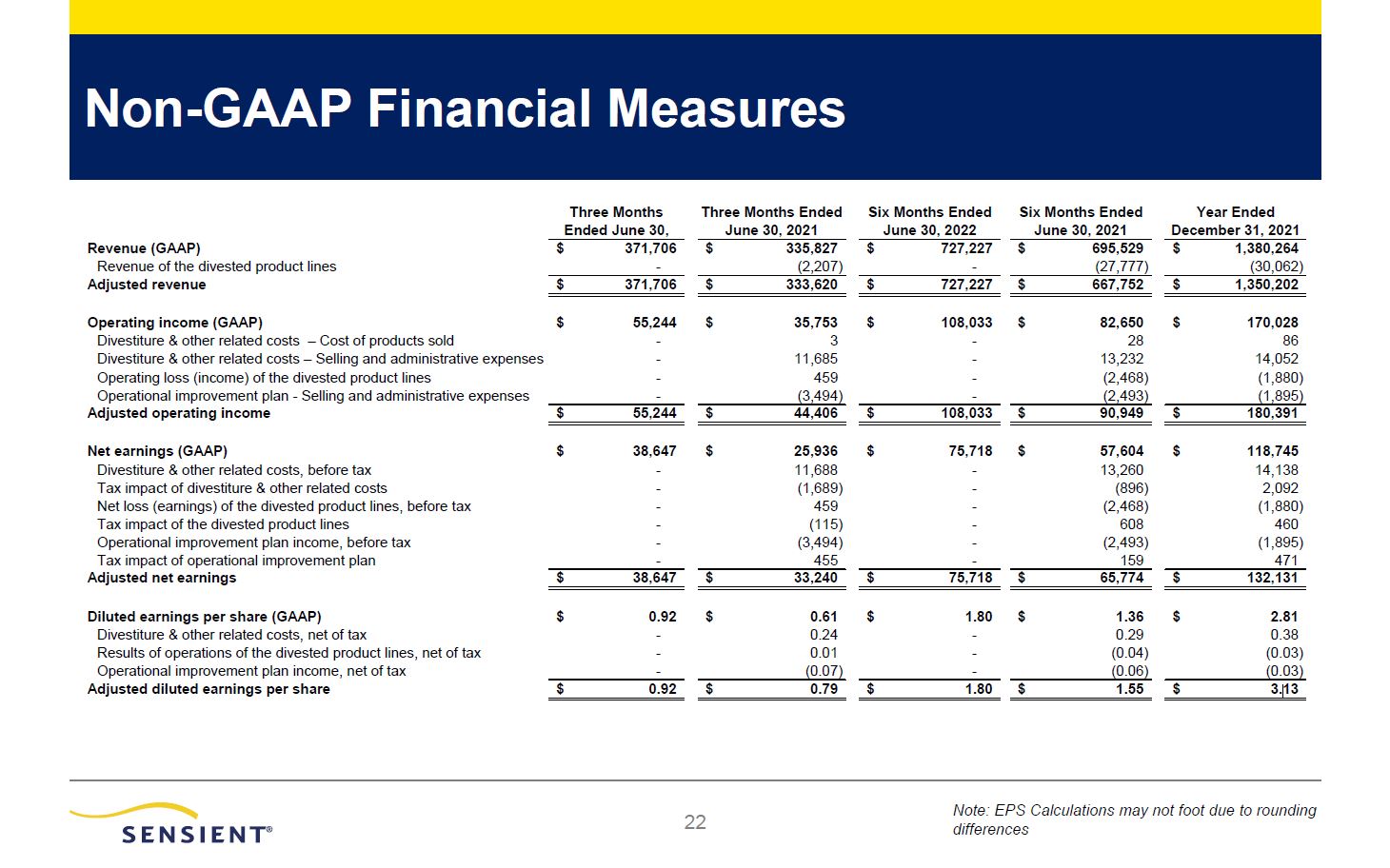

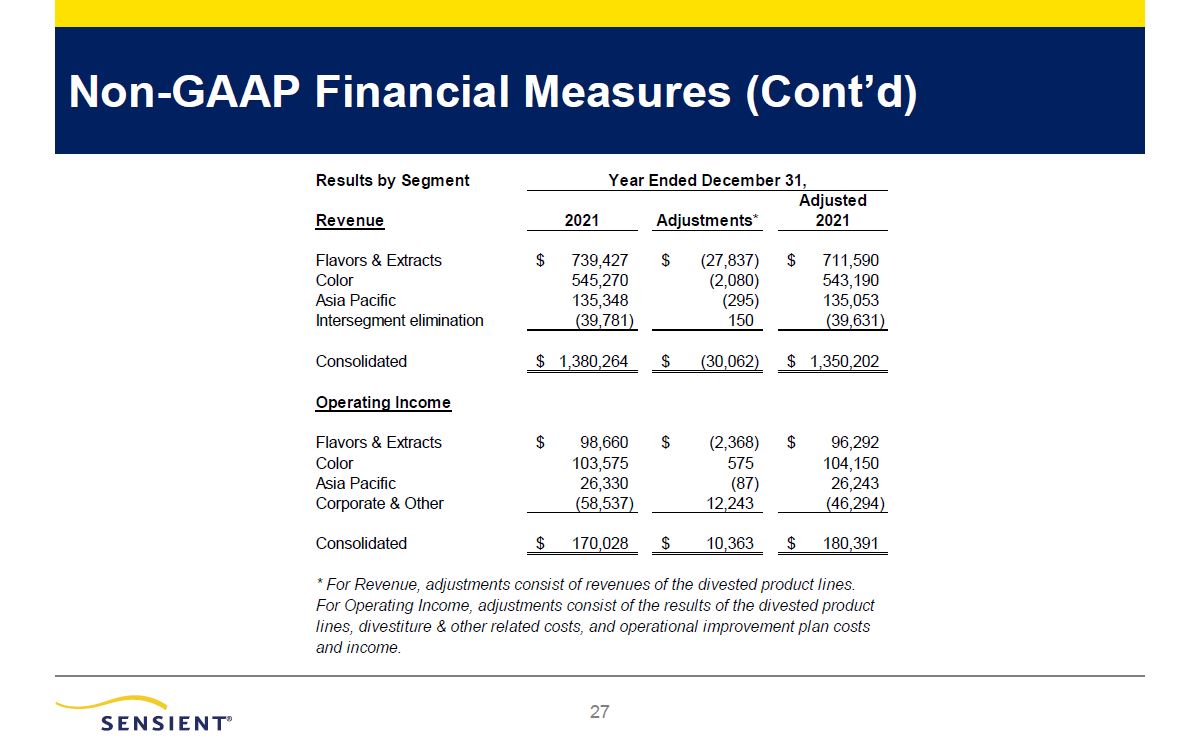

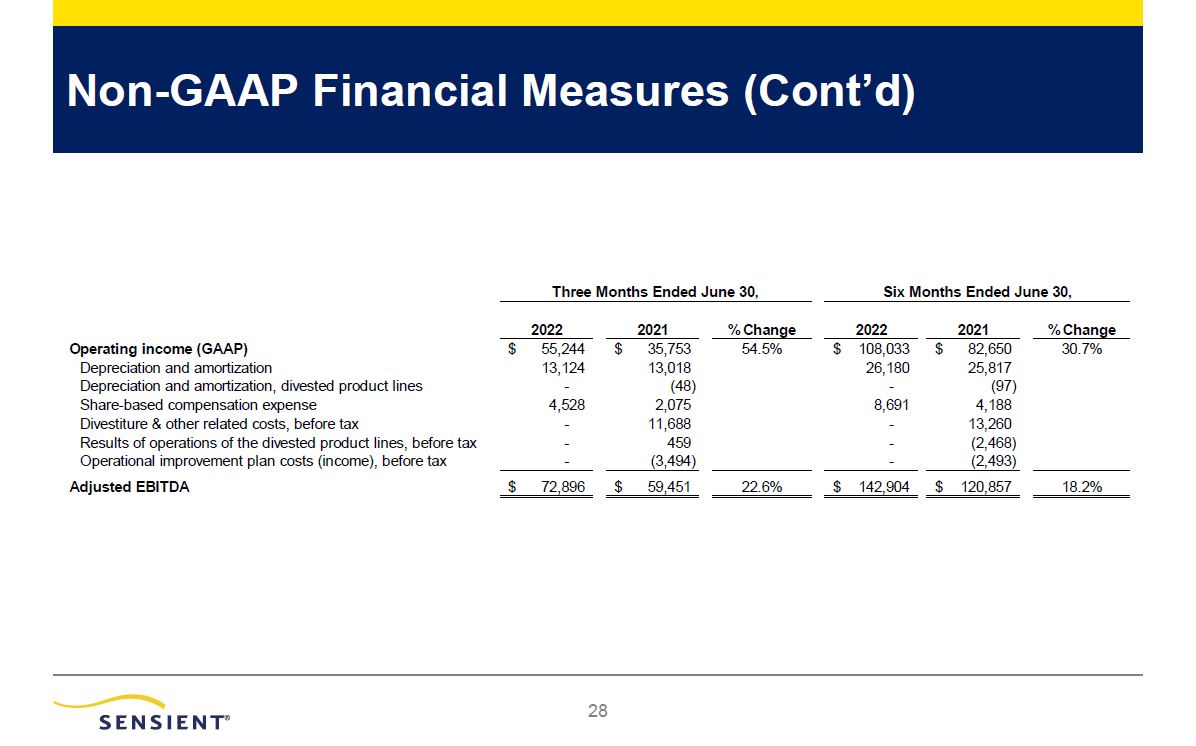

22 Non-GAAP Financial Measures Note: EPS Calculations may not foot due to rounding differences Three Months Ended June 30, Three Months Ended June 30, 2021 Six Months Ended June 30, 2022 Six Months Ended June 30, 2021 Year Ended December 31, 2021 Revenue (GAAP) $ 371,706 $ 335,827 $ 727,227 $ 695,529 $ 1,380,264 Revenue of the divested product lines - (2,207) - (27,777) (30,062) Adjusted revenue $ 371,706 $ 333,620 $ 727,227 $ 667,752 $ 1,350,202 Operating income (GAAP) $ 55,244 $ 35,753 $ 108,033 $ 82,650 $ 170,028 Divestiture & other related costs – Cost of products sold - 3 - 28 86 Divestiture & other related costs – Selling and administrative expenses - 11,685 - 13,232 14,052 Operating loss (income) of the divested product lines - 459 - (2,468) (1,880) Operational improvement plan - Selling and administrative expenses - (3,494) - (2,493) (1,895) Adjusted operating income $ 55,244 $ 44,406 $ 108,033 $ 90,949 $ 180,391 Net earnings (GAAP) $ 38,647 $ 25,936 $ 75,718 $ 57,604 $ 118,745 Divestiture & other related costs, before tax - 11,688 - 13,260 14,138 Tax impact of divestiture & other related costs - (1,689) - (896) 2,092 Net loss (earnings) of the divested product lines, before tax - 459 - (2,468) (1,880) Tax impact of the divested product lines - (115) - 608 460 Operational improvement plan income, before tax - (3,494) - (2,493) (1,895) Tax impact of operational improvement plan - 455 - 159 471 Adjusted net earnings $ 38,647 $ 33,240 $ 75,718 $ 65,774 $ 132,131 Diluted earnings per share (GAAP) $ 0.92 $ 0.61 $ 1.80 $ 1.36 $ 2.81 Divestiture & other related costs, net of tax - 0.24 - 0.29 0.38 Results of operations of the divested product lines, net of tax - 0.01 - (0.04) (0.03) Operational improvement plan income, net of tax - (0.07) - (0.06) (0.03) Adjusted diluted earnings per share $ 0.92 $ 0.79 $ 1.80 $ 1.55 $ 3.13