- FLS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Flowserve (FLS) PRE 14APreliminary proxy

Filed: 29 Mar 21, 4:08pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

☒ Filed by the Registrant ☐ Filed by a party other than the Registrant

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material 240.14a-12 | |

FLOWSERVE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Invitation to 2021 Annual Meeting of Shareholders

Dear Fellow Shareholder: | |

I am pleased to invite you to join me, our Board of Directors, executive officers, associates and other shareholders at Flowserve’s 2021 Annual Meeting of Shareholders. The attached Notice of 2021 Annual Meeting of Shareholders and Proxy Statement, which we are providing to shareholders beginning on April 9, 2021, contain details of the business to be conducted at the meeting. | |

Our Performance in 2020 | |

2020 was a year of significant challenges, not just for Flowserve but for the global economy as a whole. Despite the significant progress made in 2019, the onset of the COVID-19 pandemic, compounded by volatility in oil and gas prices, have had a significant impact on our end markets, our business and our financial performance. These impacts have only heightened the importance of continuing our Flowserve 2.0 Transformation program and accelerated the need to adapt our long-term strategy. The most significant area of focus in 2020 was keeping our people safe from the COVID-19 pandemic while performing our essential operations in order to keep critical infrastructure and industries operating, including oil and gas, water, chemical, power generation and other essential industries, such as food and beverage and healthcare. Our associates rose to the challenges presented by the COVID-19 pandemic, adapting to new policies and procedures to keep our facilities safe, adjusting to work-from-home practices, and improving hygiene and sanitation for those who have continued to keep our manufacturing facilities running, which is evidence of just how deeply our associates are committed to the Flowserve mission, values and behaviors. With bookings down 19.5% in the wake of these unprecedented challenges, our aggressive cost-saving actions combined with the process improvements implemented as part of the Flowserve 2.0 transformation allowed us to nonetheless achieve solid results in revenue, operating income, and earnings per share in light of the pressures faced by Flowserve and the broader economy in 2020. | |

2020 highlights include: |

Bolstered balance sheet by |  Safety improvements resulted |

Reaffirmed our commitment to

|  Announced aggressive carbon |

More than 20 commercial launches of |

Our Business Strategy | |

While 2020 was a challenging year for Flowserve and for our customers, through the commitment and dedication of our associates, combined with the positive impact of our transformation efforts, we are increasingly optimistic for the opportunities that lie ahead in 2021 and beyond. During 2021, we will continue our focus on cash conversion, financial returns and managing margin performance as we continue to navigate the ongoing pandemic, vaccine rollout and return to infrastructure investment and increased energy demands. We believe Flowserve is well positioned to win in the recovery and create long-term value for our shareholders and other stakeholders. | |

Shareholder Feedback | |

Flowserve’s Board and senior leadership continue to be encouraged by the positive feedback we have received about the clarity of information we provide through our proxy statement. We are continually reviewing ways to enhance the information in our public disclosures and will continue to do so based on your feedback. Your vote is very important to us and to our business. Prior to the meeting, I encourage you to sign and return your proxy card, or use telephone or Internet voting, so that your shares will be represented and voted at the meeting. You can find instructions on how to vote beginning on page 74. Thank you in advance for voting and for your continued support of Flowserve. | |

R. Scott Rowe, President and CEO |

Notice of 2021 Annual Meeting of Shareholders

| When: Thursday, May 20, 2021 at 11:30 a.m. CDT |  | Where: Online at www.virtualshareholdermeeting.com/FLS2021 |

We are pleased to invite you to join our Board of Directors and senior leadership at Flowserve’s 2021 Annual Meeting of Shareholders. The Governor of the State of New York has issued several temporary executive orders permitting New York corporations to hold virtual only shareholder meetings in light of the COVID-19 pandemic. In addition, on March 17, 2021, the New York State Legislature approved amendments to New York law that, if signed by the Governor, would permit New York corporations to hold virtual-only shareholder meetings this year.

As such, we intend to hold the Annual Meeting solely by means of remote communications with no in-person location if permitted by New York law or executive order as of the date of the Annual Meeting. In the event a solely virtual meeting is not permitted as of such date, we may provide a venue for an in-person annual meeting, in addition to virtual participation. In that case, we will notify our shareholders in advance on our website (ir.flowserve.com) and by issuing a press release and filing it as additional proxy materials with the Securities and Exchange Commission and on www.proxyvote.com.

2021 Proposals | Board Vote Recommendation | Page Reference (for more detail) | |

1 | Elect the 10 directors named in the proxy statement | For ✔ | Page 12 |

2 | Approve, on an advisory basis, the Company’s executive compensation | For ✔ | Page 61 |

3 | Ratify the appointment of PricewaterhouseCoopers as our independent auditor for 2021 | For ✔ | Page 68 |

4 | Management Proposal to Amend the Company’s Restated Certificate of Incorporation to Delete Article Tenth Regarding Supermajority Approval of Business Combinations with Certain Interested Parties | For ✔ | Page 71 |

Shareholders will also transact any other business that is properly brought before the Annual Meeting.

Record Date: Shareholders of record of the Company’s common stock, par value $1.25 per share, at the close of business on March 26, 2021 are entitled to notice of and to vote at the Annual Meeting.

Attending the Meeting Virtually: To participate in the meeting, including to vote or to ask questions during the meeting, you must access the meeting website at www.virtualshareholdermeeting.com/FLS2021, and log in using the 16-digit control number provided on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. If you do not receive a 16-digit control number, consult your voting instruction form or Notice of Internet Availability. You may need to request a “legal proxy” from your broker in advance of the meeting in order to participate online. For additional related information, please refer to the disclosure beginning on Page 76 in the enclosed proxy statement. The proxy statement and 2020 annual report to shareholders and any other proxy materials are available at www.proxyvote.com

Your vote is very important. Whether or not you plan to attend the Annual Meeting online, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described to the right on this page. Returning a proxy card or otherwise submitting your proxy does not deprive you of your right to attend the Annual Meeting and vote online at www.virtualshareholdermeeting.com/FLS2021.

By order of the Board of Directors,

Lanesha T. Minnix

Senior Vice President, Chief Legal Officer and Corporate Secretary

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find additional information in the proxy statement.

ROGER L. FIX |  R. SCOTT ROWE |  SUJEET CHAND |  | |||

Independent Chairman Age: 67 Director since 2006 Committees: * Other Public Company Boards: 2 | President & CEO, Age: 50 Director since 2017 Committees: None Other Public Company Boards: None | Independent Age: 63 Director since 2019 Committees: | ||||

● | ● | |||||

Other Public Company Boards: 1 | ||||||

RUBY R. CHANDY |  GAYLA J. DELLY |  JOHN R. FRIEDERY | ||||

Independent Age: 59 Director since 2017 Committees: | Independent Age: 61 Director since 2008 Committees: | Independent Age: 64 Director since 2007 Committees: | ||||

★ | ● | ● | ● | ★ | ● | |

Other Public Company Boards: 2 | Other Public Company Boards: 2 | Other Public Company Boards: None | ||||

JOHN L. GARRISON |  MICHAEL C. MCMURRAY |  DAVID E. ROBERTS | ||||

Independent Age: 60 Director since 2018 Committees: | Independent Age: 56 Director since 2018 Committees: | Independent Age: 60 Director since 2011 Committees: | ||||

● | ● | ★ | ● | ★ | ● | |

Other Public Company Boards: 1 | Other Public Company Boards: None | Other Public Company Boards: None | ||||

CARLYN R. TAYLOR | ||||||

Independent Age: 52 Director since 2020 Committees: | ||||||

● | ● | |||||

Other Public Company Boards: None | ||||||

Chair ● Audit Committee ● Corporate Governance and Nominating Committee Chair ● Audit Committee ● Corporate Governance and Nominating Committee● Finance and Risk Committee ● Organization and Compensation Committee * As Chairman of the Board, Mr. Fix rotates between committee meetings and serves | ||||||

2021 PROXY STATEMENT  2

2

Executive Officers (Page 26)

| Name and Position | Age | Since | Previous Position |

| R. Scott Rowe President, CEO and Director | 50 | April 2017 | President — Cameron Group, Schlumberger Ltd. |

| Elizabeth L. Burger Senior VP and Chief Human Resources Officer | 50 | April 2018 | SVP and Chief Human Resources Officer, Hanesbrands, Inc. |

| Sanjay K. Chowbey President, Aftermarket Services & Solutions | 53 | July 2019 | President, Subcom Business Unit TE Connectivity |

| Keith E. Gillespie Senior VP and Chief Sales Officer | 55 | May 2015 | Managing Director, AlixPartners LLC |

| Lanesha T. Minnix Senior VP, Chief Legal Officer and Corporate Secretary | 46 | June 2018 | SVP and General Counsel, BMC Stock Holdings, Inc. |

| Tamara M. Morytko President, Flowserve Pumps Division | 50 | September 2020 | Chief Operating Officer, Norsk Titanium |

| Amy B. Schwetz Senior VP and Chief Financial Officer | 46 | February 2020 | EVP and Chief Financial Officer, Peabody |

| Scott K. Vopni Vice President, Chief Accounting Officer | 52 | June 2020 | SVP — Finance, Chief Accounting Officer, Dean Foods Co. |

| Kirk R. Wilson President, President, Flow Control Division | 54 | July 2019 | Flowserve President, Aftermarket Services & Solutions |

2021 PROXY STATEMENT  3

3

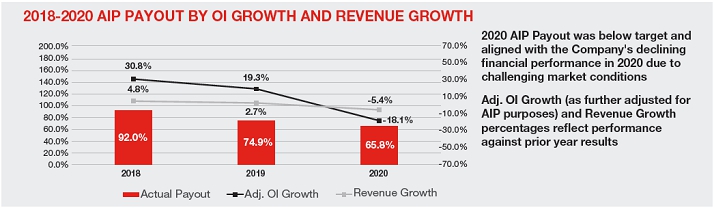

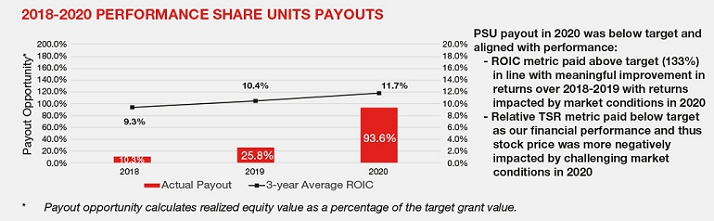

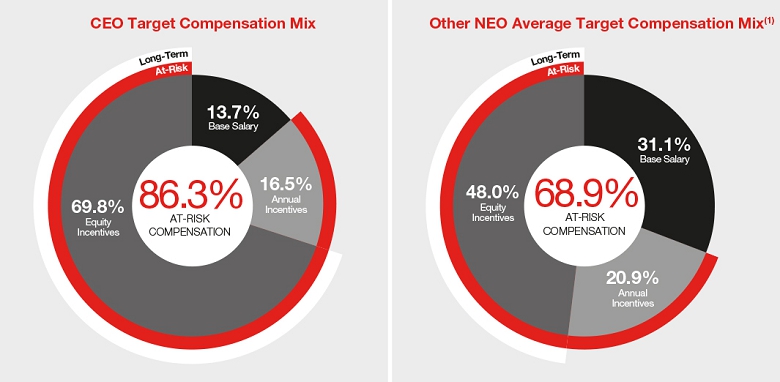

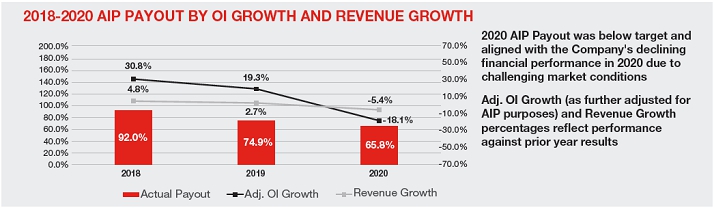

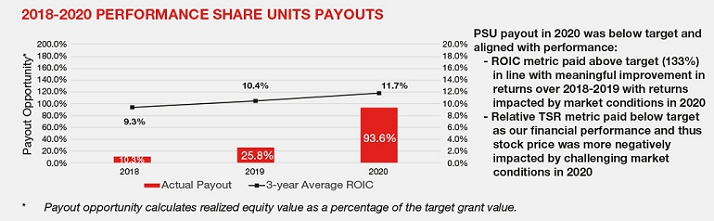

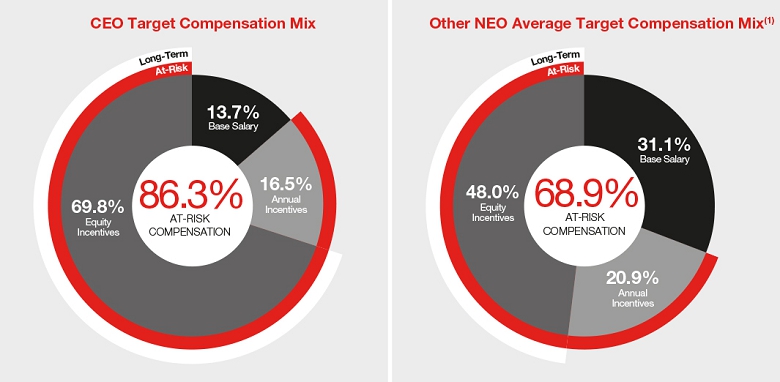

Executive Compensation Highlights (Page 29)

Compensation Philosophy and Principles

| ATTRACT & RETAIN | Attract and retain high-quality and high-performance leaders with a passion for our purpose, values, behaviors and achieving extraordinary business outcomes |

| REINFORCE OUR STRATEGY | Align our incentive programs with our vision and key business strategies with a healthy balance between short and long-term rewards |

| COMPETITIVE AND MARKET-BASED | Maintain a market-based strategy that provides a competitive total target compensation opportunity approximating the market median |

| ALIGN PAY AND PERFORMANCE | Provide incentive programs that reward short-term and long-term performance leading to shareholder value growth and appropriate risk taking |

| ALIGN WITH SHAREHOLDERS | Provide that a majority of total compensation is ‘at risk’ and aligned with shareholder interests |

2021 PROXY STATEMENT  4

4

2020 Executive Total Compensation Mix

The majority of the total target compensation provided to our Named Executive Officers is ‘at risk’ and aligned with our compensation philosophy and principals to drive shareholder value creation.

This chart reflects total annual target compensation and therefore excludes any one-time special awards discussed below under the heading “Executive Compensation—Compensation Discussion and Analysis—Special Awards.” This chart does not include Mr. Roueche given his limited role as interim CFO, which ended on February 23, 2020.

2021 PROXY STATEMENT  5

5

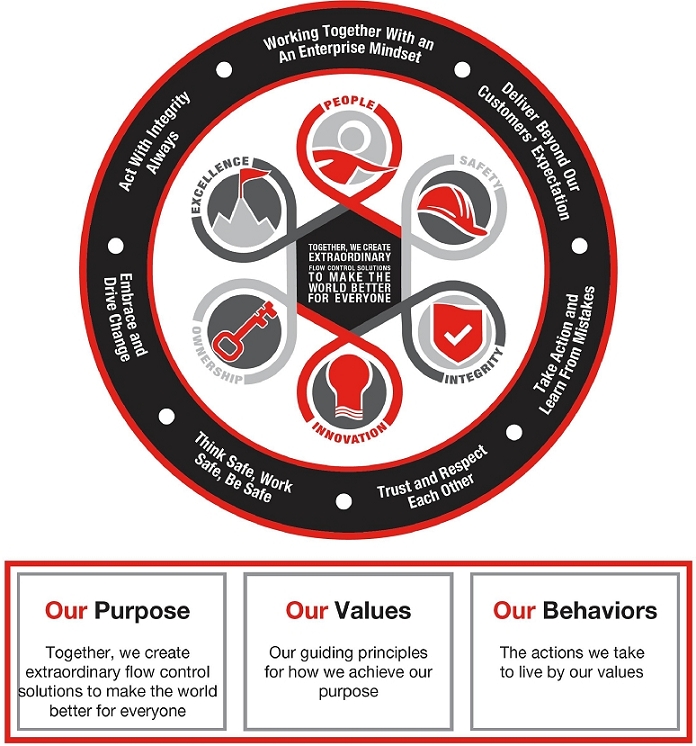

FLOWSERVE 2.0 TRANSFORMATION — Our Purpose, Values and Behaviors | |||

Annual Executive Compensation Program Review and Compensation Risk | |||

PROPOSAL TWO: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

SECURITY OWNERSHIP OF DIRECTORS AND CERTAIN EXECUTIVE OFFICERS | |

Relationship with Independent Registered Public Accounting Firm | |||

Frequently Asked Questions About The Annual Meeting & Proxy Materials | |||

A-1 | RESTATED CERTIFICATE OF INCORPORATION OF FLOWSERVE CORPORATION |

A-1 |

2021 PROXY STATEMENT  6

6

FLOWSERVE 2.0

TRANSFORMATION — Our Purpose, Values and Behaviors

In the second quarter of 2018, we launched and committed resources to our Flowserve 2.0 Transformation, a program designed to transform our business model to drive operational excellence, reduce complexity, accelerate growth, improve organizational health and better leverage our existing global platform. A significant launching point for our Flowserve 2.0 Transformation was to put a foundation in place for our organization by establishing our purpose and six core values. In 2019, we expanded this foundation to include our seven behaviors. Our purpose, values and behaviors were all created by a cross-functional, global group of employees.

2021 PROXY STATEMENT  7

7

FLOWSERVE 2.0

TRANSFORMATION — Our Focus

We have approached the Flowserve 2.0 Transformation with a focus on four key areas that are integral to our success — People, Process & Technology, Customer, and Finance.

| People The most significant focus area in 2020 was working to keep our people safe from COVID-19 while performing essential operations. During 2020, safety improved to a record low total recordable incident rate ranking Flowserve among top decile for safety among manufacturing companies. Additionally, based on the results of our annual employee engagement survey, employee engagement modestly increased in 2020 despite the challenges presented by COVID-19 and the subsequent market volatility. We reaffirmed our commitment to diversity, equity and inclusion and strengthened our leadership team with minimal organizational disruption with the hiring of our new CFO and President of our Flowserve Pumps Division. |

| Process & Technology Our globalized operations leverage our common processes and systems. We continue to make progress in our technology delivery and product innovation. During 2020, we improved upon our ZeroDefect quality program, manufacturing planning and Flowserve Lean Systems to increase productivity and first pass yield. We also continued to focus on innovation, including product enhancements and design to value product development in order to provide our customers with high quality, cost-effective product solutions, resulting in the launch of 21 new products in 2020. |

| Customer We are committed to providing quality products and services to our customers. We have significant aftermarket capabilities to serve our customers across industries and geographies, and we are leveraging the breadth of our portfolio of mission-critical products to deliver pure-play options and provide enhanced value to our customers. These capabilities were especially important in 2020 as our products were used by customers to continue to deliver essential products and services to the world. For example, we have supplied and are continuing to supply mechanical mixer seals, ball values and pumps to support North American and European production of a COVID-19 vaccine. |

| Finance Despite the market and COVID-19 headwinds faced in 2020 that led to a decrease in bookings, we were able to produce solid results in revenue, operating income, and earnings per share. We took swift action following the onset of the pandemic to reduce SG&A expenses, capital expenditures and other discretionary spending in the second quarter and bolster our balance sheet by refinancing our debt structure in the third quarter of 2020. These efforts, among others, helped to maintain strong free cash flow and end the year with approximately $1.1 billion in cash. |

2021 PROXY STATEMENT  8

8

CORPORATE SOCIAL RESPONSIBILITY

Guided by our values, we aim to create extraordinary flow control solutions to make the world better for everyone. One of the ways we strive to make the world a better place is through our commitment to environmental, social and governance (ESG) issues, both in our own operations as well as in the operations of our customers who rely on our products to improve the world around us.

We operate through governance practices that are consistent with our high standards of ethics, integrity and transparency in all our stakeholder relationships, including attracting and retaining world-class leadership talent by investing in their professional development and providing them with challenging and rewarding opportunities for personal growth, obtaining high standards of corporate citizenship by protecting the health and safety of our employees, and safeguarding the environment and communities where we do business. With executive-level participation and Board oversight of the program, sustainability has top-down support and is a company-wide priority.

During 2020, in an effort to increase transparency for our stakeholders regarding our sustainability program, we published our 2019 Sustainability Report with the SASB Industrial Machinery and Goods Reporting Standard and the TCFD Reporting Format.

| Protecting the Planet Flowserve is committed to reducing the Company’s environmental footprint and delivering environmentally responsible solutions that help customers become more sustainable in the marketplace. We do this by providing our customers with innovative and high-quality products, which reduce emissions, minimize leaks and enhance efficiency. For example, our customers have used our products across the world in the development of carbon capture technology, concentrated solar power projects and flare gas recovery.

In 2020, we set an ambitious target to reduce carbon emission intensity by 40% by 2030, using 2015 as a baseline. We also signed the WASH Pledge, committing to implement access to safe water, sanitation and hygiene in all of our facilities and to encourage our supply chain and communities to do the same. |

| Valuing Our People We live our values through programs like safety week, integrity & compliance week, providing enterprise leadership development and empowerment training, investing in research and development, and committing to improved diversity, equity and inclusion.

During 2020, our “people first” philosophy drove our response to the COVID-19 pandemic, as we developed a comprehensive pandemic response plan that included safety precautions to prevent spread and contact tracing procedures to isolate affected personnel. We implemented a work from home policy for all associates who were able to do so to promote the safety of all employees. We continue to diligently monitor the local and global impacts of the virus and continue to keep our employees informed of critical updates and changes on an internal website dedicated to the COVID-19 pandemic. Additionally, we continue to make operating decisions that prioritize the safety of our people. |

2021 PROXY STATEMENT  9

9

| Promoting Operational Excellence Our executive leadership, together with our Board of Directors, creates the operating structure, establishes strategic direction and develops a roadmap of risks and opportunities facing Flowserve. With that foundation, the entire Flowserve team diligently implements the strategic plan, seizing opportunity to build value through efficiency and continuous improvement.

As part of our strategy, in 2020 we launched TargetZero, a program that unifies our goals and initiatives to drive continuous improvement by striving for zero accidents, defects, delays, emissions and waste. |

Our Global Community Impact Program

| Supporting our Community Flowserve Cares is our community impact program that takes a global approach to the way we serve our communities, including through monetary donations, in-kind contributions and volunteerism supporting local organizations in the communities where our associates and customers live and work. Flowserve Cares focuses on at-risk youth, STEM programs and education, disaster recovery and local community-related issues.

In addition to these programs and focus areas, our associates around the globe responded to the COVID-19 pandemic by helping in their communities. For example, in Coimbatore, India, our associates distributed over 2,000 “family kits” to residents of the community near our facility, providing food, medicine and safety equipment to approximately 10,000 people. In Bangalore and Chennai, India, in partnership with other charitable organizations, our associates helped to distribute family kits, hygiene kids, and other personal protective equipment to thousands of residents.

In Bali, we also partnered with Social Impakt to distribute ceramic water filters to residents of Bali, Indonesia in order to help ease the impact of COVID-19 in two communities especially hard hit by COVID-19. |

2021 PROXY STATEMENT  10

10

Flowserve routinely engages with our shareholders to better understand their views, carefully considering the feedback we receive and taking action when appropriate. We review the results of the annual advisory vote on executive compensation in making determinations about the structure of Flowserve’s pay program, or whether any changes to the program should be considered.

In 2019, as a result of the majority shareholder vote in favor of adopting written consent, we reached out to shareholders representing approximately 80% of our outstanding shares to discuss the vote and received feedback on the implementation of written consent. The feedback we received was considered and incorporated into the changes proposed in our 2020 proxy to implement the right of shareholders to act by less than unanimous written consent. Promptly following the approval of this proposal by almost 90% of the outstanding shares at our 2020 Annual Meeting, we amended our Certificate of Incorporation and By-Laws to implement this right for our shareholders.

As in other areas of our business during 2020, the COVID-19 pandemic had a significant impact on our shareholder outreach efforts. On the one hand, the principal negative impact was that we engaged in less in-person interaction with shareholders as work-from-home policies were implemented around the globe. On the other hand, the COVID-19 pandemic had a positive impact on our ability to reach more of our shareholders as a result of the widespread adoption of virtual meetings. During 2020, members of management were able to participate and present in more electronic investor conferences and meetings than in past years due to the absence of travel. Fortunately, in February 2020 before the pandemic limited our ability to travel, our Chief Executive Officer was able to meet with five of our top shareholders in person. Thereafter, once the financial community adopted virtual conferences and meetings, we were able to provide our shareholders with even more access to our chief executive officer and chief financial officer.

As a result, members of our executive management team were able to interact with more of our shareholders than in previous years. Additionally, our CEO or CFO participated in five investor conferences during the year. We value the views and perspectives that our shareholders and the financial community provide us during these interactions, and we formally communicate the information and feedback that we obtain to the Board and its Committees on a regular basis.

2021 PROXY STATEMENT  11

11

PROPOSAL ONE:

ELECTION OF DIRECTORS

The Company’s Board of Directors (the “Board”) currently consists of ten directors. All the director nominees listed below were previously elected by shareholders at the 2020 Annual Meeting, other than Carlyn R. Taylor, who was appointed to the Board in August 2020. The Board has nominated all ten existing directors to serve a one-year term until the 2022 Annual Meeting of shareholders or until their successors have been elected and qualified. Biographical information for each nominee is provided below under the heading “Board of Directors—Biographical Information—Nominees to Serve an Annual Term Expiring at the 2022 Annual Meeting of Shareholders.” In addition to the ten director nominees listed below, during 2020, two board members, Joe E. Harlan and Rick J. Mills, served on our Board until our 2020 Annual Meeting, when Mr. Mills retired from the Board and Mr. Harlan decided not to stand for re-election to the Board.

Required Vote and Recommendation:

Our By-Laws mandate that each director be elected under a majority voting standard in uncontested elections. A majority voting standard requires that each director receive more votes “for” his or her election than votes “against” to be elected.

In an uncontested election, any incumbent nominee for director who does not receive an affirmative vote of a majority of the votes cast in favor of or against such nominee must promptly offer to resign. The resignation is reviewed by the Corporate Governance and Nominating (“CG&N”) Committee, who determines whether to accept or reject such resignation, giving due consideration to the best interests of the Company and its shareholders. Plurality voting will apply to contested elections.

The table below summarizes the key qualifications and areas of expertise that led our Board to nominate these individuals.

| Fix | Rowe | Chand | Chandy | Delly | Friedery | Garrison | McMurray | Roberts | Taylor |

Manufacturing / Operations | ● | ● | ● | ● | ● | ● | ● |

| ● |

|

Industry / Product Knowledge | ● | ● | ● |

|

|

| ● |

| ● |

|

Multinational Operations | ● | ● | ● | ● | ● | ● | ● |

| ● | ● |

Financial / Accounting |

|

| ● |

| ● |

|

| ● | ● | ● |

Product Innovation / R&D |

|

| ● | ● |

|

|

|

|

|

|

Energy / Alternative Energy Markets |

| ● | ● | ● |

| ● | ● | ● | ● | ● |

Supply Chain |

| ● |

| ● | ● | ● | ● | ● |

| ● |

HR / Talent Development |

| ● |

| ● | ● |

| ● | ● | ● | ● |

Mergers & Acquisitions | ● | ● |

| ● | ● | ● | ● | ● |

| ● |

Corporate Strategy / Governance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Manufacturing/ Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  12

12

Board of Directors — Biographical Information

Nominees to Serve an Annual Term Expiring at the 2022 Annual Meeting of Shareholders

Roger L. Fix

| ||||

Independent Chair since:

Director since:

Age: 67

Board Committees: • N/A

Current Public Company Directorships: • Thermon Group Holdings, Inc. • Commercial Vehicle Group, Inc.

Past Public Company Directorships: • Standex International Corporation • Outboard Marine Corporation | Employment History

• Standex International Corporation, publicly traded diversified manufacturing company | President and Chief Executive Officer (2003 — retirement in 2014)

• Standex International Corporation | Chief Operating Officer (2001 — 2002)

• Outboard Marine Corporation, marine manufacturing company | Chief Executive Officer and President (2000 — 2001)

• Outboard Marine Corporation | Chief Operating Officer and President (during 2000)

• John Crane Inc., global manufacturer of mechanical seals for pump and compressor applications | Chief Executive Officer (1998 — 2000)

• John Crane Inc. | President — North America (1996 — 1998)

• Xomox Corporation, manufacturer of process control valves and actuators | President (1993 – 1996)

• Reda Pump Company, manufacturer of electrical submersible pump systems for oil production | most recently as Vice President and General Manager/Eastern Division (1981 – 1993)

| |||

Other Public Company Directorships

• Thermon Group Holdings, Inc., global industrial process heating solutions provider | Director (2019 — Present)

• Commercial Vehicle Group, Inc., global supplier of cab systems in heavy-duty truck, construction and agricultural markets | Director (2014 — Present)

• Standex International Corporation | Director (2001 — 2017)

• Standex International Corporation | Non-Executive Board Chairman (2014 — 2016)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Fix is well qualified to serve as a director due to his executive leadership experience, including with John Crane Inc. and other competitor companies, which provides extensive knowledge of the Company’s products and valuable insight into the competitive landscape for flow control products. In addition to his board experience, Mr. Fix also has international operations experience and corporate development expertise.

| ||||

R. Scott Rowe

| ||||

Director since:

Age: 50

Board Committees: • N/A

Current Public Company Directorships: • None

Past Public Company Directorships: • None | Employment History

• Flowserve Corporation | President, Chief Executive Officer (2017 — Present)

• Cameron Group of Schlumberger Ltd., an oilfield services co. | President (2016 — 2017)

• Cameron International Corporation, an oilfield services co. | President, Chief Executive Officer (2015 — 2016)

• Cameron International Corporation | President, Chief Operating Officer (2014 — 2015)

• OneSubsea, a joint venture established by Cameron and Schlumberger | Chief Executive Officer (2014)

• Subsea Systems, a division of Cameron | President (2012 — 2014)

• Cameron International Corporation | President of the Engineered and Process Valves division (2010 — 2012)

| |||

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Rowe is well qualified to serve as a director due to his position as the Company’s President and Chief Executive Officer, which enables him to provide the Board with intimate knowledge of the Company’s day to day operations.

| ||||

| Manufacturing/Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  13

13

Sujeet Chand | ||||

Director since: Dec. 2019

Age: 63

Board Committees: • Audit • Finance & Risk

Current Public Company Directorships: • Proto Labs, Inc.

Past Public Company Directorships: • None | Employment History

• Rockwell Automation, Inc., industrial automation manufacturer | Senior Vice President and Chief Technology Officer (2005 – Present)

• Rockwell Automation, Inc. | Other senior leadership roles (2001 – 2005)

• XAP Corporation, an education technology company | Chief Operating Officer (2000 – 2001)

• Rockwell Scientific Company, a subsidiary of Rockwell International | Head of research and development (1988 – 2000)

| |||

Other Public Company Directorships

• Proto Labs, Inc., global digital manufacturer | Director (2017 – Present)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Chand is well qualified to serve as a director due to his technology and innovation experience as well as his electrical engineering background. Additionally, Mr. Chand has valuable multinational executive leadership and manufacturing experience from Rockwell Automation and XAP Corporation.

| ||||

Ruby R. Chandy | ||||

Director since: May 2017

Age: 59

Board Committees: • Finance & Risk — Chair • Organization & Compensation

Current Public Company Directorships: • DuPont de Nemours, Inc. • AMETEK, Inc.

Past Public Company Directorships: • IDEX Corporation | Employment History

• Pall Corporation, a leading supplier of filtration, separation, and purification technologies | President of the Industrial Division (2012 – retirement in 2015)

• The Dow Chemical Company, a multinational chemical corporation | Managing Director, Vice President of Dow Plastics Additives unit (2011 – 2012)

| |||

Other Public Company Directorships

• DuPont de Nemours, Inc., a multinational chemical corporation | Director (2019 – Present) • AMETEK, Inc., a manufacturer of electronic instruments and electromechanical devices | Director (2013 – Present) • IDEX Corporation, a designer and manufacturer of fluidics systems and specialty engineered products | Director (2006 – 2013)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Ms. Chandy is well qualified to serve as a director due to her executive management experience, marketing and strategy skills, relevant experience in industrial companies, extensive engineering and management education, broad international business and financial experience and enterprise risk oversight experience.

| ||||

| Manufacturing/ Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  14

14

Gayla J. Delly | ||||

Director since: Jan. 2008

Age: 61

Board Committees: • Organization & Compensation • Corporate Governance & Nominating

Current Public Company Directorships: • National Instruments, Inc. • Broadcom Inc.

Past Public Company Directorships: • Power One, Inc. | Employment History

• Benchmark Electronics Inc., a contract provider of manufacturing, design, engineering, test and distribution to computer, medical device, telecommunications equipment and industrial control manufacturers | President and Chief Executive Officer (2012 – retirement in 2016)

• Benchmark Electronics Inc. | President (2006 – 2011)

• Benchmark Electronics Inc. | Vice President and Chief Financial Officer (2001 – 2006)

• Benchmark Electronics Inc. | Corporate Controller and Treasurer (1995 – 2001)

• Ms. Delly is a certified public accountant.

| |||

Other Public Company Directorships

• National Instruments, Inc., a leader in software-defined automated test and automated measurement systems | Director (2020 – Present) • Broadcom Inc., a designer, developer and global supplier of semiconductor devices | Director (2017 – Present) • Power One, Inc., a designer and manufacturer of power conversion products | Director (2005 – 2008)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Ms. Delly is well qualified to serve as a director due to her international manufacturing experience, with a specific focus on engineering and technology in emerging markets, including Asia and Latin America, which provides valuable insight into the Company’s operations and assists in identifying product portfolio opportunities. In addition to her board experience, Ms. Delly has valuable executive leadership experience and financial expertise gained from her time with Benchmark Electronics Inc.

| ||||

John R. Friedery | ||||

Director since: Aug. 2007

Age: 64

Board Committees: • Corporate Governance & Nominating — Chair • Audit

Current Public Company Directorships: • None

Past Public Company Directorships: • None | Employment History

• Since 2010, Mr. Friedery has provided strategic and management consulting services to the packaging and other manufacturing industries.

• Ball Corporation, a provider of metal and plastic packaging for beverages, foods and household products, and of aerospace and other technologies services | Senior Vice President; President, Metal Beverage Packaging, Americas and Asia (2008 – 2010)

• Ball Corporation | Chief Operating Officer, Packaging Products Americas (2004 – 2007)

• Ball Corporation | President, Metal Beverage Container operations (2000 – 2004)

• Ball Corporation | Other senior leadership roles (1988 – 2000)

• Dresser/Atlas Well Services | Field operations (prior to 1988)

• Nondorf Oil and Gas | In operations, exploration and production (prior to 1988)

| |||

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Friedery is well qualified to serve as a director due to his extensive operational experience with an international industrial manufacturing focus, which provides a global business perspective and a deep understanding of the Company’s industry, end-markets and strategic focus. Mr. Friedery also has experience with renewables and sustainability expertise gained from his service with Ball Corporation.

| ||||

| Manufacturing/ Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  15

15

John L. Garrison | ||||

Director since: Oct. 2018

Age: 60

Board Committees: • Organization & Compensation • Corporate Governance & Nominating

Current Public Company Directorships: • Terex Corporation

Past Public Company Directorships: • Azurix Corporation

| Employment History

• Terex Corporation, a worldwide manufacturer of lifting and material handling solutions | President and Chief Executive Officer (2015 – Present)

• Bell Helicopter, a segment of Textron, Inc., and an aerospace manufacturer | President and Chief Executive Officer (2009 – 2015)

| |||

Other Public Company Directorships

• Terex Corporation | Chairman of the Board (2018 – Present)

• Azurix Corporation, a water services company | Director (2000 – 2002)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Garrison is well qualified to serve as a director due to his strong manufacturing, international operations and leadership experience gained through his various executive and board leadership roles. In addition, Mr. Garrison is currently leading an operational transformation at Terex Corporation that began in 2016 and has similar elements to the Company’s Flowserve 2.0 Transformation program. This experience provides Mr. Garrison with unique insights into the current climate the Company faces and the significant focus required by the Company to implement the Flowserve 2.0 Transformation.

| ||||

Michael C. McMurray | ||||

Director since: Oct. 2018

Age: 56

Board Committees: • Audit—Chair • Finance & Risk

Current Public Company Directorships: • None

Past Public Company Directorships: • None | Employment History

• LyondellBasell, a global plastics, chemicals and refining company | Executive Vice President and Chief Financial Officer (2019 – Present)

• Owens Corning, a global manufacturer of insulation, roofing and fiberglass composites | Senior Vice President and Chief Financial Officer (2012 – 2019)

• Owens Corning | Vice President and Finance Leader of Owens Corning’s Building Materials Group (2011 – 2012)

• Owens Corning | Vice President, Investor Relations and Treasurer (2008 – 2011)

• Royal Dutch Shell | various leadership roles (1987 – 2008)

| |||

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. McMurray is well qualified to serve as a director due to his extensive knowledge of global industrial manufacturing, the Company’s end markets and the financial markets, which provides valuable insight into the strategic decisions to capitalize on the Company’s growth opportunities. Additionally, Mr. McMurray has valuable multinational executive leadership and financial expertise at LyondellBasell, Owens Corning, and Royal Dutch Shell.

| ||||

| Manufacturing/ Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  16

16

David E. Roberts | ||||

Director since: Nov. 2011

Age: 60

Flowserve’s Board Committees: • Organization & Compensation—Chair • Finance & Risk

Current Public Company Directorships: • None

Past Public Company Directorships: • Penn West Exploration | Employment History

• Gavilan Resources, LLC, a private company formed in partnership with Blackstone focused on oil and natural gas development and production opportunities in South Texas | Chief Executive Officer (2017 – 2020). Gavilan filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in May 2020.

• Penn West Exploration, a Canadian oil and gas exploration and production company | President and CEO (2013 – 2016)

• Marathon Oil Corporation, an independent upstream company with international operations in exploration and production, oil sands mining and integrated gas | Executive Vice President and Chief Operating Officer (2011 – 2012)

• Marathon Oil Corporation | other key management positions, including Executive Vice President in charge of Marathon’s worldwide upstream operations and Senior Vice President of business development (2006 – 2011)

• BG Group, an integrated natural gas company | various leadership roles (2003 – 2006)

• Chevron Corporation | advisor to the Vice Chairman (2001 – 2003)

| |||

Other Public Company Directorships

• Penn West Exploration | Director (2013 – 2016)

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Mr. Roberts is well qualified to serve as a director due to his executive leadership experience, strong international operations background, business development experience and extensive knowledge of and experience in the energy industry. This provides Mr. Roberts with a unique insight into the Company’s operational challenges and opportunities and its end-markets and customer needs.

| ||||

Carlyn R. Taylor | ||||

Director since: Aug. 2020

Age: 52

Board Committees: • Audit • Corporate Governance & Nominating

Current Public Company Directorships: • None

Past Public Company Directorships: • None | Employment History

• FTI Consulting, Inc., a global business advisory firm | Corporate Finance Global Co-Leader and global leaders of Business Transformations and Transactions practice (2016 – present)

• FTI Capital Advisors, an investment banking subsidiary of FTI Consulting | Chairperson (2017 – present)

• FTI Consulting, Inc. | various roles of increasing responsibility (2002 — 2016)

• PwC, a global accounting firm | various roles, including partner, senior manager and staff consultant (1990 — 2002)

| |||

Specific Experience, Qualifications, Attributes and Skills Relevant to Flowserve

We believe that Ms. Taylor is well qualified to serve as a director due to her extensive background in corporate strategy, finance and accounting, most notably leveraging her expertise in capital allocation strategies and capital markets to help businesses spearhead transformative initiatives, as well as her experience serving on the board of directors of various privately-owned startups.

| ||||

| Manufacturing/ Operations |  | Industry/Product Knowledge |  | Multinational |  | Financial/Accounting |  | Product |

| Energy/Alternative Energy Markets |  | Supply Chain |  | HR/Talent |  | Mergers & Acquisitions |  | Corporate Strategy/ Governance |

2021 PROXY STATEMENT  17

17

Role of the Board; Corporate Governance Matters

The Board oversees the CEO and other senior management in the competent and ethical operation of the Company on a day-to-day basis and to help confirm that our shareholders’ best interests are served. In its efforts to satisfy this duty, our Board has adopted Corporate Governance Guidelines (“Guidelines”). Our Guidelines, as well as other corporate governance documents, such as the Company’s Code of Conduct for employees and directors and an additional Code of Ethics for directors, are available on the Company’s website at www.flowserve.com under the “Investors—Corporate Governance” caption. The table below highlights some of the Company’s investor friendly governance practices.

Director Elections | Board Operations | Shareholder Rights |

✓ Annual elections for full Board by majority vote (in uncontested elections) ✓ Resignation policy if a majority vote is not received (in uncontested elections) ✓ Director retirement age policy of 72 | ✓ Stock ownership requirements for directors (5x annual cash retainer) ✓ Independent board chair ✓ Annual Board and Committee evaluations ✓ Board committees composed of 100% independent directors | ✓ Right to call a special meeting ✓ Right to act by written consent ✓ Proxy access right ✓ No poison pill ✓ Annual “Say on Pay” vote |

The Board, through the CG&N Committee, regularly reviews developments in corporate governance and best practices and modifies the Guidelines, committee charters and key practices as necessary.

The Board also works with management to develop the Company’s long-term strategy. The Board dedicates one full meeting per year solely to our long-term strategy, in which the Board receives updates from management and discusses the progress made, challenges encountered and future plans to continue implementing our strategic priorities. At each quarterly meeting of the Board, management also provides additional updates on our strategic priorities based on particular focus areas, including our business platforms, culture and organizational health, regulatory and legal risk, operations, and climate change and sustainability.

Our approximately 16,000 associates around the global are a critical component of our ability to execute on our strategy. Accordingly, the Board continually monitors and assesses our human capital management, principally in the areas of workplace health and safety, employee engagement, compensation and benefits and training, development and ethics. Each year, our associates complete an annual ethics training on our Code of Conduct and participate in “Integrity & Compliance Week” and “Safety Week” to help further emphasize the ongoing training that our associates receive. We also conduct annual employee engagement surveys to solicit feedback and input directly from our associates and, based on the results of our surveys, management and the Board work together to create additional action plans as appropriate.

Board Leadership Structure and Risk Oversight

We have separated the positions of Chairman of the Board and CEO since 2005. Roger L. Fix, the Company’s current Non-Executive Chairman of the Board, presides over the meetings of the Board, including executive sessions of the Board where only non-employee directors are present. He reviews and approves the agendas for Board meetings, among his other duties as Chairman of the Board. He also serves as an alternate member for all Board committees. Mr. Fix strives to attend as many committee meetings as possible.

We believe that separating the positions of Chairman of the Board and CEO is appropriate for the Company at this time because it places an independent director in a position of leadership on the Board. We believe this independent leadership and the Non-Executive Chairman’s authority to call meetings of the non-employee directors adds value to our shareholders by facilitating a more efficient exercise of the Board’s fiduciary duties and best enables the Board to effectively manage our businesses, risks, opportunities and affairs in the best interests of our shareholders. We also believe the Non-Executive Chairman further enhances independent oversight by being responsible for establishing the Board’s annual schedule and collaborating with the CEO on the agendas for all Board meetings. The separation of Chairman and CEO also allows the Non-Executive Chairman to provide support and advice to the CEO, reinforcing the reporting relationship and accountability of the CEO to the Board.

2021 PROXY STATEMENT  18

18

The Board and its Committees exercise their risk oversight function by carefully evaluating the reports they receive from management and by making inquiries of management with respect to areas of particular interest to the Board. The Board and its Committees oversee senior management’s policies and procedures in assessing and addressing risk areas that fall within the scope of the Board’s and the Committees’ respective areas of oversight responsibility, as further detailed in the Board Committees section below. The Board and management frequently discuss the long-term strategy of the Company. The Board is regularly informed through Committee reports of each Committee’s activities in overseeing risk management.

Board meetings. There were 13 meetings of the Board during the year ended December 31, 2020. Executive sessions of non-employee directors are normally held at each regular Board meeting and are presided over by our independent Chairman of the Board, or, in the Chairman’s absence, by the Chairman of the CG&N Committee. During the year ended December 31, 2020, each Director nominee attended at least 92% of the total number of meetings of the Board and of each of the Board committees on which he or she served while he or she has been a director or committee member.

Shareholder meetings. Board members are expected to attend the Company’s Annual Meetings of shareholders. All directors then-serving were in attendance at the 2020 Annual Meeting other than Joe E. Harlan, who did not stand for re-election at the 2020 Annual Meeting.

Shareholders and other interested parties may communicate with the Board directly by writing to: Non-Executive Chairman of the Board, c/o Flowserve’s Corporate Secretary, Flowserve Corporation, 5215 N. O’Connor Blvd., Suite 2300, Irving, Texas 75039. All such communications will be delivered to our chairman. These communications are reviewed by the Corporate Secretary to determine whether it is appropriate for presentation to the Board or such director. The purpose of this screening is to avoid having the Board consider irrelevant or inappropriate communications (such as advertisements, solicitations, and product inquiries).

The identification and evaluation of director candidates begins with the Guidelines, which establish the criteria for Board membership. As a starting point under the Guidelines, all prospective Board members must, for example, adhere to the highest standards of integrity and ethics, exercise diligent and constructive oversight of the Company’s business, risk profile and strategy, demonstrate relevant and successful career experience, display a global business perspective, and possess the time to responsibly perform all director duties and effectively represent the interests of the shareholders. In addition, we believe that Board members should have varied professional expertise in areas relevant to the Company. In this regard, our director nominees bring a wide array of qualifications, skills and attributes to our Board of Directors that support its oversight role on behalf of the shareholders. The table on page 12 summarizes the key qualifications and areas of experience that led our Board to nominate these individuals.

The Guidelines further articulate the Board’s firm belief that the Board’s members should also have a diversity of backgrounds, which we view holistically. In evaluating diversity of backgrounds, the Board considers individual qualities and attributes, such as educational background, professional skills, business experience and cultural viewpoint, as well as more categorical diversity metrics, such as race, age, gender and nationality. This consideration is implemented through the selection process for director nominees, and the Board assesses its effectiveness in promoting diversity through an annual self-assessment process that solicits feedback concerning the appropriateness of the Board’s diversity, among other critical performance factors.

The CG&N Committee considers various potential director candidates who may come to the attention of the CG&N Committee through current Board members, professional search firms, shareholders or other persons. The CG&N Committee generally retains a national executive-recruiting firm to research, screen and contact potential candidates regarding their interest in serving on the Board, although the CG&N Committee may also use less formal recruiting methods. Carlyn R. Taylor was recommended to the Board by a third-party search firm. All identified candidates, including shareholder-recommended candidates, are evaluated by the CG&N Committee using generally the same

2021 PROXY STATEMENT  19

19

methods and criteria, although those methods and criteria may vary from time to time depending on the CG&N Committee’s assessment of the Company’s needs and current situation.

We believe that a robust Board evaluation and feedback process helps to promote the effectiveness of our Board and Committees and encourages our Board members, individually and collectively, to continually improve in their roles and responsibilities. Our Board evaluation process is led by an independent member of the Board, the Chair of the CG&N Committee, who engages independent external advisors each year to assist in compiling the results of the evaluations submitted by the members of the Board and to provide additional perspective on effectively responding to the evaluations and feedback received.

Our annual evaluation process begins with a self-assessment in which each independent member of the Board provides a performance rating for a series of questions in several key categories, including the structure, process and resources of the Board, effectiveness of the Committees of the Board, and management of the Company. The self-evaluation concludes with several open-ended questions in order to encourage members of the Board to freely discuss their own performance, priorities for the upcoming year, and any other comments that the applicable member of the Board deems important.

Each independent member of the Board is also required to complete a peer evaluation of each other independent member of the Board (other than the Chairman, who is evaluated separately), which solicits feedback on how the applicable director adds value to the Board and its Committees, what the applicable director could do to increase effectiveness, and any other commentary that the evaluating member of the Board deems pertinent. In 2020, due to the unique challenges presented by the COVID-19 pandemic and the necessity to hold meetings by video conference instead of in person, the peer evaluation process was temporarily changed to take into account the impact of the pandemic.

Each member of the Board is also required to complete a Chairman evaluation to provide feedback on the performance and contributions of the Chairman of the Board. The Chairman evaluation requires each member of the Board to rate the Chairman’s performance in a dozen key areas and also provides an opportunity to provide open feedback on the performance of the Chairman of the Board.

Each member of the Board is also required to complete an evaluation of our Chief Executive Officer’s performance. While our Chief Executive Officer is a member of the Board, his evaluation is focused on his performance as a member of management and not as a member of the Board.

Once the evaluations are complete, the results are compiled by an independent external advisor, anonymized (other than for the self-evaluation), and provided to the CG&N Chair, who then conducts individual interviews with members of the Board in advance of the Board’s February meetings. The results of the process are discussed by the CG&N Committee, and the full Board, at their February meeting and considered by the CG&N Committee and the Board when engaging in director recruitment, director development, strategy, and governance.

We believe that all members of the Board (other than our CEO) should be independent under the New York Stock Exchange (“NYSE”) listing standards. Under these standards, only those directors who have no material relationship with the Company (except in his or her role as a director) are deemed independent. The Board has determined that each of Roger L. Fix, Sujeet Chand, Ruby R. Chandy, Gayla J. Delly, John R. Friedery, John L. Garrison, Michael C. McMurray, David E. Roberts, and Carlyn R. Taylor (all of our current directors other than R. Scott Rowe, the Company’s President and Chief Executive Officer) meet the independence standards set forth in the NYSE corporate governance listing standards. In addition, Joe E. Harlan and Rick J. Mills, each of whom served as a director until our 2020 Annual Meeting, were independent during the period they served on the Board.

How Shareholders Can Recommend a Candidate

A shareholder desiring to recommend a candidate for election to the Board should submit a written notice, as required by the Company’s By-Laws, including the candidate’s name and qualifications, to our Corporate Secretary, who will refer the recommendation to the CG&N Committee. The CG&N Committee may require any shareholder-recommended candidate to furnish such other information as may reasonably be required to determine the eligibility of such

2021 PROXY STATEMENT  20

20

recommended candidate or to assist in evaluating the recommended candidate, including a Director and Officer Questionnaire.

Under the proxy access provisions of our By-Laws, eligible shareholders and/or shareholder groups also are permitted to include shareholder-nominated director candidates in our proxy materials. Additional details about the requirements for including shareholder-nominated director candidates in our proxy materials are set forth under “General Voting and Meeting Information—Shareholder Proposals and Nominations” below.

The Board maintains an Audit Committee, a Finance and Risk Committee (“F&R Committee”), a Corporate Governance and Nominating Committee, and an Organization and Compensation Committee (“O&C Committee”). Only independent directors are eligible to serve on Board committees. Each committee has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities and is governed by a written charter, which is available on the Company’s website at www.flowserve.com under the “Investors—Corporate Governance—Documents & Charters” caption.

Audit Committee | Primary Oversight Responsibilities |

Committee Chair: Michael C. McMurray(1)

Members: Sujeet Chand(2) John R. Friedery Carlyn R. Taylor(3)

12 Meetings in 2020 | • Oversee financial reporting process, including the integrity of Company financial statements and compliance with legal and regulatory requirements • Oversee financial performance and reporting, the Company’s independent auditor and internal audit function, and regulatory activities • Oversee the Company’s integrity and compliance program • Review and discuss the process of Board and Board committees oversight of senior management’s risk management responsibilities • Appoint independent auditor • Prepares Audit Committee report for this proxy statement |

The Board has determined that all members of the Audit Committee meet the applicable independence standards under the SEC rules and NYSE listing standards, and that all members are financially literate within the meaning of the NYSE listing standards. (1) The Board has determined that Mr. McMurray qualifies as an audit committee financial expert under the SEC rules. (2) The Board has determined that Mr. Chand qualifies as an audit committee financial expert under the SEC rules. (3) Ms. Taylor joined the Audit Committee upon her appointment to the Board in August 2020. The Board has determined that Ms. Taylor qualifies as an audit committee financial expert under the SEC rules. | |

Finance & Risk Committee | Primary Oversight Responsibilities |

Committee Chair: Ruby R. Chandy

Members: Sujeet Chand Michael C. McMurray David E. Roberts

4 Meetings in 2020 | • Oversee corporate capital structure and budgets and recommend approval of major capital projects, corporate development, and large sales orders • Review effectiveness of the Company’s IT infrastructure and cybersecurity programs and its practices for identifying and mitigating technology risks with Chief Information Officer at least twice per year • Review the Company’s enterprise risk management, including emerging risks • Review financial plans, liquidity, credit, key financial risks, treasury risk, and related matters • Oversee of enterprise sustainability program |

The Board has determined that all members of the F&R Committee meet the independence standards under the NYSE listing standards. | |

2021 PROXY STATEMENT  21

21

Corporate Governance & Nominating Committee | Primary Oversight Responsibilities |

Committee Chair: John R. Friedery

Members: Gayla J. Delly John L. Garrison Carlyn R. Taylor(1)

4 Meetings in 2020 | • Recommend to the Board nominees for Chairman of the Board, President and Chief Executive Officer • Determine Board organization • Set director compensation • Review and recommend director nominees • Manage risks associated with Board independence and potential conflicts of interest • Establish corporate governance principles and procedures, including overseeing the Company’s Code of Conduct • Prepare effective CEO and Board succession planning • Evaluate CEO performance • Oversee Board and committee self-evaluation process • Oversight of enterprise sustainability program |

The Board has determined that all members of the CG&N Committee meet the independence standards under the NYSE listing standards. (1) Ms. Taylor joined the CG&N Committee upon her appointment to the Board in August 2020. | |

Organization & Compensation Committee | Primary Oversight Responsibilities |

Committee Chair: David E. Roberts

Members: Ruby R. Chandy Gayla J. Delly John L. Garrison

5 Meetings in 2020 | • Set compensation philosophy • Oversee risk management related to executive compensation plans and succession planning • Prepare the Compensation Committee Report included in this proxy statement • Approve executive officer compensation including incentives and other benefits • Retain and evaluate the advice of the independent compensation consultant, F.W. Cook, in adherence to the philosophies and principles stated under “Executive Compensation—Compensation Discussion and Analysis” |

The Board has determined that all members of the O&C Committee meet the applicable independence standards under the SEC rules and NYSE listing standards. | |

Oversight of the Executive Compensation Program

Our executive compensation program is administered by the O&C Committee. Consistent with the NYSE corporate governance listing standards, the O&C Committee is composed entirely of independent, non-employee members of the Board. In addition, the Non-Executive Chairman of the Board generally attends the meetings of the O&C Committee.

As reflected in its charter, the O&C Committee has overall responsibility for setting the compensation for our CEO, which is approved by the full Board, and for approving the compensation of our other executive officers, including the other Named Executive Officers. The O&C Committee is also charged with overseeing the organizational design of the Company, including the development and retention of management.

The O&C Committee is also responsible for reviewing the management succession plan and for recommending changes in director compensation to the CG&N Committee and to the Board. On matters pertaining to director compensation, the O&C Committee also receives data and advice from F.W. Cook. The O&C Committee periodically reviews the organizational design, management development plans and managerial capabilities of the Company. The O&C Committee also prepares and issues the Organization and Compensation Committee Report included in this proxy statement.

2021 PROXY STATEMENT  22

22

The O&C Committee’s process of reviewing the executive compensation program and setting compensation levels for our Named Executive Officers involves several components. During the first quarter of each year, the O&C Committee reviews each Named Executive Officer’s total compensation. The O&C Committee members also meet regularly with the Named Executive Officers at various times during the year, both formally within Board meetings and informally outside of Board meetings, which allows the O&C Committee to assess directly each Named Executive Officer’s performance. The O&C Committee also solicits input from all non-employee members of the Board as to the CEO’s performance during the year.

The O&C Committee generally considers the results of the CG&N Committee’s process for reviewing the CEO’s performance with all independent Board members. The CG&N Committee’s process includes the independent Board members individually and collectively presenting their assessment of the CEO’s performance, as well as the CEO presenting his self-assessment of his performance. The O&C Committee uses these results when determining the CEO’s recommended compensation, which is subject to the independent Board members’ approval.

In addition, the CEO annually presents an evaluation of each other Named Executive Officer’s performance to the O&C Committee, which includes a review of each officer’s contributions over the past year, and his or her strengths, weaknesses, development plans and succession potential. The CEO also presents compensation recommendations for each Named Executive Officer for the O&C Committee’s consideration. Following this presentation and a benchmarking review for pay, the O&C Committee makes its own assessments and formulates compensation amounts for each Named Executive Officer with respect to each of the elements in the Company’s executive compensation program as described below.

Independent Compensation Consultant

The O&C Committee has the authority to retain outside advisors as it deems appropriate. The O&C Committee has engaged F.W. Cook as its compensation consultant to provide advice and information. F.W. Cook has assisted and advised the O&C Committee on all aspects of our executive compensation program, and they provide no other services to the Company. The services they provide include:

providing and analyzing competitive market compensation data;

analyzing the effectiveness of executive compensation programs and making recommendations, as appropriate;

analyzing the appropriateness of the performance peer group (PPG) and compensation peer group (CPG); and

evaluating how well our compensation programs adhere to the philosophies and principles stated below under “Compensation Discussion & Analysis—Compensation Program Philosophy and Principles.”

2020 Director Compensation Program

Program Overview. Our director compensation program is established by the Board after review of data prepared by the O&C Committee’s independent consultant regarding competitive director compensation levels for peer companies and the Company’s compensation peer group, which is discussed under “Executive Compensation.” In 2020, our non-employee director compensation program consisted of the following:

2021 PROXY STATEMENT  23

23

Component | Annual Amounts ($) | Form of Payment | |

Retainer | $ 85,000 |

| Cash |

Non-Executive chairman retainer | $125,000 |

| Cash |

Committee service fee (per committee) | $ 7,500 |

| Cash |

Committee chairman fee |

|

|

|

Audit Committee | $ 20,000 |

| Cash |

O&C Committee | $ 15,000 |

| Cash |

F&R Committee | $ 10,000 |

| Cash |

CG&N Committee | $ 10,000 |

| Cash |

Equity grant target value | $125,000 | (1) | Restricted Shares |

(1) In light of the unfolding COVID-19 pandemic, in May 2020 the Board approved a change to their equity compensation for 2020 by reducing the size of the annual grant to the number of shares that the Board would have received had the grant been made at the same stock price that equity grants were made to members of management on February 20, 2020. For additional information, see below under “—Equity Compensation.” | |||

Additionally, non-employee directors are also eligible to receive special additional compensation when performing certain special services. The Board has set a compensatory rate of $3,500 per day for such services, though no compensation was paid for this purpose in 2020.

Compensation Deferral. Directors may elect to defer all or a portion of their annual cash and equity compensation. The annual cash compensation may be deferred in the form of cash or in phantom shares, which reflect an equivalent value of Company common stock. Compensation deferred in the form of cash accrues interest at rates that do not exceed market rates or constitute preferential earnings. If a director elects to defer cash compensation in the form of phantom shares, the director receives a 15% premium on the amount deferred.

Equity Compensation. The equity portion of non-employee director compensation is granted on the date of the Annual Meeting of shareholders in the form of restricted stock. The restricted shares have voting rights and fully vest after the earlier of one year from the date of grant, the termination of the director’s service due to death or disability or a change in control.

In May 2020, in recognition of the unfolding COVID-19 pandemic, the Board approved a change to their equity compensation for 2020 by reducing the size of the annual equity grant to a number of shares that the Board would have received had the grant been made at the same time that equity grants were made to members of management on February 20, 2020, prior to the date on which the COVID-19 pandemic began to have a material impact on the U.S. economy and the trading price of companies listed on the NYSE. On February 20, 2020, the date on which the Company made its annual equity grant to members of management, the price per share of the Company’s common stock was $47.56, and on May 22, 2020, the date on which the Company made its annual equity grant to the Board, the price per share of the Company’s common stock was $25.20. By approving the annual equity grant to members of the Board in an amount equal to the number of shares that would have been granted at the stock price on February 20, 2020, the dollar value of the annual equity grant to Board members was reduced from the target of $125,000 to $66,225.60.

2021 PROXY STATEMENT  24

24

Stock Ownership Guidelines. Under our stock ownership guidelines, all non-employee directors must own shares of Company common stock with a value of at least five times his or her annual cash retainer (currently $425,000) by his or her fifth anniversary of Board service. If the stock ownership requirement is not met, the director will receive all future Board compensation in the form of Company common stock until the requirement is satisfied. For 2020, all non-employee directors met their stock ownership requirements.

The following table sets forth our non-employee director compensation for 2020. Mr. Rowe did not receive any compensation for his service as a director. His compensation is set forth below under “Executive Compensation—Summary Compensation Table.”

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | |

Sujeet Chand | 115,000 | (7) | 66,226 | 181,226 |

Ruby R. Chandy | 113,300 | (7) | 66,226 | 179,526 |

Gayla J. Delly | 100,000 |

| 66,226 | 166,226 |

Roger L. Fix | 225,000 | (6) | 66,226 | 291,226 |

John R. Friedery | 110,000 |

| 66,226 | 176,226 |

John L. Garrison | 115,000 | (7) | 66,226 | 181,226 |

Joe E. Harlan(3) | 39,286 |

| — | 39,286 |

Michael C. McMurray | 120,000 |

| 66,226 | 186,226 |

Rick J. Mills(4) | 39,286 |

| — | 39,286 |

David E. Roberts | 115,000 |

| 66,226 | 181,226 |

Carlyn R. Taylor(5) | 37,772 |

| — | 37,772 |

(1) Eligible directors received an annual equity grant of 2,628 shares of restricted common stock on May 22, 2020, the date of the Company’s 2020 Annual Meeting of Shareholders. In recognition of the effects of the COVID-19 pandemic on the Company’s financial performance and the world economy at large, the Board approved a reduced equity grant determined by reference to the number of shares that would have been received by the Board members had the award been granted on February 20, 2020 when members of the Company’s executive management received an annual equity grant at a price per share of $47.56. The amounts shown in this column reflect the grant date fair value of the awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification 718, “Compensation—Stock Compensation”, and are calculated using a price per share of $25.20, the closing market price of the Company’s common stock as reported by the NYSE on the date of grant. Assumptions used in the valuations are discussed in Note 8 to the Company’s audited consolidated financial statements for the year ended December 31, 2020 in the Annual Report on Form 10-K filed on February 23, 2021. (2) The non-employee directors elected at the 2020 Annual Meeting of shareholders each had 2,628 shares of restricted common stock outstanding at December 31, 2020; all other shares held are vested. (3) Mr. Harlan did not stand for re-election at the 2020 Annual Meeting and ceased his Board service on May 22, 2020. He was paid a pro-rated portion of the cash board retainer and committee member fees through that date. (4) Mr. Mills retired from the Board at the 2020 Annual Meeting on May 22, 2020 and was paid a pro-rated portion of the cash board retainer and committee member fees through that date. (5) Ms. Taylor was elected to the Board effective August 14, 2020 and was paid a pro-rated portion of the cash board retainer and committee member fees during 2020. (6) Includes an additional $125,000 cash retainer for services as Non-Executive Chairman of the Board. (7) Amount reported includes a 15% premium to actual fees due to the director’s election to defer all or a portion of cash retainer payments in the form of phantom shares under the Company’s director stock deferral plan. |

2021 PROXY STATEMENT  25

25

R. Scott Rowe | |

President, CEO and Director since: Age: 50 | • Flowserve Corporation | President, Chief Executive Officer, Director (2017 – Present) • Cameron Group of Schlumberger Ltd, an oilfield services company | President (2016 – 2017) • Cameron International Corporation, an oilfield services company | President, Chief Executive Officer (2015 – 2016) • Cameron International Corporation | President, Chief Operating Officer (2014 – 2015) • OneSubsea, a joint venture established by Cameron and Schlumberger | Chief Executive Officer (2014 – 2014) • Subsea Systems, a division of Cameron | President (2012 – 2014) • Cameron International Corporation | President of the Engineered and Process Valves division (2010 – 2012) |

Elizabeth L. Burger | |