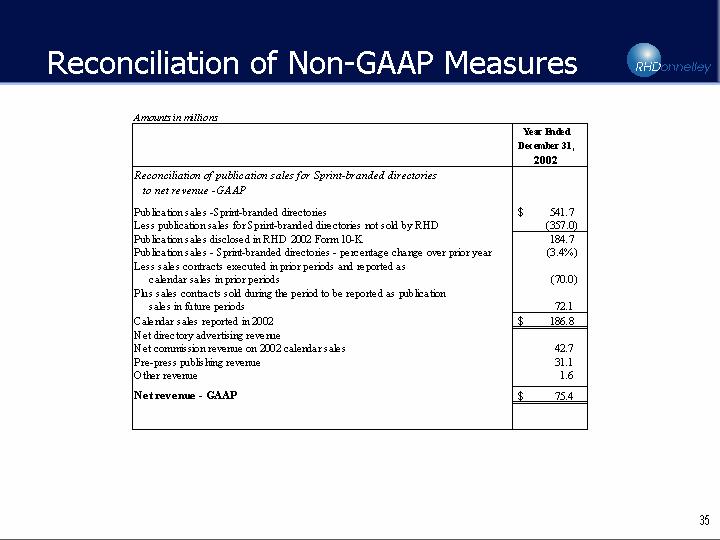

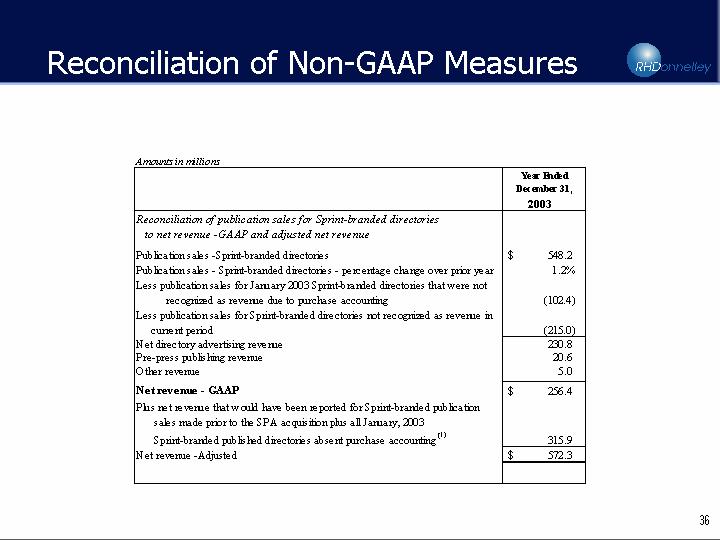

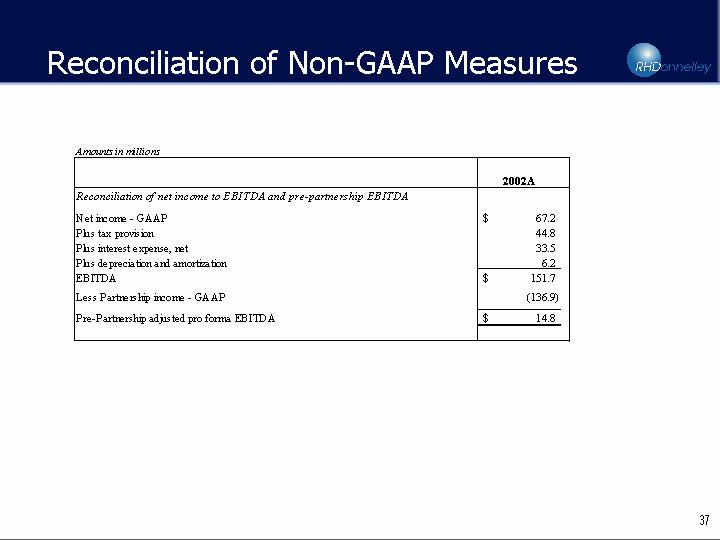

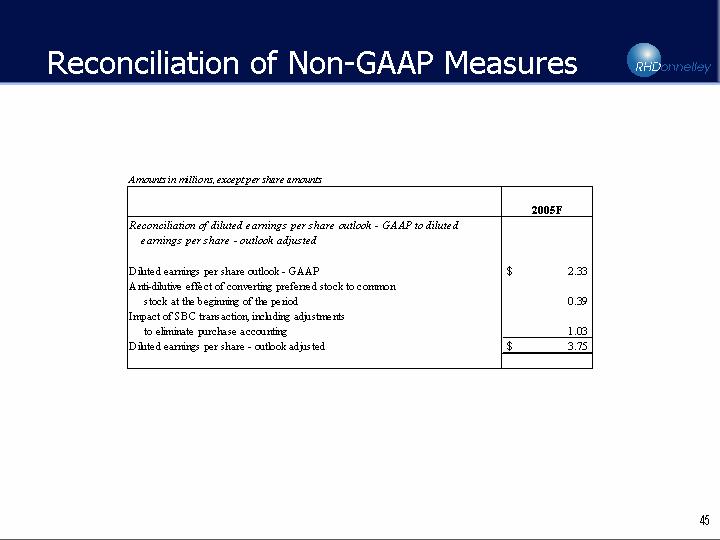

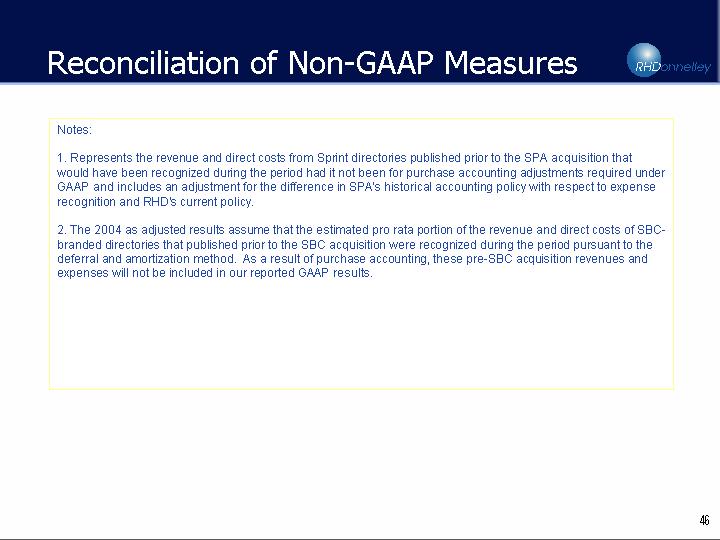

| Safe Harbor Statement Certain statements contained in this presentation regarding R.H. Donnelley's future operating results or performance or business plans or prospects and any other statements not constituting historical fact are "forward-looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where possible, the words "believe," "expect," "will," "anticipate," "should," "planned," "estimated," "projected," "forecasted" (or the symbols "E" "G" or "P"), "potential," "goal," "outlook," and similar expressions, as they relate to R.H. Donnelley or its management, have been used to identify such forward-looking statements. Regardless of any identifying phrases, these statements and all other forward-looking statements reflect only R.H. Donnelley's current beliefs and assumptions with respect to future business plans, prospects, decisions and results, and are based on information currently available to R.H. Donnelley. Accordingly, the statements are subject to significant risks, uncertainties and contingencies which could cause R.H. Donnelley's actual operating results, performance or business plans or prospects to differ from those expressed in, or implied by, these statements. Such risks, uncertainties and contingencies are described in detail in Management's Discussion and Analysis of Financial Condition and Results of Operations in the Company's Annual Report on Form 10-K for the year ended December 31, 2003, and the Company's Form 10-Q for the period ended September 30, 2004, as well as the Company's other periodic filings with the Securities and Exchange Commission, and in summary and without limitation include the following: (1) our ability to meet our substantial debt service obligations; (2) restrictive covenants under the terms of our debt and convertible preferred stock agreements; (3) usage of print yellow pages directories and changes in technology; (4) competition in the yellow pages industry and other competitive media; (5) our ability to successfully integrate the business recently acquired from SBC; (6) reliance on and extension of credit to small- and medium- sized businesses; (7) dependence on third party providers of printing, distribution and delivery services and the sale of advertising to national accounts; (8) general economic conditions and consumer sentiment in our markets; and (9) fluctuations in the price and availability of paper. During this presentation, we will also refer to certain non-GAAP financial measures. You can find additional information about these measures and a reconciliation between these measures and the comparable GAAP measures in the Appendices to this presentation, as well as pertinent information about these measures in our Current Report on Form 8-K filed with the SEC on October 27, 2004, which is available on our web site under "Investor Information," "SEC Filings." |