OmnicomGroup

Bear Stearns 21st Annual

Media Conference

March 10, 2008

1

The following materials have been prepared for use at the Bear Stearns 21st Annual Media Conference on March 10th,

2008.

Forward-Looking Statements

Certain of the statements in this document constitute forward-looking statements within the meaning of the Private

Securities Litigation Act of 1995. These statements relate to future events or future financial performance and involve

known and unknown risks and other factors that may cause our actual or our industry’s results, levels of activity or

achievement to be materially different from those expressed or implied by any forward-looking statements. These risks

and uncertainties include, but are not limited to, our future financial condition and results of operations, changes in

general economic conditions, competitive factors, changes in client communication requirements, the hiring and retention

of human resources and our international operations, which are subject to the risks of currency fluctuations and

exchange controls. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or “continue” or

the negative of those terms or other comparable terminology. These statements are present expectations. Actual events

or results may differ materially. We undertake no obligation to update or revise any forward-looking statement, except as

required by law.

Other Information

All dollar amounts are in millions except for EPS. The following financial information contained in this document has not

been audited, although some of it has been derived from Omnicom’s historical financial statements, including its audited

financial statements. In addition, industry, operational and other non-financial data contained in this document has been

derived from sources we believe to be reliable, but we have not independently verified such information, and we do not,

nor does any other person, assume responsibility for the accuracy or completeness of that information.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of

such information is required.

2

Who We Are

The World’s Leading

Advertising and Marketing

Communications Services

Group

3

OmnicomGroup

Media Advertising

Customer Relationship

Management

Public

Relations

Specialty

Communications

30+ Marketing Communications Disciplines

200+ Strategic Brand Platforms

1,500+ Individual Agencies

4

Diversified Service Offering

CONSISTENCY

Broad Client Base

5,000+ clients

Top client = 2.8% of total revenue

and was served by over 100 of

our agencies

No other client > 2.4%

Our Top 10 clients = 16.7%

Our Top 100 clients = 46.2%

Top 100 clients are served by an

average of more than 40 of our

agencies

Clients include leading companies in

every industry category

200+ strategic platforms

1,500+ individual agencies

Leadership positions in 30+

marketing communications

disciplines

Strong global presence represented

in more than 100 countries serving

national, pan-regional and global

client needs

Omnicom’s Balance and Diversity

5

Industry-Specific Trends

Long-Term Trends

Client-Specific Trends

Desire to manage brands

on a pan-regional or global basis,

with an increased focus on

Emerging Markets

Reduction in service partners

Greater coordination

of advertising with other

marketing initiatives

Continued Focus on Return on

Investment and increased focus

on alternative media

Focus on continued expansion of

pan-regional and global Marketing

Services Networks

Marketing Complexity…

Integration of the Internet within

every marketing discipline

Private equity competition on

acquisition playing field abating

consumer fragmentation

digital initiatives

increased availability of data

more informed consumers

6

Factors Impacting 2008

Focus on marketing effectiveness and efficiency

Expanding mix of Media and Marketing Opportunities

Globalization of emerging markets by large multinationals

Continuing development of technologies which increase and expand

product offerings and ease of delivery

Delivery platforms

Data collection tools

Content Development and Collaboration tools

Uncertain economic conditions

7

Objectives

Maintain the leadership positions of our brands

Continued coordination of multi-agency offering for current and

potential clients

Continue to expand our relationships with our existing clients

both by discipline and geography

Make selective accretive acquisitions that allow us to further

extend our strategic advantages in non-traditional advertising

and in emerging markets

Achieve reported double digit Revenue and EPS growth

Optimize our operating margins while maintaining a high level of

investment in our people and businesses

Use free cash flow to enhance shareholder value

8

OmnicomGroup

9

Financial Review

10

2007 vs. 2006 P&L Summary

Organic 7.1%

Acq. 0.7%

Fx 3.8%

2007

2006

% Change

Revenue

12,694.0

$

11,376.9

$

11.6%

Operating Income

1,659.1

1,483.5

11.8%

% Margin

13.1%

13.0%

Net Interest Expense

74.0

91.6

Profit Before Tax

1,585.1

1,391.9

13.9%

% Margin

12.5%

12.2%

Taxes

536.9

466.9

% Tax Rate

33.9%

33.5%

Profit After Tax

1,048.2

925.0

13.3%

Equity in Affiliates/

38.4

29.6

Minority Interest

(110.9)

(90.6)

Net Income

975.7

$

864.0

$

12.9%

EPS

2.95

2.50

18.0%

Full Year

11

2007 Revenue Mix

Advertising

43.0%

PR

10.0%

CRM

36.6%

Specialty

10.4%

United

States

52.8%

Euro

Markets

21.3%

UK

11.0%

Other

14.9%

By Discipline

By Geography

Advertising

CRM

PR

Specialty

5,463.7

4,645.7

1,273.1

1,311.5

12.0%

14.1%

11.1%

2.5%

$ Mix

% Growth(a)

United States

Euro Markets

United Kingdom

Other

6,704.2

2,709.7

1,393.8

1,886.3

8.2%

16.9%

13.3%

15.3%

$ Mix

% Growth(a)

(a) “Growth” is the year-over-year growth from the prior period.

12

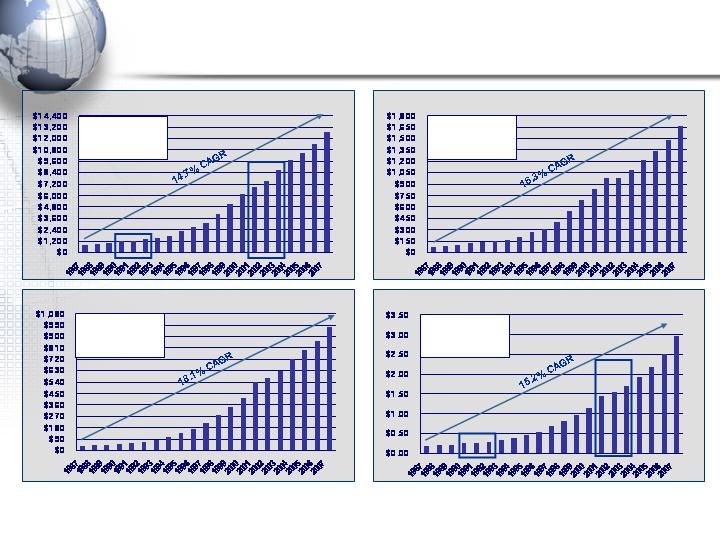

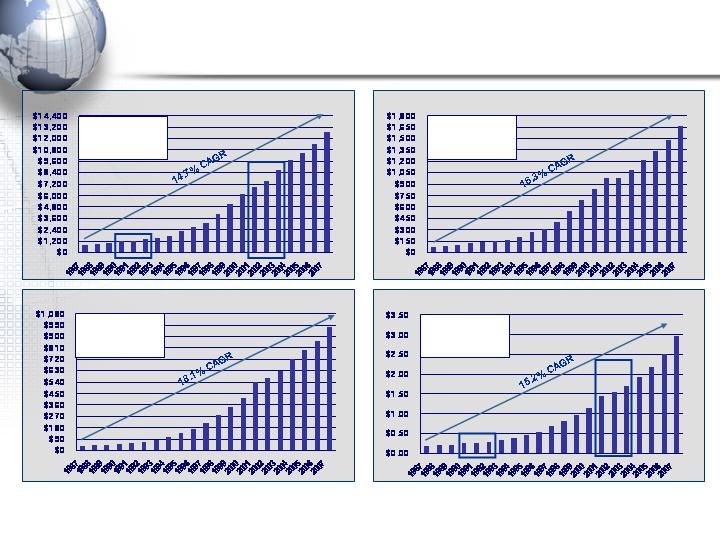

Revenue

Operating Income

Net Income

Earnings Per Share

(a) 2001 results are adjusted to assume that the cessation of goodwill amortization occurred on January 1, 2001.

All periods presented, beginning with 1995, include the effect of the adoption of Statement of Financial Accounting Standards No. 123, Accounting for Stock-Based Compensation.

Financial Performance(a)

2007 $1,659

2006 $1,484

Growth 11.8%

2007 $12,694

2006 $11,377

Growth 11.6%

2007 $976

2006 $864

Growth 12.9%

2007 $2.95

2006 $2.50

Growth 18.0%

13

Revenue

Operating Income

Net Income

Earnings Per Share

(a) 2001 results are adjusted to assume that the cessation of goodwill amortization occurred on January 1, 2001.

All periods presented, beginning with 1995, include the effect of the adoption of Statement of Financial Accounting Standards No. 123, Accounting for Stock-Based Compensation.

Financial Performance(a)

2007 $1,659

2006 $1,484

Growth 11.8%

2007 $12,694

2006 $11,377

Growth 11.6%

2007 $976

2006 $864

Growth 12.9%

2007 $2.95

2006 $2.50

Growth 18.0%

14

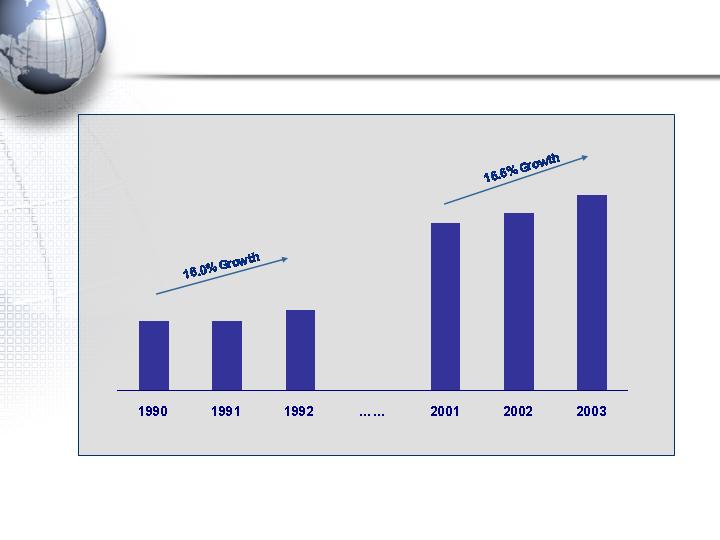

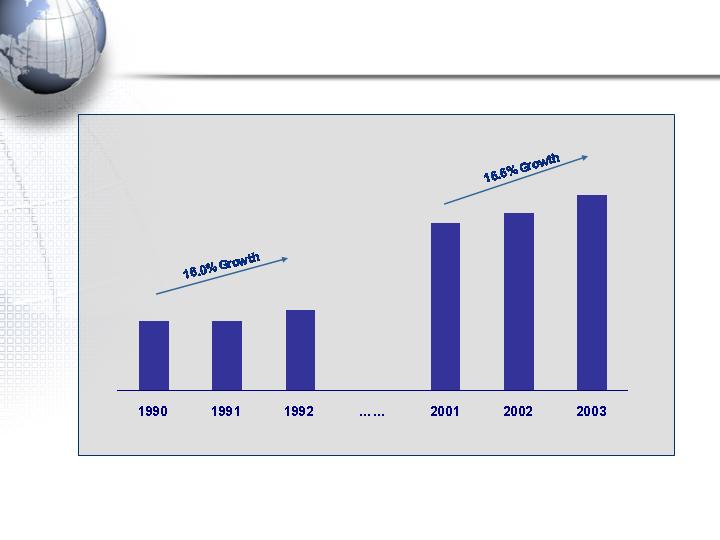

Revenue

Financial Performance

$1,178

$1,236

$1,385

$6,889

$7,536

$8,621

Earning Per Share

15

Financial Performance

$0.25

$0.25

$0.29

$1.45

$1.69

$1.54

16

Financial Objectives

Consistent industry leading long-term financial performance

- Maximize operating efficiency

Continuing to increase investment in:

- Emerging markets

- Emerging technologies

- Behavioral marketing

- Quantitative analytics

Maintain a conservative and efficient capital structure

Double digit reported growth in Revenue and EPS

Selective acquisitions

Staff development

New hires

17

OmnicomGroup