Exhibit 99.2

Second Quarter

2014 Results

July 22, 2014

Investor Presentation

2014 vs. 2013 P&L Summary – Second Quarter

Second Quarter

2014 Reported 2013 Reported

Revenue$ 3,870.9 $ 3,637.0

EBITA(a) (b)574.2 548.3

Margin % 14.8% 15.1%

Amortization of Intangibles25.8 25.3

Operating Income(b)$ 548.4 $ 523.0

Margin % 14.2% 14.4%

(a) EBITA is a non-GAAP financial measure. See page 29 for the definition of this measure and page 24 for the reconciliation of non-GAAP measures.

(b) 2014 EBITA and Operating Income includes $1.8 million of expenses related to the proposed merger with Publicis Groupe S.A. (“Publicis”). On May 8, 2014 the proposed merger with Publicis was terminated.

July 22, 2014 1

2014 vs. 2013 P&L Summary – Second Quarter

Second Quarter

2014 Reported 2013 Reported

Operating Income$ 548.4 $ 523.0

Net Interest Expense33.7 40.7

Income Taxes(a)160.3 163.6Tax Rate %(a)31.1% 33.9% Income from Equity Method Investments4.0 2.9

Noncontrolling Interests33.2 32.1

Net Income - Omnicom Group$ 325.2 $ 289.5

(a) Income taxes and the effective tax rate for the 3 months ended June 30, 2014 reflects the recognition of an income tax benefit of $11.2 million related to previously incurred expenses for the proposed merger with Publicis. On May 8, 2014, the proposed merger with Publicis was terminated. Prior to the termination of the merger, the majority of the merger costs were capitalized for income tax purposes and the related tax benefits were not recorded. Because the merger was terminated, the merger costs were no longer required to be capitalized for income tax purposes.

July 22, 2014 2

2014 vs. 2013 Earnings Per Share – Second Quarter

Second Quarter

2014 Reported 2013 Reported

Net Income - Omnicom Group$ 325.2 $ 289.5

Net Income allocated to Participating Securities(6.3) (7.8)

Net Income available for common shares$ 318.9 $ 281.7

Diluted Shares (millions)258.2 259.2

EPS - Diluted(a)$ 1.23 $ 1.09

Dividend Declared per Share$ 0.50 $ 0.40

(a) As a result of the merger expenses and the related tax benefits, the impact on 2014 EPS – Diluted was $0.03 per common share.

July 22, 2014 3

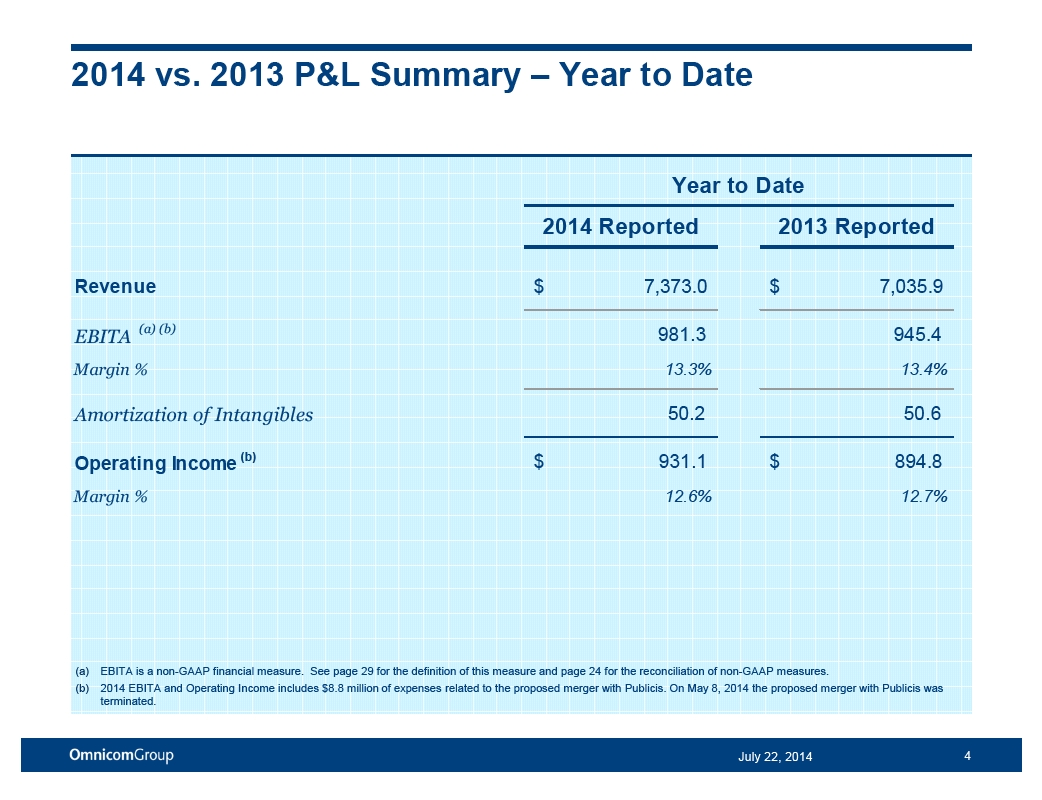

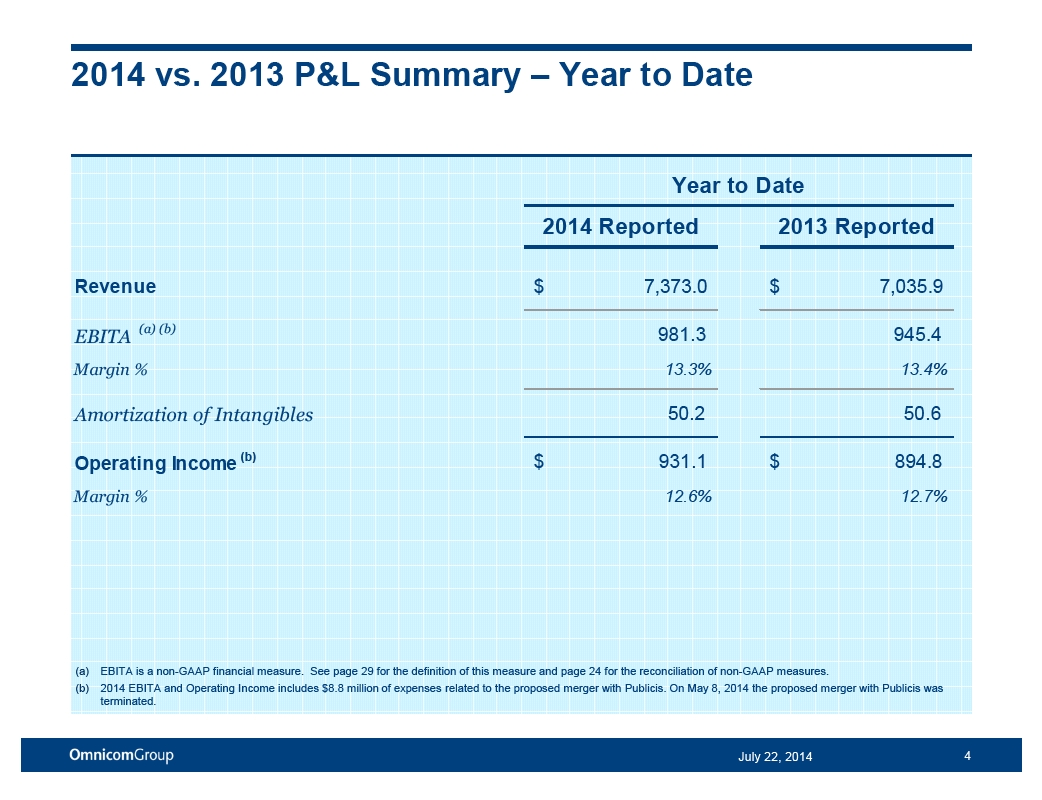

2014 vs. 2013 P&L Summary – Year to Date

Year to Date

2014 Reported 2013 Reported

Revenue$ 7,373.0 $ 7,035.9

EBITA(a) (b)981.3 945.4

Margin % 13.3% 13.4%

Amortization of Intangibles50.2 50.6

Operating Income(b)$ 931.1 $ 894.8

Margin % 12.6% 12.7%

(a) EBITA is a non-GAAP financial measure. See page 29 for the definition of this measure and page 24 for the reconciliation of non-GAAP measures.

(b) 2014 EBITA and Operating Income includes $8.8 million of expenses related to the proposed merger with Publicis. On May 8, 2014 the proposed merger with Publicis was terminated.

July 22, 2014 4

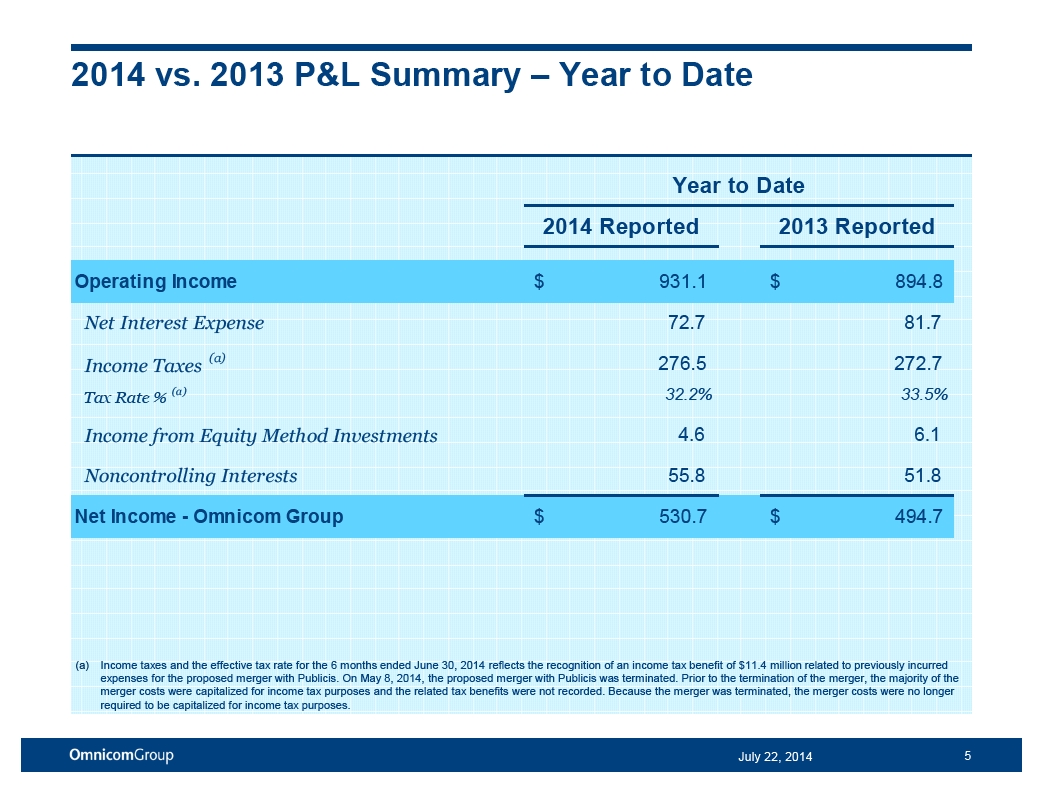

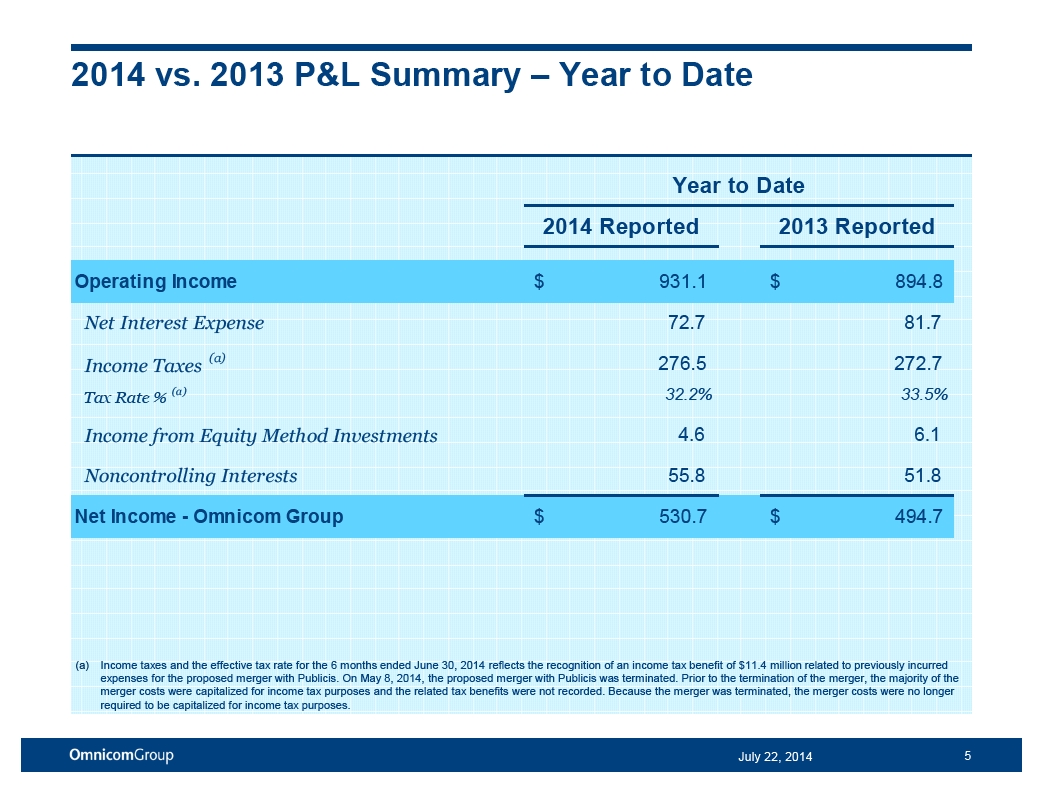

2014 vs. 2013 P&L Summary – Year to Date

Year to Date

2014 Reported 2013 Reported

Operating Income$ 931.1 $ 894.8

Net Interest Expense72.7 81.7

Income Taxes(a)276.5 272.7Tax Rate %(a)32.2% 33.5% Income from Equity Method Investments4.6 6.1

Noncontrolling Interests55.8 51.8

Net Income - Omnicom Group$ 530.7 $ 494.7

(a) Income taxes and the effective tax rate for the 6 months ended June 30, 2014 reflects the recognition of an income tax benefit of $11.4 million related to previously incurred expenses for the proposed merger with Publicis. On May 8, 2014, the proposed merger with Publicis was terminated. Prior to the termination of the merger, the majority of the merger costs were capitalized for income tax purposes and the related tax benefits were not recorded. Because the merger was terminated, the merger costs were no longer required to be capitalized for income tax purposes.

July 22, 2014 5

2014 vs. 2013 Earnings Per Share – Year to Date

Year to Date

2014 Reported 2013 Reported

Net Income - Omnicom Group$ 530.7 $ 494.7

Net Income allocated to Participating Securities(10.4) (13.4)

Net Income available for common shares$ 520.3 $ 481.3

Diluted Shares (millions)259.8 260.7

EPS - Diluted(a)$ 2.00 $ 1.85

Dividend Declared per Share$ 0.90 $ 0.80

(a) As a result of the merger expenses and the related tax benefits, the impact on 2014 EPS – Diluted was $0.01 per common share.

July 22, 2014 6

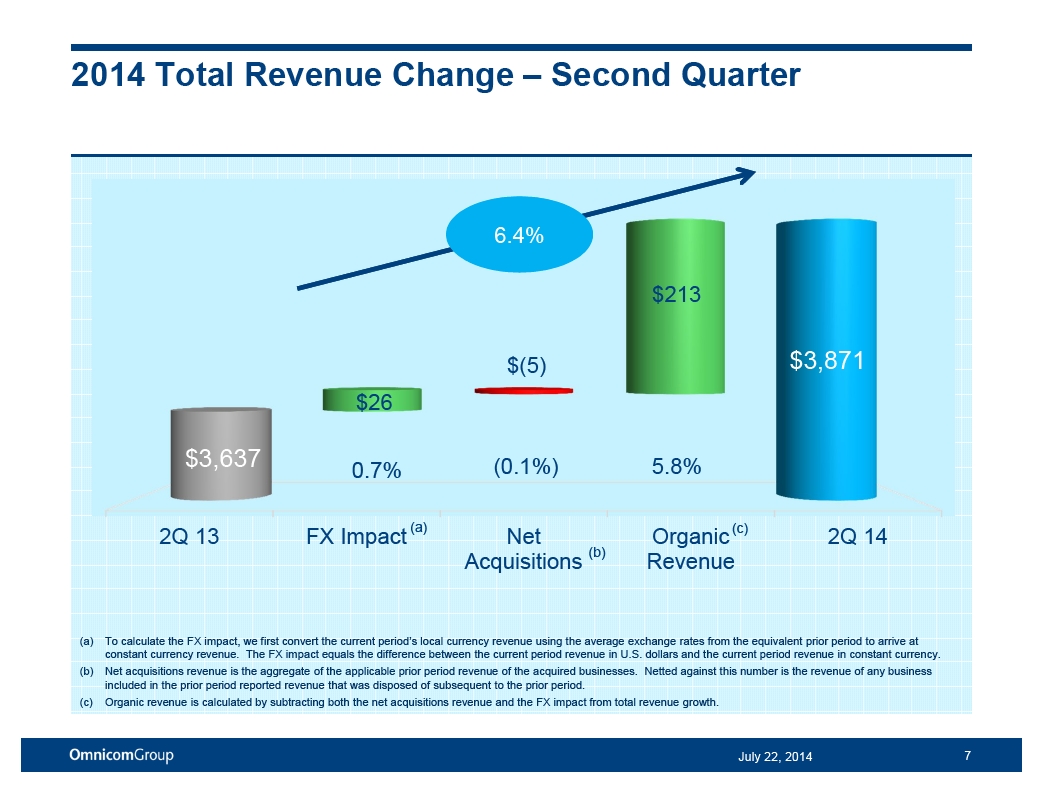

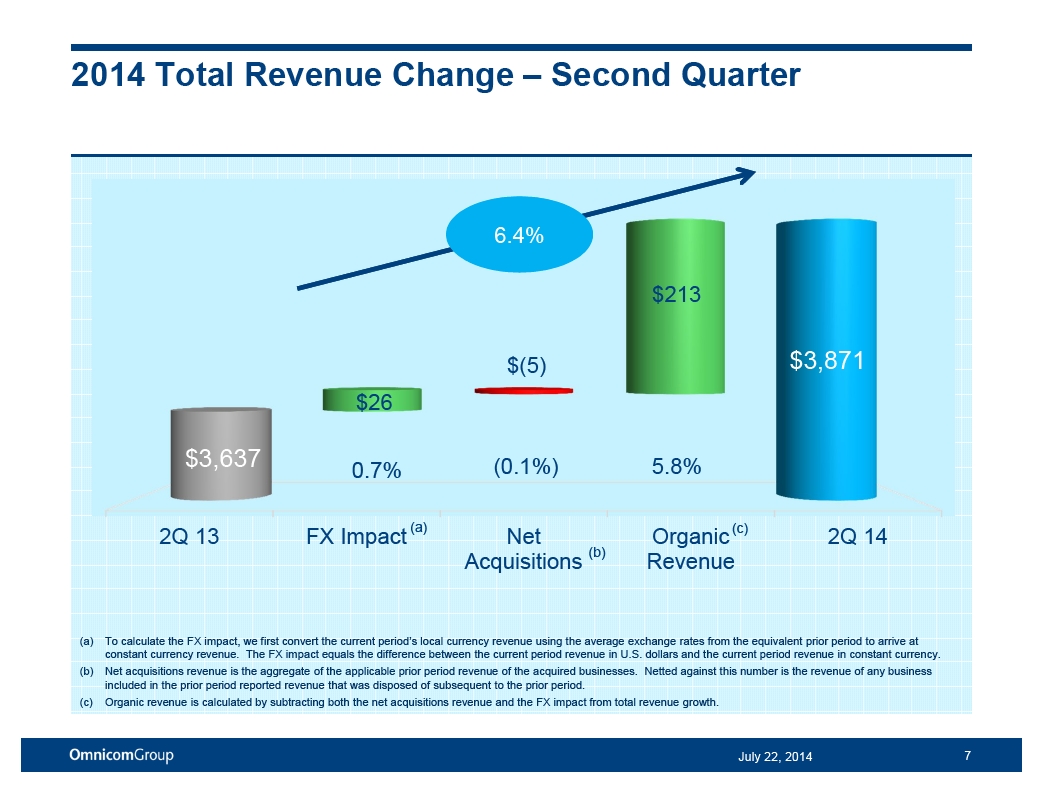

2014 Total Revenue Change – Second Quarter

6.4%

$213

$(5) $3,871

$26

$3,637 (0.1%) 5.8% 0.7%

2Q 13 FX Impact (a) Net Organic(c) 2Q 14 Acquisitions (b) Revenue

(a) To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates from the equivalent prior period to arrive at constant currency revenue. The FX impact equals the difference between the current period revenue in U.S. dollars and the current period revenue in constant currency.

(b) Net acquisitions revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this number is the revenue of any business included in the prior period reported revenue that was disposed of subsequent to the prior period.

(c) Organic revenue is calculated by subtracting both the net acquisitions revenue and the FX impact from total revenue growth.

July 22, 2014 7

2014 Total Revenue Change – Year to Date

4.8%

$360

$7,373

$4 $(27)

$7,036 0.1% (0.4%) 5.1%

YTD 2Q 13 FX Impact (a) Net Organic(c) YTD 2Q 14 Acquisitions (b) Revenue

(a) To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates from the equivalent prior period to arrive at constant currency revenue. The FX impact equals the difference between the current period revenue in U.S. dollars and the current period revenue in constant currency.

(b) Net acquisitions revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this number is the revenue of any business included in the prior period reported revenue that was disposed of subsequent to the prior period.

(c) Organic revenue is calculated by subtracting both the net acquisitions revenue and the FX impact from total revenue growth.

July 22, 2014 8

2014 Revenue by Discipline

Second Quarter Year to Date

Specialty Specialty 7.0% 7.1% PR PR

9.2% 9.3%

Advertising Advertising 49.3% 50.2%

CRM CRM 33.6% 34.3%

% Organic % Organic $ Mix % Growth Growth(a)$ Mix % Growth Growth(a)

Advertising$ 1,944.6 10.9% 10.5%Advertising$ 3,638.1 7.0% 7.8%CRM1,298.3 3.0% 1.1%CRM2,528.8 3.7% 2.7%PR357.0 6.2% 4.1%PR682.5 4.3% 2.7%Specialty271.0 -5.2% 0.2%Specialty523.6 -3.4% 2.5%

(a) “Organic Growth” reflects the year-over-year increase or decrease in revenue from the prior period, excluding the FX Impact and Acquisition/Disposition Revenue, as defined on page 7.

July 22, 2014 9

2014 Revenue by Region

Second Quarter Year to Date

Latin Africa Latin Africa America MidEast America MidEast 2.9% 1.6% 2.8% 1.6%

Asia Asia Pacific Pacific 10.3% 10.4%

North North Europe America Europe 28.6% America 28.6% 56.5% 56.7%

July 22, 2014 10

2014 Revenue by Region

Second Quarter Year to Date

% Organic % Organic $ Mix % Growth Growth(a)$ Mix % Growth Growth(a)

North America$ 2,184.9 6.6% 7.9%North America$ 4,177.9 4.7% 6.4%Europe1,108.7 8.3% 2.1%Europe2,112.3 7.2% 2.2%Asia Pacific401.5 3.0% 5.1%Asia Pacific760.5 1.4% 5.4%Latin America112.7 1.7% 7.8%Latin America203.5 -2.6% 7.6%

Africa Mid East63.1 -0.2% 2.0%Africa Mid East118.8 0.7% 4.2%

(a) “Organic Growth” reflects the year-over-year increase or decrease in revenue from the prior period, excluding the FX Impact and Acquisition/Disposition Revenue, as defined on page 7.

July 22, 2014 11

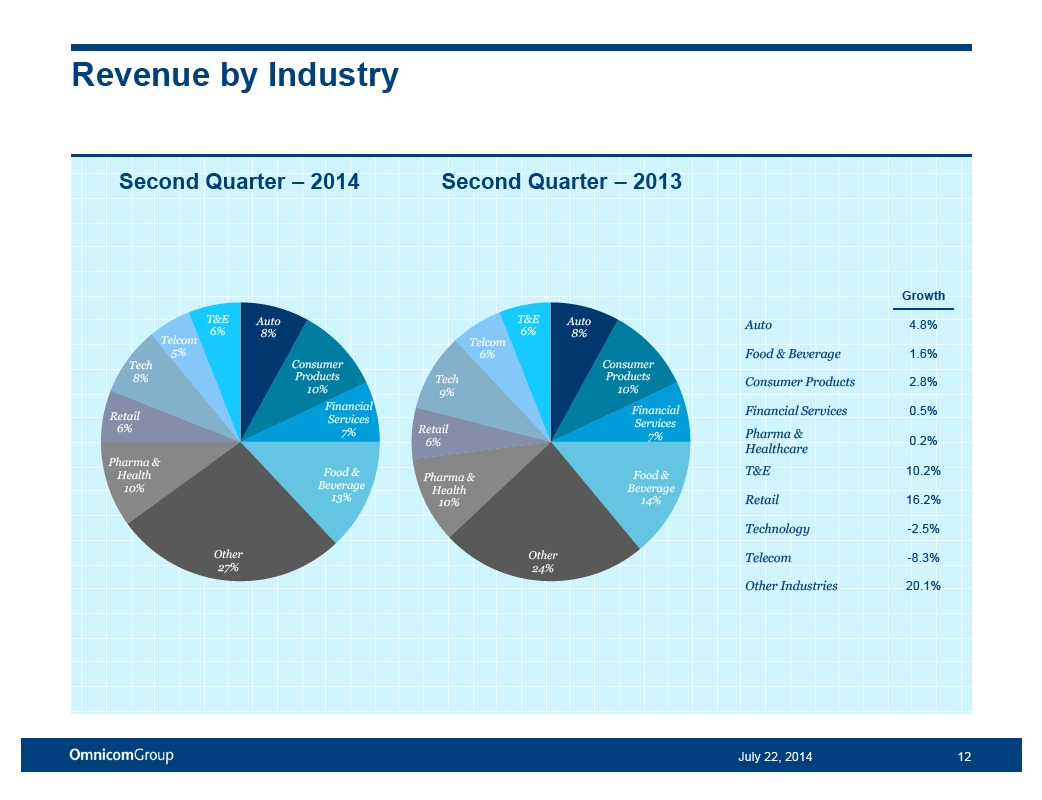

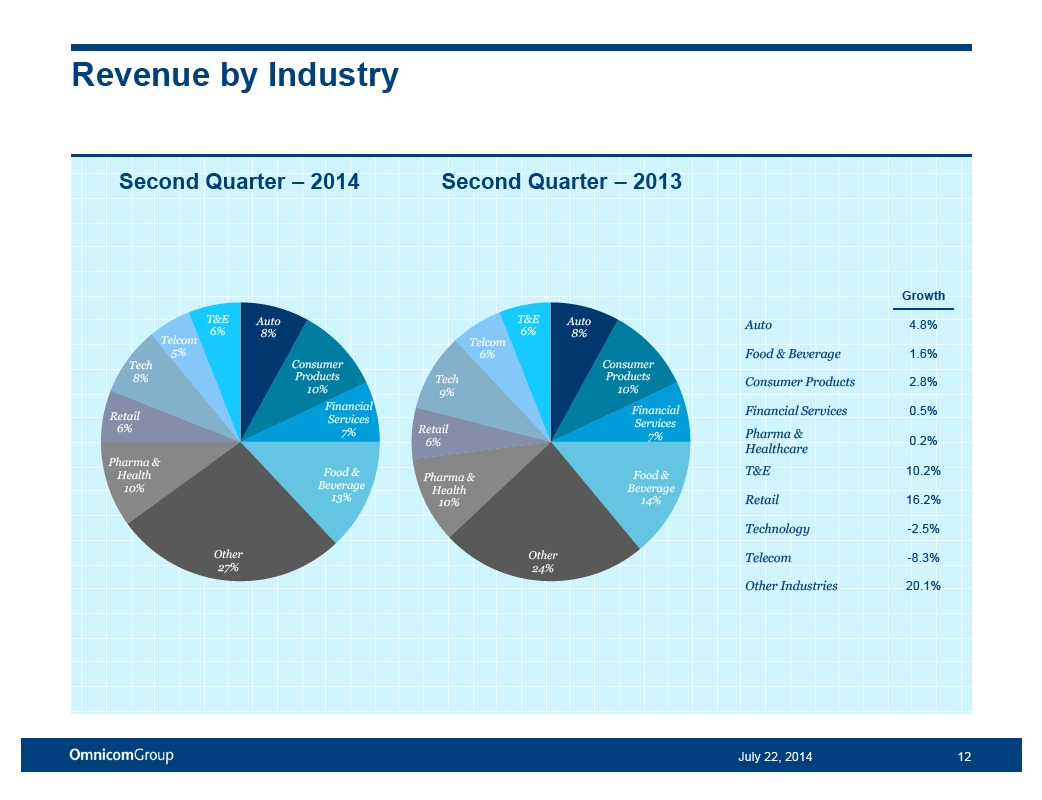

Revenue by Industry

Second Quarter – 2014 Second Quarter – 2013

Growth

T&E Auto T&E Auto Auto4.8%

6% 8% 6% 8% Telcom Telcom

5% 6% Food & Beverage1.6%Tech Consumer Consumer

8% Products Tech Products Consumer Products2.8%10% 9% 10% Financial Financial Financial Services0.5%Retail Services Services

6% 7% Retail Pharma &

7%0.2%

6%

Healthcare Pharma &

Health Food & Food & T&E10.2%Pharma & 10% Beverage Beverage Health 13% 14% Retail16.2%10%

Technology-2.5%

Other Other Telecom-8.3%27% 24% Other Industries20.1%

July 22, 2014 12

Cash Flow Performance

Six Months Ended June 30 2014 2013

Net Income $ 586.5 $ 546.5

Depreciation and Amortization Expense143.3 141.9

Share-Based Compensation Expense43.9 44.7

Other Non-Cash Items to Reconcile to Net Cash Provided by Operating

(14.3) (30.9)

Activities, net

Free Cash Flow(a)$ 759.4 $ 702.2

Additional information regarding our cash flows can be found in our condensed cash flow statement on page 23.

(a) The Free Cash Flow amounts presented above are non-GAAP financial measures. See page 29 for the definition of these measures and page 25 for the reconciliation of the non-GAAP measures.

July 22, 2014 13

Cash Flow Performance

Six Months Ended June 30 2014 2013

Free Cash Flow(a)$ 759.4 $ 702.2 Primary Uses of Cash:

Dividends(b)211.8 106.7Dividends paid to Noncontrolling Interest Shareholders66.5 59.9Capital Expenditures91.5 69.0Acquisitions and Payments for Additional Interest in Controlled Subsidiaries including Contingent Purchase Price Payments, net of105.4 45.5Proceeds from Sale of Investments Stock Repurchases, net of Proceeds from Stock Plans and Excess Tax

553.8 492.3

Benefit from Stock Plans

Primary Uses of Cash(a)1,029.0 773.4 Net Free Cash Flow(a)$ (269.6) $ (71.2)

Additional information regarding our cash flows can be found in our condensed cash flow statement on page 23.

(a) The Free Cash Flow, Primary Uses of Cash and Net Free Cash Flow amounts presented above are non-GAAP financial measures. See page 29 for the definition of these measures and page 25 for the reconciliation of non-GAAP measures.

(b) In December 2012, the Company paid its fourth quarter dividend, which historically was paid during January. As a result, there was only one dividend payment in the first six months of 2013.

July 22, 2014 14

Current Credit Picture

Twelve Months Ended June 30 2014 Reported 2013 Reported

EBITDA(a)$ 2,147.9 $ 2,116.0

Gross Interest Expense192.1 195.4EBITDA / Gross Interest Expense11.2 x 10.8 xTotal Debt / EBITDA1.9 x 1.9 xNet Debt(b)/ EBITDA1.2 x 1.2 x

Debt

Bank Loans (Due Less Than 1 Year)$ 25 $ 13CP & Borrowings Issued Under Revolver- -Convertible Notes(c)253 253Senior Notes(c)3,750 3,750Other Debt35 35

Total Debt $ 4,063 $ 4,051

Cash and Short Term Investments1,545 1,415

Net Debt(b)$ 2,518 $ 2,636

(a) EBITDA is a non-GAAP financial measure. See page 29 for the definition of this measure and page 24 for the reconciliation of non-GAAP measures. (b) Net Debt is a non-GAAP financial measure. See page 29 for the definition of this measure.

(c) See pages 19 and 20 for additional information on our Convertible Notes and Senior Notes.

July 22, 2014 15

Historical Returns

Return on Invested Capital (ROIC)(a):

Twelve Months Ended June 30, 201416.9%Twelve Months Ended June 30, 201317.5%

Return on Equity(b):

Twelve Months Ended June 30, 201431.5%Twelve Months Ended June 30, 201331.8%

(a) Return on Invested Capital is After Tax Reported Operating Income (a non-GAAP measure – see page 29 for the definition of this measure and page 25 for the reconciliation of non-GAAP measures) divided by the average of Invested Capital at the beginning and the end of the period Capital (book value of all long-term liabilities and short-term interest bearing debt plus shareholders’ equity less cash, cash equivalents and short term investments).

(b) Return on Equity is Reported Net Income for the given period divided by the average of shareholders’ equity at the beginning and end of the period.

July 22, 2014 16

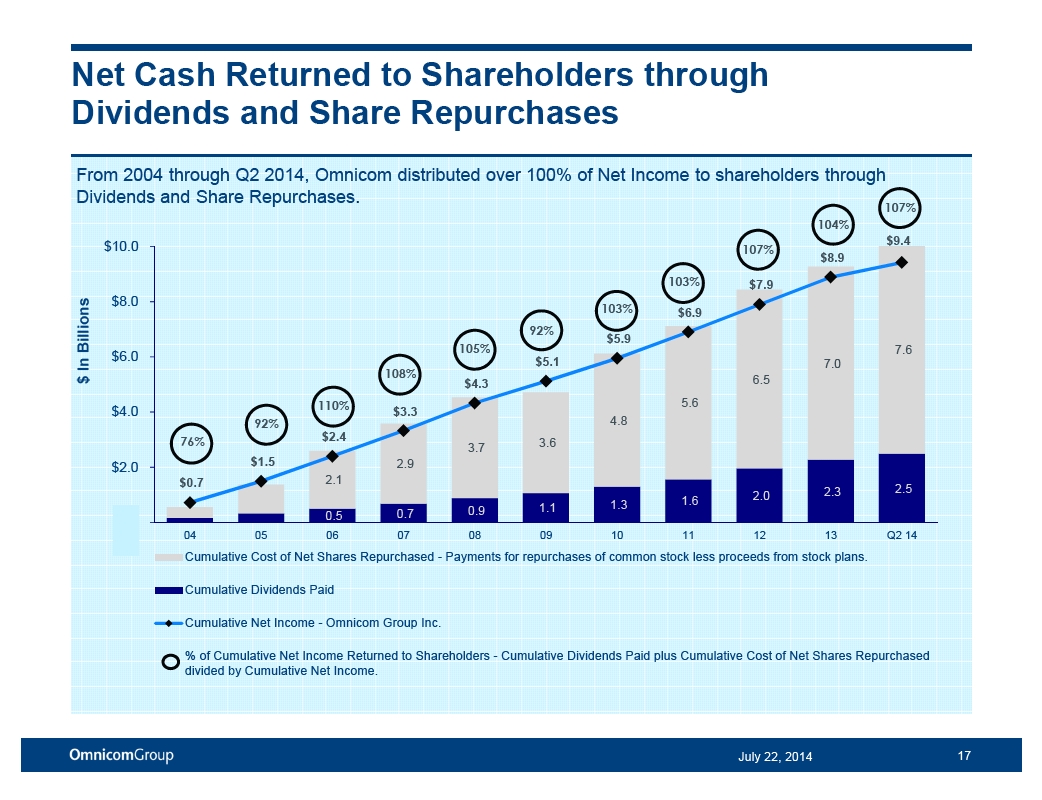

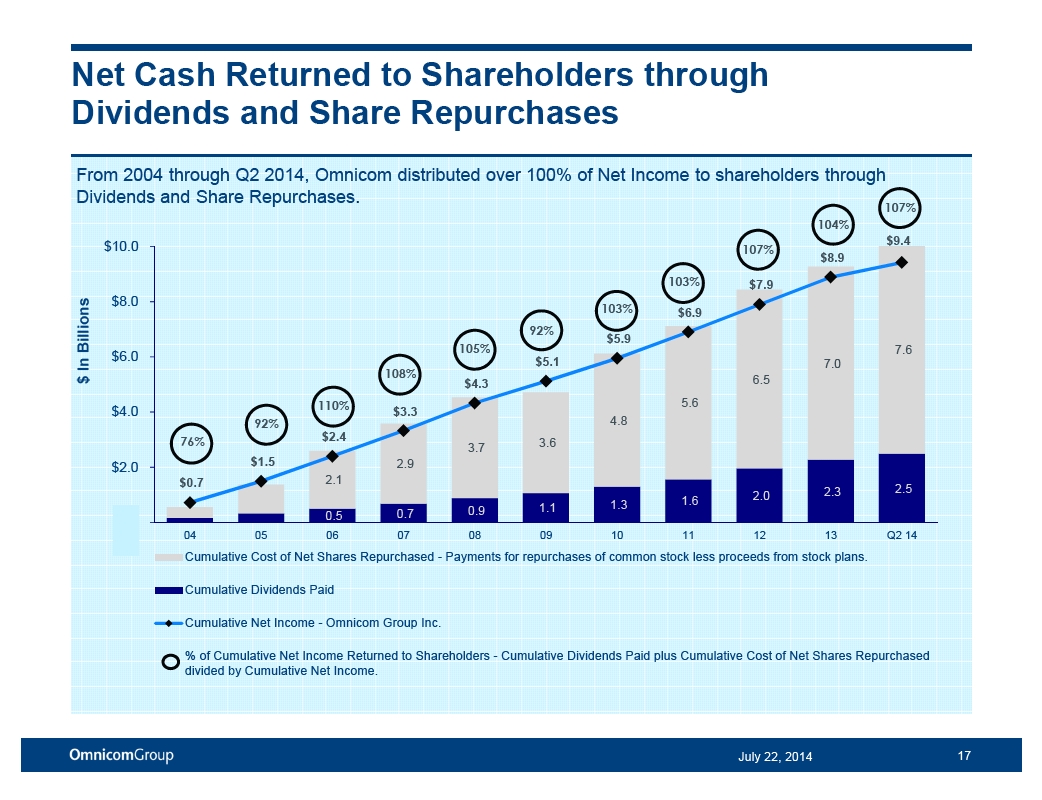

Net Cash Returned to Shareholders through Dividends and Share Repurchases

From 2004 through Q2 2014, Omnicom distributed over 100% of Net Income to shareholders through Dividends and Share Repurchases.

107% 104%$10.0$9.4

107% $8.9

103% $7.9

Billions$8.0

103% $6.9 92% $5.9

105%7.6 $6.0$5.1 In7.0

108% $ $4.36.5

110%5.6 $4.0$3.3

92%4.8

76% $2.4

3.7 3.6 $2.0$1.52.9$0.72.1

2.3 2.5 1.6 2.0 1.1 1.3 0.5 0.7 0.9

04 05 06 07 08 09 10 11 12 13 Q2 14 Cumulative Cost of Net Shares Repurchased - Payments for repurchases of common stock less proceeds from stock plans.

Cumulative Dividends Paid

Cumulative Net Income - Omnicom Group Inc.

% of Cumulative Net Income Returned to Shareholders - Cumulative Dividends Paid plus Cumulative Cost of Net Shares Repurchased divided by Cumulative Net Income.

July 22, 2014 17

Supplemental Financial Information

July 22, 2014 18

Omnicom Debt Structure

Bank Loans $25

2032 Convert $253

2016 Senior Notes $1,000

2022 Senior Notes $1,250 2019 Senior Notes $500

2020 Senior Notes $1,000

On June 5, 2014, we called our 2032 Convertible Notes for redemption on July 31, 2014 at a redemption price of 100% of the principal amount. As provided in the indenture governing the 2032 Convertible Notes, prior to redemption the noteholders have the right to convert their notes into shares of our common stock at a conversion rate of 18.463 shares per $1,000 principal amount at any time prior to July 29, 2014.

The above chart sets forth Omnicom’s debt outstanding at June 30, 2014. The amounts reflected above for the 2016, 2019, 2020 and 2022 Senior Notes represent the principal amount of these notes at maturity on April 15, 2016, July 15, 2019, August 15, 2020 and May 1, 2022, respectively.

July 22, 2014 19

Omnicom Debt Maturity Profile

2022 Senior Notes$1,250

2016 2020 Senior Notes Senior Notes$1,000

$750

2019 Senior Notes$500

2032 Converts$250

Other Borrowings$0

On June 5, 2014, we called our 2032 Convertible Notes for redemption on July 31, 2014 at a redemption price of 100% of the principal amount. As provided in the indenture governing the 2032 Convertible Notes, prior to redemption the noteholders have the right to convert their notes into shares of our common stock at a conversion rate of 18.463 shares per $1,000 principal amount at any time prior to July 29, 2014.

Other borrowings at June 30, 2014 include short-term borrowings of $25 million which are due in less than one year. For purposes of this presentation we have included these borrowings as outstanding through October 2016, the date of expiration of our five-year credit facility.

July 22, 2014 20

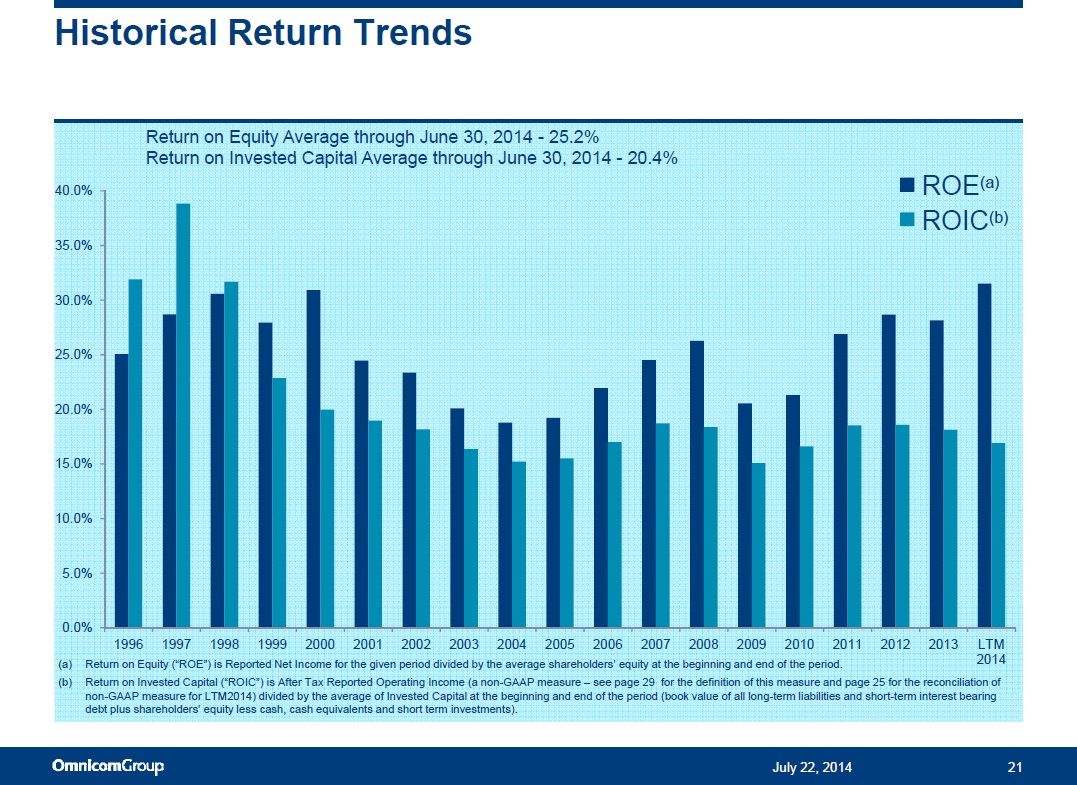

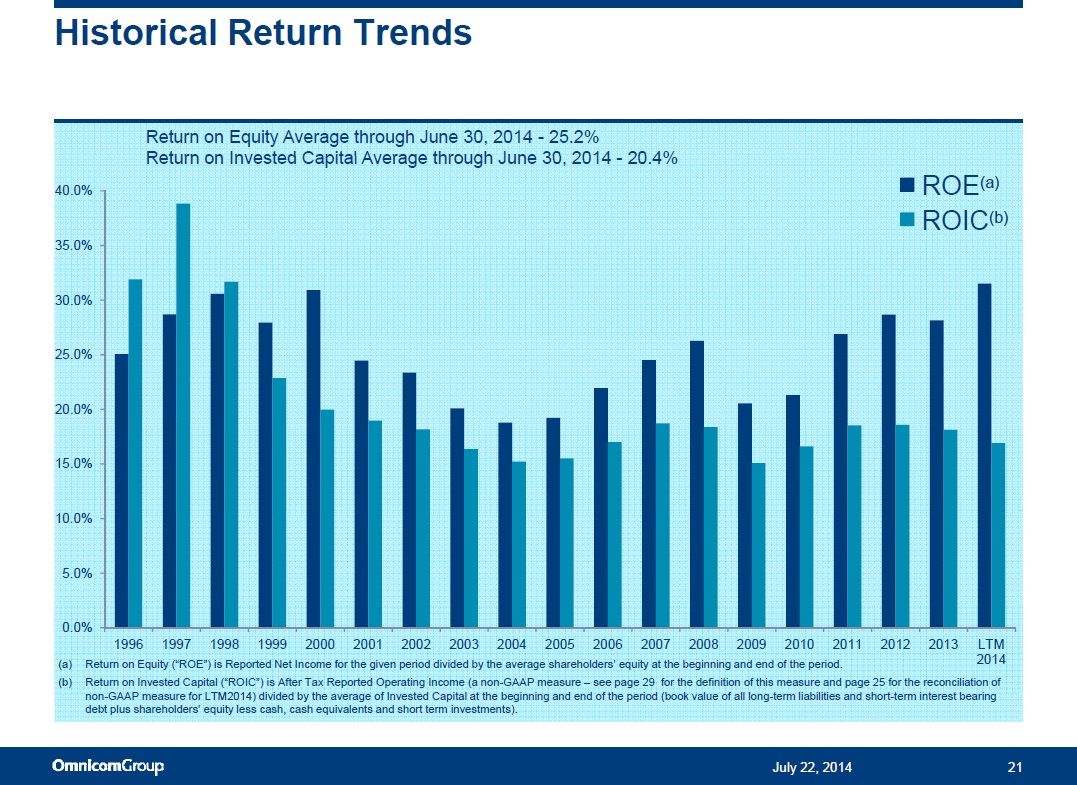

Historical Return Trends

Return on Equity Average through June 30, 2014 - 25.2%

Return on Invested Capital Average through June 30, 2014 - 20.4%

40.0% ROE(a)ROIC(b)

35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0%

0.0%

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 LTM (a) Return on Equity (“ROE”) is Reported Net Income for the given period divided by the average shareholders’ equity at the beginning and end of the period. 2014 (b) Return on Invested Capital (“ROIC”) is After Tax Reported Operating Income (a non-GAAP measure – see page 32 for the definition of this measure and page 28 for the reconciliation of non-GAAP measures) divided by the average of Invested Capital at the beginning and end of the period (book value of all long-term liabilities and short-term interest bearing debt plus shareholders’ equity less cash, cash equivalents and short term investments).

July 22, 2014 21

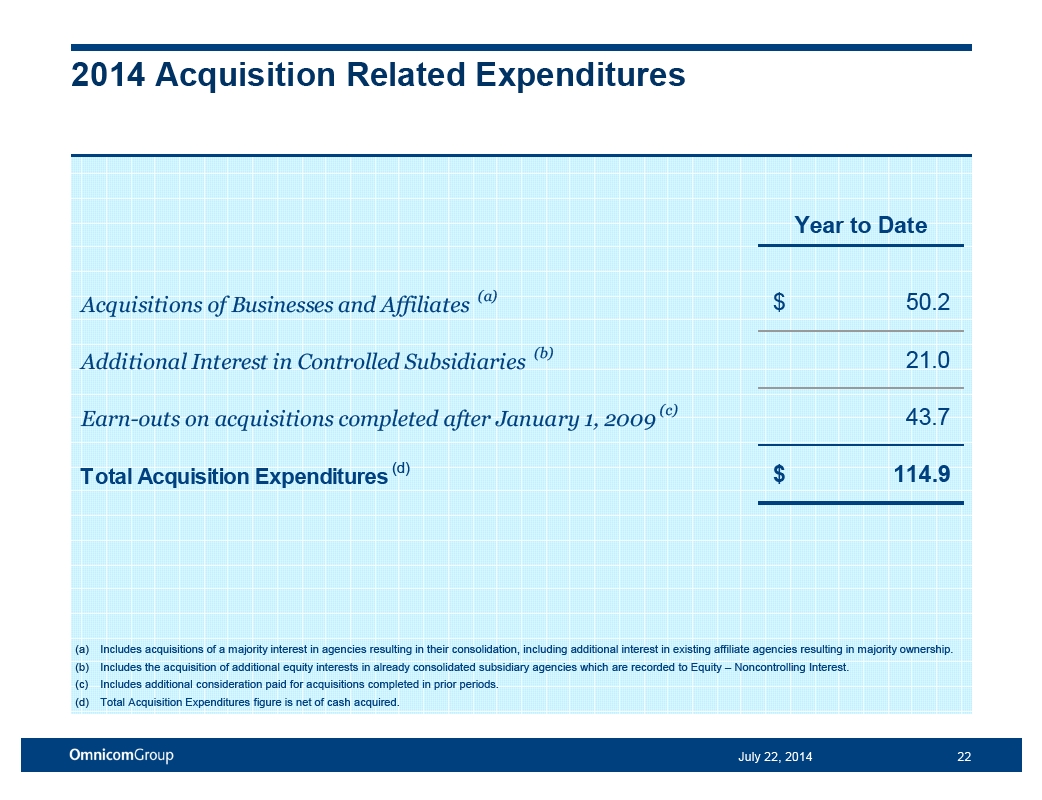

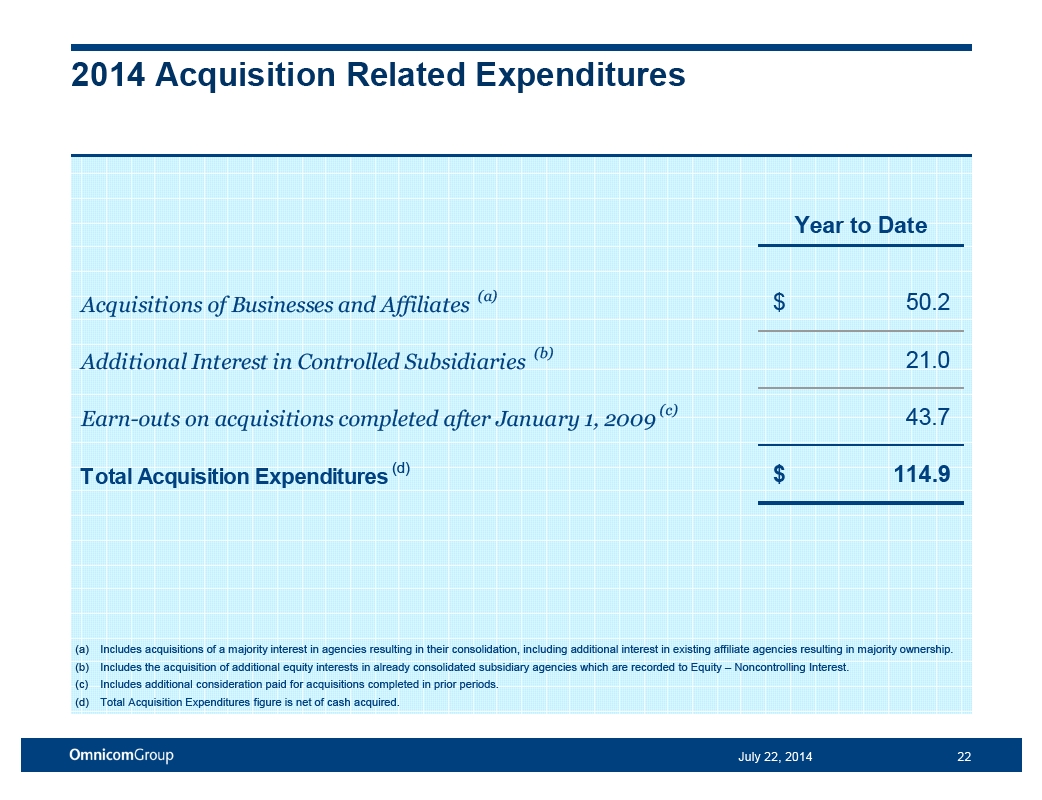

2014 Acquisition Related Expenditures

Year to Date

Acquisitions of Businesses and Affiliates(a)$ 50.2Additional Interest in Controlled Subsidiaries(b)21.0Earn-outs on acquisitions completed after January 1, 2009(c)43.7

Total Acquisition Expenditures(d)$ 114.9

(a) Includes acquisitions of a majority interest in agencies resulting in their consolidation, including additional interest in existing affiliate agencies resulting in majority ownership. (b) Includes the acquisition of additional equity interests in already consolidated subsidiary agencies which are recorded to Equity – Noncontrolling Interest.

(c) Includes additional consideration paid for acquisitions completed in prior periods. (d) Total Acquisition Expenditures figure is net of cash acquired.

July 22, 2014 22

Condensed Cash Flow

Six Months Ended June 30 2014 2013 Net Income $ 586.5 $ 546.5

Share-Based Compensation Expense43.9 44.7Depreciation and Amortization143.3 141.9Other Non-Cash Items to Reconcile to Net Cash Provided by Operating Activities, net(14.3) (30.9)Changes in Operating Capital(946.9) (635.7)

Net Cash (Used In)/Provided By Operating Activities(187.5) 66.5

Capital Expenditures(91.5) (69.0)Acquisitions, net of Proceeds from Sale of Investments(40.7) (8.3)

Net Cash Used in Investing Activities(132.2) (77.3)

Dividends(211.8) (106.7)

Dividends paid to Noncontrolling Interest Shareholders(66.5) (59.9)Repayment of Convertible Debt- (406.7)Proceeds from Short-term & Long-term Debt, net18.3 6.9Stock Repurchases, net of Proceeds from Stock Plans and Excess Tax Benefit from Stock Plans(553.8) (492.3)Payments for Additional Interest in Controlled Subsidiaries(21.0) (5.4)Contingent Purchase Price Payments(43.7) (31.8)Other Financing Activities, net(13.9) (18.0)

Net Cash Used in Financing Activities(892.4) (1,113.9)

Effect of exchange rate changes on cash and cash equivalents36.3 (153.7)Net Decrease in Cash and Cash Equivalents $ (1,175.8) $ (1,278.4)

July 22, 2014 23

Reconciliation of Non-GAAP Measures

3 Months Ended June 30 12 Months Ended June 30

2014 Reported 2013 Reported 2014 Reported 2013 Reported Revenue$ 3,870.9 $ 3,637.0 $ 14,921.7 $ 14,387.1

Operating Expenses, excluding Depreciation and Amortization3,250.1 3,043.2 12,773.8 12,271.1

EBITDA620.8 593.8 2,147.9 2,116.0Depreciation46.6 45.5 185.9 182.2

Add: Merger Expenses1.8 - 50.2 -

EBITA excluding merger expenses576.0 548.3 2,012.2 1,933.8

Merger Expenses1.8 - 50.2 -

EBITA574.2 548.3 1,962.0 1,933.8

Amortization of Intangibles25.8 25.3 100.5 103.7

Operating Income548.4 523.0 1,861.5 1,830.1

Net Interest Expense33.7 40.7 155.3 162.3

Income Before Tax514.7 482.3 1,706.2 1,667.8Taxes160.3 163.6 569.0 528.7

Income from Equity Method Investments4.0 2.9 14.5 (15.4)

Net Income358.4 321.6 1,151.7 1,123.7

Less: Net Income Attributed to Noncontrolling Interests33.2 32.1 124.5 118.1

Net Income - Omnicom Group$ 325.2 $ 289.5 $ 1,027.2 $ 1,005.6

The above reconciles EBITDA & EBITA, excluding merger expenditures and EBITA to the GAAP financial measures for the periods presented.

EBITDA, EBITA and EBITA excluding acquisition expenses incurred primarily in connection with Omnicom’s merger with Publicis are non-GAAP financial measures within the meaning of applicable SEC rules and regulations. Our credit facility defines EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses EBITDA to measure our compliance with covenants, such as interest coverage and leverage ratios, as presented on page 15 of this presentation.

July 22, 2014 24

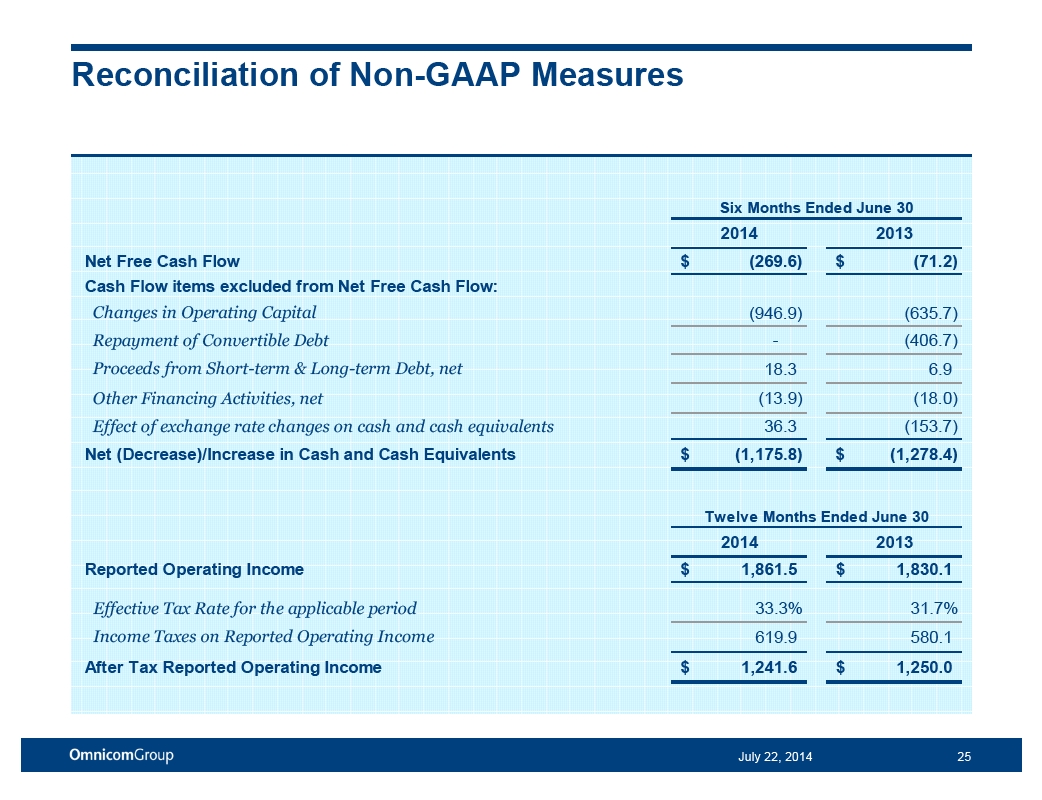

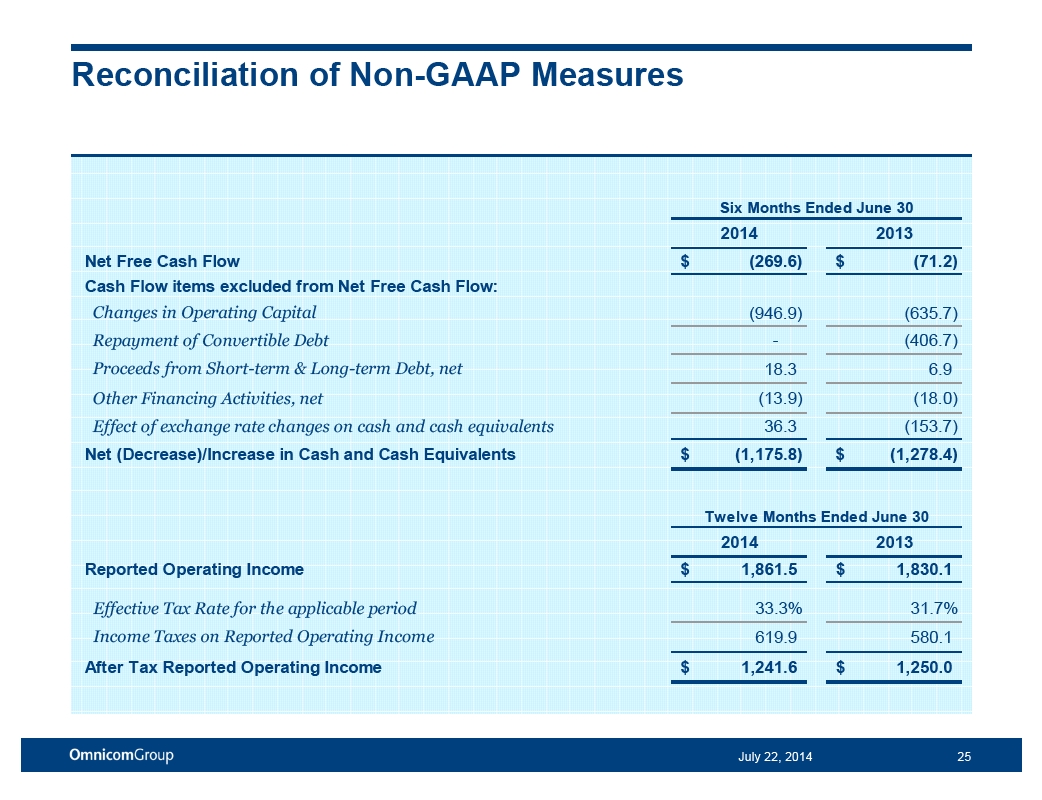

Reconciliation of Non-GAAP Measures

Six Months Ended June 30 2014 2013 Net Free Cash Flow $ (269.6) $ (71.2) Cash Flow items excluded from Net Free Cash Flow:

Changes in Operating Capital(946.9) (635.7)Repayment of Convertible Debt- (406.7)Proceeds from Short-term & Long-term Debt, net18.3 6.9Other Financing Activities, net(13.9) (18.0)Effect of exchange rate changes on cash and cash equivalents36.3 (153.7)

Net (Decrease)/Increase in Cash and Cash Equivalents $ (1,175.8) $ (1,278.4)

Twelve Months Ended June 30 2014 2013 Reported Operating Income $ 1,861.5 $ 1,830.1

Effective Tax Rate for the applicable period33.3% 31.7%Income Taxes on Reported Operating Income619.9 580.1

After Tax Reported Operating Income $ 1,241.6 $ 1,250.0

July 22, 2014 25

Supplemental Information

Second Quarter Year to Date 2014 2013 2014 2013

% %

Reported Reported Reported Reported

Operating expenses:

Salary and service costs$ 2,794.6 $ 2,607.17.2%$ 5,417.4 $ 5,148.15.2%

Office and general expenses:

Amortization of Intangibles25.8 25.3 50.2 50.6

Depreciation46.6 45.5 93.1 91.3

Merger expenses(a)1.8 - 8.8 -

Other office and general expenses453.7 436.14.0%872.4 851.12.5% Total office and general expenses527.9 506.9 1,024.5 993.0

Total operating expenses$ 3,322.5 $ 3,114.06.7%$ 6,441.9 $ 6,141.14.9%

Net Interest expense:

Interest expense$ 45.5 $ 49.2 $ 93.1 $ 98.2Interest income11.8 8.5 20.4 16.5

Net Interest expense$ 33.7 $ 40.7-17.2%$ 72.7 $ 81.7-11.0%

(a) Merger expenses relate to costs incurred in connection with Omnicom’s merger with Publicis Groupe, S.A. and are comprised primarily of professional fees. On May 8, 2014 the proposed merger with Publicis was terminated.

July 22, 2014 26

Second Quarter Acquisitions

Established in 1999, Heimat is a leading full service advertising agency, combining traditional advertising with strong interactive capabilities.

The agency’s main focus are German and Central and Eastern European based large blue chip clients to whom the company provides advertising and digital services based on excellent creative ideas.

With offices in Berlin and Hamburg, Germany Heimat will operate as part of the TBWA Germany group within the TBWA\Worldwide network.

July 22, 2014 27

Second Quarter Acquisitions

Haygarth is a brand strategy and retail agency, specializing in digital retail, shopper and fast moving consumer goods marketing.

The agency’s core services include trade and consumer promotions and events, CRM and data analysis, social media/public relations, and design and branding.

Haygarth is located in London, United Kingdom and will operate as part of the RAPP division within the DAS Group of Companies.

July 22, 2014 28

Disclosure

The preceding materials have been prepared for use in the July 22, 2014 conference call on Omnicom’s results of operations for the period ended June 30, 2014. The call will be archived on the Internet at http://www.omnicomgroup.com/financialwebcasts.

Forward-Looking Statements

This presentation contains forward-looking statements, including within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made or may make forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include international, national or local economic, social or political conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments and changes in client communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes relating to competitive factors in the advertising, marketing and corporate communications industries; ability to hire and retain key personnel; ability to attract new clients and retain existing clients in the manner anticipated; reliance on information technology systems; changes in legislation or governmental regulations affecting the Company or its clients; conditions in the credit markets; risks associated with assumptions the Company makes in connection with its critical accounting estimates and legal proceedings; and the Company’s international operations, which are subject to the risks of currency fluctuation and currency repatriation restrictions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the Company’s business, including those described in the “Risk Factors” in Omnicom’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements.

Non-GAAP Financial Measures

We present financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”) and adjustments to the GAAP presentation (“Non-GAAP”), which we believe are meaningful for understanding our performance. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. We provide a reconciliation of non-GAAP measures to the comparable GAAP measures on pages 24 and 25.

The non-GAAP measures used in this presentation include the following:

Net Free Cash Flow, defined as Free Cash Flow (defined below) less the Primary Uses of Cash (defined below). Net Free Cash Flow is one of the metrics used by us to assess our sources and uses of cash and was derived from our consolidated statements of cash flows. We believe that this presentation is meaningful for understanding our primary sources and primary uses of that cash flow. Free Cash Flow, defined as net income plus depreciation, amortization, share based compensation expense less other non-cash items to reconcile to net cash provided by operating activities. Primary Uses of Cash, defined as dividends to common shareholders, dividends paid to non-controlling interest shareholders, capital expenditures, cash paid on acquisitions, payments for additional interest in controlled subsidiaries and stock repurchases, net of the proceeds and excess tax benefit from our stock plans, and excludes changes in working capital and other investing and financing activities, including commercial paper issuances and redemptions used to fund working capital changes.

EBITDA, defined as operating income before interest, taxes, depreciation and amortization. We believe EBITDA is meaningful because the financial covenants in our credit facilities are based on EBITDA.

EBITA, defined as operating income before interest, taxes and amortization. We use EBITA as an additional operating performance measure, which excludes acquisition-related amortization expense, because we believe that EBITA is a useful measure to evaluate the performance of our businesses.

Net Debt, defined as total debt less cash, cash equivalents and short-term investments. We believe net debt, together with the comparable GAAP measures, reflects one of the metrics used by us to assess our cash management.

After Tax Reported Operating Income, defined as reported operating income less income taxes calculated using the effective tax rate for the applicable period.

Other Information

All dollar amounts are in millions except for per share amounts and figures shown on pages 3 and 6. The information contained in this document has not been audited, although some data has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational and other non-financial data contained in this document have been derived from sources that we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information. Certain amounts in prior periods have been reclassified to conform to our current presentation.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is required.

July 22, 2014 29