Filed Pursuant to Rule 424(b)(2)

Registration No. 333-265158

Underlying Supplement to the Prospectus dated May 23, 2022

and the Prospectus Supplement dated June 27, 2022

| | |

| BARCLAYS BANK PLC GLOBAL MEDIUM-TERM NOTES, SERIES A UNIVERSAL WARRANTS |

Barclays Bank PLC may, from time to time, offer and sell certain debt securities (the “notes”), as part of our Global Medium-Term Notes, Series A, and our universal warrants (the “warrants” and together with the notes, the “securities”), linked to one or more indices or exchange-traded funds.

This prospectus supplement, which we refer to as an “underlying supplement,” describes potential indices and exchange-traded funds to which the securities may be linked. This underlying supplement supplements the disclosure in any pricing supplement that may reference it, any applicable product supplement, the accompanying prospectus supplement and prospectus. A pricing supplement will describe terms that apply to specific issuances of the securities and may include updates or other modifications to the description of any relevant index or exchange-traded fund contained in this underlying supplement. You should read this underlying supplement, the related prospectus supplement dated June 27, 2022, the related prospectus dated May 23, 2022, any applicable product supplement and the applicable pricing supplement carefully before you invest. If the applicable pricing supplement is inconsistent with this underlying supplement, the applicable pricing supplement will control. Information that we indicate in this underlying supplement will or may be provided in a pricing supplement may instead be provided in a product supplement or a free writing prospectus.

This underlying supplement describes only select indices and exchange-traded funds to which the applicable securities may be linked. We do not guarantee that we will offer securities linked to any of the indices or exchange-traded funds described herein. In addition, we may offer securities linked to one or more indices or exchange-traded funds that are not described herein. In such an event, we will describe any such additional indices or exchange-traded funds in the applicable pricing supplement or in any applicable product supplement.

Investing in the securities involves a number of risks. See “Risk Factors” beginning on page US-1 of this underlying supplement and on page S-9 of the accompanying prospectus supplement for risks relating to an investment in the securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The securities are not deposit liabilities of Barclays Bank PLC and are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom or any other jurisdiction.

Barclays Capital Inc. and other entities disclosed in the applicable pricing supplement may solicit offers to subscribe for the securities as our agent. We may also issue securities to any agent as principal for its own account at prices to be agreed upon at the time of subscription. The agents may resell any securities they subscribe for as principal for their own accounts at prevailing market prices, or at other prices, as the agents determine. The applicable pricing supplement will disclose the agent’s discounts and commissions, if any. Unless we or our agent informs you otherwise in the confirmation of sale, the agents may also use this underlying supplement, the prospectus, the prospectus supplement, the applicable pricing supplement and any applicable product supplement in connection with offers and sales of the securities in market-making.

June 27, 2022

TABLE OF CONTENTS

Page

i

Offers and sales of the securities are subject to restrictions in certain jurisdictions. The distribution of this underlying supplement, the prospectus supplement, the prospectus, the pricing supplement and any applicable product supplement and the offer or sale of the securities in certain other jurisdictions may be restricted by law. Persons who come into possession of this underlying supplement, the prospectus supplement, the prospectus, the pricing supplement and any applicable product supplement or any security must inform themselves about and observe any applicable restrictions on the distribution of these materials and the offer and sale of the securities.

THE SECURITIES

The notes are part of a series of debt securities entitled “Global Medium-Term Notes, Series A” (the “medium-term notes”) that we may issue under the senior debt indenture, dated September 16, 2004, between Barclays Bank PLC and The Bank of New York Mellon, as trustee, from time to time. The warrants are part of a series of warrants entitled “Universal Warrants” (the “universal warrants”) that we may issue under either the warrant indenture to be entered into between Barclays Bank PLC and The Bank of New York Mellon, as trustee, or a warrant agreement to be entered into between Barclays Bank PLC and the applicable warrant agent, from time to time.

RISK FACTORS

You should understand the risks of investing in the securities and should reach an investment decision only after careful consideration with your advisors of the suitability of the securities in light of your particular financial circumstances and the other information included or incorporated by reference in this underlying supplement, the applicable pricing supplement, the prospectus supplement, the prospectus and any applicable product supplement. See “Risk Factors” beginning on page S-9 of the accompanying prospectus supplement for risks relating to the securities. In addition, the applicable pricing supplement will set forth additional risks relating to the particular issuance of securities including any additional risks related to any index or exchange-traded fund to which your securities are linked.

INDICES

THE BARCLAYS TRAILBLAZER SECTORS 5 INDEX

Overview

The Barclays Trailblazer Sectors 5 Index (the “Trailblazer Index”) is a rules-based proprietary index created and owned by Barclays Bank PLC. The Trailblazer Index is operated by Barclays Index Administration, an independent index administration function within Barclays Bank PLC (in such capacity, the “Trailblazer Index Sponsor”). The Trailblazer Index Sponsor has appointed a third party, Bloomberg Index Services Limited (formerly known as Barclays Risk Analytics and Index Solutions Limited) (together with any successor thereto, the “Trailblazer Index Calculation Agent”), to calculate and maintain the Trailblazer Index. While the Trailblazer Index Sponsor is responsible for the operation of the Trailblazer Index, certain aspects have thus been outsourced to the Trailblazer Index Calculation Agent. The Trailblazer Index is reported by Bloomberg under the ticker symbol “BXIITBZ5.”

The Trailblazer Index was launched on July 5, 2016. The Trailblazer Index tracks a dynamic notional portfolio selected from a universe of 14 exchange-traded funds that provide exposure to U.S. equity sectors or fixed-income assets (each, an “Index Component” and collectively, the “Index Components”), while targeting a portfolio volatility of 5.00% (the “Target Volatility”). On a daily basis, the notional financing cost described below is deducted from each Index Component and an index fee of 0.85% per annum is deducted from the Trailblazer Index.

The portfolio tracked by the Trailblazer Index is determined by in part drawing upon certain concepts from the “modern portfolio theory” approach to asset allocation. Generally, modern portfolio theory holds that an optimal investment portfolio is one that maximizes expected return for any given level of risk, where “risk” is measured by the expected volatility of the portfolio. The Trailblazer Index draws upon these ideas, in some cases with modifications, by seeking to track a portfolio constructed from the Index Components that is determined by the Trailblazer Index methodology to have the highest expected return, subject to certain weighting constraints and other conditions described below, without the portfolio volatility exceeding the Target Volatility of 5.00%.

The “Index Portfolio” on any Index Business Day (as defined below) is the hypothetical investment portfolio of Index Components and cash used to calculate the return of the Trailblazer Index on that Index Business Day. The Index Portfolio on each Index Business Day will be the Index Portfolio from the immediately preceding Index Business Day, except on an Index Business Day on which the Trailblazer Index is rebalanced. On an Index Business Day on which the Trailblazer Index is rebalanced, the Index Portfolio will consist of the Rebalance Portfolio (as defined below) as of the immediately preceding Index Business Day and, if the aggregate weight of the Rebalance Portfolio does not equal 100.00%, a cash position that will earn no return.

The Trailblazer Index is not rebalanced according to a predetermined schedule. Instead, the Trailblazer Index is monitored daily and rebalanced only when a rebalancing has been triggered. As described in more detail under “—Index Portfolio Rebalancing” below, the Trailblazer Index will be rebalanced on any Index Business Day if the composition of the Index Portfolio on the immediately preceding Index Business Day is not within specified tolerances of the composition of the Optimized Portfolio (as defined below) on the immediately preceding Index Business Day or if the volatility of the Index Portfolio or any Index Component as of the immediately preceding Index Business Day falls outside specified parameters.

The Optimized Portfolio and the Rebalance Portfolio are determined on the same basis, except that the Rebalance Portfolio includes an additional constraint to prevent an increase or decrease of more than 10 percentage points in the weight of the iShares® MBS ETF and 25 percentage points in the weight of any other Index Component in connection with a rebalancing.

| · | The Optimized Portfolio on any Index Business Day is the portfolio constructed from the Index Components that is determined by the Trailblazer Index methodology to have the highest expected return, without the Portfolio Volatility (as defined under “—Portfolio Volatility” below) of that portfolio exceeding the Target Volatility of 5.00%, where the weight of each Index Component and the aggregate weight of that portfolio are each greater than or equal to 0.00% and less than or equal to 100.00%. The Optimized Portfolio is never used to calculate the level of the Trailblazer Index but instead is used to determine whether a rebalancing of the Trailblazer Index has been triggered. |

| · | The Rebalance Portfolio on any Index Business Day is, like the Optimized Portfolio, the portfolio constructed from the Index Components that is determined by the Trailblazer Index methodology to have the highest expected return, without the Portfolio Volatility of that portfolio exceeding the Target Volatility of 5.00%, where the weight of each Index Component and the aggregate weight of that portfolio are each greater than or equal to 0.00% and less than or equal to 100.00%, but with the further constraint that the weight of each Index Component other than the iShares® MBS ETF, in the Rebalance Portfolio must be within 25 percentage points of the weight of that Index Component in the existing Index Portfolio on that Index Business Day. For the iShares® MBS ETF, the weight in the Rebalance Portfolio must be within 10 percentage points of the weight in the existing Index Portfolio on that Index Business Day. The Rebalance Portfolio reflects the portfolio of Index Components that will be included in the Index Portfolio upon a rebalancing. |

To determine the compositions of the Optimized Portfolio and the Rebalance Portfolio, the Trailblazer Index must determine which hypothetical investment portfolio constructed from the Index Components with an expected risk represented by the Target Volatility of 5.00% has the highest expected return on the relevant Index Business Day, subject to the relevant constraints set forth above. Modern portfolio theory prescribes a method for constructing an optimal investment portfolio assuming that the expected returns and risk of the available assets, and the expected degree of correlation among their returns, are known, but modern portfolio theory does not prescribe how to determine expected returns, risk or correlation. Therefore, any investment methodology that seeks to implement concepts drawn from modern portfolio theory must employ its own method of determining expected returns, risk and correlation.

The expected risk (i.e., volatility) of a portfolio depends on the expected volatility of each of the assets included in that portfolio and on the expected degree of correlation among the returns of those assets. Therefore, to determine the expected volatility of any portfolio, the Trailblazer Index requires measures of both the expected volatility of each Index Component and the expected degrees of correlation among their returns. The Trailblazer Index approximates the expected volatility of the Index Components, and the expected degree of correlation among their returns, by referencing historical volatility and correlation. These historical measures are based on the daily returns of the Index Components and are determined using calculations that give greater weight to more recent returns, as described under “—Index Component Volatility and Correlation” below.

The expected return of any portfolio reflects the expected returns of the assets that make up that portfolio and can be calculated as the weighted average of the expected returns of those assets. Therefore, the Trailblazer Index also requires a measurement of the expected returns of the Index Components in order to determine the expected return of any portfolio constructed from the Index Components.

For this purpose, the Trailblazer Index operates under the assumption that taking on greater risk (i.e., volatility) provides for potentially greater returns than taking on less risk. Specifically, the Trailblazer Index assumes that there is a relationship between expected volatility and expected returns and that this relationship is the same for each of the Index Components. In other words, the Trailblazer Index assumes that the risk-adjusted returns of the Index Components are the same. By assuming a direct relationship between expected volatility and expected return, the Trailblazer Index is able to use expected volatility as a proxy for expected return. For this purpose, the Trailblazer Index approximates the expected volatility of the Index Components by referencing historical volatility.

Accordingly, for purposes of the Trailblazer Index, and given the assumptions described above, the portfolio with the highest expected return that satisfies the relevant constraints will be the portfolio with the highest weighted-average Index Component volatility (because volatility is used as a proxy for expected return), without the Portfolio Volatility of that portfolio exceeding the Target Volatility of 5.00%.

The Trailblazer Index is an excess return index. Accordingly, each Index Component is calculated on an excess-return basis, which means that the value of each Index Component for purposes of the Trailblazer Index reflects the reinvestment of distributions and the deduction of a notional financing cost equal to the Cash Rate. The “Cash Rate” accrues at the rate equal to the ICE LIBOR USD 3 Month rate (Bloomberg Code: US0003M Index). LIBOR (the London Interbank Offered Rate) reflects the rate at which banks lend the specified currency to each other for the relevant period in the London interbank market.

The Trailblazer Index is calculated based on the value of the Index Components and cash included in the Index Portfolio, after taking into account the notional exposure of the Trailblazer Index to the Index Portfolio, as described below, minus the index fee of 0.85% per annum. The amount deducted as a result of the index fee is not affected by

the composition of the Index Portfolio or the notional exposure of the Trailblazer Index to the Index Portfolio. Accordingly, the index fee is not reduced when a portion of the Index Portfolio is allocated to the cash position or when the Trailblazer Index is partially uninvested.

In addition to targeting the Target Volatility in the rebalancing process described above, the Trailblazer Index also adjusts its notional exposure to the Index Portfolio in an attempt to maintain a volatility for the Trailblazer Index approximately equal to the Target Volatility of 5.00%, subject to a maximum exposure of 150.00% and a minimum exposure of 0.00%. We refer to the notional exposure that the Trailblazer Index has to the performance of the Index Portfolio on any Index Business Day as the “Capped Participation” on that Index Business Day. If the Capped Participation is less than 100.00% on any Index Business Day, the difference will be notionally uninvested and will earn no return. For more details, see “Capped Participation” below.

The Trailblazer Index Sponsor publishes the level of the Trailblazer Index (the “Index Level”) on each Index Business Day as soon as reasonably practical following its calculation, subject to Index Market Disruption Events and Index Adjustment Events, both as described below.

An “Index Business Day” is any day on which the New York Stock Exchange is open for trading during its regular trading session, notwithstanding the New York Stock Exchange closing prior to its scheduled weekday closing time.

The Trailblazer Index is a “notional” or “synthetic” portfolio of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Trailblazer Index merely references certain assets, the performance of which will be used in determining the composition of the Trailblazer Index and calculating the Trailblazer Index in accordance with the Trailblazer Index methodology.

Barclays Trailblazer Sectors 5 Index Components

The table below sets forth the Index Components and, for each Index Component, the asset class, the ticker symbol, the Trailblazer Index currently tracked by that Index Component (each, an “Underlying Index” and, collectively, the “Underlying Indices”), the Excess Return Index Component Base Date and the Index Component Base Date. For additional information about each Index Component, see “Background on the Index Components” below.

| Asset Class | Index Component | Ticker | Underlying Index | Excess Return Index Component Base Date | Index Component Base Date |

| Equity Sectors | Materials Select Sector SPDR® Fund | XLB UP | Materials Select Sector Index | 12/22/1998 | 12/22/1998 |

| Energy Select Sector SPDR® Fund | XLE UP | Energy Select Sector Index | 12/22/1998 | 12/22/1998 |

| Financial Select Sector SPDR® Fund | XLF UP | Financial Select Sector Index | 12/22/1998 | 12/22/1998 |

| Industrial Select Sector SPDR® Fund | XLI UP | Industrials Select Sector Index | 12/22/1998 | 12/22/1998 |

| Technology Select Sector SPDR® Fund | XLK UP | Technology Select Sector Index | 12/22/1998 | 12/22/1998 |

| Consumer Staples Select Sector SPDR® Fund | XLP UP | Consumer Staples Select Sector Index | 12/22/1998 | 12/22/1998 |

| Utilities Select Sector SPDR® Fund | XLU UP | Utilities Select Sector Index | 12/22/1998 | 12/22/1998 |

| Health Care Select Sector SPDR® Fund | XLV UP | Health Care Select Sector Index | 12/22/1998 | 12/22/1998 |

| Consumer Discretionary Select Sector SPDR® Fund | XLY UP | Consumer Discretionary Select Sector Index | 12/22/1998 | 12/22/1998 |

| Communication Services Select Sector SPDR® Fund | XLC UP | Communication Services Select Sector Index | 12/21/2007 | 5/14/2019 |

| iShares® U.S. Real Estate ETF | IYR UP | Dow Jones U.S. Real Estate Capped Index | 6/19/2000 | 6/19/2000 |

| Fixed Income | iShares® 20+ Year Treasury Bond ETF | TLT UQ | ICE U.S. Treasury 20+ Year Bond Index | 2/28/1994 | 7/26/2002 |

| iShares® MBS ETF | MBB UQ | Bloomberg U.S. MBS Index | 12/30/1988 | 3/16/2007 |

| iShares® iBoxx $ High Yield Corporate Bond ETF | HYG UP | Markit iBoxx USD Liquid High Yield Index | 12/19/2001 | 4/11/2007 |

Excess Return Index Component Levels

The Trailblazer Index is an excess return index. Accordingly, the value of each Index Component for purposes of the Trailblazer Index reflects the price of that Index Component, plus the reinvestment of that Index Component’s distributions, minus a notional financing cost equal to the Cash Rate, which is the ICE LIBOR USD 3 Month rate. We refer to this value, with respect to each Index Component, as the “Excess Return Index Component Level” of that Index Component.

The Excess Return Index Component Level of each Index Component was set equal to 100.0000 on the Excess Return Index Component Base Date for that Index Component. In order to calculate the Excess Return Index Component Level on any subsequent Index Business Day, the Trailblazer Index Sponsor must first calculate the Total Return Index Component Level (i.e., the value of the Index Component with distributions reinvested, as defined below) on that Index Business Day. The Trailblazer Index Sponsor then calculates the Excess Return Index Component Level on that Index Business Day by adjusting the Excess Return Index Component Level on the immediately preceding Index Business Day to reflect (a) the return of the Total Return Index Component Level from the immediately preceding Index Business Day to the current Index Business Day and (b) the deduction of the notional financing cost equal to the Cash Rate that has accrued since the immediately preceding Index Business Day, calculated based on the number of calendar days from but excluding the immediately preceding Index Business

Day to and including the current Index Business Day divided by 360. If the Cash Rate is not available on any Index Business Day, the latest available Cash Rate will be used.

The “Total Return Index Component Level” of each Index Component was set equal to 100.0000 on the Index Component Base Date for that Index Component. On any subsequent Scheduled Trading Day, the Trailblazer Index Sponsor calculates the Total Return Index Component Level of an Index Component by adjusting the Total Return Index Component Level of that Index Component on the immediately preceding Scheduled Trading Day to reflect the return of the Valuation Price of that Index Component from the immediately preceding Scheduled Trading Day to the current Scheduled Trading Day, where any distribution receivable from that Index Component is hypothetically reinvested in additional units of that Index Component on the Index Business Day immediately preceding the relevant ex-distribution date. If the Valuation Price of an Index Component is not available on any ex-distribution date, the relevant distribution will be hypothetically reinvested on the immediately following Scheduled Trading Day on which the Valuation Price of that Index Component is available. If the Total Return Index Component Level is not available on the immediately preceding Scheduled Trading Day, the most recent available Total Return Index Component Level will be used for purposes of calculating the Total Return Index Component Level. In the event of a share split, the Valuation Price of the relevant Index Component will be adjusted to account for the impact of that share split for purposes of calculating the Total Return Index Component Level.

The “Valuation Price” means, with respect to an Index Component on any Scheduled Trading Day, the official closing price or value of that Index Component on the primary exchange or quotation system on which that Index Component is traded on that Scheduled Trading Day, as determined by the Trailblazer Index Sponsor. If an Index Component does not have an official closing price or value available on the primary exchange or quotation system on any Scheduled Trading Day, the most recent available Valuation Price will be used on that Scheduled Trading Day. If there is a change in the primary exchange or quotation system, the new primary exchange or quotation system will be used from the first Scheduled Trading Day when there is one previous Valuation Price available from that primary exchange or quotation system.

The Valuation Price for each Index Component will be determined by the Trailblazer Index Sponsor by reference to the Data Source. The “Data Source” is Bloomberg, provided that, if the Trailblazer Index Sponsor is not able to find the relevant information from Bloomberg, the Data Source will be FactSet; provided further that, if the Trailblazer Index Sponsor is not able to find the relevant information from FactSet, the Trailblazer Index Sponsor will look for alternative information sources, including company websites, exchange notices or any other alternative generally available information sources, and any such information source will constitute the Data Source for the purposes of the Trailblazer Index.

“Scheduled Trading Day” means, with respect to an Index Component, any day on which the relevant Exchange and, if applicable, each Related Exchange for that Index Component is scheduled to be open for trading for its regular trading sessions.

“Exchange” with respect to an Index Component, the principal exchange on which that Index Component is listed for trading.

“Related Exchange” means, in respect of an Index Component, each exchange or quotation system where trading has a material effect (as determined by the Trailblazer Index Sponsor) on the overall market for futures or options contracts relating to that Index Component or any Underlying Asset of that Index Component.

“Underlying Asset” means, with respect to an Index Component, each share, bond, commodity, futures or options contract or other asset and/or component securities composing that Index Component.

Cash Level

If the Index Portfolio’s exposure to the Index Components is not 100.00%, the Index Portfolio will allocate exposure to a cash position so that the total exposure to the Index Components and the cash position will be 100.00%. The value of the cash position is represented by the “Cash Level,” which is equal to 100.0000 on each Index Business Day. Accordingly, the cash position will earn no return.

Index Component Volatility and Correlation

The historical volatility of an Index Component as of an Index Business Day is calculated based on an exponentially weighted average of the daily returns of the Excess Return Index Component Level of that Index Component over the historical period from the Excess Return Index Component Base Date of that Index Component to the current Index Business Day, which we refer to as the “Look-Back Period.” Similarly, the historical correlation of any two Index Components as of an Index Business Day is calculated based on an exponentially weighted average of the products of the daily returns of the Excess Return Index Component Levels of those Index Components, adjusted for the volatility of each Index Component, over the shorter of the Look-Back Periods for the two Index Components. For this purpose, the historical volatility of each Index Component is a statistical measurement of the degree of variability of the exponentially weighted daily returns of the Excess Return Index Component Level of that Index Component over the Look-Back Period, and the historical correlation among the Index Components is a statistical measurement of the degree to which the exponentially weighted daily returns of the Index Components moved together during the Look-Back Period and whether they moved in the same or opposite direction. Limited by the available price history of each Index Component, the daily return of an Index Component on any day prior to and including the Excess Return Index Component Base Date for such Index Component set forth in the table above is assumed to be zero for purposes of any calculation derived from such daily return.

An exponentially weighted average is a type of weighted average that gives exponentially greater weight to more recent daily returns, as illustrated in the chart below. As a result, more recent daily returns will have a greater effect on the measured historical volatility and correlation than less recent daily returns. The degree to which more recent daily returns have a greater effect than less recent daily returns is dictated by the “half-life” used in the calculation of historical volatility or correlation. For example, if the half-life is 63, in calculating the historical volatility or correlation, the aggregate weight assigned to the most recent 63 daily returns will be 50.00%, and the aggregate weight assigned to all prior daily returns will be 50.00%. In addition, the aggregate weight assigned to each subsequent group of 63 daily returns, including daily returns on days prior to and including the Excess Return Index Component Base Date, will be half of the aggregate weight assigned to the preceding group of 63 daily returns, as illustrated in the chart below.

The chart below illustrates the effect of the exponential weighting described above for a half-life of 63 over the most recent 252 daily returns, which represents the final year of the Look-Back Period. For each daily return shown, the chart indicates the percentage weight that will be given to that daily return in calculating the exponentially weighted average of the relevant Index Component’s daily returns over the Look-Back Period. For example, the most recent daily return has a weight of approximately 1.094% in calculating the exponentially weighted average. The next most recent daily return has a slightly smaller percentage weight than the percentage weight given to the most recent daily return, and each subsequent earlier daily return has a progressively smaller percentage weight. As the chart illustrates, the most recent daily returns have a significantly greater weight than less recent daily returns in determining the exponentially weighted average.

On each Index Business Day, the Trailblazer Index Sponsor calculates the volatility of each Index Component with half-lives of 21 and 63 and the correlation for each pair of Index Components with half-lives of 63, 126 and 252. We refer to the volatility of an Index Component calculated with respect to each half-life as an “Index Component Volatility Measure,” and we refer to the correlation of two Index Components calculated with respect to each half-life as an “Index Component Correlation Measure.”

Portfolio Volatility

The historical volatility of a portfolio on any Index Business Day is determined based on the weight and historical volatility of each of the Index Components that make up that portfolio on that Index Business Day, as well as the degree of historical correlation among those Index Components. A portfolio with a lower degree of correlation among its assets will have a lower volatility than a portfolio with a higher degree of correlation among its assets if the volatilities and weights of the individual assets are the same. This is because the daily returns of assets with a lower degree of correlation will offset each other to a greater extent than the daily returns of assets with a higher degree of correlation, resulting in less variability in portfolio returns for a portfolio composed of assets with a lower degree of correlation and more variability in portfolio returns for a portfolio composed of assets with a higher degree of correlation.

On each Index Business Day, the Trailblazer Index Sponsor calculates the volatility of each relevant portfolio (e.g., the Index Portfolio and the portfolios referenced in determining whether and how the Trailblazer Index will be rebalanced) using each combination of Index Component Volatility Measures and Index Component Correlation Measures, resulting in six different measures of the volatility of that portfolio (each, a “Portfolio Volatility Measure”). For example, the volatility of a portfolio calculated using Index Component Volatility Measures with a half-life of 21 and Index Component Correlation Measures with a half-life of 63 represents one of the six Portfolio Volatility Measures for that portfolio. Referencing the highest of six measures of portfolio volatility allows the Trailblazer Index to better capture any recent increases in the volatility or correlation of the Index Components and lessen the impact of any recent decreases in the volatility or correlation of the Index Components. We refer to the highest of the Portfolio Volatility Measures of a portfolio as the “Portfolio Volatility” of that portfolio.

Valuation and Composition of the Index Portfolio

The value of the Index Portfolio (the “Index Portfolio Level”) reflects the value of the Index Components and cash notionally included in the Index Portfolio on that Index Business Day. The Index Portfolio Level was set equal

to 100.0000 on December 20, 2002 (the “Index Portfolio Base Date”). On any subsequent Index Business Day, the Index Portfolio Level is equal to:

| · | the sum of the products, for each Index Component, of the number of units of that Index Component notionally included in the Index Portfolio on that Index Business Day (the “Index Component Units” of that Index Component) and the Excess Return Index Component Level of that Index Component on that Index Business Day; plus |

| · | the product of the number of units of cash notionally included in the Index Portfolio on that Index Business Day (the “Cash Units”) and the Cash Level. |

The Index Component Units of each Index Component and the Cash Units notionally included in the Index Portfolio on each Index Business Day will be the Index Component Units of that Index Component and the Cash Units, respectively, notionally included in Index Portfolio on the immediately preceding Index Business Day, except on an Index Business Day on which the Trailblazer Index is rebalanced (each, an “Index Rebalancing Date”). On an Index Rebalancing Date, the Index Component Units of each Index Component will be set to reflect the composition of the Rebalance Portfolio on the immediately preceding Index Business Day (the “Index Selection Date”) and, if the aggregate weight of the Rebalance Portfolio does not equal 100.00%, the Index Portfolio will allocate exposure to Cash Units so that the aggregate weight of the Index Components and the cash position will be 100.00%:

| · | the Index Component Units of each Index Component notionally included in the Index Portfolio on an Index Rebalancing Date will be equal to the product of (a) the weight of that Index Component in the Rebalance Portfolio on the corresponding Index Selection Date and (b) the quotient of the Index Portfolio Level on that Index Selection Date divided by the Excess Return Index Component Level of that Index Component on that Index Selection Date; and |

| · | the Cash Units notionally included in the Index Portfolio on an Index Rebalancing Date will be equal to (a) the Cash Units on the immediately preceding Index Business Day, plus (b) the number of units of cash corresponding to the value of the units of any Index Component removed from the Index Portfolio on that Index Rebalancing Date, minus (c) the number of units of cash corresponding to the value of the units of any Index Component added to the Index Portfolio on that Index Rebalancing Date. |

For this purpose, the number of units of cash corresponding to the value of the units of any Index Component added to or removed from the Index Portfolio will equal, for each such Index Component, the quotient of (a) the product of the number of units of that Index Component being added to or removed from the Index Portfolio and the Excess Return Index Component Level of that Index Component as of that Index Rebalancing Date, divided by (b) the Cash Level that Index Rebalancing Date.

The weight of any Index Component notionally included in the Index Portfolio on any Index Business Day (the “Effective Weight” of that Index Component) is equal to the quotient of (a) the product of the Index Component Units of that Index Component as of that Index Business Day and the Excess Return Index Component Level of that Index Component on that Index Business Day, divided by (b) the Index Portfolio Level on that Index Business Day.

Index Portfolio Rebalancing

The Trailblazer Index is not rebalanced according to a predetermined schedule. Instead, the Trailblazer Index is rebalanced only when a rebalancing has been triggered. A rebalancing will be triggered and the Trailblazer Index will be rebalanced on any Index Business Day if the composition of the Index Portfolio on the immediately preceding Index Business Day is not within specified tolerances of the composition of the Optimized Portfolio on the immediately preceding Index Business Day or if the volatility of the Index Portfolio or any Index Component as of the immediately preceding Index Business Day falls outside specified parameters.

More specifically, the Trailblazer Index will be rebalanced on any Index Business Day if any of the following occurs:

| · | the sum of the Effective Weights of the Index Components representing U.S. equity sectors in the Index Portfolio on the immediately preceding Index Business Day is above or below the sum of the weights of |

those Index Components in the Optimized Portfolio on the immediately preceding Index Business Day by 10.00% or more;

| · | the sum of the Effective Weights of the Index Components representing fixed-income assets in the Index Portfolio on the immediately preceding Index Business Day is above or below the sum of the weights of those Index Components in the Optimized Portfolio on the immediately preceding Index Business Day by 10.00% or more; |

| · | the Portfolio Volatility of the Index Portfolio on the immediately preceding Index Business Day is above the Target Volatility of 5.00% by more than 1.00%; or |

| · | either of the Index Component Volatility Measures of any Index Component on the immediately preceding Index Business Day is more than 5.00% above or below the corresponding Index Component Volatility of that Index Component on the Index Business Day immediately preceding the Trailblazer Index Business day on which the Trailblazer Index was last rebalanced. |

Optimized Portfolio and Rebalance Portfolio

The Optimized Portfolio and the Rebalance Portfolio are determined on the same basis, except that the Rebalance Portfolio includes an additional constraint to prevent an increase or decrease of more than 10 percentage points in the weight of the iShares® MBS ETF and 25 percentage points in the weight of any other Index Component in connection with a rebalancing:

| · | the “Optimized Portfolio” on any Index Business Day is the portfolio constructed from the Index Components that is determined by the Trailblazer Index methodology to have the highest expected return, without the Portfolio Volatility of that portfolio exceeding the Target Volatility of 5.00%, where the weight of each Index Component and the aggregate weight of that portfolio are each greater than or equal to 0.00% and less than or equal to 100.00%; and |

| · | the “Rebalance Portfolio” on any Index Business Day is, like the Optimized Portfolio, the portfolio constructed from the Index Components that is determined by the Trailblazer Index methodology to have the highest expected return, without the Portfolio Volatility of that portfolio exceeding the Target Volatility of 5.00%, where the weight of each Index Component and the aggregate weight of that portfolio are each greater than or equal to 0.00% and less than or equal to 100.00%, but with the further constraint that the weight of each Index Component other than the iShares® MBS ETF, in the Rebalance Portfolio must be within 25 percentage points of the weight of that Index Component in the existing Index Portfolio on that Index Business Day. For the iShares® MBS ETF, the weight in the Rebalance Portfolio must be within 10 percentage points of the weight in the existing Index Portfolio on that Index Business Day. |

The expected return of any portfolio reflects the expected returns of the assets that make up that portfolio and can be calculated as the weighted average of the expected returns of those assets. As described above, the Trailblazer Index uses expected volatility as a proxy for expected return, and the Trailblazer Index approximates the expected volatility of the Index Components by referencing historical volatility.

Accordingly, for purposes of the Trailblazer Index, and given the assumptions described above, the portfolio with the highest expected return that satisfies the relevant constraints will be the portfolio with the highest weighted-average Index Component volatility (because volatility is used as a proxy for expected return), without the Portfolio Volatility of that portfolio exceeding the Target Volatility of 5.00%. The Trailblazer Index Sponsor calculates the weighted-average volatility of the Index Components in any given portfolio on any Index Business Day as the sum of the products, for each Index Component, of (a) the weight of that Index Component in that portfolio and (b) the greater of the Index Component Volatility Measures of that Index Component on that Index Business Day.

Capped Participation

The Trailblazer Index adjusts its notional exposure to the Index Portfolio (also referred to as the Capped Participation of the Trailblazer Index to the Index Portfolio) in an attempt to maintain a volatility for the Trailblazer Index approximately equal to the Target Volatility of 5.00%, subject to a maximum exposure of 150.00% and a minimum exposure of 0.00%. If the Capped Participation is less than 100.00% on any Index Business Day, the difference will be notionally uninvested and will earn no return. For this purpose, the volatility of the Index Portfolio

is calculated based on an exponentially weighted average of the daily returns of the Index Portfolio over the historical period from the Index Portfolio Base Date to the current Index Business Day, calculated with a half-life of 21 (the “Index Portfolio Volatility”).

The Trailblazer Index will adjust its Capped Participation on any given Index Business Day only if the change in the exposure from the immediately preceding Index Business Day would exceed a “volatility buffer” of 10.00%. Accordingly, the Trailblazer Index Sponsor calculates the Indicated Participation on each Index Business Day and compares it to the Capped Participation on the immediately preceding Index Business Day. If the Indicated Participation on the current Index Business Day is more than 10.00% above or below the Capped Participation on the immediately preceding Index Business Day, the Capped Participation on the current Index Business Day will equal that Indicated Participation (subject to a maximum of 150.00% and a minimum of 0.00%, as described in the previous paragraph); otherwise, the Capped Participation on the current Index Business Day will equal the Capped Participation on the immediately preceding Index Business Day. For example, if the Capped Participation is 50.00% on any given Index Business Day, the Trailblazer Index will not adjust the Capped Participation on any subsequent Index Business Day until the Indicated Participation is greater than 60.00% or be less than 40.00%.

The “Indicated Participation” on each Index Business Day will equal the Target Volatility of 5.00% divided by the Index Portfolio Volatility measured as of the immediately preceding Index Business Day. The Indicated Participation will be less than 100.00% when the Index Portfolio Volatility on the immediately preceding Index Business Day is greater than 5.00% and greater than 100.00% when Index Portfolio Volatility on the immediately preceding Index Business Day is less than 5.00%.

For example, in respect of any Index Business Day, if the Index Portfolio Volatility determined with respect to the immediately preceding Index Business Day is 10.00%, the Indicated Participation on the current Index Business Day will be 50.00% (5.00% divided by 10.00%). If the Indicated Participation is used as the Capped Participation on the current Index Business Day, this would mean that if the Index Portfolio appreciates by 2.00% on the immediately following Index Business Day, the Trailblazer Index would appreciate only by 1.00%, and if the Index Portfolio depreciates by 2.00% on the immediately following Index Business Day, the Trailblazer Index would depreciate only by 1.00% (in each case, less the index fee). In addition, in respect of any Index Business Day, if the Index Portfolio Volatility determined with respect to the immediately preceding Index Business Day is 3.00%, the Indicated Participation on the current Index Business Day will be 166.70% (5.00% divided by 3.00%). Since any Capped Participation is subject to a maximum of 150.00%, an Indicated Participation of 166.70% will differ from the Capped Participation as of the immediately preceding Index Business day by more than 10.00%. As a result, the Capped Participation on the current Index Business Day will be equal to the Indicated Participation, subject to a maximum of 150.00% and a minimum of 0.00%. Therefore, the Capped Participation will be 150.00%. This would mean that if the Index Portfolio appreciates by 2.00% on the immediately following Index Business Day, the Trailblazer Index would appreciate by 3.00%, and if the Index Portfolio depreciates by 2.00% on the immediately following Index Business Day, the Trailblazer Index would depreciate by 3.00% (in each case, less the index fee).

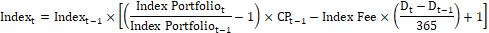

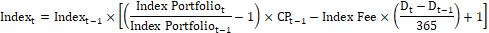

Barclays Trailblazer Sectors 5 Index Calculation

The Index Level was set equal to 100.0000 on December 31, 2003 (the “Index Base Date”). Subject to Index Market Disruption Events and Index Adjustment Events, on any subsequent Index Business Day, the Trailblazer Index Sponsor calculates the Index Level by adjusting the Index Level on the immediately preceding Index Business Day to reflect (a) the return of the Index Portfolio from the immediately preceding Index Business Day, scaled by the Capped Participation as of the immediately preceding Index Business Day and (b) the deduction of the index fee that has accrued since the immediately preceding Index Business Day, as set forth in the following formula:

where:

| · |  is the Index Level on the current Index Business Day; is the Index Level on the current Index Business Day; |

| · |  is the Index Level on the immediately preceding Index Business Day; is the Index Level on the immediately preceding Index Business Day; |

| · |  is the Index Portfolio Level on the current Index Business Day; is the Index Portfolio Level on the current Index Business Day; |

| · |  is the Index Portfolio Level on the immediately preceding Index Business Day; is the Index Portfolio Level on the immediately preceding Index Business Day; |

| · |  is the Capped Participation as of the immediately preceding Index Business Day; is the Capped Participation as of the immediately preceding Index Business Day; |

| · |  is the number of calendar days from but excluding the immediately preceding Index Business Day to and including the current Index Business Day. is the number of calendar days from but excluding the immediately preceding Index Business Day to and including the current Index Business Day. |

Background on the Index Components

Included below is a brief description of each of the Index Components. This information has been obtained from publicly available sources, without independent verification. The sponsor of each Index Component is required to file information specified by the SEC periodically. Information with respect to each Index Component provided to or filed with the SEC under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, can be located by reference to SEC file numbers set forth below with respect to that Index Component through the SEC’s website at http://www.sec.gov. We have not independently verified the accuracy or completeness of such information.

| · | The Materials Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the materials sector, as represented by the Materials Select Sector Index. The Materials Select Sector Index includes companies from the following industries: chemicals; metals and mining; paper and forest products; containers and packaging; and construction materials. The SEC file numbers with respect to the Materials Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Energy Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the energy sector, as represented by the Energy Select Sector Index. The Energy Select Sector Index includes companies from the following industries: oil, gas and consumable fuels; and energy equipment and services. The SEC file numbers with respect to the Energy Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Financial Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the financials sector, as represented by the Financial Select Sector Index. The Financial Select Sector Index includes companies from the following industries: diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts; consumer finance; and thrifts and mortgage finance. The SEC file numbers with respect to the Financial Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Industrial Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the industrials sector, as represented by the Industrials Select Sector Index. The Industrials Select Sector Index includes companies from the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; professional services; electrical equipment; construction and engineering; trading companies and distributors; airlines; and building products. The SEC file numbers with respect to the Industrial Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Technology Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the information technology sector, as represented by the Technology Select Sector Index. The Technology Select Sector Index includes companies from the following industries: technology hardware, storage and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components. The SEC file numbers with respect to the Technology Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Consumer Staples Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the consumer staples sector, as represented by the Consumer Staples Select Sector Index. The Consumer Staples Select Sector Index includes companies from the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products. The SEC file numbers with respect to the Consumer Staples Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Utilities Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the utilities sector, as represented by the Utilities Select Sector Index. The Utilities Select Sector Index includes companies from the following industries: electric utilities; water utilities; multi-utilities; independent power and renewable electricity producers; and gas utilities. The SEC file numbers with respect to the Utilities Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Health Care Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the health care sector, as represented by the Health Care Select Sector Index. The Health Care Select Sector Index includes companies from the following industries: pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology. The SEC file numbers with respect to the Health Care Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Consumer Discretionary Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the consumer discretionary sector, as represented by the Consumer Discretionary Select Sector Index. The Consumer Discretionary Select Sector Index includes companies from the following industries: retail (specialty, multiline, internet and direct marketing); hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; auto components; distributors; leisure products; and diversified consumer services. The SEC file numbers with respect to the Consumer Discretionary Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The Communication Services Select Sector SPDR® Fund is an exchange-traded fund that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the communication services sector, as represented by the Communication Services Select Sector Index. The Communication Services Select Sector Index includes companies from the following industries: diversified telecommunication services; wireless telecommunication services; media; entertainment; and interactive media and services. The SEC file numbers with respect to the Communication Services Select Sector SPDR® Fund are 333-57791 and 811-08837. |

| · | The iShares® U.S. Real Estate ETF is an exchange-traded fund that seeks to track the investment results, before fees and expenses, of an index composed of U.S. equities in the real estate sector, which is currently the Dow Jones U.S. Real Estate Capped Index. Effective January 2021, the iShares® U.S. Real Estate ETF’s underlying index changed from the Dow Jones U.S. Real Estate Index to the Dow Jones U.S. Real Estate Capped Index. The Dow Jones U.S. Real Estate Capped Index measures the performance of the real estate sector of the U.S. equity market, subject to capping methodology that limits the weight of the securities of any single issuer to a maximum of 10%. The SEC file numbers with respect to the iShares® U.S. Real Estate ETF are 333-92935 and 811-09729. |

| · | The iShares® 20+ Year Treasury Bond ETF is an exchange-traded fund that seeks to track the investment results, before fees and expenses, of an index composed of U.S. treasury bonds with remaining maturities greater than twenty years, which is currently the ICE U.S. Treasury 20+ Year Bond Index. The ICE U.S. Treasury 20+ Year Bond Index measures the performance of public obligations of the U.S. Treasury, includes publicly issued U.S. treasury securities that have a remaining maturity greater than 20 years, have $300 million or more of outstanding face value (excluding amounts held by the Federal Reserve), are fixed rate and denominated in U.S. dollars. The SEC file numbers with respect to the iShares® 20+ Year Treasury Bond ETF are 333-92935 and 811-09729. |

| · | The iShares® MBS ETF is an exchange-traded fund that seeks to track the investment results, before fees and expenses, of an index composed of investment-grade mortgage-backed pass-through securities issued and/or guaranteed by U.S. government agencies, which is currently the Bloomberg U.S. MBS Index. The Bloomberg U.S. MBS Index tracks agency mortgage backed pass-through securities (both fixed-rate and hybrid adjustable-rate mortgage) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The SEC file numbers with respect to the iShares® MBS ETF are 333-92935 and 811-09729. |

| · | The iShares® iBoxx $ High Yield Corporate Bond ETF is an exchange-traded fund that seeks to track the investment results, before fees and expenses, of an index consisting of liquid, U.S. dollar-denominated, high yield corporate bonds, which is currently the Markit iBoxx USD Liquid High Yield Index. The Markit iBoxx USD Liquid High Yield Index is designed to reflect the performance of U.S. dollar denominated high yield corporate debt through a broad coverage of the U.S. dollar high yield liquid bond universe. The SEC file numbers with respect to the iShares® iBoxx $ High Yield Corporate Bond ETF are 333-92935 and 811-09729. |

Modifications to the Trailblazer Index

Index Market Disruption Events

If an Index Market Disruption Event occurs or is continuing on any Index Business Day and that Index Market Disruption Event materially affects the Trailblazer Index, the Trailblazer Index Sponsor may:

| · | defer or suspend publication of the Index Level and any other information relating to the Trailblazer Index until it determines that no Index Market Disruption Event is continuing; |

| · | if that Index Business Day is an Index Selection Date, postpone that Index Selection Date to the next Index Business Day on which it determines that such Index Market Disruption Event is not continuing. As a result, the related Index Rebalancing Date will also be postponed and will occur on the first Index Business Day following the postponed Index Selection Date; |

| · | if that Index Business Day is an Index Rebalancing Date, postpone that Index Rebalancing Date to the next Index Business Day on which it determines that such Index Market Disruption Event is not continuing; or |

| · | discontinue supporting the Trailblazer Index or terminate the calculation and publication of the Index Level, if the Trailblazer Index Sponsor determines that the measures provided in the three bullets above produce results that are not consistent with the objectives of the Trailblazer Index. |

An “Index Market Disruption Event” means the occurrence of one or more of the following events if the Trailblazer Index Sponsor determines that such event is material with respect to any Index Component:

| · | a suspension, absence or limitation of trading in (1) that Index Component in its primary market, as determined by the Trailblazer Index Sponsor, or (2) futures or options contracts relating to that Index Component in the primary market for those contracts, as determined by the Trailblazer Index Sponsor, in either case for more than two hours of trading or at any time during the one-half hour period preceding the close of the regular trading session in that market or, if the relevant valuation time is not the close of the regular trading session in that market, the relevant valuation time; |

| · | any event that disrupts or impairs, as determined by the Trailblazer Index Sponsor, the ability of market participants in general to (1) effect transactions in, or obtain market values for, that Index Component in its primary market, or (2) effect transactions in, or obtain market values for, futures or options contracts relating to that Index Component in the primary market for those contracts, in either case for more than two hours of trading or at any time during the one-half hour period preceding the close of the regular trading session in that market or, if the relevant valuation time is not the close of the regular trading session in that market, the relevant valuation time; |

| · | the closure on any Scheduled Trading Day of the primary market for that Index Component prior to the scheduled weekday closing time of that market (without regard to after hours or any other trading outside of the regular trading session hours) unless the earlier closing time is announced by the primary market at least |

one hour prior to the earlier of (1) the actual closing time for the regular trading session on that primary market on that Scheduled Trading Day and (2) the submission deadline for orders to be entered into the relevant exchange system for execution at the close of trading on that Scheduled Trading Day for that primary market;

| · | any Scheduled Trading Day on which (1) the primary market for that Index Component or (2) the exchanges or quotation systems, if any, on which futures or options contracts relating to that Index Component are traded, fail to open for trading during their respective regular trading sessions; |

| · | a General Banking Moratorium; or |

| · | an event that makes it impossible or not reasonably practicable on any Index Business Day for the Trailblazer Index Sponsor to obtain the price of that Index Component, or any other price, level or rate required for the purposes of calculating the level of the Trailblazer Index in a manner acceptable to the Trailblazer Index Sponsor. |

The following events will not be Index Market Disruption Events:

| · | a limitation on the hours or number of days of trading in the relevant market or relevant exchange only if the limitation results from an announced change in the regular business hours of the relevant market or relevant exchange (not on a temporary basis); or |

| · | a decision to permanently discontinue trading in futures or options contracts relating to any Index Component. |

For this purpose, an absence of trading on an exchange or market will not include any time when the relevant exchange or market is itself closed for trading under ordinary circumstances.

In contrast, a suspension or limitation of trading in an Index Component in its primary market, or in futures or options contracts relating to an Index Component, if available, in the primary market for those contracts, by reason of any of:

| · | a price change exceeding limits set by that market, |

| · | an imbalance of orders relating to that Index Component or those contracts, as applicable, or |

| · | a disparity in bid and ask quotes relating to that Index Component or those contracts, as applicable, |

will constitute a suspension or material limitation of trading.

“General Banking Moratorium” means the declaration of a general moratorium in respect of banking activities in London or New York.

Index Adjustment Events

If an Index Adjustment Event occurs on any Index Business Day and that Index Adjustment Event materially affects the Trailblazer Index, the Trailblazer Index Sponsor may, acting in a manner consistent with the objectives of the Trailblazer Index:

| · | make such determinations and/or adjustments as the Trailblazer Index Sponsor considers necessary in order to maintain the objectives of the Trailblazer Index, in relation to (a) the methodology used to calculate the Trailblazer Index or (b) the Index Level; |

| · | select a successor Index Component to replace the Index Component affected by the Index Adjustment Event that is substantially similar to the affected Index Component; |

| · | defer or suspend publication of the Index Level and any other information relating to the Trailblazer Index until it determines that no Index Adjustment Event is continuing; |

| · | if the Index Business Day on which the Index Adjustment Event occurs or is continuing is an Index Selection Date, postpone that Index Selection Date to the next Index Business Day on which it determines that such Index Adjustment Event is not continuing. As a result, the Index Rebalancing Date will also be postponed and will occur on the first Index Business Day following the new Index Selection Date; |

| · | if the Index Business Day on which the Index Adjustment Event occurs or is continuing is an Index Rebalancing Date, postpone that Index Rebalancing Date to the next Index Business Day on which it determines that such Index Adjustment Event is not continuing; or |

| · | discontinue supporting the Trailblazer Index or terminate the calculation and publication of the Index Level, if the Trailblazer Index Sponsor determines that the measures provided in the five bullets above are not feasible or would produce results that are not consistent with the objectives of the Trailblazer Index. |

Any of the following will be an “Index Adjustment Event”:

| · | the Trailblazer Index Sponsor determines, at any time, that an Index Force Majeure Event occurs or is continuing; |

| · | the Trailblazer Index Sponsor determines, at any time, that there has been (or there is pending) a change in taxation (a) generally affecting commercial banks organized and subject to tax in the United Kingdom (including, but not limited to, any tax generally imposed on commercial banks organized and subject to tax in the United Kingdom), or (b) generally affecting market participants who hold positions in any of the Index Components or Underlying Assets, as the case may be; or |

| · | a change (including termination or disappearance of an Index Component) will have been made to any of the Index Components or there will have occurred any other event that would make the calculation of the Trailblazer Index impossible or infeasible, technically or otherwise, or that makes the Trailblazer Index non-representative of market prices of the Index Components or undermines the objectives of the Trailblazer Index. |

An “Index Force Majeure Event” means any event or circumstance (including, without limitation, a systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labor disruption or any similar intervening circumstance) that is beyond the reasonable control of the Trailblazer Index Sponsor and that the Trailblazer Index Sponsor determines affects the Trailblazer Index, any Index Component or, if applicable, any Underlying Asset, the methodology on which the Trailblazer Index is based or the Trailblazer Index Sponsor’s ability to calculate and publish the Trailblazer Index.

Modifications to the Trailblazer Index Methodology or the Trailblazer Index; Termination of the Trailblazer Index

While the Trailblazer Index Sponsor currently employs the methodology described above, no assurance can be given that market, regulatory, juridical, financial, fiscal or other circumstances will not arise that would, in its view, necessitate a modification or change of that methodology (including the information or inputs on which the Trailblazer Index is based) or termination of the Trailblazer Index. Consequently, the Trailblazer Index Sponsor reserves the right to modify or change that methodology, consistent with the objectives of the Trailblazer Index.

The Trailblazer Index Sponsor assumes no obligation to implement any modification or change to the methodology described above as a result of any market, regulatory, juridical, financial, fiscal or other circumstances (including, but not limited to, any changes to or any suspension or termination of, or any other events affecting, the Trailblazer Index or any Index Component).

Notwithstanding anything to the contrary under “—Index Sponsor” below, the Trailblazer Index Sponsor may, at any time and in its sole discretion, terminate the calculation and/or publication of the Index Level without regard to any other factors.

If the Trailblazer Index is modified, changed or terminated, the Trailblazer Index Sponsor will publish any modifications or changes or an announcement of that termination, as applicable.

Index Sponsor

All determinations, modifications, changes or suspensions made by the Trailblazer Index Sponsor (a) will be made by it acting in its sole discretion, by reference to such factors as the Trailblazer Index Sponsor deems appropriate, and consistent with the objectives of the Trailblazer Index and (b) will be final, conclusive and binding in the absence of manifest error, and no person shall be entitled to make any claim against the Trailblazer Index Sponsor or its affiliates regarding any such determination, modification, change or suspension.

The Trailblazer Index Sponsor reserves the right to make adjustments to correct errors contained in previously published information and to publish the corrected information, including but not limited to, Index Levels, but is under no obligation to do so.

Barclays Bank PLC may terminate the appointment of, and replace, the Trailblazer Index Sponsor with a successor index sponsor. Following termination of the appointment of the Trailblazer Index Sponsor, Barclays Bank PLC will publish an announcement of that termination and the identity of the successor index sponsor as soon as reasonably practicable.

Disclaimers

Neither Barclays Bank PLC nor the Trailblazer Index Sponsor guarantees the accuracy and/or completeness of the Trailblazer Index, any data included therein, or any data on which it is based, and neither Barclays Bank PLC nor the Trailblazer Index Sponsor will have any liability for any errors, omissions, or interruptions therein.

Neither Barclays Bank PLC nor the Trailblazer Index Sponsor makes any warranty, express or implied, as to the results to be obtained from the use of the Trailblazer Index. Barclays Bank PLC and the Trailblazer Index Sponsor make no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Trailblazer Index or any data included therein. Without limiting any of the foregoing, in no event will Barclays Bank PLC or the Trailblazer Index Sponsor have any liability for any lost revenues or profits (whether direct or indirect) or for any special, punitive, indirect or consequential damages, even if notified of the possibility of such damages.

None of Barclays Bank PLC, the Trailblazer Index Sponsor, any of their respective affiliates or subsidiaries and any of the respective directors, officers, employees, representatives, delegates or agents of any of the foregoing entities will have any responsibility to any person (whether as a result of negligence or otherwise) for any determination made or anything done (or omitted to be determined or done) in respect of the Trailblazer Index or publication of the levels of the Trailblazer Index (or failure to publish such value) and any use to which any person may put the Trailblazer Index or the levels of the Trailblazer Index. In addition, although the Trailblazer Index Sponsor reserves the right to make adjustments to correct previously incorrectly published information, including but not limited to the levels of the Trailblazer Index, the Trailblazer Index Sponsor is under no obligation to do so, and Barclays Bank PLC and the Trailblazer Index Sponsor will have no liability in respect of any errors or omissions.

Bloomberg Index Services Limited is the official index calculation and maintenance agent of the Trailblazer Index, an index owned and administered by Barclays Bank PLC. Bloomberg Index Services Limited does not guarantee the timeliness, accurateness, or completeness of the Trailblazer Index calculations or any data or information relating to the Trailblazer Index. Bloomberg Index Services Limited makes no warranty, express or implied, as to the Trailblazer Index or any data or values relating thereto or results to be obtained therefrom, and expressly disclaims all warranties of merchantability and fitness for a particular purpose with respect thereto. To the maximum extent allowed by law, Bloomberg Index Services Limited, its affiliates, and all of their respective partners, employees, subcontractors, agents, suppliers and vendors (collectively, the “protected parties”) shall have no liability or responsibility, contingent or otherwise, for any injury or damages, whether caused by the negligence of a protected party or otherwise, arising in connection with the calculation of the Trailblazer Index or any data or values included therein or in connection therewith and shall not be liable for any lost profits, losses, punitive, incidental or consequential damages.

Nothing in the disclaimers above will exclude or limit liability to the extent such exclusion or limitation is not permitted by law.

THE DOW JONES INDUSTRIAL AVERAGE®

All information contained in this underlying supplement regarding the Dow Jones Industrial Average®, including, without limitation, its make-up, method of calculation and changes in its components, has been derived from publicly available information, without independent verification. This information reflects the policies of, and is subject to change by, S&P Dow Jones Indices LLC (“S&P Dow Jones”). The Dow Jones Industrial Average® is calculated, maintained and published by S&P Dow Jones. S&P Dow Jones has no obligation to continue to publish, and may discontinue the publication of, the Dow Jones Industrial Average®.

The Dow Jones Industrial Average® is a price-weighted index that seeks to measure of the performance of 30 U.S. blue-chip companies. Except for the Global Industry Classification Standard (“GICS®”) transportation industry group from the industrials sector and the utilities sector, the Dow Jones Industrial Average® includes constituents from a variety of sectors. The Dow Jones Industrial Average® is reported by Bloomberg L.P. under the ticker symbol “INDU.”

Calculation of the Dow Jones Industrial Average®

The Dow Jones Industrial Average® is price-weighted rather than market capitalization-weighted, which means that weightings are based only on changes in the stocks’ prices, rather than by both price changes and changes in the number of shares outstanding. The value of the Dow Jones Industrial Average® is the sum of the primary exchange prices of each of the 30 component stocks included in the Dow Jones Industrial Average® divided by a divisor. The divisor used to calculate the price-weighted average of the Dow Jones Industrial Average® is not simply the number of component stocks; rather, the divisor is adjusted to smooth out the effects of price-impacting corporate actions, including price adjustments, special dividends, stock splits and rights offerings. The index divisor will also adjust in the event of an addition to or deletion from the Dow Jones Industrial Average®.

Construction and Maintenance of the Dow Jones Industrial Average®

The index universe consists of securities in the S&P 500® Index, excluding stocks classified under GICS® code 2030 (Transportation) and 55 (Utilities). While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. Since the Dow Jones Industrial Average® is price-weighted, the Averages Committee (as defined below) evaluates stock price when considering a company for inclusion. The Averages Committee monitors whether the highest-priced stock in the Dow Jones Industrial Average® has a price more than 10 times that of the lowest. Maintaining adequate sector representation within the Dow Jones Industrial Average® is also a consideration in the selection process for the Dow Jones Industrial Average®. Companies should be incorporated and headquartered in the United States, and a plurality of revenues should be derived from the United States.

Changes to the Dow Jones Industrial Average® are made on an as-needed basis. There is no annual or semi-annual reconstruction. Rather, changes in response to corporate actions and market developments can be made at any time. Constituent changes are typically announced one to five days before they are scheduled to be implemented.

Multiple Share Classes. Each company in the Dow Jones Industrial Average® is represented once by the primary listing, which is generally the most liquid share line.

Other Adjustments. In cases where there is no achievable market price for a stock being deleted, it can be removed at a zero or minimal price at the discretion of the Averages Committee, in recognition of the constraints faced by investors in trading bankrupt or suspended stocks.

The table below summarizes the treatment of certain corporate actions.

Corporate Action | Treatment |

| Company addition/deletion | Addition Only A stock is added to the Dow Jones Industrial Average® at a weight determined by the price of the added stock relative to all other index constituents. There is a divisor adjustment. |

Corporate Action | Treatment |

| | Deletion Only |

| | |

| | The weights of all stocks in the Dow Jones Industrial Average® will proportionally change but relative weights will stay the same. The index divisor will change. |

| | |

| Split/reverse split | Stock price is adjusted by the split ratio. Shares outstanding are not adjusted by the split ratio. There is a divisor adjustment. |

| | |

| Spin-off | Any potential impacts on index constituents from a spin-off are evaluated by the Averages Committee on a case by case basis. The price of the parent company is adjusted to the price of the parent company minus (the price of the spun-off company/share exchange ratio). The index divisor adjusts simultaneously. |

| | |