UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02932 |

|

Morgan Stanley High Yield Securities Inc. |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue, New York, New York | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

Randy Takian

522 Fifth Avenue, New York, New York 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-296-6990 | |

|

Date of fiscal year end: | August 31, 2008 | |

|

Date of reporting period: | August 31, 2008 | |

| | | | | | | | |

Item 1 - Report to Shareholders

INVESTMENT MANAGEMENT

Welcome, Shareholder:

In this report, you'll learn about how your investment in Morgan Stanley High Yield Securities Inc. performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund's financial statements and a list of Fund investments.

This material must be preceded or accompanied by a prospectus for the fund being offered.

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

Fund Report

For the year ended August 31, 2008

| Total Return for the 12 Months Ended August 31, 2008 | |

| Class A | | Class B | | Class C | | Class I+ | | Brothers

U.S.

Corporate

High

Yield-2%

Issuer Cap

Index1 | | Lehman

Lipper

High

Current

Yield

Bond

Funds

Index2 | |

| | 1.29 | % | | | 0.21 | % | | | 0.70 | % | | | 0.95 | % | | | –0.66 | % | | | –2.00 | % | |

+ Formerly Class D shares. Renamed Class I shares effective March 31, 2008.

The performance of the Fund's four share classes varies because each has different expenses. The Fund's total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

Market conditions were challenging for the high-yield market throughout most of the 12-month reporting period as the credit crisis and concerns about the economy kept volatility high and led investors to favor less risky assets. Although the pace of economic growth rose to 3.3 percent in the second quarter of 2008, after measuring just 0.9 percent in the first quarter and –0.2 percent in the last quarter of 2007, the overall economic picture remained weak. Job numbers weakened and the housing market remained in the doldrums. Accelerating food and energy prices have taken a toll on consumers as well, causing confidence to dwindle and promptin g concerns about inflation. These factors, coupled with ongoing writedowns by several financial institutions and restricted credit and liquidity, weighed heavily on investor sentiment.

The Federal Reserve (the "Fed") took several steps to help ease the pressure on the market, including a long series of reductions in the target federal funds rate, the last of which took place in April when the rate was cut to 2.0 percent. Although the slowing economy was still a concern, rising inflationary pressures prompted the Fed to maintain interest rates thereafter. The Fed's intervention briefly calmed the markets and resulted in an upsurge in high yield performance in April and May, but following the announcement of additional financial sector writedowns in June and growing recession fears, the market retreated again as high yield spreads moved wider. At the end of August, high yield spreads stood at 829 basis points over Treasuries, significantly wider than historical long-term averages. As a result, high yield bonds underperformed Treasury securities, though they still outpaced equities for the reporting year. As woul d be expected in this environment, higher-quality high yield bonds outperformed lower-quality issues. With regard to sectors, the wireless communications, healthcare and environmental sectors were the top performers in the high yield market, while finance companies, gaming and automotive turned in the worst performance. New issue volume slowed considerably, measuring approximately $50 billion in the first eight months of 2008 — only 40 percent of the volume for the same period last year.

Performance Analysis

All share classes of Morgan Stanley High Yield Securities Inc. outperformed the Lehman Brothers U.S. Corporate High Yield-2% Issuer Cap Index and the Lipper High

2

Current Yield Bond Funds Index for the 12 months ended August 31, 2008, assuming no deduction of applicable sales charges.

The Fund's defensive credit quality positioning was a major contributor to performance for the period. We maintained a higher overall credit quality within the portfolio than that of the Lehman Brothers U.S. Corporate High Yield-2% Issuer Cap Index for most of the reporting period. This positioning was beneficial as the uncertain environment led to a flight to quality that helped higher-rated securities outpace those with lower credit ratings. As high yield spreads moved to levels considerably wider than long-term averages late in the period, we began to increase the Fund's credit exposure to a more neutral position.

An overweight allocation and strong security selection in healthcare, the second best performing sector for the period, utilities, and energy were additive to returns. An underweight exposure to companies in the homebuilding industry was also beneficial as the housing slump has dampened its performance.

The Fund's holdings in mortgage securities, however, hindered performance somewhat. The Fund's exposure to the sector is relatively small, but given the ongoing decline in mortgage securities in the wake of the subprime market meltdown and the fact that these securities are not included in the Lehman Brothers U.S. Corporate High Yield-2% Issuer Cap Index, this position detracted from relative performance.

As of the end of the reporting period, the Fund's major sector overweights relative to the Lehman Brothers U.S. Corporate High Yield-2% Issuer Cap Index were in the healthcare, chemicals, and utility sectors. The Fund's major sector underweights relative to the Index were in building products/home builders, manufacturing, and aerospace/defense.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

| TOP FIVE INDUSTRIES as of 08/31/08 | |

| Electric Utilities | | | 5.7 | % | |

| Oil & Gas Production | | | 5.0 | | |

| Hospital/Nursing Management | | | 4.9 | | |

| Cable/Satellite TV | | | 4.8 | | |

| Finance/Rental/Leasing | | | 4.5 | | |

| LONG-TERM CREDIT ANALYSIS as of 08/31/08 | |

| A/A+ | | | 2.1 | % | |

| Baa/BBB+ | | | 6.5 | | |

| Ba/BB- | | | 18.1 | | |

| B/B | | | 50.3 | | |

| Caa/CCC | | | 21.2 | | |

| Not rated | | | 1.8 | | |

Subject to change daily. Provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned or securities in the sectors shown above. Top five sectors are as a percentage of net assets and long-term credit analysis are as a percentage of total long-term investments. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

3

Investment Strategy

The Fund will normally invest at least 80 percent of its assets in fixed-income securities (including zero coupon securities) rated below Baa by Moody's Investors Service ("Moody's") or below BBB by Standard & Poor's Rating Group, a division of The McGraw-Hill Companies, Inc. ("S&P"), or in non-rated securities considered by the Fund's Investment Adviser to be appropriate investments for the Fund. Such securities may also include "Rule 144A" securities, which are subject to resale restrictions. Shareholders of the Fund will receive at least 60 days' prior notice of any changes in this policy. The Fund may also use derivative instruments as discussed in the Fund's prospectus. These derivative instruments will be counted toward the 80 percent policy discussed above to the extent they have economic characteristics similar to the securities included within that policy. Securities rated below Baa or BBB are commonly known as "junk bonds." There are no minimum quality ratings for investments, and as such the Fund may invest in securities which no longer make payments of interest or principal, including defaulted securities.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by access ing the SEC's web site, http://www.sec.gov. You may also review and copy them at the SEC's public reference room in Washington, DC. Information on the operation of the SEC's public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Fund's Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 869-NEWS or by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. It is also available on the Securities and Exchange Commission's Web site at http://www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. This information is also available on the Securities and Exchange Commission's Web site at http://www.sec.gov.

4

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 869-NEWS, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

5

Performance Summary

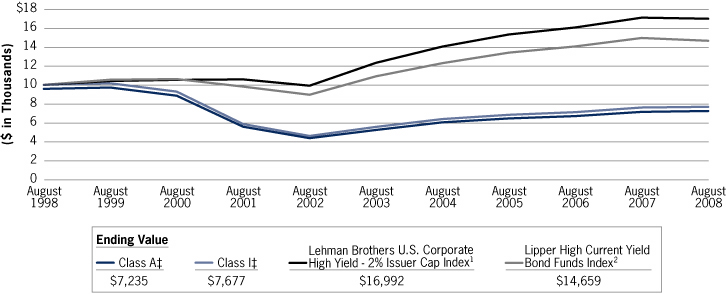

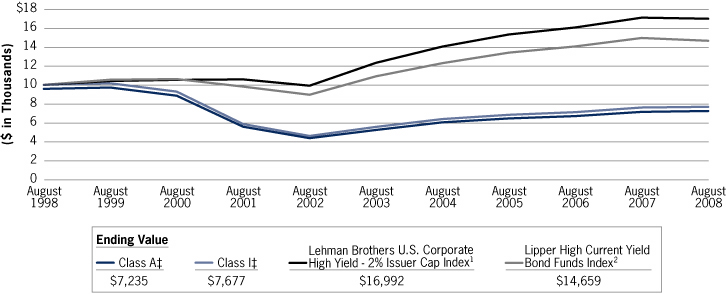

Performance of $10,000 Investment—Class A and Class I

Over 10 Years

6

| Average Annual Total Returns—Period Ended August 31, 2008 | |

| Symbol | | Class A Shares*

(since 09/26/79)

HYLAX | | Class B Shares**

(since 07/28/97)

HYLBX | | Class C Shares†

(since 07/28/97)

HYLCX | | Class I Shares††

(since 09/26/79)

HYLDX | |

| 1 Year | | 1.29%3

(3.01)4 | | 0.21%3

(4.50)4 | | 0.70%3

(0.25)4 | | 0.95%3

— | |

| 5 Years | | 6.703

5.784 | | 5.933

5.624 | | 5.943

5.944 | | 6.693

— | |

| 10 Years | | (2.76)3

(3.18)4 | | (3.25)3

(3.25)4 | | (3.39)3

(3.39)4 | | (2.61)3

— | |

| Since Inception | | 4.913

4.764 | | (2.85)3

(2.85)4 | | (3.04)3

(3.04)4 | | 5.143

— | |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/msim or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class I shares will vary due to differences in sales charges and expenses.

Prior to July 28, 1997 the Fund offered only one class of shares. Because the distribution arrangement for Class A most closely resembled the distribution arrangement applicable prior to the implementation of multiple classes (i.e., Class A is sold with a front-end sales charge), historical performance information has been restated to reflect the actual maximum sales charge applicable to Class A (i.e., 4.25%) as compared to the 5.50% sales charge in effect prior to July 28, 1997. In addition, Class A shares are now subject to an ongoing 12b-1 fee which is reflected in the restated performance for that class.

Because all shares of the Fund held prior to July 28, 1997 were designated Class I shares (formerly Class D shares), the Fund's historical performance has been restated to reflect the absence of any sales charge.

* The maximum front-end sales charge for Class A is 4.25%.

** The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. Effective April 2005, Class B shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. Performance for periods greater than eight years reflects this conversion.

† The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase.

†† Class I (formerly Class D) has no sales charge.

(1) The Lehman Brothers U.S. Corporate High Yield - 2% Issuer Cap Index is the 2% Issuer Cap component of the Lehman Brothers U.S. Corporate High Yield Index which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody's, Fitch, and S&P is Ba1/BB+/BB+ or below. The Index excludes Emerging Markets debt. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper High Current Yield Bond Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper High Current Yield Bond Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund was in the Lipper High Current Yield Bond Funds classification as of the date of this report.

(3) Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges.

(4) Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges.

‡ Ending value assuming a complete redemption on August 31, 2008.

7

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 03/01/08 – 08/31/08.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value | | Ending

Account Value | | Expenses Paid

During Period@ | |

| | | 03/01/08 | | 08/31/08 | | 03/01/08 –

08/31/08 | |

| Class A | |

| Actual (–0.84% return) | | $ | 1,000.00 | | | $ | 991.60 | | | $ | 8.81 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,016.29 | | | $ | 8.92 | | |

| Class B | |

| Actual (–1.10% return) | | $ | 1,000.00 | | | $ | 989.00 | | | $ | 11.30 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,013.77 | | | $ | 11.44 | | |

| Class C | |

| Actual (–1.14% return) | | $ | 1,000.00 | | | $ | 988.60 | | | $ | 11.80 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,013.27 | | | $ | 11.94 | | |

| Class I@@ | |

| Actual (–0.73% return) | | $ | 1,000.00 | | | $ | 992.70 | | | $ | 7.56 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,017.55 | | | $ | 7.66 | | |

@ Expenses are equal to the Fund's annualized expense ratios of 1.76%, 2.26%, 2.36% and 1.51% for Class A, Class B, Class C and Class I shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

@@ Formerly Class D shares. Renamed Class I shares effective March 31, 2008.

8

Investment Advisory Agreement Approval

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Adviser (as defined herein) under the advisory agreement, including portfolio management, investment research and equity and fixed income securities trading. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Adviser under the administration agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Adviser's expense. (The Adviser and the administrator together are referred to as the "Adviser" and the advisory and administration agreements together are referred to as the "Management Agreement.") The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advisers as reported to the Bo ard by Lipper Inc. ("Lipper").

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the advisory and administrative services to the Fund. The Board determined that the Adviser's portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory and administrative services was satisfactory.

Performance Relative to Comparable Funds Managed by Other Advisers

On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Fund, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed the Fund's performance for the one-, three- and five-year periods ended December 31, 2007, as shown in a report provided by Lipper (the "Lipper Report"), compared to the performance of comparable funds selected by Lipper (the "performance peer group"). The Board also discussed with the Adviser the performance goals and the actual results achieved in managing the Fund. The Board concluded that the Fund's performance was competitive with that of its performance peer group.

Fees Relative to Other Proprietary Funds Managed by the Adviser with Comparable Investment Strategies

The Board reviewed the advisory and administrative fee (together, the "management fee") rate paid by the Fund under the Management Agreement. The Board noted that the management fee rate was comparable to the management fee rates charged by the Adviser to other proprietary funds it manages with investment strategies comparable to those of the Fund taking into account the scope of the services provided.

9

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the management fee rate and total expense ratio of the Fund as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the "expense peer group"), managed by other advisers with investment strategies comparable to those of the Fund, as shown in the Lipper Report. The Board concluded that the Fund's total expense ratio, although higher than the peer group average, was acceptable as the management fee rate was competitive with that of its expense peer group.

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund's management fee schedule under the Management Agreement and noted that it includes breakpoints. The Board also reviewed the level of the Fund's management fee and noted that the fee, as a percentage of the Fund's net assets, would decrease as net assets increase because the management fee includes breakpoints. The Board concluded that the Fund's management fee would reflect economies of scale as assets increase.

Profitability of the Adviser and Affiliates

The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with the Fund and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Fund.

Fall-Out Benefits

The Board considered so-called "fall-out benefits" derived by the Adviser and affiliates from their relationship with the Fund and the Morgan Stanley Fund Complex, such as sales charges on sales of Class A shares and "float" benefits derived from handling of checks for purchases and sales of Fund shares, through a broker-dealer affiliate of the Adviser and "soft dollar" benefits (discussed in the next section). The Board also considered that, from time to time, the Adviser may, directly or indirectly, effect trades on behalf of certain Morgan Stanley Funds through various electronic communications networks or other alternative trading systems in which the Adviser's affiliates have ownership interests and/or board seats. The Board also considered that a broker-dealer affiliate of the Adviser receives from the Fund 12b-1 fees for distribution and shareholder services. The Board concluded that the fall-out benefits were relatively small and the sales charges and 12b-1 fees were competitive with those of other broker-dealers.

10

Soft Dollar Benefits

The Board considered whether the Adviser realizes any benefits from commissions paid to brokers who execute securities transactions for the Fund ("soft dollars"). The Board noted that the Fund invests only in fixed income securities, which do not generate soft dollars.

Adviser Financially Sound and Financially Capable of Meeting the Fund's Needs

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Fund and the Adviser

The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Fund's operations and the Board's confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Fund to continue its relationship with the Adviser.

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund's Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund's business.

General Conclusion

After considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement for another year.

11

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Corporate Bonds (95.2%) | |

| | | Advertising/Marketing Services (2.0%) | |

| $ | 3,505 | | | Idearc Inc. (l) | | | 8.00 | % | | 11/15/16 | | $ | 1,603,538 | | |

| | 660 | | | Interpublic Group of Companies, Inc. (The) | | | 6.25 | | | 11/15/14 | | | 565,950 | | |

| | 1,370 | | | Valassis Communications, Inc. | | | 8.25 | | | 03/01/15 | | | 1,147,375 | | |

| | | | 3,316,863 | | |

| | | Alternative Power Generation (0.5%) | |

| | 800 | | | NRG Energy, Inc. | | | 7.375 | | | 01/15/17 | | | 784,000 | | |

| | | Aluminum (1.1%) | |

| | 1,925 | | | Novelis, Inc. - (Canada) | | | 7.25 | | | 02/15/15 | | | 1,795,062 | | |

| | | Apparel/Footwear (0.7%) | |

| | 1,195 | | | Oxford Industries, Inc. | | | 8.875 | | | 06/01/11 | | | 1,168,112 | | |

| | | Apparel/Footwear Retail (1.0%) | |

| | 1,620 | | | Brown Shoe Co., Inc. | | | 8.75 | | | 05/01/12 | | | 1,611,900 | | |

| | | Auto Parts: O.E.M. (0.5%) | |

| | 920 | | | ArvinMeritor, Inc. (l) | | | 8.75 | | | 03/01/12 | | | 834,900 | | |

| | | Beverages: Alcoholic (0.6%) | |

| | 910 | | | Constellation Brands, Inc. | | | 7.25 | | | 05/15/17 | | | 896,350 | | |

| | | Broadcasting (1.3%) | |

| | 1,120 | | | LIN Television Corp. (l) | | | 6.50 | | | 05/15/13 | | | 924,000 | | |

| | 600 | | | Sirius XM Radio Inc | | | 9.625 | | | 08/01/13 | | | 472,500 | | |

| | 910 | | | XM Satellite Radio Holdings Inc - 144A (a) | | | 13.00 | | | 08/01/13 | | | 805,350 | | |

| | | | 2,201,850 | | |

| | | Building Products (1.7%) | |

| | 1,525 | | | Interface Inc. | | | 9.50 | | | 02/01/14 | | | 1,608,875 | | |

| | 1,950 | | | Nortek Inc. (l) | | | 8.50 | | | 09/01/14 | | | 1,199,250 | | |

| | | | 2,808,125 | | |

| | | Cable/Satellite TV (4.8%) | |

| | 1,795 | | | Cablevision Systems Corp. (Series B) | | | 7.133 | (j) | | 04/01/09 | | | 1,812,950 | | |

| | 893 | | | CCH I LLC/CCH I Cap Co. (l) | | | 11.00 | | | 10/01/15 | | | 689,843 | | |

| | 576 | | | CCH II/CCH II | | | 10.25 | | | 10/01/13 | | | 508,320 | | |

| | 445 | | | CSC Holdings Inc - 144A (a) | | | 8.50 | | | 06/15/15 | | | 449,450 | | |

| | 150 | | | DIRECTV Holdings/Finance | | | 6.375 | | | 06/15/15 | | | 142,125 | | |

| | 1,330 | | | DIRECTV Holdings/Finance - 144A (a) | | | 7.625 | | | 05/15/16 | | | 1,333,325 | | |

| | 1,360 | | | EchoStar DBS Corp. | | | 6.375 | | | 10/01/11 | | | 1,332,800 | | |

| | 1,120 | | | Intelsat Corp. - 144A (a) | | | 9.25 | | | 06/15/16 | | | 1,114,400 | | |

See Notes to Financial Statements

12

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| $ | 315 | | | Virgin Media Finance plc (United Kingdom) | | | 8.75 | % | | 04/15/14 | | $ | 302,400 | | |

| | 165 | | | Virgin Media Finance plc (United Kingdom) | | | 9.125 | | | 08/15/16 | | | 157,987 | | |

| | | | 7,843,600 | | |

| | | Casino/Gaming (4.3%) | |

| | 27,175 | | | Aladdin Gaming Holdings/Capital Corp. LLC

(Series B) (b) (c) (f) | | | 13.50 | | | 03/01/10 | | | 0 | | |

| | 3,465 | | | Harrah's Operating Co., Inc (l) | | | 5.375 | | | 12/15/13 | | | 1,585,238 | | |

| | 3,340 | | | Isle of Capri Casinos (l) | | | 7.00 | | | 03/01/14 | | | 2,404,800 | | |

| | 2,285 | | | Las Vegas Sands Corp. (l) | | | 6.375 | | | 02/15/15 | | | 1,839,425 | | |

| | 27,634 | | | Resort At Summerlin LP/Ras Co.

(Series B) (b) (c) (f) | | | 13.00 | | | 12/15/07 | | | 0 | | |

| | 1,670 | | | Station Casinos, Inc. (l) | | | 6.00 | | | 04/01/12 | | | 1,173,175 | | |

| | 265 | | | Station Casinos, Inc. (l) | | | 6.875 | | | 03/01/16 | | | 116,600 | | |

| | | | 7,119,238 | | |

| | | Chemicals: Agricultural (0.8%) | |

| | 1,335 | | | Terra Capital Inc. (Series B) | | | 7.00 | | | 02/01/17 | | | 1,304,962 | | |

| | | Chemicals: Major Diversified (0.8%) | |

| | 1,445 | | | Westlake Chemical Corp. (l) | | | 6.625 | | | 01/15/16 | | | 1,235,475 | | |

| | | Chemicals: Specialty (2.3%) | |

| | 710 | | | Innophos Holdings Inc. - 144A (a) | | | 9.50 | | | 04/15/12 | | | 713,550 | | |

| | 1,070 | | | Innophos, Inc. | | | 8.875 | | | 08/15/14 | | | 1,102,100 | | |

| | 1,045 | | | Koppers Holdings, Inc. | | | 9.875 | (k) | | 11/15/14 | | | 935,275 | | |

| | 915 | | | Koppers Industry Inc. | | | 9.875 | | | 10/15/13 | | | 965,325 | | |

| | | | 3,716,250 | | |

| | | Coal (1.7%) | |

| | 860 | | | Foundation PA Coal Co. | | | 7.25 | | | 08/01/14 | | | 866,450 | | |

| | 1,980 | | | Massey Energy Co. | | | 6.875 | | | 12/15/13 | | | 1,945,350 | | |

| | | | 2,811,800 | | |

| | | Containers/Packaging (4.0%) | |

| | 1,865 | | | Berry Plastics Holding Corp. (l) | | | 8.875 | | | 09/15/14 | | | 1,557,275 | | |

| | 565 | | | Berry Plastics Holdings Corp. (l) | | | 10.25 | | | 03/01/16 | | | 398,325 | | |

| | 940 | | | Graham Packaging Company Inc. | | | 8.50 | | | 10/15/12 | | | 890,650 | | |

| | 945 | | | Graham Packaging Company Inc. | | | 9.875 | | | 10/15/14 | | | 833,962 | | |

| | 2,000 | | | Graphic Packaging International Corp. (l) | | | 9.50 | | | 08/15/13 | | | 1,890,000 | | |

| | 1,020 | | | Owens-Illinois, Inc. (l) | | | 7.50 | | | 05/15/10 | | | 1,048,050 | | |

| | | | 6,618,262 | | |

| | | Data Processing Services (0.8%) | |

| | 1,315 | | | Sungard Data Systems Inc. | | | 9.125 | | | 08/15/13 | | | 1,341,300 | | |

See Notes to Financial Statements

13

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Drugstore Chains (0.5%) | |

| $ | 1,170 | | | Rite Aid Corp. | | | 8.625 | % | | 03/01/15 | | $ | 760,500 | | |

| | | Electric Utilities (5.7%) | |

| | 415 | | | AES Corp. (The) | | | 7.75 | | | 03/01/14 | | | 415,000 | | |

| | 1,820 | | | AES Corp. (The) - 144A (a) | | | 8.00 | | | 06/01/20 | | | 1,751,750 | | |

| | 1,215 | | | Intergen NV - 144A (a) | | | 9.00 | | | 06/30/17 | | | 1,245,375 | | |

| | 965 | | | IPALCO Enterprises, Inc. | | | 8.625 | | | 11/14/11 | | | 1,008,425 | | |

| | 980 | | | Israel Electric Corporation Ltd. - 144A (a) | | | 7.25 | | | 01/15/19 | | | 991,323 | | |

| | 1,160 | | | Reliant Energy Inc. (l) | | | 7.875 | | | 06/15/17 | | | 1,125,200 | | |

| | 1,000 | | | Texas Competitive Electric

Holdings LLC - 144A (a) | | | 10.25 | | | 11/01/15 | | | 1,002,500 | | |

| | 1,870 | | | Texas Competitive Electric

Holdings LLC - 144A (a) | | | 10.25 | | | 11/01/15 | | | 1,874,675 | | |

| | | | 9,414,248 | | |

| | | Electrical Products (1.7%) | |

| | 510 | | | Baldor Electric Co. (l) | | | 8.625 | | | 02/15/17 | | | 518,925 | | |

| | 2,373 | | | Ormat Funding Corp. | | | 8.25 | | | 12/30/20 | | | 2,295,791 | | |

| | | | 2,814,716 | | |

| | | Electronic Components (0.3%) | |

| | 550 | | | NXP B.V./NXP Funding LLC | | | 7.875 | | | 10/15/14 | | | 453,750 | | |

| | | Electronic Production Equipment (0.6%) | |

| | 975 | | | KLA Instruments Corp. | | | 6.90 | | | 05/01/18 | | | 960,409 | | |

| | | Finance/Rental/Leasing (4.5%) | |

| | 3,360 | | | Capmark Financial Group Inc. | | | 5.875 | | | 05/10/12 | | | 2,169,979 | | |

| | 140 | | | Capmark Financial Group Inc. | | | 6.30 | | | 05/10/17 | | | 82,718 | | |

| | 2,450 | | | Ford Motor Credit Co. LLC (l) | | | 7.00 | | | 10/01/13 | | | 1,776,791 | | |

| | 3,605 | | | Ford Motor Credit Co. LLC | | | 7.25 | | | 10/25/11 | | | 2,763,373 | | |

| | 317 | | | Residential Capital Corp. (l) | | | 8.125 | | | 11/21/08 | | | 285,300 | | |

| | 60 | | | Residential Capital LLC - 144A (a) | | | 8.50 | | | 05/15/10 | | | 41,700 | | |

| | 873 | | | Residential Capital LLC - 144A (a) | | | 9.625 | | | 05/15/15 | | | 292,455 | | |

| | | | 7,412,316 | | |

| | | Financial Conglomerates (1.8%) | |

| | 2,780 | | | General Motors Acceptance Corp. | | | 6.875 | | | 09/15/11 | | | 1,726,138 | | |

| | 2,115 | | | General Motors Acceptance Corp. (l) | | | 6.75 | | | 12/01/14 | | | 1,149,615 | | |

| | | | 2,875,753 | | |

| | | Financial Services (0.1%) | |

| | 115 | | | Lender Processing Services, Inc. - 144A (a) | | | 8.125 | | | 07/01/16 | | | 117,444 | | |

See Notes to Financial Statements

14

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Food Retail (1.5%) | |

| $ | 983 | | | CA FM Lease Trust - 144A (a) | | | 8.50 | % | | 07/15/17 | | $ | 1,098,042 | | |

| | 925 | | | Supervalu Inc. | | | 7.50 | | | 05/15/12 | | | 929,625 | | |

| | 505 | | | Supervalu Inc. | | | 7.50 | | | 11/15/14 | | | 502,475 | | |

| | | | 2,530,142 | | |

| | | Food: Meat/Fish/Dairy (2.5%) | |

| | 1,310 | | | Michael Foods Inc. (Series B) | | | 8.00 | | | 11/15/13 | | | 1,290,350 | | |

| | 1,945 | | | Pilgrim's Pride Corp. (l) | | | 7.625 | | | 05/01/15 | | | 1,731,050 | | |

| | 1,060 | | | Smithfield Foods Inc. | | | 7.00 | | | 08/01/11 | | | 1,012,300 | | |

| | | | 4,033,700 | | |

| | | Forest Products (0.9%) | |

| | 1,470 | | | Crown Americas, Inc. | | | 7.625 | | | 11/15/13 | | | 1,503,075 | | |

| | | Gas Distributors (1.0%) | |

| | 1,245 | | | DYNEGY Holdings Inc. | | | 7.75 | | | 06/01/19 | | | 1,154,738 | | |

| | 550 | | | Equitable Resources, Inc. | | | 6.50 | | | 04/01/18 | | | 558,218 | | |

| | | | 1,712,956 | | |

| | | Home Building (0.1%) | |

| | 170 | | | Pulte Homes, Inc. | | | 6.375 | | | 05/15/33 | | | 130,900 | | |

| | | Home Furnishings (0.9%) | |

| | 1,565 | | | Jarden Corp. (l) | | | 7.50 | | | 05/01/17 | | | 1,400,675 | | |

| | | Hospital/Nursing Management (4.9%) | |

| | 885 | | | Community Health Systems | | | 8.875 | | | 07/15/15 | | | 898,275 | | |

| | 1,200 | | | HCA, Inc. | | | 5.75 | | | 03/15/14 | | | 1,000,500 | | |

| | 390 | | | HCA, Inc | | | 6.25 | | | 02/15/13 | | | 339,300 | | |

| | 2,305 | | | HCA, Inc. (l) | | | 6.50 | | | 02/15/16 | | | 1,930,438 | | |

| | 31 | | | HCA, Inc. | | | 8.75 | | | 09/01/10 | | | 31,465 | | |

| | 210 | | | HCA, Inc. | | | 9.125 | | | 11/15/14 | | | 216,300 | | |

| | 930 | | | Sun Healthcare Group Inc. | | | 9.125 | | | 04/15/15 | | | 934,650 | | |

| | 2,125 | | | Tenet Healthcare Corp. (l) | | | 7.375 | | | 02/01/13 | | | 2,005,469 | | |

| | 615 | | | Tenet Healthcare Corp. (l) | | | 9.875 | | | 07/01/14 | | | 622,688 | | |

| | | | 7,979,085 | | |

| | | Industrial Specialties (1.7%) | |

| | 2,510 | | | Johnsondiversy, Inc. (Series B) (l) | | | 9.625 | | | 05/15/12 | | | 2,566,475 | | |

| | 213 | | | UCAR Finance, Inc. | | | 10.25 | | | 02/15/12 | | | 220,455 | | |

| | | | 2,786,930 | | |

| | | Information Technology Services (0.5%) | |

| | 960 | | | VANGENT INC | | | 9.625 | | | 02/15/15 | | | 820,800 | | |

See Notes to Financial Statements

15

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Integrated Oil (0.2%) | |

| $ | 390 | | | Cimarex Energy Co. | | | 7.125 | % | | 05/01/17 | | $ | 382,200 | | |

| | | Major Telecommunications (1.8%) | |

| | 1,580 | | | Sprint Capital Corp. | | | 6.00 | | | 12/01/16 | | | 1,444,024 | | |

| | 1,685 | | | Sprint Capital Corp. | | | 6.90 | | | 05/01/19 | | | 1,565,695 | | |

| | | | 3,009,719 | | |

| | | Media Conglomerates (1.1%) | |

| | 2,126 | | | Canwest Media Inc. (Canada) (l) | | | 8.00 | | | 09/15/12 | | | 1,835,907 | | |

| | | Medical Specialties (1.4%) | |

| | 2,030 | | | Fisher Scientific International, Inc. | | | 6.125 | | | 07/01/15 | | | 2,027,054 | | |

| | 290 | | | Invacare Corp. | | | 9.75 | | | 02/15/15 | | | 295,075 | | |

| | | | 2,322,129 | | |

| | | Medical/Nursing Services (2.3%) | |

| | 1,370 | | | DaVita Inc. | | | 6.625 | | | 03/15/13 | | | 1,342,600 | | |

| | 230 | | | FMC Finance III SA (Luxembourg) | | | 6.875 | | | 07/15/17 | | | 221,950 | | |

| | 2,200 | | | Fresenius Medical Care Capital Trust | | | 7.875 | | | 06/15/11 | | | 2,266,000 | | |

| | | | 3,830,550 | | |

| | | Miscellaneous (0.4%) | |

| | 650 | | | Alfa MTN Invest Ltd. - 144A (a)(l) | | | 9.25 | | | 06/24/13 | | | 648,375 | | |

| | | Miscellaneous Commercial Services (0.4%) | |

| | 200 | | | Iron Mountain Inc. | | | 7.75 | | | 01/15/15 | | | 201,000 | | |

| | 465 | | | Iron Mountain Inc. | | | 8.625 | | | 04/01/13 | | | 469,650 | | |

| | | | 670,650 | | |

| | | Miscellaneous Manufacturing (0.0%) | |

| | 1,470 | | | Propex Fabrics Inc. | | | 10.00 | | | 12/01/12 | | | 22,050 | | |

| | | Motor Vehicles (0.3%) | |

| | 995 | | | General Motors Corp. (l) | | | 8.375 | | | 07/15/33 | | | 497,500 | | |

| | | Oil & Gas Pipelines (2.4%) | |

| | 230 | | | Gaz Capital Sa - 144A (a) | | | 6.51 | | | 03/07/22 | | | 195,477 | | |

| | 1,370 | | | Pacific Energy Partners/Finance | | | 7.125 | | | 06/15/14 | | | 1,374,460 | | |

| | 2,300 | | | Williams Companies, Inc. (The) (l) | | | 7.875 | | | 09/01/21 | | | 2,419,957 | | |

| | | | 3,989,894 | | |

| | | Oil & Gas Production (5.0%) | |

| | 305 | | | Chaparral Energy Inc. | | | 8.875 | | | 02/01/17 | | | 266,112 | | |

| | 1,910 | | | Chaparral Energy, Inc. | | | 8.50 | | | 12/01/15 | | | 1,671,250 | | |

| | 1,355 | | | Chesapeake Energy Corp. | | | 7.50 | | | 09/15/13 | | | 1,375,325 | | |

| | 2,245 | | | Hilcorp Energy/Finance - 144A (a) | | | 7.75 | | | 11/01/15 | | | 2,042,950 | | |

See Notes to Financial Statements

16

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| $ | 255 | | | Newfield Exploration Co. | | | 7.125 | % | | 05/15/18 | | $ | 241,612 | | |

| | 1,140 | | | Opti Canada Inc. | | | 8.25 | | | 12/15/14 | | | 1,144,275 | | |

| | 275 | | | Plains Exploration & Production Co. | | | 7.625 | | | 06/01/18 | | | 260,563 | | |

| | 1,175 | | | Sandridge Energy - 144A (a) | | | 8.625 | | | 04/01/15 | | | 1,139,750 | | |

| | | | 8,141,837 | | |

| | | Oilfield Services/Equipment (1.2%) | |

| | 965 | | | CIE Gener de Geophysique S.A. (France) | | | 7.50 | | | 05/15/15 | | | 965,000 | | |

| | 1,055 | | | Helix Energy Solutions - 144A (a) | | | 9.50 | | | 01/15/16 | | | 1,055,000 | | |

| | | | 2,020,000 | | |

| | | Other Consumer Services (0.3%) | |

| | 565 | | | EXPEDIA Inc. - 144A (a) | | | 8.50 | | | 07/01/16 | | | 552,287 | | |

| | | Other Transportation (1.7%) | |

| | 2,635 | | | CHC Helicopter Corp. (Canada) | | | 7.375 | | | 05/01/14 | | | 2,753,575 | | |

| | | Pharmaceuticals: Major (0.9%) | |

| | 1,505 | | | Warner Chilcott Corp. | | | 8.75 | | | 02/01/15 | | | 1,538,862 | | |

| | | Pharmaceuticals: Other (0.3%) | |

| | 465 | | | Axcan Intermediate Holdings - 144A (a) | | | 12.75 | | | 03/01/16 | | | 469,650 | | |

| | | Precious Metals (0.7%) | |

| | 1,040 | | | Freeport-McMoran C & G | | | 8.375 | | | 04/01/17 | | | 1,104,094 | | |

| | | Publishing: Books/Magazines (0.7%) | |

| | 1,536 | | | Dex Media West/Finance | | | 9.875 | | | 08/15/13 | | | 1,186,560 | | |

| | | Pulp & Paper (1.2%) | |

| | 1,560 | | | Georgia Pacific Corp. - 144A (a) | | | 7.125 | | | 01/15/17 | | | 1,454,700 | | |

| | 525 | | | Glatfelter P.H. | | | 7.125 | | | 05/01/16 | | | 518,437 | | |

| | | | 1,973,137 | | |

| | | Real Estate Development (0.5%) | |

| | 1,375 | | | Realogy Corp. (l) | | | 10.50 | | | 04/15/14 | | | 818,125 | | |

| | | Real Estate Investment Trusts (1.1%) | |

| | 1,875 | | | Host Marriott LP | | | 6.375 | | | 03/15/15 | | | 1,640,625 | | |

| | 245 | | | ProLogis | | | 6.625 | | | 05/15/18 | | | 226,087 | | |

| | | | 1,866,712 | | |

| | | Restaurants (0.7%) | |

| | 105 | | | Aramark Corp. | | | 6.301 | (j) | | 02/01/15 | | | 98,175 | | |

| | 320 | | | Aramark Corp. | | | 8.50 | | | 02/01/15 | | | 324,000 | | |

| | 750 | | | Aramark Services Inc. | | | 5.00 | | | 06/01/12 | | | 675,000 | | |

| | | | 1,097,175 | | |

See Notes to Financial Statements

17

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Savings Banks (0.3%) | |

| $ | 900 | | | Washington Mutual Pfd - 144A (a)(l)(q) | | | 9.75 | % | | 10/29/49 | | $ | 405,435 | | |

| | | Semiconductors (0.9%) | |

| | 1,780 | | | Freescale Semiconductor (l) | | | 8.875 | | | 12/15/14 | | | 1,450,700 | | |

| | | Services to the Health Industry (2.6%) | |

| | 575 | | | Biomet, Inc. | | | 10.375 | | | 10/15/17 | | | 606,625 | | |

| | 670 | | | Medco Health Solutions, Inc. (l) | | | 7.125 | | | 03/15/18 | | | 691,942 | | |

| | 1,285 | | | National Mentor Holdings Inc. | | | 11.25 | | | 07/01/14 | | | 1,301,062 | | |

| | 1,720 | | | Omnicare Inc. (l) | | | 6.75 | | | 12/15/13 | | | 1,621,100 | | |

| | 125 | | | Omnicare Inc. (l) | | | 6.875 | | | 12/15/15 | | | 118,125 | | |

| | | | 4,338,854 | | |

| | | Specialty Stores (0.8%) | |

| | 645 | | | Sonic Automotive, Inc. | | | 8.625 | | | 08/15/13 | | | 499,875 | | |

| | 990 | | | United Auto Group, inc. | | | 7.75 | | | 12/15/16 | | | 808,087 | | |

| | | | 1,307,962 | | |

| | | Specialty Telecommunications (2.7%) | |

| | 1,395 | | | American Tower Corp. (l) | | | 7.50 | | | 05/01/12 | | | 1,429,875 | | |

| | 565 | | | Citizens Communications | | | 6.25 | | | 01/15/13 | | | 542,400 | | |

| | 945 | | | Citizens Communications | | | 7.125 | | | 03/15/19 | | | 822,150 | | |

| | 432 | | | Panamsat Corp. | | | 9.00 | | | 08/15/14 | | | 407,202 | | |

| | 633 | | | Qwest Communications International | | | 6.304 | (j) | | 02/15/09 | | | 634,583 | | |

| | 525 | | | Windstream Corp. (l) | | | 8.125 | | | 08/01/13 | | | 522,375 | | |

| | | | 4,358,585 | | |

| | | Steel (0.4%) | |

| | 665 | | | Evraz Group SA - 144A (a)(l) | | | 9.50 | | | 04/24/18 | | | 640,063 | | |

| | | Telecommunication Equipment (0.5%) | |

| | 795 | | | Nortel Networks Ltd - 144A (a) | | | 10.75 | | | 07/15/16 | | | 739,350 | | |

| | | Telecommunications (1.1%) | |

| | 6,394 | | | Exodus Communications, Inc. (b)(c)(f) | | | 11.625 | | | 07/15/10 | | | 0 | | |

| | 640 | | | Nordic Tel Company - 144A (a) (Denmark) | | | 8.875 | | | 05/01/16 | | | 619,200 | | |

| | 28,549 | | | Rhythms Netconnections, Inc. (b)(c)(f) | | | 12.75 | | | 04/15/09 | | | 0 | | |

| | 13,439 | | | Rhythms Netconnections, Inc.

(Series B) (b)(c)(f) | | | 13.50 | | | 05/15/08 | | | 0 | | |

| | 4,309 | | | Rhythms Netconnections, Inc.

(Series B) (b)(c)(f) | | | 14.00 | | | 02/15/10 | | | 0 | | |

| EUR | 530 | | | TDC AS (Denmark) | | | 6.50 | | | 04/19/12 | | | 750,323 | | |

| $ | 370 | | | U.S. West Communications Corp. | | | 5.625 | | | 11/15/08 | | | 370,925 | | |

| | | | 1,740,448 | | |

See Notes to Financial Statements

18

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Water Utilities (0.4%) | |

| $ | 670 | | | Nalco Co. | | | 7.75 | % | | 11/15/11 | | $ | 681,725 | | |

| | | Wholesale Distributors (1.2%) | |

| | 1,930 | | | RBS Global & Rexnold Corp. | | | 9.50 | | | 08/01/14 | | | 1,891,400 | | |

| | | Wireless Telecommunications (1.6%) | |

| | 685 | | | Nextel Communications, Inc. | | | 6.875 | | | 10/31/13 | | | 563,790 | | |

| | 800 | | | VIP Finance (VIMPELCOM) - 144A (a)(l) | | | 9.125 | | | 04/30/18 | | | 757,610 | | |

| | 1,320 | | | Wind Acquisition Finance SA - 144A (a) | | | 10.75 | | | 12/01/15 | | | 1,359,600 | | |

| | | | 2,681,000 | | |

| | | | | Total Corporate Bonds

(Cost $271,800,908) | | | | | | | | | 156,081,958 | | |

| | | Government Obligation (0.7%) | |

| MXN | 10,995 | | | Mexican Fixed Rate Bonds

(Cost $1,099,938) | | | 9.50 | | | 12/18/14 | | | 1,125,403 | | |

| | | Collateralized Mortgage Obligations (0.2%) | |

| | | Finance/Rental/Leasing (0.2%) | |

| $ | 583 | | | American Home Mortgage

Assets - 2006-4 1A3 (f) | | | 2.781 | | | 10/25/46 | | | 113,907 | | |

| | 678 | | | Countrywide Alternative Loan

Trust - 2006-0A21 A3 (f) | | | 2.751 | | | 03/20/47 | | | 150,778 | | |

| | 400 | | | Master Adjustable Rate Mortgage

Trust - 2007-3 1M2 | | | 3.572 | | | 05/25/47 | | | 73,977 | | |

| | | | | Total Collateralized Mortgage Obligations

(Cost $1,405,641) | | | | | | | | | 338,662 | | |

| | | Senior Loans (0.7%) | |

| | | Finance - Commercial (0.6%) | |

| | 510 | | | First Data Corp. | | | 5.222 | | | 09/24/14 | | | 469,464 | | |

| | 71 | | | First Data Corp. | | | 5.551 | | | 09/24/14 | | | 64,985 | | |

| | 517 | | | First Data Corp. | | | 5.552 | | | 09/24/14 | | | 475,897 | | |

| | | | 1,010,346 | | |

| | | Medical Specialties (0.1%) | |

| | 199 | | | Bausch and Lomb Inc. | | | 6.051 | | | 04/26/15 | | | 192,533 | | |

| | 30 | | | Bausch and Lomb Inc. | | | 6.051 | | | 04/26/15 | | | 29,025 | | |

| | | | 221,558 | | |

| | | | | Total Senior Loans

(Cost $1,293,684) | | | | | | | | | 1,231,904 | | |

See Notes to Financial Statements

19

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

NUMBER OF

SHARES | |

| | VALUE | |

| | | Common Stocks (0.1%) | |

| | | Casino/Gaming (e)(f) (0.0%) | |

| | 212,312 | | | Fitzgeralds Gaming Corp. (g) | | $ | 0 | | |

| | | Electric Utilities (0.0%) | |

| | 197 | | | PNM Resources Inc. (l) | | | 2,323 | | |

| | | Food: Specialty/Candy (d)(e)(f) (0.0%) | |

| | 13,317 | | | SFAC New Holdings Inc. (h) | | | 0 | | |

| | 2,447 | | | SFFB Holdings Inc. | | | 0 | | |

| | | | 0 | | |

| | | Restaurants (d)(e)(f) (0.1%) | |

| | 10,126 | | | American Restaurant Group Holdings, Inc. (Class A) | | | 81,008 | | |

| | | Specialty Telecommunications (d)(e) (0.0%) | |

| | 34,159 | | | Birch Telecom Inc. (i)(f) | | | 341 | | |

| | 8,510 | | | XO Holdings, Inc. (l) | | | 6,127 | | |

| | | | 6,468 | | |

| | | Telecommunications (d)(e) (0.0%) | |

| | 165 | | | Viatel Holdings Bermuda Ltd. (Bermuda) | | | 3,300 | | |

| | | Textiles (d)(e)(f) (0.0%) | |

| | 2,389,334 | | | U.S. Leather, Inc. | | | 0 | | |

| | | Wireless Telecommunications (d) (0.0%) | |

| | 5,199 | | | USA Mobility, Inc. (l) | | | 58,593 | | |

| | | Total Common Stocks

(Cost $217,202,834) | | | 151,692 | | |

| | | Convertible Preferred Stocks (0.1%) | |

| | | Finance/Rental/Leasing (0.1%) | |

| | 4,800 | | | Fannie Mae Ser 2008-1 (Cost $240,000) | | | 82,320 | | |

NUMBER OF

WARRANTS | |

| | EXPIRATION

DATE | |

| |

| | | Warrants (0.0%) | |

| | | Casino Gaming (f) (0.0%) | |

| | 319,500 | | | Aladdin Gaming Enterprises, Inc. - 144A (a) | | 03/01/10 | | | 0 | | |

| | | Specialty Telecommunications (d) (0.0%) | |

| | 17,020 | | | XO Holdings, Inc. (Series A) | | 01/16/10 | | | 511 | | |

| | 12,768 | | | XO Holdings, Inc. (Series B) | | 01/16/10 | | | 415 | | |

See Notes to Financial Statements

20

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

NUMBER OF

WARRANTS | |

| | EXPIRATION

DATE | | VALUE | |

| | 12,768 | | | XO Holdings, Inc. (Series C) | | 01/16/10 | | $ | 255 | | |

| | | | 1,181 | | |

| | | Total Warrants

(Cost $15,210) | | | | | 1,181 | | |

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| |

| |

| | | Short-Term Investments (25.9%) | |

| | | Securities Held as Collateral on Loaned Securities (23.7%) | |

| | | Repurchase Agreements (5.5%) | |

| $ | 2,383 | | | ABN Amro Bank N.V. (2.38%, dated 08/29/08, due 09/02/08; proceeds $2,383,708;

fully collateralized by common stock at the date of this Portfolio of Investments

as follows: Dish Network Corp.; Pfizer Inc.; valued at $2,502,234). | | | 2,383,079 | | |

| | 2,785 | | | Bank of America Securities LLC (1.95% - 2.38% dated 08/29/08, due 09/02/08;

proceeds $2,785,844; fully collateralized by U.S. Government Agency securities,

common stocks and equity units at the date of this Portfolio of Investments as follows:

Freddie Mac 5.00-5.13% due 07/15/12 - 05/01/38; Viacom Inc.; Puget Energy, Inc.;

National Fuel Gas Co.; Equitable Resources, Inc.; DreamWorks Animation

SKG, Inc.; Copano Energy LLC; Millicom International Cellular S.A.; Legg Mason Inc.;

valued at $2,883,782). | | | 2,785,153 | | |

| | 1,906 | | | Lehman Brothers Inc. (2.33%, dated 08/29/08, due 09/02/08; proceeds $1,906,956;

fully collateralized by Municipal Bond at the date of this Portfolio of Investments as

follows: Lehman Municipal Trust Receipts - Ser F2W 2.90% due 11/15/23; valued

at $1,945,003). | | | 1,906,464 | | |

| | 1,962 | | | Merrill Lynch & Co., Inc. (2.12%, dated 08/29/08, due 09/02/08; proceeds $1,962,213;

fully collateralized by U.S. Government Agency security at the date of this Portfolio of

Investments as follows: Federal National Mortgage Assoc. 5.95 due 06/07/27;

valued at $2,001,081). | | | 1,961,751 | | |

| | | | | Total Repurchase Agreements

(Cost $9,036,447) | | | 9,036,447 | | |

NUMBER OF

SHARES (000) | |

| |

| |

| | | Investment Company (m) (18.2%) | |

| | 29,838 | | | Morgan Stanley Institutional Liquidity Money Market Portfolio -

Institutional Class (n) (Cost $29,837,682) | | | 29,837,682 | | |

| | | | | Total Securities Held as Collateral on Loaned Securities

(Cost $38,874,129) | | | 38,874,129 | | |

See Notes to Financial Statements

21

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

NUMBER OF

SHARES (000) | |

| |

VALUE | |

| | | Investment Company (m) (0.4%) | |

| | 644 | | | Morgan Stanley Institutional Liquidity Money Market Portfolio -

Institutional Class (n) (Cost $644,415) | | $ | 644,415 | | |

PRINCIPAL

AMOUNT IN

THOUSANDS | |

| | COUPON

RATE | | MATURITY

DATE | |

| |

| | | U.S. Government Obligations (o) (1.8%) | |

| $ | 780 | | | U.S. Treasury Bills | | | 1.52 - 1.90 | % | | | 10/09/08 | | | | 778,541 | | |

| | 2,160 | | | U.S. Treasury Bills | | | 1.55 | | | | 10/09/08 | | | | 2,156,292 | | |

| | | Total U.S. Government Obligations

(Cost $2,935,091) | | | | | | | | | 2,934,833 | | |

| | | Total Short-Term Investments

(Cost $42,453,635) | | | | | | | | | 42,453,377 | | |

| | | Total Investments (Cost $535,511,850) (p) (r) | | | | | 122.9 | % | | | 201,466,497 | | |

| | | Liabilities in Excess of Other Assets | | | | | (22.9 | ) | | | (37,527,608 | ) | |

| | | Net Assets | | | | | 100.0 | % | | $ | 163,938,889 | | |

(a) Resale is restricted to qualified institutional investors.

(b) Issuer in bankruptcy.

(c) Non-income producing security; bond in default.

(d) Acquired through exchange offer.

(e) Non-income producing security.

(f) Securities with total market value equal to $346,034 have been valued at their fair value as determined in good faith under procedures established by and under general supervision of the Fund's Directors.

(g) Resale is restricted, acquired (12/22/98) at a cost basis of $957,527.

(h) Resale is restricted, acquired (06/10/99) at a cost basis of $133.

(i) Resale is restricted, acquired (between 06/18/98 and 05/11/99) at a cost basis of $17,257,340.

(j) Floating rate security. Rate shown is the rate in effect at August 31, 2008.

(k) Currently a zero coupon bond and is scheduled to pay interest at the rate shown at a future specified date.

(l) All or a portion of this security was on loan at August 31, 2008.

(m) See Note 4 to the financial statements regarding investments in Morgan Stanley Institutional Liquidity Money Market Portfolio-Institutional Class.

(n) Includes cash in the amount of $2,441,484 designated as collateral in connection with open swap contracts.

(o) These securities have been physically segregated in connection with open futures contracts in the amount of $467,420.

(p) Securities have been designated as collateral in the amount equal to $77,950,600 in connection with open forward foreign currency, futures and swap contracts.

(q) On September 26, 2008, Washington Mutual, Inc. filed for bankruptcy.

(r) The aggregate cost for federal income tax purposes is $533,372,629. The aggregate gross unrealized appreciation is $1,687,109 and the aggregate gross unrealized depreciation is $333,593,241, resulting in net unrealized depreciation of $331,906,132.

See Notes to Financial Statements

22

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

Futures Contracts Open at August 31, 2008

NUMBER OF

CONTRACTS | | LONG/SHORT | | DESCRIPTION, DELIVERY

MONTH AND YEAR | | UNDERLYING FACE

AMOUNT AT VALUE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

| | 79 | | | Long | | U.S. Treasury Note 2 Year,

December 2008 | | $ | 16,770,219 | | | $ | 3,502 | | |

| | 5 | | | Short | | U.S. Treasury Note 5 Year,

December 2008 | | | (559,688 | ) | | | (652 | ) | |

| | 25 | | | Short | | Swap Future 10 Year,

December 2008 | | | (2,785,156 | ) | | | 1,900 | | |

| | 32 | | | Short | | Swap Future 10 Year,

September 2008 | | | (3,583,000 | ) | | | (29,067 | ) | |

| | 54 | | | Short | | U.S. Treasury Bond 20 Year,

December 2008 | | | (6,334,875 | ) | | | 7,427 | | |

| | 280 | | | Short | | U.S. Treasury Note 10 Year,

December 2008 | | | (32,340,000 | ) | | | (77,629 | ) | |

| | | | | | | Net Unrealized Depreciation | | | | | | $ | (94,519 | ) | |

Credit Default Swap Contracts Open at August 31, 2008:

SWAP COUNTERPARTY &

REFERENCE OBLIGATION | | BUY/SELL

PROTECTION | | NOTIONAL

AMOUNT

(000) | | INTEREST

RATE | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

UBS Securities

Trane Inc. | | Buy | | $ | 1,020 | | | | 0.50 | % | | March 20, 2013 | | $ | (1,520 | ) | |

Goldman Sachs International

Trane Inc. | | Buy | | | 330 | | | | 0.50 | | | March 20, 2013 | | | (492 | ) | |

UBS Securities

Trane Inc. | | Buy | | | 1,070 | | | | 0.60 | | | March 20, 2018 | | | (972 | ) | |

Goldman Sachs International

Trane Inc. | | Buy | | | 125 | | | | 0.60 | | | March 20, 2018 | | | (113 | ) | |

Lehman Brothers, Inc.***

Arrow Electronics, Inc. | | Buy | | | 510 | | | | 1.40 | | | March 20, 2013 | | | (15,671 | ) | |

Credit Suisse

Arrow Electronics, Inc. | | Buy | | | 1,480 | | | | 1.11 | | | March 20, 2013 | | | (27,614 | ) | |

Credit Suisse

Arrow Electronics, Inc. | | Buy | | | 1,160 | | | | 1.00 | | | March 20, 2015 | | | (18,627 | ) | |

Lehman Brothers, Inc.***

Arrow Electronics, Inc. | | Buy | | | 200 | | | | 1.04 | | | March 20, 2018 | | | (4,258 | ) | |

Goldman Sachs International

Avalonbay Communities Inc. | | Buy | | | 1,625 | | | | 2.20 | | | June 20, 2013 | | | (3,937 | ) | |

See Notes to Financial Statements

23

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

SWAP COUNTERPARTY &

REFERENCE OBLIGATION | | BUY/SELL

PROTECTION | | NOTIONAL

AMOUNT

(000) | | INTEREST

RATE | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

Bank of America N.A.

Carnival Corp. | | Buy | | $ | 1,085 | | | | 1.57 | % | | March 20, 2018 | | $ | (9,751 | ) | |

Merrill Lynch, Inc.

Carnival Corp. | | Buy | | | 590 | | | | 1.60 | | | March 20, 2018 | | | (6,823 | ) | |

Goldman Sachs International

Coca-Cola Enterprises Inc. | | Buy | | | 1,860 | | | | 0.587 | | | March 20, 2013 | | | (10,924 | ) | |

Lehman Brothers, Inc.***

Coca-Cola Enterprises Inc. | | Buy | | | 1,660 | | | | 0.64 | | | March 20, 2013 | | | (13,399 | ) | |

Merrill Lynch, Inc.

Disney (Walt) Co. | | Buy | | | 2,710 | | | | 0.77 | | | March 20, 2013 | | | (42,975 | ) | |

Goldman Sachs International

Dow Jones Index | | Sell | | | 1,060 | | | | 1.40 | | | December 20, 2012 | | | (3,163 | ) | |

Merrill Lynch, Inc.

Dow Jones Index | | Sell | | | 1,095 | | | | 1.40 | | | December 20, 2012 | | | 17,660 | | |

Lehman Brothers, Inc.***

Dow Jones Index | | Sell | | | 6,435 | | | | 3.75 | | | December 20, 2012 | | | (252,400 | ) | |

UBS Securities

Dow Jones Index | | Sell | | | 2,595 | | | | 5.00 | | | June 20, 2013 | | | (106,112 | ) | |

Goldman Sachs International

Dow Jones Index | | Sell | | | 4,685 | | | | 5.00 | | | June 20, 2013 | | | (62,737 | ) | |

Lehman Brothers, Inc.***

Dow Jones Index | | Sell | | | 3,160 | | | | 5.00 | | | June 20, 2013 | | | (24,541 | ) | |

Citigroup Global Markets

Eaton Corp. | | Buy | | | 1,420 | | | | 0.82 | | | March 20, 2018 | | | 10,279 | | |

Goldman Sachs International

Eaton Corp. | | Buy | | | 600 | | | | 0.97 | | | March 20, 2018 | | | (2,423 | ) | |

Merrill Lynch, Inc.

Eaton Corp. | | Buy | | | 645 | | | | 0.92 | | | March 20, 2018 | | | (180 | ) | |

Bank of America N.A.

Goodrich Corp. | | Buy | | | 760 | | | | 0.70 | | | March 20, 2013 | | | (4,021 | ) | |

Bank of America N.A.

Goodrich Corp. | | Buy | | | 530 | | | | 0.82 | | | March 20, 2018 | | | (5,929 | ) | |

Lehman Brothers, Inc.***

Goodrich Corp. | | Buy | | | 430 | | | | 0.46 | | | March 20, 2018 | | | 6,998 | | |

Goldman Sachs International

Goodrich Corp. | | Buy | | | 510 | | | | 0.47 | | | March 20, 2018 | | | 7,911 | | |

J.P. Morgan Securities

Interpublic Group of Companies, Inc. (The) | | Buy | | | 570 | | | | 3.60 | | | September 20, 2013 | | | 20,331 | | |

See Notes to Financial Statements

24

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

SWAP COUNTERPARTY &

REFERENCE OBLIGATION | | BUY/SELL

PROTECTION | | NOTIONAL

AMOUNT

(000) | | INTEREST

RATE | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

UBS Securities

Martin Marietta Materials, Inc. | | Buy | | $ | 430 | | | | 1.78 | % | | March 20, 2013 | | $ | 7,669 | | |

UBS Securities

Martin Marietta Materials, Inc. | | Buy | | | 290 | | | | 1.73 | | | March 20, 2018 | | | 11,015 | | |

J.P. Morgan Securities

Merrill Lynch Co. | | Buy | | | 945 | | | | 2.30 | | | March 20, 2013 | | | 33,992 | | |

J.P. Morgan Securities

Nordstrom, Inc. | | Buy | | | 280 | | | | 1.07 | | | March 20, 2018 | | | 9,921 | | |

J.P. Morgan Securities

Nordstrom, Inc. | | Buy | | | 580 | | | | 1.15 | | | March 20, 2018 | | | 17,224 | | |

J.P. Morgan Securities

Pepsi Bottling Group, Inc. | | Buy | | | 640 | | | | 0.63 | | | March 20, 2013 | | | (3,186 | ) | |

J.P. Morgan Securities

Pepsi Bottling Group, Inc. | | Buy | | | 470 | | | | 0.58 | | | March 20, 2013 | | | (1,358 | ) | |

Credit Suisse

Pactiv Corp. | | Buy | | | 1,610 | | | | 1.35 | | | March 20, 2013 | | | (12,384 | ) | |

Bank of America N.A.

Pactiv Corp. | | Buy | | | 310 | | | | 1.375 | | | March 20, 2013 | | | (2,702 | ) | |

Deutsche Bank

Pactiv Corp. | | Buy | | | 570 | | | | 1.34 | | | March 20, 2013 | | | (4,151 | ) | |

Goldman Sachs International

Prologis | | Buy | | | 510 | | | | 2.97 | | | June 20, 2013 | | | 3,592 | | |

Goldman Sachs International

Qwest Capital Funding | | Sell | | | 515 | | | | 3.25 | | | December 20, 2012 | | | (45,264 | ) | |

Goldman Sachs International

Sealed Air Corp. | | Buy | | | 315 | | | | 1.24 | | | March 20, 2018 | | | 14,481 | | |

Goldman Sachs International

Sealed Air Corp. | | Buy | | | 595 | | | | 1.08 | | | March 20, 2018 | | | 34,017 | | |

J.P. Morgan Securities

SLM Corp. | | Sell | | | 525 | | | | 4.95 | | | March 20, 2013 | | | (9,203 | ) | |

Merrill Lynch, Inc.

SLM Corp. | | Sell | | | 525 | | | | 5.00 | | | March 20, 2013 | | | (8,302 | ) | |

Goldman Sachs International

Textron Financial Corp. | | Buy | | | 670 | | | | 1.05 | | | March 20, 2013 | | | 13,025 | | |

UBS Securities

Textron Financial Corp. | | Buy | | | 125 | | | | 1.01 | | | March 20, 2013 | | | 2,718 | | |

Bank of America N.A.

Textron Financial Corp | | Buy | | | 875 | | | | 0.80 | | | March 20, 2018 | | | 44,825 | | |

See Notes to Financial Statements

25

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

SWAP COUNTERPARTY &

REFERENCE OBLIGATION | | BUY/SELL

PROTECTION | | NOTIONAL

AMOUNT

(000) | | INTEREST

RATE | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

UBS Securities

Toll Brothers, Inc. | | Buy | | $ | 1,425 | | | | 2.90 | % | | March 20, 2013 | | $ | (9,290 | ) | |

Bank of America N.A.

Toll Brothers, Inc. | | Buy | | | 930 | | | | 2.90 | | | March 20, 2013 | | | (6,063 | ) | |

Deutsche Bank

Washington Mutual | | Buy | | | 955 | | | | 5.00 | | | June 20, 2013 | | | 243,281 | | |

| Net Unrealized Depreciation | | $ | (221,546 | ) | |

*** On September 15, 2008, Lehman Brothers Holdings, Inc. filed for bankruptcy. Subsequently, the Fund had effectively closed these transactions and had recorded a net payable to Lehman Brothers Holdings, Inc. regarding these contracts in the amount of $518,308.

Interest Rate Swap Contracts Open at August 31, 2008:

| COUNTERPARTY | | NOTIONAL

AMOUNT

(000) | | PAYMENTS

RECEIVED BY FUND | | PAYMENTS

MADE BY FUND | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

| Bank of America N.A. | | $ | 3,739 | | | Fixed Rate 5.550% | | Floating Rate 0.000# % | | February 22, 2018 | | $ | 72,013 | | |

| Bank of America N.A. | | | 12,510 | | | Fixed Rate 5.637 | | Floating Rate 0.000# | | March 7, 2018 | | | 278,473 | | |

| Bank of America N.A. | | | 3,600 | | | Fixed Rate 5.070 | | Floating Rate 0.000# | | April 14, 2018 | | | 3,708 | | |

| Bank of America N.A. | | | 2,865 | | | Fixed Rate 4.982 | | Floating Rate 0.000# | | April 15, 2018 | | | (6,188 | ) | |

| Bank of America N.A. | | | 17,098 | | | Fixed Rate 5.557 | | Floating Rate 0.000# | | July 24, 2023 | | | 144,478 | | |

| Bank of America N.A. | | | 13,305 | | | Floating Rate 0.000# | | Fixed Rate 5.380 | | July 24, 2018 | | | (148,484 | ) | |

| Bank of America N.A. | | | 4,671 | | | Floating Rate 0.000# | | Fixed Rate 5.957 | | February 22, 2023 | | | (93,560 | ) | |

| Bank of America N.A. | | | 16,085 | | | Floating Rate 0.000# | | Fixed Rate 6.040 | | March 7, 2023 | | | (358,535 | ) | |

| Bank of America N.A. | | | 4,610 | | | Floating Rate 0.000# | | Fixed Rate 5.470 | | April 14, 2023 | | | (28,167 | ) | |

| Bank of America N.A. | | | 3,450 | | | Floating Rate 0.000# | | Fixed Rate 5.380 | | April 15, 2023 | | | (12,317 | ) | |

| Citibank N.A. | | | 13,000 | | | Fixed Rate 5.004 | | Floating Rate 2.798# | | October 31, 2017 | | | 559,780 | | |

Deutsche Bank AG,

New York | | EUR | 8,975 | | | Fixed Rate 4.957 | | Floating Rate 0.000## | | July 24, 2018 | | | 133,248 | | |

Deutsche Bank AG,

New York | | | 17,245 | | | Fixed Rate 5.268 | | Floating Rate 0.000## | | July 3, 2023 | | | 199,358 | | |

Deutsche Bank AG,

New York | | | 2,750 | | | Fixed Rate 5.238 | | Floating Rate 0.000## | | July 9, 2023 | | | 28,442 | | |

Deutsche Bank AG,

New York | | | 2,500 | | | Fixed Rate 5.240 | | Floating Rate 0.000## | | July 10, 2023 | | | 26,004 | | |

Deutsche Bank AG,

New York | | | 13,765 | | | Floating Rate 0.000## | | Fixed Rate 4.934 | | July 1, 2018 | | | (191,439 | ) | |

Deutsche Bank AG,

New York | | | 2,195 | | | Floating Rate 0.000## | | Fixed Rate 4.861 | | July 9, 2018 | | | (22,090 | ) | |

Deutsche Bank AG,

New York | | | 1,990 | | | Floating Rate 0.000## | | Fixed Rate 4.860 | | July 10, 2018 | | | (19,881 | ) | |

See Notes to Financial Statements

26

Morgan Stanley High Yield Securities Inc.

Portfolio of Investments n August 31, 2008 continued

| COUNTERPARTY | | NOTIONAL

AMOUNT

(000) | | PAYMENTS

RECEIVED BY FUND | | PAYMENTS

MADE BY FUND | | TERMINATION

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

Deutsche Bank AG,

New York | | EUR | 11,248 | | | Floating Rate 0.000##% | | Fixed Rate 5.187 % | | July 24, 2023 | | $ | (92,408 | ) | |

JPMorgan Chase

Bank N.A. | | $ | 30,000 | | | Fixed Rate 4.902 | | Floating Rate 2.810# | | November 20, 2017 | | | 1,058,400 | | |

| Merrill Lynch & Co. | | | 3,825 | | | Fixed Rate 5.000 | | Floating Rate 0.000# | | April 15, 2018 | | | (5,814 | ) | |

| Merrill Lynch & Co. | | | 4,850 | | | Floating Rate 0.000# | | Fixed Rate 5.395 | | April 15, 2023 | | | (19,351 | ) | |

| Net Unrealized Appreciation | | $ | 1,505,670 | | |

# Floating rate represents USD-3 months LIBOR.

## Floating rate represents EUR-3 Months EURIBOR.

Forward Foreign Currency Contracts Open at August 31, 2008:

CONTRACTS

TO DELIVER | | IN EXCHANGE

FOR | | DELIVERY

DATE | | UNREALIZED

APPRECIATION | |

| EUR | 543,000 | | | $ | 843,279 | | | October 31, 2008 | | $ | 49,376 | | |

Currency Abbreviations:

EUR Euro.

MXN Mexican New Peso.

See Notes to Financial Statements

27

Morgan Stanley High Yield Securities Inc.

Financial Statements

Statement of Assets and Liabilities

August 31, 2008

| Assets: | |

| Investments in securities, at value (cost $505,029,753) (Including $37,270,440 securities loaned) | | $ | 170,984,400 | | |

| Investment in affiliate, at value (cost $30,482,097) | | | 30,482,097 | | |

| Unrealized appreciation on open forward foreign currency contracts | | | 49,376 | | |

| Unrealized appreciation on open swap contracts | | | 3,002,843 | | |

| Cash | | | 14,775 | | |

| Receivable for: | |

| Interest | | | 3,776,960 | | |

| Investments sold | | | 1,770,000 | | |

| Periodic interest on swap contracts | | | 810,920 | | |

| Variation margin | | | 95,982 | | |

| Capital stock sold | | | 1,615 | | |

| Dividends from affiliate | | | 1,556 | | |

| Prepaid expenses and other assets | | | 45,674 | | |

| Total Assets | | | 211,036,198 | | |

| Liabilities: | |

| Collateral on securities loaned at value | | | 38,874,129 | | |

| Swap contracts collateral due to brokers | | | 2,441,484 | | |

| Unrealized depreciation on open swap contracts | | | 1,718,719 | | |

| Payable for: | |

| Investments purchased | | | 1,819,686 | | |

| Capital stock redeemed | | | 224,962 | | |

| Periodic interest on swap contracts | | | 151,976 | | |

| Investment advisory fee | | | 58,348 | | |

| Transfer agent fee | | | 51,643 | | |

| Distribution fee | | | 48,693 | | |

| Administration fee | | | 11,154 | | |

| Accrued expenses and other payables | | | 502,087 | | |

| Premium received on swap contracts | | | 1,194,428 | | |

| Total Liabilities | | | 47,097,309 | | |

| Net Assets | | $ | 163,938,889 | | |

| Composition of Net Assets: | |

| Paid-in-capital | | $ | 2,407,355,814 | | |

| Net unrealized depreciation | | | (332,807,622 | ) | |

| Accumulated undistributed net investment income | | | 3,530,164 | | |

| Accumulated net realized loss | | | (1,914,139,467 | ) | |

| Net Assets | | $ | 163,938,889 | | |

| Class A Shares: | |

| Net Assets | | $ | 61,839,445 | | |

| Shares Outstanding (2,000,000,000 shares authorized, $.01 par value) | | | 37,731,170 | | |

| Net Asset Value Per Share | | $ | 1.64 | | |

Maximum Offering Price Per Share,

(net asset value plus 4.44% of net asset value) | | $ | 1.71 | | |

| Class B Shares: | |

| Net Assets | | $ | 41,721,180 | | |

| Shares Outstanding (2,000,000,000 shares authorized, $.01 par value) | | | 25,725,272 | | |

| Net Asset Value Per Share | | $ | 1.62 | | |

| Class C Shares: | |

| Net Assets | | $ | 11,842,872 | | |

| Shares Outstanding (2,000,000,000 shares authorized, $.01 par value) | | | 7,273,659 | | |

| Net Asset Value Per Share | | $ | 1.63 | | |

| Class I Shares@@: | |

| Net Assets | | $ | 48,535,392 | | |

| Shares Outstanding (2,000,000,000 shares authorized, $.01 par value) | | | 29,704,736 | | |

| Net Asset Value Per Share | | $ | 1.63 | | |

@@ Formerly Class D shares. Renamed Class I shares effective March 31, 2008.

See Notes to Financial Statements

28

Morgan Stanley High Yield Securities Inc.

Financial Statements continued

Statement of Operations

For the year ended August 31, 2008

Net Investment Income:

Income | |

| Interest | | $ | 15,520,286 | | |

| Dividends from affiliates | | | 154,216 | | |

| Income from securities loaned - net | | | 73,951 | | |

| Dividends | | | 161 | | |

| Total Income | | | 15,748,614 | | |

| Expenses | |

| Professional fees | | | 1,057,238 | | |

| Investment advisory fee | | | 796,868 | | |

| Transfer agent fees and expenses | | | 575,560 | | |

| Distribution fee (Class B shares) | | | 406,870 | | |

| Distribution fee (Class A shares) | | | 168,346 | | |

| Distribution fee (Class C shares) | | | 116,109 | | |

| Administration fee | | | 151,784 | | |

| Shareholder reports and notices | | | 100,783 | | |

| Registration fees | | | 59,724 | | |

| Other | | | 31,931 | | |

| Directors' fees and expenses | | | 18,393 | | |

| Custodian fees | | | 14,772 | | |

| Total Expenses | | | 3,498,378 | | |

| Less: rebate from Morgan Stanley affiliated cash sweep (Note 4) | | | (4,129 | ) | |

| Less: expense offset | | | (1,239 | ) | |

| Net Expenses | | | 3,493,010 | | |

| Net Investment Income | | | 12,255,604 | | |

Realized and Unrealized Gain (Loss):

Realized Gain (Loss) on: | |

| Investments | | | 2,383,447 | | |

| Futures contracts | | | (1,430,592 | ) | |

| Swap contracts | | | 457,568 | | |

| Foreign exchange transactions | | | (102,429 | ) | |

| Net Realized Gain | | | 1,307,994 | | |

| Change in Unrealized Appreciation/Depreciation on: | |

| Investments | | | (12,102,413 | ) | |

| Futures contracts | | | (94,519 | ) | |

| Swap contracts | | | 1,176,703 | | |

| Translation of other assets and liabilities denominated in foreign currencies | | | 47,264 | | |

| Net Change in Unrealized Appreciation/Depreciation | | | (10,972,965 | ) | |

| Net Loss | | | (9,664,971 | ) | |

| Net Increase | | $ | 2,590,633 | | |

See Notes to Financial Statements

29

Morgan Stanley High Yield Securities Inc.

Financial Statements continued

Statements of Changes in Net Assets

| | | FOR THE YEAR

ENDED

AUGUST 31, 2008 | | FOR THE YEAR

ENDED

AUGUST 31, 2007 | |

| Increase (Decrease) in Net Assets: | |

| Operations: | |

| Net investment income | | $ | 12,255,604 | | | $ | 15,501,672 | | |

| Net realized gain | | | 1,307,994 | | | | 4,906,322 | | |

| Net change in unrealized appreciation/depreciation | | | (10,972,965 | ) | | | (2,692,049 | ) | |

| Net Increase | | | 2,590,633 | | | | 17,715,945 | | |

| Dividends to Shareholders from Net Investment Income: | |

| Class A shares | | | (4,436,122 | ) | | | (4,803,404 | ) | |

| Class B shares | | | (3,333,056 | ) | | | (5,631,157 | ) | |

| Class C shares | | | (822,177 | ) | | | (1,057,620 | ) | |

| Class I shares@@ | | | (3,714,579 | ) | | | (4,454,336 | ) | |

| Total Dividends | | | (12,305,934 | ) | | | (15,946,517 | ) | |

| Net decrease from capital stock transactions | | | (40,565,263 | ) | | | (73,600,924 | ) | |

| Net Decrease | | | (50,280,564 | ) | | | (71,831,496 | ) | |

| Net Assets: | |

| Beginning of period | | | 214,219,453 | | | | 286,050,949 | | |

End of Period