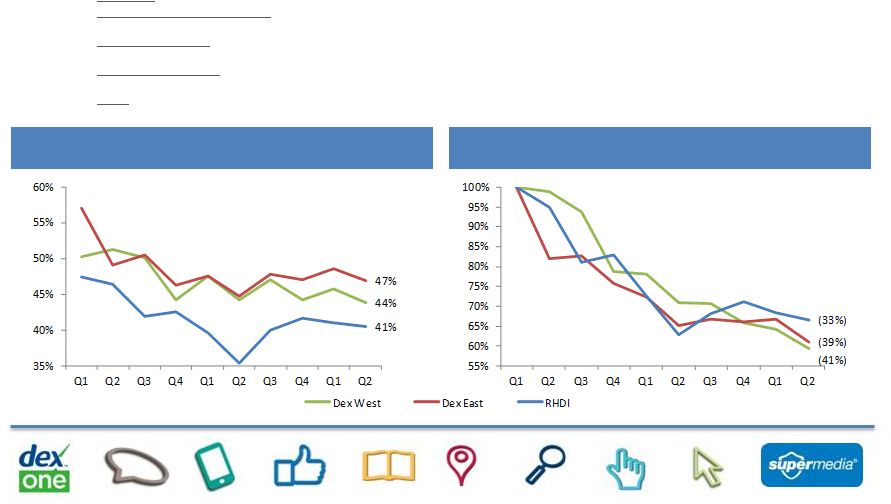

3 Forward-Looking Statements Certain statements contained in this document are "forward-looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995, including but not limited to, statements about the benefits of the proposed transaction and combined company, including future financial and operating results and synergies, plans, objectives, expectations and intentions and other statements relating to the proposed transaction and the combined company that are not historical facts. Where possible, the words "believe," "expect," "anticipate," "intend," "should," "will," "would," "planned," "estimated," "potential," "goal," "outlook," "may," "predicts," "could," or the negative of such terms, or other comparable expressions, as they relate to Dex One, SuperMedia, the combined company or their respective management, have been used to identify such forward-looking statements. All forward-looking statements reflect only Dex One’s and SuperMedia’s current beliefs and assumptions with respect to future business plans, prospects, decisions and results, and are based on information currently available to Dex One and SuperMedia. Accordingly, the statements are subject to significant risks, uncertainties and contingencies, which could cause Dex One’s, SuperMedia’s or the combined company’s actual operating results, performance or business plans or prospects to differ materially from those expressed in, or implied by, these statements. Factors that could cause actual results to differ materially from current expectations include risks and other factors described in Dex One’s and SuperMedia’s publicly available reports filed with the SEC, which contain discussions of various factors that may affect the business or financial results of Dex One, SuperMedia or the combined company. Such risks and other factors, which in some instances are beyond either company’s control, include: the continuing decline in the use of print directories; increased competition, particularly from existing and emerging digital technologies; ongoing weak economic conditions and continued decline in advertising sales; the companies’ ability to collect trade receivables from customers to whom they extend credit; the companies’ ability to generate sufficient cash to service their debt; the companies’ ability to comply with the financial covenants contained in their debt agreements and the potential impact to operations and liquidity as a result of restrictive covenants in such debt agreements; the respective companies’ ability to refinance or restructure their debt on reasonable terms and conditions as might be necessary from time to time; increasing interest rates; changes in the companies’ and the companies’ subsidiaries credit ratings; changes in accounting standards; regulatory changes and judicial rulings impacting the companies’ businesses; adverse results from litigation, governmental investigations or tax related proceedings or audits; the effect of labor strikes, lock-outs and negotiations; successful realization of the expected benefits of acquisitions, divestitures and joint ventures; the companies’ ability to maintain agreements with major Internet search and local media companies; the companies’ reliance on third-party vendors for various services; and other events beyond their control that may result in unexpected adverse operating results. With respect to the proposed merger, important factors could cause actual results to differ materially from those indicated by forward-looking statements included herein, including, but not limited to, the ability of Dex One and SuperMedia to consummate the transaction on the terms set forth in the merger agreement; the risk that anticipated cost savings, growth opportunities and other financial and operating benefits as a result of the transaction may not be realized or may take longer to realize than expected; the risk that benefits from the transaction may be significantly offset by costs incurred in integrating the companies; potential adverse impacts or delay in completing the transaction as a result of obtaining consents from lenders to Dex One or SuperMedia; failure to receive the approval of the stockholders of either Dex One or SuperMedia for the transaction; and difficulties in connection with the process of integrating Dex One and SuperMedia, including: coordinating geographically separate organizations; integrating business cultures, which could prove to be incompatible; difficulties and costs of integrating information technology systems; and the potential difficulty in retaining key officers and personnel. These risks, as well as other risks associated with the merger, will be more fully discussed in the joint proxy statement/prospectus included in the registration statement on Form S-4 that Newdex intends to file with the SEC in connection with the proposed transaction. None of Dex One, SuperMedia or the combined company is responsible for updating the information contained in this presentation beyond the presentation date. |