UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transitionperiod from to

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

| Commission file numbers | Barclays PLC | 1-09246 | ||||

| Barclays Bank PLC | 1-10257 | |||||

BARCLAYS PLC

BARCLAYS BANK PLC

(Exact Names of Registrants as Specified in their Charter[s])

ENGLAND

(Jurisdiction of Incorporation or Organization)

1 CHURCHILL PLACE, LONDON E14 5HP, ENGLAND

(Address of Principal Executive Offices)

MARIE SMITH, +44 (0)20 7116 2907, MARIE.SMITH@BARCLAYS.COM

1 CHURCHILL PLACE, LONDON E14 5HP, ENGLAND

*(Name, Telephone,E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Barclays PLC

| Title of Each Class | Name of Each Exchange On Which Registered | |

| 25p ordinary shares | New York Stock Exchange* | |

| Title of Each Class | Name of Each Exchange On Which Registered | |

American Depositary Shares, each | New York Stock Exchange | |

4.375% Fixed Rate Subordinated Notes due | New York Stock Exchange | |

2.75% Fixed Rate Senior Notes due 2019 | New York Stock Exchange | |

2.00% Fixed Rate Senior Notes due 2018 | New York Stock Exchange | |

3.65% Fixed Rate Senior Notes due 2025 | New York Stock Exchange | |

2.875% Fixed Rate Senior Notes due 2020 | New York Stock Exchange | |

5.25% Fixed Rate Senior Notes due 2045 | New York Stock Exchange | |

3.25% Fixed Rate Senior Notes due 2021 | New York Stock Exchange | |

4.375% Fixed Rate Senior Notes due 2026 | New York Stock Exchange | |

5.20% Fixed Rate Subordinated Notes due 2026 | New York Stock Exchange | |

3.20% Fixed Rate Senior Notes due 2021 | New York Stock Exchange | |

Floating Rate Senior Notes due 2021 | New York Stock Exchange | |

Floating Rate Senior Notes due 2023 | New York Stock Exchange | |

| Title of Each Class | Name of Each Exchange On Which Registered | |

3.684% Fixed Rate Senior Notes due 2023 | New York Stock Exchange | |

4.337% Fixed Rate Senior Notes due 2028 | New York Stock Exchange | |

4.950% Fixed Rate Senior Notes due 2047 | New York Stock Exchange | |

| * | Not for trading, but in connection with the registration of American Depositary Shares, pursuant to the requirements to the Securities and Exchange Commission. |

Barclays Bank PLC

Title of Each Class

| Name of Each Exchange On Which Registered

| |

| Callable Floating Rate Notes 2035 | New York Stock Exchange | |

| Non-Cumulative Callable Dollar Preference Shares, Series 3 | New York Stock Exchange* | |

| American Depositary Shares, Series 3, each representing oneNon-Cumulative Callable Dollar Preference Share, Series 3 | New York Stock Exchange | |

| Non-Cumulative Callable Dollar Preference Shares, Series 5 | New York Stock Exchange* | |

| American Depositary Shares, Series 5, each representing oneNon-Cumulative Callable Dollar Preference Share, Series 5 | New York Stock Exchange | |

| 5.140% Lower Tier 2 Notes due October 2020 | New York Stock Exchange | |

| iPath® Bloomberg Commodity Index Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Agriculture Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Aluminum Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Cocoa Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Coffee Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Copper Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Cotton Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Energy Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Grains Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Industrial Metals Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Lead Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Livestock Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Natural Gas Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Nickel Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Platinum Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Precious Metals Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Softs Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Sugar Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® Bloomberg Tin Subindex Total ReturnSM ETN | NYSE Arca | |

| iPath® S&P GSCI® Total Return Index ETN | NYSE Arca | |

| iPath® S&P GSCI® Crude Oil Total Return Index ETN | NYSE Arca | |

| iPath® CBOE S&P 500 BuyWrite IndexSM ETN | NYSE Arca | |

| iPath® MSCI India IndexSM ETN | NYSE Arca | |

| iPath® EUR/USD Exchange Rate ETN | NYSE Arca | |

| iPath® GBP/USD Exchange Rate ETN | NYSE Arca | |

| iPath® JPY/USD Exchange Rate ETN | NYSE Arca | |

| iPath® S&P 500 VIX Short-Term FuturesTM ETN | NYSE Arca | |

| iPath® S&P 500 VIXMid-Term FuturesTM ETN | NYSE Arca | |

| iPath® Inverse S&P 500 VIX Short-Term FuturesTM ETN | NYSE Arca | |

| iPath® Long Extended Russell 1000® TR Index ETN | NYSE Arca | |

| iPath® Long Extended Russell 2000® TR Index ETN | NYSE Arca | |

| iPath® Long Enhanced MSCI EAFE® TR Index ETN | NYSE Arca | |

| iPath® Long Enhanced MSCI Emerging Markets Index ETN | NYSE Arca | |

| iPath® Short Enhanced MSCI Emerging Markets Index ETN | NYSE Arca | |

| iPath® Long Extended S&P 500® TR Index ETN | NYSE Arca | |

| iPath® Global Carbon ETN | NYSE Arca | |

| iPath® Optimized Currency Carry ETN | NYSE Arca | |

| iPath® US Treasury Steepener ETN | NASDAQ | |

| iPath® US Treasury Flattener ETN | NASDAQ | |

| iPath® US Treasury2-year Bull ETN | NASDAQ | |

| iPath® US Treasury2-year Bear ETN | NASDAQ | |

| iPath® US Treasury10-year Bull ETN | NASDAQ | |

| iPath® US Treasury10-year Bear ETN | NASDAQ | |

| iPath® US Treasury Long Bond Bull ETN | NASDAQ | |

| iPath® US Treasury Long Bond Bear ETN | NASDAQ | |

| iPath® Pure Beta Broad Commodity ETN | NYSE Arca | |

| iPath® Pure Beta S&P GSCI®-Weighted ETN | NYSE Arca | |

| iPath®Pure Beta Cocoa ETN | NYSE Arca | |

| iPath® Pure Beta Coffee ETN | NYSE Arca | |

| iPath® Pure Beta Cotton ETN | NYSE Arca | |

| iPath® Pure Beta Sugar ETN | NYSE Arca | |

| iPath® Pure Beta Aluminum ETN | NYSE Arca | |

| iPath® Pure Beta Copper ETN | NYSE Arca | |

| iPath® Pure Beta Lead ETN | NYSE Arca | |

| iPath® Pure Beta Nickel ETN | NYSE Arca | |

| iPath® Pure Beta Crude Oil ETN | NYSE Arca | |

| iPath® Seasonal Natural Gas ETN | NYSE Arca | |

| iPath® Pure Beta Agriculture ETN | NYSE Arca | |

| iPath® Pure Beta Grains ETN | NYSE Arca | |

| iPath® Pure Beta Softs ETN | NYSE Arca | |

| iPath® Pure Beta Industrial Metals ETN | NYSE Arca | |

| iPath® Pure Beta Energy ETN | NYSE Arca | |

| iPath® Pure Beta Livestock ETN | NYSE Arca | |

| iPath® Pure Beta Precious Metals ETN | NYSE Arca | |

| iPath® US Treasury5-year Bull ETN | NASDAQ | |

| iPath® US Treasury5-year Bear ETN | NASDAQ | |

| iPath® S&P 500 Dynamic VIX ETN | NYSE Arca | |

| iPath® Inverse S&P 500 VIX Short-Term FuturesTM ETN (II) | NYSE Arca | |

| iPath® GEMS IndexTM ETN | NYSE Arca | |

| iPath® GEMS Asia 8 ETN | NYSE Arca | |

| iPath® Asian and Gulf Currency Revaluation ETN | NYSE Arca | |

| iPath® S&P MLP ETN | NYSE Arca | |

| iPath®Series B S&P GSCI Crude Oil Total Return Index ETN | NYSE Arca | |

| Barclays ETN+ S&P 500® VEQTOR™ ETN | NYSE Arca | |

| Barclays ETN+ Shiller CAPETM ETNs | NYSE Arca | |

| Barclays ETN+ Select MLP ETN | NYSE Arca | |

| Barclays ETN+ FI Enhanced Europe 50 ETN | NYSE Arca | |

| Barclays ETN+ FI Enhanced Global High Yield ETN | NYSE Arca | |

| Barclays ETN+ FI Enhanced Europe 50 ETN Series B | NYSE Arca | |

| Barclays Women in Leadership ETN | NYSE Arca | |

| Barclays Return on Disability ETN | NYSE Arca | |

| Barclays Inverse US Treasury Composite ETN | NASDAQ | |

| * | Not for trading, but in connection with the registration of American Depositary Shares, pursuant to the requirements to the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuers’ classes of capital or common stock as of the close of the period covered by the annual report.

| Barclays PLC | 25p ordinary shares | 16,804,603,949 | ||||

| Barclays Bank PLC | £1 ordinary shares | 2,342,558,515 | ||||

| £1 preference shares | 1,000 | |||||

| £100 preference shares | 20,930 | |||||

| €100 preference shares | 31,856 | |||||

| $0.25 preference shares | 161,000,000 | |||||

| $100 preference shares | 58,133 |

Indicate by check mark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes☑ No☐

If this report is an annual or transition report, indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act 1934.

Yes☐ No☑

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrants: (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days.

Yes☑ No☐

Indicate by check mark whether the registrants have submitted electronically and posted on their corporate Web sites, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes☐ No☐

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act. (Check one):

Barclays PLC

| Large Accelerated Filer☑ | Accelerated Filer☐ | Non-Accelerated Filer☐ |

Barclays Bank PLC

| Large Accelerated Filer☐ | Accelerated Filer☐ | Non-Accelerated Filer☑ |

*Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP☐

International Financial Reporting Standards as issued by the International Accounting Standards Board ☑

Other☐

*If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17☐

Item 18☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act).

Yes☐ No☑

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes☐ No☐

SEC Form20-F Cross reference information

| Form 20-F item number | Page and caption references in this document* | |||||

| 1 | Identity of Directors, Senior Management and Advisers | Not applicable | ||||

| 2 | Offer Statistics and Expected Timetable | Not applicable | ||||

| 3 | Key Information | |||||

| A. | Selected financial data | 193, 195, 321-322, 447-448 | ||||

| B. | Capitalization and indebtedness | Not applicable | ||||

| C. | Reason for the offer and use of proceeds | Not applicable | ||||

| D. | Risk factors | 86-96 | ||||

| 4 | Information on the Company | |||||

| A. | History and development of the company | 44-46, 188, 233 (note 6), 235 (note 9), 294-295 (note 36), 298-299 (note 38), 306-307 (note 44), 308-316 (note 46), 429, 465-467 | ||||

| B. | Business overview | v (Market and other data), 182-189, 197-211, 227-230, 231 (note 2) | ||||

| C. | Organizational structure | 188, 294-295 (note 36), 308-316 (note 46), 429 | ||||

| D. | Property, plants and equipment | 223, 264 (note 21), 266-267 (note 23), 269 (note 25) | ||||

| 4A | Unresolved staff comments | Not applicable | ||||

| 5 | Operating and Financial Review and Prospects | |||||

| A. | Operating results | vi-x, 107, 149-150, 182-189, 191-211, 231-316 | ||||

| B. | Liquidity and capital resources | 104-107, 121-122, 140, 152, 154-159, 161-177, 182-189, 242-244 (note 15), 281-284 (note 30), 285 (note 31), 299-301 (note 39), 304 (note 43) | ||||

| C. | Research and development, patents and licenses, etc. | 44 | ||||

| D. | Trend information | – | ||||

| E. | Off-balance sheet arrangements | 272 (note 28), 295-298 (note 37), 299-301 (note 39) | ||||

| F. | Tabular disclosure of contractual obligations | 406-407 | ||||

| G. | Safe harbor | iv-v (Forward-looking statements) | ||||

| 6 | Directors, Senior Management and Employees | |||||

| A. | Directors and senior management | 3-5, 332-336 | ||||

| B. | Compensation | 51-85, 287-288 (note 34), 289-293 (note 35), 302-304 (note 41), 426, 446 (note r) | ||||

| C. | Board practices | 6-50, 80-83 | ||||

| D. | Employees | 47, 50 (Permanent employees by region), 199, 200, 203, 207, 208, 210 | ||||

| E. | Share ownership | 51-85, 287-288 (note 34), 302-304 (note 41), 339-341 | ||||

| 7 | Major Shareholders and Related Party Transactions | |||||

| A. | Major shareholders | 45, 331-332 | ||||

| B. | Related party transactions | 210, 302-304 (note 41), 426, 446 (note r) | ||||

| C. | Interests of experts and counsel | Not applicable | ||||

| Form 20-F item number | Page and caption references in this document* | |||||

| 8 | Financial Information | |||||

| A. | Consolidated statements and other financial information | 193-195, 219-316, 428-446 | ||||

| B. | Significant changes | Not applicable | ||||

| 9 | The Offer and Listing | |||||

| A. | Offer and listing details | 321 | ||||

| B. | Plan of distribution | Not applicable | ||||

| C. | Markets | 321 | ||||

| D. | Selling shareholders | Not applicable | ||||

| E. | Dilution | Not applicable | ||||

| F. | Expenses of the issue | Not applicable | ||||

| 10 | Additional Information | |||||

| A. | Share capital | Not applicable | ||||

| B. | Memorandum and Articles of Association | 43-46, 317-319 | ||||

| C. | Material contracts | 67-68 | ||||

| D. | Exchange controls | 326 | ||||

| E. | Taxation | 323-325 | ||||

| F. | Dividends and paying assets | Not applicable | ||||

| G. | Statement by experts | Not applicable | ||||

| H. | Documents on display | 326 | ||||

| I. | Subsidiary information | 294-295 (note 36) 308-316 (note 46) | ||||

| 11 | Quantitative and Qualitative Disclosure about Market Risk | 103, 141-151, 304 (note 43), 373-379 | ||||

| 12 | Description of Securities Other than Equity Securities | |||||

| A. | Debt Securities | Not applicable | ||||

| B. | Warrants and Rights | Not applicable | ||||

| C. | Other Securities | Not applicable | ||||

| D. | American Depositary Shares | 321, 327-328 | ||||

| 13 | Defaults, Dividends Arrearages and Delinquencies | Not applicable | ||||

| 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | Not applicable | ||||

| 15 | Controls and Procedures | |||||

| A. | Disclosure controls and procedures | 332 | ||||

| B. | Management’s annual report on internal control over financial reporting | 41 | ||||

| C. | Attestation report of the registered public accounting firm | 218 | ||||

| D. | Changes in internal control over financial reporting | 41 | ||||

| 16A | Audit Committee Financial Expert | 11 | ||||

| 16B | Code of Ethics | 330 | ||||

| 16C | Principal Accountant Fees and Services | 17-19, 304 (note 42), 329 | ||||

| 16D | Exemptions from the Listing Standards for Audit Committees | Not applicable | ||||

| 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 46, 284 (Share repurchase) | ||||

| 16F | Change in Registrant’s Certifying Accountant | Not applicable | ||||

| 16G | Corporate Governance | 330 | ||||

| 17 | Financial Statements | Not applicable (See Item 8) | ||||

| 18 | Financial Statements | Not applicable (See Item 8) | ||||

| 19 | Exhibits | Exhibit Index | ||||

| * | Captions have been included only in respect of pages with multiple sections on the same page in order to identify the relevant caption on that page covered by the corresponding Form20-F item number. |

Building the bank

of the future

Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F |

Notes

The term Barclays or Group refers to Barclays PLC together with its subsidiaries. Unless otherwise stated, the income statement analysis compares the year ended 31 December 2016 to the corresponding 12 months of 2015 and balance sheet analysis as at 31 December 2016 with comparatives relating to 31 December 2015. The abbreviations ‘£m’ and ‘£bn’ represent millions and thousands of millions of Pounds Sterling respectively; the abbreviations ‘$m’ and ‘$bn’ represent millions and thousands of millions of US Dollars respectively; and the abbreviations ‘€m’ and ‘€bn’ represent millions and thousands of millions of Euros respectively.

Comparatives have been restated to reflect the implementation of the Group business reorganisation. These restatements were detailed in our Form6-K filed with the SEC dated 15 April 2016.

The information in this announcement, which was approved by the Board of Directors on 22 February 2017, does not comprise statutory accounts within the meaning of Section 434 of the Companies Act 2006. Statutory accounts for the year ended 31 December 2015, which included certain information required for the Joint Annual Report on Form20-F of Barclays PLC and Barclays Bank PLC to the SEC and which contained an unqualified audit report under Section 495 of the Companies Act 2006 (which did not make any statements under Section 498 of the Companies Act 2006) have been delivered to the Registrar of Companies in accordance with Section 441 of the Companies Act 2006.

Barclays is a frequent issuer in the debt capital markets and regularly meets with investors via formal road-shows and other ad hoc meetings. Consistent with its usual practice, Barclays expects that from time to time over the coming quarter it will meet with investors globally to discuss these results and other matters relating to the Group.

Certainnon-IFRS measures

Barclays management believes that thenon-International Financial Reporting Standards(non-IFRS) measures included in this document provide valuable information to readers of its financial statements because they enable the reader to identify a more consistent basis for comparing the business’ performance between financial periods, and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence or are relevant for an assessment of the Group. They also reflect an important aspect of the way in which operating targets are defined and performance is monitored by Barclays management. However, anynon-IFRS measures in this document are not a substitute for IFRS measures and readers should consider the IFRS measures as well.

There are a number of key judgement areas, for example impairment calculations, which are based on models and which are subject to ongoing adjustment and modifications. Reported numbers reflect best estimates and judgements at the given point in time.

Notable items as set out on page 197 are considered to be significant items impacting comparability of performance and have been called out for each of the business segments.

Relevant terms that are used in this document but are not defined under applicable regulatory guidance or International Financial Reporting Standards (IFRS) are explained in the Results glossary of non-IFRS performance measures on page 212 and the glossary of terms on pages 449 to 464.

i

Keynon-IFRS measures included in this document, and the most directly comparable IFRS measures, are:

– Attributable profit/(loss) excluding notable items represents profit after tax excluding notable items less profit attributable tonon-controlling interests. The comparable IFRS measure is attributable profit. A reconciliation is presented on pages vi to vii;

– Average tangible shareholders’ equity is calculated as the average equity adjusted to remove the effect of goodwill and intangible assets. The comparable IFRS measure is average equity. A reconciliation is provided on page ix;

– Average allocated tangible equity represents the average tangible equity that is allocated to Barclays Core, and to the businesses. The comparable IFRS measure is average equity. A reconciliation is provided on page ix;

– Average tangible equity is equivalent to average tangible shareholders’ equity;

– Barclays Core results are considered to benon-IFRS because Barclays Core represents the sum of three Operating Segments, each of which is prepared in accordance with IFRS 8; “Operating Segments”: Barclays UK, Barclays International and Head Office. A reconciliation is provided on pages vi to viii;

– Basic earnings per share excluding notable items represents attributable profit excluding all notable items (page 197) divided by the basic weighted average number of shares in issue. The comparable IFRS measure is basic earnings per share. A reconciliation is provided on page 215;

– Core basic earnings per share excluding notable items represents basic earnings per share excluding notable items calculated for Barclays Core. Barclays Core represents the sum of three Operating Segments, each of which is prepared in accordance with IFRS 8, “Operating Segments”: Barclays UK, Barclays International and Head Office. The comparable IFRS measure is basic earnings per share. A reconciliation is provided on page 215;

– Cost: income ratio excluding notable items represents the ratio between total operating expenses excluding notable items and total income excluding notable items. The comparable IFRS measure is cost: income ratio. A reconciliation is provided on pages vi to viii;

– Core cost: income ratio excluding notable items represents cost: income ratio excluding notable items calculated for Barclays Core. Barclays Core represents the sum of three Operating Segments, each of which is prepared in accordance with IFRS 8, “Operating Segments”: Barclays UK, Barclays International and Head Office. The comparable IFRS measure is cost: income ratio. A reconciliation is provided on pages vi to viii;

– Total income excluding notable items represents total income excluding the impact of own credit, gain on disposal of Barclays’ share of Visa Europe Limited, revision of Education, Social Housing, and Local Authority (ESHLA) valuation methodology and gain on US Lehman acquisition assets. The comparable IFRS measure is total income. A full list of notable items is shown on page 197. A reconciliation is provided on pages vi to viii;

– Net operating income excluding notable items represents net operating income excluding the impact of own credit, gain on disposal of Barclays’ share of Visa Europe Limited, gain on US Lehman acquisition assets and revision of Education, Social Housing, and Local Authority (ESHLA) valuation methodology. The comparable IFRS measure is net operating income. A full list of notable items is shown on page 197. A reconciliation is provided on pages vi to viii;

ii

– Total operating expenses excluding notable items represents total operating expenses excluding the impact of provisions for UK customer redress, provisions for ongoing investigations and litigation including Foreign Exchange, gain on valuation of a component of the defined retirement benefit liability, impairment of goodwill and other assets relating to businesses being disposed and losses on sale relating to the Spanish, Portuguese and Italian businesses. The comparable IFRS measure is total operating expenses. A full list of notable items is shown on page 197. A reconciliation is provided on pages vi to viii;

– Profit after tax excluding notable items represents profit after tax excluding thepost-tax impact of own credit, impairment of goodwill and other assets relating to businesses being disposed, provisions for UK customer redress, gain on US Lehman acquisition assets, provisions for ongoing investigations and litigation including Foreign Exchange, losses on sale relating to the Spanish, Portuguese and Italian businesses, revision of Education, Social Housing, and Local Authority (ESHLA) valuation methodology, gain on a valuation of a component of the defined retirement benefit liability, and gain on disposal of Barclays’ share of Visa Europe Limited. The comparable IFRS measure is profit after tax. A reconciliation is provided on pages vi to viii;

– Profit before tax excluding notable items represents profit before tax excluding the impact of own credit, impairment of goodwill and other assets relating to businesses being disposed, provisions for UK customer redress, excluding gain on US Lehman acquisition assets, provisions for ongoing investigations and litigation including Foreign Exchange, losses on sale relating to the Spanish, Portuguese and Italian businesses, revision of Education, Social Housing, and Local Authority (ESHLA) valuation methodology, gain on a valuation of a component of the defined retirement benefit liability, and gain on disposal of Barclays’ share of Visa Europe Limited. The comparable IFRS measure is profit before tax. A reconciliation is provided on pages vi to viii;

Return on average allocated tangible equity represents the return on average tangible equity that is allocated to Barclays Core, and to the businesses. The comparable IFRS measure is return on equity. A reconciliation is provided on page ix;

– Attributable profit/(loss) excluding notable items represents attributable profit excluding the post-tax impact of own credit, impairment of goodwill and other assets relating to businesses being disposed, provisions for UK customer redress, gain on US Lehman acquisition assets, provisions for ongoing investigations and litigation including Foreign Exchange, losses on sale relating to the Spanish, Portuguese and Italian businesses, revision of Education, Social Housing, and Local Authority (ESHLA) valuation methodology, gain on a valuation of a component of the defined retirement benefit liability, and gain on disposal of Barclays’ share of Visa Europe Limited. The comparable IFRS measure is attributable profit. A full list of notable items is shown on page 197. A reconciliation to IFRS is presented on pages vi to viii;

iii

– Return on average tangible shareholders’ equity excluding notable items represents attributable profit excluding notable items, including an adjustment for the tax credit recorded in reserves in respect of other equity instruments, as a proportion of average shareholders’ equity excludingnon-controlling interests and other equity instruments adjusted for the deduction of intangible assets and goodwill. The comparable IFRS measure is return on equity. A reconciliation is provided on page 214;

– Return on average tangible shareholders’ equity is calculated as the return on equity adjusted to remove the effect of goodwill and intangible assets. The comparable IFRS measure is return on equity. A reconciliation is provided on page ix;

– Tangible net asset value per share is calculated by dividing shareholders equity, excludingnon-controlling interests and other equity instruments, less goodwill and intangible assets, by the number of issued ordinary shares. The components of the calculation have been included on page 215;

– Total operating expenses, excluding conduct and litigation charges, and other notable items represents total operating expenses excluding the impact of impairment of goodwill and other assets relating to businesses being disposed, provisions for UK customer redress, provisions for ongoing investigations and litigation including Foreign Exchange, and gain on a valuation of a component of the defined retirement benefit liability. The comparable IFRS measure is total operating expenses. A reconciliation is provided on pages vi to viii;

– Total operating expenses excluding conduct and litigation charges represents total operating expenses excluding the impact of provisions for UK customer redress, and provisions for ongoing investigations and litigation including Foreign Exchange. The comparable IFRS measure is total operating expenses. A reconciliation to IFRS is provided on pages vi to viii; and

– Transitional CET1 ratio according to FSA October 2012. This measure is calculated by taking into account the statement of the Financial Services Authority, the predecessor of the Prudential Regulation Authority, on CRD IV transitional provisions in October 2012, assuming such provisions were applied as at 1 January 2014. This ratio is used as the relevant measure starting 1 January 2014 for purposes of determining whether the automatic write-down trigger (specified as a Transitional CET1 ratio according to FSA October 2012 of less than 7.00%) has occurred under the terms of the Contingent Capital Notes issued by Barclays Bank PLC on November 21, 2012 (CUSIP: 06740L8C2) and April 10, 2013 (CUSIP: 06739FHK0). Please refer to page 155 for a reconciliation of this measure to CRD IV CET1 ratio.

Forward-looking statements

This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to the Group. Barclays cautions readers that no forward-looking statement is a guarantee of future performance and that actual results or other financial condition or performance measures could differ materially from those contained in the forward-looking statements. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘may’, ‘will’, ‘seek’, ‘continue’, ‘aim’, ‘anticipate’, ‘target’, ‘projected’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘achieve’ or other words of similar meaning. Examples of forward-looking statements include, among others, statements or guidance regarding the Group’s future financial position, income growth, assets, impairment charges, provisions, notable items, business strategy, structural reform, capital, leverage and other regulatory ratios, payment of dividends (including dividend pay-out ratios and expected payment strategies), projected levels of growth in the banking and financial markets, projected costs or savings, original and revised commitments and targets in connection with the strategic cost programme and the Group Strategy Update, rundown of assets and businesses within Barclays Non-Core, sell down of the Group’s interest in Barclays Africa Group Limited, estimates of capital expenditures and plans and objectives for future operations, projected employee numbers and other statements that are not historical fact. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. These may be affected by changes in legislation, the development of standards and interpretations under International Financial Reporting Standards, evolving practices with regard to the interpretation and application of accounting and regulatory standards, the outcome of current and future legal proceedings and regulatory investigations, future levels of conduct provisions, future levels of notable items, the policies and actions of governmental and regulatory authorities, geopolitical risks and the impact of competition. In addition, factors including (but not limited to) the following may have an effect: capital, leverage and other regulatory rules (including with regard to the future structure of the Group) applicable to past, current and future periods; UK, US, Africa, Eurozone and global macroeconomic and business conditions; the effects of continued volatility in credit markets; market related risks such as changes in interest rates and foreign exchange rates; effects of changes in valuation of credit market exposures; changes in valuation of issued securities; volatility in capital markets; changes in credit ratings of any entities within the Group or any securities issued by such entities; the potential for one or more countries exiting the Eurozone; the implications of the results of the 23 June 2016 referendum in the United Kingdom and the disruption that may result in the UK and globally from the withdrawal of the United Kingdom from the European Union; the implementation of the strategic cost programme; and the success of future acquisitions, disposals and other strategic transactions. A number of these influences and factors are beyond the Group’s control. As a result, the Group’s actual future results, dividend payments, and capital and leverage ratios may differ materially from the plans, goals, expectations and guidance set forth in the Group’s forward-looking statements. Additional risks and factors which may impact the Group’s future financial condition and performance are identified in our filings with the SEC which are available on the SEC’s website at www.sec.gov.

Any forward-looking statements made herein speak only as of the date they are made and it should not be assumed that they have been revised or updated in the light of new information or future events. Except as required by the Prudential Regulation Authority, the Financial Conduct Authority, the London Stock Exchange plc (the LSE) or applicable law, Barclays expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Barclays’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. The reader should, however, consult any additional disclosures that Barclays has made or may make in documents it has published or may publish via the Regulatory News Service of the LSE and/or has filed or may file with the SEC.

iv

Subject to our obligations under the applicable laws and regulations of the UK and the US in relation to disclosure and ongoing information, we undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Market and other data

This document contains information, including statistical data, about certain Barclays markets and its competitive position. Except as otherwise indicated, this information is taken or derived from Datastream and other external sources. Barclays cannot guarantee the accuracy of information taken from external sources, or that, in respect of internal estimates, a third party using different methods would obtain the same estimates as Barclays.

Uses of Internet addresses

This document contains inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document.

References to Pillar 3 report

This document contains references throughout to Barclays annual risk report, the Pillar 3. Reference to the aforementioned report is made for information purposes only, and information found in this report is not incorporated by reference into this document.

v

Barclays Group results reconciliation for the year ended | 31.12.16 | |||||||||||||||||||||||

| Barclays UK | Barclays International | Head Office | Barclays Core | Barclays Non-Core | Barclays Group | |||||||||||||||||||

| £m | £m | £m | £m | £m | £m | |||||||||||||||||||

Total income | 7,517 | 14,995 | 103 | 22,615 | (1,164 | ) | 21,451 | |||||||||||||||||

Own credit | - | - | (35 | ) | (35 | ) | - | (35 | ) | |||||||||||||||

Gain on disposal of Barclays’ share of Visa Europe Limited | 151 | 464 | - | 615 | - | 615 | ||||||||||||||||||

Total income excluding notable items | 7,366 | 14,531 | 138 | 22,035 | (1,164 | ) | 20,871 | |||||||||||||||||

Credit impairment charges and other provisions | (896 | ) | (1,355 | ) | - | (2,251 | ) | (122 | ) | (2,373 | ) | |||||||||||||

Net operating income/(expenses) | 6,621 | 13,640 | 103 | 20,364 | (1,286 | ) | 19,078 | |||||||||||||||||

Notable items | 151 | 464 | (35 | ) | 580 | - | 580 | |||||||||||||||||

Net operating income/(expenses) excluding notable items | 6,470 | 13,176 | 138 | 19,784 | (1,286 | ) | 18,498 | |||||||||||||||||

Operating expenses | (3,792 | ) | (9,129 | ) | (135 | ) | (13,056 | ) | (1,509 | ) | (14,565 | ) | ||||||||||||

UK bank levy | (48 | ) | (284 | ) | (2 | ) | (334 | ) | (76 | ) | (410 | ) | ||||||||||||

| Total operating expenses excluding litigation and conduct, and other notable items | (3,840 | ) | (9,413 | ) | (137 | ) | (13,390 | ) | (1,585 | ) | (14,975 | ) | ||||||||||||

Litigation and conduct | (1,042 | ) | (48 | ) | (27 | ) | (1,117 | ) | (246 | ) | (1,363 | ) | ||||||||||||

Provisions for UK customer redress | (1,000 | ) | - | - | (1,000 | ) | - | (1,000 | ) | |||||||||||||||

Litigation and conduct excluding notable items | (42 | ) | (48 | ) | (27 | ) | (117 | ) | (246 | ) | (363 | ) | ||||||||||||

Total operating expenses | (4,882 | ) | (9,461 | ) | (164 | ) | (14,507 | ) | (1,831 | ) | (16,338 | ) | ||||||||||||

Notable items | (1,000 | ) | - | - | (1,000 | ) | - | (1,000 | ) | |||||||||||||||

Total operating expenses excluding notable items | (3,882 | ) | (9,461 | ) | (164 | ) | (13,507 | ) | (1,831 | ) | (15,338 | ) | ||||||||||||

Cost: income ratio | 65% | 63% | n/a | 64% | n/a | 76% | ||||||||||||||||||

Cost: income ratio excluding notable items | 53% | 65% | n/a | 61% | n/a | 72% | ||||||||||||||||||

Other net (expenses)/income | (1 | ) | 32 | 128 | 159 | 331 | 490 | |||||||||||||||||

Profit/(loss) before tax | 1,738 | 4,211 | 67 | 6,016 | (2,786 | ) | 3,230 | |||||||||||||||||

Notable items | (849 | ) | 464 | (35 | ) | (420 | ) | - | (420 | ) | ||||||||||||||

Profit/(loss) before tax excluding notable items | 2,587 | 3,747 | 102 | 6,436 | (2,786 | ) | 3,650 | |||||||||||||||||

Attributable profit/(loss)1 | 828 | 2,412 | 110 | 3,350 | (1,916 | ) | 1,623 | |||||||||||||||||

Notable items | (857 | ) | 451 | (25 | ) | (431 | ) | - | (431 | ) | ||||||||||||||

Attributable profit/(loss) excluding notable items1 | 1,685 | 1,961 | 135 | 3,781 | (1,916 | ) | 2,054 | |||||||||||||||||

Risk weighted assets (£bn) 1 | 67.5 | 212.7 | 53.3 | 333.5 | 32.1 | 365.6 | ||||||||||||||||||

| 1 | Attributable profit in respect of the Africa Banking discontinued operation is reported at the Group level only. Allocated tangible equity, RWAs and leverage exposure are reported in Head Office within Core. |

vi

Barclays Group results reconciliation for the year ended | 31.12.15 | |||||||||||||||||||||||

| | Barclays UK | | | Barclays International | | | Head Office | | | Barclays Core |

| | Barclays Non-Core |

| | Barclays Group | | |||||||

| £m | £m | m | £m | £m | £m | |||||||||||||||||||

Total income | 7,343 | 13,747 | 338 | 21,428 | 612 | 22,040 | ||||||||||||||||||

Own credit | - | - | 430 | 430 | - | 430 | ||||||||||||||||||

Gains on US Lehman acquisition assets | - | 496 | - | 496 | - | 496 | ||||||||||||||||||

Total income excluding notable items | 7,343 | 13,251 | (92) | 20,502 | 612 | 21,114 | ||||||||||||||||||

Credit impairment charges and other provisions | (706) | (922) | - | (1,628) | (134) | (1,762) | ||||||||||||||||||

Net operating income | 6,637 | 12,825 | 338 | 19,800 | 478 | 20,278 | ||||||||||||||||||

Notable items | - | 496 | 430 | 926 | - | 926 | ||||||||||||||||||

| Net operating income/(expenses) excluding notable items | 6,637 | 12,329 | (92) | 18,874 | 478 | 19,352 | ||||||||||||||||||

Operating expenses | (3,464) | (8,029) | (272) | (11,765) | (1,958) | (13,723) | ||||||||||||||||||

| Gain on valuation of a component of the defined retirement benefit liability | 296 | 133 | - | 429 | - | 429 | ||||||||||||||||||

| Impairment of goodwill and other assets relating to businesses being disposed | (96) | (96) | ||||||||||||||||||||||

| Losses on sale relating to the Spanish, Portuguese and Italian businesses | - | - | - | - | (3) | (3) | ||||||||||||||||||

Operating expenses excluding notable items | (3,760) | (8,162) | (272) | (12,194) | (1,859) | (14,053) | ||||||||||||||||||

UK bank levy | (77) | (253) | (8) | (338) | (88) | (426) | ||||||||||||||||||

| Total operating expenses excluding litigation and conduct, and other notable items | (3,837) | (8,415) | (280) | (12,532) | (1,947) | (14,479) | ||||||||||||||||||

Litigation and conduct | (2,511) | (1,310) | (66) | (3,887) | (500) | (4,387) | ||||||||||||||||||

Provisions for UK customer redress | (2,431) | (218) | - | (2,649) | (123) | (2,772) | ||||||||||||||||||

| Provisions for ongoing investigations and litigation including Foreign Exchange | - | (984) | (52) | (1,036) | (201) | (1,237) | ||||||||||||||||||

Litigation and conduct excluding notable items | (80) | (108) | (14) | (202) | (176) | (378) | ||||||||||||||||||

Total operating expenses | (6,052) | (9,592) | (346) | (15,990) | (2,546) | (18,536) | ||||||||||||||||||

Notable items | (2,135) | (1,069) | (52) | (3,256) | (423) | (3,679) | ||||||||||||||||||

Total operating expenses excluding notable items | (3,917) | (8,523) | (294) | (12,734) | (2,123) | (14,857) | ||||||||||||||||||

Cost: income ratio | 82% | 70% | n/a | 75% | n/a | 84% | ||||||||||||||||||

Cost: income ratio excluding notable items | 53% | 64% | n/a | 62% | n/a | 70% | ||||||||||||||||||

Other net income/(expenses) | - | 45 | (106) | (61) | (535) | (596) | ||||||||||||||||||

| Losses on sale relating to the Spanish, Portuguese and Italian businesses | - | - | (112) | (112) | (465) | (577) | ||||||||||||||||||

| Other net income/(expenses) excluding notable items | - | 45 | 6 | 51 | (70) | (19) | ||||||||||||||||||

Profit/(loss) before tax | 585 | 3,278 | (114) | 3,749 | (2,603) | 1,146 | ||||||||||||||||||

Notable items | (2,135 | ) | (573 | ) | 266 | (2,442 | ) | (888 | ) | (3,330 | ) | |||||||||||||

Profit/(loss) before tax excluding notable items | 2,720 | 3,851 | (380 | ) | 6,191 | (1,715 | ) | 4,476 | ||||||||||||||||

Attributable (loss)/profit1 | (47 | ) | 1,758 | 11 | 1,722 | (2,418 | ) | (394 | ) | |||||||||||||||

Notable items | (2,008 | ) | (562 | ) | (187 | ) | (2,383 | ) | (707 | ) | (3,090 | ) | ||||||||||||

Attributable profit/(loss) excluding notable items1 | 1,961 | 2,320 | (176 | ) | 4,105 | (1,711 | ) | 2,696 | ||||||||||||||||

Average allocated tangible equity (£bn) 1 | 9.3 | 24.9 | 2.6 | 36.8 | 10.9 | 47.7 | ||||||||||||||||||

Risk weighted assets (£bn) 1 | 69.5 | 194.8 | 39.7 | 304.1 | 54.3 | 358.4 | ||||||||||||||||||

| 1 | Attributable profit in respect of the Africa Banking discontinued operation is reported at the Group level only. Allocated tangible equity, RWAs and leverage exposure are reported in Head Office within Core. |

vii

Barclays Group results reconciliation

for the year ended | 31.12.14 | |||||||||||||||||||||||

| Barclays UK | Barclays International | Head Office | Barclays Core | Barclays Non-Core | Barclays Group | |||||||||||||||||||

| £m | £m | m | £m | £m | £m | |||||||||||||||||||

Total income | 7,436 | 12,908 | 276 | 20,620 | 1,143 | 21,763 | ||||||||||||||||||

Own credit | - | - | 34 | 34 | - | 34 | ||||||||||||||||||

Revision of ESHLA valuation methodology | - | - | - | - | (935 | ) | (935 | ) | ||||||||||||||||

Gains on US Lehman acquisition assets | - | 461 | - | 461 | - | 461 | ||||||||||||||||||

Total income excluding notable items | 7,436 | 12,447 | 242 | 20,125 | 2,078 | 22,203 | ||||||||||||||||||

Credit impairment charges and other provisions | (901 | ) | (679 | ) | - | (1,580 | ) | (241 | ) | (1,821 | ) | |||||||||||||

Net operating income | 6,535 | 12,229 | 276 | 19,040 | 902 | 19,942 | ||||||||||||||||||

Notable items | - | 461 | 34 | 495 | (935 | ) | (440 | ) | ||||||||||||||||

| Net operating income/(expenses) excluding notable items | 6,535 | 11,768 | 242 | 18,545 | 1,837 | 20,382 | ||||||||||||||||||

Operating expenses | (4,108 | ) | (8,170 | ) | (70 | ) | (12,348 | ) | (2,611 | ) | (14,959 | ) | ||||||||||||

UK bank levy | (59 | ) | (248 | ) | (9 | ) | (316 | ) | (102 | ) | (418 | ) | ||||||||||||

Total operating expenses excluding litigation and conduct, and other notable items | (4,167 | ) | (8,418 | ) | (79 | ) | (12,664 | ) | (2,713 | ) | (15,377 | ) | ||||||||||||

Litigation and conduct | (1,108 | ) | (1,333 | ) | (65 | ) | (2,506 | ) | (301 | ) | (2,807 | ) | ||||||||||||

Provisions for UK customer redress | (1,067 | ) | 32 | - | (1,035 | ) | (75 | ) | (1,110 | ) | ||||||||||||||

Provisions for ongoing investigations and litigation including Foreign Exchange | - | (1,250 | ) | - | (1,250 | ) | - | (1,250 | ) | |||||||||||||||

Litigation and conduct excluding notable items | (41 | ) | (115 | ) | (65 | ) | (221 | ) | (226 | ) | (447 | ) | ||||||||||||

Total operating expenses | (5,275 | ) | (9,751 | ) | (144 | ) | (15,170 | ) | (3,014 | ) | (18,184 | ) | ||||||||||||

Notable items | (1,067 | ) | (1,218 | ) | - | (2,285 | ) | (75 | ) | (2,360 | ) | |||||||||||||

Total operating expenses excluding notable items | (4,208 | ) | (8,533 | ) | (144 | ) | (12,885 | ) | (2,939 | ) | (15,824 | ) | ||||||||||||

Cost: income ratio | 71% | 76% | n/a | 74% | n/a | 84% | ||||||||||||||||||

Cost: income ratio excluding notable items | 57% | 69% | n/a | 64% | n/a | 71% | ||||||||||||||||||

Other net (expenses)/income | - | 52 | 316 | 368 | (813 | ) | (445 | ) | ||||||||||||||||

| Losses on sale relating to the Spanish, Portuguese and Italian businesses | - | - | 315 | 315 | (761 | ) | (446 | ) | ||||||||||||||||

Other net (expenses)/income excluding notable items | - | 52 | 1 | 53 | (52 | ) | 1 | |||||||||||||||||

Profit/(loss) before tax | 1,260 | 2,530 | 448 | 4,238 | (2,925 | ) | 1,313 | |||||||||||||||||

Notable items | (1,067 | ) | (757 | ) | 349 | (1,475 | ) | (1,771 | ) | (3,246 | ) | |||||||||||||

Profit/(loss) before tax excluding notable items | 2,327 | 3,287 | 99 | 5,713 | 1,154 | 4,559 | ||||||||||||||||||

Attributable profit/(loss)1 | 852 | 926 | 374 | 2,152 | (2,659 | ) | (174 | ) | ||||||||||||||||

Notable items | (855 | ) | (808 | ) | 260 | (1,403 | ) | (1,550 | ) | (2,605 | ) | |||||||||||||

Attributable profit/(loss) excluding notable items1 | 1,707 | 1,734 | 114 | 3,555 | (1,109 | ) | 2,779 | |||||||||||||||||

Average allocated tangible equity (£bn) 1 | 9.1 | 25.0 | (2.7 | ) | 31.4 | 15.6 | 47.0 | |||||||||||||||||

Risk weighted assets (£bn) 1 | 69.3 | 201.7 | 41.8 | 312.8 | 89.1 | 401.9 | ||||||||||||||||||

| 1 | Attributable profit in respect of the Africa Banking discontinued operation is reported at the Group level only. Allocated tangible equity, RWAs and leverage exposure are reported in Head Office within Core. |

viii

| 2016 | 2015 | 2014 | ||||||||||

Average allocated equitya | £bn | £bn | £bn | |||||||||

| ||||||||||||

Barclays UK | 13.4 | 13.7 | 13.1 | |||||||||

Corporate and Investment Bank | 23.2 | 23.1 | 23.1 | |||||||||

Consumer, Cards and Payments | 5.0 | 4.0 | 4.0 | |||||||||

| ||||||||||||

Barclays International | 28.2 | 27.1 | 27.1 | |||||||||

Head Officeb | 8.0 | 3.9 | (1.3 | ) | ||||||||

| ||||||||||||

Barclays Core | 49.6 | 44.7 | 38.9 | |||||||||

BarclaysNon-Core | 7.8 | 11.2 | 16.0 | |||||||||

| ||||||||||||

Barclays Group | 57.4 | 55.9 | 54.9 | |||||||||

Effect of Goodwill and Intangibles | £bn | £bn | £bn | |||||||||

| ||||||||||||

Barclays UK | (4.5 | ) | (4.4 | ) | (3.9 | ) | ||||||

Corporate and Investment Bank | (1.4 | ) | (1.2 | ) | (1.2 | ) | ||||||

Consumer, Cards and Payments | (1.3 | ) | (1.0 | ) | (1.0 | ) | ||||||

| ||||||||||||

Barclays International | (2.7 | ) | (2.2 | ) | (2.2 | ) | ||||||

Head Officeb | (1.4 | ) | (1.3 | ) | (1.4 | ) | ||||||

| ||||||||||||

Barclays Core | (8.6 | ) | (7.9 | ) | (7.6 | ) | ||||||

BarclaysNon-Core | (0.1 | ) | (0.3 | ) | (0.3 | ) | ||||||

| ||||||||||||

Barclays Group | (8.7 | ) | (8.2 | ) | (7.9 | ) | ||||||

Average allocated tangible equityc | £bn | £bn | £bn | |||||||||

| ||||||||||||

Barclays UK | 8.9 | 9.3 | 9.1 | |||||||||

Corporate and Investment Bank | 21.9 | 21.9 | 22.0 | |||||||||

Consumer, Cards and Payments | 3.6 | 3.0 | 3.0 | |||||||||

| ||||||||||||

Barclays International | 25.5 | 24.9 | 25.0 | |||||||||

Head Officeb | 6.5 | 2.6 | (2.7 | ) | ||||||||

| ||||||||||||

Barclays Core | 41.0 | 36.8 | 31.4 | |||||||||

BarclaysNon-Core | 7.8 | 10.9 | 15.6 | |||||||||

| ||||||||||||

Barclays Group | 48.7 | 47.7 | 47.0 | |||||||||

Notes

| a | This table shows the allocation of Group average equity across IFRS and non-IFRS segments |

| b | Includes the African Banking discontinued operation |

| c | This table shows average tangible equity for the Group and for the IFRS and non-IFRS reporting segments |

ix

| 2016 | 2015 | 2014 | ||||||||||

Profit/(loss) attributable to ordinary equity holders of the parent | £m | £m | £m | |||||||||

| ||||||||||||

Barclays UK | 857 | (33 | ) | 869 | ||||||||

Corporate and Investment Bank | 1,342 | 1,180 | 421 | |||||||||

Consumer, Cards and Payments | 1,153 | 620 | 528 | |||||||||

| ||||||||||||

Barclays International | 2,495 | 1,800 | 949 | |||||||||

Head Office | 109 | 11 | 373 | |||||||||

| ||||||||||||

Barclays Core | 3,461 | 1,778 | 2,191 | |||||||||

Barclays Non-Core | (1,899 | ) | (2,405 | ) | (2,645 | ) | ||||||

Africa Banking discontinued operation | 189 | 302 | 334 | |||||||||

| ||||||||||||

Barclays Group | 1,751 | (324 | ) | (120 | ) | |||||||

| 2016 | 2015 | 2014 | ||||||||||

Average allocated equitya | £bn | £bn | £bn | |||||||||

| ||||||||||||

Barclays UK | 13.4 | 13.7 | 13.1 | |||||||||

Corporate and Investment Bank | 23.2 | 23.1 | 23.1 | |||||||||

Consumer, Cards and Payments | 5.0 | 4.0 | 4.0 | |||||||||

| ||||||||||||

Barclays International | 28.2 | 27.1 | 27.1 | |||||||||

Head Officeb | 8.0 | 3.9 | (1.3 | ) | ||||||||

| ||||||||||||

Barclays Core | 49.6 | 44.7 | 38.9 | |||||||||

Barclays Non-Core | 7.8 | 11.2 | 16.0 | |||||||||

| ||||||||||||

Barclays Group | 57.4 | 55.9 | 54.9 | |||||||||

| 2016 | 2015 | 2014 | ||||||||||

Return on average allocated equityc | % | % | % | |||||||||

| ||||||||||||

Barclays UK | 6.4% | (0.2% | ) | 6.6% | ||||||||

Corporate and Investment Bank | 5.8% | 5.1% | 1.8% | |||||||||

Consumer, Cards and Payments | 23.1% | 15.3% | 13.2% | |||||||||

Barclays International | 8.8% | 6.6% | 3.5% | |||||||||

| ||||||||||||

Barclays Core | 7.0% | 4.0% | 5.6% | |||||||||

| ||||||||||||

Barclays Group | 3.0% | (0.6% | ) | (0.2% | ) | |||||||

Notes

| a | This table shows the allocation of Group average equity across IFRS and non-IFRS reporting segments |

| b | Includes the African Banking discontinued operation |

| c | This table shows return on average equity for the Group and the return on average allocated equity for the IFRS and non-IFRS reporting segments |

x

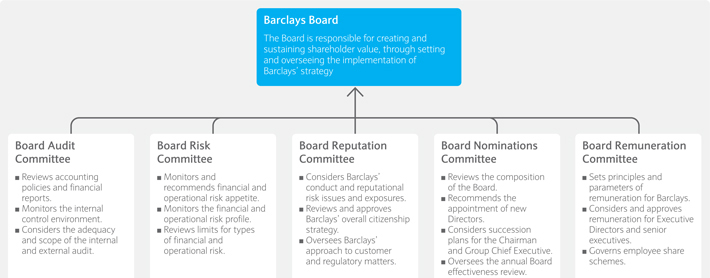

Governance

| Our corporate governance processes and the role they play in supporting the delivery of our strategy, including reports from the Chairman and each of the Board Committee Chairmen. |

Directors’ report | Page | |||

| UK Corporate Governance | § Index to disclosures | 2 | ||

| Code | ||||

| Who we are | § Board of Directors | 3 | ||

| § Group Executive Committee | 5 | |||

§ Board diversity

| 5

| |||

| What we did in 2016 | § Chairman’s introduction | 6 | ||

| § Board Audit Committee report | 10 | |||

| § Board Risk Committee report | 20 | |||

| § Board Reputation Committee report | 25 | |||

§ Board Nominations Committee report

| 29

| |||

How we comply

| 36

| |||

Other statutory information

| 51

| |||

People

| 47 | |||

Remuneration report | 43 | |||

| Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F | 1 |

Governance: Directors’ report

UK Corporate Governance Code - index to disclosures

The purpose of corporate governance is to facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company.

The purpose of corporate governance is to facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company.

The UK Corporate Governance Code

The UK Corporate Governance Code (the Code) is not a rigid set of rules. It consists of principles (main and supporting) and provisions. The Listing Rules require companies to apply the main principles and report to shareholders on how they have done so. You can find our disclosures as follows:

| Page | ||||||||

| ||||||||

| Leadership | Every company should be headed by an effective board which is collectively responsible for the long-term success of the company. | Board of Directors | | 3 to 4 39 | ||||

| ||||||||

| There should be a clear division of responsibilities at the head of the company between the running of the board and the executive responsibility for the running of the company’s business. No one individual should have unfettered powers of decision. | Roles on the Board | 37 | ||||||

| ||||||||

| The chairman is responsible for leadership of the board and ensuring its effectiveness on all aspects of its role. | Roles on the Board | 37 | ||||||

| ||||||||

| As part of their role as members of a unitary board,non-executive directors should constructively challenge and help develop proposals on strategy. | Roles on the Board | 37 | ||||||

| ||||||||

| Effectiveness | The board and its committees should have the appropriate balance of skills, experience, independence and knowledge of the company to enable them to discharge their respective duties and responsibilities effectively. | Board of Directors | 3 to 4 | |||||

| ||||||||

| There should be a formal, rigorous and transparent procedure for the appointment of new directors to the board. | Appointment and re-election of Directors | 32 | ||||||

| ||||||||

| All directors should be able to allocate sufficient time to the company to discharge their responsibilities effectively. | Attendance time commitment | | 38 39 |

| ||||

| ||||||||

| All directors should receive an induction on joining the board and should regularly update and refresh their skills and knowledge. | Induction, training and development | 39 | ||||||

| ||||||||

| The board should be supplied in a timely manner with information in a form and of a quality appropriate to enable it to discharge its duties. | Information provided to the Board | 40 | ||||||

| ||||||||

| The board should undertake a formal and rigorous annual evaluation of its own performance and that of its committees and individual directors. | Review of Board and Board Committee effectiveness | 33 | ||||||

| ||||||||

| All directors should be submitted forre-election at regular intervals, subject to continued satisfactory performance. | Roles on the Board | | 37 32 |

| ||||

| ||||||||

| Accountability | The board should present a fair, balanced and understandable assessment of the company’s position and prospects. | Risk management going concern | | 97 to 114 32 |

| |||

| ||||||||

| The board is responsible for determining the nature and extent of the principal risks it is willing to take in achieving its strategic objectives. The board should maintain sound risk management and internal control systems. | Risk management and internal control | 40 to 41 | ||||||

| ||||||||

| The board should establish formal and transparent arrangements for considering how they should apply the corporate reporting, risk management and internal control principles, and for maintaining an appropriate relationship with the company’s auditors. | Board Audit Committee report | 10 to 19 | ||||||

| ||||||||

| Remuneration | Executive directors’ remuneration should be designed to promote the long-term success of the company. Performance-related elements should be transparent, stretching and rigorously applied. | Remuneration report | 51 to 85 | |||||

| ||||||||

| There should be a formal and transparent procedure for developing policy on executive remuneration and for fixing the remuneration packages of individual directors. No director should be involved in deciding his or her own remuneration. | Remuneration report | 51 to 85 | ||||||

| ||||||||

Relations with shareholders

| There should be a dialogue with shareholders based on the mutual understanding of objectives. The board as a whole has responsibility for ensuring that a satisfactory dialogue with shareholders takes place. | Stakeholder engagement | 41 to 42 | |||||

| ||||||||

| The board should use general meetings to communicate with investors and to encourage their participation. | Stakeholder engagement | 41 to 42 | ||||||

| ||||||||

| 2 | Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F |

Governance: Directors’ report

Who we are

Board of Directors

Board of Directors

| ||||

Barclays understands the importance of having a Board containing the right balance of skills, experience and diversity and the composition of the Board is regularly reviewed by the Board Nominations Committee. The skills and experience of the current Directors and the value they bring to the Barclays Board is described below.

| ||||

| Full biographies can be accessed online via home.barclays/investorrelations

| |||

John McFarlane Chairman

Appointed: 1 January 2015

|

Relevant skills and experience John is a senior figure in global banking and financial services circles and is in his 42nd year in the sector, including 22 years as a main board director, 10 years as a CEO and six years as a chairman. John is Chairman of Barclays PLC and Barclays Bank PLC. He is also anon-executive director of Westfield Corporation and Old Oak Holdings Limited. He is chairman of TheCityUK and a member of the Financial Services Trade and Investment Board and the European Financial Round Table. John was formerly chairman of Aviva plc, where he oversaw a transformation of the company and for a brief period he was also chairman of FirstGroup plc. He was also anon-executive director of The Royal Bank of Scotland plc, joining at the time of the UK government rescue. Prior to that for 10 years he was chief executive officer of Australia and New Zealand Banking Group Ltd, Group Executive Director of Standard Chartered plc and head of Citibank in the UK.

Other current appointments None

Committees Nom*

| |||

Jes Staley Group Chief Executive

Appointed: 1 December 2015

|

Relevant skills and experience Jes joined Barclays as Group Chief Executive on 1 December 2015. He has nearly four decades of extensive experience in banking and financial services. He worked for more than 30 years at J P Morgan, initially training as a commercial banker, later advancing to the leadership of major businesses involving equities, private banking and asset management and ultimately heading the company’s Global Investment Bank. Most recently, Jes served as Managing Partner at BlueMountain Capital. These roles have provided him with a vast experience in leadership and he brings a wealth of investment banking knowledge to Barclays’ Board.

Other current appointments None

Committees None

| |||

Sir Gerry Grimstone Deputy Chairman and Senior Independent Director

Appointed: 1 January 2016

|

Relevant skills and experience Sir Gerry brings to the Board a wealth of investment banking, financial services and commercial experience gained through his senior roles at Schroders and his various board positions. Sir Gerry has global business experience across the UK, Asia, the Middle East and the US. Sir Gerry has significant experience as anon-executive director and chairman. He is currently the chairman of Standard Life plc, independentnon-executive board member of Deloitte LLP and the leadnon-executive at the Ministry of Defence.

Other current appointments Financial Services Trade and Investment Board

Committees Nom, Rep*

|

Mike Ashley Non-executive

Appointed: 18 September 2013

|

Relevant skills and experience Mike has deep knowledge of auditing and associated regulatory issues, having worked at KPMG for over 20 years, where he was a partner. Mike was the lead engagement partner on the audits of large financial services groups including HSBC, Standard Chartered and the Bank of England. While at KPMG, Mike was Head of Quality and Risk Management for KPMG Europe LLP, responsible for the management of professional risks and quality control. He also held the role of KPMG UK’s Ethics Partner.

Other current appointments ICAEW Ethics Standards Committee; Chairman, Government Internal Audit Agency; Charity Commission

Committees Aud*, Nom, Ris, Rep

| |||

Tim Breedon Non-executive

Appointed: 1 November 2012

|

Relevant skills and experience Tim joined Barclays after a distinguished career with Legal & General, where, among other roles, he was the group chief executive until June 2012. Tim’s experience as a CEO enables him to provide challenge, advice and support to the Executive on performance and decision-making.

Tim brings to the Board extensive financial services experience, knowledge of risk management and UK and EU regulation, as well as an understanding of the key issues for investors.

Other current appointments Marie Curie Cancer Care; Chairman, Apax Global Alpha Limited; Chairman, The Northview Group

Committees Aud, Nom, Rem, Ris*

| |||

Mary Francis CBE Non-executive

Appointed: 1 October 2016

|

Relevant skills and experience Mary has extensive board-level experience across a range of industries. She is a non-executive Director of Swiss Re Group and Ensco plc and was formerly Senior Independent director of Centrica and a non-executive director of the Bank of England, Aviva and Alliance and Leicester. She held senior executive positions in the UK Treasury and Prime Minister’s Office and in the City as Director General of the Association of British Insurers. She brings to Barclays strong understanding of the interaction between public and private sectors and skills in strategic decision-making and all aspects of board governance.

Other current appointments Advisory Panel of The Institute of Business Ethics

Committees Rem, Rep

| |||

Crawford Gillies Non-executive

Appointed: 1 May 2014

|

Relevant skills and experience Crawford has extensive business and management experience, gained with Bain & Company and Standard Life plc. These roles have provided him with experience in strategic decision-making and knowledge of company strategy across various sectors and geographical locations.

Crawford has also held board and committee chairman positions during his career, notably as chairman of the remuneration committees of Standard Life plc and MITIE Group PLC.

Other current appointments SSE plc; Control Risks International; The Edrington Group Limited

Committees Aud, Nom, Rem*

|

| Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F | 3 |

Governance: Directors’ report

Who we are

Board of Directors

Reuben Jeffery III Non-executive

Appointed: 16 July 2009

|

Relevant skills and experience Reuben has extensive financial services experience, particularly within investment banking and wealth management, through his role as CEO and president of Rockefeller & Co. Inc. and Rockefeller Financial Services Inc. and his former senior roles with Goldman Sachs, including as the managing partner of the Paris office. His various government roles in the US, including as chairman of the Commodity Futures Trading Commission, provides Barclays’ Board with insight into the US political and regulatory environment.

Other current appointments Advisory Board of Towerbrook Capital Partners LP; Rothschild Capital Management Limited; Financial Services Volunteer Corps; The Asia Foundation

Committees Nom, Ris

| |||

Tushar Morzaria Group Finance Director

Appointed: 15 October 2013

|

Relevant skills and experience Tushar joined Barclays in 2013 having spent the previous four years in senior management roles with JP Morgan Chase, most recently as the CFO of its Corporate & Investment Bank. Throughout his time with JP Morgan he gained strategic financial management and regulatory relations experience. Since joining the Barclays Board he has been a driving influence on the Group’s cost reduction programme and managing the Group’s capital plan, particularly in response to Structural Reform.

Other current appointments Member of the 100 Group main committee

Committees None

| |||

Dambisa Moyo Non-executive

Appointed: 1 May 2010

|

Relevant skills and experience Dambisa is an international economist and commentator on the global economy, having completed a PhD in economics. Dambisa has a background in financial services and a wide knowledge and understanding of African economic, political and social issues, in addition to her experience as a director of companies with complex, global operations. She served as anon-executive director of SABMiller Plc from 2009-2016.

Other current appointments Chevron Corporation; Barrick Gold Corporation; Seagate Technology plc

Committees Rem, Rep

| |||

Diane de Saint Victor Non-executive

Appointed: 1 March 2013

|

Relevant skills and experience Diane holds the role of general counsel and company secretary of ABB Limited, a listed pioneering technology leader in electrification products, robotics and motion, industrial automation and power grids. Diane’s legal background, combined with her knowledge of regulatory and compliance requirements bring a unique perspective to discussions of the Board and its committees.

Other current appointments American Chamber of Commerce in France

Committees Rep |

Diane Schueneman Non-executive

Appointed: 25 June 2015 |

Relevant skills and experience Diane joined Barclays after an extensive career at Merrill Lynch, holding a variety of senior roles, including responsibility for banking, brokerage services and technology provided to the company’s retail and middle market clients, and latterly for IT, operations and client services worldwide. She brings a wealth of experience in managing global, cross-discipline business operations, client services and technology in the financial services industry. Diane is a member of the board of Barclays US LLC, Barclays US intermediate holding company.

Other current appointments None

Committees Aud, Ris

| |||

Steve Thieke Non-executive

Appointed: 7 January 2014 |

Relevant skills and experience Steve has significant experience in financial services, in both investment banking with J P Morgan, where among other roles he served as the chairman of the risk management committee, and in regulation, through roles with the Federal Reserve Bank of New York and the Financial Services Authority. He also has significant board experience, having served in both executive andnon-executive director roles in his career. Steve is chairman of the board of Barclays US LLC.

Other current appointments None

Committees Ris

| |||

| Company Secretary | ||||

Claire Davies

Appointed: 1 December 2016

|

Relevant skills and experience Claire is a solicitor and a Fellow of the Institute of Chartered Secretaries and Administrators. She has substantial experience in legal, compliance and company secretarial roles gainedin-house and in professional services. She was appointed Barclays Group Company Secretary with effect from 1 December 2016, a role she has previously held at Legal & General plc and Lloyds Banking Group plc. More recently, she was Society Secretary at theCo-operative Group. She is anon-executive member of the audit and risk committee of the Department for Business, Energy & Industrial Strategy. | |||

Note

The composition of the board is shown as at 22 February 2017.

| Committee membership key | ||

| Aud | Board Audit Committee | |

| Nom | Board Nominations Committee | |

| Rem | Board Remuneration Committee | |

| Rep | Board Reputation Committee | |

| Ris | Board Risk Committee | |

| * | Committee Chairman | |

| 4 | Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F |

Who we are

Group Executive Committee

Group Executive Committee

| ||||

| Biographies for Jes Staley, Group Chief Executive, and Tushar Morzaria, Group Finance Director, who are members of the Group Executive Committee, which is chaired by Jes Staley, can be found on pages 3 and 4.

| |||

| ||||||||

|

|

| ||||||||||

Paul Compton Group Chief Operating Officer

| Bob Hoyt Group General Counsel

| Tristram Roberts Group Human Resources Director

| ||||||||||

| ||||||||||||

|

|

| ||||||||||

Mike Roemer Group Head of Compliance |

Amer Sajed CEO, Barclaycard International |

Tim Throsby President, Barclays International and Chief Executive Officer, Corporate and Investment Bank

| ||||||||||

| ||||||||||||

|

| |||||||||||

Ashok Vaswani |

CS Venkatakrishnan | |||||||||||

| CEO, Barclays UK | Chief Risk Officer | |||||||||||

| ||||||||||||

Group Executive Committee meetings are also attended on a regular basis by the Chief Internal Auditor, Sally Clark, and by anex-officio member, drawn from senior management. The currentex-officio member is Kathryn McLeland, Head of Investor Relations. | ||||||||||||

Board diversity

The Board has a balanced and diverse range of skills and experience. All Board appointments are made on merit, in the context of the diversity of skills, experience, background and gender required to be effective.

| Balance ofnon-executive Directors: executive Directors | ||||||||||

| ||||||||||

|

1 |

Chairman |

|

1 |

| |||||

| 2 | Executive Directors | 2 | ||||||||

| 3 | Non-executive Directors

| 10 | ||||||||

| ||||||||||

| Gender balance | ||||

| ||||

| Male: Female | 9:4 | |||

| ||||

| Length of tenure | ||||

| (Chairman andnon-executive Directors) | ||||

| ||||

0-3 years |

6

|

| ||

| ||||

3-6 years |

3

|

| ||

| ||||

6-9 years |

2

|

| ||

| ||||

| Geographical mix | ||||

| (Chairman andnon-executive Directors) | ||||

| ||||

UK |

6

|

| ||

| ||||

| US | 3

|  | ||

| ||||

Continental Europe | 1

|

| ||

| ||||

Other |

1

|

| ||

| ||||

Industry/background experience (Chairman andnon-executive Directors)a | ||||

| ||||

| Financial Services | 10 (91%) | |||

| Political/regulatory contacts | 11 (100%) | |||

| Current/recent Chair/CEO | 3 (27%) | |||

| Accountancy/financial | 1 (9%) | |||

| International (US) | 3 (27%) | |||

| International (Europe) | 1 (9%) | |||

| International (Rest of the World) | 3 (27%) | |||

Operations and Technology

|

| 1 (9%)

|

| |

| ||||

Note

| a | Individual Directors may fall into one or more categories |

| Barclays PLC and Barclays Bank PLC 2016 Annual Report on Form 20-F | 5 |

Governance: Directors’ report

What we did in 2016

Chairman’s introduction

Strong and effective governance… benefits companies and the UK economy more generally, by instilling public confidence and respect for the corporate sector, making the UK an attractive place to do business.

Strong and effective governance… benefits companies and the UK economy more generally, by instilling public confidence and respect for the corporate sector, making the UK an attractive place to do business.

Dear Fellow Shareholders

Welcome to my 2016 corporate governance report. When I think about corporate governance, I inevitably focus on how strong and effective governance acts to provide the necessary checks and balances at the very top of companies, thus supporting better decision-making and accountability. In turn, this benefits companies and the UK economy more generally, by instilling public confidence and respect for the corporate sector and making the UK an attractive place to do business, something that has grown in importance post the EU Referendum. As a bank, gaining this confidence and respect is paramount. Our business is founded on and operates on trust – the trust of our customers and clients, our employees and the wider public. Strong and effective corporate governance has a vital role in ensuring that we earn and keep that trust.

What is the role of the Board?

I firmly believe that the role of the Board is to focus on long-term, sustainable value creation. At the heart of our strategy, which we announced in March 2016, is building on our strength as a transatlantic consumer, corporate and investment bank, with global reach. To this end, the Board has provided critical oversight of executive management in developing and delivering this strategy, creating a smaller, simplified bank capable of producing high quality returns for our shareholders on a sustainable basis.

What were the Board’s key areas of focus in 2016?

During 2016, the Board focused its activity to support management in delivery of the agreed strategy. A summary of key items considered by the Board can be found pages 8 to 9. The main areas of Board activity have been on ensuring that we have strong foundations in place by focusing on the performance of our Core businesses, and on completing the restructuring of Barclays by accelerating therun-down of theNon-Core businesses. We also took the difficult, but important, decision to sell-down our holding in Barclays Africa. Progress in these areas is enabling us to build the Barclays of the future. As part of ensuring we are well-positioned, and to meet regulatory requirements, we have aligned our business more closely with our legal entity structure and geographic locations. You can read more about the Board’s role in preparing Barclays for Structural Reform in the case study on page 9. We also had to deal with the impacts of the UK’s vote to leave the EU and held a special meeting in the days following the EU Referendum result to assess the position for Barclays. You can read more about how we prepared for the EU Referendum in the case study on page 24.

How effective is the Board?

Effective delivery of long-term, sustainable value for shareholders requires an effective Board. It is an important part of my role as Chairman to satisfy myself that the Board – both collectively and its individual members – operates effectively. Each year, we conduct a self-assessment of our performance, with the aid of an independent facilitator, and you can read a report on the outcomes of the 2016 self-assessment on pages 34 to 35. We also describe the actions we took during 2016 in response to any matters identified for improvement during the 2015 self-assessment. I hope this provides a flavour of how seriously the Board regards this important exercise.