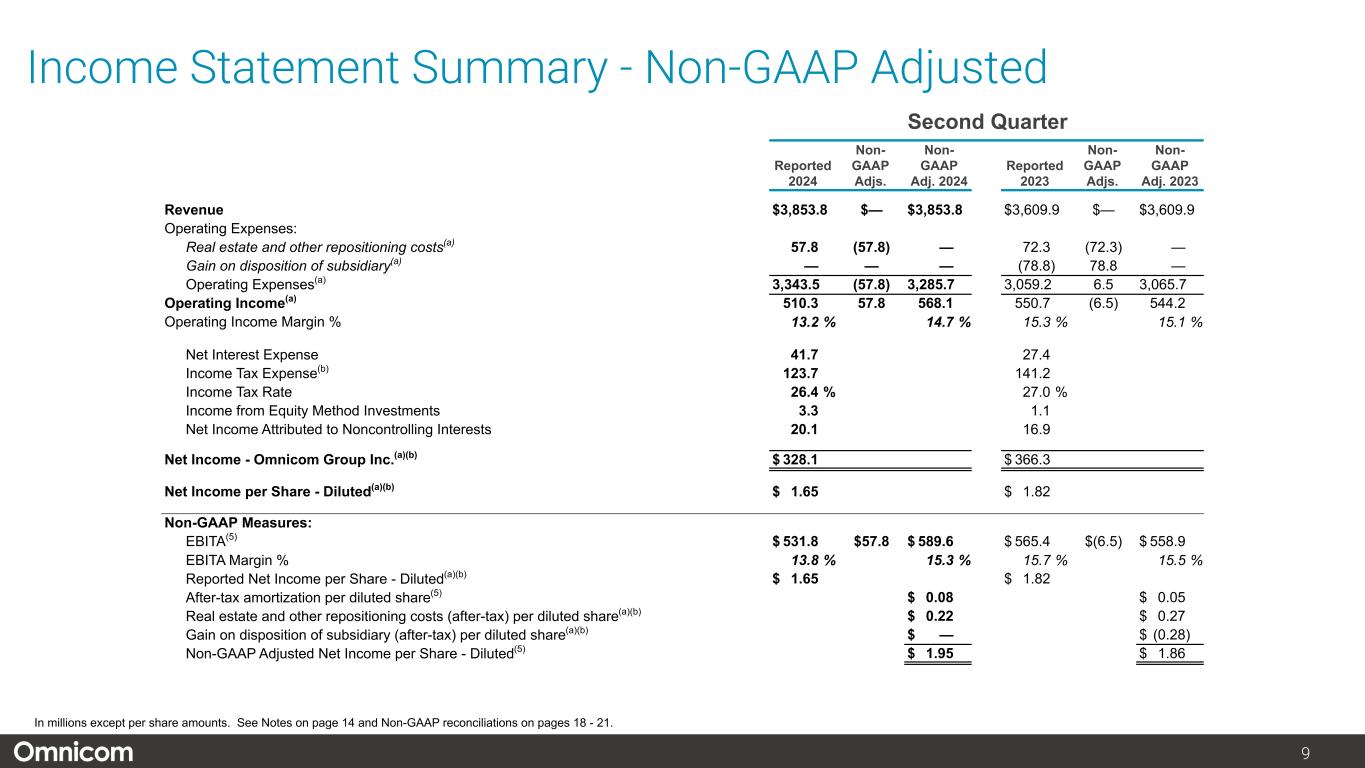

9 Second Quarter Reported 2024 Non- GAAP Adjs. Non- GAAP Adj. 2024 Reported 2023 Non- GAAP Adjs. Non- GAAP Adj. 2023 Revenue $ 3,853.8 $— $ 3,853.8 $ 3,609.9 $— $ 3,609.9 Operating Expenses: Real estate and other repositioning costs(a) 57.8 (57.8) — 72.3 (72.3) — Gain on disposition of subsidiary(a) — — — (78.8) 78.8 — Operating Expenses(a) 3,343.5 (57.8) 3,285.7 3,059.2 6.5 3,065.7 Operating Income(a) 510.3 57.8 568.1 550.7 (6.5) 544.2 Operating Income Margin % 13.2 % 14.7 % 15.3 % 15.1 % Net Interest Expense 41.7 27.4 Income Tax Expense(b) 123.7 141.2 Income Tax Rate 26.4 % 27.0 % Income from Equity Method Investments 3.3 1.1 Net Income Attributed to Noncontrolling Interests 20.1 16.9 Net Income - Omnicom Group Inc.(a)(b) $ 328.1 $ 366.3 Net Income per Share - Diluted(a)(b) $ 1.65 $ 1.82 Non-GAAP Measures: EBITA(5) $ 531.8 $57.8 $ 589.6 $ 565.4 $(6.5) $ 558.9 EBITA Margin % 13.8 % 15.3 % 15.7 % 15.5 % Reported Net Income per Share - Diluted(a)(b) $ 1.65 $ 1.82 After-tax amortization per diluted share(5) $ 0.08 $ 0.05 Real estate and other repositioning costs (after-tax) per diluted share(a)(b) $ 0.22 $ 0.27 Gain on disposition of subsidiary (after-tax) per diluted share(a)(b) $ — $ (0.28) Non-GAAP Adjusted Net Income per Share - Diluted(5) $ 1.95 $ 1.86 Income Statement Summary - Non-GAAP Adjusted In millions except per share amounts. See Notes on page 14 and Non-GAAP reconciliations on pages 18 - 21.

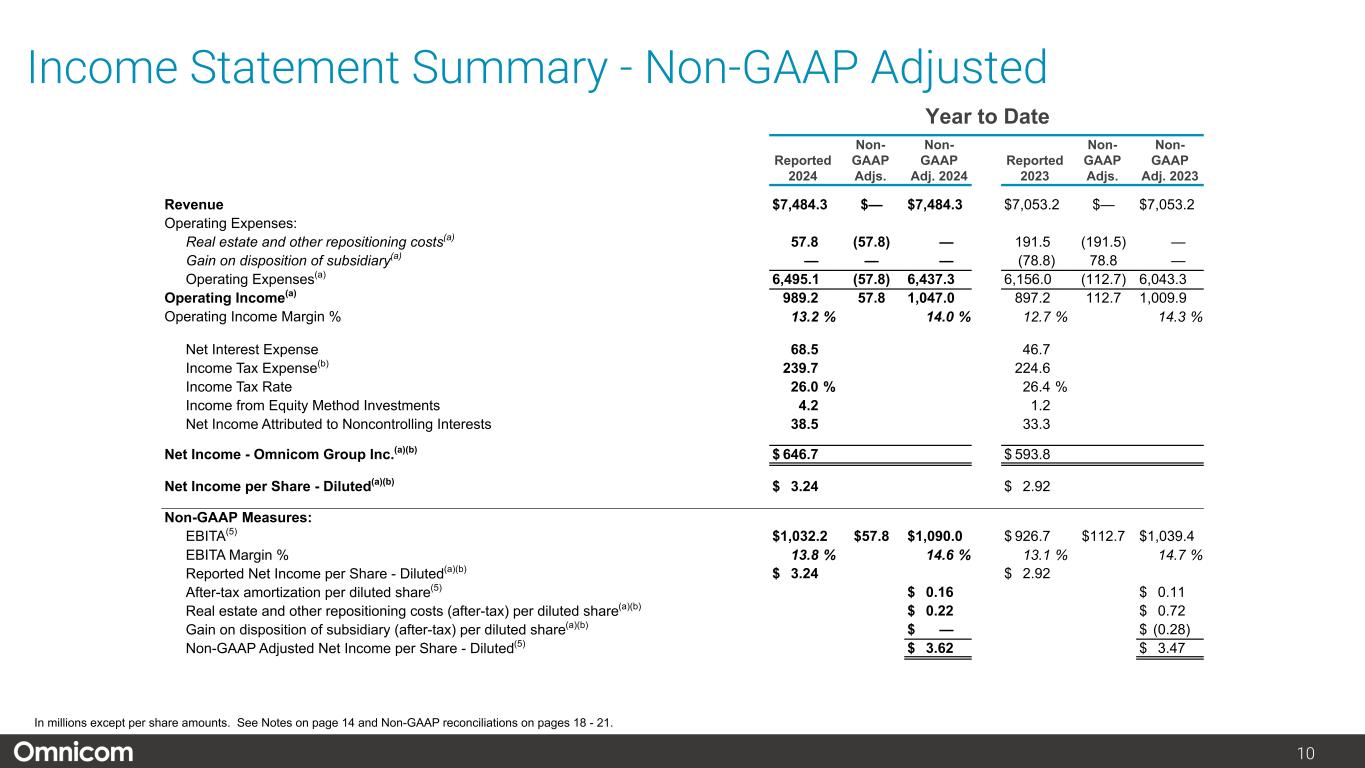

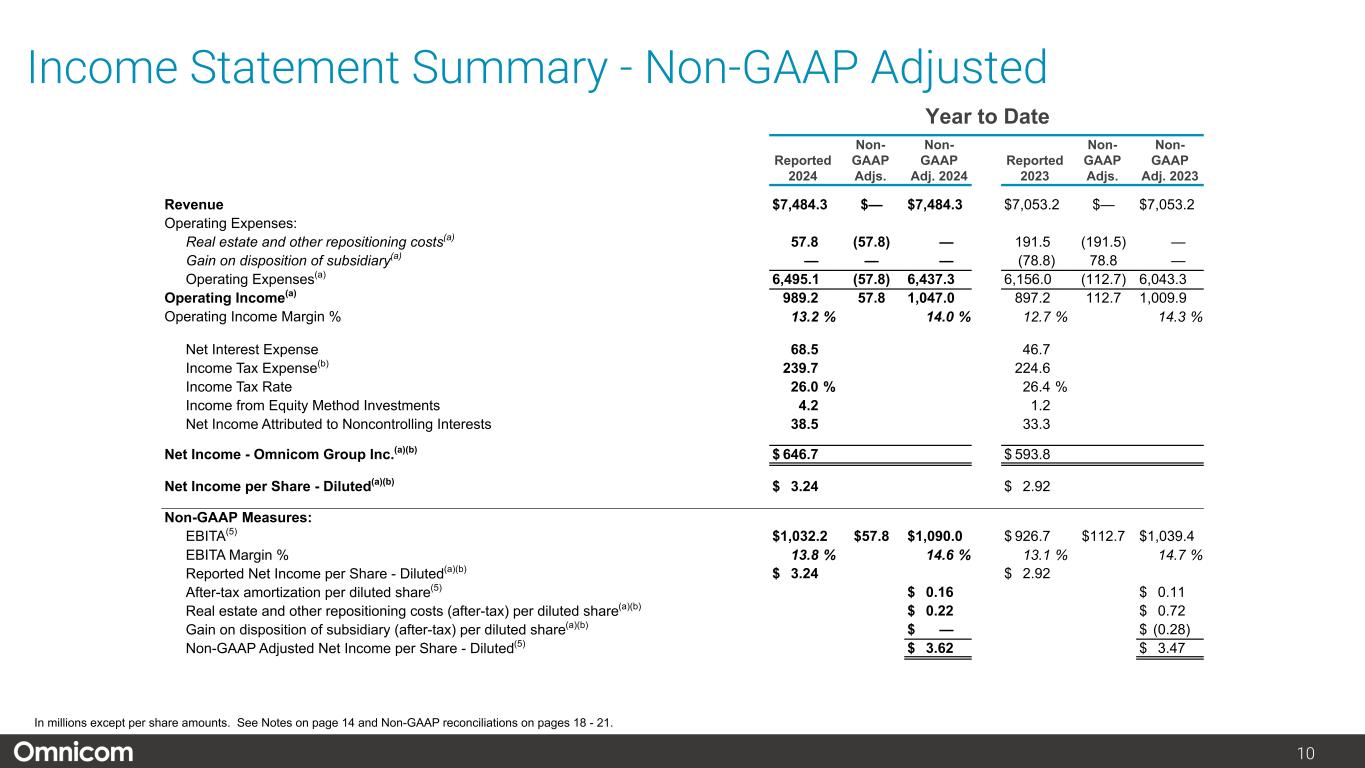

10 Year to Date Reported 2024 Non- GAAP Adjs. Non- GAAP Adj. 2024 Reported 2023 Non- GAAP Adjs. Non- GAAP Adj. 2023 Revenue $ 7,484.3 $— $ 7,484.3 $ 7,053.2 $— $ 7,053.2 Operating Expenses: Real estate and other repositioning costs(a) 57.8 (57.8) — 191.5 (191.5) — Gain on disposition of subsidiary(a) — — — (78.8) 78.8 — Operating Expenses(a) 6,495.1 (57.8) 6,437.3 6,156.0 (112.7) 6,043.3 Operating Income(a) 989.2 57.8 1,047.0 897.2 112.7 1,009.9 Operating Income Margin % 13.2 % 14.0 % 12.7 % 14.3 % Net Interest Expense 68.5 46.7 Income Tax Expense(b) 239.7 224.6 Income Tax Rate 26.0 % 26.4 % Income from Equity Method Investments 4.2 1.2 Net Income Attributed to Noncontrolling Interests 38.5 33.3 Net Income - Omnicom Group Inc.(a)(b) $ 646.7 $ 593.8 Net Income per Share - Diluted(a)(b) $ 3.24 $ 2.92 Non-GAAP Measures: EBITA(5) $ 1,032.2 $57.8 $ 1,090.0 $ 926.7 $112.7 $ 1,039.4 EBITA Margin % 13.8 % 14.6 % 13.1 % 14.7 % Reported Net Income per Share - Diluted(a)(b) $ 3.24 $ 2.92 After-tax amortization per diluted share(5) $ 0.16 $ 0.11 Real estate and other repositioning costs (after-tax) per diluted share(a)(b) $ 0.22 $ 0.72 Gain on disposition of subsidiary (after-tax) per diluted share(a)(b) $ — $ (0.28) Non-GAAP Adjusted Net Income per Share - Diluted(5) $ 3.62 $ 3.47 Income Statement Summary - Non-GAAP Adjusted In millions except per share amounts. See Notes on page 14 and Non-GAAP reconciliations on pages 18 - 21.

11 Cash Flow Performance Six Months Ended June 30, 2024 2023 Free Cash Flow(4) $ 901.3 $ 880.2 Primary Uses of Cash: Dividends paid to Common Shareholders 278.9 285.1 Dividends paid to Noncontrolling Interest Shareholders 34.2 32.0 Capital Expenditures 62.3 40.0 Acquisition payments, including payment of contingent purchase price obligations, and acquisition of additional noncontrolling interests 829.4 55.1 Stock Repurchases, net of Proceeds from Stock Plans 246.3 505.6 Primary Uses of Cash(4) 1,451.1 917.8 Net Free Cash Flow(4) $ (549.8) $ (37.6) In millions. See Definition (4) on page 14 and Non-GAAP reconciliations on pages 18 - 21.

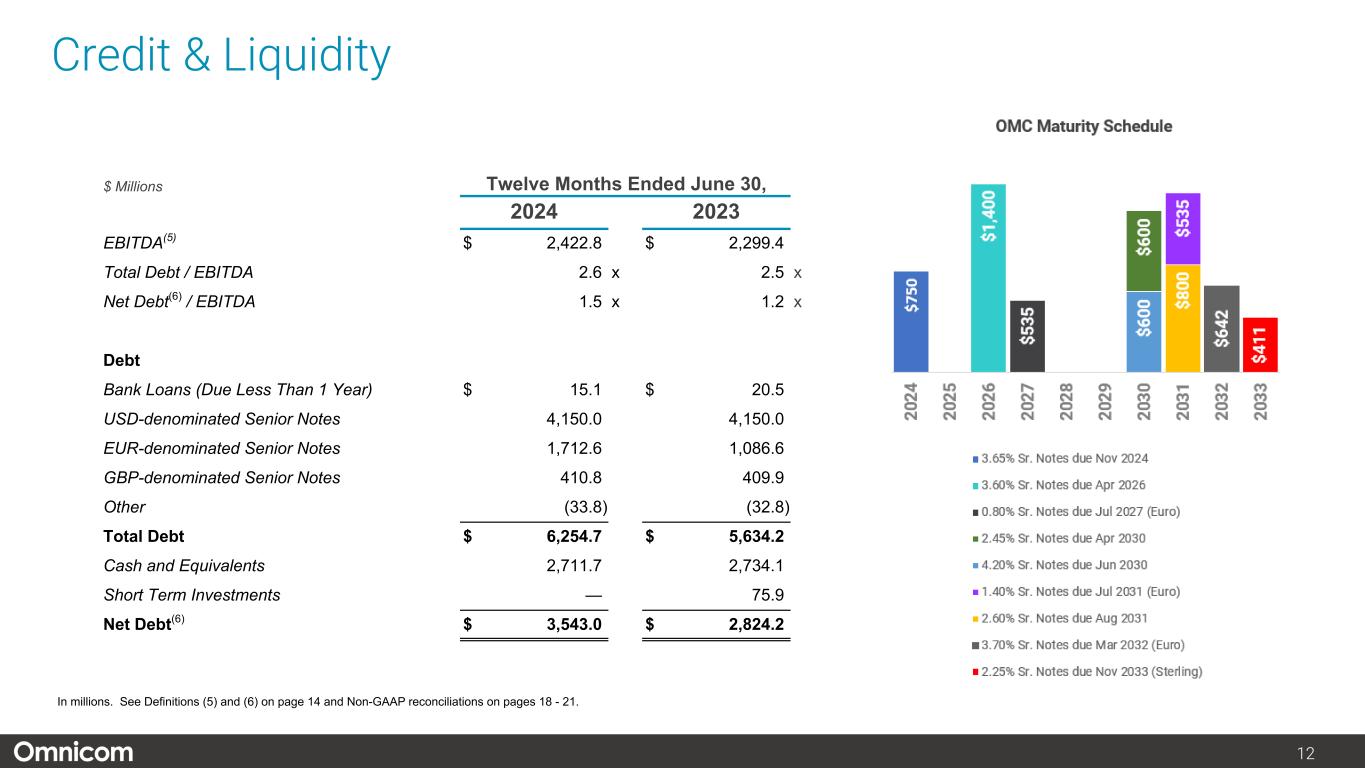

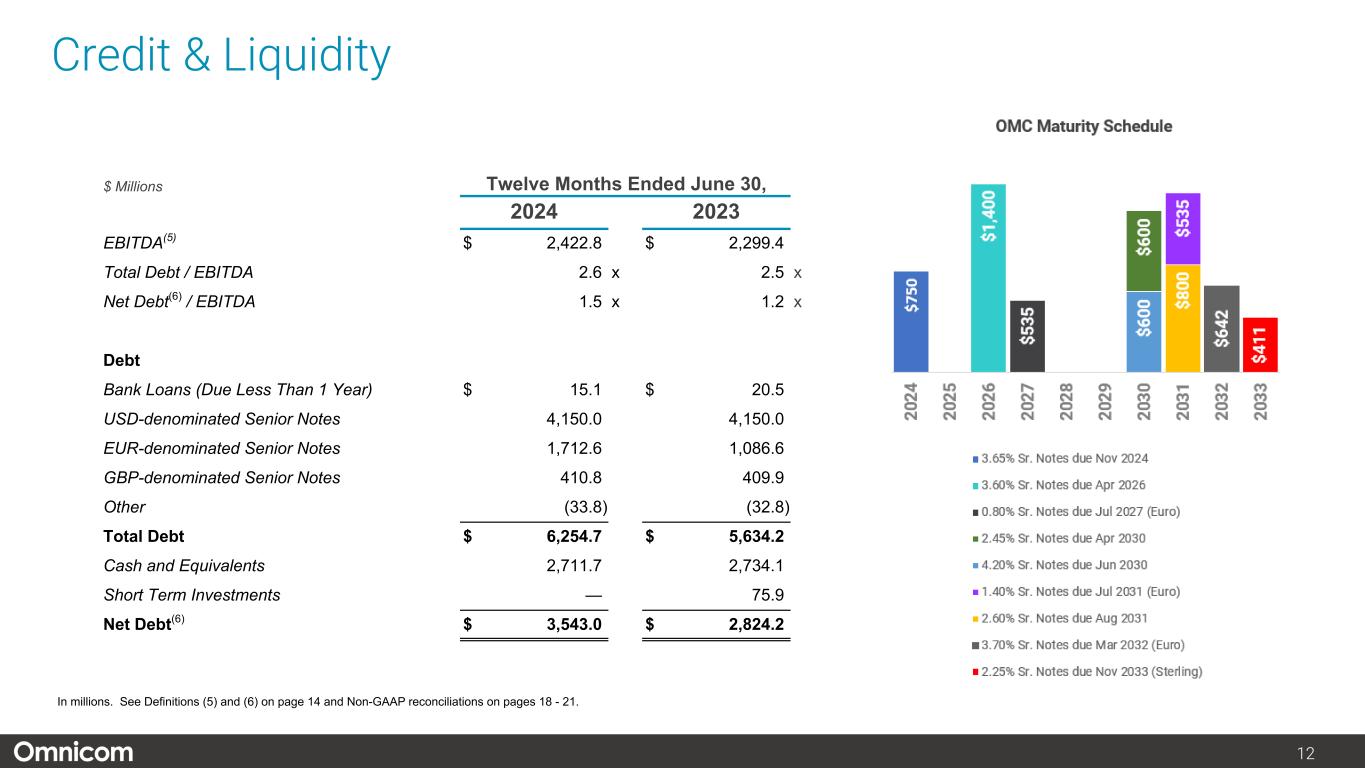

12 Credit & Liquidity $ Millions Twelve Months Ended June 30, 2024 2023 EBITDA(5) $ 2,422.8 $ 2,299.4 Total Debt / EBITDA 2.6 x 2.5 x Net Debt(6) / EBITDA 1.5 x 1.2 x Debt Bank Loans (Due Less Than 1 Year) $ 15.1 $ 20.5 USD-denominated Senior Notes 4,150.0 4,150.0 EUR-denominated Senior Notes 1,712.6 1,086.6 GBP-denominated Senior Notes 410.8 409.9 Other (33.8) (32.8) Total Debt $ 6,254.7 $ 5,634.2 Cash and Equivalents 2,711.7 2,734.1 Short Term Investments — 75.9 Net Debt(6) $ 3,543.0 $ 2,824.2 In millions. See Definitions (5) and (6) on page 14 and Non-GAAP reconciliations on pages 18 - 21.

13 Historical Returns Return on Invested Capital (ROIC)(7) Return on Equity(8) Twelve months ended June 30, 2024 20.4 % Twelve months ended June 30, 2024 42.5 % Twelve months ended June 30, 2023 22.4 % Twelve months ended June 30, 2023 46.4 % In millions. See Definitions (7) and (8) on page 14.

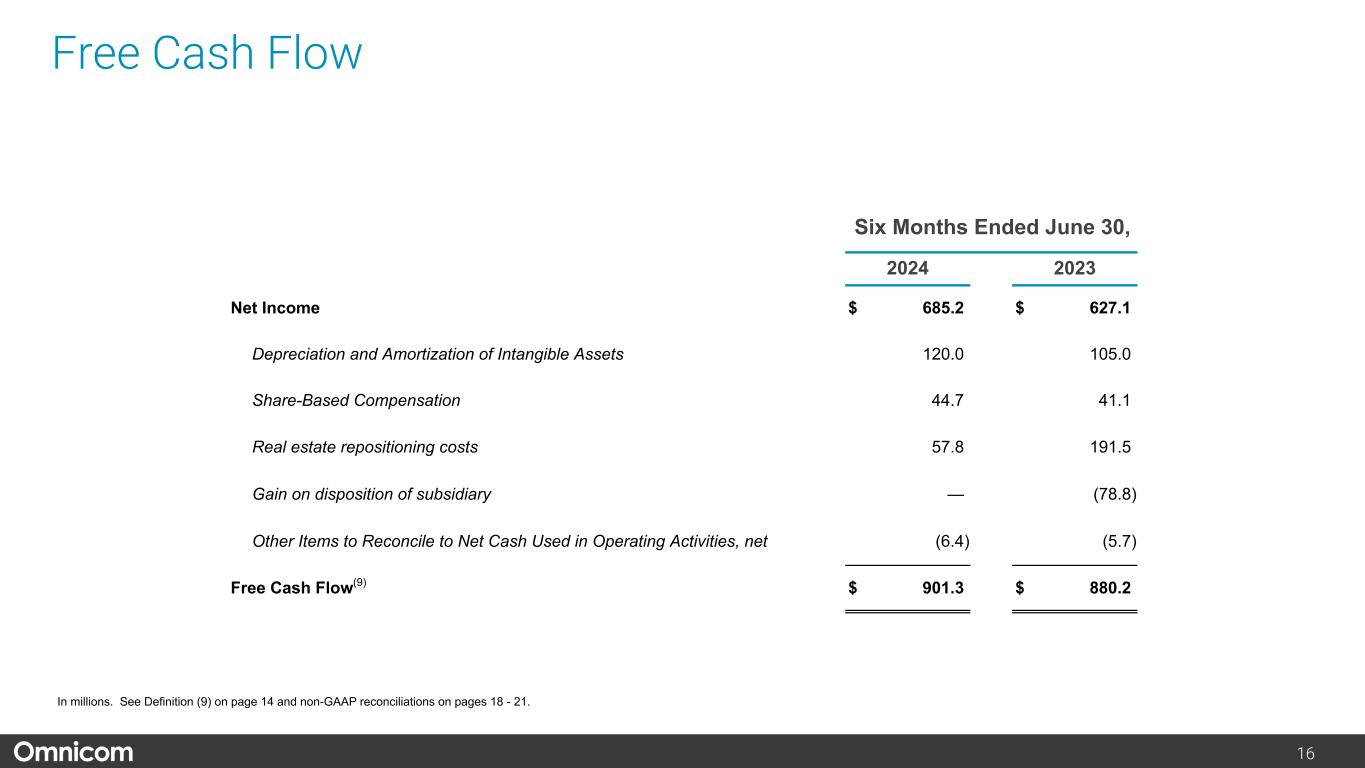

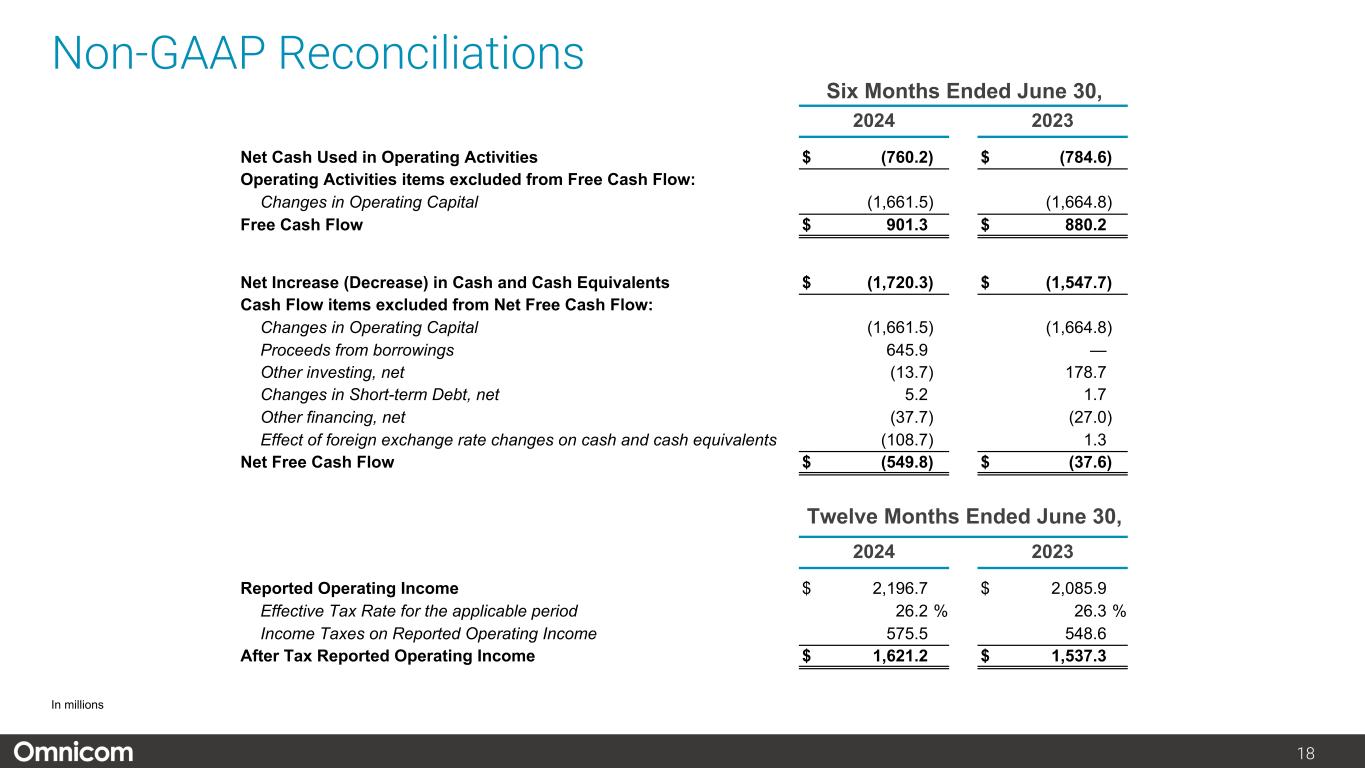

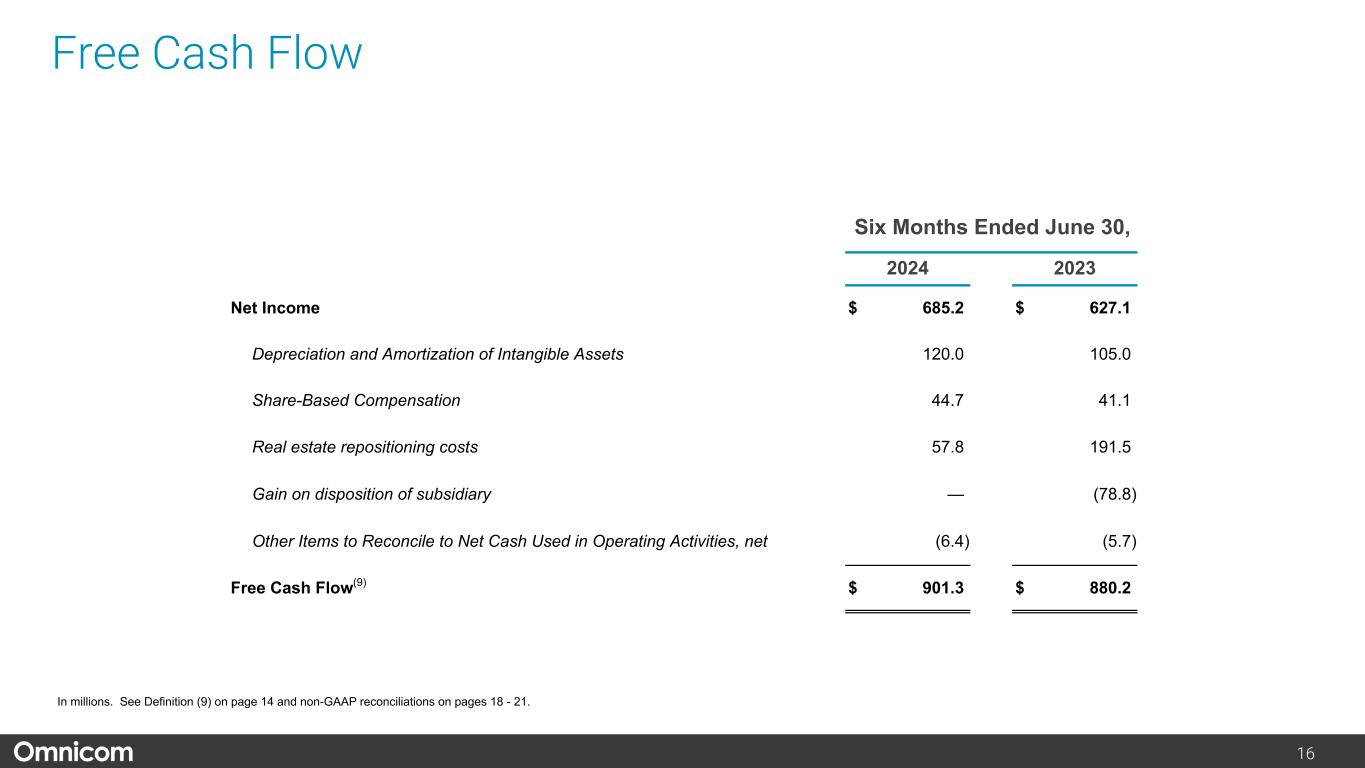

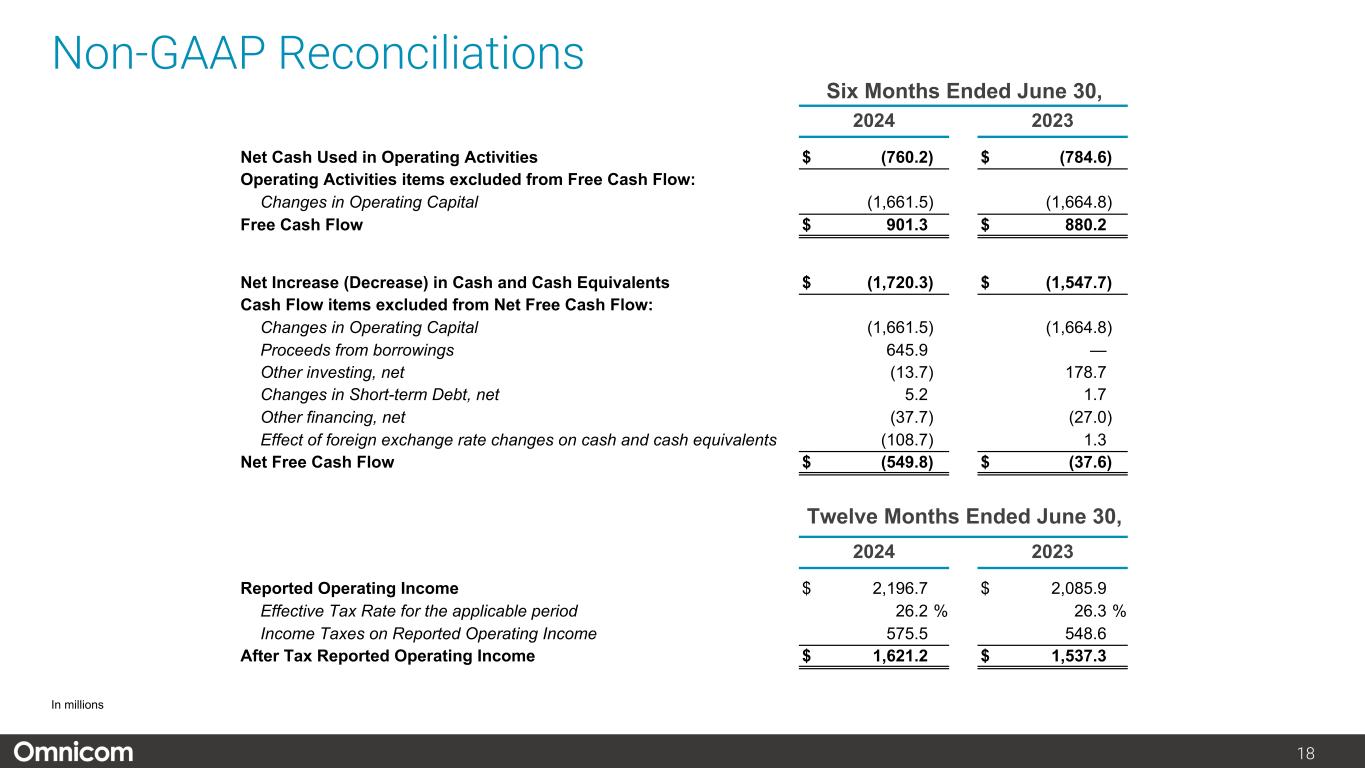

14 Notes (a) For the three and six months ended June 30, 2024, operating expenses included $57.8 million ($42.9 million after-tax) of repositioning costs, primarily related to severance, which reduced diluted net income per share - Omnicom Group Inc. by $0.22. For the three months ended June 30, 2023, operating expenses included a net decrease of $6.5 million ($1.4 million after-tax) related to a gain on the disposition of a subsidiary of $78.8 million ($55.9 million after-tax) in our Execution & Support discipline, partially offset by an increase of $72.3 million ($54.5 million after-tax) resulting from repositioning costs primarily related to severance, which increased diluted net income per share - Omnicom Group Inc. by $0.01. For the six months ended June 30, 2023, operating expenses included a net increase of $112.7 million ($89.6 million after tax) comprised of $191.5 million ($145.5 million after-tax) of repositioning and real estate charges, partially offset by the gain on the disposition of a subsidiary of $78.8 million ($55.9 million after-tax), which reduced diluted net income per share- Omnicom Group Inc. by $0.44. (b) Income tax for the three months ended June 30, 2024 and 2023 included impacts related to real estate and other repositioning actions and gain on disposition of subsidiary. (c) Third-party service costs include third-party supplier costs when we act as principal in providing services to our clients. (d) Third-party incidental costs primarily consist of client-related travel and incidental out-of-pocket costs, which we bill back to the client directly at our cost and which we are required to include in revenue. (e) Constant Dollar ("C$") expense is calculated by translating the current period’s local currency expense using the prior period average exchange rates to derive current period C$ expense. The foreign exchange rate impact is the difference between the current period expense in U.S. Dollars and the current period C$ expense. Financial Definitions (1) Foreign exchange rate impact: calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The foreign exchange rate impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue. (2) Acquisition revenue, net of disposition revenue: Acquisition revenue is calculated as if the acquisition occurred twelve months prior to the acquisition date by aggregating the comparable prior period revenue of acquisitions through the acquisition date. As a result, acquisition revenue excludes the positive or negative difference between our current period revenue subsequent to the acquisition date, and the comparable prior period revenue and the positive or negative growth after the acquisition date is attributed to organic growth. Disposition revenue is calculated as if the disposition occurred twelve months prior to the disposition date by aggregating the comparable prior period revenue of disposals through such date. The acquisition revenue and disposition revenue amounts are netted in the presentation on page 4. (3) Organic growth: calculated by subtracting the foreign exchange rate impact, and the acquisition revenue, net of disposition revenue components from total revenue growth. (4) See page 18 for the reconciliation of non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities and Net Free Cash Flow to the Net Increase (Decrease) in Cash and Cash Equivalents for the periods presented on page 11. The Free Cash Flow, Primary Uses of Cash and Net Free Cash Flow amounts presented on page 10 are non-GAAP liquidity measures. See page 23 for the definition of Net Free Cash Flow. (5) EBITA, EBITDA, and Non-GAAP Adjusted Net Income per share - Diluted are non-GAAP performance measures. Beginning with the first quarter of 2024, EBITA is defined as operating income before amortization of acquired intangible assets and internally developed strategic platform assets. As a result, we reclassified the prior year periods to be consistent with the revised definition, which reduced EBITA from previously reported amounts. Non-GAAP Adjusted Net Income per share - Diluted reflects the after-tax effects of amortization of acquired intangible assets and internally developed strategic platform assets. We use EBITA and EBITA margin as additional operating performance measures, which exclude the non-cash amortization expense of acquired intangible assets and internally developed strategic platform assets and allows for comparability of the periods presented. See page 23 for the definition of these measures and pages 19 and 20 for the reconciliation of Non-GAAP financial measures. (6) Net Debt is a non-GAAP liquidity measure. See page 23 for the definition of this measure, which is reconciled in the table on page 11. (7) Return on Invested Capital is After Tax Reported Operating Income (a non-GAAP performance measure – see page 23 for the definition of this measure and page 18 for the reconciliation of non-GAAP financial measures) divided by the average of Invested Capital at the beginning and the end of the period (book value of all long-term liabilities, including those related to operating leases, short-term interest bearing debt, the short-term liability related to operating leases plus shareholders’ equity less cash, cash equivalents, short-term investments, and operating lease right of use assets). (8) Return on Equity is Reported Net Income for the given period divided by the average of shareholders’ equity at the beginning and end of the period. (9) The Free Cash Flow amounts presented on page 16 are non-GAAP liquidity measures. See page 23 for the definition of this measure and page 18 for the reconciliation of the non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities for the periods presented on page 16.

15 Appendix

16 Free Cash Flow Six Months Ended June 30, 2024 2023 Net Income $ 685.2 $ 627.1 Depreciation and Amortization of Intangible Assets 120.0 105.0 Share-Based Compensation 44.7 41.1 Real estate repositioning costs 57.8 191.5 Gain on disposition of subsidiary — (78.8) Other Items to Reconcile to Net Cash Used in Operating Activities, net (6.4) (5.7) Free Cash Flow(9) $ 901.3 $ 880.2 In millions. See Definition (9) on page 14 and non-GAAP reconciliations on pages 18 - 21.

17 Operating Expense Detail - Constant $ Second Quarter Year to Date 2024 2024 C$(e) 2023 2024 2024 C$(e) 2023 Operating expenses: Salary and related costs $ 1,836.9 $ 1,852.9 $ 1,772.0 $ 3,684.2 $ 3,697.0 $ 3,550.0 Third-party service costs(c) 811.1 820.8 715.8 1,509.3 1,523.8 1,355.1 Third-party incidental costs(d) 152.1 154.5 130.0 299.2 302.6 255.6 Total salary and service costs 2,800.1 2,828.2 2,617.8 5,492.7 5,523.4 5,160.7 Occupancy and other costs 314.2 317.4 297.7 628.3 631.2 589.3 Real estate and other repositioning costs(a) 57.8 57.8 72.3 57.8 57.8 191.5 Gain on disposition of subsidiary(a) — — (78.8) — — (78.8) Cost of services 3,172.1 3,203.4 2,909.0 6,178.8 6,212.4 5,862.7 Selling, general and administrative expenses 111.0 111.8 99.1 196.3 197.0 188.3 Depreciation and amortization 60.4 60.7 51.1 120.0 120.0 105.0 Total operating expenses(a) $ 3,343.5 $ 3,375.9 $ 3,059.2 $ 6,495.1 $ 6,529.4 $ 6,156.0 In millions. See Notes on page 14.

18 Non-GAAP Reconciliations Six Months Ended June 30, 2024 2023 Net Cash Used in Operating Activities $ (760.2) $ (784.6) Operating Activities items excluded from Free Cash Flow: Changes in Operating Capital (1,661.5) (1,664.8) Free Cash Flow $ 901.3 $ 880.2 Net Increase (Decrease) in Cash and Cash Equivalents $ (1,720.3) $ (1,547.7) Cash Flow items excluded from Net Free Cash Flow: Changes in Operating Capital (1,661.5) (1,664.8) Proceeds from borrowings 645.9 — Other investing, net (13.7) 178.7 Changes in Short-term Debt, net 5.2 1.7 Other financing, net (37.7) (27.0) Effect of foreign exchange rate changes on cash and cash equivalents (108.7) 1.3 Net Free Cash Flow $ (549.8) $ (37.6) Twelve Months Ended June 30, 2024 2023 Reported Operating Income $ 2,196.7 $ 2,085.9 Effective Tax Rate for the applicable period 26.2 % 26.3 % Income Taxes on Reported Operating Income 575.5 548.6 After Tax Reported Operating Income $ 1,621.2 $ 1,537.3 In millions

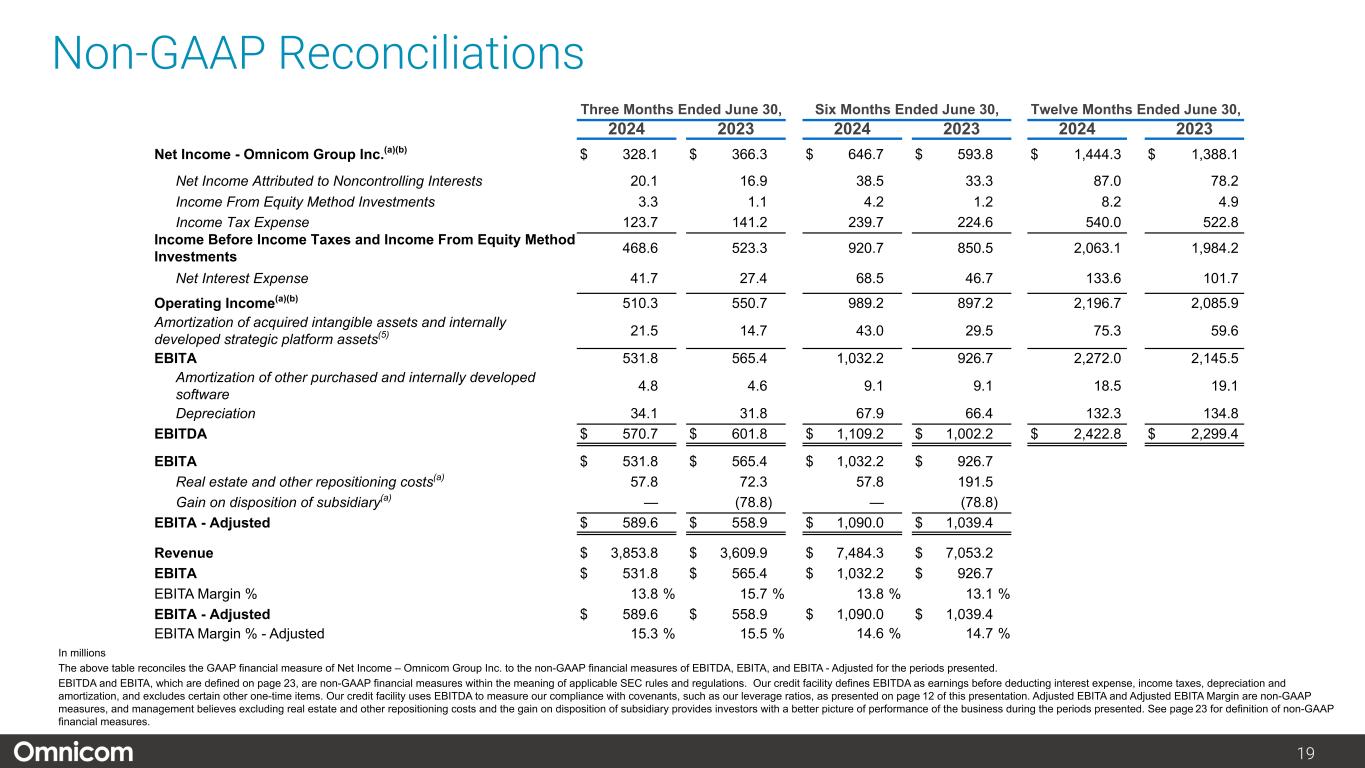

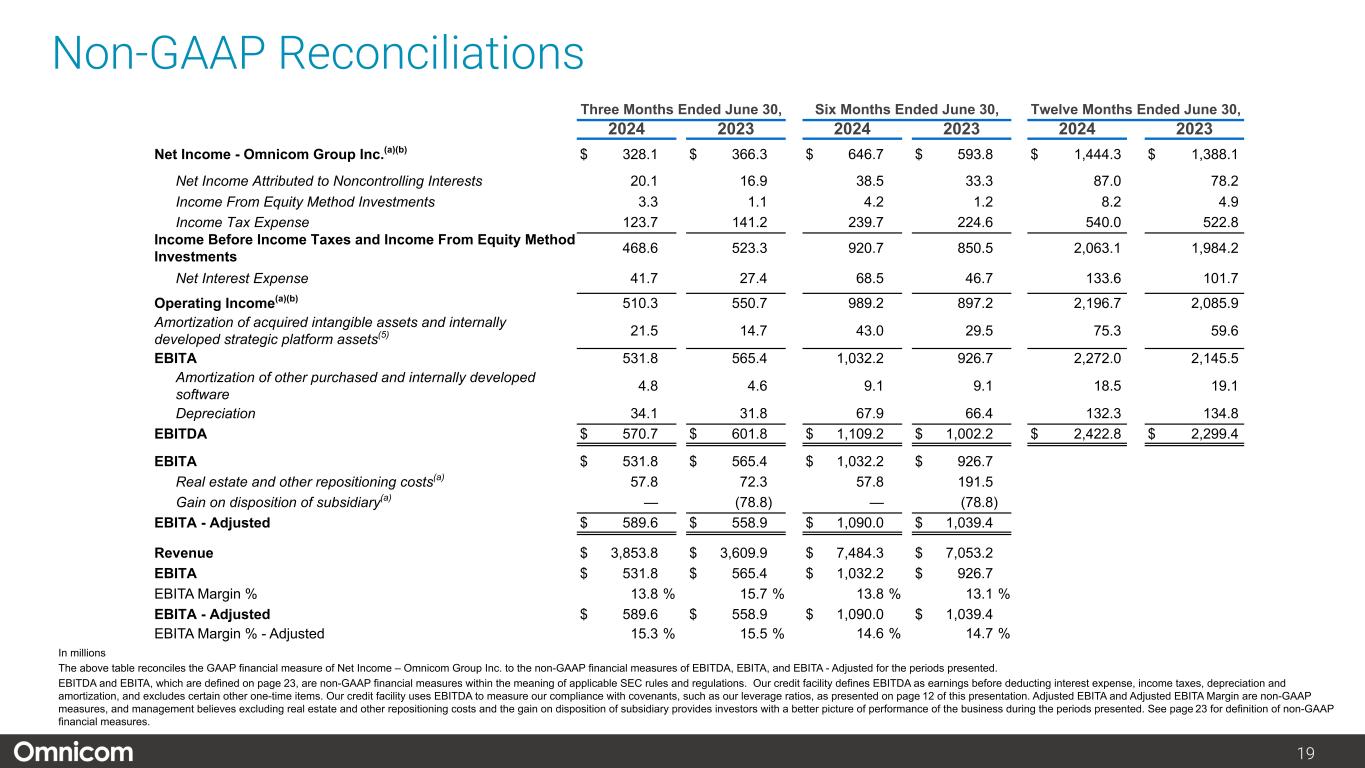

19 Non-GAAP Reconciliations In millions The above table reconciles the GAAP financial measure of Net Income – Omnicom Group Inc. to the non-GAAP financial measures of EBITDA, EBITA, and EBITA - Adjusted for the periods presented. EBITDA and EBITA, which are defined on page 23, are non-GAAP financial measures within the meaning of applicable SEC rules and regulations. Our credit facility defines EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization, and excludes certain other one-time items. Our credit facility uses EBITDA to measure our compliance with covenants, such as our leverage ratios, as presented on page 12 of this presentation. Adjusted EBITA and Adjusted EBITA Margin are non-GAAP measures, and management believes excluding real estate and other repositioning costs and the gain on disposition of subsidiary provides investors with a better picture of performance of the business during the periods presented. See page 23 for definition of non-GAAP financial measures. Three Months Ended June 30, Six Months Ended June 30, Twelve Months Ended June 30, 2024 2023 2024 2023 2024 2023 Net Income - Omnicom Group Inc.(a)(b) $ 328.1 $ 366.3 $ 646.7 $ 593.8 $ 1,444.3 $ 1,388.1 Net Income Attributed to Noncontrolling Interests 20.1 16.9 38.5 33.3 87.0 78.2 Income From Equity Method Investments 3.3 1.1 4.2 1.2 8.2 4.9 Income Tax Expense 123.7 141.2 239.7 224.6 540.0 522.8 Income Before Income Taxes and Income From Equity Method Investments 468.6 523.3 920.7 850.5 2,063.1 1,984.2 Net Interest Expense 41.7 27.4 68.5 46.7 133.6 101.7 Operating Income(a)(b) 510.3 550.7 989.2 897.2 2,196.7 2,085.9 Amortization of acquired intangible assets and internally developed strategic platform assets(5) 21.5 14.7 43.0 29.5 75.3 59.6 EBITA 531.8 565.4 1,032.2 926.7 2,272.0 2,145.5 Amortization of other purchased and internally developed software 4.8 4.6 9.1 9.1 18.5 19.1 Depreciation 34.1 31.8 67.9 66.4 132.3 134.8 EBITDA $ 570.7 $ 601.8 $ 1,109.2 $ 1,002.2 $ 2,422.8 $ 2,299.4 EBITA $ 531.8 $ 565.4 $ 1,032.2 $ 926.7 Real estate and other repositioning costs(a) 57.8 72.3 57.8 191.5 Gain on disposition of subsidiary(a) — (78.8) — (78.8) EBITA - Adjusted $ 589.6 $ 558.9 $ 1,090.0 $ 1,039.4 Revenue $ 3,853.8 $ 3,609.9 $ 7,484.3 $ 7,053.2 EBITA $ 531.8 $ 565.4 $ 1,032.2 $ 926.7 EBITA Margin % 13.8 % 15.7 % 13.8 % 13.1 % EBITA - Adjusted $ 589.6 $ 558.9 $ 1,090.0 $ 1,039.4 EBITA Margin % - Adjusted 15.3 % 15.5 % 14.6 % 14.7 %

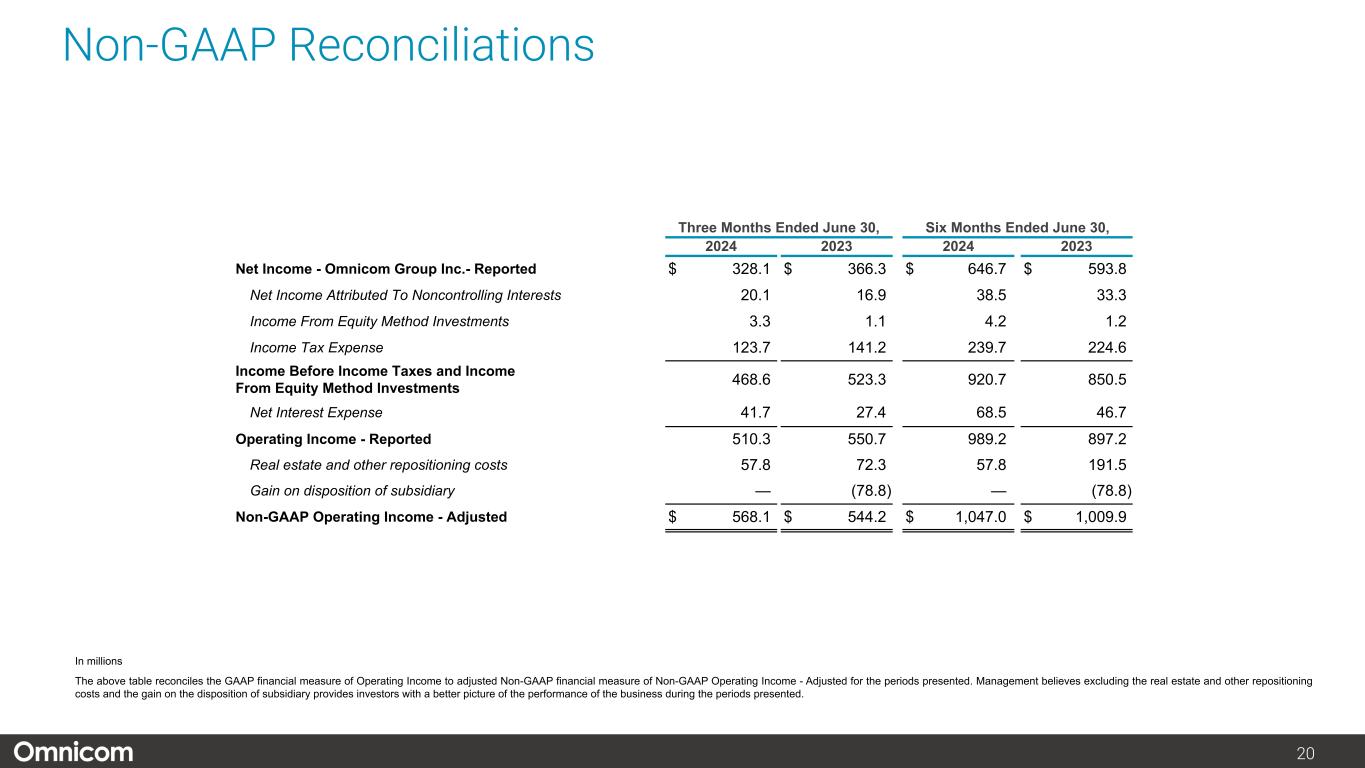

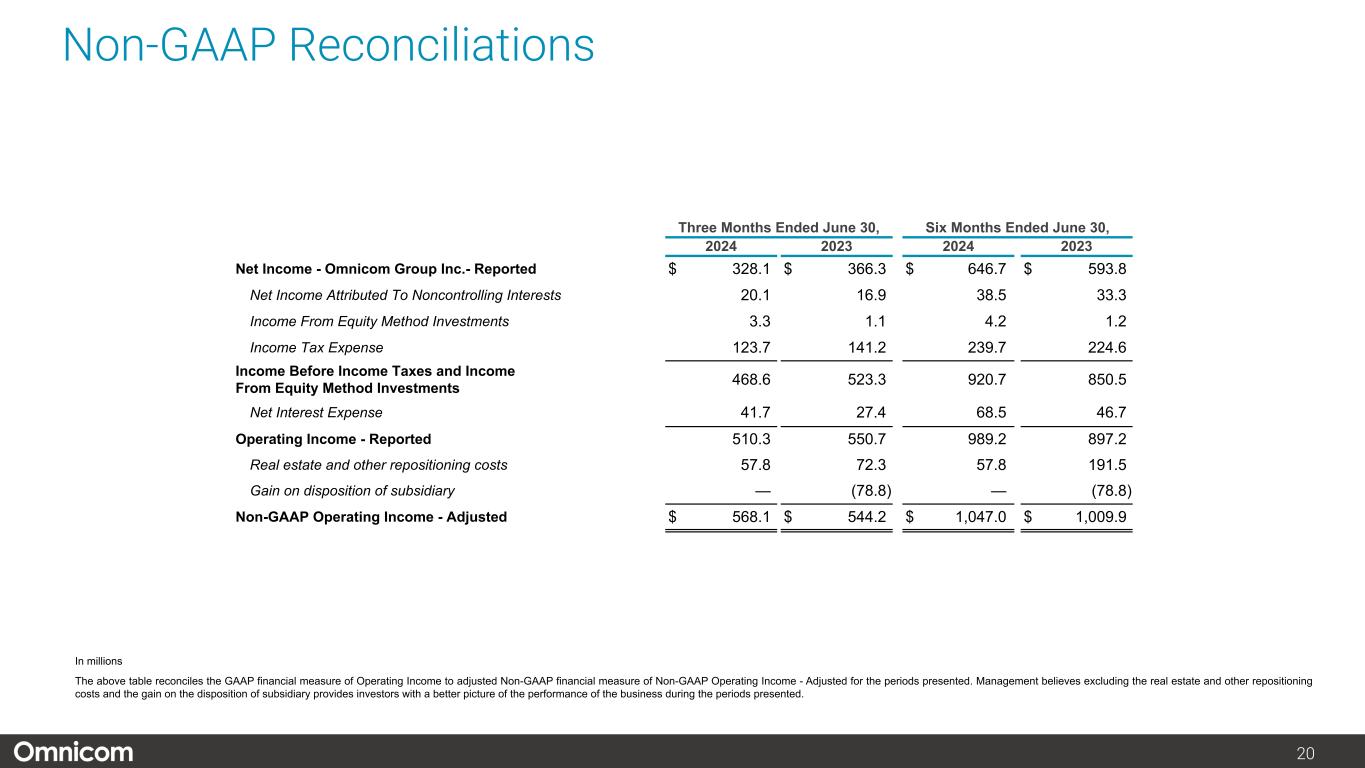

20 Non-GAAP Reconciliations In millions The above table reconciles the GAAP financial measure of Operating Income to adjusted Non-GAAP financial measure of Non-GAAP Operating Income - Adjusted for the periods presented. Management believes excluding the real estate and other repositioning costs and the gain on the disposition of subsidiary provides investors with a better picture of the performance of the business during the periods presented. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net Income - Omnicom Group Inc.- Reported $ 328.1 $ 366.3 $ 646.7 $ 593.8 Net Income Attributed To Noncontrolling Interests 20.1 16.9 38.5 33.3 Income From Equity Method Investments 3.3 1.1 4.2 1.2 Income Tax Expense 123.7 141.2 239.7 224.6 Income Before Income Taxes and Income From Equity Method Investments 468.6 523.3 920.7 850.5 Net Interest Expense 41.7 27.4 68.5 46.7 Operating Income - Reported 510.3 550.7 989.2 897.2 Real estate and other repositioning costs 57.8 72.3 57.8 191.5 Gain on disposition of subsidiary — (78.8) — (78.8) Non-GAAP Operating Income - Adjusted $ 568.1 $ 544.2 $ 1,047.0 $ 1,009.9

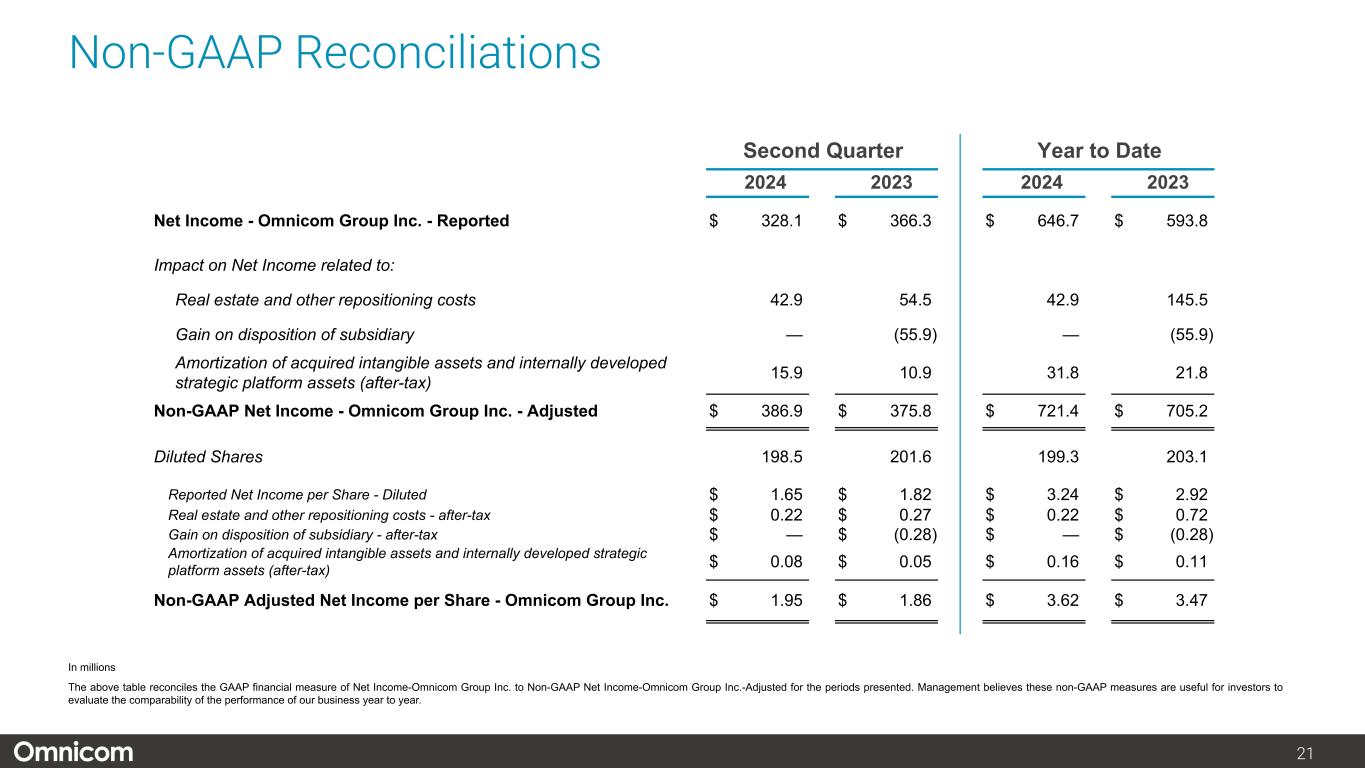

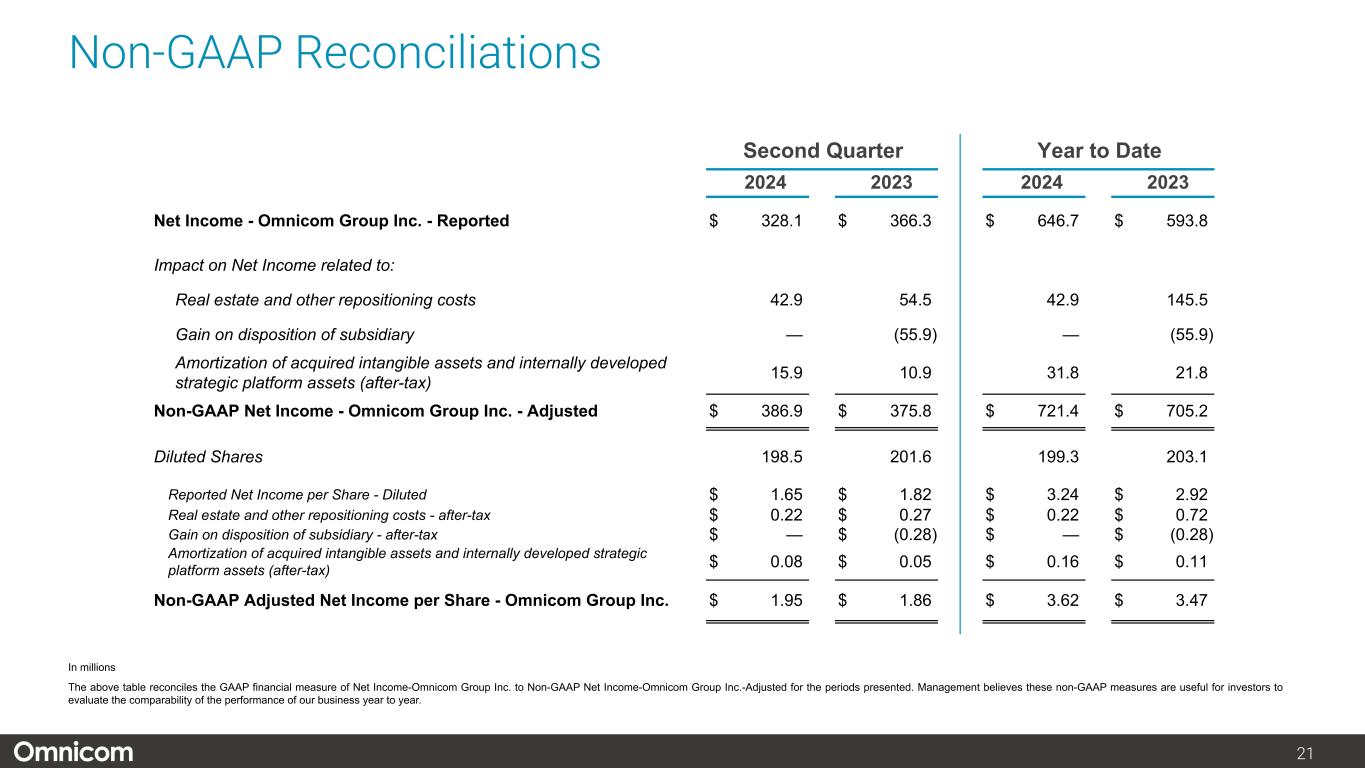

21 Second Quarter Year to Date 2024 2023 2024 2023 Net Income - Omnicom Group Inc. - Reported $ 328.1 $ 366.3 $ 646.7 $ 593.8 Impact on Net Income related to: Real estate and other repositioning costs 42.9 54.5 42.9 145.5 Gain on disposition of subsidiary — (55.9) — (55.9) Amortization of acquired intangible assets and internally developed strategic platform assets (after-tax) 15.9 10.9 31.8 21.8 Non-GAAP Net Income - Omnicom Group Inc. - Adjusted $ 386.9 $ 375.8 $ 721.4 $ 705.2 Diluted Shares 198.5 201.6 199.3 203.1 Reported Net Income per Share - Diluted $ 1.65 $ 1.82 $ 3.24 $ 2.92 Real estate and other repositioning costs - after-tax $ 0.22 $ 0.27 $ 0.22 $ 0.72 Gain on disposition of subsidiary - after-tax $ — $ (0.28) $ — $ (0.28) Amortization of acquired intangible assets and internally developed strategic platform assets (after-tax) $ 0.08 $ 0.05 $ 0.16 $ 0.11 Non-GAAP Adjusted Net Income per Share - Omnicom Group Inc. $ 1.95 $ 1.86 $ 3.62 $ 3.47 Non-GAAP Reconciliations In millions The above table reconciles the GAAP financial measure of Net Income-Omnicom Group Inc. to Non-GAAP Net Income-Omnicom Group Inc.-Adjusted for the periods presented. Management believes these non-GAAP measures are useful for investors to evaluate the comparability of the performance of our business year to year.

22 Amortization of Intangible Assets $ Millions 2024 2023 2023 2022 Q1 Q2 Q1 Q2 Q3 Q4 Full Year Full Year Acquired intangible assets $ 18.2 $ 17.8 $ 13.0 $ 12.8 $ 13.7 $ 14.5 $ 54.0 $ 53.2 Internally developed strategic platform assets 3.3 3.7 1.8 1.9 2.0 2.1 7.8 5.6 Acquired intangible assets and internally developed strategic platform assets $ 21.5 $ 21.5 $ 14.8 $ 14.7 $ 15.7 $ 16.6 $ 61.8 $ 58.8 Other purchased and internally developed software 4.3 4.8 4.5 4.6 4.6 4.8 18.5 21.5 Total Amortization Expense $ 25.8 $ 26.3 $ 19.3 $ 19.3 $ 20.3 $ 21.4 $ 80.3 $ 80.3 In prior years, we reported total amortization of intangible assets. The above table provides the components of total amortization.

23 Disclosures The preceding materials have been prepared for use in the July 16, 2024 conference call on Omnicom’s results of operations for the three and six months ended June 30, 2024. The call will be archived on the Internet at http://investor.omnicomgroup.com Forward-Looking Statements Certain statements in this document contain forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made, or may make, forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial position, or otherwise, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: adverse economic conditions, including those caused by geopolitical events, international hostilities, acts of terrorism, public health crises, high and sustained inflation in countries that comprise our major markets, high interest rates, and labor and supply chain issues affecting the distribution of our clients’ products; international, national, or local economic conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments, and a deterioration or disruption in the credit markets; the ability to attract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing, and corporate communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes related to competitive factors in the advertising, marketing, and corporate communications industries; unanticipated changes to, or the ability to hire and retain key personnel; currency exchange rate fluctuations; reliance on information technology systems and risks related to cybersecurity incidents; effective management of the risks, challenges and efficiencies presented by utilizing Artificial Intelligence (AI) technologies and related partnerships in our business; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions the Company makes in connection with its acquisitions, critical accounting estimates and legal proceedings; the Company’s international operations, which are subject to the risks of currency repatriation restrictions, social or political conditions, and an evolving regulatory environment in high-growth markets and developing countries; and risks related to our environmental, social, and governance goals and initiatives, including impacts from regulators and other stakeholders, and the impact of factors outside of our control on such goals and initiatives. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that may affect the Company’s business, including those described in Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements. Non-GAAP Financial Measures We present financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”) and adjustments to the GAAP presentation (“Non-GAAP”), which we believe are meaningful for understanding our performance. We believe these measures are useful in evaluating the impact of certain items on operating performance and allow for comparability between reporting periods. EBITA is defined as earnings before interest, taxes, and amortization of acquired intangible assets and internally developed strategic platform assets, and EBITA margin is defined as EBITA divided by revenue. We use EBITA and EBITA margin as additional operating performance measures, which exclude the non-cash amortization expense of acquired intangible assets and internally developed strategic platform assets. We also use Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted EBITA, Adjusted EBITA Margin, Adjusted Income Tax Expense, Adjusted Net Income – Omnicom Group Inc. and Adjusted Net Income per diluted share – Omnicom Group Inc. as additional operating performance measures. Free Cash Flow is defined as net income plus depreciation, amortization, share based compensation expense plus/(less) other items to reconcile to net cash (used in) provided by operating activities. We believe Free Cash Flow is a useful measure of liquidity to evaluate our ability to generate excess cash from our operations. Primary Uses of Cash is defined as dividends to common shareholders, dividends paid to non-controlling interest shareholders, capital expenditures, cash paid on acquisitions, payments for additional interest in controlled subsidiaries and stock repurchases, net of the proceeds from our stock plans, and excludes changes in operating capital and other investing and financing activities, including commercial paper issuances and redemptions used to fund working capital changes. We believe this liquidity measure is useful in identifying the significant uses of our cash. Net Free Cash Flow is defined as Free Cash Flow less the Primary Uses of Cash. Net Free Cash Flow is one of the metrics used by us to assess our sources and uses of cash and was derived from our consolidated statements of cash flows. We believe that this liquidity measure is meaningful for understanding our primary sources and primary uses of that cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization of intangible assets. Net Debt is defined as total debt less cash, cash equivalents and short-term investments. We believe net debt, together with the comparable GAAP measures, reflects one of the liquidity metrics used by us to assess our cash management. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in accordance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. Other Information All dollar amounts are in millions except for per share figures. The information contained in this document has not been audited, although some data has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational, and other non-financial data contained in this document have been derived from sources that we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information. Certain amounts in prior periods have been reclassified to conform to our current presentation. The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is required.