Resource Center: 1-800-732-6643 Exhibit 99.1

Contact: Pete Bakel

202-752-2034

Date: August 8, 2013

Fannie Mae Reports Net Income of $10.1 Billion and Comprehensive Income of $10.3 Billion for Second Quarter 2013

| |

| • | Fannie Mae reported net income of $10.1 billion, the company’s sixth consecutive quarterly profit, and comprehensive income of $10.3 billion for the second quarter of 2013. |

| |

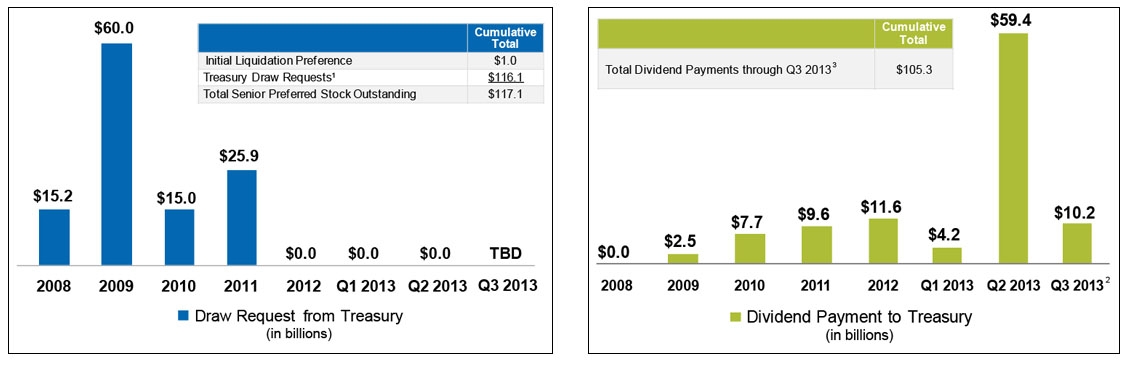

| • | Fannie Mae will pay taxpayers $10.2 billion in dividends in September 2013. After the September dividend payment, Fannie Mae will have paid an aggregate of approximately $105 billion in dividends to Treasury. Senior preferred stock outstanding and held by Treasury remained at $117.1 billion at June 30, 2013, as dividend payments do not offset Treasury draws. |

| |

| • | Fannie Mae has funded the mortgage market with approximately $3.7 trillion in liquidity since 2009, enabling families to buy, refinance, or rent a home. |

| |

| • | Fannie Mae continues to support the housing recovery and contribute to building a sustainable housing finance system for the future. |

WASHINGTON, DC - Fannie Mae (FNMA/OTC) reported net income of $10.1 billion for the second quarter of 2013, compared with net income of $5.1 billion for the second quarter of 2012. Fannie Mae’s net income for the second quarter of 2013 was the company’s sixth consecutive quarterly profit. Fannie Mae reported comprehensive income of $10.3 billion for the second quarter of 2013, compared with comprehensive income of $5.4 billion for the second quarter of 2012. Fannie Mae reported a positive net worth of $13.2 billion as of June 30, 2013 and will pay $10.2 billion to taxpayers as a dividend on the senior preferred stock.

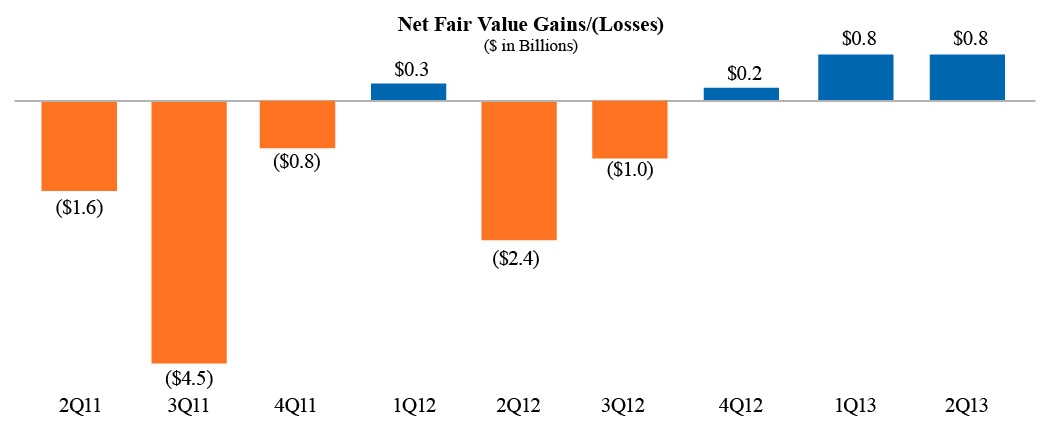

Fannie Mae reported a strong second quarter in 2013 driven primarily by continued stable revenues and boosted by a significant increase in home prices in the quarter, which resulted in a reduction in the company’s loss reserves. Year-over-year improvement was due primarily to 1) gains on Fannie Mae’s assets recorded at fair value in the second quarter of 2013 as a result of increases in interest rates, compared with fair value losses in the second quarter of 2012, and 2) an increase in credit-related income.

Fannie Mae expects to remain profitable for the foreseeable future. While the company expects its revenues to be stable and its annual earnings to remain strong over the next few years, its earnings may vary significantly from quarter to quarter due to many different factors, such as changes in interest rates or home prices. In addition to dividend payments, the company expects to make substantial federal income tax payments to Treasury going forward.

|

| | |

| Second Quarter 2013 Results | | 1 |

ABOUT FANNIE MAE’S CONSERVATORSHIP

Fannie Mae has operated under the conservatorship of the Federal Housing Finance Agency (“FHFA”) since September 6, 2008. Fannie Mae has not received funds from Treasury since the first quarter of 2012. The funding the company has received under its senior preferred stock purchase agreement with the U.S. Treasury has provided the company with the capital and liquidity needed to fulfill its mission of providing liquidity and support to the nation’s housing finance markets and to avoid a trigger of mandatory receivership under the Federal Housing Finance Regulatory Reform Act of 2008. For periods through June 30, 2013, Fannie Mae has requested cumulative draws totaling $116.1 billion and paid $95.0 billion in dividends to Treasury. Under the senior preferred stock purchase agreement, the payment of dividends cannot be used to offset prior draws. As a result, Treasury maintains a liquidation preference of $117.1 billion on the company’s senior preferred stock.

Treasury Draws and Dividend Payments

| |

(1) | Treasury draw requests are shown in the period for which requested and do not include the initial $1.0 billion liquidation preference of Fannie Mae’s senior preferred stock, for which Fannie Mae did not receive any cash proceeds. The payment of dividends cannot be used to offset prior Treasury draws. |

| |

(2) | The company’s dividend for the third quarter of 2013 is calculated based on the company’s net worth of $13.2 billion as of June 30, 2013 less the applicable capital reserve amount of $3.0 billion. |

| |

(3) | Amounts may not sum due to rounding. |

In August 2012, the terms governing the company’s dividend obligations on the senior preferred stock were amended. The amended senior preferred stock purchase agreement does not allow the company to build a capital reserve. Beginning in 2013, the required senior preferred stock dividends each quarter equal the amount, if any, by which the company’s net worth as of the end of the preceding quarter exceeds an applicable capital reserve amount. The applicable capital reserve amount is $3.0 billion for each quarter of 2013 and will be reduced by $600 million annually until it reaches zero in 2018.

The amount of remaining funding available to Fannie Mae under the senior preferred stock purchase agreement with Treasury is currently $117.6 billion.

Fannie Mae is not permitted to redeem the senior preferred stock prior to the termination of Treasury’s funding commitment under the senior preferred stock purchase agreement. The limited circumstances under which Treasury’s funding commitment will terminate are described in “Business—Conservatorship and Treasury Agreements” in the company’s annual report on Form 10-K for the year ended December 31, 2012.

|

| | |

| Second Quarter 2013 Results | | 2 |

PROVIDING LIQUIDITY AND SUPPORT TO THE MARKET

Fannie Mae provided approximately $3.7 trillion in liquidity to the mortgage market from January 1, 2009 through June 30, 2013 through its purchases and guarantees of loans, which enabled borrowers to complete 11.4 million mortgage refinancings and 3.1 million home purchases, and provided financing for 1.9 million units of multifamily housing.

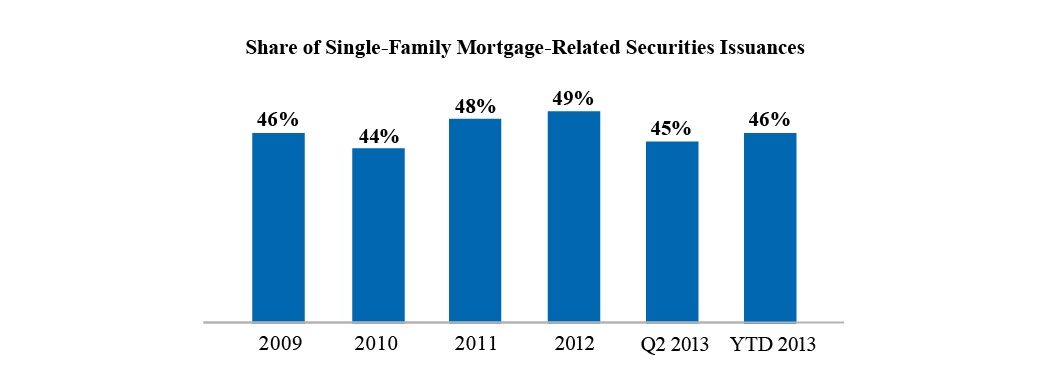

One of FHFA’s strategic goals for the company’s conservatorship involves gradually contracting Fannie Mae’s dominant presence in the marketplace. Despite this goal, Fannie Mae’s market share remained large in the first half of 2013 as the company has continued to meet the needs of the single-family mortgage market in the absence of substantial private capital. The company remained the largest single issuer of single-family mortgage-related securities in the secondary market in the second quarter of 2013, with an estimated market share of new single-family mortgage-related securities issuances of 45 percent, compared with 48 percent in the first quarter of 2013 and 46 percent in the second quarter of 2012.

Fannie Mae also remained a constant source of liquidity in the multifamily market. As of March 31, 2013 (the latest date for which information is available), the company owned or guaranteed approximately 22 percent of the outstanding debt on multifamily properties.

|

| | |

| Second Quarter 2013 Results | | 3 |

HELPING TO BUILD A NEW HOUSING FINANCE SYSTEM

In addition to continuing to provide liquidity and support to the mortgage market, Fannie Mae has devoted significant resources toward helping to build a new housing finance system for the future, including pursuing the strategic goals identified by its conservator, FHFA. These strategic goals are: build a new infrastructure for the secondary mortgage market; gradually contract the company’s dominant presence in the marketplace while simplifying and shrinking its operations; and maintain foreclosure prevention activities and credit availability for new and refinanced mortgages.

CREDIT QUALITY

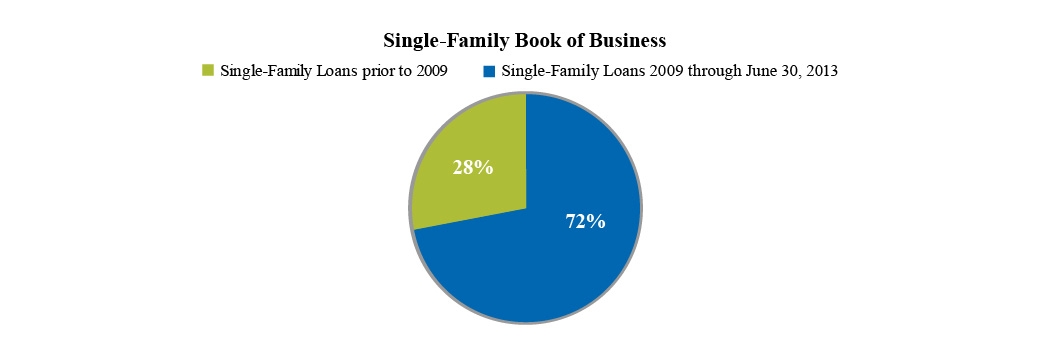

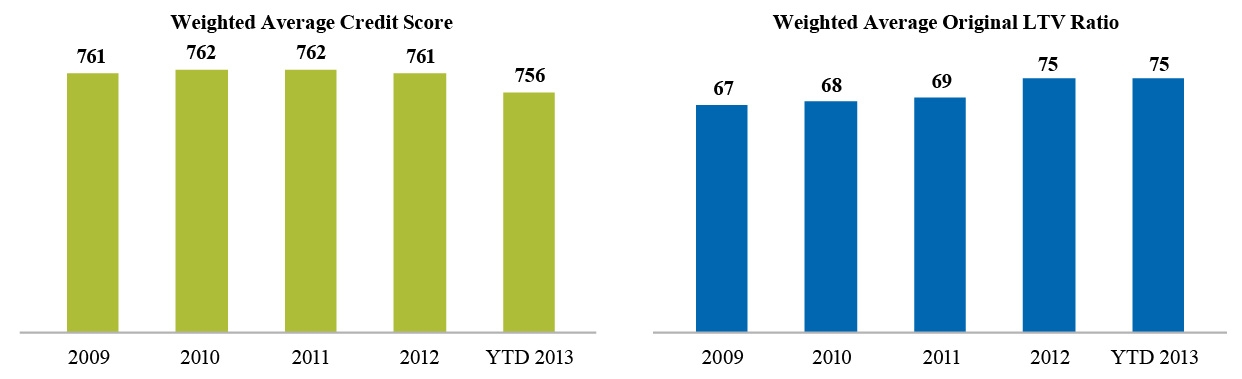

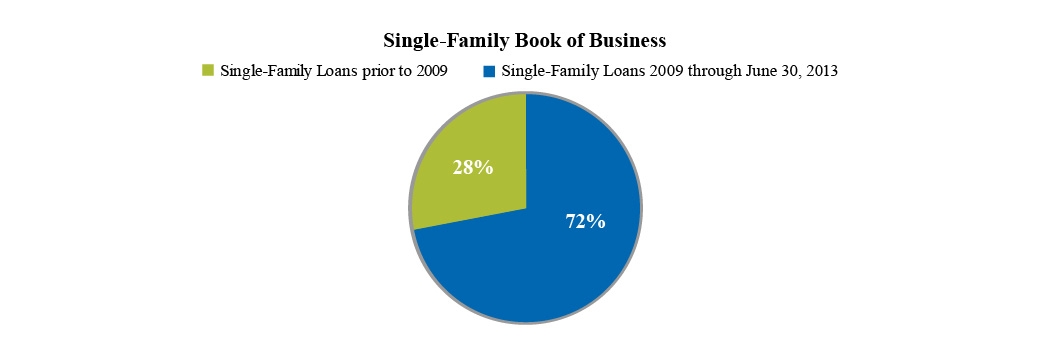

New Single-Family Book of Business: While making it possible for families to purchase, refinance, or rent a home, Fannie Mae has established responsible credit standards to protect homeowners as well as taxpayers. Since 2009, Fannie Mae has seen the effect of the actions it took, beginning in 2008, to significantly strengthen its underwriting and eligibility standards and change its pricing to promote sustainable homeownership and stability in the housing market. As of June 30, 2013, 72 percent of Fannie Mae’s single-family guaranty book of business consisted of loans it had purchased or guaranteed since the beginning of 2009. While Fannie Mae does not yet know how the single-family loans the company has acquired since January 1, 2009 will ultimately perform, given their strong credit risk profile and based on their performance so far, the company expects that these loans, in the aggregate, will be profitable over their lifetime, meaning the company’s fee income on these loans will exceed the company’s credit losses and administrative costs for them.

Single-family conventional loans acquired by Fannie Mae during the first half of 2013 had a weighted average borrower FICO credit score at origination of 756 and an average original loan-to-value (“LTV”) ratio of 75 percent. The average original LTV ratio for the company’s acquisitions increased for the full year of 2012 and the first half of 2013 as compared to prior periods because the company acquired more loans with higher LTV ratios in these periods than in the prior periods as changes to the Home Affordable Refinance Program (“HARP”) were implemented.

|

| | |

| Second Quarter 2013 Results | | 4 |

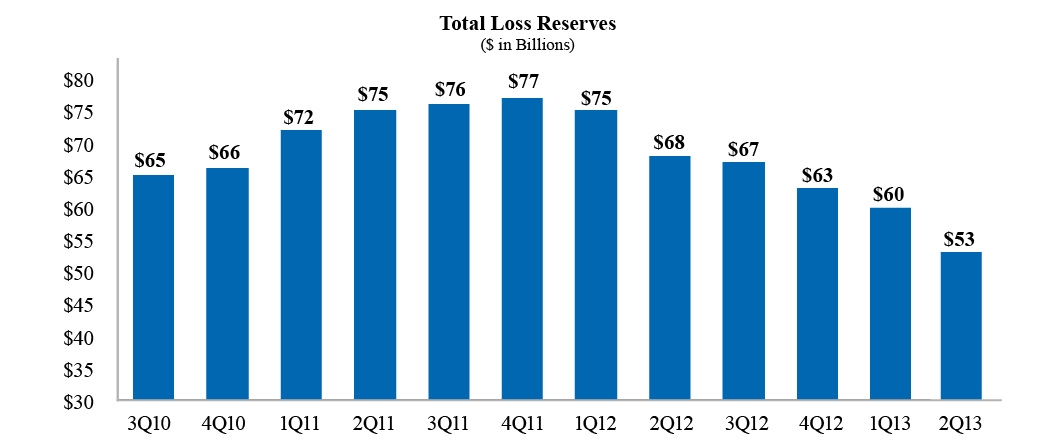

Loss Reserves: The company’s total loss reserves decreased to $53.1 billion as of June 30, 2013 from $60.2 billion as of March 31, 2013 and $62.6 billion as of December 31, 2012. The company’s total loss reserves peaked at $76.9 billion as of December 31, 2011.

|

| | |

| Second Quarter 2013 Results | | 5 |

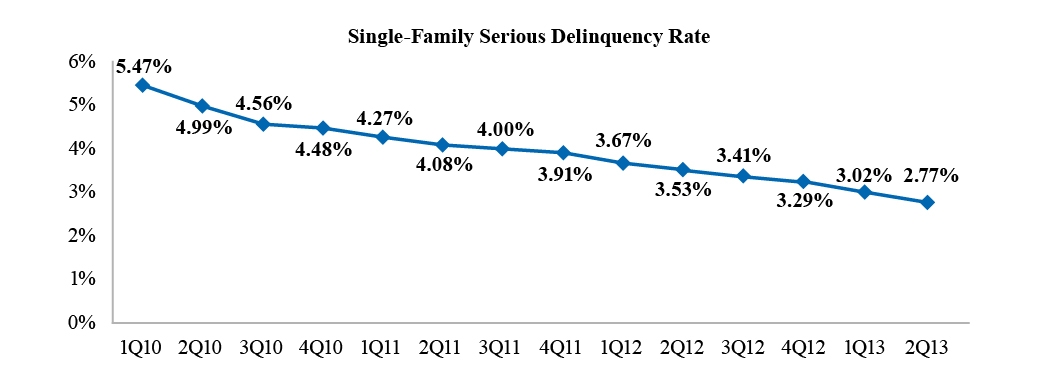

Fannie Mae’s single-family serious delinquency rate has declined each quarter since the first quarter of 2010, and was 2.77 percent as of June 30, 2013, compared with 5.47 percent as of March 31, 2010. This decrease is primarily the result of home retention solutions, foreclosure alternatives, and completed foreclosures, as well as the company’s acquisition of loans with stronger credit profiles since the beginning of 2009.

HOME RETENTION SOLUTIONS AND FORECLOSURE ALTERNATIVES

To reduce the credit losses Fannie Mae ultimately incurs on its legacy book of business, the company has been focusing its efforts on several strategies, including reducing defaults by offering home retention solutions, such as loan modifications. Fannie Mae completed more than 40,000 loan modifications during the second quarter of 2013, bringing the total number of loan modifications the company has completed since January 1, 2009 to approximately 962,000.

Fannie Mae views foreclosure as a last resort. For homeowners and communities in need, the company offers alternatives to foreclosure. These solutions have enabled 1.3 million borrowers to avoid foreclosure since 2009. In dealing with homeowners in distress, the company first seeks home retention solutions, which enable borrowers to stay in their homes, before turning to foreclosure alternatives. When there is no viable home retention solution or foreclosure alternative that can be applied, the company seeks to move to foreclosure expeditiously in an effort to minimize prolonged delinquencies that can hurt local home values and destabilize communities.

|

| | |

| Second Quarter 2013 Results | | 6 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six Months Ended | | For the Year Ended December 31 |

| | | June 30, 2013 | | 2012 | | 2011 | | 2010 |

| | | Unpaid Principal Balance | | Number of Loans | | Unpaid Principal Balance | | Number of Loans | | Unpaid Principal Balance | | Number of Loans | | Unpaid Principal Balance | | Number of Loans |

| | (Dollars in millions) |

| Home retention strategies: | | | | | | | | | | | | | | | | |

| Modifications | | $ | 15,130 |

| | 83,511 |

| | $ | 30,640 |

| | 163,412 |

| | $ | 42,793 |

| | 213,340 |

| | $ | 82,826 |

| | 403,506 |

|

| Repayment plans and forbearances completed | | 1,030 |

| | 7,906 |

| | 3,298 |

| | 23,329 |

| | 5,042 |

| | 35,318 |

| | 4,385 |

| | 31,579 |

|

| HomeSaver Advance first-lien loans | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 688 |

| | 5,191 |

|

| Total home retention strategies | | 16,160 |

| | 91,417 |

| | 33,938 |

| | 186,741 |

| | 47,835 |

| | 248,658 |

| | 87,899 |

| | 440,276 |

|

| Foreclosure alternatives: | | | | | | | | | | | | | | | | |

| Short sales | | 5,452 |

| | 25,642 |

| | 15,916 |

| | 73,528 |

| | 15,412 |

| | 70,275 |

| | 15,899 |

| | 69,634 |

|

| Deeds-in-lieu of foreclosure | | 1,352 |

| | 8,194 |

| | 2,590 |

| | 15,204 |

| | 1,679 |

| | 9,558 |

| | 1,053 |

| | 5,757 |

|

| Total foreclosure alternatives | | 6,804 |

| | 33,836 |

| | 18,506 |

| | 88,732 |

| | 17,091 |

| | 79,833 |

| | 16,952 |

| — |

| 75,391 |

|

| Total loan workouts | | $ | 22,964 |

| | 125,253 |

| | $ | 52,444 |

| | 275,473 |

| | $ | 64,926 |

| | 328,491 |

| | $ | 104,851 |

| | 515,667 |

|

| Loan workouts as a percentage of single-family guaranty book of business | | 1.62 | % | | 1.43 | % | | 1.85 | % | | 1.57 | % | | 2.29 | % | | 1.85 | % | | 3.66 | % | | 2.87 | % |

REFINANCING INITIATIVES

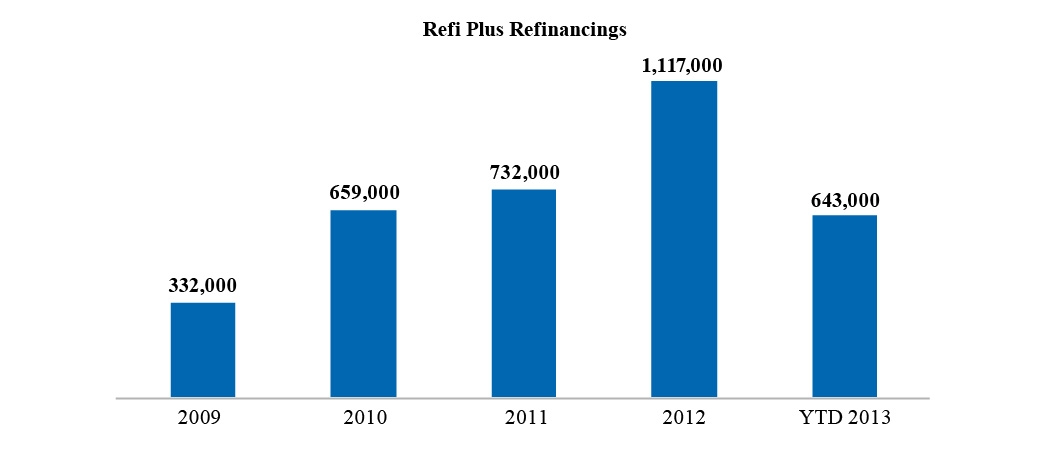

Through the company’s Refi Plus™ initiative, which offers refinancing flexibility to eligible Fannie Mae borrowers and includes HARP, the company acquired approximately 313,000 loans in the second quarter of 2013. Some borrowers’ monthly payments increased as they took advantage of the ability to refinance through Refi Plus to reduce the term of their loan, to switch from an adjustable-rate mortgage to a fixed-rate mortgage, or to switch from an interest-only mortgage to a fully amortizing mortgage. Even taking these into account, refinancings delivered to Fannie Mae through Refi Plus in the second quarter of 2013 reduced borrowers’ monthly mortgage payments by an average of $234.

|

| | |

| Second Quarter 2013 Results | | 7 |

FORECLOSURES AND REO

Fannie Mae acquired 36,106 single-family REO properties, primarily through foreclosure, in the second quarter of 2013, compared with 38,717 in the first quarter of 2013. As of June 30, 2013, the company’s inventory of single-family REO properties was 96,920, compared with 101,449 as of March 31, 2013. The carrying value of the company’s single-family REO was $9.1 billion as of June 30, 2013.

The company’s single-family foreclosure rate was 0.86 percent for the first six months of 2013. This reflects the annualized total number of single-family properties acquired through foreclosure or deeds-in-lieu of foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family guaranty book of business.

|

| | | | | | | | | |

| | |

| For the Six Months Ended June 30, | |

| | 2013 | | 2012 | | |

| Single-family foreclosed properties (number of properties): | | | | | |

| Beginning of period inventory of single-family foreclosed properties (REO) | 105,666 |

| | 118,528 |

| | |

| Total properties acquired through foreclosure | 74,823 |

| | 91,483 |

| | |

| Dispositions of REO | (83,569 | ) | | (100,745 | ) | | |

| End of period inventory of single-family foreclosed properties (REO) | 96,920 |

| | 109,266 |

| | |

| Carrying value of single-family foreclosed properties (dollars in millions) | $ | 9,075 |

| | $ | 9,421 |

| | |

| Single-family foreclosure rate | 0.86 |

| % | 1.04 |

| % | |

Fannie Mae’s financial data for the second quarter of 2013 are available in the accompanying Appendix; however, investors and interested parties should read the company’s Second Quarter 2013 Form 10-Q, which was filed today with the Securities and Exchange Commission and is available on Fannie Mae’s Web site, www.fanniemae.com. The company provides further discussion of its financial results and condition, credit performance, fair value balance sheets, and other matters in its Second Quarter 2013 Form 10-Q. Additional information about the company’s credit performance, the characteristics of its guaranty book of business, its foreclosure-prevention efforts, and other measures is contained in the “2013 Second Quarter Credit Supplement” at www.fanniemae.com.

# # #

In this release and the accompanying Appendix, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements regarding the company’s future financial results, including its profitability; the company’s future loss reserves; the company’s future revenues; the profitability of its loans; its future dividend payments to Treasury; the impact of the company’s actions to reduce credit losses; and the future fair value of the company’s trading securities and derivatives. These estimates, forecasts, expectations, and statements are forward looking statements based on the company’s current assumptions regarding numerous factors, including future home prices and the future performance of its loans. Actual results, and future projections, could be materially different from what is set forth in the forward-looking statements as a result of home price changes, interest rate changes, unemployment rates, other macroeconomic and housing market variables, government policy, credit availability, borrower behavior, including increases in the number of underwater borrowers who strategically default on their mortgage loan, the volume of loans it modifies, the nature, volume and effectiveness of its loss mitigation strategies and activities, management of its real estate owned inventory and pursuit of contractual remedies, changes in the fair value of its assets and liabilities, impairments of its assets, future legislative or regulatory requirements that have a significant impact on the company’s business such as a requirement that the company implement a principal forgiveness program, future updates to the company’s models relating to loss reserves, including the assumptions used by these models, changes in generally accepted accounting principles, changes to the company’s accounting policies, failures by its mortgage seller-servicers to fulfill their repurchase obligations to it, effects from activities the company takes to support the mortgage market and help borrowers, the conservatorship and its effect on the company’s business, the investment by Treasury and its effect on the company’s business, the uncertainty of the company’s future, the company’s future guaranty fee pricing, challenges the company faces in retaining and hiring qualified employees, the deteriorated credit performance of many loans in the company’s guaranty book of business, a decrease in the company’s credit ratings, defaults by one or more institutional counterparties, operational control weaknesses, changes in the structure and regulation of the financial services industry, limitations on the company’s ability to access the debt markets, disruptions in the housing, credit, and stock markets, government investigations and litigation, the performance of the company’s

|

| | |

| Second Quarter 2013 Results | | 8 |

servicers, conditions in the foreclosure environment, natural or other disasters, and many other factors, including those discussed in the “Risk Factors” section of and elsewhere in the company’s annual report on Form 10-K for the year ended December 31, 2012 and the company’s quarterly report on Form 10-Q for the quarter ended June 30, 2013, and elsewhere in this release.

Fannie Mae provides Web site addresses in its news releases solely for readers’ information. Other content or information appearing on these Web sites is not part of this release.

Fannie Mae enables people to buy, refinance, or rent a home.

Visit us at www.fanniemae.com/progress

Follow us on Twitter: http://twitter.com/FannieMae

|

| | |

| Second Quarter 2013 Results | | 9 |

APPENDIX

SUMMARY OF SECOND QUARTER 2013 RESULTS

Fannie Mae reported net income of $10.1 billion for the second quarter of 2013, compared with net income of $5.1 billion for the second quarter of 2012. Fannie Mae reported comprehensive income of $10.3 billion for the second quarter of 2013, compared with comprehensive income of $5.4 billion for the second quarter of 2012.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | 2Q13 | | 1Q13 | | Variance | | 2Q13 | | 2Q12 | | Variance |

| Net interest income | | $ | 5,667 |

| | $ | 6,304 |

| | $ | (637 | ) | | $ | 5,667 |

| | $ | 5,428 |

| | $ | 239 |

|

| Fee and other income | | 485 |

| | 568 |

| | (83 | ) | | 485 |

| | 395 |

| | 90 |

|

| Net revenues | | 6,152 |

| | 6,872 |

| | (720 | ) | | 6,152 |

| | 5,823 |

| | 329 |

|

| Investment gains, net | | 290 |

| | 118 |

| | 172 |

| | 290 |

| | 131 |

| | 159 |

|

| Net other-than-temporary impairments | | (6 | ) | | (9 | ) | | 3 |

| | (6 | ) | | (599 | ) | | 593 |

|

| Fair value gains (losses), net | | 829 |

| | 834 |

| | (5 | ) | | 829 |

| | (2,449 | ) | | 3,278 |

|

| Administrative expenses | | (626 | ) | | (641 | ) | | 15 |

| | (626 | ) | | (567 | ) | | (59 | ) |

| Credit-related income | | | | | | | | | | | | |

| Benefit for credit losses | | 5,383 |

| | 957 |

| | 4,426 |

| | 5,383 |

| | 3,041 |

| | 2,342 |

|

| Foreclosed property income | | 332 |

| | 260 |

| | 72 |

| | 332 |

| | 70 |

| | 262 |

|

| Total credit-related income | | 5,715 |

| | 1,217 |

| | 4,498 |

| | 5,715 |

| | 3,111 |

| | 2,604 |

|

| Other non-interest expenses | | (274 | ) | | (277 | ) | | 3 |

| | (274 | ) | | (331 | ) | | 57 |

|

| Net gains (losses) and income (expenses) | | 5,928 |

| | 1,242 |

| | 4,686 |

| | 5,928 |

| | (704 | ) | | 6,632 |

|

| Income before federal income taxes | | 12,080 |

| | 8,114 |

| | 3,966 |

| | 12,080 |

| | 5,119 |

| | 6,961 |

|

| (Provision) benefit for federal income taxes | | (1,985 | ) | | 50,571 |

| | (52,556 | ) | | (1,985 | ) | | — |

| | (1,985 | ) |

| Net income | | 10,095 |

| | 58,685 |

| | (48,590 | ) | | 10,095 |

| | 5,119 |

| | 4,976 |

|

| Less: Net income attributable to noncontrolling interest | | (11 | ) | | — |

| | (11 | ) | | (11 | ) | | (5 | ) | | (6 | ) |

| Net income attributable to Fannie Mae | | $ | 10,084 |

| | $ | 58,685 |

| | $ | (48,601 | ) | | $ | 10,084 |

| | $ | 5,114 |

| | $ | 4,970 |

|

| Total comprehensive income attributable to Fannie Mae | | $ | 10,250 |

| | $ | 59,339 |

| | $ | (49,089 | ) | | $ | 10,250 |

| | $ | 5,442 |

| | $ | 4,808 |

|

| Preferred stock dividends | | $ | (10,243 | ) | | $ | (4,224 | ) | | $ | (6,019 | ) | | $ | (10,243 | ) | | $ | (2,929 | ) | | $ | (7,314 | ) |

Net revenues were $6.2 billion for the second quarter of 2013, compared with $6.9 billion for the first quarter of 2013. Net interest income was $5.7 billion, compared with $6.3 billion for the first quarter of 2013. The decrease in net interest income compared to the first quarter of 2013 was due to lower interest income from portfolio assets due to a decline in the company’s retained portfolio and the recognition of $518 million of unamortized cost basis adjustments in the first quarter of 2013 related to loans repurchased by Bank of America under a resolution agreement Fannie Mae entered into with them, partially offset by higher income from guaranty fees. As Fannie Mae reduces the size of its retained mortgage portfolio in compliance with the terms of the senior preferred stock purchase agreement, revenues generated by its retained mortgage portfolio assets will also decrease. As a result of both the shrinking of the company’s retained mortgage portfolio and the impact of guaranty fee increases, Fannie Mae expects that, in a number of years, guaranty fees will become its primary source of revenues.

|

| | |

| Second Quarter 2013 Results | | 10 |

Credit-related income, which consists of recognition of a benefit for credit losses and foreclosed property income, was $5.7 billion in the second quarter of 2013, compared with $1.2 billion in the first quarter of 2013. The company recorded credit-related income in the second quarter of 2013 due primarily to an increase in home prices. Additionally, in the second quarter of 2013, the company updated the assumptions and data used in calculating loss reserves on modified loans to reflect faster prepayment and lower default expectations, which resulted in an incremental benefit for credit losses of $2.2 billion.

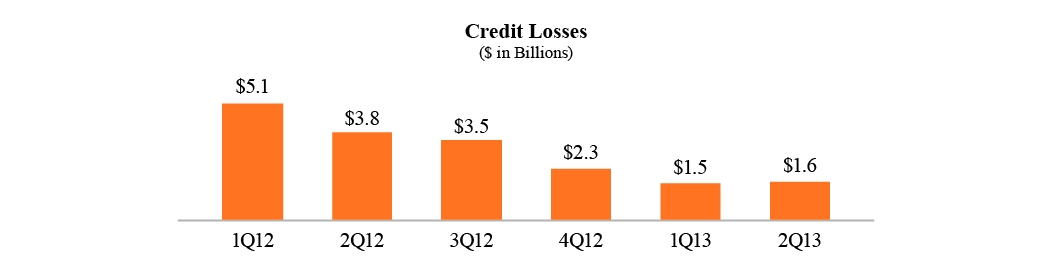

Credit losses, which the company defines as net charge-offs plus foreclosed property expense, excluding the effect of certain fair-value losses, were $1.6 billion in the second quarter of 2013, compared with $1.5 billion in the first quarter of 2013. Credit losses in both the first and second quarter of 2013 were favorably impacted by increases in home prices and sales prices on dispositions of the company’s REO, as well as by recoveries resulting from settlements relating to repurchase requests.

|

| | |

| Second Quarter 2013 Results | | 11 |

Total loss reserves, which reflect the company’s estimate of the probable losses the company has incurred in its guaranty book of business, including concessions it granted borrowers upon modification of their loans, were $53.1 billion as of June 30, 2013, compared with $60.2 billion as of March 31, 2013. The total loss reserves coverage to total nonperforming loans was 23 percent as of June 30, 2013, compared with 25 percent as of March 31, 2013.

Net fair value gains were $829 million in the second quarter of 2013, compared with $834 million in the first quarter of 2013. The company recorded fair value gains in the second quarter of 2013 due to derivative gains because interest rates increased in the second quarter of 2013, partially offset by fair value losses on its trading securities due to lower prices on commercial mortgage-backed securities (“CMBS”) driven by a widening of credit spreads and higher interest rates. The estimated fair value of the company’s trading securities and derivatives may fluctuate substantially from period to period because of changes in interest rates, credit spreads, and interest rate volatility, as well as activity related to these financial instruments.

|

| | |

| Second Quarter 2013 Results | | 12 |

BUSINESS SEGMENT RESULTS

The business groups running Fannie Mae’s three reporting segments – its Single-Family business, its Multifamily business, and its Capital Markets group – engage in complementary business activities in pursuing the company’s mission of providing liquidity, stability, and affordability to the U.S. housing market. The company’s Single-Family and Multifamily businesses work with Fannie Mae’s lender customers, who deliver mortgage loans that the company acquires and securitizes into Fannie Mae MBS. The Capital Markets group manages the company’s investment activity in mortgage-related assets and other interest-earning non-mortgage investments, funding investments in mortgage-related assets primarily with proceeds received from the issuance of Fannie Mae debt securities in the domestic and international capital markets. The Capital Markets group also provides liquidity to the mortgage market through short-term financing and other activities.

Single-Family business had net income of $6.5 billion in the second quarter of 2013, compared with $34.9 billion in the first quarter of 2013. The decrease in net income in the second quarter of 2013 compared with the first quarter of 2013 was due primarily to the release of the company’s valuation allowance against its deferred tax assets in the first quarter of 2013. Net income in the second quarter of 2013 was due primarily to credit-related income. The Single-Family guaranty book of business was $2.84 trillion as of June 30, 2013 and as of March 31 2013. Single-Family guaranty fee income was $2.5 billion in the second quarter of 2013 and $2.4 billion in the first quarter of 2013.

Multifamily had net income of $386 million in the second quarter of 2013, compared with $8.5 billion in the first quarter of 2013. The decrease in net income in the second quarter of 2013 compared with the first quarter of 2013 was due primarily to the release of the company’s valuation allowance against its deferred tax assets in the first quarter of 2013. The Multifamily guaranty book of business was $205.5 billion as of June 30, 2013, compared with $205.4 billion as of March 31, 2013. Multifamily recorded credit-related income of $34 million in the second quarter of 2013, compared with credit-related income of $183 million in the first quarter of 2013. Multifamily guaranty fee income was $300 million for the second quarter of 2013 and $291 million for the first quarter of 2013.

|

| | |

| Second Quarter 2013 Results | | 13 |

Capital Markets group had net income of $3.3 billion in the second quarter of 2013, compared with $15.9 billion in the first quarter of 2013. The decrease in net income in the second quarter of 2013 compared with the first quarter of 2013 was due primarily to the release of the company’s valuation allowance against its deferred tax assets in the first quarter of 2013. Capital Markets’ net interest income for both the second and the first quarter of 2013 was $2.7 billion. Fair value gains for the second quarter of 2013 were $841 million, compared with $875 million in the first quarter of 2013. The Capital Markets retained mortgage portfolio balance decreased to $565.2 billion as of June 30, 2013, compared with $597.8 billion as of March 31, 2013, resulting from purchases of $77.4 billion, liquidations of $34.1 billion, and sales of $75.9 billion during the quarter.

|

| | |

| Second Quarter 2013 Results | | 14 |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | 2Q13 | | 1Q13 | | Variance | | 2Q13 | | 2Q12 | | Variance |

| Single-Family Segment: | | | | | | | | | | | | |

| Guaranty fee income | | $ | 2,544 |

| | $ | 2,375 |

| | $ | 169 |

| | $ | 2,544 |

| | $ | 1,970 |

| | $ | 574 |

|

| Credit-related income | | 5,681 |

| | 1,034 |

| | 4,647 |

| | 5,681 |

| | 3,015 |

| | 2,666 |

|

| Other | | (677 | ) | | (88 | ) | | (589 | ) | | (677 | ) | | (631 | ) | | (46 | ) |

| Income before federal income taxes | | 7,548 |

| | 3,321 |

| | 4,227 |

| | 7,548 |

| | 4,354 |

| | 3,194 |

|

| (Provision) benefit for federal income taxes | | (1,050 | ) | | 31,578 |

| | (32,628 | ) | | (1,050 | ) | | — |

| | (1,050 | ) |

| Net income | | $ | 6,498 |

| | $ | 34,899 |

| | $ | (28,401 | ) | | $ | 6,498 |

| | $ | 4,354 |

| | $ | 2,144 |

|

| Multifamily Segment: | | | | | | | | | | | | |

| Guaranty fee income | | $ | 300 |

| | $ | 291 |

| | $ | 9 |

| | $ | 300 |

| | $ | 252 |

| | $ | 48 |

|

| Credit-related income | | 34 |

| | 183 |

| | (149 | ) | | 34 |

| | 96 |

| | (62 | ) |

| Other | | 62 |

| | 37 |

| | 25 |

| | 62 |

| | 10 |

| | 52 |

|

| Income before federal income taxes | | 396 |

| | 511 |

| | (115 | ) | | 396 |

| | 358 |

| | 38 |

|

| (Provision) benefit for federal income taxes | | (10 | ) | | 7,988 |

| | (7,998 | ) | | (10 | ) | | — |

| | (10 | ) |

| Net income | | $ | 386 |

| | $ | 8,499 |

| | $ | (8,113 | ) | | $ | 386 |

| | $ | 358 |

| | $ | 28 |

|

| Capital Markets Segment: | | | | | | | | | | | | |

| Net interest income | | $ | 2,680 |

| | $ | 2,742 |

| | $ | (62 | ) | | $ | 2,680 |

| | $ | 3,443 |

| | $ | (763 | ) |

| Investment gains, net | | 898 |

| | 1,349 |

| | (451 | ) | | 898 |

| | 1,458 |

| | (560 | ) |

| Fair value gains (losses), net | | 841 |

| | 875 |

| | (34 | ) | | 841 |

| | (2,461 | ) | | 3,302 |

|

| Other | | (179 | ) | | (86 | ) | | (93 | ) | | (179 | ) | | (967 | ) | | 788 |

|

| Income before federal income taxes | | 4,240 |

| | 4,880 |

| | (640 | ) | | 4,240 |

| | 1,473 |

| | 2,767 |

|

| (Provision) benefit for federal income taxes | | (925 | ) | | 11,005 |

| | (11,930 | ) | | (925 | ) | | — |

| | (925 | ) |

| Net income | | $ | 3,315 |

| | $ | 15,885 |

| | $ | (12,570 | ) | | $ | 3,315 |

| | $ | 1,473 |

| | $ | 1,842 |

|

|

| | |

| Second Quarter 2013 Results | | 15 |

ANNEX I

FANNIE MAE

(In conservatorship)

Condensed Consolidated Balance Sheets — (Unaudited)

(Dollars in millions, except share amounts)

|

| | | | | | | | | | | |

| | As of |

| | June 30, 2013 | | December 31, 2012 |

| ASSETS |

| Cash and cash equivalents | | $ | 24,718 |

| | | | $ | 21,117 |

| |

| Restricted cash (includes $48,774 and $61,976, respectively, related to consolidated trusts) | | 53,930 |

| | | | 67,919 |

| |

| Federal funds sold and securities purchased under agreements to resell or similar arrangements | | 37,800 |

| | | | 32,500 |

| |

| Investments in securities: | | | | | | | |

| Trading, at fair value | | 40,189 |

| | | | 40,695 |

| |

| Available-for-sale, at fair value (includes $665 and $935, respectively, related to consolidated trusts) | | 55,536 |

| | | | 63,181 |

| |

| Total investments in securities | | 95,725 |

| | | | 103,876 |

| |

| Mortgage loans: | | | | | | | |

| Loans held for sale, at lower of cost or fair value (includes $101 and $72, respectively, related to consolidated trusts) | | 545 |

| | | | 464 |

| |

| Loans held for investment, at amortized cost: | | | | | | | |

| Of Fannie Mae | | 328,573 |

| | | | 355,544 |

| |

| Of consolidated trusts (includes $13,770 and $10,800, respectively, at fair value and loans pledged as collateral that may be sold or repledged of $524 and $943, respectively) | | 2,696,579 |

| | | | 2,652,193 |

| |

| Total loans held for investment | | 3,025,152 |

| | | | 3,007,737 |

| |

| Allowance for loan losses | | (49,643 | ) | | | | (58,795 | ) | |

| Total loans held for investment, net of allowance | | 2,975,509 |

| | | | 2,948,942 |

| |

| Total mortgage loans | | 2,976,054 |

| | | | 2,949,406 |

| |

| Accrued interest receivable, net (includes $7,725 and $7,567, respectively, related to consolidated trusts) | | 8,997 |

| | | | 9,176 |

| |

| Acquired property, net | | 10,266 |

| | | | 10,489 |

| |

| Deferred tax asset, net | | 48,679 |

| | | | — |

| |

| Other assets (includes cash pledged as collateral of $981 and $1,222, respectively) | | 24,496 |

| | | | 27,939 |

| |

| Total assets | | $ | 3,280,665 |

| | | | $ | 3,222,422 |

| |

| LIABILITIES AND EQUITY |

| Liabilities: | | | | | | | |

| Accrued interest payable (includes $8,275 and $8,645, respectively, related to consolidated trusts) | | $ | 10,613 |

| | | | $ | 11,303 |

| |

| Debt: | | | | | | | |

| Of Fannie Mae (includes $720 and $793, respectively, at fair value) | | 603,240 |

| | | | 615,864 |

| |

| Of consolidated trusts (includes $14,601 and $11,647, respectively, at fair value) | | 2,637,295 |

| | | | 2,573,653 |

| |

| Other liabilities (includes $366 and $1,059, respectively, related to consolidated trusts) | | 16,274 |

| | | | 14,378 |

| |

| Total liabilities | | $ | 3,267,422 |

| | | | $ | 3,215,198 |

| |

| Commitments and contingencies (Note 17) | | — |

| | | | — |

| |

| Fannie Mae stockholders’ equity: | | | | | | | |

| Senior preferred stock, 1,000,000 shares issued and outstanding | | 117,149 |

| | | | 117,149 |

| |

| Preferred stock, 700,000,000 shares are authorized—555,374,922 shares issued and outstanding, respectively | | 19,130 |

| | | | 19,130 |

| |

| Common stock, no par value, no maximum authorization—1,308,762,703 shares issued, respectively, 1,158,077,970 shares outstanding, respectively | | 687 |

| | | | 687 |

| |

| Accumulated deficit | | (117,561 | ) | | | | (122,766 | ) | |

| Accumulated other comprehensive income | | 1,204 |

| | | | 384 |

| |

| Treasury stock, at cost, 150,684,733 shares, respectively | | (7,401 | ) | | | | (7,401 | ) | |

| Total Fannie Mae stockholders’ equity | | 13,208 |

| | | | 7,183 |

| |

| Noncontrolling interest | | 35 |

| | | | 41 |

| |

| Total equity (See Note 1: Impact of U.S. Government Support and (Loss) Earnings per Share for information on our dividend obligation to Treasury) | | 13,243 |

| | | | 7,224 |

| |

| Total liabilities and equity | | $ | 3,280,665 |

| | | | $ | 3,222,422 |

| |

See Notes to Condensed Consolidated Financial Statements

|

| | |

| Second Quarter 2013 Results | | 16 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Operations and Comprehensive Income — (Unaudited)

(Dollars and shares in millions, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three | | | For the Six | |

| | | Months Ended | | | Months Ended | |

| | | June 30, | | | June 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | | |

| Interest income: | | | | | | | | | | | | | | |

| Trading securities | | | $ | 222 |

| | | $ | 73 |

| | | $ | 448 |

| | | $ | 522 |

| | |

| Available-for-sale securities | | | 651 |

| | | 1,035 |

| | | 1,324 |

| | | 1,762 |

| | |

| Mortgage loans (includes $24,847 and $28,424, respectively, for the three months ended and $50,241 and $57,425, respectively, for the six months ended related to consolidated trusts) | | | 28,056 |

| | | 32,023 |

| | | 57,280 |

| | | 64,593 |

| | |

| Other | | | 49 |

| | | 40 |

| | | 106 |

| | | 78 |

| | |

| Total interest income | | | 28,978 |

| | | 33,171 |

| | | 59,158 |

| | | 66,955 |

| | |

| Interest expense: | | | | | | | | | | | | | | |

| Short-term debt | | | 37 |

| | | 32 |

| | | 80 |

| | | 74 |

| | |

| Long-term debt (includes $20,722 and $24,714, respectively, for the three months ended and $41,880 and $50,074, respectively, for the six months ended related to consolidated trusts) | | | 23,274 |

| | | 27,711 |

| | | 47,107 |

| | | 56,256 |

| | |

| Total interest expense | | | 23,311 |

| | | 27,743 |

| | | 47,187 |

| | | 56,330 |

| | |

| Net interest income | | | 5,667 |

| | | 5,428 |

| | | 11,971 |

| | | 10,625 |

| | |

| Benefit for credit losses | | | 5,383 |

| | | 3,041 |

| | | 6,340 |

| | | 1,041 |

| | |

| Net interest income after benefit for credit losses | | | 11,050 |

| | | 8,469 |

| | | 18,311 |

| | | 11,666 |

| | |

| Investment gains, net | | | 290 |

| | | 131 |

| | | 408 |

| | | 247 |

| | |

| Net other-than-temporary impairments | | | (6 | ) | | | (599 | ) | | | (15 | ) | | | (663 | ) | | |

| Fair value gains (losses), net | | | 829 |

| | | (2,449 | ) | | | 1,663 |

| | | (2,166 | ) | | |

| Debt extinguishment gains (losses), net | | | 27 |

| | | (93 | ) | | | 4 |

| | | (127 | ) | | |

| Fee and other income | | | 485 |

| | | 395 |

| | | 1,053 |

| | | 770 |

| | |

| Non-interest income (loss) | | | 1,625 |

| | | (2,615 | ) | | | 3,113 |

| | | (1,939 | ) | | |

| Administrative expenses: | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 304 |

| | | 292 |

| | | 621 |

| | | 598 |

| | |

| Professional services | | | 219 |

| | | 179 |

| | | 442 |

| | | 347 |

| | |

| Occupancy expenses | | | 47 |

| | | 48 |

| | | 93 |

| | | 91 |

| | |

| Other administrative expenses | | | 56 |

| | | 48 |

| | | 111 |

| | | 95 |

| | |

| Total administrative expenses | | | 626 |

| | | 567 |

| | | 1,267 |

| | | 1,131 |

| | |

| Foreclosed property (income) expense | | | (332 | ) | | | (70 | ) | | | (592 | ) | | | 269 |

| | |

| Other expenses | | | 301 |

| | | 238 |

| | | 555 |

| | | 490 |

| | |

| Total expenses | | | 595 |

| | | 735 |

| | | 1,230 |

| | | 1,890 |

| | |

| Income before federal income taxes | | | 12,080 |

| | | 5,119 |

| | | 20,194 |

| | | 7,837 |

| | |

| (Provision) benefit for federal income taxes | | | (1,985 | ) | | | — |

| | | 48,586 |

| | | — |

| | |

| Net income | | | 10,095 |

| | | 5,119 |

| | | 68,780 |

| | | 7,837 |

| | |

| Other comprehensive income: | | | | | | | | | | | | | | |

| Changes in unrealized gains on available-for-sale securities, net of reclassification adjustments and taxes | | | 17 |

| | | 320 |

| | | 665 |

| | | 675 |

| | |

| Other | | | 149 |

| | | 8 |

| | | 155 |

| | | 15 |

| | |

| Total other comprehensive income | | | 166 |

| | | 328 |

| | | 820 |

| | | 690 |

| | |

| Total comprehensive income | | | 10,261 |

| | | 5,447 |

| | | 69,600 |

| | | 8,527 |

| | |

| Less: Comprehensive income attributable to noncontrolling interest | | | (11 | ) | | | (5 | ) | | | (11 | ) | | | (4 | ) | | |

| Total comprehensive income attributable to Fannie Mae | | | $ | 10,250 |

| | | $ | 5,442 |

| | | $ | 69,589 |

| | | $ | 8,523 |

| | |

| Net income | | | 10,095 |

| | | 5,119 |

| | | 68,780 |

| | | 7,837 |

| | |

| Less: Net income attributable to noncontrolling interest | | | (11 | ) | | | (5 | ) | | | (11 | ) | | | (4 | ) | | |

| Net income attributable to Fannie Mae | | | 10,084 |

| | | 5,114 |

| | | 68,769 |

| | | 7,833 |

| | |

| Dividends distributed or available for distribution to senior preferred stockholder | | | (10,243 | ) | | | (2,929 | ) | | | (69,611 | ) | | | (5,746 | ) | | |

| Net (loss) income attributable to common stockholders (Note 11) | | | $ | (159 | ) | | | $ | 2,185 |

| | | $ | (842 | ) | | | $ | 2,087 |

| | |

| (Loss) earnings per share: | | | | | |

|

| | | | | | | | |

| Basic | | | $ | (0.03 | ) | | | $ | 0.38 |

| | | $ | (0.15 | ) | | | $ | 0.36 |

| | |

| Diluted | | | (0.03 | ) | | | 0.37 |

| | | (0.15 | ) | | | 0.35 |

| | |

| Weighted-average common shares outstanding: | | | | | | | | | | | | | | |

| Basic | | | 5,762 |

| | | 5,762 |

| | | 5,762 |

| | | 5,762 |

| | |

| Diluted | | | 5,762 |

| | | 5,893 |

| | | 5,762 |

| | | 5,893 |

| | |

See Notes to Condensed Consolidated Financial Statements

|

| | |

| Second Quarter 2013 Results | | 17 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Cash Flows— (Unaudited)

(Dollars in millions)

|

| | | | | | | |

| | For the Six Months Ended June 30, |

| | 2013 | | 2012 |

| Net cash provided by operating activities | $ | 4,802 |

| | $ | 24,135 |

|

| Cash flows provided by investing activities: | | | |

| Purchases of trading securities held for investment | (3,985 | ) | | (1,095 | ) |

| Proceeds from maturities and paydowns of trading securities held for investment | 1,293 |

| | 1,763 |

|

| Proceeds from sales of trading securities held for investment | 4,469 |

| | 693 |

|

| Purchases of available-for-sale securities | — |

| | (25 | ) |

| Proceeds from maturities and paydowns of available-for-sale securities | 5,861 |

| | 5,972 |

|

| Proceeds from sales of available-for-sale securities | 2,021 |

| | 696 |

|

| Purchases of loans held for investment | (119,122 | ) | | (81,192 | ) |

| Proceeds from repayments of loans held for investment of Fannie Mae | 28,762 |

| | 14,236 |

|

| Proceeds from repayments of loans held for investment of consolidated trusts | 394,972 |

| | 355,110 |

|

| Net change in restricted cash | 13,989 |

| | (5,188 | ) |

| Advances to lenders | (76,435 | ) | | (56,489 | ) |

| Proceeds from disposition of acquired property and preforeclosure sales | 22,466 |

| | 20,570 |

|

| Net change in federal funds sold and securities purchased under agreements to resell or similar arrangements | (5,300 | ) | | 22,000 |

|

| Other, net | 170 |

| | (92 | ) |

| Net cash provided by investing activities | 269,161 |

| | 276,959 |

|

| Cash flows used in financing activities: | | | |

| Proceeds from issuance of debt of Fannie Mae | 248,901 |

| | 337,683 |

|

| Payments to redeem debt of Fannie Mae | (261,959 | ) | | (408,557 | ) |

| Proceeds from issuance of debt of consolidated trusts | 235,835 |

| | 160,523 |

|

| Payments to redeem debt of consolidated trusts | (429,545 | ) | | (382,520 | ) |

| Payments of cash dividends on senior preferred stock to Treasury | (63,592 | ) | | (5,750 | ) |

| Proceeds from senior preferred stock purchase agreement with Treasury | — |

| | 4,571 |

|

| Other, net | (2 | ) | | 145 |

|

| Net cash used in financing activities | (270,362 | ) | | (293,905 | ) |

| Net increase in cash and cash equivalents | 3,601 |

| | 7,189 |

|

| Cash and cash equivalents at beginning of period | 21,117 |

| | 17,539 |

|

| Cash and cash equivalents at end of period | $ | 24,718 |

| | $ | 24,728 |

|

| Cash paid during the period for: | | | |

| Interest | $ | 55,455 |

| | $ | 60,926 |

|

| Income Taxes | $ | 1,016 |

| | $ | — |

|

See Notes to Condensed Consolidated Financial Statements

|

| | |

| Second Quarter 2013 Results | | 18 |