Third-Quarter 2015 Conference Call November 4, 2015

DAVID POPLAR Vice President Investor Relations

Today’s Agenda CEO Overview Emil Brolick Financial Update Todd Penegor Q&A

This presentation, and certain information that management may discuss in connection with this presentation, contains certain statements that are not historical facts, including information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our news release issued on November 4, 2015 and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K / Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures, such as adjusted earnings before interest, taxes, depreciation and amortization (or adjusted EBITDA), adjusted EBITDA margin and adjusted earnings per share. Adjusted EBITDA, adjusted EBITDA margin and adjusted earnings per share exclude certain expenses, net of certain benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the Appendix to this presentation, and are included in our news release issued on November 4, 2015 and posted on www.aboutwendys.com. Forward-Looking Statements and Non-GAAP Financial Measures

EMIL BROLICK President & CEO

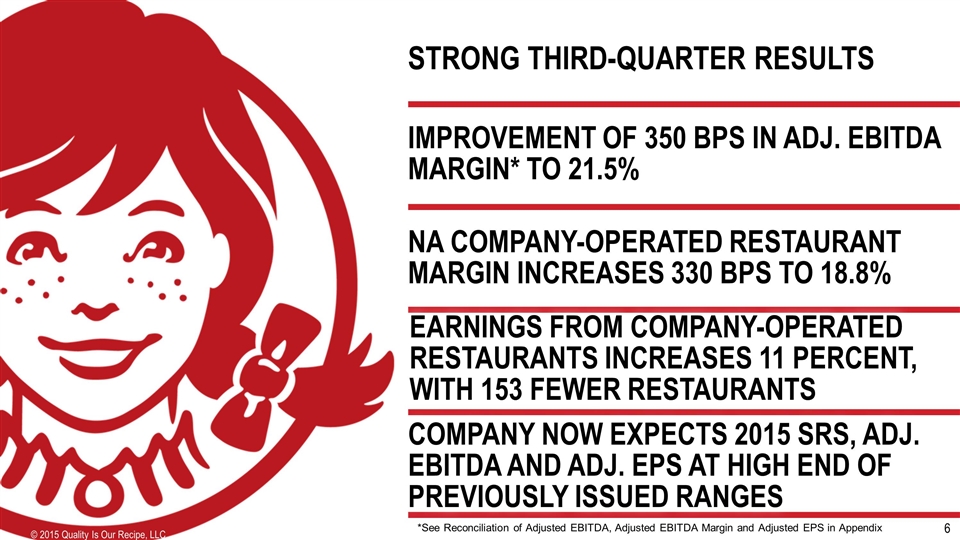

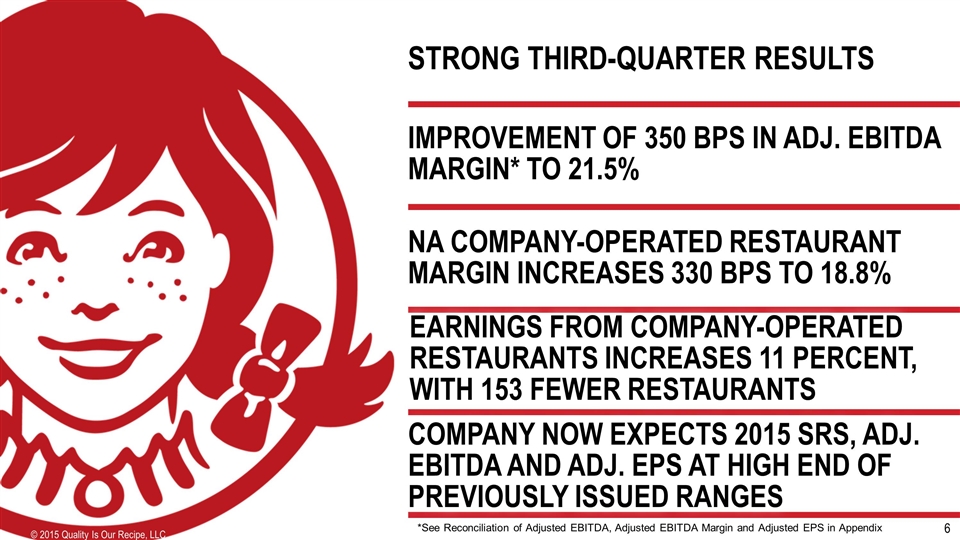

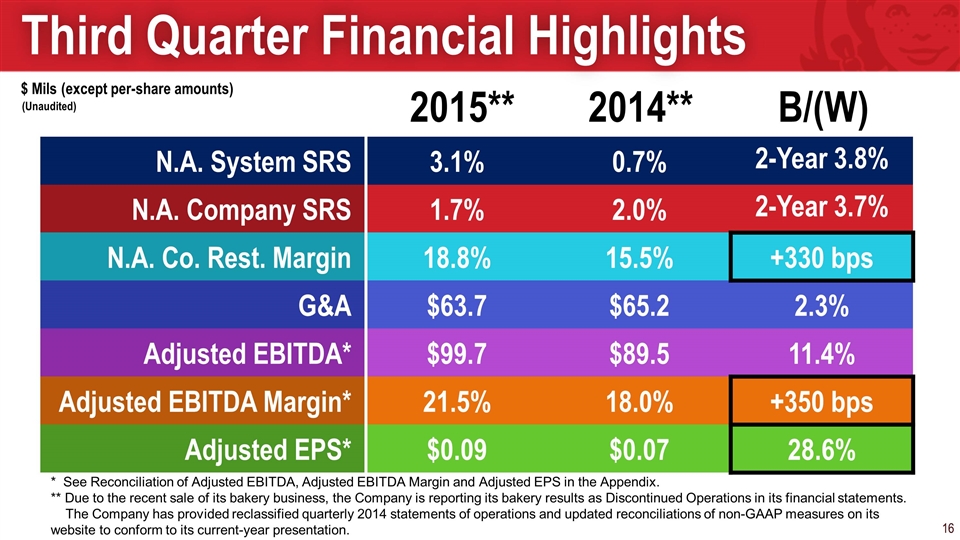

NA COMPANY-OPERATED RESTAURANT MARGIN INCREASES 330 BPS TO 18.8% IMPROVEMENT OF 350 BPS IN ADJ. EBITDA MARGIN* TO 21.5% COMPANY NOW EXPECTS 2015 SRS, ADJ. EBITDA AND ADJ. EPS AT HIGH END OF PREVIOUSLY ISSUED RANGES STRONG THIRD-QUARTER RESULTS *See Reconciliation of Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS in Appendix EARNINGS from Company-operated restaurants INCREASES 11 percent, with 153 fewer restaurants

Company Poised for Long-Term Growth On Track to Hit 2020 Goals New Restaurant Development Highest Since 2006 Balanced Marketing Messages; Encouraged by Early 4 for $4 Results Significant Restaurant Margin Improvement System Optimization Yielding Positive Results Image Activation Contemporizing Brand and Lifting AUVs

Q3 Two Year Comps See Sequential Improvement Various Price / Value Bundled Meals Tests

2015 Balanced Across Core, LTO & Price/Value Jalapeno Fresco 4 for $4 Baconator

4 For $4 Meal Promotion GOAL: DRIVE PROFITABLE CUSTOMER COUNT GROWTH COMPELLING AND CONSISTENT VALUE MESSAGING MEETS NEED FOR HIGH-QUALITY CONSUMER VALUE EARLY RESULTS ARE ENCOURAGING

Wendy’s Technology is a Differentiator

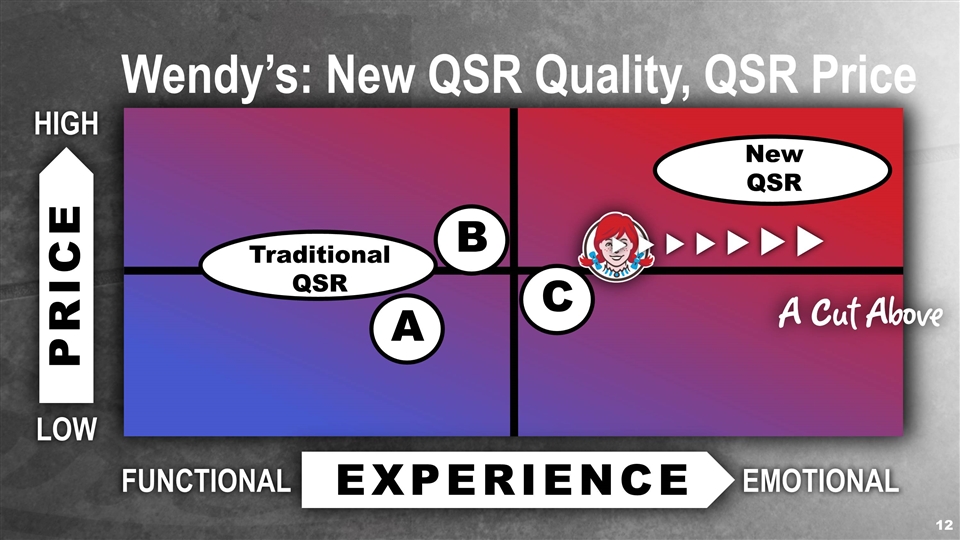

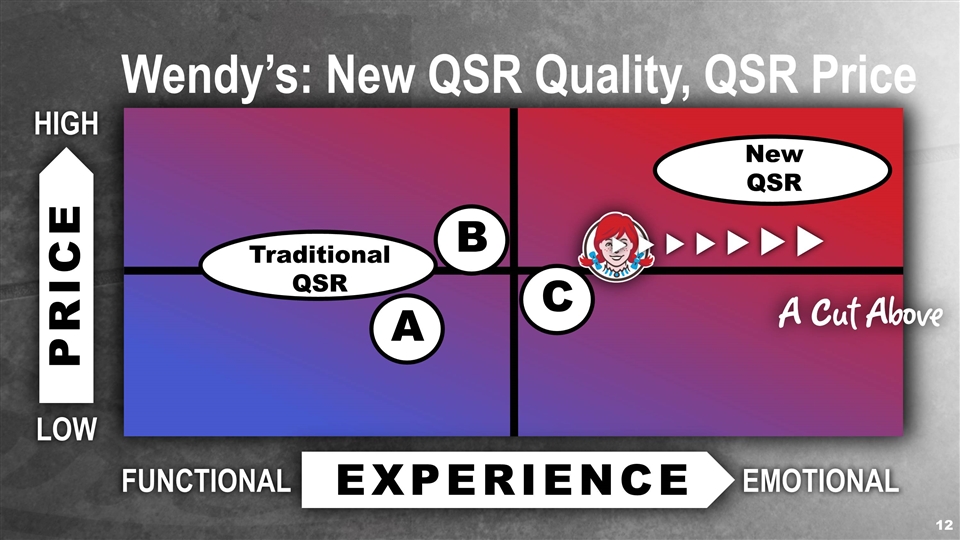

EXPERIENCE PRICE HIGH LOW FUNCTIONAL EMOTIONAL Wendy’s: New QSR Quality, QSR Price A B C New QSR Traditional QSR

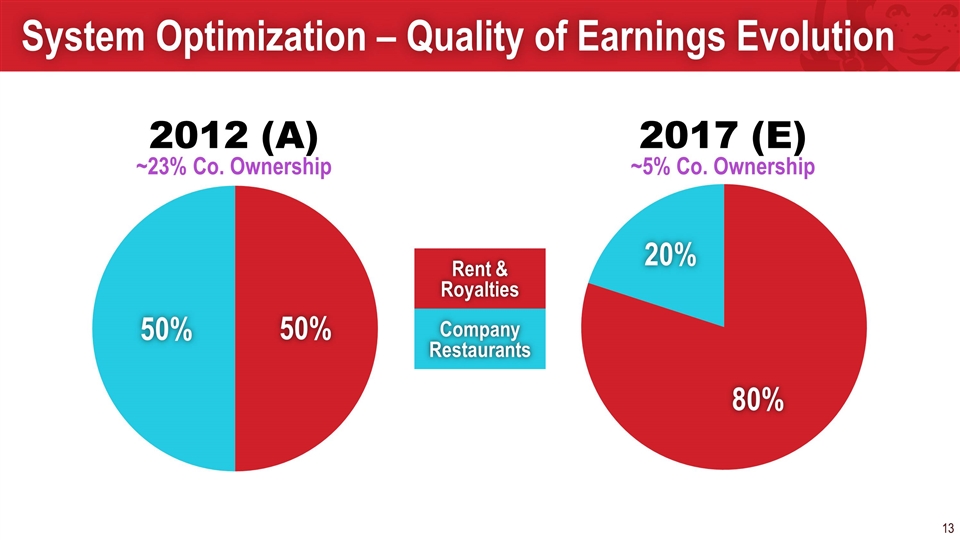

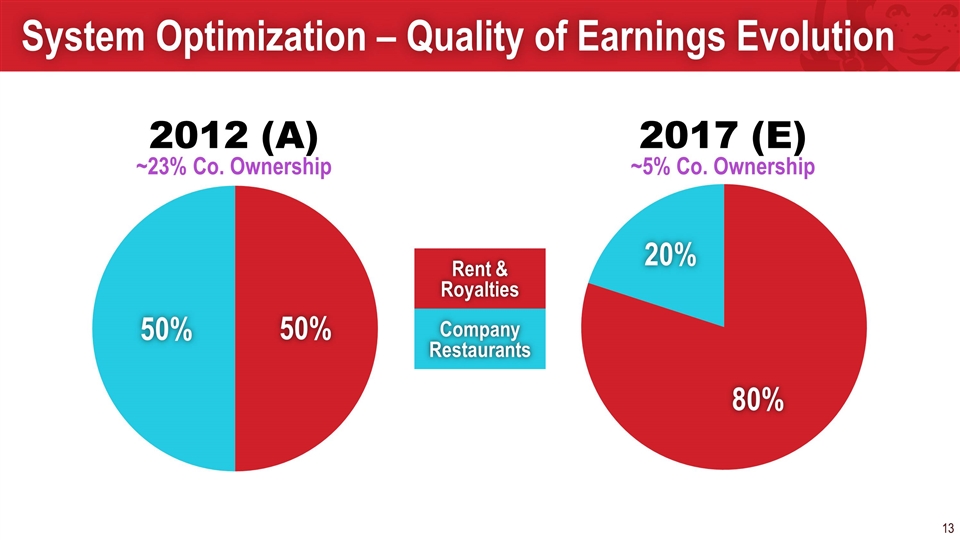

System Optimization – Quality of Earnings Evolution 2012 (A) ~23% Co. Ownership 2017 (E) ~5% Co. Ownership Rent & Royalties Company Restaurants

HOW WE GROW BRAND RELEVANCE + ECONOMIC RELEVANCE = GROWTH Financial Management Global Growth Restaurant Utilization & Brand Access System Optimization New Restaurant Growth Image / Experience Activation North America Same-Restaurant Sales Growth Shareholder Value-Enhancing Initiatives Core Organic Growth Strategies

TODD PENEGOR Chief Financial Officer

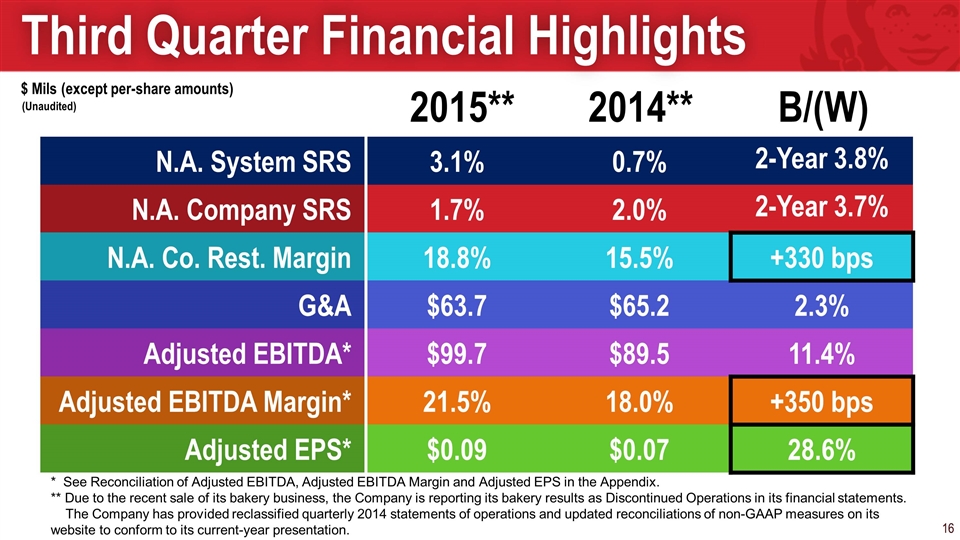

$ Mils (except per-share amounts) Third Quarter Financial Highlights N.A. System SRS 3.1% 0.7% 2-Year 3.8% N.A. Company SRS 1.7% 2.0% 2-Year 3.7% N.A. Co. Rest. Margin 18.8% 15.5% +330 bps G&A $63.7 $65.2 2.3% Adjusted EBITDA* $99.7 $89.5 11.4% Adjusted EBITDA Margin* 21.5% 18.0% +350 bps Adjusted EPS* $0.09 $0.07 28.6% 2015** 2014** B/(W) * See Reconciliation of Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS in the Appendix. ** Due to the recent sale of its bakery business, the Company is reporting its bakery results as Discontinued Operations in its financial statements. The Company has provided reclassified quarterly 2014 statements of operations and updated reconciliations of non-GAAP measures on its website to conform to its current-year presentation. (Unaudited)

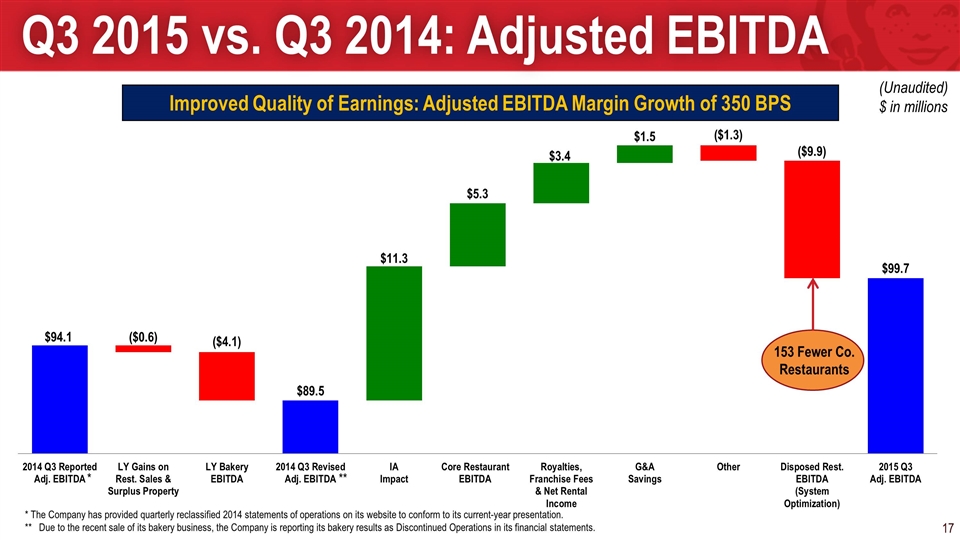

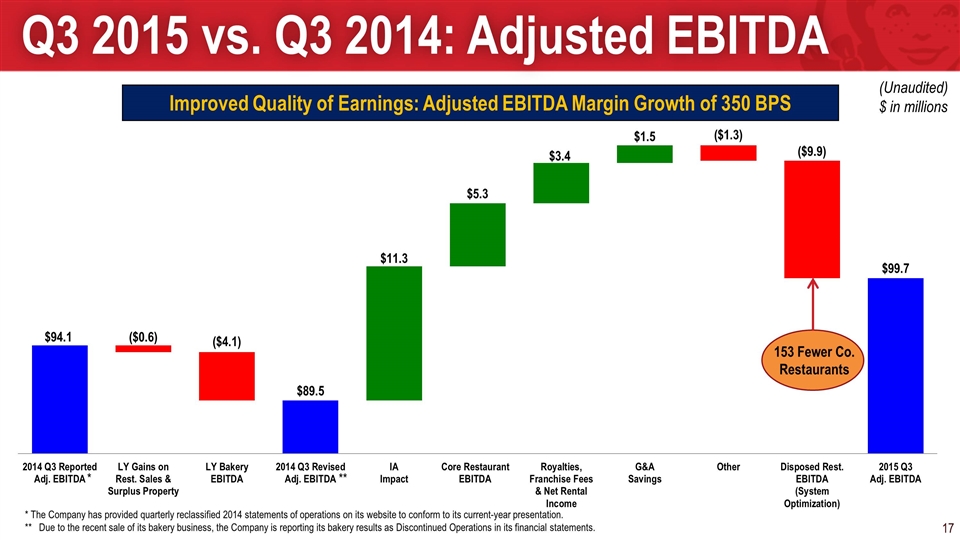

Q3 2015 vs. Q3 2014: Adjusted EBITDA * The Company has provided quarterly reclassified 2014 statements of operations on its website to conform to its current-year presentation. ** Due to the recent sale of its bakery business, the Company is reporting its bakery results as Discontinued Operations in its financial statements. (Unaudited) $ in millions Improved Quality of Earnings: Adjusted EBITDA Margin Growth of 350 BPS ** * 153 Fewer Co. Restaurants

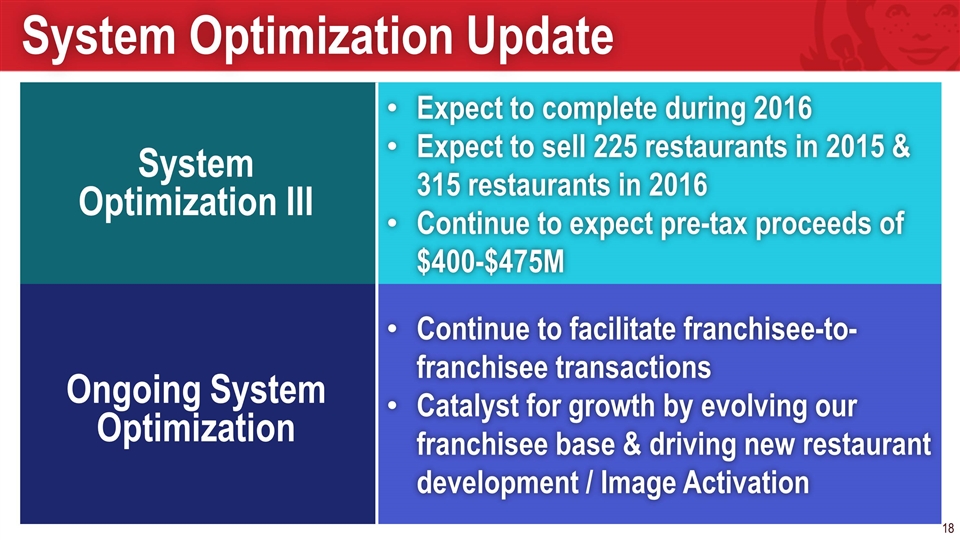

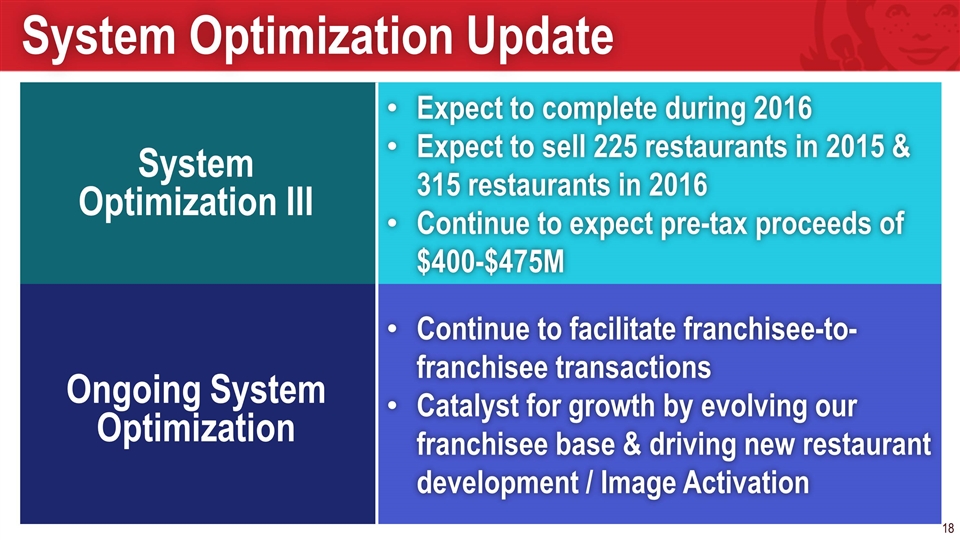

System Optimization Update System Optimization III Expect to complete during 2016 Expect to sell 225 restaurants in 2015 & 315 restaurants in 2016 Continue to expect pre-tax proceeds of $400-$475M Ongoing System Optimization Continue to facilitate franchisee-to- franchisee transactions Catalyst for growth by evolving our franchisee base & driving new restaurant development / Image Activation

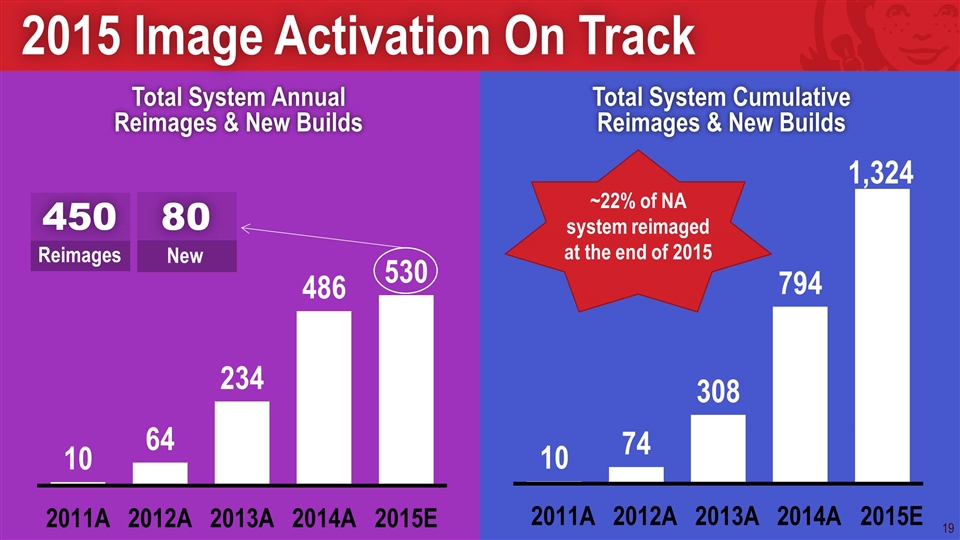

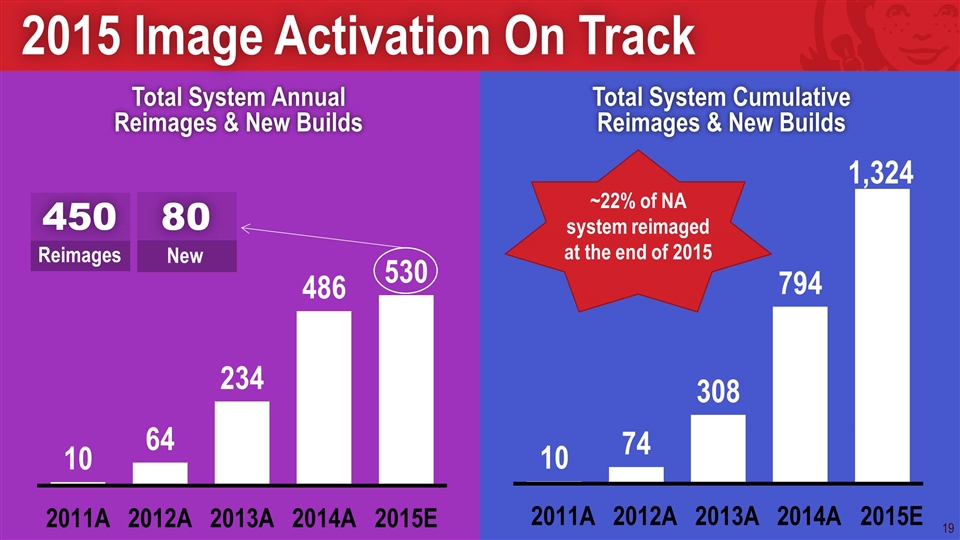

2015 Image Activation On Track Total System Annual Reimages & New Builds Total System Cumulative Reimages & New Builds 450 Reimages 80 New ~22% of NA system reimaged at the end of 2015

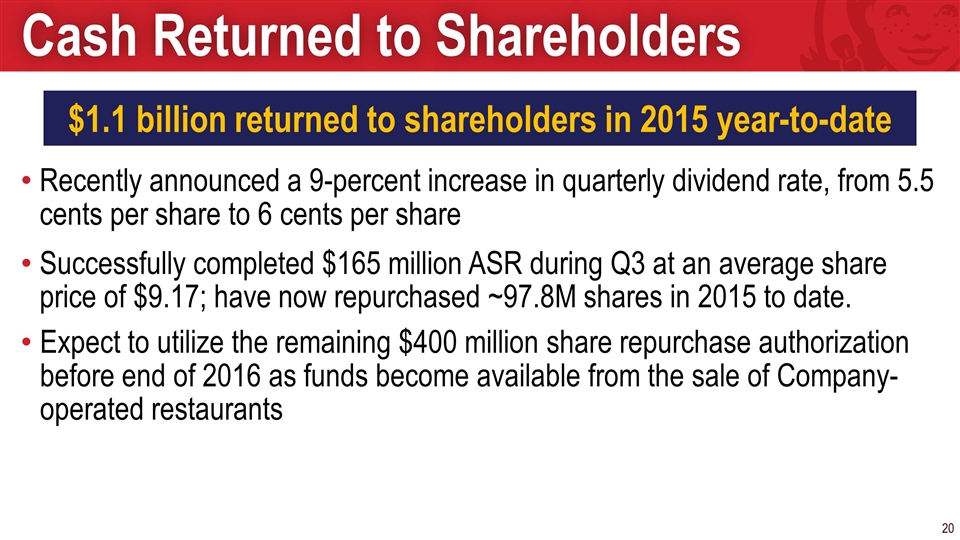

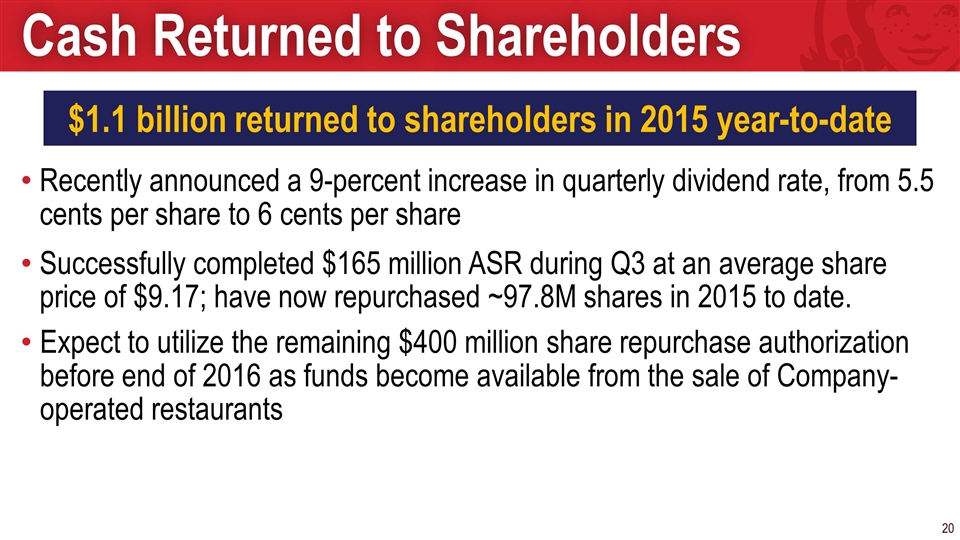

Recently announced a 9-percent increase in quarterly dividend rate, from 5.5 cents per share to 6 cents per share Successfully completed $165 million ASR during Q3 at an average share price of $9.17; have now repurchased ~97.8M shares in 2015 to date. Expect to utilize the remaining $400 million share repurchase authorization before end of 2016 as funds become available from the sale of Company-operated restaurants Cash Returned to Shareholders $1.1 billion returned to shareholders in 2015 year-to-date

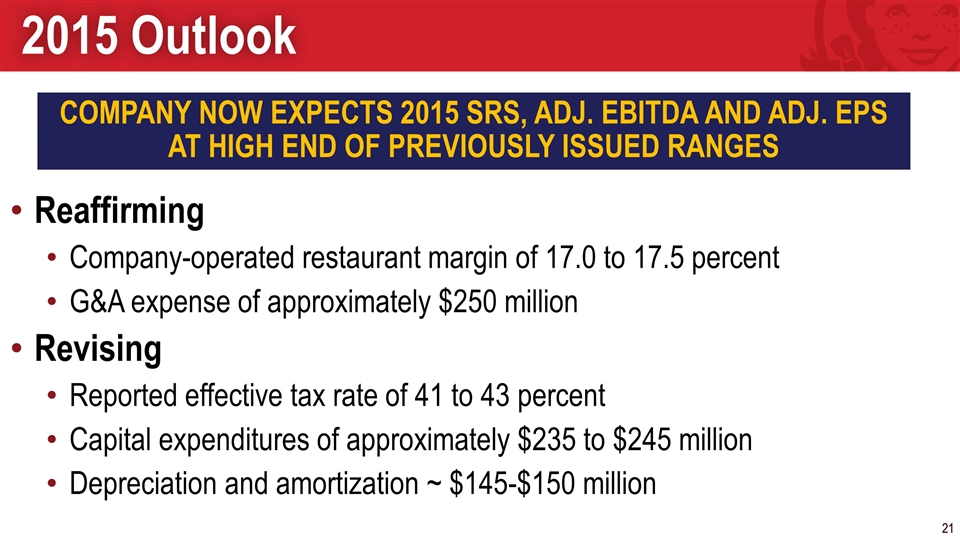

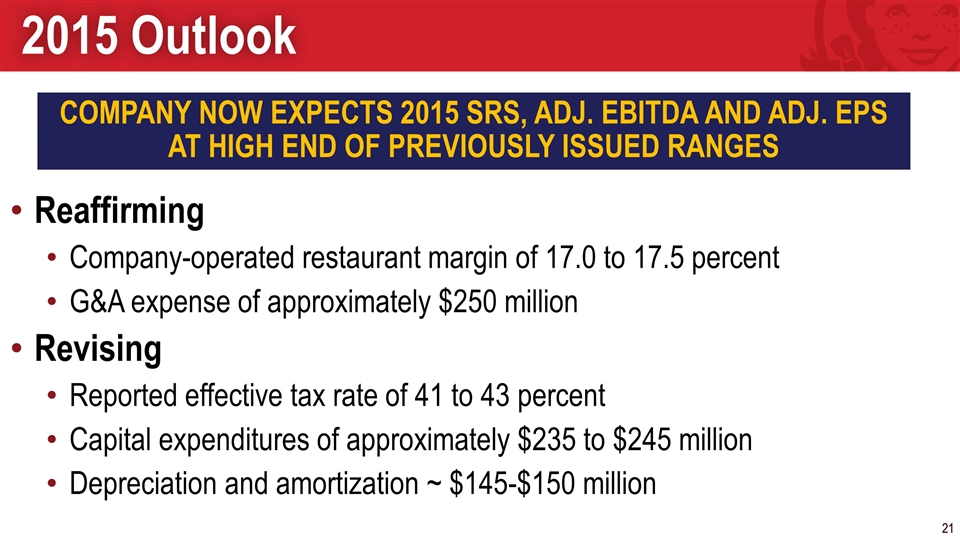

2015 Outlook Reaffirming Company-operated restaurant margin of 17.0 to 17.5 percent G&A expense of approximately $250 million Revising Reported effective tax rate of 41 to 43 percent Capital expenditures of approximately $235 to $245 million Depreciation and amortization ~ $145-$150 million COMPANY NOW EXPECTS 2015 SRS, ADJ. EBITDA AND ADJ. EPS AT HIGH END OF PREVIOUSLY ISSUED RANGES

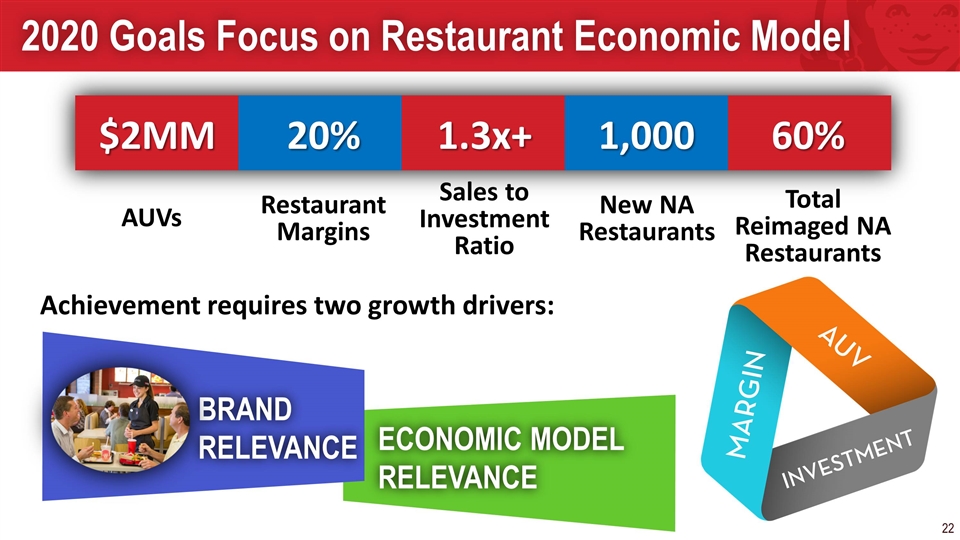

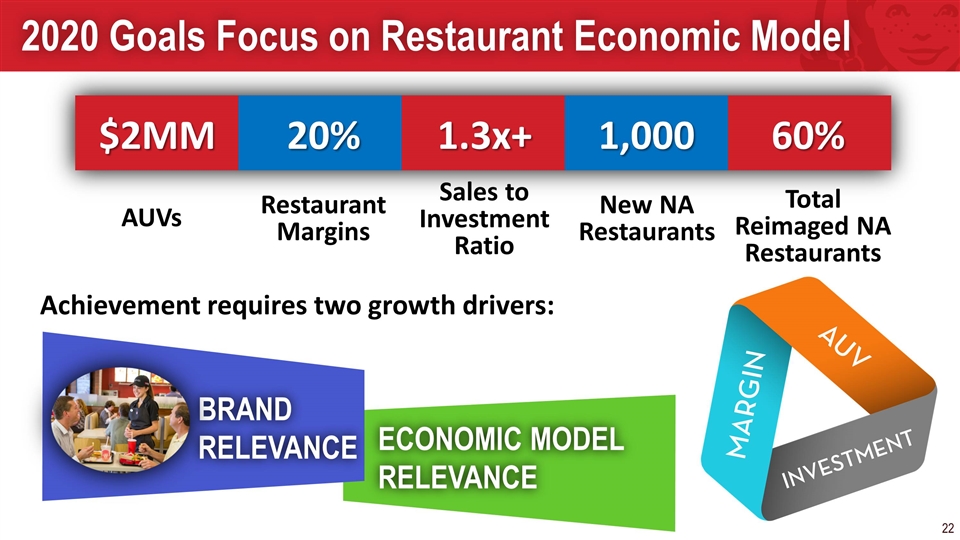

2020 Goals Focus on Restaurant Economic Model $2MM 20% 1.3x+ 1,000 AUVs Restaurant Margins Sales to Investment Ratio New NA Restaurants 60% Total Reimaged NA Restaurants BRAND RELEVANCE ECONOMIC MODEL RELEVANCE Achievement requires two growth drivers:

DAVID POPLAR Vice President Investor Relations (614) 764-3311 david.poplar@wendys.com

2015 Investor Relations Calendar: Key Dates November 12 Image Activation Market Visit with Barclays (Dublin) November 18 Morgan Stanley Conference (New York) December 9 Wedbush Conference (Santa Monica) December 16-17 Canada Roadshow – CL King (Montreal/Toronto) February 9, 2016 Preliminary Q4 Earnings Release & 2016 Investor Day (Dublin)

Q&A

Appendix

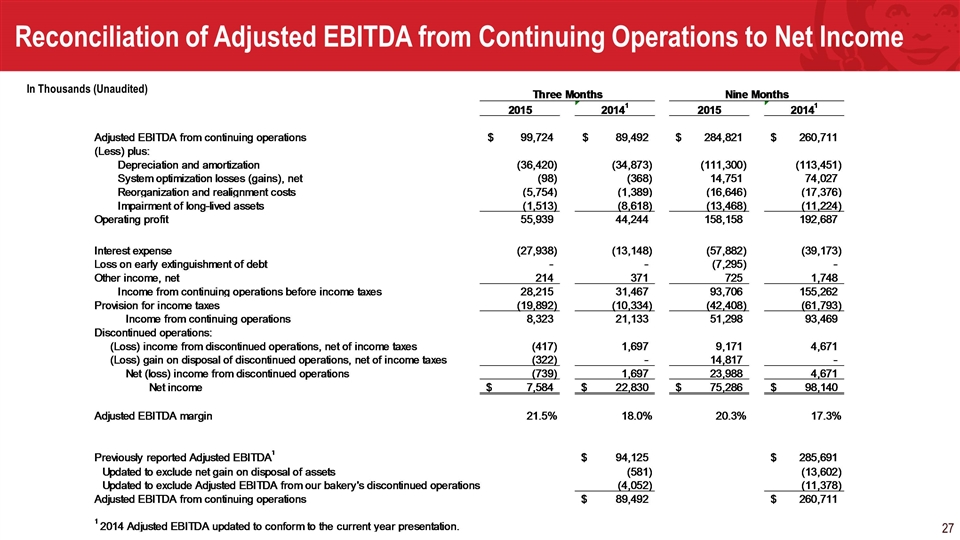

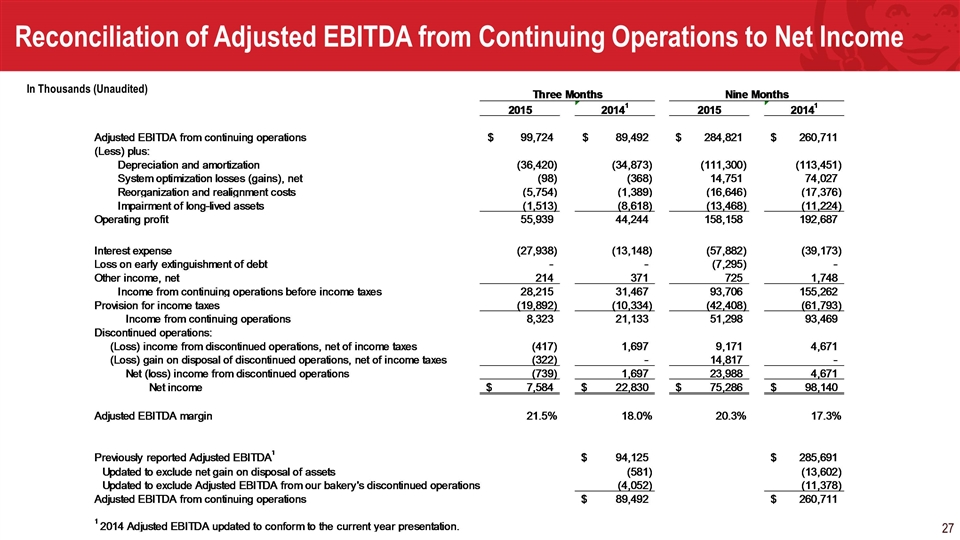

Reconciliation of Adjusted EBITDA from Continuing Operations to Net Income In Thousands (Unaudited)

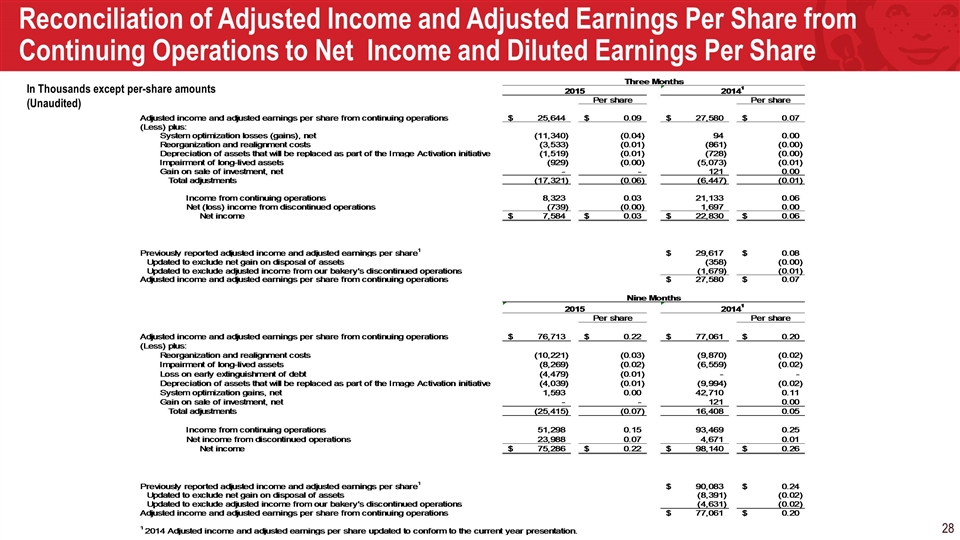

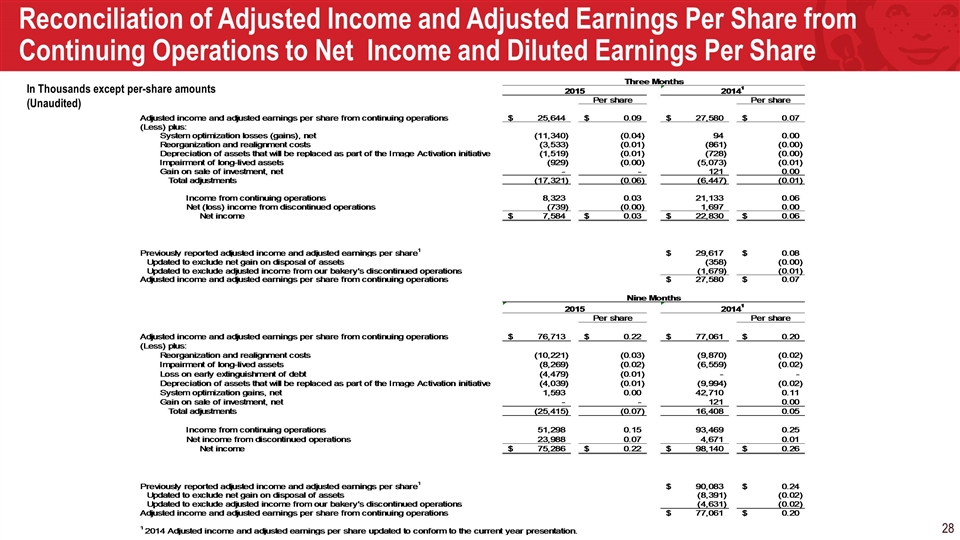

Reconciliation of Adjusted Income and Adjusted Earnings Per Share from Continuing Operations to Net Income and Diluted Earnings Per Share In Thousands except per-share amounts (Unaudited)