On March 12, 2007, the company announced its intention to divest Organon BioSciences (OBS) to Schering-Plough, following their binding cash offer of EUR 11 billion. As a consequence, in accordance with IFRS 5, the OBS activities qualify as so-called discontinued operations. As a result, going forward depreciation or amortization will no longer be recognized for the OBS activities, as a result of which pre-tax results increased by EUR 32 million. Thereof, EUR 27 million was recognized in the second quarter of 2007.

Organon

At EUR 638 million, second-quarter revenues were 5% below 2006. There was a negative currency translation effect of 2%, mainly attributable to the U.S. dollar and the Japanese yen. Contraceptives realized the strongest revenues growth, due primarily to Implanon® and NuvaRing®, for which volume increases of EUR 6 million and EUR 13 million, respectively, were realized.

Sales of Remeron®, Anzemet®, and active pharmaceutical ingredients decreased, while the loss of Avinza® also reduced revenues.

Operating income before incidentals increased to EUR 129 million (2006: EUR 102 million). The effect of lower revenues was offset by the effects of a favorable product mix, lower marketing expenses, and the non-recognition of depreciation and amortization.

For further details on the development of sales of Organon’s key products, see the Akzo Nobel website at www.akzonobel.com/ investorrelations/financialfaq.

Intervet

Second quarter revenues of Intervet grew 9% to a record EUR 306 million. Currency translation had a negative impact of 1%. Recent product introductions – including the pig vaccine Circumvent® PCV – boosted growth in the North American market. The causing agent is a virus in swine which has led to substantial losses for the North American pig industry in the past few years. In Europe, where Intervet generates more than 50% of its revenues, sales grew by 3% after a very strong growth performance realized during the previous quarter. Also in Europe, Intervet is gaining market share in the swine segment by excellent customer acceptance of our pulmonal vaccine range. Sales in Latin America increased by 16% to EUR 44 million, while only marginal increases could be realized in the rest of the world due to weaker currencies. The livestock and the companion animal businesses continue to develop at a similar pace and currently generate three-quarters and one-quarter of total Intervet sales, respectively.

Volume growth and strict cost control, combined with the non-recognition of depreciation and amortization, improved operating income by 35% to EUR 69 million.

| 14 | Report for the 2nd quarter of 2007 |

| | |

| | |

| Discontinued operations statement of income |

| | | | | | | | | | | | | | | |

| 2nd quarter | | | | | | | Millions of euros | January-June | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 2007 | | | 2006 | | Δ% | | | 2007 | | | 2006 | | Δ% | |

| | | | | | | | | | | | | | | |

| 936 | | | 950 | | (1 | ) | Revenues | 1,856 | | | 1,870 | | (1 | ) |

| (743 | ) | | (789 | ) | | | Expenses | (1,517 | ) | | (1,569 | ) | | |

|

|

|

| | | | |

|

|

|

| | | |

| 193 | | | 161 | | | | Profit before tax | 339 | | | 301 | | | |

| (47 | ) | | (34 | ) | | | Income taxes | (81 | ) | | (75 | ) | | |

|

|

|

| | | | |

|

|

|

| | | |

| | | | | | | | Income from | | | | | | | |

| 146 | | | 127 | | 15 | | discontinued operations | 258 | | | 226 | | 14 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Assets and liabilities held for sale of Organon BioSciences | | | |

| | | | |

| Millions of euros | June 30, 2007 | | |

|

|

| |

| Property, plant and equipment | 1,134 | | |

| Intangible assets | 163 | | |

| Financial noncurrent assets | 357 | | |

| Inventories | 874 | | |

| Receivables | 811 | | |

| |

|

| |

| Assets held for sale | 3,339 | | |

| | | | |

| Noncurrent liabilities | 317 | | |

| Short-term borrowings | 137 | | |

| Current payables | 725 | | |

| |

|

| |

| Liabilities held for sale | 1,179 | | |

|

|

| |

Note: Cash and cash equivalents reported for Organon BioSciences are not included in assets held for sale as these will be settled with the purchase price at the closing of the deal.

Notes

The data in this report are unaudited.

This interim financial report is in compliance with IAS 34 – Interim Financial Reporting. The same accounting policies and methods of computation have been applied as in the 2006 financial statements, a copy of which can be found on the company’s website: www.akzonobel.com.

As a consequence of the intention to divest Organon BioSciences (OBS) to Schering-Plough, in accordance with IFRS 5, the OBS activities qualify as so-called discontinued operations. As a result, going forward no depreciation or amortization is recognized anymore for the OBS activities, as a result of which pre-tax results increased by EUR 32 million. Thereof, EUR 27 million was recognized in the second quarter of 2007

Revenues consist of sales of goods and services, and royalty income.

Autonomous growth is defined as the change in revenues attributable to changed volumes and selling prices. It excludes currency, acquisition, and divestment effects.

Incidentals are special benefits, results on divestments, restructuring and impairment charges, and charges related to major legal, antitrust, and environmental cases. Operating income excluding incidentals is one of the key figures management uses to assess the company’s performance, as this figure better reflects the underlying trends in the results of the activities.

EBIT margin is operating income (EBIT) as percentage of revenues.

EBITDA is EBIT before depreciation and amortization.

Invested capital is total assets less cash and cash equivalents, less current liabilities.

Moving average ROI is EBIT before incidentals of the last four quarters divided by the average invested capital of those four quarters.

Safe Harbor Statement*

This report contains statements which address such key issues as Akzo Nobel’s growth strategy, future financial results, market positions, product development, pharmaceutical products in the pipeline, and product approvals. Such statements should be carefully considered, and it should be understood that many factors could cause forecasted and actual results to differ from these statements. These factors include, but are not limited to, price fluctuations, currency fluctuations, progress of drug development, clinical testing and regulatory approval, developments in raw material and personnel costs, pensions, physical and environmental risks, legal issues, and legislative, fiscal, and other regulatory measures. Stated competitive positions are based on management estimates supported by information provided by specialized external agencies. For a more comprehensive discussion of the risk factors affecting our business please see our Annual Report on Form 20-F filed with the United States Securities and Exchange Commission, a copy of which can be found on the company’s corporate website www.akzonobel.com.

* Pursuant to the U.S. Private Securities Litigation Reform Act 1995.

| Contact details | | |

| | | |

| Akzo Nobel NV | | |

| Velperweg 76 | | |

| P.O. Box 9300 | | |

| 6800 SB Arnhem, the Netherlands |

| Tel: | +31 26 366 4433 | |

| Fax: | +31 26 366 3250 | |

| Internet: | www.akzonobel.com | |

| | | |

| For more information: |

| The explanatory sheets used by the CEO during the press |

| conference can be viewed on Akzo Nobel’s corporate website |

| www.akzonobel.com. |

| | | |

| Akzo Nobel Corporate Communications |

| Tel: | +31 26 366 2241 | |

| Fax: | +31 26 366 5850 | |

| E-mail: | info@akzonobel.com | |

| | | |

| Akzo Nobel Investor Relations |

| Tel: | +31 26 366 4317 | |

| Fax: | +31 26 366 5797 | |

| E-mail: | investor.relations@akzonobel.com | |

| | | |

| | | |

| Financial calendar | |

Report for the 3rd quarter 2007

October 23, 2007

Quotation ex 2007 interim dividend

October 24, 2007

Payment of 2007 interim dividend

October 31, 2007

| | Contact details and financial calendar |

| | Report for the 2nd quarter of 2007 |

| 16 | Report for the 2nd quarter of 2007 |

| | |

| | |

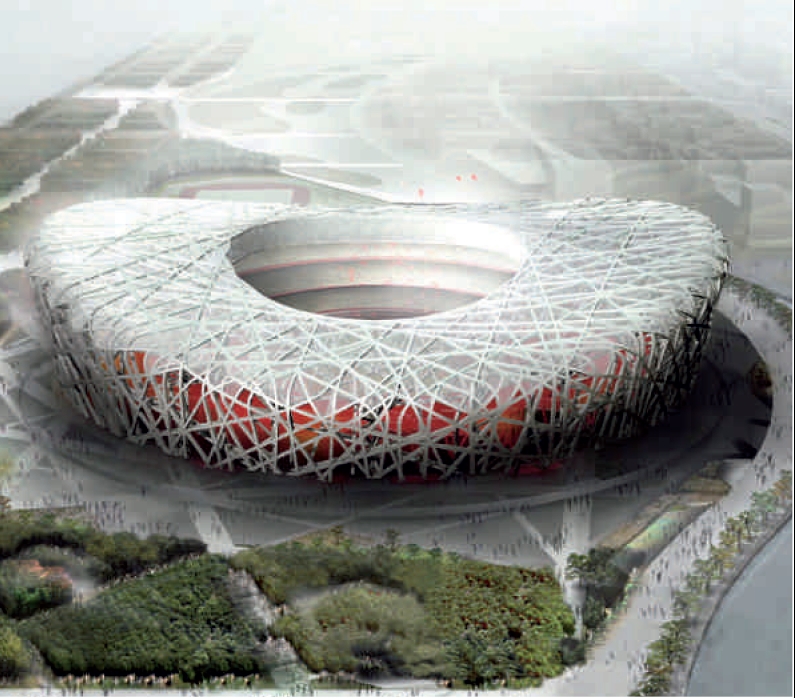

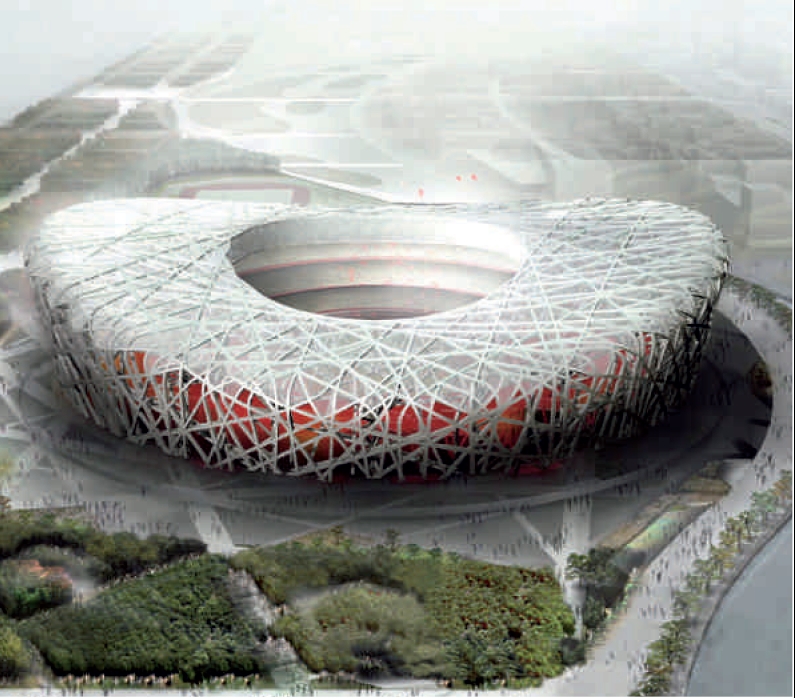

| | Main Olympic Stadium for Beijing 2008 |

| | |

| | In just over a year the world will be celebrating the 2008 Beijing Olympics and Akzo Nobel is playing a key role in the preparations, which have been ongoing ever since the Chinese city won the vote to host the event back in 2001.

With a track record which includes the 2000 and 2004 Olympic Games in Australia and Greece, the 2006 Winter Olympics in Italy, and the Commonwealth Games in England in 2000, it was almost inevitable that Akzo Nobel's Coatings businesses would become involved in the major construction program.

Along with various smaller competition venues (such as the Qingdao Sea Boat Center), the company has also supplied products fot the two most prestigious structures – the main Olympic Stadium (dubbed the Bird's Nest) and the National Aquatics Center. The 91,000-seater Olympic Stadium is due to be completed next March and will be the main focus of the 17-day sporting spectacular, while the National Aquatics Center (christened the Water Cube) will be home to the swimming, diving, water polo, and synchronized swimming events. |

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of

1934 the registrant has duly caused this report to be signed on its behalf of

the undersigned, thereto duly authorized.

Akzo Nobel N.V.

| Name : | R.J. Frohn | Name : | J.J.M. Derckx |

| Title : | Chief Financial Officer | Title : | Director External Reporting |

| | | | |

Dated : July 24, 2007