Exhibit 99.1

Northeast Seminar Boston

March 23, 2004

Safe Harbor Statement

This presentation contains forward-looking statements, the results of which may materially differ from those implied due to known and unknown risks and uncertainties, some of which are discussed below. Cash flow, earnings, earnings growth, capitalization and dividends (as well as earnings per share and total shareholder return goals) will depend on the performance of Holdings’ subsidiaries, and board policy. Demand for and pricing of electricity and landfill gas, changing market conditions and weather conditions could affect earnings levels. Duquesne Light’s earnings will be affected by the number of customers who choose to receive electric generation through POLR II, by final PUC approval of POLR III and by the continued performance of the generation supplier. POLR II customer retention will depend on market generation prices. The ultimate structure of POLR III will be subject to PUC review and approval, and may depend on the ability to negotiate appropriate terms with suitable generation suppliers. Any debt reduction or refinancing will depend on the availability of cash flows and appropriate replacement or refinancing vehicles. The amount and timing of any security issuance under Duquesne Light’s shelf registration statement will depend on financial market performance. Purchase price adjustments related to the sale of AquaSource, and the resolution and disposition of the retained liabilities and indemnities, may affect earnings and cash flows. The outcome of the current IRS audit may affect any refunds owed to us. Maintaining costs at 2003 levels will depend on our ability to operate with reduced administrative resources and to further streamline functions to eliminate remaining redundancies. Customer energy demand, fuel costs and plant operations could affect DQE Energy Services’ earnings. The outcome of the shareholder litigation initiated against Holdings may affect performance. Earnings with respect to synthetic fuel operations, landfill gas and affordable housing investments will depend, in part, on the continued viability of, and compliance with the requirements for, applicable federal tax credits. The final resolution of proposed adjustments regarding state income tax liabilities (which will depend on negotiations with the appropriate tax authorities) could affect financial position, earnings, and cash flows. The credit ratings received from the rating agencies could affect the cost of borrowing, the access to capital markets and liquidity. Overall performance by Holdings and its affiliates could be affected by economic, competitive, regulatory, governmental and technological factors affecting operations, markets, products, services and prices , as well as the factors discussed in Duquesne Light Holdings’ SEC filings made to date.

2

Company Representatives

Steve Schott

Sr. VP and Chief Financial Officer

Jim Wilson

Sr. VP and Chief Strategic Officer

Bill Fields

VP and Treasurer

Quynh McGuire

Sr. Manager, Investor Relations

3

Agenda

Strategic Overview

Operational Update

Earnings Outlook

Financial Review

POLR Opportunity

Summary

4

STRATEGIC OVERVIEW

Meeting our Commitments… Building our Future

Low risk; stable cash flow

Supports dividend

Sustainable and recurring earnings

Solid traditional utility

Building on successes at core electric utility

6

Results Achieved

Met financial goals in 2003

Removed uncertainty and volatility

IRS settlement

3-year union contract

AquaSource sale

ProAm sale (2002)

Energy-technology securities sale

Strengthened balance sheet

Retired $75M of MIPS in 2004

$468M debt retired during 2002-2003

No long-term debt maturities until 2008

7

Investment Opportunity

Top tier total shareholder return investment

Sustainable dividend with attractive yield

Strong balance sheet

Simple financials

Focus on core utility business

8

OPERATIONAL

UPDATE

DUQUESNE LIGHT

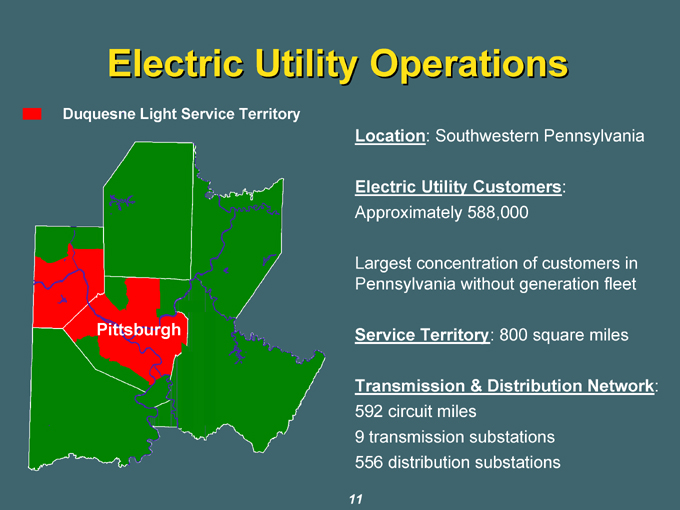

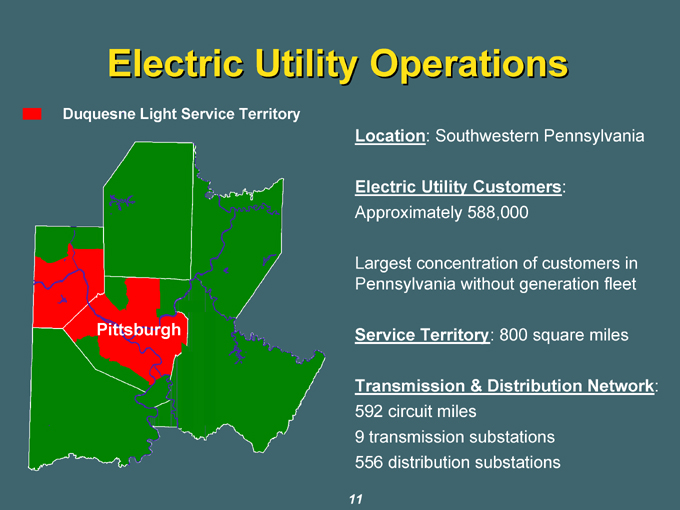

Electric Utility Operations

Duquesne Light Service Territory

Location: Southwestern Pennsylvania

Electric Utility Customers: Approximately 588,000

Largest concentration of customers in Pennsylvania without generation fleet

Service Territory: 800 square miles

Transmission & Distribution Network:

592 circuit miles

9 transmission substations

556 distribution substations

11

Operational Excellence

Delivering outstanding customer service

Meeting or exceeding reliability expectations

Customers

Regulators

Providing useful outage information

More than 90%

Managing costs aggressively

12

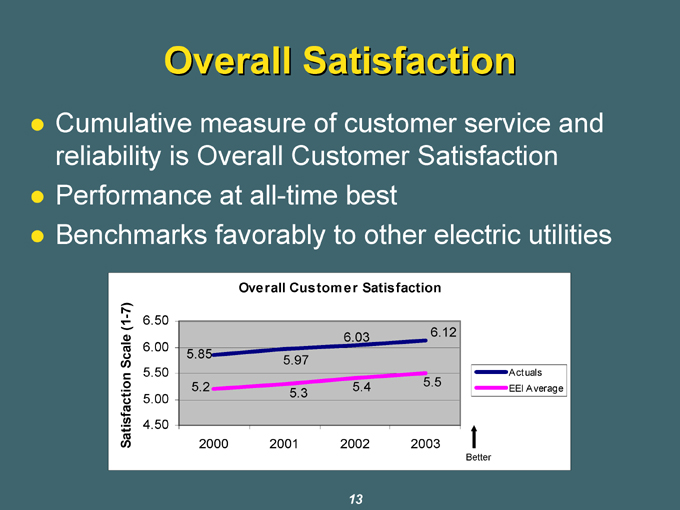

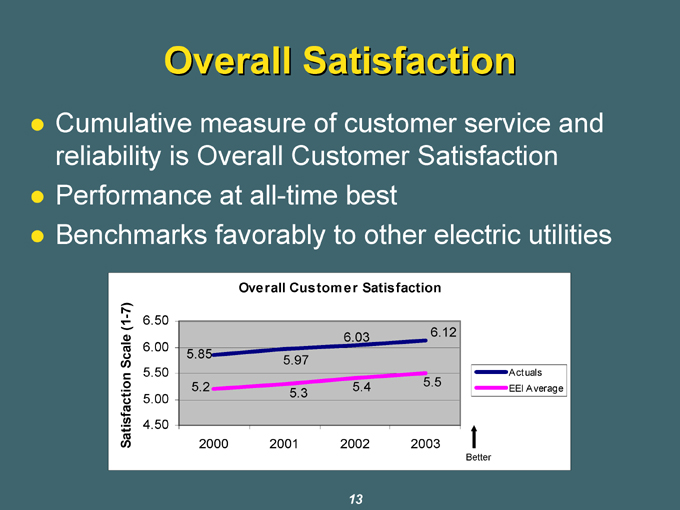

Overall Satisfaction

Cumulative measure of customer service and reliability is Overall Customer Satisfaction Performance at all-time best zBenchmarks favorably to other electric utilities

Overall Customer Satisfaction

5.85 5.2 2000

5.97 5.3 2001

6.03 5.4 2002

6.12 5.5 2003

13

Operational Goals

Continue improving customer service and operations

Maintaining good regulatory relationships

Reducing costs while improving customer satisfaction

14

UNREGULATED

BUSINESSES

DQE Energy Services

DQE Communications

DQE Financial

15

Unregulated Businesses

Key Accomplishments

Exceeded income targets

Increased margins

Resolved Fresh Kills successfully

IRS audit of synthetic fuel investment completed

16

Unregulated Businesses

2004 Plan

Restructure businesses into one operating energy company

Separate active from passive investments

May monetize certain investments

Assess future growth opportunities

Section 29 tax credit period expires end of 2007

Earnings improvement from cost reductions and efficiencies

17

EARNINGS OUTLOOK

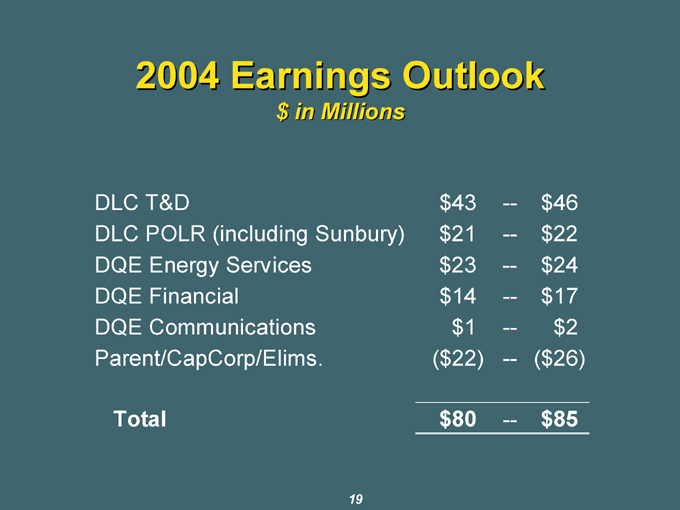

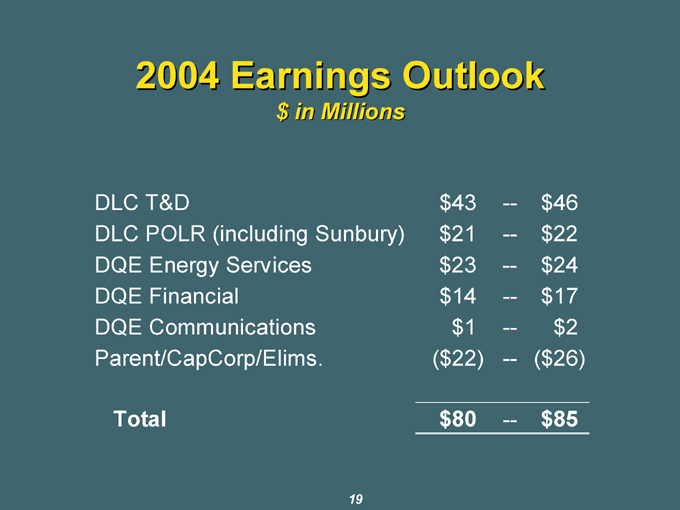

2004 Earnings Outlook

$ in Millions

DLC T&D $ 43 — $ 46

DLC POLR (including Sunbury) $ 21 — $ 22

DQE Energy Services $ 23 — $ 24

DQE Financial $ 14 — $ 17

DQE Communications $ 1 — $ 2

Parent/CapCorp/Elims. ($ 22) — ($ 26)

Total $ 80 — $ 85

19

FINANCIAL

REVIEW

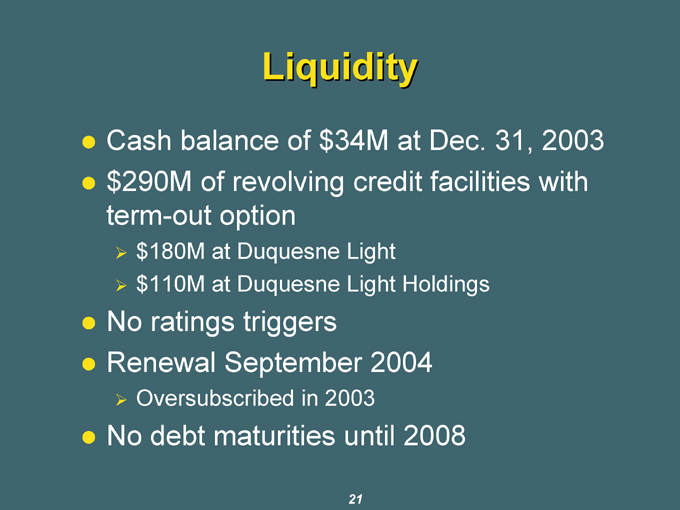

Liquidity

Cash balance of $34M at Dec. 31, 2003

$290M of revolving credit facilities with term-out option

$180M at Duquesne Light

$110M at Duquesne Light Holdings

No ratings triggers zRenewal September 2004

Oversubscribed in 2003

No debt maturities until 2008

21

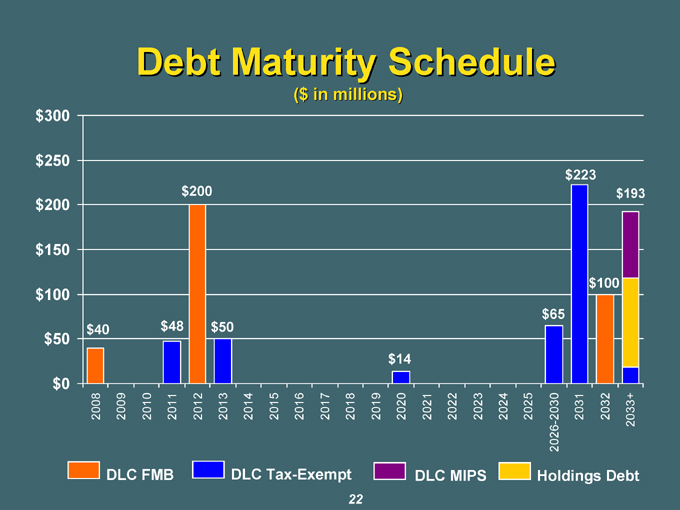

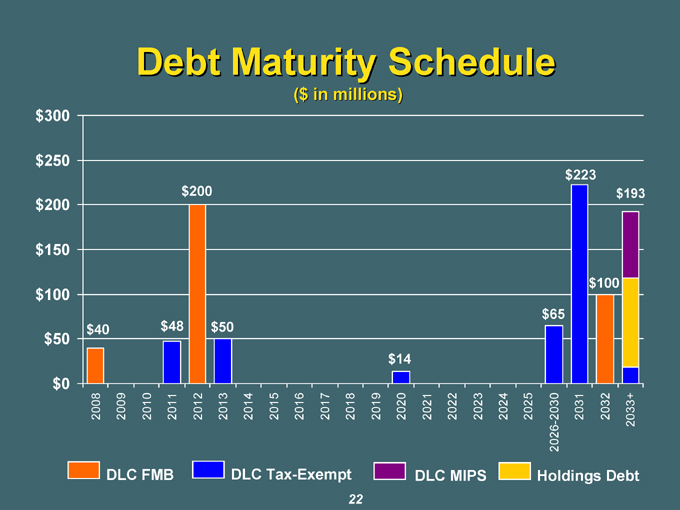

Debt Maturity Schedule

($ in millions)

DLC FMB

DLC Tax-Exempt

DLC MIPS

Holdings Debt

22

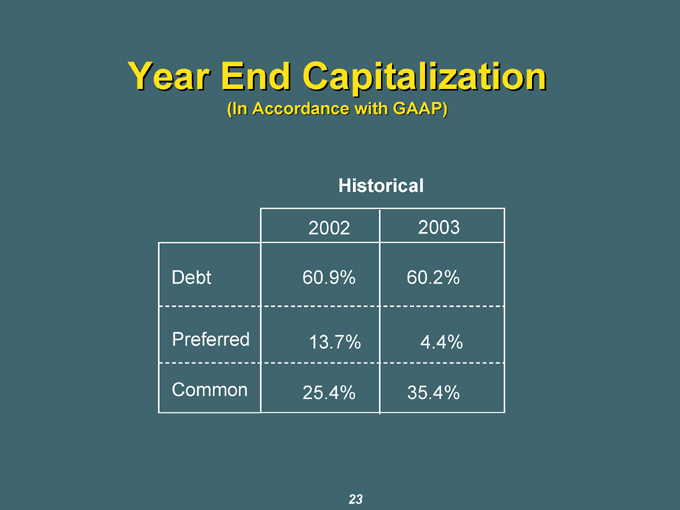

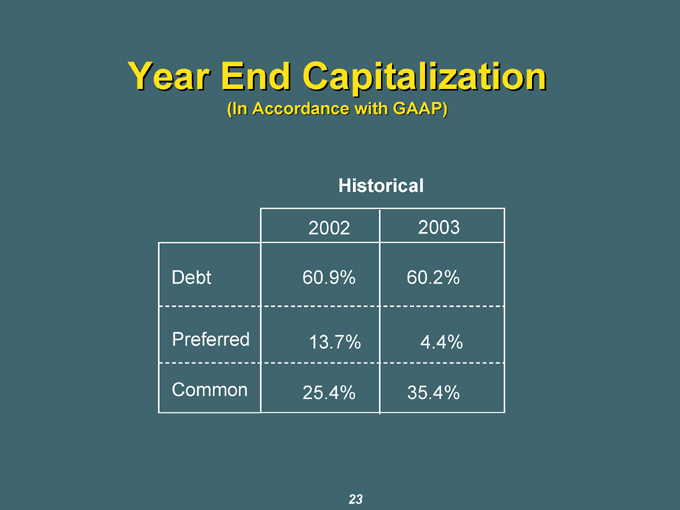

Year End Capitalization

(In Accordance with GAAP)

Historical

2002 2003

Debt 60.9% 60.2%

Preferred 13.7% 4.4%

Common 25.4% 35.4%

23

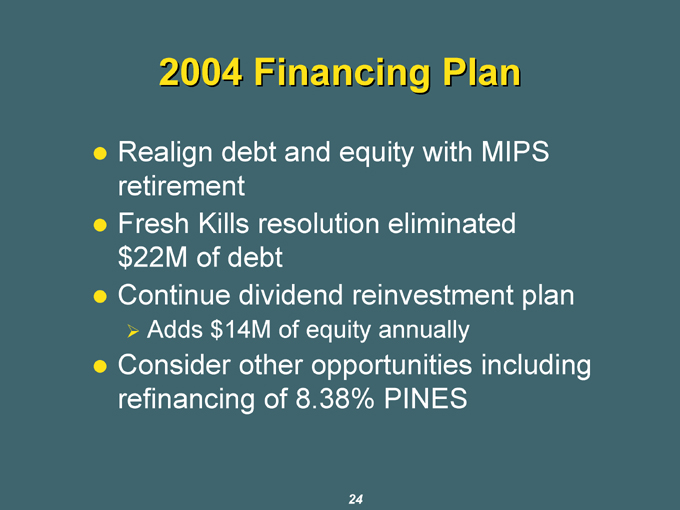

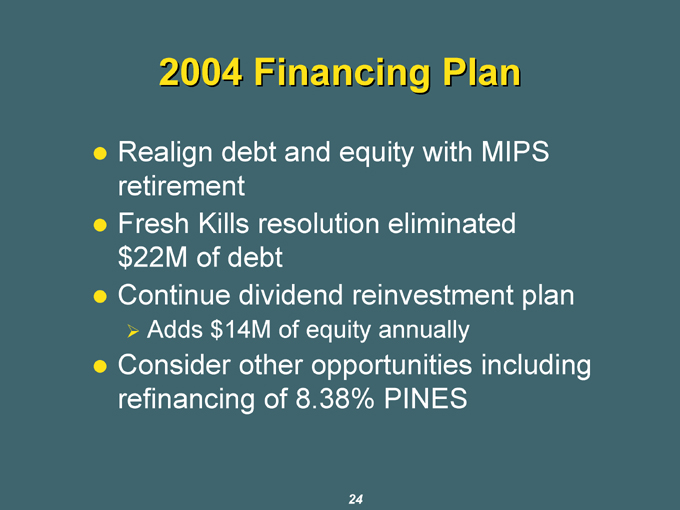

2004 Financing Plan

Realign debt and equity with MIPS retirement

Fresh Kills resolution eliminated $22M of debt

Continue dividend reinvestment plan

Adds $14M of equity annually

Consider other opportunities including refinancing of 8.38% PINES

24

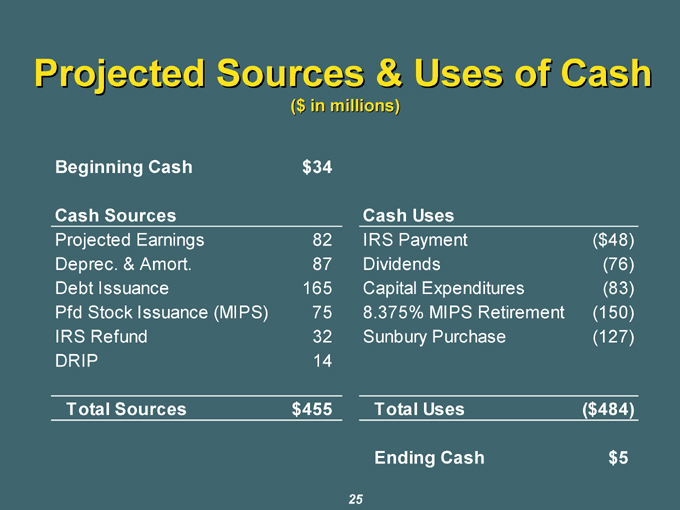

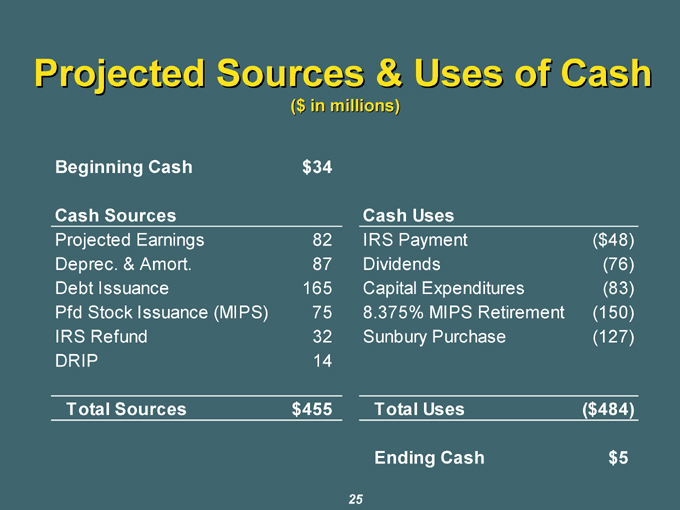

Projected Sources & Uses of Cash

($ in millions)

Beginning Cash $34

Cash Sources

Projected Earnings 82

Deprec. & Amort. 87

Debt Issuance 165

Pfd Stock Issuance (MIPS) 75

IRS Refund 32

DRIP 14

Total Sources $455

Cash Uses

IRS Payment ($48)

Dividends (76)

Capital Expenditures (83)

8.375% MIPS Retirement (150)

Sunbury Purchase (127)

Total Uses ($484)

Ending Cash $5

25

POLR OPPORTUNITY

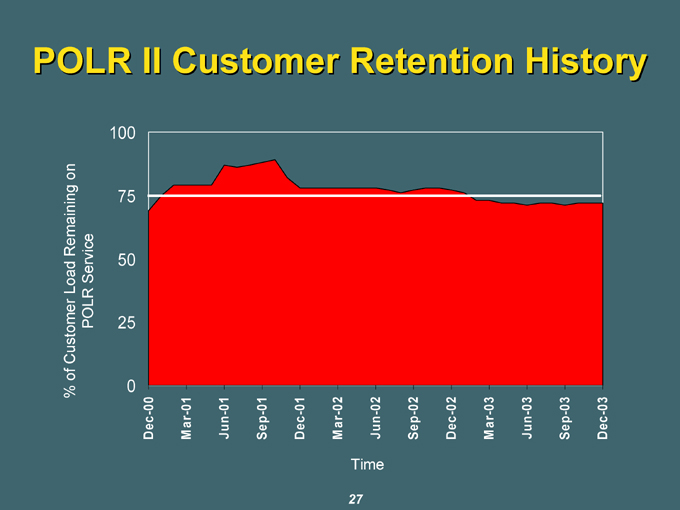

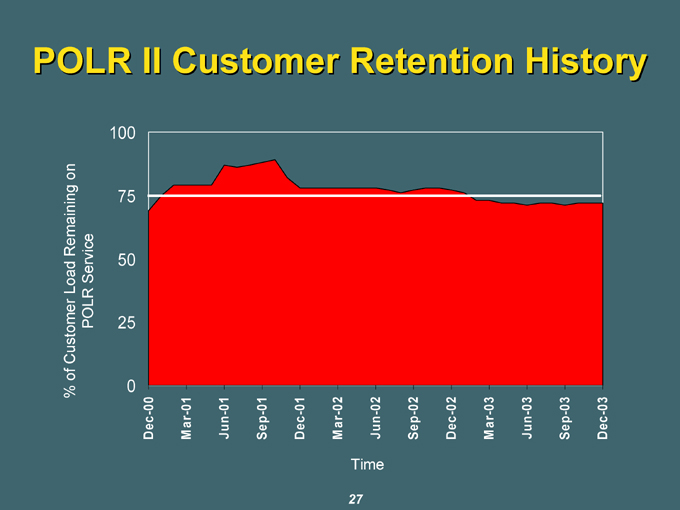

POLR II Customer Retention History

Time

27

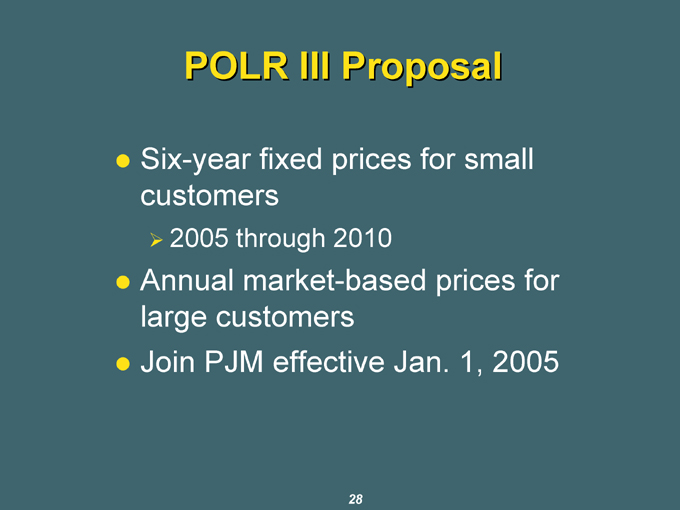

POLR III Proposal

Six-year fixed prices for small customers

2005 through 2010

Annual market-based prices for large customers

Join PJM effective Jan. 1, 2005

28

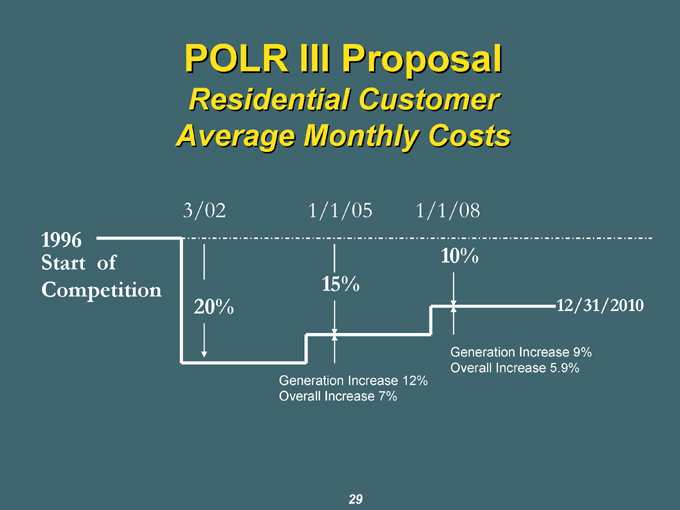

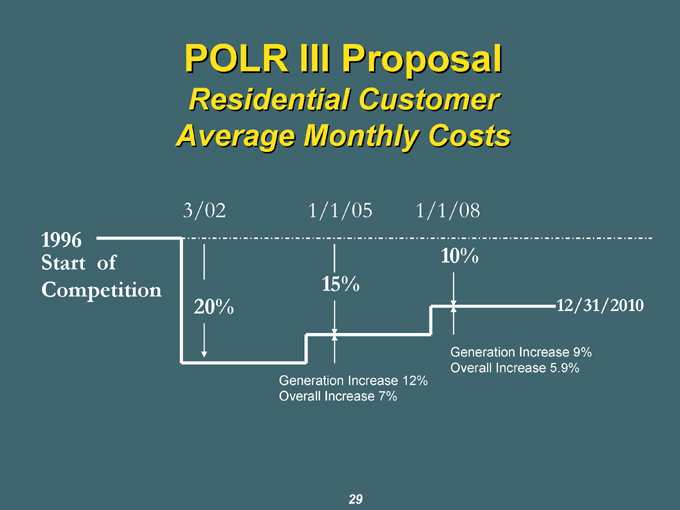

POLR III Proposal

Residential Customer Average Monthly Costs

3/02 1/1/05 1/1/08

1996

Start of 10%

Competition 15%

20% 12/31/2010

Generation Increase 12% Overall Increase 7%

Generation Increase 9% Overall Increase 5.9%

29

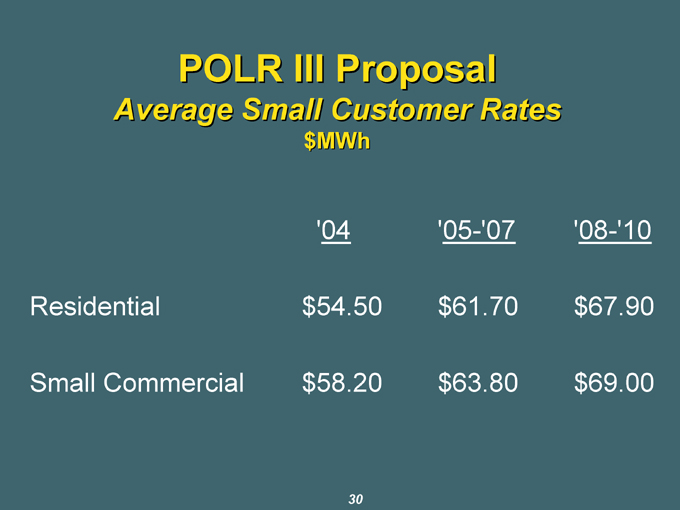

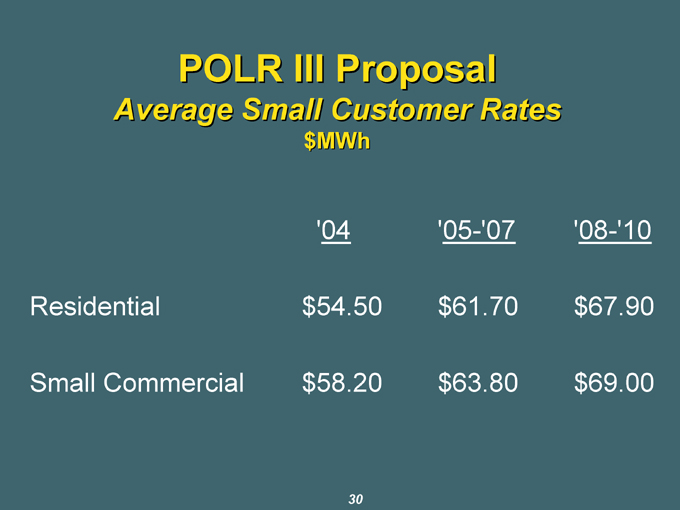

POLR III Proposal

Average Small Customer Rates

$MWh

‘04 ‘05-’07 ‘08-’10

Residential $ 54.50 $ 61.70 $ 67.90

Small Commercial $ 58.20 $ 63.80 $ 69.00

30

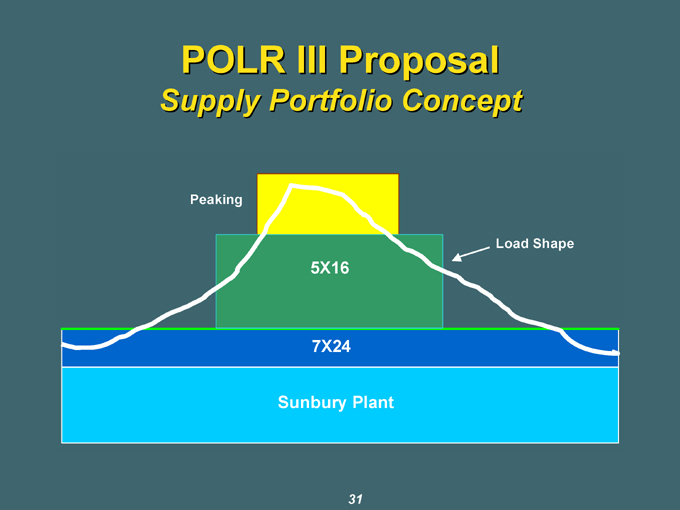

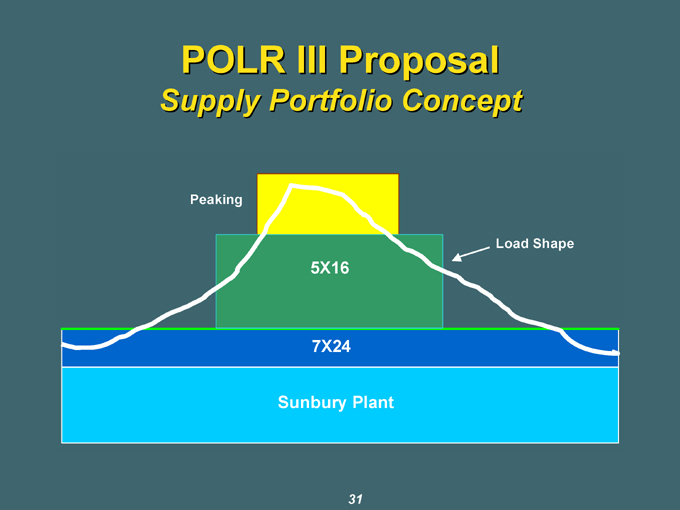

POLR III Proposal

Supply Portfolio Concept

Peaking

Load Shape

5X16

7X24

Sunbury Plant

31

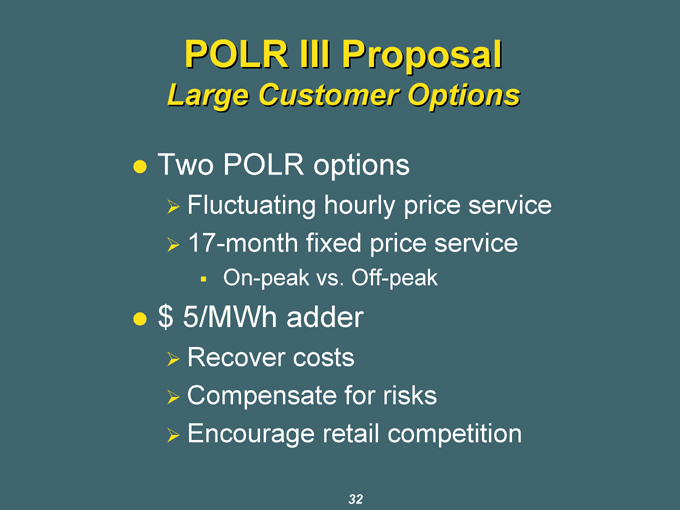

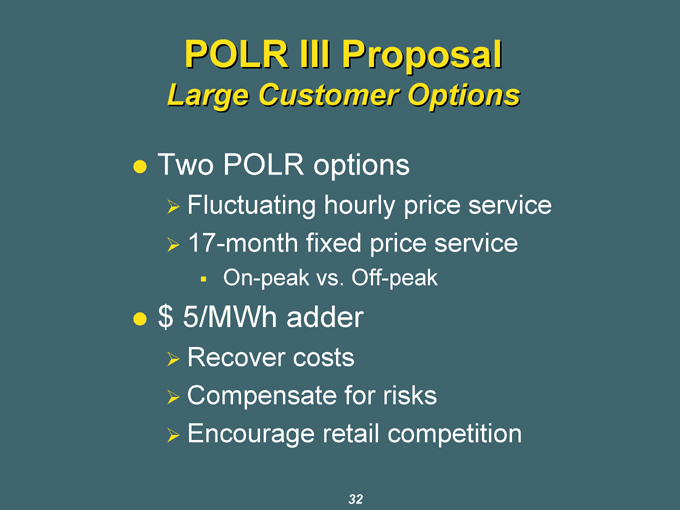

POLR III Proposal

Large Customer Options

Two POLR options

Fluctuating hourly price service

17-month fixed price service

On-peak vs. Off-peak

$5/MWh adder

Recover costs

Compensate for risks

Encourage retail competition

32

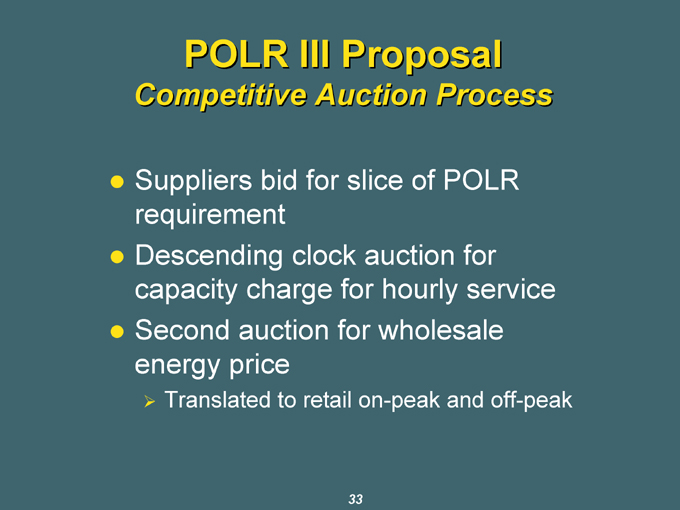

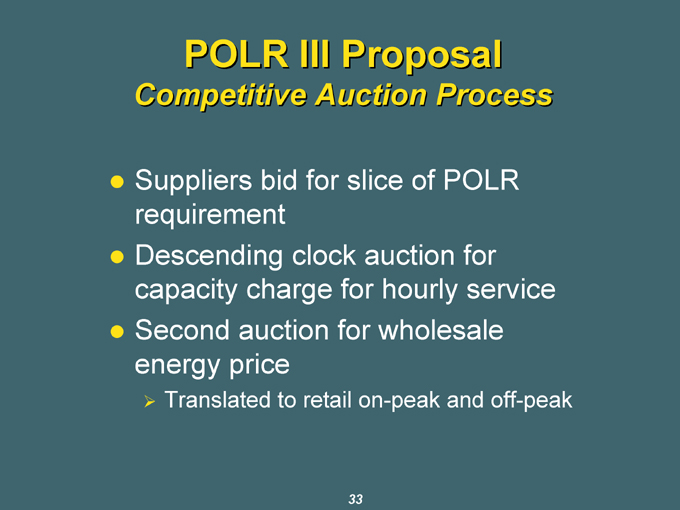

POLR III Proposal

Competitive Auction Process

Suppliers bid for slice of POLR requirement

Descending clock auction for capacity charge for hourly service

Second auction for wholesale energy price

Translated to retail on-peak and off-peak

33

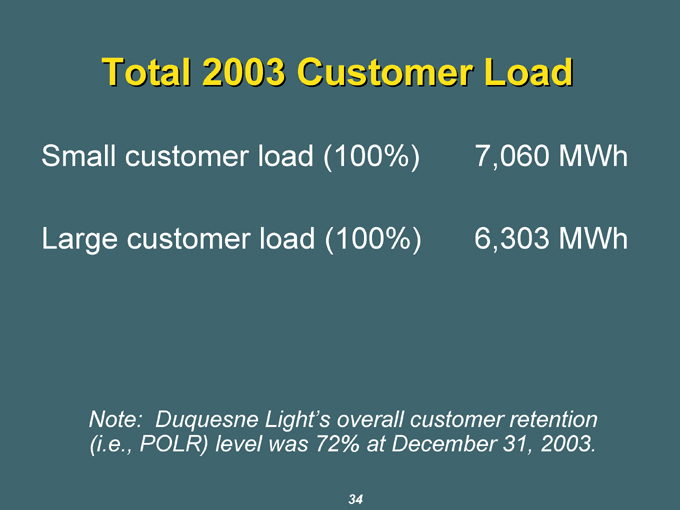

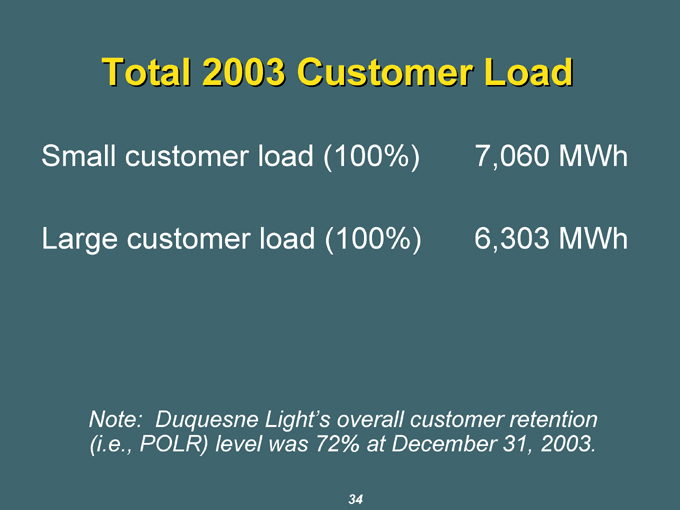

Total 2003 Customer Load

Small customer load (100%) 7,060 MWh

Large customer load (100%) 6,303 MWh

Note: Duquesne Light’s overall customer retention (i.e., POLR) level was 72% at December 31, 2003.

34

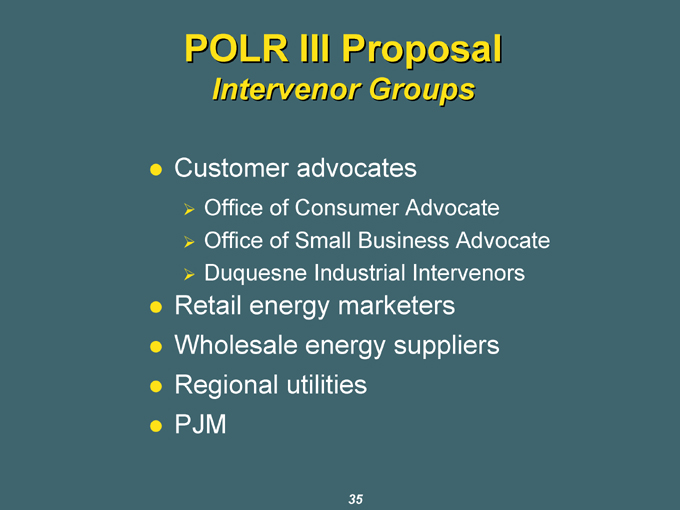

POLR III Proposal

Intervenor Groups

Customer advocates

Office of Consumer Advocate

Office of Small Business Advocate

Duquesne Industrial Intervenors

Retail energy marketers z Wholesale energy suppliers z Regional utilities z PJM

35

POLR III Proposal

Petition Schedule

Intervenor Direct Testimony February 25

Rebuttal Testimony for All Parties March 17

Last Date to Serve Discovery March 19

Last Date to Answer Discovery March 25

Surrebuttal Outline for All Parties March 26

Hearings (Pittsburgh) March 29 – April 1

Main Briefs April 16

Reply Briefs April 26

ALJ Recommended Decision Week of May 24

Exceptions/Reply Exceptions June 18

PUC Final Order July 8

(PUC Docket # P-00032071)

36

SUMMARY

Meeting our Commitments… Building our Future

Low risk; stable cash flow

Supports dividend

Sustainable and recurring earnings zSolid traditional utility

Building on successes at core electric utility

38

Q&A