Exhibit 99.2

Innovative Food Holdings

Forward-Looking Statements

This presentation contains certain forward-looking statements and information relating to Innovative Food Holdings, Inc. (the “Company”) that are based on the current beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company. Such statements, including those related to our growth plans, reflect the current views of the Company with respect to future events and are subject to certain assumptions, including those described in this release. Should one or more of these underlying assumptions prove incorrect, actual results may vary materially from those described herein, which include words such as “should,” “could,” “will,” “anticipate,” “believe,” “intend,” “plan,” “might,” “potentially” “targeting” or “expect”, or similar expressions. Additional factors that could also cause actual results to differ materially relate to current conditions and expected future developments, international crises, environmental and economic issues and other risk factors described in our public filings. As a result, readers are cautioned not to place undue reliance on these forward-looking statements and should understand that these statements are not guarantees of performance or results and that there are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from those expressed in these statements, including, among others: economic factors affecting consumer confidence and discretionary spending; cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers and interruption of product supply or increases in product costs; changes in our relationships with vendors and customers. The Company does not intend to update these forward-looking statements.

For a detailed discussion of these risks, uncertainties and other factors that could cause our actual results to differ materially from those anticipated or expressed in any forward-looking statements, see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”). Additional risks and uncertainties are discussed from time to time in current, quarterly and annual reports filed by the Company with the SEC, which are available on the SEC’s website at https://www.sec.gov/.

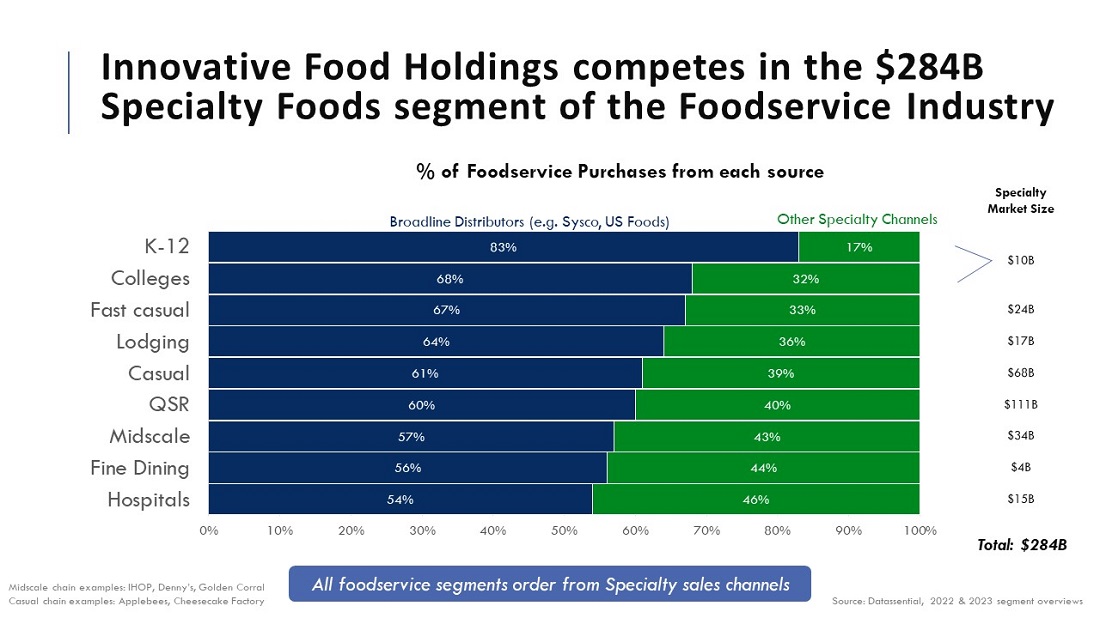

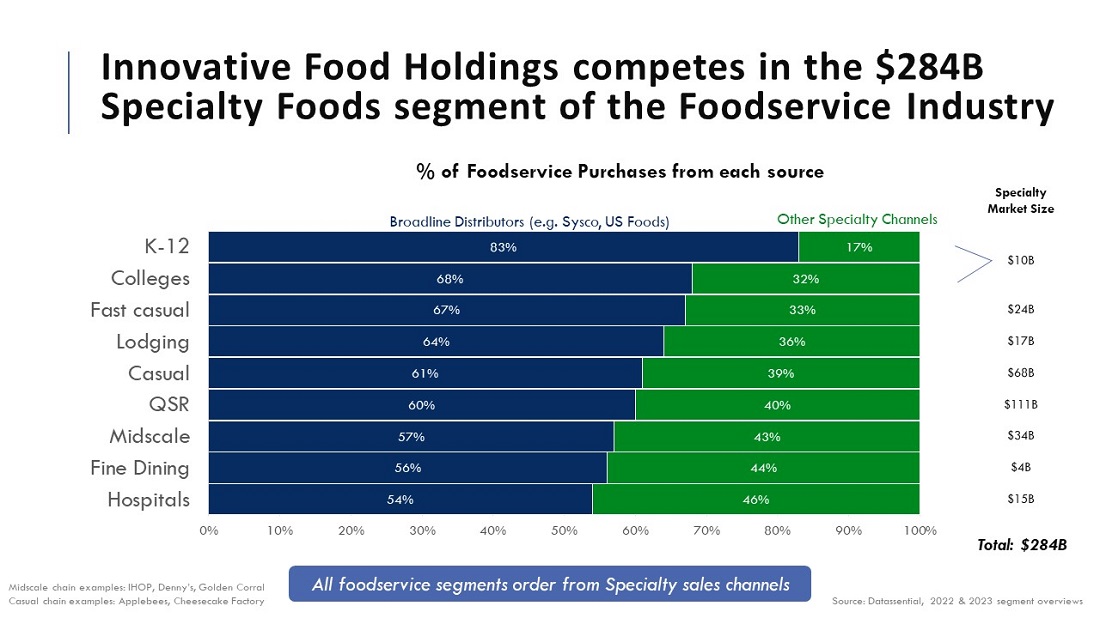

Innovative Food Holdings competes in the $284B Specialty Foods segment of the Foodservice Industry % of Foodservice Purchases from each source Broadline distributors (e.g. Sysco, US Foods) Other specialty Channels Specialty Market Size K-12 83% 17% 54% 56% 57% 60% 61% 64% 67% 8% 83% 46% 44% 43% 40% 39% 36% 33% 32% 17% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Hospitals Fine Dining Midscale QSR Casual Lodging Fast casual $10B $24B $17B $68B $111B $34B $4B $15B Total: $284B Midscale chain examples: IHOP, Denny’s, Golden Corral Casual chain examples: Applebees, Cheesecake Factory Source: Datassential, 2022 & 2023 segment overviews All foodservice segments order from Specialty sales channels

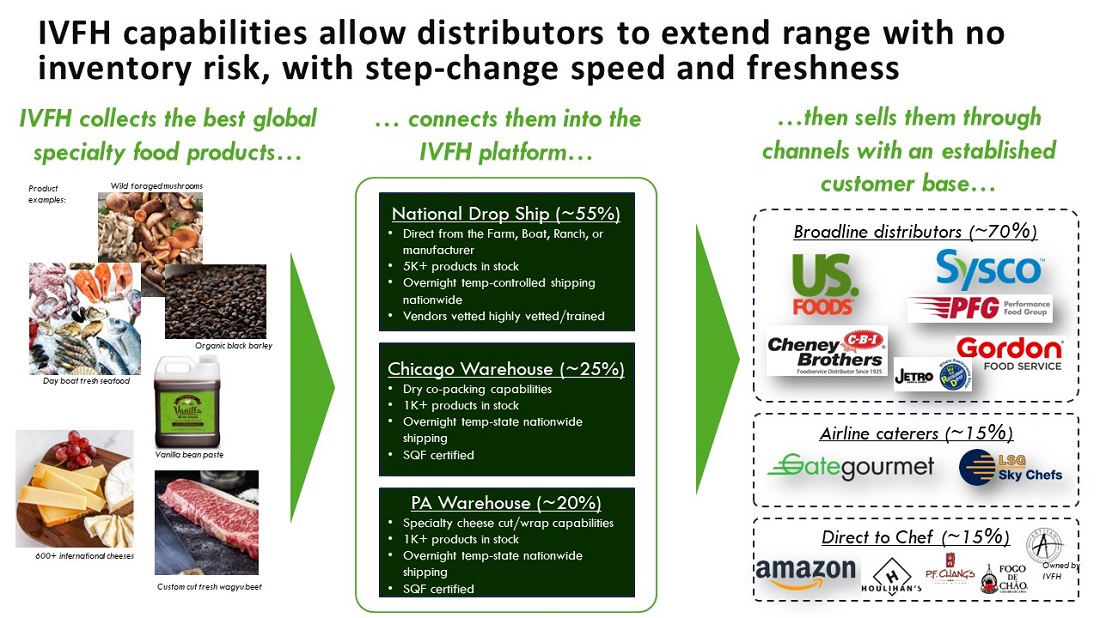

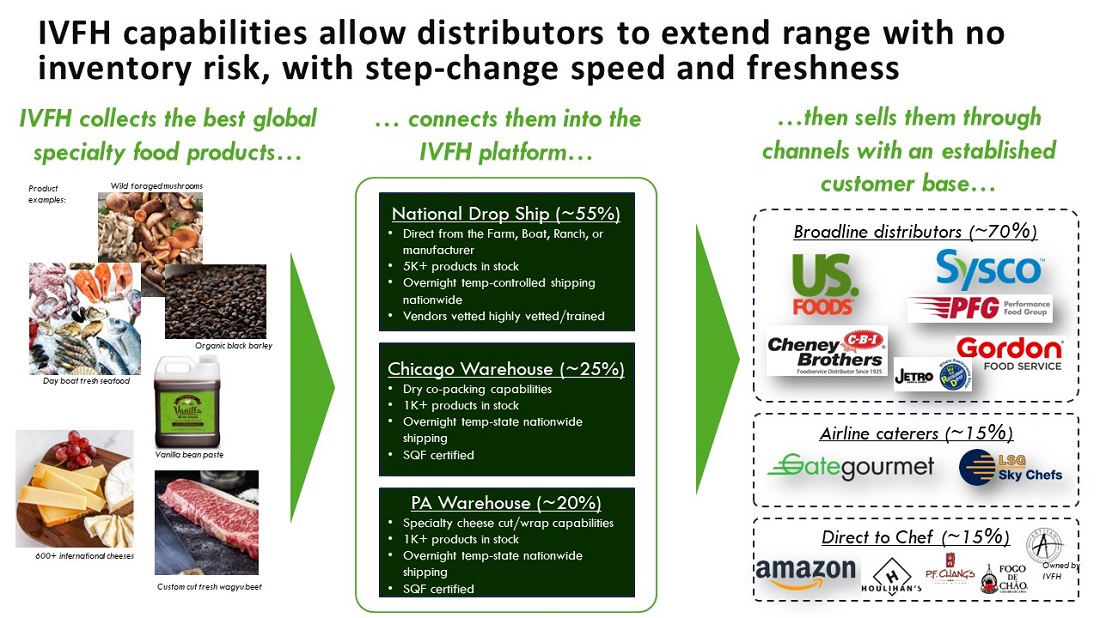

IVFH capabilities allow distributors to extend range with no inventory risk, with step-change speed and freshness IVFH collects the best global specialty food products connects them into the IVFH platform then sells them through channels with an established customer base Product examples Wild foraged mushrooms Organic black barley Day boat fresh seafood vanilla bean paste 600+ international cheeses Custom cut fresh wagyu beef National Drop Ship (~55%) Direct from the Farm, Boat, Ranch, or manufacturer 5K+ products in stock Overnight temp-controlled shipping nationwide Vendors vetted highly vetted/trained Chicago Warehouse (~25%) Dry co-packing capabilities 1K+ products in stock Overnight temp-state nationwide shipping SQF certified PA Warehouse (~20%) Specialty cheese cut/wrap capabilities 1K+ products in stock Overnight temp-state nationwide shipping SQF certified Broadline distributors (~70%) Airline caterers (~15%) Direct to Chef (~15%)

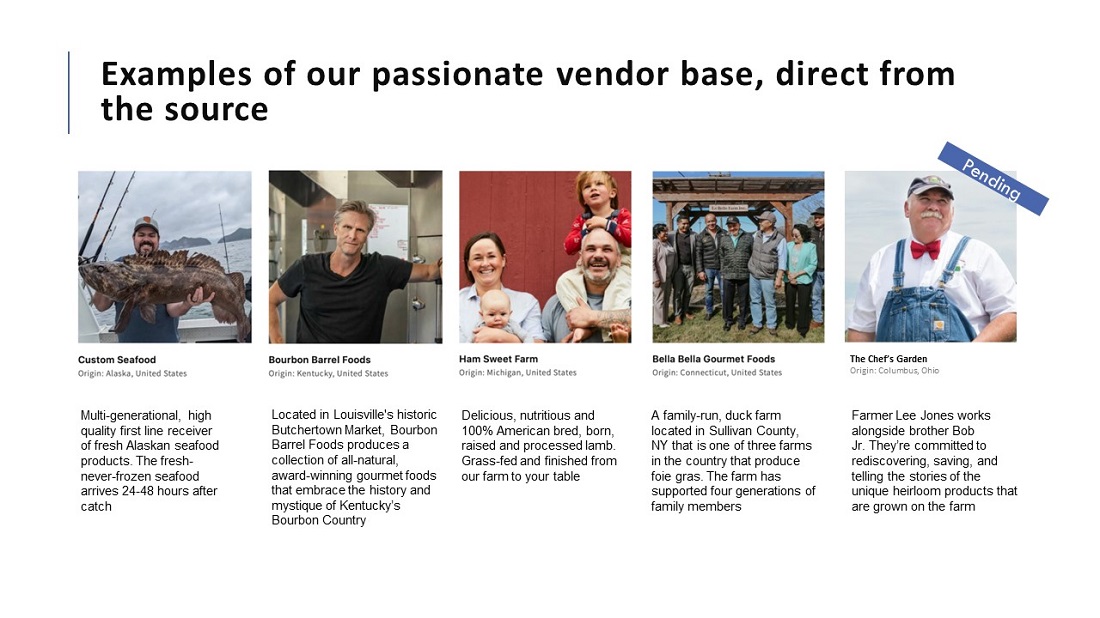

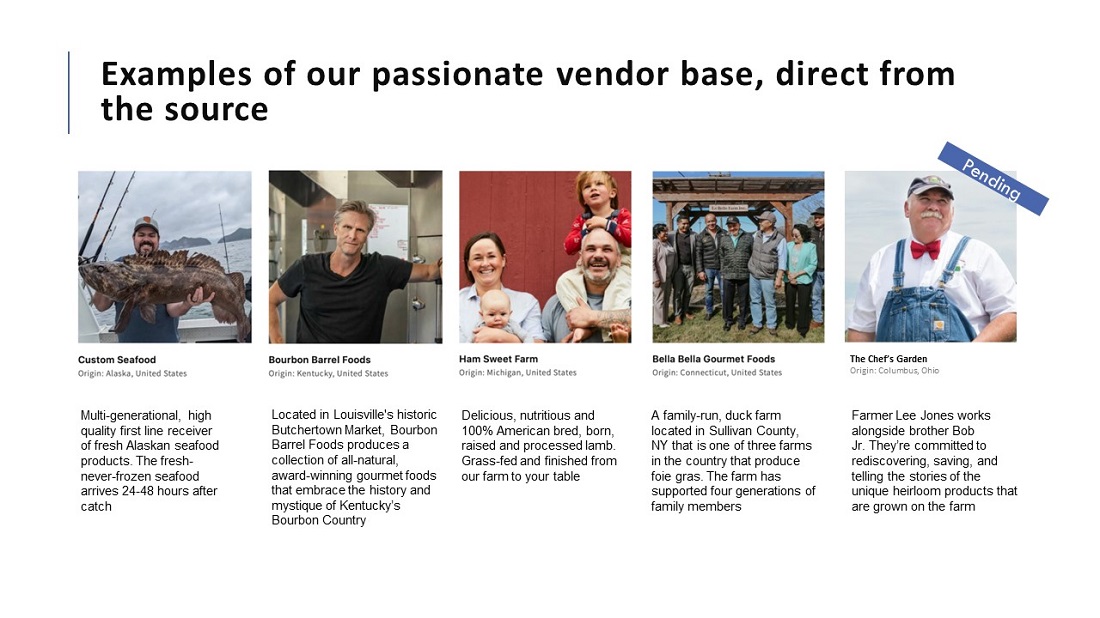

Examples of our passionate vendor base, direct from the source Multi-generational, high quality first line receiver of fresh Alaskan seafood products. The fresh-never-frozen seafood arrives 24-48 hours after catch Located in Louisville's historic Butchertown Market, Bourbon Barrel Foods produces a collection of all-natural, award-winning gourmet foods that embrace the history and mystique of Kentucky’s Bourbon Country Delicious, nutritious and 100% American bred, born, raised and processed lamb. Grass-fed and finished from our farm to your table A family-run, duck farm located in Sullivan County, NY that is one of three farms in the country that produce foie gras. The farm has supported four generations of family members Farmer Lee Jones works alongside brother Bob Jr. They’re committed to rediscovering, saving, and telling the stories of the unique heirloom products that are grown on the farm

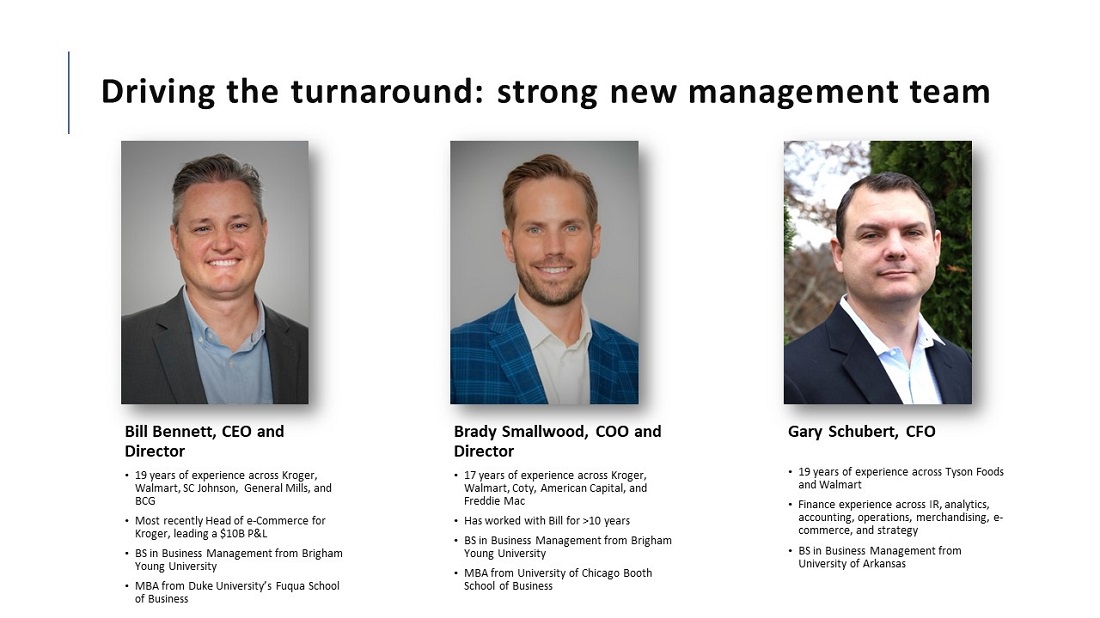

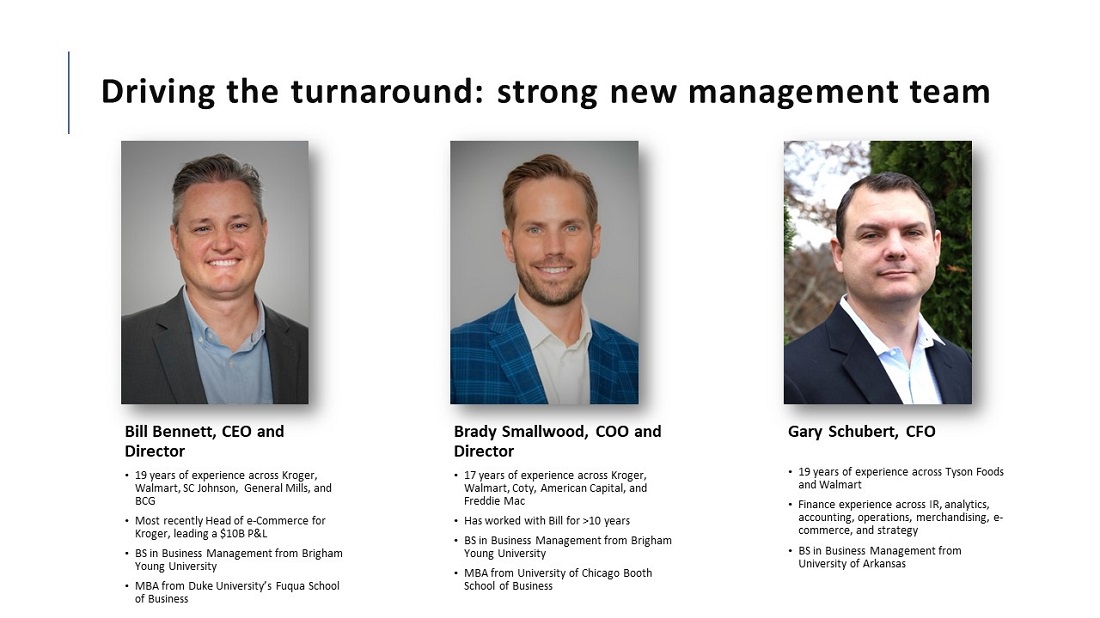

Driving the turnaround: strong new management team Bill Bennett, CEO and Director 19 years of experience across Kroger, Walmart, SC Johnson, General Mills, and BCG Most recently Head of e-Commerce for Kroger, leading a $10B P&L BS in Business Management from Brigham Young University MBA from Duke University’s Fuqua School of Business Brady Smallwood, COO and Director 17 years of experience across Kroger, Walmart, Coty, American Capital, and Freddie Mac Has worked with Bill for >10 years BS in Business Management from Brigham Young University MBA from University of Chicago Booth School of Business Gary Schubert, CFO 19 years of experience across Tyson Foods and Walmart Finance experience across IR, analytics, accounting, operations, merchandising, e- commerce, and strategy BS in Business Management from University of Arkansas

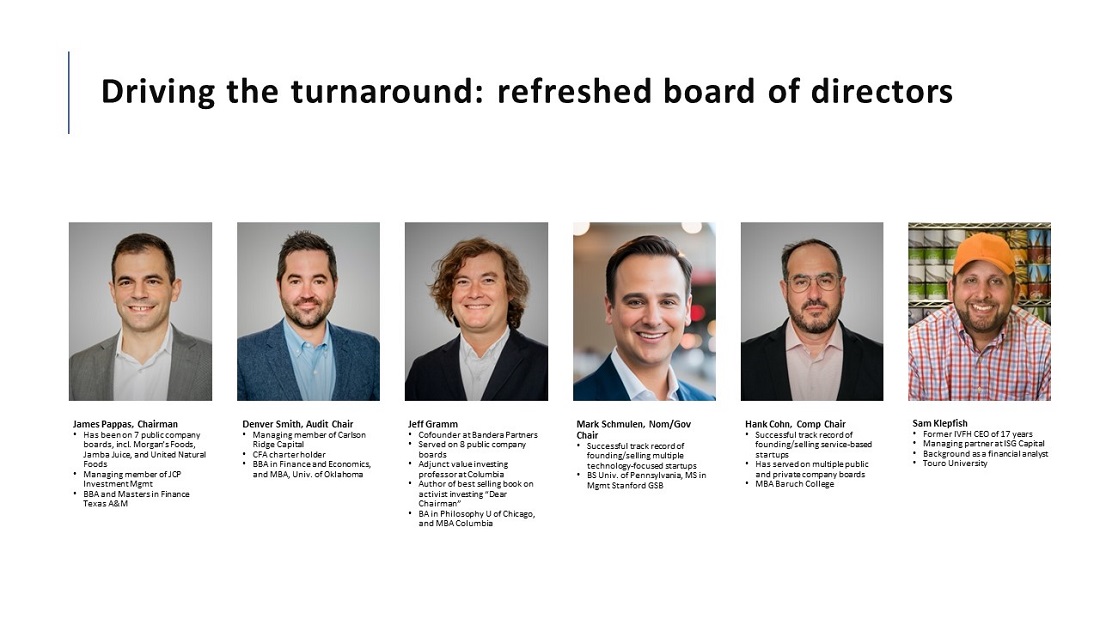

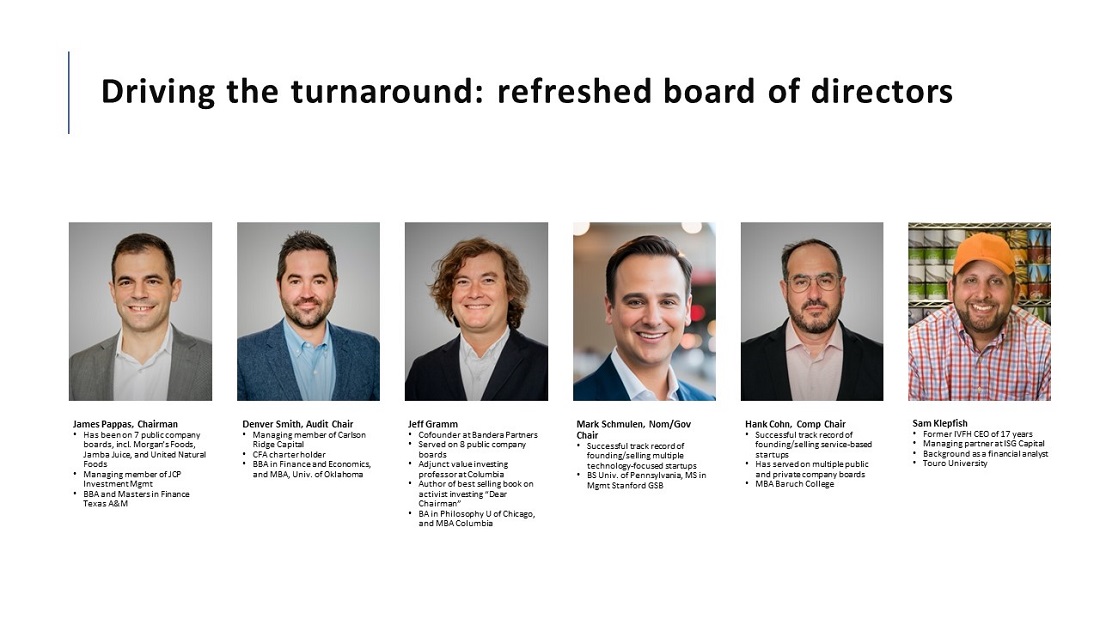

Driving the turnaround: refreshed board of directors James Pappas, Chairman Has been on 7 public company boards, incl. Morgan’s Foods, Jamba Juice, and United Natural Foods Managing member of JCP Investment Mgmt BBA and Masters in Finance Texas A&M Denver Smith, Audit Chair Managing member of Carlson Ridge Capital CFA charter holder BBA in Finance and Economics, and MBA, Univ. of Oklahoma Jeff Gramm Cofounder at Bandera Partners Served on 8 public company boards Adjunct value investing professor at Columbia Author of best selling book on activist investing “Dear Chairman” BA in Philosophy U of Chicago, and MBA Columbia Mark Schmulen, Nom/Gov Chair Successful track record of founding/selling multiple technology-focused startups BS Univ. of Pennsylvania, MS in Mgmt Stanford GSB Hank Cohn, Comp Chair Successful track record of founding/selling service-based startups Has served on multiple public and private company boards MBA Baruch College Sam Klepfish Former IVFH CEO of 17 years Managing partner at ISG Capital Background as a financial analyst Touro University

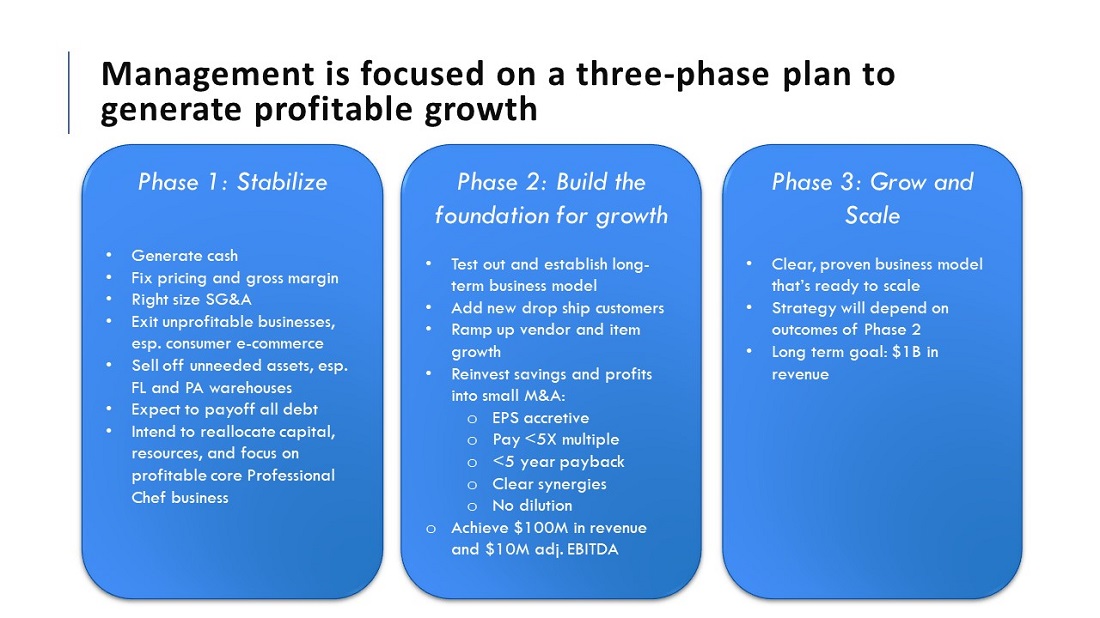

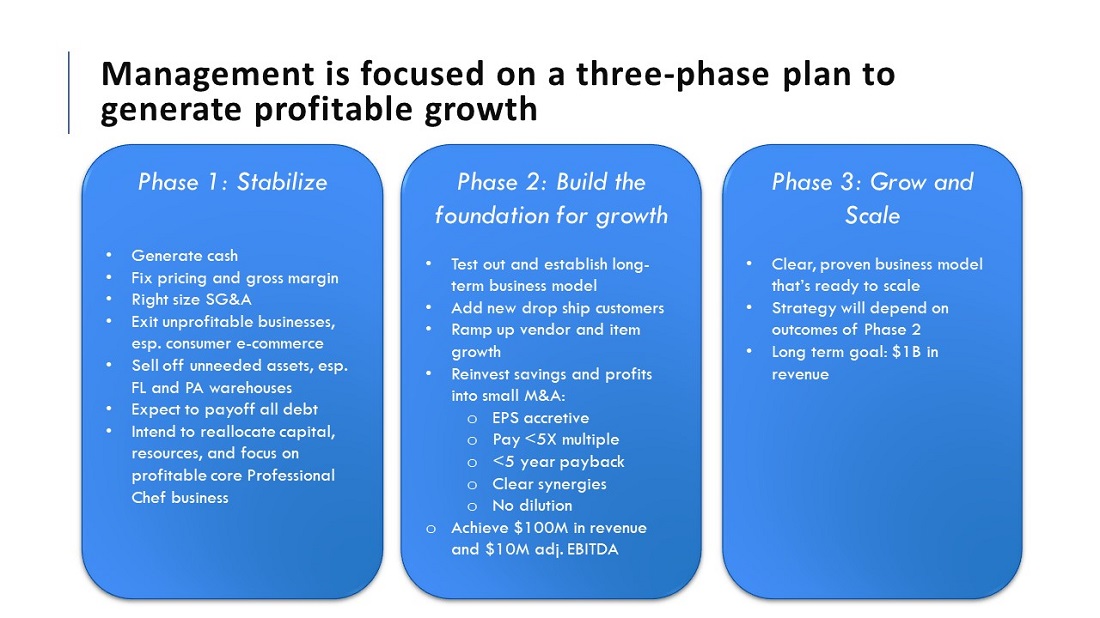

Management is focused on a three-phase plan to generate profitable growth Phase 1: Stabilize Generate cash Fix pricing and gross margin Right size SG&A Exit unprofitable businesses, esp. consumer e-commerce Sell off unneeded assets, esp. FL and PA warehouses Expect to payoff all debt Intend to reallocate capital, resources, and focus on profitable core Professional Chef business Phase 2: Build the foundation for growth Test out and establish long- term business model Add new drop ship customers Ramp up vendor and item growth Reinvest savings and profits into small M&A: EPS accretive Pay <5X multiple <5 year payback Clear synergies No dilution Achieve $100M in revenue and $10M adj. EBITDA Phase 3: Grow and Scale Clear, proven business model that’s ready to scale Strategy will depend on outcomes of Phase 2 Long term goal: $1B in revenue

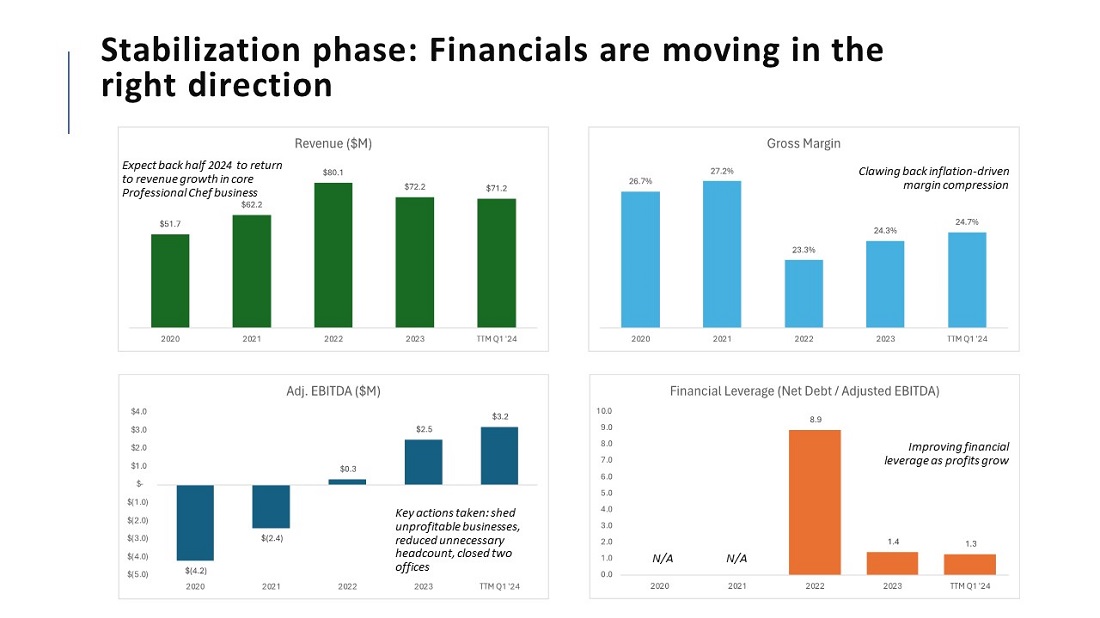

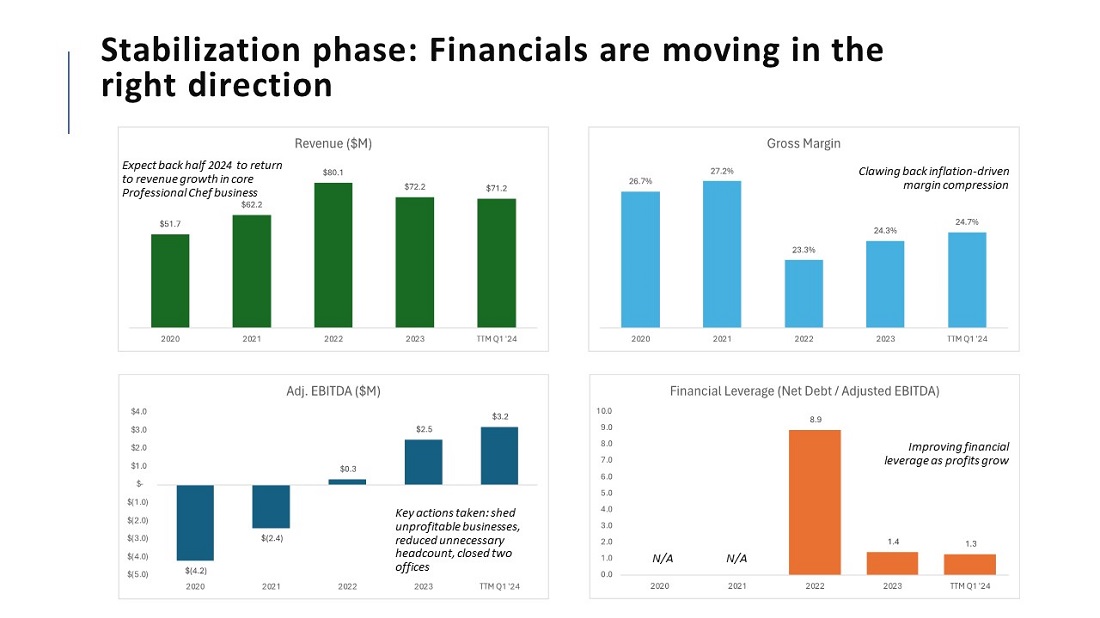

Stabilization phase: Financials are moving in the right direction Revenue ($M) Expect back half 2024 to return to revenue growth in core Professional Chef business Gross Margin Clawing back inflation-driven margin compression Adj. EBITDA ($M) Key actions taken: shed unprofitable businesses, reduced unnecessary headcount, closed two offices Financial Leverage (Net Debt / Adjusted EBITDA Improving financial leverage as profits grow

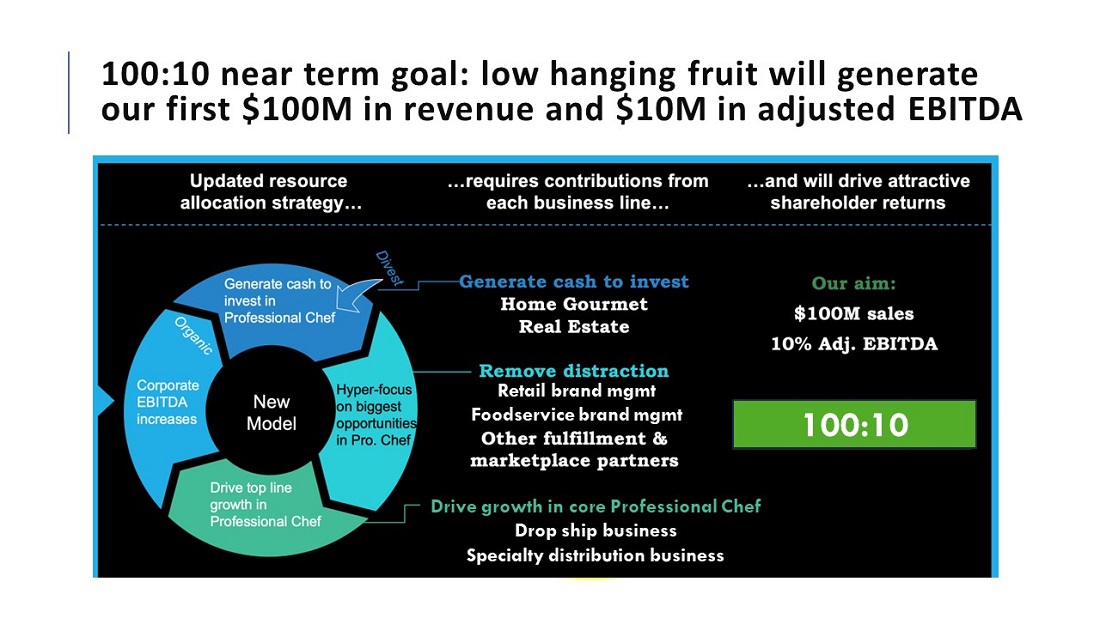

100:10 near term goal: low hanging fruit will generate our first $100M in revenue and $10M in adjusted EBITDA

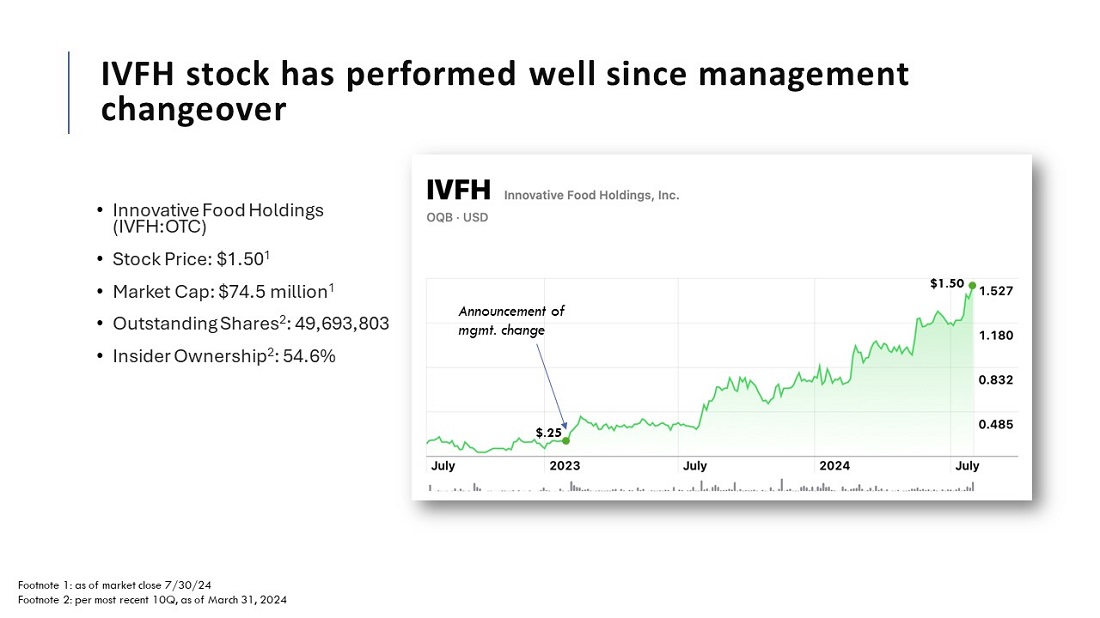

IVFH stock has performed well since management changeover Announcement of mgmt. change Innovative Food Holdings (IVFH:OTC) Stock Price: $1.501 Market Cap: $74.5 million1 Outstanding Shares2: 49,693,803 Insider Ownership2: 54.6% Footnote 1: as of market close 7/30/24 Footnote 2: per most recent 10Q, as of March 31, 2024

Questions?