Contact: Pete Bakel Resource Center: 1-800-732-6643

202-752-2034 Exhibit 99.1

Date: October 31, 2019

Fannie Mae Reports Net Income of $4.0 Billion for Third Quarter 2019

|

| | | | | | | | | | | |

| Third Quarter 2019 Results | | |

| | | | | | | | | | |

•

| Fannie Mae reported net income of $4.0 billion for the third quarter of 2019, reflecting the strength of the company’s underlying business fundamentals. This compares to net income of $3.4 billion for the second quarter of 2019.

| | “Our strong quarterly results demonstrate the strength of Fannie Mae’s business and our ability to dynamically manage credit while serving the needs of our customers. “We are focused on preparing for an eventual exit from conservatorship and providing liquidity for housing for low- and moderate-income Americans. “We will continue to work with our customers and partners to provide sustainable and stable sources of financing for affordable homes and apartments.” Hugh R. Frater, Chief Executive Officer |

| | | | | | | | | | |

| Business Highlights | |

| | | | | | | | | | |

•

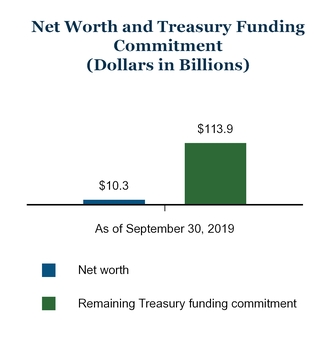

| The U.S. Department of the Treasury and the Federal Housing Finance Agency (FHFA), on the company’s behalf, agreed to increase the amount of capital Fannie Mae is permitted to retain from $3 billion to $25 billion, effective with the third quarter 2019 dividend period. Accordingly, the company can retain its quarterly earnings until it exceeds that capital reserve level, allowing it to begin restoring its capital base. As a result, Fannie Mae’s net worth increased to $10.3 billion as of September 30, 2019.

| |

| | | | | | | | | | |

•

| Fannie Mae was the largest issuer of single-family mortgage-related securities in the secondary market during the first nine months of 2019. The company’s estimated market share of new single-family mortgage-related securities issuances was 39% for the third quarter of 2019. Fannie Mae’s single-family loan acquisitions consisted of a higher share of refinance loans in the third quarter compared with the second quarter of 2019, driven primarily by continued lower interest rates. Fannie Mae has financed approximately 1 in 4 single-family mortgage loans outstanding in the United States.

| |

| | | | | | | | | | |

| • | Fannie Mae provided $52.1 billion in multifamily financing in the first nine months of 2019, which enabled the financing of 548,000 units of multifamily housing. More than 90% of the multifamily units the company financed in the third quarter of 2019 were affordable to families earning at or below 120% of the area median income, providing support for both affordable and workforce housing. | |

| |

| |

|

|

| | |

| Third Quarter 2019 Results | 1 |

WASHINGTON, DC — Fannie Mae (FNMA/OTCQB) reported net income of $4.0 billion and comprehensive income of $4.0 billion for the third quarter of 2019, compared with net income of $3.4 billion and comprehensive income of $3.4 billion for the second quarter of 2019. The increase in net income in the third quarter of 2019 was driven primarily by increases in credit-related income and net revenues, partially offset by a decrease in investment gains during the quarter. The stable guaranty books in both businesses continued to provide underlying earnings power.

|

|

| Summary of Financial Results |

|

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | 3Q19 | | 2Q19 | | Variance | | 3Q18 | | Variance |

| Net interest income | | $ | 5,229 |

| | $ | 5,150 |

| | $ | 79 |

| | $ | 5,369 |

| | $ | (140 | ) |

| Fee and other income | | 402 |

| | 246 |

| | 156 |

| | 271 |

| | 131 |

|

| Net revenues | | 5,631 |

| | 5,396 |

| | 235 |

| | 5,640 |

| | (9 | ) |

| Investment gains, net | | 253 |

| | 461 |

| | (208 | ) | | 166 |

| | 87 |

|

| Fair value gains (losses), net | | (713 | ) | | (754 | ) | | 41 |

| | 386 |

| | (1,099 | ) |

| Administrative expenses | | (749 | ) | | (744 | ) | | (5 | ) | | (740 | ) | | (9 | ) |

| Credit-related income | | | | | |

| | | | |

| Benefit for credit losses | | 1,857 |

| | 1,225 |

| | 632 |

| | 716 |

| | 1,141 |

|

| Foreclosed property expense | | (96 | ) | | (128 | ) | | 32 |

| | (159 | ) | | 63 |

|

| Total credit-related income | | 1,761 |

| | 1,097 |

| | 664 |

| | 557 |

| | 1,204 |

|

| Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) fees | | (613 | ) | | (600 | ) | | (13 | ) | | (576 | ) | | (37 | ) |

| Other expenses, net | | (571 | ) | | (535 | ) | | (36 | ) | | (377 | ) | | (194 | ) |

| Income before federal income taxes | | 4,999 |

| | 4,321 |

| | 678 |

| | 5,056 |

| | (57 | ) |

| Provision for federal income taxes | | (1,036 | ) | | (889 | ) | | (147 | ) | | (1,045 | ) | | 9 |

|

| Net income | | $ | 3,963 |

| | $ | 3,432 |

| | $ | 531 |

| | $ | 4,011 |

| | $ | (48 | ) |

| Total comprehensive income | | $ | 3,977 |

| | $ | 3,365 |

| | $ | 612 |

| | $ | 3,975 |

| | $ | 2 |

|

Net revenues, which consist of net interest income and fee and other income, were $5.6 billion for the third quarter of 2019, compared with $5.4 billion for the second quarter of 2019.

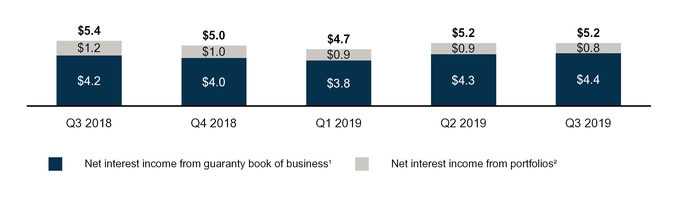

Net interest income was $5.2 billion for both the third quarter of 2019 and the second quarter of 2019. Net interest income for the third quarter of 2019 was relatively flat compared with the second quarter of 2019 as an increase in income from the guaranty book of business was offset by a decrease in income from the company’s retained mortgage portfolio and other investments portfolio.

Net Interest Income

(Dollars in Billions)

| |

(1) | Includes revenues generated by the 10 basis point guaranty fee increase the company implemented pursuant to the TCCA, the incremental revenue from which is remitted to Treasury and not retained by us. |

|

| | |

| Third Quarter 2019 Results | 2 |

| |

(2) | Includes interest income from assets held in the company’s retained mortgage portfolio and other investments portfolio, as well as other assets used to generate lender liquidity. Also includes interest expense on the company’s outstanding corporate debt and Connecticut Avenue Securities® debt. |

Fee and other income increased in the third quarter of 2019 attributed primarily to an increase in yield maintenance fees due to higher prepayments on multifamily loans.

Net fair value losses were $713 million in the third quarter of 2019, compared with $754 million in the second quarter of 2019. Net fair value losses in the third quarter of 2019 were driven primarily by:

| |

| • | net interest expense accruals on risk management derivatives combined with decreases in the fair value of pay-fixed risk management derivatives due to declines in medium- to longer-term swap rates, which were partially offset by increases in the fair value of the company’s receive-fixed risk management derivatives; |

| |

| • | decreases in the fair value of mortgage commitment derivatives due to losses on commitments to sell mortgage-related securities as a result of increases in the prices of securities as interest rates declined during the commitment periods, partially offset by gains on commitments to buy mortgage-related securities; and |

| |

| • | increases in the fair value of long-term debt of consolidated trusts due to a decline in interest rates. |

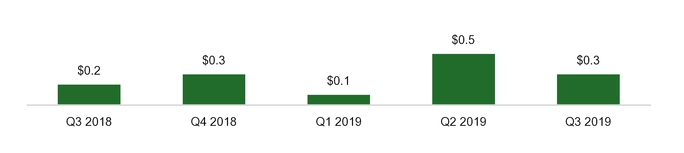

Net Fair Value Gains (Losses)

(Dollars in Billions)

Credit-related income consists of a benefit or provision for credit losses and foreclosed property expense. Credit-related income was $1.8 billion in the third quarter of 2019, compared with $1.1 billion in the second quarter of 2019. The increase in credit-related income in the third quarter of 2019 was driven primarily by an enhancement to the company's model used to estimate cash flows for individually impaired single-family loans within the company’s allowance for loan losses. This enhancement was performed as part of management’s routine model performance review process. In addition to incorporating recent loan performance data, this model enhancement better captures recent prepayment activity, default rates, and loss severity in the event of default.

Credit-Related Income

(Dollars in Billions)

|

| | |

| Third Quarter 2019 Results | 3 |

Investment gains were $253 million in the third quarter of 2019, compared with $461 million in the second quarter of 2019. The decrease in investment gains was driven primarily by a decrease in gains from sales of single-family loans and available-for-sale securities in the third quarter of 2019 compared with gains from such sales in the second quarter of 2019.

Investment Gains

(Dollars in Billions)

|

|

| Providing Liquidity and Support to the Market |

Fannie Mae’s mission is to provide a stable source of liquidity to support housing for low-and moderate-income Americans. In the first nine months of 2019, more than 90% of the multifamily units the company financed were affordable to families earning at or below 120% of the area median income, providing support for both affordable and workforce housing.

Fannie Mae provided $460 billion in liquidity to the mortgage market in the first nine months of 2019. Through its purchases and guarantees of mortgage loans in the first nine months of 2019, Fannie Mae acquired approximately 1.6 million single-family mortgage loans. Fannie Mae also financed approximately 548,000 units of multifamily housing in the first nine months of 2019.

Fannie Mae Provided $460 Billion in Liquidity in the First Nine Months of 2019

|

| | | | | |

| | Unpaid Principal Balance | | Units |

| | | | | | |

| | $240.1B | | 942K

Single-Family Home Purchases |

| |

| |

| | | | | | |

| | $167.3B | | 649K

Single-Family Refinancings |

| |

| |

| | | | | | |

| | $52.1B | | 548K

Multifamily Rental Units |

| |

| |

|

| | |

| Third Quarter 2019 Results | 4 |

Fannie Mae’s two reportable business segments—Single-Family and Multifamily—engage in complementary business activities to provide liquidity, access to credit, and affordability in all U.S. housing markets at all times, while effectively managing risk.

|

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | 3Q19 | | 2Q19 | | Variance | | 3Q18 | | Variance |

| Net interest income | | $ | 4,484 |

| | $ | 4,419 |

| | $ | 65 |

| | $ | 4,670 |

| | $ | (186 | ) |

| Fee and other income | | 156 |

| | 88 |

| | 68 |

| | 79 |

| | 77 |

|

| Net revenues | | 4,640 |

| | 4,507 |

| | 133 |

| | 4,749 |

| | (109 | ) |

| Investment gains, net | | 198 |

| | 417 |

| | (219 | ) | | 146 |

| | 52 |

|

| Fair value gains (losses), net | | (719 | ) | | (758 | ) | | 39 |

| | 417 |

| | (1,136 | ) |

| Administrative expenses | | (634 | ) | | (634 | ) | | — |

| | (636 | ) | | 2 |

|

| Credit-related income | | 1,747 |

| | 1,126 |

| | 621 |

| | 582 |

| | 1,165 |

|

| TCCA fees | | (613 | ) | | (600 | ) | | (13 | ) | | (576 | ) | | (37 | ) |

| Other expenses, net | | (424 | ) | | (418 | ) | | (6 | ) | | (282 | ) | | (142 | ) |

| Income before federal income taxes | | 4,195 |

| | 3,640 |

| | 555 |

| | 4,400 |

| | (205 | ) |

| Provision for federal income taxes | | (872 | ) | | (769 | ) | | (103 | ) | | (938 | ) | | 66 |

|

| Net income | | $ | 3,323 |

| | $ | 2,871 |

| | $ | 452 |

| | $ | 3,462 |

| | $ | (139 | ) |

| Serious delinquency rate | | 0.68 |

| % | 0.70 |

| % | | | 0.82 |

| % | |

Financial Results

| |

| • | Single-Family net income was $3.3 billion in the third quarter of 2019, compared with $2.9 billion in the second quarter of 2019. The increase in net income in the third quarter of 2019 was due primarily to an increase in credit-related income driven primarily by an enhancement to the company's model used to estimate cash flows for individually impaired single-family loans within the company’s allowance for loan losses, as described in the Summary of Financial Results above. The increase in net income was partially offset by a decrease in investment gains compared with the second quarter of 2019. |

Business Highlights

| |

| • | The average single-family conventional guaranty book of business increased by $17 billion during the third quarter of 2019, while the average charged guaranty fee, net of Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) fees, on the single-family conventional guaranty book increased slightly in the third quarter from 43.4 basis points as of June 30, 2019 to 43.5 basis points as of September 30, 2019. |

| |

| • | Fannie Mae’s average charged guaranty fee on newly acquired conventional single-family loans, net of TCCA fees, decreased nearly 1 basis point to 45.9 basis points in the third quarter of 2019 from 46.7 basis points in the second quarter of 2019, driven primarily by the stronger credit profile of the single-family loans the company acquired in the third quarter of 2019 compared with the second quarter of 2019. |

| |

| • | The single-family serious delinquency rate was 0.68% as of September 30, 2019, a decrease from 0.82% as of September 30, 2018. Single-family seriously delinquent loans are loans that are 90 days or more past due or in the foreclosure process. |

|

| | |

| Third Quarter 2019 Results | 5 |

|

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | 3Q19 | | 2Q19 | | Variance | | 3Q18 | | Variance |

| Net interest income | | $ | 745 |

| | $ | 731 |

| | $ | 14 |

| | $ | 699 |

| | $ | 46 |

|

| Fee and other income | | 246 |

| | 158 |

| | 88 |

| | 192 |

| | 54 |

|

| Net revenues | | 991 |

| | 889 |

| | 102 |

| | 891 |

| | 100 |

|

| Fair value gains (losses), net | | 6 |

| | 4 |

| | 2 |

| | (31 | ) | | 37 |

|

| Administrative expenses | | (115 | ) | | (110 | ) | | (5 | ) | | (104 | ) | | (11 | ) |

| Credit-related expense | | 14 |

| | (29 | ) | | 43 |

| | (25 | ) | | 39 |

|

| Other expenses | | (92 | ) | | (73 | ) | | (19 | ) | | (75 | ) | | (17 | ) |

| Income before federal income taxes | | 804 |

| | 681 |

| | 123 |

| | 656 |

| | 148 |

|

| Provision for federal income taxes | | (164 | ) | | (120 | ) | | (44 | ) | | (107 | ) | | (57 | ) |

| Net income | | $ | 640 |

| | $ | 561 |

| | $ | 79 |

| | $ | 549 |

| | $ | 91 |

|

| Serious delinquency rate | | 0.06 |

| % | 0.05 |

| % | | | 0.07 |

| % | |

Financial Results

| |

| • | Multifamily net income was $640 million in the third quarter of 2019, compared with $561 million in the second quarter of 2019. The increase in net income in the third quarter of 2019 was attributable primarily to an increase in yield maintenance revenue driven by higher prepayment volumes. |

Business Highlights

| |

| • | The average multifamily guaranty book of business increased by nearly $8 billion during the third quarter of 2019 to $326.1 billion, while the average charged guaranty fee on the multifamily book decreased slightly from 73.3 basis points as of June 30, 2019 to 71.9 basis points as of September 30, 2019. |

| |

| • | On September 13, 2019, FHFA announced a revised multifamily business volume cap structure. The new multifamily volume cap, which replaced the prior cap effective October 1, 2019, is $100 billion for the five-quarter period ending December 31, 2020. The new cap applies with no exclusions. In addition, FHFA directed that 37.5% of the company’s multifamily business during that time period must be mission-driven, affordable housing, pursuant to FHFA’s guidelines for mission-driven loans. Previously, FHFA’s 2019 conservatorship scorecard included an objective to maintain the dollar volume of new multifamily business at or below $35 billion for the year, excluding certain targeted affordable and underserved market business segments such as loans financing energy or water efficiency improvements. |

| |

| • | The multifamily serious delinquency rate was 0.06% as of September 30, 2019, a decrease from 0.07% as of September 30, 2018. Multifamily seriously delinquent loans are loans that are 60 days or more past due. |

|

| | |

| Third Quarter 2019 Results | 6 |

|

|

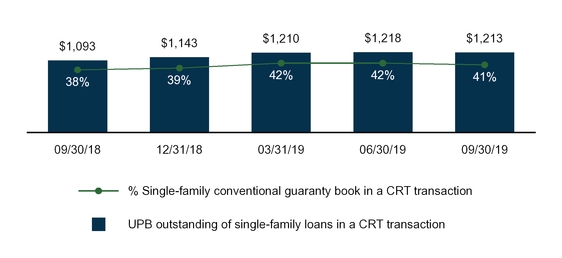

| Credit Risk Transfer Transactions |

Fannie Mae continues to support the growth of the credit risk transfer market and expand the types of loans covered in its credit risk transfer programs. For single-family mortgages, this includes Fannie Mae’s benchmark Connecticut Avenue Securities® (CAS) REMIC™ transactions and its Credit Insurance Risk Transfer™ (CIRT™) transactions. For multifamily mortgages, nearly 100% of the company’s new multifamily business volume in the first nine months of 2019 had lender risk-sharing, primarily through the company’s Delegated Underwriting and Servicing (DUS®) program. To complement the company’s lender loss sharing program through DUS, Fannie Mae also transfers a portion of the mortgage credit risk on multifamily loans in its multifamily guaranty book of business to insurers and reinsurers through multifamily CIRT transactions. On October 30, 2019, Fannie Mae also completed its first Multifamily Connecticut Avenue Securities (MCAS™) transaction.

Single-Family Credit Risk Transfer

(Dollars in Billions)

Multifamily Credit Risk Transfer

(Dollars in Billions)

|

| | |

| Third Quarter 2019 Results | 7 |

|

|

| Treasury Housing Reform Plan and Letter Agreement with Treasury |

On September 5, 2019, Treasury released a plan to reform the housing finance system. The Treasury Housing Reform Plan includes nearly 50 recommended reforms to define a limited role for the federal government in the housing finance system, enhance taxpayer protections against future bailouts, and promote competition in the housing finance system. The Treasury Housing Reform Plan includes recommendations relating to ending Fannie Mae’s conservatorship, amending its senior preferred stock purchase agreement with Treasury, considering additional restrictions and requirements on its business, and many other matters.

The Treasury Housing Reform Plan included a recommendation that Treasury and FHFA consider permitting Fannie Mae to retain earnings in excess of the $3 billion capital reserve in effect when the plan was released, with appropriate compensation to Treasury for any deferred or forgone dividends. On September 27, 2019, Fannie Mae, through FHFA in its capacity as conservator, and Treasury entered into a letter agreement modifying the terms of the senior preferred stock held by Treasury to permit Fannie Mae to retain up to $25 billion in capital, effective with the third quarter 2019 dividend period. The letter agreement also provided that, on September 30, 2019, and at the end of each fiscal quarter thereafter, the liquidation preference of the senior preferred stock will increase by an amount equal to the increase in Fannie Mae’s net worth, if any, during the immediately prior fiscal quarter, until such time as the liquidation preference has increased by $22 billion.

For more information on Treasury’s Housing Reform Plan and risks associated with the plan, as well as the letter agreement with Treasury, see “Legislation and Regulation” and “Risk Factors” in the company’s quarterly report on Form 10-Q for the quarter ended September 30, 2019 (Third Quarter 2019 Form 10-Q).

|

|

| Net Worth, Treasury Funding, and Senior Preferred Stock Dividends |

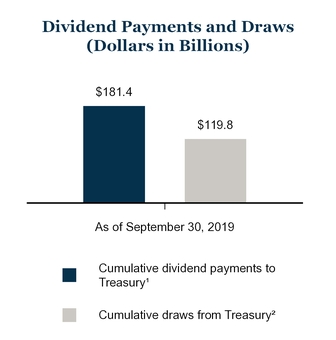

Treasury has made a commitment under a senior preferred stock purchase agreement to provide funding to Fannie Mae under certain circumstances if the company has a net worth deficit. Pursuant to this agreement and the senior preferred stock the company issued to Treasury in 2008, Fannie Mae has paid dividends to Treasury on the senior preferred stock on a quarterly basis for every dividend period for which dividends were payable since the company entered conservatorship in 2008.

Under the modified dividend provisions of the senior preferred stock described above, effective with the third quarter 2019 dividend period, Fannie Mae is not required to pay further dividends to Treasury until the company has accumulated over $25 billion in net worth. Accordingly, no dividends were payable to Treasury for the third quarter of 2019 and none will be payable for the fourth quarter of 2019.

As of September 30, 2019, Fannie Mae’s net worth was $10.3 billion. This amount reflects Fannie Mae’s net worth of $6.4 billion as of June 30, 2019, of which the company previously expected to pay Treasury $3.4 billion as a third-quarter 2019 dividend, and the company’s comprehensive income of $4.0 billion for the third quarter of 2019.

Changes in the company’s net worth can be significantly impacted by market conditions that affect its net interest income, fluctuations in the estimated fair value of the company’s derivatives and other financial instruments that the company marks to market through its earnings, developments that affect the company’s loss reserves such as changes in interest rates, home prices or accounting standards, or events such as natural disasters, and other factors, as the company discusses in “Risk Factors” and “Consolidated Results of Operations” in the company’s annual report on Form 10-K for the year ended December 31, 2018 (2018 Form 10-K) and in its Third Quarter 2019 Form 10-Q.

|

| | |

| Third Quarter 2019 Results | 8 |

The charts below show information about Fannie Mae’s net worth, the remaining amount of Treasury’s funding commitment to Fannie Mae, senior preferred stock dividends the company has paid Treasury, and funds the company has drawn from Treasury pursuant to its funding commitment.

| |

(1) | Aggregate amount of dividends the company has paid to Treasury on the senior preferred stock from 2008 through September 30, 2019. Under the terms of the senior preferred stock purchase agreement, dividend payments the company makes to Treasury do not offset its draws of funds from Treasury. |

| |

(2) | Aggregate amount of funds the company has drawn from Treasury pursuant to the senior preferred stock purchase agreement from 2008 through September 30, 2019. |

Under the modified liquidation preference provisions of the senior preferred stock described above, the aggregate liquidation preference of the senior preferred stock increased from $123.8 billion as of June 30, 2019 to $127.2 billion as of September 30, 2019 due to the $3.4 billion increase in the company’s net worth during the second quarter of 2019. The aggregate liquidation preference of the senior preferred stock will further increase to $131.2 billion as of December 31, 2019 due to the $4.0 billion increase in the company’s net worth during the third quarter of 2019.

For a description of the terms of the senior preferred stock purchase agreement and the senior preferred stock, see “Business—Conservatorship, Treasury Agreements and Housing Finance Reform” in the company’s 2018 Form 10-K and “Legislation and Regulation—Letter Agreement with Treasury” in the company’s Third Quarter 2019 Form 10-Q.

-

Fannie Mae’s financial statements for the third quarter and first nine months of 2019 are available in the accompanying Annex; however, investors and interested parties should read the company’s Third Quarter 2019 Form 10-Q, which was filed today with the Securities and Exchange Commission and is available on Fannie Mae’s website, www.fanniemae.com. The company provides further discussion of its financial results and condition, credit performance, and other matters in its Third Quarter 2019 Form 10-Q. Additional information about the company’s financial and credit performance is contained in the Fannie Mae Quarterly Financial Supplement Q3 2019 at www.fanniemae.com.

# # #

In this release, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements, including statements regarding: the company’s future dividend payments to Treasury; the future liquidation preference of the senior preferred stock; and the company’s plans relating to and the effects of the company’s credit risk transfer transactions. These estimates, forecasts, expectations, and statements are forward-looking statements based on the company’s current assumptions regarding numerous factors. Actual results, and future projections, could be materially different from what is set forth in the forward-looking statements as a result of: the uncertainty of the company’s

|

| | |

| Third Quarter 2019 Results | 9 |

future; future legislative or regulatory requirements or changes that have a significant impact on the company’s business, such as the enactment of housing finance reform legislation (including all or any portion of the Treasury Housing Reform Plan), including changes that limit the company’s business activities or footprint; home price changes; interest rate and credit spread changes; macroeconomic factors such as U.S. gross domestic product, unemployment rates, personal income, and the volume of mortgage originations; the size and the company’s share of the U.S. mortgage market and the factors that affect them, including population growth and household formation; the company’s future serious delinquency rates; the company’s and its competitors’ future guaranty fee pricing and the impact of that pricing on the company’s guaranty fee revenues and competitive environment; credit availability; changes in borrower behavior; the effectiveness of its loss mitigation strategies; significant changes in modification and foreclosure activity; the volume and pace of future nonperforming and reperforming loan sales and their impact on the company’s results and serious delinquency rates; the effectiveness of its management of its real estate owned inventory and pursuit of contractual remedies; changes in the fair value of its assets and liabilities; the company’s reliance on Common Securitization Solutions, LLC (CSS) and the common securitization platform for the operation of many of its securitization activities; the stability and adequacy of the systems and infrastructure that impact the company’s operations, including the company’s and those of CSS, its other counterparties and other third parties on which the business relies; actions by FHFA, Treasury, the Department of Housing and Urban Development, the Consumer Financial Protection Bureau or other regulators, or Congress, that affect the company’s business, including new capital requirements that become applicable to the company or changes in the ability-to-repay rule to replace the qualified mortgage patch for GSE-eligible loans; the size, composition and quality of the company’s guaranty book of business and retained mortgage portfolio; the competitive landscape in which the company operates, including the impact of legislative or other developments on levels of competition in its industry and other factors affecting its market share; the life of the loans in the company’s guaranty book of business; the company’s reliance on and future updates it makes to its models, including the assumptions used by these models; changes in generally accepted accounting principles; changes to the company’s accounting policies; effects from activities the company takes to support the mortgage market and help borrowers; the company’s future objectives and activities in support of those objectives, including actions the company may take to reach additional underserved creditworthy borrowers; actions the company may be required to take by FHFA, in its role as the company’s conservator or as its regulator, such as changes in the type of business the company does; limitations on the company’s business imposed by FHFA, in its role as the company’s conservator or as its regulator; the conservatorship, including any changes to or termination (by receivership or otherwise) of the conservatorship and its effect on the company’s business; the investment by Treasury, including potential changes to the terms of the senior preferred stock purchase agreement or senior preferred stock, and its effect on the company’s business, including restrictions imposed on the company by the terms of the senior preferred stock purchase agreement, the senior preferred stock and Treasury’s warrant, as well as the possibility that these or other restrictions on the company’s business and activities may be applied to the company through other mechanisms even if the company ceases to be subject to these agreements and instruments; the possibility that future changes in leadership at FHFA or the Administration may result in changes in FHFA’s or Treasury’s willingness to pursue the administrative reform recommendations in the Treasury plan; challenges the company faces in retaining and hiring qualified executives and other employees; the deteriorated credit performance of many loans in the company’s guaranty book of business; a decrease in the company’s credit ratings; defaults by one or more institutional counterparties; resolution or settlement agreements the company may enter into with its counterparties; the impact of increasing interdependence between the single-family mortgage securitization programs of Fannie Mae and Freddie Mac in connection with uniform mortgage-backed securities; operational control weaknesses; changes in the fiscal and monetary policies of the Federal Reserve; changes in the structure and regulation of the financial services industry; the company’s ability to access the debt markets; changes in the demand for Fannie Mae MBS; disruptions or instability in the housing and credit markets; uncertainties relating to the potential phasing out of LIBOR, or other market changes that could impact the loans the company owns or guarantees or its MBS; the company’s need to rely on third parties to fully achieve some of its corporate objectives; the company’s reliance on mortgage servicers; domestic and global political risks and uncertainties; natural disasters, environmental disasters, terrorist attacks, pandemics, or other major disruptive events; cyber attacks or other information security breaches or threats; and many other factors, including those discussed in the “Risk Factors” and “Forward-Looking Statements” sections of and elsewhere in the company’s 2018 Form 10-K, Third Quarter 2019 Form 10-Q, and elsewhere in this release.

Fannie Mae provides website addresses in its news releases solely for readers’ information. Other content or information appearing on these websites is not part of this release.

Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of Americans. We partner with lenders to create housing opportunities for families across the country. We are driving positive changes in housing finance to make the home buying process easier, while reducing costs and risk. To learn more, visit fanniemae.com and follow us on twitter.com/fanniemae.

|

| | |

| Third Quarter 2019 Results | 10 |

ANNEX

FANNIE MAE

(In conservatorship)

Condensed Consolidated Balance Sheets — (Unaudited)

(Dollars in millions)

|

| | | | | | | | | | | |

| | As of |

| | September 30, 2019 | | December 31, 2018 |

| | |

| ASSETS |

| Cash and cash equivalents | | $ | 22,592 |

| | | | $ | 25,557 |

| |

| Restricted cash (includes $35,496 and $17,849, respectively, related to consolidated trusts) | | 41,906 |

| | | | 23,866 |

| |

| Federal funds sold and securities purchased under agreements to resell or similar arrangements | | 23,176 |

| | | | 32,938 |

| |

| Investments in securities: | | | | | | | |

| Trading, at fair value (includes $4,304 and $3,061, respectively, pledged as collateral) | | 44,206 |

| | | | 41,867 |

| |

| Available-for-sale, at fair value | | 2,690 |

| | | | 3,429 |

| |

| Total investments in securities | | 46,896 |

| | | | 45,296 |

| |

| Mortgage loans: | | | | | | | |

| Loans held for sale, at lower of cost or fair value | | 12,289 |

| | | | 7,701 |

| |

| Loans held for investment, at amortized cost: | | | | | | | |

| Of Fannie Mae | | 104,367 |

| | | | 113,039 |

| |

| Of consolidated trusts | | 3,206,856 |

| | | | 3,142,858 |

| |

| Total loans held for investment (includes $8,183 and $8,922, respectively, at fair value) | | 3,311,223 |

| | | | 3,255,897 |

| |

| Allowance for loan losses | | (9,376 | ) | | | | (14,203 | ) | |

| Total loans held for investment, net of allowance | | 3,301,847 |

| | | | 3,241,694 |

| |

| Total mortgage loans | | 3,314,136 |

| | | | 3,249,395 |

| |

| Deferred tax assets, net | | 11,994 |

| | | | 13,188 |

| |

| Accrued interest receivable, net (includes $8,450 and $7,928, respectively, related to consolidated trusts) | | 8,923 |

| | | | 8,490 |

| |

| Acquired property, net | | 2,452 |

| | | | 2,584 |

| |

| Other assets | | 22,361 |

| | | | 17,004 |

| |

| Total assets | | $ | 3,494,436 |

| | | | $ | 3,418,318 |

| |

| LIABILITIES AND EQUITY |

| Liabilities: | | | | | | | |

| Accrued interest payable (includes $9,348 and $9,133, respectively, related to consolidated trusts) | | $ | 10,400 |

| | | | $ | 10,211 |

| |

| Debt: | | | | | | | |

| Of Fannie Mae (includes $6,041 and $6,826, respectively, at fair value) | | 213,522 |

| | | | 232,074 |

| |

| Of consolidated trusts (includes $22,719 and $23,753, respectively, at fair value) | | 3,248,336 |

| | | | 3,159,846 |

| |

| Other liabilities (includes $359 and $356, respectively, related to consolidated trusts) | | 11,836 |

| | | | 9,947 |

| |

| Total liabilities | | 3,484,094 |

| | | | 3,412,078 |

| |

| Commitments and contingencies (Note 13) | | — |

| | | | — |

| |

| Fannie Mae stockholders’ equity: | | | | | | | |

| Senior preferred stock (liquidation preference of $127,201 and $123,836, respectively) | | 120,836 |

| | | | 120,836 |

| |

| Preferred stock, 700,000,000 shares are authorized—555,374,922 shares issued and outstanding | | 19,130 |

| | | | 19,130 |

| |

| Common stock, no par value, no maximum authorization—1,308,762,703 shares issued and 1,158,087,567 shares outstanding | | 687 |

| | | | 687 |

| |

| Accumulated deficit | | (123,141 | ) | | | | (127,335 | ) | |

| Accumulated other comprehensive income | | 230 |

| | | | 322 |

| |

| Treasury stock, at cost, 150,675,136 shares | | (7,400 | ) | | | | (7,400 | ) | |

| Total stockholders’ equity (See Note 1: Senior Preferred Stock Purchase Agreement and Senior Preferred Stock for information on the related dividend obligation and liquidation preference) | | 10,342 |

| | | | 6,240 |

| |

| Total liabilities and equity | | $ | 3,494,436 |

| | | | $ | 3,418,318 |

| |

See Notes to Condensed Consolidated Financial Statements in the Third Quarter 2019 Form 10-Q

|

| | |

| Third Quarter 2019 Results | 11 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Operations and Comprehensive Income — (Unaudited)

(Dollars in millions, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| | |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Interest income: | | | | | | | | | | | | | | | |

| Trading securities | | $ | 418 |

| | | | $ | 363 |

| | | | $ | 1,277 |

| | | | $ | 917 |

| |

| Available-for-sale securities | | 40 |

| | | | 54 |

| | | | 138 |

| | | | 175 |

| |

| Mortgage loans (includes $27,610 and $27,058, respectively, for the three months ended and $84,157 and $79,877, respectively, for the nine months ended related to consolidated trusts) | | 28,858 |

| | | | 28,723 |

| | | | 88,005 |

| | | | 85,064 |

| |

| Federal funds sold and securities purchased under agreements to resell or similar arrangements | | 178 |

| | | | 166 |

| | | | 698 |

| | | | 457 |

| |

| Other | | 47 |

| | | | 38 |

| | | | 120 |

| | | | 102 |

| |

| Total interest income | | 29,541 |

| | | | 29,344 |

| | | | 90,238 |

| | | | 86,715 |

| |

| Interest expense: | | | | | | | | | | | | | | | |

| Short-term debt | | (125 | ) | | | | (114 | ) | | | | (369 | ) | | | | (331 | ) | |

| Long-term debt (includes $22,775 and $22,361, respectively, for the three months ended and $70,371 and $65,972, respectively, for the nine months ended related to consolidated trusts) | | (24,187 | ) | | | | (23,861 | ) | | | | (74,757 | ) | | | | (70,406 | ) | |

| Total interest expense | | (24,312 | ) | | | | (23,975 | ) | | | | (75,126 | ) | | | | (70,737 | ) | |

| Net interest income | | 5,229 |

| | | | 5,369 |

| | | | 15,112 |

| | | | 15,978 |

| |

| Benefit for credit losses | | 1,857 |

| | | | 716 |

| | | | 3,732 |

| | | | 2,229 |

| |

| Net interest income after benefit for credit losses | | 7,086 |

| | | | 6,085 |

| | | | 18,844 |

| | | | 18,207 |

| |

| Investment gains, net | | 253 |

| | | | 166 |

| | | | 847 |

| | | | 693 |

| |

| Fair value gains (losses), net | | (713 | ) | | | | 386 |

| | | | (2,298 | ) | | | | 1,660 |

| |

| Fee and other income | | 402 |

| | | | 271 |

| | | | 875 |

| | | | 830 |

| |

| Non-interest income (loss) | | (58 | ) | | | | 823 |

| | | | (576 | ) | | | | 3,183 |

| |

| Administrative expenses: | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | (361 | ) | | | | (355 | ) | | | | (1,123 | ) | | | | (1,101 | ) | |

| Professional services | | (241 | ) | | | | (247 | ) | | | | (699 | ) | | | | (744 | ) | |

| Other administrative expenses | | (147 | ) | | | | (138 | ) | | | | (415 | ) | | | | (400 | ) | |

| Total administrative expenses | | (749 | ) | | | | (740 | ) | | | | (2,237 | ) | | | | (2,245 | ) | |

| Foreclosed property expense | | (96 | ) | | | | (159 | ) | | | | (364 | ) | | | | (460 | ) | |

| Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | | (613 | ) | | | | (576 | ) | | | | (1,806 | ) | | | | (1,698 | ) | |

| Other expenses, net | | (571 | ) | | | | (377 | ) | | | | (1,514 | ) | | | | (946 | ) | |

| Total expenses | | (2,029 | ) | | | | (1,852 | ) | | | | (5,921 | ) | | | | (5,349 | ) | |

| Income before federal income taxes | | 4,999 |

| | | | 5,056 |

| | | | 12,347 |

| | | | 16,041 |

| |

| Provision for federal income taxes | | (1,036 | ) | | | | (1,045 | ) | | | | (2,552 | ) | | | | (3,312 | ) | |

| Net income | | 3,963 |

| | | | 4,011 |

| | | | 9,795 |

| | | | 12,729 |

| |

| Other comprehensive income (loss): | | | | | | | | | | | | | | | |

| Changes in unrealized gains on available-for-sale securities, net of reclassification adjustments and taxes | | 16 |

| | | | (33 | ) | | | | (85 | ) | | | | (349 | ) | |

| Other, net of taxes | | (2 | ) | | | | (3 | ) | | | | (7 | ) | | | | (8 | ) | |

| Total other comprehensive income (loss) | | 14 |

| | | | (36 | ) | | | | (92 | ) | | | | (357 | ) | |

| Total comprehensive income | | $ | 3,977 |

| | | | $ | 3,975 |

| | | | $ | 9,703 |

| | | | $ | 12,372 |

| |

| Net income | | $ | 3,963 |

| | | | $ | 4,011 |

| | | | $ | 9,795 |

| | | | $ | 12,729 |

| |

| Dividends distributed or amounts attributable to senior preferred stock | | (3,977 | ) | | | | (3,975 | ) | | | | (9,703 | ) | | | | (9,372 | ) | |

| Net income (loss) attributable to common stockholders | | $ | (14 | ) | | | | $ | 36 |

| | | | $ | 92 |

| | | | $ | 3,357 |

| |

| Earnings per share: | | | | | | | | | | | | | | | |

| Basic | | $ | 0.00 |

| | | | $ | 0.01 |

| | | | $ | 0.02 |

| | | | $ | 0.58 |

| |

| Diluted | | 0.00 |

| | | | 0.01 |

| | | | 0.02 |

| | | | 0.57 |

| |

| Weighted-average common shares outstanding: | | | | | | | | | | | | | | | |

| Basic | | 5,762 |

| | | | 5,762 |

| | | | 5,762 |

| | | | 5,762 |

| |

| Diluted | | 5,762 |

| | | | 5,893 |

| | | | 5,893 |

| | | | 5,893 |

| |

See Notes to Condensed Consolidated Financial Statements in the Third Quarter 2019 Form 10-Q

|

| | |

| Third Quarter 2019 Results | 12 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Cash Flows — (Unaudited)

(Dollars in millions)

|

| | | | | | | | | | | |

| | For the Nine Months Ended September 30, |

| | 2019 | | 2018 |

| Net cash provided by (used in) operating activities | | $ | 3,176 |

| | | | $ | (1,796 | ) | |

| Cash flows provided by investing activities: | | | | | | | |

| Proceeds from maturities and paydowns of trading securities held for investment | | 46 |

| | | | 163 |

| |

| Proceeds from sales of trading securities held for investment | | 49 |

| | | | 96 |

| |

| Proceeds from maturities and paydowns of available-for-sale securities | | 364 |

| | | | 564 |

| |

| Proceeds from sales of available-for-sale securities | | 376 |

| | | | 729 |

| |

| Purchases of loans held for investment | | (181,898 | ) | | | | (135,913 | ) | |

| Proceeds from repayments of loans acquired as held for investment of Fannie Mae | | 9,338 |

| | | | 11,651 |

| |

| Proceeds from sales of loans acquired as held for investment of Fannie Mae | | 8,987 |

| | | | 10,637 |

| |

| Proceeds from repayments and sales of loans acquired as held for investment of consolidated trusts | | 377,789 |

| | | | 306,374 |

| |

| Advances to lenders | | (95,636 | ) | | | | (83,643 | ) | |

| Proceeds from disposition of acquired property and preforeclosure sales | | 5,644 |

| | | | 7,090 |

| |

| Net change in federal funds sold and securities purchased under agreements to resell or similar arrangements | | 9,762 |

| | | | (7,128 | ) | |

| Other, net | | (74 | ) | | | | (56 | ) | |

| Net cash provided by investing activities | | 134,747 |

| | | | 110,564 |

| |

| Cash flows used in financing activities: | | | | | | | |

| Proceeds from issuance of debt of Fannie Mae | | 587,659 |

| | | | 636,466 |

| |

| Payments to redeem debt of Fannie Mae | | (606,665 | ) | | | | (666,888 | ) | |

| Proceeds from issuance of debt of consolidated trusts | | 286,126 |

| | | | 278,357 |

| |

| Payments to redeem debt of consolidated trusts | | (385,496 | ) | | | | (364,942 | ) | |

| Payments of cash dividends on senior preferred stock to Treasury | | (5,601 | ) | | | | (5,397 | ) | |

| Proceeds from senior preferred stock purchase agreement with Treasury | | — |

| | | | 3,687 |

| |

| Other, net | | 1,129 |

| | | | 720 |

| |

| Net cash used in financing activities | | (122,848 | ) | | | | (117,997 | ) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | 15,075 |

| | | | (9,229 | ) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 49,423 |

| | | | 60,260 |

| |

| Cash, cash equivalents and restricted cash at end of period | | $ | 64,498 |

| | | | $ | 51,031 |

| |

| Cash paid during the period for: | | | | | | | |

| Interest | | $ | 86,699 |

| | | | $ | 82,010 |

| |

| Income taxes | | 1,250 |

| | | | 460 |

| |

See Notes to Condensed Consolidated Financial Statements in the Third Quarter 2019 Form 10-Q

|

| | |

| Third Quarter 2019 Results | 13 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Changes in Equity (Deficit) — (Unaudited)

(Dollars and shares in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fannie Mae Stockholders’ Equity (Deficit) |

| | | Shares Outstanding | | Senior

Preferred Stock | | Preferred

Stock | | Common

Stock | |

Accumulated

Deficit | | Accumulated

Other

Comprehensive

Income | | Treasury

Stock | | Total

Equity |

| | Senior

Preferred | | Preferred | | Common | |

| Balance as of June 30, 2019 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (127,104 | ) | | $ | 216 |

| | $ | (7,400 | ) | | $ | 6,365 |

|

| Senior preferred stock dividends paid | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,963 |

| | — |

| | — |

| | 3,963 |

|

| Other comprehensive income, net of tax effect: | | | | | | | | | | | | | | | | | | | | |

| Changes in net unrealized gains on available-for-sale securities (net of taxes of $2) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 10 |

| | — |

| | 10 |

|

| Reclassification adjustment for gains included in net income (net of taxes of $1) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 6 |

| | — |

| | 6 |

|

| Other (net of taxes of $1) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (2 | ) | | — |

| | (2 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | �� | | | | 3,977 |

|

| Balance as of September 30, 2019 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (123,141 | ) | | $ | 230 |

| | $ | (7,400 | ) | | $ | 10,342 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fannie Mae Stockholders’ Equity (Deficit) |

| | | Shares Outstanding | | Senior

Preferred Stock | | Preferred

Stock | | Common

Stock | |

Accumulated

Deficit | | Accumulated

Other

Comprehensive

Income | | Treasury

Stock | | Total

Equity |

| | Senior

Preferred | | Preferred | | Common | |

| Balance as of December 31, 2018 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (127,335 | ) | | $ | 322 |

| | $ | (7,400 | ) | | $ | 6,240 |

|

| Senior preferred stock dividends paid | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5,601 | ) | | — |

| | — |

| | (5,601 | ) |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 9,795 |

| | — |

| | — |

| | 9,795 |

|

| Other comprehensive income, net of tax effect: | | | | | | | | | | | | | | | | | | | | |

| Changes in net unrealized gains on available-for-sale securities (net of taxes of $7) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 27 |

| | — |

| | 27 |

|

| Reclassification adjustment for gains included in net income (net of taxes of $30) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (112 | ) | | — |

| | (112 | ) |

| Other (net of taxes of $2) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (7 | ) | | — |

| | (7 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | 9,703 |

|

| Balance as of September 30, 2019 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (123,141 | ) | | $ | 230 |

| | $ | (7,400 | ) | | $ | 10,342 |

|

See Notes to Condensed Consolidated Financial Statements in the Third Quarter 2019 Form 10-Q

|

| | |

| Third Quarter 2019 Results | 14 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Changes in Equity (Deficit) — (Unaudited)

(Dollars and shares in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fannie Mae Stockholders’ Equity (Deficit) |

| | | Shares Outstanding | | Senior

Preferred Stock | | Preferred

Stock | | Common

Stock | |

Accumulated

Deficit | | Accumulated

Other

Comprehensive

Income | | Treasury

Stock | | Total

Equity

(Deficit) |

| | | Senior

Preferred | | Preferred | | Common | |

| Balance as of June 30, 2018 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (126,143 | ) | | $ | 349 |

| | $ | (7,400 | ) | | $ | 7,459 |

|

| Senior preferred stock dividends paid | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (4,459 | ) | | — |

| | — |

| | (4,459 | ) |

| Increase to senior preferred stock | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 4,011 |

| | — |

| | — |

| | 4,011 |

|

| Other comprehensive income, net of tax effect: | | | | | | | | | | | | | | | | | | | | |

| Changes in net unrealized gains on available-for-sale securities (net of taxes of $8) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (31 | ) | | — |

| | (31 | ) |

| Reclassification adjustment for gains included in net income (net of taxes of $1) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (2 | ) | | — |

| | (2 | ) |

| Other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (3 | ) | | — |

| | (3 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | 3,975 |

|

Reclassification related to Tax Cuts

and Jobs Act | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Balance as of September 30, 2018 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (126,591 | ) | | $ | 313 |

| | $ | (7,400 | ) | | $ | 6,975 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fannie Mae Stockholders’ Equity (Deficit) |

| | | Shares Outstanding | | Senior

Preferred Stock | | Preferred

Stock | | Common

Stock | |

Accumulated

Deficit | | Accumulated

Other

Comprehensive

Income | | Treasury

Stock | | Total

Equity (Deficit) |

| | | Senior

Preferred | | Preferred | | Common | |

| Balance as of December 31, 2017 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 117,149 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (133,805 | ) | | $ | 553 |

| | $ | (7,400 | ) | | $ | (3,686 | ) |

| Senior preferred stock dividends paid | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5,397 | ) | | — |

| | — |

| | (5,397 | ) |

| Increase to senior preferred stock | | — |

| | — |

| | — |

| | 3,687 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,687 |

|

| Comprehensive income: | |

| |

| |

| | | | | | | | | | | | | |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 12,729 |

| | — |

| | — |

| | 12,729 |

|

| Other comprehensive income, net of tax effect: | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Changes in net unrealized gains on available-for-sale securities (net of taxes of $22) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (84 | ) | | — |

| | (84 | ) |

| Reclassification adjustment for gains included in net income (net of taxes of $71) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (265 | ) | | — |

| | (265 | ) |

| Other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (8 | ) | | — |

| | (8 | ) |

| Total comprehensive income | |

| |

| |

| | | | | | | | | | | | | | 12,372 |

|

Reclassification related to Tax Cuts

and Jobs Act | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (117 | ) | | 117 |

| | — |

| | — |

|

| Other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

| Balance as of September 30, 2018 | | 1 |

| | 556 |

| | 1,158 |

| | $ | 120,836 |

| | $ | 19,130 |

| | $ | 687 |

| | $ | (126,591 | ) | | $ | 313 |

| | $ | (7,400 | ) | | $ | 6,975 |

|

See Notes to Condensed Consolidated Financial Statements in the Third Quarter 2019 Form 10-Q

|

| | |

| Third Quarter 2019 Results | 15 |