UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

Annual Meeting — April 29, 2009

March 20, 2009

Dear Stockholder:

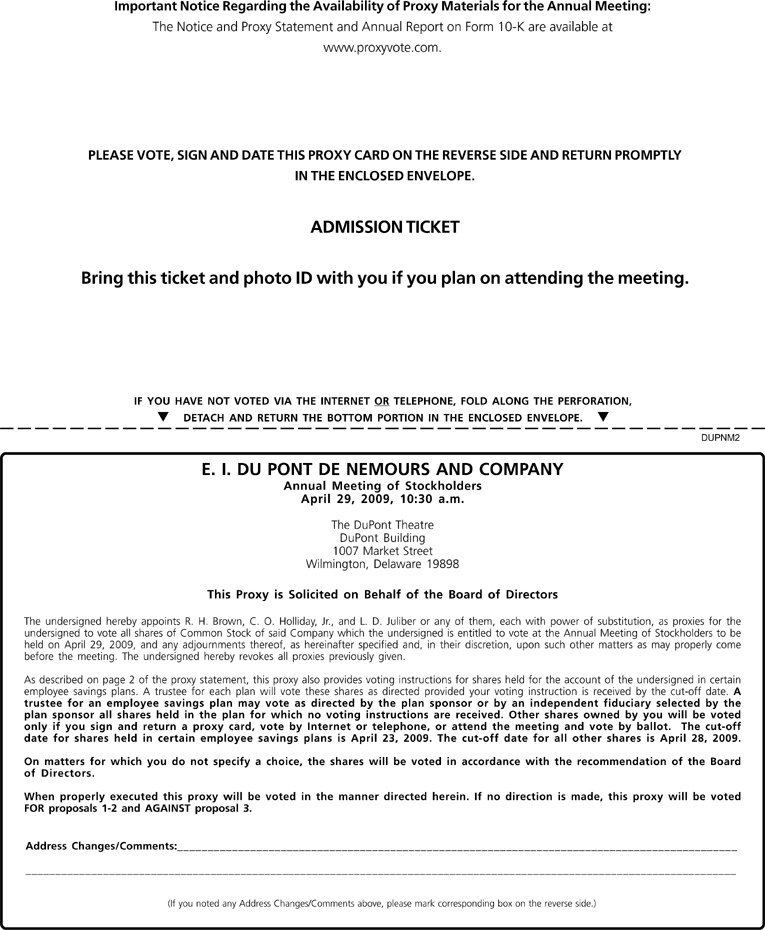

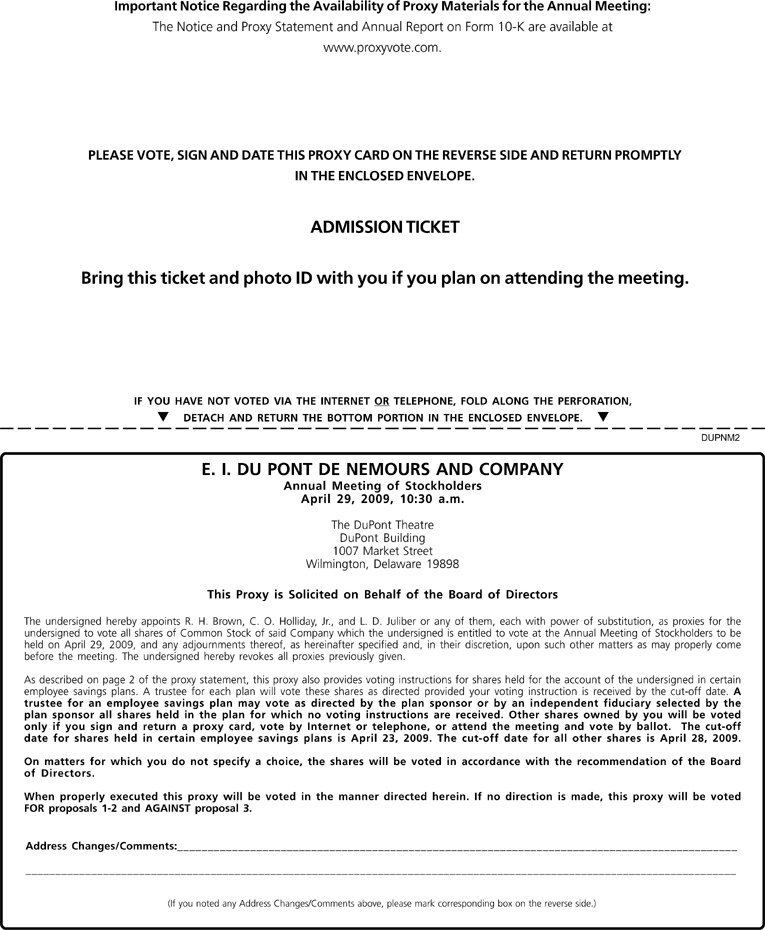

You are invited to attend the Company’s 2009 Annual Meeting on Wednesday, April 29, 2009, at 10:30 a.m. local time in the DuPont Theatre, DuPont Building, Wilmington, Delaware.

The enclosed Notice of Annual Meeting and Proxy Statement provide information about the governance of our Company and describe the various matters to be acted upon during the meeting. In addition, there will be a report on the state of the Company’s business and an opportunity for you to express your views on subjects related to the Company’s operations.

To make it easier for you to vote your shares, you have the choice of voting over the Internet, by telephone, or by completing and returning the enclosed proxy card. The proxy card describes your voting options in more detail.

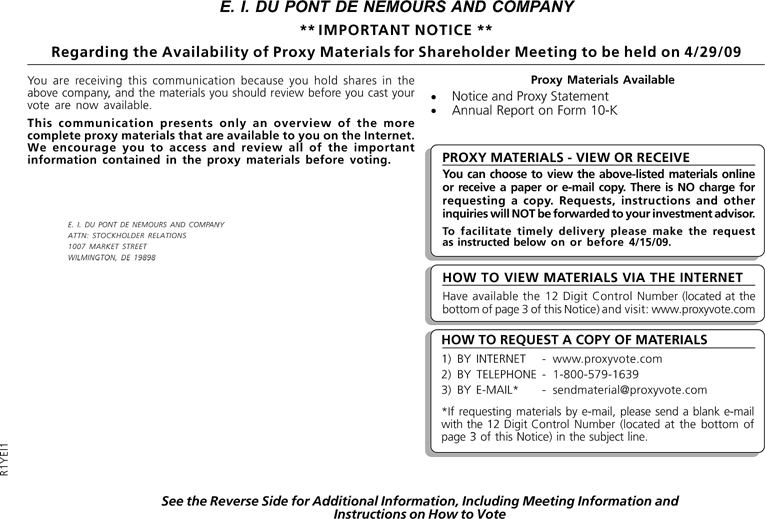

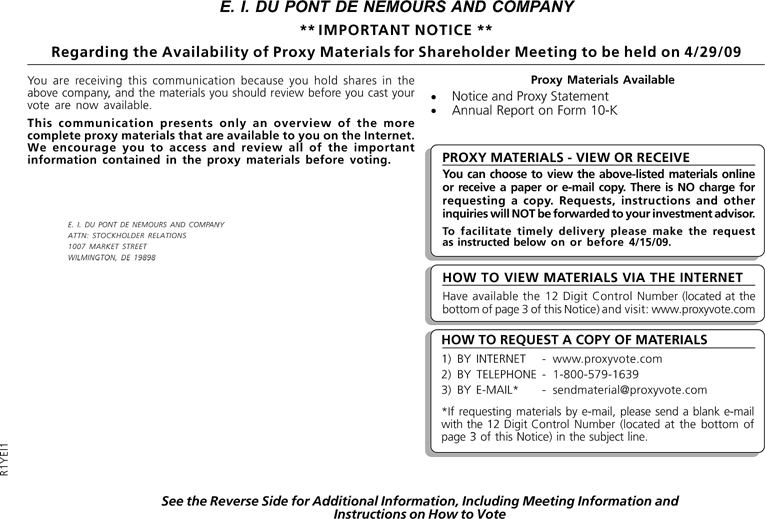

This year, we are excited to implement the Securities and Exchange Commission’s Notice and Access rules, allowing us to deliver proxy materials via the Internet. These rules give the Company a lower cost way to furnish stockholders with their proxy materials. On March 20, we began mailing to certain stockholders of record a “Notice Regarding the Availability of Proxy Materials” with instructions on how to access the proxy materials via the Internet (or request a paper copy) and how to vote online.

If you are a registered stockholder or if you hold DuPont Common Stock through a Company savings plan, your admission ticket for the Annual Meeting is included on your proxy card. A registered stockholder may also use the Notice Regarding the Availability of Proxy Materials, received in the mail, as his or her admission ticket. If you hold shares in a brokerage account, please refer to page 1 of the Proxy Statement for information on how to attend the meeting. If you need special assistance, please contact the DuPont Stockholder Relations Office at302-774-3034.

The past year was a time of unprecedented challenge and change. In the face of global economic developments, the people of DuPont relied on the core values and business strengths of ourmarket-driven science Company. We responded by focusing on the things within our control, emphasizing speed and agility. We continued to advance the products in our R&D pipeline, made gains in productivity, and stayed close to our customers to understand their needs and concerns in the current economic turmoil.

The Annual Meeting gives us an opportunity to review our progress. We appreciate your ownership of DuPont, and I hope you will be able to join us on April 29.

Sincerely,

C. O. Holliday, Jr.

E. I. du Pont de Nemours and Company

March 20, 2009

To the Holders of Common Stock of

E. I. du Pont de Nemours and Company

NOTICE OF ANNUAL MEETING

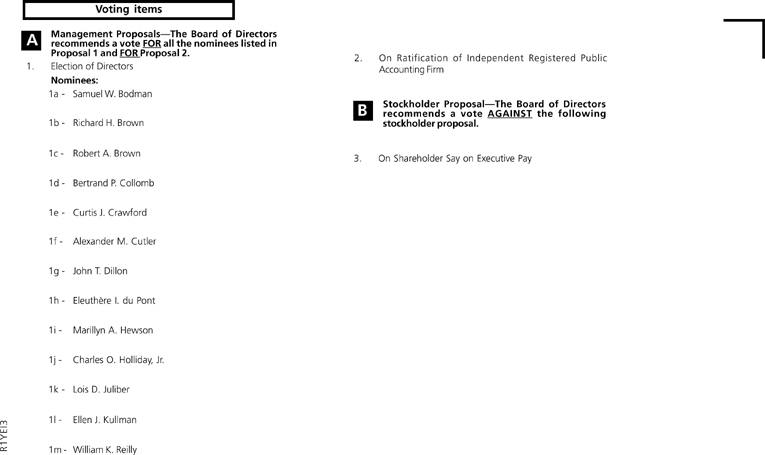

The Annual Meeting of Stockholders of E. I. DU PONT DE NEMOURS AND COMPANY will be held on Wednesday,April 29, 2009, at 10:30 a.m. local time, in the DuPont Theatre in the DuPont Building, 1007 Market Street, Wilmington, Delaware. The meeting will be held to consider and act upon the election of directors, the ratification of the Company’s independent registered public accounting firm, one stockholder proposal described in the Proxy Statement and such other business as may properly come before the meeting.

Holders of record of DuPont Common Stock at the close of business on March 4, 2009, are entitled to vote at the meeting.

This notice and the accompanying proxy materials are sent to you by order of the Board of Directors.

Mary E. Bowler

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON APRIL 29, 2009

The Notice and Proxy Statement and Annual Report onForm 10-K

are available atwww.proxyvote.com

The DuPont 2008 Annual Review will also be available at the above website.

Stockholders may request their proxy materials be delivered to them electronically in 2010 by visitinghttp://enroll.icsdelivery.com/dd.

2009 ANNUAL MEETING OF STOCKHOLDERS

Proxy Statement

| | | |

| | 1 |

| | | |

| | 3 |

| | | |

| | |

| | 3 |

| | 8 |

| | 9 |

| | 9 |

| | 11 |

| | 11 |

| | 11 |

| | | |

| | 12 |

| | | |

| | 13 |

| | | |

| | 17 |

| | | |

| | 17 |

| | | |

| | 20 |

| | | |

| | 21 |

| | | |

| | 22 |

| | | |

| | 23 |

| | | |

| | 23 |

| | 23 |

| | 24 |

| | 25 |

| | 32 |

| | 34 |

| | 35 |

| | 35 |

| | 35 |

| | 35 |

| | 36 |

| | 36 |

| | | |

| | 37 |

| | | |

| | 37 |

| | 40 |

| | 42 |

| | 45 |

| | 46 |

| | 48 |

| | 50 |

Proxy Statement

The enclosed proxy materials are being sent to shareholders at the request of the Board of Directors of E. I. du Pont de Nemours and Company to encourage you to vote your shares at the Annual Meeting of Stockholders to be held April 29, 2009. This Proxy Statement contains information on matters that will be presented at the meeting and is provided to assist you in voting your shares.

The Company’s 2008 Annual Report onForm 10-K, containing management’s discussion and analysis of financial condition and results of operations of the Company and the audited financial statements, and this Proxy Statement were distributed together beginning March 20, 2009.

General Information

Who May Vote

All holders of record of DuPont Common Stock as of the close of business on March 4, 2009 (the record date) are entitled to vote at the meeting. Each share of stock is entitled to one vote. As of the record date, 903,499,428 shares of DuPont Common Stock were outstanding. A majority of the shares voted in person or by proxy is required for the approval of each of the proposals described in this Proxy Statement. Abstentions and broker nonvotes are not counted in the vote. At least a majority of the holders of shares of DuPont Common Stock as of the record date must be present either in person or by proxy at the meeting in order for a quorum to be present.

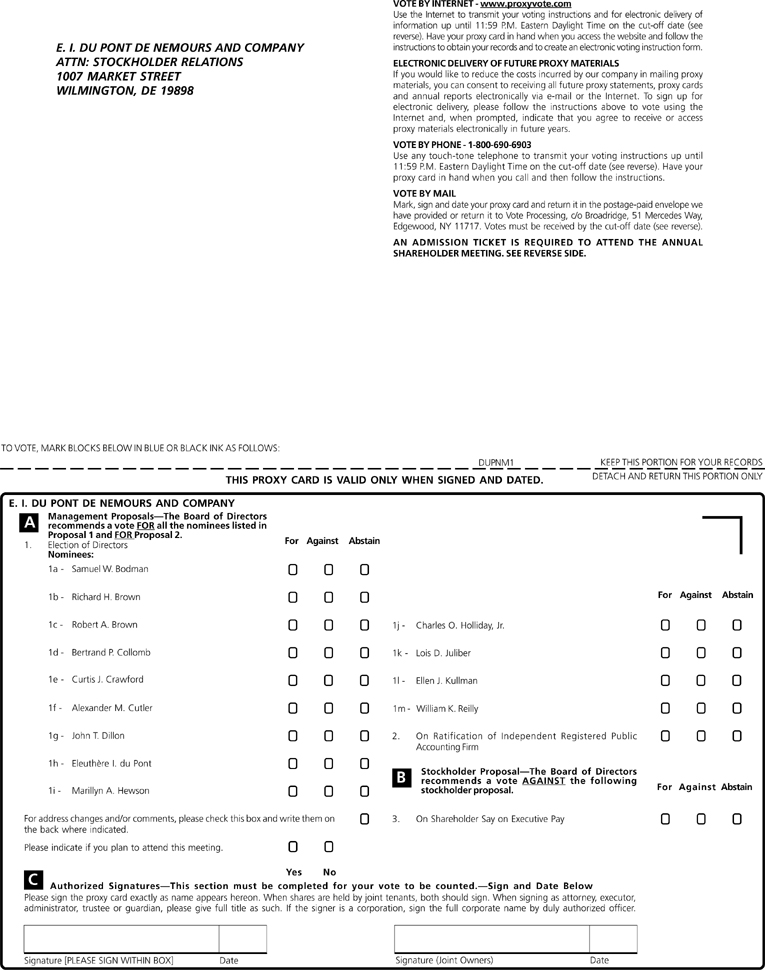

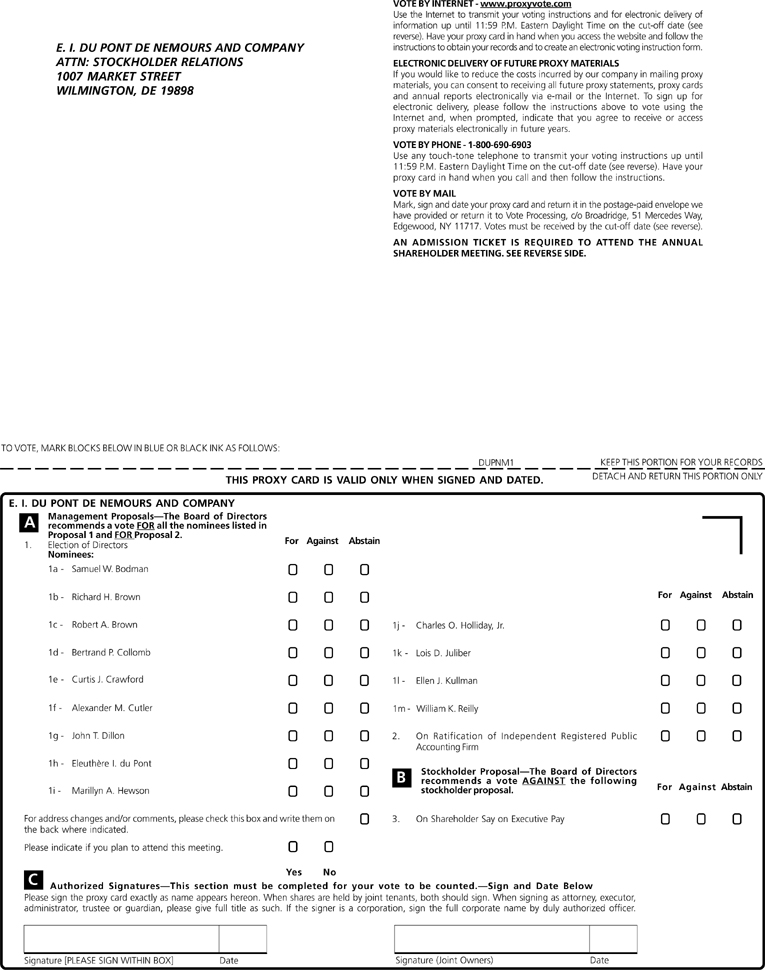

How to Vote

Even if you plan to attend the meeting you are encouraged to vote by proxy. You may vote by proxy in one of the following ways:

| | |

| | • | By Internet at the address listed on the Proxy Card or Notice Regarding the Availability of Proxy Materials (“Proxy Notice”). |

| |

| | • | By telephone using the toll-free number listed on the Proxy Card or Proxy Notice. |

| |

| | • | By returning the enclosed Proxy Card (signed and dated) in the envelope provided. |

When you vote by proxy, your shares will be voted according to your instructions. If you sign your proxy card but do not specify how you want your shares to be voted, they will be voted as the Board of Directors recommends. You can change or revoke your proxy by Internet, telephone or mail at any time before the polls close at the Annual Meeting.

How to Attend the Annual Meeting

If you are a registered shareholder or if you hold stock through one of the savings plans listed below, your admission ticket is attached to your proxy card. A registered shareholder may also use the Proxy Notice as his or her admission ticket. You will need to bring your admission ticket, along with picture identification, to the meeting. If you own shares in street name, please bring your most recent brokerage statement, along with picture identification, to the meeting. The Company will use your brokerage statement to verify your ownership of DuPont Common Stock and admit you to the meeting.

Please note that cameras, sound or video recording equipment, or other similar equipment, electronic devices, large bags or packages will not be permitted in the DuPont Theatre.

1

Shares Held In Savings Plans

If you participate in one of the following plans, your voting instruction card will include the shares you hold in the plan:

| |

| • | DuPont 401(k) and Profit Sharing Plan |

| • | DuPont Powder Coatings USA Profit Sharing Plan |

| • | DuPont Retirement Savings Plan |

| • | Pioneer Hi-Bred International, Inc. Savings Plan |

| • | Solae Savings Investment Plan |

| • | Thrift Plan for Employees of Sentinel Transportation, LLC |

The plan trustees will vote according to the instructions received on your proxy. If proxies for shares in savings plans are not received by Internet, telephone or mail, those shares will be voted by the trustees as directed by the plan sponsor or by an independent fiduciary selected by the plan sponsor.

Proxy Statement Proposals

At each annual meeting stockholders are asked to elect directors to serve on the Board of Directors and to ratify the appointment of the Company’s independent registered public accounting firm for the year. Other proposals may be submitted by the Board of Directors or stockholders to be included in the proxy statement. To be considered for inclusion in the 2010 Annual Meeting Proxy Statement, stockholder proposals must be received by the Company no later than November 20, 2009.

For any proposal that is not submitted for inclusion in next year’s proxy statement, but is instead sought to be considered as timely and presented directly at the 2010 Annual Meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if the Company: (1) receives notice of the proposal before the close of business on February 3, 2010 and advises stockholders in the 2010 Annual Meeting Proxy Statement about the nature of the matter and how management intends to vote on such matter; or (2) does not receive notice of the proposal prior to the close of business on February 3, 2010.

Stockholder Nominations for Election of Directors

The Corporate Governance Committee recommends nominees to the Board of Directors for election as directors at each annual meeting. The Committee will consider nominations submitted by stockholders of record and received by the Corporate Secretary by the first Monday in December. Nominations must include a statement by the nominee indicating a willingness to serve if elected and disclosing principal occupations or employment for the past five years.

Proxy Committee

The Proxy Committee is composed of directors of the Company who vote as instructed the shares of DuPont Common Stock for which they receive proxies. Proxies also confer upon the Proxy Committee discretionary authority to vote the shares on any matter which was not known to the Board of Directors a reasonable time before solicitation of proxies, but which is properly presented for action at the meeting.

Solicitation of Proxies

The Company will pay all costs relating to the solicitation of proxies. Innisfree M&A Incorporated has been retained to assist in soliciting proxies at a cost of $10,000 plus reasonable expenses. Proxies may be solicited by officers, directors and employees of the Company personally, by mail, or by telephone or other electronic means. The Company will also reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses in forwarding proxy materials to beneficial owners of DuPont Common Stock.

2

Secrecy in Voting

As a matter of policy, proxies, ballots and voting tabulations that identify individual stockholders are held confidential by the Company. Such documents are available for examination only by the independent tabulation agents, the independent inspectors of election and certain employees associated with tabulation of the vote. The identity of the vote of any stockholder is not disclosed except as may be necessary to meet legal requirements.

Governance of the Company

Strong corporate governance is an integral part of the Company’s core values, supporting the Company’s sustainable growth mission. DuPont is committed to having sound corporate governance principles and practices. Please visit the Company’s website atwww.dupont.com, under the “Investor Center” caption, for the Board’s Corporate Governance Guidelines, the Board-approved Charters for the Audit, Compensation and Corporate Governance Committees and related information. These Guidelines and Charters may also be obtained free of charge by writing to the Corporate Secretary.

DUPONT BOARD OF DIRECTORS

CORPORATE GOVERNANCE GUIDELINES

These Guidelines serve as an important framework for the Board’s corporate governance practices and to assist the Board in carrying out its responsibilities effectively. The Board reviews these Guidelines periodically and may modify them as appropriate to reflect the evolution of its governance practices.

The Board

Responsibility

The Board has an active responsibility for broad corporate policy and overall performance of the Company through oversight of management and stewardship of the Company to enhance the long-term value of the Company for its stockholders and the vitality of the Company for its other stakeholders.

Role

In carrying out its responsibility, the Board has specific functions, in addition to the general oversight of management and the Company’s business performance, including providing input and perspective in evaluating alternative strategic initiatives; reviewing and, where appropriate, approving fundamental financial and business strategies and major corporate actions; ensuring processes are in place to maintain the integrity of the Company; evaluating and compensating the CEO; and planning for CEO succession and monitoring succession planning for other key positions.

Duties

Directors are expected to expend sufficient time, energy and attention to assure diligent performance of their responsibility. Directors are expected to attend meetings of the Board, its Committees on which they serve, and the Annual Meeting of Stockholders; review materials distributed in advance of the meetings; and make themselves available for periodic updates and briefings with management via telephone orone-on-one meetings.

Leadership

The positions of Chair of the Board and CEO are held by the same person, except in specific circumstances.

3

Independence

A majority of the Board are independent directors in accordance with the standards of independence of the New York Stock Exchange and as described in the Guidelines. See pages 6-7. The Corporate Governance Committee as well as the Board annually reviews relationships that directors may have with the Company to make a determination of whether there are any material relationships that would preclude a director being independent.

Qualifications

Directors are selected for their integrity and character; sound, independent judgment; breadth of experience, insight and knowledge; and business acumen. Leadership skills, scientific or technology expertise, familiarity with issues affecting global businesses in diverse industries, prior government service, and diversity are among the relevant criteria, which will vary over time depending on the needs of the Board. The Corporate Governance Committee considers candidates for potential nomination to recommend for approval by the full Board.

The Board does not limit the number of other public company boards that a director may serve on. However, the Corporate Governance Committee considers the number of boards a director sits on. Directors are encouraged to limit the number of other public company boards to take into account their time and effectiveness and are expected to advise the Chair in advance of serving on another board.

When a director’s principal responsibilities or business association changes significantly, the director will tender his or her resignation to the Chair for consideration by the Corporate Governance Committee of the continued appropriateness for Board service.

No director may stand for reelection to the Board after reaching age 72. An employee director retires from the Board when retiring from employment with the Company, with the exception of the former CEO. The Board may in unusual circumstances and for a limited period ask a director to stand for re-election after the prescribed retirement date.

Election

In accordance with the Company’s Bylaws, if none of our stockholders provides the Company with notice of an intention to nominate one or more candidates to compete with the Board’s nominees in an election of directors, a nominee must receive more votes cast for than against his or her election or re-election in order to be elected or re-elected to the Board. The Board expects a director to tender his or her resignation if he or she fails to receive the required number of votes for re-election. The Board shall nominate for election orre-election as director only candidates who agree to tender, promptly following the annual meeting at which they are elected or re-elected as a director, irrevocable resignations that will be effective upon (i) the failure to receive the required vote at the next annual meeting at which they face re-election and (ii) Board acceptance of such resignation in accordance with the procedures specified in these Guidelines. In addition, the Board shall fill director vacancies and newly created directorships only with candidates who agree to tender, promptly following their appointment to the Board, the same resignation tendered by other directors in accordance with these Guidelines.

In the event an incumbent director fails to receive the required vote for re-election, the Corporate Governance Committee (or other committee designated by the Board) (“Committee”) shall make a recommendation to the Board as to whether to accept or reject the resignation of the incumbent director. The Board shall act on the resignation, taking into account the recommendation of the Committee, and publicly disclose its decision within ninety (90) days following certification of the election results. The Committee in making its recommendation and the Board in making its decision may consider all facts and circumstances they consider relevant or appropriate in reaching their determinations. The Board expects any director whose resignation is under consideration pursuant to these Guidelines to abstain from participating in the Committee recommendation or the action of the Board regarding whether to accept the resignation.

4

Orientation and Continuing Education

New directors participate in an orientation process to become familiar with the Company and its strategic plans and businesses, significant financial matters, core values including ethics, compliance programs, corporate governance practices and other key policies and practices through a review of background materials, meetings with senior executives and visits to Company facilities. The Corporate Governance Committee is responsible for providing guidance on directors’ continuing education.

Compensation

The Board believes that compensation for outside directors should be competitive. DuPont Common Stock is a key component with payment of a portion of director compensation as DuPont stock, options or similar form of equity-based compensation, combined with stock ownership guidelines requiring all outside directors to hold DuPont stock equal to at least two times the annual retainer within five years. The Compensation Committee reviews periodically the level and form of director compensation and, if appropriate, proposes changes for consideration by the full Board.

Annual Self-Evaluation

The Board and each Committee make an annual self-evaluation of its performance with a particular focus on overall effectiveness. The Corporate Governance Committee is responsible for overseeing theself-evaluation process.

Access to Management and Advisors

Directors have access to the Company’s management and, in addition, are encouraged to visit the Company’s facilities. As necessary and appropriate, the Board and its Committees may retain outside legal, financial or other advisors.

Board Meetings

Selection of Agenda Items

The Chair establishes the agenda for Board meetings, in conjunction with Chairs of the Committees. Directors are encouraged to suggest items for inclusion on the agenda and may raise subjects not specifically on the agenda.

Attendance of Senior Executives

The Board welcomes regular attendance of senior executives to be available to participate in discussions. Presentation of matters to be considered by the Board are generally made by the responsible executive.

Executive Sessions

Regularly scheduled Board meetings include a session of all directors and the CEO. In addition, the Board meets in regularly scheduled executive sessions without the participation of the CEO or other senior executives. The Presiding Director is generally the Chair of the Corporate Governance Committee, unless there is a matter within the responsibility of another Committee, such as CEO evaluation and compensation, when the Chair of that Committee presides.

Leadership Assessment

Succession Planning

The Board plans for succession to the position of CEO. The Compensation Committee oversees the succession planning process. To assist the Board, the CEO periodically provides the Board with an assessment of senior executives and their potential to succeed to the position of CEO, as well as perspective on potential candidates from outside the Company. The Board has available on a continuing basis the CEO’s recommendation shouldhe/she be unexpectedly unable to serve. The CEO also provides the Board with an assessment of potential successors to key positions.

5

CEO Evaluation and Compensation

Through an annual process overseen and coordinated by the Compensation Committee, independent directors evaluate the CEO’s performance and set the CEO’s compensation.

* * *

Guidelines for Determining the Independence

of DuPont Directors

It is the expectation and practice of the Board that, in their roles as members of the Board, all members will exercise their independent judgment diligently and in good faith, and in the best interests of the Company and its stockholders as a whole, notwithstanding any member’s other activities or affiliations.

However, in addition, the Board has determined that a majority of its members should be “independent” in that they are free of any material relationship with the Company or Company management, whether directly or as a partner, shareholder or officer of an organization that has a material relationship with the Company. In furtherance of this objective, the Board has adopted the following Guidelines for determining whether a member is considered “independent.”

The Board will re-examine the independence of each of its members once per year and again if a member’s outside affiliations change substantially during the year.

For purposes of these Guidelines, “members ofhis/her immediate family” and similar phrases will mean a person’s spouse, parents, stepparents, children, stepchildren, siblings, mothers-andfathers-in-law, sons- and daughters-in law, brothers- andsisters-in-law, and anyone (other than an employee) who shares the person’s home. “The Company” means the Company and all of its consolidated subsidiaries.

| | |

| | 1. | Regardless of other circumstances, a Board member will not be deemed independent ifhe/she does not meet the independence standards adopted by the New York Stock Exchange (see below), or any applicable legal requirement. |

| |

| | 2. | Except in special circumstances, as determined by a majority of the independent members of the Board, the following relationships will be considered not to be material relationships that would affect a Board member’s independence: |

| | |

| | (a) | If the Board member is an executive officer or employee, or any member ofhis/her immediate family is an executive officer, of a bank to which the Company is indebted, and the total amount of the indebtedness does not exceed one percent of the total assets of the bank for any of the past three years. |

| |

| | (b) | If the Board member or any member ofhis/her immediate family serves as an officer, director or trustee of a charitable or educational organization, and contributions by the Company do not exceed the greater of $1,000,000 or two percent of such organization’s annual consolidated gross revenues, including annual charitable contributions, for any of the past three years. |

| | |

| | 3. | If a Board member has a relationship that exceeds the thresholds described in Section 2 above, or another significant relationship with the Company or its management that is not described in Section 2 above, then the Board will determine by a majority of the independent members whether that member’s relationship would affect the Board member’s independence. |

| |

| | 4. | The Board will consider all relevant facts and circumstances in determining independence. |

| |

| | 5. | Any determinations of independence made pursuant to Section 3 above will be disclosed in the Company’s annual meeting proxy statement. |

6

Current New York Stock Exchange standards state that a director will not be independent:

| | |

| | (a) | If the Board member is, or has been within the last three years, an employee or any member ofhis/her immediate family is, or has been within the last three years, an executive officer of the Company; |

| |

| | (b) | If the Board member (i) is a current partner or employee of a firm that is the Company’s internal or external auditor; (ii) has an immediate family member who is a current partner of such a firm; (iii) has an immediate family member who is a current employee of such a firm and personally works on the listed company’s audit; or (iv) was, or has an immediate family member who was, within the last three years, a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

| |

| | (c) | If the Board member or any member ofhis/her immediate family is, or in the last three years has been, employed as an executive officer of another company where the Company’s present executive officers at the same time serve/served on that company’s compensation committee; |

| |

| | (d) | If the Board member is a current employee, or if any member ofhis/her family is a current executive officer, of another company that makes payments to, or receives payments from, the Company for property or services which exceed the greater of $1,000,000 or two percent of the other company’s annual consolidated gross revenues for any of the last three years; or |

| |

| | (e) | If the Board member, or a member ofhis/her immediate family, has received more than one hundred and twenty thousand dollars (US $120,000) in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service which are not contingent in any way on continued service) during any twelve-month period within the last three years. |

7

Committees of the Board

| | | | |

| |

| |

| | | | |

Audit

Committee | | | Responsibilities include:

n Employs the Company’s independent registered public accounting firm, subject to

|

| | | | stockholder ratification, to audit the Company’s Consolidated Financial Statements. |

| | | | n Pre-approves all services performed by the Company’s independent registered public accounting firm. |

| | | | n Provides oversight on the external reporting process and the adequacy of the Company’s internal controls. |

| | | | n Reviews the scope of the audit activities of the independent registered public accounting firm and the Company’s internal auditors and appraises audit efforts of both. |

| | | | n Reviews services provided by the Company’s independent registered public accounting firm and other disclosed relationships as they bear on the independence of the Company’s independent registered public accounting firm. |

| | | | n Establishes procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls or auditing matters. |

| | | | |

| | | | All members of the Audit Committee are independent directors under the Board’s Corporate Governance Guidelines and applicable regulatory and listing standards. The Board has determined that all members of the Audit Committee (C. J. Crawford, J. T. Dillon, E. I. du Pont, M. A. Hewson and L. D. Juliber) are audit committee financial experts within the meaning of applicable Securities and Exchange Commission rules. |

| | | | |

| | | | See the Audit Committee Report on page 12. The Audit Committee Charter is available on the Company’s website (www.dupont.com) under Investor Center, Corporate Governance. A Summary of the Audit Committee Policy on Pre-approval of Services Performed by the Independent Registered Public Accounting Firm is included as part of “Proposal 2 — Ratification of Independent Registered Public Accounting Firm” in this Proxy Statement. |

| | | | |

Compensation

Committee | | | Responsibilities include:

n Establishes executive compensation policy consistent with corporate objectives and

|

| | | | stockholder interests.

|

| | | | n Oversees process for evaluating performance of the Chief Executive Officer (“CEO”) against Board- approved goals and objectives and recommends to the Board compensation for the CEO.

|

| | | | n Reviews and approves grants under the Company’s compensation plans.

|

| | | | n Works with management to develop the Compensation Discussion and Analysis (CD&A).

|

| | | | n Oversees succession planning process for the CEO and key leadership. |

| | | | |

| | | | All members of the Compensation Committee are independent directors under the Board’s Corporate Governance Guidelines and applicable regulatory and listing standards. See the Compensation Committee Report on page 22. See also the CD&A beginning on page 23. The Compensation Committee Charter is available on the Company’s website (www.dupont.com) under Investor Center, Corporate Governance. |

| | | | |

Corporate

Governance

Committee | | | Responsibilities include:

n Recommends to the Board nominees for election to the Board of Directors.

n Reviews principles, policies and procedures affecting directors and the Board’s operation

|

| | | | and effectiveness.

n Oversees evaluation of the Board and its effectiveness. |

| | | | |

| | | | All members of the Corporate Governance Committee are independent directors under the Board’s Corporate Governance Guidelines and applicable regulatory and listing standards. |

| | | | |

| | | | The Corporate Governance Charter is available on the Company’s website (www.dupont.com) under Investor Center, Corporate Governance. A description of the Director Nomination Process is attached at Appendix “A.” |

1

| | | | |

| | | | |

Environmental

Policy

Committee | | | Responsibilities include:

n Reviews the Company’s environmental policies and practices.

n Provides support for the Company’s sustainable growth mission. |

| | | | |

Science and

Technology

Committee | | | Responsibilities include:

n Monitors state of science and technology capabilities within the Company.

n Oversees the development of key technologies essential to the long-term success of the

|

| | | | Company. |

| | | | |

Strategic

Direction

Committee | | | Responsibilities include:

n Reviews the strategic direction of the Company’s major business segments.

n Reviews significant trends in technology and their anticipated impact on the Company. |

| | | | |

Committee Membership

The following chart shows the current committee membership and the number of meetings that each committee held in 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | Science

| | |

| | | | | | | Corporate

| | Environmental

| | and

| | Strategic

|

| | | Audit

| | Compensation

| | Governance

| �� | Policy

| | Technology

| | Direction

|

| Director | | Committee | | Committee | | Committee | | Committee | | Committee | | Committee |

| |

| |

| Richard H. Brown | | | | | | | X | | | | C | | | | | | | | | | | | X | |

| Robert A. Brown | | | | | | | | | | | | | | | X | | | | X | | | | | |

| |

| |

| Bertrand P. Collomb | | | | | | | | | | | X | | | | X | | | | | | | | | |

| Curtis J. Crawford | | | X | | | | X | | | | | | | | | | | | C | | | | | |

| |

| |

| Alexander M. Cutler | | | | | | | X | | | | | | | | | | | | | | | | | |

| John T. Dillon | | | X | | | | C | | | | | | | | | | | | | | | | X | |

| |

| |

| Eleuthère I. du Pont | | | X | | | | X | | | | | | | | | | | | X | | | | | |

| Marillyn A. Hewson | | | X | | | | | | | | | | | | X | | | | | | | | | |

| |

| |

| Charles O. Holliday, Jr. | | | | | | | | | | | | | | | | | | | | | | | C | |

| Lois D. Juliber | | | C | | | | | | | | X | | | | | | | | | | | | X | |

| |

| |

| Ellen J. Kullman | | | | | | | | | | | | | | | | | | | | | | | X | |

| William K. Reilly | | | | | | | | | | | X | | | | C | | | | X | | | | | |

| |

| |

| Number of Meetings in 2008 | | | 6 | | | | 9 | | | | 6 | | | | 3 | | | | 4 | | | | 4 | |

| |

| |

C = Chair

Directors fulfill their responsibilities not only by attending Board and committee meetings but also through communication with the Chair and CEO and other members of management relative to matters of mutual interest and concern to the Company.

In 2008, eight meetings of the Board were held. With the exception of Masahisa Naitoh, who retired from the Board in April 2008, each director attended at least 86% of the aggregate number of meetings of the Board and the committees of the Board on which the director served. Attendance at these meetings averaged 94% among all directors in 2008. Mr. Naitoh attended 50% of the aggregate number of meetings of the Board and the committees of the Board on which he served. Mr. Naitoh’s absences from Board and committee meetings were due to illness.

As provided in the Board’s Corporate Governance Guidelines, directors are expected to attend the Company’s Annual Meeting of Stockholders. All directors but Mr. Naitoh attended the 2008 Annual Meeting.

Review and Approval of Transactions with Related Persons

The Board of Directors has adopted written policies and procedures relating to the approval or ratification of “Related Person Transactions.” Under the policies and procedures, the Corporate Governance Committee

2

(“Governance Committee”) (or its Chair, under some circumstances) reviews the relevant facts of all proposed Related Person Transactions and either approves or disapproves of the entry into the Related Person Transaction, by taking into account, among other factors it deems appropriate:

| |

| • | the commercial reasonableness of the transaction, |

| • | the materiality of the Related Person’s direct or indirect interest in the transaction, |

| • | whether the transaction may involve a conflict of interest, or the appearance of one, and |

| • | the impact of the transaction on the Related Person’s independence under the Corporate Governance Guidelines and applicable regulatory and listing standards. |

No director may participate in any discussion or approval of a Related Person Transaction for whichhe/she or any ofhis/her immediate family members is the Related Person. Related Person Transactions are approved or ratified only if they are determined to be in the best interests of DuPont and its stockholders.

If a Related Person Transaction that has not been previously approved or previously ratified is discovered, the Related Person Transaction will be presented to the Governance Committee for ratification. If such Related Person Transaction is not ratified by the Governance Committee, then the Company shall either ensure all appropriate disclosures regarding the transaction are made or, if appropriate, take all reasonable actions to attempt to terminate the Company’s participation in such transaction.

Under the Company’s policies and procedures, a “Related Person Transaction” is generally any financial transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships in which: (i) DuPont was, is or will be a participant; (ii) the aggregate amount involved exceeds $120,000 in any fiscal year; and (iii) any Related Person had, has or will have a direct or indirect material interest. A “Related Person” is generally any person who is, or at any time since the beginning of DuPont’s last fiscal year was: (i) a director or an executive officer of DuPont or a nominee to become a director of DuPont; (ii) any person who is known to be the beneficial owner of more than five percent of any class of DuPont’s outstanding Common Stock; or (iii) any immediate family member of any of the foregoing persons.

Certain Relationships and Related Transactions

As discussed above, the Governance Committee is charged with reviewing issues involving independence and all Related Person Transactions. DuPont and its subsidiaries purchase products and services fromand/or sell products and services to companies of which certain of the directors of DuPont, or their immediate family members, are executive officers. The Governance Committee and the Board have reviewed such transactions and relationships and do not consider the amounts involved in such transactions material. Such purchases from and sales to each company involve less than either $1,000,000 or two percent of the consolidated gross revenues of each of the purchaser and the seller and all such transactions are in the ordinary course of business. Some such transactions are continuing and it is anticipated that similar transactions will occur from time to time. The spouse of Ms. Kullman, Chief Executive Officer, is Director-Corporate Marketing at DuPont and received total compensation in 2008 valued at $315,000, which is commensurate with that of his peers and reflects the Company-wide reduction in short-term incentive awards.

As of December 31, 2008, State Street Bank and Trust Company was the beneficial owner of 5.8% of DuPont Common Stock. DuPont Capital Management Corporation (“DCM”), a subsidiary of DuPont, has an unconsolidated joint venture with State Street Global Advisors, Inc. (“SSgA”), called Wilton Asset Management, LLC (“Wilton”), which offers private equity investment advisory services to institutional and high net worth investors. Wilton manages a private equity fund from which DCM earned $202,800 in subadvisory fees during 2008. SSgA earned the same amount for marketing, administrative and accounting services. For 2008, unaudited net income of the joint venture was $475,856, which was shared equally between DCM and SSgA. In addition, DCM and SSgA each received a cash dividend during 2008 of $465,000 which related to prior year earnings. State Street is also trustee of the DuPont Pension Trust Fund (covering the principal U.S. pension plan and the pension plan of a subsidiary) and custodian for DuPont UK’s pension plan. Trade commissions and fees related to brokerage services totaling $277,700 were paid to State Street during 2008, of which $277,000 was paid by the DuPont UK pension plan and the remainder from other DuPont pension

10

plans. DCM also paid State Street $48,700 in transaction and maintenance fees for a product that links investment managers to custodians.

Communications with the Board and Directors

Stockholders and other parties interested in communicating directly with the Board, Chair, Presiding Director or other outside director may do so by writing in care of the Corporate Secretary, DuPont Company, 1007 Market Street, D9058, Wilmington, DE 19898. The Board’s independent directors have approved procedures for handling correspondence received by the Company and addressed to the Board, Chair, Presiding Director or other outside director. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company’s internal audit function and handled in accordance with procedures established by the Audit Committee with respect to such matters, which include an anonymous toll-free hotline(1-800-476-3016) and a website through which to report issues(https://reportanissue.com/dupont/welcome).

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics for Directors with provisions specifically applicable to directors. In addition, the Company has a Code of Conduct applicable to all employees of the Company, including executive officers, and a Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Controller. The Code of Business Conduct and Ethics for the DuPont Board of Directors, the DuPont Code of Conduct, and Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Controller are available on the Company’s website (www.dupont.com) under Investor Center, Corporate Governance. Copies of these documents may also be obtained free of charge by writing to the Corporate Secretary.

Office of the Chief Executive

The Office of the Chief Executive (OCE) has responsibility for the overall direction and operations of all the businesses of the Company and broad corporate responsibility in such areas as corporate financial performance, environmental leadership and safety, development of global talent, research and development and global effectiveness. All seven members are executive officers.

11

Audit Committee Report

The Audit Committee of the Board of Directors (the “Committee”) assists the Board in fulfilling its oversight responsibilities with respect to the external reporting process and the adequacy of the Company’s internal controls. Specific responsibilities of the Committee are set forth in the Audit Committee Charter adopted by the Board and last amended and restated effective March 4, 2009. The Charter is available on the Company’s website (www.dupont.com) under Investor Center, Corporate Governance.

The Committee is comprised of five directors, all of whom meet the standards of independence adopted by the New York Stock Exchange and the Securities and Exchange Commission. Subject to stockholder ratification, the Committee appoints the Company’s independent registered public accounting firm. The Committee approves in advance all services to be performed by the Company’s independent registered public accounting firm in accordance with the Committee’s Policy on Pre-approval of Services Performed by the Independent Registered Public Accounting Firm. A summary of the Policy is included with this Proxy Statement as part of the proposal seeking ratification of the independent registered public accounting firm.

Management is responsible for the Company’s financial statements and reporting process, for establishing and maintaining an adequate system of internal control over financial reporting, and for assessing the effectiveness of the Company’s internal control over financial reporting. PricewaterhouseCoopers LLP (PwC), the Company’s independent registered public accounting firm, is responsible for auditing the Company’s Consolidated Financial Statements and for assessing the effectiveness of internal control over financial reporting. The Committee has reviewed and discussed the Company’s 2008 Annual Report onForm 10-K, including the audited Consolidated Financial Statements of the Company and Management’s Report on Internal Control over Financial Reporting, for the year ended December 31, 2008 with management and with representatives of PwC.

The Committee has also discussed with PwC matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), as amended. The Committee has received from PwC the written disclosures required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with PwC its independence.

The Committee has considered whether the provision to the Company by PwC of limited nonaudit services is compatible with maintaining the independence of PwC. The Committee has satisfied itself as to the independence of PwC.

Based on the Committee’s review of the audited Consolidated Financial Statements of the Company, and on the Committee’s discussions with management of the Company and with PwC, the Committee recommended to the Board of Directors that the audited Consolidated Financial Statements be included in the Company’s Annual Report onForm 10-K for the year ended December 31, 2008.

AUDIT COMMITTEE

Lois D. Juliber, Chair

Curtis J. Crawford

John T. Dillon

Eleuthère I. du Pont

Marillyn A. Hewson

12

Directors’ Compensation

Nonemployee directors receive compensation for Board service, which is designed to fairly compensate directors for their Board responsibilities and align their interests with the long-term interests of stockholders. An employee director receives no additional compensation for Board service.

The Compensation Committee, which consists solely of independent directors, has the primary responsibility to review and consider any revisions to directors’ compensation. The process for setting director pay is guided by the following principles:

| | |

| | - | Director compensation is reviewed annually by the Compensation Committee, with recommendation to the full Board which approves changes to director pay. |

| | - | Details of director compensation are disclosed in the proxy statement annually. |

| |

| • | Fair and competitive compensation that aligns director behavior with the best interests of stockholders |

| | |

| | - | A significant portion of the annual retainer is paid in restricted stock units, the restrictions on which lapse over a three-year period. |

| | - | Stock Ownership Guidelines exist to encourage ownership. |

| | - | DuPont’s goal is to recognize the new realities of Board service while assuring competitive levels of director pay, reflective of the significant time commitment expected, through a director compensation program built upon an annual retainer and committee fees (in lieu of meeting fees). |

| | - | Directors must act in the best interest of the Company and its stockholders. DuPont’s Stock Ownership Guidelines and use of restricted stock units support and reinforce this commitment. |

| | - | Director compensation is monitored closely against Market trends and external practices, as well as against changes at the Peer Group companies. “Market” and “Peer Group” are defined on page 23. |

With the assistance of Frederic W. Cook & Co., Inc., the independent compensation consultant retained by the Compensation Committee, the Committee closely monitors trends in director compensation in the marketplace.

The compensation program for nonemployee directors for 2008 and 2009 is described in detail in the chart below:

| | | | | |

| |

Compensation

| | | | |

| Element | | 2008 | | 2009 |

| |

| |

| Annual Retainer | | $85,000 (cash) | | $85,000 (cash) |

| | | | | |

(Cash and

Long-Term

Incentive) | | $115,000 — delivered in the form of 2,580 Time-Vested Restricted Stock Units | | $115,000 — delivered in the form of 4,940 Time-Vested Restricted Stock Units |

| | | | | |

| | | Granted February 6, 2008; provide for dividend equivalent units; restrictions lapse in three equal annual installments; payable in stock | | Granted February 4, 2009; provide for dividend equivalent units; restrictions lapse in three equal annual installments; payable in stock |

| |

| |

Annual Committee

Member Fee | | Audit $15,000 | | Audit $15,000 |

| | | All Other Committees $9,000 | | All Other Committees $9,000 |

| |

| |

Annual Committee

Chair Fee | | Audit $25,000 | | Audit $25,000 |

| | | All Other Committees $18,000 | | All Other Committees $18,000 |

| |

| |

Stock Ownership

Guideline | | 2 × Total Annual Retainer = $400,000 | | 2 × Total Annual Retainer = $400,000 |

| |

| |

13

The Company does not pay meeting fees, but does pay for or reimburse directors for reasonable travel expenses related to attending Board, committee, educational, and Company business meetings. Spouses are invited occasionally to accompany directors to Board-related events. In such situations, the Company pays or reimburses travel expenses for spouses. These travel expenses are imputed as income to the directors and are grossed up to cover taxes. Details are reflected in the following 2008 Directors’ Compensation table:

2008 DIRECTORS’ COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Change in

| | | | | | |

| | | | | | | | | | Pension

| | | | | | |

| | | | | | | | | | Value and

| | | | | | |

| | | | | | | | | | Nonqualified

| | | | | | |

| | | | Fees Earned

| | | | | | Deferred

| | | | | | |

| | | | or Paid in

| | | Stock

| | | Compensation

| | | All Other

| | | |

| Name | | | Cash(1) | | | Awards(2)(3) | | | Earnings(4) | | | Compensation(5) | | | Total |

| R. H. Brown | | | $ | 121,000 | | | | $ | 73,803 | | | | | — | | | | $ | 299 | | | | $ | 195,102 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| R. A. Brown | | | | 100,000 | | | | | 89,179 | | | | | — | | | | | 299 | | | | | 189,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| B. P. Collomb | | | | 100,000 | | | | | 89,179 | | | | | — | | | | | 299 | | | | | 189,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| C. J. Crawford | | | | 127,000 | | | | | 73,803 | | | | $ | 13,649 | | | | | 299 | | | | | 214,751 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| A. M. Cutler | | | | 60,417 | | | | | 80,055 | | | | | — | | | | | 268,088 | | | | | 408,560 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| J. T. Dillon | | | | 127,000 | | | | | 73,803 | | | | | — | | | | | 299 | | | | | 201,102 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| E. I. du Pont | | | | 118,000 | | | | | 70,854 | | | | | — | | | | | 299 | | | | | 189,153 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| M. A. Hewson | | | | 101,000 | | | | | 161,400 | | | | | — | | | | | 299 | | | | | 262,699 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| L. D. Juliber | | | | 128,000 | | | | | 73,803 | | | | | 13,089 | | | | | 299 | | | | | 215,191 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| W. K. Reilly | | | | 121,000 | | | | | 73,803 | | | | | 15,512 | | | | | 299 | | | | | 210,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Former Directors | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| M. Naitoh | | | | 34,333 | | | | | (41,626 | )(6) | | | | — | | | | | — | | | | | (7,293 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| S. O’Keefe | | | | 72,667 | | | | | 88,013 | | | | | — | | | | | 200 | | | | | 160,880 | |

| |

| | |

| (1) | | The term of office for directors who are elected at the Company’s Annual Meeting of Stockholders begins immediately following the election and ends upon the election of directors at the annual meeting held the following year. Board retainers and committee fees are paid monthly. |

| |

| (2) | | Outstanding equity award data for individual directors are noted below: |

| | | | | | | | | |

| |

| | | Outstanding Stock Awards

| | Outstanding Option Awards

|

| Name | | at December 31, 2008(a) | | at December 31, 2008 |

| |

| |

| R. H. Brown | | | 5,399 | | | | 20,000 | |

| R. A. Brown | | | 4,293 | | | | — | |

| B. P. Collomb | | | 4,293 | | | | — | |

| C. J. Crawford | | | 5,399 | | | | 20,000 | |

| A. M. Cutler | | | 2,223 | | | | — | |

| J. T. Dillon | | | 5,399 | | | | 8,700 | |

| E. I. du Pont | | | 5,399 | | | | — | |

| M. A. Hewson | | | 4,446 | | | | — | |

| L. D. Juliber | | | 5,399 | | | | 20,000 | |

| W. K. Reilly | | | 5,399 | | | | 20,000 | |

Former Directors | | | | | | | | |

M. Naitoh(b) | | | 2,709 | | | | 20,000 | |

| S. O’Keefe | | | 5,399 | | | | — | |

| |

| |

| | |

| | (a) | Includes dividend equivalent units. Does not include deferred units. |

| | (b) | 2,603 stock units were forfeited in 2008 upon termination of service. |

14

| | |

| (3) | | Represents the compensation cost of time-vested restricted stock units (“RSUs”) recognized in 2008 under Statement of Financial Accounting Standards (“SFAS”) 123(R) and reflected in the Company’s financial statements. |

| |

| | Directors receive an annual RSU award with a fair value of approximately $115,000 on grant date (see table on page 13). |

| |

| | RSUs awarded prior to 2008 are settled in cash. RSUs awarded during 2008 and thereafter are settled in DuPont Common Stock and accounted for as equity awards under SFAS 123(R). As all directors are retirement eligible as of the date of grant, compensation costs for stock-settled director RSUs are fully recognized six months after the grant date. RSUs awarded during 2008 are valued at the closing price of DuPont Common Stock on grant date. Expense associated with cash-settled RSUs is recognized six months after the grant date and the fair value of these awards is adjusted quarterly during the restriction period based on changes in the fair value of DuPont Common Stock. The Company accounts for these cash-settled RSUs as liability awards under SFAS 123(R). |

| |

| (4) | | Includes change in pension value under the Company’s discontinued retirement income plan for nonemployee directors for the following directors: C. J. Crawford: $13,649; L. D. Juliber: $13,089; and W. K. Reilly: $15,512. This column is also intended to report above-market earnings on nonqualified deferred compensation balances. The interest rate used to credit earnings on deferrals under the plan is the30-year Treasury rate, which is traditionally below the applicable federal market rate. Accordingly, no above-market earnings are reported here. |

| |

| (5) | | Includes Company-paid accidental death and disability insurance premiums and accruals made in 2008 under the discontinued Directors’ Charitable Gift Plan. During first year of participation on the Board, reflects the full initial accrual required. Accordingly, reflects $267,888 for A.M. Cutler who joined the Board in 2008. |

| |

| (6) | | Represents the SFAS 123(R) expense, recognized in 2008, associated with unvested cash-settled RSUs awarded prior to 2008. Stock awards granted during 2008 were forfeited in 2008 upon termination of service; accordingly, SFAS 123(R) expense for awards granted during 2008 was reversed. |

Stock Ownership Guidelines

Stock ownership guidelines require each nonemployee director to hold DuPont Common Stock equal to a multiple of two times the annual retainer. Directors have up to five years from date of election to achieve the required ownership. As of the end of 2008, four of ten directors met or exceeded the ownership requirements. The six remaining directors are on track to achieve the ownership goal within the five-year period established.

Deferred Compensation

Under the DuPont Stock Accumulation and Deferred Compensation Plan for Directors, a director may defer all or part of the Board retainer and committee fees in cash or stock units until a specified year, until retirement as a director, or until death. Interest accrues on deferred cash payments and dividend equivalents accrue on deferred stock units. This deferred compensation is an unsecured obligation of the Company.

Retirement Income Plan

The Company’s retirement income plan for nonemployee directors was discontinued in 1998. Nonemployee directors who began their service on the Board before the plan’s elimination continue to be eligible to receive benefits under the plan. Annual benefits payable under the plan equal one-half of the annual Board retainer (exclusive of any committee compensation and stock, RSU or option grants) in effect at the director’s retirement. Benefits are payable for the lesser of life or ten years.

Directors’ Charitable Gift Plan

Effective October 29, 2008, the Company discontinued its Charitable Gift Plan with respect to future directors. The Directors’ Charitable Gift Plan was established in 1993. After the death of a director, the Company will donate five consecutive annual installments of up to $200,000 each to tax-exempt educational institutions or charitable organizations recommended by the director and approved by the Company.

15

A director is fully vested in the plan after five years of service as a director or upon death or disability. The plan is unfunded; the Company does not purchase insurance policies to satisfy its obligations under the plan. The directors do not receive any personal financial or tax benefit from this program because any charitable, tax-deductible donations accrue solely to the benefit of the Company. Employee directors may participate in the plan if they pay their allocable cost.

Accidental Death and Disability Insurance

The Company also maintains $300,000 accidental death and disability insurance on nonemployee directors.

16

1 — ELECTION OF DIRECTORS

The 13 nominees for election as directors are identified on pages 17 through 20. With the exception of Mr. Bodman, all nominees are now members of the Board of Directors.

The Board has determined that, except for C. O. Holliday, Jr., the Chair, and E. J. Kullman, the Chief Executive Officer, each of the nominees and each other person who served as director during 2008 is or was, as the case may be, independent within the independence requirements of the New York Stock Exchange listing standards and in accordance with the Guidelines for Determining the Independence of DuPont Directors set forth in the Board’s Corporate Governance Guidelines. See pages 6-7.

The Board knows of no reason why any nominee would be unable to serve as a director. If any nominee should for any reason become unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board of Directors may designate following recommendation by the Corporate Governance Committee, or the Board may reduce the number of directors to eliminate the vacancy.

The following material contains information concerning the nominees, including their period of service as director, their recent employment, other directorships, and age as of the 2009 Annual Meeting.

| | | |

| | | |

| | SAMUEL W. BODMAN, 70

Former United States Secretary of Energy, a position he held from January 2005 to January 2009. Mr. Bodman previously served as Deputy Secretary of the Treasury from February 2004 to January 2005, and Deputy Secretary of Commerce from June 2001 to February 2004. He also serves as a trustee of Cornell University. Prior to beginning his government service in 2001, Mr. Bodman was chairman, chief executive officer, and a director of Cabot Corporation, a global producer of specialty chemicals and materials. |

| | | |

| | RICHARD H. BROWN, 61 Director since 2001

Former chairman and chief executive officer of Electronic Data Systems Corporation, a leading global services company. Mr. Brown is a director of Browz Group, LC. He is a former member of The Business Council; The Business Roundtable; U.S.-Japan Business Council; the French-American Business Council; the President’s Advisory Committee on Trade and Policy Negotiations and the President’s National Security Telecommunications Advisory Committee. |

| | | |

| | ROBERT A. BROWN, 57 Director since 2007

President of Boston University since September 2005. He previously was provost and professor of chemical engineering at the Massachusetts Institute of Technology from July 1998 through July 2005. Dr. Brown is a member of the National Academy of Sciences, the American Academy of Arts and Sciences, the National Academy of Engineering and a former member of the President’s Council of Advisors on Science and Technology. |

17

| | | |

| | BERTRAND P. COLLOMB, 66 Director since 2007

Former Chairman, from 1989 to 2007, and chief executive officer, from 1989 to 2004, of Lafarge, a global manufacturer of building materials, headquartered in Paris, France. He is also a director of Total and ATCO Ltd. Mr. Collomb is chairman of the French Institute of International Relations (IFRI) and the French Institute for Science and Technology (IHEST). He is Vice Chairman of the Global Business Coalition Against HIV/AIDS. Mr. Collomb is founder of the Center for Management Research at the Ecole Polytechnique, former chairman of the World Business Council for Sustainable Development and a member of the Institut de France. |

| | | |

| | CURTIS J. CRAWFORD, 61 Director since 1998

President and Chief Executive Officer, since June 2003, of XCEO, Inc., a consulting firm specializing in leadership and corporate governance, and author of two books on these subjects. He formerly served as president and chief executive officer of Onix Microsystems, Inc. Dr. Crawford is a director of ITT Corporation and ON Semiconductor Corporation. He also serves as a trustee of DePaul University. |

| | | |

| | ALEXANDER M. CUTLER, 57 Director since 2008

Chairman and Chief Executive Officer, since 2000, of Eaton Corporation, a global diversified industrial manufacturer. He formerly served as president and chief operating officer, executive vice president and chief operating officer-Controls and executive vice president-Operations. Mr. Cutler is a director of KeyCorp and the Greater Cleveland Partnership and is a member of the Yale University Development Board. He is also a member of The Business Roundtable and The Business Council. |

| | | |

| | JOHN T. DILLON, 70 Director since 2004

Vice Chairman and Senior Managing Director, since March 2005, of Evercore Capital Partners. From April 1996 to October 2003, Mr. Dillon was the chairman and chief executive officer of International Paper, a global paper and paper distribution, packaging and forest products company. He is a director of Caterpillar, Inc. and Kellogg Company. A member of The Business Council, Mr. Dillon is a former chairman of The Business Roundtable, was a member of the President’s Advisory Council on Trade Policy and Negotiations and served as chairman of the National Council on Economic Education. |

| | | |

| | ELEUTHÈRE I. DU PONT, 42 Director since 2006

President, Longwood Foundation since 2008. From May 2007 to May 2008,

he served as senior vice president, operations and chief financial officer of drugstore.com, a leading online provider of health, beauty, vision and pharmacy products. Prior to that, Mr. du Pont served as president and chief financial officer of Wawa, Inc., a chain of food markets in the mid-Atlantic region. |

18

| | | |

| | MARILLYN A. HEWSON, 55 Director since 2007

President, since September 2008, Lockheed Martin Systems Integration-Owego, a leader in providing advanced technology products, services and systems integration solutions to defense, civil and commercial customers worldwide. From April 2007 to August 2008, Ms. Hewson served as executive vice president, global sustainment, for Lockheed Martin Aeronautics Company. She served as president, Logistics Services for Lockheed Martin Corporation from January 2007 to March 2007. Prior to that, Ms. Hewson was president, Kelly Aviation Center L.P. She is a member of the Board of Visitors of the College of Commerce and Business of the University of Alabama. |

| | | |

| | CHARLES O. HOLLIDAY, JR., 61 Director since 1997

Chairman, since 1999, of DuPont. Mr. Holliday served as chief executive officer of the Company from 1999 through 2008. He formerly served as president, executive vice president, president and chairman-DuPont Asia Pacific and senior vice president. He is a director of Deere and Company and Chairman of Catalyst. Mr. Holliday formerly served as chairman of the Business Roundtable’s Task Force for Environment, Technology and Economy, the World Business Council for Sustainable Development, The Business Council, and the Society of Chemical Industry-American Section. He is Chairman of the U.S. Council on Competitiveness and is a founding member of the International Business Council. He alsoco-authored “Walking the Talk” which details the business case for sustainable development and corporate responsibility. |

| | | |

| | LOIS D. JULIBER, 60 Director since 1995

Retired vice chairman, a position she held from July 2004 to March 2005, ofColgate-Palmolive Company, the principal business of which is the production

and marketing of consumer products. Ms. Juliber was chief operating officer ofColgate-Palmolive from 2000 to 2004. She formerly served as executive vicepresident-Developed Markets, president, Colgate-Palmolive North America and chief technological officer ofColgate-Palmolive. Ms. Juliber is a director of Goldman Sachs and Kraft Foods Inc. She also serves as Chairman of the MasterCa rd Foundation and a member of the board of trustees of Wellesley College and Women’s World Banking. |

| | | |

| | ELLEN J. KULLMAN, 53 Director since October 2008

Chief Executive Officer of DuPont since January 2009. Ms. Kullman served as president of DuPont from October 2008 to December 2008. From June 2006 through September 2008, she served as executive vice president responsible for DuPont Coatings & Color Technologies; DuPont Electronic & Communication Technologies; DuPont Performance Materials; DuPont Safety & Protection; Marketing & Sales; Pharmaceuticals; Risk Management; and Safety & Sustainability. Prior to that, Ms. Kullman was group vice president-DuPont Safety & Protection. She is a member of the boards of Tufts University and the Blood Bank of Delmarva. |

19

| | | |

| | WILLIAM K. REILLY, 69 Director since 1993

Senior Advisor, since October 2006, at TPG Capital LP and Founding Partner, since 1997, of Aqua International Partners, L.P., an affiliate which finances water supply and renewable energy. He formerly served as administrator of the United States Environmental Protection Agency, and president of the World Wildlife Fund and The Conservation Foundation. Mr. Reilly is a director of ConocoPhillips, Royal Caribbean International, National Geographic Society and the Packard Foundation. He also serves as Chairman Emeritus of the Board of the World Wildlife Fund, Chairman of the Advisory Board of the Nicholas Institute for Environmental Policy Solutions of Duke University and Co-Chair of the National Commission on Energy Policy. |

Ownership of Company Stock

Set forth below is certain information, as of December 31, 2008, concerning beneficial owners known to DuPont of more than five percent of DuPont’s outstanding Common Stock:

| | | | | | | | | |

| |

| | | Number of Shares

| | Percent of Shares

|

| Name and Address of Beneficial Owner | | Beneficially Owned | | Outstanding |

| |

| Capital World Investors | | | 47,455,620(1) | | | | 5.3%(1) | |

| 333 South Hope Street | | | | | | | | |

| Los Angeles, CA 90071 | | | | | | | | |

| | | | | | | | | |

| State Street Bank and Trust Company | | | 52,189,280(2) | | | | 5.8%(2) | |

| State Street Financial Center | | | | | | | | |

| One Lincoln Street | | | | | | | | |

| Boston, MA 02111 | | | | | | | | |

| |

| |

| | |

| | (1) | Based solely on a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2009, Capital World Investors (“CWI”), a division of Capital Research and Management Company, reported aggregate beneficial ownership of approximately 5.3%, or 47,455,620 shares, of DuPont Common Stock as of December 31, 2008. CWI reported that it possessed sole voting power over 3,210,000 shares and sole dispositive power over 47,455,620 shares. CWI also reported that it did not possess shared voting or shared dispositive power over any shares beneficially owned. |

| |

| | (2) | Based solely on a Schedule 13G filed with the Securities and Exchange Commission on February 18, 2009, State Street Bank and Trust Company (“State Street”), acting in various fiduciary capacities, reported aggregate beneficial ownership of approximately 5.8%, or 52,189,280 shares, of DuPont Common Stock as of December 31, 2008. State Street reported that it possessed sole voting and shared dispositive power over 52,189,280 shares. State Street also reported that it did not possess shared voting or sole dispositive power over any shares beneficially owned. |

The following table includes shares of DuPont Common Stock beneficially owned by each director and nominee, by each executive officer named in the 2008 Summary Compensation Table on page 37 of this Proxy Statement and by all directors and executive officers as a group as of December 31, 2008 (unless otherwise noted).

Under rules of the Securities and Exchange Commission, “beneficial ownership” includes shares for which the individual, directly or indirectly, has or shares voting or investment power, whether or not the shares are held for the individual’s benefit.

20

| | | | | | | | | | | | | | | | | | | | | |

| | | | Amount and Nature of

| | | |

| | | | Beneficial Ownership | | | |

| | | | (Number of Shares) | | | |

| | | | | | | | | | | | | Percent

|

| | | | | | | | | | Right to

| | | of

|

| Name | | | Direct(1) | | | Indirect(2) | | | Acquire(3) | | | Class(4) |

| S. W. Bodman | | | | 41,100 | (5) | | | | — | | | | | — | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| R. H. Brown | | | | 2,340 | | | | | — | | | | | 34,345 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| R. A. Brown | | | | — | | | | | 110 | | | | | 897 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| B. P. Collomb | | | | 5,290 | | | | | — | | | | | 897 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| T. M. Connelly, Jr. | | | | 23,295 | | | | | 1,496 | | | | | 600,798 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| C. J. Crawford | | | | 150 | | | | | 235 | | | | | 29,374 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| A. M. Cutler | | | | 2,000 | | | | | — | | | | | 1,740 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| J. T. Dillon | | | | 1,000 | | | | | — | | | | | 11,349 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| E. I. du Pont | | | | 769 | | | | | 1,361 | | | | | 897 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| R. R. Goodmanson | | | | — | | | | | — | | | | | 1,530,055 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| M. A. Hewson | | | | 2,000 | | | | | — | | | | | 4,083 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| C. O. Holliday, Jr. | | | | 124,230 | | | | | 548 | | | | | 3,896,756 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| L. D. Juliber | | | | — | | | | | 600 | | | | | 42,270 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| J. L. Keefer | | | | 17,447 | | | | | — | | | | | 320,593 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| E. J. Kullman | | | | 30,140 | | | | | 6,004 | | | | | 656,498 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| W. K. Reilly | | | | — | | | | | — | | | | | 51,444 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Directors and Executive Officers as a Group | | | | 262,167 | | | | | 21,406 | | | | | 8,036,155 | | | | | 0.9 | % |

| |

| |

| (1) | These shares are held individually or jointly with others, or in the name of a bank, broker or nominee for the individual’s account. |

| |

| (2) | This column includes other shares over which directors and executive officers have or share voting or investment power, including shares directly owned by certain relatives with whom they are presumed to share voting and/or investment power, and shares held under the DuPont Savings and Investment Plan. |

| |

| (3) | This column includes shares which directors and executive officers had a right to acquire within 60 days from December 31, 2008, through the exercise of stock options or through the conversion of restricted stock units or deferred stock units granted or held under DuPont’s equity-based compensation plans. |

| |

| (4) | Unless otherwise indicated, beneficial ownership of any named individual does not exceed 0.5% of the outstanding shares of the class. |

| |

| (5) | Ownership as of February 6, 2009. |

Section 16(a) Beneficial Ownership Reporting Compliance

Directors and executive officers are required to file reports of ownership and changes in ownership of DuPont Common Stock with the Securities and Exchange Commission. In 2008, one report for J. L. Keefer covering one transaction was filed one day late because of an administrative error.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was at any time during 2008 an officer or employee of DuPont or any of the Company’s subsidiaries nor was any such person a former officer of DuPont or any of the Company’s subsidiaries. In addition, no Compensation Committee member is an executive officer of another entity at which one of the Company’s executive officers serves on the board of directors.

21

Compensation Committee Report

The Compensation Committee of the Board of Directors has reviewed the Compensation Discussion and Analysis (“CD&A”) section included in this Proxy Statement.

The Compensation Committee has also reviewed and discussed the CD&A with management.

Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the CD&A be included in the Company’s Annual Report onForm 10-K for the year ended December 31, 2008 and in this Proxy Statement.

The members of the Compensation Committee of the Board of Directors have provided this report.

COMPENSATION COMMITTEE

John T. Dillon, Chair

Richard H. Brown

Curtis J. Crawford

Alexander M. Cutler

Eleuthère I. du Pont

22

Compensation Discussion and Analysis (CD&A)

Executive Compensation Philosophy and Core Principles