Omnicom Group

SECOND QUARTER 2008 RESULTS

Investor Presentation

July 22, 2008

Exhibit 99.2

1

The following materials have been prepared for use in the July 22, 2008 conference call on Omnicom’s results of operations for the period

ended June 30, 2008. The call will be archived on the Internet at http://www.omnicomgroup.com/financialwebcasts.

Forward-Looking Statements

Certain of the statements in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Act of

1995. These statements relate to future events or future financial performance and involve known and unknown risks and other factors that may

cause our actual or our industry’s results, levels of activity or achievement to be materially different from those expressed or implied by any

forward-looking statements. These risks and uncertainties include, but are not limited to, our future financial condition and results of operations,

changes in general economic conditions, competitive factors, changes in client communication requirements, the hiring and retention of human

resources and our international operations, which are subject to the risks of currency fluctuations and exchange controls. In some cases,

forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“believe,” “estimate,” “predict,” “potential” or “continue” or the negative of those terms or other comparable terminology. These statements are

present expectations. Actual events or results may differ materially. We undertake no obligation to update or revise any forward-looking

statement, except as required by law.

Other Information

All dollar amounts are in millions except for EPS. The financial information contained in this document has not been audited, although some of it

has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational and

other non-financial data contained in this document have been derived from sources we believe to be reliable, but we have not independently

verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is

required.

2

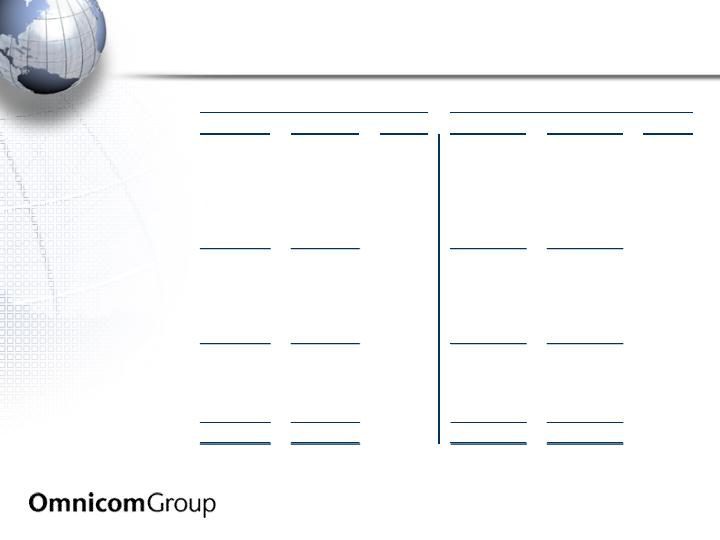

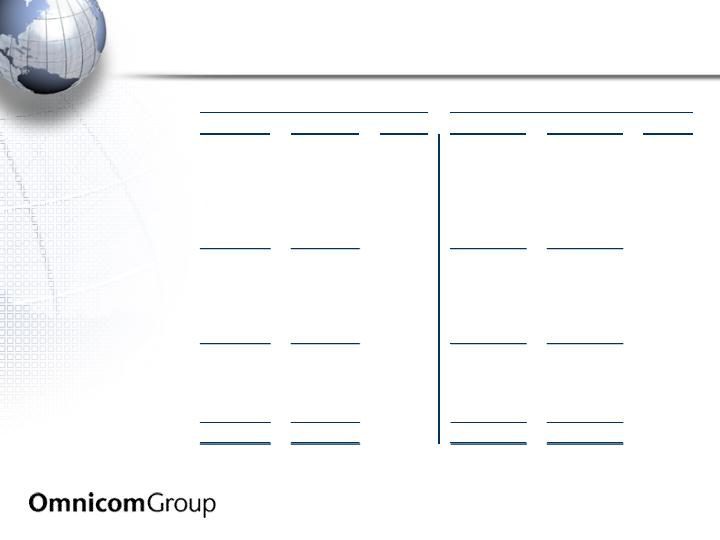

2008 vs. 2007 P&L Summary

2008

2007

%

2008

2007

%

Revenue

3,476.9

$

3,126.1

$

11.2%

6,672.3

$

5,966.7

$

11.8%

Operating Profit

516.8

461.6

12.0%

867.6

777.1

11.6%

% Margin

14.9%

14.8%

13.0%

13.0%

Net Interest Expense

18.7

22.2

29.7

40.5

Profit Before Tax

498.1

439.4

13.4%

837.9

736.6

13.8%

% Margin

14.3%

14.1%

12.6%

12.3%

Taxes

167.2

148.8

282.4

249.3

% Tax Rate

33.6%

33.9%

33.7%

33.8%

Profit After Tax

330.9

290.6

13.9%

555.5

487.3

14.0%

Equity in Affiliates

11.0

12.5

19.1

17.7

Minority Interest

(34.9)

(26.4)

(59.0)

(45.3)

Net Income

307.0

$

276.7

$

11.0%

515.6

$

459.7

$

12.2%

Second Quarter

Year to Date

3

2008 vs. 2007 Earnings Per Share

Earnings per Share:

Basic

Diluted

Growth Rate, Diluted

Weighted Average Shares (millions):

Basic

Diluted

Dividend Declared Per Share

$ 0.97

0.96

14.3

317.5

320.8

$0.150

2007

2008

Second Quarter

$ 0.85

0.84

325.8

330.8

$0.150

$ 1.62

1.61

16.7

317.9

321.1

$0.300

2007

2008

Year to Date

$ 1.40

1.38

328.4

333.5

$0.275

%

%

4

2008 Total Revenue Growth

(a)

To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates from the equivalent prior period to arrive

at constant currency revenue. The FX impact equals the difference between the current period revenue in U.S. dollars and the current period revenue in constant

currency.

(b)

Acquisition revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this number is the revenue of any business

included in the prior period reported revenue that was disposed of subsequent to the prior period.

(c)

Organic revenue is calculated by subtracting both the acquisition revenue and the FX impact from total revenue growth.

$

%

$

%

Prior Period Revenue

3,126.1

$

5,966.7

$

Foreign Exchange (FX) Impact (a)

162.9

5.2%

308.5

5.2%

Acquisition Revenue (b)

38.0

1.2%

65.9

1.1%

Organic Revenue (c)

149.9

4.8%

331.2

5.6%

Current Period Revenue

3,476.9

$

11.2%

6,672.3

$

11.8%

Second Quarter

Year to Date

5

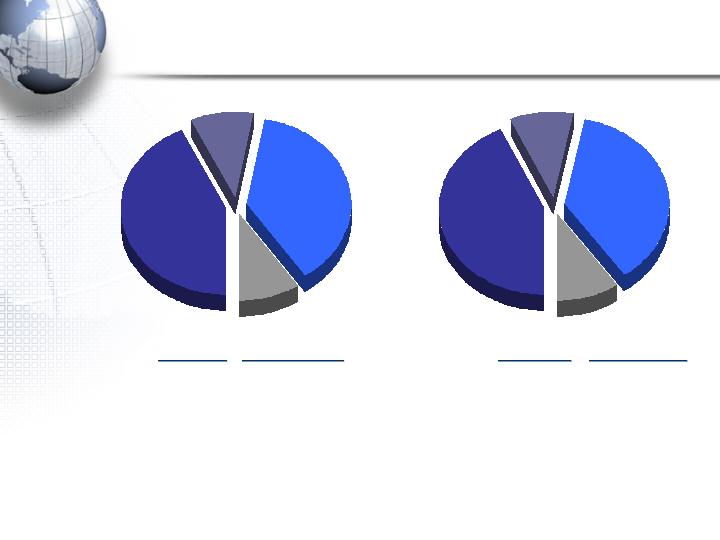

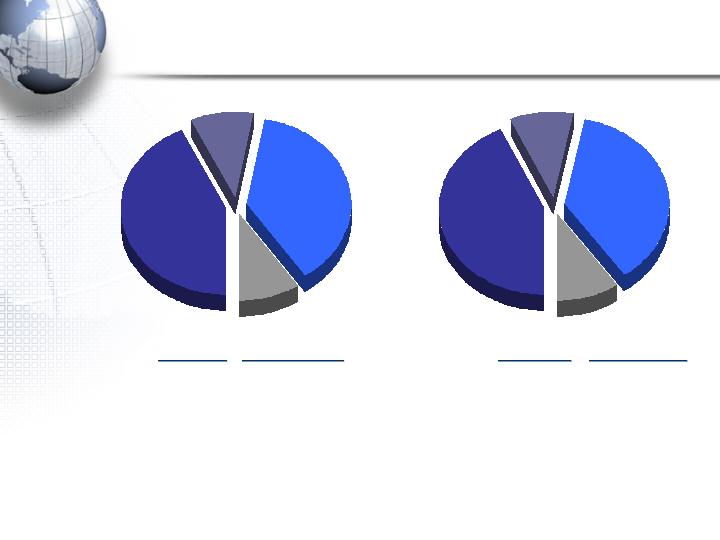

Second Quarter

Year to Date

Advertising

43.3%

PR

9.7%

CRM

37.2%

Specialty

9.8%

Advertising

43.1%

PR

9.6%

CRM

37.8%

Specialty

9.5%

(a) “Growth” is the year-over-year increase or decrease from the prior period.

2008 Revenue By Discipline

Pie Chart

$ Mix

% Growth

(a)

$ Mix

% Growth

(a)

Advertising

1,499.9

9.8%

####

Advertising

2,891.2

11.5%

CRM

1,313.8

17.2%

####

CRM

2,481.3

16.1%

PR

333.4

3.7%

9.6%

PR

648.4

5.3%

Specialty

329.8

4.1%

9.5%

Specialty

651.4

4.9%

6

Second Quarter

2008 Revenue By Geography

United

States

51.1%

UK

10.3%

Euro

Markets

22.5%

Other

16.1%

Year to Date

United

States

50.4%

UK

9.9%

Euro

Markets

23.0%

Other

16.7%

(a) “Growth” is the year-over-year increase or decrease from the prior period.

$ Mix

$ Growth

(a)

$ Mix

$ Growth

(a)

United States

1,751.3

$

91.6

$

United States

3,412.5

$

209.0

$

Organic

71.7

Organic

175.1

Acquisition

19.9

Acquisition

33.9

International

1,725.6

$

259.2

$

International

3,259.8

$

496.6

$

Organic

78.2

Organic

156.1

Acquisition

18.1

Acquisition

32.0

FX

162.9

FX

308.5

$ Mix

% Growth

(a)

$ Mix

% Growth

(a)

United States

1,751.3

$

5.5%

United States

3,412.5

$

6.5%

Euro Currency Markets

798.6

19.6%

Euro Currency Markets

1,499.6

20.6%

United Kingdom

345.9

-0.4%

United Kingdom

688.9

2.3%

Other

581.1

28.8%

Other

1,071.3

26.5%

7

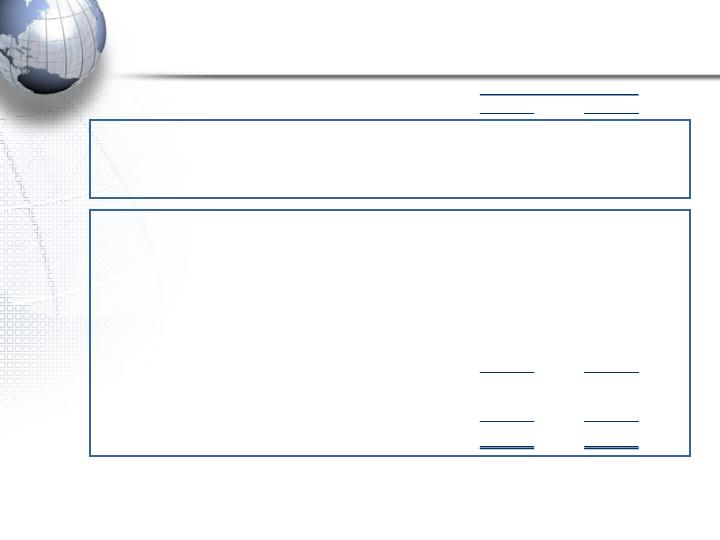

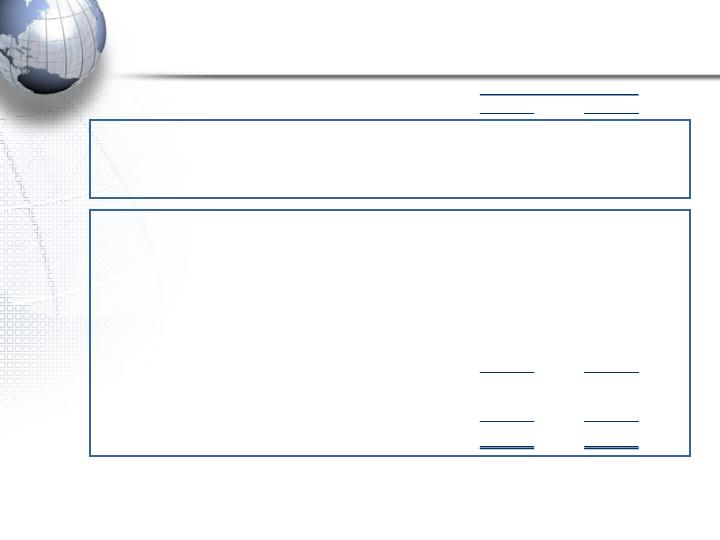

Cash Flow – GAAP Presentation (condensed)

2008

2007

Net Income

515.6

$

459.7

$

Stock-Based Compensation Expense

27.8

36.2

Depreciation and Amortization

115.7

98.3

Other Non-Cash Items to Reconcile to Net Cash Provided by Operations

58.6

43.4

Other Changes in Working Capital

(799.6)

(670.6)

Excess Tax Benefit on Stock Compensation

(9.6)

(14.5)

Net Cash Used by Operations

(91.5)

(47.5)

Capital Expenditures

(92.7)

(101.2)

Acquisitions

(210.1)

(143.9)

Other Investing Activities, net

(0.2)

141.3

Net Cash Used by Investing Activities

(303.0)

(103.8)

Dividends

(97.3)

(84.2)

Stock Repurchases

(407.8)

(756.8)

Share Transactions Under Employee Stock Plans

63.7

66.3

Excess Tax Benefit on Stock Compensation

9.6

14.5

Other Financing Activities

(48.0)

(43.0)

Net Cash Used by Financing Activities

(479.8)

(803.2)

Effect of exchange rate changes on cash and cash equivalents

(3.1)

(12.6)

Net Decrease in Cash and Cash Equivalents

(877.4)

$

(967.1)

$

6 Months Ended June 30,

8

Current Credit Picture

(a) “Operating Income (EBIT)” and “Net Interest Expense” calculations shown are the latest twelve month (“LTM”) figures for the periods specified.

Although our bank agreements reference EBITDA, we have used EBIT for this presentation because EBITDA is a non-GAAP measure.

2008

2007

Operating Income (EBIT)

(a)

$

1,750

$

1,559

Net Interest Expense

(a)

$

63.3

$

91.4

EBIT / Net Interest

27.6

x

17.1

x

Net Debt / EBIT

1.2

x

1.4

x

Debt:

Bank Loans (Due Less Than 1 Year)

$

23

$

11

CP Issued Under $2.5B - 5 Year Revolver Due 6/23/11

-

-

Convertible Notes Due 2/7/31

847

847

Convertible Notes Due 7/31/32

727

727

Convertible Notes Due 6/15/33

-

-

Convertible Notes Due 7/1/38

468

467

10 Year Notes Due 4/15/16

996

996

Other Debt

20

19

Total Debt

$

3,081

$

3,067

Cash and Short Term Investments

959

821

Net Debt

$

2,122

$

2,246

LTM Ended June 30,

9

Current Liquidity Picture

(a)

Credit facility expires June 23, 2011.

(b)

Represents uncommitted facilities in the U.S., U.K. and Canada as of June 30, 2008. These amounts are excluded

from our available liquidity for purposes of this presentation.

Total Amount

Of Facility

Outstanding

Available

Committed Facilities

5 Year Revolver

(a)

2,500

$

-

$

2,500

$

Other Committed Credit Facilities

23

23

-

Total Committed Facilities

2,523

23

2,500

Uncommitted Facilities

(b)

598

-

-

(b)

Total Credit Facilities

3,121

$

23

$

2,500

$

Cash and Short Term Investments

959

Total Liquidity Available

3,459

$

As of June 30, 2008

10

Acquisitions Summary

11

Acquisition Related Expenditures

Note: See appendix for subsidiary acquisition profiles.

Includes acquisitions of a majority interest in agencies resulting in their consolidation.

Includes acquisitions of additional equity interests in existing affiliate agencies resulting in their majority ownership and consolidation.

Includes acquisitions of less than a majority interest in agencies in which Omnicom did not have a prior equity interest and the acquisition

of additional interests in existing affiliated agencies that did not result in majority ownership.

Includes the acquisition of additional equity interests in already consolidated subsidiary agencies.

Includes additional consideration paid for acquisitions completed in prior periods.

(a)

(b)

(c)

(d)

(e)

New Subsidiary Acquisitions

(a)

53

$

Affiliates to Subsidiaries

(b)

-

Affiliates

(c)

9

Existing Subsidiaries

(d)

57

Earn-outs

(e)

109

Total Acquisition Expenditures

228

$

6 Months YTD 2008

12

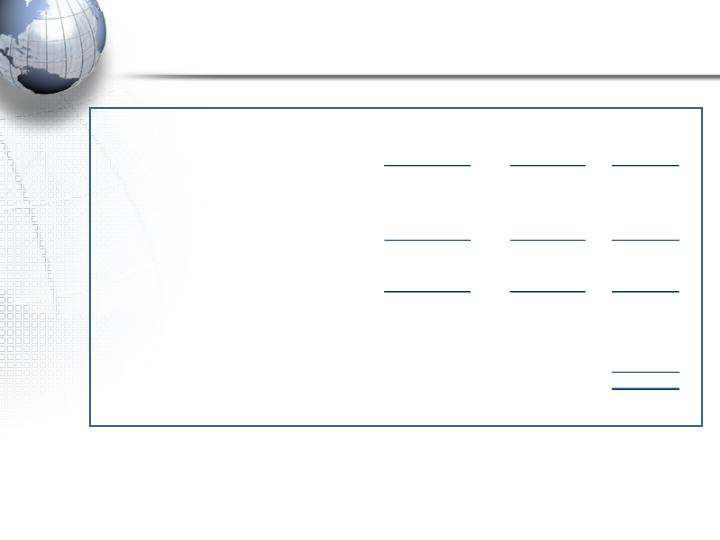

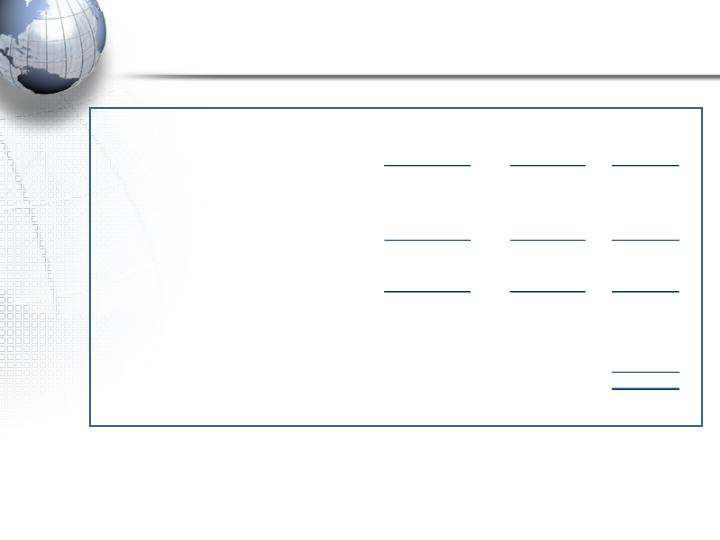

Potential Earn-out Obligations

The following is a calculation of future earn-out obligations as of

June 30, 2008, assuming that the underlying acquired agencies

continue to perform at their current levels: (a)

(a)

The ultimate payments will vary as they are dependent on future events and changes in FX rates.

2008

2009

2010

2011

Thereafter

Total

75

$

104

$

82

$

28

$

23

$

312

$

13

Potential Obligations

(a) The ultimate payments will vary as they are dependent on future events and changes in FX rates.

In conjunction with certain transactions, Omnicom has agreed to

acquire (at the sellers’ option) additional equity interests. If these rights

are exercised, there would likely be an increase in our net income as a

result of our increased ownership and the reduction of minority interest

expense. The following is a calculation of these potential future

obligations (as of June 30, 2008), assuming these underlying acquired

agencies continue to perform at their current levels: (a)

Currently

Exercisable

Not Currently

Exercisable

Total

Subsidiary Agencies

186

$

86

$

272

$

Affiliated Agencies

56

6

62

Total

242

$

92

$

334

$

14

Second Quarter Acquisitions

Sterling Brands

Sterling Brands is a leading brand consultancy specializing in brand

strategy and design. Specific services offered include brand

positioning, strategic research, innovation, design planning, brand

identity and packaging design.

Sterling Brands is based in New York and San Francisco.