- OMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Omnicom (OMC) 8-KOmnicom Reports Fourth Quarter 2008 Results

Filed: 10 Feb 09, 12:00am

Investor Presentation

Fourth Quarter 2008 Results

February 10, 2009

Exhibit 99.2

Disclosure

The following materials have been prepared for use in the February 10, 2009 conference call on Omnicom’s results of

operations for the period ended December 31, 2008. The call will be archived on the Internet at

http://www.omnicomgroup.com/financialwebcasts ..

Forward-Looking Statements

Certain of the statements in this document constitute forward-looking statements within the meaning of the Private

Securities Litigation Act of 1995. These statements relate to future events or future financial performance and involve

known and unknown risks and other factors that may cause our actual or our industry’s results, levels of activity or

achievement to be materially different from those expressed or implied by any forward-looking statements. These

risks and uncertainties include, but are not limited to, our future financial condition and results of operations, changes

in general economic conditions, competitive factors, changes in client communication requirements, the hiring and

retention of human resources and our international operations, which are subject to the risks of currency fluctuations

and exchange controls. In some cases, forward-looking statements can be identified by terminology such as “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or

“continue” or the negative of those terms or other comparable terminology. These statements are present

expectations. Actual events or results may differ materially. We undertake no obligation to update or revise any

forward-looking statement, except as required by law.

Other Information

All dollar amounts are in millions except for EPS. The financial information contained in this document has not been

audited, although some of it has been derived from Omnicom’s historical financial statements, including its audited

financial statements. In addition, industry, operational and other non-financial data contained in this document have

been derived from sources we believe to be reliable, but we have not independently verified such information, and we

do not, nor does any other person, assume responsibility for the accuracy or completeness of that information.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of

such information is required.

1

February 10, 2009

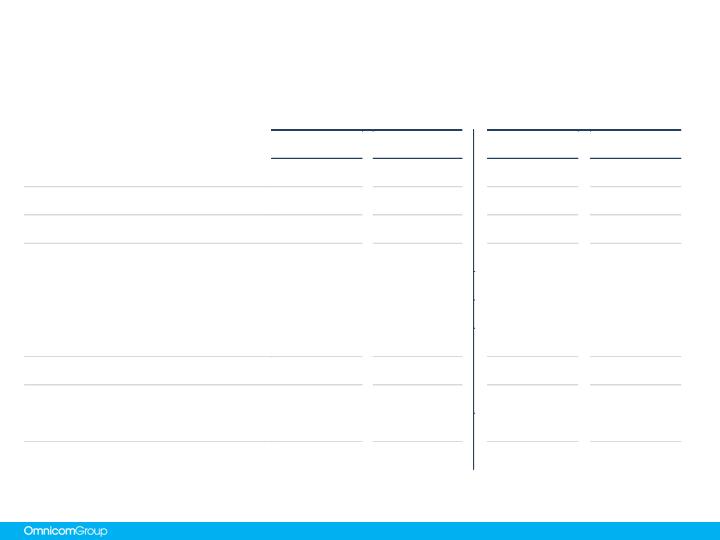

2008 vs. 2007 P&L Summary

February 10, 2009

2

Fourth Quarter

Full Year

2008

2007

%

2008

2007

%

Revenue

$

3,371.3

$

3,626.0

-

7.0%

$

13,359.9

$

12,694.0

5.2%

Operating Income

448.4

531.9

-

15.7%

1,689.4

1,659.1

1.8%

% Margin

13.3%

14.7%

12.6%

13.1%

Net Interest Expense

23.9

14.3

74.3

74.0

Profit Before Tax

424.5

517.6

-

18.0%

1,615.1

1,585.1

1.9%

% Margin

12.6%

14.3%

12.1%

12.5%

Taxes

142.0

175.5

542.7

536.9

% Tax Rate

33.5%

33.9%

33.6%

33.9%

Equity in Affiliates

16.0

12.7

42.0

38.4

Minority Interest

(27.5)

(40.9)

(114.1)

(110.9)

Net Income

$

271.0

$

313.9

-

13.7%

$

1,000.3

$

975.7

2.5%

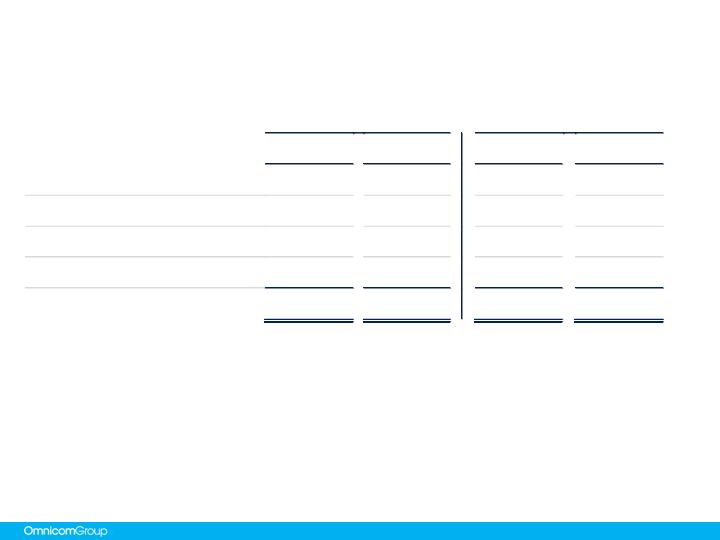

2008 vs. 2007 Earnings per Share

February 10, 2009

3

Fourth Quarter

Full Year

2008

2007

2008

2007

Earnings per Share:

Basic

$

0.88

$

0.97

$

3.20

$

2.99

Diluted

0.88

0.96

3.17

2.95

Growth Rate, Diluted

-

8.3%

7.5%

Weighted Average Shares (millions):

Basic

307.2

323.2

313.0

326.0

Diluted

307.2

327.0

315.4

330.4

Dividend Declared per Share

$

0.150

$

0.150

$

0.600

$

0

.575

2008 Total Revenue Growth

February 10, 2009

4

(a)

To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates

from the equivalent prior period to arrive at constant currency revenue. The FX impact equals the difference between the

current period revenue in U.S. dollars and the current period revenue in constant currency.

(b)

Acquisition revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this

number is the revenue of any business included in the prior period reported revenue that was disposed of subsequent to

the prior period.

(c)

Organic revenue is calculated by subtracting both the acquisition revenue and the FX impact from total revenue growth.

Fourth Quarter

Full Year

$

%

$

%

Prior Period Revenue

$

3,626.0

$

12,694.0

Foreign Exchange (FX) Impact (a)

(210.7)

-

5.8%

163.9

1.3%

Acquisition Revenue (b)

39.2

1.1%

128.1

1.0%

Organic Revenue (c)

(83.2)

-

2.3%

373.9

2.9%

Current Period Revenue

$

3,371.3

-

7.0%

$

13,359.9

5.2%

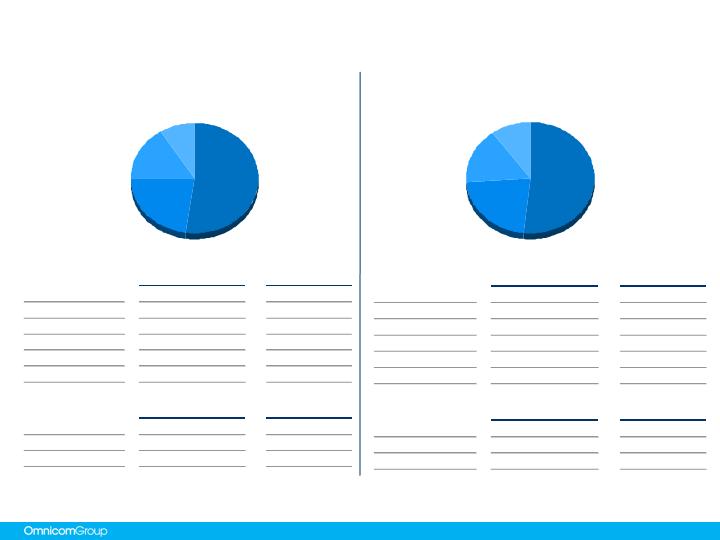

2008 Revenue by Discipline

February 10, 2009

5

$ Mix

% Growth (a)

Advertising

$ 1,458.6

-7.6%

CRM

1,298.0

-3.3%

PR

304.9

-10.2%

Specialty

309.8

-15.3%

$ Mix

% Growth (a)

Advertising

$ 5,731.8

4.9%

CRM

5,084.9

9.5%

PR

1,267.4

-0.4%

Specialty

1,275.8

-2.7%

(a)

“Growth” is the year-over-year increase or decrease from the prior period.

9.9%

U.K.

16.2%

Other

22.3%

Euro Markets

51.6%

U.S.

Full Year

14.5%

2,158.9

Other

-4.9%

1,325.4

United Kingdom

10.2%

2,985.6

Euro Currency Markets

2.8%

$

6,890.0

United States

% Growth(a)

$ Mix

163.9

FX

57.8

Acquisition

258.4

Organic

$

480.1

$

6,469.9

International

70.3

Acquisition

115.5

Organic

$

185.8

$

6,890.0

United States

$ Growth(a)

$ Mix

8.8%

U.K.

16.2%

Other

22.8%

Euro Markets

52.2%

U.S.

Fourth Quarter

2008 Revenue By Geography

February 10, 2009

6

(a)

“Growth” is the year-over-year increase or decrease from the prior period.

$ Mix

$ Growth(a)

United States

1,759.5

$

(86.4)

$

Organic

(106.4)

Acquisition

20.0

International

1,611.8

$

(168.3)

$

Organic

23.2

Acquisition

19.2

FX

(210.7)

$ Mix

% Growth(a)

United States

1,759.5

$

-4.7%

Euro Currency Markets

767.6

-7.6%

United Kingdom

298.9

-18.7%

Other

545.3

-6.2%

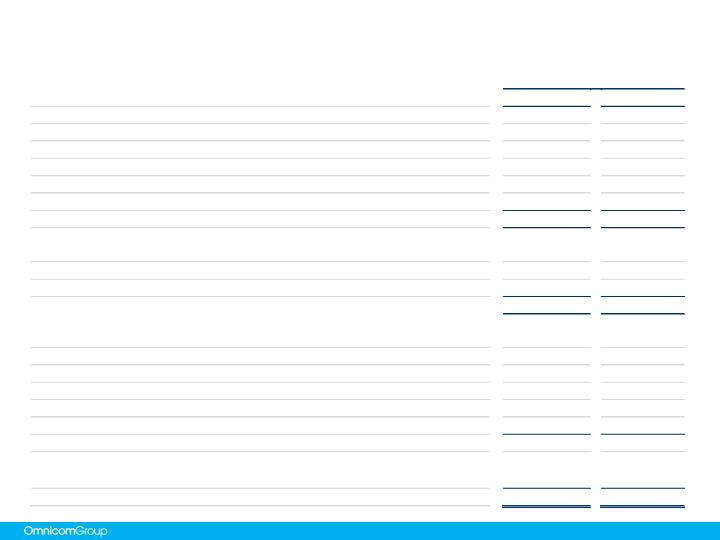

Cash Flow – GAAP Presentation (condensed)

February 10, 2009

7

Full Year

2008

2007

Net Income

$

1,000.3

$

975.7

Share-Based Compensation Expense

59.3

68.7

Depreciation and Amortization

235.9

208.6

Other Non-Cash Items to Reconcile to Net Cash Provided by Operations

123.6

119.7

Other Changes in Working Capital

(12.0)

243.8

Excess Tax Benefit on Share-Based Compensation

-

(12.9)

(17.2)

Net Cash Provided by Operating Activities

1,394.2

1,599.3

Capital Expenditures

(212.2)

(223.0)

Acquisitions

(441.4)

(358.8)

Other Investing Activities, net

(26

.4

)

141.3

Net Cash Used in Investing Activities

(680.0)

(440.5)

Dividends

(192.0)

(182.8)

Stock Repurchases

(846.8)

(899.7)

Share Transactions Under Employee Stock Plans

86.0

100.9

Proceeds from Issuance of Debt

2.4

3.4

Excess Tax Benefit on Stock Compensation

12.9

17.2

Other Financing Activities, net

(116.3)

(79.7)

Net Cash Used in Financing Activities

(

1,053.8)

(1,040.7)

Effect of exchange rate on cash and cash equivalents

(356.3)

(64.4)

Net (Decrease) Increase in Cash and Cash Equivalents

$

(

695.9)

$

53.7

Current Credit Picture

February 10, 2009

8

(a)

“EBITDA” and “Gross Interest Expense” calculations shown are for the twelve months ending December 31. EBITDA is defined as operating income before interest, taxes,

depreciation and amortization. Although EBITDA is a non-GAAP measure, we believe EBITDA is more meaningful for purposes of this analysis because the financial

covenants in our credit facilities are based on EBITDA (see reconciliation of Operating Income to EBITDA on page 21).

(b)

On February 9, 2009, holders of $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 put their notes to Omnicom for purchase at par in

accordance with the terms of the indenture under which the convertible notes were issued. Omnicom borrowed $814.4 million under its existing $2.5 billion five-year revolving

credit facility and received $26.8 million from unaffiliated equity investors in the partnership referred to below to fund the purchase of the notes. Omnicom purchased and

retired $295.2 million aggregate principal amount of the convertible notes that had been put. A partnership controlled by Omnicom and formed for the purpose of buying the

convertible notes used a portion of Omnicom’s credit facility borrowings and the contributed equity to purchase the remaining $546.0 million aggregate principal amount of

convertible notes that were put. The partnership purchased the convertible notes intending to sell such notes back into the marketplace over the next 12 months if market

conditions permit. The partnership will be consolidated within Omnicom’s financial statements.

2008

2007

EBITDA (a)

$

1,925

$

1,868

Gross Interest Expense (a)

$

124.6

$

106.9

EBITDA / Gross Interest Expense

15.4

x

17.5

x

Total Debt / EBITDA

1.6

x

1.6

x

Debt:

Short-term borrowings (Due Less Than 1 Year)

$

16

$

12

CP Issued Under $2.5B - 5 Year Revolver Due 6/23/11

-

(b)

-

Convertible Notes Due 2/7/31

847

(b)

847

Convertible Notes Due 7/31/32

727

727

Convertible Notes Due 6/15/33

-

-

Convertible Notes Due 7/1/38

467

467

10 Year Notes Due 4/15/16

996

996

Other Debt

20

20

Total Debt

$

3,073

$

3,069

Cash and Short Term Investments

1,112

1,841

Net Debt

$

1,961

$

1,228

Full Year

Current Liquidity Picture

February 10, 2009

9

As of December 31, 2008

Total Amount

of Facility

Outstanding

Available

Committed Facilities

5 Year Revolver (a)

$ 2,500

$ —

$ 2,500

Other Committed Credit Facilities

16

16

—

Total Committed Facilities

2,516

16

2,500

Uncommitted Facilities (b)

354

—

— (b)

Total Credit Facilities

$ 2,870

$ 16

$ 2,500

Cash and Short Term Investments

1,112

Total Liquidity Available

$ 3,612

(a)

Credit Facility expires June 23, 2011. For an update, see the Current Credit Picture Update on page 13.

(b)

Represents uncommitted facilities in the U.S., U.K. and Canada as of December 31, 2008. These amounts are excluded from our

available liquidity for purposes of this presentation.

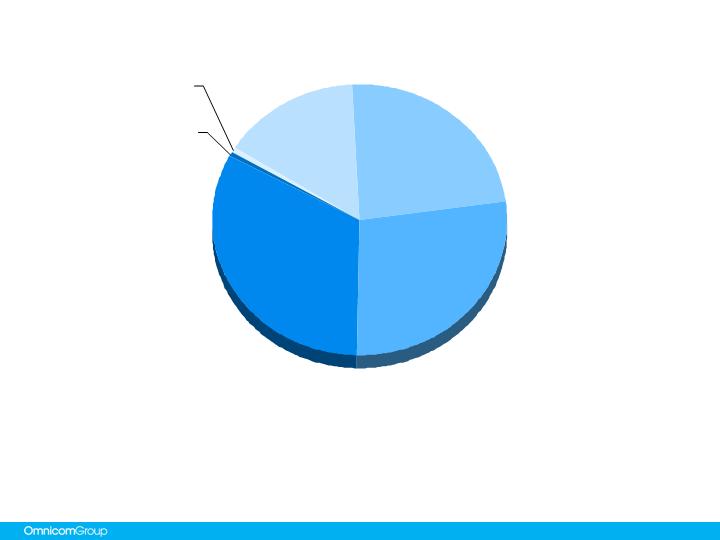

Omnicom Debt Structure

Supplemental Information

The above chart reflects Omnicom’s debt outstanding at December 31, 2008. The amount reflected above for the 10 Year Notes represents the principal

amount of these notes at maturity on April 15, 2016.

On February 9, 2009, holders of $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 put their notes to Omnicom for purchase

at par in accordance with the terms of the indenture under which the convertible notes were issued. Omnicom borrowed $814.4 million under its existing $2.5

billion five-year revolving credit facility and received $26.8 million from unaffiliated equity investors in the partnership referred to below to fund the purchase of

the notes. Omnicom purchased and retired $295.2 million aggregate principal amount of the convertible notes that had been put. A partnership controlled by

Omnicom and formed for the purpose of buying the convertible notes used a portion of Omnicom’s credit facility borrowings and the contributed equity to

purchase the remaining $546.0 million aggregate principal amount of convertible notes that were put. The partnership purchased the convertible notes

intending to sell such notes back into the marketplace over the next 12 months if market conditions permit. The partnership will be consolidated within

Omnicom’s financial statements.

11

February 10, 2009

Omnicom Debt Structure

2032 Convert

$727

2038 Convert

$467

10 Year Notes

$1,000

2031 Convert

$847

Other Debt $20

Short-term

Borrowings $16

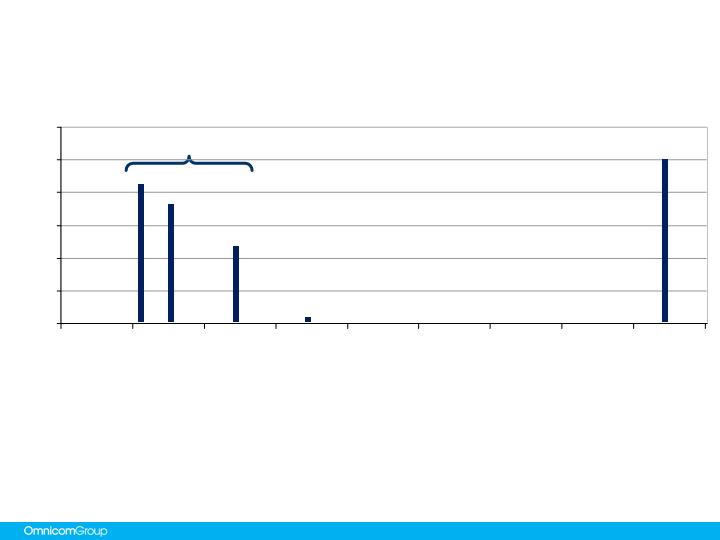

Omnicom Debt Structure

February 10, 2009

12

The Bank Facility and Commercial Paper Program together provide liquidity in the event any convertible notes are

put. We then have flexibility to refinance in different debt capital markets.

Our 2031 Notes are putable annually, with the next put date in February 2009. Our 2032 Notes are putable annually, with the next put date in July 2009. Our 2038

Notes are putable in June 2010, 2013, 2018, 2023 and annually thereafter.

On February 9, 2009, holders of $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 put their notes to Omnicom for purchase at

par in accordance with the terms of the indenture under which the convertible notes were issued. Omnicom borrowed $814.4 million under its existing $2.5 billion

five-year revolving credit facility and received $26.8 million from unaffiliated equity investors in the partnership referred to below to fund the purchase of the notes.

Omnicom purchased and retired $295.2 million aggregate principal amount of the convertible notes that had been put. A partnership controlled by Omnicom and

formed for the purpose of buying the convertible notes used a portion of Omnicom’s credit facility borrowings and the contributed equity to purchase the remaining

$546.0 million aggregate principal amount of convertible notes that were put. The partnership purchased the convertible notes intending to sell such notes back

into the marketplace over the next 12 months if market conditions permit. The partnership will be consolidated within Omnicom’s financial statements.

For purposes of this presentation we have included the following borrowings as of December 31, 2008 as outstanding through June 2011, the date of expiration of

our five-year credit facility: short-term borrowings of $16 million and other debt of $20 million. We believe that this presentation is more meaningful for purposes of

understanding how we evaluate the maturities of our debt structure.

Other

Borrowings

$2.04 Billion

Senior Convertible Notes

$1.0 Billion

10-Year Note

2038

2032

2031

$0

$200

$400

$600

$800

$1,000

$1,200

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Current Credit Picture Update

February 10, 2009

13

On February 9, 2009, holders of $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 put their notes to

Omnicom for purchase at par in accordance with the terms of the indenture under which the convertible notes were issued. Omnicom

borrowed $814.4 million under its existing $2.5 billion five-year revolving credit facility and received $26.8 million from unaffiliated equity

investors in the partnership referred to below to fund the purchase of the notes. Omnicom purchased and retired $295.2 million aggregate

principal amount of the convertible notes that had been put. A partnership controlled by Omnicom and formed for the purpose of buying the

convertible notes used a portion of Omnicom’s credit facility borrowings and the contributed equity to purchase the remaining $546.0 million

aggregate principal amount of convertible notes that were put. The partnership purchased the convertible notes intending to sell such

notes back into the marketplace over the next 12 months if market conditions permit. The partnership will be consolidated within

Omnicom’s financial statements.

On February 9, 2009 $841 million of the 2031 notes were put back to us for purchase.

The below amounts reflect how we financed the purchase of these bonds and do not

reflect any other financing activities that occurred subsequent to December 31, 2008.

Debt at

Updated to Reflect

Put of 2031 Notes

Debt:

Short-term borrowings (Due Less Than 1 Year)

$

16

$

16

5 Year Revolver Due 6/23/11

-

814

Convertible Notes Due 2/7/31

847

6

Convertible Notes Due 7/31/32

727

727

Convertible Notes Due 6/15/33

-

-

Convertible Notes Due 7/1/38

467

467

10 Year Notes Due 4/15/16

996

996

Other Debt

20

20

Total Debt

$

3,073

$

3,046

December 31, 2008

Senior Notes Due 2016

February 10, 2009

14

Principal Amount

$1 Billion

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 29, 2006

Maturity

April 15, 2016

Security

Unsecured, pari passu with Bank Facility

Coupon

5.90%

Spread Over Comparable Treasury at Issue

1.30%

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2031 Convertible Notes

February 10, 2009

15

Principal Amount

$847 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

February 7, 2001

Maturity

February 7, 2031 with annual puts each February

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$55

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

Note: On February 9, 2009, holders of $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 put their notes

to Omnicom for purchase at par in accordance with the terms of the indenture under which the convertible notes were issued. Omnicom

borrowed $814.4 million under its existing $2.5 billion five-year revolving credit facility and received $26.8 million from unaffiliated equity

investors in the partnership referred to below to fund the purchase of the notes. Omnicom purchased and retired $295.2 million aggregate

principal amount of the convertible notes that had been put. A partnership controlled by Omnicom and formed for the purpose of buying the

convertible notes used a portion of Omnicom’s credit facility borrowings and the contributed equity to purchase the remaining $546.0 million

aggregate principal amount of convertible notes that were put. The partnership purchased the convertible notes intending to sell such

notes back into the marketplace over the next 12 months if market conditions permit. The partnership will be consolidated within

Omnicom’s financial statements.

2032 Convertible Notes

February 10, 2009

16

Principal Amount

$727 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 6, 2002

Maturity

July 31, 2032 with annual puts each July

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$55

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2038 Convertible Notes

February 10, 2009

17

Principal Amount

$467 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

June 10, 2003

Maturity

June 15, 2038 with puts in June of 2010, 2013, 2018, 2023

and annually thereafter until maturity

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$51.50

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

Current Bank Credit Facility

February 10, 2009

18

Amount

$2.5 Billion

Type

Unsecured Revolving Credit

Maturity

5 Years – June 2011

Facility Fee

13BP per annum

Drawn Rate

Libor +17BP

Covenants

-Maximum Debt to EBITDA 3:1

-Minimum Interest Coverage 5:1

Current Bank Credit Facility – Distribution of 33 Banks

February 10, 2009

19

North America

Bank of America ($200)

Wells Fargo ($175)

Northern Trust ($50)

PNC ($50)

Union Bank of California ($50)

US Bancorp ($50)

Scotia ($40)

Comerica ($25)

Key ($25)

Fifth Third ($15)

Global

Citigroup ($100) • JP Morgan ($200) • HSBC ($200) • Royal Bank of Scotland ($150)

Europe

Societe Generale ($150)

Deutsche ($150)

BBVA ($100)

Commerzbank ($80)

Fortis ($70)

BNP Paribas ($60)

Barclays ($50)

Den Danske ($50)

UBS ($35)

Intesa San Paolo ($30)

ING ($25)

Nordea ($25)

Unicredit ($25)

Asia

Sumitomo ($100)

Bank of Tokyo ($50)

Mizuho ($50)

ANZ ($50)

Standard Chartered ($45)

Westpac ($25)

Current Omnicom Credit Ratings

February 10, 2009

20

Moody’s

S&P

Fitch

Long Term Ratings

Baa1

A-

A-

Short Term Ratings

P2

A2

F2

Outlook

Stable

Stable

Stable

Reconciliation of Operating Income to EBITDA

February 10, 2009

21

The covenants contained in our credit facility are based on the EBITDA ratios as presented on pages 8 & 18 of this presentation. The

above reconciles our GAAP Operating Income to EBITDA for the periods presented.

EBITDA is a non-GAAP financial measure within the meaning of applicable SEC rules and regulations Our credit facility defines EBITDA

as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses EBITDA to measure

our compliance with covenants, such as interest coverage and leverage. EBITDA is not, and should not, be used as a substitute for

Operating Income as determined in accordance with GAAP and is only used to measure our compliance with our debt covenants.

Management does not use EBITDA for any other measurement purpose.

2008

2007

Operating Income

$

1,689

1,659

Depreciation

183

164

Amortization

53

45

EBITDA

$

1,925

1,868

Full Year

Acquisitions Summary

Acquisition Related Expenditures

February 10, 2009

23

Note: See pages 26-28 for acquisition profiles.

a)

Includes acquisitions of a majority interest in agencies resulting in their consolidation.

b)

Includes acquisitions of additional equity interests in existing affiliate agencies resulting in their majority ownership and consolidation.

c)

Includes acquisitions of less than a majority interest in agencies in which Omnicom did not have a prior equity interest and the acquisition

of additional interests in existing affiliated agencies that did not result in majority ownership.

d)

Includes the acquisition of additional equity interests in already consolidated subsidiary agencies.

e)

Includes additional consideration paid for acquisitions completed in prior periods.

Full Year 2008

New Subsidiary Acquisitions (a)

89

$

Affiliates to Subsidiaries (b)

37

Affiliates (c)

88

Existing Subsidiaries (d)

99

Earn-outs (e)

179

Total Acquisition Expenditures

492

$

Potential Earn-out Obligations

February 10, 2009

24

The following is a calculation of future earn-out obligations as of December 31, 2008,

assuming that the underlying acquired agencies continue to perform at their current levels: (a)

(a)

The ultimate payments will vary as they are dependent on future events, including changes in FX rates.

2009

2010

2011

2012

Thereafter

Total

$ 118

$ 99

$ 53

$ 33

$ 12

$ 315

Potential Obligations

February 10, 2009

25

a)

The ultimate payments will vary as they are dependent on future events, including changes in FX rates.

In conjunction with certain transactions, Omnicom has agreed to acquire (at the sellers’ option)

additional equity interests. If these rights are exercised, there would likely be an increase in our

net income as a result of our increased ownership and the reduction of minority interest

expense. The following is a calculation of these potential future obligations, assuming the

underlying acquired agencies continue to perform at their current levels: (a)

Currently

Exercisable

Not Currently

Exercisable

Total

Subsidiary Agencies

138

$

63

$

201

$

Affiliated Agencies

41

-

41

Total

179

$

63

$

242

$

Fourth Quarter Acquisitions

February 10, 2009

26

Access Communications is a full service public relations agency that

provides comprehensive, integrated marketing programs, focusing in the hi-

tech and consumer-tech area. The company’s services include strategic

planning, social media relations including blogger relations and blog

monitoring, tracking online presence, building on-line communities and

producing blog, vlog and podcast content.

With offices in San Francisco and New York, Access Communications will

operate within Ketchum’s Global Technology practice.

Fourth Quarter Acquisitions

February 10, 2009

27

New Performance is a full service healthcare advertising agency, creating integrated

healthcare campaigns for global as well as local clients within Germany. A member

of the DAS affiliate network for the past three years, New Performance has

collaborated with many Omnicom agencies as the healthcare resource in Germany

on international healthcare clients.

Located in Munich, Germany, New Performance will form part of the Cline Davis &

Mann (CDM) global network and will be rebranded CDM Munich.

Fourth Quarter Acquisitions

February 10, 2009

28

Yellowwood Future Architects is a marketing and brand strategy agency established

in 1997. One of the most respected entities in its field in South Africa, Yellowwood

Future Architects’ offering includes brand and marketing strategy, brand insights and

intelligence, brand design and experience creation.

Yellowwood Future Architects has offices in Cape Town and Johannesburg, South

Africa and will operate within TBWA\South Africa.