UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K/A

|

| | |

| ☑ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| | For the fiscal year ended | December 31, 2019 |

| | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-32360

AKORN, INC.

(Exact name of registrant as specified in its charter)

|

| |

| Louisiana | 72-0717400 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

1925 W. Field Court, Suite 300, Lake Forest, Illinois 60045

(Address of principal executive offices and zip code)

(847) 279-6100

Registrant’s telephone number, including area code

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | AKRX | The NASDAQ Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

(None)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company,” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ☐ | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock of the registrant held by non-affiliates (affiliates being, for these purposes only, directors, executive officers and holders of more than 5% of the registrant’s common stock) of the registrant as of June 30, 2019, was approximately $497.2 million based on the closing market price of $5.15 reported on the NASDAQ Global Select Market.

The number of shares of the registrant’s common stock, no par value per share, outstanding as of April 7, 2020 was 132,990,343.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Form 10-K/A”) is being filed by Akorn, Inc. (the “Company”) in order to disclose information required by Items 10, 11, 12, 13 and 14 of Part III, which was previously omitted in reliance on Instruction G to Form 10-K from its Annual Report on Form 10-K (the “Original Form 10-K”) for the year ended December 31, 2019, filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2020. The Company is not filing its definitive proxy statement for its 2020 annual stockholder meeting within 120 days of the end of its most recent fiscal year as required under Instruction G to Form 10-K in order to incorporate information contained in the definitive proxy statement into the Original Form 10-K and list additional exhibits. This Form 10-K/A discloses such information. In connection with the filing of this Form 10-K/A and pursuant to the rules of the SEC, we are including with this Form 10-K/A certain other exhibits, including certifications with respect to this filing by our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002; accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new exhibits. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. We are not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Form 10-K/A. This Form 10-K/A is limited in scope to the items identified above and should be read in conjunction with the Original Form 10-K and our other filings with the SEC. This Form 10-K/A does not reflect events occurring after the filing of the Original Form 10-K or modify or update those disclosures affected by subsequent events. Consequently, all other information is unchanged and reflects the disclosures made at the time of the filing of the Original Form 10-K.

FORM 10-K TABLE OF CONTENTS

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Board of Directors

In 2019, there were nine members on the Company’s Board of Directors (“Board”). During the year, one director resigned, leaving a vacancy on the Board. In early 2020, the Board reduced its size to eight members to eliminate the vacant seat. The table below sets forth the age, position with the Company, and year first elected or appointed as a director of the Company, of each director. At the Company’s 2019 annual meeting of shareholders, each of the directors were elected to serve until the 2020 annual meeting and until his or her successor is elected and qualified, or, if earlier, until the director’s death, resignation or removal. The narrative descriptions below set forth the principal occupation, employment, position with the Company (if any), and directorships in other public corporations, of each of the eight directors. Unless otherwise indicated, each director has been engaged in the principal occupation or occupations described below for more than the past five years.

|

| | | | |

| Name | Age | Director Since | Independent | Present Position with Akorn |

| Alan D. Weinstein | 77 | 2009 | Yes | Chairman of the Board |

| Douglas S. Boothe | 56 | 2019 | No | President & CEO; Director |

| Kenneth S. Abramowitz | 69 | 2010 | Yes | Director |

| Adrienne L. Graves, Ph.D. | 66 | 2012 | Yes | Director |

| Steven J. Meyer | 63 | 2009 | Yes | Director |

| Thomas G. Moore, PharmD | 68 | 2019 | Yes | Director |

| Terry Allison Rappuhn | 63 | 2015 | Yes | Director |

| Brian A. Tambi | 74 | 2009 | No | Director |

|

| |

| ALAN D. WEINSTEIN | |

Chairman of the Board Director Since: 2009 Age: 77 | Committees: Compensation, Nominating and Corporate Governance (Chair) |

Mr. Weinstein joined the Board in July 2009 and was appointed Chairman of the Board in October 2017. Since 2000, Mr. Weinstein has provided consulting services to supplier clients in the areas of hospital organization, hospital operations, and working with GPOs. Mr. Weinstein founded and served as President of Premier, Inc., a national GPO providing services for hospitals nationwide. Mr. Weinstein serves as a director on the board of Supply Clinic, a privately held company which provides an internet exchange for dental practices to buy dental supplies, services and equipment. Mr. Weinstein also serves on the board of trustees of the Rosalind Franklin University of Medicine and Science. Previously, Mr. Weinstein served on the boards of privately held companies in the healthcare industry whose primary customers were hospitals, including: OpenMarkets (a services and technology company providing a platform for efficiently purchasing healthcare equipment), Vascular Pathways, Inc. (a medical device company), Precyse (a healthcare services and technology company), SutureExpress (a healthcare services company) and Sterilmed, Inc. (a healthcare services company). Mr. Weinstein received his MBA from Cornell University.

Among other qualifications, Mr. Weinstein brings to Akorn’s Board in-depth knowledge of the provider side of the healthcare industry, specifically hospital management, materials management and channel partner relationships, as well as business leadership and innovative and strategic planning skills gained from his years of service as a founder, and later a consultant, advisor and board member, for a number of privately held healthcare services/technology companies.

|

| |

| DOUGLAS S. BOOTHE | |

President & CEO Director Since: 2019 Age: 56 | Committees: None

|

Mr. Boothe joined the Board in January 2019, shortly after being appointed President and CEO of the Company. Prior to joining Akorn, from 2016 to 2018, Mr. Boothe served as president of the generics division of publicly held Impax Laboratories

which developed, manufactured and marketed bioequivalent pharmaceuticals and was acquired by Amneal Pharmaceuticals LLC [AMRX: NYSE]. From 2013 to 2016, Mr. Boothe served as the executive vice president and general manager of Perrigo Company Plc [PRGO: NYSE], with responsibility for the U.S. pharmaceuticals business, which included generics and specialty pharmaceutical products. From 2006 to 2012, Mr. Boothe served as the CEO of Actavis Inc., the U.S. manufacturing and marketing division of Actavis Group, and held senior positions at Alpharma and Pharmacia Corp. Following Mr. Boothe’s time at Impax Laboratories, in May 2018, he started his own consulting company, Channel Advantage Consulting LLC, where he served as principal consultant. Mr. Boothe received his undergraduate degree from Princeton University and his MBA from the Wharton School of Business at the University of Pennsylvania.

Among other qualifications, Mr. Boothe brings to Akorn’s Board management insight into the Company as well as analytical expertise and valuable perspective of healthcare companies gained from his in-depth and high-level industry experience across a number of large public companies, including in the generics space.

|

| |

KENNETH S. ABRAMOWITZ | |

Director Since: 2010 Age: 69 | Committees: Audit |

Mr. Abramowitz joined the Board in May 2010. Mr. Abramowitz is Managing General Partner of NGN Capital, a venture capital firm that he co-founded in 2003 which focuses on investments in the healthcare and biotechnology sectors. Mr. Abramowitz joined NGN Capital from The Carlyle Group in New York where he was Managing Director from 2001 to 2003 and focused on U.S. buyout opportunities in the healthcare industry. Prior to that, Mr. Abramowitz worked as an analyst at Sanford C. Bernstein & Company, where he covered the medical supply, hospital management and health maintenance organization (HMO) industries for 23 years. Mr. Abramowitz earned a B.A. from Columbia University in 1972 and an M.B.A. from Harvard Business School in 1976. Mr. Abramowitz currently sits on the boards of the following privately held companies: OptiScan Biomedical Corporation (a company that develops continuous monitoring systems for use in hospital ICUs), Cerapedics, Inc. (an orthobiologics company) and MitralTech Ltd. (a company that develops and manufactures cardiovascular devices for mitral valve replacement). Mr. Abramowitz previously served as a director at EKOS Corp., Small Bone Innovations, Inc., Option Care, Inc., Sightline Technologies Ltd. (acquired by Stryker) and Power Medical Interventions (acquired by Covidien), as well as MedPointe and ConnectiCare Holdings, Inc.

Among other qualifications, Mr. Abramowitz brings to Akorn’s Board analytical expertise, in-depth research and valuable perspective of healthcare and biotechnology companies gained from his experience as a co-founder, managing general partner and his other leadership and analyst roles at international investment firms with specialization in healthcare, as well as his current and prior service on the boards of privately held healthcare, biotechnology and medical device companies.

|

| |

ADRIENNE L. GRAVES, PH.D | |

Director Since: 2012 Age: 66

| Committees: Compensation (Chair), Quality Compliance, Nominating and Corporate Governance |

Dr. Graves joined the Board in March 2012. Dr. Graves is a visual scientist by training and a global industry leader in ophthalmology. From 2002 to 2010, Dr. Graves was President and Chief Executive Officer of Santen Inc., the U.S. subsidiary of Santen Pharmaceutical Co., Ltd., Japan’s market leader in ophthalmic pharmaceuticals. Dr. Graves joined Santen Inc. in 1995 as Vice President of Clinical Affairs to initiate the company’s clinical development efforts in the United States. Prior to joining Santen, Dr. Graves spent nine years with Alcon Laboratories, Inc. in various roles, including Senior Vice President, World Wide Clinical Development and Vice President Clinical Affairs. She currently serves on the boards of directors of the public companies: Iveric Bio [ISEE: NASDAQ], Nicox SA [COX: Euronext Paris], Oxurion NV [OXUR: Euronext Brussels] (formerly ThromboGenics), Greenbrook TMS Inc. [GTMS: TSX] and the privately held company Surface Pharmaceuticals. Dr. Graves is also a board member for several non-profit organizations; including, the American Academy of Ophthalmology Foundation (Emeritus), the American Association for Cataract and Refractive Surgery, the Glaucoma Research Foundation, the RD Fund for Foundation Fighting Blindness, and Himalayan Cataract Project. Dr. Graves co-founded Ophthalmic Women Leaders and Glaucoma 360. She received her B.A. in Psychology with honors from Brown University, her Ph. D. in Psychobiology from the University of Michigan and completed a postdoctoral fellowship in visual neuroscience at the University of Paris.

Among other qualifications, Dr. Graves brings to Akorn’s Board more than 30 years of ophthalmic pharmaceutical industry experience, financial expertise, business leadership skills, and a deep knowledge of pre-clinical and clinical development in this sector, regulatory affairs and pharmaceutical sales and marketing, as well as a vast network of leading clinicians and thought leaders in the ophthalmic space and a familiarity with corporate governance matters gained in part from serving as CEO and head of R&D at Santen and serving on other public company boards.

|

| |

STEVEN J. MEYER | |

Director Since: 2009 Age: 63 | Committees: Audit, Nominating and Corporate Governance |

Mr. Meyer joined the Board in June 2009. Since 2005, Mr. Meyer has served as the Chief Financial Officer, and since 2018, as Chief Investment Officer of JVM Realty, a private investment firm specializing in the acquisition, re-positioning and management of real estate for investors. Prior to that, Mr. Meyer was employed by Baxter International Incorporated, a global healthcare company that provides renal and hospital products. Mr. Meyer served as the Corporate Treasurer and International Controller and VP of Global Operations during a 23-year career at Baxter International, Inc. Mr. Meyer previously served as the chairman of the board of directors of the publicly held drug development company Insys Therapeutics. Mr. Meyer earned his MBA in finance and accounting from the Kellogg Graduate School of Management at Northwestern University and his B.A. in Economics from the University of Illinois in Champaign-Urbana. He is an Illinois Certified Public Accountant.

Among other qualifications, Mr. Meyer brings to Akorn’s Board financial expertise, extensive knowledge of the healthcare industry, including an international perspective, as well as business leadership skills, which he gained in part from serving as CFO of an investment firm, as the corporate treasurer and international controller and vice president of global operations at a Fortune 500 healthcare company and his service on the board of a publicly held specialty pharmaceutical company.

|

| |

THOMAS G. MOORE, PHARMD | |

Director Since: 2019 Age: 68

| Committees: Quality Compliance (Chair), Compensation

|

Dr. Moore joined the Board in January 2019. Dr. Moore brings 35 years of strategic and operational pharmaceutical experience as a former executive at the global company Abbott Laboratories [ABT: NYSE], later known as Hospira [HSP: NYSE], and its affiliates. Dr. Moore served as President of Hospira USA from 2009 until his retirement in 2014. He was President of Global Pharmaceuticals for Hospira Worldwide, Inc. from 2007 to 2009, and served as VP and General Manager of Specialty Pharmaceuticals for Hospira, Inc. from 2003 to 2007. Dr. Moore sits on the board of directors of Avenue Therapeutics, Inc. [ATXI: NASDAQ] (a company engaged in the development of branded, proprietary pharmaceuticals), and the board of trustees for Rosalind Franklin University of Medicine and Science. Previously, Dr. Moore was a member of the boards of the Generic Pharmaceutical Association, the Society for Vascular Surgery (f/k/a American Vascular Association), and ZHOPL Private Ltd., a joint venture corporation for the manufacturing of injectable oncology pharmaceuticals. Dr. Moore received his undergraduate degree from Loyola Marymount University Los Angeles, and his Doctor of Pharmacy from the University of Southern California.

Among other qualifications, Dr. Moore brings to Akorn’s Board extensive knowledge of the pharmaceutical industry, including strategic planning and business development based on his work at major public companies, as well as his prior board experience.

|

| |

TERRY ALLISON RAPPUHN | |

Director Since: 2015 Age: 63

| Committees: Audit (Chair), Nominating and Corporate Governance |

Ms. Rappuhn joined the Board in April 2015. In 2017, Ms. Rappuhn was appointed to the board of directors and in 2018 was elected chair of Quorum Health Corporation [QHC: NYSE], an operator of general acute care hospitals and outpatient services. Also in 2017, Ms. Rappuhn was elected to serve on the board of directors of Genesis Healthcare, Inc. [GEN: NYSE], one of the nation’s largest post-acute care providers. From 2016 to 2017 Ms. Rappuhn served on the board of directors of Span-America Medical Systems, Inc. (previously a publicly held company that was acquired by Savaria Corporation), a manufacturer of beds and pressure management products for the medical market. From 2006 to 2010, Ms. Rappuhn served on the board of AGA Medical

Holdings, Inc. (previously a publicly held company that was acquired by St. Jude Medical), a medical device company. From 2003 to 2007, she served on the board of directors of Genesis HealthCare Corporation (previously a publicly held company that merged), an operator of skilled nursing and assisted living centers, where she served as the audit committee chairperson. From 1999 to April 2001, Ms. Rappuhn served as Senior Vice President and Chief Financial Officer of Quorum Health Group, Inc. (previously a publicly held company that was acquired by Triad Hospitals, Inc.), an owner and operator of acute care hospitals. From 1996 to 1999 and from 1993 to 1996, Ms. Rappuhn served as Quorum’s Vice President, Controller and Assistant Treasurer and as Vice President, Internal Audit, respectively. Ms. Rappuhn has 15 years of experience with Ernst & Young, LLP and is a Certified Public Accountant.

Among other qualifications, Ms. Rappuhn brings to Akorn’s Board experience as a member of the boards of directors of six public companies, expertise in the fields of finance and accounting in various segments of the healthcare industry, especially hospital operations, knowledge of cybersecurity oversight and understanding of strategic, operational and financial issues of public companies.

|

| |

BRIAN A. TAMBI | |

Director Since: 2009 Age: 74

| Committees: Quality Compliance

|

Mr. Tambi joined the Board in June 2009. Since 2006, Mr. Tambi has served as the chairman of the board, President and Chief Executive Officer of Antrim Pharmaceuticals, LLC, a pharmaceutical company he formed which focuses on developing, manufacturing and marketing combinations of leading single agent drugs and delivery systems. Mr. Tambi previously served as a member of the board of directors of Insys Therapeutics, a publicly held drug development company focused on pain and therapeutic cannabinoids. From 1995 to 2006, Mr. Tambi was the chairman of the board of directors, President and Chief Executive Officer of Morton Grove Pharmaceuticals, Inc., a leading manufacturer and marketer of oral liquid and topical pharmaceuticals. Prior to Morton Grove, Mr. Tambi served as President of Ivax North American Pharmaceuticals and as a member of the board of directors of Ivax Corporation (previously a publicly held pharmaceutical company that was acquired by Teva). Mr. Tambi also served as Chief Operating Officer of Fujisawa USA, Inc., a subsidiary of Fujisawa Pharmaceutical Company, Ltd. Mr. Tambi also held executive positions at Lyphomed, Inc. and Bristol-Myers Squibb. Mr. Tambi earned his MBA in International Finance & Economics and his B.S. in Corporate Finance from Syracuse University. Mr. Tambi holds one of the seats on Akorn’s Board of Directors that was designated for nomination by EJ Funds LP.

Among other qualifications, Mr. Tambi brings to Akorn’s Board extensive pharmaceutical industry experience, particularly FDA knowledge and drug development and commercialization expertise, as well as business leadership skills gained from his experience as a founder, executive and board member of numerous public and private pharmaceutical companies.

Additional Disclosure

None of our directors or executive officers has a family relationship that is required to be disclosed under Item 401(d) of Regulation S-K of the Exchange Act. During the past ten years none of the persons currently serving as an executive officer and/or director of the Company has been the subject matter of any legal proceedings that are required to be disclosed pursuant to Item 401(f) of Regulation S-K, which include: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions or a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

The Company’s Board of Directors consists of eight seats. John N. Kapoor, Ph.D., has been a principal shareholder of the Company. On July 19, 2019, Dr. Kapoor filed an amendment to his Schedule 13D with the SEC indicating that he relinquished voting and investment power over 26,038,551 shares of common stock by resigning his position as trustee of various trusts and as officer and director of certain companies and by granting a proxy that is irrevocable for three years. Through the Kapoor Trust, Dr. Kapoor is entitled to nominate one person to serve on our Board in accordance with terms of the Stock Purchase Agreement dated November 15, 1990. As President and sole director of EJ Financial Enterprises, Inc., which is the managing general partner

of EJ Funds LP and holder of Dr. Kapoor’s proxy as a stockholder of this entity, Rao Akella is entitled to nominate up to two persons to serve on our Board pursuant to terms of the Modification, Warrant and Investor Rights Agreement entered into on April 13, 2009. Mr. Brian Tambi was nominated for these purposes by EJ Funds LP. The other nominations remain unused.

Committees of the Board

The Board has four standing committees: an audit committee (the “Audit Committee”), a compensation committee (the “Compensation Committee”), a nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”), and a quality compliance committee (the “Quality Compliance Committee”). The composition of Board committees is reviewed and determined each year at the initial meeting of the Board after the annual meeting of shareholders. From time to time, the Board may create special committees. The chart below shows the current members and chairpersons of our four standing committees, though the Board has created, and may create other special committees from time to time, which committees may not necessarily be listed below or described herein.

|

| | | | |

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Quality Compliance Committee |

| Alan D. Weinstein | − | Member | Chair | − |

| Douglas S. Boothe | − | − | − | − |

| Kenneth S. Abramowitz | Member | − | − | − |

| Adrienne L. Graves, Ph.D. | − | Chair | Member | Member |

| Steven J. Meyer | Member | − | Member | − |

| Thomas G. Moore, PharmD | − | Member | − | Chair |

| Terry Allison Rappuhn | Chair | − | Member | − |

| Brian A. Tambi | − | − | − | Member |

Audit Committee

The Audit Committee oversees the Company’s corporate accounting and financial reporting process and audits of the Company’s financial statements. The Audit Committee met nine times during the 2019 fiscal year. A current copy of the Audit Committee Charter, which has been adopted and approved by the Board, is available on our website at http://www.akorn.com (the contents of such website are not incorporated into this document). See also the “Report of the Audit Committee” in this document for more information regarding the Audit Committee.

The Board has reviewed NASDAQ’s definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are “independent” under the listing standards of NASDAQ. Further, the Board determined that each of the members of the Audit Committee is “independent” in accordance with Rule 10A-3 of the Exchange Act. The Board has determined that Mr. Abramowitz, Mr. Meyer and Ms. Rappuhn each qualify as an “audit committee financial expert,” as defined in applicable SEC rules. Additionally, the Board determined that Dr. Graves, who does not serve on the Audit Committee, also meets the qualifications of an “audit committee financial expert.”

The Board made a qualitative assessment of Mr. Abramowitz’s level of knowledge and experience based on a number of factors, including his formal education and his experience as a Managing Director for the Carlyle Group, as an analyst for more than 20 years at Sanford C. Bernstein & Company as well as his experience as Managing General Partner of a venture capital firm.

The Board made a qualitative assessment of Mr. Meyer’s level of knowledge and experience based on a number of factors, including his formal education, and his experience as the Chief Financial Officer of JVM Realty, a private firm specializing in the acquisition, re-positioning and management of multi-family housing for qualified investors, as well as his experience as Corporate Treasurer and International Controller and Vice President of Global Operations at Baxter International, Inc.

The Board made a qualitative assessment of Ms. Rappuhn’s level of knowledge and experience based on a number of factors, including her formal education and her experience as a Chief Financial Officer of Quorum Health Group, Inc., a previously public company that owned and operated acute care hospitals, her 15 years of experience with Ernst & Young, LLP and her prior service as audit committee chairperson for other public companies.

The Board made a qualitative assessment of Dr. Graves’ level of knowledge and experience based on a number of factors, including her experience as President and Chief Executive Officer of Santen Inc., serving on numerous boards of public and private companies, as well as her leadership roles and experience with several non-profit organizations and foundations.

Shareholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Abramowitz’s, Mr. Meyer’s and Ms. Rappuhn’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Abramowitz, Dr. Graves, Mr. Meyer or Ms. Rappuhn any duties, obligations or liabilities that are greater than are generally imposed on them as members of the Audit Committee or the Board, and their designation as a financial expert pursuant to this SEC requirement does not affect the duties, obligations or liabilities of any other member of our Audit Committee or the Board.

Compensation Committee

The Compensation Committee, which met nine times during 2019, reviews and approves the overall compensation strategy and policies for the Company in line with the risk assessments of the Board. The Compensation Committee reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s executive officers and other senior management; reviews and approves the compensation and other terms of employment of the Company’s executive officers; and administers equity awards and stock purchase plans. Each member of the Compensation Committee has been determined by the Board to be “independent” under the listing standards of NASDAQ. A current copy of the Compensation Committee Charter, which has been adopted and approved by the Board, is available on the Company’s website at http://www.akorn.com (the contents of such website are not incorporated into this document). The Compensation Committee has authority to obtain advice and seek assistance from internal and external accounting and other advisors and to determine the extent of funding necessary for the payment of any consultant retained to advise it.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for developing and implementing policies and processes regarding corporate governance matters, assessing Board membership needs and making recommendations regarding potential director candidates to the Board. A current copy of the Nominating and Corporate Governance Committee Charter, which has been adopted and approved by the Board, is available on the Company’s website at http://www.akorn.com (the contents of such website are not incorporated into this document). Each member of the Nominating and Corporate Governance Committee has been determined by the Board to be “independent” under the listing standards of NASDAQ. The Nominating and Corporate Governance Committee met eleven times during 2019.

Quality Compliance Committee

Although the Company has had a special quality compliance committee for some time, the Board officially made the Quality Compliance Committee a standing committee of the Board in the fourth quarter of 2019. The purpose of the committee is to assist the Board with oversight of the Company’s compliance with the U.S. Federal Food, Drug and Cosmetics Act, as amended, including requirements issued by the U.S. Food and Drug Administration (“FDA”) and comparable applicable laws and regulations related to product safety and quality, as well as the Company’s quality compliance practices. The Quality Compliance Committee has the authority to conduct or authorize the conduct of further inquiry into matters under its oversight or otherwise reported to it for the purpose of discharging its duties and responsibilities and ensuring the adequacy of the Company’s policies, procedures and programs for fulfilling its obligations under the laws and regulations pertaining to product safety and quality. A current copy of the Quality Compliance Committee Charter is available on the Company’s website at http://www.akorn.com (the contents of such website are not incorporated). Each member of the Quality Compliance Committee is a non-employee director of the Company.

Qualifications for Nominees to the Board of Directors

The Board believes that candidates for director should have certain minimum qualifications; including, being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Board also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our shareholders. Board members should possess such attributes and experience as are necessary to provide a broad range of personal characteristics, including management skills, and pharmaceutical industry, financial, technological, business and international experience. Directors selected should be able to commit the requisite time for

preparation and attendance at regularly scheduled Board and committee meetings, as well as be able to participate in other matters necessary for good corporate governance. The Board modifies the qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of shareholders. In conducting this assessment, the Board considers skills, diversity, age, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a range of knowledge, experience and capability. The Board strives to achieve diversity in the broadest sense, including persons diverse in geography, age, gender, ethnicity, knowledge and experiences. Although the Board does not have a stand-alone diversity policy, the Board’s overall diversity is a significant consideration in the director selection and nomination process. The Board and Nominating and Corporate Governance Committee assess the effectiveness of board diversity efforts in connection with the annual nomination process as well as in new director searches. Currently, one-third of the directors are women or minorities. The Board and the Nominating and Corporate Governance Committee review directors’ overall service to the Company, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such director’s independence. In the case of new director candidates, the Board also determines whether the nominee must be independent, which determination is based upon applicable SEC and NASDAQ rules.

In order to identify a potential Board candidate, the Nominating and Corporate Governance Committee uses the Board’s network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. The Committee, in 2019, retained a third-party consultant which conducted an assessment of the Board as well as a consultant to conduct a board member search. While candidates were identified, none has been nominated.

Although there is no formal procedure for shareholders to recommend nominees for the Board, the Nominating and Corporate Governance Committee will consider recommendations from shareholders. Shareholders should provide all information relating to a recommended nominee that is required to be disclosed in solicitation of proxies pursuant to Regulation 14A under the Exchange Act, well in advance of any upcoming meeting so that sufficient and timely review can be given to the evaluation process. The Board does not believe that a formal procedure for shareholders to recommend nominees for the Board is necessary. All nominees recommended by shareholders will be given appropriate consideration by the Nominating and Corporate Governance Committee.

Code of Ethics

Our Board has adopted a Code of Ethics that is applicable to all employees, including members of the Board. Any amendment to, or waiver from, our Code of Ethics with respect to our principal executive officer, principal financial officer, principal accounting officer, or controller would be disclosed on our website or in a report on Form 8-K. A copy of the Code of Ethics can be obtained at our website. Our website address is http://www.akorn.com (the contents of such website are not incorporated into this document).

Our Audit Committee has adopted a whistleblower policy in compliance with Section 806 of the Sarbanes-Oxley Act and Section 21F of the Exchange Act. The whistleblower policy allows employees to confidentially submit a good faith complaint regarding accounting or audit matters to the Audit Committee and management without fear of dismissal or retaliation. The expectations of the Code of Ethics and the methods for raising concerns in accordance with the whistleblower policy are communicated to our employees on a regular basis, as part of corporate compliance program which governs all employees of the Company.

Item 11. Executive Compensation and Other Information.

Executive Summary

|

|

| 2019 Performance Highlights |

| Generated Net revenue of $682.4 million |

| Generated Operating loss of $227.4 million |

| Akorn received 5 new ANDA product approvals from the FDA and launched 5 new products in the year ended December 31, 2019 |

|

| |

| 2019 Named Executive Officers (“NEOs”) |

Douglas S. Boothe | President and Chief Executive Officer |

Duane A. Portwood | Executive Vice President and Chief Financial Officer |

Joseph Bonaccorsi | Executive Vice President, General Counsel and Secretary |

Erislandy Dorado-Boladeres | Executive Vice President, Global Quality |

Jonathan Kafer | Executive Vice President and Chief Commercial Officer |

Christopher C. Young

| Executive Vice President, Global Operations |

Compensation Discussion and Analysis

Table of Contents

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Retention Awards | |

| Inducement Awards | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Subsequent Developments | |

| COMPENSATION COMMITTEE REPORT | |

| EXECUTIVE COMPENSATION TABLES AND OTHER INFORMATION | |

How We Determine Pay

Compensation Philosophy and Objectives and Role of the Compensation Committee

The Compensation Committee leads the development of our compensation philosophies and practices to assure that the total compensation paid to our executive officers is fair and reasonable relative to the extremely competitive nature of the specialty pharmaceutical industry of which we are a part. Consistent with our ongoing goal to keep the Company’s key executives’ objectives and incentive pay aligned with the goals of our shareholders, we continue to pursue a compensation philosophy that is intended to provide total compensation opportunities, which include base salary, performance-based cash bonus, long term equity compensation, and a health and welfare benefits package.

Our compensation philosophy is based on the following goals and principles:

| |

| • | Attract and retain results-oriented executives with proven track records of success to ensure the Company has the caliber of executives needed to perform at the highest levels of the industry; |

| |

| • | Support Company growth, alignment with shareholder interests and the achievement of other key corporate goals and objectives; |

| |

| • | Design compensation packages to achieve external competitiveness, internal equity, and be cost-effective; |

| |

| • | Focus attention on and appropriately balance current priorities and the longer-term strategy of the Company through short- and long-term incentives; |

| |

| • | Encourage teamwork and cooperation while recognizing individual contributions by linking variable compensation to Company and individual performance based on position responsibilities and ability to influence financial and organizational results; |

| |

| • | Promote ownership of Company stock by executives to enhance the alignment of interests with shareholders; |

| |

| • | Motivate and reward a prudent level of risk and decision making in an effort to drive reasonable performance; |

| |

| • | Provide flexibility and some discretion in applying the compensation principles to appropriately reflect individual circumstances as well as changing healthcare and pharmaceutical industry conditions and priorities; and |

| |

| • | Involve a limited use of perquisites and supplemental benefits which will only be provided if a compelling business rationale exists. |

Our Compensation Committee is composed exclusively of independent directors and meets regularly both with and without management. The Compensation Committee annually approves Named Executive Officer base salaries, establishes annual incentive compensation pay for performance objectives based on both goals for the Company and individual employees, makes actual awards of annual incentive compensation based on attainment of these goals and other factors the Compensation Committee deems appropriate and considers awards of long-term equity compensation.

Role of the CEO

The Compensation Committee also seeks input from the CEO, particularly related to the establishment and measurement of corporate and individual objectives and recommendations related to overall employee compensation matters. The CEO provides the Board with a self-evaluation of his performance, but the CEO does not participate in discussions or make recommendations with respect to his own compensation.

Our CEO reviews the performance of, and proposes salary increases for, all managers who report to him, including the other Named Executive Officers. Any increases are generally based upon the individual’s performance during the previous year and any changes in responsibilities for the upcoming year. The Compensation Committee reviews the reasonableness of any proposed compensation for the Named Executive Officers. In conducting its review and making its determinations, the Compensation Committee reviews a history of base salary, cash incentive bonus targets and payouts, and equity awards, prepared by the Company’s Human Resources Department. During the year, our CEO may change the base salary of the managers who report to him, with the exception of our Named Executive Officers, without approval of our Compensation Committee. He may do so in order to address significant changes in the individual’s responsibilities, to be competitive in the market or for other business reasons.

Proposed compensation changes for the Named Executive Officers are submitted by our CEO to the Compensation Committee for review and approval.

Our Human Resources Department (“HR”) evaluates total compensation levels and elements of compensation and fashions competitive pay packages on a company-wide basis. HR also works with the Compensation Committee and the CEO in planning for recruitment and retention of employees. Based on HR’s research and the CEO’s recommendations, we set these salaries at rates that we believe are generally competitive, but we do not attempt to pay at the high end relative to our competition.

Role of the Compensation Consultants

The Compensation Committee has maintained a structured approach to compensation for our Named Executive Officers and, since 2012, has retained Willis Towers Watson as its independent compensation consultant to provide the Compensation Committee with support, advice and recommendations on our compensation program for our executive officers.

The Compensation Committee has analyzed whether the work of our compensation consultant Willis Towers Watson has raised any conflict of interest, taking into consideration the following factors: (i) the provision of other services to the Company by Willis Towers Watson; (ii) the amount of fees from the Company paid to Willis Towers Watson as a percentage of Willis Towers Watson’s total revenue; (iii) the policies and procedures of Willis Towers Watson that are designed to prevent conflicts of interest; (iv) any business or personal relationship of Willis Towers Watson or the individual compensation advisors employed by Willis Towers Watson with our CEO; (v) any business or personal relationship of the individual compensation advisors with any member of the Compensation Committee; and (vi) any stock of the Company owned by Willis Towers Watson or the individual compensation advisors employed by Willis Towers Watson. The Compensation Committee has determined, based on its analysis of the above factors, that the work of Willis Towers Watson and the individual compensation advisors employed by Willis Towers Watson as compensation consultants to the company has not created any conflict of interest.

Role of Peer Group

Our compensation consultant has worked with the Compensation Committee in comparing our executive compensation with pertinent market data. The data was taken from filings made with the SEC by a selected peer group. The following companies comprised our selected peer group at the start of 2019:

|

| |

| 2019 Peer Group |

| Alkermes Plc. | IQVIA Holdings Inc. |

| Amneal Pharmaceuticals, Inc. | Jazz Pharmaceuticals Plc. |

| BioMarin Pharmaceuticals, Inc. | Lannett Company, Inc. |

| Catalent, Inc. | Mallinckrodt, Plc. |

| Endo International Plc. | Prestige Consumer Healthcare Inc. |

| Horizon Therapeutics Plc. | United Therapeutics Corporation |

| Incyte Corporation | |

In the third quarter of 2019, based on changes in the Company’s revenue and market capitalization, the Compensation Committee requested that its compensation consultant review the peer group and recommend changes, if necessary. An analysis was undertaken and after discussion, the peer group was revised. The following companies comprise our revised peer group:

|

| |

| Acorda Therapeutics, Inc. | Horizon Therapeutics Public Limited Company |

| Alkermes plc. | Ironwood Pharmaceuticals, Inc. |

| AMAG Pharmaceuticals, Inc. | Lannett Company, Inc. |

| Amneal Pharmaceuticals, Inc. | Pacira BioSciences, Inc. |

| Amphastar Pharmaceuticals, Inc. | Prestige Consumer Healthcare Inc. |

| Assertio Therapeutics, Inc. | SIGA Technologies, Inc. |

| Emergent BioSolutions, Inc. | Supernus Pharmaceuticals, Inc. |

| FibroGen, Inc. | United Therapeutics Corporation |

The Compensation Committee requested that the consultant prepare a report on base and annual salary incentive percentages for executives in similar sized companies based on revenue and market capitalization and/or similar industries. This analysis has been reviewed and updated as necessary in each year since 2013, including 2019, in order to confirm the appropriateness of the data, measures and comparisons.

With respect to establishing the CEO and CFO’s compensation, we gather, analyze and evaluate the compensation mix provided by our peer group, as well as consider the other factors set forth in the Compensation Committee’s charter. We do not target or benchmark our Named Executive Officers’ compensation at a certain level or percentage based on other companies’ compensation arrangements.

Role of the Shareholders

The Compensation Committee considers shareholder input when setting compensation for the Company’s Named Executive Officers. At the last annual shareholder meeting, the Company’s advisory vote on executive compensation was approved by the following non-binding advisory vote:

|

| | | |

| For | Against | Abstain | Broker Non-Votes |

| 92,028,322 | 4,643,288 | 159,362 | 17,083,108 |

This represents more than a 95% favorable vote. Although the effect of the advisory vote on executive compensation is non-binding, the Board and the Compensation Committee consider these results when reviewing and establishing the compensation programs.

The Compensation Committee will continue to consider the outcome of the future advisory votes, as well as shareholder feedback that we receive from our shareholder outreach program, and other analysis and data when making compensation decisions for our Named Executive Officers and our compensation programs generally.

Elements of Our Compensation Program

For 2019, the principal components of compensation for our Named Executive Officers were base salary, performance-based annual cash incentive and long-term equity incentives. In addition, we offer health and welfare benefits and certain limited perquisites and separation benefits.

|

| | |

| Element | Type | At Risk |

| Base salary | Cash | No, fixed |

| Performance-based annual incentive | Cash | Yes, at risk based on Company and individual performance |

| Long-term incentives | Equity | Yes, at risk because vesting occurs over a period of years and PSUs are based on performance. |

We occasionally award discretionary cash bonuses to recognize superior individual performance, new responsibilities or to compensate new hires for amounts forfeited from their previous employer. From time to time, we have also awarded retention cash or equity bonuses that vest over a period of time.

Base Salary

The salaries for our Named Executive Officers are established to be competitive with market practices in order to allow us to attract and retain senior executive talent. Salary decisions are also influenced by internal equity taking into consideration the relationship between salaries among the executives and each executive’s role and responsibilities and the impact on Company performance. Other factors considered by the Compensation Committee include an executive’s experience, specific skills, tenure and individual performance. In setting base salaries for the CEO and our other executive officers, we also consider external equity based on analysis of peer group data. The Compensation Committee typically reviews the base salaries of our Named Executive Officers annually in the first quarter with any increases effective as of March of that year.

Performance-Based Annual Incentive Plan

Each year, the Compensation Committee adopts guidelines pursuant to which it calculates the annual performance-based cash incentive awards available to our Named Executive Officers. We have instituted management-by-objectives (MBO) to assess performance as a basis for determining awards for all of our Named Executive Officers paid out under our 2017 Omnibus Incentive Compensation Plan (the “Omnibus Plan”). Our MBO based incentive program affords us the opportunity and framework for establishing both corporate and individual performance objectives. Individual MBOs extend beyond financial performance and include actions required for the continued future growth of the Company. Each Named Executive Officer’s MBOs align with each of the corporate MBOs. Named Executive Officers are also eligible to receive a “stretch” bonus if certain objectives are achieved under the “stretch” portion of this incentive bonus plan. The Compensation Committee believes that our annual incentive program provides our Named Executive Officers with a team incentive to both enhance our financial performance and perform at the highest level.

Since 2017, the Company’s performance-based annual incentive plan also included a performance goal of achieving the Adjusted EBITDA target that was set in the annual budget and that goal was required to be achieved in order for the executive officers to receive an annual incentive bonus, no matter whether the Company and or the individual executive MBOs had been achieved for the year. In 2017 and 2018 the Company did not achieve the Adjusted EBITDA target and therefore there was no bonus available to executives under the plan.

In 2019, in connection with structural changes within the Company and consistent with advice and analysis from the Company’s compensation consultant, the Compensation Committee and the Board, we changed the design of the annual cash incentive plan.

The Performance-Based Annual Incentive Plan for 2019 was designed to achieve several objectives:

| |

| • | Incent executives to deliver results and provide the opportunity to be recognized for delivering results beyond the base plan. |

| |

| • | Increase the weight of the incentive on the Company performance to keep the focus on the enterprise in total. |

| |

| • | Establish targets that are critical to the Company’s success and participants see as achievable with appropriate stretch to gain upside earnings. |

Structure of the 2019 Performance-Based Annual Incentive Plan

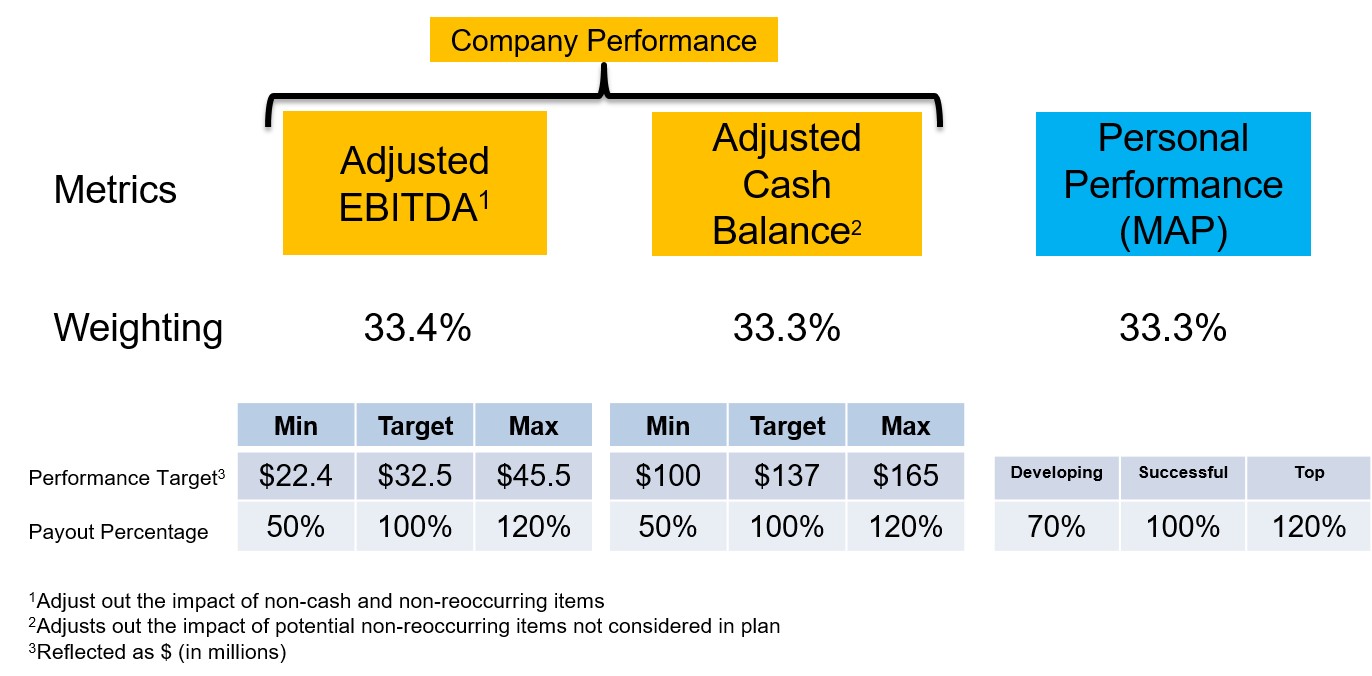

To achieve the objectives as outlined above, the 2019 Performance-Based Annual Incentive Plan was established with two-thirds of the potential payout being linked to Company performance metrics and one-third being linked to the achievement of the Named Executive Officers’ individual MBO’s as assessed through our Managing and Appraising Performance (MAP) program. The following diagram outlines the 2019 plan.

The Adjusted EBITDA and Adjusted Cash Balance are non-GAAP financial measures used by management. Adjusted Cash Balance, as defined by the Company, is a measurement of available cash that adjusts out the impact of potential non-recurring items that were not considered in the Company’s annual plan. Adjusted EBITDA, as defined by the Company, is calculated as Net loss, (minus) plus:

| |

| • | Provision (benefit) for income taxes |

| |

| • | Depreciation and amortization |

| |

| • | Non-cash expenses, such as impairment of long-lived assets, share-based compensation expense, and amortization of deferred financing costs |

| |

| • | Other adjustments, such as legal settlements, restatement expenses and various merger and acquisition-related expenses, employee retention expense, legal and financial advisory fees, fixed asset impairment, executive termination expenses, data integrity investigations & assessment, gain on disposal of fixed assets, and |

| |

| • | Fresenius transaction & Securities Class Action Litigation. |

“Stretch Bonus” Opportunity

In addition, executives have the opportunity to earn more than the maximum amount called a “stretch” bonus based on achievement of certain Adjusted EBITDA targets as described in detail below.

The design of the 2019 performance-based annual incentive plan reflected a major shift in the Company’s approach to the annual incentive program.

|

| |

| 2019 Plan | Old Plan |

| Multiple metrics on Company performance | Single metric on Company performance |

| Minimum thresholds on multiple metrics | One threshold on one metric required for any payout |

| Greater (2/3) weighting on Company performance to drive enterprise thinking | Equal weighting of Company and individual performance |

| Upside potential of 120% to drive performance | Payment maximum at 100%, which could have the effect of creating a governor on performance |

| Payout calculations for achievement between the minimum, target and maximum thresholds for the corporate metrics | Payout for corporate performance only at the threshold amounts |

| Structure more common in industry | Structure unique to company |

| Participants can see how they impact Company performance and that “extra” effort can have an impact on payout. | Link between participant impact and the threshold metric was not clear to many |

The payouts associated with the Adjusted EBITDA metric and the Adjusted Cash Balance metric were calculated based on the minimum, target and maximum payouts defined in the explanatory diagram above, taking into account performance that falls between the threshold amounts.

The payout associated with personal performance was based on the performance rating that the executive received through our Managing and Appraising Performance (MAP) program. This is a direct percentage applied to the 33.3% of the bonus awarded based on personal performance.

|

| | | |

| Personal Performance Rating | Developing Contributor | Successful Contributor | Top Contributor |

| Payout Percentage | 70 | 100 | 120 |

The Company maintains the stretch bonus for executives who are direct reports to the CEO and the CEO himself. This bonus amount is an additional 50% of the executive’s bonus target. For example, the bonus target for an Executive Vice President (EVP) is 50% of base salary. The stretch bonus is therefore an additional 25% of the EVP’s base salary.

For 2019, the stretch bonus maximum payout was for achievement of 200% of our Adjusted EBITDA target. In contrast to past years, the stretch bonus was also earned based on the scale set forth below.

|

| |

| Percent Achievement of Adjusted EBITDA Target | Percent of Stretch Bonus Payout |

| 120% | 0% |

| 160% | 50% |

| 200% | 100% |

In addition to cash bonus payments made under our annual cash incentive plan, the Compensation Committee may provide discretionary bonuses to reward an executive’s superior performance in overcoming unforeseen circumstances and exceptional achievements.

Long-Term Equity Incentive Plan

Under the Omnibus Plan, the Compensation Committee has the flexibility to make equity awards with respect to the common stock of the Company, including time- and performance-based awards of stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance stock, and other equity based awards. Our Board developed a long-term equity incentive plan as part of our goal to structure our compensation in a manner in which the largest increase in total direct

compensation for our Named Executive Officers comes from appreciation in a long-term equity incentive award made under the Omnibus Plan (“Long-Term Incentive Award”). Under the plan, the Long-Term Incentive Awards to executive officers are awarded in the form of options and RSUs. The Company does not have long-term cash incentives nor does it maintain a pension plan or a supplemental executive retirement plan. The Company may from time to time grant other types of equity awards.

Stock Options

We grant nonqualified stock options to our Named Executive Officers as a means of rewarding past performance and encouraging continued efforts to achieve personal and Company objectives in the current and future years. Our options are awarded at the closing price of our stock on the date of grant. Options awarded to our executive officers vest with respect to 25% of the award per year on each of the first four anniversaries of the date of grant and expire five, seven or ten years after the date of grant, as determined by the Compensation Committee and set forth in the applicable award agreement. Over time, the Company has moved from awarding options that expire after five or seven years to options that expire after ten years.

Restricted Stock Units (RSUs)

For 2019, based in part upon the recommendation of the compensation consultant, the Compensation Committee determined that the Long-Term Incentive Awards to executive officers would be awarded such that 50% of the grant-date fair value of each executive’s equity grant would be provided in the form of RSUs and 50% in options. Each RSU represents the right to receive one share of our common stock on a stated date (the “vesting date”) unless the award is terminated earlier in accordance with terms and conditions established by the administrator of our Omnibus Plan. The RSUs generally vest in four equal installments on each of the first four anniversaries of the date of grant. Unless the Compensation Committee determines otherwise, RSUs that do not vest will be forfeited. Holders of RSUs have no voting, dividend or other rights as a shareholder until such units are vested.

Retention Awards

Performance Stock Unit (PSU) Retention Awards

Beginning in 2019, based in part upon the recommendation of the Company’s compensation consultant, the Compensation Committee began using PSUs to compensate executives based on longer-term goals and performance metrics. Each PSU represents the right to receive one share of our common stock on a stated date (the “vesting date”) unless the award is terminated earlier in accordance with terms and conditions established by the administrator of our Omnibus Plan. In 2019, PSUs were granted to certain executives as retention awards. The vesting of PSUs granted in 2019 is tied to the Company’s performance against a financial metric and a quality metric. These PSUs vest in full on the second anniversary of the grant date at between 0% and 120% of grant value, subject to the Company achieving the designated financial metric and quality metric. PSUs that do not vest are forfeited. Holders of PSUs have no voting, dividend or other rights as a shareholder until such units are vested.

Cash Retention Awards

In December 2018 and January 2019, based in part upon the recommendation of the Company’s compensation consultant and other advisors, the Company made cash retention awards to certain executives and other non-executive employees. These awards were structured with 50% of the award being paid at the time the award was made and 50% being paid on the first anniversary of the grant date of the award. The awards provided for clawback if the employee were to be terminated other than for cause or leave during that one-year period. In December 2019, the Company made the second payment under the awards that were due and accelerated the second payment of those awards that were originally coming due for payment in January 2020. This acceleration was undertaken after consultation with advisors given the circumstances surrounding the expiration of the Company’s Standstill Agreement in December 2019.

Inducement Awards

In 2019, the Company used equity inducement awards under NASDAQ Listing Rule 5635(c)(4) as a part of the compensation package that was offered to Mr. Boothe in recruiting him to lead the Company as the President & CEO. Based on a recommendation of the Company’s compensation consultant, the inducement awards were a combination of stock options, RSUs and PSUs.

The stock options and RSUs granted to Mr. Boothe had the same award and vesting criteria as outlined above for options and RSUs granted to other executive officers. The PSUs granted to Mr. Boothe vest in full on the fourth anniversary of the grant date at between 0% and 300% of grant value subject to the closing price of the Company’s common stock on the vesting date.

Timing of Equity Grants and Equity Grant Practices

At the Board meeting held immediately after our annual meeting of shareholders, the Compensation Committee typically will recommend equity compensation, if any, to be awarded to our Named Executive Officers and all other Company employees. All awards are made based on the closing price of our stock on the date of grant. In addition, throughout the year, awards may be made to new employees upon their joining the Company and to employees who are promoted. The timing of such awards depends on those specific circumstances and is not tied to any other particular company event, anticipated events or announcements. Under our long-term equity incentive plan, in 2019 each executive officer was eligible to receive an award with a value up to a percentage of the executive’s annual salary as follows: Mr. Boothe 400%; Mr. Portwood 250%, Mr. Bonaccorsi 250%, and Mr. Kafer 200%. For 2019, the equity awards granted to Mr. Boothe were granted outside the Omnibus Plan (but otherwise subject to the terms and conditions of the Omnibus Plan) as an “employment inducement award” under NASDAQ Listing Rule 5635(c)(4), and such award was intended to constitute both Mr. Boothe’s 2019 annual award and an additional incentive for Mr. Boothe to join the Company.

In addition to awards made under our incentive plans, the Compensation Committee may provide discretionary bonuses to reward an executive’s superior performance in overcoming unforeseen circumstances and exceptional achievements.

Analysis of What We Paid

2019 Base Salaries

In 2019, the Compensation Committee reviewed the base salaries of our Named Executive Officers. Based in part on industry survey information (CEB HR Leadership Council for Mid-Sized Companies) the Compensation Committee approved an increase to the base salaries of our continuing Named Executive Officers by 3% in comparison to 2018 effective March 4, 2019.

|

| | | | | | | |

| | 2019 Base Salary ($) | 2018 Base Salary(1) ($) | What We Took Into Consideration in Setting 2019 Salaries |

| Douglas S. Boothe | $ | 800,000 |

| $ | — |

| Mr. Boothe joined the Company on January 1, 2019. Salary was set based on a review of the market for comparable roles with comparable companies. |

| Duane A. Portwood | $ | 496,500 |

| $ | 482,000 |

| Annual increase based on market assessment and merit budget.

|

| Joseph Bonaccorsi | $ | 483,800 |

| $ | 469,700 |

| Annual increase based on market assessment and merit budget.

|

| Erislandy Dorado-Boladeres | $ | 375,000 |

| $ | — |

| Mr. Dorado-Boladeres joined the Company on March 25, 2019. Salary was set based on a review of the market for comparable roles with comparable companies. |

| Jonathan Kafer | $ | 385,000 |

| $ | 385,000 |

| Mr. Kafer’s salary increased to $385,000 on December 11, 2018, in connection with his promotion, no increase in 2019. |

| Christopher C. Young | $ | 375,000 |

| $ | — |

| Mr. Young joined the Company on January 24, 2019. Salary was set based on a review of the market for comparable roles with comparable companies. |

(1) Salary as of December 31, 2018.

2019 Performance-Based Annual Incentive Awards

We structured specific annual incentive awards for 2019 based upon MBOs for our CEO and other Named Executive Officers, as well as the Company’s achievement of its overall goals. After the Board reviewed the strategic plan and budget for the year,

the Compensation Committee set annual incentive compensation targets designed to induce achievement of that plan and budget.

For 2019, we set the CEO’s bonus target at 100% of base salary, and the bonus for the other Named Executive Officers at 50% of base salary. In 2019, the CEO had additional opportunity for “stretch” bonus equal to 50% of base salary, while the other Named Executive Officers had additional opportunity for “stretch” bonus equal to 25% of base salary if certain additional objectives were achieved. In general, the Compensation Committee considered the experience, responsibilities, title and historical performance of each particular Named Executive Officer when determining the target and stretch bonus opportunities and approved specific performance objectives based on the CEO’s recommendation and the Compensation Committee’s review.

Given the uncertainty in December of 2019 regarding the Company’s Standstill Agreement, the Board decided, supported by the advice and research of its consultants, to accelerate the payment of the executive bonuses on December 13, 2020 based on the expectation that the Company was going to exceed its performance targets for the year. The decision was made to pay based on a personal performance component achieving 100% target and the Company achieving 120% target. In 2019, the Company exceeded the performance targets that were set by the Board of Directors.

|

| | | | | | | | | | | | | | |

| | 2019 Target Base Incentive Bonus Opportunity as % of Base Salary(1) | 2019 Target Base Incentive Bonus Opportunity(1) $ | 2019 Stretch Incentive Bonus Opportunity as % of Base Salary(1) | 2019 Stretch Incentive Bonus Opportunity(1) $ | 2019 Total Target Incentive Bonus Opportunity(1) $ | Total Incentive Bonus Earned for 2019(2)(3) $ |

| Douglas S. Boothe | 100% | $ | 800,000 |

| 50% | $ | 400,000 |

| $ | 1,200,000 |

| $ | 1,306,720 |

|

| Duane A. Portwood | 50% | 247,018 |

| 25% | 123,509 |

| 370,528 |

| 403,480 |

|

| Joseph Bonaccorsi | 50% | 240,702 |

| 25% | 120,351 |

| 361,054 |

| 393,163 |

|

| Erislandy Dorado-Boladeres | 50% | 144,863 |

| 25% | 72,432 |

| 217,295 |

| 234,804 |

|

| Jonathan Kafer | 50% | 192,500 |

| 25% | 96,250 |

| 288,750 |

| 314,430 |

|

Christopher C. Young

| 50% | $ | 175,685 |

| 25% | $ | 87,842 |

| $ | 263,527 |

| $ | 286,695 |

|

(1) For purposes of our performance-based incentive plan, bonus eligible Base Salary is defined as the officer’s base pay earnings as shown on the officer’s W-2 for the applicable year. However, all Bonus Opportunity amounts in the table above were calculated based on each officer’s Base Salary, which approximates his base pay earnings on his W-2.

(2) The incentive bonus amounts paid for 2019 reflected achievement at 113% of targets, thereby exceeding the 2019 Total Target Incentive Bonus Opportunity, which was based on 100% achievement.

| |

| (3) | As noted above, in December 2019, the Company accelerated the payment of 2019 annual bonuses to all salaried employees, including our Named Executive Officers that were to be made under the Company’s 2019 Salaried Incentive Plan. The accelerated 2019 bonus payments represented each such employee’s 2019 annual bonus calculated based on Company performance year-to-date. The Board determined that the Company expected to exceed the 2019 corporate performance metrics and assumed that individual performance metrics were satisfied at “target” levels. The Bonus Payments and Retention Premium Awards were made on December 13, 2019. The bonus payments to employees of the Company at the Vice President level or above, including our Named Executive Officers, were subject to recoupment if their employment with the Company terminated, subject to certain exceptions, prior to the date on which annual bonuses would ordinarily be paid. |

2019 Long-Term Incentive Grants

During 2019, the Board made the following grants of stock options, RSUs and PSUs to the Company’s Named Executive Officers:

|

| | | | | | | | | | | | |

| | Number of Options Granted in 2019 | Grant Date Fair Value 2019 Options $ | Number of PSUs Granted in 2019 | Grant Date Fair Value 2019 PSUs $ | Number of RSUs Granted in 2019 | Grant Date Fair Value 2019 RSUs $ |

| Douglas S. Boothe | 405,938 | $ | 999,704 |

| 253,807 | $ | 946,700 |

| 507,614 | $ | 2,000,000 |

|

| Duane A. Portwood | 265,291 | $ | 620,356 |

| 134,236 | $ | 544,998 |

| 273,078 | $ | 1,165,622 |

|

| Joseph Bonaccorsi | 258,505 | $ | 604,488 |

| 325,123 | $ | 1,320,000 |

| 460,413 | $ | 1,924,746 |

|

| Erislandy Dorado-Boladeres | 173,681 | $ | 374,908 |

| — | — |

| 109,329 | $ | 375,000 |

|

Jonathan Kafer

| 164,571 | $ | 384,833 |

| 73,892 | $ | 300,000 |

| 160,021 | $ | 685,000 |

|

| Christopher C. Young | 147,166 | $ | 374,876 |

| — | — |

| 92,364 | $ | 375,000 |

|

| Total | 1,415,152 | $ | 3,359,165 |

| 787,058 | $ | 3,111,698 |

| 1,602,819 | $ | 6,525,368 |

|

Other Elements of Compensation

Below are additional elements of compensation that we provide to our executive officers. For information regarding employment agreements and our executive severance plan, see “Potential Payments Upon Termination.”

Company-Wide Benefits

The Company does not have a pension plan and does not have a supplemental executive retirement plan. Executive officers and all full-time employees are eligible to participate in the Company’s benefit programs, which include health insurance (which is partially funded by the employee), 401(k), disability and life insurance (separate programs for executives and all other employees), flexible spending accounts, an employee stock purchase plan, an employee assistance program, an education assistance program, pre-tax commuter program, paid time off and holidays. Part-time employees are eligible to participate in a limited benefits program which includes a 401(k) plan, an employee stock purchase plan, and limited holiday and paid time off. The Company matches employee 401(k) contributions at a rate of 50% up to the first 6% of the employee’s eligible wages contributed to the plan.

Perquisites

The Company has largely eliminated perquisites for its executive officers. In 2019, the Company made several additions to its team of executive officers, and in doing so paid moving, temporary housing and related relocation costs to some executive officers.

ESPP

The 2016 Akorn Inc., Employee Stock Purchase Plan (“ESPP”) permits eligible employees to acquire shares of our common stock at a 15% discount from market price, through payroll deductions not exceeding 15% of base wages. Purchases under the ESPP are subject to an annual maximum purchase of the lesser of $25,000 in market value of our common stock or 15,000 shares. The Company initiated two offering periods during 2019, one starting on February 1, 2019 and the second starting on July 1, 2019. However, the Company suspended the ESPP during the quarter ended December 31, 2019, and refunded all accumulated contributions.

Executive Share Retention and Ownership Guidelines

In order to promote equity ownership and further align the interests of management with the Company’s shareholders, the Company adopted stock ownership guidelines for the Company’s executive officers. The executive officers are expected to achieve the ownership level associated with their position within five years of their respective appointments. The Nominating and Governance Committee in its discretion may extend the period of time for attainment of such ownership levels in appropriate circumstances.

|

| |

| Role | Guideline |

President and Chief Executive Officer

| 5 times base salary |

| All Other Executive Officers | 3 times base salary |

Until the specified ownership levels are met, an executive officer will be required to retain 50% of all shares acquired upon option exercises and the vesting of RSUs (in both cases, less shares withheld to pay taxes or cost of exercise). The value of a share shall be measured as the greater of the then current market price or the closing price of a share of the Company’s common stock on the acquisition date. For purposes of determining compliance with the stock ownership guidelines, stock ownership includes:

|

| |

| • | shares purchased on the open market, |

| • | shares owned jointly with, or separately, by the officer’s spouse and dependent children, |

| • | shares held in trust for the officer or immediate family member, |

| • | shares held through any Company-sponsored plan, including specifically the ESPP, |

| • | shares obtained through the exercise of stock options, and |

| • | 50% of unvested RSUs. |

As of March 16, 2019, Mr. Bonaccorsi met the minimum ownership guidelines. The remaining Named Executive Officers have until five years from their respective appointments to their executive officer positions to attain the required ownership levels.

Clawback Policy