Contact: Pete Bakel Resource Center: 1-800-732-6643

202-752-2034 Exhibit 99.1

Date: August 3, 2021

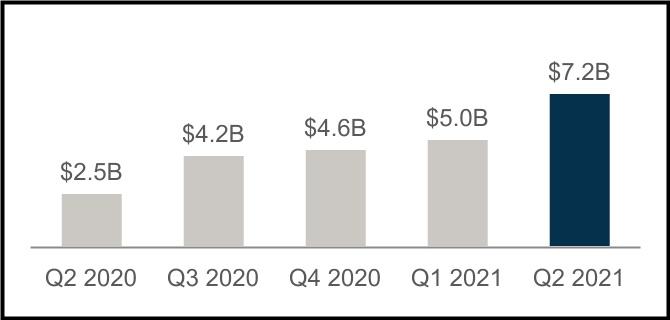

Fannie Mae Reports Net Income of $7.2 Billion for Second Quarter 2021

| | | | | | | | | | | | | | |

| | | |

| • | $7.2 billion net income for the second quarter of 2021 compared with $5.0 billion for the first quarter of 2021 | | “Fannie Mae’s second quarter results demonstrate our ability to advance our mission, operate safely and soundly, and grow our capital. To meet our mission through business cycles, we must be safe and sound – and to be safe and sound, we need to have adequate capital. These priorities are the foundation for our work with our industry partners to address the nation’s long-term housing challenges, including housing affordability, supply, and equity.”

Hugh R. Frater, Chief Executive Officer |

| | |

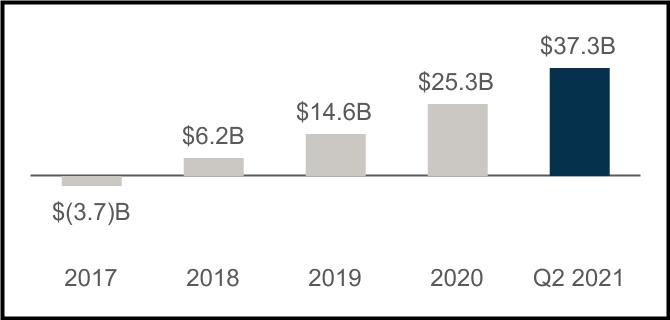

| • | Net worth increased to $37.3 billion as of June 30, 2021 | |

| | |

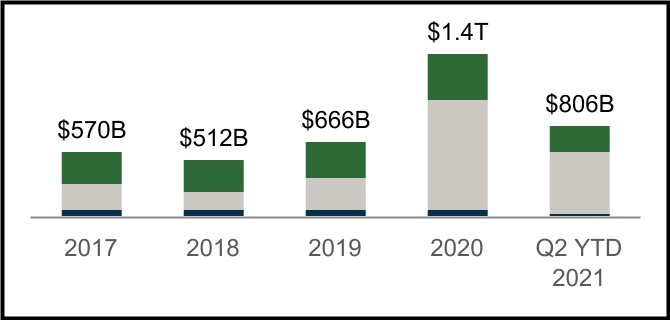

| • | $384 billion in liquidity provided to the Single-Family and Multifamily mortgage markets in the second quarter of 2021 | |

| | |

| • | $129.5 billion of Single-Family home purchase acquisitions, a record high, of which nearly 50% were for first-time homebuyers | |

| | |

| | |

| | |

| • | 128,000 units of rental housing financed, more than 90% affordable to families earning at or below 120% of area median income | |

| | |

| • | Nearly 1.4 million single-family forbearance plans initiated to help borrowers since the onset of the COVID-19 pandemic; as of June 30, 2021, approximately 1.1 million of these loans have exited forbearance, including approximately 659,000 through reinstatement or payoff, and approximately 323,000 through the company’s payment deferral option | |

| | |

| • | Home price growth in the first half of 2021 was 10.5%, the highest six-month growth rate in the history of Fannie Mae’s home price index | |

| | | | |

| | | | |

| | | | |

| |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2021 Key Results | | | | | | | | | | |

| $37.3 Billion Net Worth | $806 Billion Supporting Housing Activity |

| | | | | | | | | | | |

| Increase of $7.1 billion in Q2 2021 | | | SF Home Purchases | | | SF Refinancings | | | MF Rental Units |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

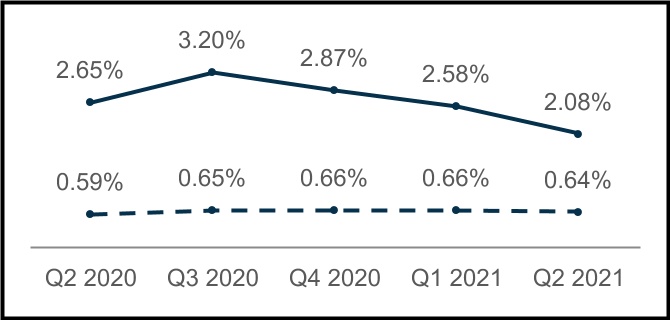

| $7.2 Billion Net Income | | Single-Family SDQ Rate |

| | | | | | |

| Increase of $2.2 billion compared with first quarter 2021 | | SDQ Rate | | SDQ Rate without Forbearances |

|

| | | |

| | | | | | | | |

| Second Quarter 2021 Results | 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary of Financial Results | |

| (Dollars in millions) | | Q221 | | Q121 | | Variance | | % Change | | | | Q220 | | Variance | | % Change | |

| Net interest income | | $ | 8,286 | | | $ | 6,742 | | | $ | 1,544 | | | 23 | % | | | | 5,777 | | | 2,509 | | | 43 | % | |

| Fee and other income | | 103 | | | 87 | | | 16 | | | 18 | % | | | | 90 | | | 13 | | | 14 | % | |

| Net revenues | | 8,389 | | | 6,829 | | | 1,560 | | | 23 | % | | | | 5,867 | | | 2,522 | | | 43 | % | |

| Investment gains, net | | 646 | | | 45 | | | 601 | | | NM | | | | 149 | | | 497 | | | NM | |

| Fair value gains (losses), net | | (446) | | | 784 | | | (1,230) | | | NM | | | | (1,018) | | | 572 | | | 56 | % | |

| Administrative expenses | | (746) | | | (748) | | | 2 | | | — | % | | | | (754) | | | 8 | | | 1 | % | |

| Credit-related income (expenses) | | 2,547 | | | 770 | | | 1,777 | | | NM | | | | (22) | | | 2,569 | | | NM | |

| Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) fees | | (758) | | | (731) | | | (27) | | | 4 | % | | | | (660) | | | (98) | | | 15 | % | |

| Other expenses, net* | | (598) | | | (634) | | | 36 | | | (6) | % | | | | (348) | | | (250) | | | 72 | % | |

| Income before federal income taxes | | 9,034 | | | 6,315 | | | 2,719 | | | 43 | % | | | | 3,214 | | | 5,820 | | | 181 | % | |

| Provision for federal income taxes | | (1,882) | | | (1,322) | | | (560) | | | 42 | % | | | | (669) | | | (1,213) | | | 181 | % | |

| Net income | | $ | 7,152 | | | $ | 4,993 | | | $ | 2,159 | | | 43 | % | | | | $ | 2,545 | | | $ | 4,607 | | | 181 | % | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total comprehensive income | | $ | 7,120 | | | $ | 4,966 | | | $ | 2,154 | | | 43 | % | | | | $ | 2,532 | | | $ | 4,588 | | | 181 | % | |

| Net worth | | $ | 37,345 | | | $ | 30,225 | | | $ | 7,120 | | | 24 | % | | | | $ | 16,477 | | | $ | 20,868 | | | 127 | % | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| NM - Not meaningful | | | | | | | | | | | | | | | | | |

* Other expense, net also includes credit enhancement expense and change in expected credit enhancement recoveries | |

| | | | | | | | | |

| | | |

| Financial Highlights | |

| | | |

| • | | Net income increased $2.2 billion in the second quarter of 2021 compared with the first quarter of 2021 driven primarily by an increase in credit-related income and higher net interest income, partially offset by a shift from fair value gains in the first quarter of 2021 to fair value losses in the second quarter of 2021. | |

| | | |

| • | | Credit-related income increased $1.8 billion in the second quarter of 2021 compared with the first quarter of 2021. Credit-related income in the second quarter of 2021 was driven by higher actual and forecasted home prices, as well as an increase in the volume of redesignations of reperforming single-family mortgage loans from held-for-investment to held-for sale. | |

| | | |

| • | | Net interest income increased $1.5 billion in the second quarter of 2021 compared with the first quarter of 2021, driven primarily by an increase in net amortization income, particularly in the beginning of the second quarter. Single-family mortgage loan prepayment activity slowed some throughout the second quarter of 2021 compared to the first quarter of 2021; however refinancing activity remained strong due to the continued low interest-rate environment. | |

| | | |

| • | | Fair value losses were $446 million in the second quarter of 2021, compared with fair value gains of $784 million in the first quarter of 2021. The $1.2 billion shift from gains to losses was driven by a decrease in Treasury yields, which drove losses on commitments to sell securities and fair value debt as prices rose. | |

| | | |

| • | | Investment gains increased $601 million in the second quarter of 2021, driven by gains from the sale of single-family reperforming loans in the second quarter of 2021, compared with no such sales in the first quarter of 2021. | |

| | | | | | | | |

| Second Quarter 2021 Results | 2 |

| | | | | | |

| Single-Family Business Financial Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | Q221 | | Q121 | | Variance | | % Change | | | | Q220 | | Variance | | % Change |

| Net interest income | | $ | 7,323 | | | $ | 5,894 | | | $ | 1,429 | | | 24 | % | | | | $ | 4,939 | | | $ | 2,384 | | | 48 | % |

| Fee and other income | | 80 | | | 62 | | | 18 | | | 29 | % | | | | 71 | | | 9 | | | 13 | % |

| Net revenues | | 7,403 | | | 5,956 | | | 1,447 | | | 24 | % | | | | 5,010 | | | 2,393 | | | 48 | % |

| Investment gains, net | | 658 | | | 64 | | | 594 | | | NM | | | | 96 | | | 562 | | | NM |

| Fair value gains (losses), net | | (386) | | | 740 | | | (1,126) | | | NM | | | | (1,030) | | | 644 | | | 63 | % |

| Administrative expenses | | (619) | | | (623) | | | 4 | | | (1) | % | | | | (625) | | | 6 | | | (1) | % |

| Credit-related income | | 2,525 | | | 679 | | | 1,846 | | | NM | | | | 216 | | | 2,309 | | | NM |

| Temporary Payroll Tax Cut Continuation Act of 2011 (TCCA) fees | | (758) | | | (731) | | | (27) | | | 4 | % | | | | (660) | | | (98) | | | (15) | % |

Other expenses, net* | | (591) | | | (529) | | | (62) | | | 12 | % | | | | (351) | | | (240) | | | (68) | % |

| Income before federal income taxes | | 8,232 | | | 5,556 | | | 2,676 | | | 48 | % | | | | 2,656 | | | 5,576 | | | NM |

| Provision for federal income taxes | | (1,725) | | | (1,162) | | | (563) | | | 48 | % | | | | (556) | | | (1,169) | | | NM |

| Net income | | $ | 6,507 | | | $ | 4,394 | | | $ | 2,113 | | | 48 | % | | | | $ | 2,100 | | | $ | 4,407 | | | NM |

| | | | | | | | | | | | | | | | |

| Average charged guaranty fee on new conventional acquisitions, net of TCCA | | 47.9 bps | | 48.0 bps | | (0.1) bps | | — | % | | | | 46.7 bps | | 1.2 bps | | 3 | % |

| Average charged guaranty fee on conventional guaranty book of business, net of TCCA | | 45.2 bps | | 44.9 bps | | 0.3 bps | | 1 | % | | | | 44.2 bps | | 1.0 bps | | 2 | % |

| | | | | | | | | | | | | | | | |

* Other expense, net also includes credit enhancement expense and change in expected credit enhancement recoveries |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | |

|

| | |

| | |

| | |

| | |

| Key Business Highlights |

| | |

| • | Single-family conventional acquisition volume was $373.3 billion in the second quarter of 2021. Purchase acquisitions reached a record high of $129.5 billion, of which nearly 50% were for first-time homebuyers. Refinance acquisitions were $243.8 billion in the second quarter of 2021, a decline compared with the first quarter of 2021, but remaining at a high level due to the continued low interest-rate environment. | |

| | |

| • | Average single-family conventional guaranty book of business during the second quarter of 2021 increased from the first quarter of 2021 by 2.7%. Credit characteristics of the single-family conventional guaranty book of business remained strong, with a weighted-average mark-to-market loan-to-value ratio of 55% and weighted-average FICO credit score of 752. | |

| | |

| • | Average charged guaranty fee, net of TCCA fees, on the single-family conventional guaranty book increased from 44.9 basis points for the three months ended March 31, 2021 to 45.2 basis points for the three months ended June 30, 2021. Average charged guaranty fee on newly acquired single-family conventional loans, net of TCCA fees, remained relatively flat at 47.9 basis points. | |

| | |

| • | As of June 30, 2021, 1.8% of the single-family guaranty book of business based on loan count, or 313,679 loans, was in forbearance, the vast majority of which was related to the COVID-19 pandemic, compared with 2.5% as of March 31, 2021. Since the start of the pandemic, 74% of loans that entered forbearance have successfully exited. | |

| | |

| • | Single-family serious delinquency rate decreased to 2.08% as of June 30, 2021, from 2.58% as of March 31, 2021, due to the on-going economic recovery and the decline in the number of the company’s single-family loans in a COVID-19 forbearance plan. Single-family serious delinquency rate excluding loans in forbearance decreased from 0.66% as of March 31, 2021 to 0.64% as of June 30, 2021. Single-family seriously delinquent loans are loans that are 90 days or more past due or in the foreclosure process. | |

| | | | | | | | |

| Second Quarter 2021 Results | 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Multifamily Business Financial Results |

| (Dollars in millions) | | Q221 | | Q121 | | Variance | | % Change | | | | Q220 | | Variance | | % Change |

| Net interest income | | $ | 963 | | | $ | 848 | | | $ | 115 | | | 14 | % | | | | $ | 838 | | | $ | 125 | | | 15 | % |

| Fee and other income | | 23 | | | 25 | | | (2) | | | (8) | % | | | | 19 | | | 4 | | | 21 | % |

| Net revenues | | 986 | | | 873 | | | 113 | | | 13 | % | | | | 857 | | | 129 | | | 15 | % |

| | | | | | | | | | | | | | | | |

| Fair value gains (losses), net | | (60) | | | 44 | | | (104) | | | NM | | | | 12 | | | (72) | | | NM |

| Administrative expenses | | (127) | | | (125) | | | (2) | | | 2 | % | | | | (129) | | | 2 | | | (2) | % |

| Credit-related income (expenses) | | 22 | | | 91 | | | (69) | | | (76) | % | | | | (238) | | | 260 | | | NM |

| Credit enhancement expense | | (55) | | | (58) | | | 3 | | | (5) | % | | | | (53) | | | (2) | | | 4 | % |

| Change in expected credit enhancement recoveries | | 13 | | | (15) | | | 28 | | | NM | | | | 65 | | | (52) | | | (80) | % |

| Other income (expense), net | | 23 | | | (51) | | | 74 | | | NM | | | | 44 | | | (21) | | | (48) | % |

| Income before federal income taxes | | 802 | | | 759 | | | 43 | | | 6 | % | | | | 558 | | | 244 | | | 44 | % |

| Provision for federal income taxes | | (157) | | | (160) | | | 3 | | | (2) | % | | | | (113) | | | (44) | | | 39 | % |

| Net income | | $ | 645 | | | $ | 599 | | | $ | 46 | | | 8 | % | | | | $ | 445 | | | $ | 200 | | | 45 | % |

| | | | | | | | | | | | | | | | |

| Average charged guaranty fee rate on multifamily guaranty book of business, at end of period | | 76.8 bps | | 75.9 bps | | 0.9 bps | | 1 | % | | | | 72.3 bps | | 4.5 bps | | 6 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | |

| Key Business Highlights |

| | |

| • | New multifamily business volume was $10.9 billion in the second quarter of 2021, resulting in $32.4 billion for the first half of 2021. The Federal Housing Finance Agency (FHFA) established a 2021 multifamily volume cap of $70 billion, of which 50% must be mission-driven, focused on certain affordable and underserved market segments, and 20% must be affordable to residents earning 60% or less of area median income. | |

| | |

| • | The multifamily guaranty book of business grew by $2.8 billion in the second quarter of 2021 to $401.9 billion. The average charged guaranty fee on the multifamily book increased from 75.9 basis points for the first quarter of 2021 to 76.8 basis points for the second quarter of 2021 as a result of higher pricing on acquisitions. This resulted in an increase in guaranty fee revenue, which drove the increase in net interest income for the quarter. | |

| | |

| • | As of June 30, 2021, based on unpaid principal balance, 1.2% of Fannie Mae’s multifamily guaranty book of business had received a forbearance plan (excluding loans that liquidated prior to period end), primarily as a result of the COVID-19 pandemic. More than 70% of those loans, measured by unpaid principal balance, were in a repayment plan or reinstated and only 0.2% of the book, or $1.0 billion in unpaid principal balance, was still in active forbearance as of June 30, 2021. | |

| | |

| • | The multifamily serious delinquency rate continued to decrease in the second quarter to 0.53% as of June 30, 2021 from 0.66% as of March 31, 2021, driven primarily by the on-going economic recovery resulting in loans that received forbearance finishing repayment plans or otherwise reinstating. The multifamily serious delinquency rate excluding loans that have received a forbearance remained at 0.03% as of June 30, 2021. Multifamily seriously delinquent loans are loans that are 60 days or more past due. | |

| | | | | | | | |

| Second Quarter 2021 Results | 4 |

Fannie Mae’s condensed consolidated balance sheets and condensed statements of operations and income for the second quarter of 2021 are available in the accompanying Annex; however, investors and interested parties should read the company’s Second Quarter 2021 Form 10-Q, which was filed today with the Securities and Exchange Commission and is available on Fannie Mae’s website, www.fanniemae.com. The company provides further discussion of its financial results and condition, credit performance, and other matters in its Second Quarter 2021 Form 10-Q. Additional information about the company’s financial and credit performance is contained in Fannie Mae’s “Q2 2021 Financial Supplement” at www.fanniemae.com.

# # #

Fannie Mae provides website addresses in its news releases solely for readers’ information. Other content or information appearing on these websites is not part of this release.

Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of people in America. We partner with lenders to create housing opportunities for families across the country. We are driving positive changes in housing finance to make the home buying process easier, while reducing costs and risk. To learn more, visit fanniemae.com and follow us on twitter.com/fanniemae.

| | | | | | | | |

| Second Quarter 2021 Results | 5 |

ANNEX

FANNIE MAE

Condensed Consolidated Balance Sheets - (Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| As of |

| June 30,

2021 | | December 31, 2020 |

| |

| ASSETS |

| Cash and cash equivalents | | $ | 48,879 | | | | | $ | 38,337 | |

| Restricted cash and cash equivalents (includes $68,777 and $68,308, respectively, related to consolidated trusts) | | 76,420 | | | | | 77,286 | |

Federal funds sold and securities purchased under agreements to resell or similar arrangements (includes $17,775 and $0, respectively, related to consolidated trusts) | | 43,888 | | | | | 28,200 | |

| Investments in securities: | | | | | | |

| Trading, at fair value (includes $6,186 and $6,544, respectively, pledged as collateral) | | 95,101 | | | | | 136,542 | |

| Available-for-sale, at fair value (with an amortized cost of $932 and $1,606, net of allowance for credit losses of $3 as of June 30, 2021 and December 31, 2020) | | 955 | | | | | 1,697 | |

| Total investments in securities | | 96,056 | | | | | 138,239 | |

| Mortgage loans: | | | | | | |

| Loans held for sale, at lower of cost or fair value | | 6,933 | | | | | 5,197 | |

| Loans held for investment, at amortized cost: | | | | | | |

| Of Fannie Mae | | 81,363 | | | | | 112,726 | |

| Of consolidated trusts | | 3,770,125 | | | | | 3,546,521 | |

| Total loans held for investment (includes $5,616 and 6,490, respectively, at fair value) | | 3,851,488 | | | | | 3,659,247 | |

| Allowance for loan losses | | (7,114) | | | | | (10,552) | |

| Total loans held for investment, net of allowance | | 3,844,374 | | | | | 3,648,695 | |

| Total mortgage loans | | 3,851,307 | | | | | 3,653,892 | |

| Advances to lenders | | 6,257 | | | | | 10,449 | |

| Deferred tax assets, net | | 12,575 | | | | | 12,947 | |

| Accrued interest receivable, net (includes $9,821 and $9,635, respectively, related to consolidated trusts and net of an allowance of $168 and $216 as of June 30, 2021 and December 31, 2020, respectively) | | 10,169 | | | | | 9,937 | |

| Acquired property, net | | 1,138 | | | | | 1,261 | |

| Other assets | | 11,349 | | | | | 15,201 | |

| Total assets | | $ | 4,158,038 | | | | | $ | 3,985,749 | |

| LIABILITIES AND EQUITY |

| Liabilities: | | | | | | |

| Accrued interest payable (includes $8,653 and $8,955, respectively, related to consolidated trusts) | | $ | 9,374 | | | | | $ | 9,719 | |

| Debt: | | | | | | |

| Of Fannie Mae (includes $2,946 and $3,728, respectively, at fair value) | | 251,576 | | | | | 289,572 | |

| Of consolidated trusts (includes $22,972 and $24,586, respectively, at fair value) | | 3,844,699 | | | | | 3,646,164 | |

| Other liabilities (includes $1,325 and $1,523, respectively, related to consolidated trusts) | | 15,044 | | | | | 15,035 | |

| Total liabilities | | 4,120,693 | | | | | 3,960,490 | |

| Commitments and contingencies (Note 13) | | — | | | | | — | |

| Fannie Mae stockholders’ equity: | | | | | | |

| Senior preferred stock (liquidation preference of $151,724 and $142,192, respectively) | | 120,836 | | | | | 120,836 | |

| Preferred stock, 700,000,000 shares are authorized—555,374,922 shares issued and outstanding | | 19,130 | | | | | 19,130 | |

Common stock, no par value, no maximum authorization—1,308,762,703 shares issued and 1,158,087,567 shares outstanding | | 687 | | | | | 687 | |

| Accumulated deficit | | (95,965) | | | | | (108,110) | |

| Accumulated other comprehensive income | | 57 | | | | | 116 | |

| Treasury stock, at cost, 150,675,136 shares | | (7,400) | | | | | (7,400) | |

| Total stockholders’ equity (See Note 1: Senior Preferred Stock Purchase Agreement and Senior Preferred Stock for information on the related dividend obligation and liquidation preference) | | 37,345 | | | | | 25,259 | |

| Total liabilities and equity | | $ | 4,158,038 | | | | | $ | 3,985,749 | |

See Notes to Condensed Consolidated Financial Statements in the Second Quarter 2021 Form 10-Q

| | | | | | | | |

| Second Quarter 2021 Results | 6 |

FANNIE MAE

(In conservatorship)

Condensed Consolidated Statements of Operations and Comprehensive Income - (Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months

Ended June 30, | | For the Six Months Ended June 30, |

| |

| 2021 | | 2020 | | 2021 | | | 2020 |

| Interest income: | | | | | | | | | | | | | | | |

| Trading securities | | $ | 122 | | | | | $ | 219 | | | | | $ | 262 | | | | | $ | 535 | | |

| Available-for-sale securities | | 18 | | | | | 26 | | | | | 37 | | | | | 57 | | |

| Mortgage loans | | 24,932 | | | | | 27,007 | | | | | 48,285 | | | | | 55,945 | | |

| Federal funds sold and securities purchased under agreements to resell or similar arrangements | | 4 | | | | | 14 | | | | | 12 | | | | | 121 | | |

| Other | | 31 | | | | | 25 | | | | | 73 | | | | | 59 | | |

| Total interest income | | 25,107 | | | | | 27,291 | | | | | 48,669 | | | | | 56,717 | | |

| Interest expense: | | | | | | | | | | | | | | | |

| Short-term debt | | (1) | | | | | (54) | | | | | (4) | | | | | (156) | | |

| Long-term debt | | (16,820) | | | | | (21,460) | | | | | (33,637) | | | | | (45,437) | | |

| Total interest expense | | (16,821) | | | | | (21,514) | | | | | (33,641) | | | | | (45,593) | | |

| Net interest income | | 8,286 | | | | | 5,777 | | | | | 15,028 | | | | | 11,124 | | |

| Benefit (provision) for credit losses | | 2,588 | | | | | (12) | | | | | 3,353 | | | | | (2,595) | | |

| Net interest income after benefit (provision) for credit losses | | 10,874 | | | | | 5,765 | | | | | 18,381 | | | | | 8,529 | | |

| Investment gains (losses), net | | 646 | | | | | 149 | | | | | 691 | | | | | (9) | | |

| Fair value gains (losses), net | | (446) | | | | | (1,018) | | | | | 338 | | | | | (1,294) | | |

| Fee and other income | | 103 | | | | | 90 | | | | | 190 | | | | | 210 | | |

| Non-interest loss | | 303 | | | | | (779) | | | | | 1,219 | | | | | (1,093) | | |

| Administrative expenses: | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | (365) | | | | | (382) | | | | | (752) | | | | | (775) | | |

| Professional services | | (184) | | | | | (231) | | | | | (398) | | | | | (443) | | |

| | | | | | | | | | | | | | | |

| Other administrative expenses | | (197) | | | | | (141) | | | | | (344) | | | | | (285) | | |

| Total administrative expenses | | (746) | | | | | (754) | | | | | (1,494) | | | | | (1,503) | | |

| Foreclosed property expense | | (41) | | | | | (10) | | | | | (36) | | | | | (90) | | |

| Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | | (758) | | | | | (660) | | | | | (1,489) | | | | | (1,297) | | |

| Credit enhancement expense | | (274) | | | | | (360) | | | | | (558) | | | | | (736) | | |

| Change in expected credit enhancement recoveries | | (44) | | | | | 273 | | | | | (75) | | | | | 461 | | |

| Other expenses, net | | (280) | | | | | (261) | | | | | (599) | | | | | (479) | | |

| Total expenses | | (2,143) | | | | | (1,772) | | | | | (4,251) | | | | | (3,644) | | |

| Income before federal income taxes | | 9,034 | | | | | 3,214 | | | | | 15,349 | | | | | 3,792 | | |

| Provision for federal income taxes | | (1,882) | | | | | (669) | | | | | (3,204) | | | | | (786) | | |

| Net income | | 7,152 | | | | | 2,545 | | | | | 12,145 | | | | | 3,006 | | |

| Other comprehensive income (loss): | | | | | | | | | | | | | | | |

| Changes in unrealized gains (losses) on available-for-sale securities, net of reclassification adjustments and taxes | | (31) | | | | | (11) | | | | | (54) | | | | | 7 | | |

| Other, net of taxes | | (1) | | | | | (2) | | | | | (5) | | | | | (5) | | |

| Total other comprehensive income (loss) | | (32) | | | | | (13) | | | | | (59) | | | | | 2 | | |

| Total comprehensive income | | $ | 7,120 | | | | | $ | 2,532 | | | | | $ | 12,086 | | | | | $ | 3,008 | | |

| Net income | | $ | 7,152 | | | | | $ | 2,545 | | | | | $ | 12,145 | | | | | $ | 3,006 | | |

| Dividends distributed or amounts attributable to senior preferred stock | | (7,120) | | | | | (2,532) | | | | | (12,086) | | | | | (3,008) | | |

| Net income (loss) attributable to common stockholders | | $ | 32 | | | | | $ | 13 | | | | | $ | 59 | | | | | $ | (2) | | |

| Earnings per share: | | | | | | | | | | | | | | | |

| Basic | | $ | 0.01 | | | | | $ | 0.00 | | | | | $ | 0.01 | | | | | $ | 0.00 | | |

| Diluted | | 0.01 | | | | | 0.00 | | | | | 0.01 | | | | | 0.00 | | |

| Weighted-average common shares outstanding: | | | | | | | | | | | | | | | |

| Basic | | 5,867 | | | | | 5,867 | | | | | 5,867 | | | | | 5,867 | | |

| Diluted | | 5,893 | | | | | 5,893 | | | | | 5,893 | | | | | 5,867 | | |

See Notes to Condensed Consolidated Financial Statements in the Second Quarter 2021 Form 10-Q

| | | | | | | | |

| Second Quarter 2021 Results | 7 |