| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-2625 |

| |

| Dreyfus A Bonds Plus, Inc. |

| (Exact name of Registrant as specified in charter) |

| |

| |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| Date of fiscal year end: | | 3/31 |

| Date of reporting period: | | 3/31/07 |

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | T H E F U N D |

| |

|

| 2 | | A Letter from the CEO |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 7 | | Understanding Your Fund’s Expenses |

| 7 | | Comparing Your Fund’s Expenses |

| | | With Those of Other Funds |

| 8 | | Statement of Investments |

| 29 | | Statement of Financial Futures |

| 30 | | Statement of Assets and Liabilities |

| 31 | | Statement of Operations |

| 32 | | Statement of Changes in Net Assets |

| 33 | | Financial Highlights |

| 34 | | Notes to Financial Statements |

| 47 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 48 | | Important Tax Information |

| 49 | | Information About the Review and Approval |

| | | of the Fund’s Management Agreement |

| 53 | | Board Members Information |

| 56 | | Officers of the Fund |

| |

| | | F O R M O R E I N F O R M AT I O N |

| |

|

| | | Back Cover |

Dreyfus

A Bonds Plus, Inc.

The Fund

A L E T T E R F R O M T H E C E O

Dear Shareholder:

We are pleased to present this annual report for Dreyfus A Bonds Plus, Inc., covering the 12-month period from April 1, 2006, through March 31, 2007.

Recent volatility in U.S. stock and bond markets has suggested to us that investors’ appetite for risk may be waning. Until late February 2007, the appetite for risk was relatively high, even in market sectors where the danger of fundamental deterioration was clear,such as “sub-prime”mort-gages. While overall valuation levels within the broad stock and bond markets seemed appropriate to us, prices of many lower-quality assets did not fully compensate investors for the risks they typically entail.

Heightened volatility sometimes signals a shift in the economy,but we do not believe this currently is the case.We continue to expect a midcycle economic slowdown and a monetary policy of “prolonged pause and eventual ease.”Tightness in the labor market should ease, with the unemployment rate driven somewhat higher by housing-related layoffs.While we believe there will be a gradual moderation of both CPI and PCE “core” inflation — a measure of underlying long-term inflation that generally excludes energy and food products — we expect the Fed to remain vigilant against inflation risks as it continues to closely monitor upcoming data. As always, your financial advisor can help you identify the investments that may help you potentially profit from these trends and maintain an asset allocation strategy that’s suited for your needs.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Manager.

Thank you for your continued confidence and support.

2

D I S C U S S I O N O F F U N D P E R F O R M A N C E

Catherine Powers, Portfolio Manager

How did Dreyfus A Bonds Plus perform relative to its benchmark?

For the 12-month period ended March 31, 2007, the fund achieved a total return of 6.48% and produced aggregate income dividends of $0.62 per share.1 In comparison, the fund’s benchmark, the Lehman Brothers U.S.Aggregate Index (the “Index”), achieved a total return of 6.59% for the same period.2

Despite occasional bouts of heightened volatility, bonds fared relatively well in an environment of moderating economic growth, subdued inflationary pressures and, over much of the reporting period, stable interest rates.The fund’s return was generally in line with the Index, exceeding it on a gross of fee basis. The fund’s performance can be attributed mainly to our duration strategy and sector allocations.

What is the fund’s investment approach?

The fund seeks to maximize total return, consisting of capital appreciation and current income.The fund invests at least 80% of its assets in bonds that, when purchased, are rated single-A or better, or if unrated, deemed to be of comparable quality by Dreyfus.

When selecting securities for the fund, we first examine U.S. and global economic conditions and other market factors in an effort to determine what we believe is the likely direction of long- and short-term interest rates. Using a research-driven investment process, we then attempt to identify potentially profitable sectors before they are widely perceived by the market. Finally, we look for underpriced or mispriced securities within those sectors that, in our opinion, appear likely to perform well over time.

T h e F u n d 3

D I S C U S S I O N O F F U N D P E R F O R M A N C E (continued)

What other factors influenced the fund’s performance?

Although the market encountered heightened volatility at times during the reporting period, bonds generally rallied in response to slowing U.S. economic growth, with particular weakness coming from the housing market.The Federal Reserve Board (the “Fed”) continued to raise short-term interest rates early in the reporting period, but it held the overnight federal funds rate steady at 5.25% between July 2006 and the reporting period’s end.The Fed’s move to the sidelines came after more than two years of steady rate hikes.

Despite the economic slowdown, business fundamentals remained healthy in most industries. In this environment, corporate bonds outperformed Treasuries, with especially strong returns from lower quality debt.As a result, the portfolio’s positions in high yield corporate bonds boosted performance during the reporting period. In the international markets, we established unhedged positions in countries with high inflation-adjusted interest rates, such as Brazil and Mexico.The portfolio benefited from this allocation to non-U.S. bonds, due to a positive yield advantage and improving currency exchange rates relative to the U.S. dollar. Our security selection strategy in investment-grade corporate bonds also contributed positively to the fund’s relative performance. We focused primarily on BBB-rated bonds from issuers in regulated industries where LBO activities are less likely or issuers offering strong covenant protections to bondholders.

Our duration management strategy also achieved good results, as a slightly short position early in the reporting period proved to be a positive influence on performance while the Fed was still raising rates, and a longer position subsequently boosted the fund’s participation in the rally that occurred in later months. Our “bulleted” yield curve strategy also helped support returns when the yield curve steepened in the first quarter of 2007.

Low levels of volatility helped mortgage-backed securities and other high-quality,“yield advantaged” instruments outperform U.S.Treasury securities during the reporting period. While the fund’s under-

4

weighted position in mortgage-backed securities detracted modestly from its relative performance, any resulting weakness was offset by an overweighted position in high-quality asset-backed and commercial mortgage-backed securities. A tactical position in Treasury Inflation Protected Securities (“TIPS”) underperformed as energy prices fell from the record highs set during the summer of 2006.

What is the fund’s current strategy?

We currently expect the Fed to leave the fund’s rate unchanged as policymakers wait to see if moderating economic growth brings down inflation.The Fed’s comments late in the reporting period that inflation may not fall as expected effectively pushed back investors’ previous expectations of a rate cut by mid-2007.

We recently increased the fund’s allocation to hedged non-dollar securities, seeking to benefit from the yield advantages currently available in global markets, including Japan and Sweden. We have remained defensive regarding corporate bonds in light of the slowing U.S. economy and robust M&A and LBO activity. In our view, these strategies position the portfolio for a slower-growth environment.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. Return figure provided |

| | | reflects the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an |

| | | agreement in effect until June 30, 2007, at which time it may be extended, modified or |

| | | terminated. Had these expenses not been absorbed, the fund’s return would have been lower. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Lehman Brothers U.S. Aggregate Index is a widely accepted, unmanaged |

| | | total return index of corporate, U.S. government and U.S. government agency debt instruments, |

| | | mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years. |

T h e F u n d 5

F U N D P E R F O R M A N C E

| Average Annual Total Returns | | as of 3/31/07 | | | | | | |

| | | | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

| |

|

| Fund | | | | 6.48% | | 4.76% | | 5.31% |

† Source: Lipper Inc.

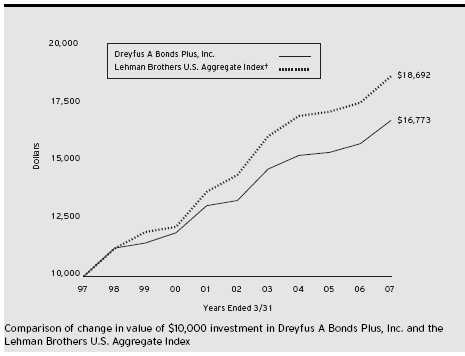

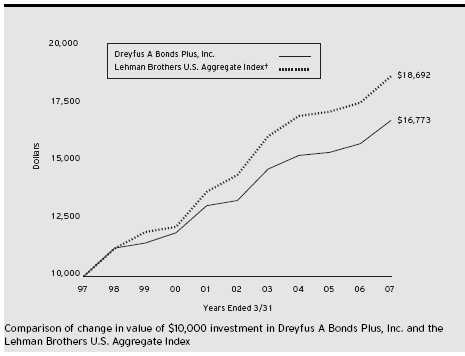

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The above graph compares a $10,000 investment made in Dreyfus A Bonds Plus, Inc. on 3/31/97 to a $10,000 investment made in the Lehman Brothers U.S. Aggregate Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph takes into account all applicable fees and expenses.The Index is a widely accepted, unmanaged total return index of corporate, government and government agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years and does not take into account charges, fees and other expenses. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

U N D E R S TA N D I N G YO U R F U N D ’ S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus A Bonds Plus, Inc. from October 1, 2006 to March 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended March 31, 2007 |

|

| |

| Expenses paid per $1,000 † | | $ 4.60 |

| Ending value (after expenses) | | $1,029.70 |

C O M P A R I N G Y O U R F U N D ’ S E X P E N S E S W I T H T H O S E O F O T H E R F U N D S ( U n a u d i t e d )

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended March 31, 2007 |

|

| |

| Expenses paid per $1,000 † | | $ 4.58 |

| Ending value (after expenses) | | $1,020.39 |

† Expenses are equal to the fund’s annualized expense ratio of .91%; multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

T h e F u n d 7

| S TAT E M E N T | | O F | | I N V E S T M E N T S |

| M a r c h 3 1 , 2 0 0 7 | | | | |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes—134.9% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Aerospace & Defense—.5% | | | | | | | | |

| L-3 Communications, | | | | | | | | |

| Gtd. Notes, Ser. B | | 6.38 | | 10/15/15 | | 190,000 | | 189,288 |

| L-3 Communications, | | | | | | | | |

| Gtd. Notes | | 7.63 | | 6/15/12 | | 730,000 | | 755,550 |

| Raytheon, | | | | | | | | |

| Sr. Notes | | 5.50 | | 11/15/12 | | 375,000 | | 381,946 |

| | | | | | | | | 1,326,784 |

| Agricultural—.6% | | | | | | | | |

| Philip Morris, | | | | | | | | |

| Debs. | | 7.75 | | 1/15/27 | | 1,475,000 | | 1,767,743 |

| Airlines—.0% | | | | | | | | |

| U.S. Air, | | | | | | | | |

| Enhanced Equip. Notes, | | | | | | | | |

| Ser. CL C | | 8.93 | | 10/15/09 | | 904,468 a,b | | 90 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Auto Receivables—2.3% | | | | | | | | |

| Chase Manhattan Auto Owner Trust, | | | | | | |

| Ser. 2005-B, Cl. A2 | | 4.77 | | 3/15/08 | | 126,383 | | 126,434 |

| Ford Credit Auto Owner Trust, | | | | | | | | |

| Ser. 2005-B, Cl. B | | 4.64 | | 4/15/10 | | 1,140,000 | | 1,134,107 |

| Ford Credit Auto Owner Trust, | | | | | | | | |

| Ser. 2006-C, Cl. C | | 5.47 | | 9/15/12 | | 340,000 | | 341,397 |

| WFS Financial Owner Trust, | | | | | | | | |

| Ser. 2003-3, Cl. A4 | | 3.25 | | 5/20/11 | | 4,491,726 | | 4,459,106 |

| WFS Financial Owner Trust, | | | | | | | | |

| Ser. 2005-2, Cl. B | | 4.57 | | 11/19/12 | | 575,000 | | 570,935 |

| | | | | | | | | 6,631,979 |

| Asset-Backed Ctfs./Credit Cards—2.8% | | | | | | |

| BA Credit Card Trust, | | | | | | | | |

| Ser. 2007-C1, Cl. C1 | | 5.61 | | 6/15/14 | | 2,875,000 c | | 2,873,765 |

| Citibank Credit Card Issuance | | | | | | | | |

| Trust, Ser. 2006-C4, Cl. C4 | | 5.54 | | 1/9/12 | | 4,530,000 c | | 4,531,613 |

| Credit Suisse Mortgage Capital | | | | | | | | |

| Certificates, Ser. 2007-1, | | | | | | | | |

| Cl. 1A6A | | 5.86 | | 2/25/37 | | 960,000 c | | 964,609 |

| | | | | | | | | 8,369,987 |

8

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | |

| Home Equity Loans—10.2% | | | | | | | | |

| Accredited Mortgage Loan Trust, | | | | | | | | |

| Ser. 2006-1, Cl. A1 | | 5.38 | | 4/25/36 | | 471,467 c | | 471,812 |

| Accredited Mortgage Loan Trust, | | | | | | | | |

| Ser. 2005-3, Cl. A2A | | 5.42 | | 9/25/35 | | 34,702 c | | 34,702 |

| Ameriquest Mortgage Securities, | | | | | | | | |

| Ser. 2003-11, Cl. AF6 | | 5.14 | | 1/25/34 | | 925,000 c | | 918,157 |

| Carrington Mortgage Loan Trust, | | | | | | | | |

| Ser. 2006-RFC1, Cl. A1 | | 5.36 | | 5/25/36 | | 450,043 c | | 450,343 |

| Centex Home Equity, | | | | | | | | |

| Ser. 2006-A, Cl. AV1 | | 5.37 | | 6/25/36 | | 325,650 c | | 325,853 |

| Citicorp Residential Mortgage | | | | | | | | |

| Securities, Ser. 2006-2, Cl. A2 | | 5.56 | | 9/25/36 | | 1,600,000 c | | 1,602,119 |

| Citicorp Residential Mortgage | | | | | | | | |

| Securities, Ser. 2006-2, | | | | | | | | |

| Cl. A1A | | 5.87 | | 9/25/36 | | 1,165,568 c | | 1,164,812 |

| Citicorp Residential Mortgage | | | | | | | | |

| Securities, Ser. 2006-1, Cl. A1 | | 5.96 | | 7/25/36 | | 2,402,045 c | | 2,401,873 |

| Countrywide Asset-Backed | | | | | | | | |

| Certificates, Ser. 2006-SPS1, | | | | | | | | |

| Cl. A | | 5.43 | | 12/25/25 | | 1,318,329 c | | 1,318,931 |

| Countrywide Asset-Backed | | | | | | | | |

| Certificates, Ser. 2004-3, | | | | | | | | |

| Cl. M3 | | 6.19 | | 5/25/34 | | 290,000 c | | 291,188 |

| Credit-Based Asset Servicing and | | | | | | | | |

| Securitization, Ser. 2005-CB7, | | | | | | | | |

| Cl. AF1 | | 5.21 | | 11/25/35 | | 434,745 c | | 433,130 |

| Credit-Based Asset Servicing and | | | | | | | | |

| Securitization, Ser. 2005-CB4, | | | | | | | | |

| Cl. AV1 | | 5.42 | | 8/25/35 | | 174,552 c | | 174,657 |

| Credit-Based Asset Servicing and | | | | | | | | |

| Securitization, Ser. 2005-CB8, | | | | | | | | |

| Cl. AF1B | | 5.45 | | 12/25/35 | | 533,531 c | | 531,713 |

| Credit-Based Asset Servicing and | | | | | | | | |

| Securitization, Ser. 2006-CB1, | | | | | | | | |

| Cl. AF1 | | 5.46 | | 1/25/36 | | 948,321 c | | 944,719 |

T h e F u n d 9

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | |

| Home Equity Loans (continued) | | | | | | | | |

| Credit-Based Asset Servicing and | | | | | | | | |

| Securitization, Ser. 2006-CB2, | | | | | | | | |

| Cl. AF1 | | 5.72 | | 12/25/36 | | 187,290 c | | 186,750 |

| First NLC Trust, | | | | | | | | |

| Ser. 2005-3, Cl. AV2 | | 5.55 | | 12/25/35 | | 724,938 c | | 725,819 |

| GSAA Trust, | | | | | | | | |

| Ser. 2006-7, Cl. AV1 | | 5.40 | | 3/25/46 | | 844,228 c | | 844,631 |

| GSAMP Trust, | | | | | | | | |

| Ser. 2006-S4, Cl. A1 | | 5.41 | | 5/25/36 | | 455,897 c | | 456,199 |

| Home Equity Asset Trust, | | | | | | | | |

| Ser. 2005-5, Cl. 2A1 | | 5.43 | | 11/25/35 | | 348,540 c | | 348,793 |

| Home Equity Asset Trust, | | | | | | | | |

| Ser. 2005-8, Cl. 2A1 | | 5.43 | | 2/25/36 | | 247,680 c | | 247,872 |

| Home Equity Mortgage Trust, | | | | | | | | |

| Ser. 2006-3, Cl. A1 | | 5.47 | | 9/25/36 | | 481,305 c | | 481,801 |

| Home Equity Mortgage Trust, | | | | | | | | |

| Ser. 2006-5, Cl. A1 | | 5.50 | | 1/25/37 | | 1,824,087 c | | 1,829,965 |

| Home Equity Mortgage Trust, | | | | | | | | |

| Ser. 2006-4, Cl. A1 | | 5.67 | | 11/25/36 | | 936,673 c | | 939,254 |

| J.P. Morgan Mortgage Acquisition, | | | | | | | | |

| Ser. 2006-CW1, Cl. A2 | | 5.36 | | 5/25/36 | | 336,995 c | | 337,219 |

| Morgan Stanley ABS Capital I, | | | | | | | | |

| Ser. 2006-HE3, Cl. A2A | | 5.36 | | 4/25/36 | | 306,950 c | | 307,141 |

| Morgan Stanley ABS Capital I, | | | | | | | | |

| Ser. 2005-WMC6, Cl. A2A | | 5.43 | | 7/25/35 | | 89,632 c | | 89,697 |

| Morgan Stanley Home Equity Loans, | | | | | | |

| Ser. 2006-3, Cl. A1 | | 5.37 | | 4/25/36 | | 495,729 c | | 496,038 |

| Morgan Stanley Mortgage Loan | | | | | | | | |

| Trust, Ser. 2006-15XS, Cl. A6B | | 5.83 | | 11/25/36 | | 485,000 c | | 488,637 |

| Newcastle Mortgage Securities | | | | | | | | |

| Trust, Ser. 2006-1, Cl. A1 | | 5.39 | | 3/25/36 | | 803,717 c | | 804,320 |

| Ownit Mortgage Loan Asset Backed | | | | | | |

| Certificates, Ser. 2006-1, | | | | | | | | |

| Cl. AF1 | | 5.42 | | 12/25/36 | | 1,004,353 c | | 999,997 |

| Popular ABS Mortgage Pass-Through | | | | | | |

| Trust, Ser. 2005-D, Cl. A1 | | 5.36 | | 1/25/36 | | 605,409 c | | 602,930 |

| Renaissance Home Equity Loan | | | | | | | | |

| Trust, Ser. 2006-2, Cl. AF1 | | 6.00 | | 8/25/36 | | 1,772,441 c | | 1,769,347 |

10

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | |

| Home Equity Loans (continued) | | | | | | | | |

| Renaissance Home Equity Loan | | | | | | | | |

| Trust, Ser. 2006-2, Cl. M1 | | 6.25 | | 8/25/36 | | 1,115,000 c | | 1,135,129 |

| Residential Asset Mortgage | | | | | | | | |

| Products, Ser. 2005-EFC5, | | | | | | | | |

| Cl. A1 | | 5.42 | | 10/25/35 | | 374,933 c | | 375,206 |

| Residential Asset Securities, | | | | | | | | |

| Ser. 2006-EMX4, Cl. A1 | | 5.36 | | 6/25/36 | | 486,323 c | | 486,649 |

| Residential Asset Securities, | | | | | | | | |

| Ser. 2006-EMX3, Cl. A1 | | 5.38 | | 4/25/36 | | 524,944 c | | 525,325 |

| Residential Asset Securities, | | | | | | | | |

| Ser. 2005-AHL2, Cl. A1 | | 5.42 | | 10/25/35 | | 121,253 c | | 121,336 |

| Residential Asset Securities, | | | | | | | | |

| Ser. 2005-EMX3, Cl. AI1 | | 5.43 | | 9/25/35 | | 252,267 c | | 252,449 |

| Residential Asset Securities, | | | | | | | | |

| Ser. 2003-KS7, Cl. MI3 | | 5.75 | | 9/25/33 | | 265,962 | | 260,339 |

| Residential Funding Mortgage | | | | | | | | |

| Securities II, Ser. 2006-HSA2, | | | | | | | | |

| Cl. AI2 | | 5.50 | | 3/25/36 | | 240,000 c | | 239,613 |

| Saxon Asset Securities Trust, | | | | | | | | |

| Ser. 2004-2, Cl. AF2 | | 4.15 | | 8/25/35 | | 1,602,058 c | | 1,593,026 |

| Soundview Home Equity Loan Trust, | | | | | | |

| Ser. 2005-B, Cl. M3 | | 5.83 | | 5/25/35 | | 450,000 c | | 445,294 |

| Specialty Underwriting & | | | | | | | | |

| Residential Finance, | | | | | | | | |

| Ser. 2006-BC2, Cl. A2A | | 5.38 | | 2/25/37 | | 957,481 c | | 958,160 |

| Wells Fargo Home Equity Trust, | | | | | | | | |

| Ser. 2006-1, Cl. A1 | | 5.35 | | 5/25/36 | | 554,688 c | | 554,798 |

| | | | | | | | | 29,967,743 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Manufactured Housing—.5% | | | | | | | | |

| Green Tree Financial, | | | | | | | | |

| Ser. 1994-7, Cl. M1 | | 9.25 | | 3/15/20 | | 499,686 | | 517,490 |

| Origen Manufactured Housing, | | | | | | | | |

| Ser. 2005-A, Cl. A1 | | 4.06 | | 7/15/13 | | 176,657 | | 176,244 |

| Origen Manufactured Housing, | | | | | | | | |

| Ser. 2005-B, Cl. A1 | | 5.25 | | 2/15/14 | | 771,253 | | 768,994 |

| | | | | | | | | 1,462,728 |

T h e F u n d 11

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Automobile Manufacturers—.2% | | | | | | | | |

| DaimlerChrysler N.A. Holding, | | | | | | | | |

| Notes | | 4.88 | | 6/15/10 | | 295,000 | | 292,220 |

| DaimlerChrysler N.A. Holding, | | | | | | | | |

| Gtd. Notes | | 8.50 | | 1/18/31 | | 325,000 | | 407,058 |

| | | | | | | | | 699,278 |

| Automotive, Trucks & Parts—.1% | | | | | | |

| Johnson Controls, | | | | | | | | |

| Sr. Notes | | 5.25 | | 1/15/11 | | 195,000 | | 195,441 |

| Banks—9.7% | | | | | | | | |

| Chevy Chase Bank, | | | | | | | | |

| Sub. Notes | | 6.88 | | 12/1/13 | | 480,000 | | 506,400 |

| Chuo Mitsui Trust & Banking, | | | | | | | | |

| Sub. Notes | | 5.51 | | 12/29/49 | | 1,005,000 c,d | | 972,134 |

| Colonial Bank N.A./ | | | | | | | | |

| Montgomery, AL, Sub. Notes | | 6.38 | | 12/1/15 | | 750,000 | | 779,870 |

| Colonial Bank N.A./ | | | | | | | | |

| Montgomery, AL, Sub. Notes | | 8.00 | | 3/15/09 | | 250,000 | | 261,411 |

| Glitnir Banki, | | | | | | | | |

| Sub. Notes | | 6.69 | | 6/15/16 | | 450,000 c,d | | 472,164 |

| Glitnir Banki, | | | | | | | | |

| Unscd. Bonds | | 7.45 | | 9/14/49 | | 350,000 c,d | | 376,392 |

| HBOS Capital Funding, | | | | | | | | |

| Bank Gtd. Bonds | | 6.07 | | 6/29/49 | | 5,410,000 c,d,e | | 5,519,103 |

| ICICI Bank, | | | | | | | | |

| Bonds | | 5.90 | | 1/12/10 | | 400,000 c,d | | 400,770 |

| Landsbanki Islands, | | | | | | | | |

| Notes | | 6.10 | | 8/25/11 | | 850,000 d | | 873,131 |

| Manufacturers & Traders Trust, | | | | | | | | |

| Sub. Notes | | 5.59 | | 12/28/20 | | 475,000 c | | 474,306 |

| Merrill Lynch and Company, | | | | | | | | |

| Sr. Unscd. Notes, Ser. 1 | | 5.45 | | 3/23/10 | | 3,010,000 c | | 3,012,543 |

| NB Capital Trust IV, | | | | | | | | |

| Gtd. Cap. Secs. | | 8.25 | | 4/15/27 | | 1,000,000 | | 1,040,139 |

| Northern Rock, | | | | | | | | |

| Sub. Notes | | 5.60 | | 4/29/49 | | 975,000 c,d | | 951,380 |

| Regions Financial, | | | | | | | | |

| Sr. Notes | | 5.44 | | 8/8/08 | | 1,450,000 c | | 1,452,166 |

| Resona Bank, | | | | | | | | |

| Notes | | 5.85 | | 9/29/49 | | 835,000 c,d | | 832,361 |

12

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | |

| Shinsei Finance Cayman, | | | | | | | | |

| Jr. Sub. Bonds | | 6.42 | | 1/29/49 | | 795,000 c,d | | 804,400 |

| Societe Generale, | | | | | | | | |

| Notes | | 5.92 | | 12/29/49 | | 800,000 c,d,f | | 801,008 |

| Sovereign Bancorp, | | | | | | | | |

| Sr. Notes | | 5.30 | | 9/1/10 | | 925,000 c | | 910,311 |

| Sovereign Bancorp, | | | | | | | | |

| Sr. Unscd. Notes | | 5.58 | | 3/23/10 | | 585,000 c | | 585,184 |

| Sumitomo Mitsui Banking, | | | | | | | | |

| Notes | | 5.63 | | 7/29/49 | | 560,000 c,d | | 552,531 |

| SunTrust Preferred Capital I, | | | | | | | | |

| Bank Gtd. Notes | | 5.85 | | 12/31/49 | | 705,000 c,e | | 715,591 |

| USB Capital IX, | | | | | | | | |

| Gtd. Notes | | 6.19 | | 4/15/49 | | 1,000,000 c | | 1,026,253 |

| Wachovia Bank N.A., | | | | | | | | |

| Sub. Notes | | 5.00 | | 8/15/15 | | 850,000 | | 825,911 |

| Washington Mutual, | | | | | | | | |

| Sub. Notes | | 4.63 | | 4/1/14 | | 1,695,000 | | 1,587,835 |

| Washington Mutual, | | | | | | | | |

| Notes | | 5.66 | | 1/15/10 | | 810,000 c | | 810,868 |

| Wells Fargo & Co., | | | | | | | | |

| Sub. Notes | | 6.38 | | 8/1/11 | | 540,000 | | 565,873 |

| Zions Bancorporation, | | | | | | | | |

| Sr. Unscd. Notes | | 5.48 | | 4/15/08 | | 620,000 c | | 620,753 |

| Zions Bancorporation, | | | | | | | | |

| Sub. Notes | | 6.00 | | 9/15/15 | | 825,000 | | 841,656 |

| | | | | | | | | 28,572,444 |

| Building & Construction—.2% | | | | | | | | |

| Masco, | | | | | | | | |

| Sr. Unscd. Notes | | 5.66 | | 3/12/10 | | 410,000 c | | 410,271 |

| Owens Corning, | | | | | | | | |

| Sr. Unscd. Notes | | 6.50 | | 12/1/16 | | 210,000 d | | 214,876 |

| | | | | | | | | 625,147 |

| Chemicals—.8% | | | | | | | | |

| Equistar Chemicals/Funding, | | | | | | | | |

| Gtd. Notes | | 10.13 | | 9/1/08 | | 360,000 | | 380,700 |

| ICI Wilmington, | | | | | | | | |

| Gtd. Notes | | 4.38 | | 12/1/08 | | 725,000 | | 714,567 |

T h e F u n d 13

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Chemicals (continued) | | | | | | | | |

| Lubrizol, | | | | | | | | |

| Sr. Notes | | 4.63 | | 10/1/09 | | 815,000 | | 805,606 |

| Lubrizol, | | | | | | | | |

| Sr. Notes | | 5.50 | | 10/1/14 | | 450,000 | | 441,077 |

| | | | | | | | | 2,341,950 |

| Commercial & Professional Services—.4% | | | | | | |

| ERAC USA Finance, | | | | | | | | |

| Bonds | | 5.60 | | 5/1/15 | | 550,000 d | | 551,437 |

| ERAC USA Finance, | | | | | | | | |

| Notes | | 5.61 | | 4/30/09 | | 200,000 c,d | | 200,580 |

| ERAC USA Finance, | | | | | | | | |

| Notes | | 7.95 | | 12/15/09 | | 360,000 d | | 384,728 |

| | | | | | | | | 1,136,745 |

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs.—7.1% | | | | | | | | |

| Banc of America Commercial | | | | | | | | |

| Mortgage, Ser. 2005-2, Cl. A2 | | 4.25 | | 7/10/43 | | 1,481,876 | | 1,469,221 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2006-SP1, Cl. A1 | | 5.59 | | 4/25/36 | | 478,354 c,d | | 478,503 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2004-1, Cl. A | | 5.68 | | 4/25/34 | | 391,746 c,d | | 392,480 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2003-1, Cl. A | | 5.90 | | 8/25/33 | | 272,184 c,d | | 272,410 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2003-2, Cl. A | | 5.90 | | 12/25/33 | | 367,512 c,d | | 368,087 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2006-2A, Cl. B2 | | 6.79 | | 7/25/36 | | 722,898 c,d | | 722,615 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2005-3A, Cl. B3 | | 8.32 | | 11/25/35 | | 212,601 c,d | | 215,952 |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2005-4A, Cl. B3 | | 8.82 | | 1/25/36 | | 203,688 c,d | | 203,688 |

| Bear Stearns Commercial Mortgage | | | | | | |

| Securities, Ser. 2006-PW13, | | | | | | | | |

| Cl. A3 | | 5.52 | | 9/11/41 | | 350,000 | | 354,722 |

| Bear Stearns Commercial Mortgage | | | | | | |

| Securities, Ser. 2006-T24, | | | | | | | | |

| Cl. AAB | | 5.53 | | 10/12/41 | | 775,000 | | 785,321 |

| Bear Stearns Commercial Mortgage | | | | | | |

| Securities, Ser. 2006-PW12, | | | | | | | | |

| Cl. AAB | | 5.69 | | 9/11/38 | | 715,000 c | | 734,194 |

14

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | |

| Calwest Industrial Trust, | | | | | | | | |

| Ser. 2002-CALW, Cl. A | | 6.13 | | 2/15/17 | | 1,750,000 d | | 1,822,592 |

| Citigroup/Deutsche Bank Commercial | | | | | | |

| Mortgage Trust, Ser. 2006-CD2, | | | | | | | | |

| Cl. A2 | | 5.41 | | 1/15/46 | | 580,000 | | 584,937 |

| Credit Suisse/Morgan Stanley | | | | | | | | |

| Commercial Mortgage | | | | | | | | |

| Certificates, Ser. 2006-HC1A, | | | | | | | | |

| Cl. A1 | | 5.51 | | 5/15/23 | | 725,000 c,d | | 725,610 |

| Crown Castle Towers, | | | | | | | | |

| Ser. 2005-1A, Cl. D | | 5.61 | | 6/15/35 | | 445,000 d | | 443,544 |

| Crown Castle Towers, | | | | | | | | |

| Ser. 2006-1A, Cl. D | | 5.77 | | 11/15/36 | | 550,000 d | | 544,858 |

| Global Signal Trust, | | | | | | | | |

| Ser. 2006-1, Cl. D | | 6.05 | | 2/15/36 | | 580,000 d | | 580,696 |

| Global Signal Trust, | | | | | | | | |

| Ser. 2006-1, Cl. E | | 6.50 | | 2/15/36 | | 320,000 d | | 320,156 |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2005-LDP5, Cl. A2 | | 5.20 | | 12/15/44 | | 1,250,000 | | 1,252,876 |

| J.P. Morgan Chase Commercial | | | | | | | | |

| Mortgage Securities, | | | | | | | | |

| Ser. 2006-LDP7, Cl. ASB | | 5.88 | | 4/15/45 | | 710,000 c | | 735,964 |

| Merrill Lynch Mortgage Trust, | | | | | | | | |

| Ser. 2005-CIP1, Cl. A2 | | 4.96 | | 7/12/38 | | 885,000 | | 881,452 |

| Merrill Lynch Mortgage Trust, | | | | | | | | |

| Ser. 2005-CKI1, Cl. A2 | | 5.22 | | 11/12/37 | | 300,000 c | | 301,793 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-T21, Cl. A2 | | 5.09 | | 10/12/52 | | 1,000,000 | | 999,387 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-IQ12, Cl. AAB | | 5.33 | | 12/15/43 | | 1,540,000 | | 1,541,678 |

| Morgan Stanley Capital I, | | | | | | | | |

| Ser. 2006-HQ9, Cl. A3 | | 5.71 | | 7/12/44 | | 1,550,000 | | 1,587,101 |

| SBA CMBS Trust, | | | | | | | | |

| Ser. 2006-1A, Cl. D | | 5.85 | | 11/15/36 | | 235,000 d | | 233,556 |

| Washington Mutual Asset | | | | | | | | |

| Securities, Ser. 2003-C1A, | | | | | | | | |

| Cl. A | | 3.83 | | 1/25/35 | | 2,490,947 d | | 2,420,748 |

| | | | | | | | | 20,974,141 |

T h e F u n d 15

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Diversified Financial Services—9.3% | | | | | | |

| American Express, | | | | | | | | |

| Sub. Debs. | | 6.80 | | 9/1/66 | | 325,000 c,e | | 346,711 |

| Ameriprise Financial, | | | | | | | | |

| Jr. Sub. Notes | | 7.52 | | 6/1/66 | | 792,000 c,e | | 856,257 |

| Amvescap, | | | | | | | | |

| Gtd. Notes | | 5.38 | | 2/27/13 | | 1,000,000 | | 999,734 |

| Amvescap, | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 12/15/14 | | 500,000 | | 495,529 |

| Bear Stearns Cos., | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 8/15/11 | | 785,000 | | 793,719 |

| Boeing Capital, | | | | | | | | |

| Sr. Notes | | 7.38 | | 9/27/10 | | 890,000 | | 956,608 |

| Cit Group, | | | | | | | | |

| Sr. Notes | | 5.48 | | 3/12/10 | | 1,530,000 c | | 1,530,148 |

| Countrywide Financial, | | | | | | | | |

| Gtd. Notes | | 5.50 | | 1/5/09 | | 1,450,000 c | | 1,448,177 |

| Countrywide Home Loans, | | | | | | | | |

| Gtd. Notes, Ser. L | | 4.00 | | 3/22/11 | | 505,000 | | 479,143 |

| Credit Suisse USA, | | | | | | | | |

| Sr. Unsub. Notes | | 5.50 | | 8/16/11 | | 1,215,000 | | 1,234,333 |

| Fuji JGB Investment, | | | | | | | | |

| Sub. Bonds | | 9.87 | | 12/29/49 | | 750,000 c,d | | 789,601 |

| Glencore Funding, | | | | | | | | |

| Gtd. Notes | | 6.00 | | 4/15/14 | | 440,000 d | | 436,741 |

| Goldman Sachs Group, | | | | | | | | |

| Notes | | 4.50 | | 6/15/10 | | 920,000 | | 905,099 |

| HSBC Finance Capital Trust IX, | | | | | | | | |

| Gtd. Notes | | 5.91 | | 11/30/35 | | 400,000 c | | 397,719 |

| HSBC Finance, | | | | | | | | |

| Notes | | 5.50 | | 1/19/16 | | 800,000 | | 796,603 |

| Jefferies Group, | | | | | | | | |

| Sr. Unscd. Debs. | | 6.25 | | 1/15/36 | | 1,195,000 | | 1,156,938 |

| John Deere Capital, | | | | | | | | |

| Notes | | 5.40 | | 9/1/09 | | 555,000 c | | 555,329 |

| JPMorgan Chase & Co., | | | | | | | | |

| Sub. Notes | | 5.13 | | 9/15/14 | | 1,460,000 | | 1,439,338 |

| Kaupthing Bank, | | | | | | | | |

| Sub. Notes | | 7.13 | | 5/19/16 | | 750,000 d,e | | 812,667 |

| Lehman Brothers Holdings E-Capital | | | | | | |

| Trust I, Gtd. Notes | | 6.14 | | 8/19/65 | | 170,000 c | | 172,167 |

16

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Diversified Financial Services (continued) | | | | | | |

| Lehman Brothers Holdings, | | | | | | | | |

| Notes | | 5.50 | | 4/4/16 | | 315,000 | | 313,772 |

| MBNA, | | | | | | | | |

| Notes | | 6.13 | | 3/1/13 | | 1,345,000 | | 1,402,582 |

| Morgan Stanley, | | | | | | | | |

| Sub. Notes | | 4.75 | | 4/1/14 | | 1,919,000 | | 1,825,303 |

| Morgan Stanley, | | | | | | | | |

| Sr. Unscd. Notes | | 5.47 | | 2/9/09 | | 820,000 c | | 821,079 |

| MUFG Capital Finance 1, | | | | | | | | |

| Bank Gtd. Bonds | | 6.35 | | 7/29/49 | | 590,000 c | | 610,052 |

| Nuveen Investments, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 9/15/10 | | 500,000 | | 495,547 |

| Residential Capital, | | | | | | | | |

| Gtd. Notes | | 6.13 | | 11/21/08 | | 350,000 | | 349,955 |

| Residential Capital, | | | | | | | | |

| Gtd. Notes | | 6.38 | | 6/30/10 | | 815,000 | | 815,369 |

| Residential Capital, | | | | | | | | |

| Sr. Notes | | 6.50 | | 4/17/13 | | 100,000 | | 99,173 |

| Residential Capital, | | | | | | | | |

| Gtd. Notes | | 7.19 | | 4/17/09 | | 900,000 c,d | | 892,647 |

| SLM, | | | | | | | | |

| Notes, Ser. A | | 5.50 | | 7/27/09 | | 1,600,000 c | | 1,601,154 |

| SMFG Preferred Capital, | | | | | | | | |

| Bonds | | 6.08 | | 1/29/49 | | 835,000 c,d | | 840,795 |

| St. George Funding, | | | | | | | | |

| Bonds | | 8.49 | | 12/29/49 | | 475,000 c,d | | 496,943 |

| Windsor Financing, | | | | | | | | |

| Gtd. Notes | | 5.88 | | 7/15/17 | | 191,113 d | | 192,072 |

| | | | | | | | | 27,359,004 |

| Diversified Metals & Mining—.3% | | | | | | | | |

| Alcan, | | | | | | | | |

| Notes | | 6.13 | | 12/15/33 | | 600,000 | | 585,312 |

| Reliance Steel & Aluminum, | | | | | | | | |

| Gtd. Notes | | 6.20 | | 11/15/16 | | 425,000 d | | 427,871 |

| | | | | | | | | 1,013,183 |

| Electric Utilities—3.3% | | | | | | | | |

| American Electric Power, | | | | | | | | |

| Sr. Unsub. Notes | | 5.25 | | 6/1/15 | | 625,000 | | 615,798 |

| Cleveland Electris Illumination, | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 4/1/17 | | 825,000 e | | 821,583 |

T h e F u n d 17

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | |

| Consolidated Edison of NY, | | | | | | | | |

| Sr. Unscd. Debs., Ser. D | | 5.30 | | 12/1/16 | | 675,000 | | 671,172 |

| Consumers Energy, | | | | | | | | |

| First Mortgage Bonds | | 5.00 | | 2/15/12 | | 1,160,000 | | 1,147,423 |

| Dominion Resources/VA, | | | | | | | | |

| Sr. Unscd. Notes, Ser. E | | 7.20 | | 9/15/14 | | 835,000 e | | 919,160 |

| DTE Energy, | | | | | | | | |

| Sr. Unsub. Notes | | 6.35 | | 6/1/16 | | 415,000 | | 434,754 |

| FPL Energy National Wind, | | | | | | | | |

| Scd. Bonds | | 5.61 | | 3/10/24 | | 183,288 d | | 181,419 |

| FPL Group Capital, | | | | | | | | |

| Gtd. Debs. | | 5.63 | | 9/1/11 | | 1,570,000 | | 1,598,747 |

| Gulf Power, | | | | | | | | |

| Sr. Unsub. Notes, Ser. M | | 5.30 | | 12/1/16 | | 800,000 | | 795,464 |

| National Grid, | | | | | | | | |

| Sr. Unscd. Notes | | 6.30 | | 8/1/16 | | 1,000,000 | | 1,046,149 |

| NiSource Finance, | | | | | | | | |

| Gtd. Notes | | 5.25 | | 9/15/17 | | 650,000 | | 615,107 |

| NiSource Finance, | | | | | | | | |

| Gtd. Notes | | 5.93 | | 11/23/09 | | 385,000 c | | 385,665 |

| Southern, | | | | | | | | |

| Sr. Unsub. Notes, Ser. A | | 5.30 | | 1/15/12 | | 475,000 | | 478,666 |

| | | | | | | | | 9,711,107 |

| Environmental Control—.9% | | | | | | | | |

| Allied Waste of North America, | | | | | | | | |

| Scd. Notes, Ser. B | | 5.75 | | 2/15/11 | | 300,000 e | | 294,000 |

| Allied Waste, | | | | | | | | |

| Scd. Notes | | 6.38 | | 4/15/11 | | 240,000 e | | 240,600 |

| Republic Services, | | | | | | | | |

| Sr. Notes | | 6.75 | | 8/15/11 | | 610,000 | | 642,431 |

| USA Waste Services, | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 7/15/28 | | 1,000,000 | | 1,067,267 |

| Waste Management, | | | | | | | | |

| Gtd. Notes | | 7.38 | | 5/15/29 | | 350,000 | | 385,847 |

| | | | | | | | | 2,630,145 |

| Food & Beverages—.7% | | | | | | | | |

| H.J. Heinz, | | | | | | | | |

| Notes | | 6.43 | | 12/1/20 | | 425,000 d | | 432,513 |

18

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Food & Beverages (continued) | | | | | | | | |

| Safeway, | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 8/15/14 | | 650,000 | | 641,589 |

| Stater Brothers Holdings, | | | | | | | | |

| Sr. Notes | | 8.13 | | 6/15/12 | | 360,000 | | 372,600 |

| Tyson Foods, | | | | | | | | |

| Sr. Unscd. Notes | | 6.85 | | 4/1/16 | | 520,000 c,e | | 542,002 |

| | | | | | | | | 1,988,704 |

| Foreign/Governmental—2.9% | | | | | | | | |

| Banco Nacional de Desenvolvimento | | | | | | | | |

| Economico e Social, Unsub. | | | | | | | | |

| Notes | | 5.17 | | 6/16/08 | | 1,185,000 c | | 1,174,928 |

| Export-Import Bank of Korea, | | | | | | | | |

| Sr. Notes | | 4.50 | | 8/12/09 | | 1,075,000 | | 1,059,902 |

| Federal Republic of Brazil, | | | | | | | | |

| Unscd. Bonds BRL | | 12.50 | | 1/5/16 | | 3,310,000 e,g | | 1,840,847 |

| Republic of Argentina, | | | | | | | | |

| Bonds | | 5.48 | | 8/3/12 | | 1,205,000 c | | 864,889 |

| Republic of Argentina, | | | | | | | | |

| Bonds, Ser. VII | | 7.00 | | 9/12/13 | | 720,000 | | 694,440 |

| Republic of South Africa, | | | | | | | | |

| Notes | | 9.13 | | 5/19/09 | | 840,000 | | 905,100 |

| Russian Federation, | | | | | | | | |

| Unsub. Bonds | | 8.25 | | 3/31/10 | | 1,135,573 d | | 1,192,352 |

| United Mexican States, | | | | | | | | |

| Notes, Ser. A | | 6.75 | | 9/27/34 | | 745,000 | | 814,285 |

| | | | | | | | | 8,546,743 |

| Health Care—1.2% | | | | | | | | |

| American Home Products, | | | | | | | | |

| Unscd. Notes | | 6.95 | | 3/15/11 | | 580,000 c | | 617,177 |

| Coventry Health Care, | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 3/15/17 | | 400,000 | | 399,851 |

| Medco Health Solutions, | | | | | | | | |

| Sr. Unscd. Notes | | 7.25 | | 8/15/13 | | 275,000 | | 297,798 |

| Quest Diagnostics, | | | | | | | | |

| Gtd. Notes | | 5.13 | | 11/1/10 | | 365,000 | | 362,264 |

| Teva Pharmaceutical Finance, | | | | | | | | |

| Gtd. Notes | | 6.15 | | 2/1/36 | | 565,000 | | 546,747 |

T h e F u n d 19

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Health Care (continued) | | | | | | | | |

| UnitedHealth Group, | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 3/15/16 | | 860,000 | | 855,150 |

| WellPoint, | | | | | | | | |

| Unscd. Notes | | 5.00 | | 1/15/11 | | 455,000 | | 453,095 |

| | | | | | | | | 3,532,082 |

| Lodging & Entertainment—.3% | | | | | | | | |

| MGM Mirage, | | | | | | | | |

| Gtd. Notes | | 8.38 | | 2/1/11 | | 350,000 e | | 370,125 |

| Mohegan Tribal Gaming Authority, | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/15/13 | | 620,000 | | 613,800 |

| | | | | | | | | 983,925 |

| Machinery—.3% | | | | | | | | |

| Case New Holland, | | | | | | | | |

| Gtd. Notes | | 7.13 | | 3/1/14 | | 320,000 | | 334,400 |

| Terex, | | | | | | | | |

| Gtd. Notes | | 7.38 | | 1/15/14 | | 405,000 | | 419,175 |

| | | | | | | | | 753,575 |

| Media—1.3% | | | | | | | | |

| AOL Time Warner, | | | | | | | | |

| Gtd. Notes | | 6.75 | | 4/15/11 | | 900,000 | | 949,317 |

| British Sky Broadcasting, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 2/23/09 | | 900,000 | | 925,495 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 5.50 | | 3/15/11 | | 990,000 e | | 1,001,709 |

| News America Holdings, | | | | | | | | |

| Debs. | | 7.70 | | 10/30/25 | | 775,000 | | 884,824 |

| | | | | | | | | 3,761,345 |

| Oil & Gas—1.3% | | | | | | | | |

| Amerada Hess, | | | | | | | | |

| Unscd. Notes | | 6.65 | | 8/15/11 | | 810,000 | | 853,805 |

| Chesapeake Energy, | | | | | | | | |

| Gtd. Notes | | 7.50 | | 6/15/14 | | 155,000 | | 163,138 |

| Enterprise Products Operating, | | | | | | | | |

| Gtd. Notes, Ser. B | | 5.60 | | 10/15/14 | | 1,395,000 | | 1,393,929 |

| Gazprom, | | | | | | | | |

| Sr. Unscd. Notes | | 6.51 | | 3/7/22 | | 715,000 d | | 727,513 |

| Pemex Project Funding Master | | | | | | | | |

| Trust, Gtd. Notes | | 5.75 | | 12/15/15 | | 650,000 | | 652,113 |

| | | | | | | | | 3,790,498 |

20

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Packaging & Containers—.7% | | | | | | | | |

| Ball, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 12/15/12 | | 205,000 | | 208,075 |

| Crown Americas/Capital, | | | | | | | | |

| Gtd. Notes | | 7.63 | | 11/15/13 | | 575,000 | | 594,406 |

| Crown Americas/Capital, | | | | | | | | |

| Gtd. Notes | | 7.75 | | 11/15/15 | | 325,000 | | 339,625 |

| Sealed Air, | | | | | | | | |

| Notes | | 5.63 | | 7/15/13 | | 830,000 d | | 833,505 |

| | | | | | | | | 1,975,611 |

| Paper & Forest Products—1.0% | | | | | | | | |

| Georgia-Pacific, | | | | | | | | |

| Gtd. Notes | | 7.00 | | 1/15/15 | | 560,000 d | | 565,600 |

| Georgia-Pacific, | | | | | | | | |

| Sr. Notes | | 8.00 | | 1/15/24 | | 780,000 e | | 787,800 |

| Temple-Inland, | | | | | | | | |

| Bonds | | 6.63 | | 1/15/18 | | 700,000 | | 737,303 |

| Westvaco, | | | | | | | | |

| Unscd. Debs. | | 7.95 | | 2/15/31 | | 465,000 | | 506,452 |

| Weyerhaeuser, | | | | | | | | |

| Unscd. Debs. | | 7.13 | | 7/15/23 | | 435,000 | | 446,677 |

| | | | | | | | | 3,043,832 |

| Property & Casualty | | | | | | | | |

| Insurance—3.9% | | | | | | | | |

| Aegon Funding, | | | | | | | | |

| Gtd. Notes | | 5.75 | | 12/15/20 | | 950,000 | | 968,431 |

| American International Group, | | | | | | | | |

| Sr. Notes | | 5.05 | | 10/1/15 | | 470,000 | | 460,624 |

| American International Group, | | | | | | | | |

| Jr. Sub. Bonds | | 6.25 | | 3/15/37 | | 425,000 | | 415,036 |

| Assurant, | | | | | | | | |

| Sr. Notes | | 6.75 | | 2/15/34 | | 725,000 | | 781,260 |

| Chubb, | | | | | | | | |

| Sr. Unscd. Notes | | 5.47 | | 8/16/08 | | 1,600,000 | | 1,606,073 |

| Hartford Financial Services Group, | | | | | | | | |

| Sr. Unscd. Notes | | 5.55 | | 8/16/08 | | 730,000 | | 733,365 |

| ING Groep, | | | | | | | | |

| Bonds | | 5.78 | | 12/29/49 | | 700,000 c | | 697,588 |

| Leucadia National, | | | | | | | | |

| Sr. Notes | | 7.13 | | 3/15/17 | | 905,000 d | | 903,869 |

T h e F u n d 21

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Property & Casualty Insurance (continued) | | | | | | |

| Lincoln National, | | | | | | | | |

| Sr. Unscd. Notes | | 5.42 | | 3/12/10 | | 720,000 c | | 720,663 |

| Lincoln National, | | | | | | | | |

| Jr. Unsub. Cap. Secs. | | 7.00 | | 5/17/66 | | 830,000 c | | 871,226 |

| Metlife, | | | | | | | | |

| Sr. Notes | | 5.50 | | 6/15/14 | | 2,195,000 | | 2,213,888 |

| Nippon Life Insurance, | | | | | | | | |

| Notes | | 4.88 | | 8/9/10 | | 850,000 d | | 837,360 |

| Phoenix Cos., | | | | | | | | |

| Sr. Unscd. Notes | | 6.68 | | 2/16/08 | | 355,000 | | 357,379 |

| | | | | | | | | 11,566,762 |

| Real Estate Investment Trusts—5.3% | | | | | | |

| Archstone-Smith Operating Trust, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 5/1/15 | | 900,000 | | 889,965 |

| Arden Realty, | | | | | | | | |

| Notes | | 5.25 | | 3/1/15 | | 675,000 | | 671,330 |

| Boston Properties, | | | | | | | | |

| Sr. Notes | | 5.00 | | 6/1/15 | | 810,000 | | 789,193 |

| Commercial Net Lease Realty, | | | | | | | | |

| Sr. Unscd. Notes | | 6.15 | | 12/15/15 | | 375,000 | | 382,603 |

| Duke Realty, | | | | | | | | |

| Notes | | 3.50 | | 11/1/07 | | 890,000 | | 880,110 |

| Duke Realty, | | | | | | | | |

| Sr. Notes | | 5.88 | | 8/15/12 | | 2,210,000 | | 2,257,495 |

| ERP Operating, | | | | | | | | |

| Notes | | 5.13 | | 3/15/16 | | 615,000 | | 600,845 |

| ERP Operating, | | | | | | | | |

| Notes | | 5.25 | | 9/15/14 | | 150,000 | | 148,928 |

| ERP Operating, | | | | | | | | |

| Unscd. Notes | | 5.38 | | 8/1/16 | | 255,000 e | | 253,476 |

| Federal Realty Investment Trust, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.65 | | 6/1/16 | | 550,000 | | 551,435 |

| Federal Realty Investment Trust, | | | | | | | | |

| Notes | | 6.00 | | 7/15/12 | | 155,000 | | 159,375 |

| Healthcare Realty Trust, | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 4/1/14 | | 875,000 | | 842,619 |

| Host Hotels & Resorts, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 11/1/14 | | 135,000 | | 137,700 |

22

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Real Estate Investment Trusts (continued) | | | | | | |

| HRPT Properties Trust, | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 3/16/11 | | 825,000 c | | 825,908 |

| Istar Financial, | | | | | | | | |

| Sr. Unscd. Notes | | 5.69 | | 3/9/10 | | 1,100,000 c | | 1,101,342 |

| Liberty Property, | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 12/15/16 | | 320,000 | | 318,363 |

| Mack-Cali Realty, | | | | | | | | |

| Unscd. Notes | | 5.05 | | 4/15/10 | | 400,000 | | 396,731 |

| Mack-Cali Realty, | | | | | | | | |

| Notes | | 5.25 | | 1/15/12 | | 675,000 | | 669,636 |

| Mack-Cali Realty, | | | | | | | | |

| Bonds | | 5.80 | | 1/15/16 | | 690,000 | | 695,831 |

| Regency Centers, | | | | | | | | |

| Gtd. Notes | | 5.25 | | 8/1/15 | | 220,000 | | 214,506 |

| Simon Property Group, | | | | | | | | |

| Unsub. Notes | | 5.00 | | 3/1/12 | | 1,000,000 | | 991,599 |

| Simon Property Group, | | | | | | | | |

| Unscd. Notes | | 5.75 | | 5/1/12 | | 200,000 | | 204,708 |

| Socgen Real Estate, | | | | | | | | |

| Bonds | | 7.64 | | 12/29/49 | | 1,590,000 c,d | | 1,608,081 |

| | | | | | | | | 15,591,779 |

| Residential Mortgage | | | | | | | | |

| Pass-Through Ctfs.—5.7% | | | | | | | | |

| Bayview Commercial Asset Trust, | | | | | | | | |

| Ser. 2006-1A, Cl. B2 | | 7.02 | | 4/25/36 | | 205,246 c,d | | 207,191 |

| ChaseFlex Trust, | | | | | | | | |

| Ser. 2006-2, Cl. A1A | | 5.59 | | 9/25/36 | | 446,149 c | | 445,864 |

| Citigroup Mortgage Loan Trust, | | | | | | | | |

| Ser. 2005-WF2, Cl. AF2 | | 4.92 | | 8/25/35 | | 577,873 c | | 574,029 |

| Citigroup Mortgage Loan Trust, | | | | | | | | |

| Ser. 2005-WF2, Cl. AF7 | | 5.25 | | 8/25/35 | | 1,650,000 c | | 1,626,653 |

| Citigroup Mortgage Loan Trust, | | | | | | | | |

| Ser. 2006-WF1, Cl. A2A | | 5.70 | | 3/25/36 | | 226,389 c | | 225,776 |

| Countrywide Asset-Backed | | | | | | | | |

| Certificates, Ser. 2007-4, | | | | | | | | |

| Cl. A1A | | 5.44 | | 9/25/37 | | 645,000 c | | 645,000 |

| CSAB Mortgage Backed Trust, | | | | | | | | |

| Ser. 2006-3, Cl. A1A | | 6.00 | | 11/25/36 | | 2,416,078 c | | 2,410,860 |

T h e F u n d 23

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Residential Mortgage | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | |

| First Horizon Alternative Mortgage | | | | | | |

| Securities, Ser. 2004-FA1, | | | | | | | | |

| Cl. 1A1 | | 6.25 | | 10/25/34 | | 4,147,898 | | 4,184,594 |

| Impac Secured Assets CMN Owner | | | | | | | | |

| Trust, Ser. 2006-1, Cl. 2A1 | | 5.67 | | 5/25/36 | | 491,893 c | | 493,165 |

| IndyMac Index Mortgage Loan Trust, | | | | | | |

| Ser. 2006-AR9, Cl. B2 | | 6.07 | | 6/25/36 | | 119,904 c | | 119,566 |

| IndyMac Index Mortgage Loan Trust, | | | | | | |

| Ser. 2006-AR25, Cl. 4A2 | | 6.18 | | 9/25/36 | | 1,504,704 c | | 1,523,955 |

| J.P. Morgan Alternative Loan | | | | | | | | |

| Trust, Ser. 2006-S4, Cl. A6 | | 5.71 | | 12/25/36 | | 745,000 c | | 753,520 |

| Nomura Asset Acceptance, | | | | | | | | |

| Ser. 2005-AP2, Cl. A5 | | 4.98 | | 5/25/35 | | 775,000 c | | 759,572 |

| Nomura Asset Acceptance, | | | | | | | | |

| Ser. 2005-WF1, Cl. 2A5 | | 5.16 | | 3/25/35 | | 779,000 c | | 768,117 |

| Residential Funding Mortgage | | | | | | | | |

| Securities I, Ser. 2004-S3, | | | | | | | | |

| Cl. M1 | | 4.75 | | 3/25/19 | | 1,165,211 | | 1,127,273 |

| Washington Mutual, | | | | | | | | |

| Ser. 2005-AR4, Cl. A4B | | 4.67 | | 4/25/35 | | 1,025,000 c | | 1,012,045 |

| | | | | | | | | 16,877,180 |

| Retail—.2% | | | | | | | | |

| CVS, | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 8/15/11 | | 255,000 | | 259,946 |

| Federated Retail Holding, | | | | | | | | |

| Gtd. Bonds | | 5.35 | | 3/15/12 | | 155,000 | | 154,760 |

| Federated Retail Holding, | | | | | | | | |

| Gtd. Notes | | 5.90 | | 12/1/16 | | 265,000 | | 264,493 |

| | | | | | | | | 679,199 |

| State/Government Gen. Oblg.—2.0% | | | | | | |

| Erie Tobacco Asset | | | | | | | | |

| Securitization/NY, Tobacco | | | | | | | | |

| Settlement Asset-Backed Bonds | | 6.00 | | 6/1/28 | | 600,000 | | 603,012 |

| Michigan Tobacco Settlement | | | | | | | | |

| Finance Authority, Tobacco | | | | | | | | |

| Settlement Asset-Backed Bonds | | 7.31 | | 6/1/34 | | 2,410,000 | | 2,525,126 |

| Michigan Tobacco Settlement | | | | | | | | |

| Finance Authority, Tobacco | | | | | | | | |

| Settlement Asset-Backed Bonds | | 7.43 | | 6/1/34 | | 600,000 c | | 599,004 |

24

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| State/Government Gen. Oblg. (continued) | | | | | | |

| Tobacco Settlement Authority of | | | | | | | | |

| Iowa, Tobacco Settlement | | | | | | | | |

| Asset-Backed Bonds | | 6.50 | | 6/1/23 | | 2,320,000 | | 2,312,831 |

| | | | | | | | | 6,039,973 |

| Technology—.2% | | | | | | | | |

| Hewlett-Packard, | | | | | | | | |

| Sr. Unscd. Notes | | 5.49 | | 5/22/09 | | 650,000 c | | 650,935 |

| Telecommunications—2.8% | | | | | | | | |

| AT & T Wireless, | | | | | | | | |

| Sr. Notes | | 8.75 | | 3/1/31 | | 440,000 | | 569,207 |

| AT & T, | | | | | | | | |

| Sr. Notes | | 5.45 | | 5/15/08 | | 450,000 c | | 450,446 |

| AT & T, | | | | | | | | |

| Sr. Notes | | 7.30 | | 11/15/11 | | 740,000 c | | 804,100 |

| Deutsche Telekom International | | | | | | | | |

| Finance, Gtd. Bonds | | 8.25 | | 6/15/30 | | 655,000 c | | 813,660 |

| France Telecom, | | | | | | | | |

| Notes | | 8.50 | | 3/1/31 | | 615,000 c | | 801,640 |

| KPN, | | | | | | | | |

| Sr. Unsub. Bonds | | 8.38 | | 10/1/30 | | 1,435,000 | | 1,628,988 |

| Nextel Communications, | | | | | | | | |

| Gtd. Notes, Ser. F | | 5.95 | | 3/15/14 | | 500,000 | | 492,595 |

| Nextel Partners, | | | | | | | | |

| Gtd. Notes | | 8.13 | | 7/1/11 | | 410,000 | | 428,282 |

| Nordic Telephone Holdings, | | | | | | | | |

| Scd. Notes EUR | | 8.25 | | 5/1/16 | | 285,000 d,g | | 415,825 |

| Qwest, | | | | | | | | |

| Notes | | 8.88 | | 3/15/12 | | 50,000 c | | 55,500 |

| Telefonica Emisiones, | | | | | | | | |

| Gtd. Notes | | 5.98 | | 6/20/11 | | 625,000 | | 641,266 |

| Verizon Global Funding, | | | | | | | | |

| Sr. Notes | | 5.85 | | 9/15/35 | | 300,000 | | 284,655 |

| Verizon Global Funding, | | | | | | | | |

| Notes | | 7.75 | | 6/15/32 | | 245,000 | | 285,187 |

| Windstream, | | | | | | | | |

| Gtd. Notes | | 8.13 | | 8/1/13 | | 595,000 | | 647,063 |

| | | | | | | | | 8,318,414 |

| Textiles & Apparel—.2% | | | | | | | | |

| Mohawk Industries, | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 1/15/11 | | 700,000 | | 710,338 |

T h e F u n d 25

S TAT E M E N T O F I N V E S T M E N T S (continued)

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| U.S. Government Agencies—.2% | | | | | | | | |

| Small Business Administration | | | | | | | | |

| Participation Ctfs., Gov’t | | | | | | | | |

| Gtd. Ctfs., Ser. 97-J | | 6.55 | | 10/1/17 | | 545,792 | | 563,338 |

| U.S. Government Agencies/ | | | | | | | | |

| Mortgage-Backed—37.9% | | | | | | | | |

| Federal Home Loan Mortgage Corp: | | | | | | | | |

| 3.50%, 9/1/10 | | | | | | 282,668 | | 272,766 |

| 4.50%, 4/1/19 | | | | | | 3,200,000 h | | 3,097,984 |

| 5.00%, 4/15/14 | | | | | | 7,425,000 | | 7,322,906 |

| 5.50%, 4/15/14 | | | | | | 7,210,000 | | 7,225,718 |

| Multiclass Mortgage Participation Ctfs., | | | | | | |

| Ser. 51, Cl. E, 10.00%, 7/15/20 | | | | 338,100 | | 337,167 |

| Multiclass Mortgage Participation Ctfs. | | | | | | |

| (Interest Only) Ser. 2750, | | | | | | | | |

| Cl. IK, 5.00%, 5/15/26 | | | | | | 4,617,400 i | | 589,155 |

| Federal National Mortgage Association: | | | | | | |

| 5.00% | | | | | | 18,355,000 h | | 17,927,519 |

| 5.50% | | | | | | 14,300,000 h | | 14,152,424 |

| 6.00% | | | | | | 21,495,000 h | | 21,764,933 |

| 4.00%, 5/1/10 | | | | | | 1,536,660 | | 1,495,048 |

| 5.50%, 9/1/34 | | | | | | 631,669 | | 626,324 |

| 6.00%, 1/1/19—4/1/33 | | | | | | 1,691,979 | | 1,722,228 |

| 8.00%, 12/1/25 | | | | | | 41,901 | | 44,284 |

| Pass-Through Ctfs., | | | | | | | | |

| Ser. 2004-58, Cl. LJ, 5.00%, 7/25/34 | | | | 2,186,394 | | 2,178,830 |

| Pass-Through Ctfs., | | | | | | | | |

| Ser. 1988-16, Cl. B, 9.50%, 6/25/18 | | | | 166,680 | | 180,040 |

| Government National Mortgage Association I: | | | | | | |

| 5.50%, 4/15/33 | | | | | | 4,849,112 | | 4,830,395 |

| 7.00%, 6/15/08 | | | | | | 1,368 | | 1,373 |

| 6.86%, 4/15/07 | | | | | | 12,672,165 | | 12,382,776 |

| 9.50%, 11/15/17 | | | | | | 363,166 | | 388,726 |

| Ser. 2004-23, Cl. B, 2.95%, 3/16/19 | | | | 2,633,727 | | 2,539,181 |

| Ser. 2005-90, Cl. A, 3.76%, 9/16/28 | | | | 1,366,276 | | 1,327,446 |

| Ser. 2005-29, Cl. A, 4.02%, 7/16/27 | | | | 872,834 | | 852,401 |

| Ser. 2006-6, Cl. A, 4.05%, 10/16/23 | | | | 170,993 | | 167,857 |

| Ser. 2006-66, Cl. A, 4.09%, 1/16/30 | | | | 1,589,604 | | 1,552,523 |

| Ser. 2006-3, Cl. A, 4.21%, 1/16/28 | | | | 1,698,833 | | 1,665,869 |

| Ser. 2006-5, Cl. A, 4.24%, 7/16/29 | | | | 1,214,907 | | 1,191,665 |

| Ser. 2006-55, Cl. A, 4.25%, 7/16/29 | | | | 1,445,023 | | 1,415,284 |

| Ser. 2005-32, Cl. B, 4.39%, 8/16/30 | | | | 1,175,000 | | 1,157,845 |

| Ser. 2005-87, Cl. A, 4.45%, 3/16/25 | | | | 1,011,512 | | 996,994 |

26

| | | Principal | | |

| Bonds and Notes (continued) | | Amount ($) | | Value ($) |

| |

| |

|

| U.S. Government Agencies/ | | | | |

| Mortgage-Backed (continued) | | | | |

| Federal Home Loan Mortgage Corp., | | | | |

| Multiclass Mortgage Participation Ctfs., | | |

| Ser. 2586, Cl. WE, 4.00%, 12/15/32 | | 2,438,051 | | 2,308,790 |

| | | | | 111,716,451 |

| U.S. Government Securities—17.6% | | | | |

| U.S. Treasury Bonds: | | | | |

| 4.50%, 2/15/36 | | 3,800,000 f | | 3,583,878 |

| 4.75%, 2/15/37 | | 9,095,000 f | | 8,955,737 |

| U.S. Treasury Notes: | | | | |

| 4.38%, 12/31/07 | | 750,000 j | | 746,778 |

| 4.50%, 3/31/09 | | 14,335,000 f | | 14,317,096 |

| 4.50%, 9/30/11 | | 3,150,000 e | | 3,145,816 |

| 4.63%, 11/15/09 | | 6,845,000 e | | 6,857,567 |

| 4.63%, 2/15/17 | | 14,260,000 f | | 14,235,501 |

| | | | | 51,842,373 |

| Total Bonds and Notes | | | | |

| (cost $400,095,068) | | | | 397,718,696 |

| |

| |

|

| |

| | | Face Amount | | |

| | | Covered by | | |

| Options—.1% | | Contracts ($) | | Value ($) |

| |

| |

|

| Call Options—.1% | | | | |

| 3-Month Floor USD Libor-BBA | | | | |

| Interest Rate, January 2009 @ 4 | | 15,500,000 | | 13,960 |

| 3-Month USD Libor-BBA, | | | | |

| Swaption | | 9,020,000 | | 398,422 |

| | | | | 412,382 |

| Put Options—.0% | | | | |

| 3-Month Capped USD Libor-BBA | | | | |

| Interest Rate, June 2007 @ 5.75 | | 63,000,000 | | 1 |

| Total Options | | | | |

| (cost $486,165) | | | | 412,383 |

| |

| |

|

| |

| | | Principal | | |

| Short-Term Investments—.9% | | Amount ($) | | Value ($) |

| |

| |

|

| Commercial Paper | | | | |

| Cox Enterprises, | | | | |

| 5.60%, 8/15/07 | | | | |

| (cost $2,600,000) | | 2,600,000 c,d | | 2,600,000 |

T h e F u n d 27

S TAT E M E N T O F I N V E S T M E N T S (continued)

| Other Investment—4.3% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | | | |

| (cost $12,604,000) | | | | 12,604,000 k | | 12,604,000 |

| |

| |

| |

|

| |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—4.3% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash | | | | | | |

| Advantage Fund | | | | | | |

| (cost $12,639,265) | | | | 12,639,265 k | | 12,639,265 |

| |

| |

| |

|

| |

| Total Investments (cost $428,424,498) | | 144.5% | | 425,974,344 |

| |

| Liabilities, Less Cash and Receivables | | (44.5%) | | (131,220,148) |

| |

| Net Assets | | | | 100.0% | | 294,754,196 |

| |

| a | | Non-income producing—security in default. | | | | |

| b | | The value of this security has been determined in good faith under the direction of the Board of Directors. |

| c | | Variable rate security—interest rate subject to periodic change. | | |

| d | | Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold |

| | | transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2007, these securities |

| | | amounted to $39,047,055 or 13.2% of net assets. | | | | |

| e | | All or a portion of these securities are on loan. At March 31, 2007, the total market value of the fund’s securities |

| | | loan is $21,873,585 and the total market value of the collateral held by the fund is $22,713,078, consisting of |

| | | cash collateral of $12,639,265, U.S. Government and agency securities valued at $3,287,813, and Letters of |

| | | Credit valued at $6,786,000. | | | | | | |

| f | | Purchased on a delayed delivery basis. | | | | |

| g | | Principal amount stated in U.S. Dollars unless otherwise noted. | | |

| | | BRL—Brazilian Real EUR—Euro. | | | | |

| h | | Purchased on a forward commitment basis. | | | | |

| i | | Notional face amount shown. | | | | | | |

| j | | Held by a broker as collateral for open financial futures positions. | | |

| k | | Investment in affiliated money market mutual fund. | | | | |

| |

| |

| |

|

| |

| |

| Portfolio Summary (Unaudited) † | | | | |

| |

| | | | | Value (%) | | | | Value (%) |

| |

| |

| |

| |

|

| U.S. Government & Agencies | | 55.7 | | Foreign/Governmental | | 2.9 |

| Corporate Bonds | | 45.7 | | State/Government | | |

| Asset/Mortgage-Backed | | 28.6 | | General Obligations | | 2.0 |

| Short-Term/Money | | | | Options | | .1 |

| Market Investments | | 9.5 | | | | 144.5 |

| |

| † | | Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

28

S TAT E M E N T O F F I N A N C I A L F U T U R E S

| M a r c h 3 1 , 2 0 0 7 | | | | | | | | |

| |

| |

| |

| |

|

| |

| |

| |

| | | | | | | | | Unrealized |

| | | | | Market Value | | | | Appreciation |

| | | | | Covered by | | | | (Depreciation) |

| | | Contracts | | Contracts ($) | | Expiration | | at 3/31/2007 ($) |

| |

| |

| |

| |

|

| Financial Futures Long | | | | | | | | |

| U.S. Treasury 2 Year Notes | | 178 | | 36,470,530 | | June 2007 | | 11,499 |

| U.S. Treasury 5 Year Notes | | 64 | | 6,771,000 | | June 2007 | | (5,999) |

| Financial Futures Short | | | | | | | | |

| U.S. Treasury 10 Year Notes | | 249 | | (26,923,124) | | June 2007 | | 80,766 |

| U.S. Treasury 30 Year Bonds | | 174 | | (19,357,500) | | June 2007 | | 233,117 |

| | | | | | | | | 319,383 |

See notes to financial statements.

T h e F u n d 29

S TAT E M E N T O F A S S E T S A N D L I A B I L I T I E S

| M a r c h 3 1 , 2 0 0 7 | | | | |

| |

| |

|

| |

| |

| |

| |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement | | | | |

| of Investments (including securities on loan, | | |

| valued at $21,873,585)—Note 1(c): | | | | |

| Unaffiliated issuers | | 403,181,233 | | 400,731,079 |

| Affiliated issuers | | 25,243,265 | | 25,243,265 |

| Cash denominated in foreign currencies | | 22 | | 22 |

| Receivable for investment securities sold | | | | 15,031,880 |

| Dividends and interest receivable | | | | 3,616,707 |

| Unrealized appreciation on swap contracts—Note 4 | | 102,739 |

| Swaps premiums paid | | | | 65,426 |

| Receivable for futures variation margin—Note 4 | | 63,337 |

| Receivable from broker for swap transactions—Note 4 | | 22,711 |

| Receivable for shares of Common Stock subscribed | | 13,989 |

| Prepaid expenses | | | | 29,920 |

| | | | | 444,921,075 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 207,287 |

| Payable for investment securities purchased | | 114,571,734 |

| Cash overdraft due to Custodian | | | | 14,253,792 |

| Liability for securities on loan—Note 1(c) | | | | 12,639,265 |

| Payable for shares of Common Stock redeemed | | 8,144,298 |

| Unrealized depreciation on swap contracts—Note 4 | | 193,317 |

| Unrealized depreciation on forward currency | | |

| exchange contracts—Note 4 | | | | 421 |

| Accrued expenses | | | | 156,765 |

| | | | | 150,166,879 |

| |

| |

|

| Net Assets ($) | | | | 294,754,196 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 333,371,758 |

| Accumulated undistributed investment income—net | | 4,255,450 |

| Accumulated net realized gain (loss) on investments | | (40,694,537) |

| Accumulated net unrealized appreciation (depreciation) | | |

| on investments, foreign currency transactions, options | | |

| transactions and swap transactions (including $319,383 net | | |

| unrealized appreciation on financial futures) | | (2,178,475) |

| |

|

| Net Assets ($) | | | | 294,754,196 |

| |

| |

|

| Shares Outstanding | | | | |

| (100 million shares of $.001 par value Common Stock authorized) | | 21,709,642 |

| Net Asset Value, offering and redemption price per share ($) | | 13.58 |

See notes to financial statements.

30

| S TAT E M E N T | | O F O P E R AT I O N S | | |

| Ye a r E n d e d M a r c h | | 3 1 , 2 0 0 7 | | |

| |

| |

|

| |

| |

| |

| |

| Investment Income ($): | | |

| Income: | | | | |

| Interest | | | | 16,751,116 |

| Cash dividends; | | | | |

| Affiliated issuers | | | | 294,218 |

| Income from securities lending | | 15,239 |

| Total Income | | | | 17,060,573 |

| Expenses: | | | | |

| Management fee—Note 3(a) | | 2,055,808 |

| Shareholder servicing costs—Note 3(b) | | 723,066 |

| Custodian fees—Note 3(b) | | 64,929 |

| Professional fees | | | | 63,183 |

| Prospectus and shareholders’ reports | | 46,532 |

| Directors’ fees and expenses—Note 3(c) | | 40,391 |

| Registration fees | | | | 29,527 |

| Miscellaneous | | | | 60,902 |

| Total Expenses | | | | 3,084,338 |

| Less—reduction in management fee | | |

| due to undertaking—Note 3(a) | | (198,820) |

| Less—reduction in custody fees due to | | |

| earnings credits—Note 1(c) | | (15,354) |

| Net Expenses | | | | 2,870,164 |

| Investment Income—Net | | 14,190,409 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments and foreign currency transactions | | (868,455) |

| Net realized gain (loss) on forward currency exchange contracts | | 104,907 |

| Net realized gain (loss) on financial futures | | (489,455) |

| Net realized gain (loss) on options transactions | | (21,295) |

| Net realized gain (loss) on swap transactions | | 277,392 |

| Net Realized Gain (Loss) | | (996,906) |

| Net unrealized appreciation (depreciation) on investments, | | |

| foreign currency transactions, options transactions and | | |

| swap transactions (including $52,289 net unrealized | | |

| appreciation on financial futures) | | 6,785,092 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 5,788,186 |

| Net Increase in Net Assets Resulting from Operations | | 19,978,595 |

| |

| See notes to financial statements. | | |

T h e F u n d 31

S TAT E M E N T O F C H A N G E S I N N E T A S S E T S

| | | | | Year Ended March 31, |

| |

| |

|

| | | 2007 | | 2006 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 14,190,409 | | 13,569,028 |

| Net realized gain (loss) on investments | | (996,906) | | (1,005,583) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 6,785,092 | | (3,525,476) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 19,978,595 | | 9,037,969 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net | | (14,736,923) | | (17,484,365) |

| |

| |

|

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold | | 16,132,089 | | 24,627,689 |

| Dividends reinvested | | 13,012,053 | | 15,462,472 |

| Cost of shares redeemed | | (77,714,773) | | (79,625,020) |

| Increase (Decrease) in Net Assets from | | | | |

| Capital Stock Transactions | | (48,570,631) | | (39,534,859) |

| Total Increase (Decrease) in Net Assets | | (43,328,959) | | (47,981,255) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 338,083,155 | | 386,064,410 |

| End of Period | | 294,754,196 | | 338,083,155 |

| Undistributed investment income—net | | 4,255,450 | | 3,864,186 |

| |

| |

|

| Capital Share Transactions (Shares): | | | | |

| Shares sold | | 1,201,558 | | 1,798,349 |

| Shares issued for dividends reinvested | | 973,439 | | 1,132,772 |

| Shares redeemed | | (5,798,835) | | (5,830,650) |

| Net Increase (Decrease) in Shares Outstanding | | (3,623,838) | | (2,899,529) |

See notes to financial statements.

32

F I N A N C I A L H I G H L I G H T S

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended March 31, | | |

| |

| |

| |

|

| | | 2007 | | 2006 | | 2005 | | 2004a | | 2003 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 13.35 | | 13.67 | | 14.14 | | 14.12 | | 13.47 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net b | | .60 | | .50 | | .47 | | .44 | | .63 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .25 | | (.17) | | (.35) | | .11 | | .71 |

| Total from Investment Operations | | .85 | | .33 | | .12 | | .55 | | 1.34 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.62) | | (.65) | | (.59) | | (.53) | | (.69) |

| Net asset value, end of period | | 13.58 | | 13.35 | | 13.67 | | 14.14 | | 14.12 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 6.48 | | 2.39 | | .89 | | 4.01 | | 10.30 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .98 | | .92 | | .93 | | .93 | | .93 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | .91 | | .82 | | .91 | | .93 | | .93 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 4.49 | | 3.66 | | 3.42 | | 3.09 | | 4.56 |

| Portfolio Turnover Rate | | 405.17c | | 444.62c | | 648.92c | | 803.93c | | 636.05 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 294,754 | | 338,083 | | 386,064 | | 509,354 | | 606,960 |

| a | | As of April 1, 2003, the fund has adopted the method of accounting for interim payments on swap contracts in |

| | | accordance with Financial Accounting Standards Board Statement No. 133.These interim payments are reflected |

| | | within net realized and unrealized gain (loss) on swap contracts, however, prior to April 1, 2003, these interim |

| | | payments were reflected within interest income/expense in the Statement of Operations.The effect of this change for |

| | | the period ended March 31, 2004, was to increase net investment income per share by $.01, decrease net realized |

| | | and unrealized gain (loss) on investments per share by $.01 and increase the ratio of net investment income to |