OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response...18.9

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2910

Madison Mosaic Government Money Market Trust

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: September 30

Date of reporting period: September 30, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

September 30, 2008

Madison Mosaic Government Money Market

(Madison Mosaic logo)

Madison Mosaic Funds

www.mosaicfunds.com

Contents

Letter to Shareholders | 1 |

Report of Independent Registered Public Accounting Firm | 3 |

Portfolio of Investments | 4 |

Statement of Assets and Liabilities | 5 |

Statement of Operations | 6 |

Statements of Changes in Net Assets | 6 |

Financial Highlights | 7 |

Notes to Financial Statements | 8 |

Fund Expenses | 10 |

Management Information | 12 |

Madison Mosaic Government Money Market September 30, 2008

Letter to Shareholders

(photograph of Christopher Nisbet)

The one-year period ended September 30, 2008 saw the seven-day yield of Government Money Market dip in the midst of a massive financial crisis, as the stock market suffered one of its worse declines since the Great Depression. The Federal Reserve Board cut its Fed Funds Target Rate from 4.75% at the beginning of the period six times to a period-ending 2.00%. Rate cuts were just one of many government and Federal Reserve Board interventions designed to inject liquidity and produce confidence in the struggling debt markets.

Money markets, generally a sleepy corner of the investment world, were actually in the headlines towards the end of the period as a number of prominent money market funds revealed serious problems with troubled or defaulting short-term notes. These issues were never a factor in the management of Madison Mosaic Government Money Market, since the problem securities which were disrupting these funds were corporate issuances, to which your fund has no exposure. However, the resulting concerns over the safety of money markets caused the Treasury to create, in the final weeks of the annual period, a temporary guarantee program for money market funds. (This program was not originally conceived for funds like yours, which only owns securities issued by the government and its agencies and we determined that it would be an unnecessary expense for shareholders so did not participate in the program.) All of these concerns and dislocations during this period inspired a massive flight to the safest securities, primarily short-term government notes. This trend in a troubled time was a reminder that investors in Madison Mosaic Government Money Market selected an investment that provided excellent shelter even in one of the worst financial storms of our lifetimes.

Economic Overview

The period of this report will be one that will be studied by students of economics for generations to come. The period began with some optimism that the worst of the subprime credit crisis might be behind us, with the major stock market indices reaching record highs in the fall of 2007. But by September 30, 2008, the end of this reporting period, we were in the midst of a worldwide financial crisis that was creating sell-offs in virtually every asset class, other than the most secure assets issued or insured by the federal government. Several large and highly regarded institutions failed or required government-sponsored bailouts. Banks were unwilling to lend to each other and the general market mood was characterized by fear. In early September, the Treasury Department announced it would effectively take over Fannie Mae and Freddie Mac, the government-sponsored mortgage companies. This confirmed our belief that the investments in these two companies held in your fund would not suffer from the general financial crisis. It is our belief, one supported by market activity, that this takeover increased the security of these bonds, as the government’s role moved from indirect to direct support for bondholders. Meanwhile, fearing a meltdown of the U.S. financial system, Congress rushed to put together a massive “bailout” legislation package in an attempt to aid banking balance sheets and get credit flowing again.

Madison Mosaic Government Money Market 1

Letter to Shareholders (concluded)

In terms of investment trends, we saw a massive flight to quality, as investors sold off holdings in the stock and corporate bond markets and bid up the prices of Treasuries. This put further pressure on Treasury yields, which were already being dampened by the Federal Reserve rate cuts. In other words, a wide range of investors were demonstrating a distinct preference for the sorts of investments already held by shareholders of Madison Mosaic Government Money Market.

Outlook

We see signs of economic hope in the various government sponsored initiatives, but there are still many systemic problems in our financial system and economy, many of which go back to a fundamental cause of the crisis: falling home prices. Until home prices stabilize, we will not be completely out of the woods. We see the U.S. economy experiencing at least a mild recession, but not the kind of financial disaster that seems to be widely feared. As painful as this period has been, we believe some good will come of it in the long run. Leverage in the U.S. economy will be reduced to more rational and manageable levels. Credit will be extended only to those with the capacity to repay. Risk will be placed on equal footing with reward and be priced at an appropriate level. In the meantime, investors seeking security of principal and predictable yield will be well served with an allocation to the short-term government and government agency notes held in Madison Mosaic Government Money Market. We thank you for your continued confidence in our management.

Sincerely,

(signature)

Christopher Nisbet, CFA

Vice President and Portfolio Manager

2 Annual Report • September 30, 2008

Madison Mosaic Government Money Market September 30, 2008

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF TRUSTEES AND SHAREHOLDERS OF MADISON MOSAIC GOVERNMENT MONEY MARKET

We have audited the accompanying statement of assets and liabilities of the Madison Mosaic Government Money Market (the “Fund”) as of September 30, 2008 and the related statements of operations for the year then ended and the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2008 by correspondence with the Fund’s custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Madison Mosaic Government Money Market as of September 30, 2008, and the results of its operations for the year then ended and the changes in its net assets for each of the two years in the period then ended and financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Grant Thornton LLP

(signature)

Chicago, Illinois

November 14, 2008

Madison Mosaic Government Money Market 3

Madison Mosaic Government Money Market September 30, 2008

Portfolio of Investments

PRINCIPAL AMOUNT | VALUE | |

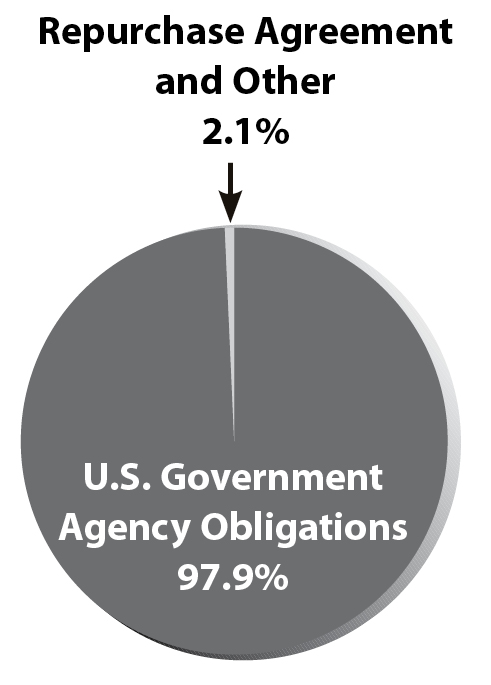

US GOVERNMENT AGENCY OBLIGATIONS: 97.9% of net assets | ||

Federal Home Loan Bank, 2.33%, 10/3/08 | $750,000 | $749,903 |

Federal Home Loan Bank, 2.3%, 10/6/09 | 750,000 | 749,760 |

Federal Home Loan Bank, 2.31%, 10/10/08 | 1,000,000 | 999,422 |

Federal Home Loan Bank, 2.43%, 10/22/08 | 1,000,000 | 998,579 |

Federal Home Loan Bank, 2.35%, 10/29/08 | 1,750,000 | 1,746,725 |

Federal Home Loan Bank, 2.38%, 11/7/08 | 750,000 | 748,162 |

Federal Home Loan Bank, 2.25%, 11/21/08 | 1,000,000 | 996,800 |

Federal Home Loan Bank, 2.51%, 11/24/08 | 1,250,000 | 1,245,287 |

Federal Home Loan Bank, 2.5%, 12/2/08 | 1,250,000 | 1,244,610 |

Federal Home Loan Bank, 2.6%, 12/3/08 | 750,000 | 746,583 |

Federal Home Loan Bank, 2.54%, 12/9/08 | 1,750,000 | 1,742,078 |

Federal Home Loan Bank, 2.1%, 12/12/08 | 1,000,000 | 995,798 |

Freddie Mac, 2.31%, 10/14/08 | 1,000,000 | 999,160 |

Freddie Mac, 2.37%, 10/28/08 | 1,000,000 | 998,214 |

Freddie Mac, 2.23%, 10/31/08 | 750,000 | 748,601 |

Freddie Mac, 2.4%, 11/3/08 | 1,000,000 | 997,793 |

Freddie Mac, 2.58%, 12/15/08 | 1,900,000 | 1,890,793 |

Freddie Mac, 2.7%, 12/29/08 | 750,000 | 744,993 |

Freddie Mac, 2.5%, 01/5/09 | 1,750,000 | 1,738,529 |

Fannie Mae, 2.35%, 10/15/08 | 1,000,000 | 999,083 |

Fannie Mae, 2.38%, 10/22/08 | 1,000,000 | 998,609 |

Fannie Mae, 2.54%, 11/19/08 | 1,000,000 | 996,523 |

Fannie Mae, 2.65%, 12/22/08 | 2,000,000 | 1,987,891 |

Fannie Mae, 2.63%, 12/24/08 | 1,000,000 | 993,856 |

Fannie Mae, 2.24%, 01/7/09 | 2,040,000 | 2,027,623 |

Fannie Mae, 2.85%, 01/28/09 | 750,000 | 742,934 |

Fannie Mae, 2.81%, 02/27/09 | 500,000 | 494,183 |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $30,322,492) | $30,322,492 | |

REPURCHASE AGREEMENT: 2.1% of net assets | ||

With U.S. Bank National Association issued 9/30/08 at 0.5%, due 10/1/08, collateralized by $674,998 in United States Treasury Notes due 9/1/18. Proceeds at maturity are $661,756 (Cost $661,747). | 661,747 | |

TOTAL INVESTMENTS: (Cost $30,984,239) | $30,984,239 | |

LIABILITIES LESS CASH AND RECEIVABLES: 0%* of net assets | (9,461) | |

NET ASSETS: 100% | $30,974,778 |

+ Aggregate cost for federal income tax purposes as of September 30, 2008

*Less than 0.1% but greater than 0%.

The Notes to Financial Statements are an integral part of these statements.

4 Annual Report • September 30, 2008

Madison Mosaic Government Money Market September 30, 2008

Statement of Assets and Liabilities

ASSETS | |

Investment, at value (Note 1) | |

Total government agency obligations | $30,322,492 |

Repurchase agreement | 661,747 |

Total investments (Cost $30,984,239) | 30,984,239 |

Capital Shares Sold | 899 |

Interest Receivable | 9 |

Total assets | $30,985,147 |

LIABILITIES | |

Payables | |

Dividends | 798 |

Capital shares redeemed | 3,071 |

Independent trustee fees | 1,500 |

Auditor fees | 5,000 |

Total liabilities | 10,369 |

NET ASSETS | $30,974,778 |

Net assets consists of: | |

Paid in capital | 30,972,667 |

Accumulated net realized gains | 2,111 |

Net Assets | $30,974,778 |

CAPITAL SHARES OUTSTANDING An unlimited number of capital shares, without par value, are authorized (Note 5) | 30,972,751 |

NET ASSETS VALUE PER SHARE | $1.00 |

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Government Money Market 5

Madison Mosaic Government Money Market

Statement of Operations

For the year ended September 30, 2008

INVESTMENT INCOME (Note 1) | |

Interest income | $1,142,454 |

EXPENSES (Notes 3, 4 and 6) | |

Investment advisory fees | 170,280 |

Service agreement fees | 119,196 |

Independent trustee fees | 6,000 |

Auditor fees | 5,000 |

Line of credit interest and fees | 261 |

Expenses waived | (85,140) |

Total expenses | 215,597 |

NET INVESTMENT INCOME | $926,857 |

NET REALIZED GAIN ON INVESTMENTS | 3,639 |

TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $930,496 |

Madison Mosaic Government Money Market

Statements of Changes in Net Assets

Year Ended September 30, | ||

2008 | 2007 | |

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | ||

Net investment income | $926,857 | $1,669,102 |

Net realized gain on investments | 3,639 | 74 |

Total increase in net assets resulting from operations | 930,496 | 1,669,176 |

DISTRIBUTION TO SHAREHOLDERS | ||

From net investment income | (926,857) | (1,669,102) |

CAPITAL SHARE TRANSACTIONS (Note 5) | (4,888,388) | (986,190) |

TOTAL DECREASE IN NET ASSETS | (4,884,749) | (986,116) |

NET ASSETS | ||

Beginning of year | $35,859,527 | $36,845,643 |

End of year | $30,974,778 | $35,859,527 |

The Notes to Financial Statements are an integral part of these statements.

6 Annual Report • September 30, 2008

Madison Mosaic Government Money Market

Financial Highlights

Selected data for a share outstanding for the periods indicated.

Year Ended September 30, | |||||

2008 | 2007 | 2006 | 2005 | 2004 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.03 | 0.05 | 0.04 | 0.02 | 0.01 |

Less distributions from net investment income | (0.03) | (0.05) | (0.04) | (0.02) | (0.01) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return (%) | 2.73 | 4.70 | 4.05 | 2.08 | 0.52 |

Ratios and supplemental data | |||||

Net assets, end of period (thousands) | $30,975 | $35,860 | $36,846 | $41,884 | $37,687 |

Ratio of expenses to average net assets before fee waiver (%) | 0.88 | 0.88 | 0.88 | 0.88 | 0.88 |

Ratio of expenses to average net assets after fee waiver1 (%) | 0.63 | 0.63 | 0.63 | 0.63 | 0.63 |

Ratio of net investment income to average net assets before fee waiver (%) | 2.47 | 4.35 | 3.69 | 1.84 | 0.27 |

Ratio of net investment income to average net assets after fee waiver1 (%) | 2.72 | 4.60 | 3.94 | 2.09 | 0.52 |

1-See Note 3 to the Financial Statements.

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Government Money Market 7

Madison Mosaic Government Money Market

Notes to Financial Statements

1. Summary of Significant Accounting Policies. Madison Mosaic Government Money Market (the “Fund”) is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as an open-end, diversified investment management company. The Fund invests solely in securities issued by the U.S. Government or any of its agencies or instrumentalities or in repurchase agreements backed by such securities. Because the Fund is 100% no-load, its shares are offered and redeemed at the net asset value per share.

Securities Valuation: Portfolio securities are valued at acquisition cost as adjusted for amortization of premium or accretion of discount, which approximates fair market value.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and Federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security using the effective interest method.

Distribution of Income: Net investment income, determined as gross investment income less total expenses, is declared as a dividend each business day. Dividends are distributed to shareholders or reinvested in additional shares as of the close of business at the end of each month. Distributions paid during the years ended September 30, 2008 and 2007 were $926,857 and $1,669,102, respectively. All distributions were paid from ordinary income and were identical for book purposes and tax purposes. As of September 30, 2008, the Fund had $2,111 of accumulated net realized gains as the only component of distributable earnings on a tax basis.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Fund to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribution to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal income taxes. As of September 30, 2008, capital loss carryovers available to offset future capital gains for Federal income tax purposes was $1,528 expiring September 30, 2014.

The Funds adopted the provisions of Financial Accounting Standards Board Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes,” on June 29, 2007. The implementation of FIN 48 resulted in no material liability for unrecognized tax benefits and no material change to the beginning net asset value of the fund.

As of and during the year ended September 30, 2008, the Funds did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Funds did not incur any interest or penalties.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period.

8 Annual Report • September 30, 2008

Notes to Financial Statements (continued)

Actual results could differ from those estimates.

2. Investment in Repurchase Agreements. When the Fund purchases securities under agreements to resell, the securities are held in safekeeping by the Fund’s custodian bank as collateral. Should the market value of the securities purchased under such an agreement decrease below the principal amount to be received at the termination of the agreement plus accrued interest, the counterparty is required to place an equivalent amount of additional securities in safekeeping with the Fund’s custodian bank. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having Advisory and Services Agreements with the same advisor, transfers uninvested cash balances into a joint trading account. The aggregate balance in this joint trading account is invested in one or more consolidated repurchase agreements whose underlying securities are U.S. Treasury or Federal agency obligations. The Fund has approximately a 5.0% interest or $661,747 in the consolidated repurchase agreement of $13,202,814 collateralized by $13,467,203 in United States Treasury Notes. Proceeds at maturity are $13,202,998.

3. Investment Advisory Fee and Other Transactions with Affiliates. The Investment Advisor to the Fund, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc. (the “Advisor”), earns an advisory fee equal to 0.5% per annum of the average net assets of the Fund. The fee is accrued daily and paid monthly. Since December 9, 2002, the Advisor has been irrevocably waiving 0.25% of this fee for the Fund. For the year ended September 30, 2008, the waived amount was $85,140. This waiver may end at any time.

The Advisor will reimburse the Fund for the amount of any expenses of the Fund (less certain expenses) that exceed 1.5% per annum of the average net assets of the Fund up to $40 million and 1% per annum of such amount in excess of $40 million. No amounts were reimbursed to the Fund by the Advisor for the year ended September 30, 2008.

4. Other Expenses. Under a separate Services Agreement, the Advisor will provide or arrange for the Fund to have all other necessary operational and support services for a fee based on a percentage of average net assets, other than the expenses of the Fund’s Independent Trustees and auditor (“Independent Service Providers”) which are paid directly based on cost and any costs associated with the Line of Credit described in Note 6. For the year ended September 30, 2008, this services fee was 0.35%. The Fund paid $11,000 directly for Independent Service Providers fees for the year ended September 30, 2008. The Fund uses US Bancorp Fund Services, LLC as its transfer agent and US Bank as its custodian. The transfer agent and custodian fees are paid by the Advisor and allocated to the Fund pursuant to a services agreement and are included in other expenses.

5. Accounting Pronouncements. In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (FAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. As of September 30, 2008, the Adviser does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required about the inputs used to develop the measurements of fair value and the effect of certain measurements reported on the Statement of Operations for a fiscal period.

Madison Mosaic Government Money Market 9

Notes to Financial Statements (concluded)

On March 19, 2008, Financial Accounting Standards Board released Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (FAS 161). FAS 161 requires qualitative disclosures about objectives an strategies for using derivatives, quantitative disclosures about fair value amounts of and gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The application of FAS 161 is required for fiscal years and interim periods beginning after November 15, 2008. At tis time, management is evaluating the implications of FAS 161 and its impact on the financial statements has not yet been determined.

6. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares (in dollars) were as follows:

Year Ended September 30, | ||

2008 | 2007 | |

Shares sold | $16,212,597 | $15,024,196 |

Shares issued in reinvestment of dividends | 909,089 | 1,630,009 |

Total shares issued | 17,121,686 | 16,654,205 |

Shares redeemed | (22,010,074) | (17,640,395) |

Net decrease | $ (4,888,388) | $(986,190) |

7. Line of Credit. The Fund has a $10 million revolving credit facility with a bank for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 0.5% (effective rate of 4.5% at September 30, 2008). The line of credit contains loan covenants with respect to certain financial ratios and operating matters. The Fund was in compliance with these covenants as of September 30, 2008 and 2007. During the year ended September 30, 2008, the Fund drew $18,000 with interest paid on the draw and renewal fees of $261. The Fund had repaid in full its line of credit as of September 30, 2008.

Fund Expenses (unaudited).

Example: This Example is intended to help you understand your costs (in dollars) of investing in the Fund and to compare these costs with the costs of investing in other mutual funds. See footnotes 3 and 4 above for an explanation of the types of costs charged by the Fund.

This Example is based on an investment of $1,000 invested on April 1, 2008 and held for the six-months ended September 30, 2008.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,500 ending account valued divided by $1,000 = 8.5), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

10 Annual Report • September 30, 2008

Fund Expenses (concluded)

Based on Actual Total Return-1 | |||||

Actual | Beginning | Ending | Annualized | Expenses Paid | |

Government Money Market | 0.88% | $1,000.00 | $1,008.78 | 0.63% | $3.18 |

1-For the six months ended September 30, 2008. 2-Assumes reinvestment of all dividends and capital gains distributions, if any, at net asset value. 3-Expenses (net of voluntary waiver) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. | |||||

Hypothetical Example for Comparison Purposes

The table on the next page titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Based on Hypothetical Total Return-1 | |||||

Hypothetical Annualized | Beginning | Ending | Annualized | Expenses Paid | |

Government Money Market | 5.00% | $1,000.00 | $1,025.26 | 0.63% | $3.21 |

1-For the six months ended September 30, 2008. 2-Expenses (net of voluntary waiver) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. | |||||

Madison Mosaic Government Money Market 11

Madison Mosaic Government Money Market

Management Information

Independent Trustees

Name, Address | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) | Number of Portfolios in Fund Complex Overseen | Other Directorships Held |

Philip E. Blake | Trustee | Indefinite Term since May 2001 | Retired investor; formerly Vice President - Publishing, Lee Enterprises, Inc. | All 12 Madison Mosaic Funds | Madison Newspapers, Inc. of Madison, WI; Trustee of the Madison Claymore Covered Call and Equity Strategy Fund and Madison Strategic Sector Premium Fund; Nerites Corp. |

James R. Imhoff, Jr. | Trustee | Indefinite Term since July 1996 | Chairman and CEO of First Weber Group, Inc. (real estate brokers) of Madison, WI. | All 12 Madison Mosaic Funds | Trustee of the Madison Claymore Covered Call and Equity Strategy Fund and Madison Strategic Sector Premium Fund; Park Bank, FSB; Grand Mountain Bancshares, Inc. |

Lorence D. Wheeler | Trustee | Indefinite Term since July 1996 | Retired investor; formerly Pension Specialist for CUNA Mutual Group (insurance) and President of Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide). | All 12 Madison Mosaic Funds | Trustee of the Madison Claymore Covered Call and Equity Strategy Fund and Madison Strategic Sector Premium Fund; Grand Mountain Bank, FSB; Grand Mountain Bancshares, Inc. |

Interested Trustees*

Frank E. Burgess | Trustee and Vice President | Indefinite Terms since July 1996 | Founder, President and Director of Madison Investment Advisors, Inc. | All 12 Madison Mosaic Funds | Trustee of the Madison Claymore Covered Call and Equity Strategy Fund and Madison Strategic Sector Premium Fund; Capitol Bank, FSB; Santa Barbara Community Bancorp, Inc. |

Katherine L. Frank | Trustee and President | Indefinite Terms President since July 1996, Trustee since May 2001 | Principal and Vice President of Madison Investment Advisors, Inc. and President of Madison Mosaic, LLC | President of all 12 Madison Mosaic Funds, Trustee of all Madison Mosaic Funds except Madison Mosaic Equity Trust | Trustee of Madison Strategic Sector Premium Fund |

12 Annual Report • September 30, 2008

Management Information (concluded)

Officers*

Jay R. Sekelsky | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Madison Mosaic Funds | None |

Christopher Berberet | Vice President | Indefinite Term since July 1996 | Principal and Vice President of Madison Investment Advisors, Inc. and Vice President of Madison Mosaic, LLC | All 12 Madison Mosaic Funds | None |

W. Richard Mason | Secretary, General Counsel and Chief Compliance Officer | Indefinite Terms since November 1992 | Principal of Mosaic Funds Distributor, LLC; General Counsel for Madison Investment Advisors, Madison Scottsdale, LC and Madison Mosaic, LLC | All 12 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund | None |

Greg Hoppe | Chief Financial Officer | Indefinite Term since August 1999 | Vice President of Madison Mosaic, LLC. | All 12 Madison Mosaic Funds and the Madison Strategic Sector Premium Fund | None |

*All interested Trustees and Officers of the Trust are employees and/or owners of Madison Investment Advisors, Inc. Since Madison Investment Advisors, Inc. serves as the investment advisor to the Trust, each of these individuals is considered an “interested person” of the Trust as the term is defined in the Investment Company Act of 1940.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Mosaic Funds at 1-800-368-3195.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “will,” “expect,” “believe,” “plan” and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Fund only invests in non-voting securities. Nevertheless, the Fund adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Fund’s portfolio. These policies are available to you upon request and free of charge by writing to Madison Mosaic Funds, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195.

Madison Mosaic Government Money Market 13

The Fund’s proxy voting policies may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Fund will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure. The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-942-8090. Form N-Q and other information about the Fund are available on the EDGAR Database on the Commission’s Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the Commission’s Public Reference Section, Washington, DC 20549-0102. Finally, you may call us at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Discussion of Contract Renewal (Unaudited).

The Trustees considered a number of factors when the Board most recently approved the advisory contract between the Advisor and the Fund in July 2008. Rather than providing you with a list of factors or conclusory statements that explained the Board’s decisionmaking process, the following discussion is designed to describe what you would have seen and heard if you had been at the Trust’s Board meeting when it most recently approved the advisory contract:

With regard to the nature, extent and quality of the services to be provided by the Advisor, the Board reviewed the biographies and tenure of the personnel involved in fund management. They recognized the wide array of investment professionals employed by the firm. The officers of the investment advisor discussed the firm’s ongoing investment philosophies and strategies intended to provide superior performance consistent with the Fund’s investment objectives under various market scenarios. The Trustees also noted their familiarity with the Advisor due to the advisor’s history of providing advisory services to the Madison Mosaic family.

The Board also discussed the quality of services provided by the transfer agent, US Bancorp Fund Services, LLC. The advisor reported that the transfer agent has routinely ranked at or near the top in customer service surveys for third party transfer agents. The Independent Trustees noted that they had just completed a satisfactory on-site review of the transfer agent’s facilities and operations, including its main operations in Milwaukee, Wisconsin and its emergency recovery center located in West Allis, Wisconsin.

With regard to the investment performance of the Fund and the investment advisor, the Board reviewed current performance information. They discussed the reasons for both outperformance and underperformance compared with peer groups and applicable indices.

The officers of the Advisor also discussed the Advisor’s methodology for arriving at the peer groups and indices used for performance comparisons. The Board reviewed both short-term and long-term standardized performance, i.e. one, five and ten year (or since inception) average annual total returns for each fund and comparable funds, as well as standardized yields for fixed income funds.

14 Annual Report • September 30, 2008

With regard to the costs of the services to be provided and the profits to be realized by the investment advisor and its affiliates from the relationship with the Fund, the Board reviewed the expense ratios for each Madison Mosaic fund compared with funds with similar investment objectives and of similar size. The Board reviewed such comparisons based on a variety of peer group comparisons from data extracted from industry databases including comparison to funds with similar investment objectives based on their broad asset category and total asset size, as well as from data provided directly by funds that most resembled the Fund’s asset size and investment objective for the last year. The Advisor discussed the objective manner by which Madison Mosaic fees were compared to fees in the industry.

As in past years, the Trustees recognized that each Madison Mosaic fund’s fee structure should be reviewed based on total fund expense ratio rather than simply comparing advisory fees to other advisory fees in light of the simple expense structure (i.e. a single advisory and a single services fee, with only the fixed fees of the Independent Trustees and auditors paid separately). As such, the Board focused its attention on the total expense ratios paid by other funds of similar size and category when considering the individual components of the expense ratios. The Board also recognized that investors are often required to pay distribution fees (loads) over and above the amounts identified in the expense ratio comparison reviewed by the Board, whereas no such fees are paid by Madison Mosaic shareholders.

The Trustees sought to ensure that fees were adequate so that the Advisor did not neglect its management responsibilities for the Trusts in favor of more “profitable” accounts. At the same time, the Trustees sought to ensure that compensation paid to the Advisor was not unreasonably high. The Board reviewed materials demonstrating that although the Advisor is compensated for a variety of the administrative services it provides or arranges to provide pursuant to its Services Agreements, such compensation generally does not cover all costs due to the relatively small size of the funds in the Madison Mosaic family. Administrative, operational, regulatory and compliance fees and costs in excess of the Services Agreement fees are paid by the advisor from its investment advisory fees earned. For these reasons, the Trustees recognized that examination of total expense ratios compared to those of other investment companies was more meaningful than a simple comparison of basic “investment management only” fee schedules.

In reviewing costs and profits, the Trustees recognized that Madison Mosaic Funds are to a certain extent “subsidized” by the greater Madison Investment Advisors, Inc. organization because the salaries of all portfolio management personnel, trading desk personnel, corporate accounting personnel and employees of the Advisor who serve as officers of the funds, as well as facility costs (rent), could not be supported by fees received from the funds alone. However, although Madison Mosaic represents only a few hundred million dollars of assets out of the multiple billions of assets managed by the Madison Investment Advisors, Inc. organization in Wisconsin at the time of the meeting, the Madison Mosaic family is profitable to the advisor at the margin because such salaries and fixed costs are proportionately paid from revenue generated by management of the remaining assets. The Trustees reviewed a profitability analysis of the funds and recognized that, as explained above, full salaries of all portfolio managers had not been factored into the analyses. As a result, although the fees paid by each respective Madison Mosaic fund at its present size might not be sufficient to profitably support a “stand-alone” mutual fund complex, the funds are reasonably profitable to the advisor as part of its larger, diversified organization. The Trustees

Madison Mosaic Government Money Market 15

also recognized that Madison Mosaic’s reputation benefited the Advisor’s reputation in attracting separately managed accounts and other investment advisory business. In sum, the Trustees recognized that Madison Mosaic Funds are important to the Advisor, are managed with the attention given to other firm clients and are not treated as “loss leaders.”

The Board engaged in a general and detailed discussion regarding fees. As part of the Board’s review of the costs of services and the profits to be realized by the Advisor, the Board considered the reasonableness and propriety of the securities research and so-called “soft dollar” benefits, if any, that the advisor receives in connection with brokerage transactions. The Trustees recognized that “soft-dollar” benefits were not generated by fixed-income transactions.

The Trustees recognized that the advisor continues to waive fees and expenses applicable to the Fund.

With regard to the extent to which economies of scale would be realized as a fund grows, the Trustees recognized that Madison Mosaic Funds, both individually and as a complex, remain small and that economies of scale would likely be addressed after funds see assets grow significantly beyond their current levels. In light of their size, the Trustees noted that at current asset levels, it was premature to discuss additional economies of scale.

Finally, the Board reviewed the role of Mosaic Funds Distributor, LLC. They noted that the Advisor pays all distribution expenses of Madison Mosaic Funds because the funds themselves do not pay distribution fees. Such expenses include FINRA regulatory fees and “bluesky” fees charged by state governments in order to permit the funds to be offered in the various United States jurisdictions.

Based on all of the material factors explained above, plus a number of other matters that the Trustees are generally required to consider under guidelines developed by the Securities and Exchange Commission, the Trustees concluded that Madison’s contract should be renewed for another year.

16 Annual Report • September 30, 2008

The Madison Mosaic Family of Mutual Funds

Madison Mosaic Equity Trust

Investors Fund

Balanced Fund

Mid-Cap Fund

Foresight Fund

Madison Institutional Equity Option Fund

Madison Mosaic Income Trust

Government Fund

Intermediate Income Fund

Institutional Bond Fund

Corporate Income Shares (COINS) Fund

Madison Mosaic Tax-Free Trust

Virginia Tax-Free Fund

Tax-Free National Fund

Madison Mosaic Government Money Market

For more complete information on any Madison Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Madison Mosaic Funds(R)

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3600

550 Science Drive

Madison, Wisconsin 53711

(Madison Mosaic logo)

Madsion Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-2910

Item 2. Code of Ethics.

(a) The Trust has adopted a code of ethics that applies to the Trust’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the Trust or a third party. The code was first adopted during the fiscal year ended September 30, 2003.

(c) The code has not been amended since it was initially adopted.

(d) The Trust granted no waivers from the code during the period covered by this report.

(f) Any person may obtain a complete copy of the code without charge by calling Madison Mosaic Funds at 800-368-3195 and requesting a copy of the Madison Mosaic Funds Sarbanes Oxley Code of Ethics.

Item 3. Audit Committee Financial Expert.

In July 2008, Lorence R. Wheeler, an “independent” Trustee and a member of the Trust’s audit committee, was elected to serve as the Trust’s audit committee financial expert among the three Mosaic independent Trustees who so qualify to serve in that capacity. He succeeded Mr. Philip E. Blake who served in that capacity from July 2007 through July 2008.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. Note that fees are accrued pursuant to the Services Agreement, but are paid directly to the accountants. Total audit fees paid (or to be paid) to the registrant's principal accountant for the fiscal years ended September 30, 2008 and 2007, respectively, out of the Services Agreement fees collected from all Madison Mosaic Funds were $88,500 ($113,750 including the Madison Strategic Sector Premium Fund, an affiliated closed-end fund ("MSP")) and $86,500 ($111,500 including MSP). Of these amounts, approximately $5,000 and $5,000, respectively, was or will be attributable to the registrant and the remainder was or will be attributable to audit services provided to other Madison Mosaic Funds registrants.

(b) Audit-Related Fees. Not applicable.

(c) Tax-Fees. Not applicable.

(d) All Other Fees. Not applicable.

(e) (1) Before any accountant is engaged by the registrant to render audit or non-audit services, the engagement must be approved by the audit committee as contemplated by paragraph (c)(7)(i)(A) of Rule 2-01of Regulation S-X.

(2) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments

Schedule included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The Trust does not normally hold shareholder meetings. There have been no changes to the Trust's procedures during the period covered by this report.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the Trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the "Act")) are effective, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934 within 90 days of the date of this report. There were no significant changes in the Trust’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There were no changes in the Trust's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics referred to in Item 2 (no change from the previously filed Code).

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Act.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Madison Mosaic Government Money Market Trust

By: (signature)

W. Richard Mason, Secretary

Date: November 19, 2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: (signature)

Katherine L. Frank, Chief Executive Officer

Date: November 19, 2008

By: (signature)

Greg Hoppe, Chief Financial Officer

Date: November 19, 2008