UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 0-511

COBRA ELECTRONICS CORPORATION

(Exact name of Registrant as specified in its Charter)

| | |

DELAWARE

| | 36-2479991

|

( State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

6500 WEST CORTLAND STREET

CHICAGO, ILLINOIS

| | 60707

|

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:(773) 889-8870

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $.33 1/3 Per Share; Common stock traded on the NASDAQ stock market

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company x |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2011, was $22,757,738.

The number of shares of Registrant’s Common Stock outstanding as of March 9, 2012 was 6,610,580.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders, scheduled to be held on May 8, 2012, are incorporated by reference into Part III of this Report.

TABLE OF CONTENTS

PART I

Item 1. Business

General

Cobra Electronics Corporation (the “Company”), incorporated in Delaware in 1961, is traded on The NASDAQ Stock Market under the symbol “COBR”. The Company is a leading designer and marketer of two-way mobile communications and mobile navigation products in the United States, Canada and Europe, holding the number one or strong number two position in each of its longstanding product lines and targeting a similar position for marine VHF radios, photo-enforcement detection and mobile navigation for professional drivers. Cobra® is a leading brand in Citizens Band radios, radar detectors, speed camera detection, truck navigation and two-way radios. Performance Products Limited (“PPL”), a wholly-owned subsidiary based in the UK, designs and markets mobile navigation, photo-enforcement and detection products primarily under the Snooper® brand in the UK and elsewhere in Europe. The Company’s AURA™ database of photo-enforcement locations and road hazards covers the United States, Canada and most of Europe. The Company has a 50-year track record of innovation and the development of award-winning products and is an industry leader in developing technology applications that serve consumers’ needs in the following product lines:

| | Ÿ | | Photo-enforcement and safety detection |

| | Ÿ | | Mobile navigation for professional drivers |

| | Ÿ | | Wireless solutions and mobile app products |

Management believes that the Company’s future success depends upon its ability to predict and respond in a timely and effective manner to changes in the markets it serves. Technology, product performance, reliability, price, availability and service are the main competitive factors. The Company’s sales are dependent upon timely introduction of new products, which incorporate new features desired by consumers, at competitive prices.

Recent Developments

Innovation remains the hallmark of the Company’s success, as demonstrated by just a few of its recent product introductions and other recent developments. The Company expects to continue attracting new customers with innovative product extensions and new product categories.

Cobra was recognized with Design and Engineering Awards from the Consumer Electronics Association (“CEA”) at the 2012 Consumer Electronics Show. The products recognized were the: Cobra iRadarTMSmart Detection System, CobraTagTM and Cobra JoyRideTM. Cobra iRadar Smart Detection System, the second generation of iRadar, allows the Cobra iRadar Community to report and warn other users of police, caution areas and photo-enforcement areas in real-time; and, when iRadar detects a safety alert or caution, it automatically shares the information with other iRadar Community users nearby. CobraTag, an alarm and loss prevention system for AndroidTM, Blackberry® or iPhone® smartphones, is a small sleek key fob device with a companion smartphone application that uses Bluetooth® wireless technology and a separation alarm to link valuables to your smartphone ensuring valuables are never left behind. Cobra JoyRide for AndroidTM smartphones automatically configures your phone for in-car usage and personalizes how your phone operates in the car. Pushing a single button can initiate phone calls, launch voice commands, share information on road hazards and live police, pause or play music, and launch GPS applications and other in-car applications.

1

In November 2011, the Snooper Truckmate TM S7000 was recognized by Trucking Magazine with a Trucking Test Winner Award and a 5-star rating for the second year running.

The Company’s 2012 product line will include the following new products:

Cobra Segment

| | Ÿ | | 25 LX, 29 LX BT and 29 LX EU |

| | Ÿ | | 6000 PRO HD and 8000 PRO HD |

PPL Segment

| | Ÿ | | S6500 Truckmate and VenturaTM |

| | Ÿ | | S8500 Truckmate and Ventura with DAB radio |

| | Ÿ | | Shotsaver S320 and Shotsaver S430 Tour Pro Units |

Sales and Distribution

Demand for consumer electronics products tends to be seasonal and varies according to channel of distribution. Historically, sales in the last half of the year are significantly greater than in the first half, reflecting increasing purchases by retailers and distributors for various promotional activities that begin mainly in the third quarter and culminate with the holiday selling season.

Suppliers

One of the Company’s fundamental strengths is its product sourcing ability. Substantially all of the Company’s products are manufactured to its specifications and engineering designs by a number of suppliers, primarily in China, Hong Kong and South Korea. The Company utilizes multiple manufacturers for its products whenever practical, however certain products are dependent on a single manufacturer. The Company maintains control over the design and production quality of its products through its wholly owned subsidiary in Hong Kong, which seeks out new suppliers, monitors technological changes, performs source inspection of key suppliers, provides selected engineering services and expedites shipments from suppliers.

Over a period of years, the Company has developed a network of suppliers for its products. To maintain flexibility in product sourcing, all of the Company’s contracts with its suppliers can be terminated by the Company “at will”. While it is the Company’s goal to maintain strong relationships with its current suppliers, management believes that, if necessary, alternate suppliers could be found. The extent to which a change in a supplier would have an adverse effect on the Company’s business depends upon the timing of the change, the product or products that the supplier produces for the Company and the volume of that production. The Company also maintains insurance coverage that would, under certain limited circumstances, reimburse the Company for lost profits resulting from a supplier’s inability to fulfill its commitments to the Company. The Company historically has negotiated substantially all of its purchases in U.S. dollars and uses forward contracts on occasion to purchase dollars at a fixed exchange rate to the British pound sterling and the euro.

Research and Development

Research and product development expenditures, as well as non-capitalized engineering costs, are expensed as incurred and amounted to $1.6 million in 2011, $1.6 million in 2010 and $1.8 million in 2009.

2

Patents and Other Intellectual Property

Patents and other intellectual property can be important marketing, merchandising and competitive tools across a broad range of products, but particularly for the Company’s newer products such as the Cobra iRadar, AURA and Bluetooth® products. Whenever the Company develops a unique design or technology, patents are applied for to preserve exclusivity. In 2011 the Company was awarded a design patent for the 29 LX Citizens Band Radio and a technical patent for the Bluetooth Citizens Band radios.

The Company’s two-way radios, detectors, Citizens Band radios, HighGear™ accessories, GPS receivers, marine electronic products and mobile navigation devices are marketed globally under the Cobra brand name. The Cobra trademark is registered in the United States, most European countries, China, as well as other jurisdictions. The Company believes the Cobra trademark, which is indefinitely renewable, is a significant factor in the successful marketing of its products.

Personal navigation devices, GPS locators and other products designed and marketed by PPL are marketed in the United Kingdom and Europe under the Snooper brand name. The Snooper trademark is registered in the United Kingdom and Europe and is a significant factor to successful marketing of PPL products in the United Kingdom and Europe.

Competition

Major competitors in the Cobra business segment are Motorola, Midland and Uniden (two-way radios); Whistler and Escort/Beltronics (detection); Uniden and Midland (Citizens Band radios); Icom, Uniden and Standard Radio (marine electronic products); and Garmin and Rand McNally (mobile navigation for professional drivers).

Competitors in the PPL segment include Garmin, Tom Tom and Navman for personal navigation devices, and Coyote and Road Angel for GPS products.

The Company’s main competitive factors are technology, product performance, reliability, price, availability and timely introduction of new products and service.

Employees

As of December 31, 2011, the Company employed 110 persons in the United States and 40 persons in its international operations. None of the Company’s employees are a member of a union.

Information by Segment and Geographic Area

The consolidated entity consists of Cobra Electronics Corporation and its subsidiaries in Hong Kong, Ireland and United Kingdom. The Company segregates and reports its operating results into the Cobra Consumer Electronics (“Cobra”) business segment, which sells under the COBRA brand name, and the Performance Products Limited (“PPL”) business segment, which sells under the SNOOPER brand name. The Cobra segment is comprised of Cobra Electronics Corporation, Cobra Electronics (HK) Limited (“CHK”) and Cobra Electronics Europe Limited (“CEEL”).

Long–lived assets located outside of the United States totaled $6.4 million and $7.2 million at December 31, 2011 and 2010, respectively. International sales, primarily in Canada and Europe (including those of PPL), were $33.8 million, $29.1 million, and $25.5 million in 2011, 2010, and 2009, respectively. For additional financial information about business segment and geographic areas, see Note 4 to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

3

Cobra Segment

Principal products marketed under the Cobra trade name include:

| | Ÿ | | Photo-enforcement and safety detection |

| | Ÿ | | Mobile navigation for professional drivers |

| | Ÿ | | Wireless solutions and mobile app products |

In the United States, Cobra competes primarily with various manufacturers and distributors of consumer electronics products, principally on the basis of technology, product performance, product features and consumer value, and expects the market for its products to remain highly competitive. Cobra also markets its products in nearly 80 countries through distributors. Cobra’s products are distributed through a strong, well-established network of nearly 300 retailers and distributors located primarily in the United States, representing nearly 40,000 storefronts where Cobra products can be purchased. Approximately 50 percent of the Company’s sales are made directly to retailers, such as general merchandisers, mass marketers, consumer electronics specialty stores, warehouse clubs, television home-shopping and internet retailers, direct-response merchandisers, home centers, specialty stores and a major travel center. Most of the remaining sales are through two-step wholesale distributors that carry Cobra products to fill orders for travel centers, small department stores and appliance dealers, independent wireless agents and for export and marine products. Cobra’s primary sales force is composed of independent sales representatives who work on a straight commission basis. In both Canada and Europe, as well as elsewhere throughout the world, the Company utilizes distributors, which sell primarily to retailers. Cobra’s return policies and payment terms are similar to those of other companies serving the consumer electronics market. Cobra products generally must be shipped within a short time after an order is received and, as a result, order backlog is not significant.

For 2011, sales to DAS, a distributor, were 14.6 percent of net sales and sales to Wal-Mart were 11.4 percent. In 2010 and 2009 only sales to Wal-Mart exceeded 10.0 percent, with 11.1 percent in 2010, and 15.4 percent in 2009.

Radar Detection

Cobra is the number one brand in the domestic market for integrated radar/laser detectors. Cobra commands a leading market share by offering innovative products with the latest technology. Cobra detectors feature Voice AlertTM Technology, 360 degree detection, Strobe AlertTM Technology and a photo enforcement database. Recent detection products feature IntelliMute Pro, which provides radar-detector-detector (RDD) immunity; and IntelliView and Intelliview Pro™, which provide locations of photo enforcement cameras and radar/laser detection warnings, full color displays, battery voltage meter, IntelliShield™, Intellimute Pro, 8 point GPS compass, and the AURA database.

Cobra iRadar, using Bluetooth wireless technology to connect the iPhone or iPod Touch® with the detector and allowing the driver to control the detector’s settings and access to the AURA redlight and speed camera database, was launched in the fourth quarter of 2010. The Cobra iRadar system for Android users became available in the first quarter of 2011. Location-based crowd sourcing database capabilities that store location-based signals from the Cobra iRadar user community and allow sharing of information with other users were offered as an enhancement in the latter part of 2011. The second generation of iRadar allows the Cobra iRadar Community to report and warn other users of police, caution areas and photo-enforcement areas in real-time; when iRadar detects a safety alert or caution, it automatically shares the information with other iRadar Community users nearby.

4

The 2011 detection line-up included five new models across two product series, the Formula S and Formula R series, was reengineered on an all new technology platform with advanced detection circuitry, improved performance and range, enhanced false signal rejection, a redesigned high-gain radar/laser lens, decorative badges, a sleek, compact profile and affordable price-points. The ultra-performance Formula R Series XRS 9670 and XRS 9770 feature 15 band detection, Intellishield Tri-Level City mode, Smart Power, advanced DigiView data display and an 8-point compass at price points starting at less than $160. The high performance Formula S Series XRS 9370, XRS 9470 and XRS 9570 feature 14 band detection, city/highway selector, auto-mute, LaserEyeTM 360 laser detection and voice alerts at price points starting at less than $90.

Cobra iRadar received three awards in 2010 from the Specialty Equipment Market Association (“SEMA”), two Consumer Electronics Show (“CES”) innovation awards from the Consumer Electronics Association (“CEA”) in 2011, the Mac/Life innovation award in 2011 and was recognized by the Industrial Designer Society of America (“IDSA”) with an International Design Excellence Award (“IDEA”) in 2011. Cobra received 2012 CES Innovation Awards for both the Cobra iRadar Community and the Cobra JoyRide.

Photo-Enforcement and Safety Detection

Cobra began marketing a database of photo-enforcement locations as a feature of its high-end radar detectors in 2008. Based on consumer response, Cobra rolled out the AURA database, the only verified photo-enforcement database in North America, in January 2009. AURA provides the capability to offer a unique feature to the Company’s top-selling line of radar detectors and its mobile navigation products for the professional driver.

Mobile Navigation For Professional Drivers

The Company’s mobile navigation strategy is to pursue a worldwide trucking navigation platform that can be shared with Cobra and PPL, therefore allowing lower overall development costs. Accordingly, in August 2010, Cobra extended its focus on the professional driver and introduced the 7750 PLT. It is a GPS navigation system for professional drivers and includes the following features: 7 inch screen, AURA database, ability to customize by truck type, size and load, truck-specific routing and over 33,000 trucker points of interest, commercial vehicle service and support information powered by TruckDown™, enhanced graphics, junction view with lane assist, state mileage log and hours-of-service log. The 7750 PLT was selected as an Innovations 2011 Design and Engineering Award honoree by the Consumer Electronics Association (“CEA”). A GPS trucker navigation system, 5550 PRO, with a 5 inch screen and a retail selling price under $300 debuted in the first quarter of 2011.

Citizens Band Radios

Cobra is the leading brand in the domestic Citizens Band radio market. Most of this market is for mobile Citizens Band radios purchased primarily by professional truck drivers. The remaining part of the domestic market is for hand-held Citizens Band radios used for sport and recreational activities. Cobra has a history of being the technology leader in this market, Cobra Citizens Band radios feature NOAA all hazard alert radio, SoundTrackerTM noise reduction, NightWatchTM illumination, and patented Bluetooth technology.

The 29 LX LE product introduced as a limited edition anniversary model in 2010 was continued in 2011 as the 29 LX. The 29 LX features a revolutionary patented design, four-color LCD display, an ergonomic microphone, a weather alert scan and an industry first, Radio Check Diagnostic, which allows drivers to monitor RF output, SWR setting and battery voltage. In mid-2011, Cobra unveiled the Remote CB Microphone System for the standard 4-pin CB radio from Cobra and other manufacturers. The remote CB microphone system includes a retractable cord, state-of-the art boom microphone with noise cancelling technology, and a heavy–duty push-to-talk button that allows drivers to operate their CB radio without moving their hands or taking their eyes off the road. During 2011, Cobra partnered with iSpeech® to enable Android and BlackBerry smartphone users to listen and respond to incoming text and e-mail messages in real time through Citizens Band radio and Marine products.

Cobra looks for opportunities to introduce limited edition Citizens Band radios to drive incremental sales. Historically, Cobra has licensed Harley-Davidson®, Dale Earnhardt® and Dale Earnhardt Jr.® trademarks for this purpose.

5

Power Inverters

In 1997, the Company introduced its first line of power inverters, which permit users to power devices requiring 120-volt AC power, such as computers, video games and appliances, using the 12-volt outlet in a vehicle. Cobra’s broad range of products extends from low power 130 watt requirements to applications that draw as much as 2,500 watts. For example, the CPI 150 micro size inverter includes a USB port for an iPod®, Blackberry®, mobile phones, laptops and many more USB devices and is available for sale at most major airports in the United States. The CPI 2500 is used by many professional drivers and can power microwaves, refrigerators and other small appliances. All inverter models offered include USB output and provide Pentagon™ protection, which includes reverse polarity, low voltage, over voltage, temperature and low voltage alarm. Eco-friendly packaging was featured on selected inverter products in 2011.

Two-Way Radios

Cobra two-way radios feature the smallest high-powered radios, VibrAlertTM silent vibrating alert, lithium battery power, smaller environmentally friendly packaging and Rewind Say-AgainTM to differentiate from competitors. The 2012 product line includes two new models, the CXT135 and CXT235, which feature the NOAA Weather Radio (“NWR”) and All Hazards Alert which were previously only available on expensive high-end models. The NWR broadcasts official Weather Service warnings, watches, forecasts and other hazard information 24 hours a day, 7 days a week. The CXT135 features NOAA Weather Radio capabilities, a range up to 16 miles, Power Saver circuitry for extended battery life, Call Alert, and rechargeable NiMH batteries. The CTX235 includes the features of the CXT135 plus an extended range up to 20 miles and an audible weather or emergency alert that is activated even when the audio is turned off. The CXT425, CXR725, CXR825 and CXR925 models featuring maximum performance and a range up to 35 miles, NOAA Weather and Emergency radio capabilities and desktop chargers, complete the 2012 product line. Although this market has matured and continued category sales declines are expected, the Company expects to maintain a leading market position.

Marine Electronics

Cobra marine products feature the largest illuminated LCD display, Rewind Say-AgainTM, combination VHF/GMRS radio, combo speaker-microphone, and a marine Bluetooth microphone. In 2009, the Company announced a long-term agreement to distribute the popular European C-pod Security System, provided by Seakey AB in Sweden, and serve as the exclusive U.S. distributor of C-pod©.

In 2010, two floating handheld VHF radios were introduced with a bright orange core, making these floating radios highly visible to facilitate retrieval by the boater. The MR HH 330 features a 6-watt VHF with NOAA weather channels. The MR HH475 features a 6-watt VHF, NOAA weather channels and Bluetooth technology that allows the answering of cell phones.

Wireless Solutions and Mobile App Products

With most households in the United States covered by one or more wireless providers, the market is strongly trending towards the mobile phone as being the primary phone number or in some cases the only phone number for a household. The Cobra PhoneLynxTM system, introduced in November 2010, allows users to make and receive cell phone calls on any phone, thereby eliminating the need for landline phone services. PhoneLynx delivers exceptional call clarity, does not require a connection other than an electrical outlet and involves no fees of any kind. Other products that promise to eliminate the need for a landline require an internet connection and many charge a monthly or annual service fee. The PhoneLynx included features such as voice dial, message waiting, speed dial, auto hands-free, voice mail, alarm clock, improved reception and ClearCallTM. Eliminating a landline phone service can save hundreds of dollars year after year and allow users to take advantage of carry-over minutes, free evening and weekend calling and unlimited call plans. Cobra PhoneLynx is ideally suited to transition users from a landline phone service to mobile-only phone. PhoneLynx received two CES awards for design and innovation in 2011.

6

CobraTag alarm and loss prevention system for Android, Blackberry or iPhone smartphones was launched in 2011. The CobraTag is a small sleek key fob device with a companion smartphone app that uses Bluetooth wireless technology and a separation alarm to link valuables to your smartphone. A CobraTag sensor is attached the user’s keys, purse, computer bag, or any other valuable requiring protection. The CobraTag system monitors the distance between the smartphone and the tagged item and produces an audible alert when the items are separated. Additionally, the CobraTag can record the GPS location and time of day the items become separated and send an e-mail or text message to a preconfigured contact list.

Popular Mechanics recognized CobraTag with its Editors Choice Award at the CES for 2011. CobraTag was selected as a finalist for the CTIA 2011 Hot for the Holidays Award in the “Fashionita” category and the Cobra Tag G5 was honored with a 2012 CES Innovation Award.

PPL Segment

Products marketed by PPL include personal navigation devices, marketed under the trade name of Snooper Truckmate, Snooper Ventura, Snooper Sapphire Plus and GPS-enabled speed camera location detectors, marketed under the trade names of Snooper My Speed and Snooper 3 Zero, among others. PPL also markets under the AURA brand, a global database of speed camera locations and other driving hazards, such as high-accident zones, for driver safety.

Sales are primarily in the UK and Europe. Sales are made through a network of approximately 1,500 retailers and distributors and PPL’s website. Principal products marketed by PPL include:

| | Ÿ | | Outdoor leisure products |

Personal Navigation

Snooper portable satellite navigation systems include the very best street level mapping from a global supplier of digital maps and Snooper’s market leading speed camera detector technology. Portable satellite navigation systems from Snooper are award winning, utilizing Traffic Message Channel (“TMC”) traffic information technology, Bluetooth hands free and multi routing technology.

The Snooper Truckmate is a personal navigation device with dedicated routing within the UK and Europe for trucks, buses, motor homes and other large vehicles. Information available includes low bridges, weight restrictions and width limitations. Entering specific vehicle information enables the device to select the most appropriate route. In 2010, the product line was expanded to include the following:

| | Ÿ | | S6000 Truckmate/ S6000 Ventura – 7 inch screen version of the S2000 Truckmate and S2000 Ventura products incorporating TMC traffic information technology and Bluetooth connectivity. |

| | Ÿ | | AVN S7000 Truckmate/ AVN S7000 Ventura – the S7000 unit included a motorized screen designed to be installed into a vehicle using a single din slot. In addition to the standard S7000 Truckmate and S7000 Ventura features, the AVN unit also included a DVD/CD player, radio tuner plus iPod connectivity. |

During 2011 the personal navigation product line was expanded to include the following:

| | Ÿ | | S900 Ventura Lite – designed specifically for caravan and motor-home use, the unit allows the user to input the dimensions of a vehicle and will then calculate only routes that are suitable for that size vehicle. This unit includes information on over 20,000 campsites and stopovers throughout Europe. |

7

| | Ÿ | | S5000 and S7000 Truckmate Pro – these units feature enhanced functions of the existing Truckmate range such as Junction View and Lane Guidance along with free TMC traffic information. |

Speed Camera Locators

PPL markets speed camera detection devices, including the Snooper Sapphire and the Snooper Evolution, which use GPS location technology and the AURA database to alert drivers to upcoming speed camera and hazard locations. In the first quarter of 2010, the Snooper MySpeed GPS detector was introduced. This unit uses the latest GPS technology to allow an end user to be continually advised of the speed limit of the road on which he or she is travelling. The MySpeed unit can also be upgraded to a MySpeed AURA, which allows an end user to be advised of all new speed camera and other hazards by linking to the AURA database.

In the second quarter of 2011, the Snooper Tigre EU was introduced. This unit has been designed specifically for use in the UK and mainland Europe and incorporates Snooper’s unique “All Band” European specification radar/laser technology to provide excellent detection distances across all radar and laser frequencies used in Europe.

Outdoor Leisure Products

The Shotsaver S400 Laser range finder and the S430 Shotsaver golf units were launched in 2010. The Shotsaver S400 Laser range finder allowed golfers to accurately determine their distance to various targets from a range of up to 250 yards utilizing the most up to date laser technology available. The S430 Shotsaver unit incorporated a super-bright 3.5 inch OLED screen that makes it easy to read in all conditions and is fully waterproof, ensuring it functions in all types of weather conditions. The S430 unit featured a built in rechargeable battery capable of running for 12 hours, is fully waterproof, can be purchased with or without satellite navigation capabilities, offers a complete golf course management tool for over 4,500 golf courses in the UK and Western Europe and includes distance calculations.

The A3500 Adventurer, an outdoor GPS portable navigation system with complete coverage of UK using Ordnance Survey® Landranger® 1:50,000 scale maps, was launched in the fourth quarter of 2010. The unit features a 3.5 inch OLED screen to give much better screen definition, and it can also be purchased with Snooper’s in-car satellite navigation, featuring turn by turn navigation and AURA speed camera detection technology.

In the third quarter of 2011, the Snooper S210 Shotsaver GPS golf range finder was introduced. This unit comes preloaded with over 5,000 golf courses across Europe and provides accurate distances to the front, middle and back of each green, plus other key hazards on the course. The unit features a compact, waterproof and sunlight-readable two inch screen and is the most cost effective GPS range finder on the market.

During 2011 work has been ongoing on the “Tour Pro” software, which will be launched in the first quarter of 2012 and feature much improved graphics and functionality when compared to the existing Shotsaver software. This software will be featured on the S320 and S430 models early in 2012.

AURA Database

PPL markets a proprietary AURA database that provides drivers with advance notice of upcoming speed camera and hazard locations. The database provides a competitive advantage because unlike database capabilities of competitors, the AURA database is updated daily and makes information available to its subscribers 24 hours a day, 7 days a week, thereby making new speed camera locations readily available to customers.

Other Products

In 2010 PPL broadened its product line by introducing the E-Bike and the WPT250M tracker. The E-Bike is a compact, lightweight folding electric bike, and the WPT250M, is a tracking device that uses GPS, GPRS and GSM technology to monitor the location of any boat, vehicle, pet or individual with an accuracy of 2.5 meters.

8

During the second quarter of 2011, the Snooper Lynx iPhone application was introduced. This application allows the user to share and receive the positions of mobile speed traps with other users. It displays current speed and the speed limit of the road being traveled, provides alerts for all types of fixed and mobile speed traps and features automatic wireless downloads of the AURA database. It can also be used as a stand-alone laser detector.

In the third quarter of 2011, the Snooper Laser Pod was introduced. This unit has been designed to add laser detection to most portable satellite navigation systems and will detect the majority of laser guns used throughout Europe. Laser Pod mounts on the back of a satellite navigation device and is powered from the device with no installation required.

In the fourth quarter of 2011, the Snooper AVNS9000 Ventura Pro satellite navigation unit was introduced. This unit features a six inch full color LCD with Bluetooth hands-free and iPod® connectivity. The double din unit requires installation into a vehicle and also includes a DVD player along with a radio and CD player and is compatible with a reversing camera for added convenience.

Available Information

The Company’s website address is “www.cobra.com”. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge through our website, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). We include our website address in this annual report on Form 10-K only as an inactive textual reference and do not intend it to be an active lead to our website.

Executive Officers of the Registrant

As of the date of this filing, the executive officers of the Company are as follows:

| | | | | | |

Name, Age and Present Position | | Has Held Present

Position Since | | | Prior Business Experience In Past Five Years |

James R. Bazet, 64 | | | Sept. 2008 | | | President and Chief Executive Officer, 1998 to 2008. |

Chairman of the Board, President and Chief Executive Officer* | | |

| | |

Sally A. Washlow, 40 | | | July 2010 | | | Vice President Product Development and Marketing, 2007 to 2010, Vice President Marketing and Consumer Products, 2006 to 2007. |

Senior Vice President Marketing and Sales | | |

| | |

Robert J. Ben, 47 Senior Vice President and Chief Financial Officer | | | May 2011 | | | Vice President, Corporate Controller and Interim Chief Financial Officer, January to April 2011; Vice President Corporate Controller, 2007 to 2010; Senior Corporate Controller, 2006 to 2007 |

| | |

Gerald M. Laures, 64 | | | March 1994 | | | Vice President - Finance and Corporate Secretary, 1994 to present. |

Vice President - Finance and Corporate Secretary | | |

9

Item 1A. Risk Factors

This section identifies certain risks and uncertainties that the Company faces. If the Company is unable to appropriately address these and other circumstances that could have a negative effect on its business, the Company’s business may suffer. Negative events may decrease revenues, increase costs, negatively affect financial results and decrease financial strength, thereby, causing the price of the Company’s stock to decline.

Business, financial condition or results of operation could be adversely affected by the inability to enhance existing products or introduce new products to meet consumer preferences, including timely introductions as new consumer technologies are introduced.

Management believes that the Company’s future success depends upon its ability to predict and respond in a timely and effective manner to changes in the markets it serves. Consequently, the Company strives to introduce distinctive new products that anticipate changing consumer demands and capitalize upon emerging technologies. If the Company fails to introduce or suffers delays in introducing new products, misinterprets consumer preferences or fails to respond to changes in the marketplace, consumer demand for our products could decrease and our brand image could suffer. In addition, competitors may introduce new designs or technologies, undermining our products’ desirability. If any of the foregoing occurs, our business, financial condition or results of operations could be materially harmed.

Failure to maintain relationships with key customers and failure by key customers to purchase expected quantities of our products could have an adverse effect on our business.

Cobra products are distributed through a network of nearly 300 retailers and distributors in the United States and over 30 distributors in Europe and elsewhere around the world. PPL products are sold through a network of 1,500 retailers and distributors in Europe. The Company’s success is dependent upon the ability to retain an existing base of customers to sell the Company’s products. Loss of customers means loss of product placement and, consequently, a possible reduction in sales volume.

Certain of the Company’s customers account for a large portion of the Company’s net sales. For instance, in 2011 sales to DAS were 14.6 percent of net sales and sales to Wal-Mart were 11.4 percent of net sales. We anticipate that DAS and Wal-Mart will continue to account for a significant portion of our net sales in the foreseeable future. Customers are not obligated by any firm, long-term purchase commitments for our products. As a result, customers may cancel purchase commitments or reduce or delay orders on relatively short notice. The loss of sales to or a material delay in orders from, our key customers could materially harm our business, financial condition and results of operations.

If the Company is unable to obtain sufficient amounts of high quality products on a timely basis, customer needs may not be met and reduced sales may result.

Substantially all products are manufactured by third party manufacturers located outside of the United States, primarily in China, Hong Kong and South Korea. The ability to meet customers’ needs depends on the ability to maintain an uninterrupted supply of products from multiple third party manufacturers. While the Company purchases most products from multiple third party manufacturers, business, financial condition or results of operations could be adversely affected if any of the principal third party manufacturers experience production problems, lack of capacity or transportation disruptions. The Company utilizes multiple manufacturers for its products whenever practical, however certain products are dependent on a single manufacturer. Additionally, certain of our third party manufacturers serve other customers, a number of which have greater production requirements than we do. As a result, third party manufacturers could determine to prioritize production capacity for other customers or reduce or eliminate services for us on short notice. The extent to which changes in third party manufacturers would have an adverse effect on the Company’s business depends upon the timing of the changes, the product or products that the third party manufacturers produce and the volume of production.

Dependence on third party manufacturers for products subjects the Company to the risk of supplier failure and customer dissatisfaction with the quality or performance of such products. Quality or performance failures by

10

third party manufacturers or changes in their financial or business condition, which affects their production, could disrupt the ability to supply quality products to customers and thereby materially harm our business, financial condition and results of operations.

Shortages of components and materials may disrupt the supply of products.

The inability of third party manufacturers to obtain sufficient quantities of components and other materials used in our products could disrupt the supply of products or increase costs. Materials and components for some products may not be available in sufficient quantities to satisfy sales requirements as a result of supply shortages. Supply interruptions relating to products could result in lost sales opportunities which may harm our business, financial condition and results of operations.

Impact of higher commodity prices and increased labor costs overseas.

Substantially all products are manufactured by third party manufacturers in China, Hong Kong and South Korea. Labor costs, particularly in China, are rising as are the costs of certain components used in our products because of higher commodity prices. To the extent we are not able to increase the prices of our products to offset these increased labor and component costs, our profitability and cash flow may be adversely affected.

Reliance on retailers and third party distributors to sell our products.

Cobra products are sold through a network of nearly 300 retailers and distributors in the United States and over 30 distributors in Europe and elsewhere around the world. PPL products are sold through a network of 1,500 retailers and distributors in Europe. Certain distributors market competitors’ products. The loss, termination or failure of one or more of the distributors to effectively promote our products could affect the Company’s ability to bring its products to market and could reduce sales. Changes in the financial or business condition of these distributors and retailers could also affect the level of their purchases of our products which could materially harm our business, financial condition and results of operations.

The Company competes with a large number of companies in the consumer electronics business, and if we are unable to compete effectively, our business, financial condition and results of operations may be materially affected.

The Company encounters strong competition from a number of companies in the consumer electronics business. Some of our current and potential competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial resources than we do. Competition is based principally on the introduction of new products and pricing. Competitors may have greater resources and operating and financial flexibility to introduce new products and withstand changes in pricing. To compete for sales, the Company may have to lower its prices or increase its investment in development of new technologies, which could reduce gross margin and adversely affect our business, financial condition and results of operations. There is no assurance that the Company will continue to compete effectively against existing and new competitors that may enter our markets.

A downturn in global economic and market conditions could negatively impact our business, financial condition and results of operations.

The consumer electronics products sold by the Company are generally discretionary purchases for consumers. Consumer spending is affected by many factors, including consumer confidence levels, interest rates, tax rates, employment levels and prospects and other general economic conditions. The recent economic slowdown and recession in the United States and worldwide economies decreased the demand for products and adversely affected sales, which could happen again if a similar downturn in global economic and market conditions occurs. Since economic and market conditions vary within the Company’s business segments, the Company’s future performance by business segment will accordingly vary. In addition, deteriorating or weak economic conditions, or the forecast or perception of the same, may trigger changes in inventory levels at our retail customers,

11

including a reduction in product offerings and out of stock situations, which may adversely affect our results of operations. Also, the cash surrender value of life insurance policies owned by the Company for the purpose of recovering the costs of deferred compensation programs for several current and former officers of the Company is affected by the market value of the underlying investments. Adverse market conditions may result in a decline in the cash surrender value of these life insurance policies, which would result in a non-cash expense that reduces our net income and would also reduce the collateral base available for our secured credit facility.

International markets expose us to political and economic risks in foreign countries, as well as to risks relating to currency values and import/export policies.

Substantially all of our products are manufactured to our specifications and engineering designs by suppliers located primarily in China, Hong Kong and South Korea. In addition, international sales, primarily in Canada and Europe, represent a significant portion of our total sales. International activities pose risks not faced by companies that limit themselves to the United States market. These risks include:

| | Ÿ | | changes in foreign currency exchange rates; |

| | Ÿ | | changes in a specific country’s or region’s political or economic conditions; |

| | Ÿ | | issues affecting health and safety in specific countries or regions; |

| | Ÿ | | tariffs, quotas, trade barriers, other trade protection measures in the United States or foreign countries and import or export licensing requirements; |

| | Ÿ | | increased shipping costs, disruptions in shipping or reduced availability of freight transportation; |

| | Ÿ | | difficulties in enforcing remedies in foreign jurisdictions and compliance with applicable foreign laws; |

| | Ÿ | | difficulties to recover inventory and equipment from vendors seeking protection pursuant to local bankruptcy laws; |

| | Ÿ | | potentially negative consequences from changes in tax laws in the United State and/or foreign countries; and |

| | Ÿ | | different regulatory structures and unexpected changes in regulatory requirements. |

Revenues and purchases are predominately in U.S. dollars; however, a portion of revenue is collectible in other currencies, principally euros and British pound sterling. The Company historically has negotiated substantially all of its purchases in U.S. dollars and, occasionally uses forward contracts to purchase dollars at a fixed exchange rate to the British pound sterling or a fixed exchange rate to the euro. The Company considers opportunities to make purchases in other currencies to the extent that doing so would be advantageous in light of currency fluctuations involving the U.S. dollar and other currencies. As sales expand in international markets, customers may increasingly make payments in currencies other than U.S. dollars, which could have a considerable effect on margins. The Company frequently hedges foreign currency fluctuations; however, it may not be able to fully hedge against the risks of such fluctuations and future exchange rate fluctuations could materially affect our operating results.

The Company is subject to various governmental regulations that could adversely affect its business.

The Company’s operations are subject to various federal, state and local regulatory requirements, including those relating to environmental, health and safety matters. The Company could become subject to liabilities as a result of a failure to comply with applicable laws and could incur substantial costs to comply with existing or new, more stringent regulations. In addition, the use of the Company’s products is also governed by a variety of federal, state and local regulations, including the regulations of the Federal Communications Commission, and changes in such regulations may affect demand for our products.

12

The Company is subject to governmental regulation in the countries in which it operates.

The Company’s business is subject to governmental regulations in the countries in which it operates. From time to time, such governments may consider proposed legislation relating to the regulation of products that we or our subsidiaries sell. The loss of sales as a result of any such regulations and any similar legislation could materially harm our business, financial condition and results of operations.

Mobile navigation devices and other GPS-enabled products marketed in the United States depend upon a network of satellites maintained by the United States Department of Defense. If these satellites become inoperable or the policies of the United States regarding civilian use of the GPS system change, there would be a material effect on our business.

The global positioning system capabilities of our products marketed in the United States function through a network of satellites launched, operated and maintained by the United States Department of Defense. Should the satellites or underlying support systems become inoperable or if the United States government were to choose to degrade the quality of signals available to civilians, GPS products will not function as designed and there would likely be an adverse effect on demand for these products. Additionally, the Department of Defense does not currently charge users for access to the signals used by these devices and any move to do so could affect the economics of our business.

If we are unable to enforce or defend our rights with respect to intellectual property, our business may be adversely affected.

The Cobra trademark is a key factor in the marketing of our products. Trademark protection with respect to the Cobra trademark in the United States could be subject to challenge in some product areas. In addition, the Company may not be able to obtain trademark protection for the Cobra trademark in each country in which it sells products. If we are unable to use the Cobra trademark with respect to some products or in some markets, our results of operations could be adversely affected.

The Snooper trademark is a well-known trademark in the United Kingdom and Europe and contributes to the success of PPL. If we are unable to use the Snooper trademark in the United Kingdom or in other areas where PPL is expanding its business, our results of operations could be adversely affected.

The Company maintains patents for certain of its products and licenses patents for use in certain of its products, particularly navigation products. If the patents are challenged, or third parties claim that products infringe upon the intellectual property rights of others, the Company may incur significant costs to defend its intellectual property rights and may not ultimately be successful. If any of our products are determined to have infringed upon the intellectual property rights of others, the Company may face substantial damages as well as injunctive relief which could effectively block our ability to market these products in the United States and abroad. Such a judgment could materially harm our business, financial condition and results of operations.

We may be required to record impairment charges for intangible assets in future periods.

The carrying value of intangible assets totaled $8.4 million at December 31, 2011. We test for impairment whenever evidence of impairment exists. Impairment charges, which will reduce net income and may have material adverse effect on financial results, will be recorded when warranted by our financial performance or market conditions.

Our profitability and financial condition depend on our ability to collect on amounts due from customers.

We have significant accounts receivable due from customers. It is not uncommon for a customer to suspend payments of amounts due if the customer experiences operational difficulties. A customer experiencing severe operational difficulties may file for bankruptcy. In these cases, we may be unable to collect on that customer’s outstanding accounts receivable balance. The failure of our customers to pay amounts due could negatively affect our business, financial condition and results of operations.

13

Our secured credit facility contains restrictive covenants and our failure to comply with those restrictions could result in a default, which could have a material adverse effect on our business, financial condition and results of operations.

Our secured credit facility is our principal source of available liquidity, other than cash generated by operations. As of December 31, 2011, we had $18.7 million of outstanding indebtedness under our credit facility. The Company is a party to a credit facility providing a borrowing capacity of $30.0 million. The Credit Agreement contains customary covenants, including but not limited to financial covenants requiring the Company to maintain a Fixed Charge Coverage Ratio (as defined in the Credit Agreement) of 1.10 to 1.00 for the periods set forth in the Credit Agreement and annual capital expenditures cannot exceed $3.5 million. Our credit facility contains a number of significant restrictions that limit our ability to, among other things, do the following:

| | Ÿ | | incur additional indebtedness; |

| | Ÿ | | merge, consolidate or dispose of our assets; or |

| | Ÿ | | pay dividends to shareholders in excess of $1,250,000. |

The secured credit facility also requires compliance with certain financial covenants. A breach of the covenants contained in the credit facility could result in any outstanding indebtedness under the credit facility becoming immediately due and payable and in our inability to borrow additional funds under the credit facility, either of which could adversely affect our business, financial condition and results of operations.

Our inability to secure credit that we may require in the future may negatively impact liquidity.

In the current credit environment it is increasingly difficult for businesses to secure financing. If we require additional financing in the future, we may be unable to secure financing or may only be able to secure financing on terms which could have a material adverse effect on our business, financial condition or results of operations.

Economic conditions may limit the access to credit needed by our customers and suppliers.

Our business may be adversely impacted by the availability of credit and consumer spending rates. Recent deterioration of national and global economic conditions and its impact on the credit environment could materially adversely impact our business, financial condition or results of operations. The financial stability of our customers or suppliers may be compromised, which could result in additional bad debts for the Company or non-performance by suppliers. Uncertainty about current global economic conditions and the higher costs or unavailability of credit may cause consumers of our products to postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values. In some cases our customers or suppliers may be unable to stay in business. This could have a material adverse impact on the demand for our products and on our business, financial condition and operating results.

Sales of our products are subject to seasonal variations and, as a result, our quarterly operating results may fluctuate and may not be a reliable indicator of our future performance.

Historically, sales in the last half of the year are significantly greater than in the first half reflecting purchases by retailers and distributors for the various promotional activities that begin in the third quarter and culminate with the holiday selling season. Consequently, our results of operations during any particular quarter should not be relied upon as an indication of our results for a full year or any other quarter. In addition, if investors inaccurately estimate our results of operations in one or more future quarters and our operating results fall below expectations, our stock price may decline.

14

The price of our common stock may be subject to sudden decreases due to the inherent volatility of operating and competitive factors.

The market price of the Company’s common stock may be highly volatile and subject to wide fluctuations in response to various factors. We have experienced extreme price and volume fluctuations with respect to the Company’s common stock. The market price of our common stock is dependent upon, but not limited to:

| | Ÿ | | press releases or publicity relating to the Company or its competitors or relating to trends in the consumer electronics industry; |

| | Ÿ | | changes in the legal or regulatory environment affecting our business; |

| | Ÿ | | changes in expectations as to future financial performance, including financial estimates by securities analysts and investors; |

| | Ÿ | | the operating and stock performance of other companies that investors may deem comparable; |

| | Ÿ | | developments affecting us, customers or suppliers; and |

| | Ÿ | | general domestic or international economic, market and political conditions. |

These factors may adversely affect the trading price of our common stock, regardless of our actual operating performance, and could prevent our stockholders from selling their common stock at or above the price at which they purchased it. In addition, the stock markets from time to time experience extreme price and volume fluctuations that may be unrelated or disproportionate to the operating performance of companies. In the past, some stockholders have brought securities class action lawsuits against companies following periods of volatility in the market price of their securities. We may in the future be the target of similar litigation. Securities litigation, regardless of whether we are ultimately successful, could result in substantial costs and divert management’s attention and resources.

The loss of key members of our management and technical team may adversely affect our business.

The Company’s success depends on the performance of key management, sales, technical and other critical personnel and our ability to continue to attract, motivate and retain management and highly qualified key personnel. Failure to do so could disrupt our operations, adversely affect customer relationships and impair the ability to successfully implement and complete Company initiatives. The loss of any services of any key management or technical personnel could make it more difficult to successfully pursue business goals. In addition, the Company may not be as successful as its competitors at recruiting, assimilating and retaining key personnel.

Our performance depends on favorable relations with our employees and our ability to attract and retain them. Any deterioration of those relations, increase in labor costs or inability to attract and retain employees could adversely affect our business, financial condition and results of operations.

Any significant deterioration in employee relations increases in labor costs or shortages of labor at any facility could have a material adverse effect on our business, financial condition and results of operations. As of December 31, 2011, none of our employees were covered by collective bargaining agreements. A slowdown or work stoppage at one facility that lasts for a significant period of time could cause lost sales and increased costs and could adversely affect the Company’s ability to meet customers’ needs.

Business could be adversely affected by a disruption to our Chicago, Illinois and Runcorn, UK facilities.

Our Chicago, Illinois facility accounts for 81 percent of the total space utilized by the Company or 92 percent of the space utilized by the Cobra segment. The Runcorn, UK facility accounts for 12 percent of the total space utilized by the Company or 100 percent of the space utilized by the PPL segment. Therefore, any disruption to our operations at either of these facilities could adversely impact our performance and impair our ability to deliver products and services to customers on a timely basis. Operations at the Chicago, Illinois and Runcorn, United Kingdom facilities could be disrupted in the event of:

| | Ÿ | | damage to, or inoperability of, its warehouse; |

15

| | Ÿ | | a hardware or software error, failure or crash; |

| | Ÿ | | a power or telecommunications failure; or |

| | Ÿ | | fire, flood or other natural disaster. |

Any disruption could damage the Company’s reputation and cause customers to cease purchasing products from the Company. The Company could be subject to claims or litigation with respect to these losses. The Company’s property and business interruption insurance may not adequately compensate us for all of the losses that we may incur.

Damage to or disruptions in the operations of our computer infrastructure and software systems could harm our business, financial condition and results of operations.

The unavailability of any of our information management systems for any significant period of time could have a material adverse effect on our operations. In particular, our ability to deliver products to our customers when needed, collect receivables and manage inventory levels successfully largely depends on the efficient operation of our computer hardware and software systems. Our information management systems are potentially vulnerable to damage or interruption from a variety of sources, including but not limited to computer viruses, security breaches, energy blackouts, natural disasters, terrorism, war and telecommunication failures. There also may be system or network disruptions if new or upgraded business management systems are defective or are not installed properly. Any system failure or security breach could negatively impact our business and results of operations. In addition, we may incur additional costs to remedy the damages caused by these system failures or security breaches.

Our internal controls over financial reporting may not be considered effective, which could result in possible regulatory sanctions and a decline in our stock price.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to furnish annually a report on our internal controls over financial reporting. The internal control report must contain an assessment by our management of the effectiveness of our internal controls over financial reporting (including the disclosure of any material weakness). The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls over financial reporting. In order for management to evaluate our internal controls, the Company must regularly review and document its internal control processes and procedures and test such controls. Ultimately, the Company could conclude that our internal control over financial reporting may not be effective if, among other things:

| | Ÿ | | any material weakness in our internal controls over financial reporting exist; or |

| | Ÿ | | assessed deficiencies are not remediated. |

Due to the number of controls to be examined, the complexity of the project, and the subjectivity involved in determining the effectiveness of controls, we cannot be certain that, in the future, all of our controls will be considered effective by management.

If, as required by the Sarbanes-Oxley Act, the Company is unable to assert that its internal control over financial reporting is effective, the Company could be subject to regulatory sanctions or lose investor confidence in the accuracy and completeness of the financial reports, either of which could have an adverse effect on the market price for the Company’s common stock.

Acquisitions and strategic investments may divert our resources and management attention; results may fall short of expectations.

From time to time, we evaluate potential acquisitions and investments in technologies and product lines that may strategically fit our business objectives. If we are unable to successfully integrate and develop acquired businesses, including PPL, which was acquired in 2006, we could fail to achieve anticipated synergies and cost savings, including the expected increases in revenues and operating results, any of which could materially and adversely

16

affect our financial results. Acquisitions in particular involve numerous risks, including difficulties in the integration and assimilation of the operations, technologies, products and personnel of an acquired business, diversion of management’s attention from other business concerns, increased expenses associated with the acquisition, and potential loss of key employees or customers of any acquired business. We cannot assure you that our acquisitions will be successful and will not adversely affect our business, results of operations or financial condition.

Effects of climate change on the Company’s business.

Global warming could result in a significant reduction in demand for certain of the Company’s products, such as radar detectors and Citizens Band radios, as surface transportation is constrained by flooding of coastal areas making roads and highways impassable.

17

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company’s office and warehouse facilities in the United States, Hong Kong and Europe are as follows:

| | | | | | |

Segment | | Location | | Owned or

Leased | | Utilization |

| Cobra | | Chicago, Illinois | | Owned | | Office and warehouse space |

| Cobra | | Kowloon, Hong Kong | | Leased | | Office space |

| Cobra | | Dublin, Ireland | | Leased | | Office space |

| Cobra | | Moen, Belgium | | Leased | | Warehouse space |

| PPL | | Runcorn, United Kingdom | | Leased | | Office and warehouse space |

Item 3. Legal Proceedings

The Company is subject to various unresolved legal actions and proceedings, which arise in the normal course of its business. None of these actions is expected to have a material adverse effect on the Company’s financial condition or results of operations.

Item 4. Mine Safety Disclosure

Not applicable.

18

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock trades on The NASDAQ Stock Market under the symbol COBR. As of March 5, 2012, the Company had approximately 451 shareholders of record and approximately 770 shareholders for whom securities firms acted as nominees. The Company’s common stock is the only class of equity securities outstanding.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | STOCK PRICE RANGE AND DIVIDENDS | |

| | | 2011 | | | 2010 | |

Quarter | | High | | | Low | | | Dividends Declared | | | High | | | Low | | | Dividends Declared | |

First | | $ | 4.24 | | | $ | 3.02 | | | $ | - | | | $ | 3.02 | | | $ | 1.51 | | | $ | - | |

Second | | | 4.38 | | | | 3.25 | | | | - | | | | 3.02 | | | | 2.01 | | | | - | |

Third | | | 4.10 | | | | 2.99 | | | | - | | | | 2.75 | | | | 1.60 | | | | - | |

Fourth | | | 5.33 | | | | 2.53 | | | | - | | | | 3.30 | | | | 1.96 | | | | - | |

Year | | | 5.33 | | | | 2.53 | | | | - | | | | 3.30 | | | | 1.51 | | | | - | |

Note: Stock price data compiled from The NASDAQ Stock Market Monthly Summary of Activity Reports.

The Company’s credit facility permits the Company to pay cash dividends subject to the limitations set forth therein.

Refer to Item 12 of Part III of this Annual Report for information with respect to compensation plans under which equity securities of the Company are authorized for issuance.

19

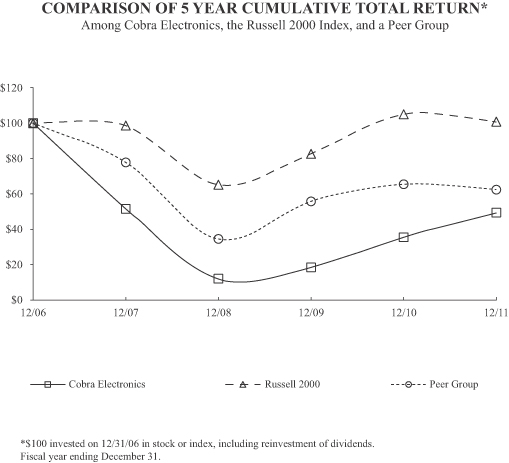

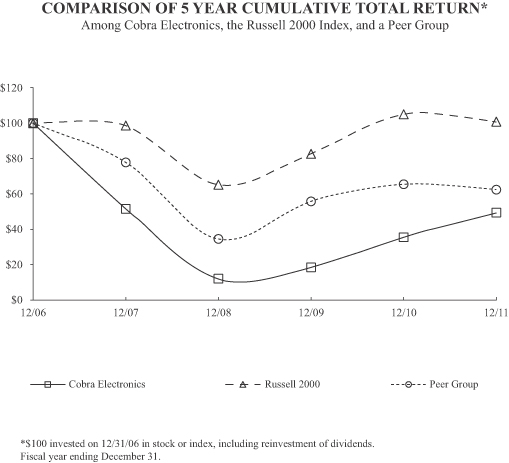

Performance Graph

The following Performance Graph compares the yearly percentage change in the Company’s cumulative total shareholder return on the Company’s Common Stock for the five-year period, December 31, 2006 to December 31, 2011, with the percentage change in the cumulative total return for the Russell 2000 Index and a peer group of companies selected by the Company.

Peer Group consists of Emerson Radio Corporation, Koss Corporation and Voxx International (formerly Audiovox) Corporation. In selecting companies for the peer groups, the Company focused on publicly traded companies that design and market electronics products, which have characteristics similar to that of the Company’s in terms of one or more of the following: type of product, end market, distribution channels, sourcing or sales volume. The returns of each of the companies in the peer groups have been weighted according to their respective stock market capitalizations at the beginning of each period for which a return is indicated.

20

Item 6. Selected Financial Data

The following table sets forth the Company’s selected financial data for each of the past five years. Read this information together with the consolidated financial statements and notes to those statements included in Item 8 of this Annual Report on Form 10-K and the information set forth under the captionManagement’s Discussion and Analysis of Financial Conditionand Results of Operations in Item 7 of this Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | | | | | |

Year Ended December 31 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (in thousands, except per share amounts) | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 123,259 | | | $ | 110,520 | | | $ | 105,229 | | | $ | 124,745 | | | $ | 155,935 | |

Net earnings (loss) attributable to Cobra | | | 3,087 | | | | 1,332 | | | | (10,867 | ) | | | (19,042 | ) | | | (4,658 | ) |

Net earnings (loss) attributable to Cobra per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.47 | | | $ | 0.21 | | | $ | (1.68 | ) | | $ | (2.94 | ) | | $ | (0.72 | ) |

Diluted | | | 0.47 | | | | 0.21 | | | | (1.68 | ) | | | (2.94 | ) | | | (0.72 | ) |

Dividends per share | | $ | — | | | $ | — | | | $ | — | | | $ | 0.16 | | | $ | 0.16 | |

As of December 31: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 80,595 | | | $ | 74,354 | | | $ | 75,703 | | | $ | 79,341 | | | $ | 114,538 | |

Bank debt | | | 18,655 | | | | 18,042 | | | | 17,869 | | | | 17,671 | | | | 19,985 | |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following management’s discussion and analysis should be read in conjunction with the Company’s audited Consolidated Financial Statements and Notes thereto included elsewhere in this Form 10-K, and any forward-looking statements contained herein or elsewhere in this Form 10-K involve risks, uncertainties and assumptions. Actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, those presented underRisk Factors in Item 1A in this Form 10-K and elsewhere herein.

Executive Summary

The Company had net earnings of $3.1 million, or $.47 per share, for the year ending December 31, 2011 compared to net earnings of $1.3 million, or $.21 per share, for 2010.

The following is a summary of the highlights related to the $1.8 million improvement in net earnings reported for 2011 compared to 2010:

| | Ÿ | | Net sales increased $12.7 million, or 11.5 percent, largely due to higher sales of Citizens Band radios and Truck Navigation products in the Cobra segment and higher sales of Truck Navigation products in the PPL segment. |

| | Ÿ | | Gross profit in 2011 increased $6.5 million while the gross margin improved to 29.3 percent for 2011 from 26.8 percent for 2010 mainly because of favorable sales mix in both the Cobra and PPL segments. |

| | Ÿ | | Selling, general and administrative expenses increased $3.3 million, or 11.8 percent, due to higher fixed selling and administrative expenses in both the Cobra and PPL segments. |

| | Ÿ | | Interest expense decreased by $461,000 primarily due to the non-recurrence of the prepaid loan fees written off in 2010. |

| | Ÿ | | Other expense increased $1.3 million mainly due to unfavorable CSV and foreign exchange variations from 2010. |

| | Ÿ | | A $169,000 tax expense in 2011 compared to a $380,000 tax benefit for 2010 due to higher state income taxes in the U.S. in 2011, non-recurrence of the U.S. federal income tax refund in 2010 and higher pre-tax earnings in Ireland for 2011. |

21

Correction of Immaterial Errors

In the second quarter of 2011, management discovered that the Company’s customs broker used an incorrect duty rate for its detection products. The cumulative adjustment for the incorrect duty rate, covering the period from July 1, 2006 to June 30, 2011, was approximately $1.5 million. The adjustment applicable to the fourth quarter of 2010 was approximately $79,000, the adjustment applicable to the twelve months of 2010 was approximately $245,000, and the adjustment applicable to prior years (2006 - 2010) totaled approximately $1.4 million. Pursuant to the guidance of SEC Staff Accounting Bulletin (“SAB”) No. 99,Materiality, the Company concluded that the errors were not material to any of its prior period financial statements. However, in accordance with SAB No. 108,Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in the Current Year Financial Statements, the prior period financial statements were revised. Prior period amounts stated in this Form 10-K have been revised to facilitate comparability between current and prior year periods.

EBITDA

Improved operating results in 2011 generated an improvement in EBITDA from the prioryear. The following table shows the reconciliation of net income to EBITDA and EBITDA As Defined for the years ended December 31, 2011 and 2010:

| | | | | | | | |

| | | Years Ended December 31 | |

| | | 2011 | | | 2010 | |

| | | (in thousands) | |

Net earnings attributable to Cobra | | $ | 3,087 | | | $ | 1,332 | |

Depreciation and amortization | | | 3,805 | | | | 3,936 | |

Interest expense, excluding loan fee amortization | | | 867 | | | | 1,012 | |

Income tax provision (benefit) | | | 169 | | | | (380 | ) |

| | | | | | | | |

EBITDA | | | 7,928 | | | | 5,900 | |

Stock option expense | | | 203 | | | | 202 | |

CSV loss (gain) | | | 152 | | | | (574 | ) |

Deferred revenue, database | | | 13 | | | | 511 | |

Other non-cash items | | | (443 | ) | | | 127 | |

| | | | | | | | |

EBITDA As Defined | | $ | 7,853 | | | $ | 6,166 | |

| | | | | | | | |

EBITDA represents earnings before interest, taxes, depreciation and amortization. EBITDA As Defined represents EBITDA adjusted to conform with the EBITDA measurement for compliance with the financial covenants of the Company’s lenders. The Company believes EBITDA is a useful performance indicator and is frequently used by management, securities analysts and investors to judge operating performance between time periods and among other companies. The Company uses EBITDA As Defined to assess operating performance and ensure compliance with financial covenants.

EBITDA and EBITDA As Defined are Non-GAAP performance indicators that should be used in conjunction with U. S. Generally Accepted Accounting Principles (“GAAP”) performance measurements such as net sales, operating profit and net income to evaluate the Company’s operating performance. EBITDA and EBITDA As Defined are not alternatives to net income or cash flow from operations determined in accordance with GAAP. Furthermore, EBITDA and EBITDA As Defined may not be comparable to the calculation of similarly titled measures reported by other companies.

22

Results of Operations — 2011 Compared to 2010

The following table contains sales and pre-tax income (loss) after eliminating intercompany accounts by business segment for the years ended December 31, 2011 and 2010.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2011 vs. 2010 | |

| | | 2011 | | | 2010 | | | Increase (Decrease) | |

| | | (in thousands) | |

Business Segment | | Net

Sales | | | Pre-tax

Income

(Loss) | | | Net

Sales | | | Pre-tax

Income

(Loss) | | | Net

Sales | | | Pre-tax

Income

(Loss) | |

Cobra | | $ | 107,808 | | | $ | 3,142 | | | $ | 95,797 | | | $ | 958 | | | $ | 12,011 | | | $ | 2,184 | |

PPL | | | 15,451 | | | | 114 | | | | 14,723 | | | | (6 | ) | | | 728 | | | | 120 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Company | | $ | 123,259 | | | $ | 3,256 | | | $ | 110,520 | | | $ | 952 | | | $ | 12,739 | | | $ | 2,304 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cobra Business Segment