U. S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2918

DUPREE MUTUAL FUNDS

(Exact Name of Registrant as Specified in Charter)

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Address of Principal Executive Offices) (Zip Code)

Allen E. Grimes, III

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code (859) 254-7741

Date of fiscal year end: June 30, 2023

Date of reporting period: July 1, 2022 through June 30, 2023

Item 1. Report to Stockholders

June 30, 2023

ANNUAL REPORT

TO SHAREHOLDERS

ABOUT DUPREE MUTUAL FUNDS

In 1941, Dupree & Company, Inc. began business in Harlan, Kentucky as a small securities brokerage firm specializing in tax-exempt municipal bonds.

Over the years the firm, which in 1963 moved its offices to Lexington, Kentucky, grew to become a regional leader in public finance, helping to structure complex and innovative municipal bond financing for some of the largest public projects in the Commonwealth of Kentucky.

In 1979, Dupree & Company began what is now Dupree Mutual Funds with the Kentucky Tax-Free Income Series and became the Fund’s investment adviser. The Fund was one of the first single-state municipal bond funds in the country, and the first mutual fund to invest solely in Kentucky municipal bonds. Since then, several new offerings have been added to the Dupree Mutual Funds family:

Kentucky Tax-Free Short-to-Medium Series in 1987;

Intermediate Government Bond Series in 1992;

Tennessee Tax-Free Income Series in 1993;

Tennessee Tax-Free Short-to-Medium Series in 1994;

North Carolina Tax-Free Income Series in 1995;

North Carolina Tax-Free Short-to-Medium Series in 1995;

Alabama Tax-Free Income Series in 2000;

Mississippi Tax-Free Income Series in 2000; and

Taxable Municipal Bond Series in 2010.

Today, after more than 60 years in business, Dupree continues to be a pioneer in the industry. Our Kentucky, Tennessee, and Mississippi Series are currently the ONLY 100% “no-load” municipal bond funds available in those states. No-load means simply that shares of the funds are offered directly to investors with no front or back-end sales charges, as opposed to load funds, which are sold through brokerage firms or other institutions that typically carry sales charges.

At Dupree Mutual Funds, our goal is a simple one: to offer investors a high-quality, low-cost way to invest in municipal and government bonds while providing superior service to our shareholders. We encourage you to let us know how we’re doing.

TABLE OF CONTENTS

Management’s Discussion of Fund Performance: | Unaudited |

Twelve Months Ended June 30, 2023i

The investment objective of our tax-free municipal bond funds is to provide a high and stable level of tax-free income derived from state-specific municipal bonds without incurring undue risk to principal. The investment objective of our government bond fund is to provide a high and stable level of taxable income derived from securities of the U.S. government and its agencies without incurring undue risk to principal. Similarly, the investment objective of the taxable municipal bond fund is to provide a high and stable level of taxable income derived from taxable municipal securities without incurring undue risk to principal.

This report covers the twelve month period from July 1, 2022 through June 30, 2023 (the “reporting period”). After contracting during the first half of 2022, economic activity expanded at a modest but steady pace throughout the reporting period. Real gross domestic product (GDP) expanded at a impressive 3.2% annual rate during the third quarter of 2022. Economic growth then started to slow with real GDP increasing during the fourth quarter of 2022 at a 2.6% annual rate. The slowdown continued during the first quarter of 2023 with real GDP increasing at a 2.0% annual rate. The pace of economic growth picked up again during the second quarter of 2023 with real GDP increasing at a 2.4% annual rate (advance estimate).

Labor market conditions remained tight during the reporting period. Over the first five months of 2023, monthly job gains averaged a robust 314,000. The seasonally adjusted national unemployment rate was 3.6% in June, which is low by historical standards. Wage growth increased at a moderate pace, but at a slower pace than inflation, with average hourly earnings increasing at a 4.4% annual rate in June.

Key measures of inflation remained elevated well above the Fed’s longer-run goal of 2% during the reporting period. The Federal Reserve’s (Fed) preferred inflation index, the personal consumption expenditure price index (PCE), increased 3.0% on a year-over-year basis through June 30, 2023. The core PCE, which excludes food and energy prices, increased at an annual rate of 4.1% in June. The Consumer Price Index (CPI) increased at an annual rate of 3.0% rate in June. Inflation has proven to be more persistent than the Fed originally anticipated, but it has continued to slowly abate.

The Federal Open Market Committee (FOMC) raised the target rate for the Fed funds rate at six of its seven meetings held during the reporting period, with the Fed funds rate increasing by a total of 350 basis points. The target rate for the Fed funds rate ended the reporting period at 5.00%-5.25%. Notably, the Fed decided to pause its interest rate hikes at its June meeting to “allow the Committee to assess additional information and its implications for monetary policy.” In the meantime, the Fed continued to reduce its holdings of Treasury securities, agency debt, and agency mortgage-backed securities.

The municipal bond market posted positive total returns during the reporting period. The Bloomberg Municipal Bond Index (BMBI), which tracks investment grade municipal securities across all sectors and maturities, provided a total return of 3.19% for the twelve month period ended June 30, 2023. At the end of the reporting period, the BMBI had a modified adjusted duration of 6.06 years, an average coupon of 4.49%, and an average credit quality of AA2/AA3.

Municipal bond yields increased sharply (prices down) during the third quarter of 2022 as stubbornly high inflation and an aggressive Fed intent on bringing inflation under control continued to batter the bond market. However, municipal bonds rebounded nicely in the fourth quarter of 2022, with yields declining and prices rising. Favorable supply and demand dynamics led to a very solid performance for the municipal bond market during the first quarter of 2023. Performance was mostly flat during the second quarter of 2023. During the reporting period, most longer-dated tax-exempt municipal bonds outperformed shorter-dated tax-exempt municipal bonds and lower-rated credits outperformed higher-rated credits. Overall, despite experiencing some volatility, investment grade tax-exempt municipal bonds performed relatively well and ended up generating positive total returns for the twelve months ending June 30, 2023.

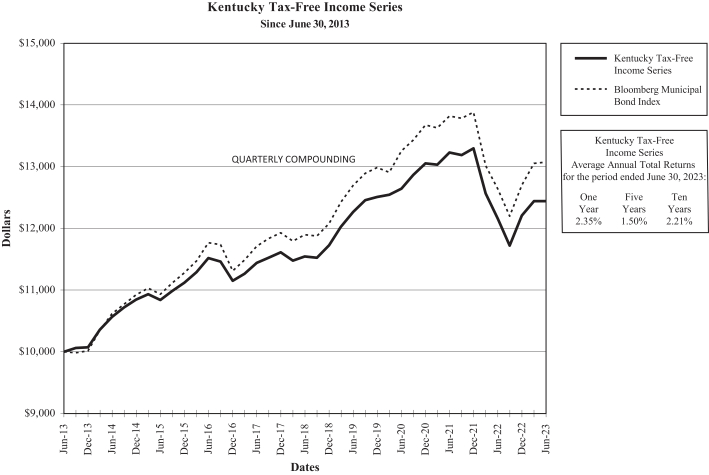

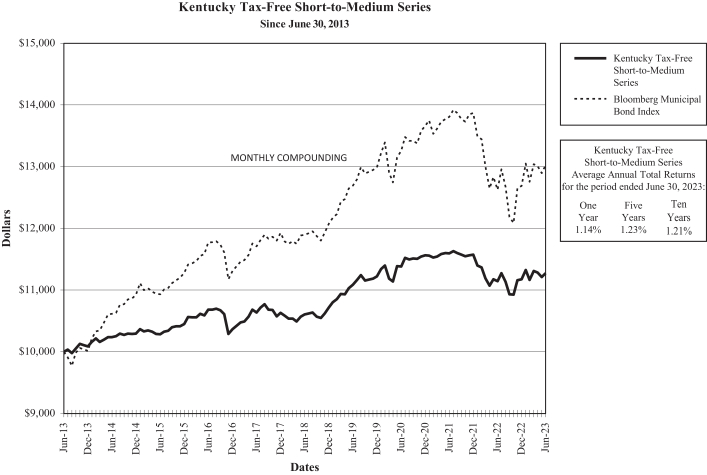

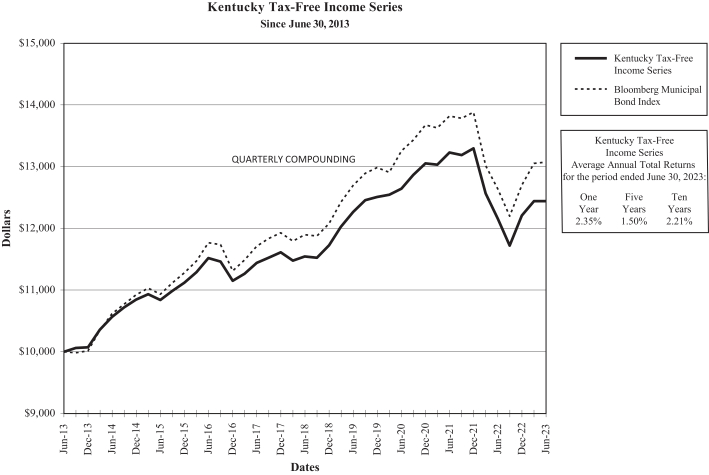

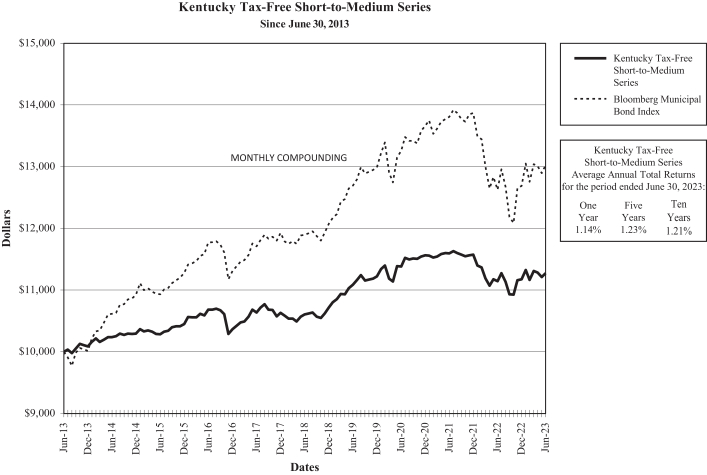

The Kentucky Tax-Free Income Series provided shareholders a total return of 2.35% for the twelve month period ended June 30, 2023. The Kentucky Tax-Free Short-to-Medium Series provided shareholders with a total return of 1.14% for the same time period. Both the Kentucky Tax-Free Income Series and Kentucky Tax-Free Short-to-Medium Series underperformed the BMBI during the reporting period due to the fact that both funds had shorter durations and higher credit qualities than the BMBI.

In 2022, Kentucky’s real GDP increased at a 1.8% annual rate; the 2021-2022 national growth rate was 2.1%. Kentucky’s 2022 current-dollar GDP was $260.3 billion. The state’s annual average seasonally adjusted unemployment rate at the end of June was 3.8%. In 2022, Kentucky had a per capita personal income of $52,109. Kentucky’s appropriation supported debt was rated A1 by Moody’s and A by Standard & Poor’s as of June 30, 2023.

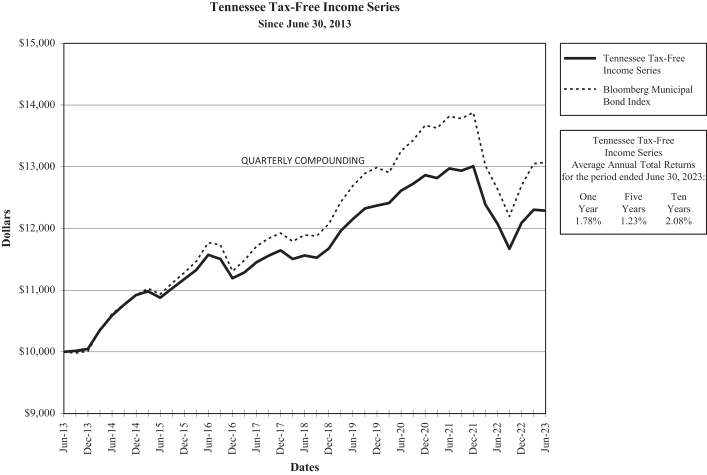

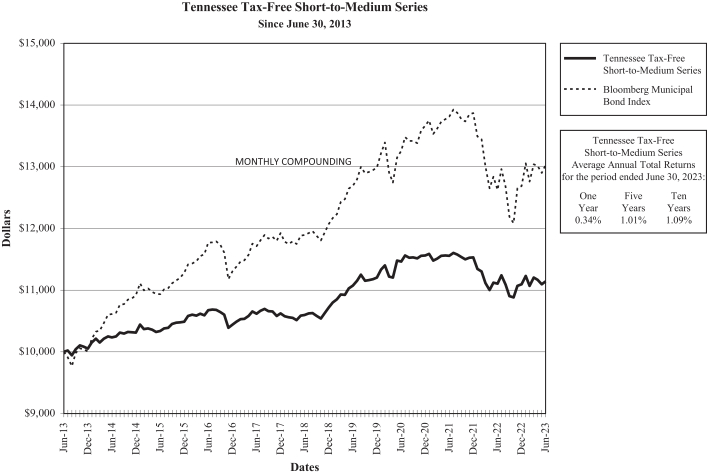

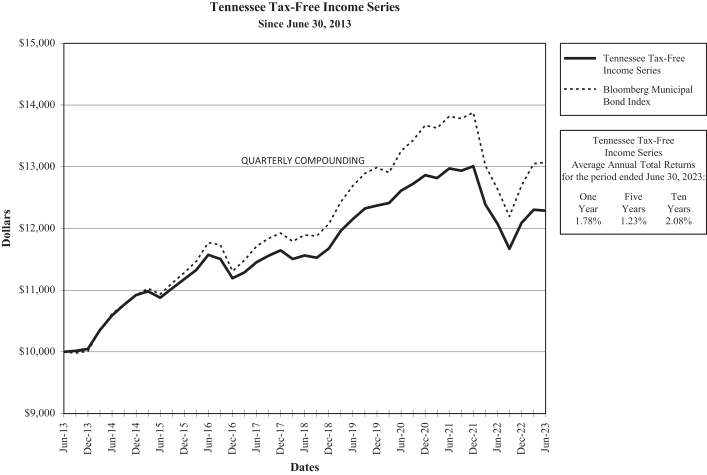

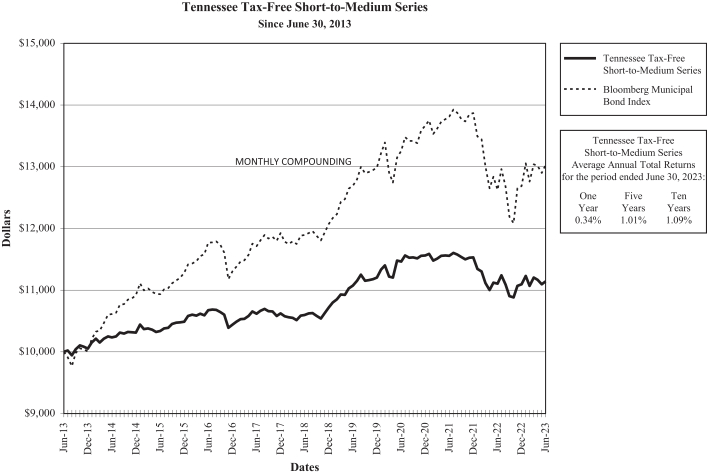

The Tennessee Tax-Free Income Series provided shareholders with a total return of 1.78% for the twelve month period ended June 30, 2023. The Tennessee Tax-Free Short-to-Medium Series provided a total return of 0.34% for the same time period. Both

i

the Tennessee Tax-Free Income Series and the Tennessee Tax-Free Short-to-Medium Series underperformed the BMBI during the reporting period due to the fact that both funds had shorter durations and higher credit qualities than the BMBI.

In 2022, Tennessee’s real GDP increased at a 4.3% annual rate; the 2021-2022 national growth rate was 2.1%. Tennessee’s 2022 current-dollar GDP was $475.7 billion. The state’s annual average seasonally adjusted unemployment rate at the end of June was 3.2%. In 2022, the state had a per capita personal income of $58,279. Tennessee’s general obligation (G.O.) bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2023

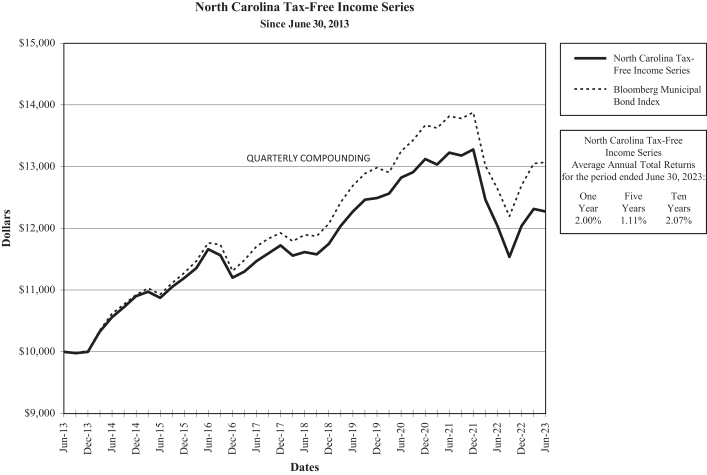

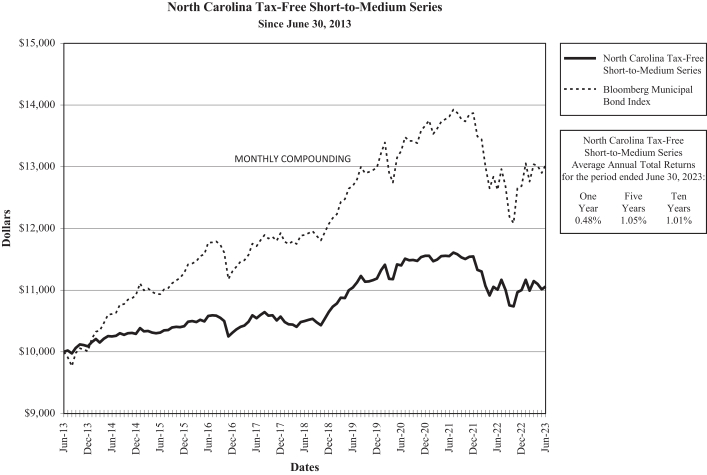

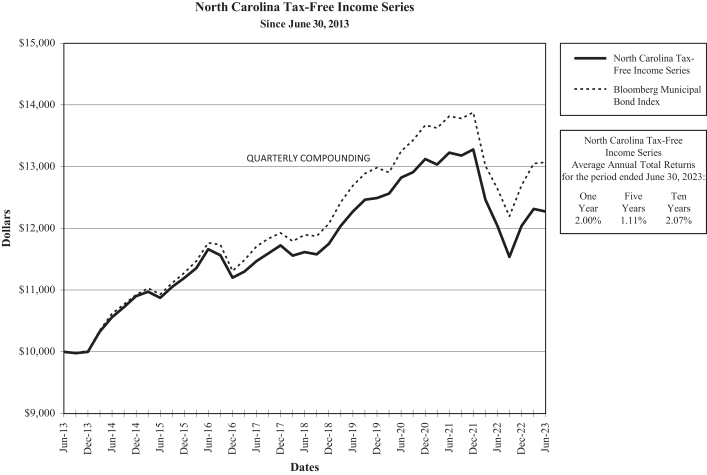

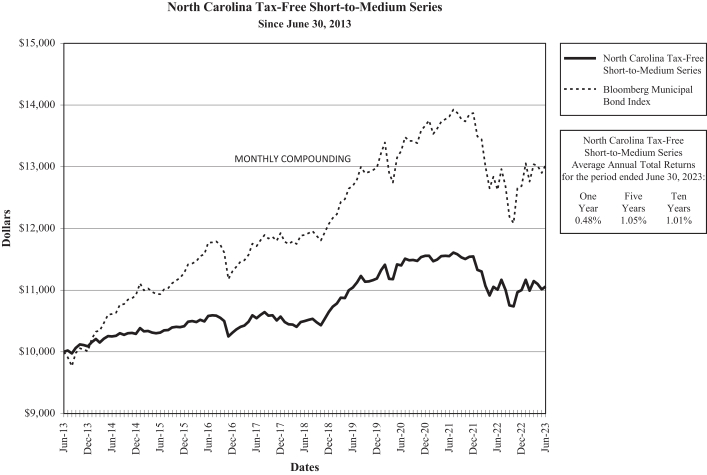

The North Carolina Tax-Free Income Series provided shareholders with a total return of 2.00% for the twelve month period ended June 30, 2023. The North Carolina Tax-Free Short-to-Medium Series provided shareholders with a total return of 0.48% for the same time period. Both the North Carolina Tax-Free Income Series and the North Carolina Tax-Free Short-to-Medium Series underperformed the BMBI during the reporting period due to the fact that both funds had shorter durations and higher credit qualities than the BMBI.

In 2022, North Carolina’s real GDP increased at a 3.2% annual rate; the 2021-2022 national growth rate was 2.1%. North Carolina’s 2022 current-dollar GDP was $730.0 billion. The state’s average annual seasonally adjusted unemployment rate at the end of June was 3.3%. In 2022, North Carolina had a per capita personal income of $57,416. North Carolina’s G.O. bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2023.

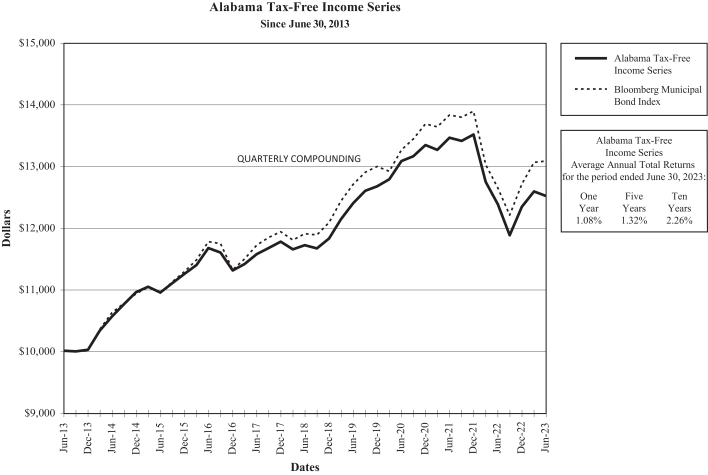

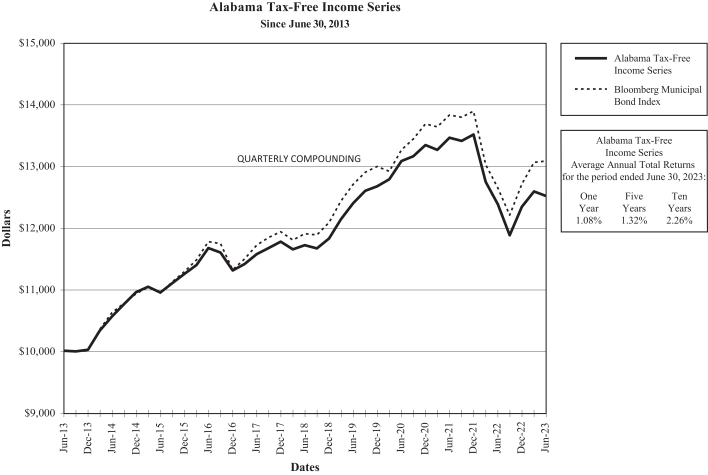

The Alabama Tax-Free Income Series provided shareholders with a total return of 1.08% for the twelve month period ended June 30, 2023. The Alabama Tax-Free Income Series underperformed the BMBI during the reporting period due to the fact that it had a shorter duration and higher credit quality than the BMBI.

In 2022, Alabama’s real GDP increased at a 1.6% annual rate; the 2021-2022 national growth rate was 2.1%. Alabama’s 2022 current-dollar GDP was $277.8 billion. The state’s average annual seasonally adjusted unemployment rate at the end of June was 2.2%. In 2022, Alabama had a per capita personal income of $50,637. Alabama’s G.O. bonds were rated Aa1 by Moody’s and AA by Standard & Poor’s as of June 30, 2023.

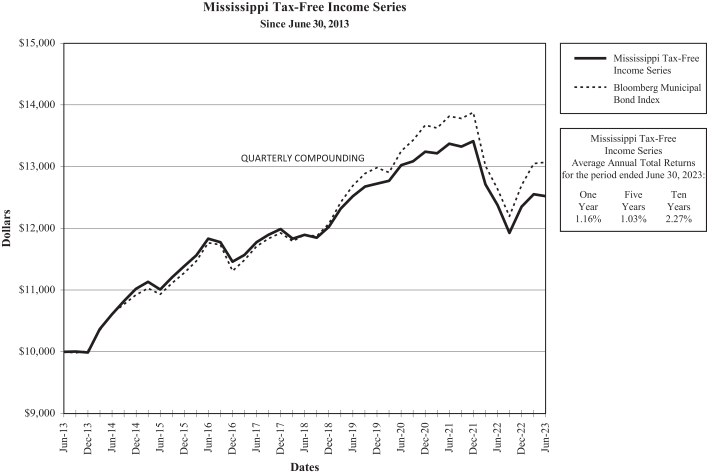

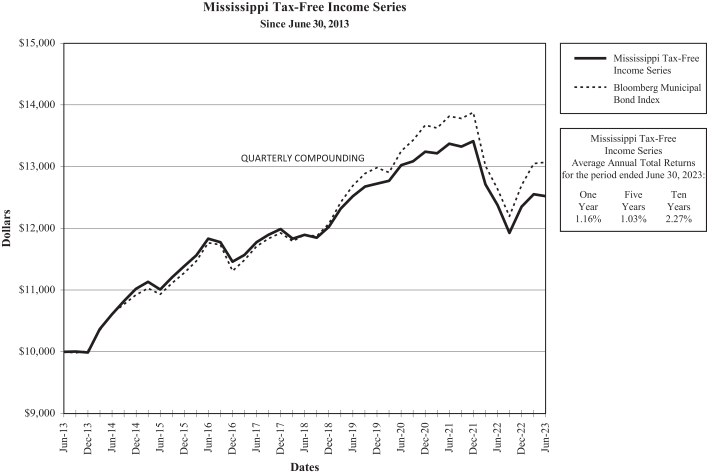

The Mississippi Tax-Free Income Series provided shareholders with a total return of 1.16% for the twelve month period ended June 30, 2023. The Mississippi Tax-Free Income Series underperformed the BMBI during the reporting period due to the fact that it had a shorter duration and higher credit quality than the BMBI.

In 2022, Mississippi’s real GDP increased at a 0.2% annual rate; the 2021-2022 national growth rate was 2.1%. Mississippi’s 2022 current-dollar GDP was $138.7 billion. The state’s average annual seasonally adjusted unemployment rate at the end of June was 3.1%. In 2022, Mississippi had a per capita personal income of $46,248. The state’s G.O. bonds were rated Aa2 by Moody’s and AA by Standard & Poor’s as of June 30, 2023

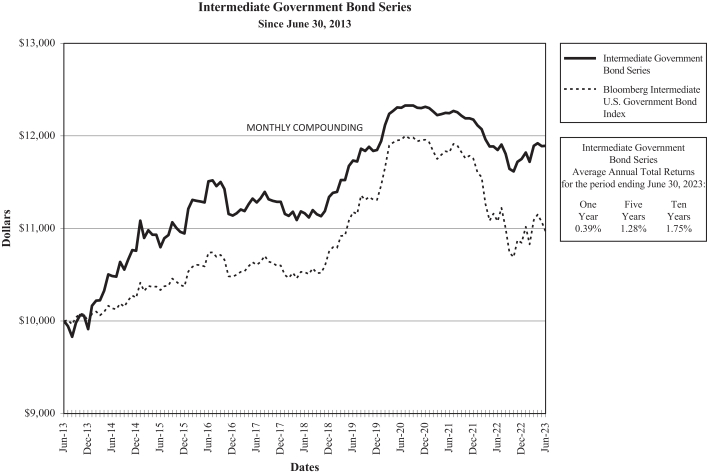

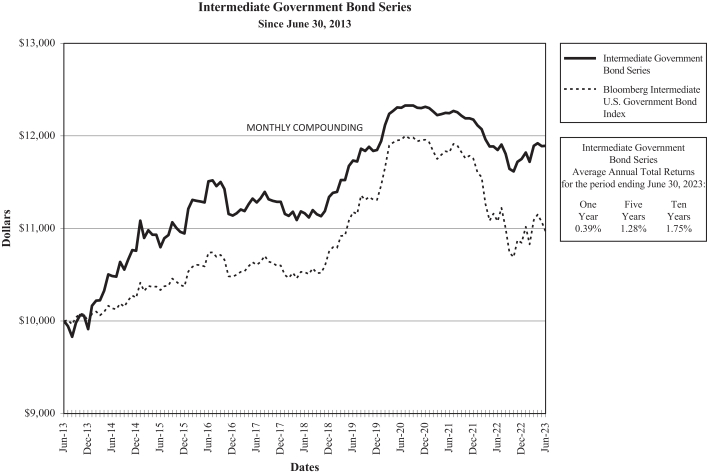

The Intermediate Government Bond Series provided shareholders with a total return of 0.39% for the twelve months ended June 30, 2023. The Bloomberg U.S. Intermediate Government Bond Index (BGBI) had a total return of -0.99% for the twelve month period ended June 30, 2023. Taxable yields increased during the reporting period causing bond prices to fall. The Intermediate Government Bond Series outperformed the BGBI due to the fact that it had a shorter duration than the index.

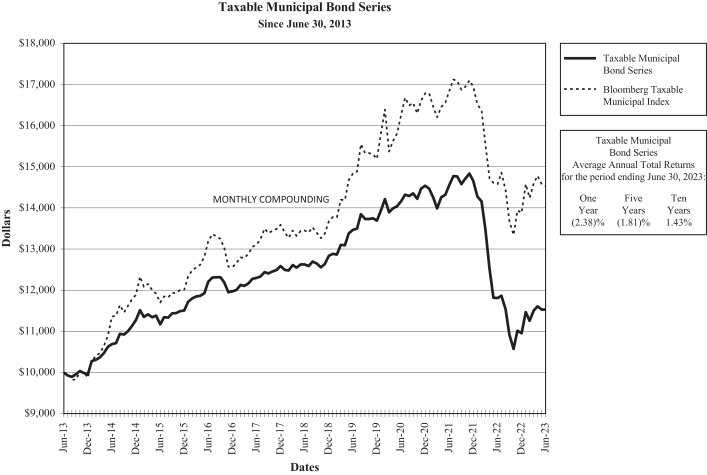

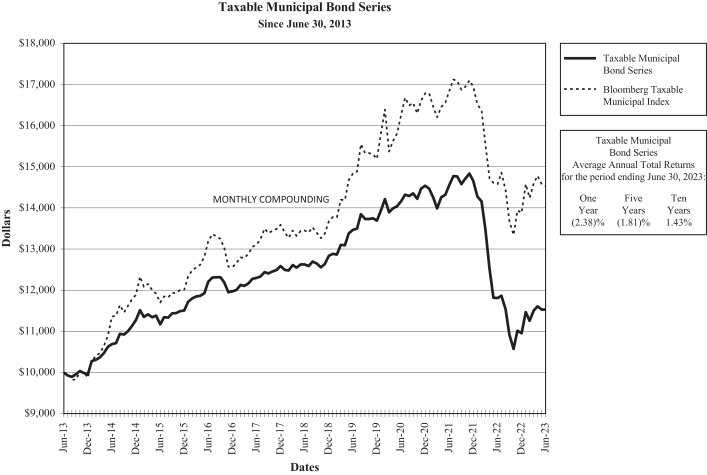

The Taxable Municipal Bond Series provided shareholders with a total return of -2.38% for the twelve month period ended June 30, 2023. The Bloomberg Municipal Bond Taxable Index (BTMI) had a total return of -0.295% for the same time period. Taxable municipal bonds typically track the performance of the U.S. Treasury market. Treasury yields increased during the reporting period, causing taxable municipal bond prices to fall. The Taxable Municipal Bond Series had a longer duration and nominal maturity than the BTMI which led to its underperformance during the reporting period.

Please note that index information is provided for reference only. No index can perfectly match the investments that make up a fund’s portfolio. In making investment decisions for our portfolios, we do not attempt to track indices. The Bloomberg Municipal Bond index is national in scope and does not necessarily reflect the performance of state-specific municipal bond funds. Indices do not take into account any operating expenses or transaction costs. An investment cannot be made directly in an index.

i Data are from the Bureau of Economic Analysis, the U.S. Department of Labor Bureau of Labor Statistics, and various other sources management deems to be reliable. Some of the quoted data are preliminary in nature and may be subject to revision. Any opinions expressed herein are those of the funds’ portfolio management and are current as of June 30, 2023. They are not guarantees of performance or investment results and should not be taken as investment advice. Past performance is not a guarantee of future performance and you may lose money investing in the funds.

ii

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2023. | Unaudited |

| | | | |

| |

Alabama Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 0.97% | |

Aa/AA | | | 95.47% | |

A | | | 1.47% | |

Not Rated | | | 2.09% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Prerefunded | | | 25.49% | |

School Improvement | | | 21.40% | |

Public Facilities Revenue | | | 15.48% | |

University Consolidated Education and Building Revenue | | | 14.65% | |

Municipal Utility Revenue | | | 12.90% | |

Miscellaneous Public Improvement | | | 3.35% | |

Hospital and Healthcare Revenue | | | 2.64% | |

Refunding | | | 2.46% | |

Other Assets Less Liabilities | | | 1.63% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Kentucky Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aa/AA | | | 80.42% | |

A | | | 19.30% | |

Not Rated | | | 0.28% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 35.31% | |

School Improvement | | | 20.63% | |

University Consolidated Education and Building Revenue | | | 12.90% | |

Municipal Utility Revenue | | | 8.11% | |

Prerefunded | | | 7.22% | |

Public Facilities Revenue | | | 5.52% | |

Hospital and Healthcare Revenue | | | 4.47% | |

Turnpikes/Toll Road/Highway Revenue | | | 2.77% | |

Refunding | | | 1.20% | |

Airport Revenue | | | 0.65% | |

Ad Valorem Property | | | 0.33% | |

Other Assets Less Liabilities | | | 0.89% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | |

| |

Kentucky Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aa/AA | | | 61.15% | |

A | | | 37.63% | |

Not Rated | | | 1.22% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Public Facilities Revenue | | | 17.70% | |

School Improvement | | | 17.11% | |

Miscellaneous Public Improvement | | | 12.06% | |

Turnpikes/Toll Road/Highway Revenue | | | 11.67% | |

University Consolidated Education and Building Revenue | | | 10.99% | |

Municipal Utility Revenue | | | 9.02% | |

Hospital and Healthcare Revenue | | | 7.64% | |

Prerefunded | | | 6.40% | |

Ad Valorem Property | | | 1.82% | |

Refunding | | | 1.58% | |

Airport Revenue | | | 1.41% | |

Other Assets Less Liabilities | | | 2.60% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Mississippi Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 7.12% | |

Aa/AA | | | 84.15% | |

A | | | 8.73% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 32.76% | |

Prerefunded | | | 16.30% | |

Turnpikes/Toll Road/Highway Revenue | | | 9.27% | |

Miscellaneous Public Improvement | | | 7.73% | |

State and Local Mortgage/Housing Revenue | | | 6.95% | |

Refunding | | | 6.34% | |

School Improvement | | | 6.11% | |

Municipal Utility Revenue | | | 5.68% | |

Hospital and Healthcare Revenue | | | 5.26% | |

Public Facilities Revenue | | | 1.20% | |

Other Assets Less Liabilities | | | 2.40% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

iii

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2023. | Unaudited |

| | | | |

| |

North Carolina Tax-Free Income Series | |

| CREDIT QUALITY * | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 6.07% | |

Aa/AA | | | 77.67% | |

A | | | 14.88% | |

Not Rated | | | 1.38% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement | | | 20.20% | |

Public Facilities Revenue | | | 16.40% | |

Municipal Utility Revenue | | | 15.10% | |

University Consolidated Education and Building Revenue | | | 11.72% | |

Prerefunded | | | 10.60% | |

Hospital and Healthcare Revenue | | | 7.05% | |

Refunding | | | 6.38% | |

Miscellaneous Public Improvement | | | 4.08% | |

Airport Revenue | | | 3.73% | |

Turnpikes/Toll Road/Highway Revenue | | | 3.37% | |

State and Local Mortgage/Housing Revenue | | | 0.31% | |

Other Assets Less Liabilities | | | 1.06% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

North Carolina Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY * | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 9.72% | |

Aa/AA | | | 57.63% | |

A | | | 31.14% | |

Not Rated | | | 1.51% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 29.57% | |

School Improvement | | | 13.48% | |

Municipal Utility Revenue | | | 12.17% | |

Refunding | | | 8.60% | |

Turnpikes/Toll Road/Highway Revenue | | | 8.26% | |

Miscellaneous Public Improvement | | | 7.59% | |

Public Facilities Revenue | | | 7.13% | |

Hospital and Healthcare Revenue | | | 3.73% | |

Prerefunded | | | 3.13% | |

Ad Valorem Property | | | 1.18% | |

Lease Revenue | | | 1.00% | |

Airport Revenue | | | 0.77% | |

Other Assets Less Liabilities | | | 3.39% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Tennessee Tax-Free Income Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 4.36% | |

Aa/AA | | | 80.18% | |

A | | | 15.46% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 30.72% | |

Prerefunded | | | 16.34% | |

School Improvement | | | 12.75% | |

Hospital and Healthcare Revenue | | | 10.25% | |

Miscellaneous Public Improvement | | | 8.86% | |

Public Facilities Revenue | | | 5.07% | |

University Consolidated Education and Building Revenue | | | 4.43% | |

Refunding | | | 3.89% | |

Airport Revenue | | | 3.59% | |

State and Local Mortgage/Housing Revenue | | | 2.50% | |

Other Assets Less Liabilities | | | 1.60% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Tennessee Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aa/AA | | | 90.69% | |

A | | | 9.31% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Refunding | | | 36.17% | |

Municipal Utility Revenue | | | 21.32% | |

School Improvement | | | 14.19% | |

University Consolidated Education and Building Revenue | | | 8.98% | |

Prerefunded | | | 7.90% | |

Public Facilities Revenue | | | 6.97% | |

Miscellaneous Public Improvement | | | 0.96% | |

Other Assets Less Liabilities | | | 3.51% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

iv

The illustrations below provide each Fund’s sector allocation and

summarize key information about each Fund’s investments as of June 30, 2023. | Unaudited |

| | | | |

| |

Intermediate Government Bond Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aaa/AAA | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Federal Home Loan Bank | | | 66.47% | |

Federal Home Loan Mortgage Corporation | | | 24.17% | |

Federal Farm Credit | | | 6.89% | |

Other Assets Less Liabilities | | | 2.47% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| |

Taxable Municipal Bond Series | |

| CREDIT QUALITY* | | % of Fair Value of

Investments Held | |

Aa/AA | | | 91.00% | |

A | | | 8.39% | |

Not Rated | | | 0.61% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

| COMPOSITION | | | |

| | | | % of Net Assets | |

Municipal Utility Revenue | | | 22.18% | |

Public Facilities Revenue | | | 16.24% | |

University Consolidated Education and Building Revenue | | | 15.11% | |

Turnpikes/Toll Road/Highway Revenue | | | 8.39% | |

State and Local Mortgage/Housing Revenue | | | 7.94% | |

Miscellaneous Public Improvement | | | 6.16% | |

School Improvement | | | 6.00% | |

Marina/Port Authority Revenue | | | 5.83% | |

Hospital and Healthcare Revenue | | | 5.08% | |

Airport Revenue | | | 2.06% | |

Prerefunded | | | 0.58% | |

Other Assets Less Liabilities | | | 4.43% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | | |

| | | | | |

| * | Ratings by Moody’s Investors Services, Inc. unless noted otherwise. See Schedules of Portfolio Investments for individual bond ratings. |

v

PERFORMANCE COMPARISON (Unaudited)

The following graphs compare the change in value of a $10,000 investment in each series of Dupree Mutual Funds with the change in value of a $10,000 investment in a comparable index. The comparisons are made over 10 years or since the inception of the series, if shorter than ten years. Results are for the fiscal years ended June 30.

PERFORMANCE DISCLOSURES

Past performance is not indicative of future results. The current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

The performance tables and the graphs above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

For performance data current to the most recent month-end call 800-866-0614 or visit our website at www.dupree-funds.com.

Notes on Graphs:

Results reflect reinvestment of all dividend and capital gain distributions. No index can perfectly match the investments that make up a fund’s portfolio. For each series, we have selected an index that we believe gives the most accurate picture of how the series performed during the reporting period. The investor should understand that an index is a mathematical hypothesis and does not reflect a real market situation. For example, the portfolio of each index is replaced with an entirely different portfolio each year without reflecting operating expenses or transaction costs. On the other hand, the fund’s performance reflects not only these factors but management costs as well.

vi

vii

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| PREREFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 25.49% of Net Assets | | | | | | | | | | | | | | | | | | |

Alabaster AL Board of Education Special Tax Warrants** | | | 5.000 | % | | | 09/01/2039 | | | A1 | | $ | 600,000 | | | $ | 612,412 | |

Auburn AL Waterworks Board Water Revenue | | | 5.000 | | | | 09/01/2036 | | | Aa2 | | | 250,000 | | | | 259,828 | |

Decatur City AL Board of Education Special Tax | | | 5.000 | | | | 02/01/2040 | | | Aa2 | | | 225,000 | | | | 231,597 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2031 | | | A2 | | | 250,000 | | | | 252,995 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2032 | | | A2 | | | 450,000 | | | | 455,391 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2033 | | | AA* | | | 290,000 | | | | 308,409 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2034 | | | AA-* | | | 250,000 | | | | 251,808 | |

Madison AL Warrants | | | 5.000 | | | | 04/01/2035 | | | Aa3 | | | 350,000 | | | | 361,669 | |

Northport AL Warrants** | | | 5.000 | | | | 08/01/2040 | | | AA* | | | 735,000 | | | | 749,781 | |

Trussville AL Warrants | | | 5.000 | | | | 10/01/2039 | | | NR | | | 445,000 | | | | 446,860 | |

Trussville AL Warrants** | | | 5.000 | | | | 10/01/2039 | | | Aa2 | | | 775,000 | | | | 778,441 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 07/01/2034 | | | Aa1 | | | 300,000 | | | | 305,676 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2036 | | | Aa3 | | | 250,000 | | | | 269,168 | |

Tuscaloosa County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2037 | | | Aa3 | | | 250,000 | | | | 269,168 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,553,203 | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 21.40% of Net Assets | | | | | | | | | | | | | | | | | | |

Athens AL Warrants | | | 3.000 | | | | 05/01/2041 | | | Aa3 | | | 125,000 | | | | 103,660 | |

Bibb County AL Board of Education Special Tax | | | 4.000 | | | | 04/01/2032 | | | AA* | | | 380,000 | | | | 392,013 | |

Cherokee County AL Board of Education Tax Warrants | | | 4.000 | | | | 12/01/2034 | | | A1 | | | 310,000 | | | | 315,437 | |

Cherokee County AL Board of Education Tax Warrants | | | 4.250 | | | | 12/01/2042 | | | A1 | | | 150,000 | | | | 151,662 | |

Elmore County AL Board of Education | | | 4.000 | | | | 08/01/2038 | | | Aa3 | | | 250,000 | | | | 250,128 | |

Florence AL City Board of Education Special Tax School Warrants | | | 4.000 | | | | 03/01/2046 | | | Aa3 | | | 225,000 | | | | 213,089 | |

Guntersville AL Warrants | | | 3.000 | | | | 08/01/2040 | | | AA-* | | | 250,000 | | | | 208,530 | |

Houston County AL Board of Education Special Tax School Warrants | | | 3.000 | | | | 12/01/2037 | | | AA* | | | 250,000 | | | | 216,808 | |

Jackson County AL Board of Education School Tax Warrants | | | 3.000 | | | | 03/01/2038 | | | AA* | | | 350,000 | | | | 303,289 | |

Jefferson County AL Board of Education Public School Warrants | | | 4.000 | | | | 02/01/2042 | | | A1 | | | 325,000 | | | | 316,251 | |

Jefferson County AL Public Schools | | | 4.000 | | | | 02/01/2038 | | | A1 | | | 165,000 | | | | 164,815 | |

Madison AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 02/01/2041 | | | Aa3 | | | 370,000 | | | | 364,927 | |

Marshall County AL Board of Education Special Tax School Warrants | | | 4.000 | | | | 03/01/2033 | | | A1 | | | 250,000 | | | | 252,768 | |

Mountain Brook AL City Board of Education | | | 3.000 | | | | 03/01/2042 | | | Aa1 | | | 250,000 | | | | 208,850 | |

Oxford AL Board of Education School Tax Warrants | | | 4.000 | | | | 05/01/2045 | | | Aa3 | | | 350,000 | | | | 333,778 | |

Pell City AL Warrants | | | 4.500 | | | | 02/01/2042 | | | AA* | | | 200,000 | | | | 203,270 | |

Pike Road AL Warrants | | | 5.000 | | | | 03/01/2043 | | | AA+* | | | 250,000 | | | | 276,848 | |

Saint Clair AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2040 | | | A1 | | | 125,000 | | | | 136,533 | |

Saint Clair County AL Board of Education Special Tax Warrants | | | 3.000 | | | | 02/01/2038 | | | A1 | | | 250,000 | | | | 217,273 | |

Troy AL Public Educational Building Authority | | | 5.250 | | | | 12/01/2036 | | | A1 | | | 30,000 | | | | 30,008 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,659,937 | |

| PUBLIC FACILITIES REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 15.48% of Net Assets | | | | | | | | | | | | | | | | | | |

Adamsville AL Warrants | | | 3.000 | | | | 09/01/2045 | | | AA* | | | 250,000 | | | | 206,353 | |

AL State Corrections Institution Finance Authority | | | 5.000 | | | | 07/01/2042 | | | Aa2 | | | 350,000 | | | | 376,241 | |

Anniston AL Public Building Authority DHR Project | | | 5.250 | | | | 05/01/2030 | | | AA-* | | | 50,000 | | | | 50,057 | |

Anniston AL Public Building Authority DHR Project | | | 5.500 | | | | 05/01/2033 | | | AA-* | | | 200,000 | | | | 200,158 | |

Bessemer AL Public Educational Building Authority Revenue | | | 5.000 | | | | 07/01/2030 | | | AA* | | | 140,000 | | | | 140,080 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2037 | | | Aa3 | | | 500,000 | | | | 533,310 | |

Birmingham Jefferson AL Civic Center Authority Revenue | | | 5.000 | | | | 05/01/2038 | | | Aa3 | | | 250,000 | | | | 265,510 | |

Boaz AL Warrants | | | 4.000 | | | | 02/01/2037 | | | AA* | | | 250,000 | | | | 251,138 | |

Bullock County AL Public Building Authority | | | 4.000 | | | | 10/01/2038 | | | AA-* | | | 500,000 | | | | 505,760 | |

Montgomery County AL Public Building Authority | | | 5.000 | | | | 03/01/2036 | | | Aa2 | | | 350,000 | | | | 375,641 | |

Phenix City AL Public Building Authority | | | 4.000 | | | | 10/01/2035 | | | AA-* | | | 100,000 | | | | 102,217 | |

Phenix City AL Public Building Authority | | | 4.000 | | | | 10/01/2037 | | | AA-* | | | 120,000 | | | | 120,853 | |

Saint Clair County AL Public Building Authority | | | 4.000 | | | | 02/01/2041 | | | AA-* | | | 250,000 | | | | 244,733 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,372,051 | |

The accompanying footnotes are an integral part of the financial statements.

1

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | |

| 14.65% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Community College System Gadsden State Community College | | | 5.000 | % | | | 06/01/2038 | | | A1 | | $ | 325,000 | | | $ | 346,574 | |

AL State Public School & College Authority | | | 4.000 | | | | 11/01/2040 | | | Aa1 | | | 250,000 | | | | 250,463 | |

Auburn University AL General Fee Revenue | | | 4.000 | | | | 06/01/2036 | | | Aa2 | | | 380,000 | | | | 384,798 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 250,000 | | | | 256,825 | |

Troy University AL Facilities Revenue | | | 4.000 | | | | 11/01/2032 | | | A1 | | | 300,000 | | | | 310,866 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2037 | | | A1 | | | 200,000 | | | | 210,646 | |

University of AL General Fee Revenue | | | 5.000 | | | | 09/01/2037 | | | Aa3 | | | 250,000 | | | | 268,690 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 435,000 | | | | 465,572 | |

University of AL Huntsville General Fee Revenue | | | 5.000 | | | | 09/01/2038 | | | Aa3 | | | 500,000 | | | | 538,595 | |

University of South AL | | | 5.000 | | | | 04/01/2044 | | | A1 | | | 150,000 | | | | 157,004 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,190,033 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 12.90% of Net Assets | | | | | | | | | | | | | | | | | | |

Athens AL Water & Sewer | | | 4.000 | | | | 05/01/2039 | | | A1 | | | 200,000 | | | | 199,992 | |

Athens AL Water & Sewer | | | 4.000 | | | | 05/01/2040 | | | A1 | | | 100,000 | | | | 99,631 | |

Berry AL Water & Sewer Revenue | | | 4.000 | | | | 09/01/2039 | | | AA* | | | 250,000 | | | | 251,320 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2037 | | | Aa2 | | | 250,000 | | | | 252,280 | |

Birmingham AL Waterworks | | | 4.000 | | | | 01/01/2041 | | | Aa2 | | | 225,000 | | | | 220,556 | |

Limestone County AL Water & Sewer Authority | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 400,000 | | | | 408,247 | |

Opelika AL Utilities Board | | | 4.000 | | | | 06/01/2039 | | | Aa3 | | | 250,000 | | | | 248,538 | |

Prattville AL Sewer Warrants | | | 4.000 | | | | 11/01/2042 | | | AA-* | | | 375,000 | | | | 364,635 | |

Scottsboro AL Waterworks Sewer & Gas | | | 4.000 | | | | 08/01/2040 | | | AA* | | | 150,000 | | | | 148,166 | |

Talladega AL Water & Sewer Revenue | | | 3.000 | | | | 09/01/2046 | | | AA* | | | 250,000 | | | | 188,925 | |

Tuskegee AL Utilities Board | | | 3.000 | | | | 08/01/2037 | | | A1 | | | 260,000 | | | | 234,291 | |

Warrior River AL Water Authority | | | 4.000 | | | | 08/01/2043 | | | AA* | | | 200,000 | | | | 192,238 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,808,819 | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 3.35% of Net Assets | | | | | | | | | | | | | | | | | | |

Arab AL | | | 3.000 | | | | 12/01/2041 | | | AA* | | | 250,000 | | | | 206,968 | |

Birmingham AL Warrants | | | 4.000 | | | | 12/01/2035 | | | Aa3 | | | 250,000 | | | | 255,597 | |

Birmingham AL Warrants | | | 5.000 | | | | 12/01/2037 | | | Aa3 | | | 250,000 | | | | 266,455 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 729,020 | |

| HOSPITAL AND HEALTHCARE REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 2.64% of Net Assets | | | | | | | | | | | | | | | | | | |

Chilton County AL Health Care Authority Chilton County Hospital** | | | 5.000 | | | | 11/01/2035 | | | AA-@ | | | 550,000 | | | | 575,377 | |

| | | | | | | | | | | | | | | | | | |

| REFUNDING BONDS | |

| 2.46% of Net Assets | | | | | | | | | | | | | | | | | | |

Montgomery AL Warrants | | | 5.000 | | | | 06/15/2035 | | | A1 | | | 500,000 | | | | 535,610 | |

| | | | | | | | | | | | | | | | | | |

Total Investments 98.37% of Net Assets (cost $22,374,738) (See footnote 6 for further explanation) | | | | | | | | | $ | 21,424,050 | |

| | | | | | | | | | | | | | | | | | |

Other assets in excess of liabilities 1.63% | | | | | | | | | | 355,843 | |

| | | | | | | | | | | | | | | | | | |

Net Assets 100% | | | | | | | | | | | | | | | | $ | 21,779,893 | |

| | | | | | | | | | | | | | | | | | |

| | # | | Ratings by Moody’s Investors Service unless noted otherwise. |

| | | | Bond ratings are unaudited and not covered by Report of Independent Registered Public Accounting Firm. |

| | | | All ratings are as of the date indicated and do not reflect subsequent changes. |

| | * | | Rated by Standard & Poor’s Corporation |

| | @ | | Rated by Fitch’s Investors Service |

| | ** | | Security is segregated against line of credit — see footnote 7 |

The accompanying footnotes are an integral part of the financial statements.

2

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2023

Other Information

The following is a summary of the inputs used, as of June 30, 2023, involving the Fund’s investments in securities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

| | | | | | |

| | | Valuation Inputs | | Municipal Bonds | |

Level 1 | | Quoted Prices | | $ | — | |

Level 2 | | Other Significant Observable Inputs | | | 21,424,050 | |

Level 3 | | Significant Unobservable Inputs | | | — | |

| | | | | | |

| | | | $ | 21,424,050 | |

| | | | | | |

The accompanying footnotes are an integral part of the financial statements.

3

ALABAMA TAX-FREE INCOME SERIES

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2023

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (Cost: $22,374,738) | | | | | | $ | 21,424,050 | |

Cash | | | | | | | 258,977 | |

Interest receivable | | | | | | | 251,508 | |

| | | | | | | | |

Total assets | | | | | | | 21,934,535 | |

LIABILITIES: | | | | | | | | |

Payable for: | | | | | | | | |

Distributions to shareholders | | | 77,328 | | | | | |

Fund shares redeemed | | | 36,637 | | | | | |

Investment advisory fee | | | 2,396 | | | | | |

Transfer agent fee | | | 6,562 | | | | | |

Printing expense | | | 10,554 | | | | | |

Registration fees | | | 5,124 | | | | | |

Professional fees | | | 4,388 | | | | | |

Audit fees | | | 4,117 | | | | | |

Trustees fees | | | 2,057 | | | | | |

Custodian fee | | | 906 | | | | | |

Accrued expenses | | | 4,573 | | | | | |

| | | | | | | | |

Total liabilities | | | | | | | 154,642 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Paid-in capital | | | | | | | 23,038,936 | |

Total accumulated loss | | | | | | | (1,259,043 | ) |

| | | | | | | | |

Total Net Assets | | | | | | $ | 21,779,893 | |

| | | | | | | | |

NET ASSET VALUE, offering price and redemption price per share

(1,909,846 shares outstanding; unlimited number of shares authorized; no par value) | | | | | | $ | 11.40 | |

| | | | | | | | |

STATEMENT OF OPERATIONS

For the year ended June 30, 2023

| | | | |

Net investment income: | | | | |

Interest income | | $ | 745,184 | |

| | | | |

Expenses: | | | | |

Investment advisory fee | | | 116,896 | |

Transfer agent fee | | | 34,055 | |

Registration fees | | | 14,847 | |

Custodian fee | | | 8,776 | |

Pricing fees | | | 7,665 | |

Compliance fees | | | 7,200 | |

Professional fees | | | 7,046 | |

Trustees fees | | | 3,408 | |

Other expenses | | | 16,607 | |

| | | | |

Total expenses | | | 216,500 | |

Fees waived by Adviser (Note 2) | | | (52,673 | ) |

Custodian fee reduction (Note 7) | | | (23 | ) |

| | | | |

Net expenses | | | 163,804 | |

| | | | |

Net investment income | | | 581,380 | |

| | | | |

Realized and unrealized loss on investments: | | | | |

Net realized loss | | | (308,354 | ) |

Net change in unrealized appreciation/depreciation | | | (66,438 | ) |

| | | | |

Net realized and unrealized loss on investments | | | (374,792 | ) |

| | | | |

Net increase in net assets resulting from operations | | $ | 206,588 | |

| | | | |

The accompanying footnotes are an integral part of the financial statements.

4

ALABAMA TAX-FREE INCOME SERIES

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended June 30, 2023 and 2022

| | | | | | | | |

| | | 2023 | | | 2022 | |

Operations: | | | | | | | | |

Net investment income | | $ | 581,380 | | | $ | 606,402 | |

Net realized gain/(loss) on investments | | | (308,354 | ) | | | 13,595 | |

Net change in unrealized appreciation/depreciation | | | (66,438 | ) | | | (2,883,506 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets resulting from operations | | | 206,588 | | | | (2,263,509 | ) |

Total distributions (Note 6) | | | (594,975 | ) | | | (608,060 | ) |

Net Fund share transactions (Note 4) | | | (3,592,740 | ) | | | 423,477 | |

| | | | | | | | |

Total decrease | | | (3,981,127 | ) | | | (2,448,092 | ) |

Net assets: | | | | | | | | |

Beginning of year | | | 25,761,020 | | | | 28,209,112 | |

| | | | | | | | |

End of year | | $ | 21,779,893 | | | $ | 25,761,020 | |

| | | | | | | | |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding: | | For the years ended June 30, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

Net asset value, beginning of year | | $ | 11.57 | | | $ | 12.86 | | | $ | 12.78 | | | $ | 12.43 | | | $ | 12.08 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.28 | | | | 0.27 | | | | 0.29 | | | | 0.33 | | | | 0.34 | |

Net gains/(losses) on investments (c) | | | (0.16 | ) | | | (1.29 | ) | | | 0.08 | | | | 0.35 | | | | 0.35 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.12 | | | | (1.02 | ) | | | 0.37 | | | | 0.68 | | | | 0.69 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.28 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.33 | ) | | | (0.34 | ) |

Distributions from capital gains | | | (0.01 | ) | | | 0.00 | (b) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.29 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.33 | ) | | | (0.34 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 11.40 | | | $ | 11.57 | | | $ | 12.86 | | | $ | 12.78 | | | $ | 12.43 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 1.08% | | | | (8.03)% | | | | 2.93% | | | | 5.49% | | | | 5.80% | |

Net assets, end of year (in thousands) | | $ | 21,780 | | | $ | 25,761 | | | $ | 28,209 | | | $ | 27,354 | | | $ | 26,154 | |

Ratio of net expenses to average net assets (a) | | | 0.70% | | | | 0.70% | | | | 0.70% | | | | 0.70% | | | | 0.70% | |

Ratio of gross expenses to average net assets | | | 0.93% | | | | 0.87% | | | | 0.80% | | | | 0.82% | | | | 0.84% | |

Ratio of net investment income to average net assets | | | 2.49% | | | | 2.19% | | | | 2.26% | | | | 2.58% | | | | 2.79% | |

Portfolio turnover | | | 4.46% | | | | 2.55% | | | | 13.38% | | | | 6.98% | | | | 16.54% | |

| (a) | | Percentages are after expense waivers and reductions by the Adviser and Custodian. The Adviser and Custodian have agreed not to seek recovery of these waivers and reductions. |

| (b) | | Rounds to less than $0.01. |

| (c) | | Realized and unrealized gains and losses per share in this caption may be balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the Fund’s statement of operations due to share transactions for the period. |

The accompanying footnotes are an integral part of the financial statements.

5

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | |

| 35.31% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Association of Counties | | | 4.000 | % | | | 02/01/2029 | | | AA-* | | $ | 240,000 | | | $ | 249,869 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2030 | | | AA-* | | | 385,000 | | | | 424,740 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2031 | | | AA-* | | | 255,000 | | | | 280,906 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2033 | | | AA-* | | | 420,000 | | | | 428,921 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2034 | | | AA-* | | | 435,000 | | | | 443,983 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 690,000 | | | | 703,897 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2035 | | | AA-* | | | 460,000 | | | | 468,551 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2036 | | | AA-* | | | 445,000 | | | | 471,642 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2037 | | | AA-* | | | 745,000 | | | | 749,634 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2037 | | | AA-* | | | 460,000 | | | | 482,356 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2038 | | | AA-* | | | 3,165,000 | | | | 3,167,532 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2038 | | | AA-* | | | 1,045,000 | | | | 1,038,124 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2038 | | | AA-* | | | 490,000 | | | | 508,723 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2039 | | | AA-* | | | 1,000,000 | | | | 990,810 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2039 | | | AA-* | | | 515,000 | | | | 531,650 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2039 | | | AA-* | | | 550,000 | | | | 601,667 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2040 | | | AA-* | | | 535,000 | | | | 549,948 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2041 | | | AA-* | | | 565,000 | | | | 578,735 | |

KY Association of Counties | | | 3.500 | | | | 02/01/2042 | | | AA-* | | | 1,215,000 | | | | 1,098,688 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2042 | | | AA-* | | | 1,050,000 | | | | 1,069,446 | |

KY Association of Counties | | | 4.500 | | | | 02/01/2043 | | | AA-* | | | 1,455,000 | | | | 1,482,194 | |

KY Association of Counties | | | 4.000 | | | | 02/01/2048 | | | AA-* | | | 920,000 | | | | 859,768 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2032 | | | AA-* | | | 550,000 | | | | 530,937 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2033 | | | AA-* | | | 1,010,000 | | | | 966,762 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2034 | | | AA-* | | | 1,070,000 | | | | 1,010,262 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2034 | | | AA-* | | | 925,000 | | | | 875,707 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2035 | | | AA-* | | | 1,170,000 | | | | 1,091,271 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2035 | | | AA-* | | | 930,000 | | | | 867,420 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2036 | | | AA-* | | | 1,240,000 | | | | 1,135,617 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2036 | | | AA-* | | | 965,000 | | | | 881,952 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2037 | | | AA-* | | | 990,000 | | | | 882,179 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2038 | | | AA-* | | | 980,000 | | | | 860,538 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2038 | | | AA-* | | | 1,025,000 | | | | 892,857 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2039 | | | AA-* | | | 1,050,000 | | | | 903,662 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2040 | | | AA-* | | | 1,030,000 | | | | 873,440 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2041 | | | AA-* | | | 1,000,000 | | | | 836,330 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2041 | | | AA-* | | | 1,065,000 | | | | 891,852 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2042 | | | AA-* | | | 420,000 | | | | 345,866 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2043 | | | AA-* | | | 430,000 | | | | 347,096 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2044 | | | AA-* | | | 450,000 | | | | 360,000 | |

KY Bond Corporation Finance Program | | | 3.000 | | | | 02/01/2047 | | | AA-* | | | 1,100,000 | | | | 827,354 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2031 | | | A1 | | | 2,110,000 | | | | 2,111,055 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2032 | | | A1 | | | 2,205,000 | | | | 2,206,125 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2033 | | | A1 | | | 2,310,000 | | | | 2,311,178 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2026 | | | A1 | | | 955,000 | | | | 987,833 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2028 | | | A1 | | | 2,670,000 | | | | 2,766,707 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2030 | | | A1 | | | 5,000,000 | | | | 5,182,150 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 8,820,000 | | | | 9,146,693 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 5,270,000 | | | | 5,463,040 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 4,900,000 | | | | 5,079,487 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2029 | | | A1 | | | 4,200,000 | | | | 4,349,562 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2032 | | | A1 | | | 1,515,000 | | | | 1,571,116 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2033 | | | A1 | | | 1,000,000 | | | | 1,036,630 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2034 | | | A1 | | | 1,900,000 | | | | 1,954,872 | |

KY State Property & Building #110 | | | 5.000 | | | | 08/01/2035 | | | A1 | | | 3,680,000 | | | | 3,805,010 | |

KY State Property & Building #112 | | | 5.000 | | | | 11/01/2028 | | | A1 | | | 2,765,000 | | | | 2,938,310 | |

KY State Property & Building #112 | | | 5.000 | | | | 02/01/2035 | | | A1 | | | 8,325,000 | | | | 8,706,535 | |

The accompanying footnotes are an integral part of the financial statements.

6

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

KY State Property & Building #112 | | | 5.000 | % | | | 02/01/2036 | | | A1 | | $ | 7,920,000 | | | $ | 8,234,978 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2033 | | | A1 | | | 4,565,000 | | | | 4,843,237 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2034 | | | A1 | | | 13,975,000 | | | | 14,811,544 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2036 | | | A1 | | | 14,460,000 | | | | 15,247,052 | |

KY State Property & Building #115 | | | 5.000 | | | | 04/01/2037 | | | A1 | | | 5,000,000 | | | | 5,255,950 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2031 | | | A1 | | | 5,055,000 | | | | 5,403,441 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2032 | | | A1 | | | 3,680,000 | | | | 3,933,662 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2033 | | | A1 | | | 3,550,000 | | | | 3,788,063 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 5,825,000 | | | | 6,217,780 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2035 | | | A1 | | | 5,065,000 | | | | 5,378,270 | |

KY State Property & Building #117 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 5,275,000 | | | | 5,566,180 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2030 | | | A1 | | | 3,685,000 | | | | 4,003,937 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2034 | | | A1 | | | 725,000 | | | | 783,007 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2035 | | | A1 | | | 10,000,000 | | | | 10,716,700 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2036 | | | A1 | | | 10,000,000 | | | | 10,643,200 | |

KY State Property & Building #119 | | | 5.000 | | | | 05/01/2037 | | | A1 | | | 500,000 | | | | 528,290 | |

KY State Property & Building #122 | | | 5.000 | | | | 11/01/2031 | | | A1 | | | 790,000 | | | | 868,566 | |

KY State Property & Building #122 | | | 5.000 | | | | 11/01/2033 | | | A1 | | | 1,000,000 | | | | 1,088,640 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2035 | | | A1 | | | 500,000 | | | | 509,370 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2036 | | | A1 | | | 750,000 | | | | 758,963 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2037 | | | A1 | | | 675,000 | | | | 676,256 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2038 | | | A1 | | | 5,345,000 | | | | 5,357,507 | |

KY State Property & Building #122 | | | 4.000 | | | | 11/01/2039 | | | A1 | | | 9,655,000 | | | | 9,668,421 | |

KY State Property & Building #126 | | | 5.000 | | | | 05/01/2039 | | | A1 | | | 5,565,000 | | | | 6,110,147 | |

KY State Property & Building #126 | | | 5.000 | | | | 05/01/2040 | | | A1 | | | 5,845,000 | | | | 6,357,840 | |

KY State Property & Building #126 | | | 5.000 | | | | 05/01/2041 | | | A1 | | | 6,135,000 | | | | 6,673,285 | |

KY State Property & Building #126 | | | 5.000 | | | | 05/01/2042 | | | A1 | | | 2,000,000 | | | | 2,156,800 | |

KY State Property & Building #126 | | | 4.000 | | | | 05/01/2042 | | | A1 | | | 1,980,000 | | | | 1,908,720 | |

KY State Property & Building #127 | | | 5.250 | | | | 06/01/2040 | | | A1 | | | 10,000,000 | | | | 11,176,200 | |

KY State Property & Building #127 | | | 5.250 | | | | 06/01/2041 | | | A1 | | | 8,745,000 | | | | 9,724,353 | |

KY State Property & Building #127 | | | 5.250 | | | | 06/01/2042 | | | A1 | | | 15,975,000 | | | | 17,687,520 | |

Louisville & Jefferson County Visitors & Convention Commission | | | 4.000 | | | | 06/01/2034 | | | Aa3 | | | 3,720,000 | | | | 3,794,958 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 282,052,026 | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | |

| 20.63% of Net Assets | | | | | | | | | | | | | | | | | | |

Bardstown KY Independent School District Finance Corporation | | | 4.000 | | | | 02/01/2040 | | | A1 | | | 1,495,000 | | | | 1,447,325 | |

Bardstown KY Independent School District Finance Corporation | | | 4.000 | | | | 02/01/2042 | | | A1 | | | 1,525,000 | | | | 1,453,645 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2034 | | | A1 | | | 1,890,000 | | | | 1,930,144 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2035 | | | A1 | | | 2,215,000 | | | | 2,251,614 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2036 | | | A1 | | | 2,305,000 | | | | 2,326,944 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | A1 | | | 2,395,000 | | | | 2,405,993 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 04/01/2043 | | | A1 | | | 3,085,000 | | | | 3,006,610 | |

Bowling Green KY School District Finance Corporation | | | 4.000 | | | | 04/01/2045 | | | A1 | | | 2,500,000 | | | | 2,418,625 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | A1 | | | 1,820,000 | | | | 1,843,187 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2036 | | | A1 | | | 2,985,000 | | | | 3,009,328 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | A1 | | | 3,075,000 | | | | 3,084,164 | |

Bullitt County KY School District Finance Corporation | | | 4.000 | | | | 03/01/2038 | | | A1 | | | 575,000 | | | | 568,681 | |

Butler County KY School District Finance Corporation | | | 4.000 | | | | 03/01/2037 | | | A1 | | | 360,000 | | | | 359,608 | |

Butler County KY School District Finance Corporation | | | 4.250 | | | | 03/01/2040 | | | A1 | | | 755,000 | | | | 756,050 | |

Clark County KY School District Finance Corporation | | | 4.000 | | | | 03/01/2039 | | | A1 | | | 3,090,000 | | | | 3,026,377 | |

Clark County KY School District Finance Corporation | | | 4.000 | | | | 03/01/2040 | | | A1 | | | 1,475,000 | | | | 1,432,918 | |

Covington KY Independent School District Finance Corporation | | | 4.000 | | | | 06/01/2041 | | | A1 | | | 490,000 | | | | 482,586 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2028 | | | Aa3 | | | 1,330,000 | | | | 1,380,899 | |

Fayette County KY School District Finance Corporation | | | 4.750 | | | | 11/01/2031 | | | Aa3 | | | 1,730,000 | | | | 1,767,230 | |

Fayette County KY School District Finance Corporation** | | | 5.000 | | | | 08/01/2032 | | | Aa3 | | | 10,600,000 | | | | 11,023,152 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2034 | | | Aa3 | | | 8,750,000 | | | | 9,084,863 | |

Glasgow KY School District Finance Corporation | | | 3.000 | | | | 02/01/2042 | | | A1 | | | 1,820,000 | | | | 1,490,653 | |

Hardin County KY School District Finance Corporation | | | 4.000 | | | | 05/01/2030 | | | Aa3 | | | 635,000 | | | | 651,078 | |

The accompanying footnotes are an integral part of the financial statements.

7

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Jefferson County KY School District Finance Corporation | | | 5.000 | % | | | 10/01/2026 | | | Aa3 | | $ | 255,000 | | | $ | 270,438 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2030 | | | Aa3 | | | 975,000 | | | | 1,006,317 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2031 | | | Aa3 | | | 1,025,000 | | | | 1,057,923 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2033 | | | Aa3 | | | 5,145,000 | | | | 5,228,298 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2033 | | | Aa3 | | | 4,310,000 | | | | 4,431,973 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2034 | | | Aa3 | | | 1,165,000 | | | | 1,201,931 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2034 | | | Aa3 | | | 5,405,000 | | | | 5,492,507 | |

Jefferson County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2034 | | | Aa3 | | | 3,500,000 | | | | 3,579,345 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 04/01/2035 | | | Aa3 | | | 1,220,000 | | | | 1,255,709 | |

Jefferson County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2035 | | | Aa3 | | | 11,140,000 | | | | 10,347,835 | |

Jefferson County KY School District Finance Corporation | | | 4.250 | | | | 10/01/2037 | | | Aa3 | | | 2,110,000 | | | | 2,135,468 | |

Jefferson County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2038 | | | Aa3 | | | 6,470,000 | | | | 5,642,099 | |

Jefferson County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2039 | | | Aa3 | | | 4,385,000 | | | | 3,779,344 | |

Jefferson County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2040 | | | Aa3 | | | 1,940,000 | | | | 1,643,646 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2036 | | | A1 | | | 1,210,000 | | | | 1,220,382 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2037 | | | A1 | | | 1,255,000 | | | | 1,262,505 | |

Kenton County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2038 | | | A1 | | | 1,300,000 | | | | 1,291,342 | |

Kenton County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2040 | | | A1 | | | 1,965,000 | | | | 1,639,046 | |

Kenton County KY School District Finance Corporation | | | 3.000 | | | | 12/01/2041 | | | A1 | | | 2,025,000 | | | | 1,656,227 | |

Marion County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2038 | | | A1 | | | 1,000,000 | | | | 992,240 | |

Marion County KY School District Finance Corporation | | | 4.000 | | | | 04/01/2040 | | | A1 | | | 1,190,000 | | | | 1,167,128 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | A1 | | | 2,215,000 | | | | 2,236,242 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2037 | | | A1 | | | 2,255,000 | | | | 2,264,809 | |

Meade County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2038 | | | A1 | | | 2,400,000 | | | | 2,386,584 | |

Morgan County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2029 | | | A1 | | | 960,000 | | | | 993,648 | |

Oldham County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2034 | | | A1 | | | 1,560,000 | | | | 1,580,358 | |

Paris KY Independent School District Finance Corporation | | | 4.000 | | | | 03/01/2042 | | | A1 | | | 1,000,000 | | | | 961,710 | |

Raceland-Worthington KY Independent School District Finance Corporation | | | 3.400 | | | | 06/01/2037 | | | A1 | | | 605,000 | | | | 568,379 | |

Scott County KY School District Finance Corporation | | | 4.500 | | | | 01/01/2025 | | | A1 | | | 4,890,000 | | | | 4,970,290 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 02/01/2029 | | | Aa3 | | | 5,040,000 | | | | 5,281,466 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2035 | | | Aa3 | | | 1,440,000 | | | | 1,459,786 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2035 | | | Aa3 | | | 2,235,000 | | | | 2,267,609 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 06/01/2036 | | | Aa3 | | | 1,500,000 | | | | 1,513,140 | |

Scott County KY School District Finance Corporation | | | 4.000 | | | | 10/01/2037 | | | Aa3 | | | 2,415,000 | | | | 2,424,394 | |

Scott County KY School District Finance Corporation | | | 5.000 | | | | 09/01/2041 | | | Aa3 | | | 7,120,000 | | | | 7,851,295 | |

Scott County KY School District Finance Corporation | | | 4.125 | | | | 04/01/2047 | | | Aa3 | | | 1,025,000 | | | | 1,001,394 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2037 | | | Aa3 | | | 6,240,000 | | | | 6,275,880 | |

Shelby County KY School District Finance Corporation | | | 4.000 | | | | 08/01/2038 | | | Aa3 | | | 3,000,000 | | | | 3,000,780 | |

Warren County KY School District Finance Corporation | | | 4.000 | | | | 02/01/2040 | | | Aa3 | | | 2,000,000 | | | | 1,959,520 | |

Williamstown KY Independent School District Finance Corporation | | | 4.125 | | | | 05/01/2044 | | | A1 | | | 490,000 | | | | 483,566 | |

Woodford County KY School District Finance Corporation | | | 5.000 | | | | 08/01/2038 | | | A1 | | | 1,650,000 | | | | 1,807,525 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 164,791,752 | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | | | | | | | | | | | |

| 12.90% of Net Assets | | | | | | | | | | | | | | | | | | |

Boyle County Centre College | | | 5.000 | | | | 06/01/2037 | | | A3 | | | 2,865,000 | | | | 2,972,094 | |

Boyle County KY Educational Facilities Revenue Centre College | | | 5.250 | | | | 06/01/2043 | | | A3 | | | 2,000,000 | | | | 2,159,440 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2033 | | | A3 | | | 1,345,000 | | | | 1,443,589 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2034 | | | A3 | | | 1,605,000 | | | | 1,722,647 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2035 | | | A3 | | | 2,165,000 | | | | 2,307,500 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2036 | | | A3 | | | 2,835,000 | | | | 3,004,533 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 5.000 | | | | 06/01/2038 | | | A3 | | | 1,340,000 | | | | 1,406,585 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 4.000 | | | | 06/01/2038 | | | A3 | | | 200,000 | | | | 196,682 | |

The accompanying footnotes are an integral part of the financial statements.

8

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

KY Bond Development Corporation Educational Facilities Centre College | | | 3.000 | % | | | 06/01/2039 | | | A3 | | $ | 860,000 | | | $ | 702,465 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 4.000 | | | | 06/01/2040 | | | A3 | | | 640,000 | | | | 618,566 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 3.000 | | | | 06/01/2041 | | | A3 | | | 1,405,000 | | | | 1,140,073 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 4.000 | | | | 06/01/2046 | | | A3 | | | 2,545,000 | | | | 2,353,820 | |

KY Bond Development Corporation Educational Facilities Centre College | | | 4.000 | | | | 06/01/2051 | | | A3 | | | 4,400,000 | | | | 3,987,148 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2032 | | | A1 | | | 2,795,000 | | | | 2,943,806 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2033 | | | A1 | | | 2,940,000 | | | | 3,094,673 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2034 | | | A1 | | | 3,090,000 | | | | 3,251,576 | |

KY State Property & Building #114 | | | 5.000 | | | | 10/01/2035 | | | A1 | | | 1,945,000 | | | | 2,035,695 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2035 | | | A1 | | | 4,165,000 | | | | 4,433,393 | |

KY State Property & Building #116 | | | 5.000 | | | | 10/01/2036 | | | A1 | | | 2,725,000 | | | | 2,892,806 | |

Murray State University | | | 5.000 | | | | 03/01/2032 | | | A1 | | | 2,220,000 | | | | 2,279,984 | |

Murray State University | | | 3.000 | | | | 09/01/2037 | | | A1 | | | 1,310,000 | | | | 1,161,446 | |

Murray State University | | | 3.000 | | | | 09/01/2039 | | | A1 | | | 1,390,000 | | | | 1,200,057 | |

Murray State University | | | 3.000 | | | | 09/01/2041 | | | A1 | | | 1,470,000 | | | | 1,243,958 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2033 | | | Aa3 | | | 885,000 | | | | 917,612 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2034 | | | Aa3 | | | 1,020,000 | | | | 1,051,569 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2039 | | | Aa3 | | | 4,660,000 | | | | 4,648,956 | |

University of Kentucky Certificate of Participation | | | 4.000 | | | | 05/01/2044 | | | Aa3 | | | 3,755,000 | | | | 3,692,216 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2030 | | | Aa2 | | | 5,490,000 | | | | 5,670,182 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2036 | | | Aa2 | | | 16,160,000 | | | | 16,352,625 | |

University of Kentucky General Receipts | | | 4.000 | | | | 10/01/2038 | | | Aa2 | | | 10,855,000 | | | | 10,905,042 | |

University of Kentucky Higher Educational | | | 4.750 | | | | 04/01/2034 | | | Aa2 | | | 5,435,000 | | | | 5,602,561 | |

University of Louisville | | | 3.000 | | | | 09/01/2039 | | | A1 | | | 1,450,000 | | | | 1,245,681 | |

University of Louisville | | | 3.000 | | | | 09/01/2040 | | | A1 | | | 1,495,000 | | | | 1,265,562 | |

University of Louisville | | | 3.000 | | | | 09/01/2042 | | | A1 | | | 1,575,000 | | | | 1,284,255 | |

Western KY University | | | 4.000 | | | | 09/01/2034 | | | A1 | | | 575,000 | | | | 586,477 | |

Western KY University | | | 4.000 | | | | 09/01/2035 | | | A1 | | | 595,000 | | | | 605,258 | |

Western KY University | | | 4.000 | | | | 09/01/2036 | | | A1 | | | 620,000 | | | | 627,527 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 103,008,059 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | |

| 8.11% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Rural Water Finance Corporation | | | 4.500 | | | | 02/01/2024 | | | AA-* | | | 880,000 | | �� | | 880,220 | |

KY Rural Water Finance Corporation | | | 3.000 | | | | 02/01/2032 | | | AA-* | | | 240,000 | | | | 232,726 | |

KY Rural Water Finance Corporation | | | 3.000 | | | | 02/01/2033 | | | AA-* | | | 370,000 | | | | 360,043 | |

KY Rural Water Finance Corporation | | | 5.125 | | | | 02/01/2035 | | | AA-* | | | 295,000 | | | | 295,103 | |

KY Rural Water Finance Corporation | | | 3.000 | | | | 08/01/2036 | | | AA-* | | | 285,000 | | | | 262,211 | |

KY Rural Water Finance Corporation | | | 3.000 | | | | 08/01/2037 | | | AA-* | | | 280,000 | | | | 251,185 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2031 | | | AA-* | | | 405,000 | | | | 419,058 | |

KY State Association of Counties Finance Corporation | | | 4.000 | | | | 02/01/2033 | | | AA-* | | | 415,000 | | | | 427,973 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2033 | | | Aa3 | | | 1,000,000 | | | | 1,005,550 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2034 | | | Aa3 | | | 2,230,000 | | | | 2,287,891 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2034 | | | Aa3 | | | 4,595,000 | | | | 4,836,421 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2035 | | | Aa3 | | | 2,245,000 | | | | 2,301,731 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2035 | | | Aa3 | | | 4,825,000 | | | | 5,072,812 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2036 | | | Aa3 | | | 2,795,000 | | | | 2,856,127 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.000 | | | | 05/15/2037 | | | Aa3 | | | 10,000,000 | | | | 10,177,100 | |

Louisville & Jefferson County Metropolitan Sewer | | | 3.000 | | | | 05/15/2044 | | | Aa3 | | | 21,515,000 | | | | 17,608,091 | |

Louisville & Jefferson County Metropolitan Sewer | | | 3.250 | | | | 05/15/2046 | | | Aa3 | | | 2,450,000 | | | | 2,052,439 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2036 | | | A1 | | | 370,000 | | | | 335,819 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2037 | | | A1 | | | 380,000 | | | | 338,272 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2038 | | | A1 | | | 395,000 | | | | 345,696 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2039 | | | A1 | | | 405,000 | | | | 350,815 | |

The accompanying footnotes are an integral part of the financial statements.

9

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2023

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Murray KY Electric Plant | | | 3.000 | % | | | 12/01/2040 | | | A1 | | $ | 420,000 | | | $ | 359,570 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2041 | | | A1 | | | 430,000 | | | | 363,281 | |

Murray KY Electric Plant | | | 3.000 | | | | 12/01/2042 | | | A1 | | | 445,000 | | | | 366,253 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2031 | | | A3 | | | 245,000 | | | | 252,103 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2033 | | | A3 | | | 275,000 | | | | 282,326 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2034 | | | A3 | | | 305,000 | | | | 311,500 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2035 | | | A3 | | | 200,000 | | | | 203,402 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2036 | | | A3 | | | 325,000 | | | | 329,670 | |

Owensboro KY Electric Light & Power | | | 4.000 | | | | 01/01/2037 | | | A3 | | | 410,000 | | | | 412,800 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2034 | | | A1 | | | 2,075,000 | | | | 2,136,503 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2035 | | | A1 | | | 2,155,000 | | | | 2,203,509 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2037 | | | A1 | | | 1,950,000 | | | | 1,962,675 | |

Owensboro KY Water Revenue | | | 4.000 | | | | 09/15/2039 | | | A1 | | | 2,125,000 | | | | 2,117,372 | |

Owensboro-Daviess County KY Water | | | 4.000 | | | | 12/01/2043 | | | A+* | | | 800,000 | | | | 769,680 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 64,767,927 | |

| PREREFUNDED BONDS | | | | | | | | | | | |

| 7.22% of Net Assets | | | | | | | | | | | | | | | | | | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2029 | | | Aa3 | | | 3,660,000 | | | | 3,675,701 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2032 | | | Aa3 | | | 3,615,000 | | | | 3,630,508 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 10/01/2033 | | | Aa3 | | | 4,385,000 | | | | 4,403,812 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2034 | | | NR | | | 695,000 | | | | 710,499 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2035 | | | NR | | | 725,000 | | | | 741,168 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2036 | | | NR | | | 760,000 | | | | 776,948 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2028 | | | A1 | | | 2,030,000 | | | | 2,038,709 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2029 | | | A1 | | | 4,130,000 | | | | 4,148,337 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2030 | | | A1 | | | 7,165,000 | | | | 7,196,813 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2031 | | | A1 | | | 4,910,000 | | | | 4,931,800 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2032 | | | A1 | | | 6,275,000 | | | | 6,302,860 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2033 | | | Aa3 | | | 2,500,000 | | | | 2,500,125 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2029 | | | Aa2 | | | 345,000 | | | | 354,912 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2036 | | | Aa2 | | | 4,820,000 | | | | 4,876,587 | |

University of Kentucky General Receipts | | | 5.000 | | | | 04/01/2037 | | | Aa2 | | | 3,815,000 | | | | 3,859,788 | |