QuickLinks -- Click here to rapidly navigate through this document

Notice of Meeting, Invitation to Shareholders and Management Proxy Circular, dated February 24, 2021

| Contents |

| 1 | Invitation to Shareholders | |

| 2 | About this Management Proxy Circular | |

| 3 | Meeting Participation, Voting and Proxies: Questions and Answers | |

| 7 | Business of the Meeting | |

| 7 | Financial Statements | |

| 7 | Election of Directors | |

| 14 | Appointment of Auditor | |

| 15 | Increase in Common Shares Reserved for Issuance under the Suncor Energy Inc. Stock Option Plan | |

| 16 | Advisory Vote on Approach to Executive Compensation | |

| 17 | Board of Directors Compensation | |

| 23 | Executive Compensation | |

| 23 | Letter to Shareholders | |

| 25 | Compensation Discussion and Analysis | |

| 50 | Compensation Disclosure of Named Executive Officers | |

| 56 | Termination Agreements and Change of Control Arrangements | |

| 58 | Indebtedness of Directors, Executive Officers and Senior Officers | |

| 58 | Summary of Incentive Plans | |

| 62 | Claw Back Policy | |

| 62 | Directors' and Officers' Insurance | |

| 62 | Advance Notice By-Law | |

| 63 | Corporate Governance | |

| 63 | Additional Information | |

| 63 | Advisories | |

| A-1 | Schedule A: Named Executive Officers' Outstanding Option-Based Awards and Grant Date Fair Values for Share-Based Awards | |

| B-1 | Schedule B: Corporate Governance Summary | |

| C-1 | Schedule C: Position Description for Independent Board Chair | |

| D-1 | Schedule D: Director Independence Policy and Criteria | |

| E-1 | Schedule E: Board Terms of Reference | |

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS OF SUNCOR ENERGY INC.

The annual meeting (the meeting) of shareholders of Suncor Energy Inc. (the Corporation) will be held on May 4, 2021 at 10:30 a.m. Mountain Daylight Time (MDT). This year, to proactively address the health impact of COVID-19 and in alignment with the current restrictions on large public gatherings, the meeting will be conducted in a virtual-only format via live webcast online at https://web.lumiagm.com/400990259 (Password: Suncor2021 (case sensitive)).

Registered shareholders and duly appointed proxyholders can participate, vote and ask questions during the meeting, provided they are connected to the internet and comply with all the requirements set out in the management proxy circular. Non-registered (or beneficial) shareholders who have not duly appointed themselves as proxyholder will be able to attend the meeting as guests. Guests will not be able to vote or ask questions at the meeting.

The meeting will have the following purposes:

- •

- to receive the consolidated financial statements of the Corporation for the year ended December 31, 2020 together with the notes thereto and the auditor report thereon;

- •

- to elect directors of the Corporation to hold office until the close of the next annual meeting;

- •

- to appoint the auditor of the Corporation to hold office until the close of the next annual meeting;

- •

- to consider and, if deemed fit, approve an amendment to the Suncor Energy Inc. Stock Option Plan to increase the number of common shares reserved for issuance thereunder by 15,000,000 common shares;

- •

- to consider and, if deemed fit, approve an advisory resolution on the Corporation's approach to executive compensation; and

- •

- to transact such other business as may properly be brought before the meeting or any continuation of the meeting after an adjournment or postponement.

The accompanying management proxy circular provides detailed information relating to the matters to be dealt with at the meeting and forms part of this notice.

Shareholders are encouraged to express their vote in advance of the meeting by completing the form of proxy or voting instruction form provided to them. Detailed instructions on how to complete and return proxies are provided on pages 3 to 6 of the accompanying management proxy circular. To be effective, the completed form of proxy must be received by our transfer agent and registrar, Computershare Trust Company of Canada, Proxy Department, 135 West Beaver Creek, P.O. Box 300, Richmond Hill, Ontario, L4B 4R5, at any time prior to 10:30 a.m. MDT on April 30, 2021 or, in the case of any adjournment or postponement of the meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed meeting.

Shareholders may also vote their shares by telephone or through the internet using the procedures described in the form of proxy or voting instruction form.

Shareholders registered at the close of business on March 8, 2021 will be entitled to receive notice of and vote at the meeting.

By order of the Board of Directors of Suncor Energy Inc.

Arlene Strom

Chief Legal Officer and Corporate Secretary

February 24, 2021

Calgary, Alberta

Invitation to Shareholders

Dear Shareholder:

On behalf of the board of directors (the Board), management and employees of Suncor Energy Inc. (the Corporation), we invite you to attend our annual meeting (the meeting) of shareholders on May 4, 2021 at 10:30 a.m. Mountain Daylight Time. This year, to proactively address the health impact of COVID-19 and in alignment with the current restrictions on large public gatherings, we will hold the meeting in a virtual-only format, which will be conducted via live webcast online at https://web.lumiagm.com/400990259 (Password: Suncor2021 (case sensitive)). The virtual-only format will mitigate the risk to the health and safety of our communities, shareholders, employees and other stakeholders and will allow shareholders an equal opportunity to participate in the meeting regardless of their geographic location.

The items of business to be considered at this meeting are described in the Notice of Annual Meeting of shareholders of the Corporation and the accompanying management proxy circular. The contents and sending of the management proxy circular have been approved by the Board.

Your participation at this meeting is very important to us. We encourage you to vote by following the instructions in the form of proxy or voting instruction form provided to you, or by voting at the virtual meeting. Following the formal portion of the meeting, management will review the Corporation's operational and financial performance for 2020 and provide an outlook on priorities for 2021 and beyond. You will also have an opportunity to ask questions.

Many of our public documents, including our 2020 Annual Report, are available in the Investor Centre on our website located at www.suncor.com. We encourage you to visit our website during the year for information about the Corporation, including news releases and investor presentations. To ensure you receive all the latest news relating to the Corporation, including the speeches of senior executives, you can use the 'Email Alerts' subscribe feature on the Corporation's website. Additional information relating to the Corporation is also available under the Corporation's profile on SEDAR at www.sedar.com or EDGAR at www.sec.gov.

We look forward to having you join us at the meeting.

Yours sincerely,

| Michael M. Wilson Chair of the Board | Mark S. Little President and Chief Executive Officer |

Management Proxy Circular 2021 Suncor Energy Inc. 1

About this Management Proxy Circular

You are invited to attend the annual meeting (the meeting) of holders (shareholders) of common shares (common shares or shares) of Suncor Energy Inc. to be held on May 4, 2021, at 10:30 a.m. Mountain Daylight Time (MDT) for the purposes indicated in the Notice of Annual Meeting. The meeting will be conducted in a virtual-only format via live webcast online at https://web.lumiagm.com/400990259 (Password: Suncor2021 (case sensitive)).

Suncor's management proxy circular includes important information regarding the matters to be acted upon at the meeting, and our compensation practices for, and compensation of, the board of directors of Suncor (the Board

or Board of Directors) and Suncor's Named Executive Officers (as defined on page 25) for the year ended December 31, 2020.

This management proxy circular is dated February 24, 2021, and all information contained in this management proxy circular is given as of such date, unless stated otherwise.

In this management proxy circular, references to "Suncor", the "corporation", the "company", "our" or "we" mean Suncor Energy Inc., its subsidiaries, partnerships and joint arrangements, unless the context otherwise requires.

Forward-Looking Information and Risks This management proxy circular contains forward-looking information based on Suncor's current expectations, estimates, projections and assumptions. This information is subject to a number of risks and uncertainties, including those discussed in Suncor's Annual Information Form for the year ended December 31, 2020 (the AIF), Suncor's Management's Discussion and Analysis for the year ended December 31, 2020 (the MD&A), and Suncor's other disclosure documents, many of which are beyond the corporation's control. Users of this information are cautioned that actual results may differ materially. Refer to the "Advisories" section of this management proxy circular for information on the material risk factors and assumptions underlying the forward-looking information contained in this management proxy circular. The corporation's business, reserves, financial condition and results of operations may be affected by a number of factors, including, but not limited to, the factors described in the "Advisories" section of this management proxy circular. Non-GAAP Financial Measures Certain financial measures in this management proxy circular – namely operating earnings, funds from operations (FFO), free funds flow and return on capital employed (ROCE) – are not prescribed by generally accepted accounting principles (GAAP). Refer to the "Advisories" section of this management proxy circular. These non-GAAP financial measures are used by management to analyze business performance, leverage and liquidity. These non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. Therefore, these non-GAAP financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. | Measurement Conversions Suncor converts certain natural gas volumes to barrels of oil equivalent (boe) on the basis of one barrel (bbl) for every six thousand cubic feet (mcf) of natural gas. Any figure presented in boe may be misleading, particularly if used in isolation. A conversion ratio of six mcf of natural gas to one bbl of crude oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not necessarily represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, conversion on a 6:1 basis may be misleading as an indication of value. In this management proxy circular, references to "bbls/d" mean thousands of barrels per day and "boe/d" mean thousands of barrels of oil equivalent per day. Website References Information contained in or otherwise accessible through Suncor's website and other websites, though referenced herein, does not form part of this management proxy circular and is not incorporated by reference into this management proxy circular. |

2 Management Proxy Circular 2021 Suncor Energy Inc.

Meeting Participation, Voting and Proxies: Questions and Answers

This management proxy circular is provided in connection with the solicitation by or on behalf of management of Suncor of proxies to be used at the annual meeting of shareholders of Suncor. It is expected that solicitation will be primarily by mail, but proxies may also be solicited personally, by telephone or other similar means by Suncor employees or agents. Custodians and fiduciaries will be supplied with proxy materials to forward to beneficial owners of Suncor common shares and normal handling charges will be paid by Suncor for such forwarding services.

Your vote is very important to us. We encourage you to exercise your vote to ensure your shares are represented at the meeting.

To be valid, proxy forms must be dated, completed, signed and deposited with our transfer agent and registrar, Computershare Trust Company of Canada (Computershare): (i) by mail using the enclosed return envelope or one addressed to Computershare Trust Company of Canada, Proxy Department, 135 West Beaver Creek, P.O. Box 300, Richmond Hill, Ontario, L4B 4R5; or (ii) by hand delivery to Computershare, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. Additionally, you may vote by using the internet at www.investorvote.com or by calling 1-866-732-VOTE (8683). Your proxy instructions must be received in each case no later than 10:30 a.m. MDT on April 30, 2021 or, in the case of any adjournment or postponement of the meeting, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed meeting. The time limit for deposit of proxies may be waived or extended by the chair of the meeting at his or her discretion, without notice. Please read the following for commonly asked questions and answers regarding meeting participation, voting and proxies.

Q. Why is Suncor having a virtual meeting?

A. Due to the health impact of COVID-19, and in alignment with the current restrictions on large public gatherings, Suncor is holding its annual meeting (the meeting) virtually this year. The virtual-only format will mitigate risk to the health and safety of our communities, shareholders, employees and other stakeholders.

Q. How will I be able to participate in the meeting?

A. Suncor is holding the meeting in a virtual-only format via live webcast. You can participate online using your smartphone, tablet or computer. Attending the meeting online enables registered shareholders and duly appointed proxyholders, including non-registered (beneficial)

shareholders who have duly appointed themselves as proxyholder, to listen to and view the meeting, ask questions and vote. Non-registered (beneficial) shareholders who have not duly appointed themselves as proxyholders may still attend the meeting as guests. Guests will be able to listen to and view the meeting but will not be able to ask questions or vote at the meeting.

Following the meeting we will hold a Q&A session to answer the questions submitted through the online platform. Questions may be submitted at any time during the meeting. To ensure the meeting is conducted in a manner that is fair to all shareholders, the Chair of the meeting may exercise discretion in responding to the questions including the order in which the questions are answered, the grouping of the questions and the amount of time devoted to any question. Shareholders will be afforded the same opportunities to participate as at an in-person meeting. The questions and answers from the Q&A session will be included in the replay posted on Suncor's website following the meeting.

Additional details on meeting participation are set forth in the Virtual Meeting User Guide that will be sent to registered holders with their proxy packages and posted on Suncor's website.

Q. How do I attend the meeting?

A. To attend the meeting log in online at https://web.lumiagm.com/400990259. We recommend that you log in at least thirty minutes before the meeting starts and check that the browser on your device is compatible. You will need the latest version of Chrome, Safari, Edge or Firefox. Please do not use Internet Explorer. You will be able to log into the site from 9:30 a.m. MDT on May 4, 2021.

Next click "Login". If you are a registered shareholder or duly appointed proxyholder click "Shareholder" and enter your Control Number or Proxyholder Username as applicable (see below) and password Suncor2021 (case sensitive) OR if you are non-registered (beneficial) shareholder, click "Guest" and complete the online form.

Registered shareholders: The control number located on the form of proxy or in the email notification you received is your "Control Number".

Duly appointed proxyholders: Computershare will provide the proxyholder with a username consisting of a four-letter appointee code (Proxyholder Username) by email after the proxy voting deadline has passed and the proxyholder has been duly appointed AND registered as described under the question "Can I appoint someone other than the individuals named in the proxy form to vote my shares?" below.

It is important that you are connected to the internet at all times during the meeting in order to vote when balloting

Management Proxy Circular 2021 Suncor Energy Inc. 3

commences. It is your responsibility to ensure connectivity for the duration of the meeting. You should allow yourself ample time to check into the meeting.

If you are having trouble getting into the meeting you may click on the support button 'Having issues connecting?' at the login page. This will provide you with a list of common connectivity issues and answers, as well as a link to the FAQ on using the platform.

Q. Am I entitled to vote?

A. You are entitled to vote if you are a holder of common shares as of the close of business on March 8, 2021, the record date for the meeting. Subject to certain restrictions required by the Petro-Canada Public Participation Act (as described in the AIF under the heading "Description of Capital Structure – Petro-Canada Public Participation Act") which section is incorporated by reference herein, each Suncor common share is entitled to one vote. A simple majority of votes (50% plus one vote) cast at the meeting in person (virtually) or by proxy is required to approve all matters to be considered at the meeting.

Q. What am I voting on?

A. You will be voting on:

- •

- the election of directors of the corporation until the close of the next annual meeting;

- •

- the appointment of KPMG LLP as auditor of the corporation until the close of the next annual meeting;

- •

- the resolution to approve an amendment to the Suncor Energy Inc. Stock Option Plan to increase the number of common shares reserved for issuance thereunder by 15,000,000 common shares; and

- •

- the advisory resolution on the corporation's approach to executive compensation disclosed in this management proxy circular.

Q. What if amendments are made to these matters or if other matters are brought before the meeting?

A. If you attend the meeting in person (virtually) and are eligible to vote, you may vote on such matters as you choose. If you have completed and returned a proxy, the common shares represented by proxy will be voted or withheld from voting in accordance with your instructions on any ballot that may be called for and, if you specify a choice with respect to any matter to be acted upon, the common shares will be voted accordingly. The persons named in the proxy form will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual Meeting and to other matters that may properly come before the meeting. As of the date of this management proxy circular, our management knows of no such amendment, variation or other matter expected to come before the meeting. If any other matters properly

come before the meeting, the management nominees named in the proxy form will vote on them in accordance with their best judgment.

Q. Who is soliciting my proxy?

A. The management of Suncor is soliciting your proxy. Solicitation of proxies will be done primarily by mail, supplemented by telephone or other contact, by our employees or our strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors who we have retained at a cost of $69,500 for their advisory services and will reimburse them for any related expenses. Any other costs related to the solicitation are paid by Suncor.

Q. How can I vote?

A. If you are eligible to vote and your shares are registered in your name, you can vote your shares during the meeting by completing a ballot online, or by completing your proxy form through any of the methods described above.

If your shares are not registered in your name but are held by a nominee, please see below.

Q. How can a non-registered shareholder vote?

A. If your shares are not registered in your name but are held in the name of a nominee (usually a bank, trust company, securities broker or other financial institution), your nominee is required to seek your instructions as to how to vote your shares. Your nominee should have provided you with a package of information respecting the meeting, including either a proxy or a voting form. Carefully follow the instructions accompanying the proxy or voting form.

Q. How can a non-registered shareholder vote at the meeting?

A. Non-registered (beneficial) shareholders who have not duly appointed themselves as proxyholders will not be able to vote at the meeting but will be able to participate as a guest. This is because Suncor does not have access to all the names of its non-registered shareholders, and as a result we will have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as a proxyholder. If you wish to vote at the meeting, insert your name in the space provided on the proxy or voting form sent to you by your nominee. In doing so you are instructing your nominee to appoint you as a proxyholder. You must complete the form by following the return instructions provided by your nominee AND register yourself as proxyholder online at http://www.computershare.com/SuncorEnergy, all as described below under Step 1 and Step 2 of the question "Can I appoint someone other than the individuals named in the proxy form to vote my shares?".

4 Management Proxy Circular 2021 Suncor Energy Inc.

Non-registered (beneficial) shareholders located in the United States: If you are a non-registered (beneficial) shareholder located in the United States, to attend and vote at the meeting you must first obtain a valid legal proxy from your broker, bank or other agent and then register in advance to attend the meeting, by submitting a copy of your legal proxy to Computershare. Requests for registration should be sent to: Computershare, Attention Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, OR emailed at uslegalproxy@computershare.com. Requests for registration must be labeled as "Legal Proxy" and be received no later than 10:30 a.m. MDT on April 30, 2021. You will receive a confirmation of your registration by email once Computershare receives your registration materials. Please note that you also are required to register your appointment at http://www.computershare.com/SuncorEnergy.

Q. Who votes my shares and how will they be voted if I return a proxy?

A. By properly completing and returning a proxy, you are authorizing the person named in the proxy to attend the meeting and vote your shares. You can use the proxy form provided to you, or any other proper form of proxy, to appoint your proxyholder.

Once appointed, you will also need to register your proxyholder online at http://www.computershare.com/SuncorEnergy, as described below under Step 2 of the question "Can I appoint someone other than the individuals named in the proxy form to vote my shares?".

The shares represented by your proxy must be voted or withheld from voting according to your instructions in the proxy. If you properly complete and return your proxy but do not specify how you wish your shares to be voted, your shares will be voted or withheld from voting as your proxyholder sees fit. Unless contrary instructions are provided, shares represented by proxies received by management will be voted:

- •

- FOR the election of the director nominees set out in this management proxy circular;

- •

- FOR the appointment of KPMG LLP as auditor;

- •

- FOR the amendments to the Suncor Energy Inc. Stock Option Plan to increase the number of common shares reserved for issuance thereunder by 15,000,000 common shares; and

- •

- FOR the approach to executive compensation disclosed in this management proxy circular.

Q. Can I appoint someone other than the individuals named in the proxy form to vote my shares?

A. Yes, you have the right to appoint the person or company of your choice, who does not need to be a

shareholder, to attend and act on your behalf at the meeting.

Shareholders who wish to appoint someone other than Suncor proxyholders to attend and participate at the meeting as their proxy and vote their common shares MUST submit their form of proxy or voting instruction form, as applicable, appointing that person as proxyholder AND register that proxyholder online, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your form of proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Proxyholder Username that is required to vote at the meeting.

Step 1: Submit your form of proxy or voting instruction form: If you wish to appoint a person other than the persons named in your form of proxy or voting instruction form, then strike out those printed names and insert the name of your chosen proxyholder in the space provided and follow the instructions for submitting such form of proxy or voting instruction form as outlined on the form of proxy or voting instruction form. This must be completed before registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

Step 2: Register your proxyholder: To register a third-party proxyholder (including yourself, if you are a non-registered (beneficial) shareholder) shareholders must visit http://www.computershare.com/SuncorEnergy by 10:30 a.m. MDT on April 30, 2021 and provide Computershare with the required proxyholder contact information so that Computershare may provide the proxyholder with a Proxyholder Username via email. Without a Proxyholder Username, proxyholders will not be able to vote at the meeting but will be able to participate as a guest.

Q. What if my shares are registered in more than one name or in the name of my corporation?

A. If the shares are registered in more than one name, all those registered must sign the form of proxy. If the shares are registered in the name of your corporation or any name other than yours, you may be required to provide documentation that proves you are authorized to sign the proxy form.

Q. Can I revoke a proxy or voting instruction?

A. If you are a registered shareholder and have returned a proxy, you may revoke it by:

- 1.

- completing and signing a proxy bearing a later date, and delivering it to Computershare not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the meeting (or any adjourned or postponed meeting); or

Management Proxy Circular 2021 Suncor Energy Inc. 5

- 2.

- delivering a written statement, signed by you or your authorized attorney to:

- (a)

- the Corporate Secretary of Suncor Energy Inc. at P.O. Box 2844, 150 – 6th Avenue S.W., Calgary, Alberta, T2P 3E3 at any time up to and including the last business day prior to the meeting, or the business day preceding the day to which the meeting is adjourned or postponed; or

- (b)

- the chair of the meeting prior to the start of the meeting.

If you are a non-registered (beneficial) shareholder, contact your nominee for information on how to revoke your proxy or voting instruction.

If you have followed the process for attending and are a registered shareholder and voting at the meeting online, voting at the meeting online will revoke your previous proxy.

Q. Is my vote confidential?

A. Your proxy vote is confidential. Proxies are received, counted and tabulated by our transfer agent, Computershare. Computershare does not disclose the results of individual shareholder votes unless: they contain a written comment clearly intended for management; in the event of a proxy contest or proxy validation issue; or if necessary to meet legal requirements.

Q. How many shares are outstanding?

A. As of February 19, 2021, there were 1,525,150,794 common shares outstanding. We have no other class or series of voting shares outstanding.

As of February 19, 2021, there was no person or company who, to the knowledge of our directors and executive officers, beneficially owned, or controlled or directed, directly or indirectly, common shares carrying 10% or more of the voting rights attached to all outstanding common shares.

Q. How will meeting materials be delivered?

A. We are using notice and access to deliver this management proxy circular to both our registered and non-registered shareholders. This means that Suncor will post the management proxy circular online for our shareholders to access electronically. You will receive a package in the mail with a notice (the Notice) outlining the matters to be addressed at the meeting and explaining how to access and review the management proxy circular electronically, and how to request a paper copy at no charge. You will also receive a form of proxy or a voting instruction form in the mail so you can vote your shares. All applicable meeting related materials will be indirectly forwarded to non-registered shareholders at Suncor's expense.

Notice and access is an environmentally friendly and cost-effective way to distribute the management proxy circular because it reduces printing, paper and postage.

Q. How can I request a paper copy of the management proxy circular?

A. Both registered and non-registered shareholders can request a paper copy of the management proxy circular for

up to one year from the date it is filed on SEDAR (www.sedar.com). The management proxy circular will be sent to you at no charge. If you would like to receive a paper copy of the management proxy circular, please follow the instructions provided in the Notice. If you request a paper copy of the management proxy circular, you will not receive a new form of proxy or voting instruction form, so you should keep the original form sent to you in order to vote.

Suncor will provide paper copies of the management proxy circular to shareholders who have standing instructions to receive, or for whom Suncor has otherwise received a request to provide, paper copies of materials.

If you have any questions about notice and access you can call our Investor Relations line at 1-800-558-9071.

Q. What is electronic delivery?

A. Electronic delivery is voluntary e-mail notification sent to shareholders when documents such as our annual report, quarterly reports and this management proxy circular are available on our website. If you wish, you may elect to be notified by e-mail when documentation is posted on our website. Electronic delivery saves paper, reduces our impact on the environment and reduces costs.

Q. How can I ask for electronic delivery?

A. If you are a registered shareholder, you can sign up for electronic delivery through Computershare via the Investor Centre website at www.investorcentre.com/suncor.

You will need your Control Number and your PIN number (you will find them on the proxy form provided in your package).

Non-registered shareholders can sign up for mailings (not proxy materials) through www.computershare.com/mailinglist.

Q. What if I have other questions?

A. If you have a question regarding the meeting please contact Computershare at 1-877-982-8760 or visit www.computershare.com.

Webcast Posting after Meeting

The meeting will be posted for viewing on www.suncor.com following its completion.

Shareholder Proposals

Eligible shareholders should direct any proposals they plan to present at the 2022 annual meeting of shareholders to our Corporate Secretary. To be included in our 2022 management proxy circular, the proposal must be received at Suncor Energy Inc. at P.O. Box 2844, 150 – 6th Avenue S.W., Calgary, Alberta, Canada T2P 3E3 by November 27, 2021.

6 Management Proxy Circular 2021 Suncor Energy Inc.

Financial Statements

The audited consolidated financial statements for the year ended December 31, 2020, together with the notes thereto and the report of the auditor thereon will be placed before the meeting. These audited consolidated financial statements form part of our 2020 Annual Report. Copies of the 2020 Annual Report may be obtained from the Corporate

Secretary upon request and will be available at the meeting. The full text of the 2020 Annual Report is available on Suncor's website at www.suncor.com and has been filed with the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission (SEC).

Election of Directors

Number of Directors. Suncor's articles stipulate there shall be not more than fifteen nor fewer than eight directors. The Board is currently composed of ten directors, with nine non-employee directors, including Michael M. Wilson, our Board chair, and one member of management, Mark S. Little, our President and Chief Executive Officer (CEO).

Mel E. Benson will be retiring from the Board this year and will not stand for re-election. Mr. Benson was appointed to the Board in 2000. Suncor has benefited greatly from Mr. Benson's exceptional commitment and sound business judgement. The Board and management would like to thank Mr. Benson for his significant contributions to the company. Mr. Benson's retirement will take effect at the conclusion of the meeting.

In accordance with our by-laws, the Board has determined that eleven directors will be elected at the meeting. Following the meeting, and assuming that all proposed nominees for director are elected as contemplated in this management proxy circular, the Board will be composed of ten non-employee directors and Mark S. Little, Suncor's President and CEO. The term of office of each director is from the date of the meeting at which he or she is elected or appointed until the next annual meeting of shareholders or until a successor is elected or appointed.

Unless authority to do so is withheld, the persons named in the form of proxy intend to vote FOR the election of the nominees whose names appear on pages 8 to 13.

Management does not expect that any of the nominees will be unable to serve as a director but, if that should occur for any reason prior to the meeting, the persons named in the

form of proxy reserve the right to vote for another nominee at their discretion unless the proxy specifies the common shares are to be withheld from voting in the election of directors.

Majority Voting for Directors. The Board has adopted a policy (the Majority Voting Policy) that requires that any nominee for director who receives a greater number of votes "withheld" than votes "for" his or her election as a director shall submit his or her resignation to the Governance Committee of the Board for consideration promptly following the meeting. The Majority Voting Policy applies only to uncontested elections, meaning elections where the number of nominees for directors is equal to the number of directors to be elected. The Governance Committee shall consider the resignation and shall provide a recommendation to the Board. The Board will consider the recommendation of the Governance Committee and determine whether to accept it within 90 days of the applicable meeting. Absent exceptional circumstances, the Board shall accept the resignation which will be effective upon such acceptance. A news release will be issued promptly by Suncor announcing the Board's determination, including, if applicable, the reasons for rejecting the resignation. A director who tenders his or her resignation will not participate in any meetings to consider whether the resignation shall be accepted.

Shareholders should note that, as a result of the Majority Voting Policy, a "withhold" vote is effectively the same as a vote against a director nominee in an uncontested election. A copy of the Majority Voting Policy is available on Suncor's website at www.suncor.com.

Management Proxy Circular 2021 Suncor Energy Inc. 7

The Persons Nominated for Election as Directors Are:

| Patricia M. Bedient 67 Sammamish, Washington, USA Skills and Experience(1) Finance, Technology and Innovation, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance, Risk Management, Capital Markets |  | Patricia Bedient retired as executive vice president of Weyerhaeuser Company (Weyerhaeuser), one of the world's largest integrated forest products companies, effective July 1, 2016. From 2007 until February 2016, she also served as chief financial officer. Prior to this, she held a variety of leadership roles in finance and strategic planning at Weyerhaeuser after joining the company in 2003. Before joining Weyerhaeuser, she spent 27 years with Arthur Andersen LLP and ultimately served as the managing partner for its Seattle office and partner in charge of the firm's forest products practice. Ms. Bedient serves on the board of directors of Alaska Air Group, Inc. and Park Hotels & Resorts Inc. and also serves on the Overlake Hospital Medical Center board of trustees, the Oregon State University board of trustees, and the University of Washington Foster School of Business advisory board. She achieved national recognition in 2012 when The Wall Street Journal named her one of the Top 25 CFOs in the United States. She is a member of the American Institute of CPAs and the Washington Society of CPAs. Ms. Bedient received her bachelor's degree in business administration, with concentrations in finance and accounting, from Oregon State University in 1975. | |||

| Director since February 24, 2016 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | Alaska Air Group, Inc. | ||||||

| Audit (Chair) | 7 of 7 | 100% | 2020 | 99.85% | Park Hotels & Resorts Inc. | ||||||

| Governance | 5 of 5 | 100% | 2019 | 99.27% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| Nil | 54 605 | 54 605 | 1 165 817 | Board Member Target Met | ||||||

| John D. Gass 68 Palm Coast, Florida, USA Skills and Experience(1) Energy, Operations, Public Policy / Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance, Risk Management, Global Experience |  | John Gass is former vice president, Chevron Corporation, a major integrated oil and gas company, and former president of Chevron Gas and Midstream, positions he held from 2003 until his retirement in 2012. He has extensive international experience, having served in a diverse series of operational positions in the oil and gas industry with increasing responsibility throughout his career. Mr. Gass serves as a director of Southwestern Energy Company. He is also a member of the advisory board for the Vanderbilt Eye Institute. Mr. Gass graduated from Vanderbilt University in Nashville, Tennessee, with a bachelor's degree in civil engineering. He also holds a master's degree in civil engineering from Tulane University in New Orleans, Louisiana. A resident of Florida, he is a member of the American Society of Civil Engineers and the Society of Petroleum Engineers. | |||

| Director since February 3, 2014 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | Southwestern Energy Company | ||||||

| Governance | 5 of 5 | 100% | 2020 | 99.35% | |||||||

| Human Resources and Compensation (Chair) | 5 of 5 | 100% | 2019 | 98.59% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 6 698 | 67 347 | 74 045 | 1 580 861 | Board Member Target Met | ||||||

8 Management Proxy Circular 2021 Suncor Energy Inc.

| Russell Girling 58 Calgary, Alberta, Canada Skills and Experience(1) Energy, CEO Experience, Finance, Operations, Technology and Innovation, Public Policy / Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance, Risk Management, Global Experience, Capital Markets |  | Russell (Russ) K. Girling was the President and Chief Executive Officer of TransCanada Pipelines Limited and TC Energy Corporation, a North American energy infrastructure company, from 2010 until his retirement on December 31, 2020. Mr. Girling is a director on the board of Nutrien Ltd. Until December 31, 2020 Mr. Girling was a member of the U.S. National Petroleum Council and the U.S. Business Roundtable, and served as a director of the American Petroleum Institute, the Business Council of Canada and the Business Council of Alberta. Mr. Girling is a graduate of the Institute of Corporate Directors Education Program and holds a Bachelor of Commerce and a Master of Business Administration (Finance) from the University of Calgary. | |||

| Director Nominee(6) – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | N/A | Year | Votes in Favour | Nutrien Ltd. | |||||||

| Committees | N/A | 2020 | N/A | ||||||||

| 2019 | N/A | ||||||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 16 554 | N/A | 16 554 | 353 428 | December 31, 2026 | ||||||

| Jean Paul (JP) Gladu 47 Sand Point First Nation, Ontario, Canada Skills and Experience(1) Energy, Mining CEO Experience, Operations, Public Policy / Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance, Risk Management |  | Jean Paul (JP) Gladu is currently the President of the Alaska – Alberta Railway Development Corporation (A2A Rail), a privately owned corporation headquartered in Calgary, Alberta. He previously served as President and CEO of the Canadian Council for Aboriginal Business (CCAB) for approximately eight years. Mr. Gladu has over 25 years of experience in the natural resource sector including work with Indigenous communities and organizations, environmental non-government organizations, industry and governments from across Canada. Chair of Mikisew Group of Companies, Mr. Gladu also serves on the board of Noront Resources Ltd. He was appointed Chancellor of St. Paul's University College Waterloo in 2017 and served on the board of Ontario Power Generation. Mr. Gladu has a forestry technician diploma, an undergraduate degree in forestry from Northern Arizona University, an Executive MBA from Queens University and the ICD.D from Rotman School of Management at the University of Toronto. Anishinaabe from Thunder Bay, Mr. Gladu is a member of Bingwi Neyaashi Anishinaabek located on the Lake Nipigon, Ontario. | |||

| Director since November 17, 2020(6) – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 1 of 1 | 100% | Year | Votes in Favour | Noront Resources Ltd. | ||||||

| Environment, Health, Safety and Sustainable Development | 1 of 1 | 100% | 2020 | N/A | |||||||

| Human Resources and Compensation | 1 of 1 | 100% | 2019 | N/A | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 185 | 13 692 | 13 877 | 296 274 | December 31, 2025 | ||||||

Management Proxy Circular 2021 Suncor Energy Inc. 9

| Dennis M. Houston 69 Spring, Texas, USA Skills and Experience(1) Energy, Operations, Strategy and Economics, EHS, Social Performance, Governance, Global Experience |  | Dennis Houston served as executive vice president of ExxonMobil Refining and Supply Company, chairman and president of ExxonMobil Sales & Supply LLC and chairman of Standard Tankers Bahamas Limited until his retirement in 2010. Prior to that, Mr. Houston held a variety of leadership and engineering roles in the midstream and downstream businesses in the ExxonMobil organization. Mr. Houston has approximately 40 years' experience in the oil and gas industry, including over 35 years with ExxonMobil and its related companies. Mr. Houston serves on the board of directors of Argus Media Limited. Mr. Houston holds a bachelor's degree in chemical engineering from the University of Illinois and an honorary doctorate of public administration degree from Massachusetts Maritime Academy. Mr. Houston has served on a variety of advisory councils, including an appointment by President George H.W. Bush to the National Infrastructure Advisory Council, the Chemical Sciences Leadership Council at the University of Illinois and the Advisory Council – Center for Energy, Marine Transportation & Public Policy at Columbia University. Mr. Houston also serves on the Alexander S. Onassis Public Benefit Foundation board, is honorary consul to the Texas Region for the Principality of Liechtenstein and a board member for the American Bureau of Shipping Group of Companies. | |||

| Director since January 1, 2018 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | None | ||||||

| Environment, Health, Safety and Sustainable Development | 4 of 4 | 100% | 2020 | 99.47% | |||||||

| Human Resources and Compensation | 5 of 5 | 100% | 2019 | 99.31% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 15 600 | 34 875 | 50 475 | 1 077 641 | Board Member Target Met | ||||||

| Mark S. Little 58 Calgary, Alberta, Canada Skills and Experience(1) Energy, Mining, CEO Experience, Finance, Operations, Technology and Innovation, Public Policy / Government Relations, Strategy and Economics, EHS, Social Performance, Governance, Risk Management, Global Experience, Capital Markets |  | Mark Little is president and chief executive officer of Suncor. He previously served as the company's president and chief operating officer before being appointed to his current position in May 2019. His past roles include serving as president of Suncor's upstream organization with responsibility for all of Suncor's operated and non-operated oil sands, in situ, conventional exploration and production assets worldwide, as well as executive vice president, Oil Sands and senior vice president, International and Offshore. Mr. Little was also senior vice president, Integration, following Suncor's merger with Petro-Canada and senior vice president, Strategic Growth and Energy Trading. In these roles, Mr. Little's accountabilities have spanned from operations in the Wood Buffalo region to operations in offshore East Coast Canada, the North Sea, and international onshore operations in Latin America, North Africa and the Near East, where he oversaw significant improvements in efficiency and performance, as well as portfolio growth. Before joining Suncor, Mr. Little led the development of oil sands projects for a major international energy company. His past experience also includes leadership roles in oil sands production and refining operations, strategic planning, environment, health and safety, and energy trading. Mr. Little has been active in industry and the community, serving as chair of the board of directors of Syncrude Canada and as a member of Energy Safety Canada until 2018. Mr. Little also was chair of the Oil Sands Safety Association prior to its merger into Energy Safety Canada. Having played an integral role in the signing of agreements with the Fort McKay and Mikisew Cree First Nations relating to Suncor's East Tank Farm, he has actively promoted the partnership as a model for future energy development with Indigenous communities. He is a current member of the Canadian Association of Petroleum Producers, where he also serves as a member of the Executive Committee and Oil Sands CEO Council. He has co-chaired the Canadian Council of Aboriginal Business' procurement initiative and is a past board member of Accenture Global Energy. Mr. Little holds degrees in computer science from the University of Calgary, applied petroleum engineering technology from SAIT, is a graduate of the advanced management program at Harvard Business School and holds an honorary degree in Business Administration from SAIT. He was also awarded the Canadian Engineering Leader award from the Schulich School of Engineering at the University of Calgary. | |||

| Director since May 2, 2019 – Non-Independent, Management | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | None | ||||||

| 2020 | 98.97% | ||||||||||

2019 | 99.09% | ||||||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target Compliance or | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4)(7) | Compliance Date(5) Current Status | |||||||

| EVP Target Met | ||||||||||

80 327 | 120 283 | 200 610 | 4 283 024 | CEO Target: December 31, 2024 | ||||||

10 Management Proxy Circular 2021 Suncor Energy Inc.

| Brian P. MacDonald 55 Naples, Florida, USA Skills and Experience(1) Energy, CEO Experience, Finance, Operations, Technology and Innovation, Strategy and Economics, EHS, Governance, Risk Management, Global Experience, Capital Markets |  | Brian MacDonald was the president and chief executive officer of CDK Global, Inc., a leading global provider of integrated information technology and digital marketing solutions to the automotive retail and adjacent industries from 2016 to November 2018. Prior to joining CDK Global, Inc., Mr. MacDonald served as chief executive officer and president of Hertz Equipment Rental Corporation and served as interim chief executive officer of Hertz Corporation. Mr. MacDonald previously served as president and chief executive officer of ETP Holdco Corporation, an entity formed following Energy Transfer Partners' $5.3 billion acquisition of Sunoco Inc., where Mr. MacDonald had served as chairman, president and chief executive officer. He was the chief financial officer at Sunoco Inc. and held senior financial roles at Dell Inc. Prior to Dell Inc., Mr. MacDonald spent more than 13 years in several financial management roles at General Motors Corporation in North America, Asia and Europe. He previously served on the board of directors for Computer Sciences Corporation (now DXC Technology Company), Ally Financial Inc., Sunoco Inc., Sunoco Logistics L.P. and CDK Global, Inc. Mr. MacDonald earned a MBA from McGill University and a bachelor's of science, with a concentration in chemistry, from Mount Allison University. | |||

| Director since July 23, 2018 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | None | ||||||

| Audit | 7 of 7 | 100% | 2020 | 99.86% | |||||||

| Governance | 5 of 5 | 100% | 2019 | 99.80% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 13 000 | 32 333 | 45 333 | 967 860 | Board Member Target Met | ||||||

| Maureen McCaw 66 Edmonton, Alberta, Canada Skills and Experience(1) Public Policy / Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance |  | Maureen McCaw was most recently executive vice president of Leger Marketing, Canada's largest privately held market research firm and formerly president of Criterion Research, a company she founded. Ms. McCaw currently serves as a director of the Francis Winspear Centre for Music and the Edmonton Symphony, the Nature Conservancy of Canada and the Royal Alexandra Hospital Foundation Social Enterprise Company. Ms. McCaw has previously served on a number of boards, including as chair of the CBC Pension Plan board of trustees, the Edmonton International Airport and the Edmonton Chamber of Commerce. Ms. McCaw has also served on the board of directors of the Canadian Broadcasting Corporation. Ms. McCaw holds a bachelor of arts degree in economics from the University of Alberta, completed Columbia Business School's executive program in financial accounting and earned an ICD.D certification from the Institute of Corporate Directors. | |||

| Director since April 27, 2004(8) – Independent | |||||

| Suncor Board and Board Committees(9) | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | None | ||||||

| Audit | 7 of 7 | 100% | 2020 | 97.09% | |||||||

| Environment, Health, Safety and Sustainable Development (Chair) | 4 of 4 | 100% | 2019 | 97.11% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Target(5) | |||||||

| 6 658 | 120 831 | 127 489 | 2 721 890 | Board Member Target Met | ||||||

Management Proxy Circular 2021 Suncor Energy Inc. 11

| Lorraine Mitchelmore 58 Calgary, Alberta, Canada Skills and Experience(1) Energy, Mining, CEO Experience, Operations, Technology and Innovation, Public Policy and Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance, Risk Management, Global Experience |  | Lorraine Mitchelmore has over 30 years' international oil and gas industry experience. She most recently served as president and CEO for Enlighten Innovations Inc., a private equity backed fuel upgrading technology company. Prior to Enlighten Innovations Inc., she held progressively senior roles at Royal Dutch Shell. Ms. Mitchelmore joined Shell in 2002, becoming President and Country Chair of Shell Canada Limited in 2009, in addition to her role as Executive Vice President of Heavy Oil Americas. Prior to joining Shell, she worked with Petro-Canada, Chevron and BHP Petroleum in the upstream business units in a combination of technical, exploration & development, and commercial roles. Ms. Mitchelmore has been a director of the Bank of Montreal since 2015 and has served on the boards of Shell Canada Limited, the Canada Advisory Board at Catalyst, Inc. and Trans Mountain Corporation. Ms. Mitchelmore holds a bachelor's of science (Honours) in geophysics from Memorial University of Newfoundland, master's of science in geophysics from the University of Melbourne, Australia and a MBA with Distinction from Kingston Business School in London, England. | |||

| Director since November 6, 2019(6) – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | Bank of Montreal | ||||||

| Audit | 7 of 7 | 100% | 2020 | 99.86% | |||||||

| Environment, Health, Safety and Sustainable Development | 4 of 4 | 100% | 2019 | N/A | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 1 385 | 21 734 | 23 119 | 493 591 | December 31, 2024 | ||||||

| Eira M. Thomas 52 Vancouver, British Columbia, Canada Skills and Experience(1) Mining, CEO Experience, Finance, Operations, Technology and Innovation, Public Policy / Government Relations, Strategy and Economics, Human Resources and Compensation, EHS, Social Performance, Governance |  | Eira Thomas is a Canadian geologist with over 25 years of experience in the Canadian diamond business. She is currently the chief executive officer and a director of Lucara Diamond Corp., a publicly traded diamond producing company. Previous roles include serving as chief executive officer and director of Kaminak Gold Corporation, vice president of Aber Resources, now Dominion Diamond Corp., and as founder and CEO of Stornoway Diamond Corp. Ms. Thomas graduated from the University of Toronto with a bachelor of science degree in geology. Her awards and recognition include: "Canada's Top 40 under 40" by the Caldwell Partners and the Report on Business Magazine; selected as one of "Top 100 Canada's Most Powerful Women"; and one of only four Canadians in 2008 to be named to the "Young Global Leaders", by the World Economic Forum. | |||

| Director since April 27, 2006 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors | 10 of 10 | 100% | Year | Votes in Favour | Lucara Diamond Corp. | ||||||

| Human Resources and Compensation | 5 of 5 | 100% | 2020 | 98.11% | |||||||

| Governance (Chair) | 5 of 5 | 100% | 2019 | 96.78% | |||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 4 000 | 119 625 | 123 625 | 2 639 394 | Board Member Target Met | ||||||

12 Management Proxy Circular 2021 Suncor Energy Inc.

| Michael M. Wilson 69 Bragg Creek, Alberta, Canada Skills and Experience(1) CEO Experience, Finance, Operations, Strategy and Economics, Human Resources and Compensation, Governance |  | Michael Wilson is former president and chief executive officer of Agrium Inc., a retail supplier of agricultural products and services and a wholesale producer and marketer of agricultural nutrients, a position he held from 2003 until his retirement in 2013. Prior thereto, he served as executive vice president and chief operating officer. Mr. Wilson has significant experience in the petrochemical industry, serving as president of Methanex Corporation, and holding various positions with increasing responsibility in North America and Asia with Dow Chemical Company. Mr. Wilson has a bachelor's degree in chemical engineering from the University of Waterloo and currently serves on the boards of Air Canada and Celestica Inc. | |||

| Director since February 3, 2014 – Independent | |||||

| Suncor Board and Board Committees | Meeting Attendance | Annual General Meeting Voting Results | Other Public Company Boards | ||||||||

| Board of Directors (Chair) | 10 of 10 | 100% | Year | Votes in Favour | Air Canada | ||||||

| 2020 | 99.57% | Celestica Inc. | |||||||||

2019 | 99.68% | ||||||||||

| Common Shares and Share Units Held as at December 31, 2020 | Common | DSUs(3) | Total Common | Total Value of Common | Share Ownership Target | |||||

| Shares(2) | Shares and DSUs | Shares and DSUs ($)(4) | Compliance or Compliance Date(5) | |||||||

| 10 000 | 102 772 | 112 772 | 2 407 682 | Board Chair Target Met | ||||||

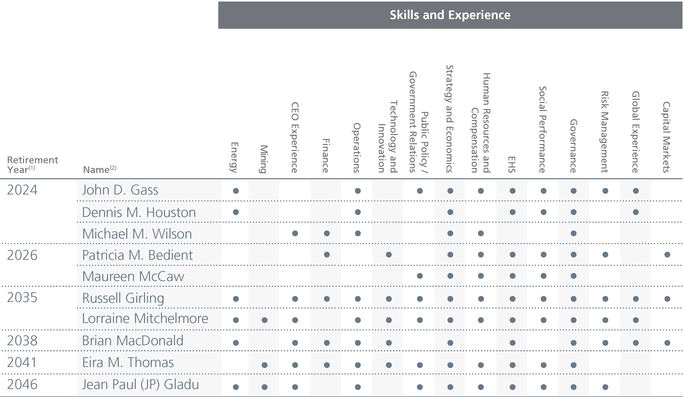

- (1)

- See the Board of Directors Skills Matrix on Page B-3.

- (2)

- Reflects the number of common shares, excluding fractional amounts, beneficially owned, or controlled or directed, directly or indirectly, by the director as at December 31, 2020. Subsequent to December 31, 2020, Mr. Little acquired 1,103 common shares through Suncor's employee savings plan, and Mr. Girling, a director nominee, acquired an additional 12,500 common shares. As at February 19, 2021, there had been no other changes to the share ownership of the directors from December 31, 2020.

- (3)

- Reflects deferred share units (DSUs) granted to the directors. DSUs are not voting securities and exclude fractional amounts. DSUs were granted pursuant to the Suncor Deferred Share Unit Plan (the DSU Plan) and the closed Petro-Canada Deferred Stock Unit Plan (Non-Employee Directors of Petro-Canada) (the PCCDSU Plan). See "Board of Directors Compensation – Equity Based Compensation" and "Summary of Incentive Plans – Closed Plans".

- (4)

- Reflects the number of common shares and DSUs held by the director multiplied by the closing price on the Toronto Stock Exchange (the TSX) of a common share on the final trading day of 2020 ($21.35).

- (5)

- Reflects the compliance status as at December 31, 2020 or, if the total value shown is below the ownership requirement, the deadline for compliance. See "Board of Directors Compensation – Structure – Building Equity Ownership" for non-employee directors and "Compensation Discussion and Analysis – Our Approach to Executive Compensation – Executive Share Ownership Guidelines" for Mr. Little. Mr. Houston joined the Board on January 1, 2018 and has until December 31, 2023 to attain the required share ownership level. Mr. MacDonald joined the Board on July 23, 2018 and has until December 31, 2023 to attain the required share ownership level. Ms. Mitchelmore joined the Board on November 6, 2019 and has until December 31, 2024 to attain the required share ownership level. Mr. Gladu joined the Board on November 17, 2020 and has until December 31, 2025 to attain the required share ownership level. If elected on May 4, 2021, Mr. Girling will have until December 31, 2026 to attain the required share ownership level.

- (6)

- Mr. Girling is not currently a director or Suncor. Accordingly, information as to 2019 and 2020 annual general meeting voting results is not applicable to him. Mr. Gladu was appointed to the Board effective November 17, 2020. Accordingly, information as to 2019 and 2020 annual general meeting voting results is not applicable to him. Ms. Mitchelmore was appointed to the Board effective November 6, 2019. Accordingly, information as to 2019 annual general meeting voting results is not applicable to her.

- (7)

- Mr. Little holds stock options, performance share units and restricted share units that were granted to him in his capacity as an executive officer of Suncor, as set forth in Schedule A. Only common shares and DSUs count towards fulfillment of share ownership guidelines.

- (8)

- Ms. McCaw served on the Petro-Canada Board of Directors from April 27, 2004 until Petro-Canada's amalgamation with Suncor.

Management Proxy Circular 2021 Suncor Energy Inc. 13

Cease Trade Orders, Bankruptcies, Penalties or Sanctions. No proposed director is, as at the date hereof, or has been in the last ten years, a director, chief executive officer or chief financial officer of any company (including Suncor) that (a) was the subject of a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued while the proposed director was acting in that capacity, or (b) was subject to a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in that capacity.

No proposed director is, as at the date hereof, or has been in the last ten years, a director or executive officer of any company (including Suncor) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, other than Mr. Gass, a current and proposed director of Suncor, who was a director of Weatherford International plc (Weatherford) when it underwent a financial restructuring under Chapter 11 of the U.S. Bankruptcy Code which was initiated on July 1, 2019. Mr. Gass ceased to be a director of Weatherford on December 13, 2019.

No proposed director has, within the last ten years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold his or her assets.

No proposed director has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Appointment of Auditor

Management and the Board propose that KPMG LLP be appointed as Suncor's auditor until the close of the next annual meeting. KPMG LLP have been Suncor's auditors since March 1, 2019. Unless authority to do so is withheld, the persons named in the form of proxy intend to vote FOR the appointment of KPMG LLP.

Fees paid and payable to KPMG LLP, the corporation's auditor, for the years ended December 31, 2019 and 2020 are detailed below.

| ($ thousands) | 2020 | 2019 | |||

| Audit Fees | 4 723 | 4 350 | |||

| Tax Fees | — | — | |||

| Audit-Related Fees | 457 | 410 | |||

| All Other Fees | — | — | |||

| Total | 5 180 | 4 760 | |||

The nature of each category of fees is as follows:

Audit Fees. Audit Fees were for professional services rendered by the auditor for the audit of Suncor's annual financial statements, or services provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Audit-Related Fees were for professional services rendered by the auditor for the review of quarterly financial statements and for the preparation of reports on specified procedures as they relate to audits of joint arrangements and attestation services not required by statute or regulation.

All Other Fees. All Other Fees were subscriptions to auditor-provided and supported tools.

All services described beside the captions "Audit Fees", "Audit-Related Fees" and "All Other Fees" were approved by the Audit Committee in compliance with paragraph (c)(7)(i) of Rule 2-01 of Regulation S-X under the U.S. Securities Exchange Act of 1934, as amended (the Exchange Act). None of the fees described above were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Regulation S-X under the Exchange Act. Further details respecting our auditor is provided in our AIF under the heading "Audit Committee Information".

14 Management Proxy Circular 2021 Suncor Energy Inc.

Increase in Common Shares Reserved for Issuance under the Suncor Energy Inc. Stock Option Plan

As part of the merger with Petro-Canada, effective August 1, 2009, Suncor adopted the Suncor Energy Inc. Stock Option Plan (SOP), which provides for the grant of options to purchase Suncor common shares, as well as the grant of Stock Appreciation Rights (SARs). For further details on the SOP, see "Summary of Incentive Plans – Suncor Energy Stock Option Plan".

The purpose of the SOP is to align the interests of the officers, employees and, if designated by the Board, certain other persons providing services on an ongoing basis to Suncor and its subsidiaries with the profitability, growth and future success of Suncor by providing eligible plan participants with the opportunity to acquire an ownership interest in Suncor. Non-employee directors are not eligible for stock option awards or SARs under the SOP. The Board believes that the granting of options is an important part of Suncor's overall compensation program. As a long-term incentive, it also serves to ensure Suncor delivers market competitive compensation to plan participants and supports attracting and retaining talented employees.

The Board of Directors has approved, subject to shareholder approval, an amendment to increase the total number of common shares reserved for issuance under the SOP by 15,000,000.

The purpose of the additional reservation is to ensure that a sufficient number of common shares remain reserved for issuance under the SOP to enable the Corporation to continue its current practice of granting options to eligible plan participants as a component of Suncor's long-term incentive program. The long-term incentive program, consisting of options, performance share units and restricted share units at the executive level and options and restricted share units at the General Manager level, aligns eligible participants' interests with those of shareholders by rewarding them for increases in Suncor's share price and for shareholder returns that exceed those of our peers.

Shareholders are being requested to approve an increase in the number of common shares reserved for issuance under the SOP by 15,000,000. The following table sets forth the number of common shares which are subject to awards granted under the SOP and would be available for future awards under the SOP, both before and after giving effect to the proposed amendment, as of February 19, 2021.

| Common Shares Subject to Outstanding Awards | Common Shares Available for Future Award Grants | Maximum Common Shares Subject to and Available to Award Grants | |||||

| Currently Approved | 39 177 947 | 8 193 973 | 47 371 920 | ||||

| Proposed Increase | N/A | 15 000 000 | 15 000 000 | ||||

| Total | 39 177 947 | 23 193 973 | 62 371 920 | ||||

| Percentage of Outstanding Common Shares | 2.6% | 1.5% | 4.1% | ||||

If the proposed increase is not approved, the SOP would have 8,193,973 common shares reserved for future option grants and, once this remaining reserve is used, Suncor would no longer be permitted to grant options under the SOP. This would limit Suncor's ability to continue its current practice of granting options to eligible plan participants as a component of the long-term incentive program and would require Suncor to provide an alternate form of long-term incentive compensation. This additional reservation has been conditionally approved by the TSX and must be approved by a majority of votes cast by shareholders at the meeting. Accordingly, at the meeting, shareholders will be asked to consider and, if deemed fit, to approve, by a simple majority of votes cast at the meeting, the following resolution:

"RESOLVED as an ordinary resolution of Suncor Energy Inc. (the "Corporation") that:

- 1.

- The number of common shares in the capital of the Corporation reserved for issuance pursuant to the Suncor Energy Inc. Stock Option Plan be and is hereby increased by an additional 15,000,000 common shares.

- 2.

- Any officer or director of the Corporation be and is hereby authorized for and on behalf of the Corporation, under corporate seal or otherwise, to do all such things and to execute all such documents or instruments as may be necessary or desirable to give effect to this resolution."

Management Proxy Circular 2021 Suncor Energy Inc. 15

Advisory Vote on Approach to Executive Compensation

The Board believes that shareholders should have the opportunity to fully understand the objectives, philosophy and principles that the Board has used to make executive compensation decisions.

We hope you will carefully review the "Letter to Shareholders" beginning on page 23 and our "Compensation Discussion and Analysis" beginning on page 25 before voting on this matter. We encourage any shareholder who has comments on our approach to executive compensation to forward these comments to the chair of the Human Resources and Compensation Committee (HR&CC) c/o the Corporate Secretary, Suncor Energy Inc., P.O. Box 2844, 150 – 6th Avenue S.W., Calgary, Alberta, T2P 3E3. The "Compensation Discussion and Analysis" section discusses our compensation philosophy and approach to executive compensation, what our Named Executive Officers are paid and how their level of compensation is determined. This disclosure has been approved by the Board on the recommendation of the HR&CC.

At the meeting, shareholders will have an opportunity to vote on our approach to executive compensation through consideration of the following advisory resolution:

"RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in the management proxy circular of Suncor Energy Inc. delivered in advance of its 2021 annual meeting of shareholders."

As this is an advisory vote, the results will not be binding upon the Board. However, in considering its approach to compensation in the future, the Board will take into account the results of the vote, together with feedback received from shareholders in the course of our engagement activities. Since instituting a vote on an advisory resolution on our approach to executive compensation in 2011, Suncor has received strong support from shareholders with an average of 93.66% of votes "for", including 94.64% of the votes cast in favour in 2020.

16 Management Proxy Circular 2021 Suncor Energy Inc.

Board of Directors Compensation

Philosophy and Approach

Philosophy. Compensation of non-employee directors is intended to:

- •

- deliver an appropriate level of remuneration to enable Suncor to attract highly qualified individuals with the desired competencies, skills and attributes and the capability to meet the demanding responsibilities of Board members; and

- •

- provide a significant portion of such remuneration in equity (DSUs) to closely align non-employee directors' interests with shareholder interests.

Approach. The Governance Committee reviews Board compensation levels periodically to ensure Suncor's approach to Board compensation is competitive at the median of the Suncor Compensation Peers (as defined below) and takes into account governance and best practice trends.

As part of this review, the Governance Committee engages Willis Towers Watson to benchmark compensation for non-employee directors and the Board chair and provide information on Board compensation governance and best practice trends. This information is used by the Governance Committee in determining the compensation components, mix and pay level for non-employee directors, including the Board chair, that is then recommended to the full Board for approval.

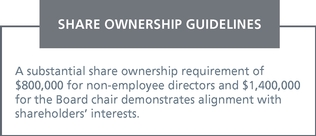

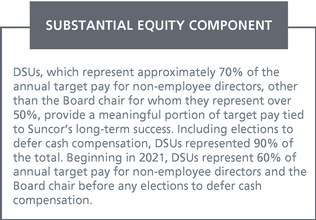

The total compensation structure for non-employee directors for 2020 consisted of annual retainers and an annual equity award provided in the form of DSUs. DSUs are notional units that have the same value as our common shares, and therefore have the same upside potential and downside risk. Directors are required to meet robust share ownership guidelines. DSUs, along with Suncor common shares, count towards meeting these guidelines.

Structure

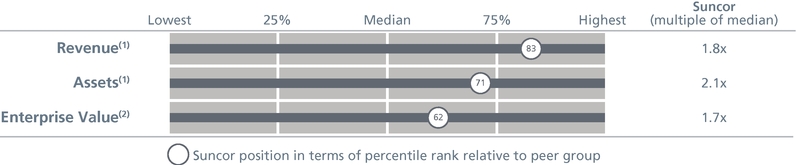

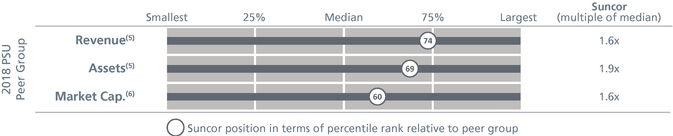

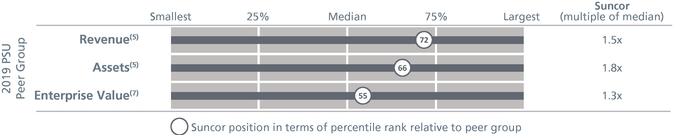

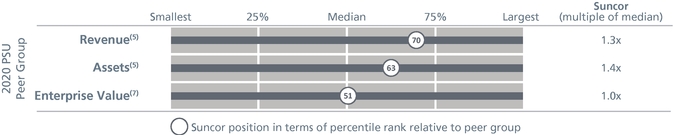

Suncor's North American energy peers, identified on page 33 (the Suncor Compensation Peers), used for benchmarking Suncor's non-employee director and Board chair compensation structure are the same companies used for benchmarking senior executive compensation. Suncor's rank, as compared to the Suncor Compensation Peers, in relation to revenue, assets and enterprise value, is also provided on page 33. The following tables display the compensation structure for 2020 for all non-employee directors.

| Compensation Structure Components for Non-Employee Directors (excluding Board chair) | ($) | |||

Retainer | ||||

| Annual Retainer(1) | 72 500 | |||

| Annual Committee Chair Retainer: | ||||

| Audit Committee | 25 000 | |||

| HR&CC | 15 000 | |||

| EHS&SD Committee and Governance Committee | 10 000 | |||

| Annual Committee Member Retainer: | ||||

| Audit Committee | 7 500 | |||

| EHS&SD Committee, Governance Committee and HR&CC | 5 000 | |||

| Travel within continental North America (Per Round Trip)(2) | 1 500 | |||

| Travel originating from outside continental North America (Per Round Trip)(3) | 3 000 | |||

Annual Equity | ||||

| Annual DSU Target Value(4) | 217 500 | |||

Management Proxy Circular 2021 Suncor Energy Inc. 17

| Compensation Structure Components for Board chair(5) | ($) | ||

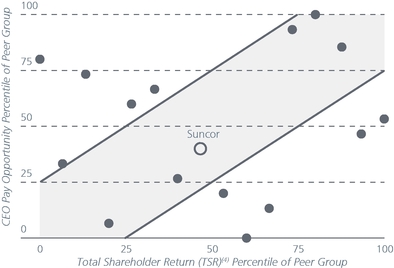

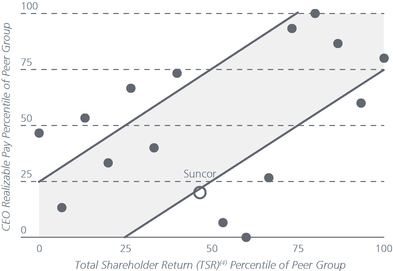

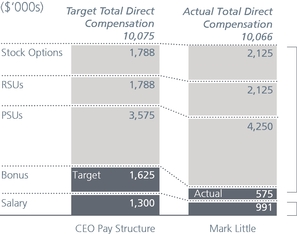

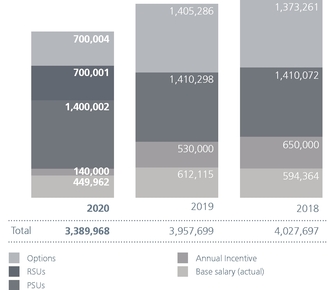

Retainer | |||