Reconciliation of Non-GAAP Measures

($ in millions)

Net income Outlook—GAAP

$116.0

Plus Expected Tax Provision

76.0

Plus Expected Interest Expense, Net

164.0

Plus Expected Depreciation and Amortization

59.0

EBITDA Outlook, Pre-Acquisition

$415.0

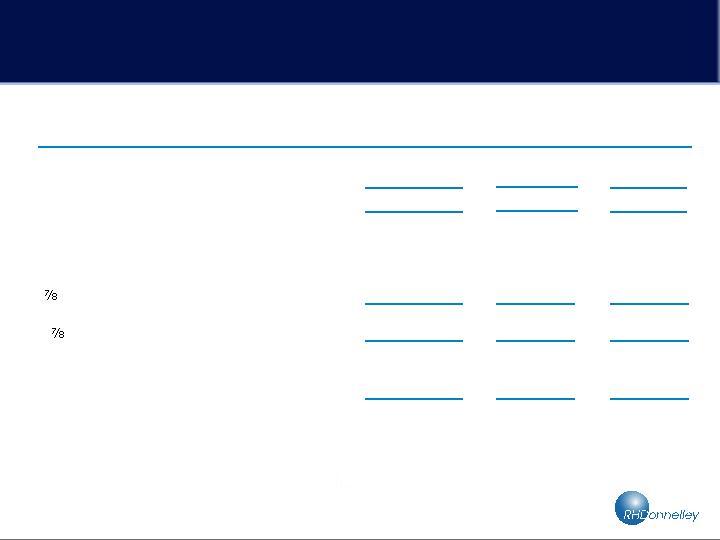

Impact of Acquisition:(1)

Plus Expected Revenue from Acquired Directories that

Published Prior to the Acquisition that would have been

Recognized During the Period Absent Purchase Accounting

Adjustments Required Under GAAP(2)

$252.6

Plus Expected Revenue from Acquired Directories that will

Publish After the Acquisition

221.3

Less Estimated Pre-Press Revenue that would not be Recognized

as a Result of the Acquisition

(19.0)

Less Estimated Expenses from Directories that Published Prior to

the Acquisition that would have been Recognized During the Period

Absent Purchase Accounting Adjustments Required Under GAAP(2)

(32.9)

Less Estimated Operating Expenses that would be Recognized as

a Result of the Acquisition

(139.0)

Less Expected Partnership Income that would have been Recognized

Absent the Acquisition

(112.0)

EBITDA Outlook, Adjusted

$586.0

Reconciliation of net income outlook, pre-acquisition to

EBITDA outlook, adjusted, post-acquisition

2004 Pro Forma

Assuming 1/01/04 Close

Reconciliation of Non-GAAP Measures (cont.)

Notes:

1. On July 28, 2004, R.H. Donnelley announced a definitive agreement to acquire

SBC Communications Inc.’s directory publishing business in Illinois and

Northwest Indiana, including SBC's interest in the DonTech partnership. For

illustration purposes, we are presenting a reconciliation of pro forma

net income outlook to pro forma adjusted EBITDA outlook to show full year

adjusted pro forma EBITDA as if the transaction closed in January 1, 2004.

2. The 2004 as adjusted results assume that the estimated pro rata

portion of the revenue and direct costs of directories that published

prior to the acquisition were recognized during the period pursuant to

the deferral and amortization method. As a result of purchase

accounting, these pre-acquisition revenues and expenses will not be

included in our reported GAAP results.