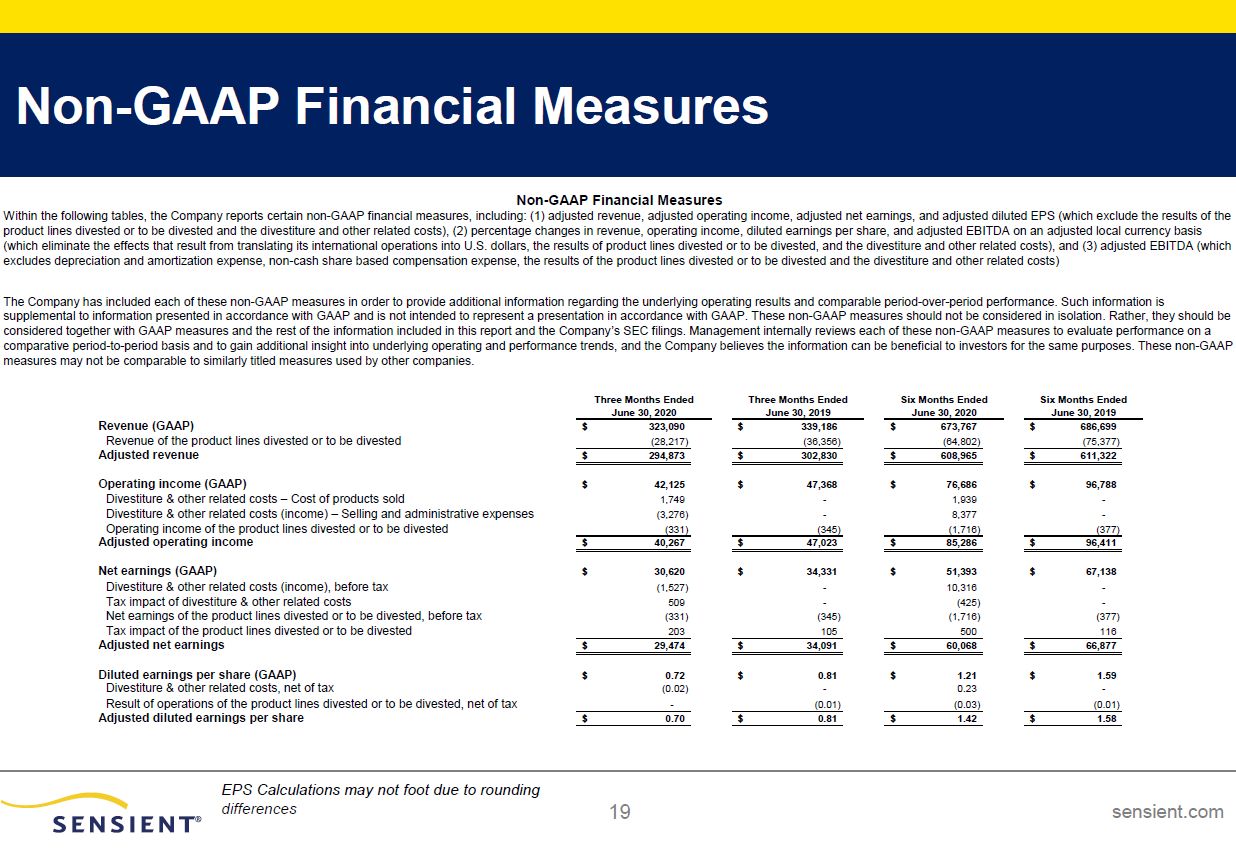

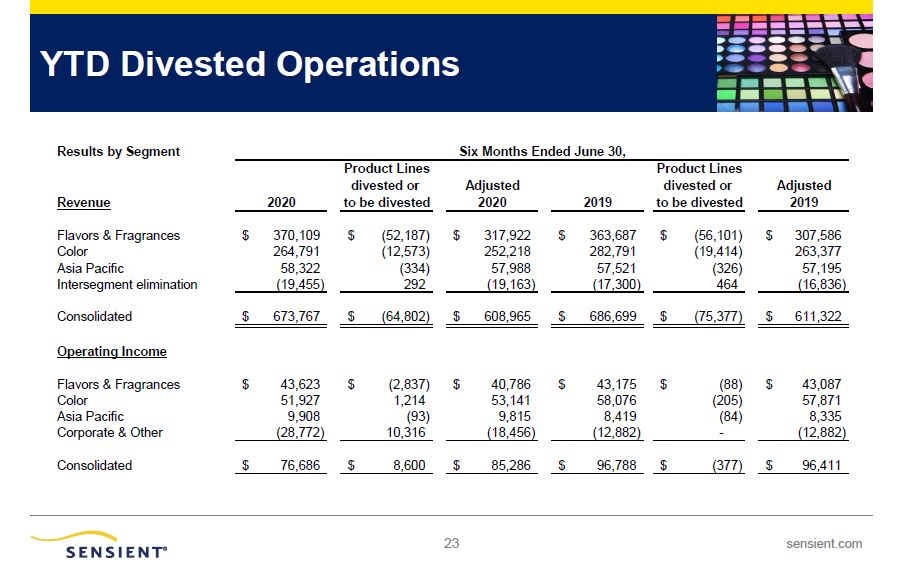

19 sensient.com Non-GAAP Financial Measures EPS Calculations may not foot due to roundingdifferences Non-GAAP Financial MeasuresWithin the following tables, the Company reports certain non-GAAP financial measures, including: (1) adjusted revenue, adjusted operating income, adjusted net earnings, and adjusted diluted EPS (which exclude the results of the product lines divested or to be divested and the divestiture and other related costs), (2) percentage changes in revenue, operating income, diluted earnings per share, and adjusted EBITDA on an adjusted local currency basis (which eliminate the effects that result from translating its international operations into U.S. dollars, the results of product lines divested or to be divested, and the divestiture and other related costs), and (3) adjusted EBITDA (which excludes depreciation and amortization expense, non-cash share based compensation expense, the results of the product lines divested or to be divested and the divestiture and other related costs)The Company has included each of these non-GAAP measures in order to provide additional information regarding the underlying operating results and comparable period-over-period performance. Such information is supplemental to information presented in accordance with GAAP and is not intended to represent a presentation in accordance with GAAP. These non-GAAP measures should not be considered in isolation. Rather, they should be considered together with GAAP measures and the rest of the information included in this report and the Company’s SEC filings. Management internally reviews each of these non-GAAP measures to evaluate performance on a comparative period-to-period basis and to gain additional insight into underlying operating and performance trends, and the Company believes the information can be beneficial to investors for the same purposes. These non-GAAP measures may not be comparable to similarly titled measures used by other companies. Three Months Ended Three Months Ended Six Months Ended Six Months Ended June 30, 2020 June 30, 2019 June 30, 2020 June 30, 2019 Revenue (GAAP) $ 323,090 $ 339,186 $ 673,767 $ 686,699 Revenue of the product lines divested or to be divested (28,217) (36,356) (64,802) (75,377) Adjusted revenue $ 294,873 $ 302,830 $ 608,965 $ 611,322 Operating income (GAAP) $ 42,125 $ 47,368 $ 76,686 $ 96,788 Divestiture & other related costs – Cost of products sold 1,749 - 1,939 - Divestiture & other related costs (income) – Selling and administrative expenses (3,276) - 8,377 - Operating income of the product lines divested or to be divested (331) (345) (1,716) (377) Adjusted operating income $ 40,267 $ 47,023 $ 85,286 $ 96,411 Net earnings (GAAP) $ 30,620 $ 34,331 $ 51,393 $ 67,138 Divestiture & other related costs (income), before tax (1,527) - 10,316 - Tax impact of divestiture & other related costs 509 - (425) - Net earnings of the product lines divested or to be divested, before tax (331) (345) (1,716) (377) Tax impact of the product lines divested or to be divested 203 105 500 116 Adjusted net earnings $ 29,474 $ 34,091 $ 60,068 $ 66,877 Diluted earnings per share (GAAP) $ 0.72 $ 0.81 $ 1.21 $ 1.59 Divestiture & other related costs, net of tax (0.02) - 0.23 - Result of operations of the product lines divested or to be divested, net of tax - (0.01) (0.03) (0.01) Adjusted diluted earnings per share $ 0.70 $ 0.81 $ 1.42 $ 1.58