Exhibit 99.1

Akorn, Inc. Nasdaq: AKRX May 12, 2014 VersaPharm Acquisition Announcement

Disclaimer This presentation includes certain forward-looking statements regarding our views with respect to our business and our expected performance for future periods. These statements are intended as “forward-looking statements” under the Private Securities Litigation Reform Act of 1995.Actual results may differ materially from expectations due to the risks, uncertainties and other factors that affect our business and VersaPharm’s business. These factors include, among others, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; the failure to satisfy conditions to completion of the Merger, including receipt of regulatory approvals; changes in the business or operating prospects of VersaPharm; our ability to obtain additional funding or financing to operate and grow our business; the effects of federal, state and other governmental regulation on our business; our ability to obtain and maintain regulatory approvals for our products; our success in developing, manufacturing, acquiring and marketing new products; the success of our strategic partnerships for the development and marketing of new products; our ability to successfully integrate acquired businesses and products; and the effects of competition from other generic pharmaceuticals and from other pharmaceutical companies.If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during the presentation reflects Akorn, Inc.’s current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The addressable IMS/IRI market size figures in this presentation outline the approximate aggregate size of the potential market and are not forecasts of our future sales.For more complete information about Akorn, you should read the reports filed by Akorn with the SEC. You may get these documents for free through EDGAR on the SEC website at www.sec.gov, which you may also access through our website at http://www.akorn.com.

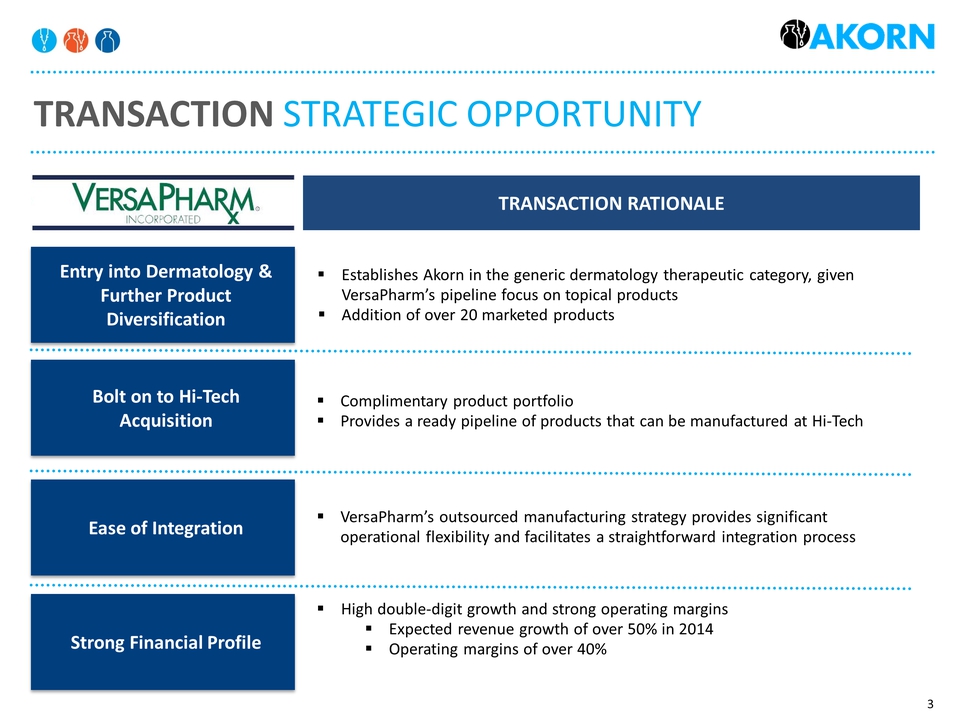

Transaction strategic opportunity Entry into Dermatology & Further Product Diversification Establishes Akorn in the generic dermatology therapeutic category, given VersaPharm’s pipeline focus on topical productsAddition of over 20 marketed products Bolt on to Hi-Tech Acquisition Ease of Integration Strong Financial Profile Complimentary product portfolioProvides a ready pipeline of products that can be manufactured at Hi-Tech VersaPharm’s outsourced manufacturing strategy provides significant operational flexibility and facilitates a straightforward integration process High double-digit growth and strong operating marginsExpected revenue growth of over 50% in 2014Operating margins of over 40% Transaction rationale

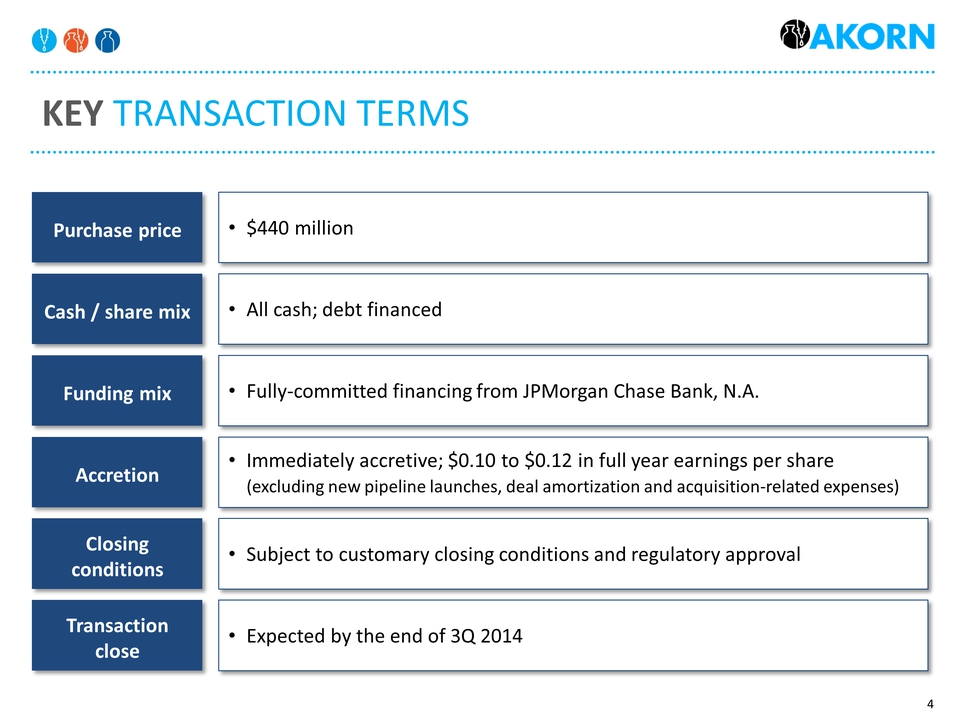

Key transaction terms Purchase price $440 million Cash / share mix All cash; debt financed Funding mix Fully-committed financing from JPMorgan Chase Bank, N.A. Accretion Immediately accretive; $0.10 to $0.12 in full year earnings per share(excluding new pipeline launches, deal amortization and acquisition-related expenses) Closing conditions Subject to customary closing conditions and regulatory approval Transaction close Expected by the end of 3Q 2014

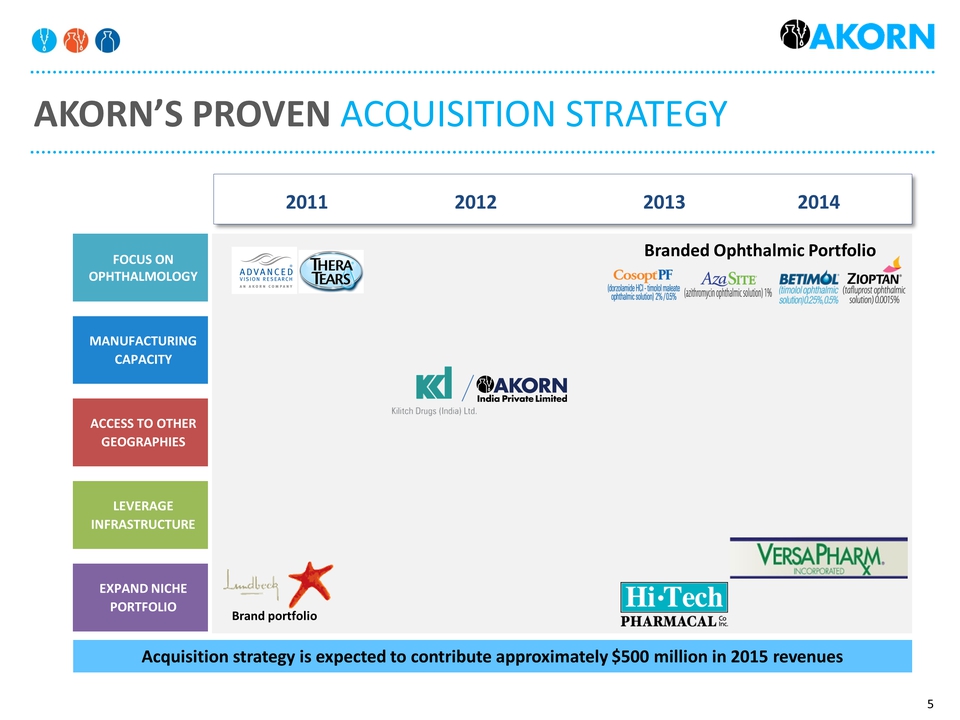

MANUFACTURING CAPACITY LEVERAGE INFRASTRUCTURE FOCUS ON OPHTHALMOLOGY EXPAND NICHE PORTFOLIO ACCESS TO OTHER GEOGRAPHIES Akorn’s Proven acquisition strategy 2011 2012 2013 2014 Acquisition strategy is expected to contribute approximately $500 million in 2015 revenues Brand portfolio Branded Ophthalmic Portfolio

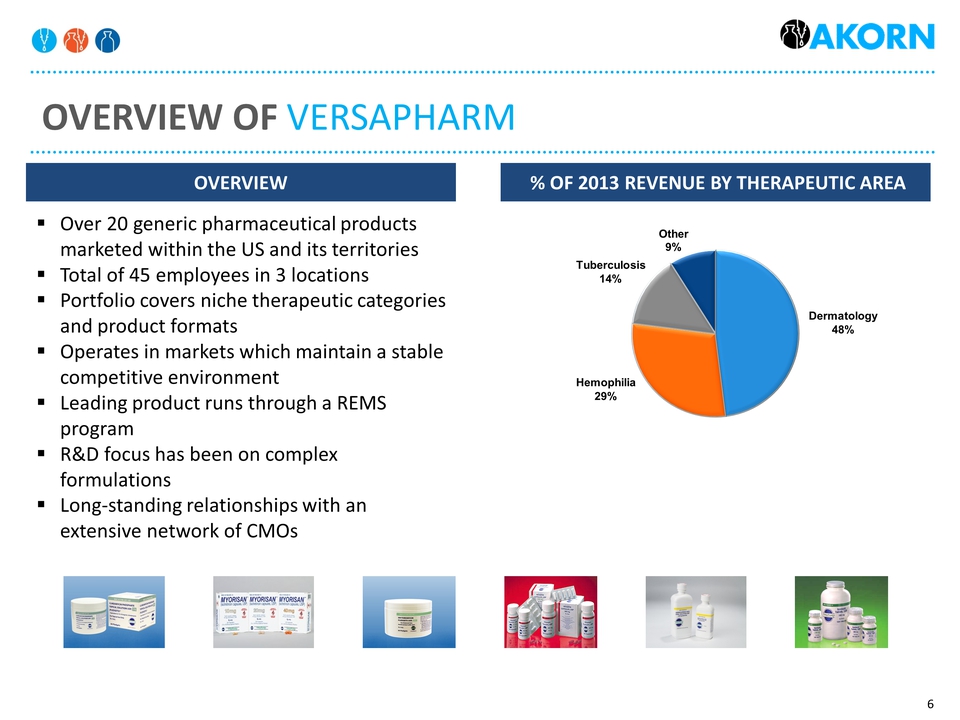

Overview of Versapharm Overview % of 2013 revenue By therapeutic area Over 20 generic pharmaceutical products marketed within the US and its territoriesTotal of 45 employees in 3 locationsPortfolio covers niche therapeutic categories and product formatsOperates in markets which maintain a stable competitive environmentLeading product runs through a REMS programR&D focus has been on complex formulationsLong-standing relationships with an extensive network of CMOs Hemophilia29% Dermatology48% Tuberculosis14%

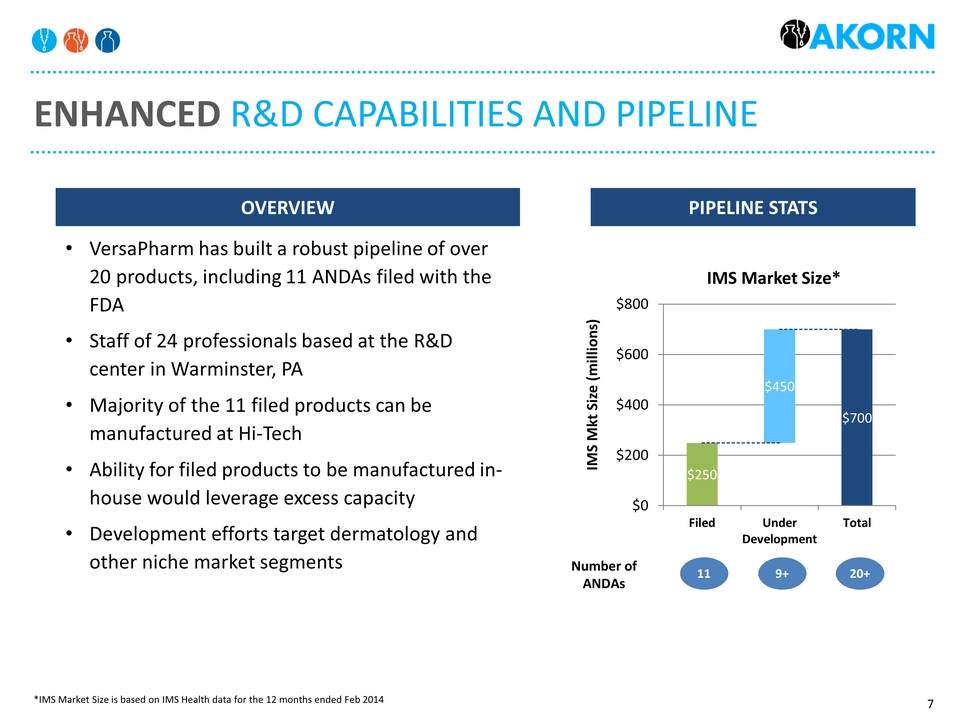

Enhanced R&D Capabilities and pipeline Pipeline stats Overview VersaPharm has built a robust pipeline of over 20 products, including 11 ANDAs filed with the FDAStaff of 24 professionals based at the R&D center in Warminster, PAMajority of the 11 filed products can be manufactured at Hi-Tech Ability for filed products to be manufactured in-house would leverage excess capacityDevelopment efforts target dermatology and other niche market segments 11 9+ 20+ Number of ANDAs *IMS Market Size is based on IMS Health data for the 12 months ended Feb 2014

Acquisition summary Highly strategic fit with Akorn’s focus on niche dosage formsIncreases presence in the highly attractive niche dermatology market Robust pipeline of over 20 products, including 11 ANDAs filed with the FDA, with an addressable IMS market value of over $700 millionExpertise in developing topical products complements Akorn’s recently acquired manufacturing platform through the merger with Hi-Tech Pharmacal Expected to add $90 to $100 million in annual revenues and $0.10 to $0.12 in earnings per share*Assuming an end of Q3 close we expect the acquisition to contribute to 2014 between $23 to $25 million in revenue and approximately $0.03 in earnings per share* Anticipated transaction benefits *Excluding new pipeline launches, deal amortization and acquisition-related expenses