- OMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Omnicom (OMC) 8-KOmnicom Reports First Quarter 2009 Results

Filed: 27 Apr 09, 12:00am

Investor Presentation

First Quarter 2009 Results

April 27, 2009

Exhibit 99.2

Disclosure

The following materials have been prepared for use in the April 27, 2009 conference call on Omnicom’s results of operations

for the quarter ended March 31, 2009. The call will be archived on the Internet at

http://www.omnicomgroup.com/financialwebcasts.

Forward-Looking Statements

Certain of the statements in this document constitute forward-looking statements within the meaning of the Private Securities

Litigation Act of 1995 . In addition, from time to time, we or our representatives have made or may make forward-looking

statements, orally or in writing. These statements relate to future events or future financial performance and involve known and

unknown risks and other factors that may cause our actual or our industry’s results, levels of activity or achievement to be

materially different from those expressed or implied by any forward-looking statements. These risks and uncertainties include,

but are not limited to, our future financial condition and results of operations, the continuing global economic recession and

credit crisis, losses on media purchases on behalf of clients, reductions in client spending and/or a slowdown in client

payments, competitive factors, changes in client communication requirements, the hiring and retention of personnel, our ability

to attract new clients and retain existing clients, changes in government regulations impacting our advertising and marketing

strategies, risks associated with assumptions we make in connection with our critical accounting estimates, legal proceedings,

settlements, investigations and claims, and our international operations, which are subject to the risks of currency fluctuations

and exchange controls. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or “continue” or the

negative of those terms or other comparable terminology. These statements are present expectations. Actual events or results

may differ materially. We undertake no obligation to update or revise any forward-looking statement, except as required by law.

Other Information

All dollar amounts are in millions except for EPS. The following financial information contained in this document has not been

audited, although some of it has been derived from Omnicom’s historical financial statements, including its audited financial

statements. In addition, industry, operational and other non-financial data contained in this document have been derived from

sources we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other

person, assume responsibility for the accuracy or completeness of that information.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of such

information is required.

1

April 27, 2009

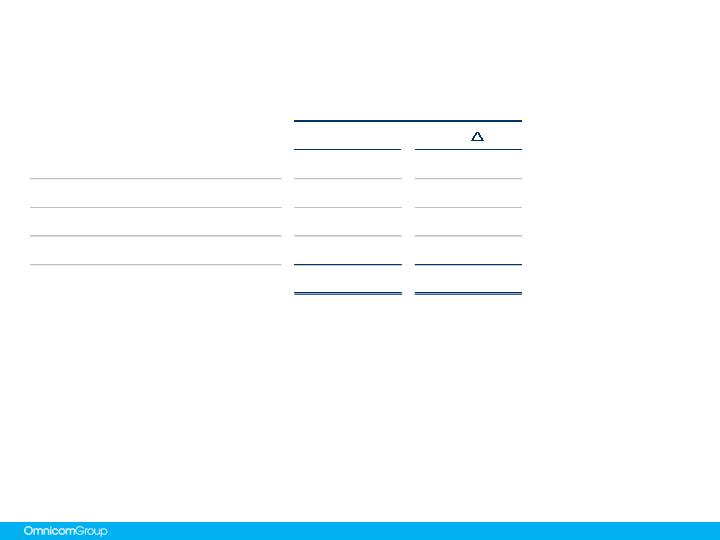

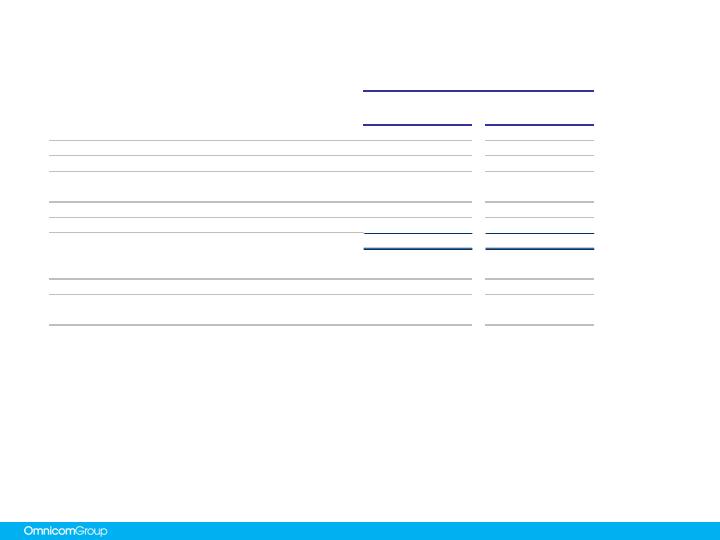

2009 vs. 2008 P&L Summary

April 27, 2009

2

(a)

On January 1, 2009 we adopted SFAS 160, Noncontrolling Interests in Consolidated Financial Statements - an amendment of

ARB No. 51. In accordance with the presentation requirements of SFAS 160, we have reclassified the amounts reported previously

as minority interest expense in 2008 as noncontrolling interests to be consistent with the 2009 presentation.

(b)

See pages 20-21 for supplemental earnings per share information.

2009

2008

% Δ

Revenue

$ 2,746.6

$ 3,195.4

-14.0%

Operating Income

282.4

350.8

-19.5%

% Margin

10.3%

11.0%

Net Interest Expense

21.4

11.0

Income Before Tax

261.0

339.8

-23.2%

% Margin

9.5%

10.6%

Taxes

88.7

115.2

% Tax Rate

34.0%

33.9%

Income from Equity Method Investments

5.9

8.1

Net Income (a)

178.2

232.7

Less: Net Income Attributed to Noncontrolling Interests (a)

(13.7)

(24.0)

Net Income - Omnicom Group

$ 164.5

$ 208.7

-21.2%

Net Income per Common Share - Omnicom Group - Diluted (b)

0.53

$

0.64

$

-17.2%

First Quarter

3

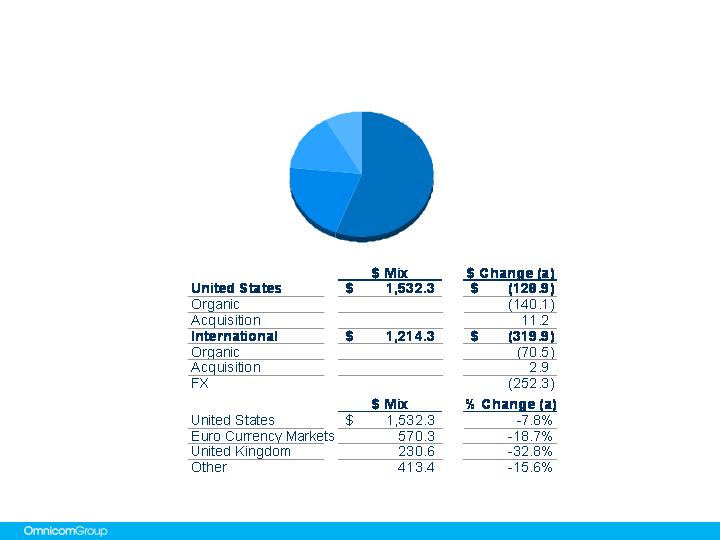

Total Revenue Growth – First Quarter 2009

April 27, 2009

(a)

To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates from the

equivalent prior period to arrive at constant currency revenue. The FX impact equals the difference between the current period revenue

in U.S. dollars and the current period revenue in constant currency.

(b)

Acquisition revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this number is

the revenue of any business included in the prior period reported revenue that was disposed of subsequent to the prior period.

(c)

Organic revenue is calculated by subtracting both the acquisition revenue and the FX impact from total revenue growth.

$

%

Prior Period Revenue

3,195.4

$

Foreign Exchange (FX) Impact (a)

(252.3)

-7.8%

Acquisition Revenue (b)

14.1

0.4%

Organic Revenue (c)

(210.6)

-6.6%

Current Period Revenue

2,746.6

$

-14.0%

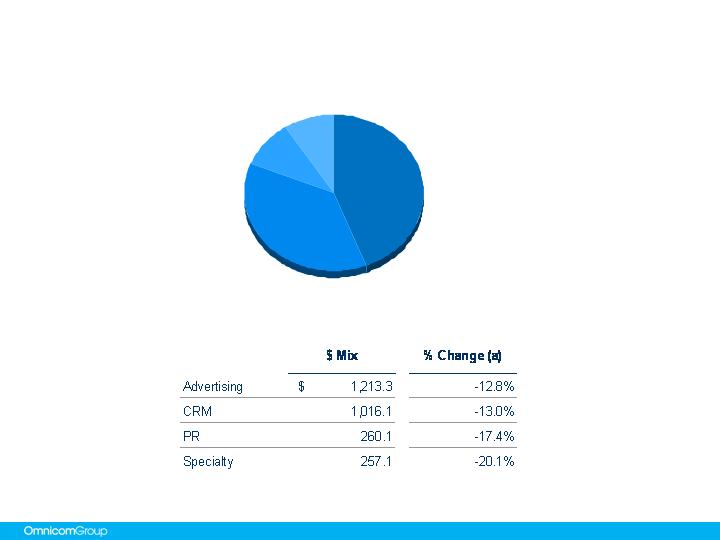

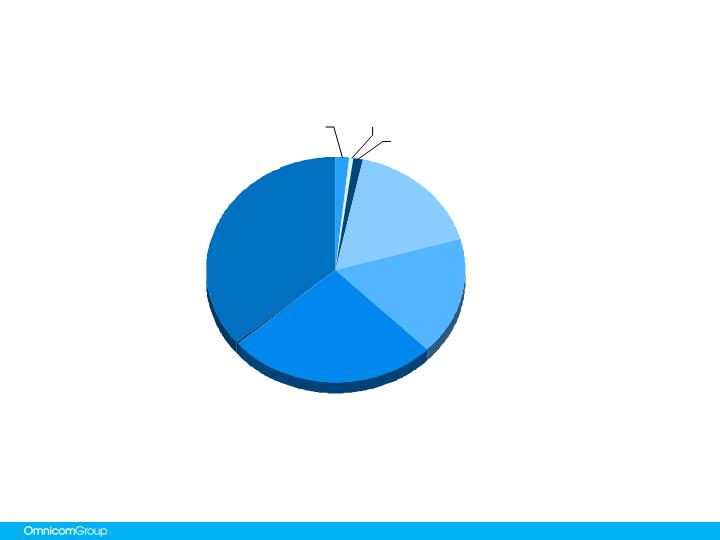

Revenue by Discipline – First Quarter 2009

April 27, 2009

4

(a)

“Change” is the year-over-year increase or decrease from the prior period.

CRM

37.0%

PR

9.5%

Specialty

9.3%

Advertising

44.2%

(a)

“Change” is the year-over-year increase or decrease from the prior period.

5

April 27, 2009

Revenue by Geography – First Quarter 2009

Euro

Markets

20.8%

U.S.

55.8%

Other

15.0%

U.K.

8.4%

6

Cash Flow – GAAP Presentation (condensed)

April 27, 2009

2009

2008

Net Income

Share-Based Compensation Expense

Depreciation and Amortization

Other Non-Cash Items to Reconcile to Net Cash Used for Operations

Other Changes in Operating Capital

Net Cash Used by Operations

Capital Expenditures

Acquisitions

Other Investing Activities, net

Net Cash (Used) Provided by Investing Activities

Dividends

Proceeds from Short-term Debt, net

Proceeds from Long-term Debt, net

Repayment of Convertible Debt

Stock Repurchases

Proceeds from Stock Plans

Excess Tax Benefit on Share-based Compensation

-

Other Financing Activities, net

Net Cash Used by Financing Activities

Effect of exchange rate changes on cash and cash equivalents

Net Decrease in Cash and Cash Equivalents

178.2

$

14.5

55.8

(2.8)

(474.1)

(228.4)

(23.3)

(3.1)

3.8

(22.6)

(46.7)

28.3

505.5

(841.8)

(1.8)

0.2

(14.2)

(370.5)

(63.4)

(684.9)

$

232.7

$

15.2

57.2

(3.5)

(809.2)

(507.6)

(42.2)

(89.0)

(3.7)

(134.9)

(49.1)

7.4

1.7

(0.1)

(316.0)

33.2

4.1

(21.7)

(340.5)

3.7

(979.3)

$

3 Months ended March 31,

Current Credit Picture

April 27, 2009

7

(a)

“EBITDA” and “Gross Interest Expense” calculations shown are for the twelve months ending March 31. EBITDA is defined as

operating income before interest, taxes, depreciation and amortization. Although EBITDA is a non-GAAP measure, we believe

EBITDA is more meaningful for purposes of this analysis because the financial covenants in our credit facilities are based on EBITDA

(see reconciliation of Operating Income to EBITDA on page 23).

2009

2008

EBITDA (a)

$

1,856

$

1,912

Gross Interest Expense (a)

$

126.0

$

104.5

EBITDA / Gross Interest Expense

14.7

x

18.3

x

Total Debt / EBITDA

1.5

x

1.6

x

Debt:

Bank Loans (Due Less Than 1 Year)

$

44

$

20

CP Issued Under $2.5B Revolver Due 6/23/11

30

-

Borrowings Under $2.5B Revolver Due 6/23/11

475

-

Convertible Notes Due 2/7/31

6

847

Convertible Notes Due 7/31/32

727

727

Convertible Notes Due 6/15/33

-

-

Convertible Notes Due 7/1/38

467

467

10 Year Notes Due 4/15/16

997

996

Other Debt

18

21

Total Debt

$

2,764

$

3,078

Cash and Short Term Investments

427

863

Net Debt

$

2,337

$

2,215

12 Months ended March 31,

8

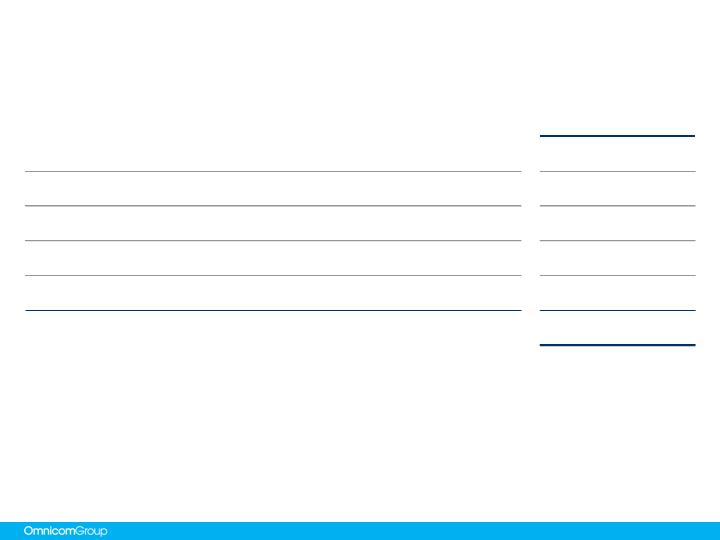

Current Liquidity Picture

April 27, 2009

(a)

Credit facility expires June 23, 2011.

(b)

Represents uncommitted facilities in the U.S., U.K. and Canada. These amounts are excluded from our available liquidity for purposes

of this presentation.

Total

Amount of

Facility

Outstanding

Available

Committed Facilities

Revolver & Commercial Paper (a)

2,500

$

505

$

1,995

$

Other Committed Credit Facilities

44

44

-

Total Committed Facilities

2,544

549

1,995

Uncommitted Facilities (b)

370

-

-

(b)

Total Credit Facilities

2,914

$

549

$

1,995

$

Cash and Short Term Investments

427

Total Liquidity Available

2,422

$

As of March 31, 2009

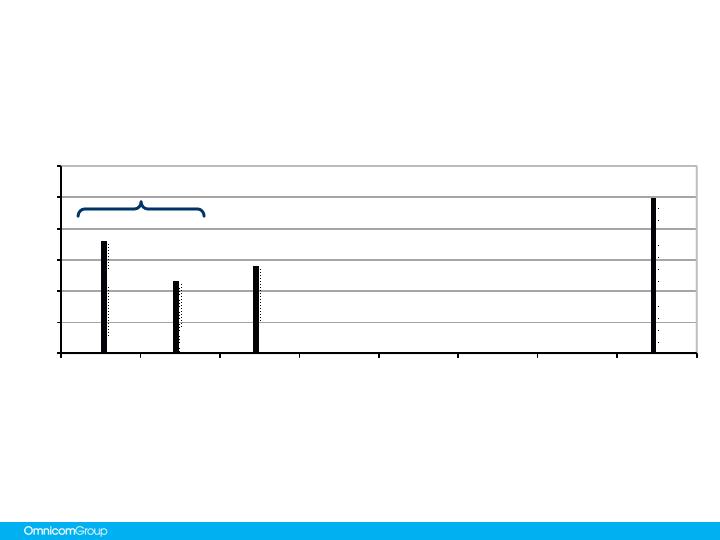

Omnicom Debt Structure

Supplemental Information

The above chart reflects Omnicom’s debt outstanding at March 31, 2009. The amount reflected above for the 10 Year Notes

represents the principal amount of these notes at maturity on April 15, 2016.

10

April 27, 2009

Omnicom Debt Structure

Other Debt

$18

Short-term

Borrowings

$44

Commercial Paper

$30

2031 Convert

$6

Revolver

Borrowing

$475

2038

Convert

$467

2032

Convert

$727

10 Year Notes

$1,000

Omnicom Debt Structure

April 27, 2009

11

The Bank Facility and Commercial Paper Program together provide liquidity in the event any

convertible notes are put. We then have flexibility to refinance in different debt capital

markets.

Our 2031 Notes are putable annually, with the next put date in February 2010. Our 2032 Notes are putable annually, with the

next put date in July 2009. Our 2038 Notes are putable in June 2010, 2013, 2018, 2023 and annually thereafter.

For purposes of this presentation we have included the following borrowings as of March 31, 2009 as outstanding through

June 2011, the date of expiration of our five-year credit facility: short-term borrowings of $44 million, revolver borrowings of

$475 million, commercial paper of $30 million and and other debt of $18 million. We believe that this presentation is more

meaningful for purposes of understanding how we evaluate the maturities of our debt structure.

Revolver

and Other

Borrowings

$1.2 Billion

Senior Convertible Notes

$1.0 Billion

10-Year Note

2038

2032

2031

$0

$200

$400

$600

$800

$1,000

$1,200

Jan

-

09

Jan

-

10

Jan

-

11

Jan

-

12

Jan

-

13

Jan

-

14

Jan

-

15

Jan

-

16

Senior Notes Due 2016

April 27, 2009

12

Principal Amount

$1 Billion

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 29, 2006

Maturity

April 15, 2016

Security

Unsecured, pari passu with Bank Facility

Coupon

5.90%

Spread Over Comparable Treasury at Issue

1.30%

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2031 Convertible Notes

April 27, 2009

13

Principal Amount

$6 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

February 7, 2001

Maturity

February 7, 2031 with annual puts each February

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$55

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

Note: On February 9, 2009, $841.2 million aggregate principal amount of Omnicom’s convertible notes due 2031 were put

to Omnicom for purchase at par and $5.8 million of the notes remain outstanding. Omnicom borrowed $814.4 million under

its existing $2.5 billion five-year revolving credit facility. A partnership controlled by Omnicom and formed for the purpose of

buying the convertible notes used a portion of the proceeds under Omnicom’s borrowing to purchase $546.0 million

aggregate principal amount of convertible notes that were put. The controlled partnership purchased the convertible notes

with the intent to sell such notes back into the marketplace over the next 12 months if market conditions permit. The

partnership is consolidated within Omnicom’s financial statements.

Omnicom repurchased the remaining $295.2 million aggregate principal amount of the convertible notes that had been put,

all of which have been retired.

2032 Convertible Notes

April 27, 2009

14

Principal Amount

$727 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 6, 2002

Maturity

July 31, 2032 with annual puts each July

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$55

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2038 Convertible Notes

April 27, 2009

15

Principal Amount

$467 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

June 10, 2003

Maturity

June 15, 2038 with puts in June of 2010, 2013, 2018, 2023

and annually thereafter until maturity

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$51.50

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

Current Bank Credit Facility

April 27, 2009

16

Amount

$2.5 Billion

Type

Unsecured Revolving Credit

Maturity

5 Years – June 2011

Facility Fee

13BP per annum

Drawn Rate

Libor +17BP

Covenants

-Maximum Debt to EBITDA 3:1

-Minimum Interest Coverage 5:1

Current Bank Credit Facility – Distribution of 33 Banks

April 27, 2009

17

North America

Bank of America ($200)

Wells Fargo ($175)

Northern Trust ($50)

PNC ($50)

Union Bank of California ($50)

US Bancorp ($50)

Scotia ($40)

Comerica ($25)

Key ($25)

Fifth Third ($15)

Global

Citigroup ($100) • JPMorgan ($200) • HSBC ($200) • Royal Bank of Scotland ($150)

Europe

Societe Generale ($150)

Deutsche ($150)

BBVA ($100)

Commerzbank ($80)

Fortis ($70)

BNP Paribas ($60)

Barclays ($50)

Den Danske ($50)

UBS ($35)

Intesa San Paolo ($30)

ING ($25)

Nordea ($25)

Unicredit ($25)

Asia

Sumitomo ($100)

Bank of Tokyo ($50)

Mizuho ($50)

ANZ ($50)

Standard Chartered ($45)

Westpac ($25)

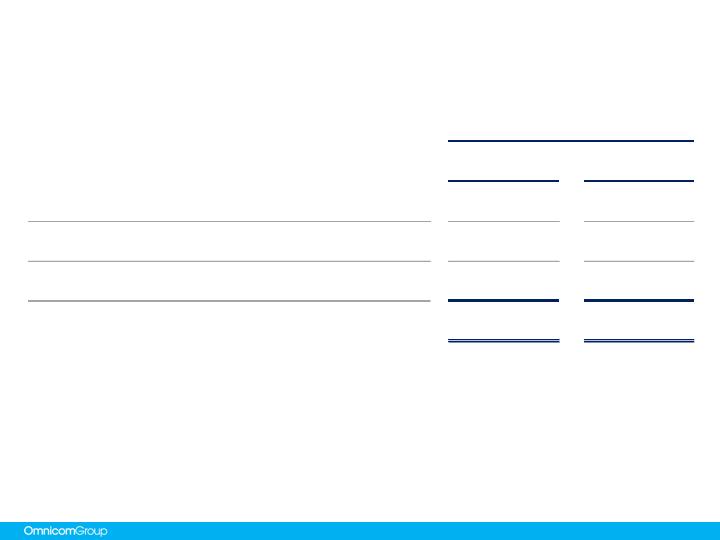

Current Omnicom Credit Ratings

April 27, 2009

18

Moody’s

S&P

Fitch

Long Term Ratings

Baa1

A-

A-

Short Term Ratings

P2

A2

F2

Outlook

Negative

Negative

Stable

Supplemental Financial Information

20

Q1 2009 vs. Q1 2008 Earnings Per Share (a)

April 27, 2009

a)

On January 1, 2009, we adopted FSP EITF 03-6-1 entitled “Determining Whether Instruments Granted in Share-Based

Payment Transactions Are Participating Securities”. Our unvested restricted stock awards pay dividends and therefore

qualify as participating securities. In accordance with EITF 03-6-1, Net income, for the purposes of the basic and diluted

EPS calculation is reduced for a presumed hypothetical distribution of earnings to the holders of the unvested restricted

stock. Accordingly, the effect of the allocation required under EITF 03-6-1 reduces Earnings Available to Common

Shareholders. Additionally, the unvested restricted shares were excluded from the calculation of diluted EPS because their

inclusion would have been anti-dilutive. The above information reflects the effect of the adoption on Earnings per Share as if

we adopted EITF 03-6-1 at the beginning of the period and the 2008 amounts have been adjusted (see page 21).

2009

2008

Net Income per Common Share - Omnicom Group:

Basic

$0.53

$0.65

Diluted

0.53

0.64

Earnings Available for Common Shares:

Net Income - Omnicom Group

$ 164.5

$ 208.7

Earnings Allocated to Participating Securities

(2.2)

(2.6)

Earnings Available for Common Shares

$ 162.3

$ 206.1

Weighted Average Shares (millions):

Basic

307.5

318.3

Diluted

307.6

320.1

Dividend Declared per Share

$0.150

$0.150

21

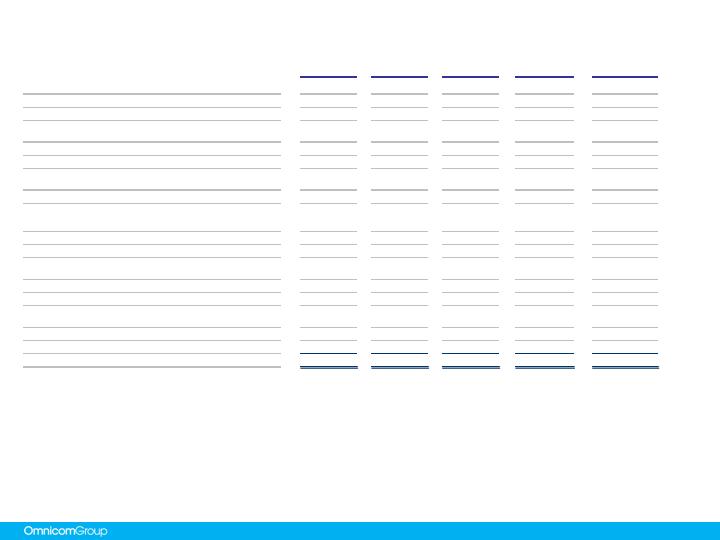

2008 Earnings Per Share Revised (a)

a)

On January 1, 2009, we adopted FSP EITF 03-6-1 entitled “Determining Whether Instruments Granted in Share-Based

Payment Transactions Are Participating Securities”. Our unvested restricted stock awards pay dividends and therefore

qualify as participating securities. In accordance with EITF 03-6-1, Net income, for the purposes of the basic and

diluted EPS calculation is reduced for a presumed hypothetical distribution of earnings to the holders of the unvested

restricted stock. Accordingly, the effect of the allocation required under EITF 03-6-1 reduces Earnings Available to

Common Shareholders. Additionally, the unvested restricted shares were excluded from the calculation of diluted EPS

because their inclusion would have been anti-dilutive. The above information reflects the effect of the adoption on

Earnings per Share as if we adopted EITF 03-6-1 at the beginning of the period and the 2008 amounts have been

adjusted.

April 27, 2009

Q1

Q2

Q3

Q4

Full Year

As Previously Presented:

Basic EPS

$0.65

$0.97

$0.69

$0.88

$3.20

Diluted EPS

0.65

0.96

0.69

0.88

3.17

Weighted Average Shares (millions):

Basic

318.6

317.5

309.1

307.2

313.0

Diluted

320.9

320.8

310.7

307.2

315.4

Net Income for EPS:

Diluted

$208.7

$307.0

$213.6

$271.0

$1,000.3

As Revised:

Basic EPS

$0.65

$0.96

$0.68

$0.87

$3.15

Diluted EPS

0.64

0.95

0.68

0.87

3.14

Weighted Average Shares (millions):

Basic

318.3

317.5

309.1

307.2

313.0

Diluted

320.1

319.6

310.3

307.2

314.8

Earnings Available for Common Shares:

Net Income - Omnicom Group

$208.7

$307.0

$213.6

$271.0

$1,000.3

Earnings Allocated to Participating Securities

(2.6)

(3.1)

(3.1)

(3.9)

(12.8)

Earnings Available for Common Shares

$206.1

$303.9

$210.5

$267.1

$987.5

Acquisition Related Expenditures

April 27, 2009

22

a)

Includes acquisitions of a majority interest in agencies resulting in their consolidation.

b)

Includes acquisitions of additional equity interests in existing affiliate agencies resulting in their majority ownership and

consolidation.

c)

Includes acquisitions of less than a majority interest in agencies in which Omnicom did not have a prior equity interest and

the acquisition of additional interests in existing affiliated agencies that did not result in majority ownership.

d)

Includes the acquisition of additional equity interests in already consolidated subsidiary agencies. On January 1, 2009 we

adopted SFAS No. 160 “Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51”.

As required by SFAS 160, these transactions are now reported directly in equity.

e)

Includes additional consideration paid for acquisitions completed in prior periods.

First Quarter 2009

New Subsidiary Acquisitions (a)

-

$

Affiliates to Subsidiaries (b)

-

Affiliates (c)

-

Existing Subsidiaries (d)

1

Earn-outs (e)

2

Total Acquisition Expenditures

3

$

Reconciliation of Operating Income to EBITDA

April 27, 2009

23

The covenants contained in our credit facility are based on the EBITDA ratios as presented on pages 7 & 16 of this presentation.

The above reconciles our GAAP Operating Income to EBITDA for the periods presented.

EBITDA is a non-GAAP financial measure within the meaning of applicable SEC rules and regulations Our credit facility defines

EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses

EBITDA to measure our compliance with covenants, such as interest coverage and leverage. EBITDA is not, and should not, be

used as a substitute for Operating Income as determined in accordance with GAAP and is only used to measure our compliance

with our debt covenants. Management does not use EBITDA for any other measurement purpose.

2009

2008

Operating Income

1,621

$

1,694

$

Depreciation

181

171

Amortization

54

47

EBITDA

1,856

$

1,912

$

12 Months ended March 31,