Exhibit 13.1

SENSIENT TECHNOLOGIES CORPORATION

is a leading global developer, manufacturer and marketer of colors, flavors and fragrances. Sensient uses advanced, proprietary technologies at facilities around the world to develop specialty food and beverage systems, cosmetic and pharmaceutical systems, inkjet and specialty inks and colors and other specialty chemicals.

| | | | |

CORPORATE Milwaukee, Wisconsin, U.S.A. ASIA PACIFIC Singapore Melbourne, Australia Sydney, Australia Mumbai, India Jakarta, Indonesia Auckland, New Zealand Manila, Philippines Bangkok, Thailand | | FLAVORS & FRAGRANCES Indianapolis, Indiana, U.S.A. Amboy, Illinois, U.S.A. Harbor Beach, Michigan, U.S.A. Juneau, Wisconsin, U.S.A. Greenfield, California, U.S.A. Livingston, California, U.S.A.(2) Turlock, California, U.S.A. Delta, British Columbia, Canada Cornwall, Ontario, Canada Mississauga, Ontario, Canada Rexdale, Ontario, Canada, Tara, Ontario, Canada, Celaya, Mexico Mexico City, Mexico (2) São Paulo, Brazil Brussels, Belgium Heverlee, Belgium Marchais, France Strasbourg, France Bremen, Germany Milan, Italy Elburg, Netherlands Naarden, Netherlands Barcelona, Spain Granada, Spain Kristianstad, Sweden Milton Keynes (Bletchley), U.K. Ceredigion (Felinfach), U.K. Beijing, China Guangzhou, China Hong Kong, China Qingdao, China Shanghai, China Hitachi, Japan Osaka, Japan Tokyo, Japan Seoul, Korea | | COLOR St. Louis, Missouri, U.S.A. Escondido, California, U.S.A. South Plainfield, New Jersey, U.S.A.(2) Kingston, Ontario, Canada Lerma, Mexico Tijuana, Mexico Buenos Aires, Argentina São Paulo, Brazil Prague, Czech Republic Paris, France (2) Hamburg, Germany Leipzig, Germany Budapest, Hungary Reggio Emilia, Italy Warsaw, Poland Oradea, Romania Zenta, Serbia Johannesburg, South Africa Lausanne, Switzerland King’s Lynn, U.K. |

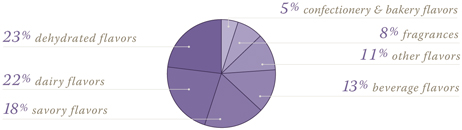

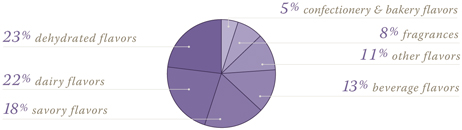

FLAVORS & FRAGRANCES GROUP

Sensient develops, manufactures and distributes flavor and fragrance systems that are found in thousands of consumer products worldwide. The Company’s formulations are essential components of food, beverage, household and personal care products. Sensient’s value-added flavors and fragrances enable our customers to excel in highly competitive markets. The Company’s operations in China and Japan are now part of the Flavors & Fragrances Group.

REVENUE BY PRODUCT LINE

COLOR GROUP

Sensient is a leading developer, manufacturer and marketer of natural and synthetic color systems for businesses around the globe. The Company’s high-performance products play an integral role in the manufacture of food and beverages, cosmetics, pharmaceuticals, inkjet and specialty inks and colors, textiles and paper products.

REVENUE BY PRODUCT LINE

TABLE OF CONTENTS

2 Letter to Shareholders 4 Our Markets 14 Financial Review

48 Board of Directors 48 Officersinside back coverInvestor Information

– 1 –

LETTER TO SHAREHOLDERS

In 2005, Sensient Technologies Corporation took action to reposition the Company for higher sales and more cost-effective operations. Our outlook remains excellent.

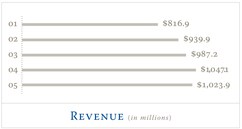

2005 RESULTS

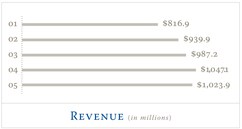

Total 2005 revenue was $1.024 billion. The Company achieved solid revenue growth in flavor and in food and beverage color product lines. Success in several markets was offset by higher raw material and energy costs.

As we contain these costs, we will continue to focus on profit improvement as well as revenue growth. We have identified areas of the business where our cost structure can be significantly reduced, and implemented a cost reduction program. We anticipate that cost reductions will save $10 million in 2006. Our strategy of cost reduction and price increases is aimed at improving earnings.

We are taking other actions to enhance shareholder value, including continuing our share repurchase program. We repurchased 1.1 million shares of Sensient stock in the fourth quarter of 2005. These repurchases represent an excellent investment for the Company and should result in higher returns to our stockholders.

EXPANDING SALES IN FOOD AND BEVERAGE

Sensient’s dedication to innovation in our traditional food and beverage businesses was rewarded in the marketplace in 2005. Sensient’s industry-leading extraction, savory and dehydrated flavor technologies differentiate our products in the marketplace. Traditional flavor sales in North America and Asia increased. Our food and beverage flavor and color revenue in Latin America grew at a healthy pace in 2005. We added new customers in all geographic regions and now provide about 30,000 flavors worldwide.

Color Group profits this year were reduced by lower inkjet ink revenues and higher raw material costs. Nevertheless, profits from food and beverage color product lines were up, reflecting a strong competitive position. The Company develops and markets the widest array of synthetic and natural food color systems available in the world. Our color chemists serve as important product development partners for both established and new customers. Sensient’s country-specific knowledge and technical expertise are providing opportunities in the emerging markets of Central Europe, China and Latin America.

Sensient continues to benefit from product breadth. Gains are expected from our 156 new product introductions in 2006. We provide efficiency and dependability as a unified Company operating under the well-respected and recognized Sensient brand.

GLOBAL PRODUCTS FOR GLOBAL MARKETS

In our industry, Sensient provides a unique combination of regional expertise and global range. We

– 2 –

KENNETH P. MANNING

Chairman, President

and Chief Executive Officer

operate from 70 facilities in 30 countries. More than half of our 2005 revenue came from sales outside the U.S.

Sensient’s local knowledge enables us to develop customized products for regional tastes. At the same time, the Company develops high-margin products that enjoy a growing international market. High-performance cosmetics formulations developed primarily at European and U.S. facilities can be found in consumer products in Latin America, China and Australia.

We are also marketing our lines of pharmaceutical colors and coatings all around the globe. Pharmaceuticals play an increasingly important role in health care, and Sensient’s business is expected to grow as a result. China recently updated its national standards for pharmaceutical manufacturing, and Sensient is well positioned to benefit in this market. In addition, we will seek to extend our business in colors for printing on pharmaceuticals.

Cultural, technological and economic changes are creating new global opportunities for Sensient’s industrial colors, inkjet inks and specialty inks. Digital photography continues to replace traditional photography on a global scale, and Sensient provides inks for home and professional photographic printing. We also develop technical colors for a wide range of commercial and industrial applications. Sensient’s technical sophistication enables us to meet the growing demand for printing products that address environmental concerns.

OPPORTUNITIES ON THE HORIZON

The strength of Sensient’s operations is the result of substantial changes that we made in the direction of the Company, beginning about 10 years ago. We divested under-performing domestic operations and expanded into faster-growing, value-added lines of business. I believe that the Company survives today because we had the foresight to exit businesses that offered little, if any, opportunity for growth. Our international presence is also a hallmark of our transformation.

We plan to continue to grow the Company by maximizing our present strengths, including the production capacity of our state-of- the-art facilities.

I expect many opportunities for Sensient on the horizon. I look forward to a great future and continuing success for the Company.

|

| Sincerely, |

|

|

KENNETH P. MANNING |

Chairman, President and Chief Executive Officer |

– 3 –

Right now in

NORTH AMERICA

For the North American market, Sensient develops customized technologies preferred by manufacturers of food, beverages, cosmetics, pharmaceuticals and household products and other technology companies. We continue to expand our flavor and color offerings with unique formulations for foods and beverages and specialty chemical applications.

– 4 –

| | |

| | The Company’s colors for inkjet inks are found in both consumer and professional digital photo printers manufactured by some of the best-known technology companies. Our inkjet and specialty inks also play an important role in printing on textiles, paper and food products. |

– 5 –

Right now in

WESTERN EUROPE

Sensient’s colors and ingredients for cosmetics supply leading European manufacturers of high-performance beauty products. The Company’s formulations are found in lipstick, foundation, blush and moisturizers sold throughout the continent. The high-margin global cosmetics business continues to offer significant growth opportunities. Sensient also provides color and flavor systems and specialty chemicals to food, beverage and technology companies in Europe.

– 6 –

| | |

| | At facilities in Western Europe, Sensient’s flavor and color scientists are finding new ways to use natural and synthetic ingredients to formulate innovative products. Our colors and flavors are enabling leading food and beverage manufacturers to enhance their product lines and improve quality. |

– 7 –

Right now in

CENTRAL EUROPE

In Central Europe, Sensient is benefiting from fast-growing markets in new member countries of the European Union. As local manufacturers in Hungary, the Czech Republic, Romania and Poland pursue new ventures, Sensient is supplying them with a wide range of sophisticated products, including confectionery color and flavor systems. We are also drawing on a highly educated local workforce to lead innovation in our Central European facilities.

– 8 –

| | |

| | Urban consumers in Central Europe are increasingly purchasing manufactured foods, from ice cream to sauces to spice mixes. Sensient’s market-leading natural color and savory flavor technologies are finding favor among local manufacturers and food service companies. |

– 9 –

Right now in

LATIN AMERICA

Sensient’s color and flavor systems, including chiral tropical flavors, are helping Latin American beverage manufacturers provide a wide variety of high-quality products to local markets. Traditionally, many beverages were made with local, fresh ingredients, and today people in Latin America seek similar taste and quality from manufactured beverages. Sensient’s expertise in beverage formulation is helping win new business throughout the region, from Chile to Brazil to Mexico.

– 10 –

| | |

| | Food processors in Latin America are increasingly turning to Sensient to help them stand out in highly competitive markets. Our value-added color and flavor systems are found in ice cream, meat products, canned foods and seasonings manufactured throughout the region. |

– 11 –

Right now in

ASIA PACIFIC

Sensient is positioned to benefit from cultural change and economic growth in China and the Asia Pacific region. Larger incomes are enabling people in China’s metropolitan centers to purchase high-quality processed foods, including savory soup base made with Sensient dehydrated flavor systems. At facilities in Guangzhou, we offer product development, testing and manufacturing for a variety of goods that appeal to the traditional and emerging tastes of Chinese consumers.

– 12 –

| | |

| | From colorful dish soaps to delicately flavored teas, Sensient is bringing our global expertise in color purification and flavor extraction to consumer products in China. In the coming years, we expect to increase sales further in China and throughout the Asia Pacific region. |

– 13 –

FINANCIAL REVIEW

TABLE OF CONTENTS

| | |

15 | | MANAGEMENT’S DISCUSSION & ANALYSISOF OPERATIONS & FINANCIAL CONDITION |

25 | | CONSOLIDATED STATEMENTSOF EARNINGS |

26 | | CONSOLIDATED BALANCE SHEETS |

27 | | CONSOLIDATED STATEMENTSOF CASH FLOWS |

28 | | CONSOLIDATED STATEMENTSOF SHAREHOLDERS’ EQUITY |

30 | | NOTESTO CONSOLIDATED FINANCIAL STATEMENTS |

43 | | MANAGEMENT’S REPORTON INTERNAL CONTROL OVER FINANCIAL REPORTING |

43 | | REPORTOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

44 | | REPORTOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMON INTERNAL CONTROL OVER FINANCIAL REPORTING |

45 | | CHANGEININDEPENDENTREGISTEREDPUBLICACCOUNTINGFIRM |

45 | | QUARTERLY DATA |

45 | | COMMON STOCK PRICESAND DIVIDENDS |

46 | | FIVE YEAR REVIEW |

FINANCIAL HIGHLIGHTS

in thousands except per share, employee and shareholder data

| | | | | | | | | |

Years ended December 31, | | 2005 | | 2004 | | % CHANGE | |

RESULTS OF OPERATIONS | | | | | | | | | |

Revenue | | $ | 1,023,930 | | $ | 1,047,133 | | (2.2 | ) |

Operating Income* | | | 94,214 | | | 129,156 | | (27.1 | ) |

Net Earnings* | | | 44,195 | | | 73,918 | | (40.2 | ) |

| | | | | | | | | |

PER COMMON SHARE | | | | | | | | | |

Net Earnings:* | | | | | | | | | |

Basic | | $ | 0.95 | | $ | 1.59 | | (40.3 | ) |

Diluted | | | 0.94 | | | 1.58 | | (40.5 | ) |

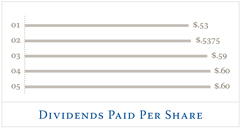

Dividends | | | 0.60 | | | 0.60 | | — | |

Book Value | | | 13.43 | | | 13.99 | | (4.0 | ) |

| | | | | | | | | |

OTHER INFORMATION | | | | | | | | | |

Capital Expenditures | | $ | 36,102 | | $ | 49,845 | | (27.6 | ) |

Depreciation and Amortization | | $ | 46,769 | | $ | 46,243 | | 1.1 | |

Total Debt | | $ | 553,682 | | $ | 615,196 | | (10.0 | ) |

Number of Employees | | | 3,518 | | | 3,728 | | (5.6 | ) |

Number of Shareholders of Record | | | 3,708 | | | 3,954 | | (6.2 | ) |

Average Common Shares Outstanding – Basic | | | 46,746 | | | 46,562 | | 0.4 | |

Average Common Shares Outstanding – Diluted | | | 47,067 | | | 46,877 | | 0.4 | |

| * | The 2005 results include restructuring and other charges of $12.8 million ($9.8 million after tax, or $0.21 per share) related to a cost reduction program and an impairment charge (see Note 11). |

– 14 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

Overview

During 2005, Sensient Technologies Corporation (the “Company”) was adversely affected by increases in raw material and energy costs. In response to these rising costs, the Company initiated a cost reduction program to improve profitability. The restructuring costs associated with the cost reduction program were recorded in the fourth quarter of 2005 and are discussed below. In addition, the Company’s Flavors & Fragrances Group began to recognize benefits from price increases late in 2005. It is expected that these increases and additional increases planned for 2006 will offset the impact of the Group’s higher costs during 2006. Sensient strengthened its competitive position in 2005 and was able to grow its share in certain markets such as food and beverage colors. As a result of the actions taken in 2005, management believes that the Company is positioned to deliver earnings growth in 2006.

The Company recorded restructuring and other charges of $12.8 million ($9.8 million after tax, or $0.21 per share) in the fourth quarter of 2005 related to the previously disclosed cost reduction program. The charges included an impairment charge to write-down the value of a minority investment as a result of a change in plans for that business by its majority shareholder. The cost reduction program also addresses the need to close facilities and reduce head-count in response to lower inkjet ink volumes following the termination of a significant supply agreement discussed below. The program resulted in the closure of two excess manufacturing facilities, a total reduction in global head-count of approximately 140 employees across all segments and the elimination of three product lines. The charges were recorded in cost of products sold ($4.3 million) and in restructuring and other charges ($8.5 million) and are included in the Corporate and Other segment. Savings of approximately $10 million are anticipated in 2006 as a result of this plan.

Revenue for 2005 was $1,023.9 million compared to $1,047.1 million in 2004. The primary reason for the decrease is due to the previously disclosed winding-up of a supply agreement with an original equipment manufacturer at the end of 2004. During 2004, this customer represented approximately $47.5 million of revenue (see Segment Information on Color for additional information).

Sensient’s operating income was $94.2 million in 2005 versus $129.2 million in 2004. The primary factors for the lower operating income in 2005 include the winding-up of the supply agreement in 2004, which contributed approximately $10.3 million of operating income, the 2005 restructuring and other charges ($12.8 million) and the impact of an arbitration order ($4.5 million). Operating income in 2004 also included the benefits of $6.8 million related to the reduction of purchase accounting reserves. Additional information on these items is included above and in Results of Operations. Net earnings in 2005 were $44.2 million versus $73.9 million in 2004. Diluted earnings per share were $0.94, compared to $1.58 per share in 2004.

Results of Operations

2005 vs. 2004

Revenue for 2005 was $1,023.9 million compared to $1,047.1 million in 2004, a decrease of $23.2 million, or 2.2%. Revenue for the Flavors & Fragrances Group in 2005 was $670.6 million, an increase of $22.3 million, or 3.4%, over 2004. Color Group revenue decreased $43.9 million, or 11.4%, from 2004, to $339.9 million for 2005. The Asia Pacific Group increased revenue by 4.3%. Consolidated revenue decreased primarily as a result of decreases in sales of technical colors ($48.6 million) discussed below partially offset by an increase from the impact of favorable exchange rates ($8.1 million) and the increase in sales for Flavors & Fragrances. Additional information on Group results can be found in the Segment Information section.

The Company’s 2005 gross margin decreased 120 basis points to 28.6% from 29.8% in 2004. Approximately 90 basis points of the margin decrease was due to the impact of higher raw material costs in both the Flavors & Fragrances and Color Groups. Approximately 40 basis

– 15 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

points of the decrease related to higher energy costs in the Flavors & Fragrances Group. The $4.3 million portion of the 2005 restructuring charge reported in cost of products sold reduced margins by 40 basis points. Favorable product mix and pricing in the Flavors & Fragrances Group were the primary factors that partially offset these declines.

Selling and administrative expenses as a percent of revenue in 2005 were 18.6% versus 17.5% in 2004. The increase in percentage was a result of an expense recorded in the first quarter of 2005 related to an arbitration order in the matter of Kraft Foods North America, Inc. v. Sensient Colors Inc. ($4.5 million) and the benefits recorded in 2004 from the reduction of purchase accounting reserves ($6.8 million) as a result of lower than expected shut-down costs associated with the closure of two facilities (see Segment Information on Color for additional information).

Operating income in 2005 was $94.2 million compared to $129.2 million in 2004. The 2005 restructuring and other charges discussed above had the net effect of decreasing 2005 operating income by $12.8 million. Favorable exchange rates increased operating income by $2.1 million in 2005 compared to 2004.

Interest expense increased to $35.7 million in 2005 from $31.3 million in 2004. The increase was the result of higher interest rates partially offset by a reduction in average outstanding debt.

The effective income tax rate was 24.4% and 24.5% in 2005 and 2004, respectively. The effective tax rates for both 2005 and 2004 were reduced by discrete items primarily including the favorable resolution of prior years’ tax matters and the reduction of the valuation allowance related to the planned use of foreign tax losses. The 2005 reported rate was increased because certain costs incurred as part of the 2005 restructuring program are not expected to generate a tax benefit. These net discrete items reduced the effective tax rate for 2005 and 2004 by 5.3% and 4.2%, respectively.

| | | | | | |

| | | 2005 | | | 2004 | |

Rate excluding discrete items | | 29.7 | % | | 28.7 | % |

Discrete items | | (6.7 | %) | | (4.2 | %) |

Restructuring and other charges | | 1.4 | % | | — | |

| | | | | | |

Reported effective tax rate | | 24.4 | % | | 24.5 | % |

| | | | | | |

The effective tax rate for 2006 is expected to be approximately 31% prior to the recording of any discrete items.

Segment Information

The Company determines its operating segments based on information utilized by senior management to allocate resources and assess performance. The Company’s reportable segments consist of the Flavors & Fragrances Group and the Color Group. The Asia Pacific Group, which is reported in the Corporate and Other segment, was realigned during the third quarter of 2005. As a result, the Company’s operations in Japan and China, previously included within the Asia Pacific Group, are now reported as part of the Flavors & Fragrances Group. In addition, the sales of dehydrated flavor products within the Asia Pacific region are now included in the Flavors & Fragrances segment. These changes in reporting segments have been reflected in the results for 2005 and other years presented.

FLAVORS & FRAGRANCES Revenue for the Flavors & Fragrances segment in 2005 increased 3.4%, to $670.6 million, over 2004. The increase in revenue is primarily due to higher sales of traditional flavors in North America ($7.0 million) and Latin America ($2.9 million) and higher dehydrated flavors sales ($6.2 million) combined with the favorable impact of exchange rates ($5.7 million).

Gross margin was 24.8% in 2005, a 190 basis point decrease from the 26.7% gross margin in 2004. This change was

– 16 –

Sensient Technologies Corporation2005Annual Report

primarily related to higher raw material, energy and other manufacturing costs in all businesses. Selling prices began to increase late in 2005 and are expected to offset the effect of higher costs in 2006.

Operating income for 2005 was $82.5 million compared to $84.8 million last year. The operating income decrease of $2.3 million was due to lower profit in traditional flavors ($ 3.8 million) and fragrances ($0.8 million) partially offset by improved profit in dehydrated flavors ($0.6 million) and the favorable impact of exchange rates ($1.7 million). The prior year comparison of operating income for the Group is impacted by a $3.0 million write-off of a receivable in the traditional flavor business that occurred in 2004. The decrease in profits from traditional flavors is primarily due to higher raw material, transportation and energy costs. The impact of these factors more than offset the benefit of price increases. The decrease in profit for fragrances was primarily due to higher raw material costs. Operating profit for the dehydrated flavors business improved as price increases more than offset the impact of higher raw material and energy costs. Operating income as a percent of revenue was 12.3%, a decrease of 80 basis points from last year. This change was primarily a result of the reasons provided above.

COLOR The Color segment reported revenue of $339.9 million in 2005, a decrease of $43.9 million, or 11.4%, from 2004. The decrease in revenue was primarily as a result of reduced sales of technical colors ($48.6 million) partially offset by increased food and beverage color sales ($4.1 million) in North America, Latin America and Europe and the favorable impact of exchange rates ($2.0 million). The decrease in sales of technical colors is primarily attributed to the previously disclosed winding-up of a supply agreement with an original equipment manufacturer at the end of 2004 ($47.5 million).

Gross margin for the Color segment was 34.7% in 2005, an increase of 150 basis points from the 33.2% gross margin in 2004. The margin increase was due to improved product mix in part because the sales under the terminated supply agreement mentioned above were at a lower margin than the average margin for the Color segment. Benefits from the restructuring of synthetic dye production which occurred in 2003 and 2004 had a positive impact on margins but were offset by unfavorable raw material costs.

Operating income for 2005 was $54.2 million versus $68.0 million for 2004. Results in 2004 included approximately $10.3 million related to the above-mentioned supply agreement, which ended in December 2004. Results for 2004 also included benefits of $6.8 million related to the reduction of purchase accounting reserves. The reduction of purchase accounting reserves in 2004 was due to lower than expected environmental costs, shutdown costs and inventory-related costs associated with the closure of two manufacturing sites. The unfavorable impact of these two items was partially offset by improved profits from higher sales of food and beverage colors ($6.5 million) and the favorable impact of exchange rates ($0.5 million). Operating income as a percent of revenue was 15.9%, a decrease of 180 basis points from last year. This change was primarily a result of the reasons provided above.

2004 vs. 2003

Revenue for 2004 was $1,047.1 million, an increase of $59.9 million, or 6.1%, over 2003. Revenue for the Flavors & Fragrances Group increased by $38.8 million, or 6.4%, over 2003, to $648.3 million for 2004. The Color Group increased revenue by $23.1 million, or 6.4%, over 2003, to

– 17 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

$383.8 million for 2004. The Asia Pacific Group revenue increased 1.7%. The increase in consolidated revenue was primarily as a result of the favorable impact of exchange rates ($33.0 million), an acquisition ($3.4 million) and increases in sales of flavors in North America and Latin America ($9.9 million) as well as higher sales of technical colors ($7.1 million). Additional information on Group results can be found in the Segment Information section.

The Company’s gross margin decreased 160 basis points to 29.8% in 2004, versus 31.4% in 2003. Approximately one-half of the margin decrease was due to lower pricing in the dehydrated flavors business and in technical colors. The decrease in selling prices was a result of increased competitive activity. The remainder of the decrease primarily related to lower production costs in 2003 from the buildup of inventory in anticipation of manufacturing consolidations at the Company, which were completed in the first half of 2004.

Selling and administrative expenses as a percent of revenue increased to 17.5% in 2004, versus 16.8% in 2003. The increase in percentage was the result of a postretirement credit recorded in 2003 of $13.3 million, partially offset by savings in 2004 from the cost reduction programs initiated in 2003 and 2004. The postretirement credit recorded in 2003 was the result of the Company’s decision to end its subsidy of retiree health care coverage.

Operating income in 2004 was $129.2 million compared to $137.5 million in 2003. Favorable exchange rates increased operating income by $3.5 million compared to 2003. A separately stated charge of $6.5 million recorded in 2003 and the postretirement credit discussed above had the effect of increasing 2003 operating income by a net amount of $6.8 million.

Interest expense increased to $31.3 million in 2004 from $29.1 million in 2003. The increase was primarily the result of higher interest rates.

The effective income tax rate was 24.5% and 24.8% in 2004 and 2003, respectively. The effective tax rates for both 2004 and 2003 were reduced as a result of discrete items, including favorable resolution of certain prior years’ tax matters and the reduction of the valuation allowance related to the planned use of foreign tax losses. These discrete items reduced the effective tax rate for 2004 and 2003 by 4.2% and 6.2%, respectively.

| | | | | | |

| | | 2004 | | | 2003 | |

Rate excluding discrete items | | 28.7 | % | | 31.0 | % |

Discrete items | | (4.2 | %) | | (6.2 | %) |

Reported effective tax rate | | 24.5 | % | | 24.8 | % |

Segment Information

Results for 2004 and 2003 have been restated to reflect the changes in segments noted previously.

FLAVORS & FRAGRANCES For the year ended December 31, 2004, revenue for the Flavors & Fragrances segment increased 6.4%, to $648.3 million. The increase of $38.8 million was primarily as a result of the favorable impact of exchange rates ($21.4 million), higher sales of traditional flavors in North America and Latin America ($ 9.9 million) and higher fragrance sales due to the expansion in the aroma chemical product line ($2.3 million).

Gross margin was 26.7% in 2004, a 50 basis point decrease from the 27.2% gross margin in 2003. This change was primarily a result of more competitive pricing in the dehydrated flavors business.

Operating income for 2004 was $84.8 million compared to $86.7 million in 2003. The decrease in operating income was primarily attributable to two events. In the fourth quarter of 2004, operating income was reduced by the write-off of a $3.0 million receivable related to a previously divested product line. The $2.9 million postretirement

– 18 –

Sensient Technologies Corporation2005Annual Report

credit recorded in the fourth quarter of 2003 also unfavorably impacted comparability. In addition to these items, operating income was impacted by favorable product mix and increased sales of traditional flavors in North America ($ 8.6 million) and the favorable impact of exchange rates ($1.3 million), partially offset by lower profits in the dehydrated flavors business due to lower pricing ($3.7 million), and lower profits in fragrances due to lower pricing and higher costs of production ($3.1 million). Operating income as a percent of revenue was 13.1%, a decrease of 110 basis points from 2003. This change was primarily a result of the reasons provided above.

COLOR For the year ended December 31, 2004, revenue for the Color segment increased 6.4% to $383.8 million. The increase in revenue was primarily due to the favorable impact of exchange rates ($11.9 million) and an acquisition ($3.4 million) combined with revenue increases in technical colors ($7.1 million), cosmetic colors ($4.8 million) and pharmaceuticals ($1.0 million). These revenue increases were partially offset by lower volumes and prices in food and beverage colors ($5.2 million). Cosmetic colors and pharmaceuticals each showed double-digit growth. Within technical colors, revenue related to inkjet ink products increased in advance of the wind-up of a supply agreement by a major customer. The customer decided to consolidate inkjet ink purchases with other suppliers, but increased purchases in advance of the changeover. During 2004, this customer represented 12% or approximately $47.5 million and 15% or approximately $10.3 million of Sensient’s Color Group total revenue and operating income, respectively. The increase in sales to this customer was offset by lower sales of technical colors due to competitive pressures reducing pricing and volume.

Gross margin was 33.2% in 2004, a 340 basis point decrease from Color’s 36.6% gross margin in 2003. Approximately one-half of this change was a result of more competitive pricing in synthetic colors and in technical colors. The remainder of the decrease was related primarily to lower production costs in 2003 from the buildup of inventory in anticipation of manufacturing consolidations at the Company, which were completed in the first half of 2004.

Operating income for 2004 was $68.0 million versus $71.6 million for 2003. The $3.6 million decrease in operating income was the result of several factors. These factors include the $1.1 million post-retirement credit recorded in 2003, declines in the food and beverage colors business in North America and Europe ($7.2 million and $2.7 million, respectively) and lower margins from the paper/industrial colors business ($3.6 million). These lower margins were attributable to pricing declines and a change in product mix to lower-margin products. These items were partially offset by continued growth in the cosmetic color business ($1.2 million), the reduction of purchase accounting reserves ($6.8 million) and the favorable impact of exchange rates ($2.0 million) and acquisitions ($0.8 million). The reduction of purchase accounting reserves was related to lower than expected environmental costs, shutdown costs and inventory-related costs associated with the closure of two manufacturing sites. Operating income as a percent of revenue was 17.7%, a decrease of 220 basis points from 2003. This change was primarily a result of the reasons provided above.

– 19 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

Liquidity and Financial Position

The Company’s financial position remains strong, enabling it to meet cash requirements for operations, capital expansion programs and dividend payments to shareholders. The Company intends to fund working capital requirements, principal and interest payments, acquisitions (if any) and other liabilities with cash provided by operations, to the extent available, and short-term and long-term borrowings under new and existing credit facilities. The Company intends to finance current maturities of long-term debt of $207.3 million by using existing bank facilities and by utilizing new sources of financing with banks and other financial institutions.

In the Consolidated Statements of Cash Flows, the changes in operating assets and liabilities are presented excluding the effects of changes in foreign currency exchange rates, as these do not reflect actual cash flows. Accordingly, the amounts in the Consolidated Statements of Cash Flows do not agree with changes in the operating assets and liabilities that are presented in the Consolidated Balance Sheets.

The Company’s ratio of debt to total capital improved to 47.1% at December 31, 2005, compared to 48.3% and 53.0% at December 31, 2004 and 2003, respectively. The improvement resulted primarily from a reduction in debt. Debt was reduced $61.5 million since December 31, 2004, and over $100 million since December 31, 2003. The reduction of debt resulted from strong net cash provided by operating activities.

Net cash provided by operating activities was $110.3 million in 2005, $125.7 million in 2004 and $56.5 million in 2003. Operating cash flow provided the primary source of funds to finance operating needs, capital expenditures, share repurchases and shareholder dividends, and to reduce net borrowings. The decrease in net cash provided by operating activities in 2005 was primarily due to lower net earnings.

Net cash used in investing activities was $34.0 million in 2005, $44.8 million in 2004 and $85.2 million in 2003. Cash proceeds from the sale of assets were $1.1 million in 2005, $2.0 million in 2004 and $8.2 million in 2003. Capital expenditures were $36.1 million in 2005, $49.8 million in 2004 and $74.2 million in 2003. Capital expenditures decreased in 2005 and 2004 primarily due to the completion of several large facility improvements and the integration of certain acquired companies. Net cash used in investing activities in 2003 also included $19.3 million for the acquisitions of a manufacturer and marketer of specialty inks in Spain and a Japanese flavor producer.

Net cash used in financing activities was $71.2 million in 2005 and $83.5 million in 2004, compared to net cash provided of $28.4 million in 2003. The Company had net reductions in debt of $28.5 million in 2005 and $59.7 million in 2004, versus net borrowings of $69.7 million in 2003. In 2005 and 2004, the Company’s net cash provided by operating activities was more than adequate to finance capital expenditures, share repurchases and dividend payments.

On August 18, 2005, the Company amended its unsecured revolving credit facility which increased the available credit to $225 million from $150 million and extended the term to August 2010. At December 31, 2005, the Company had outstanding commercial paper backed by the revolving credit facility of $50.9 million and no direct borrowings under the facility. The Company has available credit facilities with domestic and foreign banks for various purposes. The amount of unused credit facilities at December 31, 2005, was $217.3 million. Additional information on the amended facility and the Company’s borrowings and available credit is included in Note 4 to the Consolidated Financial Statements. The Company maintains debt levels it considers prudent based on its cash flows, interest coverage and percentage of total debt to total capital.

– 20 –

Sensient Technologies Corporation2005Annual Report

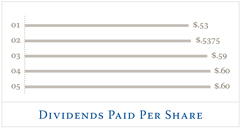

The Company has paid uninterrupted quarterly cash dividends since commencing public trading in its stock in 1962. In 2005 and 2004, dividends paid per share were $0.60 each year, or $28.3 million and $28.1 million, respectively.

With the exception of the increase in energy and raw material costs discussed above, the impact of inflation on both the Company’s financial position and its results of operations has been minimal and is not expected to adversely affect 2006 results.

Issuer Purchases of Equity Securities

During 2005, the Company repurchased 1.1 million shares of Company stock at a total cost of $18.9 million. The Company did not repurchase any shares of Company stock during 2004. During 2003, the Company repurchased 0.9 million shares at a cost of $17.9 million. On April 27, 2001, the Board approved a share repurchase program under which the Company is authorized to repurchase up to 5.0 million shares of Company stock in addition to amounts remaining from prior Board authorizations. As of December 31, 2005, 3.2 million shares were authorized to be repurchased. The Company’s share repurchase program has no expiration date.

Critical Accounting Policies

In preparing the financial statements in accordance with accounting principles generally accepted in the U.S., management is required to make estimates and assumptions that have an impact on the assets, liabilities, revenue and expense amounts reported. These estimates can also affect supplemental information disclosures of the Company, including information about contingencies, risk and financial condition. The Company believes, given current facts and circumstances, that its estimates and assumptions are reasonable, adhere to accounting principles generally accepted in the U.S. and are consistently applied. Inherent in the nature of an estimate or assumption is the fact that actual results may differ from estimates and estimates may vary as new facts and circumstances arise. The Company makes routine estimates and judgments in determining the net realizable value of accounts receivable, inventories, property, plant and equipment, and prepaid expenses. Management believes the Company’s most critical accounting estimates and assumptions are in the following areas:

REVENUE RECOGNITION The Company recognizes revenue, net of estimated discounts, allowances and returns, upon shipment of goods to customers, at which time title passes, the customer is obligated to pay the Company, and the Company has no remaining obligations.

GOODWILL VALUATION The Company reviews the carrying value of goodwill annually utilizing several valuation methodologies, including a discounted cash flow model. Changes in estimates of future cash flows caused by items such as unforeseen events or changes in market conditions could negatively affect the reporting segment’s fair value and result in an impairment charge. However, the current fair values of the reporting segments are significantly in excess of carrying values. The Company estimates that a 100 basis point increase in its weighted average cost of capital would not result in impairment. Accordingly, management believes that only significant changes in its cash flow assumptions would result in impairment.

INCOME TAXESThe Company estimates its income tax expense in each of the taxing jurisdictions in which it operates. The Company is subject to a tax audit in each of these jurisdictions, which could result in changes to the estimated tax expense. The amount of these changes would vary by jurisdiction and would be recorded when known. These changes could impact the Company’s financial statements. Management has recorded valuation allowances to reduce its deferred tax assets to the amount that is more likely than not to be realized. In doing so, management has considered future taxable income and ongoing tax planning strategies in assessing the need for the valuation allowance. An adjustment to the recorded valuation allowance as a result of changes in facts or circumstances could result in a significant change in the Company’s tax expense.

– 21 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

COMMITMENTSAND CONTINGENCIES The Company is subject to litigation and other legal proceedings arising in the ordinary course of its businesses or arising under provisions related to the protection of the environment. Estimating liabilities and costs associated with these matters requires the judgment of management, which relies in part on information from Company counsel. When it is probable that the Company has incurred a liability associated with claims or pending or threatened litigation matters and the Company’s exposure is reasonably estimable, the Company records a charge against earnings. The estimate of any exposure to the Company may change as further facts and circumstances become known.

Market Risk Factors

The Company is exposed to market risks, including changes in interest rates, currency exchange rates and commodity prices. To manage the volatility relating to these exposures on a consolidated basis, the Company nets the exposures to take advantage of natural offsets. The Company also enters into various derivative transactions for some of the remaining exposures pursuant to the Company’s policies covering hedging practices. The financial impacts of these hedging instruments are offset by corresponding changes in the underlying exposures being hedged.

The Company does not hold or issue derivative financial instruments for trading purposes. Note 1 and Note 5 to the Consolidated Financial Statements include a discussion of the Company’s accounting policies for financial instruments.

A key part of the Company’s strategy is to expand into new geographic markets. Because the Company manufactures and sells its products throughout the world, it is exposed to movements in foreign currency exchange rates. The major foreign currency exposures involve the markets in Western Europe, Mexico and Canada. The primary purpose of the Company’s foreign currency hedging activities is to protect against the volatility associated with foreign currency sales, purchases of materials and other assets and liabilities created during the normal course of business. The Company utilizes foreign exchange contracts with durations of generally less than 12 months that qualify as cash flow hedges under Statement of Financial Accounting Standards (“SFAS”) No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended. At December 31, 2005 and 2004, the fair values of these instruments, based on dealer quotes, were an asset of $0.1 million and a liability of $0.7 million, respectively. At December 31, 2005 and 2004, the potential gain or loss in the fair value of the Company’s outstanding foreign exchange contracts, assuming a hypothetical 10% fluctuation in the currencies of such contracts, would be approximately $2.2 million and $4.7 million, respectively. However, any change in the value of the contracts, real or hypothetical, would be significantly offset by an equivalent change in the value of the underlying hedged items. In addition, this hypothetical calculation assumes that each exchange rate would change in the same direction relative to the U.S. dollar.

The Company has certain long-term debt denominated in Swiss Francs, Euros and British Pounds. These non-derivative debt instruments have been designated as partial hedges of the Company’s Swiss Franc, Euro and British Pound net asset positions. The potential increase or decrease in the annual U.S. dollar interest expense of the Company’s outstanding foreign currency-denominated debt, assuming a hypothetical 10% fluctuation in the currencies of such debt, would be approximately $1.0 million and $1.1 million at December 31, 2005 and 2004, respectively. However, any change in interest expense from fluctuations in currency, real or hypothetical, would be offset by an equivalent change in the value of the foreign income before interest. In addition, this hypothetical calculation assumes that each exchange rate would change in the same direction relative to the U.S. dollar.

– 22 –

Sensient Technologies Corporation2005Annual Report

The Company manages its debt structure and interest rate risk through the use of fixed rate and floating rate debt and through the use of derivatives. The Company’s primary exposure is to interest rates in the U.S. and Western Europe. The Company may use interest rate swaps to hedge its exposure to interest rate changes, manage the level of fixed and floating interest exposure and lower its financing costs. During 2003 and 2002, the Company entered into a series of interest rate swap agreements to manage the mix of fixed and floating interest rate debt. In October 2003 and September 2005, the Company settled all of the outstanding swap agreements. At December 31, 2005, there were no outstanding interest rate swaps. At December 31, 2004, the notional principal amounts of outstanding interest rate swap agreements were $177.1 million with varying maturities through 2011. These instruments were accounted for as fair value hedges under SFAS No. 133. The fair value of the swaps at December 31, 2004, based on dealer quotes, was an asset of $2.6 million, which was recorded in the other assets line on the consolidated balance sheets. The potential gain or loss in the fair value of the outstanding interest rate swaps at December 31, 2004, assuming a hypothetical 10% fluctuation in interest rates of such contracts, would be approximately $2.9 million. At December 31, 2005 and 2004, the potential increase or decrease in annual interest expense, assuming a hypothetical 10% fluctuation in interest rates of floating rate debt, including the impact of swap contracts, would be approximately $0.3 million and $0.7 million, respectively.

The Company is the purchaser of certain commodities such as corn, sugar, soybean meal and fruits. The Company generally purchases these commodities based upon market prices that are established with the vendor as part of the purchase process. In general, the Company does not use commodity financial instruments to hedge commodity prices due to a high correlation between the commodity cost and the ultimate selling price of the Company’s products. On occasion, the Company may enter into non-cancelable forward purchase contracts, as deemed appropriate, to reduce the effect of price fluctuations on future manufacturing requirements.

Contractual Obligations

The Company is subject to certain contractual obligations, including long-term debt, operating leases, manufacturing purchases and pension benefit obligations. The following table summarizes the Company’s significant contractual obligations as of December 31, 2005.

Payments due by period

| | | | | | | | | | | | | | | |

(in Thousands) | | TOTAL | | £1 YEAR | | 2-3 YEARS | | 4-5 YEARS | | >5 YEARS |

Long-term debt | | $ | 490,464 | | $ | 207,341 | | $ | 97,225 | | $ | 181,222 | | $ | 4,676 |

Interest payments on long-term debt | | | 61,467 | | | 27,612 | | | 29,134 | | | 4,592 | | | 129 |

Operating lease obligations | | | 26,544 | | | 7,650 | | | 9,168 | | | 4,392 | | | 5,334 |

Manufacturing purchase commitments | | | 56,810 | | | 30,419 | | | 15,055 | | | 11,336 | | | — |

Pension benefit obligations | | | 30,506 | | | 1,590 | | | 8,352 | | | 6,864 | | | 13,700 |

| | | | | | | | | | | | | | | |

Total contractual obligations | | $ | 665,791 | | $ | 274,612 | | $ | 158,934 | | $ | 208,406 | | $ | 23,839 |

| | | | | | | | | | | | | | | |

– 23 –

MANAGEMENT’S DISCUSSION & ANALYSIS OF OPERATIONS & FINANCIAL CONDITION

New Pronouncements

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement No. 123 (revised 2004), “Stock Based Compensation.” The statement will require the Company to expense its stock options and restricted stock over the requisite service period based on the fair value at the date of grant. This statement is effective for the Company on January 1, 2006. The Company will adopt the statement using the modified prospective method. The impact of adoption of the revised statement in 2006 is anticipated to reduce net earnings by approximately $1.3 million to $1.7 million (approximately $0.03 per share). The actual impact on net earnings in 2006 will depend on a number of factors, including the amount of the awards granted and the fair value of those awards at the time of the grant.

Off-Balance Sheet Arrangements

The Company had no off-balance sheet arrangements as of December 31, 2005.

Forward-looking Statements

This document contains forward-looking statements that reflect management’s current assumptions and estimates of future economic circumstances, industry conditions, Company performance and financial results. Forward- looking statements include statements in the future tense, statements referring to any period after December 31, 2005, and statements including the terms “expect,” “believe,” “anticipate” and other similar terms that express expectations as to future events or conditions. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for such forward-looking statements. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that could cause actual events to differ materially from those expressed in those statements. A variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results. These factors and assumptions include the pace and nature of new product introductions by the Company’s customers; results of acquired businesses; the Company’s ability to successfully implement its growth strategies; the outcome of the Company’s various productivity-improvement and cost-reduction efforts; changes in costs of raw materials and energy; industry and economic factors related to the Company’s domestic and international business; competition from other suppliers of color and flavors and fragrances; growth or contraction in markets for products in which the Company competes; terminations and other changes in customer relationships; industry acceptance of price increases; currency exchange rate fluctuations; and the matters discussed above including the critical accounting policies described therein. The Company does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

– 24 –

| | |

| CONSOLIDATED STATEMENTS OF EARNINGS | | Sensient Technologies Corporation2005 Annual Report |

| | | | | | | | | |

(in thousands except per share amounts) Years ended December 31, | | 2005 | | 2004 | | 2003 |

REVENUE | | $ | 1,023,930 | | $ | 1,047,133 | | $ | 987,209 |

Cost of products sold (includes restructuring charges of $4,340 in 2005 – see Note 11) | | | 731,253 | | | 734,596 | | | 677,414 |

Selling and administrative expenses | | | 189,998 | | | 183,381 | | | 165,835 |

Restructuring and other charges (see Note 11) | | | 8,465 | | | — | | | 6,476 |

| | | | | | | | | |

OPERATING INCOME | | | 94,214 | | | 129,156 | | | 137,484 |

Interest expense | | | 35,737 | | | 31,265 | | | 29,140 |

| | | | | | | | | |

EARNINGS BEFORE INCOME TAXES | | | 58,477 | | | 97,891 | | | 108,344 |

Income taxes | | | 14,282 | | | 23,973 | | | 26,912 |

| | | | | | | | | |

NET EARNINGS | | $ | 44,195 | | $ | 73,918 | | $ | 81,432 |

| | | | | | | | | |

Earnings per share | | | | | | | | | |

Basic | | $ | .95 | | $ | 1.59 | | $ | 1.74 |

Diluted | | $ | .94 | | $ | 1.58 | | $ | 1.73 |

Average common shares outstanding – basic | | | 46,746 | | | 46,562 | | | 46,741 |

Average common shares outstanding – diluted | | | 47,067 | | | 46,877 | | | 47,041 |

See notes to consolidated financial statements.

– 25 –

| | |

| CONSOLIDATED BALANCE SHEETS | | |

| | | | | | | | |

(in thousands except share and per share amounts) December 31, | | 2005 | | | 2004 | |

ASSETS | | | | | | | | |

Current Assets: | | | | | | | | |

Cash and cash equivalents | | $ | 7,068 | | | $ | 2,243 | |

Trade accounts receivable, less allowance for losses of $7,327 and $6,629, respectively | | | 163,724 | | | | 172,912 | |

Inventories | | | 313,513 | | | | 328,191 | |

Prepaid expenses and other current assets | | | 23,188 | | | | 24,886 | |

Deferred income taxes | | | 12,851 | | | | 8,012 | |

| | | | | | | | |

Total current assets | | | 520,344 | | | | 536,244 | |

Other assets | | | 63,384 | | | | 66,352 | |

Intangible assets – at cost, less accumulated amortization of $6,223 and $4,794, respectively | | | 14,964 | | | | 17,904 | |

Goodwill | | | 420,201 | | | | 452,427 | |

Property, Plant and Equipment: | | | | | | | | |

Land | | | 33,351 | | | | 33,203 | |

Buildings | | | 235,802 | | | | 230,488 | |

Machinery and equipment | | | 535,655 | | | | 530,922 | |

Construction in progress | | | 13,779 | | | | 40,446 | |

| | | | | | | | |

| | | 818,587 | | | | 835,059 | |

Less accumulated depreciation | | | (439,207 | ) | | | (419,408 | ) |

| | | | | | | | |

| | | 379,380 | | | | 415,651 | |

| | | | | | | | |

Total assets | | $ | 1,398,273 | | | $ | 1,488,578 | |

| | | | | | | | |

LIABILITIESAND SHAREHOLDERS’ EQUITY | | | | | | | | |

Current Liabilities: | | | | | | | | |

Trade accounts payable | | $ | 77,080 | | | $ | 75,066 | |

Accrued salaries, wages and withholdings from employees | | | 15,249 | | | | 13,591 | |

Other accrued expenses | | | 57,589 | | | | 58,133 | |

Income taxes | | | 21,610 | | | | 18,392 | |

Short-term borrowings | | | 63,218 | | | | 69,774 | |

Current maturities of long-term debt | | | 207,341 | | | | 20,269 | |

| | | | | | | | |

Total current liabilities | | | 442,087 | | | | 255,225 | |

Deferred income taxes | | | 4,881 | | | | 10,470 | |

Other liabilities | | | 3,974 | | | | 4,461 | |

Accrued employee and retiree benefits | | | 41,980 | | | | 34,571 | |

Long-term debt | | | 283,123 | | | | 525,153 | |

Commitments and contingencies | | | — | | | | — | |

Shareholders’ Equity: | | | | | | | | |

Common stock, par value $.10 a share, authorized 100,000,000 shares; issued 53,954,874 shares | | | 5,396 | | | | 5,396 | |

Additional paid-in capital | | | 71,582 | | | | 72,117 | |

Earnings reinvested in the business | | | 736,544 | | | | 720,625 | |

Treasury stock, 7,620,068 and 6,887,161 shares, respectively, at cost | | | (152,727 | ) | | | (140,507 | ) |

Unearned portion of restricted stock | | | (5,965 | ) | | | (5,500 | ) |

Accumulated other comprehensive (loss) income | | | (32,602 | ) | | | 6,567 | |

| | | | | | | | |

| | | 622,228 | | | | 658,698 | |

| | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 1,398,273 | | | $ | 1,488,578 | |

| | | | | | | | |

See notes to consolidated financial statements.

– 26 –

| | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | | Sensient Technologies Corporation2005 Annual Report |

| | | | | | | | | | | | |

(in thousands) Years ended December 31, | | 2005 | | | 2004 | | | 2003 | |

CASH FLOWSFROM OPERATING ACTIVITIES | | | | | | | | | | | | |

Net earnings | | $ | 44,195 | | | $ | 73,918 | | | $ | 81,432 | |

Adjustments to arrive at net cash provided by operating activities: | | | | | | | | | | | | |

Depreciation and amortization | | | 46,769 | | | | 46,243 | | | | 43,098 | |

Restructuring and other charges | | | 5,390 | | | | — | | | | 6,476 | |

Gain on sale of assets | | | (389 | ) | | | (437 | ) | | | (4,368 | ) |

Changes in operating assets and liabilities (net of effects from acquisition of businesses): | | | | | | | | | | | | |

Trade accounts receivable | | | 8,941 | | | | 3,999 | | | | 1,236 | |

Inventories | | | (616 | ) | | | 1,186 | | | | (31,334 | ) |

Prepaid expenses and other assets | | | (3,460 | ) | | | (7,542 | ) | | | (13,240 | ) |

Accounts payable and other accrued expenses | | | 6,285 | | | | (284 | ) | | | (6,447 | ) |

Accrued salaries, wages and withholdings from employees | | | 2,302 | | | | 108 | | | | (2,407 | ) |

Income taxes | | | 4,050 | | | | 6,306 | | | | (9,270 | ) |

Deferred income taxes | | | (10,105 | ) | | | 4,738 | | | | 10,538 | |

Other liabilities | | | 6,928 | | | | (2,503 | ) | | | (19,171 | ) |

| | | | | | | | | | | | |

Net cash provided by operating activities | | | 110,290 | | | | 125,732 | | | | 56,543 | |

| | | | | | | | | | | | |

CASH FLOWSFROM INVESTING ACTIVITIES | | | | | | | | | | | | |

Acquisition of property, plant and equipment | | | (36,102 | ) | | | (49,845 | ) | | | (74,208 | ) |

Acquisition of businesses – net of cash acquired | | | — | | | | — | | | | (19,307 | ) |

Proceeds from sale of assets | | | 1,101 | | | | 2,016 | | | | 8,223 | |

Decrease in other assets | | | 1,033 | | | | 3,065 | | | | 112 | |

| | | | | | | | | | | | |

Net cash used in investing activities | | | (33,968 | ) | | | (44,764 | ) | | | (85,180 | ) |

| | | | | | | | | | | | |

CASH FLOWSFROM FINANCING ACTIVITIES | | | | | | | | | | | | |

Proceeds from additional borrowings | | | 80,652 | | | | 199,760 | | | | 121,761 | |

Debt and capital lease payments | | | (109,163 | ) | | | (259,420 | ) | | | (52,044 | ) |

Purchase of treasury stock | | | (18,005 | ) | | | — | | | | (17,931 | ) |

Dividends paid | | | (28,276 | ) | | | (28,096 | ) | | | (28,154 | ) |

Proceeds from options exercised and other equity transactions | | | 3,630 | | | | 4,213 | | | | 4,809 | |

| | | | | | | | | | | | |

Net cash (used in) provided by financing activities | | | (71,162 | ) | | | (83,543 | ) | | | 28,441 | |

| | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | | (335 | ) | | | 1,568 | | | | 1,343 | |

| | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 4,825 | | | | (1,007 | ) | | | 1,147 | |

Cash and cash equivalents at beginning of year | | | 2,243 | | | | 3,250 | | | | 2,103 | |

| | | | | | | | | | | | |

Cash and cash equivalents at end of year | | $ | 7,068 | | | $ | 2,243 | | | $ | 3,250 | |

| | | | | | | | | | | | |

Cash paid during the year for: | | | | | | | | | | | | |

Interest | | $ | 34,816 | | | $ | 30,788 | | | $ | 29,544 | |

Income taxes | | | 16,850 | | | | 13,870 | | | | 23,482 | |

Liabilities assumed in acquisitions | | | — | | | | — | | | �� | 992 | |

Capitalized interest | | | 908 | | | | 1,152 | | | | 2,081 | |

| | | | | | | | | | | | |

See notes to consolidated financial statements.

– 27 –

|

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY |

| | | | | | | |

(in thousands except share and per share amounts) | | COMMON

STOCK | | ADDITIONAL

PAID-IN

CAPITAL | |

BALANCESAT DECEMBER 31, 2002 | | $ | 5,396 | | $ | 72,390 | |

Net earnings | | | | | | | |

Unrealized gain on cash flow hedges, arising during the period, net of tax of $1,809 | | | | | | | |

Reclassification adjustment for cash flow hedges included in net income, net of tax of $ 1,633 | | | | | | | |

Minimum pension liability, net of tax of $52 | | | | | | | |

Foreign currency translation | | | | | | | |

Total comprehensive income | | | | | | | |

Cash dividends paid – $.59 a share | | | | | | | |

Redemption of rights – $.01 a share | | | | | | | |

Stock options exercised | | | | | | (285 | ) |

Benefit plans | | | | | | 216 | |

Restricted stock | | | | | | (127 | ) |

Purchase of treasury stock | | | | | | | |

Other | | | | | | | |

| | | | | | | |

BALANCESAT DECEMBER 31, 2003 | | | 5,396 | | | 72,194 | |

Net earnings | | | | | | | |

Unrealized gain on cash flow hedges, arising during the period, net of tax of $205 | | | | | | | |

Reclassification adjustment for cash flow hedges included in net income, net of tax of $223 | | | | | | | |

Minimum pension liability, net of tax of $418 | | | | | | | |

Foreign currency translation | | | | | | | |

Total comprehensive income | | | | | | | |

Cash dividends paid – $.60 a share | | | | | | | |

Stock options exercised | | | | | | (378 | ) |

Benefit plans | | | | | | (2 | ) |

Restricted stock | | | | | | 302 | |

Other | | | | | | 1 | |

| | | | | | | |

BALANCESAT DECEMBER 31, 2004 | | | 5,396 | | | 72,117 | |

Net earnings | | | | | | | |

Unrealized gain on cash flow hedges, arising during the period, net of tax of $529 | | | | | | | |

Reclassification adjustment for cash flow hedges included in net income, net of tax of $598 | | | | | | | |

Minimum pension liability, net of tax of $2,162 | | | | | | | |

Foreign currency translation | | | | | | | |

Total comprehensive income | | | | | | | |

Cash dividends paid – $.60 a share | | | | | | | |

Stock options exercised | | | | | | (350 | ) |

Benefit plans | | | | | | 39 | |

Restricted stock | | | | | | (223 | ) |

Purchase of treasury stock | | | | | | | |

Other | | | | | | (1 | ) |

| | | | | | | |

BALANCESAT DECEMBER 31, 2005 | | $ | 5,396 | | $ | 71,582 | |

| | | | | | | |

See notes to consolidated financial statements.

– 28 –

| | |

| | Sensient Technologies Corporation 2005 Annual Report |

| | | | | | | | | | | | | | | | | | | |

EARNINGS

REINVESTED IN THE

BUSINESS | | TREASURY STOCK | | | UNEARNED

PORTION OF

RESTRICTED

STOCK | | | ACCUMULATED

OTHER

COMPREHENSIVE

(LOSS) INCOME | | | TOTAL

COMPREHENSIVE

INCOME (LOSS) | |

| | SHARES | | | AMOUNT | | | | |

| $621,525 | | 6,746,164 | | | $ | (137,074 | ) | | $ | (2,951 | ) | | $ | (59,928 | ) | | | | |

| 81,432 | | | | | | | | | | | | | | | | | $ | 81,432 | |

| | | | | | | | | | | | | | 16,330 | | | | 16,330 | |

| | | | | | | | | | | | | | (14,741 | ) | | | (14,741 | ) |

| | | | | | | | | | | | | | (84 | ) | | | (84 | ) |

| | | | | | | | | | | | | | 37,464 | | | | 37,464 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $ | 120,401 | |

| | | | | | | | | | | | | | | | | | | |

| (27,688) | | | | | | | | | | | | | | | | | | | |

| (466) | | | | | | | | | | | | | | | | | | | |

| | (235,004 | ) | | | 4,781 | | | | | | | | | | | | | |

| | (108,307 | ) | | | 2,201 | | | | | | | | | | | | | |

| | (89,200 | ) | | | 1,821 | | | | (893 | ) | | | | | | | | |

| | 856,000 | | | | (17,931 | ) | | | | | | | | | | | | |

| | 61,128 | | | | (1,270 | ) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 674,803 | | 7,230,781 | | | | (147,472 | ) | | | (3,844 | ) | | | (20,959 | ) | | | | |

| 73,918 | | | | | | | | | | | | | | | | | $ | 73,918 | |

| | | | | | | | | | | | | | 1,850 | | | | 1,850 | |

| | | | | | | | | | | | | | (2,005 | ) | | | (2,005 | ) |

| | | | | | | | | | | | | | (1,814 | ) | | | (1,814 | ) |

| | | | | | | | | | | | | | 29,495 | | | | 29,495 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $ | 101,444 | |

| | | | | | | | | | | | | | | | | | | |

| (28,096) | | | | | | | | | | | | | | | | | | | |

| | (204,927 | ) | | | 4,137 | | | | | | | | | | | | | |

| | (16,693 | ) | | | 340 | | | | | | | | | | | | | |

| | (121,200 | ) | | | 2,472 | | | | (1,656 | ) | | | | | | | | |

| | (800 | ) | | | 16 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 720,625 | | 6,887,161 | | | | (140,507 | ) | | | (5,500 | ) | | | 6,567 | | | | | |

| 44,195 | | | | | | | | | | | | | | | | | $ | 44,195 | |

| | | | | | | | | | | | | | 5,996 | | | | 5,996 | |

| | | | | | | | | | | | | | (5,378 | ) | | | (5,378 | ) |

| | | | | | | | | | | | | | (3,191 | ) | | | (3,191 | ) |

| | | | | | | | | | | | | | (36,596 | ) | | | (36,596 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $ | 5,026 | |

| | | | | | | | | | | | | | | | | | | |

| (28,276) | | | | | | | | | | | | | | | | | | | |

| | (173,534 | ) | | | 3,540 | | | | | | | | | | | | | |

| | (26,000 | ) | | | 530 | | | | | | | | | | | | | |

| | (129,700 | ) | | | 2,620 | | | | (465 | ) | | | | | | | | |

| | 1,062,541 | | | | (18,918 | ) | | | | | | | | | | | | |

| | (400 | ) | | | 8 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| $736,544 | | 7,620,068 | | | $ | (152,727 | ) | | $ | (5,965 | ) | | $ | (32,602 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

– 29 –

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands except employee and per share data) Years ended December 31, 2005, 2004 and 2003

| 1. | Summary of Significant Accounting Policies |

PRINCIPLESOF CONSOLIDATIONThe consolidated financial statements include the accounts of Sensient Technologies Corporation and its subsidiaries (the “Company”). All significant intercompany accounts and transactions are eliminated.

USEOF ESTIMATESThe preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

REVENUE RECOGNITION The Company recognizes revenue, net of estimated discounts, allowances and returns, upon shipment of goods to customers, at which time title passes, the customer is obligated to pay the Company, and the Company has no remaining obligations.

COSTOF PRODUCT SOLD Cost of products sold includes materials, labor and overhead expenses incurred in the manufacture of our products. Cost of products sold also includes charges for obsolete and slow moving inventories, as well as costs for quality control, purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs, other costs of our internal distribution network and costs incurred for shipping and handling. The Company records fees billed to customers for shipping and handling as revenue.

SELLINGAND ADMINISTRATIVE EXPENSESSelling and administrative expenses primarily include the salaries and related costs for executive, finance, accounting, human resources, research and development and legal personnel as well as salaries and related costs of salespersons, and commissions paid to external sales agents.

CASH EQUIVALENTS The Company considers all highly liquid investments with maturities of three months or less at the date of acquisition as cash equivalents.

INVENTORIES Inventories are stated at the lower of cost or market. Market is determined on the basis of estimated realizable values. Cost is determined using the first-in, first-out (“FIFO”) method. Inventories include finished and in-process products totaling $234.1 million and $242.8 million at December 31, 2005 and 2004, respectively, and raw materials and supplies of $79.4 million and $85.4 million at December 31, 2005 and 2004, respectively.

PROPERTY, PLANTAND EQUIPMENT Property, plant and equipment are recorded at cost reduced by accumulated depreciation. Depreciation is provided over the estimated useful life using the straight-line method for financial reporting. The estimated useful lives for buildings ranges from 5 to 35 years. The buildings category consists of building improvements, which have useful lives ranging from 5 to 35 years, and buildings, which have useful lives ranging from 10 to 35 years. Machinery and equipment have useful lives ranging from 3 to 20 years.

GOODWILLAND OTHER INTANGIBLE ASSETSThe carrying value of goodwill and other intangible assets with indefinite lives is evaluated for impairment on an annual basis. The impairment assessment includes comparing the carrying amount of net assets, including goodwill, of each reporting unit to their respective fair value as of the date of the assessment. Fair value was estimated based upon an evaluation of future discounted cash flow as well as the public trading and private transaction valuation multiples for comparable companies. Such determination of fair value yielded no impairment.

The cost of intangible assets with determinable useful lives is amortized on a straight-line basis to reflect the pattern of economic benefits consumed, ranging from 5 to 20 years. These assets include technological know-how, customer relationships, patents, trademarks and non-compete agreements among others.

IMPAIRMENTOF LONG-LIVED ASSETS The Company reviews long-lived assets for impairment whenever events or changes in business circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company performs undiscounted cash flow analyses to determine if an impairment exists. If an impairment is determined to exist, any related impairment loss is calculated based on discounted future cash flows.

– 30 –

Sensient Technologies Corporation2005Annual Report

FINANCIAL INSTRUMENTS The Company uses derivative financial instruments for the purpose of hedging currency and interest rate exposures which exist as part of ongoing business operations. As a policy, the Company does not engage in speculative or leveraged transactions, nor does the Company hold or issue financial instruments for trading purposes.

Hedge effectiveness is determined by how closely the changes in the fair value of the hedging instrument offset the changes in the fair value or cash flows of the hedged item. Hedge accounting is permitted only if the hedging relationship is expected to be highly effective at the inception of the transaction and on an ongoing basis. Any ineffective portions are to be recognized in earnings immediately.

INTEREST RATE HEDGING The Company is exposed to interest rate risk through its corporate borrowing activities. The objective of the Company’s interest rate risk management activities is to manage the levels of the Company’s fixed and floating interest rate exposure to be consistent with the Company’s preferred mix. The interest rate risk management program may include entering into interest rate swaps, which qualify as fair value hedges, when there is a desire to modify the Company’s exposure to interest rates. Gains or losses on fair value hedges are recognized in earnings, net of gains and losses on the fair value of the hedged instruments.

The Company did not have any interest rate swaps outstanding at December 31, 2005.

CURRENCY RATE HEDGING The primary objectives of the foreign exchange risk management activities are to understand and mitigate the impact of potential foreign exchange fluctuations on the Company’s financial results and its economic well-being. Generally, these risk management transactions involve the use of foreign currency derivatives to protect against exposure resulting from recorded accounts receivable and payable. The Company primarily utilizes forward exchange contracts with maturities of less than 12 months, which qualify as cash flow hedges. These foreign exchange contracts are intended to offset the effect of exchange rate fluctuations on recorded intercompany receivables and payables. Gains and losses on these instruments are deferred in accumulated other comprehensive income (loss) (“OCI”) until the underlying transaction is recognized in earnings.

The Company’s existing cash flow hedges are highly effective. As a result, any current impact on earnings due to cash flow hedge ineffectiveness is immaterial.

NET INVESTMENT HEDGING The Company may enter into foreign-denominated debt to be used as a non-derivative instrument to hedge the Company’s net investment in foreign subsidiaries. The change in the carrying amount of the foreign-denominated debt on the Company’s books, attributable to changes in the spot foreign exchange rate, is a hedge of the net investment in its foreign subsidiaries.

COMMODITY PURCHASES The Company purchases certain commodities in the normal course of business which result in physical delivery of the goods and hence, are excluded from SFAS No. 133, as amended.

TRANSLATIONOF FOREIGN CURRENCIES For all significant foreign operations, the functional currency is the local currency. Assets and liabilities of foreign operations are translated into U.S. dollars at current exchange rates. Revenue and expense accounts are translated into U.S. dollars at average exchange rates prevailing during the year. Adjustments resulting from the translation of assets and liabilities to U.S. dollars are included in OCI as foreign currency translation adjustments. Transaction gains and losses are included in earnings and were not significant during the three-year period ended December 31, 2005.

STOCK-BASED COMPENSATION The Company accounts for its stock-based compensation plans using the intrinsic value-based method in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees.” Stock options are granted at prices equal to the fair market value of the Company’s common stock on the grant dates. Accordingly, the Company did not record any compensation expense with respect to the grant of stock options during the three-year period ended December 31, 2005. If the Company had elected to recognize compensation cost based on the fair value of the options granted at grant date as prescribed by SFAS No. 123, net earnings and earnings per share would have been reduced to the pro-forma amounts indicated below:

– 31 –

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands except employee and per share data) Years ended December 31, 2005, 2004 and 2003

| | | | | | | | | | | | |

(in thousands except per share data) | | 2005 | | | 2004 | | | 2003 | |

Net earnings: | | | | | | | | | | | | |

As reported | | $ | 44,195 | | | $ | 73,918 | | | $ | 81,432 | |

Reported stock compensation expense–net of tax | | | 1,167 | | | | 693 | | | | 493 | |

Less: fair value stock compensation expense–net of tax | | | (3,403 | ) | | | (2,371 | ) | | | (2,442 | ) |

| | | | | | | | | | | | |

Pro forma net earnings | | $ | 41,959 | | | $ | 72,240 | | | $ | 79,483 | |

| | | | | | | | | | | | |

Earnings per common share: | | | | | | | | | | | | |

Basic as reported | | $ | .95 | | | $ | 1.59 | | | $ | 1.74 | |

Less: net impact of fair value stock expense–net of tax | | | (.05 | ) | | | (.04 | ) | | | (.04 | ) |

| | | | | | | | | | | | |

Basic pro forma | | $ | .90 | | | $ | 1.55 | | | $ | 1.70 | |

Diluted as reported | | $ | .94 | | | $ | 1.58 | | | $ | 1.73 | |

Less: net impact of fair value stock expense – net of tax | | | (.05 | ) | | | (.04 | ) | | | (.04 | ) |

| | | | | | | | | | | | |

Diluted pro forma | | $ | .89 | | | $ | 1.54 | | | $ | 1.69 | |

| | | | | | | | | | | | |

The weighted-average fair value per share of options granted was $4.79 in 2005, $4.81 in 2004 and $4.68 in 2003.

The fair value of each option granted was estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions:

| | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Dividend yield | | 3.1 | % | | 2.8 | % | | 2.9 | % |

Volatility | | 28.3 | % | | 27.3 | % | | 29.0 | % |

Risk-free interest rate | | 4.3 | % | | 3.2 | % | | 3.1 | % |

Expected term (years) | | 5.1 | | | 5.4 | | | 5.5 | |

The pro-forma expense for 2005 includes $1.0 million after-tax compensation expense related to accelerated amortization for retirement eligible participants. Beginning in the first quarter of 2005, stock compensation expense for retirement eligible participants was reported in pro-forma net earnings and recognized over six months. Previously, this expense was recognized over the vesting period, which is three years.

See New Pronouncements below for further discussion of stock-based compensation.