August 10, 2016 Second-Quarter 2016 Conference Call Exhibit 99.1

Group Manager – Investor Relations Peter Koumas

Today’s Agenda CEO Overview Todd Penegor Financial Update Gunther Plosch Key Initiatives Update Todd Penegor Q&A 3

Forward-Looking Statements and Non-GAAP Financial Measures This presentation, and certain information that management may discuss in connection with this presentation, contains certain statements that are not historical facts, including information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our news release issued on August 10, 2016 and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K / Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures (i.e., adjusted EBITDA, adjusted EBITDA margin, adjusted earnings per share, adjusted tax rate and free cash flow). These non-GAAP financial measures exclude certain expenses and benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the Appendix to this presentation, and are included in our news release issued on August 10, 2016 and posted on www.aboutwendys.com. As used in this presentation, the terms adjusted EBITDA and adjusted earnings per share refer to adjusted EBITDA from continuing operations and adjusted earnings per share from continuing operations, respectively.

President and Chief Executive Officer Todd Penegor

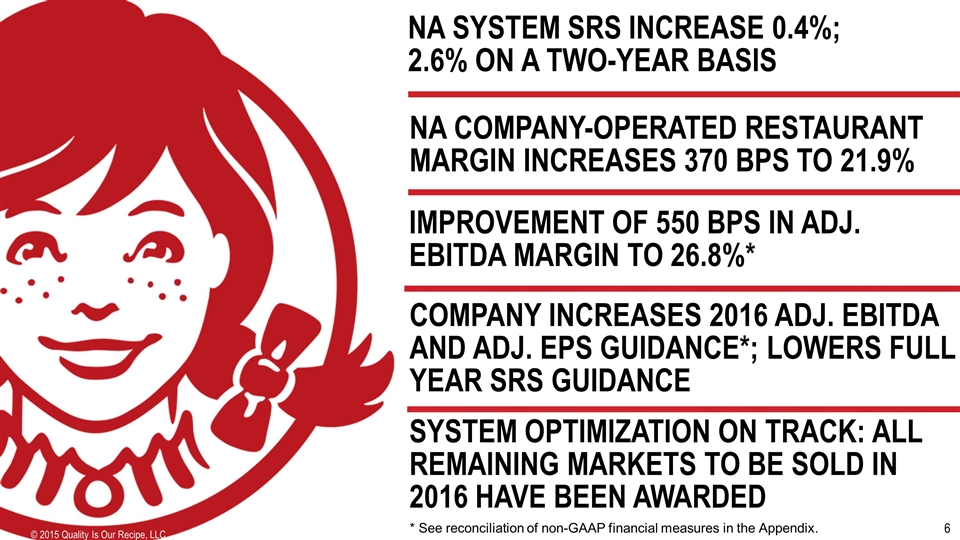

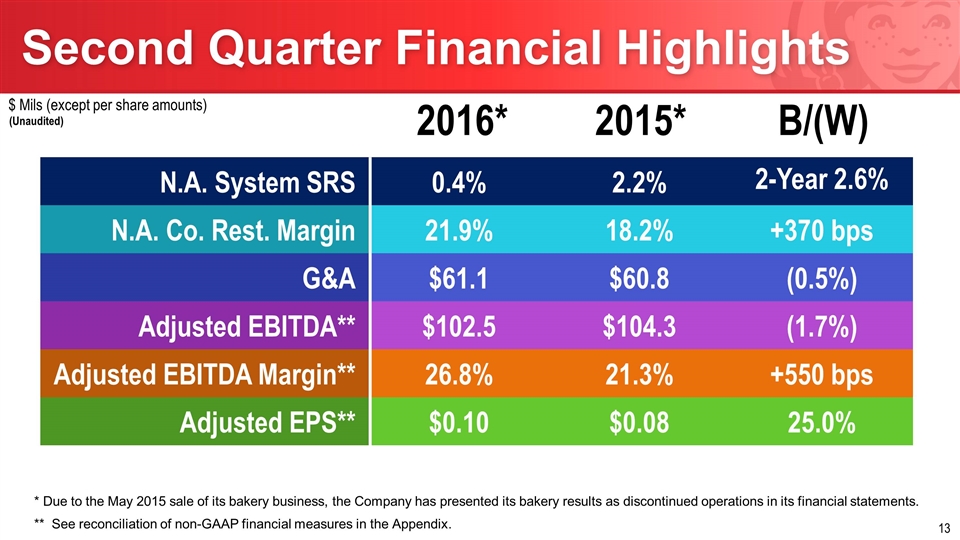

NA COMPANY-OPERATED RESTAURANT MARGIN INCREASES 370 BPS to 21.9% NA SYSTEM SRS INCREASE 0.4%; 2.6% ON A TWO-YEAR BASIS System optimization on track: all remaining markets to be sold in 2016 have been awarded Improvement of 550 bps in adj. ebitda margin to 26.8%* Company increases 2016 adj. ebitda and adj. eps guidance*; lowers full year srs guidance * See reconciliation of non-GAAP financial measures in the Appendix.

QSR Traffic Momentum has Slowed in 2016 Traffic % Change vs. Year Ago Source: The NPD Group / CREST â Total Day

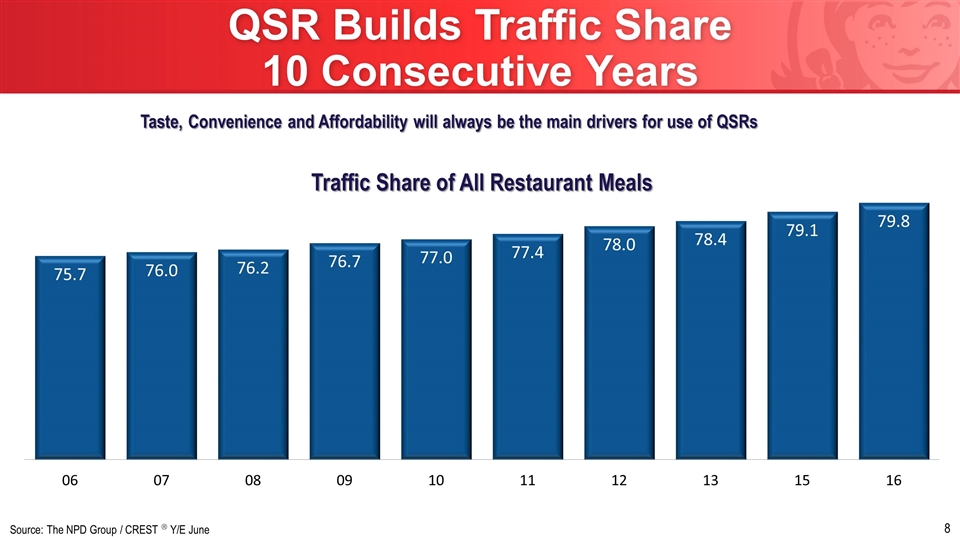

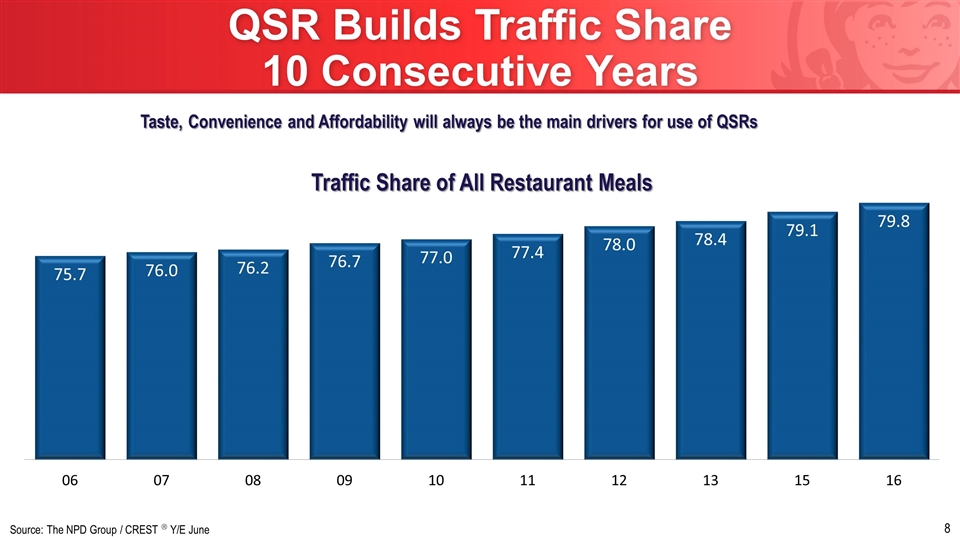

QSR Builds Traffic Share 10 Consecutive Years Taste, Convenience and Affordability will always be the main drivers for use of QSRs Source: The NPD Group / CREST â Y/E June

Price/Value Core LTO Balance Across the Menu

The Wendy’s Way

Chief Financial Officer Gunther Plosch

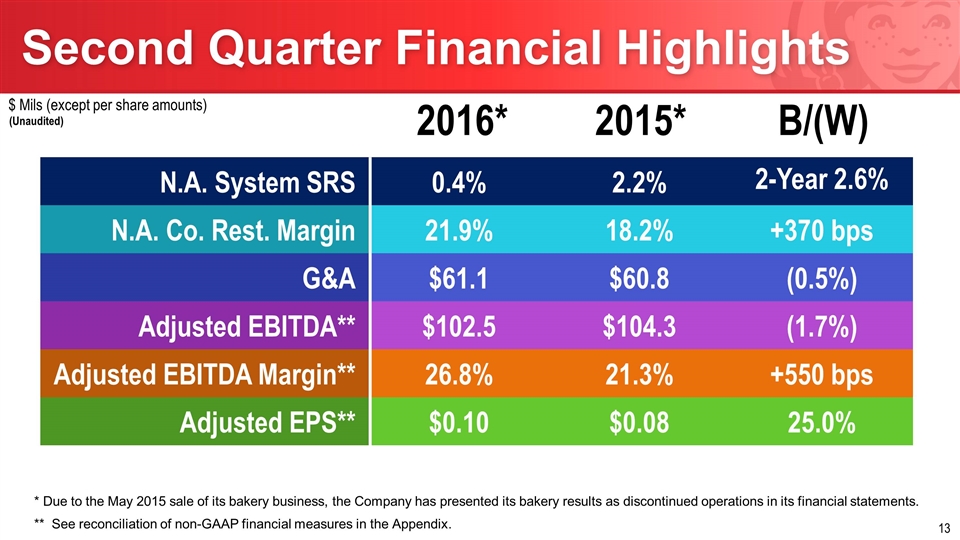

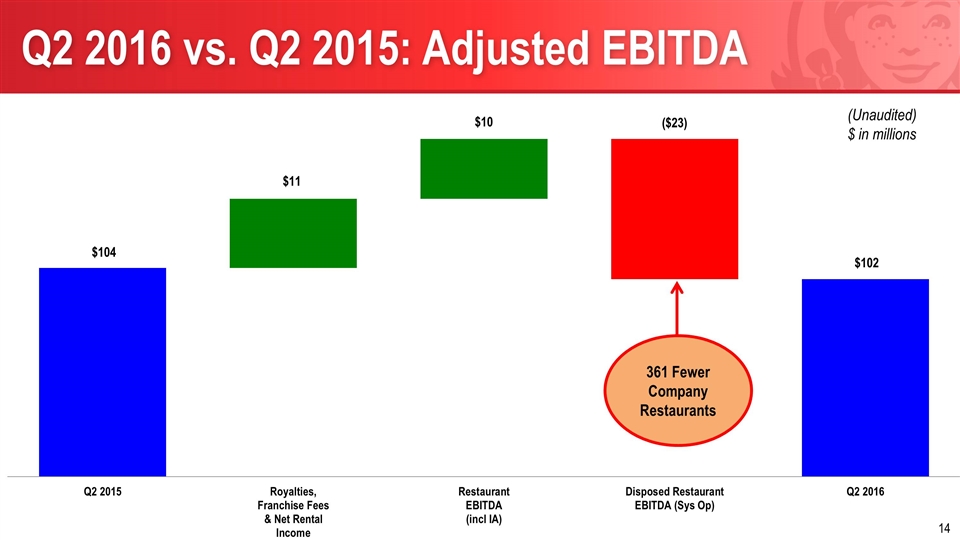

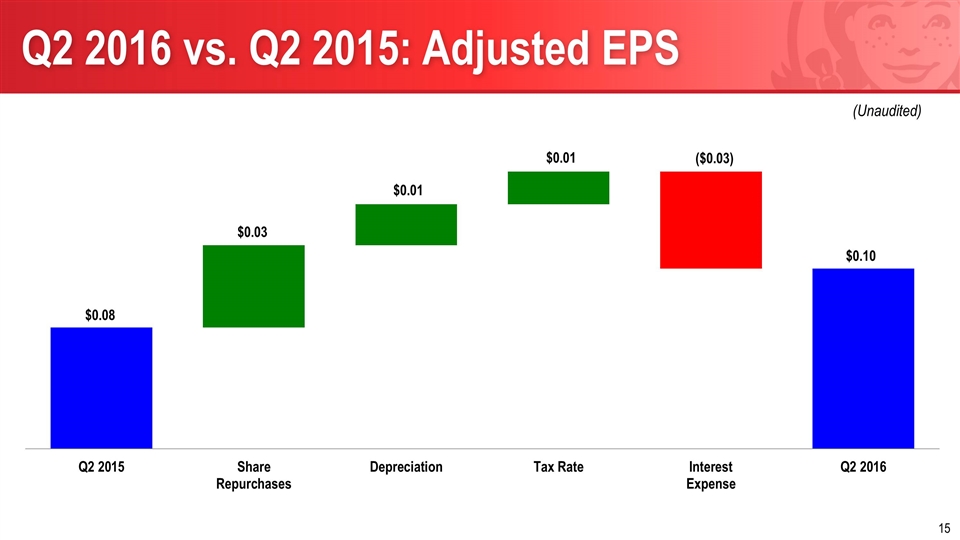

N.A. System SRS 0.4% 2.2% 2-Year 2.6% N.A. Co. Rest. Margin 21.9% 18.2% +370 bps G&A $61.1 $60.8 (0.5%) Adjusted EBITDA** $102.5 $104.3 (1.7%) Adjusted EBITDA Margin** 26.8% 21.3% +550 bps Adjusted EPS** $0.10 $0.08 25.0% $ Mils (except per share amounts) Second Quarter Financial Highlights 2016* 2015* B/(W) ** See reconciliation of non-GAAP financial measures in the Appendix. (Unaudited) * Due to the May 2015 sale of its bakery business, the Company has presented its bakery results as discontinued operations in its financial statements.

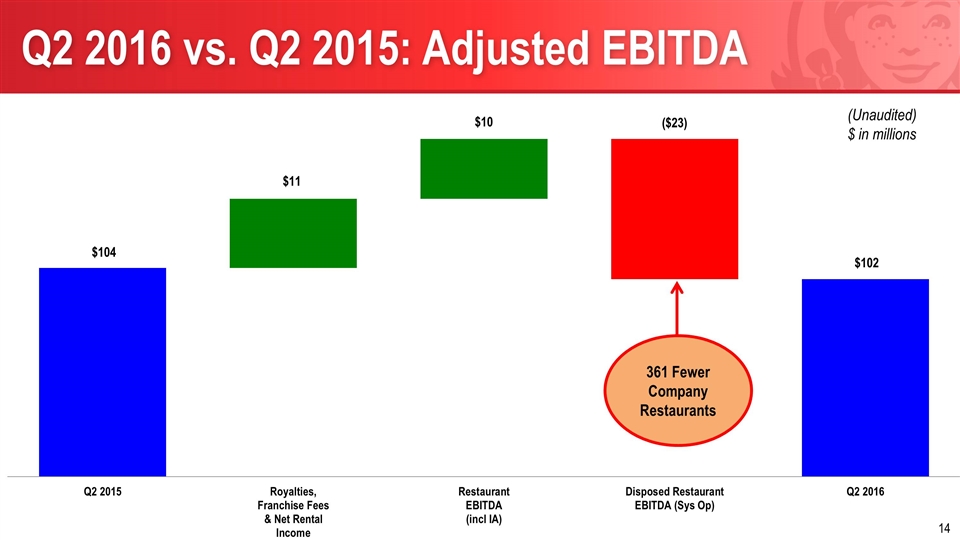

Q2 2016 vs. Q2 2015: Adjusted EBITDA 361 Fewer Company Restaurants (Unaudited) $ in millions

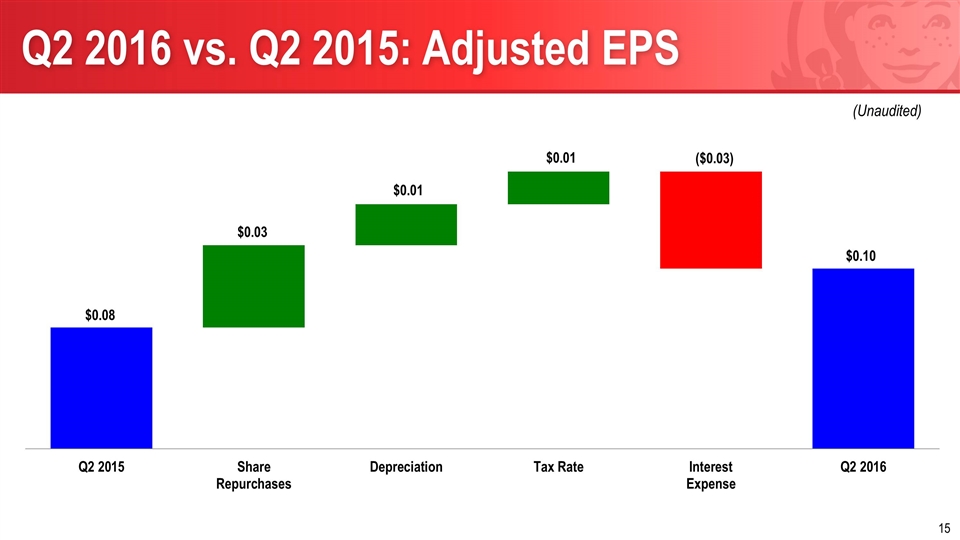

Q2 2016 vs. Q2 2015: Adjusted EPS (Unaudited)

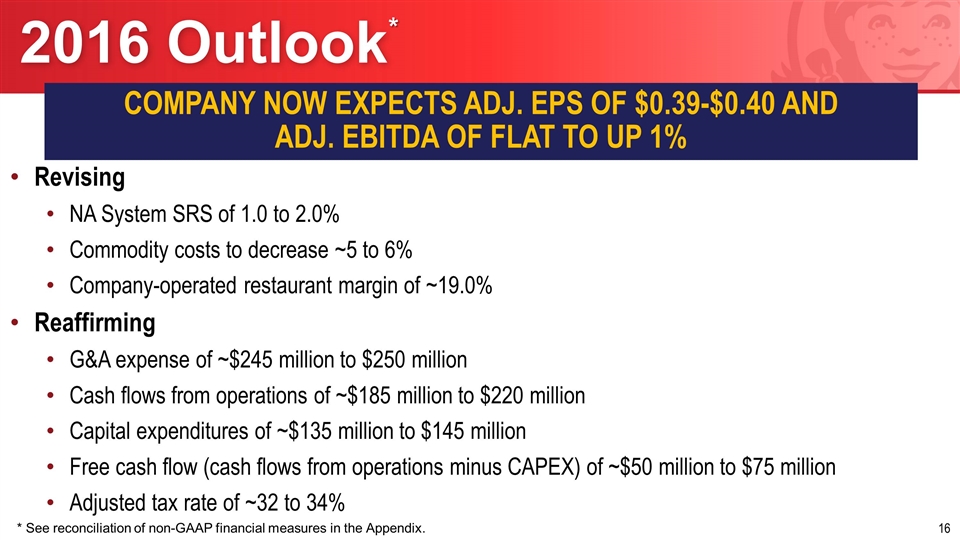

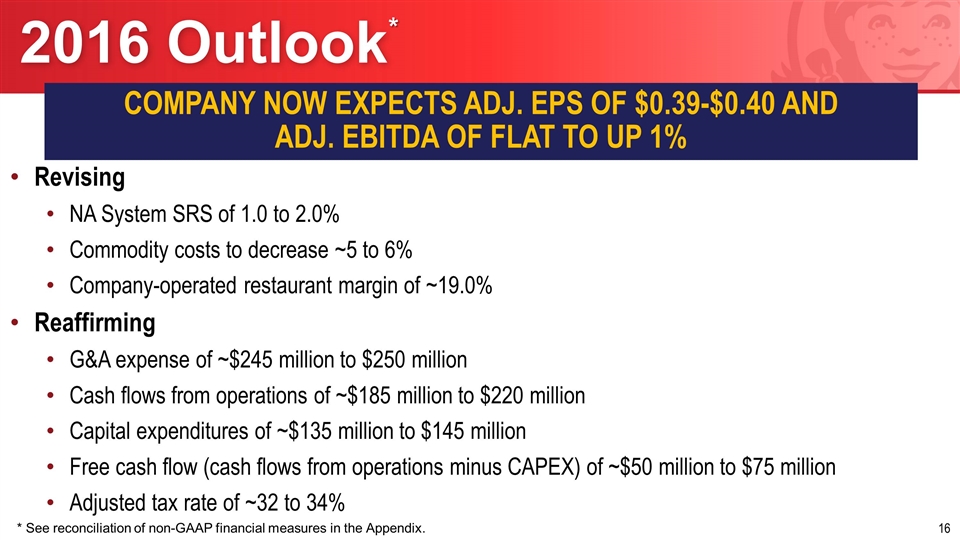

2016 Outlook Revising NA System SRS of 1.0 to 2.0% Commodity costs to decrease ~5 to 6% Company-operated restaurant margin of ~19.0% Reaffirming G&A expense of ~$245 million to $250 million Cash flows from operations of ~$185 million to $220 million Capital expenditures of ~$135 million to $145 million Free cash flow (cash flows from operations minus CAPEX) of ~$50 million to $75 million Adjusted tax rate of ~32 to 34% COMPANY NOW EXPECTS ADJ. EPS OF $0.39-$0.40 AND ADJ. EBITDA OF FLAT TO UP 1% * * See reconciliation of non-GAAP financial measures in the Appendix.

President and Chief Executive Officer Todd Penegor

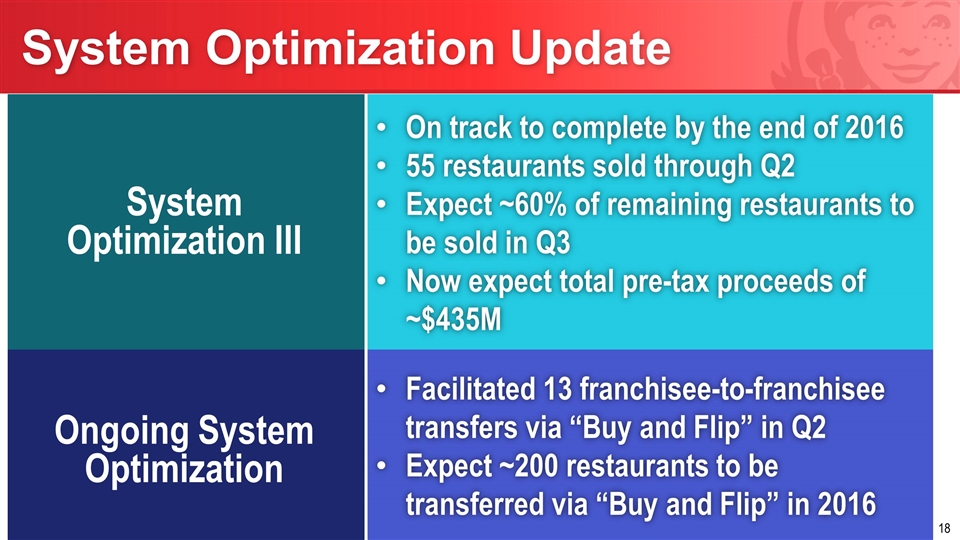

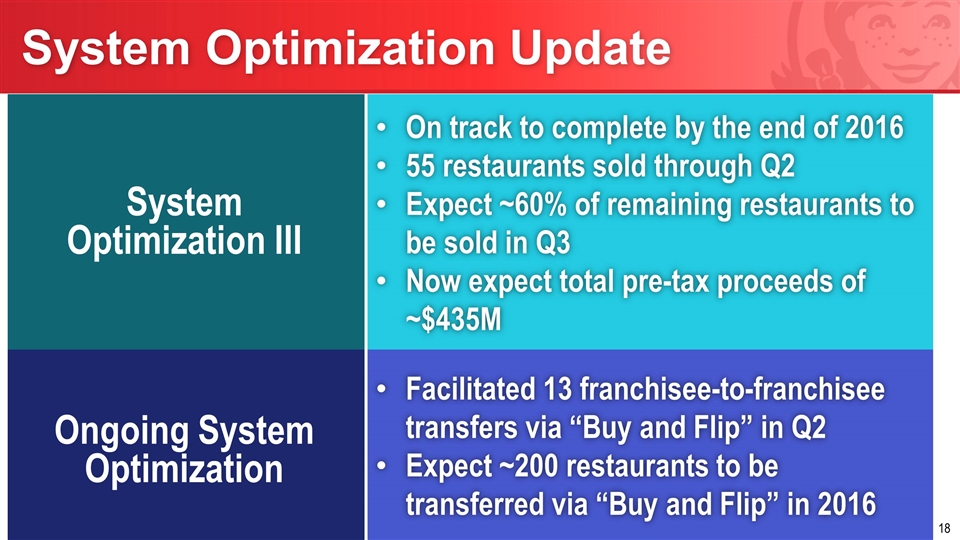

System Optimization Update System Optimization III On track to complete by the end of 2016 55 restaurants sold through Q2 Expect ~60% of remaining restaurants to be sold in Q3 Now expect total pre-tax proceeds of ~$435M Ongoing System Optimization Facilitated 13 franchisee-to-franchisee transfers via “Buy and Flip” in Q2 Expect ~200 restaurants to be transferred via “Buy and Flip” in 2016

Shreveport Atlanta Raleigh-Durham Miami New Orleans Baton Rouge/Lafayette New York Chicago Virginia Beach System Optimization Market Update 2016 Q1 Q1 Q3 Q3 Q3 Q3 Q4 Q4 Q4

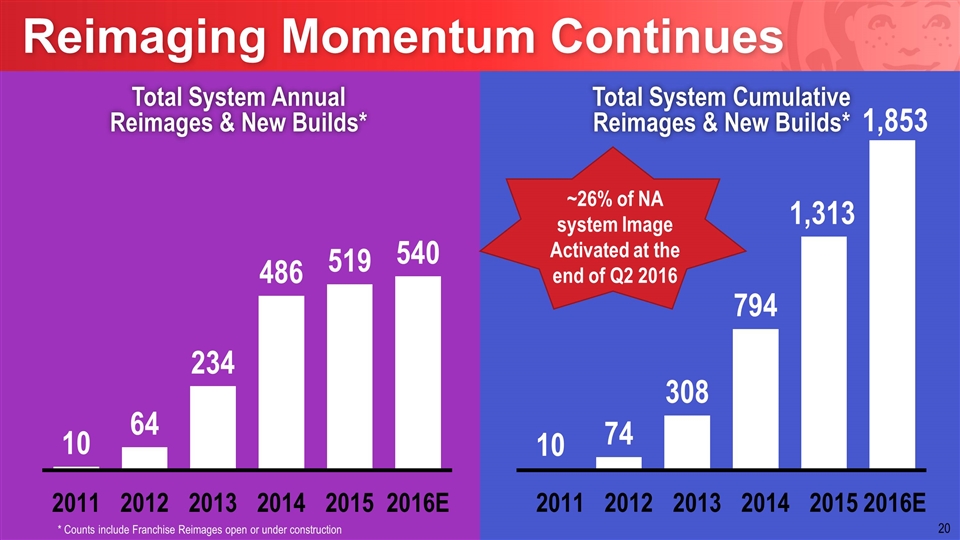

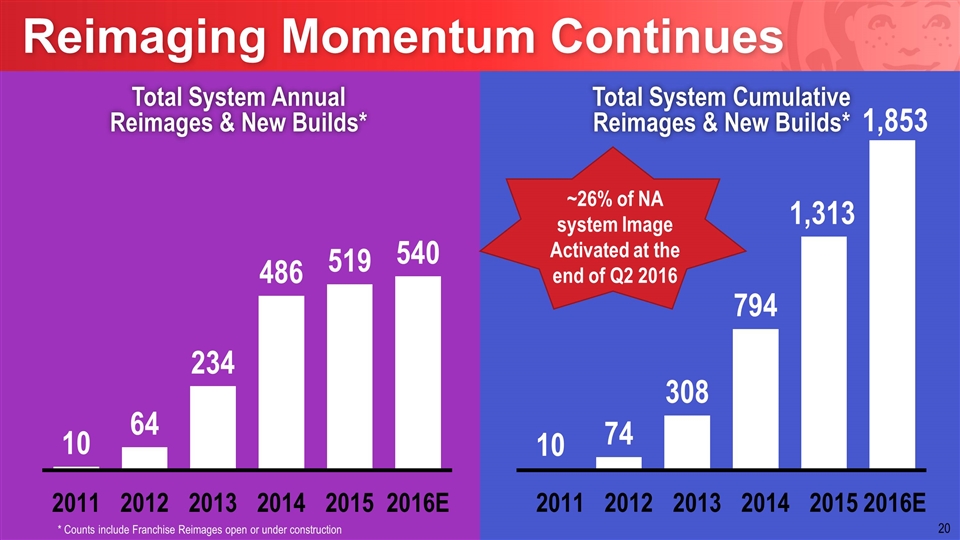

Reimaging Momentum Continues Total System Annual Reimages & New Builds* Total System Cumulative Reimages & New Builds* ~26% of NA system Image Activated at the end of Q2 2016 * Counts include Franchise Reimages open or under construction

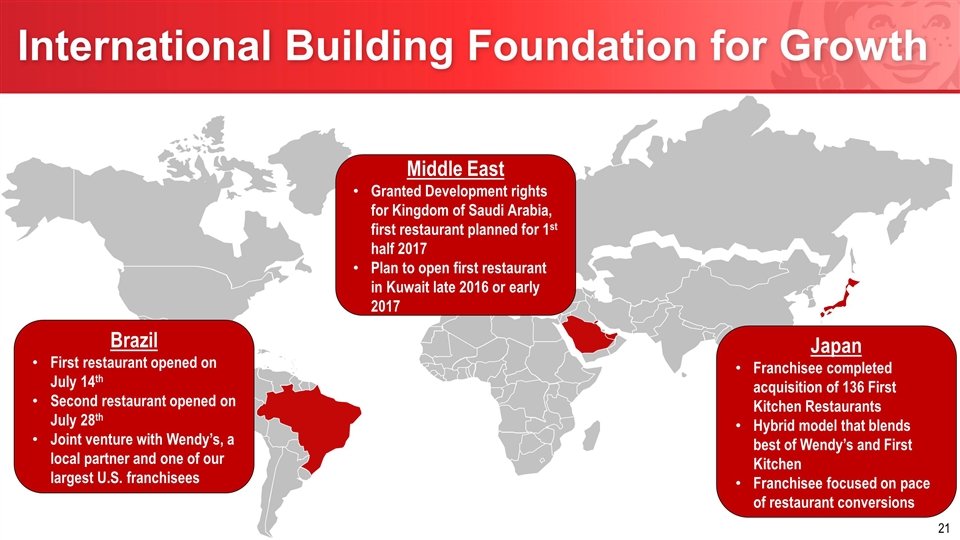

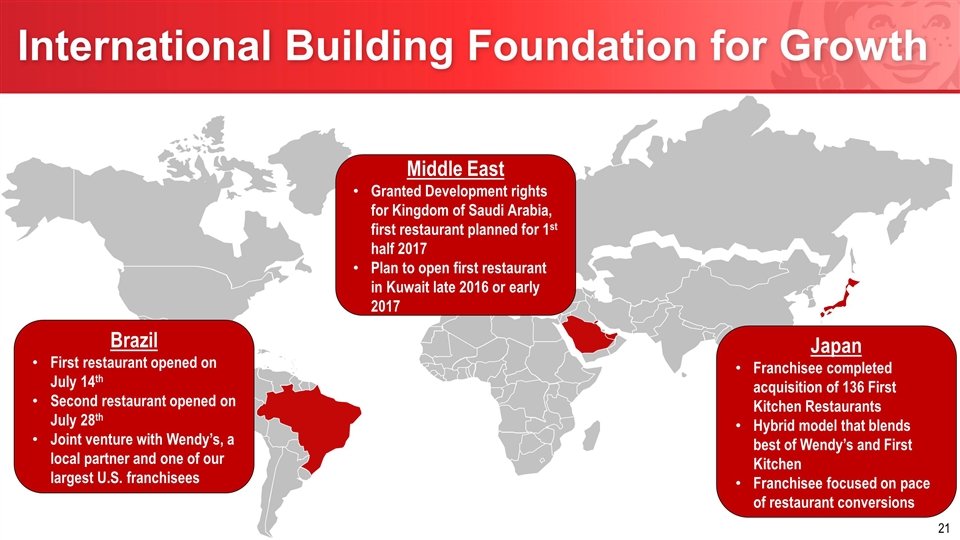

International Building Foundation for Growth Brazil First restaurant opened on July 14th Second restaurant opened on July 28th Joint venture with Wendy’s, a local partner and one of our largest U.S. franchisees Middle East Granted Development rights for Kingdom of Saudi Arabia, first restaurant planned for 1st half 2017 Plan to open first restaurant in Kuwait late 2016 or early 2017 Japan Franchisee completed acquisition of 136 First Kitchen Restaurants Hybrid model that blends best of Wendy’s and First Kitchen Franchisee focused on pace of restaurant conversions

2020 North America System Goals Are On Track! $2M 20% ≥1.3x 1,000 AUVs Restaurant Margins Sales to Investment Ratio New Restaurants 60% Total Reimaged Restaurants + (~500 Net) 2 New 2020 Company Goal: 38-40% Adjusted EBITDA Margin

Group Manager – Investor Relations Peter Koumas

2016 Investor Relations Calendar: Key Dates August 26 RBC NDR (New York) September 12 Stifel Baltusrol Executive Summit (New Jersey) September 13 CL King Best Ideas Conference (New York) September 28 Wells Fargo Retail, Restaurant & Consumer Forum (Boston) September 29 Evercore NDR (Toronto) November 9 3Q earnings release

Q&A

Appendix

In addition to the GAAP financial measures included in this presentation, the Company has included certain non-GAAP financial measures (i.e., adjusted EBITDA, adjusted EBITDA margin, adjusted earnings per share, adjusted tax rate and free cash flow). These non-GAAP financial measures exclude certain expenses and benefits as detailed in the accompanying reconciliation tables. This presentation also includes forward-looking guidance for certain non-GAAP financial measures including adjusted EBITDA, adjusted earnings per share and adjusted tax rate. The Company excludes certain expenses and benefits from adjusted EBITDA, adjusted earnings per share and adjusted tax rate, such as impairment of long-lived assets, reorganization and realignment costs and system optimization gains, net. Due to the uncertainty and variability of the nature and amount of certain future expenses and benefits related to our system optimization initiative, the Company is unable without unreasonable effort to provide projections of net income, earnings per share or reported tax rate or a reconciliation of projected adjusted EBITDA, adjusted earnings per share or adjusted tax rate to projected net income, earnings per share or reported tax rate. Reconciliation of Non-GAAP Financial Measures

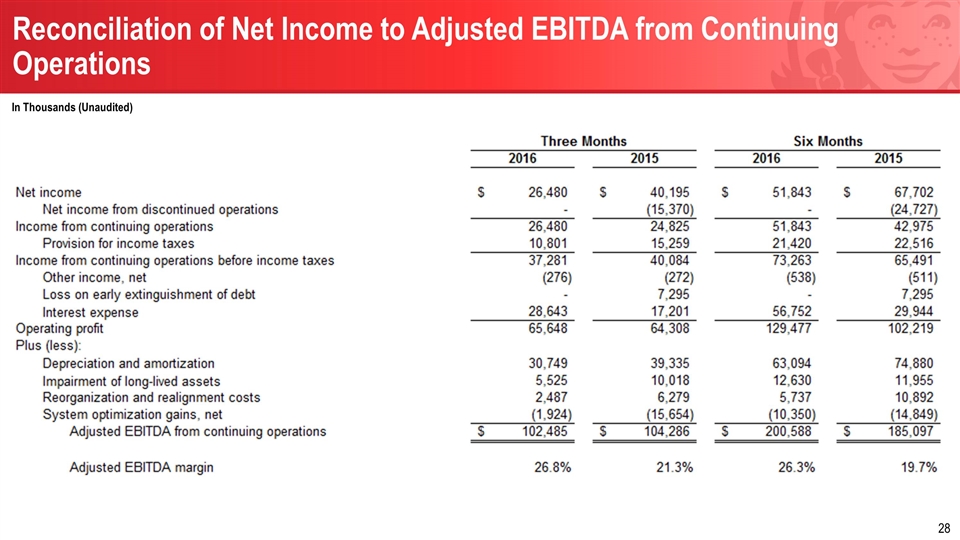

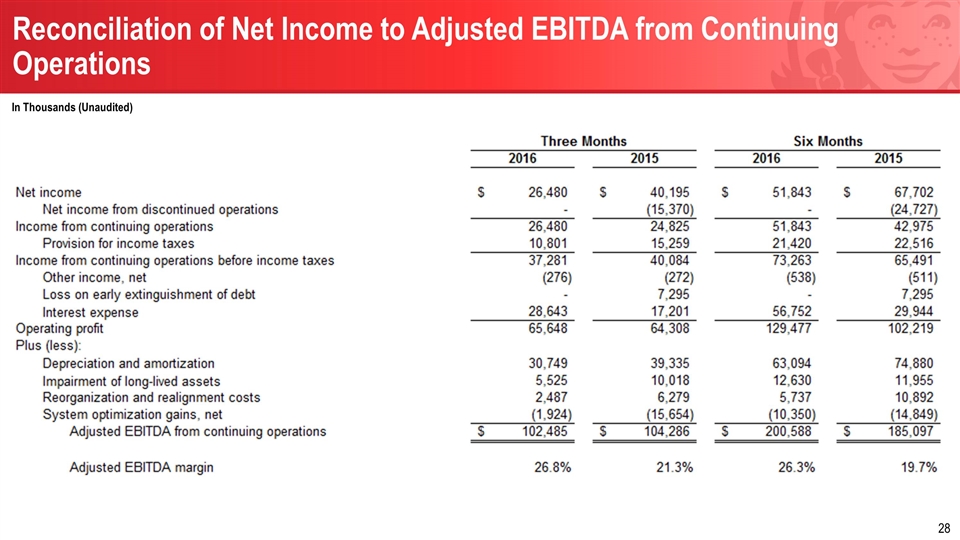

Reconciliation of Net Income to Adjusted EBITDA from Continuing Operations In Thousands (Unaudited)

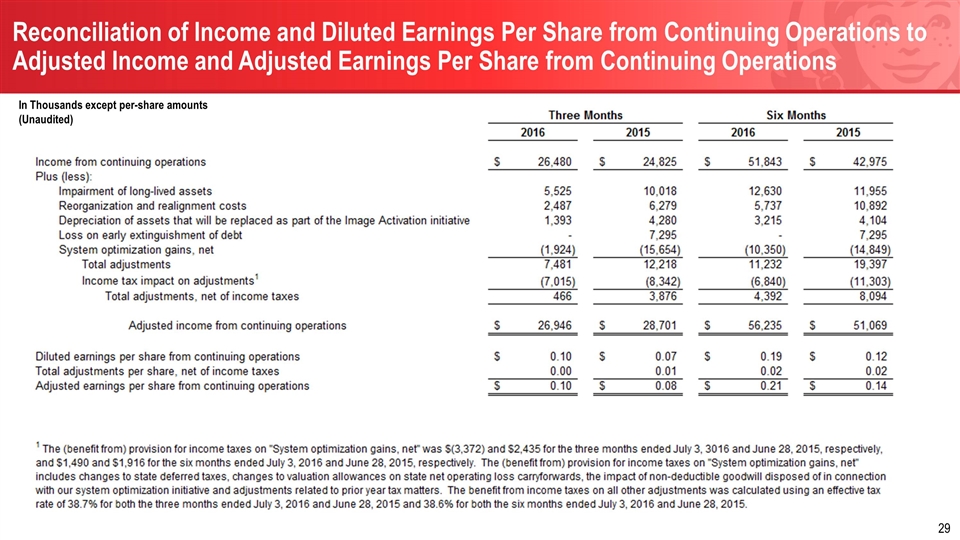

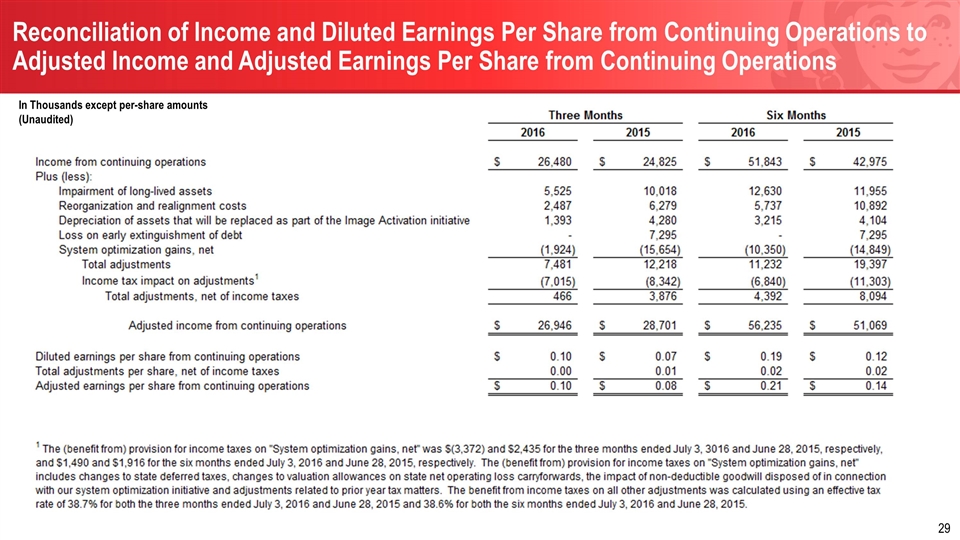

Reconciliation of Income and Diluted Earnings Per Share from Continuing Operations to Adjusted Income and Adjusted Earnings Per Share from Continuing Operations In Thousands except per-share amounts (Unaudited)