DEFA14A

PROXY STATEMENT PURSUANT TO SECTION 14 (a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a Party other than the [_]

Registrant

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[_ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[_] Soliciting Materials under Rule 14a-12

The Dreyfus Third Century Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

(4) Proposed maximum aggregate value of transaction:

(5) Total Fee Paid:

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0- 11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Good (morning, afternoon, evening), my name is(AGENT’S FULL NAME).

May I please speak with(SHAREHOLDER’S FULL NAME)?(Re-Greet If Necessary)

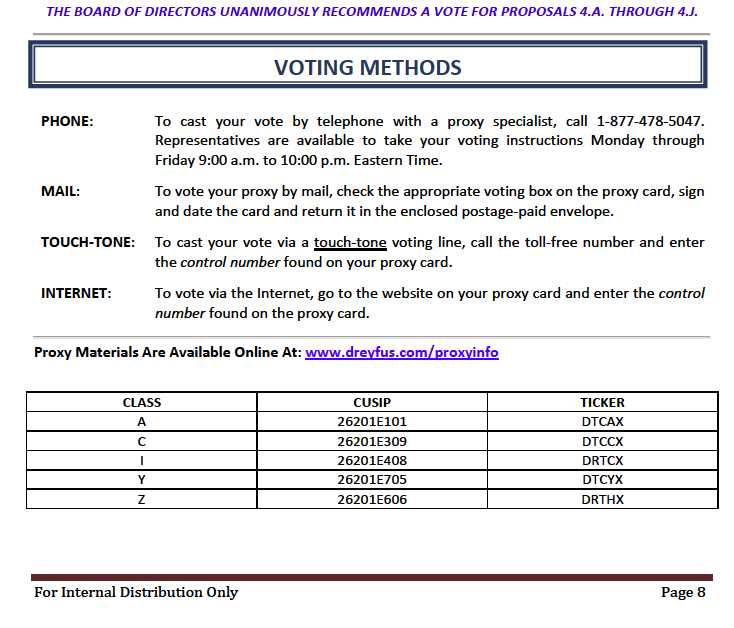

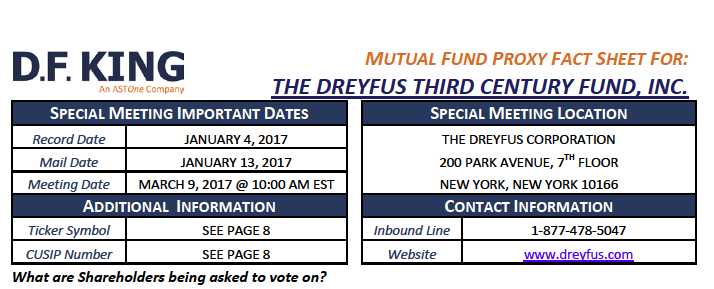

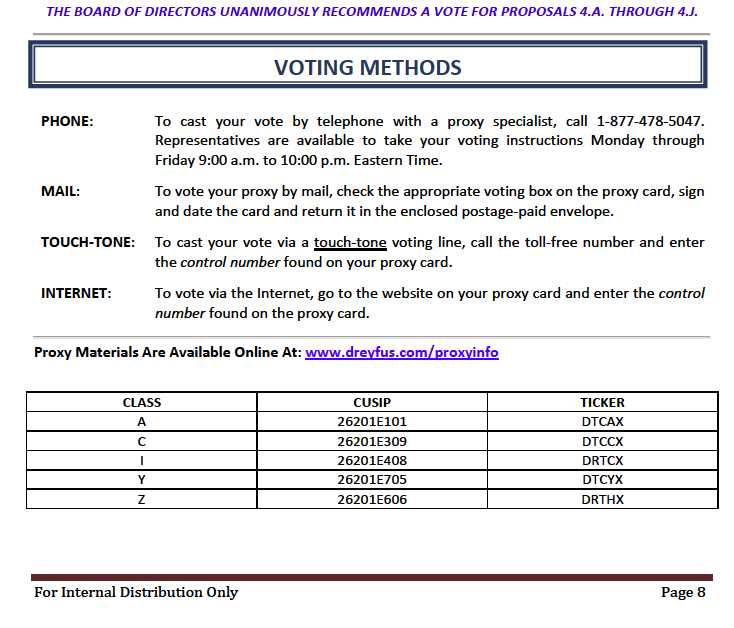

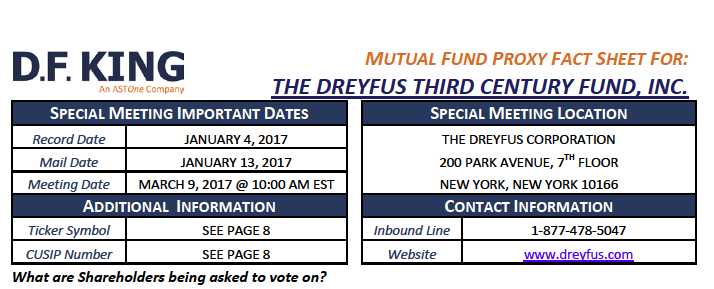

I am calling on a recorded line from D.F. King and Co. regarding your current investment with The Dreyfus Third Century Fund, Inc. (the “Fund”). You were recently sent proxy materials along with a proxy card or voting instruction form to cast your vote at the Special Meeting of Shareholders scheduled to take place on March 9, 2017.

1.Have you received this information?(Pause for response)

If “Yes” or positive response to receiving information:

If you’re not able to attend the meeting, I can record your voting instructions by phone. The Fund’s Board has approved each proposal and is recommending a vote “In Favor” (proceed to #2).

If “No” or negative response to receiving information:

We would be happy to resend the information to you. For verification purposes, please state your mailing address.

(If address is incorrect, go to “Shareholder states a different address during confirmation”) (If still incorrect, go to “Wrong address given by investor”)Would you prefer mail or e-mail?(Pause For Response)

E-mail:I would be happy to e-mail you the information and, if you’d like, you can reply to the e-mail with your voting instructions and we can process your vote accordingly. You can also e-mail us back with any questions you have, or feel free to contact us at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time. May I please have your e-mail address?

(Pause & record e-mail, read e-mail back to shareholder to confirm)

Please allow 24 hours to receive the materials. The e-mail will come from D.F. King and Co. Please check your spam folder if you don’t see our e-mail in your inbox. Once you receive your proxy statement and other materials, if you have any questions, or would like us to take your vote by phone, feel free to contact us at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time. Thank you for your time and have a good(morning, afternoon, evening).

Mail:We will send the materials to you by mail. Please allow 5 to 7 business days for delivery. Once you receive your proxy statement and other materials, if you have any questions, or would like us to take your vote by phone, feel free to contact us at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time. Thank you for your time and have a good(morning, afternoon, evening).

2. Would you like to vote along with the Board’s Recommendation?(Pause For Response)

Voting with Board’s Recommendation:(Proceed to Confirmation)If not voting with Board’s recommendation or unsure how to vote:

Use appropriate Rebuttal and/or explanation from Fact Sheet and follow up with:

Based on this information, would you like to vote “In Favor” along with the Board’s recommendation?

(Pause For Response)

CONFIRMATION:

If we identify any additional accounts you hold in the Fund before the meeting takes place, would you like us to vote those accounts in the same manner as well?(Pause For Response)

I am recording your(Recap Voting Instructions). For confirmation purposes:

Please state your full name.(Pause – refer to “Shareholder neglects to state middle initial/namesuffix/street direction/apartment during confirmation”if neglects to state middle initial or suffix)

To ensure that we have the correct address for the written confirmation, please state your full streetaddress.(Pause)(If Wrong address is stated, go to “Shareholder states a different address during confirmation”)(If still incorrect, go to “Wrong address/name/middle initial/name suffix/street direction/apartmentgiven by investor”)

Shareholder states a different address during confirmation:

Our records indicate a different address. Is it possible the account has been registered at a different address?

Wrong address/name/middle initial/name suffix/street direction/apartmentgiven by investor:Mr./Mrs./Ms.(SHAREHOLDER’S LAST NAME)I apologize but the(address/name/middle initial/name suffix/street direction/apartment)that you just recited for me doesn’t match our records and, therefore, I can’t take your vote by telephone. Instead, I urge you to complete, sign, date and return your proxy card or voting instruction form at your earliest convenience, or vote your shares by touch-tone telephone or on the Internet by following the instructions provided on your proxy card or voting instruction form. Thank you for your time and have a good (morning, afternoon, evening).

Shareholder neglects to state middle initial/name suffix/street direction/apartment during confirmation:

Our records also show a(middle initial/name suffix/street direction/apartment). Can you please confirm that as well?(If neglected information is not given, go to “Wrong address/name/middle initial/name suffix/street direction/apartment given by investorgiven by investor”)

“Why do I need to vote?” or “Why is it so important that I vote?”

We want to ensure that your shares are represented at the upcoming special meeting of shareholders. If there is a lack of shareholder participation,the meeting might be delayed or adjourned, which may create additional solicitation costs. The Board has approved and is recommending a vote “In Favor”. May I record your vote at this time?

Shareholder refuses to vote or give address:

I understand you don’t wish to vote at this time, please remember your vote is very important and your time is appreciated. If you change your mind and would like us to assist you in voting by telephone, please call us back toll-free at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time. You can vote at any time by completing, signing, dating and returning your proxy card or voting instruction form using the postage-paid envelope provided, or by touch-tone telephone or on the Internet by following the instructions provided on your proxy card or voting instruction form. Thank you for your time and have a good

(morning, afternoon, evening).

ANSWERING MACHINE SCRIPT:

Hello. My name is [AGENT’S FULL NAME] and I am calling from D.F. King & Co. regarding your investment in The Dreyfus Third Century Fund, Inc. You should have recently received proxy materials in the mail concerning the Fund’s Special Meeting of Shareholders to be held on March 9, 2017. Your vote is important. Please sign, date and promptly mail your proxy card or voting instruction form in the postage-paid envelope provided. Internet or touch-tone telephone voting also is available. Please follow the instructions provided on your proxy card or voting instruction form. If you have any questions, would like to vote or need new proxy materials, please call D.F. King, which is your Fund’s proxy solicitor, at 1-877-478-5047. Thank you.

| | |

| 1 | .A. | To approve removing The Dreyfus Third Century Fund, Inc.’s (the “Fund”) current fundamental social |

| | | investment policy and related fundamental social considerations regarding its investment strategy. |

| 1 | .B. | To approve a sub-investment advisory agreement between The Dreyfus Corporation (“Dreyfus”) and |

| | | Newton Investment Management (North America) Limited (“Newton”) with respect to the Fund. |

| 2 | .A. | To approve changing the Fund's investment objective. |

| 2 | .B. | To approve changing the Fund's investment objective from a fundamental policy to a non- |

| | | fundamental policy. |

| 3 | .A. | To approve the implementation of a "manager of managers" arrangement whereby Dreyfus, under |

| | | certain circumstances, would be able to hire and replace Fund sub-advisers that are either |

| | | unaffiliated with Dreyfus or are wholly-owned subsidiaries of Dreyfus' ultimate parent company, The |

| | | Bank of New York Mellon Corporation ("BNY Mellon"), without obtaining shareholder approval. |

| 3 | .B. | To approve the implementation of a "manager of managers" arrangement whereby Dreyfus, under |

| | | certain circumstances, and subject to the Securities and Exchange Commission's (the “SEC”) issuance |

| | | of an exemptive order to the Fund and Dreyfus, would be able to hire and replace Fund sub-advisers |

| | | that are either unaffiliated or affiliated with Dreyfus (whether or not wholly-owned subsidiaries of |

| | | BNY Mellon) without obtaining shareholder approval. |

| 4 | .A. | To approve changing a fundamental investment restriction regarding investing in commodities, real |

| | | estate, oil and gas, including adopting a separate fundamental investment restriction regarding |

| | | investing in physical commodities and certain derivative instruments. |

| 4 | .B. | To approve changing fundamental investment restrictions regarding issuer diversification. |

| 4 | .C. | To approve changing a fundamental investment restriction regarding industry concentration. |

| 4 | .D. | To approve changing a fundamental investment restriction on margin, including changing it to a non- |

| | | fundamental policy. |

| 4 | .E. | To approve removing a fundamental investment restriction regarding short sales and certain |

| | | derivative transactions. |

| 4 | .F. | To approve changing a fundamental investment restriction regarding underwriting the securities of |

| | | other issuers. |

| 4 | .G. | To approve changing a fundamental investment restriction regarding investing in companies for the |

| | | purpose of exercising control to a non-fundamental policy. |

| 4 | .H. | To approve removing a fundamental investment restriction regarding companies with limited |

| | | operations. |

| 4 | .I. | To approve removing fundamental investment restrictions regarding investments in securities where |

| | | affiliated persons are involved. |

| 4 | .J. | To approve removing a fundamental investment restriction regarding warrants. |

What is happening?

As a shareholder of the Fund, you are being asked to vote on certain matters in connection with the implementation of proposed changes to the Fund’s investment strategy. These changes are part of a recommendation by Dreyfus, the Fund’s investment adviser, to change the Fund’s investment strategy to focus on sustainable andenvironmental,social andgovernance (“ESG”) investing.

If approved, when will the proposed changes take effect?

If shareholders approve the Proposals set forth, the proposed changes would take effect on or about May 1, 2017 (the “Effective Date”).

Who will bear the costs of the proxy solicitation?

The Fund will bear the costs of the proxy solicitation. By voting promptly, you can help avoid additional costs that are incurred with follow-up letters and calls. Because the cost of the proxy solicitation is being borne by the Fund, such additional costs would be borne indirectly by Fund shareholders. The Fund has retained D.F. King & Co., Inc. to assist in the solicitation of proxies, primarily by contacting shareholders by telephone. This information is mentioned on pages 32 and 33 of the proxy statement.

Is approval of the proposals contingent upon one another?

Yes. IfeitherProposal 1.A. or Proposal 1.B. is not approved by shareholders, Proposals 1.A. and 1.B. Proposal 2.A. and Proposals 3.A. and 3.B. will not take effect. Proposals 2.B. and 4.A. through 4.J. arenotcontingent on the approval of any other proposals, and each will take effect if approved by shareholders, regardless of whether any other proposals are approved.

What will happen if shareholders do not approve the proposals?

IfeitherProposal 1.A. or Proposal 1.B. is not approved, the Fund’s investment strategy will continue to be implemented as currently described, unless Fund management or the Board proposes further changes.

If Proposal 2.A. is not approved, the Fund will maintain its current investment objective, unless Fund management or the Board proposes further changes.

If Proposal 2.B. is not approved, shareholder approval would continue to be required to change the Fund’s investment objective.

If Proposal 3.A. is not approved, shareholder approval would continue to be required for Dreyfus to enter into or materially amend Fund sub-investment advisory agreements with sub-advisers that are either unaffiliated with Dreyfus or are wholly-owned subsidiaries of Dreyfus’ ultimate parent company, BNY Mellon.

If Proposal 3.B. is not approved, but Proposal 3.A. is approved, shareholder approval would continue to be required for Dreyfus to enter into or materially amend Fund sub-investment advisory agreements with affiliates of Dreyfus that are not wholly-owned subsidiaries of BNY Mellon, even if the requested order described below were to be granted by the SEC.

If neither Proposal 3.A. nor Proposal 3.B. is approved, shareholder approval would continue to be required to enter into or materially amend any Fund sub-investment advisory agreement.

If any or all of Proposals 4.A. through 4.J. are not approved, it is not anticipated that there will be any practical effect on the Fund’s current or proposed investment strategies.

PROPOSAL 1.A. - To approve removing the Fund's current fundamental investment policy and related fundamental social considerations regarding its investment strategy.

See pages 8 and 9 of Proxy Statement for additional information on the (Fund’s current fundamental social investment policy)

PROPOSAL 1.B. - To approve a sub-investment advisory agreement between Dreyfus and Newton with respect to the Fund.

Why are shareholders being asked to approve Proposals 1.A. and 1.B.?

In connection with Dreyfus’ recommendation to change the Fund’s investment strategy to focus on sustainable and ESG investing, the Fund’s Board of Directors (the “Board”) has approved, subject to shareholder approval of Proposals 1.A. and 1.B., removing certain current fundamental social investment policies and considerations of the Fund and Dreyfus’ engagement of Newton, an affiliate of Dreyfus, as sub-adviser for the Fund.

Are the changes proposed in Proposals 1.A. and 1.B. believed to be in the best interests of Fund shareholders?

Yes. Management of the Fund believes that, and the Board approved, replacing the Fund’s current investment strategy that applies social screening criteria to investment decisions with one that integrates sustainable and ESG considerations in the investment process, combined with the investment management skills afforded by Newton generally and with respect to sustainable/ESG investing in particular, would be in the best interests of Fund shareholders.

Why has Fund Management proposed removing the Fund’s current fundamental investment policy?

To enable the Fund to change its investment strategy and Newton to fully implement for the Fund its investment approach that systematically integrates the consideration of ESG issues, management proposed, and the Board has approved, subject to shareholder approval, removing the Fund’s current fundamental investment policy of investing in companies that, in the opinion of the Fund’s management, conduct their business in a manner that contributes to the enhancement of the quality of life in America and related fundamental social considerations.

What is the proposed investment strategy for the Fund?

Under the proposed investment strategy, the Fund normally would invest at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities (or derivative instruments with similar economic characteristics) of U.S. companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable ESG issues. Newton considers a company to engage in “sustainable business practices” if the company engages in such practices in an economic sense (i.e., the durability of the company’s strategy, operations and finances), and takes appropriate account of material externalities caused by or affecting its business.

Will advisory fees decrease as a result of Proposals 1.A. and 1.B.?

Yes. In connection with, and subject to shareholder approval of, Proposals 1.A. and 1.B., Dreyfus will contractually reduce the annual rate of its management fee from 0.75% to 0.60% of the value of the Fund’s average daily net assets, effective as of the Effective Date.

consequence of the appointment of Newton or the implementation of the Newton Sub-Advisory Agreement.

Will the Fund’s name be changed in connection with the proposed change to the Fund’s investment strategy?

Yes. To be consistent with the proposed change to the Fund’s investment strategy, the Fund’s name would be changed to “The Dreyfus Sustainable U.S. Equity Fund, Inc.”

Can you provide me with additional information on Newton?

Newton is an indirect wholly-owned subsidiary of BNY Mellon, located at 160 Queen Victoria Street, London, EC4V 4LA, United Kingdom. Newton, a registered investment adviser, was formed in 1978 and, as of September 30, 2016, together with its affiliates that comprise the Newton group of companies, managed approximately $70.9 billion in discretionary separate accounts and other investment accounts. Newton is affiliated with Dreyfus.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSALS 1.A. & 1.B.

PROPOSAL 2.A. – To approve changing the Fund's investment objective.

PROPOSAL 2.B. – To approve changing the Fund's investment objective from a fundamental policy to a non-fundamental policy.

Why are shareholders being asked to approve proposal 2.A.?

The Board has approved, subject to shareholder approval of Proposal 2.A. and both Proposals 1.A. and 1.B., changing the Fund’s investment objective. To be consistent with the proposed change to the Fund’s investment strategy, the Fund’s new investment objective would change to seeking long-term capital appreciation and the Fund would no longer seek current income as a secondary goal. Currently, the Fund seeks to provide capital growth, with current income as a secondary goal. Changing the Fund’s investment objective is not required to enable the Fund to change its investment strategy and Newton to fully implement its investment approach for the Fund. Under the proposed investment strategy, the Fund will invest principally in common stocks of companies that meet Newton’s ESG and traditional standards, which Newton believes will benefit fromlong-termtrends.

Why are shareholders being asked to approve proposal 2.B.?

The Board also has approved, subject to shareholder approval of Proposal 2.B., changing the Fund’s investment objective from a fundamental policy (which may not be changed without Board and shareholder approval) to a non-fundamental policy (which may be changed by the Board upon 60 days’ prior notice to shareholders). Although the Fund has no current intention of changing the Fund’s investment objective (other than as described in Proposal 2.A.), if in the future it is determined that changing the Fund’s investment objective may be advantageous, the process of changing the investment objective would not involve the time and expense of seeking shareholder approval.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSALS 2.A. & 2.B.

PROPOSAL 3.A. - To approve the implementation of a "manager of managers" arrangement whereby Dreyfus, under certain circumstances, would be able to hire and replace Fund sub-advisers that are either unaffiliated with Dreyfus or are wholly-owned subsidiaries of Dreyfus' ultimate parent company, BNY Mellon, without obtaining shareholder approval.

PROPOSAL 3.B. - To approve the implementation of a "manager of managers" arrangement whereby Dreyfus, under certain circumstances, and subject to the SEC’s issuance of an exemptive order to the Fund and Dreyfus, would be able to hire and replace Fund sub-advisers that are either unaffiliated or affiliated with Dreyfus (whether or not wholly-owned subsidiaries of BNY Mellon) without obtaining shareholder approval.

Why are shareholders being asked to approve Proposals 3.A. and 3.B.?

Currently, hiring or replacing a sub-adviser generally requires shareholder approval of the sub-investment advisory agreement. Because the process of seeking shareholder approval of sub-investment advisory agreements is administratively burdensome and costly to a fund (and therefore indirectly to the fund’s shareholders), it may cause delays in executing changes that the Fund’s Board and Dreyfus have determined are necessary or desirable. Implementation of a “manager of managers” arrangement for the Fund would provide the Fund with increased flexibility and avoid costs associated with shareholder meetings.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSALS 3.A. & 3.B.

PROPOSAL 4

Why are shareholders being asked to approve Proposals 4.A. through 4.J.?

The Board has approved, subject to shareholder approval of Proposals 4.A. through 4.J., changing or removing certain of the Fund’s fundamental investment restrictions to provide the Fund with additional investment flexibility, to clarify and/or expand the Fund’s ability to enter into certain types of transactions and/or to better align the relevant fundamental investment restrictions with those of other funds in the Dreyfus Family of Funds. Consistency in investment restrictions among the Fund and other funds in the Dreyfus Family of Funds, when appropriate, simplifies the investment process for investment personnel managing similar funds and also simplifies the compliance monitoring process for compliance personnel and relevant systems. Simplification of the investment process and compliance monitoring process should enable Fund shareholders to benefit from more efficient management of portfolio compliance. These restrictions pertain to investing in commodities, real estate, oil and gas, and certain derivative instruments; selling securities short; issuer diversification; industry concentration; margin; underwriting the securities of other issuers; investing for control; investing in companies with limited operations; investing in securities where affiliated persons are involved; and investing in warrants. The changes to, or removal of, these fundamental investment restrictions are not required to enable the Fund to change its investment strategy and Newton to fully implement its investment approach for the Fund.

4.A. To approve changing a fundamental investment restriction regarding investing in commodities, real estate, oil and gas, including adopting a separate fundamental investment restriction regarding investing in physical commodities and certain derivative instruments.

Rationale for changing:

Although the Fund does not have any current intention of investing in physical commodities or commodity contracts, in oil, gas, or other mineral exploration or development programs, or in real estate (other than real estate investment trusts) or in a manner inconsistent with current non-fundamental policy No. 5 (illiquid investments), the Board recommends that Fund shareholders

approve changing the investment restriction to provide the Fund with maximum flexibility, including changing the investment restriction to add certain exceptions to the restriction on the Fund purchasing, holding or dealing in commodities or commodity contracts or investing in real estate in order to clarify and/or expand the Fund’s ability to invest in certain securities and derivatives. Moreover, it is proposed that the restriction regarding real estate, oil and gas and the restriction regarding commodities be separated into two investment restrictions.

4.B. To approve changing fundamental investment restrictions regarding issuer diversification.

Rationale for changing:

The Board recommends that Fund shareholders approve changing the Fund’s fundamental investment restrictions regarding issuer diversification to better align such investment restrictions with those of other funds in the Dreyfus Family of Funds and to provide the Fund with additional investment flexibility consistent with the Investment Company Act of 1940, as amended (the “1940 Act”). Changing these investment restrictions wouldnothave the effect of changing the sub-classification of the Fund from a “diversified company” to a “non-diversified company,” as such terms are defined in the 1940 Act.

4.C. To approve changing a fundamental investment restriction regarding industry concentration.

Rationale for changing:

The Board recommends that Fund shareholders approve changing the Fund’s fundamental investment restriction to better align such investment restriction with that of other funds in the Dreyfus Family of Funds and to provide the Fund with additional investment flexibility consistent with the 1940 Act. The proposed change to the Fund’s fundamental investment restriction regarding industry concentration would clarify that (1) the Fund would be permitted to invest more than 25% of the value of its total assets in obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities or as otherwise permitted by the SEC, and (2) securities issued or guaranteed by governments other than the U.S. Government or by foreign supranational entities are not considered to be the securities of issuers in a single industry for purposes of this fundamental investment restriction (although all the sovereign debt of a single country would be considered investments in a single industry).

4.D. To approve changing a fundamental investment restriction on margin, including changing it to a non-fundamental policy.

Rationale for changing:

The Board recommends that Fund shareholders approve changing this investment restriction to clarify that the Fund has the ability to engage in transactions that might be considered to be on “margin,” such as short sales and certain types of derivatives transactions. In addition, this investment restriction, although currently a regulatory limitation for open-end investment companies, is not required to be a fundamental investment restriction and may be a non-fundamental investment restriction, which may be changed by the Board at any time without shareholder approval. If in the future regulatory requirements regarding purchasing securities on margin change, the process of removing or changing this investment restriction would be streamlined if the restriction were a non-fundamental investment restriction.

4.E. To approve removing a fundamental investment restriction regarding short sales and certain derivative transactions.

Rationale for removing:

Although the Fund does not have any current intention to sell securities short or engage in option writing or selling in excess of the limits stated in the restriction, under the Fund’s proposed investment strategy, it may use derivative instruments, including purchasing or selling put, call, straddle, or spread options or combinations thereof for purposes related to the management of the Fund. Accordingly, the Board recommends that Fund shareholders approve removing this investment restriction to provide the Fund with maximum flexibility.

| | |

| 4 | .F. | To approve changing a fundamental investment restriction regarding underwriting the securities |

| | | of other issuers. |

| | | Rationale for changing: |

| | | Although the Fund does not have any current intention of acting as an underwriter of securities of |

| | | other issuers, the Board recommends that Fund shareholders approve changing this investment |

| | | restriction to clarify that the Fund may act as an underwriter of securities to the extent that the Fund |

| | | would be deemed an underwriter under the Securities Act of 1933, as amended, by virtue of |

| | | purchasing or selling portfolio securities. |

| |

| 4 | .G. | To approve changing a fundamental investment restriction regarding investing in companies for |

| | | the purpose of exercising control to a non-fundamental policy. |

| | | Rationale for changing: |

| | | This investment restriction is not required to be a fundamental investment restriction and may be a |

| | | non-fundamental investment restriction, which may be changed by the Board at any time without |

| | | shareholder approval. Although the Fund has no current intention of investing in companies for the |

| | | purpose of exercising control, if in the future the Fund is deemed to be exercising control or if the |

| | | Fund determines that investing for the purpose of exercising control is advantageous for the Fund, |

| | | the process of removing or changing this investment restriction would be streamlined if the |

| | | restriction were a non-fundamental investment restriction. Accordingly, the Board has approved, |

| | | and recommends that shareholders approve, changing the investment restriction from a |

| | | fundamental investment restriction to a non-fundamental investment restriction. If the Proposal is |

| | | approved, the language of the investment restriction would not change; the investment restriction |

| | | would become a non-fundamental investment restriction that could be changed by the Board at any |

| | | time without shareholder approval. |

| |

| 4 | .H. | To approve removing a fundamental investment restriction regarding companies with limited |

| | | operations. |

| | | Rationale for removing: |

| | | Although the Fund does not have any current intention to purchase securities of any company |

| | | having less than three years’ continuous operating history (including that of any predecessors), the |

| | | Board recommends that Fund shareholders approve removing this investment restriction to provide |

| | | the Fund with maximumflexibility in the event of future changes to its investment strategy. |

| | | Accordingly, the Board has approved, and recommends that Fund shareholders approve, removing |

| | | this investment restriction. |

4.I. To approve removing fundamental investment restrictions regarding investments in securities where affiliated persons are involved.

Rationale for removing:

Although the Fund does not have any current intention to invest in a manner inconsistent with these investment restrictions, the Board recommends that Fund shareholders approve removing these investment restrictions to provide the Fund with maximum flexibility in the event of future changes to its investment strategy. Accordingly, the Board has approved, and recommends that Fund shareholders approve, removing these investment restrictions.

4.J. To approve removing a fundamental investment restriction regarding warrants.

Rationale for removing:

Although the Fund does not have any current intention to purchase warrants in excess of 2% of the value of its net assets, the Board recommends that Fund shareholders approve removing this investment restriction to provide the Fund with maximum flexibility in the event of future changes to its investment strategy. Accordingly, the Board has approved, and recommends that Fund shareholders approve, removing this investment restriction.