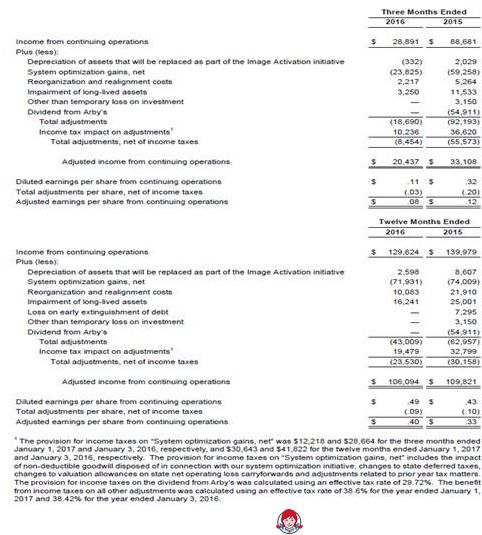

5 THE WENDY'S COMPANY | Forward-Looking Statements and Non-GAAP Financial Measures This presentation, and certain information that management may discuss in connection with this presentation, contains certain statements that are not historical facts, including information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward- looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our news release issued on February 16, 2017 and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K / Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures (i.e., adjusted EBITDA, adjusted EBITDA margin, adjusted earnings per share, adjusted tax rate and free cash flow). These non-GAAP financial measures exclude certain expenses and benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the Appendix to this presentation, and are included in our news release issued on February 16, 2017 and posted on www.aboutwendys.com. As used in this presentation, the terms adjusted EBITDA and adjusted earnings per share refer to adjusted EBITDA from continuing operations and adjusted earnings per share from continuing operations, respectively. |